0000318154false2020FYus-gaap:AccountsPayableAndAccruedLiabilitiesCurrentus-gaap:AccountsPayableAndAccruedLiabilitiesCurrentus-gaap:OtherLiabilitiesNoncurrentus-gaap:OtherLiabilitiesNoncurrent00003181542020-01-012020-12-310000318154exch:XNGSus-gaap:CommonStockMember2020-01-012020-12-310000318154amgn:A1.250SeniorNotesDue2022Memberexch:XNYS2020-01-012020-12-310000318154amgn:A2.00SeniorNotesDue2026Memberexch:XNYS2020-01-012020-12-31iso4217:USD00003181542020-06-30xbrli:shares00003181542021-02-030000318154us-gaap:ProductMember2020-01-012020-12-310000318154us-gaap:ProductMember2019-01-012019-12-310000318154us-gaap:ProductMember2018-01-012018-12-310000318154us-gaap:ProductAndServiceOtherMember2020-01-012020-12-310000318154us-gaap:ProductAndServiceOtherMember2019-01-012019-12-310000318154us-gaap:ProductAndServiceOtherMember2018-01-012018-12-3100003181542019-01-012019-12-3100003181542018-01-012018-12-31iso4217:USDxbrli:shares00003181542020-12-3100003181542019-12-310000318154us-gaap:CommonStockMember2017-12-310000318154us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2017-12-310000318154us-gaap:RetainedEarningsMember2017-12-310000318154us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-12-3100003181542017-12-310000318154us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2017-12-310000318154us-gaap:AccumulatedOtherComprehensiveIncomeMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2017-12-310000318154srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2017-12-310000318154us-gaap:RetainedEarningsMember2018-01-012018-12-310000318154us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310000318154us-gaap:CommonStockMember2018-01-012018-12-310000318154us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2018-01-012018-12-310000318154us-gaap:CommonStockMember2018-12-310000318154us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2018-12-310000318154us-gaap:RetainedEarningsMember2018-12-310000318154us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-3100003181542018-12-310000318154us-gaap:RetainedEarningsMember2019-01-012019-12-310000318154us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310000318154us-gaap:CommonStockMember2019-01-012019-12-310000318154us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2019-01-012019-12-310000318154us-gaap:CommonStockMember2019-12-310000318154us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2019-12-310000318154us-gaap:RetainedEarningsMember2019-12-310000318154us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310000318154us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310000318154srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310000318154us-gaap:RetainedEarningsMember2020-01-012020-12-310000318154us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310000318154us-gaap:CommonStockMember2020-01-012020-12-310000318154us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2020-01-012020-12-310000318154us-gaap:CommonStockMember2020-12-310000318154us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2020-12-310000318154us-gaap:RetainedEarningsMember2020-12-310000318154us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-31amgn:segmentxbrli:pure0000318154srt:MinimumMember2020-01-012020-12-310000318154srt:MaximumMember2020-01-012020-12-310000318154us-gaap:AccountingStandardsUpdate201602Member2019-01-0100003181542018-01-012018-03-31amgn:market0000318154amgn:OtezlaMember2020-12-310000318154amgn:OtezlaMember2019-11-212019-11-210000318154amgn:OtezlaMemberus-gaap:DevelopedTechnologyRightsMember2019-11-210000318154amgn:OtezlaMemberamgn:MarketingRelatedRightsMember2019-11-210000318154amgn:OtezlaMember2019-11-210000318154amgn:OtezlaMemberus-gaap:DevelopedTechnologyRightsMember2019-11-212019-11-210000318154amgn:OtezlaMemberamgn:AssembledWorkforceMemberamgn:MarketingRelatedRightsMember2019-11-212019-11-210000318154amgn:OtezlaMemberus-gaap:InventoriesMember2019-11-212019-11-210000318154amgn:NuevolutionMember2019-07-152019-07-150000318154amgn:NuevolutionMemberamgn:RDTechnologyrightsMember2019-07-152019-07-150000318154amgn:NuevolutionMember2019-07-150000318154amgn:KirinAmgenInc.KAMember2018-03-310000318154amgn:KirinAmgenInc.KAMember2018-03-310000318154amgn:KirinAmgenInc.KAMember2018-01-012018-03-310000318154amgn:KirinAmgenInc.KAMemberus-gaap:LicensingAgreementsMember2018-03-310000318154amgn:KirinAmgenInc.KAMemberus-gaap:LicensingAgreementsMember2018-01-012018-03-310000318154country:USamgn:EnbrelMember2020-01-012020-12-310000318154amgn:EnbrelMemberus-gaap:NonUsMember2020-01-012020-12-310000318154amgn:EnbrelMember2020-01-012020-12-310000318154country:USamgn:EnbrelMember2019-01-012019-12-310000318154amgn:EnbrelMemberus-gaap:NonUsMember2019-01-012019-12-310000318154amgn:EnbrelMember2019-01-012019-12-310000318154country:USamgn:EnbrelMember2018-01-012018-12-310000318154amgn:EnbrelMemberus-gaap:NonUsMember2018-01-012018-12-310000318154amgn:EnbrelMember2018-01-012018-12-310000318154country:USamgn:ProliaMember2020-01-012020-12-310000318154us-gaap:NonUsMemberamgn:ProliaMember2020-01-012020-12-310000318154amgn:ProliaMember2020-01-012020-12-310000318154country:USamgn:ProliaMember2019-01-012019-12-310000318154us-gaap:NonUsMemberamgn:ProliaMember2019-01-012019-12-310000318154amgn:ProliaMember2019-01-012019-12-310000318154country:USamgn:ProliaMember2018-01-012018-12-310000318154us-gaap:NonUsMemberamgn:ProliaMember2018-01-012018-12-310000318154amgn:ProliaMember2018-01-012018-12-310000318154country:USamgn:NeulastaMember2020-01-012020-12-310000318154us-gaap:NonUsMemberamgn:NeulastaMember2020-01-012020-12-310000318154amgn:NeulastaMember2020-01-012020-12-310000318154country:USamgn:NeulastaMember2019-01-012019-12-310000318154us-gaap:NonUsMemberamgn:NeulastaMember2019-01-012019-12-310000318154amgn:NeulastaMember2019-01-012019-12-310000318154country:USamgn:NeulastaMember2018-01-012018-12-310000318154us-gaap:NonUsMemberamgn:NeulastaMember2018-01-012018-12-310000318154amgn:NeulastaMember2018-01-012018-12-310000318154country:USamgn:OtezlaMember2020-01-012020-12-310000318154amgn:OtezlaMemberus-gaap:NonUsMember2020-01-012020-12-310000318154amgn:OtezlaMember2020-01-012020-12-310000318154country:USamgn:OtezlaMember2019-01-012019-12-310000318154amgn:OtezlaMemberus-gaap:NonUsMember2019-01-012019-12-310000318154amgn:OtezlaMember2019-01-012019-12-310000318154country:USamgn:OtezlaMember2018-01-012018-12-310000318154amgn:OtezlaMemberus-gaap:NonUsMember2018-01-012018-12-310000318154amgn:OtezlaMember2018-01-012018-12-310000318154country:USamgn:XgevaMember2020-01-012020-12-310000318154us-gaap:NonUsMemberamgn:XgevaMember2020-01-012020-12-310000318154amgn:XgevaMember2020-01-012020-12-310000318154country:USamgn:XgevaMember2019-01-012019-12-310000318154us-gaap:NonUsMemberamgn:XgevaMember2019-01-012019-12-310000318154amgn:XgevaMember2019-01-012019-12-310000318154country:USamgn:XgevaMember2018-01-012018-12-310000318154us-gaap:NonUsMemberamgn:XgevaMember2018-01-012018-12-310000318154amgn:XgevaMember2018-01-012018-12-310000318154country:USamgn:AranespMember2020-01-012020-12-310000318154amgn:AranespMemberus-gaap:NonUsMember2020-01-012020-12-310000318154amgn:AranespMember2020-01-012020-12-310000318154country:USamgn:AranespMember2019-01-012019-12-310000318154amgn:AranespMemberus-gaap:NonUsMember2019-01-012019-12-310000318154amgn:AranespMember2019-01-012019-12-310000318154country:USamgn:AranespMember2018-01-012018-12-310000318154amgn:AranespMemberus-gaap:NonUsMember2018-01-012018-12-310000318154amgn:AranespMember2018-01-012018-12-310000318154country:USamgn:KyprolisMember2020-01-012020-12-310000318154us-gaap:NonUsMemberamgn:KyprolisMember2020-01-012020-12-310000318154amgn:KyprolisMember2020-01-012020-12-310000318154country:USamgn:KyprolisMember2019-01-012019-12-310000318154us-gaap:NonUsMemberamgn:KyprolisMember2019-01-012019-12-310000318154amgn:KyprolisMember2019-01-012019-12-310000318154country:USamgn:KyprolisMember2018-01-012018-12-310000318154us-gaap:NonUsMemberamgn:KyprolisMember2018-01-012018-12-310000318154amgn:KyprolisMember2018-01-012018-12-310000318154country:USamgn:RepathaevolocumabMember2020-01-012020-12-310000318154us-gaap:NonUsMemberamgn:RepathaevolocumabMember2020-01-012020-12-310000318154amgn:RepathaevolocumabMember2020-01-012020-12-310000318154country:USamgn:RepathaevolocumabMember2019-01-012019-12-310000318154us-gaap:NonUsMemberamgn:RepathaevolocumabMember2019-01-012019-12-310000318154amgn:RepathaevolocumabMember2019-01-012019-12-310000318154country:USamgn:RepathaevolocumabMember2018-01-012018-12-310000318154us-gaap:NonUsMemberamgn:RepathaevolocumabMember2018-01-012018-12-310000318154amgn:RepathaevolocumabMember2018-01-012018-12-310000318154amgn:OtherProductsMembercountry:US2020-01-012020-12-310000318154amgn:OtherProductsMemberus-gaap:NonUsMember2020-01-012020-12-310000318154amgn:OtherProductsMember2020-01-012020-12-310000318154amgn:OtherProductsMembercountry:US2019-01-012019-12-310000318154amgn:OtherProductsMemberus-gaap:NonUsMember2019-01-012019-12-310000318154amgn:OtherProductsMember2019-01-012019-12-310000318154amgn:OtherProductsMembercountry:US2018-01-012018-12-310000318154amgn:OtherProductsMemberus-gaap:NonUsMember2018-01-012018-12-310000318154amgn:OtherProductsMember2018-01-012018-12-310000318154country:USus-gaap:ProductMember2020-01-012020-12-310000318154us-gaap:NonUsMemberus-gaap:ProductMember2020-01-012020-12-310000318154country:USus-gaap:ProductMember2019-01-012019-12-310000318154us-gaap:NonUsMemberus-gaap:ProductMember2019-01-012019-12-310000318154country:USus-gaap:ProductMember2018-01-012018-12-310000318154us-gaap:NonUsMemberus-gaap:ProductMember2018-01-012018-12-310000318154us-gaap:ProductAndServiceOtherMembercountry:US2020-01-012020-12-310000318154us-gaap:ProductAndServiceOtherMemberus-gaap:NonUsMember2020-01-012020-12-310000318154us-gaap:ProductAndServiceOtherMembercountry:US2019-01-012019-12-310000318154us-gaap:ProductAndServiceOtherMemberus-gaap:NonUsMember2019-01-012019-12-310000318154us-gaap:ProductAndServiceOtherMembercountry:US2018-01-012018-12-310000318154us-gaap:ProductAndServiceOtherMemberus-gaap:NonUsMember2018-01-012018-12-310000318154country:US2020-01-012020-12-310000318154us-gaap:NonUsMember2020-01-012020-12-310000318154country:US2019-01-012019-12-310000318154us-gaap:NonUsMember2019-01-012019-12-310000318154country:US2018-01-012018-12-310000318154us-gaap:NonUsMember2018-01-012018-12-31amgn:customer0000318154amgn:CustomerOneMemberus-gaap:ProductMember2020-01-012020-12-310000318154amgn:CustomerOneMemberus-gaap:ProductMember2019-01-012019-12-310000318154amgn:CustomerOneMemberus-gaap:ProductMember2018-01-012018-12-310000318154amgn:CustomerTwoMemberus-gaap:ProductMember2020-01-012020-12-310000318154amgn:CustomerTwoMemberus-gaap:ProductMember2019-01-012019-12-310000318154amgn:CustomerTwoMemberus-gaap:ProductMember2018-01-012018-12-310000318154us-gaap:ProductMemberamgn:CustomerThreeMember2020-01-012020-12-310000318154us-gaap:ProductMemberamgn:CustomerThreeMember2019-01-012019-12-310000318154us-gaap:ProductMemberamgn:CustomerThreeMember2018-01-012018-12-310000318154amgn:PerformanceUnitsMember2020-01-012020-12-310000318154us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310000318154us-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-310000318154us-gaap:RestrictedStockUnitsRSUMember2018-01-012018-12-310000318154amgn:PerformanceUnitsMember2019-01-012019-12-310000318154amgn:PerformanceUnitsMember2018-01-012018-12-310000318154us-gaap:EmployeeStockOptionMember2020-01-012020-12-310000318154us-gaap:EmployeeStockOptionMember2019-01-012019-12-310000318154us-gaap:EmployeeStockOptionMember2018-01-012018-12-310000318154us-gaap:RestrictedStockUnitsRSUMember2019-12-310000318154us-gaap:RestrictedStockUnitsRSUMember2020-12-310000318154us-gaap:EmployeeStockOptionMember2019-12-310000318154us-gaap:EmployeeStockOptionMember2020-12-310000318154amgn:PerformanceUnitsMember2020-12-310000318154amgn:PerformanceUnitsMember2019-12-310000318154us-gaap:DomesticCountryMember2020-01-012020-12-310000318154us-gaap:DomesticCountryMember2019-01-012019-12-310000318154us-gaap:DomesticCountryMember2018-01-012018-12-310000318154us-gaap:ForeignCountryMember2020-01-012020-12-310000318154us-gaap:ForeignCountryMember2019-01-012019-12-310000318154us-gaap:ForeignCountryMember2018-01-012018-12-310000318154us-gaap:DomesticCountryMember2020-12-310000318154amgn:ExpirationInTaxYearsBetween2023And2035Memberus-gaap:DomesticCountryMember2020-12-310000318154us-gaap:StateAndLocalJurisdictionMember2020-12-310000318154us-gaap:DomesticCountryMemberamgn:OperatingLossesThatExpireBetween2021And2035Member2020-12-310000318154us-gaap:ForeignCountryMember2020-12-310000318154us-gaap:ForeignCountryMemberamgn:OperatingLossesThatExpireBetween2021And2030Member2020-12-310000318154amgn:BeiGeneMember2020-01-020000318154amgn:BeiGeneMember2020-01-022020-01-020000318154amgn:BeiGeneMemberus-gaap:ResearchAndDevelopmentExpenseMember2020-01-012020-12-310000318154us-gaap:OtherCurrentAssetsMemberamgn:BeiGeneMember2020-12-310000318154amgn:CollaborativeArrangementwithNovartisPharmaAGMember2020-12-310000318154us-gaap:SellingGeneralAndAdministrativeExpensesMemberamgn:CollaborativeArrangementwithNovartisPharmaAGMember2020-01-012020-12-310000318154us-gaap:SellingGeneralAndAdministrativeExpensesMemberamgn:CollaborativeArrangementwithNovartisPharmaAGMember2019-01-012019-12-310000318154us-gaap:SellingGeneralAndAdministrativeExpensesMemberamgn:CollaborativeArrangementwithNovartisPharmaAGMember2018-01-012018-12-310000318154us-gaap:CostOfSalesMemberamgn:CollaborativeArrangementwithNovartisPharmaAGMember2020-01-012020-12-310000318154us-gaap:CostOfSalesMemberamgn:CollaborativeArrangementwithNovartisPharmaAGMember2019-01-012019-12-310000318154us-gaap:CostOfSalesMemberamgn:CollaborativeArrangementwithNovartisPharmaAGMember2018-01-012018-12-310000318154us-gaap:ProductAndServiceOtherMemberamgn:CollaborativeArrangementwithNovartisPharmaAGMember2018-01-012018-12-31amgn:country0000318154amgn:CollaborativeArrangementswithBayerHealthCarePharmaceuticalsInc.Memberamgn:NexavarMember2020-01-012020-12-310000318154amgn:NonUsExcludingJapanMemberamgn:CollaborativeArrangementswithBayerHealthCarePharmaceuticalsInc.Memberamgn:NexavarMember2020-01-012020-12-310000318154country:USamgn:CollaborativeArrangementswithBayerHealthCarePharmaceuticalsInc.Memberamgn:NexavarMember2020-01-012020-12-310000318154us-gaap:RoyaltyMemberamgn:OtherRevenuesMemberamgn:CollaborativeArrangementswithBayerHealthCarePharmaceuticalsInc.Member2020-01-012020-12-310000318154us-gaap:RoyaltyMemberamgn:OtherRevenuesMemberamgn:CollaborativeArrangementswithBayerHealthCarePharmaceuticalsInc.Member2019-01-012019-12-310000318154us-gaap:RoyaltyMemberamgn:OtherRevenuesMemberamgn:CollaborativeArrangementswithBayerHealthCarePharmaceuticalsInc.Member2018-01-012018-12-310000318154amgn:OtherRevenuesMemberamgn:CollaborativeArrangementswithBayerHealthCarePharmaceuticalsInc.Memberamgn:NexavarMember2019-01-012019-12-310000318154amgn:OtherRevenuesMemberamgn:CollaborativeArrangementswithBayerHealthCarePharmaceuticalsInc.Memberamgn:NexavarMember2018-01-012018-12-310000318154us-gaap:USTreasurySecuritiesMember2020-12-310000318154us-gaap:USTreasuryBillSecuritiesMember2020-12-310000318154amgn:CorporateDebtSecuritiesFinancialMember2020-12-310000318154amgn:CorporateDebtSecuritiesIndustrialMember2020-12-310000318154amgn:CorporateDebtSecuritiesOtherMember2020-12-310000318154us-gaap:ResidentialMortgageBackedSecuritiesMember2020-12-310000318154us-gaap:MoneyMarketFundsMember2020-12-310000318154amgn:OtherShortTermInterestBearingSecuritiesMember2020-12-310000318154us-gaap:USTreasurySecuritiesMember2019-12-310000318154us-gaap:USTreasuryBillSecuritiesMember2019-12-310000318154amgn:CorporateDebtSecuritiesFinancialMember2019-12-310000318154amgn:CorporateDebtSecuritiesIndustrialMember2019-12-310000318154amgn:CorporateDebtSecuritiesOtherMember2019-12-310000318154us-gaap:ResidentialMortgageBackedSecuritiesMember2019-12-310000318154us-gaap:MoneyMarketFundsMember2019-12-310000318154amgn:OtherShortTermInterestBearingSecuritiesMember2019-12-310000318154amgn:AvailableForSalesInvestmentsMember2020-12-310000318154amgn:AvailableForSalesInvestmentsMember2019-12-310000318154us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembersrt:PartnershipInterestMember2020-12-310000318154us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembersrt:PartnershipInterestMember2019-12-310000318154us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembersrt:PartnershipInterestMember2020-01-012020-12-310000318154us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembersrt:PartnershipInterestMember2019-01-012019-12-310000318154us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembersrt:PartnershipInterestMember2018-01-012018-12-310000318154srt:MinimumMemberamgn:BeiGeneMember2020-01-012020-12-310000318154amgn:BeiGeneMembersrt:MaximumMember2020-01-012020-12-310000318154amgn:BeiGeneMember2020-01-012020-12-310000318154amgn:BeiGeneMember2020-12-310000318154srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2020-01-012020-12-310000318154us-gaap:BuildingAndBuildingImprovementsMembersrt:MaximumMember2020-01-012020-12-310000318154srt:MinimumMemberamgn:ManufacturingEquipmentMember2020-01-012020-12-310000318154amgn:ManufacturingEquipmentMembersrt:MaximumMember2020-01-012020-12-310000318154srt:MinimumMemberamgn:LaboratoryEquipmentMember2020-01-012020-12-310000318154srt:MaximumMemberamgn:LaboratoryEquipmentMember2020-01-012020-12-310000318154amgn:FixedEquipmentMember2020-01-012020-12-310000318154us-gaap:SoftwareAndSoftwareDevelopmentCostsMembersrt:MinimumMember2020-01-012020-12-310000318154us-gaap:SoftwareAndSoftwareDevelopmentCostsMembersrt:MaximumMember2020-01-012020-12-310000318154srt:MinimumMemberus-gaap:PropertyPlantAndEquipmentOtherTypesMember2020-01-012020-12-310000318154us-gaap:PropertyPlantAndEquipmentOtherTypesMembersrt:MaximumMember2020-01-012020-12-310000318154country:US2020-12-310000318154country:US2019-12-310000318154country:PR2020-12-310000318154country:PR2019-12-310000318154amgn:RestOfWorldMember2020-12-310000318154amgn:RestOfWorldMember2019-12-310000318154us-gaap:DevelopedTechnologyRightsMember2020-12-310000318154us-gaap:DevelopedTechnologyRightsMember2019-12-310000318154us-gaap:LicensingAgreementsMember2020-12-310000318154us-gaap:LicensingAgreementsMember2019-12-310000318154us-gaap:MarketingRelatedIntangibleAssetsMember2020-12-310000318154us-gaap:MarketingRelatedIntangibleAssetsMember2019-12-310000318154amgn:AcquiredResearchAndDevelopmentTechnologyRightsMember2020-12-310000318154amgn:AcquiredResearchAndDevelopmentTechnologyRightsMember2019-12-310000318154us-gaap:InProcessResearchAndDevelopmentMember2020-12-310000318154us-gaap:InProcessResearchAndDevelopmentMember2019-12-310000318154amgn:AbandonedLeasesMember2020-12-310000318154srt:MinimumMember2020-12-310000318154srt:MaximumMember2020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FourPointFiveZeroPercentNotesDue2020Member2020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FourPointFiveZeroPercentNotesDue2020Member2019-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPointOneTwoFivePercentNotesDueTwoZeroTwoZeroMember2020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPointOneTwoFivePercentNotesDueTwoZeroTwoZeroMember2019-12-310000318154amgn:FloatingRateNotesDue2020Memberus-gaap:NotesPayableToBanksMember2020-12-310000318154amgn:FloatingRateNotesDue2020Memberus-gaap:NotesPayableToBanksMember2019-12-310000318154amgn:TwoPointTwoZeroNotesDue2020Memberus-gaap:NotesPayableToBanksMember2020-12-310000318154amgn:TwoPointTwoZeroNotesDue2020Memberus-gaap:NotesPayableToBanksMember2019-12-310000318154amgn:ThreePointFourFivePercentNotesDue2020Memberus-gaap:NotesPayableToBanksMember2020-12-310000318154amgn:ThreePointFourFivePercentNotesDue2020Memberus-gaap:NotesPayableToBanksMember2019-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FourPointOneZeroPercentNotesDue2021Member2020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FourPointOneZeroPercentNotesDue2021Member2019-12-310000318154amgn:OnePointEightFivePercentNotesDueTwoZeroTwoOneMemberus-gaap:NotesPayableToBanksMember2020-12-310000318154amgn:OnePointEightFivePercentNotesDueTwoZeroTwoOneMemberus-gaap:NotesPayableToBanksMember2019-12-310000318154amgn:ThreePointEightSevenFivePercentNotesDue2021Memberus-gaap:NotesPayableToBanksMember2020-12-310000318154amgn:ThreePointEightSevenFivePercentNotesDue2021Memberus-gaap:NotesPayableToBanksMember2019-12-310000318154amgn:OnePointTwoFivePercentEuroNotesdueTwoZeroTwoTwoMemberus-gaap:NotesPayableToBanksMember2020-12-31iso4217:EUR0000318154amgn:OnePointTwoFivePercentEuroNotesdueTwoZeroTwoTwoMemberus-gaap:NotesPayableToBanksMember2019-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPointSevenZeroPercentNotesDueTwoZeroTwoTwoMember2020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPointSevenZeroPercentNotesDueTwoZeroTwoTwoMember2019-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPointSixFiveNotesDue2022Member2020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPointSixFiveNotesDue2022Member2019-12-310000318154amgn:ThreePointSixTwoFivePercentNotesDue2022Memberus-gaap:NotesPayableToBanksMember2020-12-310000318154amgn:ThreePointSixTwoFivePercentNotesDue2022Memberus-gaap:NotesPayableToBanksMember2019-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:ZeroPointFortyOnePercentSwissFrancBondsDueTwoThousandTwentyThreeMember2020-12-31iso4217:CHF0000318154us-gaap:NotesPayableToBanksMemberamgn:ZeroPointFortyOnePercentSwissFrancBondsDueTwoThousandTwentyThreeMember2019-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPointTwoFivePercentNotesDueTwoZeroTwoThreeMember2020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPointTwoFivePercentNotesDueTwoZeroTwoThreeMember2019-12-310000318154amgn:ThreePointSixTwoFivePercentNotesDue2024Memberus-gaap:NotesPayableToBanksMember2020-12-310000318154amgn:ThreePointSixTwoFivePercentNotesDue2024Memberus-gaap:NotesPayableToBanksMember2019-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:OnePointNineZeroPercentNotesDueTwoZeroTwoFiveMember2020-12-310000318154amgn:ThreePointOneTwoFivePercentNotesDueTwoZeroTwoFiveMemberus-gaap:NotesPayableToBanksMember2020-12-310000318154amgn:ThreePointOneTwoFivePercentNotesDueTwoZeroTwoFiveMemberus-gaap:NotesPayableToBanksMember2019-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPercentEuroNotesDueTwoThousandTwentySixMember2020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPercentEuroNotesDueTwoThousandTwentySixMember2019-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPointSixZeroNotesDueTwoZeroTwoSixMember2020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPointSixZeroNotesDueTwoZeroTwoSixMember2019-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FivePointFiveZeroPercentPoundSterlingNotesDue2026Member2020-12-31iso4217:GBP0000318154us-gaap:NotesPayableToBanksMemberamgn:FivePointFiveZeroPercentPoundSterlingNotesDue2026Member2019-12-310000318154amgn:TwoPointTwoZeroPercentNotesDueTwoZeroTwoSevenMemberus-gaap:NotesPayableToBanksMember2020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:ThreePointTwoZeroNotesDue2027Member2020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:ThreePointTwoZeroNotesDue2027Member2019-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FourPercentPoundSterlingNotesDue2029Member2020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FourPercentPoundSterlingNotesDue2029Member2019-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPointFourFivePercentNotesDue2030Member2020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPointThreeZeroPercentNotesDue2031Member2020-12-310000318154amgn:SixPointThreeSevenFivePercentNotesDue2037Memberus-gaap:NotesPayableToBanksMember2020-12-310000318154amgn:SixPointThreeSevenFivePercentNotesDue2037Memberus-gaap:NotesPayableToBanksMember2019-12-310000318154amgn:SixPointNineZeroPercentNotesDue2038Memberus-gaap:NotesPayableToBanksMember2020-12-310000318154amgn:SixPointNineZeroPercentNotesDue2038Memberus-gaap:NotesPayableToBanksMember2019-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:SixPointFourZeroPercentNotesDue2039Member2020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:SixPointFourZeroPercentNotesDue2039Member2019-12-310000318154amgn:ThreePointOneFivePercentNotesDue2040Memberus-gaap:NotesPayableToBanksMember2020-12-310000318154amgn:FivePointSevenFivePercentNotesDue2040Memberus-gaap:NotesPayableToBanksMember2020-12-310000318154amgn:FivePointSevenFivePercentNotesDue2040Memberus-gaap:NotesPayableToBanksMember2019-12-310000318154amgn:FourPointNineFivePercentNotesDue2041Memberus-gaap:NotesPayableToBanksMember2020-12-310000318154amgn:FourPointNineFivePercentNotesDue2041Memberus-gaap:NotesPayableToBanksMember2019-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FivePointOneFivePercentNotesDue2041Member2020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FivePointOneFivePercentNotesDue2041Member2019-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FivePointSixFivePercentNotesDue2042Member2020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FivePointSixFivePercentNotesDue2042Member2019-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FivePointThreeSevenFivePercentNotesDue2043Member2020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FivePointThreeSevenFivePercentNotesDue2043Member2019-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FourPointFourZeroPercentNotesDueTwoZeroFourFiveMember2020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FourPointFourZeroPercentNotesDueTwoZeroFourFiveMember2019-12-310000318154amgn:FourPointFiveSixThreePercentNotesDueTwoZeroFourEightMemberus-gaap:NotesPayableToBanksMember2020-12-310000318154amgn:FourPointFiveSixThreePercentNotesDueTwoZeroFourEightMemberus-gaap:NotesPayableToBanksMember2019-12-310000318154amgn:ThreePointThreeSevenFivePercentNotesDue2050Memberus-gaap:NotesPayableToBanksMember2020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FourPointSixSixThreePercentNotesDueTwoZeroFiveOneMember2020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FourPointSixSixThreePercentNotesDueTwoZeroFiveOneMember2019-12-310000318154amgn:TwoPointSevenSevenPercentNotesDueTwoZeroFiveThreeMemberus-gaap:NotesPayableToBanksMember2020-12-310000318154amgn:TwoPointSevenSevenPercentNotesDueTwoZeroFiveThreeMemberus-gaap:NotesPayableToBanksMember2019-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:OtherNotesDue2097Member2020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:OtherNotesDue2097Member2019-12-310000318154amgn:FourPointFiveSixThreePercentNotesDueTwoZeroFourEightMemberus-gaap:NotesPayableToBanksMember2020-01-012020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FourPercentPoundSterlingNotesDue2029Member2020-01-012020-12-310000318154amgn:OnePointEightFivePercentNotesDueTwoZeroTwoOneMemberus-gaap:NotesPayableToBanksMember2020-01-012020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPointOneTwoFivePercentNotesDueTwoZeroTwoZeroMember2020-01-012020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FivePointThreeSevenFivePercentNotesDue2043Member2020-01-012020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FivePointSixFivePercentNotesDue2042Member2020-01-012020-12-310000318154amgn:ThreePointEightSevenFivePercentNotesDue2021Memberus-gaap:NotesPayableToBanksMember2020-01-012020-12-310000318154amgn:FourPointNineFivePercentNotesDue2041Memberus-gaap:NotesPayableToBanksMember2020-01-012020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FivePointFiveZeroPercentPoundSterlingNotesDue2026Member2020-01-012020-12-310000318154amgn:SixPointThreeSevenFivePercentNotesDue2037Memberus-gaap:NotesPayableToBanksMember2020-01-012020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FourPointSixSixThreePercentNotesDueTwoZeroFiveOneMember2020-01-012020-12-310000318154amgn:FloatingRateNotesDue2020Memberus-gaap:NotesPayableToBanksMember2020-01-012020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPointSixZeroNotesDueTwoZeroTwoSixMember2020-01-012020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FourPointFiveZeroPercentNotesDue2020Member2020-01-012020-12-310000318154amgn:ThreePointFourFivePercentNotesDue2020Memberus-gaap:NotesPayableToBanksMember2020-01-012020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:ThreePointTwoZeroNotesDue2027Member2020-01-012020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPointSevenZeroPercentNotesDueTwoZeroTwoTwoMember2020-01-012020-12-310000318154amgn:ThreePointOneTwoFivePercentNotesDueTwoZeroTwoFiveMemberus-gaap:NotesPayableToBanksMember2020-01-012020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:ZeroPointFortyOnePercentSwissFrancBondsDueTwoThousandTwentyThreeMember2020-01-012020-12-310000318154amgn:ThreePointSixTwoFivePercentNotesDue2024Memberus-gaap:NotesPayableToBanksMember2020-01-012020-12-310000318154amgn:TwoPointTwoZeroNotesDue2020Memberus-gaap:NotesPayableToBanksMember2020-01-012020-12-310000318154amgn:SixPointNineZeroPercentNotesDue2038Memberus-gaap:NotesPayableToBanksMember2020-01-012020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:SixPointFourZeroPercentNotesDue2039Member2020-01-012020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:OnePointNineZeroPercentNotesDueTwoZeroTwoFiveMember2020-01-012020-12-310000318154amgn:ThreePointOneFivePercentNotesDue2040Memberus-gaap:NotesPayableToBanksMember2020-01-012020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPercentEuroNotesDueTwoThousandTwentySixMember2020-01-012020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FourPointFourZeroPercentNotesDueTwoZeroFourFiveMember2020-01-012020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPointSixFiveNotesDue2022Member2020-01-012020-12-310000318154amgn:OnePointTwoFivePercentEuroNotesdueTwoZeroTwoTwoMemberus-gaap:NotesPayableToBanksMember2020-01-012020-12-310000318154amgn:FivePointSevenFivePercentNotesDue2040Memberus-gaap:NotesPayableToBanksMember2020-01-012020-12-310000318154amgn:TwoPointSevenSevenPercentNotesDueTwoZeroFiveThreeMemberus-gaap:NotesPayableToBanksMember2020-01-012020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPointFourFivePercentNotesDue2030Member2020-01-012020-12-310000318154amgn:ThreePointSixTwoFivePercentNotesDue2022Memberus-gaap:NotesPayableToBanksMember2020-01-012020-12-310000318154amgn:ThreePointThreeSevenFivePercentNotesDue2050Memberus-gaap:NotesPayableToBanksMember2020-01-012020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FivePointOneFivePercentNotesDue2041Member2020-01-012020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPointTwoFivePercentNotesDueTwoZeroTwoThreeMember2020-01-012020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPointThreeZeroPercentNotesDue2031Member2020-01-012020-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:FourPointOneZeroPercentNotesDue2021Member2020-01-012020-12-310000318154amgn:TwoPointTwoZeroPercentNotesDueTwoZeroTwoSevenMemberus-gaap:NotesPayableToBanksMember2020-01-012020-12-310000318154amgn:ZeroPointFortyOnePercentSwissFrancBondsDueTwoThousandTwentyThreeMember2020-12-310000318154srt:MinimumMemberus-gaap:DebtSecuritiesPayableMember2020-01-012020-12-310000318154us-gaap:DebtSecuritiesPayableMembersrt:MaximumMember2020-01-012020-12-310000318154us-gaap:NotesPayableToBanksMember2020-02-290000318154us-gaap:NotesPayableToBanksMemberamgn:OnePointNineZeroPercentNotesDueTwoZeroTwoFiveMember2020-02-290000318154amgn:TwoPointTwoZeroPercentNotesDueTwoZeroTwoSevenMemberus-gaap:NotesPayableToBanksMember2020-02-290000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPointFourFivePercentNotesDue2030Member2020-02-290000318154amgn:ThreePointOneFivePercentNotesDue2040Memberus-gaap:NotesPayableToBanksMember2020-02-290000318154amgn:ThreePointThreeSevenFivePercentNotesDue2050Memberus-gaap:NotesPayableToBanksMember2020-02-290000318154us-gaap:NotesPayableToBanksMember2020-05-310000318154amgn:TwoPointTwoZeroPercentNotesDueTwoZeroTwoSevenMemberus-gaap:NotesPayableToBanksMember2020-05-310000318154amgn:ThreePointOneFivePercentNotesDue2040Memberus-gaap:NotesPayableToBanksMember2020-05-310000318154amgn:ThreePointThreeSevenFivePercentNotesDue2050Memberus-gaap:NotesPayableToBanksMember2020-05-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPointThreeZeroPercentNotesDue2031Member2020-05-310000318154us-gaap:NotesPayableToBanksMember2020-01-012020-12-310000318154us-gaap:NotesPayableToBanksMember2019-01-012019-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPointTwoZeroPercentNotesDue2019Member2019-01-012019-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:TwoPointTwoZeroPercentNotesDue2019Member2019-12-310000318154amgn:FivePointSevenZeroPercentNotesDue2019Memberus-gaap:NotesPayableToBanksMember2019-01-012019-12-310000318154amgn:FivePointSevenZeroPercentNotesDue2019Memberus-gaap:NotesPayableToBanksMember2019-12-310000318154amgn:TwoPointOneTwoFivePercentEuroNotesDue2019Memberus-gaap:NotesPayableToBanksMember2019-01-012019-12-310000318154amgn:TwoPointOneTwoFivePercentEuroNotesDue2019Memberus-gaap:NotesPayableToBanksMember2019-12-310000318154amgn:OnePointNineZeroNotesDue2019Memberus-gaap:NotesPayableToBanksMember2019-01-012019-12-310000318154amgn:OnePointNineZeroNotesDue2019Memberus-gaap:NotesPayableToBanksMember2019-12-310000318154amgn:FloatingRateNotesDue2019Memberus-gaap:NotesPayableToBanksMember2019-01-012019-12-310000318154us-gaap:NotesPayableToBanksMember2018-01-012018-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:SixPointOneFivePercentNotesDue2018Member2018-01-012018-12-310000318154us-gaap:NotesPayableToBanksMemberamgn:SixPointOneFivePercentNotesDue2018Member2018-12-310000318154amgn:FourPointThreeSevenFivePercentEuroNotesDue2018Memberus-gaap:NotesPayableToBanksMember2018-01-012018-12-310000318154amgn:FourPointThreeSevenFivePercentEuroNotesDue2018Memberus-gaap:NotesPayableToBanksMember2018-12-310000318154us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2020-12-310000318154us-gaap:DesignatedAsHedgingInstrumentMemberamgn:InterestRateSwapTwoMemberus-gaap:InterestRateSwapMember2020-12-310000318154us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2020-01-012020-12-310000318154us-gaap:DesignatedAsHedgingInstrumentMemberamgn:InterestRateSwapThreeMemberus-gaap:InterestRateSwapMember2020-12-310000318154amgn:ThreePointFourFivePercentNotesDue2020Memberus-gaap:NotesPayableOtherPayablesMember2020-12-310000318154amgn:ThreePointFourFivePercentNotesDue2020Memberus-gaap:NotesPayableOtherPayablesMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-12-310000318154amgn:ThreePointFourFivePercentNotesDue2020Memberus-gaap:NotesPayableOtherPayablesMember2019-12-310000318154amgn:ThreePointFourFivePercentNotesDue2020Memberus-gaap:NotesPayableOtherPayablesMemberus-gaap:LondonInterbankOfferedRateLIBORMember2019-12-310000318154us-gaap:NotesPayableOtherPayablesMemberamgn:FourPointOneZeroPercentNotesDue2021Member2020-12-310000318154us-gaap:NotesPayableOtherPayablesMemberus-gaap:LondonInterbankOfferedRateLIBORMemberamgn:FourPointOneZeroPercentNotesDue2021Member2020-12-310000318154us-gaap:NotesPayableOtherPayablesMemberamgn:FourPointOneZeroPercentNotesDue2021Member2019-12-310000318154us-gaap:NotesPayableOtherPayablesMemberus-gaap:LondonInterbankOfferedRateLIBORMemberamgn:FourPointOneZeroPercentNotesDue2021Member2019-12-310000318154amgn:ThreePointEightSevenFivePercentNotesDue2021Memberus-gaap:NotesPayableOtherPayablesMember2020-12-310000318154amgn:ThreePointEightSevenFivePercentNotesDue2021Memberus-gaap:NotesPayableOtherPayablesMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-12-310000318154amgn:ThreePointEightSevenFivePercentNotesDue2021Memberus-gaap:NotesPayableOtherPayablesMember2019-12-310000318154amgn:ThreePointEightSevenFivePercentNotesDue2021Memberus-gaap:NotesPayableOtherPayablesMemberus-gaap:LondonInterbankOfferedRateLIBORMember2019-12-310000318154amgn:ThreePointSixTwoFivePercentNotesDue2022Memberus-gaap:NotesPayableOtherPayablesMember2020-12-310000318154amgn:ThreePointSixTwoFivePercentNotesDue2022Memberus-gaap:NotesPayableOtherPayablesMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-12-310000318154amgn:ThreePointSixTwoFivePercentNotesDue2022Memberus-gaap:NotesPayableOtherPayablesMember2019-12-310000318154amgn:ThreePointSixTwoFivePercentNotesDue2022Memberus-gaap:NotesPayableOtherPayablesMemberus-gaap:LondonInterbankOfferedRateLIBORMember2019-12-310000318154amgn:ThreePointSixTwoFivePercentNotesDue2024Memberus-gaap:NotesPayableOtherPayablesMember2020-12-310000318154amgn:ThreePointSixTwoFivePercentNotesDue2024Memberus-gaap:NotesPayableOtherPayablesMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-12-310000318154amgn:ThreePointSixTwoFivePercentNotesDue2024Memberus-gaap:NotesPayableOtherPayablesMember2019-12-310000318154amgn:ThreePointSixTwoFivePercentNotesDue2024Memberus-gaap:NotesPayableOtherPayablesMemberus-gaap:LondonInterbankOfferedRateLIBORMember2019-12-310000318154amgn:ThreePointOneTwoFivePercentNotesDueTwoZeroTwoFiveMemberus-gaap:NotesPayableOtherPayablesMember2020-12-310000318154amgn:ThreePointOneTwoFivePercentNotesDueTwoZeroTwoFiveMemberus-gaap:NotesPayableOtherPayablesMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-12-310000318154amgn:ThreePointOneTwoFivePercentNotesDueTwoZeroTwoFiveMemberus-gaap:NotesPayableOtherPayablesMember2019-12-310000318154amgn:ThreePointOneTwoFivePercentNotesDueTwoZeroTwoFiveMemberus-gaap:NotesPayableOtherPayablesMemberus-gaap:LondonInterbankOfferedRateLIBORMember2019-12-310000318154us-gaap:NotesPayableOtherPayablesMemberamgn:TwoPointSixZeroNotesDueTwoZeroTwoSixMember2020-12-310000318154us-gaap:NotesPayableOtherPayablesMemberus-gaap:LondonInterbankOfferedRateLIBORMemberamgn:TwoPointSixZeroNotesDueTwoZeroTwoSixMember2020-12-310000318154us-gaap:NotesPayableOtherPayablesMemberamgn:TwoPointSixZeroNotesDueTwoZeroTwoSixMember2019-12-310000318154us-gaap:NotesPayableOtherPayablesMemberus-gaap:LondonInterbankOfferedRateLIBORMemberamgn:TwoPointSixZeroNotesDueTwoZeroTwoSixMember2019-12-310000318154us-gaap:NotesPayableOtherPayablesMemberamgn:FourPointSixSixThreePercentNotesDueTwoZeroFiveOneMember2020-12-310000318154us-gaap:NotesPayableOtherPayablesMemberamgn:FourPointSixSixThreePercentNotesDueTwoZeroFiveOneMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-12-310000318154us-gaap:NotesPayableOtherPayablesMemberamgn:FourPointSixSixThreePercentNotesDueTwoZeroFiveOneMember2019-12-310000318154us-gaap:NotesPayableOtherPayablesMemberamgn:FourPointSixSixThreePercentNotesDueTwoZeroFiveOneMemberus-gaap:LondonInterbankOfferedRateLIBORMember2019-12-310000318154us-gaap:NotesPayableOtherPayablesMember2020-12-310000318154us-gaap:NotesPayableOtherPayablesMember2019-12-310000318154amgn:FourPointSixSixThreePercentNotesDueTwoZeroFiveOneMember2020-01-012020-12-310000318154amgn:OnePointTwoFivePercentEuroNotesdueTwoZeroTwoTwoMemberus-gaap:NotesPayableOtherPayablesMember2020-12-310000318154us-gaap:NotesPayableOtherPayablesMemberamgn:ZeroPointFortyOnePercentSwissFrancBondsDueTwoThousandTwentyThreeMember2020-12-310000318154us-gaap:NotesPayableOtherPayablesMemberamgn:TwoPercentEuroNotesDueTwoThousandTwentySixMember2020-12-310000318154us-gaap:LineOfCreditMember2020-12-310000318154us-gaap:LineOfCreditMember2020-01-012020-12-31amgn:renewal_option0000318154us-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:LineOfCreditMember2020-01-012020-12-310000318154us-gaap:FederalFundsEffectiveSwapRateMemberus-gaap:LineOfCreditMember2020-01-012020-12-310000318154us-gaap:LineOfCreditMember2019-12-3100003181542020-01-012020-03-3100003181542019-01-012019-03-3100003181542020-04-012020-06-3000003181542019-04-012019-06-3000003181542018-04-012018-06-3000003181542020-07-012020-09-3000003181542019-07-012019-09-3000003181542018-07-012018-09-3000003181542020-10-012020-12-3100003181542019-10-012019-12-3100003181542018-10-012018-12-310000318154srt:ScenarioForecastMember2021-03-082021-03-0800003181542020-12-162020-12-160000318154us-gaap:AccumulatedTranslationAdjustmentMember2017-12-310000318154us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2017-12-310000318154us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2017-12-310000318154amgn:AccumulatedOtherAdjustmentAttributabletoParentMember2017-12-310000318154srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2017-12-310000318154us-gaap:AccumulatedTranslationAdjustmentMember2018-01-012018-12-310000318154us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2018-01-012018-12-310000318154us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2018-01-012018-12-310000318154amgn:AccumulatedOtherAdjustmentAttributabletoParentMember2018-01-012018-12-310000318154us-gaap:AccumulatedTranslationAdjustmentMember2018-12-310000318154us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2018-12-310000318154us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2018-12-310000318154amgn:AccumulatedOtherAdjustmentAttributabletoParentMember2018-12-310000318154us-gaap:AccumulatedTranslationAdjustmentMember2019-01-012019-12-310000318154us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-01-012019-12-310000318154us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-01-012019-12-310000318154amgn:AccumulatedOtherAdjustmentAttributabletoParentMember2019-01-012019-12-310000318154us-gaap:AccumulatedTranslationAdjustmentMember2019-12-310000318154us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-12-310000318154us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-12-310000318154amgn:AccumulatedOtherAdjustmentAttributabletoParentMember2019-12-310000318154us-gaap:AccumulatedTranslationAdjustmentMember2020-01-012020-12-310000318154us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-01-012020-12-310000318154us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-01-012020-12-310000318154amgn:AccumulatedOtherAdjustmentAttributabletoParentMember2020-01-012020-12-310000318154us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310000318154us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-12-310000318154us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-12-310000318154amgn:AccumulatedOtherAdjustmentAttributabletoParentMember2020-12-310000318154us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:ProductMember2020-01-012020-12-310000318154us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:ProductMember2019-01-012019-12-310000318154us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:ProductMember2018-01-012018-12-310000318154us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberamgn:CrossCurrencySwapContractsMemberus-gaap:CashFlowHedgingMember2020-01-012020-12-310000318154us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberamgn:CrossCurrencySwapContractsMemberus-gaap:CashFlowHedgingMember2019-01-012019-12-310000318154us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberamgn:CrossCurrencySwapContractsMemberus-gaap:CashFlowHedgingMember2018-01-012018-12-310000318154us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-01-012020-12-310000318154us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-01-012019-12-310000318154us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2018-01-012018-12-310000318154us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-01-012020-12-310000318154us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-01-012019-12-310000318154us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2018-01-012018-12-310000318154us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMember2020-12-310000318154us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310000318154us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel3Member2020-12-310000318154us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryBillSecuritiesMember2020-12-310000318154us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryBillSecuritiesMember2020-12-310000318154us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryBillSecuritiesMember2020-12-310000318154us-gaap:FairValueInputsLevel1Memberamgn:CorporateDebtSecuritiesFinancialMember2020-12-310000318154us-gaap:FairValueInputsLevel2Memberamgn:CorporateDebtSecuritiesFinancialMember2020-12-310000318154us-gaap:FairValueInputsLevel3Memberamgn:CorporateDebtSecuritiesFinancialMember2020-12-310000318154us-gaap:FairValueInputsLevel1Memberamgn:CorporateDebtSecuritiesIndustrialMember2020-12-310000318154us-gaap:FairValueInputsLevel2Memberamgn:CorporateDebtSecuritiesIndustrialMember2020-12-310000318154amgn:CorporateDebtSecuritiesIndustrialMemberus-gaap:FairValueInputsLevel3Member2020-12-310000318154us-gaap:FairValueInputsLevel1Memberamgn:CorporateDebtSecuritiesOtherMember2020-12-310000318154us-gaap:FairValueInputsLevel2Memberamgn:CorporateDebtSecuritiesOtherMember2020-12-310000318154us-gaap:FairValueInputsLevel3Memberamgn:CorporateDebtSecuritiesOtherMember2020-12-310000318154us-gaap:FairValueInputsLevel1Memberus-gaap:ResidentialMortgageBackedSecuritiesMember2020-12-310000318154us-gaap:FairValueInputsLevel2Memberus-gaap:ResidentialMortgageBackedSecuritiesMember2020-12-310000318154us-gaap:FairValueInputsLevel3Memberus-gaap:ResidentialMortgageBackedSecuritiesMember2020-12-310000318154us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2020-12-310000318154us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2020-12-310000318154us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2020-12-310000318154us-gaap:FairValueInputsLevel1Memberamgn:OtherShortTermInterestBearingSecuritiesMember2020-12-310000318154amgn:OtherShortTermInterestBearingSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310000318154amgn:OtherShortTermInterestBearingSecuritiesMemberus-gaap:FairValueInputsLevel3Member2020-12-310000318154us-gaap:FairValueInputsLevel1Member2020-12-310000318154us-gaap:FairValueInputsLevel2Member2020-12-310000318154us-gaap:FairValueInputsLevel3Member2020-12-310000318154us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignExchangeContractMember2020-12-310000318154us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeContractMember2020-12-310000318154us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignExchangeContractMember2020-12-310000318154us-gaap:ForeignExchangeContractMember2020-12-310000318154us-gaap:FairValueInputsLevel1Memberamgn:CrossCurrencySwapContractsMember2020-12-310000318154us-gaap:FairValueInputsLevel2Memberamgn:CrossCurrencySwapContractsMember2020-12-310000318154us-gaap:FairValueInputsLevel3Memberamgn:CrossCurrencySwapContractsMember2020-12-310000318154amgn:CrossCurrencySwapContractsMember2020-12-310000318154us-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateSwapMember2020-12-310000318154us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMember2020-12-310000318154us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateSwapMember2020-12-310000318154us-gaap:InterestRateSwapMember2020-12-310000318154us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMember2019-12-310000318154us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310000318154us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel3Member2019-12-310000318154us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryBillSecuritiesMember2019-12-310000318154us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryBillSecuritiesMember2019-12-310000318154us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryBillSecuritiesMember2019-12-310000318154us-gaap:FairValueInputsLevel1Memberamgn:CorporateDebtSecuritiesFinancialMember2019-12-310000318154us-gaap:FairValueInputsLevel2Memberamgn:CorporateDebtSecuritiesFinancialMember2019-12-310000318154us-gaap:FairValueInputsLevel3Memberamgn:CorporateDebtSecuritiesFinancialMember2019-12-310000318154us-gaap:FairValueInputsLevel1Memberamgn:CorporateDebtSecuritiesIndustrialMember2019-12-310000318154us-gaap:FairValueInputsLevel2Memberamgn:CorporateDebtSecuritiesIndustrialMember2019-12-310000318154amgn:CorporateDebtSecuritiesIndustrialMemberus-gaap:FairValueInputsLevel3Member2019-12-310000318154us-gaap:FairValueInputsLevel1Memberamgn:CorporateDebtSecuritiesOtherMember2019-12-310000318154us-gaap:FairValueInputsLevel2Memberamgn:CorporateDebtSecuritiesOtherMember2019-12-310000318154us-gaap:FairValueInputsLevel3Memberamgn:CorporateDebtSecuritiesOtherMember2019-12-310000318154us-gaap:FairValueInputsLevel1Memberus-gaap:ResidentialMortgageBackedSecuritiesMember2019-12-310000318154us-gaap:FairValueInputsLevel2Memberus-gaap:ResidentialMortgageBackedSecuritiesMember2019-12-310000318154us-gaap:FairValueInputsLevel3Memberus-gaap:ResidentialMortgageBackedSecuritiesMember2019-12-310000318154us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2019-12-310000318154us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2019-12-310000318154us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2019-12-310000318154us-gaap:FairValueInputsLevel1Memberamgn:OtherShortTermInterestBearingSecuritiesMember2019-12-310000318154amgn:OtherShortTermInterestBearingSecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310000318154amgn:OtherShortTermInterestBearingSecuritiesMemberus-gaap:FairValueInputsLevel3Member2019-12-310000318154us-gaap:FairValueInputsLevel1Member2019-12-310000318154us-gaap:FairValueInputsLevel2Member2019-12-310000318154us-gaap:FairValueInputsLevel3Member2019-12-310000318154us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignExchangeContractMember2019-12-310000318154us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeContractMember2019-12-310000318154us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignExchangeContractMember2019-12-310000318154us-gaap:ForeignExchangeContractMember2019-12-310000318154us-gaap:FairValueInputsLevel1Memberamgn:CrossCurrencySwapContractsMember2019-12-310000318154us-gaap:FairValueInputsLevel2Memberamgn:CrossCurrencySwapContractsMember2019-12-310000318154us-gaap:FairValueInputsLevel3Memberamgn:CrossCurrencySwapContractsMember2019-12-310000318154amgn:CrossCurrencySwapContractsMember2019-12-310000318154us-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateSwapMember2019-12-310000318154us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMember2019-12-310000318154us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateSwapMember2019-12-310000318154us-gaap:InterestRateSwapMember2019-12-310000318154us-gaap:InProcessResearchAndDevelopmentMemberus-gaap:OtherOperatingIncomeExpenseMember2018-01-012018-12-310000318154us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForwardContractsMember2020-12-310000318154us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForwardContractsMember2019-12-310000318154us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForwardContractsMember2018-12-310000318154us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OptionMember2018-12-310000318154amgn:CrossCurrencySwapContractsMemberamgn:OnePointTwentyFivePercentEuroNotesDueTwoThousandTwentyTwoMemberus-gaap:CashFlowHedgingMember2020-12-310000318154amgn:CrossCurrencySwapContractsMemberamgn:OnePointTwentyFivePercentEuroNotesDueTwoThousandTwentyTwoMemberus-gaap:CashFlowHedgingMembercurrency:EUR2020-12-310000318154currency:USDamgn:CrossCurrencySwapContractsMemberamgn:OnePointTwentyFivePercentEuroNotesDueTwoThousandTwentyTwoMemberus-gaap:CashFlowHedgingMember2020-12-310000318154amgn:CrossCurrencySwapContractsMemberus-gaap:CashFlowHedgingMemberamgn:ZeroPointFortyOnePercentSwissFrancBondsDueTwoThousandTwentyThreeMember2020-12-310000318154currency:CHFamgn:CrossCurrencySwapContractsMemberus-gaap:CashFlowHedgingMemberamgn:ZeroPointFortyOnePercentSwissFrancBondsDueTwoThousandTwentyThreeMember2020-12-310000318154currency:USDamgn:CrossCurrencySwapContractsMemberus-gaap:CashFlowHedgingMemberamgn:ZeroPointFortyOnePercentSwissFrancBondsDueTwoThousandTwentyThreeMember2020-12-310000318154amgn:CrossCurrencySwapContractsMemberamgn:TwoPercentEuroNotesDueTwoThousandTwentySixMemberus-gaap:CashFlowHedgingMember2020-12-310000318154amgn:CrossCurrencySwapContractsMemberamgn:TwoPercentEuroNotesDueTwoThousandTwentySixMemberus-gaap:CashFlowHedgingMembercurrency:EUR2020-12-310000318154currency:USDamgn:CrossCurrencySwapContractsMemberamgn:TwoPercentEuroNotesDueTwoThousandTwentySixMemberus-gaap:CashFlowHedgingMember2020-12-310000318154amgn:CrossCurrencySwapContractsMemberus-gaap:CashFlowHedgingMemberamgn:FivePointFiveZeroPercentPoundSterlingNotesDue2026Member2020-12-310000318154amgn:CrossCurrencySwapContractsMemberus-gaap:CashFlowHedgingMemberamgn:FivePointFiveZeroPercentPoundSterlingNotesDue2026Membercurrency:GBP2020-12-310000318154currency:USDamgn:CrossCurrencySwapContractsMemberus-gaap:CashFlowHedgingMemberamgn:FivePointFiveZeroPercentPoundSterlingNotesDue2026Member2020-12-310000318154amgn:CrossCurrencySwapContractsMemberamgn:FourPercentPoundSterlingNotesDue2029Memberus-gaap:CashFlowHedgingMember2020-12-310000318154amgn:CrossCurrencySwapContractsMemberamgn:FourPercentPoundSterlingNotesDue2029Memberus-gaap:CashFlowHedgingMembercurrency:GBP2020-12-310000318154currency:USDamgn:CrossCurrencySwapContractsMemberamgn:FourPercentPoundSterlingNotesDue2029Memberus-gaap:CashFlowHedgingMember2020-12-310000318154us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMember2020-01-012020-12-310000318154us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMember2019-01-012019-12-310000318154us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMember2018-01-012018-12-310000318154amgn:CrossCurrencySwapContractsMemberus-gaap:CashFlowHedgingMember2020-01-012020-12-310000318154amgn:CrossCurrencySwapContractsMemberus-gaap:CashFlowHedgingMember2019-01-012019-12-310000318154amgn:CrossCurrencySwapContractsMemberus-gaap:CashFlowHedgingMember2018-01-012018-12-310000318154amgn:ForwardInterestRateContractMemberus-gaap:CashFlowHedgingMember2020-01-012020-12-310000318154amgn:ForwardInterestRateContractMemberus-gaap:CashFlowHedgingMember2019-01-012019-12-310000318154amgn:ForwardInterestRateContractMemberus-gaap:CashFlowHedgingMember2018-01-012018-12-310000318154us-gaap:CashFlowHedgingMember2020-01-012020-12-310000318154us-gaap:CashFlowHedgingMember2019-01-012019-12-310000318154us-gaap:CashFlowHedgingMember2018-01-012018-12-310000318154us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2019-12-310000318154us-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMember2020-01-012020-12-310000318154us-gaap:LongTermDebtMemberamgn:InterestRateSwapAtThenCurrentInterestRatesMember2020-12-310000318154amgn:LongTermDebtCurrentMaturitiesMember2020-12-310000318154amgn:LongTermDebtCurrentMaturitiesMember2019-12-310000318154us-gaap:LongTermDebtMember2020-12-310000318154us-gaap:LongTermDebtMember2019-12-310000318154us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeContractMemberus-gaap:ProductMember2020-01-012020-12-310000318154us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberamgn:CrossCurrencySwapContractsMember2020-01-012020-12-310000318154us-gaap:InterestRateSwapMember2020-01-012020-12-310000318154us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeContractMemberus-gaap:ProductMember2019-01-012019-12-310000318154us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberamgn:CrossCurrencySwapContractsMember2019-01-012019-12-310000318154us-gaap:InterestRateSwapMember2019-01-012019-12-310000318154us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeContractMemberus-gaap:ProductMember2018-01-012018-12-310000318154us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberamgn:CrossCurrencySwapContractsMember2018-01-012018-12-310000318154us-gaap:InterestRateSwapMember2018-01-012018-12-310000318154amgn:ForeignCurrencyAndCrossCurrencySwapsMember2020-12-310000318154us-gaap:NondesignatedMemberus-gaap:ForwardContractsMember2020-12-310000318154us-gaap:NondesignatedMemberus-gaap:ForwardContractsMember2019-12-310000318154us-gaap:NondesignatedMemberus-gaap:ForwardContractsMember2018-12-310000318154us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMemberamgn:OtherCurrentNoncurrentAssetsMember2020-12-310000318154us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMemberamgn:AccruedLiabilitiesOtherNonCurrentLiabilitiesMember2020-12-310000318154us-gaap:DesignatedAsHedgingInstrumentMemberamgn:CrossCurrencySwapContractsMemberamgn:OtherCurrentNoncurrentAssetsMember2020-12-310000318154us-gaap:DesignatedAsHedgingInstrumentMemberamgn:CrossCurrencySwapContractsMemberamgn:AccruedLiabilitiesOtherNonCurrentLiabilitiesMember2020-12-310000318154us-gaap:DesignatedAsHedgingInstrumentMemberamgn:OtherCurrentNoncurrentAssetsMemberus-gaap:InterestRateSwapMember2020-12-310000318154us-gaap:DesignatedAsHedgingInstrumentMemberamgn:AccruedLiabilitiesOtherNonCurrentLiabilitiesMemberus-gaap:InterestRateSwapMember2020-12-310000318154us-gaap:DesignatedAsHedgingInstrumentMember2020-12-310000318154us-gaap:OtherCurrentAssetsMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2020-12-310000318154us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMemberus-gaap:AccruedLiabilitiesMember2020-12-310000318154us-gaap:NondesignatedMember2020-12-310000318154us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMemberamgn:OtherCurrentNoncurrentAssetsMember2019-12-310000318154us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMemberamgn:AccruedLiabilitiesOtherNonCurrentLiabilitiesMember2019-12-310000318154us-gaap:DesignatedAsHedgingInstrumentMemberamgn:CrossCurrencySwapContractsMemberamgn:OtherCurrentNoncurrentAssetsMember2019-12-310000318154us-gaap:DesignatedAsHedgingInstrumentMemberamgn:CrossCurrencySwapContractsMemberamgn:AccruedLiabilitiesOtherNonCurrentLiabilitiesMember2019-12-310000318154us-gaap:DesignatedAsHedgingInstrumentMemberamgn:OtherCurrentNoncurrentAssetsMemberus-gaap:InterestRateSwapMember2019-12-310000318154us-gaap:DesignatedAsHedgingInstrumentMemberamgn:AccruedLiabilitiesOtherNonCurrentLiabilitiesMemberus-gaap:InterestRateSwapMember2019-12-310000318154us-gaap:DesignatedAsHedgingInstrumentMember2019-12-310000318154us-gaap:OtherCurrentAssetsMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2019-12-310000318154us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMemberus-gaap:AccruedLiabilitiesMember2019-12-310000318154us-gaap:NondesignatedMember2019-12-31amgn:patent0000318154amgn:KYPROLIScarfilzomibPatentLitigationMembersrt:SubsidiariesMember2016-10-012018-04-3000003181542020-05-082020-05-08amgn:lawsuit0000318154amgn:SandozIncMember2018-06-012018-06-300000318154amgn:AmnealPharmaceuticalsLLCMember2016-09-012016-09-30amgn:affiliate0000318154amgn:ImmunexAndSandozMember2016-02-012016-02-280000318154amgn:ImmunexAndSamsungBioepisCoMember2019-04-012019-04-300000318154amgn:SanofiRegeneronPatentLitigationMember2014-10-012014-10-310000318154amgn:SanofiRegeneronPatentLitigationMember2016-02-012016-02-280000318154amgn:SanofiRegeneronPatentLitigationMember2018-03-012018-03-31amgn:claim00003181542019-05-20amgn:agreement0000318154amgn:NovartisBreachOfContractActionMember2019-04-012019-04-30amgn:plaintiffs0000318154amgn:SensiparAntitrustClassActionsMember2019-02-012019-04-300000318154amgn:HumiraBiosimilarAntitrustClassActionsMember2020-05-31amgn:complaints0000318154amgn:HumiraBiosimilarAntitrustClassActionsMember2019-03-012019-05-310000318154amgn:HumiraBiosimilarAntitrustClassActionsMember2019-06-04amgn:installment0000318154us-gaap:ProductMember2020-10-012020-12-310000318154us-gaap:ProductMember2020-07-012020-09-300000318154us-gaap:ProductMember2020-04-012020-06-300000318154us-gaap:ProductMember2020-01-012020-03-310000318154us-gaap:ProductMember2019-10-012019-12-310000318154us-gaap:ProductMember2019-07-012019-09-300000318154us-gaap:ProductMember2019-04-012019-06-300000318154us-gaap:ProductMember2019-01-012019-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-37702

Amgen Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 95-3540776 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| One Amgen Center Drive | | 91320-1799 |

| Thousand Oaks | |

| California | |

| (Address of principal executive offices) | | (Zip Code) |

(805) 447-1000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol (s) | Name of each exchange on which registered |

| Common stock, $0.0001 par value | AMGN | The Nasdaq Stock Market LLC |

| 1.250% Senior Notes Due 2022 | AMGN22 | The Nasdaq Stock Market LLC |

| 2.00% Senior Notes Due 2026 | AMGN26 | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or Section 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | Accelerated filer | Non-accelerated filer | Smaller reporting company | Emerging growth company |

| ☒ | ☐ | ☐ | ☐ | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes ☐ No ý

The approximate aggregate market value of voting and non-voting stock held by non-affiliates of the registrant was $138,056,968,288 as of June 30, 2020.(A)

(A)Excludes 1,045,777 shares of common stock held by directors and executive officers, and any stockholders whose ownership exceeds ten percent of the shares outstanding, at June 30, 2020. Exclusion of shares held by any person should not be construed to indicate that such person possesses the power, directly or indirectly, to direct or cause the direction of the management or policies of the registrant, or that such person is controlled by or under common control with the registrant.

577,566,383

(Number of shares of common stock outstanding as of February 3, 2021)

DOCUMENTS INCORPORATED BY REFERENCE

Specified portions of the registrant’s Proxy Statement with respect to the 2021 Annual Meeting of Stockholders to be held May 18, 2021, are incorporated by reference into Part III of this annual report.

INDEX

| | | | | | | | |

| | Page No. |

| | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| Item 15. | | |

| Item 16. | | |

| | |

PART I

Amgen Inc. (including its subsidiaries, referred to as “Amgen,” “the Company,” “we,” “our” or “us”) is committed to unlocking the potential of biology for patients suffering from serious illnesses by discovering, developing, manufacturing and delivering innovative human therapeutics. This approach begins by using tools like advanced human genetics to unravel the complexities of disease and understand the fundamentals of human biology.

Amgen focuses on areas of high unmet medical need and leverages its expertise to strive for solutions that improve health outcomes and dramatically improve people’s lives. A biotechnology pioneer, Amgen has grown to be one of the world’s leading independent biotechnology companies, has reached millions of patients around the world and is developing a pipeline of medicines with breakaway potential.

Amgen was incorporated in California in 1980 and became a Delaware corporation in 1987. We have a presence in approximately 100 countries worldwide. Amgen operates in one business segment: human therapeutics.

Significant Developments

Following is a summary of significant developments affecting our business that have occurred and that we have reported since the filing of our Annual Report on Form 10-K for the year ended December 31, 2019.

COVID-19 pandemic

A novel strain of coronavirus (SARS-CoV-2, or severe acute respiratory syndrome coronavirus 2, causing coronavirus disease 19, or COVID-19) was declared a global pandemic by the World Health Organization (WHO) on March 11, 2020. Since the first quarter of 2020 and continuing into 2021, we have seen some impact of the pandemic to our operations. We continue to monitor and respond as the pandemic evolves to ensure the continued development, manufacture and distribution of our medicines. For further discussion, see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Overview, Selected Financial Information and Results of Operations. For a discussion of the risks presented by the COVID-19 pandemic to our results, see Risk Factors in Item 1A. Also see the remainder of Item 1. Business for discussion of pandemic-related impacts to our overall business.

Products/Pipeline

Oncology/Hematology

KYPROLIS® (carfilzomib)

•In August 2020, we announced that the U.S. Food and Drug Administration (FDA) had approved the expansion of the KYPROLIS® U.S. prescribing information to include its use in combination with DARZALEX® (daratumumab) plus dexamethasone in two dosing regimens—once weekly and twice weekly—for the treatment of patients with relapsed or refractory multiple myeloma who have received one to three previous lines of therapy.

Sotorasib (formerly AMG 510)

•In September 2020, we announced updated phase 1 data evaluating sotorasib in 129 patients across multiple advanced solid tumors with Kirsten rat sarcoma viral oncogene homolog (KRAS) G12C mutation, which were published in the New England Journal of Medicine. Data from 59 patients with advanced non-small cell lung cancer (NSCLC) were also featured in an oral presentation at a September 2020 medical conference. In the patients with advanced NSCLC who were treated with the 960 mg daily dose, the confirmed objective response rate (ORR) was 35.3%. Across all dose levels, the confirmed ORR was 32.2%, with median duration of response of 10.9 months and median progression-free survival (PFS) of 6.3 months; 10 of 19 responders were still in response as of the data cutoff.

•In October 2020, we announced top-line phase 2 results in 126 patients with KRAS G12C-mutant advanced NSCLC. Sotorasib demonstrated an ORR (primary endpoint) consistent with previously reported phase 1 data in patients taking the 960 mg daily dose. Other measures of efficacy, including duration of response, were promising, and more than half of the responders were still on treatment and continuing to respond as of the data cutoff date. The results of this phase 2 study are potentially registrational, and a phase 3 confirmatory study comparing sotorasib to docetaxel is currently recruiting patients with KRAS G12C-mutant advanced NSCLC.

•In December 2020, we announced that the FDA had granted Breakthrough Therapy designation for our investigational KRASG12C inhibitor, sotorasib, for the treatment of patients with locally advanced or metastatic NSCLC with KRAS G12C mutation, as determined by an FDA-approved test, following at least one prior systemic therapy. Following this announcement, we submitted a New Drug Application (NDA) to the FDA. The sotorasib NDA is being reviewed by the FDA’s Real-Time Oncology Review (RTOR) pilot program, which aims to explore a more efficient review process that ensures safe and effective treatments are made available to patients as early as possible. Later in December, we also submitted a Marketing Authorization Application (MAA) to the European Medicines Agency (EMA).

•In January 2021, we announced results from the phase 2 cohort of the clinical study evaluating sotorasib in 126 patients with KRAS G12C-mutant advanced NSCLC. Sotorasib demonstrated a confirmed ORR and disease control rate of 37.1% and 80.6%, respectively, a median duration of response of 10 months and median progression-free survival of 6.8 months. In addition, sotorasib was granted Breakthrough Therapy designation by the Center for Drug Evaluation of the National Medical Products Administration in China.

RIABNITM (rituximab-arrx) (formerly ABP 798)

•In December 2020, we announced that the FDA had approved RIABNITM, a biosimilar to Rituxan® (rituximab), for the treatment of adult patients with non-Hodgkin’s lymphoma, chronic lymphocytic leukemia, granulomatosis with polyangiitis (Wegener’s granulomatosis) and microscopic polyangiitis. RIABNITM launched in the United States in January 2021.

Inflammation

Otezla® (apremilast)

•In May 2020, we announced positive top-line results from a phase 3 study to assess the efficacy of Otezla® in adults with mild-to-moderate plaque psoriasis. The study showed that oral Otezla® 30 mg twice daily achieved a statistically significant improvement, compared with placebo, in the primary endpoint of the static Physician’s Global Assessment (sPGA) response (defined as an sPGA score of clear (0) or almost clear (1) with at least a 2-point reduction from baseline) at week 16.

Enbrel® (etanercept)

•In July 2020, the U.S. Court of Appeals for the Federal Circuit affirmed the judgment by the U.S. District Court for the District of New Jersey upholding the validity of the two patents that describe and claim ENBREL and methods for making it. See Note 19, Contingencies and commitments, to the Consolidated Financial Statements.

Tezepelumab

•In November 2020, we and AstraZeneca plc (AstraZeneca) announced positive top-line results from the registrational phase 3 NAVIGATOR trial in adults and adolescents with severe uncontrolled asthma. The trial met the primary endpoint with tezepelumab added to standard of care (SoC), demonstrating a statistically significant and clinically meaningful reduction compared with placebo plus SoC in the annualized asthma exacerbation rate (AAER) over 52 weeks in the overall patient population. SoC consisted of medium- or high-dose inhaled corticosteroids (ICS) plus at least one additional controller medication with or without oral corticosteroids (OCS). We expect to submit results of this study to regulators in 2021.

•In December 2020, we and AstraZeneca announced that the SOURCE trial had not met the primary endpoint of a statistically significant reduction in the daily OCS dose, without loss of asthma control, with tezepelumab compared to placebo. The results of this trial have no impact on our submission plans.

Cardiovascular

Omecamtiv mecarbil

•In November 2020, based on results of the omecamtiv mecarbil phase 3 trial, we provided notice to Cytokinetics, Incorporated (Cytokinetics) of termination of our collaboration and our intention to transition to them the development and commercialization rights for omecamtiv mecarbil and AMG 594.

Establishment of wholly owned affiliate in Japan

•In April 2020, we completed our purchase from Astellas of the remaining shares of Amgen Astellas BioPharma K.K. (AABP), a joint venture between Amgen and Astellas established in 2013. AABP, now a wholly owned Amgen affiliate in Japan and renamed Amgen K.K., has enabled us to build a strong presence in Japan as we continue to advance treatments for serious illnesses. The purchase did not have a material impact to our consolidated financial statements.

Marketing, Distribution and Selected Marketed Products

The largest concentration of our sales and marketing forces is based in the United States and Europe. In addition, we continue to expand the commercialization and marketing of our products into other geographic territories, including parts of Asia, the Middle East, Canada and Latin America. This expansion is occurring by establishing our own affiliates, by acquiring existing third-party businesses or product rights or by collaborating with third parties. See Business Relationships for our significant alliances. Whether we use our own sales and marketing forces or a third party’s varies across these markets. Such use typically depends on several factors, including the nature of entry into the new market, the size of an opportunity and operational capabilities. Together with our collaborators, we market our products to healthcare providers, including physicians or their clinics, dialysis centers, hospitals and pharmacies.

In the United States, substantially all of our sales are to pharmaceutical wholesale distributors, which are the principal means of distributing our products to healthcare providers. We also market certain products through direct-to-consumer channels, including print, television and online media. For further discussion, see Government Regulation—Regulation in the United States—Regulation of Product Marketing and Promotion. Outside the United States, we sell principally to healthcare providers and/or pharmaceutical wholesale distributors depending on the distribution practice in each country.

Our product sales to three large wholesalers, AmerisourceBergen Corporation, McKesson Corporation and Cardinal Health, Inc., each individually accounted for more than 10% of total revenues for each of the years 2020, 2019 and 2018. On a combined basis, these wholesalers accounted for 83%, 81% and 84% of worldwide gross revenues for 2020, 2019 and 2018, respectively. We monitor the financial condition of our larger customers and limit our credit exposure by setting credit limits and, in certain circumstances, by requiring letters of credit or obtaining credit insurance.

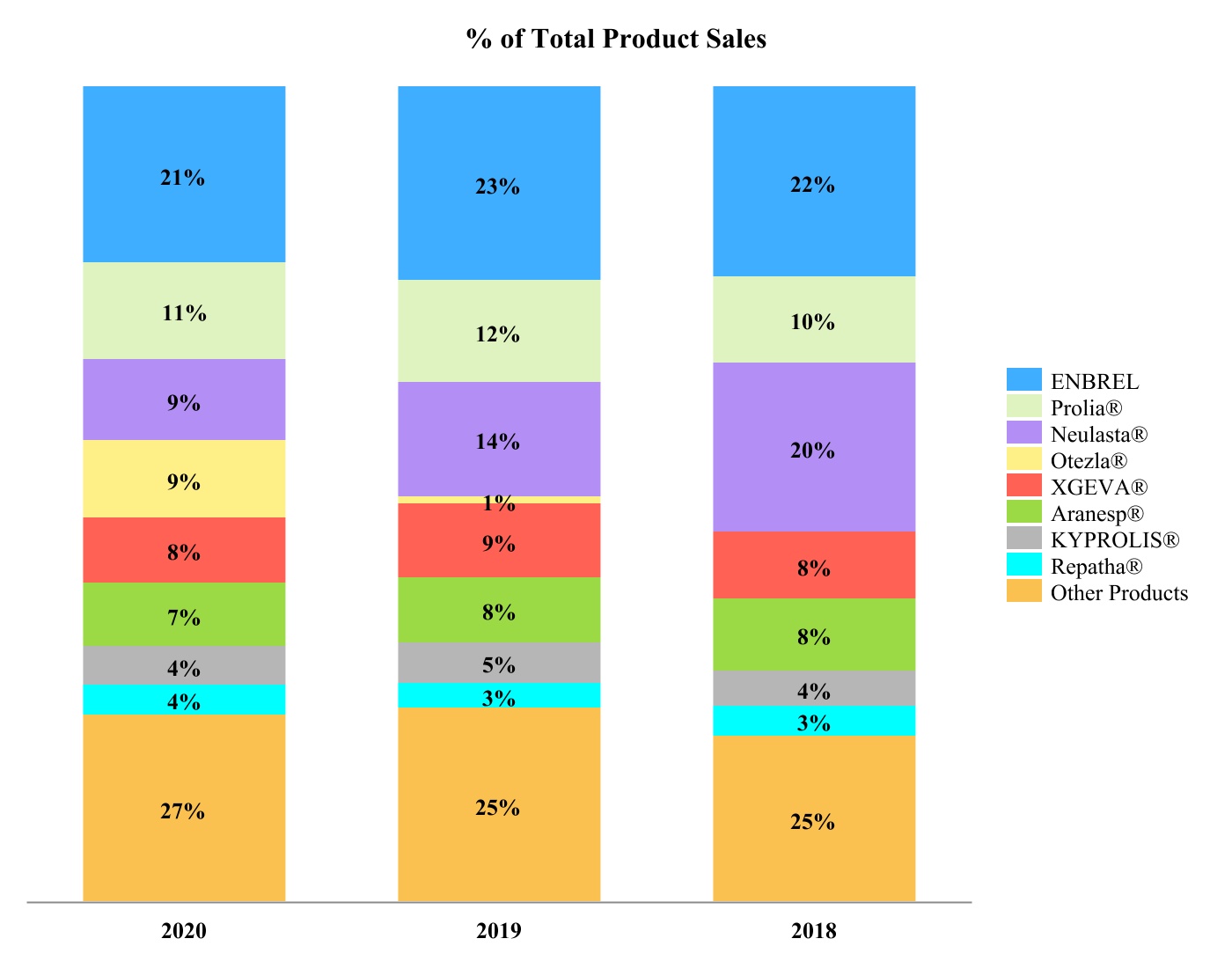

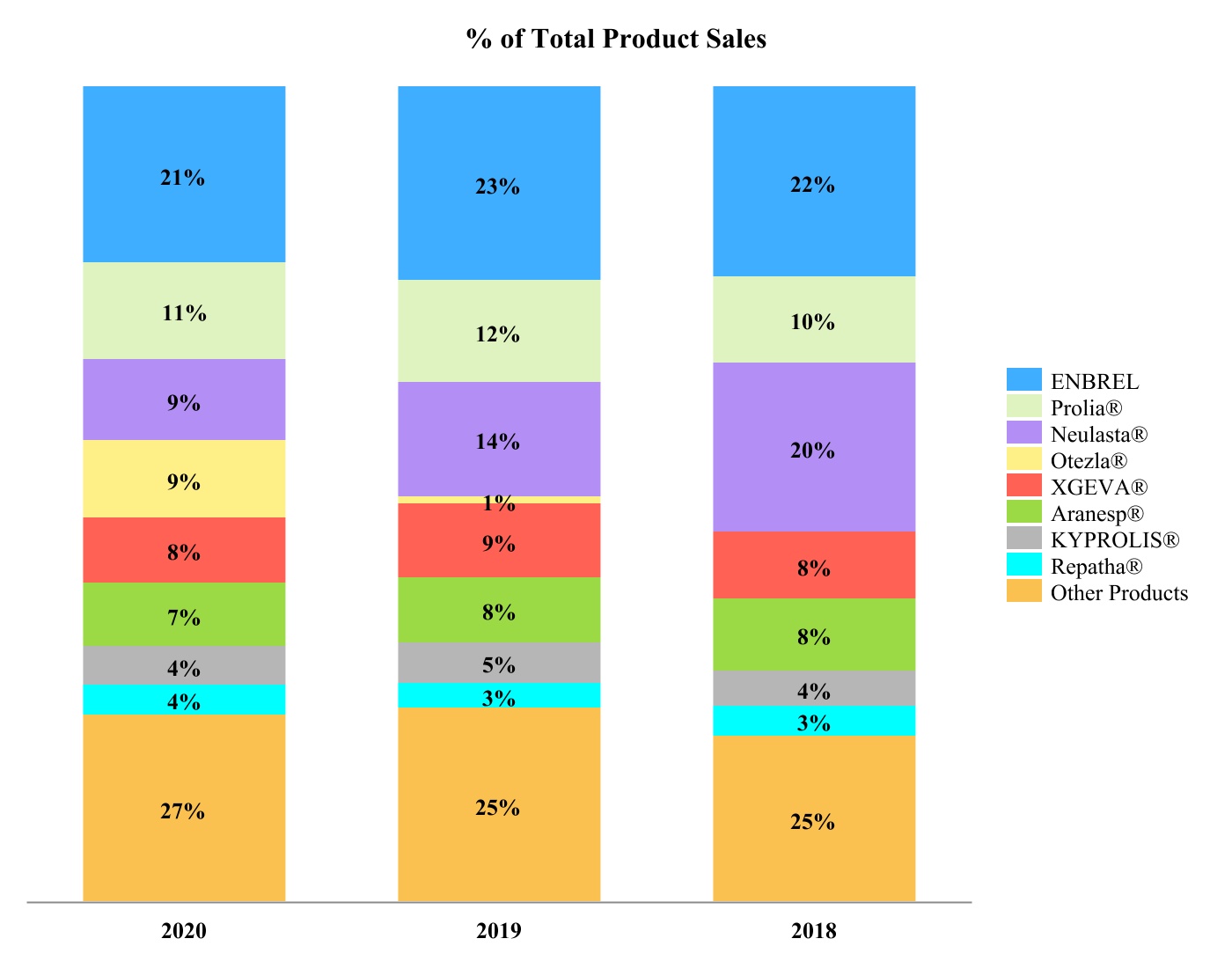

Our products are marketed around the world, with the United States being our largest market. The following chart shows our product sales by principal product, and the table below (dollar amounts in millions) shows product sales by geography for the years 2020, 2019 and 2018.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2020 | | 2019 | | 2018 |

| Product Sales by Geography: | | | | | | | | |

| U.S. | $ | 17,985 | | 74 | % | | $ | 16,531 | | 74 | % | | $ | 17,429 | | 77 | % |

| Ex-U.S. | 6,255 | | 26 | % | | 5,673 | | 26 | % | | 5,104 | | 23 | % |

| Total | $ | 24,240 | | 100 | % | | $ | 22,204 | | 100 | % | | $ | 22,533 | | 100 | % |

ENBREL

We market ENBREL, a tumor necrosis factor blocker, primarily in the United States. ENBREL was launched in 1998 and is used primarily in indications for the treatment of adult patients with moderately to severely active rheumatoid arthritis, patients with chronic moderate-to-severe plaque psoriasis who are candidates for systemic therapy or phototherapy and patients with active psoriatic arthritis.

Prolia® (denosumab)

We market Prolia® primarily in the United States, Europe and the Asia Pacific region. Prolia® contains the same active ingredient as XGEVA® (denosumab) but is approved for different indications, patient populations, doses and frequencies of administration. Prolia® was launched in the United States and Europe in 2010. In the United States, it is used primarily in the indication for the treatment of postmenopausal women with osteoporosis at high risk of fracture, defined as a history of osteoporotic fracture, or multiple risk factors for fracture; or in patients who have failed or are intolerant to other available osteoporosis therapy. In Europe, Prolia® is used primarily for the treatment of osteoporosis in postmenopausal women at increased risk of fracture.

Neulasta® (pegfilgrastim)