Trade to Order Volume Ratios

DATA HIGHLIGHT 2013-01

October 9, 2013

Launch the Data Visualization Tool

Analysis

This chart introduces a data series that compares trade volumes against order and quote volumes in a fashion that accounts for the entire depth of book available. At present, data is sufficiently detailed for 12 of 13 equity exchange feeds to compute this metric. For each of these exchanges we aggregate the total share volume of every displayed limit order at any price level, as well as the total number of shares traded during the continuous market when such orders are displayed (i.e. volume resulting from the opening and closing crosses are excluded).

The ratio of these volumes provides a good measure of the extent to which orders posted at public exchanges are either canceled or filled. Using share volume as opposed to simply counting the total number of orders and trades provides a measure that is not affected by the fact that orders can be partially filled or partially canceled, which could result in double-counting (or more) some orders and trades.

A trade-to-order volume ratio of 100% would indicate that the total volume of all posted orders and quotes result in filled trade executions. A ratio of 50% would indicate that only half of this total volume was filled, and the other half canceled (or in some cases ended the trading day without being filled).

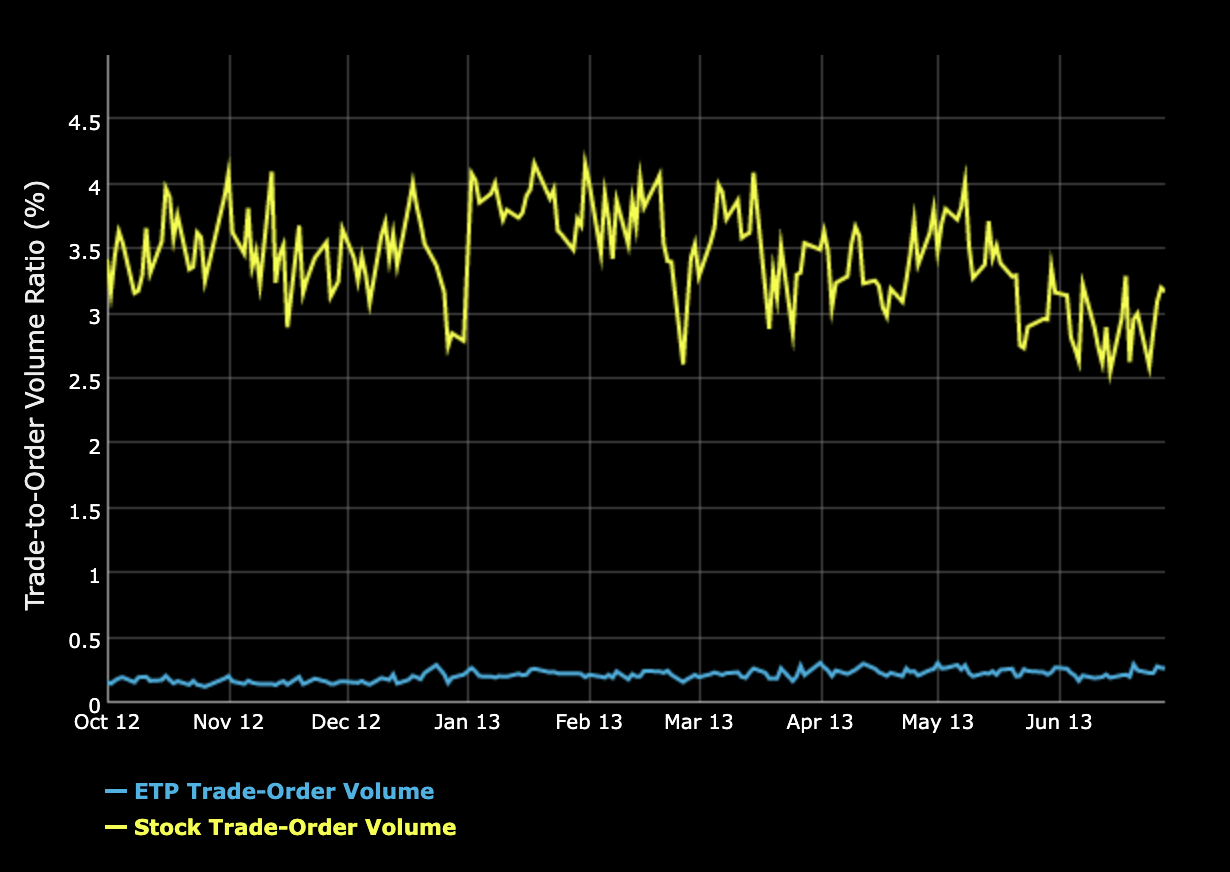

The chart above separately plots daily trade-to-order volume ratios for corporate stocks (stocks - upper line) and exchange-trade products (ETPs – lower line) over three calendar quarters ending June 30, 2013.

What the Chart Reveals

The chart shows that the trade-to-order volume ratio for stocks is typically between 2.5% and 4.2%, with an average of 3.5% in Q4 2012, 3.7% in Q1 2013 and 3.2% in Q2 2013. In contrast, the trade-to-order volume ratio for ETPs is less than one-tenth of the ratio for stocks, averaging 0.17% in Q4 2012, 0.22% in Q1 2013 and 0.24% in Q2 2013.

The significantly lower trade-to-order volume ratio for ETPs could be a result of the structural differences between how stocks and ETPs trade: ETPs are typically designed to either passively or actively track a stated basket of financial instruments (such as individual stocks, commodities, bonds, currencies, etc.). Whereas over short periods of time the market price of a stock may be influenced by buy and sell pressures on that specific stock (or of a broader market index related to that stock), short-term changes in the market prices of ETPs may additionally be influenced by the arbitrage relationship between the price of the ETP and the prices of its underlying components. Market participants seeking to arbitrage these differences may cancel standing limit orders and replace these orders with newly priced orders as the prices of the underlying components of the ETP fluctuate throughout the day. Of course, this arbitrage-motivated limit order re-pricing would occur whether the ETP trades or not.

As a further example, the table below compares the trade-to-order volume ratio for the ten most active stocks against the ten most active ETPs (by dollar volume traded) for a randomly-selected day (June 4, 2013).

The chart below shows the impact of removing Amex and NYSE message counts from the aggregate cancel-to-trade measure.

Trade-to-Order Volume Ratio (%) by Dollar Volume Traded — June 4, 2013

Corporate Stocks

| TICKER | NAME | VOLUME (MILLION) | TRADE-TO-ORDER VOLUME (%) |

|---|---|---|---|

| AAPL | Apple | $4,951.05 | 3.80 |

| MSFT | Microsoft | $2,262.89 | 5.90 |

| PFE | Pfizer | $1,935.41 | 7.39 |

| MRK | Merck | $1,829.81 | 5.00 |

| BAC | Bank of America | $1,737.54 | 4.37 |

| INTC | Intel | $1,721.34 | 5.28 |

| GOOG | $1,714.51 | 2.23 | |

| T | AT&T | $1,443.56 | 4.44 |

| C | Citigroup | $1,429.27 | 2.40 |

| JPM | JP Morgan Chase | $1,190.20 | 2.30 |

Exchange-Traded Products

| TICKER | NAME | VOLUME (MILLION) | TRADE-TO-ORDER VOLUME (%) |

|---|---|---|---|

| SPY | SPDR S&P 500 | $25,782.19 | 0.91 |

| IWM | iShares Russell 2000 | $6,662.48 | 0.88 |

| QQQ | Powershares QQQ | $2,570.40 | 0.44 |

| EEM | iShares MSCI Emerging Markets | $2,551.94 | 1.00 |

| XLE | SPDR Energy Sector | $1,288.71 | 1.31 |

| XLF | SPDR Financial Sector | $1,234.88 | 0.40 |

| IYR | iShares DJ US Real Estate | $1,212.92 | 1.35 |

| DIA | DJ Industrial Average | $1,206.55 | 0.32 |

| EFA | iShares MSCI EAFE | $1,030.32 | 0.13 |

| IVV | iShares Core S&P 500 | $999.56 | 0.24 |

As shown, the median trade-to-order volume ratio for the ten most traded stocks on this day is 4.4%. The median for ETPs is 0.66%, or about 15% of the median stock trade-to-order volume. Even the most liquid ETP trade-to-order volume ratios are less than 1/3 of the average ratios for all stocks in Q2 2013.

Why This is of Interest

The trade-to-order volume ratio is one of several measures designed to characterize the nature of order placement and cancellation in equity markets. These measures provide background about how our modern equity markets operate today.

As the marketplace continues to evolve (due to new products, developing technologies, changing economics, and/or changes in rules and regulations), variation in these measures may reveal the extent to which such changes influence order cancellations.

Furthermore, differences in these measures between security types, across security characteristics, or between exchanges can provide further insights into structural differences between products or venues that influence order cancellations. For example, the data above suggest that if quoting and trading in ETPs continues to grow relative to corporate stocks, the overall order cancellation rates across the entire market will similarly grow since ETPs generally have significantly lower trade-to-order volume ratios than do corporate stocks.

Related Data Series

The order cancellation data series is a simple measure of the number of displayed orders canceled per the number executed, and is mathematically related to the inverse of the trade-to-order volume ratio. Users can plot both of these data series on the Data Visualizations page and download daily stock-by-stock data from the Data Download page (currently released on a quarterly basis).

This analysis was prepared by the Staff of the U.S. Securities and Exchange Commission. The Commission has expressed no view regarding such analysis or any statement contained therein.

Data Downloads

Market Activity Overview MetricsOct. 2012 - June 2013 (csv, 33 kb)

Methodology

Learn how the SEC constructs trade-to-order volume ratios and other metrics.

Last Reviewed or Updated: Aug. 13, 2025