U.S. GAAP – XBRL Custom Tags Trend for 2021 - 2023

The staff in the Commission's Division of Economic and Risk Analysis (DERA) recently analyzed custom tags used in eXtensible Business Reporting Language (XBRL) filings submitted by issuers to comply with the 2009 Interactive Data rules requiring financial statement information to be reported in XBRL.[1] Our analysis covered XBRL exhibits submitted in Forms 10-K and 10-K/A using U.S. Generally Accepted Accounting Principles (GAAP) for fiscal years 2021 through 2023.[2] The analysis looked at trends in filers' use of custom tags [3] in their XBRL submissions during the last three years.

The Commission's rules allow filers to create custom tags when the standard taxonomy does not provide an appropriate element to tag the data. While this customization accommodates unique circumstances in a filer's particular disclosure, the Commission has acknowledged that the use of custom tags could potentially reduce the comparability of inter-company data.[4] Thus, the Commission's rules specify the limited circumstances under which a filer may create custom tags.[5]

I. TREND ANALYSIS

The analysis for Forms 10-K and 10-K/A shows a decrease in average custom tag rate for filings in 2023 compared to 2022 across all filer status except the accelerated filer category, for which the rate remains flat.

* DERA staff classified “large accelerated filers,” “accelerated filers,” “non-accelerated filers,” and “smaller reporting companies” based on the filers’ self-identification in XBRL data of their Forms 10-K and 10-K/A. Filers that self-identified as a smaller reporting company and also reported a separate filer status (i.e., large accelerated filer, accelerated filer, or non-accelerated filer status) were included in both categories.

II. CONCLUSION

DERA staff intends to continue reviewing filers’ use of XBRL custom tags in their submissions to the Commission. Depending on the results of those efforts, DERA staff may share additional trends, issue guidance, or pursue other actions.

For the staff observations DERA staff published on custom tag rates in 2014, see http://www.sec.gov/dera/reportspubs/assessment-custom-tag-rates-xbrl.html. For the staff’s previous trend analyses on custom tags, see the Trends section on this page, https://www.sec.gov/structureddata/osdstaffobsandguide. DERA staff welcomes your questions and comments. Please feel free to call us at (202) 551-5494 or email us at StructuredData@sec.gov.

[1] Release No. 33-9002 (Jan. 30, 2009), 74 FR 6776 (Feb. 10, 2009).

[2] Our analysis includes custom tags of line item tags and excludes tags that are abstract, member, domain, and related to the document and entity. For definitions of abstract, member, and domain, see XBRL glossary. Document and entity tags are largely related to identification of filings and filers including, for example, form type, company name, filer size, and public float.

[3] 17 CFR 232.405(c)(1)(iii).

[4] See n. 1 at 104-05.

[5] See 17 CFR 232.405(c)(1)(iii)(B) (“An electronic filer must create and use a new special element if and only if an appropriate tag does not exist in the standard list of tags for reasons other than or in addition to an inappropriate standard label.”).

Past Trends

2022

Trend Analysis on Custom Tag Rates in XBRL Exhibits Submitted from 2020 to 2022

The staff in the Commission's Division of Economic and Risk Analysis (DERA) recently analyzed custom tags used in eXtensible Business Reporting Language (XBRL) filings submitted by issuers to comply with the 2009 Interactive Data rules requiring financial statement information to be reported in XBRL.[1] Our analysis covered XBRL exhibits submitted in Forms 10-K and 10-K/A using U.S. Generally Accepted Accounting Principles (GAAP) for fiscal years 2020 through 2022.[2] The analysis looked at trends in filers' use of custom tags [3] in their XBRL submissions during the last three years.

The Commission's rules allow filers to create custom tags when the standard taxonomy does not provide an appropriate element to tag the data. While this customization accommodates unique circumstances in a filer's particular disclosure, the Commission has acknowledged that the use of custom tags could potentially reduce the comparability of inter-company data.[4] Thus, the Commission's rules specify the limited circumstances under which a filer may create custom tags.[5]

I. TREND ANALYSIS

The analysis for Forms 10-K and 10-K/A shows a consistent average custom tag rate for filings in 2022 compared to 2021 across each filer status.

* DERA staff classified “large accelerated filers,” “accelerated filers,” “non-accelerated filers,” and “smaller reporting companies” based on the filers' self-identification in XBRL data of their Forms 10-K and 10-K/A. Filers that self-identified as a smaller reporting company and also reported a separate filer status (i.e., large accelerated filer, accelerated filer, or non-accelerated filer status) were included in both categories.

II. CONCLUSION

DERA staff intends to continue reviewing filers' use of XBRL custom tags in their submissions to the Commission. Depending on the results of those efforts, DERA staff may share additional trends, issue guidance, or pursue other actions.

The staff observations DERA staff published the custom tag rates in 2014. Rates. For the staff's previous trend analyses on custom tags, see the Trends section. DERA staff welcomes your questions and comments. Please feel free to call us at (202) 551-5494 or email us at StructuredData@sec.gov.

[1] Release No. 33-9002 (Jan. 30, 2009), 74 FR 6776 (Feb. 10, 2009).

[2] Our analysis includes custom tags of line item tags and excludes tags that are abstract, member, domain, and related to the document and entity. For definitions of abstract, member, and domain, see XBRL glossary. Document and entity tags are largely related to identification of filings and filers including, for example, form type, company name, filer size, and public float.

[3] 17 CFR 232.405(c)(1)(iii).

[4] See n. 1 at 104-05.

[5] See 17 CFR 232.405(c)(1)(iii)(B) (“An electronic filer must create and use a new special element if and only if an appropriate tag does not exist in the standard list of tags for reasons other than or in addition to an inappropriate standard label.”).

2021

Trend Analysis on Custom Tag Rates in XBRL Exhibits Submitted from 2019 to 2021

The staff in the Commission’s Division of Economic and Risk Analysis (DERA) recently analyzed custom tags used in eXtensible Business Reporting Language (XBRL) filings submitted by issuers to comply with the 2009 Interactive Data rules requiring financial statement information to be reported in XBRL.[1] Our analysis covered XBRL exhibits submitted in Forms 10-K and 10-K/A using U.S. Generally Accepted Accounting Principles (GAAP) for fiscal years 2019 through 2021.[2] The analysis looked at trends in filers’ use of custom tags[3] in their XBRL submissions during the last three years.

The Commission’s rules allow filers to create custom tags when the standard taxonomy does not provide an appropriate element to tag the data. While this customization accommodates unique circumstances in a filer’s particular disclosure, the Commission has acknowledged that the use of custom tags could potentially reduce the comparability of inter-company data.[4] Thus, the Commission’s rules specify the limited circumstances under which a filer may create custom tags.[5]

I. TREND ANALYSIS

The analysis for Forms 10-K and 10-K/A shows a decrease in the average custom tag rate for filers across each status in 2021 compared to 2020, with the exception of smaller reporting companies. Smaller reporting companies have seen steady increases in the average custom tag rate since 2019.

* DERA staff classified “large accelerated filers,” “accelerated filers,” “non-accelerated filers,” and “smaller reporting companies” based on the filers’ self-identification in XBRL data of their Forms 10-K and 10-K/A. The Commission adopted amendments to the definition of “smaller reporting company” on June 10, 2018 with a rule effective date of September 10, 2018.[6] As part of these amendments, the Commission removed the parenthetical next to the “non-accelerated filer” definition in these forms that states “(Do not check if a smaller reporting company)” and directed filers to “check all applicable boxes on the cover page addressing, among other things, non-accelerated, accelerated, and large accelerated filer status, SRC status, and emerging growth company status.”[7] For purposes of this analysis, filers that self-identified as a smaller reporting company and also reported a separate filer status (i.e., large accelerated filer, accelerated filer, or non-accelerated filer status) were included in both categories.

II. CONCLUSION

DERA staff intends to continue reviewing filers’ use of XBRL custom tags in their submissions to the Commission. Depending on the results of those efforts, DERA staff may share additional trends, issue guidance, or pursue other actions.

The staff observations DERA staff published the custom tag rates in 2014. For the staff’s previous trend analyses on custom tags, see the Trends section. DERA staff welcomes your questions and comments. Please feel free to call us at (202) 551-5494 or email us at StructuredData@sec .gov.

[1] Release No. 33-9002 (Jan. 30, 2009), 74 FR 6776 (Feb. 10, 2009).

[2] Our analysis includes custom tags of line item tags and excludes tags that are abstract, member, domain, and related to the document and entity. For definitions of abstract, member, and domain, see XBRL glossary. Document and entity tags are largely related to identification of filings and filers including, for example, form type, company name, filer size, and public float.

[3] 17 CFR 232.405(c)(1)(iii).

[4] See n. 1 at 104-05.

[5] See 17 CFR 232.405(c)(1)(iii)(B) (“An electronic filer must create and use a new special element if and only if an appropriate tag does not exist in the standard list of tags for reasons other than or in addition to an inappropriate standard label.”).

[6] Release No. 33-10513 (Jun. 28, 2018), 83 FR 31992 (Jul. 10, 2018).

[7] See id. at n. 131.

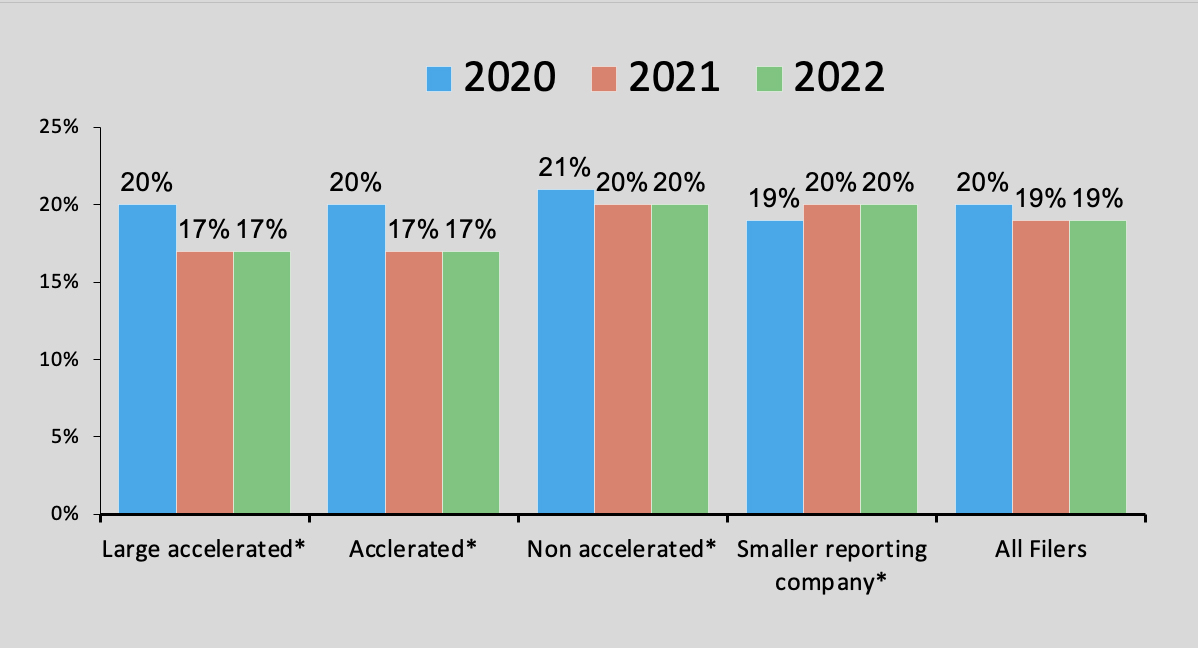

2020

Trend Analysis on Custom Tag Rates in XBRL Exhibits Submitted from 2018 to 2020

The staff in the Commission’s Division of Economic and Risk Analysis (DERA) recently analyzed custom tags used in eXtensible Business Reporting Language (XBRL) exhibits[1] submitted by issuers to comply with the 2009 Interactive Data rules requiring financial statement information to be reported in XBRL.[2] Our analysis covered XBRL exhibits submitted in Forms 10-K and 10-K/A for fiscal years 2018 through 2020.[3] The analysis looked at trends in filers’ use of custom tags[4] in their XBRL submissions during the last three years.

The Commission’s rules allow filers to create custom tags when the standard taxonomy does not provide an appropriate element to tag the data. While this customization accommodates unique circumstances in a filer’s particular disclosure, the Commission has acknowledged that the use of custom tags could potentially reduce the comparability of inter-company data.[5] Thus, the Commission’s rules specify the limited circumstances under which a filer may create custom tags.[6]

I. TREND ANALYSIS

The analysis for Forms 10-K and 10-K/A shows an increase in the average custom tag rates for filers across each status in 2020 compared to 2019, indicating a reversal of the decrease from 2018 to 2019 with the exception of smaller reporting companies. Smaller reporting companies have seen steady increases in the average custom tag rate since 2018.

* DERA staff classified “large accelerated filers,” “accelerated filers,” “non-accelerated filers,” and “smaller reporting companies” based on the filers’ self-identification in XBRL data of their Forms 10-K and 10-K/A. The Commission adopted amendments to the definition of “smaller reporting company” on June 10, 2018 with a rule effective date of September 10, 2018. As part of these amendments, the Commission removed the parenthetical next to the “non-accelerated filer” definition in these forms that states “(Do not check if a smaller reporting company)” and directed filers to “check all applicable boxes on the cover page addressing, among other things, non-accelerated, accelerated, and large accelerated filer status, SRC status, and emerging growth company status .” For purposes of this analysis, filers that self-identified as a smaller reporting company and also reported a separate filer status (i.e., large accelerated filer, accelerated filer, or non-accelerated filer status) were included in both categories.

II. CONCLUSION

DERA staff intends to continue reviewing filers’ use of XBRL custom tags in their submissions to the Commission. Depending on the results of those efforts, DERA staff may share additional trends, issue guidance, or pursue other actions.

The staff observations DERA staff published the custom tag rates in 2014. For the staff’s previous trend analyses on custom tags, see the Trends section. DERA staff welcomes your questions and comments. Please feel free to call us at (202) 551-5494 or email us at StructuredData@sec .gov.

[1] Includes Inline XBRL exhibits. 3,479 out of 5,658 filers that submitted fiscal year 2020 filings have made them using Inline XBRL

[2] Release No. 33-9002 (Jan. 30, 2009), 74 FR 6776 (Feb. 10, 2009).

[3] Our analysis includes custom tags of line item tags and excludes tags that are abstract, text-related, member, domain, and document and entity. For definitions of abstract, member, and domain, see XBRL glossary. Document and entity tags are largely related to identification of filings and filers including, for example, form type, company name, filer size, and public float.

[4] 17 CFR 232.405(c)(1)(iii).

[5] See n. 2. at 104-05.

[6] See 17 CFR 232.405(c)(1)(iii)(B) (“An electronic filer must create and use a new special element if and only if an appropriate tag does not exist in the standard list of tags for reasons other than or in addition to an inappropriate standard label.”).

2019

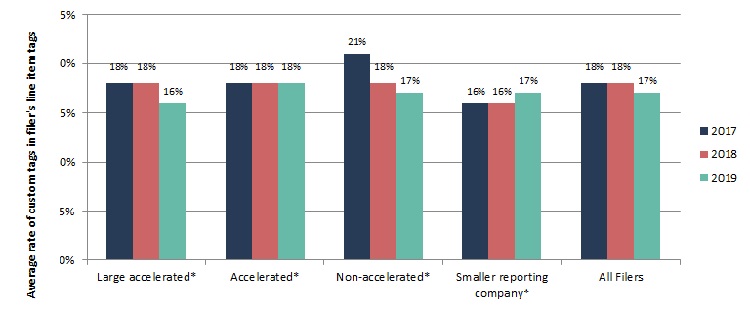

Trend Analysis of Custom Tag Rates in XBRL Exhibits Submitted from 2017 to 2019

The staff in the Commission’s Division of Economic and Risk Analysis (DERA) recently analyzed eXtensible Business Reporting Language (XBRL) exhibits[1] submitted by issuers complying with the 2009 Interactive Data rules to file financial statement information in an XBRL format.[2] Our analysis covered XBRL exhibits submitted in Forms 10-K and 10-K/A from January 2017 to December 2019.[3] The purpose of the analysis was to analyze trends in filers’ use of custom tags[4] in their XBRL submissions during the last three years.

The Commission’s rules allow filers to create custom tags when the standard taxonomy does not provide a tag for the necessary financial element. While this customization accommodates unique circumstances in a filer’s particular disclosure, the Commission has acknowledged that the use of unnecessary customized tags could potentially reduce the comparability of inter-company data.[5] Thus, the Commission’s rules specify the limited circumstances under which a filer may create custom tags.[6]

I. TREND ANALYSIS

Graph A: Average Custom Tag Rates by Calendar Year – Forms 10-K and 10-K/A

* DERA staff identified “large accelerated filers,” “accelerated filers,” “non-accelerated filers,” and “smaller reporting companies” based on the filers’ self-identifications in XBRL data of their Forms 10-K and 10-K/A. The Commission adopted amendments to the definition of “smaller reporting company” on June 10, 2018 with the rule effective date of September 10, 2018.[7] In conjunction with these amendments, the Commission also modified several forms (including Form 10-K) to remove the parenthetical next to the “non-accelerated filer” definition that states “(Do not check if a smaller reporting company)” and directed filers to “check all applicable boxes on the cover page addressing, among other things, non-accelerated, accelerated, and large accelerated filer status, SRC status, and emerging growth company status.”[8]

For the purposes of this analysis, filers that self-identified as smaller reporting companies and also reported a separate filer status (i.e., large accelerated filer, accelerated filer, or non-accelerated filer status) were included in the respective categories of large accelerated filers, accelerated filers, or non-accelerated filers in the 2019 analysis along with other filers that only reported one filer status (i.e., large accelerated filer, accelerated filer or non-accelerated filer).

In light of the aforementioned cover page modification and the consequent increase in filers self-identifying as smaller reporting companies while also reporting a separate filer status, such companies were included in the smaller reporting company category for 2019 in order to maintain the trend analysis on smaller reporting companies.

The smaller reporting company category for 2019 also includes twenty filers that self-identified as smaller reporting companies and did not report a separate filer status in 2019.

Verifying the accuracy of the filers’ self-identification is beyond the scope of this analysis.

The trend analysis for Forms 10-K and 10-K/A shows that the average custom tag rates for the filers remained flat from 2017 to 2018, but decreased in 2019. With respect to filer subsets, custom tag rates for large accelerated filers and non-accelerated filers declined over the three-year assessment period, while custom tag rates for accelerated filers remained flat. Custom tag rates for smaller reporting companies remained flat from 2017 to 2018, but increased in 2019.

II. CONCLUSION

DERA staff intends to continue reviewing filers’ use of XBRL custom tags in their submissions to the Commission. Depending on the results of those efforts, DERA staff may share additional trends, issue guidance, or pursue other actions.

For the staff observations DERA staff published on custom tag rates in 2014. For the staff’s previous trend analyses on custom tags, see the Trends section. DERA staff welcomes your questions and comments. Please feel free to call us at (202) 551-5494 or email us at StructuredData@sec.gov.

[1]Exhibits submitted in the Inline XBRL format were included in the analysis. In 2019, 1,330 of 2,716 surveyed filers submitted Forms 10-K and 10-K/A in the Inline XBRL format.

[2]Release No. 33-9002 (Jan. 30, 2009), 74 FR 6776 (Feb. 10, 2009).

[3]Our analysis includes custom tags of line item tags and excludes tags that are abstract, text-related, member, domain, and document and entity. For definitions of abstract, member, and domain, see XBRL glossary. Document and entity tags are largely related to identification and classification of filers and include, among other things, form type, company name, filer size, and public float.

[4]17 CFR 232.405(c)(1)(iii).

[5]See n. 1. at 104-05.

[6]See 17 CFR 232.405(c)(1)(iii)(B) (“An electronic filer must create and use a new special element if and only if an appropriate tag does not exist in the standard list of tags for reasons other than or in addition to an inappropriate standard label.”).

[7]Release No. 33-10513 (Jun. 28, 2018), 83 FR 31992 (Jul. 10, 2018).

[8]See id. at n. 131.

2018

Trend Analysis on Custom Tag Rates in XBRL Exhibits Submitted from 2016 to 2018

The staff in the Commission’s Division of Economic and Risk Analysis (DERA) recently analyzed eXtensible Business Reporting Language (XBRL) exhibits[1] submitted by issuers complying with the 2009 Interactive Data rules to file financial statement information in an XBRL format.[2] Our analysis covered XBRL exhibits submitted in Forms 10-K and 10-K/A from January 2016 to December 2018.[3] The purpose of the analysis was to analyze trends in filers’ use of custom tags[4] in their XBRL submissions during the last three years.

The Commission’s rules allow filers to create custom tags when the standard taxonomy does not provide a tag for the necessary financial element. While this customization accommodates unique circumstances in a filer’s particular disclosure, the Commission has acknowledged that the use of unnecessary customized tags could potentially reduce the comparability of inter-company data.[5] Thus, the Commission’s rules specify the limited circumstances under which a filer may create custom tags. [6]

I. TREND ANALYSIS

Graph A: Average Custom Tag Rates by Fiscal Year – Forms 10-K and 10-K/A

[1] 963 of 18,057 forms included in the analysis represent voluntary Inline XBRL filings.

[2] Release No. 33-9002 (Jan. 30, 2009), 74 FR 6776 (Feb. 10, 2009).

[3] Our analysis includes custom tags of line item tags and excludes tags that are abstract, text-related, member, domain, and document and entity. For definitions of abstract, member, and domain, see XBRL glossary. Document and entity tags are largely related to identification and classification of filers and include, among other things, form type, company name, filer size, and public float.

[4] 17 CFR 232.405(c)(iii).

[5] See n. 1. at 104-05.

[6] See 17 CFR 232.405(c)(iii)(B) (“An electronic filer must create and use a new special element if and only if an appropriate tag does not exist in the standard list of tags for reasons other than or in addition to an inappropriate standard label.”).

* DERA staff identified “large accelerated filers,” “accelerated filers,” “non-accelerated filers,” and “smaller reporting companies” based on their self-identifications on their Forms 10-K and 10-K/A. Verification of the accuracy of the self-identification is beyond the scope of this analysis.

The trend analysis for Forms 10-K and 10-K/A shows that the average custom tag rates for the surveyed filers declined over the three-year assessment period. With respect to filer subsets, custom tag rates for non-accelerated filers and smaller reporting companies declined over the three-year assessment period, while custom tag rates for large accelerated filers and accelerated filers remained flat. Additionally, the trend analysis shows that while the average custom tag rates for non-accelerated filers declined over the assessment period, those filers had the highest average custom tag rates. By contrast, the smaller reporting companies had the lowest average custom tag rates.

II. CONCLUSION

DERA staff intends to continue to review filers’ use of XBRL in their submissions to the Commission. Depending on the results of those efforts, DERA staff may share additional trends, issue guidance, or pursue other actions.

For the staff observations DERA staff published on custom tag rates in 2014. For the staff’s previous trend analyses on custom tags, see section Trends.

DERA staff welcomes your questions and comments. Please feel free to call us at (202) 551-5494 or email us at StructuredData@sec.gov.

2017

Trend Analysis on Custom Tag Rates in XBRL Exhibits Submitted from 2015 to 2017

The staff in the Commission’s Division of Economic and Risk Analysis (DERA) recently analyzed eXtensible Business Reporting Language (XBRL) exhibits submitted by issuers complying with the 2009 Interactive Data rules to file financial statement information in an XBRL format.[1] Our analysis covered XBRL exhibits submitted in Forms 10-K and 10-K/A from January 2015 to December 2017.[2] The purpose of the analysis was to monitor filers’ use of custom tags[3] in their XBRL submissions during the last three years.

The Commission’s rules allow filers to create custom tags when the standard taxonomy does not provide a tag for the necessary financial element. While this customization accommodates unique circumstances in a filer’s particular disclosure, the Commission acknowledged that the use of unnecessary customized tags could potentially reduce the comparability of inter-company data.[4] Thus, the Commission’s rules specify the limited circumstances under which a filer may create custom tags. [5]

I. TREND ANALYSIS

[1] Release No. 33-9002 (Jan. 30, 2009), 74 FR 6776 (Feb. 10, 2009).

[2] Our analysis includes custom tags of line item tags and excludes tags that are abstract, text-related, member, domain, and document and entity.

[3] 17 CFR 232.405(c)(iii).

[4] See n. 1. at 104-05.

[5] See 17 CFR 232.405(c)(iii)(B) (“An electronic filer must create and use a new special element if and only if an appropriate tag does not exist in the standard list of tags for reasons other than or in addition to an inappropriate standard label.”).

* DERA staff identified “large accelerated filers,” “accelerated filers,” “non-accelerated filers,” and “smaller reporting companies” based on their self-identifications on their Forms 10-K and 10-K/A. Verification of the accuracy of the self-identification is beyond the scope of this analysis.

The trend analysis for Forms 10-K and 10-K/A shows that the average custom tag rates continue to decline in the last three years for all filers, except for accelerated filers whose custom tag rates remained the same in all three years. In addition, the trend analysis reveals that the non-accelerated filers had the highest average custom tag rates while the smaller reporting companies had the lowest average custom tag rates.

II. CONCLUSION

DERA staff intends to continue to review filers’ use of XBRL in their submissions to the Commission XBRL submissions. Depending on the results of those efforts, DERA staff may share additional trends, issue guidance, or pursue other actions.

The staff observations DERA staff published the custom tag rates in 2014. The staff’s previous trend analysis on custom tags from 2017.

DERA staff welcomes your questions and comments. Please feel free to call us at (202) 551-5494 or email us at StructuredData@sec.gov.

2016

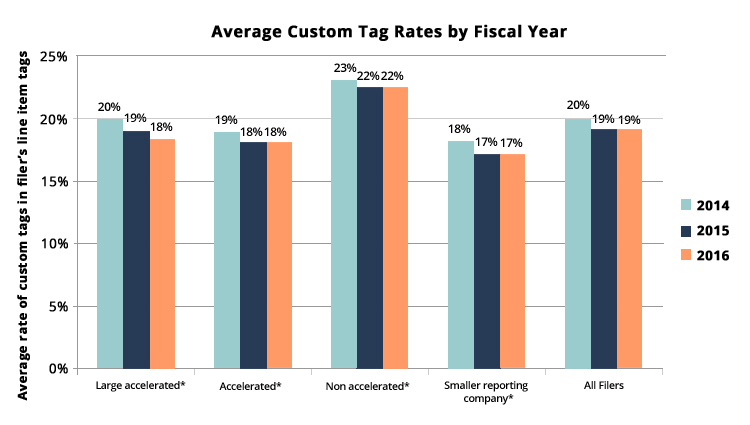

Trend Analysis on Custom Tag Rates in XBRL Exhibits Submitted from 2014 to 2016

The staff in the Commission’s Division of Economic and Risk Analysis (DERA) recently analyzed eXtensible Business Reporting Language (XBRL) exhibits submitted by issuers complying with the 2009 Interactive Data rules to file financial statement information in an XBRL format.[1] The analysis covered XBRL exhibits submitted in Forms 10-K and 10-K/A from March 2014 to December 2016 with fiscal year ends ending in 2014, 2015, and 2016.[2] The purpose of the analysis was to monitor filers’ use of custom tags[3] in their XBRL submissions during the last three years.

The Commission’s rules allow filers to create custom tags when the standard taxonomy does not provide a tag for the necessary financial element. While this customization accommodates unique circumstances in a filer’s particular disclosure, the Commission acknowledged that the use of customized tags could potentially and unnecessarily reduce the comparability of inter-company data.[4] Thus, the Commission’s rules specify the limited circumstances under which a filer may create custom tags. [5]

I. TREND ANALYSIS

* DERA staff identified “large accelerated filers,” “accelerated filers,” “non-accelerated filers,” and “smaller reporting companies” based on their self-identifications on their Forms 10-K and 10-K/A. Verification of the accuracy of the self-identification is beyond the scope of this analysis.

The trend analysis shows that the average custom tag rates have been slowly declining in the last three years for all filers. In addition, the trend analysis reveals that the non-accelerated filers had the highest average custom tag rates while the smaller reporting companies had the lowest average custom tag rates.

II. CONCLUSION

DERA staff intends to continue to review filers’ use of XBRL in their submissions to the Commission. Depending on the results of those efforts, DERA staff may share additional trends, issue guidance, or pursue other actions.

The staff observations DERA staff published on custom tag rates in 2014.

DERA staff welcomes your questions and comments. Please feel free to call us at (202) 551-5494 or email us at StructuredData@sec.gov

[1] Release No. 33-9002 (Jan. 30, 2009), 74 FR 6776 (Feb. 10, 2009) (“2009 Rule”).

[2] Our analysis includes custom tags of line item tags and excludes tags that are abstract, text-related, member, domain, and document and entity.

[3] 17 CFR 232.405(c)(iii).

[4] See n. 1. at 104-05.

[5] See 17 CFR 232.405(c)(iii)(B) (“An electronic filer must create and use a new special element if and only if an appropriate tag does not exist in the standard list of tags for reasons other than or in addition to an inappropriate standard label.”).

Also see IFRS - XBRL Custom Tags Trends

Last Reviewed or Updated: June 28, 2024