Testimony Before the House Appropriations Subcommittee on Financial Services and General Government

Good morning, Chairman Quigley, Ranking Member Womack, and members of the Subcommittee. I’m honored to appear before you for the second time as Chair of the Securities and Exchange Commission. It is good to be here alongside Federal Trade Commission Chair Khan. As is customary, I’d like to note that my views are my own, and I am not speaking on behalf of my fellow Commissioners or the SEC staff.

The Gold Standard of Capital Markets

I’d like to open by discussing two key years in economic policymaking: 1933 and 1934.

We were in the midst of the Great Depression. President Franklin Delano Roosevelt and Congress addressed this crisis through a number of landmark policies.

Amongst them, in 1933 and 1934, Congress and FDR came together to craft the first two federal securities laws. These statutes created requirements and regulations around disclosure, registration, exchanges, and broker-dealers, and established the SEC to oversee the markets.

Additionally, in 1933, President Roosevelt formally suspended the use of the gold standard.[1] Then, in 1934, the Gold Reserve Act was enacted, prohibiting government and financial institutions from redeeming dollars for gold.[1]

Though it takes constant vigilance to protect investors, maintain fair, orderly and efficient markets, and facilitate capital formation, the U.S. laws became the gold standard for capital markets around the world.

In other words, in those two key years, one could say we replaced one gold standard with another gold standard: the securities laws.

The core principles of the securities markets laid out in these statutes were important for issuers and investors in our domestic markets. I believe they also contributed to America’s geopolitical standing around the globe.

We are blessed with the largest and most innovative capital markets in the world. The U.S. capital markets represent 38 percent of the globe’s capital markets.[1] This exceeds even our impact on the world’s gross domestic product, where we hold a 24 percent share.

What’s more, U.S. market participants rely on capital markets more than market participants in any other country. For example, debt capital markets account for 80 percent of financing for non-financial corporations in the U.S. In the rest of the world, by contrast, nearly 80 percent of lending to such firms comes from banks.[2]

We are the destination of choice for companies seeking to raise money in both public and private markets. Private capital markets, such as venture capital, have brought new ideas to market quickly and flexibly.

We can’t take our leadership in capital markets for granted, though.

New financial technologies and business models continue to change the face of finance for investors and issuers. More retail investors than ever are accessing our markets. Other countries are developing deep, competitive capital markets as well, seeking to surpass ours.

Further, market participant incentives, economic cycles, and the nature of finance itself will constantly challenge even a gold standard. In recent years, we’ve seen as much — whether the market events of March 2020, the meme stock-related volatility in early 2021, the speculative crypto markets, the boom of special purpose acquisition companies (SPACs), or the collapse of Archegos Capital Management, which we recently charged with fraud and market manipulation.

What’s more, we are in the midst of uncertain geopolitical events. On top of that, around the globe, central banks have started to transition from an accommodating to a tightening policy stance.

Given these trends, I think we should do everything we can to maintain and enhance that gold standard of the markets.

Maintaining the Gold Standard

There are two broad ways to do that, in my view.

One is to work with the Commission and staff to update our rules for modern markets and technologies as we execute our mission: to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation. We must remain vigilant to opportunities to enhance competition, transparency, fairness, and resiliency.

The other way — and the main focus of today’s testimony — is to ensure that the SEC is adequately resourced so we can remain the cop on the beat. The SEC is deficit-neutral, fully funding ourselves with fees on securities transactions.

Having worked in finance for decades, I’d long respected the SEC and its tremendous staff. What I couldn’t fully appreciate is the sheer magnitude of this agency’s work on a daily basis.

We oversee 24 national securities exchanges, 99 alternative trading systems, nine credit rating agencies, seven active registered clearing agencies, five self-regulatory organizations and other external entities. We look after the accounting and auditing functions of the public markets, process thousands of periodic filings and registration statements, and work through thousands of examinations and enforcement actions each year. We review the disclosures and financial statements of more than 8,200 reporting companies.

Markets don’t stand still. The world isn’t standing still. Our resources can’t stand still, either.

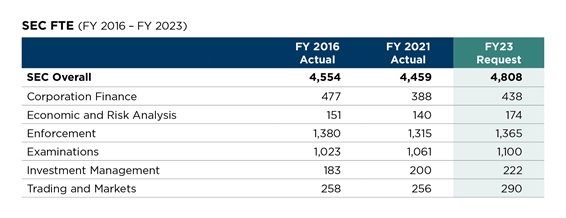

And yet, as I will detail, our agency has shrunk. When I testified you last year, the agency had 4 percent fewer staff than it did in 2016; it remains modestly below where it was in 2016. We can’t shrink when we’re trying to maintain a gold standard. The best athletes in the world still practice — generally, even more than their competitors.

Our capital markets are a national treasure. We, at the SEC, must work to maintain them as the envy of the world. But we can’t do it alone. We need the help of Congress.

Growth in the Markets

The last five years have been a remarkable time in our $100-trillion capital markets. Thus, while there are many measures of market activity, by most objective measures, we should have grown during the past five years.

Instead, the opposite has happened. As our capital markets have grown, this agency has shrunk.

As just a few examples:

In the past five years, the number of registered entities we oversee has grown by 12 percent (from 26,000 to 29,000), even though the SEC has shrunk in that time.

Since 2016, the number of private funds managed by registered investment advisers has increased 40 percent, to 50,000.

The amount of data that the SEC processes has swelled by 20 percent annually for each of the last two years.

Moreover, the highly volatile and speculative crypto marketplace has mushroomed, attracting tens of millions of American investors and traders.[3] In 2016, there were an estimated 644 crypto tokens on the worldwide market. Five years later, that number had gone up more than tenfold.[4] The volatility in the crypto markets in recent weeks highlights the risks to the investing public.

Technology is rapidly changing as well. Predictive data analytics, including machine learning, are increasingly being adopted in finance — from trading, to asset management, to risk management.[5] Growing cybersecurity risks have implications for the financial sector, investors, issuers, and the economy at large.[6]

Beyond that, our responsibilities have grown. Important legislation, such as the Holding Foreign Companies Accountable Act of 2020 (HFCAA), has placed additional demands on our resources. Rules implementing certain mandates of the Dodd-Frank Act of 2010 recently went into effect. Such mandates, designed to protect investors, often have been unfunded.

Thus, I am pleased to support the President’s Fiscal Year 2023 (FY23) budget request for SEC operations, totaling $2.149 billion, an 8 percent increase over FY22. This request would allow us to maintain current services, add full-time equivalents in critical growth areas, and devote more resources to technology. This number would support a modest growth of (about 6 percent) in full-time equivalents (FTEs) above our previous peak in FY16, assuming consistent vacancy rates.

This increase would be modest, given the major trends affecting our markets since 2016. Moreover, to fund our operations, the agency collects fees on securities transactions at a rate intended to fully offset our appropriation.

Thanks to the work of the remarkable staff, the SEC has faced the challenges of limited resources well.

For the SEC to continue to succeed in carrying out our mission, our personnel level must continue to grow commensurate with the expansion and complexity in the capital markets around the globe.

This is not a time to scrimp on the SEC’s resources.

The SEC has 30 Divisions and Offices across our 11 regional locations and Washington, D.C., headquarters. In the interest of time, I will focus the bulk of this testimony on our six Divisions:

- The Divisions of Enforcement and Examinations, our cops on the beat and eyes and ears on the ground;

- The programmatic Divisions of Corporation Finance, Trading and Markets, and Investment Management; and

- The Division of Economic Risk and Analysis, whose economic analysis undergirds all of our work.

I also briefly will discuss the technology budget at the agency and separate appropriations for the SEC’s new headquarters.

Budget Request: Enforcement and Examinations

The Divisions of Enforcement and Examinations account for about half of the SEC’s staff. Without examination against and enforcement of our rules and laws, we can’t instill the trust necessary for our markets to thrive. Stamping out fraud, manipulation, and abuse lowers risk in the system. It protects investors and reduces the cost of capital. The whole economy benefits from that.[7]

Enforcement

The Division of Enforcement shrank 5 percent from FY16 to FY21. The FTEs level supported by the FY23 budget request would still be 1 percent shy of where we were in 2016.

About a quarter of the SEC’s staff work in our Division of Enforcement.

The Division continues to serve as the cops on the beat of the capital markets, though the demands on their resources has grown.

Last year, Enforcement filed about 700 total actions. We also had a record year for our whistleblower program, awarding $564 million to 108 whistleblowers,[8] compared to 39 whistleblowers in FY20.[9] The Office of the Whistleblower received and processed more than 12,000 tips, complaints, and referrals — up nearly threefold over the previous five years.[10] Further, in FY21, we received 46,000 tips, complaints, and referrals from members of the public, up from about 16,000 five years earlier.[11]

After peaking in 2016, the last three fiscal years, the Division opened, on average, 1,100 matters under inquiry and investigations. At any given time, we have approximately 1,700 open matters. Our resources may be constrained here. Additional resources will help us keep up with the increasing workload.

Beyond that, more cases are being litigated and going to trial. We expect the number of litigated cases to continue to rise as Enforcement increasingly holds wrongdoers accountable with meaningful and, in some instances, escalating sanctions.

Moreover, various market events, including the effects of the pandemic, the market volatility in early 2021, and recent events in Ukraine, have placed significant stress on Enforcement resources.

Meanwhile, misconduct in emerging and new areas, from complex securities products to new financial technologies to crypto, requires new tools and expertise.

The additional staff will provide the Division with more capacity to investigate misconduct and accelerate enforcement actions. It also will strengthen our litigation support, bolster the capabilities of the Crypto Assets and Cyber Unit, and investigate the tens of thousands of tips, complaints, and referrals we receive from the public.

Examinations

The Division of Examinations has grown modestly (4 percent) since FY16. The FY23 budget request would support an additional 4 percent increase in FTEs compared with FY21.

About another quarter of the staff works in our Division of Examinations. This Division serves as the eyes and ears of the Commission, conducting about 3,000 exams per year, compared with 2,427 in 2016.

In part, we’ve maintained this level of productivity because we’re doing remote exams due to the pandemic. There’s no replacement for on-site exams, though. As registrants are coming back, we will need to factor in additional resources for our Examinations Division to conduct on-site exams.

Given the evolving markets, heightened geopolitical environment, and increased attention paid to cyber risks, I expect the demands on Examinations to continue to grow.

Since 2016, the number of registered investment advisers has increased 25 percent, to 15,000. This growth directly affects our work. Unlike many other aspects of the markets, including broker-dealers, investment advisers do not have a self-regulatory organization. Thus, the Division of Examinations is the only entity conducting exams of SEC-registered investment advisers.

We examined about 15 percent of advisers registered with the SEC in FY20 and FY21. The funds we requested will support only about a 5 percent increase in the number of staff that examine investment advisers.

The Division also needs to increase its capacity to examine broker-dealers, particularly when it comes to compliance with Regulation Best Interest.

Furthermore, last year, security-based swap dealers and major security-based swap participants were required to register with the Commission for the first time. The Division has begun standing up a team to examine them and to spot risks and issues.

Budget Request: Programmatic Divisions

Next, I will turn to our three programmatic Divisions.

Corporation Finance

The Division of Corporation Finance has shrunk 19 percent since 2016. The FY23 budget request would still leave us 8 percent shy of the number of FTEs we had in FY16.

The Division oversees the disclosures of registered issuers so that investors have the material information they need to make informed investment decisions. Like other Divisions, their responsibilities have grown in recent years.

In FY16, Corporation Finance reviewed filings related to approximately 510 new registrants. That grew almost fourfold last year, to 1,960. Initial public offerings create new disclosures and ongoing streams of work for which SEC staff are responsible. Our role in protecting investors is heightened when a company is being introduced to public investors for the first time.

And yet, during that time, the staff of the Division fell. The Division’s ability to review filings of existing registrants is more limited given transaction volume and complexity of deals.

Furthermore, the Division has sought enhanced disclosures from China-based variable interest entities so that they fully represent the risks of these structures to investors in U.S. capital markets. Recent developments in China, along with the implementation of the HFCAA, have placed additional demands across the Division.[12]

Trading and Markets

The Division of Trading and Markets has shrunk 1 percent since FY16. The FY23 budget request would support a 12 percent increase in FTEs compared with FY16.

The Division serves as the front lines for maintaining fair, orderly, and efficient markets. From FY16 to FY21, the size of the Division was basically flat, in terms of FTEs, even as there have been dramatic changes in technology, increased retail participation, and greater volume in the markets.

For instance, the average daily number of transactions in equity markets was 35 million in 2016. In 2021, that number had nearly doubled, to 69 million per day.

In addition, Trading and Markets reviews thousands of proposed rule changes and advance notices filed by self-regulatory organizations.

Investment Management

The Division of Investment Management grew 9 percent since FY16 because of the creation of an Analytics Office within that Division; without this new important function, this Division would have shrunk. The FY23 budget request would support FTE levels of 10 percent above FY21.

The Division oversees the investment companies and advisers stewarding the nest eggs for millions of American investors.

In the past five years, the Division has overseen 50 percent growth (from $67 trillion to $100 trillion) in combined assets under management in registered investment companies, private funds, and separately managed accounts.[13] These sums include the life savings of more than 106 million American investors (an increase of 14 percent from 2016).[14]

As the asset management field has grown dramatically in recent years through the rise of 401ks and target-date funds, the demands placed on this key Division have increased even more rapidly, with innovative filings proliferating in particular.

Since 2016, the number of registered investment advisers has increased 25 percent, from 12,000 to 15,000. The number of clients for RIAs has expanded 70 percent, from 32 million in 2016 to 55 million in 2021.[15] This is due to the dramatic growth in robo-advisers and other firms that use algorithms and models to provide investment advice directly to investors through separately managed accounts rather than through investment funds.

Since 2016, the number of ETFs has increased by 25 percent to roughly 2,300. The amount of assets has more than doubled in that time, to $5.5 trillion.[16] Interest in these financial innovations is driven largely by retail investors and their advisers, so each of those fund filings is reviewed by the Division’s disclosure review team.

Further, this Division oversees private fund advisers — including private equity fund and venture capital fund advisers — which represent more than $21 trillion in gross assets, a 75 percent increase from 2016.[17] From 2016 to 2021, the number of private funds managed by registered investment advisers has increased 40 percent, to 50,000.[18]

Additionally, filings across the board are becoming increasingly complex, reflecting asset growth in innovative areas like crypto, thematic index funds, and Environmental, Social, and Governance. In 2021, 45 filings referred to crypto in their summary prospectuses, up from 6 filings just two years earlier.

Budget Request: Three Other Areas

Before I conclude, I will discuss three other topics.

Economic Risk and Analysis

The Division of Economic Risk and Analysis has shrunk 7 percent since FY16. The FY23 budget request would support a 15 percent increase in FTEs compared with FY16.

This Division shapes every aspect of our policymaking, from the early design phase to the proposing releases to the consideration of public comments to the adopting releases. It helps us determine the size of fines for enforcement actions. It provides important context for every one of our meetings.

Technology

Next, when it comes to technology, we live in transformational times. The amount of data that the SEC processes has grown by 20 percent annually for the past two years. Further, cyber threats have placed our financial sector on high alert. As technologies evolve, it is important that the SEC’s information technology follows suit.

We continue to need additional resources to support the Commission’s data, cybersecurity, and other IT needs. While our $370 million request for the Office of Information Technology is basically flat with the last two years of spending, in real terms it is up only modestly from FY16. Moreover, for comparison’s sake, JPMorgan spends an average of $1 billion in technology each month.[19]

It is critical that the SEC have additional technological resources to incorporate analytics and machine learning capabilities for our oversight and surveillance functions, protect agency and registrant information, provide data to the investing public, and much more.

Headquarters

The General Services Administration (GSA) also recently secured a new lease to move the SEC headquarters in Washington to another building. The separate FY23 request of $57.4 million would support GSA’s work on the building construction and move-related costs. As requested in the past, the SEC proposes to offset these costs with fee collections and return any unused amounts to fee payers or the Treasury after project completion.

Conclusion

A year into this role, I remain deeply grateful for the opportunity to work with this remarkable staff and my fellow Commissioners to help maintain American capital markets as the best in the world.

As we continue to navigate geopolitical challenges, we must always think about ways to enhance the efficiency, resiliency, and transparency of our markets. What additional resources do we need? Which new rules of the road might we need to meet the promise of our modern markets?

The sheer growth and added complexity in the capital markets continue to necessitate greater resources for the SEC.

In considering how best to maintain the world’s best markets in the 2020s and the 2030s, I can’t help but think about the establishment of the federal securities regime in the 1930s. These foundational laws help us maintain our extraordinary competitiveness on the world stage. They are the gold standard. Let’s do everything we can to keep them that way in the future.

[1] See Securities Industry and Financial Markets Association, “2021 SIFMA Capital Markets Fact Book” (July 2021), available at https://www.sifma.org/wp-content/uploads/2021/07/CM-Fact-Book-2021-SIFMA.pdf.

[2] See World Bank data: https://data.worldbank.org/indicator/NY.GDP.MKTP.CD.

[3] See Andrew Perrin/Pew Research Center, “16% of Americans say they have ever invested in, traded or used cryptocurrency” (Nov. 11, 2021), available at https://www.pewresearch.org/fact-tank/2021/11/11/16-of-americans-say-they-have-ever-invested-in-traded-or-used-cryptocurrency/.

[4] See Statista, “Number of cryptocurrencies worldwide from 2013 to February 2022,” available at https://www.statista.com/statistics/863917/number-crypto-coins-tokens.

[5] See Gary Gensler, “Prepared Remarks at DC Fintech Week” (Oct. 21, 2021), available at https://www.sec.gov/news/speech/gensler-dc-fintech-2021-10-21.

[6] See Gary Gensler, “Cybersecurity and Securities Laws” (Jan. 24, 2022), available at https://www.sec.gov/news/speech/gensler-cybersecurity-and-securities-laws-20220124.

[7] See Gary Gensler, “Prepared Remarks at the Securities Enforcement Forum” (Nov. 4, 2021), available at https://www.sec.gov/news/speech/gensler-securities-enforcement-forum-20211104.

[8] See “SEC Announces Enforcement Results for FY 2021” (Nov. 18, 2021), available at https://www.sec.gov/news/press-release/2021-238.

[9] See “SEC Division of Enforcement Publishes Annual Report for Fiscal Year 2020” (Nov. 2020), available at https://www.sec.gov/news/press-release/2020-274

[10] See “Whistleblower Program: 2021 Annual Report to Congress” (p. 28), available at https://www.sec.gov/files/owb-2021-annual-report.pdf.

[11] See “Fiscal Year 2023 Congressional Budget Justification, Annual Performance Plan; Fiscal Year 2021 Annual Performance Report” (p. 25), available at https://www.sec.gov/files/FY%202023%20Congressional%20Budget%20Justification%20Annual%20Performance%20Plan_FINAL.pdf, and “Division of Enforcement: 2020 Annual Report” (p. 19) https://www.sec.gov/files/enforcement-annual-report-2020.pdf and “Division of Enforcement: Annual Report – A Look Back at Fiscal Year 2017” (p. 2), available at https://www.sec.gov/files/enforcement-annual-report-2017.pdf.

[12] See Gary Gensler, “Statement on Investor Protection Related to Recent Developments in China” (July 30, 2021), available at https://www.sec.gov/news/public-statement/gensler-2021-07-30.

[13] Assets in registered investment companies grew from $18.1 trillion in 2016 to $29.7 trillion in 2021. See Investment Company Institute, “2016 Investment Company Fact Book,” available at https://www.ici.org/doc-server/pdf%3A2016_factbook.pdf, and “2021 Investment Company Fact Book,” available at https://www.ici.org/system/files/2021-05/2021_factbook.pdf ). Assets in private funds grew from $8.7 trillion in 2016 to $21 trillion in 2021 (based on data reported on Form ADV, Schedule D, Section 7.B.1 in 2016 & 2021); and assets in separately managed accounts grew from $40 trillion in 2016 to $49.6 trillion in 2021 (based on data reported on Form ADV, Item 5.D. in 2016 & 2021). The Form ADV data consist of assets that are reported by both advisers and sub-advisers.

[14] See “2016 Investment Company Fact Book” and “2021 Investment Company Fact Book.”

[15] Based on analysis of data reported on Form ADV, Item 5.D. in 2016 and 2021. The data consist of clients that are reported by both advisers and sub-advisers.

[16] See Investment Company Institute, “2021 Investment Company Fact Book,” available at https://www.ici.org/system/files/2021-05/2021_factbook.pdf.

[17] Based on analysis of data reported on Form ADV in 2016 and 2021.The data consist of private funds that are reported by both advisers and sub-advisers.

[18] Id.

[19] See JPMorgan Chase & Co., “This $12 Billion Tech Investment Could Disrupt Banking,” available at https://www.jpmorganchase.com/news-stories/tech-investment-could-disrupt-banking.

Last Reviewed or Updated: July 24, 2024