Investment Scams Involving Fake Form 4 Filings: Updated Investor Alert

March 15, 2024

The SEC’s Office of Investor Education and Advocacy is issuing this updated Investor Alert to warn about fraudsters sending investors fake Form 4 filings as part of a scam.

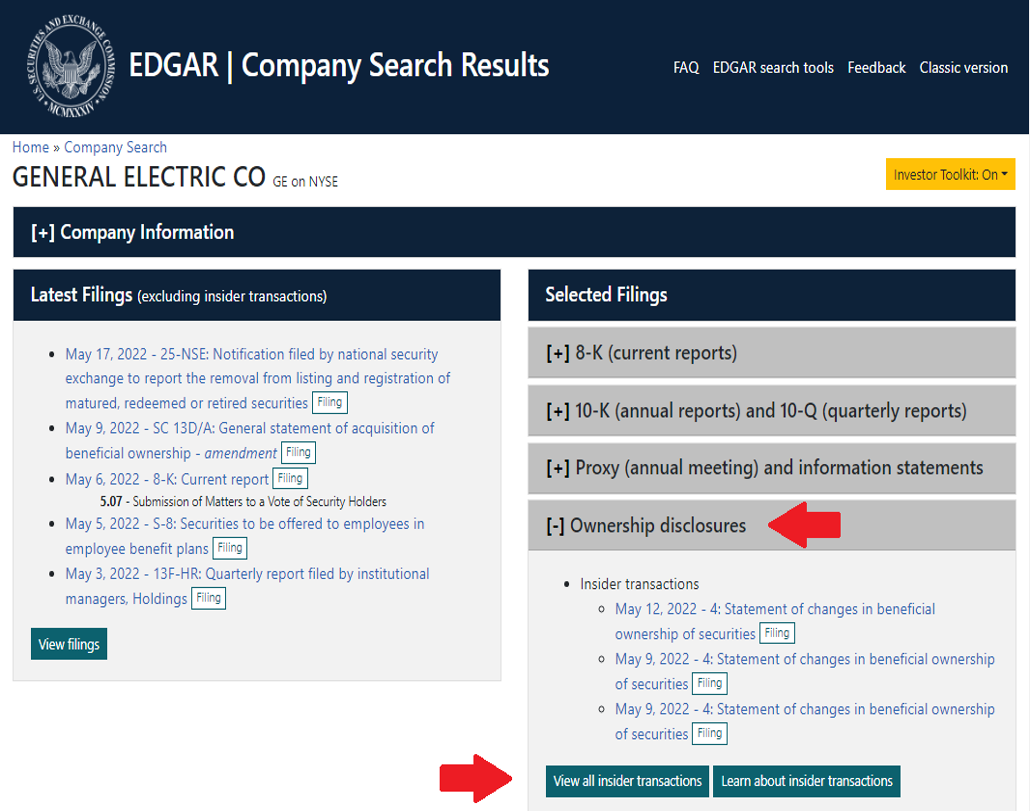

Fraudsters often use official-looking forms to try to establish credibility with potential victims. One example is Form 4, which is a type of form filed with the SEC to make the public aware of a corporate insider’s purchases and sales of the company’s securities.

In some cases, fraudsters — posing as brokers, investment advisers, asset recovery firms, or regulators — may email fake Form 4 filings to an investor and claim that the fake filings confirm the investor’s purchase of shares, even though the trades were never made and the fraudsters may have simply stolen the money. They may make it appear that the email is coming from the SEC.

In other cases, fraudsters may email fake Form 4 filings to an investor and claim that the fake filings prove that stock is held in the name of the investor, asking the investor to pay purported taxes or fees to recover money that they lost. In reality, if the investor pays the “taxes or fees,” they will not recover their money and will instead have been scammed out of additional money.

Here are a few things to keep in mind that may help you to avoid an investment scam involving a fake Form 4 filing.

A Form 4 is not a confirmation statement.

Form 4 filings are not confirmations of purchases or transfers of shares. Being provided Form 4 filings for these purposes is a red flag of fraud. Instead, a Form 4 filing is a disclosure filing that is generally filed by corporate insiders (such as directors, executive officers and holders of more than 10% of any class of a company’s securities) to report purchases and sales of the company’s securities. If you are not a director, officer or 10% owner of the company, you are not required to file a Form 4.

The SEC does not send trade confirmations.

If you buy a security through a U.S.-registered broker-dealer, the broker-dealer generally must send you a trade confirmation statement. The SEC does not independently confirm trading transactions by email, correspondence or otherwise. Fraudsters may imitate SEC filings or otherwise seek to make it look like the correspondence is from the SEC. Any email or correspondence purportedly from the SEC confirming a specific securities transaction is a red flag of fraud.

You should always check the background and registration status of a broker.

When someone tries to sell you an investment, the first thing you should do is check whether they are registered. Investors can use the free tool on Investor.gov to check out the background, including registration or license status, of any firm or financial professional. You can also contact your state regulator. Investors outside of the United States should contact their countries’ financial regulators and the regulators in the jurisdictions where the broker appears to be located.

Fraudsters may provide you online access to an account that looks like a real brokerage firm website. Do not be fooled by con artists who create websites that look and feel legitimate, who sound convincing, or who are very responsive when you contact them just as legitimate brokers may be. Even if someone tells you that they are registered, verify this fact independently. A few minutes of your time may save you from handing over your money to fraudsters.

Always verify that you are communicating with an investment professional and not an imposter. For example, contact the professional using a phone number or website listed in the firm’s Client Relationship Summary (Form CRS). To ensure you are looking at a genuine copy of the firm’s Form CRS, follow these steps:

- In the “Check Out Your INVESTMENT PROFESSIONAL” search box on Investor.gov, select “Firm” from the drop down options and type in the name of the firm.

- In the search results, click on the relevant firm and then click on “Get Details.”

- Click on “Relationship Summary” or “Part 3 Relationship Summary.”

If someone misrepresents that they are registered or impersonates a registered investment professional, report it to the SEC.

Beware of fraudsters impersonating the SEC.

Fraudsters, including in scams involving fake Form 4 filings, may send fake emails that pretend to be from official U.S. government sources, including the SEC. The SEC has received complaints from investors who received a fake Form 4 (from the email address no-reply@edgarlink.us) and were directed to an official SEC website. A private entity registered the edgarlink.us domain name without SEC authorization and the SEC has obtained an order suspending this Internet domain name. You should be on alert, however, to fraudsters using similar official-looking domain names.

Be aware that communications — including phone calls, voicemails, text messages, messages via social media, emails, letters, and certificates — may falsely appear to be from the SEC. If you receive a communication that appears to be from the SEC, do not provide any personal information until you have verified that you are dealing with someone from the SEC, and not an impersonator.

If you receive a communication that falsely appears to be from the SEC, submit an Investor Complaint Form to the SEC. If you have lost money in a scheme involving SEC impersonation, submit a complaint at www.sec.gov/oig to the SEC’s Office of Inspector General (“OIG”) or call the OIG’s toll-free hotline at (833) SEC-OIG1 (732-6441).

Look out for advance fee fraud.

In investment scams, including ones that involve fake Form 4 filings, fraudsters may demand that investors pay additional costs (such as purported taxes) to withdraw money from their accounts. This is an example of an advance fee fraud, where investors are asked to pay a bogus fee in advance of receiving proceeds, money, stock, or warrants. Learn more about how to avoid advance fee schemes on our Advance Fee Fraud webpage.

Additional Information

Impersonation Schemes webpage on Investor.gov

Public Alert: Unregistered Soliciting Entities (PAUSE)

Beware of False Claims of SEC Registration

Report possible securities fraud to the SEC. Ask a question or report a problem concerning your investments, your investment account or a financial professional.

Visit Investor.gov, the SEC's website for individual investors.

Receive Investor Alerts and Bulletins from the Office of Investor Education and Advocacy (OIEA) by email or RSS feed.