Staff Observations of Custom Axis Tags

As part of our ongoing process to monitor registrant compliance with the requirements to report their financial information in their eXtensible Business Reporting Language (XBRL) exhibits,1 staff in the SEC Division of Economic and Risk Analysis recently assessed certain aspects of the XBRL exhibits that affect the data quality of the disclosures provided. Specifically, the staff examined the use of custom axis tags in XBRL exhibits that reporting companies submitted with their annual reports on Form 10-K. An axis tag in XBRL allows a filer to divide reported elements into different dimensions (e.g., revenue by geographical area, fair value measurement levels, components of total equity (e.g., common, preferred)) while also showing the relationships between separately reported elements. Over 300 standard axis tags exist in the U.S. GAAP taxonomy, and the average annual XBRL exhibit uses about 20 axis tags. In general, the need to create a custom axis tag – one that is not in the standard taxonomy – should be infrequent. When companies create a custom axis tag when an appropriate standard axis tag already exists within the U.S. GAAP Taxonomy, data quality is diminished and comparability among and between reporting company filings is unnecessarily impaired.

The staff’s analysis resulted in a few key observations. First, unlike our previous staff observations that revealed a lower average rate of custom line item tags among large filers,2 staff observed a higher average use of custom axis tags as filer size increased, with the rate of custom axis tags highest for large accelerated filers. Second, for a random sample of filings that staff reviewed, staff observed instances of filers creating custom axis tags unnecessarily when an appropriate standard axis tag existed in the U.S. GAAP taxonomy.

Staff believes that the complexities of larger company financial disclosures may contribute to the higher rate of custom axis tags among the larger filers. Filers should carefully evaluate their need for custom axis tags and, where possible, eliminate their use. Because FASB updates the U.S. GAAP Taxonomy on an annual basis, filers should take the opportunity to re-evaluate their axis tags with each new release. FASB offers updated models and guidance for structuring dimensioned information using axes within the U.S. GAAP Taxonomy.3 Filers can reference those models and guidance in order to accurately represent their structured disclosures, and to help comply with the Commission’s rules.

I. BACKGROUND

In 2009, the Commission adopted regulations that require companies to file their financial statement disclosures with the Commission in the XBRL format.4 A filer is required to use an axis structure when the reported financial element requires it, such as when an element is reported with different segments or broken down into different classes, such as stock.5 In general, each axis represents a way that financial elements may be dimensioned (or classified). For example, an XBRL exhibit may include several revenue financial elements that could be reported along a business unit axis, a country axis, a product axis, or an axis with another relevant dimension. The current U.S. GAAP Taxonomy contains hundreds of standard axis tags from which filers may choose.

As with all custom tags, Commission rules only allow filers to create custom axis tags when the U.S. GAAP Taxonomy does not provide a choice that appropriately describes the filer’s particular reporting need.6 The use of custom axis tags can adversely impact the ability of investors and other market participants to compare and analyze financial statement data, particularly footnote disclosures which generally rely on axis tags to identify the reported information. In particular, when filers characterize like-dimensions differently by creating custom axis tags, automated information processing and large-scale statistical analysis across filings is unnecessarily inhibited. In contrast, when filers use standard axis tags, investors can more easily compare financial information over time at the same reporting company, and at the same point in time across different reporting companies.

II. STAFF OBSERVATIONS

Exhibits with Custom Axis Tags

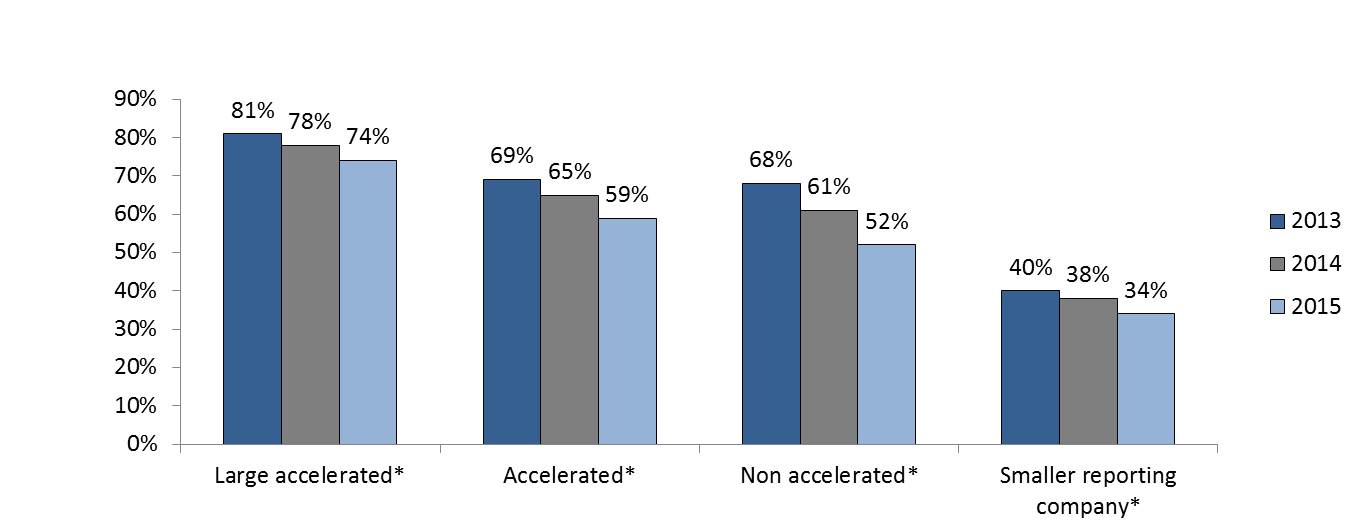

A large percentage of XBRL exhibits submitted with annual reports on Form 10-K from 2013 through 2015 contain one or more custom axis tags, particularly those submitted by large accelerated filers.7 Although the rate of filings with custom axis tags within the XBRL exhibits of annual reports on Form 10-K has been slowly declining since 2013, a trend that is consistent with the overall decline in the use of custom tags generally (as highlighted in previous staff observations), a large fraction (approximately 50%) of all filers continue to create one or more custom axis tags.8 XBRL exhibits of smaller reporting companies9 use custom axis tags less than half as often as compared to large accelerated filers (see figure below). A contributing factor may be that smaller reporting companies are more likely to have less complex financial disclosures that can be structured primarily using axis options provided by the U.S. GAAP Taxonomy. In looking only at XBRL exhibits submitted with annual reports on Form 10-K during 2015, the staff’s analysis revealed a correlation between a higher average rate of custom axis tags per filing and particular third-party providers.10 The 29 third-party providers identified in the XBRL exhibits had a mean custom axis tag rate of 5.9%, but 2 of the 29 had significantly higher custom axis tag rates of 21% and 31%.

Average % of filings with custom axis tags (XBRL exhibits submitted with annual reports on Form 10-K)

Note: Based on 2013 – 2015 XBRL exhibits to annual reports on Form 10-K (as of September 1, 2015).

* The staff identified “large accelerated filers,” “accelerated filers,” non-accelerated filers,” and “smaller reporting companies” based on their self-identifications on their Form 10-K. Verification of the accuracy of the self-identification is beyond the scope of this assessment.

Notable Examples of Custom Axis Tags Use

As part of the analysis, staff also reviewed a sample of custom axis tags.11 Within this random sample, staff noted instances of certain inappropriate practices:

- Creation of custom axis tag when appropriate standard axis tag already existed in the U.S. GAAP Taxonomy. Staff observed instances where filers created a custom axis tag when an appropriate standard axis tag existed. For example, there is already a standard axis for subcategories of “cash and cash equivalents.” It is inappropriate to create a custom axis tag for “only cash.”12

- Creation of custom axis tag for reuse when appropriate standard axis tag already existed in the U.S. GAAP Taxonomy. Some standard axis tags are provided with the intent to be reused no matter where and how many times in the exhibit they appear. For example, standard axis tags that provide for subcategories of minimum, maximum, weighted average, and average values already exist. It is inappropriate to create custom axis tags for those same purposes.13

- Creation of non-practical custom axis tags. Sometimes specific disclosures do not require an axis tag at all. For example, there are a number of different standard line items for each type of debt. It is inappropriate for a filer to create a custom “type of debt” axis to subcategorize generic “debt” line items when the standard line items should be used to capture that information.14

III. CONCLUSION

Commission staff hopes the information contained in this document will help inform filers and vendors as to the importance of reducing the rate of custom axis tag use and looking to each taxonomy release as an opportunity to reconsider custom axis tag use in light of updates in order to foster improved data quality. Staff intends to continue monitoring the use of custom axis tags as new exhibits are submitted. Depending on the results of this effort, Commission staff may issue further guidance or pursue other action. The staff welcomes your questions and comments. Please feel free to call us at (202) 551-5494, or email us at StructuredData@sec.gov.

[1] See Interactive Data to Improve Financial Reporting, Release No. 33-9002 (Jan. 30, 2009), 74 FR 6776 (Feb. 10, 2009).

[3] See e.g., http://www.fasb.org/jsp/FASB/Page/LandingPage&cid=1176164131053 and http://www.fasb.org/cs/ContentServer?c=Page&pagename=FASB%2FPage%2FSectionPage&cid=1176160665046.

[4] See supra note 1.

[5] See 17 CFR 232.405(a)(3) (requiring all XBRL exhibits to be submitted in accordance with the EDGAR Filer Manual); see also Items 6.6 and 6.8 of the EDGAR Filer Manual Volume II for requirements relating to axis tag use.

[6] See 17 CFR 232.405(c)(iii)(B) (“An electronic filer must create and use a new special element if and only if an appropriate tag does not exist in the standard list of tags for reasons other than or in addition to an inappropriate standard label.”); see also Item 6.8.20 of the EDGAR Filer Manual.

[7] The staff identified “large accelerated filers,” “accelerated filers,” non-accelerated filers,” and “smaller reporting companies” based on their self-identifications on their Form 10-K. Verification of the accuracy of the self-identification is beyond the scope of this assessment.

[8] On average an annual report uses a total of 20-25 axis tags.

[9] See supra note 7.

[10] Companies who rely on a third-party provider to create their XBRL exhibits are still responsible for their exhibits’ accuracy and compliance with the filing requirements.

[11] Our sample of custom axis tags was of approximately 100 custom axis tags that filers had created.

[12] See supra note 6.

[13] See id.

[14] See id.

Last Reviewed or Updated: March 29, 2016