MIDAS: Market Information Data Analytics System

What is MIDAS?

MIDAS is the SEC’s implementation of a new system that combines advanced technologies with empirical data to promote better understanding of markets.

Most investors are familiar with the ticker that crawls across TV screens on business channels. It’s based on the consolidated tape that generally includes every trade of 100 shares or more in listed equities, such as corporate stocks and exchange-traded products.

But the consolidated tape does not provide a complete picture. First, for all but a few equities, trades of less than 100 shares are not currently reported. Second, though the tape does provide data on the price and size of the best bid and best offer for each stock on each exchange, it does not provide information on orders placed below the best bid or above the best offer.

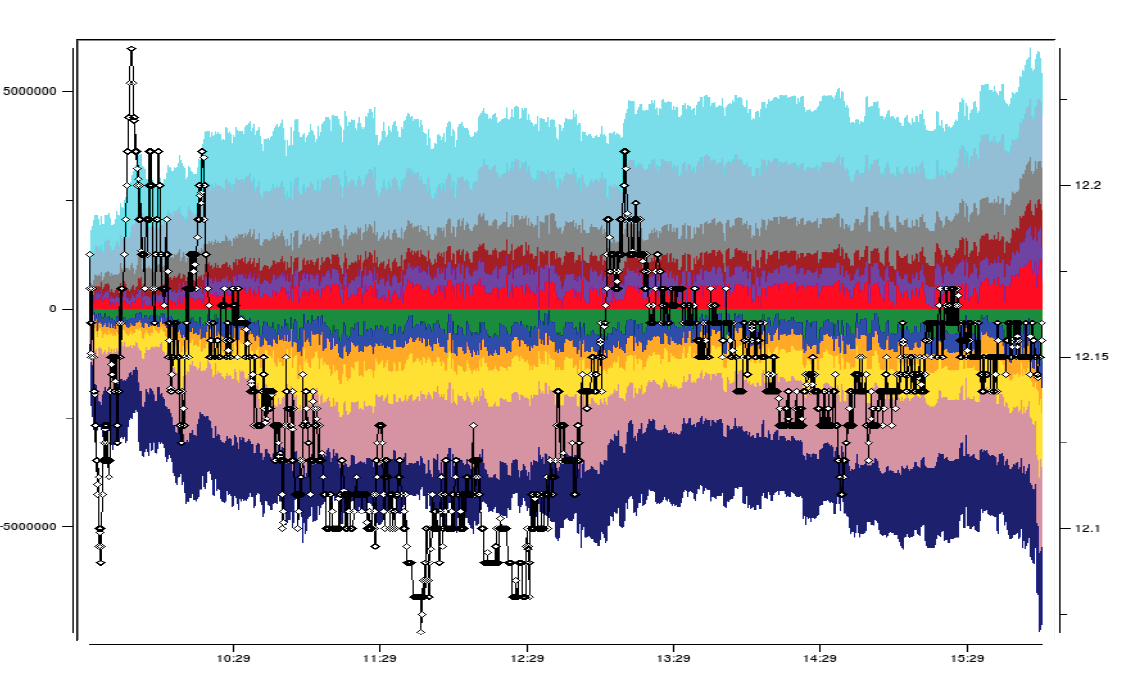

As an example, the chart below graphs the order book for a typical large cap stock in 10-second snapshots over the course of an entire trading day. Each band represents the total number of shares bid (below the center line) and offered (above the center line) at different price levels. The two bands nearest to center line represent size at the best bid and offer. As shown however, this is just a small portion of the total number of shares bid or offered at prices above the best offer or below the best bid.

MIDAS can be used to quickly reconstruct order books for a specific time period.

MIDAS Data

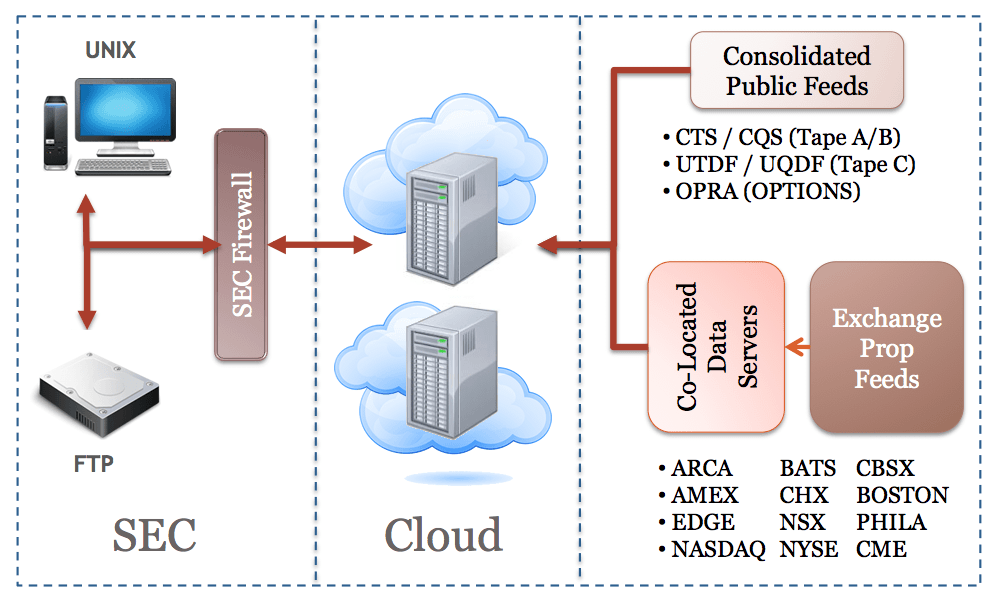

To view and analyze the complete order books of individual equities, MIDAS collects and processes data from the consolidated tapes as well as from the separate proprietary feeds made individually available by each equity exchange. These individual exchange feeds are typically used by only the most sophisticated of market participants such as market makers and high-frequency traders. Most institutional investors, retail investors, and academics, generally do not consume this data – it is extremely voluminous, challenging to process correctly, and requires specialized data expertise.

Every day MIDAS collects about 1 billion records from the proprietary feeds of each of the 13 national equity exchanges time-stamped to the microsecond. MIDAS allows us to readily perform analyses of thousands of stocks and over periods of six months or even a year, involving 100 billion records at a time.

Specifically, MIDAS collects:

- Posted orders and quotes on national exchanges

- Modifications/cancellations of those orders

- Trade executions against those orders

- Off-exchange trade executions

In addition to data on listed stocks and exchange-trade products, MIDAS also collects and processes data on equity options and futures contracts.

MIDAS leverages the cloud to provide a robust platform for analyses of market data.

MIDAS has many applications at the SEC. It can help us monitor and understand mini-flash crashes, reconstruct market events, and develop a better understanding of long-term trends.

But more importantly, it will provide dramatically better insight into the functioning of a market that moves many millions of dollars in thousandths of a second.

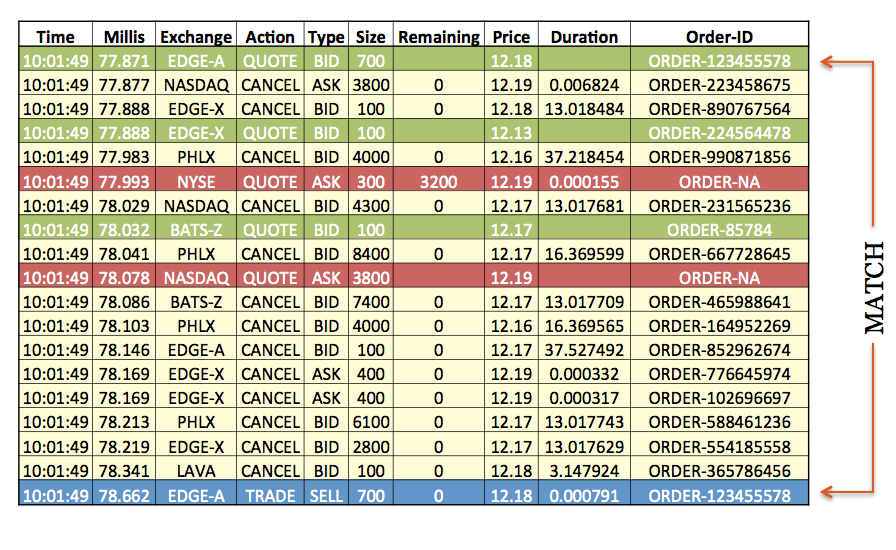

This chart represents one millisecond of activity for a corporate stock.

MIDAS Milestones

The history of MIDAS began with the need to more efficiently collect and analyze order book data for equities and futures.

- Summer 2010: Flash Crash analyses of equity order books

- October 2010: Issued Request for Information (RFI)

- November 2011: Issued Request for Proposal (RFP)

- June 2012: Vendor contract awarded

- January 2013: Rollout MIDAS to staff at SEC

Methodology

Learn how the SEC uses MIDAS data to construct trade-to-order ratios, quote lifetime distributions, and other metrics.

Last Reviewed or Updated: June 28, 2024