10K Q4 2012

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

|

| |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2012

Commission File Number 0-452

TECUMSEH PRODUCTS COMPANY

(Exact name of registrant as specified in its charter) |

| | |

Michigan | | 38-1093240 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification Number) |

| |

5683 Hines Drive | | |

Ann Arbor, Michigan 48108 | | (734) 585-9500 |

(Address of Principal Executive Offices, including zip code) | | (Registrant’s telephone number, including area code) |

Securities Registered Pursuant to Section 12(b) of the Act:

|

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

Class B Common Stock, $1.00 Par Value | | The Nasdaq Stock Market LLC |

Class A Common Stock, $1.00 Par Value | | The Nasdaq Stock Market LLC |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | | |

Large accelerated filer | ¨ | Accelerated filer | ý | Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

| | (Do not check if a smaller reporting company) |

| |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

As of June 29, 2012, directors and executive officers of the Registrant and holders of more than 10% of our Class B Common Stock held an aggregate of 13,275 shares of the Registrant’s Class A Common Stock and 1,705,278 shares of its Class B Common Stock. The aggregate market value as of June 29, 2012 (based on the closing prices of $5.05 per Class A share and $4.90 per Class B share, as reported on the Nasdaq Stock Market on such date) of the 13,388,663 Class A shares and 3,372,468 Class B shares held by non-affiliates was $84,137,841.

Numbers of shares outstanding of each of the registrant’s classes of Common Stock at March 4, 2013:

|

| | |

Class B Common Stock, $1.00 Par Value: | 5,077,746 |

|

Class A Common Stock, $1.00 Par Value: | 13,401,938 |

|

DOCUMENTS INCORPORATED BY REFERENCE

Certain information in the definitive proxy statement to be used in connection with the registrant’s 2013 Annual Meeting of Shareholders scheduled to be held on April 24, 2013 has been incorporated herein by reference in Part III hereof.

TABLE OF CONTENTS

PART I

General

Tecumseh Products Company is a Michigan corporation organized in 1934. Unless the context states otherwise, the terms “Company”, “we”, “us” and “our” refer to Tecumseh Products Company and its consolidated subsidiaries. We are a global manufacturer of hermetically sealed compressors for residential and specialty air conditioning, household refrigerators and freezers and commercial refrigeration applications.

Our products include air conditioning and refrigeration compressors, as well as condensing units, heat pumps and complete refrigeration systems. Products range from fractional horsepower reciprocating compressors used in small refrigerators and dehumidifiers to large reciprocating, rotary and scroll compressors used in commercial air conditioning and refrigeration systems. We sell compressors for three primary applications: (i) commercial refrigeration, including walk-in coolers and freezers, ice makers, dehumidifiers, water coolers, food service equipment and refrigerated display cases and vending machines; (ii) household refrigerators and freezers; and (iii) residential and specialty air conditioning and heat pumps, including window air conditioners, packaged terminal air conditioners and recreational vehicle and mobile air conditioners. Tecumseh’s products are sold to original equipment manufacturers (“OEMs”) and authorized wholesale distributors.

Foreign Operations and Sales

We maintain manufacturing plants in the United States (“U.S.”), Brazil, France, and India as well as assembly plants in Canada, Mexico, Malaysia and a joint venture in China. In 2012, sales to customers outside the U.S. represented approximately 80% of total sales.

Our dependence on sales, assembly and manufacturing in foreign countries entails certain commercial and political risks, including currency fluctuations, unstable economic or political conditions in some areas and the possibility of U.S. government embargoes on sales to certain countries. In 2012, the U.S. government extended economic sanctions and export controls to Iran and Syria. None of our sales in these countries in 2012, even prior to the extended sanctions, would have violated extended economic sanctions and export controls to Iran and Syria. Our foreign manufacturing operations are subject to other risks including, governmental expropriation, governmental regulations that may be disadvantageous to businesses owned by foreign nationals and instabilities in the workforce due to changing political and social conditions. These considerations exist in all of our foreign countries, but are especially significant in the context of our Brazilian operations, given the importance of their overall size and performance in relation to our total operating results.

Compressor Product Lines

A compressor is a device that compresses a refrigerant gas. In applications that utilize compressors, when the gas is later permitted to expand, it removes heat from the room or appliance by absorbing and transferring it, producing a cooling effect. This technology forms the basis for a wide variety of refrigeration and air conditioning products. All of the compressors we produce are hermetically sealed. Our current compressor line consists primarily of reciprocating, rotary, and scroll designs.

Our lines of compressors include:

| |

• | reciprocating piston models ranging from 145 to 1,100 BTU/hour used in household refrigerators and freezers, |

| |

• | reciprocating piston models ranging from 365 to 73,000 BTU/hour used in commercial refrigeration applications, such as ice makers, vending machines, food service equipment, display cases and refrigerated walk-in cold rooms, |

| |

• | rotary compressors ranging from approximately 5,000 to 32,000 BTU/hour used in stationary and mobile air conditioning applications, and |

| |

• | scroll compressors ranging from 7,400 to 44,000 BTU/hour that are designed specifically for demanding commercial refrigeration applications. |

Rotary and scroll compressors generally provide increased operating efficiency, lower equipment space requirements and reduced sound levels when compared to reciprocating piston models. In addition, we produce variable speed compressors for a wide range of uses, including military, medical, telecommunications, aircraft, transportation and automotive applications. These compressors use a variety of refrigerants for different applications, including hydrocarbon refrigerants. We also produce sub-assemblies and complete refrigeration systems that use our compressors as components. Such products include indoor and

outdoor condensing units, multi-cell units, and complete refrigeration systems that use both single speed and variable speed AC/DC powered compressors. These products are sold to both OEMs and authorized wholesale distributors.

In the last couple of years, we have introduced two major new products: the Mini and the Midi. The Mini compressor platform is for use in household refrigerators and freezers, and the Midi compressor platform is for use in commercial refrigeration. Commercial sales for these two products started in the fourth quarter of 2011. The Midi compressor models have all moved from the engineering phase to the production phase, and, as of December 31, 2012, over 90% of the Mini compressor models have moved from the engineering phase to the production phase. Major customers have tested these compressors and approved them for their applications. We expect significant transition from the prior models to the new products to occur in 2013.

Manufacturing and Assembly Operations

We manufacture our products in facilities located in the U.S., Brazil, France and India. We also have assembly plants located in Canada, Mexico, Malaysia and a joint venture located in China. Our Brazilian compressor operations are the largest of our manufacturing locations. They include two sites producing our broadest product offerings, with an installed capacity of approximately 11.1 million compressors a year. Products that we produce in Brazil are sold throughout the world. Brazilian exports were approximately 29%, 26%, and 35% of Brazilian production in 2012, 2011, and 2010, respectively. The weakening of the Brazilian Real in the second half of 2011 and continuing in 2012 favorably impacted our competitiveness.

We produce compressor products in North America in our Mississippi manufacturing facility and assembly plants in Canada and Mexico. Installed capacity in Mississippi is approximately 3.0 million compressors a year. We also manufacture electric motors, a component of finished compressors, at our facility in Tennessee. In 2012, 2011 and 2010 approximately 13%, 14% and 21%, respectively, of the compressor products produced in our North American operations were exported outside of North America.

We operate three manufacturing facilities in France. The facilities in France have an aggregate compressor capacity of 3.7 million units a year. We also operate two manufacturing facilities in India with a current total compressor capacity of 4.5 million units a year.

We produce a significant portion of our component needs internally; however we also make strategic and concentrated purchases, particularly of raw materials, from a few suppliers. The principle raw materials used in our manufacturing processes are steel, copper and aluminum. In recent years, the volatility of commodity prices and related components has impacted us and the industry in general. We attempt to mitigate the volatility and impact of higher commodity prices through a combination of entering into commodity derivative contracts, price increases, material surcharges and cost reduction initiatives.

Our required raw materials and components are generally available in sufficient quantities from a variety of non-affiliated suppliers. To the extent possible, we concentrate purchases with one to two suppliers and develop long-term relationships with these vendors. By developing these relationships, we leverage our material needs to help in reducing costs.

Sales and Marketing

We market our compressor and condensing unit products under the following brand names; “Tecumseh,” “L’Unité Hermétique by Tecumseh,” “Masterflux by Tecumseh,” “Silensys by Tecumseh,” “Celseon” and “Vector.” We sell our products in 103 countries primarily through our own sales staff as well as independent sales representatives and authorized wholesale distributors.

A substantial portion of our sales of compressor products for room air conditioners and for household refrigerators and freezers are to OEMs. Sales of compressor products for unitary central air conditioning systems and commercial refrigeration applications include substantial sales to both OEMs and wholesale distributors.

The breakdown of sales by class for 2012, 2011 and 2010 is set forth in the table below:

|

| | | | | | | | | |

| | % of Total Sales Volume |

| | 2012 | | 2011 | | 2010 |

Commercial Refrigeration | | 59 | % | | 58 | % | | 57 | % |

Household Refrigerator and Freezer | | 22 | % | | 21 | % | | 27 | % |

Residential and Specialty Air Conditioning | | 19 | % | | 21 | % | | 16 | % |

Total | | 100 | % | | 100 | % | | 100 | % |

| | | | | | |

We have over 1,500 customers for compressors and condensing units. The majority of our customers are for commercial refrigeration products, while our customer base for household refrigeration and freezer (“R&F”) applications is much more concentrated. In 2012, our largest customers, Electrolux and Whirlpool Corporation, both of whom were primarily R&F customers, accounted for 7.2% and 6.6%, respectively of consolidated net sales. Loss of either of these customers could have a material adverse effect on our results. Generally, we do not enter into long-term contracts with our customers. However, we do pursue long-term agreements with selected major customers where a business relationship has existed for a substantial period of time.

Competition

All of the compressor and condensing unit markets in which we operate are highly competitive. We compete with other compressor producers, including manufacturers of end products and other manufacturers that have internal compressor manufacturing operations. Most of these competitors manufacture their products outside the U.S. in countries where customers are manufacturing products that use compressors and where manufacturing costs are lower, including Asia and Eastern Europe. Worldwide productive capacities exceed global demand, which has put downward pressure on prices.

Participants compete on the basis of efficiency, price, sound level, refrigerant, delivery, reliability, availability and service, as well as compliance with various global environmental and safety standards and regulations. For most applications there are numerous competitors. Some of our competitors have larger product lines and greater financial, technical, manufacturing, research and development and management resources than we do. Products in these markets are relatively undifferentiated and competitors are introducing many new products. Before the introduction of our Mini and Midi compressor platforms, our products were behind those of our competitors with respect to some of these competitive factors. The household refrigerator and freezer market is vertically integrated with many appliance producers manufacturing a substantial portion of their compressor needs. Due to the robust nature of our compressors for specialty air conditioning applications, we are particularly well suited for specialized, niche markets located in parts of the Middle East and Asia. In the U.S. and Europe specialty air conditioning compressor markets, we compete primarily with two manufacturers: Copeland Corporation and Danfoss, Inc.

In Brazil, domestic compressor manufacturers have some protection from outside competition, including import duties for compressors delivering up to 18,000 BTU/hour of cooling capacity. This protection only pertains to components (e.g., compressors) and final products, not equipment. We believe that we and Whirlpool, S.A (selling compressors under the brand name “Embraco”) account for a majority of the compressors sold in Latin America for refrigeration and freezer applications. However, in recent years our market share in Brazil has been reduced, as the strength of the Brazilian currency has made foreign imports relatively cheap despite the presence of duties. In 2012, the Brazil real weakened and we believe this will improve our competitiveness. As a result, Asian manufacturers have captured market share, including small shares of the market for compressors for refrigeration and freezer applications, and importation of the end products containing compressors, particularly in the room air conditioning market. In addition, our Latin American sales are concentrated and we believe that Embraco is capturing additional market share. In 2012, approximately 43.5% of the sales from our Brazilian facilities were made to its three largest customers, and the loss of any of these customers would have a significant impact on the results of operations of these facilities and on our consolidated results as a whole.

In East Asia, domestic compressor manufacturers also have some protection from outside competition, including import duties. We have manufacturing facilities in India, where our sales in this region are concentrated. We compete in this market primarily for compressors used in air conditioning and household refrigerator applications. This region has not yet fully developed a cold chain with temperature-controlled storage and distribution facilities. Our Indian sales are concentrated because there are fewer end product manufacturers in India. In 2012, approximately 47.7% of the sales from our Indian facilities into East Asian and Middle Eastern markets were made to its three largest customers, and the loss of any of these customers would have a significant impact on the results of operations of our Indian facilities and on our consolidated results as a whole.

Regulatory Requirements

Hydrochlorofluorocarbon compounds (“HCFCs”) are still used as a refrigerant in many air conditioning systems in some regions of the world. Under a 1992 international agreement, the use of virgin HCFCs in new pre-charged equipment was banned beginning January 1, 2010 in the U.S. Some Western European countries began HCFC phase-outs as early as 1998, and some of these countries have fully eliminated the use of HCFCs. Within the last several years, we have approved and released a number of compressor models utilizing U.S. government approved hydrofluorocarbon (“HFC”) refrigerants. HFCs are also currently under global scrutiny and subject to possible future restrictions. We believe we are positioned to react in a timely manner to expected changes in the regulatory landscape.

In the last few years, there has been an even greater political and consumer movement toward the use of hydrocarbons (“HCs”) and carbon dioxide as alternative refrigerants, moving further away from the use of chlorine (which depletes the ozone layer of

the atmosphere) and the use of fluorine (which contributes to the “green-house” effect). The most common HC refrigerants are isobutane (R600a) and propane (R290). HCs are flammable compounds and are approved by the U.S. Government with limits on the amount of refrigerant charge by application type. As part of the U.S. Environmental Protection Agency’s Significant New Alternatives Policy ("SNAP"), HC refrigerants have been approved in household refrigerators and freezers and self-contained commercial refrigeration applications. The Environmental Protection Agency ("EPA") rule limits the charge size of isobutane to a maximum of 57 grams (2 ounces) for household refrigerator and freezer applications, and the charge size of propane for self-contained commercial refrigeration applications to a maximum of 150 grams (5.3 ounces). We build compressors utilizing HCs for sale into European, Latin American and Indian markets. We also supply a small volume of HC compressors in the U.S., where these compressors are slowly being adopted by the market. It is not presently possible to estimate the level of expenditures that will be required to meet future industry requirements or the effect on our earnings or competitive position. Nonetheless, we expect that our product development process will address these changes in a timely manner.

The U.S. National Appliance Energy Conservation Act of 1987 (“NAECA”) requires specified energy efficiency ratings on room air conditioners and household refrigerators and freezers. Most of the world markets’ manufacturing communities have issued energy efficiency directives that specify the acceptable level of energy consumption for refrigerators and freezers. These efficiency ratings apply to the overall performance of the specific appliance, of which the compressor is one component. We have ongoing projects aimed at improving the efficiency levels of our compressor products and have products available to meet energy efficiency requirements as determined by our customers.

Geographic Location Information

The results of operations and other financial information by geographic location for each of the years ended December 31, 2012, 2011, and 2010 appear in Note 16 “Business Segments – Geographic Information” of the Notes to Consolidated Financial Statements which is in Part II, Item 8, of this report, “Financial Statements and Supplementary Data,” and that information is incorporated by reference into this Item 1.

Backlog and Seasonal Variations

Most of our production is against short-term purchase orders and order backlog is not significant.

Compressor products are subject to some seasonal variation among individual product lines. In particular, sales for compressor products are higher in the first and second quarters for customer needs prior to the commencement of warmer weather in the northern hemisphere, for both residential air conditioning products and commercial refrigeration applications. This seasonal effect is somewhat, though not completely, offset by sales volumes in the southern hemisphere. Depending on relative performance among the regions, and external factors such as foreign currency changes and global weather, trends can vary. In the past three years, consolidated sales in the aggregate have not exhibited any pronounced seasonal trend.

Patents, Licenses and Trademarks

We own a substantial number of patents, licenses and trademarks and deem them to be important to certain lines of our business; however, the success of our overall business is not considered primarily dependent on them. In the conduct of our business, we own and use a variety of registered trademarks, the most familiar of which is the trademark consisting of the word “Tecumseh” in combination with a Native American silhouette.

Research and Development

The ability to successfully bring new products to market in a timely manner has become a critical factor in competing in the compressor products business as a result of, among other things, the imposition of energy efficiency standards and environmental regulations, including those related to refrigerant requirements as discussed above. We must continually develop new and improved products in order to compete effectively and to meet evolving regulatory standards in all of our major product lines. We use global design teams to bring new products to market. In addition, in 2012 we completed a new Technology Center in Ann Arbor, Michigan, with a dedicated research and development team. We spent approximately $15.1 million, $19.8 million, and $18.6 million during 2012, 2011 and 2010, respectively, on research activities relating to the development of new products and the development of improvements to existing products.

Employees

On December 31, 2012, we employed approximately 5,800 full-time equivalent employees and an additional 1,900 temporary employees and contractors worldwide, 91% of whom were employed in foreign locations. While none of our U.S. employees were represented by labor unions, many of our foreign location personnel are represented by national trade unions. Over the course of the past few years, we have focused on reducing our permanent global workforce and aligning our temporary workforce as part of our overall efforts to restructure the business and improve our overall cost structure. We believe we generally have a good relationship with our employees.

Available Information

We provide public access to our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to these reports filed with or furnished to the Securities and Exchange Commission (“SEC”) under the Securities Exchange Act of 1934. These documents may be accessed free of charge through the Investor Relations section of our website at the following address: http://www.tecumseh.com. These documents are provided as soon as reasonably practicable after filing with, or furnishing to, the SEC. These documents may also be found at the SEC website at http://www.sec.gov.

Set forth below and elsewhere in this Annual Report on Form 10-K are descriptions of material risks and uncertainties that could cause our actual business results to differ materially from those described in any forward-looking statements contained in this report. These risk factors should be considered in addition to our cautionary statements concerning forward-looking statements in this report, including statements related to markets for our products and trends in our business, which involve a number of risks and uncertainties. Our separate section in Item 7 below, “Cautionary Statements Relating To Forward-Looking Statements,” should be considered in addition to the following statements.

Current and future global or regional economic conditions could have an adverse effect on our sales volumes, liquidity and profitability.

Our sales volumes, liquidity and profitability depend significantly on worldwide economic conditions. Uncertainty about global economic conditions poses a risk as consumers postpone spending in response to tighter credit, unemployment, negative financial news and/or declines in income or asset values, and reduced purchases by customers of our products because of uncertainty regarding purchases of their products by consumers and others. The global recession precipitated by the financial crisis and subsequent weak and uncertain global economy, had a detrimental effect on our sales volumes over the last several years, and a related detrimental effect on our liquidity and profitability. A number of factors, including, but not limited to, gross domestic product, availability of consumer credit, interest rates, consumer confidence, unemployment levels, debt levels, retail trends, housing starts, inventory levels, commodity costs and foreign currency exchange rates, generally affect demand for our products. In the event of financial turmoil affecting the banking system and financial markets, including in Europe, additional consolidation of the financial services industry, or significant financial service institution failures, there could be a new or incremental tightening in the credit markets, low liquidity, and extreme volatility in fixed income, credit, currency, and equity markets. This could have a number of effects on our business, including the inability of end customers to obtain credit to finance purchases of products containing our products, and failure of derivative counterparties and other financial institutions. A further decline in economic activity and conditions, or continued volatility in global economic conditions in the U.S., Brazil, Europe, Asia and the other markets in which we operate could adversely affect our financial condition and results of operations, including our sales volumes, liquidity and profitability.

Regional economic conditions can also have an adverse effect on our sales volumes, with a resulting adverse impact on our liquidity and profitability. For example, lower commodities and labor costs in China during 2012 compared to other regions coupled with a general strengthening and volatility of the Brazilian Real over the past several years (although it weakened overall in 2011 and 2012) have allowed manufacturers located in China to charge less for their products and gain market share in India and Brazil, despite trade barriers in those countries. The general strengthening and volatility of the Brazilian Real over the past several years (although it weakened overall in 2011 and 2012) generally makes our exported products more expensive than those of our competitors that do not manufacture in Brazil. The U.S. market for R&F products is already saturated, and the Brazilian market is expected to become saturated in less than three years. All of these conditions could adversely affect our financial condition and results of operations, including our sales volumes, liquidity and profitability.

The loss of, or substantial decline in sales to, any of our key customers, including Electrolux or Whirlpool, could adversely affect our sales volumes, profitability and liquidity.

In 2012, our largest customers, Electrolux and Whirlpool Corporation, both of whom were R&F customers, accounted for 7.2% and 6.6%, respectively of consolidated net sales. Sales to these two customers were down in 2012 due to temporary plant shutdowns. Loss of either of these customers, or substantial declines in sales to either of them, could have an adverse effect on our sales volumes and our resulting profitability and liquidity. Generally, we do not enter into long-term contracts with our customers, making it easier for the customer to change volume among suppliers. Larger customers may also seek to use their position to improve their performance by various means, including improved efficiency, lower pricing, and increased promotional programs. If we are unable to meet their requirements, our sales volume and related profitability and liquidity could be negatively affected. Additionally, the loss of market share or financial difficulties, including bankruptcy, by these large customers could have a material adverse effect on our liquidity, financial position and results of operations.

We have a history of losses and might not maintain our current level of liquidity.

Our cash position has become increasingly important in light of constrained capital markets and the current economic environment. Our cash position has not been generated from operations but instead by non-recurring divestitures and pension plan reversions. However, we may not be able to maintain our current levels of liquidity. We have incurred losses in five of our last six years and would have incurred a loss in 2012 if we had not recognized a $45 million postretirement benefit curtailment gain in the second quarter of 2012 due to the termination of certain postretirement benefits for salaried employees and retirees. We believe we will continue to incur net losses. Challenges remain with respect to our ability to generate appropriate levels of liquidity solely from cash flows from operations, particularly uncertainties related to future sales levels, global economic conditions, currency exchange effects and commodity pricing. We may not be able to generate cash from operating activities unless further restructuring activities are implemented or sales or economic conditions improve. Additional restructuring activities may be necessary and might include changing our current footprint, consolidating facilities, otherwise reducing our manufacturing capacity, selling assets or reducing the number of our employees. These actions could result in significant restructuring or asset impairment charges, severance costs, losses on asset sales and use of cash. Accordingly, these restructuring activities could have a significant effect on our consolidated financial position, operating profit, cash flows and future operating results. While we believe that current cash balances, available borrowings under our credit facilities, proceeds from sales of assets and cash inflows related to non-income tax refunds will produce adequate liquidity to implement our business strategy over at least the next twelve months, there is a risk that the costs of any such restructuring and cash required will exceed the benefits received from such activities or that such benefits will ultimately be inadequate if sales or economic conditions deteriorate. In addition, while our business dispositions in prior years have improved our liquidity, many of the sale agreements provide for certain retained liabilities and indemnities, including liabilities that relate to environmental issues and product warranties. Future events could result in the recognition of additional liabilities that could consume available liquidity and management attention.

If we are unable to restructure to reduce our costs and increase productivity and quality and develop successful new products, our sales could be adversely affected and we might not be profitable.

If we do not effectively reduce costs, increase productivity and make quality improvements we might not be profitable. Our net income of $22.6 million in 2012 included a non-recurring gain due to a curtailment of postretirement benefits of $45 million. In addition, if we are unable to develop and successfully market competitive products, our sales volumes could be adversely affected. Products in our markets are relatively undifferentiated and new products are continuously introduced to the market. Our future results and our ability to maintain or improve our competitive position will depend on our capacity to gauge the direction of our key markets and on our ability to successfully and timely identify, develop, manufacture, market, and sell new or improved products in these changing markets. If we fail to do so, our financial condition and results of operations could be adversely affected.

We operate in highly competitive markets.

All of the compressor and condensing unit markets in which we operate are highly competitive. We compete on the basis of efficiency, price, sound level, refrigerant, delivery, reliability, availability and service, as well as compliance with various global environmental and safety standards and regulations. For most applications there are numerous competitors, some of which have larger product lines and greater financial, technical, manufacturing, research and development and management resources than we do. Products in our markets are relatively undifferentiated and competitors are continuously introducing new products. Before the introduction of our Mini and Midi compressor platforms, our products were behind those of our competitors with respect to some of these competitive factors. If our products do not meet or exceed the attributes of our competitors' offerings, we could be at a disadvantage in the affected product lines. These and other factors might have a material adverse effect on our results of operations.

In particular, we operate in environments where worldwide productive capacities exceed global demand and customers and competitors are establishing new productive capacities in low cost countries. These trends have put downward pressure on prices and reduced our margins and in some cases have resulted in us losing market share. These trends may also result in the need for us to restructure our operations further by removing excess capacities, lowering our cost of purchased inputs and engaging in joint ventures with manufacturers in low cost countries in order to improve our overall cost structure, restore margins and improve our competitive position in our major markets. There is no guarantee that these initiatives, which could include plant closures, reductions in the number of our employees, asset sales and expanded operations in low cost countries, would improve our profitability in the future.

Our results of operations may be negatively impacted by litigation and environmental claims.

Our business exposes us to potential litigation and environmental claims, such as environmental clean-up obligations, resource damage claims and product liability suits that are inherent in the design, manufacture, and sale of our current products and some products that we sold in the past. We are also potentially exposed to litigation related to prior sales of businesses, securities laws, antitrust laws or other types of business disputes. Results of legal proceedings and environmental claims cannot be predicted with certainty. Regardless of merit, litigation and environmental claims can be both time-consuming and disruptive to our operations and can cause significant expense and diversion of management attention. We estimate loss contingencies and establish reserves as required by generally accepted accounting principles in the United States (“U.S. GAAP”) based on our assessment of contingencies where liability is deemed probable and the amount is reasonably estimable in light of the facts and circumstances known to us at a particular point in time. Subsequent developments in legal proceedings, volatility in foreign currency exchange rates and other factors may affect our assessment and estimates of the loss contingency recorded and could result in an adverse effect on our results of operations in the period in which a liability would be recognized or cash flows for the period in which amounts would be paid. Actual results may significantly vary from our reserves.

We self-insure a portion of product liability claims; an unsuccessful defense of a product liability claim or series of successful claims against us could materially and adversely affect our product reputation and our financial condition, results of operations, and cash flows. Even if we are successful in defending against a claim relating to our products, claims of this nature could cause our customers to lose confidence in our products and our company.

Given the inherent uncertainty of litigation and environmental claims, we cannot be certain that existing litigation or environmental claims or any future adverse legal developments will not have a material adverse impact on our financial condition, liquidity or results of operations. See “Item 8 – Financial Statements and Supplementary Data – Note 15, “Commitments and Contingencies – Litigation” of Notes to Consolidated Financial Statements” for a description of our legal matters.

We are subject to, and could be further subject to, governmental investigations and actions by other third parties relating to antitrust laws that could have an adverse effect on our results of operations, liquidity and financial condition.

We are one of several companies involved in investigations by government regulators in various jurisdictions into possible anti-competitive practices in the compressor industry. While we have entered into conditional amnesty agreements under which we do not expect to be subject to criminal prosecution with respect to the investigations, we are not exempt from civil litigation. We have been named as a defendant in numerous related class action lawsuits in various jurisdictions, which lawsuits seek damages in connection with the pricing of compressors; additional lawsuits may be filed. The impact of these and other investigations and lawsuits could have a material adverse effect on our financial condition, liquidity and results of operations.

Price volatility of commodities we purchase could have an adverse effect on our cash flow or results of operations.

The price of raw materials, such as steel, copper and aluminum are one of the most significant cost and cash flow impacts on our business. The prices of these commodities have remained extremely volatile over the past few years and due to competitive markets, we are typically not able to quickly recover product cost increases through price increases or other cost savings. While we have been proactive in addressing volatility of these costs by using derivatives to hedge price risk associated with forecasted purchases of certain raw materials, our hedged price could result in our paying higher or lower prices for commodities as compared to the market prices for those commodities when purchased and will not protect us against longer term price increases. Decreases in spot prices below our hedged prices can put us at a competitive disadvantage compared to less hedged competitors and can also require us to post cash collateral with our hedge counterparties, which could impact our liquidity and cash flows. At December 31, 2012, we were required to post $0.6 million of cash collateral on our commodity hedges. In addition, increases in steel prices have a particularly negative impact as there is currently no well-established global market for hedging against increases in the cost of steel. These hedging activities might not be successful to manage our costs. Continued volatility of commodities or failure of our initiatives to generate cost savings or improve productivity may negatively impact our results of operations. See “Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of

Operations – Executive Summary – Commodities” and “—Outlook” and “Item 7A – Quantitative and Qualitative Disclosures about Market Risk – Commodity Price Risk” for a description of raw material price volatility and a description of our hedging activity.

Our international operations subject us to risks associated with foreign currency fluctuations.

We are exposed to significant exchange rate risk because the majority of our revenues, expenses, assets and liabilities are derived from operations conducted outside the U.S. in local and other currencies and, for purposes of financial reporting, the results are translated into U.S. Dollars based on currency exchange rates prevailing during or at the end of the reporting period. During times of a strengthening U.S. Dollar, our reported net revenues and net income (loss) and assets are reduced because the local currency will translate into fewer U.S. Dollars, and during times of a weakening U.S. Dollar, our reported expenses and liabilities are increased because the local currency will translate into more U.S. Dollars. Because of the geographic diversity of our operations, weaknesses in some currencies might be offset by strengths in others over time. However, fluctuations in foreign currency exchange rates, particularly the strengthening of the U.S. Dollar against major currencies could materially affect our financial results.

We are also exposed to significant exchange rate risk when an operation has sales or expense transactions in a currency that differs from its local, functional currency or when the sales and expenses are denominated in different currencies. Since our primary risk stems from sales transacted at foreign locations which have the resulting receivable denominated in U.S. Dollars, this risk affects our business adversely when the Brazilian Real, Euro or Indian Rupee strengthens against the Dollar. In these cases, when the receivable is ultimately paid in less valuable U.S. Dollars, the foreign location realizes less net revenue in its local currency, which can adversely impact its margins. We have developed strategies to mitigate or partially offset these impacts, primarily hedging against transactional exposure where the risk of loss is greatest. While the use of currency hedging instruments may provide us with short-term protection from adverse fluctuations in currency exchange rates, by utilizing these instruments we potentially forego the benefits that might result from favorable fluctuations in currency exchange rates.

Ultimately, long term changes in currency exchange rates have lasting effects on the relative competitiveness of operations located in certain countries versus competitors located in different countries. See “Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations – Executive Summary – Currency Exchange” and “—Outlook” and “Item 7A – Quantitative and Qualitative Disclosures about Market Risk – Foreign Currency Exchange Risk” for a description of foreign currency volatility and a description of our hedging activity.

Significant supply interruptions could have an adverse effect on our cash flow or results of operations.

We generally concentrate purchases for a given raw material or component with a small number of suppliers. Although we believe there are alternative suppliers for all of our key raw material and component needs, if a supplier is unable or unwilling to meet our supply requirements, we could experience supply interruptions or cost increases, either of which could have an adverse effect on our results of operations.

Our global operations subject us to risks associated with changes in government regulations.

Our international sales and operations, including our purchases of raw materials from international suppliers, are subject to risks associated with changes in local government laws, regulations and policies, including those related to tariffs and trade barriers, investments, taxation, exchange controls, governmental expropriation and governmental regulations that may be disadvantageous to businesses owned by foreign nationals, and instabilities in the workforce due to changing political and social conditions. Our international sales and operations are also sensitive to changes in foreign national priorities, including government budgets, as well as to political and economic instability. International transactions may involve increased financial and legal risks due to differing legal systems and customs in foreign countries. The ability to manage these risks could be difficult and may limit our operations, as well as, make the manufacture and sale of our products more difficult, which could negatively affect our business and results of operations. See “Item 7– Management’s Discussion and Analysis of Financial Condition and Results of Operations – Executive Summary – Liquidity” and “Liquidity Sources – Cash inflows related to taxes” for a description of our outstanding refundable non-income taxes in Brazil and India.

We also face risks arising from the imposition of exchange controls and currency devaluations. Exchange controls may limit our ability to convert foreign currencies into U.S. Dollars or to remit dividends and other payments by our foreign subsidiaries or businesses located in or conducted within a country imposing controls. Currency devaluations result in a diminished value of funds denominated in the currency of the country instituting the devaluation. Actions of this nature, if they occur or continue for significant periods of time, could have an adverse effect on our results of operations and financial condition in any given period.

We are also subject to additional disclosure requirements, including conflict minerals disclosure requirements and compliance with these new requirements could have a material adverse impact on our results of operations, financial condition and liquidity, as well as, divert management's attention away from running our business.

Our operations and products are subject to extensive environmental laws and energy regulations.

Our manufacturing operations are subject to stringent environmental laws and regulations in all of the countries in which we operate, including laws and regulations governing emissions to air, discharges to water and the generation, handling, storage, transportation, treatment and disposal of waste materials. These regulations can vary widely across the countries in which we do business. While we believe that we are in compliance in all material respects with these environmental laws and regulations, we could still be adversely impacted by costs, liabilities or claims with respect to existing, previously divested, or subsequently acquired operations, under either present laws and regulations or those that may be adopted or imposed in the future. We are also subject to laws requiring the cleanup of contaminated property. If a release of hazardous substances occurs at or from any of our current or former properties or at a landfill or another location where we have disposed of hazardous materials, we may be held liable for the contamination and the amount of such liability could be material. See “Item 8 – Financial Statements and Supplementary Data – Note 15 “Commitments and Contingencies – Litigation – Environmental Matters” of Notes to Consolidated Financial Statements" for a description of our environmental matters.

In addition, governmental regulations control the types of refrigerants that may be utilized in our products, and this global scrutiny continues to evolve over time. We have continued to address these changes in regulation by approving and releasing new models that meet governmental and consumer requirements. We also strive to have our products meet requirements for energy efficiency, which can vary substantially in the different geographic markets in which we sell our products. Future legislation may require substantial levels of expenditure to meet industry requirements, which could have a material adverse effect on our business, results of operations and financial condition.

Increased or unexpected product warranty claims could adversely affect us.

We provide our customers a warranty on products we manufacture. Our warranty generally provides that products will be free from defects for periods ranging from 12 months to 36 months. If a product fails to comply with the warranty, we may be obligated, at our expense, to correct any defect by repairing or replacing the defective product. Although we maintain warranty reserves in an amount based primarily on the number of units shipped and on historical and anticipated warranty claims, future warranty claims might not follow historical patterns or we might not accurately anticipate the level of future warranty claims. An increase in the rate of warranty claims or the occurrence of unexpected warranty claims could materially and adversely affect our financial condition, results of operations and cash flows.

We may be adversely impacted by work stoppages and other labor matters.

As of December 31, 2012, we employed approximately 5,800 full-time equivalent employees and an additional 1,900 temporary employees and contractors worldwide. The majority of people we employ on a full time and temporary basis are in foreign locations and approximately 4,600 are represented by national trade unions. While we do not believe that we will be impacted by work stoppages and other labor matters, future issues with our labor unions might not be resolved favorably and we might encounter future strikes, further unionization efforts or other types of conflicts with labor unions or our employees. Any of these factors may have an adverse effect on us or may limit our flexibility in dealing with our workforce. In addition, many of our customers have unionized work forces. Work stoppages or slow-downs experienced by our customers could result in slow-downs or closures at their plants where our products are installed. If one or more of our customers experience a material work stoppage, it could have a material adverse effect on our business, results of operations and financial condition.

|

| |

ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

Our headquarters are located in the United States of America in Ann Arbor, Michigan, approximately 40 miles west of Detroit. We have properties in the United States, Brazil, France, India, Canada, Mexico, China, Malaysia, Poland and Thailand, occupying approximately 4.8 million square feet; approximately 3.9 million square feet are devoted to manufacturing and assembly. Manufacturing and assembly facility utilization varies during the year depending on the production cycle. All owned and leased properties are adequate and suitable, well maintained and equipped for the purposes for which they are used. Management believes our manufacturing facilities have excess capacity around the world and is considering reducing excess capacity which could result in a significant change in our manufacturing footprint.

The schedule below outlines our significant facilities by location, ownership and function as of December 31, 2012.

|

| | | | | | | |

Location | | Square Feet | | Ownership | | Use |

United States: | | | | | | |

Verona, Mississippi | | 530,000 |

| | Leased | | Manufacturing |

Verona, Mississippi | | 135,200 |

| | Leased | | Distribution |

Verona, Mississippi | | 100,000 |

| | Leased | | Distribution |

Paris, Tennessee | | 190,000 |

| | Owned | | Manufacturing |

Tecumseh, Michigan | | 26,343 |

| | Owned | | Storage |

Ann Arbor, Michigan (a) | | 32,400 |

| | Leased | | Office |

Ann Arbor, Michigan | | 49,500 |

| | Owned | | Technical Center |

Brazil: | | | | | | |

Sao Carlos, Brazil Plant 1 | | 431,905 |

| | Owned | | Manufacturing |

Sao Carlos, Brazil Plant 2 | | 1,001,249 |

| | Owned | | Manufacturing |

France: | | | | | | |

Cessieu, France | | 316,925 |

| | Owned | | Manufacturing |

Barentin, France | | 312,363 |

| | Owned | | Manufacturing |

La Mure, France | | 114,379 |

| | Owned | | Manufacturing |

La Verpilliere, France | | 341,415 |

| | Owned | | Technical Center |

Vaulx Milieu, France | | 240,078 |

| | Leased | | Office and Distribution |

India: | | | | | | |

Hyderabad, India (b) | | 466,962 |

| | Owned | | Manufacturing |

Ballabgarh, India (b) | | 246,128 |

| | Owned | | Manufacturing |

Canada: | | | | | | |

Aylmer, Ontario, Canada | | 77,700 |

| | Owned | | Assembly |

Mexico: | | | | | | |

Monterrey, Mexico | | 50,000 |

| | Leased | | Assembly |

China: | | | | | | |

Song Jiang, China | | 72,000 |

| | Leased | | Assembly |

Malaysia: | | | | | | |

Port Klang, Malaysia | | 53,792 |

| | Leased | | Assembly |

(a) In November 2012, we entered into a sublease and in February 2013, we moved our corporate office function into the previously undeveloped space in our Technical Center.

(b) This land is classified as "lease-hold" property. We treat this land as Tecumseh property, however, prior to any sale government approval must be obtained.

See “Note 15 – Commitments and Contingencies – Litigation” of the Notes to Financial Statements (Part II, Item 8 of this

Form 10-K) for information regarding legal proceedings in which we are involved, which is incorporated into this Item 3 by reference.

|

| |

ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

PART II

|

| |

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our Class A and Class B common stock trade on The Nasdaq Stock Market LLC under the symbols TECUA and TECUB, respectively. Total shareholders of record as of February 27, 2013 were approximately 218 for Class A Common Stock and 221 for Class B common stock. As of February 27, 2013, the closing price per share of our Class A Common Stock was $9.27 and the closing price per share of our Class B Common Stock was $8.96. We do not currently expect to pay dividends. See “Item 8 – Financial Statements and Supplementary Data – Note 8 “Debt” of Notes to Consolidated Financial Statements” for a description of restrictions in our credit facility limiting our ability to pay dividends. As of the date of this report, we have no equity securities authorized for issuance under compensation plans. We did not repurchase any of our equity securities during the fourth quarter of 2012.

Market Price and Dividend Information

Range of Common Stock Prices and Dividends for 2012

|

| | | | | | | | | | | | | | | | | | | |

| Sales Price | | Cash Dividends Declared |

| Class A | | Class B | |

Quarter Ended | High | | Low | | High | | Low | |

March 31 | $ | 5.31 |

| | $ | 4.02 |

| | $ | 5.01 |

| | $ | 3.99 |

| | $ | — |

|

June 30 | 5.13 |

| | 3.10 |

| | 5.16 |

| | 3.34 |

| | — |

|

September 30 | 5.91 |

| | 4.96 |

| | 6.47 |

| | 5.13 |

| | — |

|

December 31 | 5.25 |

| | 4.38 |

| | 6.20 |

| | 4.01 |

| | — |

|

Range of Common Stock Prices and Dividends for 2011

|

| | | | | | | | | | | | | | | | | | | |

| Sales Price | | Cash Dividends Declared |

| Class A | | Class B | |

Quarter Ended | High | | Low | | High | | Low | |

March 31 | $ | 13.66 |

| | $ | 8.44 |

| | $ | 14.20 |

| | $ | 8.11 |

| | $ | — |

|

June 30 | 10.55 |

| | 9.11 |

| | 10.28 |

| | 9.12 |

| | — |

|

September 30 | 11.00 |

| | 6.75 |

| | 10.82 |

| | 6.88 |

| | — |

|

December 31 | 7.94 |

| | 4.01 |

| | 7.50 |

| | 4.30 |

| | — |

|

Stock Performance Graph

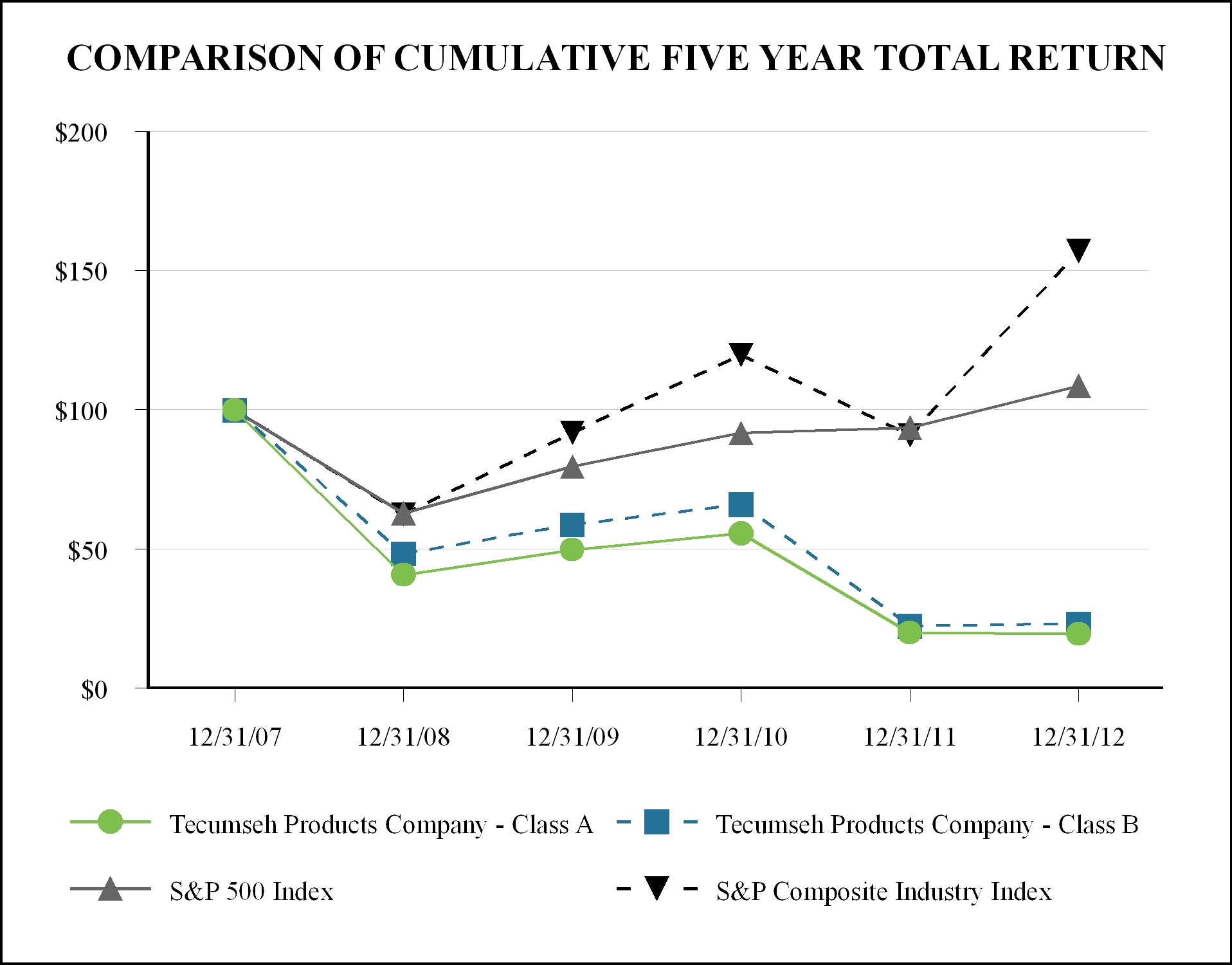

The following graph and table depict the cumulative total shareholder return (assuming reinvestment of dividends) on $100 invested in each class of Tecumseh common stock, the S&P 500 Index, and the S&P Composite Industry Index for the five year period from December 31, 2007 through December 31, 2012.

|

| | | | | | | | | | | |

| Base | | INDEXED RETURNS |

| Period | | Years Ending |

Company / Index | 2007 | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 |

Tecumseh Products Company - Class A | 100 | | 40.92 | | 49.94 | | 55.75 | | 20.08 | | 19.74 |

Tecumseh Products Company - Class B | 100 | | 48.48 | | 58.88 | | 66.24 | | 22.59 | | 23.35 |

S&P 500 Index | 100 | | 63.00 | | 79.67 | | 91.68 | | 93.61 | | 108.59 |

S&P Composite Industry Index * | 100 | | 62.63 | | 91.93 | | 119.84 | | 90.98 | | 157.09 |

|

| |

* | S&P Composite Industry Index comprises the S&P Household Appliances Index (50%), the S&P Industrial Machinery Index (25%) and the S&P Electrical Components and Equipment Index (25%). |

|

| |

ITEM 6. | SELECTED FINANCIAL DATA |

The following is a summary of certain of our financial information. The Consolidated Statements of Operations for 2008 have been restated to reflect the reclassification of the Electrical Components Group (with the exception of the Paris, Tennessee operations), the Engine & Power Train Group, MP Pumps, and Manufacturing Data Systems, Inc. as discontinued operations. |

| | | | | | | | | | | | | | | | | | | | |

| Years Ended December 31, |

(In millions, except share and per share data) | 2012 | | 2011 (c) | 2010 (a)(c) | 2009 (a)(c) | 2008 (a)(b)(c) |

Net sales | $ | 854.7 |

| | $ | 864.4 |

| | $ | 933.8 |

| | $ | 735.9 |

| | $ | 996.4 |

|

Cost of sales | (790.0 | ) | | (826.5 | ) | | (849.5 | ) | | (687.6 | ) | | (897.3 | ) |

Gross Profit | 64.7 |

| | 37.9 |

| | 84.3 |

| | 48.3 |

| | 99.1 |

|

Selling and administrative expenses | (107.7 | ) | | (108.1 | ) | | (114.1 | ) | | (125.2 | ) | | (129.6 | ) |

Other income (expense), net | 22.3 |

| | 14.7 |

| | 14.3 |

| | 7.4 |

| | 6.0 |

|

Impairments, restructuring charges, and other items | 40.6 |

| | (8.5 | ) | | (50.3 | ) | | (24.4 | ) | | (43.8 | ) |

Operating income (loss) | 19.9 |

| | (64.0 | ) | | (65.8 | ) | | (93.9 | ) | | (68.3 | ) |

Interest expense | (10.2 | ) | | (10.5 | ) | | (10.6 | ) | | (10.8 | ) | | (24.4 | ) |

Interest income | 3.2 |

| | 2.3 |

| | 1.2 |

| | 2.3 |

| | 9.7 |

|

Income (loss) from continuing operations before taxes | 12.9 |

| | (72.2 | ) | | (75.2 | ) | | (102.4 | ) | | (83.0 | ) |

Tax benefit | 10.2 |

| | 0.9 |

| | 16.6 |

| | 10.6 |

| | 5.0 |

|

Income (loss) from continuing operations | 23.1 |

| | (71.3 | ) | | (58.6 | ) | | (91.8 | ) | | (78.0 | ) |

(Loss) income from discontinued operations, net of tax | (0.5 | ) | | (1.9 | ) | | 1.8 |

| | (1.6 | ) | | 27.5 |

|

Net income (loss) | $ | 22.6 |

| | $ | (73.2 | ) | | $ | (56.8 | ) | | $ | (93.4 | ) | | $ | (50.5 | ) |

Basic and diluted income (loss) per share: | | | | | | | | | |

Income (loss) from continuing operations | $ | 1.25 |

| | $ | (3.86 | ) | | $ | (3.17 | ) | | $ | (4.97 | ) | | $ | (4.22 | ) |

(Loss) income from discontinued operations, net of tax | (0.03 | ) | | (0.10 | ) | | 0.10 |

| | (0.09 | ) | | 1.49 |

|

Net income (loss) per share | $ | 1.22 |

| | $ | (3.96 | ) | | $ | (3.07 | ) | | $ | (5.06 | ) | | $ | (2.73 | ) |

Weighted average shares, basic and diluted (in thousands) | 18,480 |

| | 18,480 |

| | 18,480 |

| | 18,480 |

| | 18,480 |

|

Cash dividends declared per share | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

Cash and cash equivalents | $ | 55.3 |

| | $ | 49.6 |

| | $ | 65.9 |

| | $ | 90.7 |

| | $ | 113.1 |

|

Working capital | $ | 105.0 |

| | $ | 107.4 |

| | $ | 185.2 |

| | $ | 149.8 |

| | $ | 164.0 |

|

Property, plant and equipment, net | $ | 157.0 |

| | $ | 189.4 |

| | $ | 234.9 |

| | $ | 259.7 |

| | $ | 253.7 |

|

Total assets | $ | 527.9 |

| | $ | 563.7 |

| | $ | 761.8 |

| | $ | 767.1 |

| | $ | 798.5 |

|

Long-term debt | $ | 5.8 |

| | $ | 4.8 |

| | $ | 13.2 |

| | $ | 8.0 |

| | $ | 0.4 |

|

Stockholders’ equity | $ | 258.4 |

| | $ | 285.9 |

| | $ | 434.9 |

| | $ | 463.4 |

| | $ | 477.4 |

|

Capital expenditures | $ | 13.8 |

| | $ | 17.7 |

| | $ | 9.2 |

| | $ | 7.9 |

| | $ | 8.0 |

|

Depreciation and amortization | $ | 36.4 |

| | $ | 40.5 |

| | $ | 40.4 |

| | $ | 45.2 |

| 42.5 |

| $ | 42.5 |

|

| |

(a) | Certain reclassifications have been made to prior results to conform to classifications used at December 31, 2011. These classifications have no impact on net income. |

| |

(b) | Adjusted from amounts reported in prior periods to reclassify our Paris, Tennessee operations from discontinued operations to continuing operations to conform to current year consolidated statements of operations presentation. The reclassification has the effect on income (loss) from continuing operations, net of tax, of $1.9 million, for the year ended December 31, 2008. |

| |

(c) | In 2007, we issued a warrant to a lender to purchase 1,390,944 shares of our Class A Common Stock, at $6.05 per share, which is equivalent to 7% of our fully diluted common stock (including both Class A and Class B shares). This warrant is not included in diluted earnings per share, as the effect would be antidilutive. This warrant expired on April 9, 2012 without the purchase or issuance of additional shares. |

|

| |

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Cautionary Statements Relating To Forward-Looking Statements

The following information should be read in connection with the information contained in the Consolidated Financial Statements and Notes to Consolidated Financial Statements in Item 8 of this report.

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act that are subject to the safe harbor provisions created by that Act. In addition, forward-looking statements may be made orally in the future by or on behalf of us. Forward-looking statements can be identified by the use of terms such as “expects,” “should,” “may,” “believes,” “anticipates,” “will,” and other future tense and forward-looking terminology, or by the fact that they appear under the caption “Outlook.” Our forward-looking statements generally relate to our future performance, including our anticipated operating results and liquidity sources and requirements, our business strategies and goals, and the effect of laws, rules, regulations, new accounting pronouncements and outstanding litigation, on our business, operating results, and financial condition.

Readers are cautioned that actual results may differ materially from those projected as a result of certain risks and uncertainties, including, but not limited to, i) current and future global or regional economic conditions, including housing starts, and the condition of credit markets, which may magnify other risk factors; ii) loss of, or substantial decline in sales to, any of our key customers; iii) our history of losses and our ability to maintain adequate liquidity in total and within each foreign operation; iv) our ability to restructure or reduce our costs and increase productivity and quality and develop successful new products in a timely manner; v) actions of competitors in highly competitive markets with intense competition; vi) the ultimate cost of defending and resolving legal and environmental matters, including any liabilities resulting from the regulatory antitrust investigations commenced by the United States Department of Justice Antitrust Division and the Secretariat of Economic Law of the Ministry of Justice of Brazil, both of which could preclude commercialization of products or adversely affect profitability and/or civil litigation related to such investigations; vii) availability and volatility in the cost of materials, particularly commodities, including steel and copper, whose cost can be subject to significant variation; viii) financial market changes, including fluctuations in foreign currency exchange rates and interest rates; ix) default on covenants of financing arrangements and the availability and terms of future financing arrangements; x) reduction or elimination of credit insurance; xi) significant supply interruptions or cost increases; xii) potential political and economic adversities that could adversely affect anticipated sales and production in Brazil; xi) potential political and economic adversities that could adversely affect anticipated sales and production in India, including potential military conflict with neighboring countries; xiii) local governmental, environmental, trade and energy regulations; xiv) increased or unexpected warranty claims; xv) the extent of any business disruption caused by work stoppages initiated by organized labor unions; xvi) the extent of any business disruption that may result from the restructuring and realignment of our manufacturing operations and personnel or system implementations, the ultimate cost of those initiatives and the amount of savings actually realized; xvii) the success of our ongoing effort to bring costs in line with projected production levels and product mix; xviii) weather conditions affecting demand for replacement products; xix) the effect of terrorist activity and armed conflict. These forward-looking statements are made only as of the date of this report, and we undertake no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

For more information regarding these and other uncertainties and factors that could cause our actual results to differ materially from what we have anticipated in our forward-looking statements or otherwise could materially adversely affect our business, financial condition, or operating results, see “Risk Factors” in Item 1A of this report.

EXECUTIVE SUMMARY

In addition to the relative competitiveness of our products, our business is significantly influenced by several specific economic factors: the strength of the overall global economy, which can have a significant impact on our sales; our product costs, especially the price of copper, steel and aluminum; and the relative value compared to the U.S. Dollar of those foreign currencies of countries where we operate.

Economy

Our sales depend significantly on worldwide economic conditions and the demand for the products in which our products are used. Global economic weakness and uncertainty, including the ongoing challenges in the U.S. and the debt crisis in certain countries in the European Union, continue to impact our sales. Sales decreased in 2012 compared to 2011 primarily due to the unfavorable impact of changes in currency exchange rates, partially offset by net higher volumes and favorable changes in mix and net price increases. Excluding the effects of foreign currency translation, sales in 2012 were approximately 6.2% higher than in 2011.

Commodities

Due to the high content of copper and steel in compressor products, our results of operations are very sensitive to the prices of these commodities.

The weighted average market costs for the types of copper used in our products decreased 11.6% in 2012 as compared to 2011. After consideration of our hedge positions, our weighted average cost of copper in 2012 was 4.4% lower in our results of operations when compared to 2011, primarily due to our hedge positions relative to the market. Extreme volatilities create substantial challenges in our ability to control the cost of our products, as the final product cost can depend greatly on our ability to secure optimally priced futures contracts.

The weighted average market costs for the types of steel used in our products decreased 9.4% in 2012 as compared to 2011. Any rapid increase in steel prices has a particularly negative impact on our product costs, as there is currently no well-established global market for hedging against increases in the price of steel. Although we have been successful in securing a few contracts to help mitigate the risk of the rising steel market, this market is not very liquid and only available against our U.S. steel purchases.

Based upon the introduction of the new Mini and Midi platforms, we used more aluminum in our motors in 2012 and expect to continue this trend in 2013. While aluminum is currently not as volatile as copper and steel, we have proactively executed some futures contracts for aluminum to help mitigate the risk of rising aluminum prices.

We have been proactive in addressing the volatility of copper and aluminum costs, including executing futures contracts, as of December 31, 2012 to cover approximately 32.6% and 30.7% of our anticipated usage in 2013, respectively. However; continued volatility of these costs could nonetheless have an adverse effect on our results of operations both in the near and long term as our anticipated needs are not 100% hedged.

While the use of futures can mitigate the risks of price increases associated with these commodities by “locking in” prices at a specific level, they also reduce the benefits of price decreases associated with these commodities. In addition, declines in the prices of the underlying commodities can result in downward pressure in selling prices, particularly if competitors have lesser future purchase positions, thus causing a contraction of our margins.

We expect to continue our approach of mitigating the effect of short-term price swings of commodities through the appropriate use of hedging instruments, price increases and modified pricing structures with our customers, where available, to allow us to recover our costs in the event that the prices of commodities escalate. Due to competitive markets for our finished products, we are typically not able to quickly recover product cost increases through price increases or other cost savings. For a discussion of the risks to our business associated with commodity price risk fluctuations, refer to “Quantitative and Qualitative Disclosures about Market Risk – Commodity Price Risk” in Part II, Item 7A of this report.

Currency Exchange

The compressor industry, and our business in particular, are characterized by global and regional markets that are served by manufacturing locations positioned throughout the world. Most of our manufacturing presence is in international locations. During each of 2012 and 2011, approximately 80% of our compressor sales activity took place outside the U.S., primarily in Brazil, Europe, and India. As a result, our consolidated financial results are sensitive to changes in foreign currency exchange rates, including the Brazilian Real, the Euro and the Indian Rupee. Ultimately, long-term changes in currency exchange rates have lasting effects on the relative competitiveness of operations located in certain countries versus competitors located in different countries. Only one major competitor of our compressor business faces similar exposure to the Brazilian Real. Our Brazilian and European manufacturing and sales presence is significant and changes in the Brazilian Real and the Euro have been especially harmful to our results of operations when compared to prior periods. The Brazilian Real experienced significant volatility against the U.S. Dollar during 2011. During the first half of 2011, the Brazilian Real strengthened against the U.S. Dollar by 6.3%, which was followed by a 20.0% weakening during the second half of 2011, showing significant swings from month to month. During 2012, the Brazilian Real and the Indian Rupee weakened against the U.S. Dollar by 8.9% and 3.7%, respectively, while the Euro strengthened against the U.S. Dollar by 1.8%, compared to 2011. For a discussion of the risks to our business associated with currency fluctuations, refer to “Quantitative and Qualitative Disclosures about Market Risk – Foreign Currency Exchange Risk” in Part II, Item 7A of this report.

Postretirement Curtailment Gain

In 2012, we recorded a postretirement benefit curtailment gain of $45.0 million in impairments, restructuring charges and other items. Refer to Note 11, "Impairments, Restructuring Charges and Other Items" and Note 5, "Pension and Other Postretirement Benefit Plans" of the Notes to Consolidated Financial Statements in Item 8 of this report for further information.

Liquidity

Challenges remain with respect to our ability to generate appropriate levels of liquidity solely from cash flows from operations, particularly related to uncertainties of future sales levels, global economic conditions, currency exchange rates and commodity pricing as discussed above. In 2012, however, we generated $8.8 million of cash flow from operations. Our net income included the following non-recurring cash inflows: a $4.4 million refund from the IRS related to a previously unrecognized tax benefit and $1.3 million in interest income related to the refund, income of $2.9 million due to the sale of proceeds from a future potential settlement of a lawsuit involving our Brazilian location and a $1.7 million payment received from a mutual release agreement that we signed in the second quarter of 2012.

We have received cash inflows from non-operating activities and expect to receive further cash inflows from recoverable non-income taxes through the end of 2014. We have received and expect to receive refunds of outstanding Indian and Brazilian non-income taxes. In 2012, we received approximately $15.8 million and $9.2 million of outstanding refundable non-income taxes in India and Brazil, respectively. Due to changes in exchange rates, the actual amounts received as expressed in U.S. Dollars will vary depending on the exchange rate at the time of receipt or future reporting date.

We expect to recover approximately $15.9 million of the $32.5 million outstanding refundable taxes in Brazil and $3.9 million of the $6.1 million outstanding refundable taxes in India, in 2013. The tax authorities will not commit to an actual date of payment and the timing of receipt may be different than planned if the tax authorities change their pattern of payment or past practices.

We realize that we may not generate cash flow from operating activities unless further restructuring activities are implemented or sales or economic conditions improve. As a result, we continued to adjust our workforce levels as conditions demanded in 2012 to reduce salary, wages and employee benefits. Total realized savings on an annual basis were approximately $4.0 million and incurred a charge of $3.8 million associated with this restructuring plan. The realized savings in 2012 are consistent with our initial estimates. Additional restructuring actions may be necessary and might include changing our current footprint, consolidation of facilities, other reductions in manufacturing capacity, further reductions in our workforce, sales of assets, and other restructuring activities. These actions could result in significant restructuring or asset impairment charges, severance costs, losses on asset sales and use of cash. Accordingly, these restructuring activities could have a significant effect on our consolidated financial position, operating profit, cash flows and future operating results. Cash required by these restructuring activities might be provided by our cash balances and the cash proceeds from sales of assets. If such restructuring activities are undertaken, there is a risk that the costs of the restructuring and cash required will exceed the benefits received from such activities. We have engaged a financial adviser and are exploring our strategic alternatives.