Investing Smart from the Start: Five Questions to Ask Before You Invest

Whether you’re a first-time investor or have been investing for many years, there are some basic questions you should always ask before you commit your hard-earned money to an investment.

We see too many investors who might have avoided trouble and losses if they had asked questions from the start and verified the answers with information from independent sources.

When you consider your next investment opportunity, start with these five questions:

Question 1: Is the seller licensed?

Smart investors check out the background of anyone promoting an investment opportunity – even before learning about opportunity itself. Why? Research shows that con-artists are experts at the art of persuasion, often using a variety of influence tactics tailored to the vulnerabilities of their victims. Even a little information about your family, interests, or job can help a skilled con-artist swindle your money.

|

Examples of Common Persuasion Tactics

Source: FINRA Investor Education Foundation |

Fortunately, it’s easy to find information that can help you protect your investment dollars. Federal and state securities laws require investment professionals and their firms to be licensed or registered, and to make important information public. Be sure to ask anyone promoting an investment opportunity if he or she is licensed and then check out the answer with an independent source. Just one phone call or visit to a web site may save you from sending your money to a con artist, a bad financial professional, or disreputable firm.

For information about brokers, contact your state securities regulator and the Financial Industry Regulatory Authority (FINRA). In addition to licensing and registration information, both resources can help you determine if a firm or individual has a history of complaints from investors or problems with regulators. You can find contact information for your state securities regulator on the website of the North American Securities Administrators Association. To contact FINRA, visit FINRA's BrokerCheck website, or call them toll-free at (800) 289-9999.

For information about investment advisers, read their registration forms, called the “Form ADV.” You can view an adviser's most recent Form ADV online by visiting the SEC’s Investment Adviser Public Disclosure (IAPD) website. At present, the IAPD database contains Forms ADV only for investment adviser firms that register electronically using the Investment Adviser Registration Depository. You can also get copies of Form ADV for individual advisers and firms from the investment adviser, your state securities regulator, or the SEC, depending on the size of the adviser.

If you are not sure who to contact or have any questions regarding checking the background of an investment professional, call the SEC’s toll-free investor assistance line at (800) 732-0330.

Question 2: Is the investment registered?

Smart investors always check whether an investment is registered with the SEC by using the SEC’s EDGAR database or contacting the SEC’s toll-free investor assistance line at (800) 732-0330.

Any offer or sale of securities must be registered, or exempt from registration. Registration is important because it provides investors with access to key information about the company's management, products, services, and finances. Some exemptions from the registration requirement include private offerings to a limited number of persons or institutions, offerings of limited size, intrastate offerings, and securities of municipal, state, and federal governments.

The mere fact that a company registers or files reports with the SEC does not make the company a “good” investment or immune to fraud. Conversely, the fact that a company does not file reports with the SEC does not mean the company lacks legitimacy. The critical difference is that you assume more risk when you invest in a company about which little or no information is publicly available.

Far too often, the lack of reliable, readily available, current information opens the door to fraud. It's much easier for scam artists to spread false information and to manipulate a stock's price when accurate information about the company is scarce. All it takes for a fraudster to make a large profit is a handful of unwary investors who believed what they saw in spam emails, unsolicited faxes, web postings, newsletters, or questionable press releases.

If an investment is not registered with the SEC, find out if it is registered with your state securities regulator. If you can’t find any record that it is registered with the SEC or your state, or that it's exempt from registration, call or write your state's securities regulator or the SEC immediately with all the details. You may have come face to face with a scam.

Question 3: How do the risks compare with the potential rewards?

The potential for greater returns comes with greater risk. Understanding this crucial trade-off between risk and reward can help you separate legitimate opportunities from unlawful schemes.

Investments with greater risk may offer higher potential returns, but they may expose you to greater investment losses. Keep in mind every investment carries some degree of risk and no legitimate investment offers the best of both worlds.

Many investment frauds are pitched as high return opportunities with little or no risk. Ignore these opportunities or, better yet, report them to the SEC.

|

Examples of “Too Good To Be True” Investments In a recent enforcement action, the SEC alleged that an individual told investors that he would use a proven trading strategy to protect investors' principal and generate guaranteed returns of as much as 21 percent per year. In another case, the SEC alleged that three individuals and their companies conducted an investment scheme by selling unsecured notes and promising to double investors’ money every 90 days. |

If you’re not sure if an investment opportunity is “too good to be true,” consider these rules of thumb:

- Low risk generally means low yield. If you are offered a “no risk” investment opportunity, compare its potential return with a financial choice that is truly guaranteed, such as a federally insured savings account. If the potential return of the investment opportunity is significantly higher, it could be fraudulent or contain risks you haven’t considered.

- High yields typically involve high risk. The stock market, which has produced large investment gains as well as huge losses from year to year, has provided an average annual return of approximately ten percent since the Great Depression. Any investment opportunity that claims you’ll get substantially more could be highly risky.

- Promises of consistent double-digit returns are consistently frauds. Investments seeking high returns tend to be volatile. For example, it’s actually quite rare for the stock market to return its historical ten-percent average in any given year; larger gains or losses are more common.

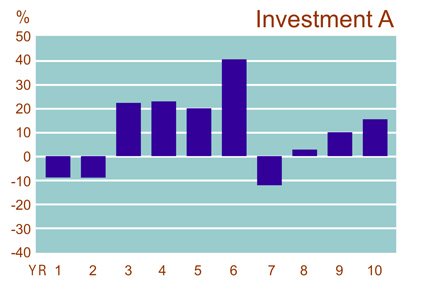

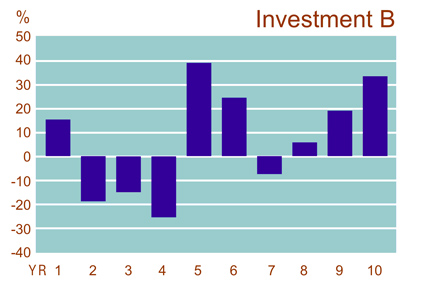

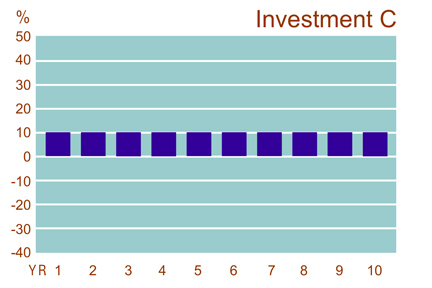

Test Your Knowledge:

Look at the annual returns of three hypothetical investments below. Which investment is likely a scam?

Answer: Investment C

Question 4: Do you understand the investment?

Many successful investors follow this rule of thumb: Never invest in something you don’t understand. Sometimes, even the simplest sounding products or investment opportunities can be pretty complex. Always read an investment’s prospectus or disclosure statement carefully. If you can’t understand the investment and how it will help you make money, ask a trusted financial professional for help. If you are still confused, you should think twice about investing.

Question 5: Where Can I Turn for Help?

Whether checking out an investment professional, researching an investment, or learning about new products or scams, unbiased information can be a great advantage when it comes to investing wisely. Make it a habit of using the information and tools on securities regulators’ websites. If you have a question or concern about an investment, please contact the SEC, FINRA, or your state securities regulator for help.

U.S. Securities and Exchange Commission

Office of Investor Education and Advocacy

100 F Street, NE

Washington, D.C. 20549-0213

Telephone: (800) 732-0330

Fax: (202) 772-9295

Web: www.sec.gov/investor

www.investor.gov

Online complaint form: www.sec.gov/complaint.shtml

Financial Industry Regulatory Authority (FINRA)

FINRA Complaints and Tips

9509 Key West Avenue

Rockville, MD 20850

Telephone: (301) 590-6500

Fax: (866) 397-3290

Web: www.finra.org/investor

Online complaint form: www.finra.org/complaint

North American Securities Administrators Association

750 First Street N.E. Suite 1140

Washington, D.C. 20002

Telephone: (202) 737-0900

Fax: (202) 783-3571

Web: www.nasaa.org

Last Reviewed or Updated: Dec. 14, 2009