Odd Lot Rates

DATA HIGHLIGHT 2013-03

October 9, 2013

Data Downloads

Market Activity Overview Metrics Oct. 2012 - June 2013 (csv, 33 kb)

U.S. Stocks Odd Lot Rate by Decile Oct. 2012 - June 2013 (csv, 91 kb)

Methodology

Learn how the SEC constructs trade-to-order ratios and other metrics.

Analysis

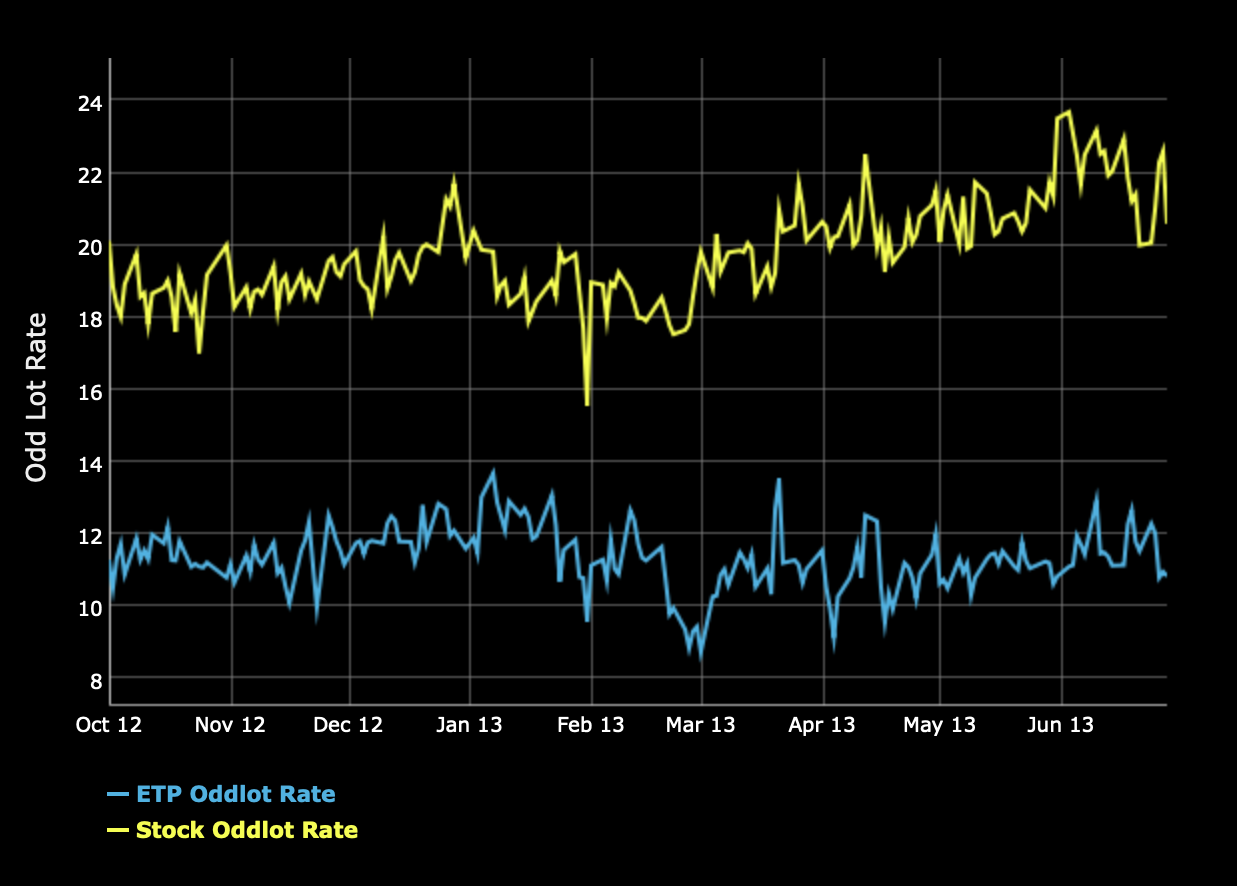

This chart introduces a data series that measures the percentage of exchange-based trades that are smaller than one round lot (100 shares for nearly all equities). At present, data is sufficiently detailed for 12 of 13 equity exchange feeds to compute this metric. For each of these exchanges we only include trades that are executed during the continuous market (i.e. volume resulting from the opening and closing crosses are excluded).

The chart above separately plots the odd lot rates for corporate stocks (stocks – upper line) and exchange-trade products (ETPs – lower line) over three calendar quarters ending June 30, 2013.

What the Chart Reveals

The data show that a significant fraction of trades are executed in odd lot sizes. The odd lot rate for stocks is typically between 18% and 24%, with an average of 19.1% in Q4 2012, 19.1% in Q1 2013 and 21.1% in Q2 2013. The odd lot rate for ETPs is lower than for stocks, averaging 11.5% in Q4 2012, 11.3% in Q1 2013 and 11.2% in Q2 2013.

Odd lot trades can be the result of numerous factors. Since trade records reflect both the size of the marketable order and the size of the individual resting order with which the marketable order interacts, an odd lot trade can be the result of a small-size marketable order or a large-size marketable order that is filled by multiple small-sized resting orders.

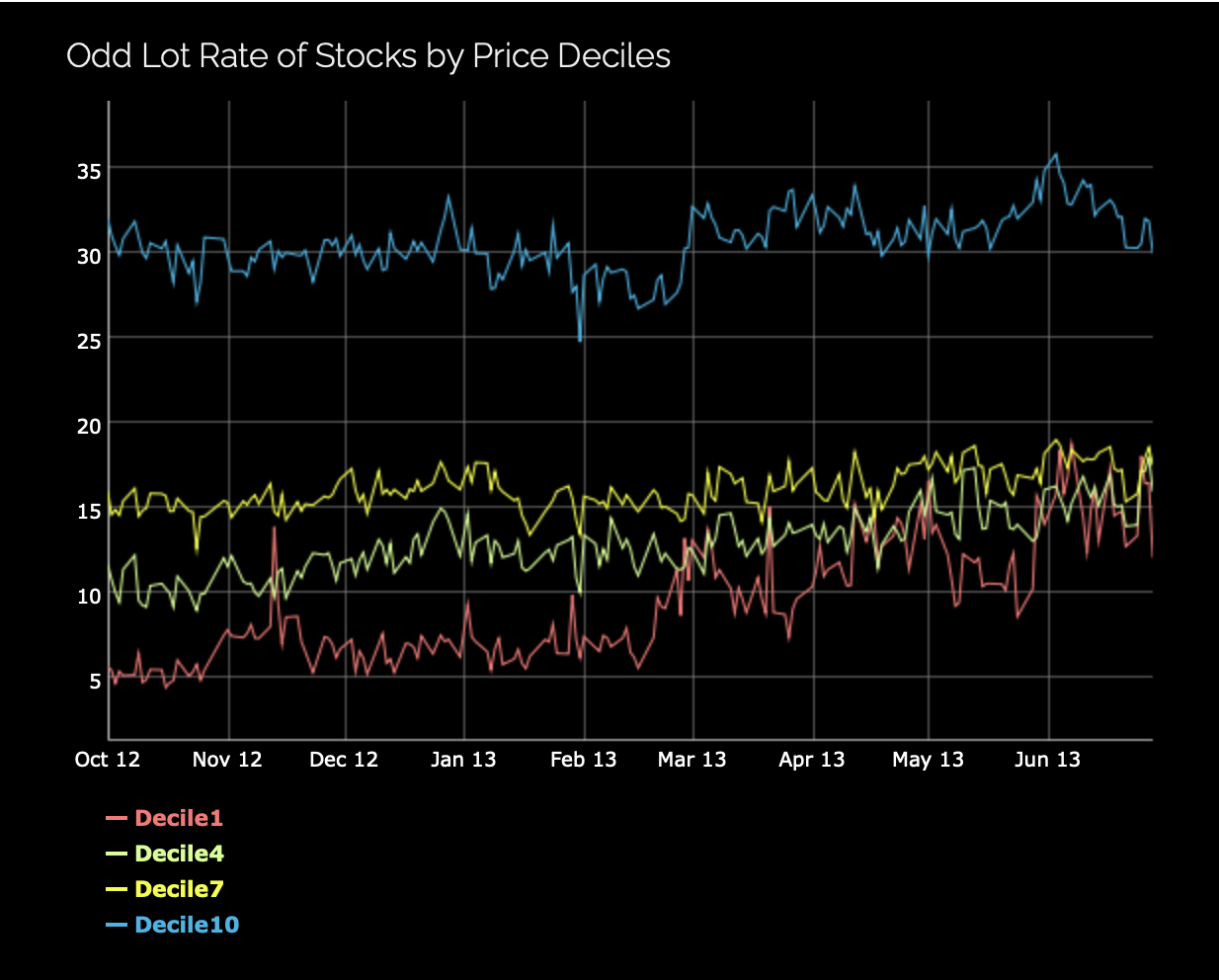

The chart below explores the relationship between odd lot rates and market prices for stocks by partitioning the data according to price decile. There are approximately 3700 stocks in a typical daily sample.

As shown, the odd lot rate for the highest priced stocks is typically much larger than for the remaining lower priced deciles of stocks. This result might be expected since high priced stocks require a larger sum of money to execute one round lot. Less expected is the observed rise in odd lot usage in the smallest stocks from 5% in October 2012 to over 15% at the end of June 2013.

Why This is of Interest

Odd lot trades are currently not reported to the consolidated tape, though they are reported on individual exchange feeds. However, a sizable fraction of market participants do not subscribe to the individual exchange feeds and rely upon the tape for post-trade transparency. The odd lot rate is one measure of the extent to which potential price-discovery transactions are not known to these market participants.

Apart from the apparent relationship between odd lot rates and price, the data does not reveal the reason why liquidity-takers may choose to execute an odd lot trade, or why liquidity-providers may choose to post limit orders for less than one round lot. Among the many reasons it is possible that certain participants choose to execute in odd lot sizes because these trades are not reported to the consolidated public tape (though as mentioned above, these trades are generally reported on the individual exchange feeds). If this reporting practice is the reason for at least some odd lot trades, then any changes in odd lot reporting might lead to observable changes in odd lot rates.

Related Data Series

The odd lot ratio data series is similar to the odd lot rate data series except it uses share volume. Since odd lot trades are, by definition, small volume trades, the volume based odd lot ratio is smaller than the count based odd lot rate. Users can plot both of these data series on the Data Visualizations page and download daily stock-by-stock data from the Data Download page (currently released on a quarterly basis).

This analysis was prepared by the Staff of the U.S. Securities and Exchange Commission. The Commission has expressed no view regarding such analysis or any statement contained therein.

Last Reviewed or Updated: Aug. 16, 2022