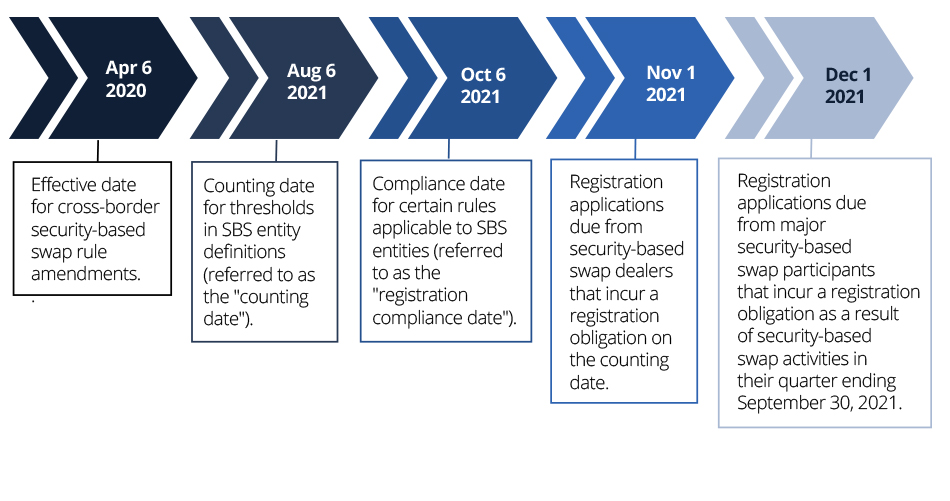

Key Dates for Registration of Security-Based Swap Dealers and Major Security-Based Swap Participants

This guidance represents the views of the staff of the Division of Trading and Markets. It is not a rule, regulation, or statement of the Securities and Exchange Commission (“Commission”). The Commission has neither approved nor disapproved its content. This guidance, like all staff guidance, has no legal force or effect: it does not alter or amend applicable law, and it creates no new or additional obligations for any person.

Frequently Asked Questions

When should market participants begin to assess whether they meet the relevant thresholds to register as a security-based swap dealer or major security-based swap participant?

August 6, 2021.

Sections 3(a)(71) and 3(a)(67) of the Securities Exchange Act of 1934 (the “Exchange Act”) define, respectively, the terms “security-based swap dealer” and “major security-based swap participant.” These statutory provisions, in turn, require the Commission to define certain thresholds used in the definitions. [1] The Commission adopted Exchange Act Rules 3a71-1 through 3a71-5 and 3a67-1 through 3a67-10 to define those thresholds, but noted that market participants need not register as a security-based swap dealer or major security-based swap participant (each, an “SBS Entity”) or comply with rules applicable to SBS Entities until the dates provided in the rules for registration of SBS Entities. [2] In the release accompanying those registration rules, the Commission determined that market participants are not required to assess whether their activities meet or exceed these thresholds until the “counting date.” [3] This counting date occurs two months prior to the “registration compliance date.” [4] The Commission has set the registration compliance date as 18 months after the effective date of rules adopted in Release No. 34-87780. [5] Because the effective date of those rules is April 6, 2020, the counting date is August 6, 2021.

When should market participants that meet the definition of “security-based swap dealer” as of August 6, 2021, register with the Commission?

No later than November 1, 2021.

Only security-based swap positions connected with dealing activity engaged in on or after August 6, 2021, will count toward determining a person’s status as a security-based swap dealer. [6] As a result, before August 6, 2021, all market participants satisfy the de minimis exception to the definition of “security-based swap dealer” in Exchange Act Rule 3a71-2(a) and thus are deemed not to be security-based swap dealers. Beginning on August 6, 2021, market participants should assess whether they meet the definition of “security-based swap dealer,” including whether they are able to continue to satisfy the de minimis exception after counting security-based swap dealing activity engaged in on or after that date. This de minimis exception requires that the aggregate gross notional amount of certain security-based swap positions connected with security-based swap dealing activity engaged in over a defined period fall below certain thresholds. [7]

When a person becomes no longer able to satisfy the de minimis exception, and otherwise meets the requirements of the definition of “security-based swap dealer,” a transitional period applies before the person is deemed to be a security-based swap dealer and is required to comply with rules applicable to security-based swap dealers and to register with the Commission. [8] This transitional period runs until two months after the end of the month in which the person becomes no longer able to take advantage of the exception (or, if earlier, the date on which the person submits a complete application for registration to the Commission). Accordingly, a person that is no longer able to satisfy the de minimis exception as of August 6, 2021, and that otherwise meets the definition of “security-based swap dealer” on that date, will be deemed not to be a security-based swap dealer, and therefore will not be subject to the registration and other requirements of Section 15F of the Exchange Act, until November 1, 2021 (or, if earlier, the date on which the person submits a complete application for registration to the Commission). Such a person should submit a complete application to register as a security-based swap dealer with the Commission no later than November 1, 2021.

When should a market participant that meets the definition of “major security-based swap participant” as a result of its security-based swap activities in its quarter ending September 30, 2021, register with the Commission?

No later than December 1, 2021.

Only security-based swap positions held on or after August 6, 2021, will count towards determining a person’s status as a major security-based swap participant. [9] As a result, no market participant will meet the definition of “major security-based swap participant” before that date. Market participants should count security-based swap positions held on or after August 6, 2021, when assessing whether they meet the definition of “major security-based swap participant.”

When a person meets the requirements of the definition of “major security-based swap participant” as a result of its security-based swap activities in a quarter, a transitional period applies before the person is deemed to be a major security-based swap participant and is required to comply with rules applicable to major security-based swap participants and to register with the Commission. [10] This transitional period runs until two months after the end of the quarter in which the person’s security-based swap activities cause the person to meet the definition of “major security-based swap participant” (or, if earlier, the date on which the person submits a complete application for registration to the Commission). Accordingly, a person whose security-based swap activities in its quarter ending September 30, 2021, counting only security-based swap activities from August 6, 2021, to September 30, 2021, cause the person to meet the definition of “major security-based swap participant” will be deemed not to be a major security-based swap participant, and therefore will not be subject to the registration and other requirements of Section 15F of the Exchange Act, until December 1, 2021 (or, if earlier, the date on which the person submits a complete application for registration to the Commission). Such a person should submit a complete application to register as a major security-based swap participant with the Commission no later than December 1, 2021 (or, alternatively, register with the Commission as a security-based swap dealer, which will cause the person not to meet the definition of “major security-based swap participant” [11]).

When is the registration compliance date, and what is the significance of this date?

The registration compliance date is October 6, 2021, and marks the earliest compliance date for several rules applicable to SBS Entities.

The Commission has set the registration compliance date to occur 18 months after the effective date of rules adopted in Release No. 34-87780. [12] Accordingly, because the effective date of those rules is April 6, 2020, the registration compliance date is October 6, 2021. The registration compliance date is set to occur two months after the counting date, which is August 6, 2021. [13]

The registration compliance date is the compliance date for several rules applicable to SBS Entities. [14] These rules include (1) SBS Entity segregation requirements and nonbank SBS Entity capital and margin requirements; [15] (2) SBS Entity recordkeeping and reporting requirements; [16] (3) SBS Entity business conduct standards; [17] (4) SBS Entity trade acknowledgment and verification requirements; [18] and (5) SBS Entity risk mitigation requirements. [19] As noted above, when a person meets the definition of “security-based swap dealer” or “major security-based swap participant,” a transitional period applies before the person is deemed to be an SBS Entity and required to comply with rules applicable to SBS Entities. [20] This transitional period ends on the earlier of a defined date after the person meets the definition of “security-based swap dealer” or “major security-based swap participant” or the date that the person submits a complete application for registration to the Commission. For persons that meet the definition of “security-based swap dealer” on the counting date of August 6, 2021, this transition period will elapse no later than November 1, 2021. For persons whose security-based swap activities in the quarter ending September 30, 2021, counting only security-based swap activities from August 6, 2021, to September 30, 2021, cause them to meet the definition of “major security-based swap participant,” this transition period will elapse no later than December 1, 2021. Also as noted above, market participants should submit a complete application to register with the Commission as a security-based swap dealer or major security-based swap participant, as applicable, on or before the end of their transition period.

For purposes of Exchange Act Rule 3a71-3(b)(1)(iii)(A) and (b)(2)(iii), when should market participants count transactions entered into between a non-U.S. person and a foreign branch of a U.S. person not registered as a security-based swap dealer?

For this limited purpose, market participants should count transactions entered into on or after December 31, 2021, between a non-U.S. person and a foreign branch of a U.S. person not registered as a security-based swap dealer.

As noted above, the counting date is August 6, 2021. However, some market participants temporarily may delay counting a limited type of security-based swap positions against the de minimis thresholds in the definition of “security-based swap dealer.” Exchange Act Rule 3a71-3(b)(1)(iii) outlines the security-based swap positions that a non-U.S. person other than a conduit affiliate must count against these thresholds. A non-U.S. person that is not a conduit affiliate generally must count against the thresholds security-based swap positions connected with dealing activity in which the person engages that are entered into with a U.S. person. [21] Similarly, Exchange Act Rule 3a71-3(b)(2)(iii) generally requires any U.S. or non-U.S. person that engages in its own security-based swap dealing transactions also to count against the de minimis thresholds security-based swap transactions connected with dealing activity in which a non-U.S. person affiliate (other than a conduit affiliate) engages that are entered into with a U.S. person. [22] However, these requirements do not apply to qualified transactions conducted through a foreign branch of a U.S. person counterparty that is registered as a security-based swap dealer. [23] The requirements also do not apply to qualified transactions conducted through a foreign branch of a U.S. person counterparty, whether or not registered as a security-based swap dealer, when the transaction is entered into prior to 60 days following “the earliest date on which the registration of security-based swap dealers is first required.” [24] When the Commission adopted these requirements, it explained that this 60-day delay “will help to avoid requiring non-U.S. persons to speculate whether their counterparties would register [as security-based swap dealers], and to face the consequences of their speculation being wrong." [25]

The compliance date for the Commission’s registration rules for SBS Entities is the registration compliance date, [26] which as explained above is October 6, 2021. Because compliance with these registration rules is not required before that date, October 6, 2021 is the earliest date on which registration of security-based swap dealers is first required. However, some market participants may expect that “the earliest date on which the registration of security-based swap dealers is first required” would be November 1, 2021, which is the latest date by which a person that meets the definition of “security-based swap dealer” as of August 6, 2021, should register with the Commission. Accordingly, in the staff’s view, market participants should count, for purposes of Exchange Act Rule 3a71-3(b)(1)(iii)(A) and (b)(2)(iii), transactions entered into on or after December 31, 2021 (i.e., 60 days after November 1, 2021), between a non-U.S. person and a foreign branch of a U.S. person not registered as a security-based swap dealer.

[1] See Section 761(a)(6) of the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”), 15 U.S.C. §§ 78c(a)(67), (71) (definitions of the terms “security-based swap dealer” and “major security-based swap participant,” each of which requires the Commission to define certain thresholds used in the definitions).

[2] See Further Definition of “Swap Dealer,” “Security-Based Swap Dealer,” “Major Swap Participant,” “Major Security-Based Swap Participant” and “Eligible Contract Participant,” Release No. 34-66868 (Apr. 27, 2012), 77 FR 30596, 30700 (May 23, 2012) (“[P]ersons determined to be [SBS Entities] . . . need not register as such until the dates provided in the SEC’s final rules regarding [SBS Entity] registration requirements, and will not be subject to the requirements applicable to [SBS Entities] until the dates provided in the applicable final rules.”); see also Application of “Security-Based Swap Dealer” and “Major Security-Based Swap Participant” Definitions to Cross-Border Security-Based Swap Activities, Release No. 34-72472 (June 25, 2014), 79 FR 47278, 47368 (Aug. 12, 2014) (“Cross-Border Entity Definitions Adopting Release”).

[3] See Registration Process for Security-Based Swap Dealers and Major Security-Based Swap Participants, Release No. 34-75611 (Aug. 5, 2015), 80 FR 48964, 48988 (Aug. 14, 2015) (“SBS Entity Registration Adopting Release”) (“[F]or purposes of complying with the registration and other requirements [applicable to security-based swap dealers and major security-based swap participants], persons are not required to begin calculating whether their activities meet or exceed the thresholds established in Exchange Act Rules 3a71-2, 3a67-3, and 3a67-5 until two months prior to the [r]egistration [c]ompliance [d]ate.”); see also Security-Based Swap Transactions Connection with a Non-U.S. Person’s Dealing Activity That Are Arranged, Negotiated, or Executed by Personnel Located in a U.S. Branch or Office or in a U.S. Branch or Office of an Agent; Security-Based Swap Dealer De Minimis Exception, Exchange Act Release No. 77104 (Feb. 10, 2016), 81 FR 8598, 8636 (Feb. 19, 2016).

[4] See SBS Entity Registration Adopting Release, 80 FR at 48988.

[5] See Cross-Border Application of Certain Security-Based Swap Requirements, Release No. 34-87780 (Dec. 18, 2019), 85 FR 6270, 6345-46 (Feb. 4, 2020) (“Cross-Border SBS Amendments Adopting Release”).

[6] See SBS Entity Registration Adopting Release, 80 FR at 48988-89.

[7] See Exchange Act Rule 3a71-2(a), 17 C.F.R. § 240.3a71-2(a).

[8] See Exchange Act Rule 3a71-2(b), 17 C.F.R. § 240.3a71-2(b) (a person no longer able to satisfy the de minimis exception receives a transitional period before the person is deemed to be a security-based swap dealer); Section 15F of the Exchange Act, 15 U.S.C. § 78o-10(a)(1) (persons who act as a security-based swap dealer must register as such with the Commission).

[9] See SBS Entity Registration Adopting Release, 80 FR at 48988-89.

[10] See Exchange Act Rule 3a67-8(a), 17 C.F.R. § 240.3a67-8(a) (a person that meets the definition of “major security-based swap participant” receives a transitional period before the person is deemed to be a security-based swap dealer); Section 15F of the Exchange Act, 15 U.S.C. § 78o-10(a)(2) (persons who act as a major security-based swap participant must register as such with the Commission).

[11] See Exchange Act Rule 3a67-1(a)(1), 17 C.F.R. § 240.3a67-1(a)(1) (definition of “major security-based swap participant” requires that the person is not a security-based swap dealer); Exchange Act Rule 3a71-3(b), 17 C.F.R. § 240.3a71-3(b) (for a person that meets the definition of “security-based swap dealer,” submitting a complete application for registration with the Commission as a security-based swap dealer ends the transition period during which the person is deemed not to be a security-based swap dealer); Exchange Act Rule 3a71-3(e), 17 C.F.R. § 240.3a71-3(e) (for a person that does not meet the definition of “security-based swap dealer,” voluntary registration with the Commission as a security-based swap dealer causes the person to be deemed to be a security-based swap dealer).

[12] See Cross-Border SBS Amendments Adopting Release, 85 FR at 6345-46.

[13] See SBS Entity Registration Adopting Release, 80 FR at 48988.

[14] See Cross-Border SBS Amendments Adopting Release, 85 FR at 6345-46.

[15] See Capital, Margin, and Segregation Requirements for Security-Based Swap Dealers and Major Security-Based Swap Participants and Capital and Segregation Requirements for Broker-Dealers, Release No. 34-86175 (June 21, 2019), 84 FR 43872, 43954 (Aug. 22, 2019).

[16] See Recordkeeping and Reporting Requirements for Security-Based Swap Dealers, Major Security-Based Swap Participants, and Broker-Dealers, Release No. 34-87005 (Sep. 19, 2019), 84 FR 68550, 68600-01 (Dec. 16, 2019); Cross-Border SBS Amendments Adopting Release, 85 FR at 6346.

[17] See Business Conduct Standards for Security-Based Swap Dealers and Major Security-Based Swap Participants, Release No. 34-77617 (Apr. 14, 2016), 81 FR 29960, 30081-82 (May 13, 2016).

[18] See Trade Acknowledgment and Verification of Security-Based Swap Transactions, Release No. 34-78011 (June 8, 2016), 81 FR 39808, 39828-29 (June 17, 2016).

[19] See Risk Mitigation Techniques for Uncleared Security-Based Swaps, Release No. 34-87782 (Dec. 18, 2019), 85 FR 6359, 6381 (Feb. 4, 2020).

[20] See Exchange Act Rule 3a71-2(b), 17 C.F.R. § 240.3a71-2(b); Exchange Act Rule 3a67-8(a), 17 C.F.R. § 240.3a67-8(a).

[21] See Exchange Act Rule 3a71-3(b)(1)(iii)(A), 17 C.F.R. § 240.3a71-3(b)(1)(iii)(A).

[22] See Exchange Act Rule 3a71-3(b)(2)(iii), 17 C.F.R. § 240.3a71-3(b)(2)(iii).

[23] See Exchange Act Rule 3a71-3(b)(1)(iii)(A)(1), 17 C.F.R. § 240.3a71-3(b)(1)(iii)(A)(1).

[24] See Exchange Act Rule 3a71-3(b)(1)(iii)(A)(2), 17 C.F.R. § 240.3a71-3(b)(1)(iii)(A)(2).

[25] See Cross-Border Entity Definitions Adopting Release, 79 FR at 47321 n.368.

[26] See SBS Entity Registration Adopting Release, 80 FR at 48988.

Last Reviewed or Updated: Sept. 9, 2024