Initial Public Offerings (IPOs)

An initial public offering, or IPO, refers to the first time a company offers its shares of capital stock to the general public in a registered offering. Under the federal securities laws, a company may not lawfully offer or sell shares unless the transaction has been registered with the SEC or an exemption applies. An IPO helps to establish a trading market for the company’s shares. In conjunction with an IPO, a company usually applies to list its shares on a stock exchange, such as the New York Stock Exchange, NASDAQ, or over-the-counter market. An IPO gives the investing public an opportunity to own and participate in the growth of a formerly private company.

Data Visualizations

Click on the link below each image to access interactive features of the graph.

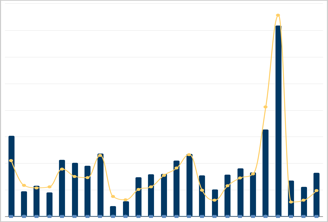

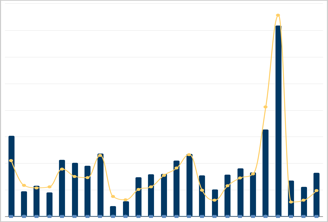

Number and Proceeds

(2000 - 2024 and 2000:Q1 - 2025:Q3)

Number and Proceeds by Major Industry Group

(2024 and 2025:Q1-Q3)

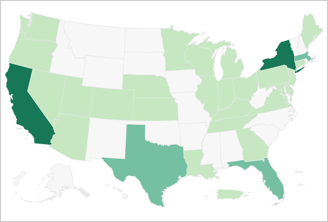

Number of Offerings by Issuer Location

(2024)

Statistics

Below are the most recent quarterly statistics from 2024:Q1 to 2025:Q3 and the most recent annual statistics from 2024. IPO statistics are updated quarterly. For all available IPO statistics from 2000:Q1 to 2025:Q3, view Statistics Download.

| Metric | 2024 | 2024 Q1 | 2024 Q2 | 2024 Q3 | 2024 Q4 | 2025 Q1 | 2025 Q2 | 2025 Q3 |

|---|---|---|---|---|---|---|---|---|

| Total number of IPOs | 246 | 44 | 58 | 63 | 81 | 84 | 96 | 110 |

| Number of IPOs by U.S. and non-U.S. issuers | ||||||||

| U.S. issuers | 140 | 25 | 36 | 35 | 44 | 44 | 59 | 66 |

| Non-U.S. issuers | 106 | 19 | 22 | 28 | 37 | 40 | 37 | 44 |

| Number of IPOs by corporate, blank check/SPAC, and fund issuers | ||||||||

| Corporates | 186 | 38 | 46 | 44 | 58 | 63 | 48 | 75 |

| Blank checks/SPACs | 58 | 6 | 11 | 18 | 23 | 20 | 46 | 34 |

| Funds | 2 | 0 | 1 | 1 | 0 | 1 | 2 | 1 |

| IPO total proceeds (US$ Millions) | 39,212.6 | 8,705.6 | 10,724.3 | 11,171.2 | 8,611.5 | 11,730.0 | 15,809.6 | 22,104.5 |

| IPO total proceeds by U.S. and non-U.S. issuers | ||||||||

| U.S. issuers (US$ Millions) | 32,473.2 | 5,144.1 | 9,513.0 | 10,188.6 | 76,27.6 | 10,589.8 | 13,377.2 | 17,982.7 |

| Non-U.S. issuers (US$ Millions) | 6,739.4 | 3,561.6 | 1,211.3 | 982.6 | 983.9 | 1,140.1 | 2,432.4 | 4,121.8 |

| IPO total proceeds by corporate, blank check/SPAC, and fund issuers | ||||||||

| Corporates (US$ Millions) | 30,412.8 | 8,091.6 | 9,034.1 | 8,070.6 | 5,216.5 | 8,677.6 | 7,030.9 | 15,083.7 |

| Blank checks/SPACs (US$ Millions) | 8,669.2 | 614.0 | 1,610.2 | 3,050.0 | 3,395.0 | 3,052.0 | 8,722.5 | 6,960.8 |

| Funds (US$ Millions) | 130.6 | 0.0 | 80.0 | 50.6 | 0.0 | 0.4 | 56.3 | 60.0 |

| IPO average proceeds (US$ Millions) | 159.4 | 197.9 | 184.9 | 177.3 | 106.3 | 139.6 | 164.7 | 201.0 |

| IPO average proceeds by U.S. and non-U.S. issuers | ||||||||

| U.S. issuers (US$ Millions) | 232.0 | 205.8 | 264.2 | 291.1 | 173.4 | 240.7 | 226.7 | 272.5 |

| Non-U.S. issuers (US$ Millions) | 63.6 | 187.5 | 55.1 | 35.1 | 26.6 | 28.5 | 65.7 | 93.7 |

| IPO average proceeds by corporate, blank check/SPAC, and fund issuers | ||||||||

| Corporates ($US Millions) | 163.5 | 212.9 | 196.4 | 183.4 | 89.9 | 137.7 | 146.5 | 201.1 |

| Blank checks/SPACs (US$ Millions) | 149.5 | 102.3 | 146.4 | 169.4 | 147.6 | 152.6 | 189.6 | 204.7 |

| Funds* (US$ Millions) | 65.3 | - | 80.0 | 50.6 | - | 0.4 | 28.1 | 60.0 |

| IPO median proceeds IPO (US$ Millions) | 53.6 | 79.3 | 77.5 | 50.0 | 12.0 | 15.3 | 150.0 | 100.0 |

| IPO median proceeds by U.S. and non-U.S. issuers | ||||||||

| U.S. issuers (US$ Millions) | 152.6 | 103.4 | 177.6 | 198.0 | 130.0 | 150.5 | 200.0 | 200.0 |

| Non-U.S. issuers (US$ Millions) | 8.0 | 9.6 | 8.3 | 8.8 | 7.0 | 8.4 | 10.7 | 8.0 |

| IPO median proceeds by corporate, blank check/SPAC, and fund issuers | ||||||||

| Corporates (US$ Millions) | 10.0 | 53.8 | 63.8 | 10.0 | 8.4 | 10.0 | 14.6 | 15.0 |

| Blank checks/SPACs (US$ Millions) | 155.0 | 84.5 | 150.0 | 200.0 | 150.0 | 175.0 | 200.0 | 200.0 |

| Funds* (US$ Millions) | 65.3 | - | 80.0 | 50.6 | - | 0.4 | 28.1 | 60.0 |

* The average and median proceeds are presented as "-" when the number of offerings is 0.

Statistics Guide

The Guide below provides a description of each metric, calculation method, and data source. To download IPO Statistics Guide: IPO Statistics Guide

Description

The number of initial public offerings (IPOs) in the U.S. market based on pricing date.

Calculation Method

The estimate is produced by counting priced IPOs in each time period.

Data Source

LSEG SDC Platinum, Dealogic ECM

Description

The number of IPOs based on pricing date in the U.S. market by U.S and non-U.S. issuers in each time period.

Calculation Method

For purposes of this estimate, the U.S. and non-U.S. issuer classifications are based on the location of the primary offices at the time of the offerings.

Data Source

LSEG SDC Platinum, Dealogic ECM

Description

The number of IPOs based on pricing date in the U.S. market by corporate, blank check/SPAC, and fund issuers in each time period.

Calculation Method

For purposes of this estimate, funds include closed-end funds (registered under the Investment Company Act of 1940) and business development companies (closed-end investment funds exempt under the Investment Company Act of 1940). Corporate issuers are all other IPO issuers except funds, as defined above, and blank checks/SPACs at the time of offerings.

Data Source

LSEG SDC Platinum, Dealogic ECM

Description

Total proceeds from IPOs based on pricing date in the U.S. market in each time period.

Calculation Method

The estimate is produced by aggregating the proceeds from priced IPOs based on pricing date in the U.S. market in each time period.

Data Source

LSEG SDC Platinum, Dealogic ECM

Description

Total proceeds from IPOs based on pricing date in the U.S. market by U.S. and non-U.S. issuers in each time period.

Calculation Method

For purposes of this estimate, the U.S. and non-U.S. issuer classifications are based on the location of the primary offices at the time of the offerings.

Data Source

LSEG SDC Platinum, Dealogic ECM

Description

Total proceeds from IPOs based on pricing date in the U.S. market by corporate, blank check/SPAC, and fund issuers in each time period.

Calculation Method

For purposes of this estimate, funds include closed-end funds (registered under the Investment Company Act of 1940) and business development companies (closed-end investment funds exempt under the Investment Company Act of 1940). Corporate issuers are all other IPO issuers except funds, as defined above, and blank checks/SPACs at the time of offerings.

Data Source

LSEG SDC Platinum, Dealogic ECM

Description

Average of proceeds from IPOs based on pricing date in the U.S. market in each time period.

Calculation Method

The estimate is produced by averaging the proceeds from priced IPOs in the U.S. market in each time period.

Data Source

LSEG SDC Platinum, Dealogic ECM

Description

Average of proceeds from IPOs based on pricing date in the U.S. market by U.S and non-U.S. issuers in each time period.

Calculation Method

For purposes of this estimate, the U.S. and non-U.S. issuer classifications are based on the location of the primary offices at the time of the offering.

Data Source

LSEG SDC Platinum, Dealogic ECM

Description

Average of proceeds from IPOs based on pricing date in the U.S. market by corporate, blank check/SPAC, and fund issuers in each time period.

Calculation Method

For purposes of this estimate, funds include closed-end funds (registered under the Investment Company Act of 1940) and business development companies (closed-end investment funds exempt under the Investment Company Act of 1940). Corporate issuers are all other IPO issuers except funds, as defined above, and blank checks/SPACs at the time of offerings.

Data Source

LSEG SDC Platinum, Dealogic ECM

Description

Median proceeds from IPOs based on pricing date in the U.S market in each time period.

Calculation Method

The estimate is produced by locating the issuer with the middle value of the proceeds (or average of two middle values for even number of observations) from sorted priced IPO proceeds in each time period.

Data Source

LSEG SDC Platinum, Dealogic ECM

Description

Median of proceeds from IPOs based on pricing date in the US market by U.S. and non-U.S. issuers in each time period.

Calculation Method

For purposes of this estimate, the U.S. and non-U.S. issuer classifications are based on the location of the primary offices at the time of the offering.

Data Source

LSEG SDC Platinum, Dealogic ECM

Description

Median of proceeds from IPOs based on pricing date in the U.S. market by corporate, blank check/SPAC, and fund issuers in each time period.

Calculation Method

For purposes of this estimate, funds include closed-end funds (registered under the Investment Company Act of 1940) and business development companies (closed-end investment funds exempt under the Investment Company Act of 1940). Corporate issuers are all other IPO issuers except funds, as defined above, and blank checks/SPACs at the time of offerings.

Data Source

LSEG SDC Platinum, Dealogic ECM

Description

The number of IPOs based on pricing date in the U.S. market by major industry group in each time period.

Calculation Method

The industry classification is based on 4-digit primary SIC codes of IPO issuers, which are grouped to form 12 major industries at the time of offerings. All other 4-digit SIC codes that are not among the 12 major industry groups are classified as Other.

Data Source

LSEG SDC Platinum, Dealogic ECM

Description

Total proceeds from IPOs based on pricing date in the U.S. market by major industry group in each time period.

Calculation Method

The industry classification is based on 4-digit primary SIC codes of IPO issuers, which are grouped to form 12 major industries at the time of offerings. All other 4-digit SIC codes that are not among the 12 major industry groups are classified as Other.

Data Source

LSEG SDC Platinum, Dealogic ECM

Statistics Download

The file below contains all available IPO statistics from 2000:Q1 to 2025:Q3.

| File | Format | Size |

|---|---|---|

| IPO Statistics | xlsx | 40.29KB |

Related Materials

- Regulatory Background:

- Investor Bulletin:

These statistics are produced by the staff of the U.S. Securities and Exchange Commission and the Commission expresses no view regarding the statistics. The statistics are produced from commercial data sets provided by third parties. Staff cannot guarantee the accuracy of third-party data. The statistics may change based on updated or revised data and methodology.

Citation

URL: https://www.sec.gov/data-research/statistics-data-visualizations/initial-public-offerings-ipos

Author: U.S. Securities and Exchange Commission Staff

Name: SEC Statistics & Data Visualizations: Initial Public Offerings (IPOs)

Publication Date: Dec. 22, 2025

Last Reviewed or Updated: Dec. 22, 2025