SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

FOR ANNUAL AND TRANSITION REPORTS

PURSUANT TO SECTION 13 OR 15(d) THE SECURITIES EXCHANGE ACT OF 1934

(Mark One)

For the fiscal year ended

OR

For the transition period from ________to ________

Commission File Number

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

|

| |

|

|

|

|

(Address of Principal Executive Offices) |

(Zip Code) |

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered |

|

|

|

|

|

| ||

|

Securities registered pursuant to Section 12(g) of the Act: | ||

|

None | ||

|

(Title of Class) | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ NO

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ☐ ☒

Indicate by check mark whether registrant (1) has filed all reports required to be filed by Section 13 or Section 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or shorter such period of time that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). YES ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “accelerated filer,” “large accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C 7262(b)) by the registered public accounting firm that prepared or issued its audit report. [☒]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of June 30, 2020:

Common Stock, $1 par value - $

The number of shares outstanding of the registrant's common stock as of February 12, 2021: Common Stock, $1 par value -

DOCUMENTS INCORPORATED BY REFERENCE.

1

TABLE OF CONTENTS

|

PART I | |

|

Item 1.Business |

4 |

|

Item 1A.Risk Factors |

10 |

|

Item 1B.Unresolved Staff Comments |

14 |

|

Item 2.Properties |

14 |

|

Item 3.Legal Proceedings |

15 |

|

Item 4.Mine Safety Disclosures |

15 |

|

PART II | |

|

16 | |

|

Item 6.Selected Financial Data |

19 |

|

Item 7.Management’s Discussion and Analysis of Financial Condition and Results of Operations |

20 |

|

Item 7A.Quantitative and Qualitative Disclosures About Market Risk |

43 |

|

44 | |

|

Item 9.Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

75 |

|

Item 9A.Controls and Procedures |

75 |

|

Item 9B.Other Information |

76 |

|

PART III | |

|

Item 10.Directors, Executive Officers and Corporate Governance |

76 |

|

Item 11.Executive Compensation |

76 |

|

Item 12.Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

76 |

|

Item 13.Certain Relationships and Related Transactions and Director Independence |

76 |

|

76 | |

2

|

PART IV | |

|

Item 15.Exhibits and Financial Schedules |

77 |

|

79 | |

|

80 | |

|

82 | |

|

84 | |

EXPLANATORY NOTE:

In this Annual Report on Form 10-K, Sturm, Ruger & Company, Inc. and Subsidiary (the “Company”) makes forward-looking statements and projections concerning future expectations. Such statements are based on current expectations and are subject to certain qualifying risks and uncertainties, such as market demand, sales levels of firearms, anticipated castings sales and earnings, the need for external financing for operations or capital expenditures, the results of pending litigation against the Company, the impact of future firearms control and environmental legislation, and accounting estimates, any one or more of which could cause actual results to differ materially from those projected. Words such as “expect,” “believe,” “anticipate,” “intend,” “estimate,” “will,” “should,” “could” and other words and terms of similar meaning, typically identify such forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date made. The Company undertakes no obligation to publish revised forward-looking statements to reflect events or circumstances after the date such forward-looking statements are made or to reflect the occurrence of subsequent unanticipated events.

PART I

ITEM 1—BUSINESS

Company Overview

Sturm, Ruger & Company, Inc. and Subsidiary (the “Company”) is principally engaged in the design, manufacture, and sale of firearms to domestic customers. Virtually all of the Company’s sales for the year ended December 31, 2020 were from the firearms segment, with approximately 1% from the castings segment. Export sales represent approximately 4% of firearms sales. The Company’s design and manufacturing operations are located in the United States and almost all product content is domestic.

The Company has been in business since 1949 and was incorporated in its present form under the laws of Delaware in 1969. The Company primarily offers products in three industry product categories – rifles, pistols, and revolvers. The Company’s firearms are sold through independent wholesale distributors, principally to the commercial sporting market.

The Company manufactures and sells investment castings made from steel alloys and metal injection molding (“MIM”) parts for internal use in the firearms segment and has minimal sales to outside customers. The castings and MIM parts sold to outside customers, either directly or through manufacturers’ representatives, represented approximately 1% of the Company’s total sales for the year ended December 31, 2020.

On November 23, 2020, the Company acquired substantially all of the Marlin Firearms assets. The agreement to purchase these assets emanated from the Remington Outdoor Company, Inc. bankruptcy and was approved by the United States Bankruptcy Court for the Northern District of Alabama on September 30, 2020. The purchase price of approximately $28.3 million was paid with available cash on hand. These assets have been moved to the Company’s facilities where manufacturing cells that will produce Marlin rifles will be established. Shipments of Marlin rifles are anticipated in the latter half of 2021.

For the years ended December 31, 2020, 2019, and 2018, net sales attributable to the Company's firearms operations were $565.9 million, $406.3 million and $490.6 million. The balance of the Company's net sales for the aforementioned periods was attributable to its castings operations.

Firearms Products

The Company presently manufactures firearm products, under the “Ruger” name and trademark, in the following industry categories:

|

Rifles |

Revolvers | |||

|

• |

Single-shot |

• |

Single-action | |

|

• |

Autoloading |

• |

Double-action | |

|

• |

Bolt-action | |||

|

• |

Modern sporting | |||

|

| ||||

|

Pistols | ||||

|

• |

Rimfire autoloading | |||

|

• |

Centerfire autoloading | |||

Most firearms are available in several models based upon caliber, finish, barrel length, and other features.

Rifles

A rifle is a long gun with spiral grooves cut into the interior of the barrel to give the bullet a stabilizing spin after it leaves the barrel. Net sales of rifles by the Company accounted for $234.3 million, $200.6 million, and $258.1 million of total net sales for the years 2020, 2019, and 2018, respectively.

Pistols

A pistol is a handgun in which the ammunition chamber is an integral part of the barrel and which typically is fed ammunition from a magazine contained in the grip. Net sales of pistols by the Company accounted for $198.1 million, $124.8 million, and $144.3 million of revenues for the years 2020, 2019, and 2018, respectively.

Revolvers

A revolver is a handgun that has a cylinder that holds the ammunition in a series of chambers which are successively aligned with the barrel of the gun during each firing cycle. There are two general types of revolvers, single-action and double-action. To fire a single-action revolver, the hammer is pulled back to cock the gun and align the cylinder before the trigger is pulled. To fire a double-action revolver, a single trigger pull advances the cylinder and cocks and releases the hammer. Net sales of revolvers by the Company accounted for $79.1 million, $56.8 million, and $63.3 million of revenues for the years 2020, 2019, and 2018, respectively.

Accessories

The Company also manufactures and sells accessories and replacement parts for its firearms. These sales accounted for $54.1 million, $24.1 million, and $25.0 million of total net sales for the years 2020, 2019, and 2018, respectively.

Castings Products

Net sales attributable to the Company’s casting operations (excluding intercompany transactions) accounted for $3.0 million, $4.2 million, and $5.0 million, for 2020, 2019, and 2018, respectively. These sales represented approximately 1% of total net sales in each of these years.

Manufacturing

Firearms

The Company produces one model of pistol, all of its revolvers and most of its rifles at the Newport, New Hampshire facility. Most of the Company’s pistols are produced at the Prescott, Arizona facility. Some rifle models and pistol models are produced at the Mayodan, North Carolina facility.

Many of the basic metal component parts of the firearms manufactured by the Company are produced by the Company's castings segment through processes known as precision investment casting. The Company also uses many MIM parts in its firearms. See "Manufacturing- Investment Castings and Metal Injected Moldings" below for a description of these processes. The Company believes that investment castings and MIM parts provide greater design flexibility and result in component parts which are generally close to their ultimate shape and, therefore, require less machining than processes requiring machining a solid billet of metal to obtain a part. Through the use of investment castings and MIM parts, the Company endeavors to produce durable and less costly component parts for its firearms.

All assembly, inspection, and testing of firearms manufactured by the Company are performed at the Company's manufacturing facilities. Every firearm, including every chamber of every revolver manufactured by the Company, is test-fired prior to shipment.

Investment Castings and Metal Injection Moldings

To produce a product by the investment casting method, a wax model of the part is created and coated (“invested”) with several layers of ceramic material. The shell is then heated to melt the interior wax, which is poured off, leaving a hollow mold. To cast the desired part, molten metal is poured into the mold and allowed to cool and solidify. The mold is then broken off to reveal a near net shape cast metal part.

Metal injection molding is a three part powder metallurgy process by which a feedstock consisting of finely powdered metal and binders is processed through injection molding, debinding, and sintering equipment to produce steel, stainless steel, and alloy parts of complex shape and geometry. This process allows for high volume production while eliminating many of the wastes of traditional metal working methods, yielding net shape and near net shape parts.

Marketing and Distribution

Firearms

The Company's firearms are primarily marketed through a network of federally licensed, independent wholesale distributors who purchase the products directly from the Company. They resell to federally licensed, independent retail firearms dealers who in turn resell to legally authorized end users. All retail purchasers are subject to a point-of-sale background check by law enforcement. These end users include sportsmen, hunters, people interested in self-defense, law enforcement and other governmental organizations, and gun collectors. Each domestic distributor carries the entire line of firearms manufactured by the Company for the commercial market. Currently, 14 distributors service the domestic commercial market, with an additional 26 distributors servicing the domestic law enforcement market and 41 distributors servicing the export market.

In 2020, the Company’s largest customers and the percent of firearms sales they represented were as follows: Sports South - 22%; Lipsey’s - 22%; and Davidson’s - 18%.

In 2019, the Company’s largest customers and the percent of firearms sales they represented were as follows: Lipsey’s - 26%; Sports South - 22%; and Davidson’s - 15%.

In 2018, the Company’s largest customers and the percent of firearms sales they represented were as follows: Davidson’s - 21%; Lipsey’s - 20%; and Sports South - 16%.

The Company employs 15 employees who service these distributors and call on retailers and law enforcement agencies. Because the ultimate demand for the Company's firearms comes from end users rather than from the independent wholesale distributors, the Company believes that the loss of any distributor would not have a material, long-term adverse effect on the Company, but may have a material adverse effect on the Company’s financial results for a particular period. The Company considers its relationships with its distributors to be satisfactory.

The Company also exports its firearms through a network of selected commercial distributors and directly to certain foreign customers, consisting primarily of law enforcement agencies and foreign governments. Foreign sales were no more than 5% of the Company's consolidated net sales for each of the past three fiscal years.

The Company does not consider its overall firearms business to be predictably seasonal; however, orders of many models of firearms from the distributors tend to be stronger in the first quarter of the year and weaker in the third quarter of the year. This is due in part to the timing of the distributor show season, which occurs during the first quarter.

Investment Castings and Metal Injection Moldings

The castings segment provides castings and MIM parts for the Company’s firearms segment. In addition, the castings segment produces some products for a number of customers in a variety of industries.

Competition

Firearms

Competition in the firearms industry is intense and comes from both foreign and domestic manufacturers. While some of these competitors concentrate on a single industry product category such as rifles or pistols, several competitors manufacture products in all four industry categories (rifles, shotguns, pistols, and revolvers). The principal methods of competition in the industry are product innovation, quality, availability, brand, and price. The Company believes that it can compete effectively with all of its present competitors.

Investment Castings and Metal Injection Moldings

There are a large number of investment castings and MIM manufacturers, both domestic and foreign, with which the Company competes. Competition varies based on the type of investment castings products and the end use of the product. Companies offering alternative methods of manufacturing such as wire electric discharge machining (EDM) and advancements in computer numeric controlled (CNC) machining also compete with the Company’s castings segment. Many of these competitors are larger corporations than the Company with substantially greater financial resources than the Company, which could affect the Company’s ability to compete with these competitors. The principal methods of competition in the industry are quality, price, and production lead time.

Human Capital

The Company is an equal opportunity employer dedicated to the attraction, development, and retention of our employees by providing a preferred work environment that promotes and celebrates our core values of Integrity, Respect, Innovation and Teamwork. Our goal is to develop, retain and reward passionate and dedicated employees.

As of February 1, 2021, the Company employed approximately 1,870 full-time employees, approximately 26% of whom had at least ten years of service with the Company.

The Company attracts candidates and retains employees by offering competitive compensation packages, which include:

•

Base wages or salary,

•

Profit sharing,

•

Medical and welfare coverage,

•

Holidays and other “paid time off” (PTO), and

•

401(k) plan participation.

The Company believes its compensation packages:

•

Provide a base level of compensation to reflect an individual’s role and responsibilities;

•

Recognize and reward employees for the Company’s success; and

•

Provide for the safety, security and well-being of employees.

Our primary vehicle for human capital development is Ruger University, whose mission is to:

•

Enhance the understanding of our industry, Company and culture,

•

Strengthen the technical, interpersonal and leadership skills of each employee, and

•

Allow employees to positively change their own lives while creating value for all Ruger stakeholders.

In addition to the competitive compensation package and the development of employees, the Company retains its employees by maintaining a safe, responsible, and preferred workplace. The Company is committed to conducting business in conformance with the highest ethical standards and in compliance with all relevant legal and regulatory requirements. The “Code of Business Conduct and Ethics” and the “Corporate Compliance Program” are two active programs that guide the Company’s practices to achieve these goals.

During the global outbreak of the Coronavirus disease 2019 (“COVID-19”), the Company took many proactive steps to maintain the health and safety of its employees and maintain a preferred workplace. These actions included:

•

Providing all hourly employees with additional COVID-19 PTO;

•

Encouraging employees to work remotely, wherever possible, and implementing social distancing throughout each manufacturing facility, including in every manufacturing cell;

•

Through dedicated facility nurses, confidentially communicating with and assisting employees with potential health issues;

•

Restricting visitor access to avoid introducing new people to the factory environment;

•

Implementing additional cleaning, sanitizing, improved ventilation and other health and safety processes to maintain a clean and safe workplace; and

•

Providing all employees with multiple facemask coverings and other personal protective equipment and mandating their use at all times in our facilities.

To assess and improve employee retention and engagement, the Company surveys employees on an annual basis with the assistance of a third-party consultant, and takes actions to address areas of employee concern and build on the competencies that are important for our future success.

Research and Development

In 2020, 2019, and 2018, the Company spent approximately $8.0 million, $8.2 million, and $8.5 million, respectively, on research and development activities relating to new products and the improvement of existing products. Research and development expenses are included in costs of products sold. As of February 1, 2021, the Company had approximately 65 employees whose primary responsibilities were research and development activities.

Patents and Trademarks

The Company owns various United States and foreign patents and trademarks which have been secured over a period of years and which expire at various times. It is the policy of the Company to apply for patents and trademarks whenever new products or processes deemed commercially valuable are developed or marketed by the Company. However, none of these patents and trademarks are considered to be fundamental to any important product or manufacturing process of the Company and, although the Company deems its patents and trademarks to be valuable and therefore works to police and protect them, it does not consider its business materially dependent on patent or trademark protection.

Environmental Matters

The Company is committed to achieving high standards of environmental quality and product safety, and strives to provide a safe and healthy workplace for its employees and others in the communities in which it operates. The Company has programs in place that monitor compliance with various environmental regulations. However, in the normal course of its manufacturing operations the Company is subject to governmental proceedings and orders pertaining to waste disposal, air emissions, and water discharges into the environment. These regulations are integrated into the Company’s manufacturing, assembly, and testing processes. The Company believes that it is generally in compliance with applicable environmental regulations and that the outcome of any environmental proceedings and orders will not have a material adverse effect on the financial position of the Company, but could have a material adverse effect on the financial results for a particular period.

Information about our Executive Officers

Set forth below are the names, ages, and positions of the executive officers of the Company. Officers serve at the discretion of the Board of Directors of the Company.

|

Name |

Age |

Position With Company | |

|

| |||

|

Christopher J. Killoy |

62 |

President and Chief Executive Officer | |

|

| |||

|

Thomas A. Dineen |

52 |

Senior Vice President, Treasurer, and Chief Financial Officer | |

|

| |||

|

Thomas P. Sullivan |

60 |

Senior Vice President of Operations | |

|

| |||

|

Kevin B. Reid, Sr. |

60 |

Vice President, General Counsel, and Corporate Secretary | |

|

| |||

|

Shawn C. Leska |

49 |

Vice President, Sales |

Christopher J. Killoy became President & Chief Executive Officer on May 9, 2017. Previously he served as President and Chief Operating Officer since January 1, 2014. Prior to that he served as Vice President of Sales and Marketing since November 27, 2006. Mr. Killoy originally joined the Company in 2003 as Executive Director of Sales and Marketing, and subsequently served as Vice President of Sales and Marketing from November 1, 2004 to January 25, 2005.

Thomas A. Dineen became Senior Vice President on July 10, 2017. Previously he served as Vice President since May 24, 2006. Prior to that he served as Treasurer and Chief Financial Officer since May 6, 2003 and had been Assistant Controller since 2001. Mr. Dineen joined the Company as Manager, Corporate Accounting in 1997.

Thomas P. Sullivan became Senior Vice President of Operations on July 1, 2017. Mr. Sullivan joined the Company as Vice President of Newport Operations for the Newport, New Hampshire Firearms and Pine Tree Castings divisions on August 14, 2006.

Kevin B. Reid, Sr. became Vice President and General Counsel on April 23, 2008. Previously he served as the Company’s Director of Marketing from June 4, 2007. Mr. Reid joined the Company in July 2001 as an Assistant General Counsel.

Shawn C. Leska became Vice President, Sales on November 6, 2015. Mr. Leska joined the Company in 1989 and has served in a variety of positions in the sales department. Most recently, Mr. Leska served as Director of Sales since 2011.

Where You Can Find More Information

The Company is subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and accordingly, files its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Definitive Proxy Statements, Current Reports on Form 8-K, and other information with the Securities and Exchange Commission (the "SEC"). As an electronic filer, the Company's public filings are maintained on the SEC's Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that website is http://www.sec.gov.

The Company makes its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Definitive Proxy Statements, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act accessible free of charge through the Company's Internet site after the Company has electronically filed such material with, or furnished it to, the SEC. The address of that website is http://www.ruger.com. However, such reports may not be accessible through the Company's website as promptly as they are accessible on the SEC’s website.

Additionally, the Company’s corporate governance materials, including its Corporate Governance Guidelines, the charters of the Audit, Compensation, Nominating and Corporate Governance, Risk Oversight and Capital Policy committees, and the Code of Business Conduct and Ethics may also be found under the “Investor Relations” subsection of the “Corporate” section of the Company’s Internet site at http://www.ruger.com/corporate. A copy of the foregoing corporate governance materials is available upon written request to the Corporate Secretary at Sturm, Ruger & Company, Inc., 1 Lacey Place, Southport, Connecticut 06890.

ITEM 1A—RISK FACTORS

The Company’s operations could be affected by various risks, many of which are beyond its control. Based on current information, the Company believes that the following identifies the most significant risk factors that could adversely affect its business. Past financial performance may not be a reliable indicator of future performance and historical trends should not be used to anticipate results or trends in future periods.

In evaluating the Company’s business, the following risk factors, as well as other information in this report, should be carefully considered.

Changes in government policies and firearms legislation could adversely affect the Company’s financial results.

The sale, purchase, ownership, and use of firearms are subject to thousands of federal, state and local governmental regulations. The basic federal laws are the National Firearms Act, the Federal Firearms Act, and the Gun Control Act of 1968. Federal law generally prohibits the private ownership of fully automatic weapons manufactured after 1986 and place certain restrictions on the interstate sale of firearms unless certain licenses are obtained. The Company does not manufacture fully automatic weapons and holds all necessary licenses under these federal laws. If the scope of the National Firearms Act is expanded to regulate firearms currently regulated by the Gun Control Act, it could make acquisition of commonly owned and used firearms more expensive and complicated for consumers, which could have a material adverse impact on demand for Company products. Several states currently have laws in effect similar to the aforementioned legislation.

In 2005, Congress enacted the Protection of Lawful Commerce in Arms Act (“PLCAA”). The PLCAA was enacted to address abuses by cities and agenda-driven individuals who wrongly sought to make firearms manufacturers liable for legally manufactured and lawfully sold products if those products were later used in criminal acts. The Company believes the PLCAA merely codifies common sense and long standing tort principles. If the PLCAA is repealed or efforts to circumvent it are successful and lawsuits similar to those filed by cities and agenda-driven individuals in the late 1990s and early 2000s are allowed to proceed, it could have a material adverse impact on the Company.

Currently, federal and several states’ legislatures are considering additional legislation relating to the regulation of firearms. These proposed bills are numerous and extremely varied, but many seek either to restrict or ban the sale and, in some cases, the ownership of various types of firearms. Other legislation seeks to require new technologies, such as microstamping and so-called “smart gun” technology, which are not proven, reliable or feasible. Such legislation became effective in California in 2013, which has limited our ability to sell certain products in California. If similar legislation is enacted in other states, or at the Federal level, it could effectively ban or severely limit the sale of affected firearms. There also are legislative proposals to limit magazine capacity.

The Company believes that the lawful private ownership of firearms is guaranteed by the Second Amendment to the United States Constitution and that the widespread private ownership of firearms in the United States will continue. However, there can be no assurance that the regulation of firearms will not become more restrictive in the future and that any such restriction would not have a material adverse effect on the business of the Company. Numerous bills regulating the ownership of firearms have been proposed at the state and federal levels, and these bills propose a wide variety of restrictions including, for example, limiting the number of firearms that may be purchased in a specified time, increasing the age for ownership, imposing additional licensing or registration requirements, creating additional restrictions on certain, common firearm features, and levying new taxes on firearms and/or ammunition.

The Company’s results of operations could be further adversely affected if legislation with diverse requirements is enacted.

With literally thousands of laws being proposed at the federal, state and local levels, if even a small percentage of these laws are enacted and they are incongruent, the Company could find it difficult, expensive or even practically impossible to comply with them, impeding new product development and distribution of existing products.

The COVID-19 pandemic could have a significant adverse impact on the Company’s operations, financial results, cash flow, and financial condition.

The COVID-19 pandemic has created significant uncertainty and adversely impacted many industries throughout the global economy. Thus far, the Company has been able to mitigate the impact of COVID-19 through its proactive measures. However, as this pandemic continues, it is unknown how it may impact the Company in the future. The extent to which it impacts the Company’s operations, financial results, cash flow, and financial condition is difficult to predict and dependent upon many factors over which the Company has no control. These factors include, but are not limited to, the duration and severity of the pandemic; government restrictions on businesses and individuals; potential significant adverse impacts on the Company’s employees, customers, suppliers, or service providers; the impact on U.S. and global economies and the timing and rate of economic recovery; and potential adverse effects on the financial markets, any of which could negatively impact the Company.

The Company’s results of operations could be adversely affected by litigation.

The Company faces risks arising from various asserted and unasserted litigation matters. These matters include, but are not limited to, assertions of allegedly defective product design or manufacture, alleged failure to warn, purported class actions against firearms manufacturers, generally seeking relief such as medical expense reimbursement, property damages, and punitive damages arising from accidents involving firearms or the criminal misuse of firearms, and those lawsuits filed on behalf of municipalities alleging harm to the general public. Various factors or developments can lead to changes in current estimates of liabilities such as final adverse judgment, significant settlement or changes in applicable law. A future adverse outcome in any one or more of these matters could have a material adverse effect on the Company’s financial results. See Note 20 to the financial statements which are included in this Annual Report on Form 10-K.

The Company relies upon relationships with financial institutions.

The Company utilizes the services of numerous financial institutions, including banks, insurance carriers, transfer agents, and others. Anti-gun politicians, gun-control activists, and others may target these institutions and attempt to pressure them into ceasing to do business with the Company, or to use financial relationships to impose unacceptable and improper restrictions on the Company’s business, which could have a material adverse impact on our business, operating results, and financial condition.

Our insurance may be insufficient to protect us from claims or losses.

We maintain insurance coverage with third-party insurers. However, not every risk or liability is or can be protected by insurance, and, for those risks we insure, the limits of coverage we purchase or that are reasonably obtainable in the market may not be sufficient to cover all actual losses or liabilities incurred. Moreover, there is a risk that commercially available liability insurance will not continue to be available to us at a reasonable cost, if at all. If liability claims or losses exceed our current or available insurance coverage, our business and prospects may be harmed.

The Company’s results of operations could be adversely affected by a decrease in demand for Company products.

If demand for the Company’s products decreases significantly, the Company would be unable to efficiently utilize its capacity, and profitability would suffer. Decreased demand could result from a macroeconomic downturn, or could be specific to the firearms industry as a result of social, political, or other factors. If the decrease in demand occurs abruptly, the adverse impact would be even greater.

The financial health of our independent distributors is critical to our success.

Over 90% of our sales are made to 14 federally licensed, independent wholesale distributors. We review our distributors’ financial statements and have credit insurance for many of them. However, our credit evaluations of distributors and credit insurance may not be completely effective, especially if an interest rate increase exacts an additional financial strain.

If one or more independent distributors experience financial distress or liquidity issues, our sales could be adversely affected and we may not be able to collect our accounts receivable on a timely basis, which would have an adverse impact on our operating results and financial condition.

The Company must comply with various laws and regulations pertaining to workplace safety and environment, environmental matters, and firearms manufacture.

In the normal course of its manufacturing operations, the Company is subject to numerous federal, state and local laws and governmental regulations, and governmental proceedings and orders. These laws and regulations pertain to matters like workplace safety and environment, firearms serial number tracking and control, waste disposal, air emissions and water discharges into the environment. Noncompliance with any one or more of these laws and regulations could have a material adverse impact on the Company.

Misconduct of our employees or contractors could cause us to lose customers and could have a significant adverse impact on our business and reputation.

Misconduct, fraud or other improper activities by our employees or contractors could have a material adverse impact on our business and reputation. Such misconduct could include the failure to comply with federal, state, local or foreign government procurement regulations, regulations regarding the protection of personal information, laws and regulations relating to antitrust and any other applicable laws or regulations.

Product quality and performance is important to the Company’s success.

The Company has a long history of producing rugged, reliable firearms for the commercial market. While we believe our record of designing, manufacturing, and selling high-quality products demonstrates our commitment to safety and quality, we have occasionally identified design and/or manufacturing issues with respect to some firearms and, as a result, issued a product safety bulletin or initiated a product recall. Depending upon the volume of products we have shipped into the market, any future recall or safety bulletin could harm our reputation, cause us to lose business, and cause us to incur significant support and repair costs.

Business disruptions at one of the Company’s manufacturing facilities could adversely affect the Company’s financial results.

The Newport, New Hampshire, Prescott, Arizona, Mayodan, North Carolina, and Earth City, Missouri facilities are critical to the Company’s success. These facilities house the Company’s principal production, research, development, engineering, design, and shipping operations. Any event that causes a disruption of the operation of any of these facilities for even a relatively short period of time could have a material adverse effect on the Company’s ability to produce and ship products and to provide service to its customers.

We rely on our information and communications systems in our operations. Security breaches and other disruptions could adversely affect our business and results of operations.

Cyber-security threats are significant and evolving and include, among others, malicious software, attempts to gain unauthorized access to data, and other electronic security breaches that could lead to disruptions in mission critical systems, unauthorized release of confidential or otherwise protected information and corruption of data. In addition to security threats, we are also subject to other systems failures, including network, software or hardware failures, whether caused by us, third-party service providers, natural disasters, power shortages, terrorist attacks or other events. The unavailability of our information or communications systems, the failure of these systems to perform as anticipated or any significant breach of data security could cause loss of data, disrupt our operations, lead to financial losses from remedial actions, require significant management attention and resources, and negatively impact our reputation among our customers and the public, which could have a negative impact on our financial condition, results of operations and liquidity.

The lack of available raw materials or component parts could disrupt or even cease the Company’s manufacturing operations. Even if manufacturing operations are not disrupted, increased costs of raw materials and component parts could adversely affect the Company’s financial results.

Third parties supply the Company with various raw materials for its firearms and castings, such as fabricated steel components, walnut, birch, beech, maple and laminated lumber for rifle stocks, wax, ceramic material, metal alloys, various synthetic products and other component parts. There is a limited supply of these materials in the marketplace at any given time, which can cause the purchase prices to vary based upon numerous market factors. If market conditions result in a significant prolonged inflation of certain prices or if adequate quantities of raw materials cannot be obtained, the Company’s manufacturing processes could be interrupted and the Company’s financial condition or results of operations could be materially adversely affected.

The integration of Marlin branded firearms may be more difficult than anticipated.

If we are unable to execute our strategy related to the acquisition of Marlin assets and we are not able to manufacture Marlin branded firearms to the planned level of quality, quantity, cost effectiveness, or timeliness as planned, our financial condition, results of operations, and reputation would suffer.

Retention of key management is critical to the success of the Company.

We rely on the management and leadership skills of our senior management team. Our senior executives are not bound by employment agreements. The loss of the services of one or more of our senior executives or other key personnel could have a significant adverse impact on our business.

ITEM 1B—UNRESOLVED STAFF COMMENTS

None

ITEM 2—PROPERTIES

The Company’s manufacturing operations are carried out at four facilities. The following table sets forth certain information regarding each of these facilities:

|

Approximate Aggregate Usable Square Feet |

Status |

Segment | |

|

| |||

|

Newport, New Hampshire |

350,000 |

Owned |

Firearms/Castings |

|

| |||

|

Prescott, Arizona |

230,000 |

Leased |

Firearms |

|

| |||

|

Mayodan, North Carolina |

220,000 |

Owned |

Firearms |

|

| |||

|

Earth City, Missouri |

35,000 |

Leased |

Castings |

Each firearms facility contains enclosed ranges for testing firearms. The lease of the Prescott facility provides for rental payments which are approximately equivalent to estimated rates for real property taxes.

The Company has other facilities that were not used in its manufacturing operations in 2020:

|

Approximate Aggregate Usable Square Feet |

Status |

Segment | |

|

| |||

|

Southport, Connecticut |

25,000 |

Owned |

Corporate |

|

| |||

|

Newport, New Hampshire (Dorr Woolen Building) |

45,000 |

Owned |

Firearms |

|

| |||

|

Enfield, Connecticut |

10,000 |

Leased |

Firearms |

|

| |||

|

Rochester, New Hampshire |

2,000 |

Leased |

Firearms |

|

| |||

|

Fairport, New York |

3,700 |

Leased |

Corporate |

|

| |||

|

Madison, North Carolina |

130,000 |

Leased |

Firearms |

There are no mortgages or any other major encumbrance on any of the real estate owned by the Company.

The Company’s principal executive offices are located in Southport, Connecticut.

ITEM 3—LEGAL PROCEEDINGS

The nature of the legal proceedings against the Company is discussed at Note 20 to the financial statements, which are included in this Form 10-K.

The Company has reported all cases instituted against it through September 26, 2020, and the results of those cases, where terminated, to the SEC on its previous Form 10-Q and 10-K reports, to which reference is hereby made.

There were no lawsuits formally instituted against the Company during the three months ending December 31, 2020.

ITEM 4—MINE SAFETY DISCLOSURES – NOT APPLICABLE

PART II

ITEM 5—MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The Company’s common stock is traded on the New York Stock Exchange under the symbol “RGR.” At February 5, 2021, the Company had 1,756 stockholders of record.

Issuer Repurchase of Equity Securities

In 2019 the Company repurchased shares of its common stock. In 2018 and 2020, the Company did not repurchase any shares of its common stock. Details of the purchases in 2019 follow:

|

Period |

Total Number of Shares Purchased |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Program |

Maximum Dollar Value of Shares that May Yet Be Purchased Under the Program | ||||||||||||

|

| ||||||||||||||||

|

Third Quarter 2019 | ||||||||||||||||

|

July 28 to August 24 |

44,500 |

44.83 |

44,500 |

$86,710,000 | ||||||||||||

All of these purchases were made with cash held by the Company and no debt was incurred.

At December 31, 2020 approximately $86.7 million remained authorized for share repurchases.

|

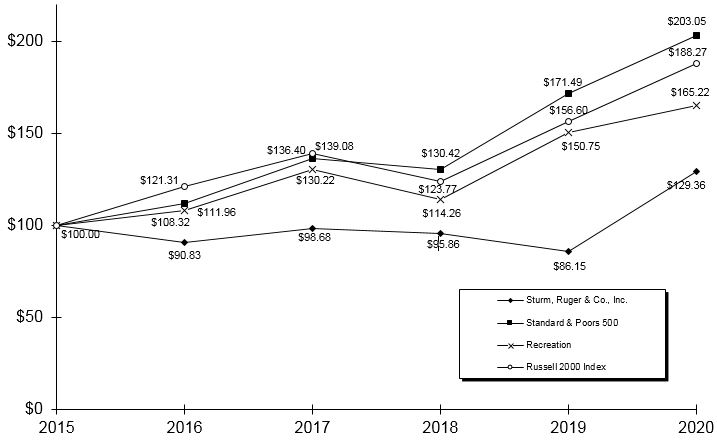

Comparison of Five-Year Cumulative Total Return* |

|

Sturm, Ruger & Co., Inc., Standard & Poor’s 500, Recreation and Russell 2000 Index |

|

(Performance Results Through 12/31/20) |

|

|

Assumes $100 invested at the close of trading 12/15 in Sturm, Ruger & Co., Inc. common stock, Standard & Poor’s 500, Recreation, and Russell 2000 Index.

* Cumulative total return assumes reinvestment of dividends.

Source: Value Line Publishing LLC

|

2015 |

2016 |

2017 |

2018 |

2019 |

2020 | |||||||

|

Sturm, Ruger & Co., Inc. |

$100.00 |

$90.83 |

$98.68 |

$95.86 |

$86.15 |

$129.36 | ||||||

|

Standard & Poor’s 500 |

$100.00 |

$111.96 |

$136.40 |

$130.42 |

$171.49 |

$203.05 | ||||||

|

Recreation |

$100.00 |

$108.32 |

$130.22 |

$114.26 |

$150.75 |

$165.22 | ||||||

|

Russell 2000 Index |

$100.00 |

$121.31 |

$139.08 |

$123.77 |

$156.60 |

$188.27 |

Securities Authorized for Issuance Under Equity Compensation Plans

The following table provides information regarding compensation plans under which equity securities of the Company are authorized for issuance as of December 31, 2020:

|

Equity Compensation Plan Information | |||

|

Plan category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) |

Weighted-average exercise price of outstanding options, warrants and rights (b) * |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) |

|

Equity compensation plans approved by security holders

| |||

|

— | |||

|

2017 Stock Incentive Plan |

362,165 |

— |

351,867 |

|

Equity compensation plans not approved by security holders

| |||

|

None. | |||

|

Total |

362,165 |

— |

351,867 |

|

| |

|

* |

Restricted stock units are settled in shares of common stock or the cash equivalent. Accordingly, the weighted-average exercise price is not applicable. |

ITEM 6 — SELECTED FINANCIAL DATA

|

(Dollars in thousands, except per share data) | ||||||||||||||||||||

|

| ||||||||||||||||||||

|

December 31, |

2020 |

2019 |

2018 |

2017 |

2016 | |||||||||||||||

|

Net firearms sales |

$ |

565,863 |

$ |

406,326 |

$ |

490,607 |

$ |

517,701 |

$ |

658,433 | ||||||||||

|

Net castings sales |

3,005 |

4,180 |

5,028 |

4,555 |

5,895 | |||||||||||||||

|

Total net sales |

568,868 |

410,506 |

495,635 |

522,256 |

664,328 | |||||||||||||||

|

Cost of products sold |

377,427 |

310,958 |

361,277 |

368,248 |

444,774 | |||||||||||||||

|

Gross profit |

191,441 |

99,548 |

134,358 |

154,008 |

219,554 | |||||||||||||||

|

Income before income taxes |

120,981 |

43,027 |

68,714 |

77,646 |

135,921 | |||||||||||||||

|

Income taxes |

30,583 |

10,736 |

17,781 |

25,504 |

48,449 | |||||||||||||||

|

Net income |

90,398 |

32,291 |

50,933 |

52,142 |

87,472 | |||||||||||||||

|

Basic earnings per share |

5.17 |

1.85 |

2.92 |

2.94 |

4.62 | |||||||||||||||

|

Diluted earnings per share |

5.09 |

1.82 |

2.88 |

2.91 |

4.59 | |||||||||||||||

|

Cash dividends per share |

$ |

6.51 |

$ |

0.82 |

$ |

1.10 |

$ |

1.36 |

$ |

1.73 |

|

| ||||||||||||||||||||

|

December 31, |

2020 |

2019 |

2018 |

2017 |

2016 | |||||||||||||||

|

Working capital |

$ |

152,612 |

$ |

188,072 |

$ |

160,998 |

$ |

114,107 |

$ |

133,870 | ||||||||||

|

Total assets |

348,258 |

348,961 |

335,532 |

284,318 |

346,879 | |||||||||||||||

|

Total stockholders’ equity |

264,699 |

285,458 |

264,242 |

230,149 |

265,900 | |||||||||||||||

|

Book value per share |

$ |

15.13 |

$ |

16.05 |

$ |

15.14 |

$ |

13.21 |

$ |

14.23 | ||||||||||

|

Return on stockholders’ equity |

32.9% |

11.8% |

20.6% |

21.0% |

35.4% | |||||||||||||||

|

Current ratio |

2.9 to 1 |

4.1 to 1 |

3.3 to 1 |

3.2 to 1 |

2.7 to 1 | |||||||||||||||

|

Common shares outstanding |

17,495,900 |

17,450,500 |

17,458,000 |

17,427,100 |

18,688,500 | |||||||||||||||

|

Number of stockholders of record |

1,727 |

1,675 |

1,652 |

1,664 |

1,678 | |||||||||||||||

|

Number of employees |

1,839 |

1,609 |

1,811 |

1,838 |

2,120 | |||||||||||||||

|

Number of temporary employees |

1 |

0 |

11 |

2 |

310 |

ITEM 7—MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Company Overview

Sturm, Ruger & Company, Inc. (the “Company”) is principally engaged in the design, manufacture, and sale of firearms to domestic customers. Approximately 99% of sales are from firearms. Export sales represent approximately 5% of total sales. The Company’s design and manufacturing operations are located in the United States and almost all product content is domestic. The Company’s firearms are sold through a select number of independent wholesale distributors, principally to the commercial sporting market.

The Company also manufactures investment castings made from steel alloys and metal injection molding (“MIM”) parts for internal use in its firearms and for sale to unaffiliated, third-party customers. Approximately 1% of sales are from the castings segment.

Orders of many models of firearms from the independent distributors tend to be stronger in the first quarter of the year and weaker in the third quarter of the year. This is due in part to the timing of the distributor show season, which occurs during the first quarter.

Impact of Covid-19

The global outbreak of the coronavirus disease 2019 (“COVID-19”) was declared a pandemic by the World Health Organization and a national emergency by the U.S. Government in March 2020. The COVID-19 pandemic has created significant uncertainty and adversely impacted many industries throughout the global economy. In 2020, the Company was able to mitigate the adverse impact on its business resulting from government restrictions on the movement of people, goods, and services. The impact of the COVID-19 pandemic is fluid and continues to evolve, and, therefore, the Company cannot predict the extent to which its business, results of operations, financial condition, or cash flows will ultimately be impacted. Management continues to monitor and assess the situation and to prepare for potential implications for the Company’s business, supply chain and customer demand.

From a liquidity perspective, the Company believes it is currently well positioned to manage through this global crisis. At the end of 2020, the Company was debt-free, and had cash and short-term investments totaling $141.2 million and an unused $40.0 million revolving credit facility.

The Company has taken many proactive steps to maintain the health and safety of its employees and to mitigate the impact on its business. These actions include:

•

Providing all hourly employees with an additional two weeks of paid time off,

•

Encouraging employees to work remotely, wherever possible, and implementing social distancing throughout each manufacturing facility, including in every manufacturing cell,

•

Communicating with and assisting employees with potential health issues,

•

Restricting visitor access to avoid introducing new people to the factory environment,

•

Implementing additional cleaning, sanitizing and other health and safety processes to maintain a clean and safe workplace, and

•

Manufacturing and donating personal protective equipment to local hospitals, health care facilities, and police and fire departments in its local communities.

The costs of these actions totaled approximately $3.6 million in 2020. The Company has also experienced expense reductions and deferrals in certain areas of our business, including reductions or delays in sponsorships and advertising, reduced conference and trade show participation costs, and reduced travel expenditures. These expense reductions and deferrals approximated $2.9 million in 2020.

The Company has been able to keep all of its facilities safe and open with only limited restrictions on operations. While certain parts of the economy have begun to reopen as restrictions have been lifted, it is possible that additional restrictions will be put in place in the future which could adversely impact the Company’s business for an indeterminate period.

Since the latter stages of the first quarter of 2020, there has been a significant increase in consumer demand for firearms, as evidenced by the increase in adjusted National Instant Criminal Background Check System (“NICS”) checks. This increased demand may be attributable, in part, to COVID-19. The sustainability of this increased consumer demand, and the ultimate impact of COVID-19 on consumer demand, cannot be predicted at this time.

The ultimate impact of COVID-19 on the Company’s business, results of operations, financial condition and cash flows is dependent on future developments, including the duration of the pandemic and the related length of its impact on the global economy, which are uncertain and cannot be predicted at this time. The Company estimates that COVID related costs of $1.5 million to $3 million will be incurred in 2021.

Results of Operations - 2020

Product Demand

The estimated sell-through of the Company’s products from the independent distributors to retailers in 2020 increased 44% from 2019. For the same period, the National Instant Criminal Background Check System (“NICS”) background checks (as adjusted by the National Shooting Sports Foundation (“NSSF”)) increased 60%.

These substantial increases may be attributable to increased public concern about personal protection and home defense in reaction to:

•

Some political and public leaders calling for a reduction in funding and limitations on law enforcement activities,

•

Protests, demonstrations, and civil unrest in many cities throughout the United States,

•

The continuing COVID-19 pandemic, and

•

Concern about possible legislation that could curtail or limit gun ownership rights by both state and Federal governments.

New products represented $111.2 million or 22% of firearms sales in 2020, compared to $102.0 million or 26% of firearms sales in 2019. New product sales include only major new products that were introduced in the past two years. In 2020, new products included the Wrangler revolver, the Ruger-57 pistol, the LCP II in .22 LR pistol, the PC Charger, and the AR-556 pistol.

Estimated sell-through from distributors to retailers and total adjusted NICS background checks:

|

2020 |

2019 |

2018 | |||||||||

|

| |||||||||||

|

Estimated Units Sold from Distributors to Retailers (1) |

1,948,900 |

1,355,500 |

1,654,600 | ||||||||

|

| |||||||||||

|

Total Adjusted NICS Background Checks (2) |

21,084,000 |

13,199,000 |

13,116,000 | ||||||||

|

(1) |

The estimates for each period were calculated by taking the beginning inventory at the distributors, plus shipments from the Company to distributors during the period, less the ending inventory at distributors. These estimates are only a proxy for actual market demand as they: | ||

|

| |||

|

• |

Rely on data provided by independent distributors that are not verified by the Company, | ||

|

• |

Do not consider potential timing issues within the distribution channel, including goods-in-transit, and | ||

|

• |

Do not consider fluctuations in inventory at retail. | ||

|

| |||

|

(2) |

NICS background checks are performed when the ownership of most firearms, either new or used, is transferred by a Federal Firearms Licensee. NICS background checks are also performed for permit applications, permit renewals, and other administrative reasons. | ||

|

| |||

|

The adjusted NICS data presented above was derived by the NSSF by subtracting NICS checks that are not directly related to the sale of a firearm, including checks used for concealed carry (“CCW”) permit application checks as well as checks on active CCW permit databases. | |||

|

| |||

|

Adjusted NICS data can be impacted by changes in state laws and regulations and any directives and interpretations issued by governmental agencies. For example, the use of state issued permits to carry firearms, in lieu of NICS background checks, for certain transactions was significantly curtailed in 2020. This resulted in increases in adjusted NICS background checks for Alabama and Michigan of 95% and 180%, respectively. Excluding these states, adjusted NICS increased 56%, compared with a reported increase of 60%, in 2020. | |||

Orders Received and Ending Backlog

The Company uses the estimated unit sell-through of our products from the independent distributors to retailers, along with inventory levels at the independent distributors and at the Company, as the key metrics for planning production levels.

Orders Received in 2020 increased 149% from 2019. Our ending order backlog of 1,511,900 units at December 31, 2020 increased 1,324,000 units from a backlog of 187,900 units at December 31, 2019.

The units ordered, value of orders received and ending backlog, net of Federal Excise Tax, for the trailing three years are as follows (dollars in millions, except average sales price):

|

2020 |

2019 |

2018 | |||||||||

|

| |||||||||||

|

Orders Received |

$ |

992.9 |

$ |

398.4 |

$ |

430.0 | |||||

|

| |||||||||||

|

Average Sales Price of Orders Received |

$ |

326 |

$ |

293 |

$ |

281 | |||||

|

| |||||||||||

|

Ending Backlog |

$ |

516.6 |

$ |

57.8 |

$ |

55.6 | |||||

|

| |||||||||||

|

Average Sales Price of Ending Backlog |

$ |

342 |

$ |

308 |

$ |

364 | |||||

Production

The Company reviews the estimated sell-through from the independent distributors to retailers, as well as inventory levels at the independent distributors and at the Company, semi-monthly to plan production levels and manage inventories. These reviews resulted in an increase in total unit production of 26% in 2020 compared to 2019. Reduced hiring to help maintain the health and safety of employees and the cleanliness of our facilities during the COVID-19 pandemic negatively impacted production in 2020.

Annual Summary Unit Data

Firearms unit data for orders, production, and shipments follows:

|

2020 |

2019 |

2018 | |||||||||

|

| |||||||||||

|

Units Ordered |

3,041,700 |

1,361,100 |

1,531,100 | ||||||||

|

| |||||||||||

|

Units Produced |

1,659,100 |

1,313,400 |

1,610,300 | ||||||||

|

| |||||||||||

|

Units Shipped |

1,717,700 |

1,326,200 |

1,633,000 | ||||||||

|

| |||||||||||

|

Average Sales Price |

$ |

329 |

$ |

306 |

$ |

300 | |||||

|

| |||||||||||

|

Units – Backlog |

1,511,900 |

187,900 |

153,000 | ||||||||

Inventories

The Company’s finished goods inventory decreased by 58,600 units during 2020.

Distributor inventories of the Company’s products decreased by 231,200 units during 2020 and are significantly below the level needed to support rapid fulfillment of retailer demand. In the aggregate, total Company and distributor inventories decreased by 86% in 2020.

Inventory data follows:

|

December 31, | ||||||||||||

|

2020 |

2019 |

2018 | ||||||||||

|

| ||||||||||||

|

Units – Company Inventory |

8,800 |

67,400 |

80,300 | |||||||||

|

| ||||||||||||

|

Units – Distributor Inventory (3) |

39,200 |

270,400 |

299,700 | |||||||||

|

| ||||||||||||

|

Total inventory (4) |

48,000 |

337,800 |

380,000 | |||||||||

|

(3) |

Distributor ending inventory as provided by the independent distributors of the Company’s products. These numbers do not include goods-in-transit inventory that has been shipped from the Company but not yet received by the distributors. | |

|

(4) |

This total does not include inventory at retailers. The Company does not have access to data on retailer inventories. |

Year ended December 31, 2020, as compared to year ended December 31, 2019:

Net Sales

Consolidated net sales were $568.9 million in 2020. This represents an increase of $158.4 million or 38.6% from 2019 consolidated net sales of $410.5 million.

Firearms segment net sales were $565.9 million in 2020. This represents an increase of $159.6 million or 39.3% from 2019 firearms net sales of $406.3 million. Firearms unit shipments increased 29.5% in 2020.

Casting segment net sales were $3.0 million in 2020. This represents a decrease of $1.2 million or 28.1% from 2019 casting sales of $4.2 million.

Cost of Products Sold and Gross Profit

Consolidated cost of products sold was $377.4 million in 2020. This represents an increase of $66.4 million or 21.4% from 2019 consolidated cost of products sold of $311.0 million.

The gross margin was 33.7% in 2020. This represents an increase from 24.3% in 2019 as illustrated below:

|

(in thousands) | ||||||||||||||||

|

Year Ended December 31, |

2020 |

2019 | ||||||||||||||

|

| ||||||||||||||||

|

Net sales |

$ |

568,868 |

100 |

% |

$ |

410,506 |

100 |

% | ||||||||

|

| ||||||||||||||||

|

Cost of products sold, before LIFO, overhead and labor rate adjustments to inventory, product liability, and product safety bulletins and recalls |

375,489 |

65.9 |

% |

313,769 |

76.4 |

% | ||||||||||

|

| ||||||||||||||||

|

LIFO expense |

879 |

0.2 |

% |

796 |

0.2 |

% | ||||||||||

|

| ||||||||||||||||

|

Overhead rate adjustments to inventory |

472 |

0.1 |

% |

(3,710 |

) |

(0.9 |

)% | |||||||||

|

| ||||||||||||||||

|

Labor rate adjustments to inventory |

318 |

0.1 |

% |

(415 |

) |

(0.1 |

)% | |||||||||

|

| ||||||||||||||||

|

Product liability |

1,139 |

0.2 |

% |

718 |

0.2 |

% | ||||||||||

|

| ||||||||||||||||

|

Product safety bulletins and recalls |

(870 |

) |

(0.2 |

)% |

(200 |

) |

(0.1 |

)% | ||||||||

|

| ||||||||||||||||

|

Total cost of products sold |

377,427 |

66.3 |

% |

310,958 |

75.7 |

% | ||||||||||

|

| ||||||||||||||||

|

Gross profit |

$ |

191,441 |

33.7 |

% |

$ |

99,548 |

24.3 |

% | ||||||||

Cost of products sold, before LIFO, overhead and labor rate adjustments to inventory, product liability, and product safety bulletins and recalls- In 2020, cost of products sold, before LIFO, overhead and labor rate adjustments to inventory, product liability and safety bulletins and recalls decreased 10.5% as a percentage of sales compared to 2019. This decrease was due primarily to to the significant increase in sales and production which resulted in favorable leveraging of fixed costs and a reduction in promotional activities.

LIFO- The Company recognized LIFO expense in 2020 and 2019 of $0.9 million and $0.8 million, respectively, which increased cost of products sold in both periods.

Overhead Rate Change- The net impact on inventory in 2020 and 2019 from the change in the overhead rates used to absorb overhead expenses into inventory was a decrease of $0.5 million and an increase of $3.7 million, respectively, reflecting increased overhead efficiency in 2020 and decreased overhead efficiency in 2019. The increase in inventory value in 2020 resulted in a corresponding decrease to cost of products sold and the decrease in inventory value in 2019 resulted in a corresponding increase to cost of products sold.

Labor Rate Adjustments- In 2020, the change in inventory value resulting from the change in the labor rates used to absorb labor expenses into inventory was a decrease of $0.3 million, reflecting increased labor efficiency. This decrease in inventory value resulted in a corresponding increase to cost of products sold. In 2019, the change in inventory value resulting from the change in the labor rates used to absorb labor expenses into inventory was an increase of $0.4 million, reflecting decreased labor efficiency. This increase in inventory value resulted in a corresponding decrease to cost of products sold.

Product Liability- This expense includes the cost of outside legal fees, insurance, and other expenses incurred in the management and defense of product liability matters. These costs totaled $1.1 million and $0.7 million in 2020 and 2019, respectively. See Note 20 in the notes to the financial statements “Contingent Liabilities” for further discussion of the Company’s product liability.

Product Safety Bulletins and Recalls- In October 2018, the Company issued a safety bulletin announcing that some Ruger American Pistols chambered in 9mm may exhibit premature wear of the locking surfaces between the slide and barrel. The Company offered a free retrofit to customers of affected pistols and recorded a $1.0 million expense in 2018, which was the expected total cost of the safety bulletin. In 2019 and 2020, the estimated costs remaining for the product safety bulletin was reduced, which decreased cost of sales by $0.2 million and $0.9 million in 2019 and 2020, respectively.

Gross Profit- Gross profit was $191.4 million or 33.7% of sales in 2020. This is an increase of $91.9 million from 2019 gross profit of $99.5 million or 24.3% of sales in 2019.

Selling, General and Administrative

Selling, general and administrative expenses were $72.3 million in 2020, an increase of $12.2 million from $60.1 million in 2019, and a decrease from 14.6% of sales in 2019 to 12.7% of sales in 2020. The increase in expense was primarily attributable to increased sales and incentive compensation expenses and the decrease in the percentage of sales was attributable to the significant increase in sales.

Other Operating Income, net

Other operating income, net was de minimis in 2020 and 2019.

Operating Income

Operating income was $119.1 million or 20.9% of sales in 2020. This is an increase of $79.7 million from 2019 operating income of $39.4 million or 9.6% of sales.

Royalty Income

Royalty income was $0.8 million in 2020 and $0.7 million in 2019.

Interest Income

Interest income was $1.1 million in 2020, a decrease of $1.5 million from $2.6 million in 2019, due to decreased interest rates earned on short-term investments in 2020.

Interest Expense

Interest expense was $0.2 million and $0.2 million in 2020 and 2019, respectively.

Other Income, Net

Other income, net was $0.1 million in 2020, a decrease of $0.5 million from $0.6 million in 2019.

Income Taxes and Net Income

The effective income tax rate was 25.3% in 2020 and 25.0% in 2019.

As a result of the foregoing factors, consolidated net income was $90.4 million in 2020. This represents an increase of $58.1 million from 2019 consolidated net income of $32.3 million.

Non-GAAP Financial Measure

In an effort to provide investors with additional information regarding its results, the Company refers to various United States generally accepted accounting principles (“GAAP”) financial measures and one non-GAAP financial measure, EBITDA, which management believes provides useful information to investors. This non-GAAP measure may not be comparable to similarly titled measures being disclosed by other companies. In addition, the Company believes that the non-GAAP financial measure should be considered in addition to, and not in lieu of, GAAP financial measures. The Company believes that EBITDA is useful to understanding its operating results and the ongoing performance of its underlying business, as EBITDA provides information on the Company’s ability to meet its capital expenditure and working capital requirements, and is also an indicator of profitability. The Company believes that this reporting provides better transparency and comparability to its operating results. The Company uses both GAAP and non-GAAP financial measures to evaluate its financial performance.

Non-GAAP Reconciliation – EBITDA

EBITDA

(Unaudited, dollars in thousands)

|

Year ended December 31, |

2020 |

2019 | ||||||

|

| ||||||||

|

Net income |

$ |

90,398 |

$ |

32,291 | ||||

|

| ||||||||

|

Income tax expense |

30,583 |

10,736 | ||||||

|

Depreciation and amortization expense |

27,576 |

29,331 | ||||||

|

Interest expense |

191 |

192 | ||||||

|

Interest income |

(1,126 |

) |

(2,594 |

) | ||||

|

EBITDA |

$ |

147,622 |

$ |

69,956 |

EBITDA is defined as earnings before interest, taxes, and depreciation and amortization. The Company calculates this by adding the amount of interest expense, income tax expense and depreciation and amortization expenses that have been deducted from net income back into net income, and subtracting the amount of interest income that was included in net income from net income to arrive at EBITDA. The Company’s EBITDA calculation also excludes any one-time non-cash, non-operating expense.

Quarterly Data

To supplement the summary annual unit data and discussion above, the same data for the last eight quarters follows:

|

2020 | ||||||||||||||||

|

Q4 |

Q3 |

Q2 |

Q1 | |||||||||||||

|

| ||||||||||||||||

|

Units Ordered |

733,200 |

935,200 |

746,600 |

626,700 | ||||||||||||

|

| ||||||||||||||||

|

Units Produced |

491,000 |

430,400 |

374,400 |

363,300 | ||||||||||||

|

| ||||||||||||||||

|

Units Shipped |

493,000 |

430,700 |

395,100 |

398,900 | ||||||||||||

|

| ||||||||||||||||

|

Estimated Units Sold from Distributors to Retailers |

513,100 |

457,400 |

501,600 |

476,800 | ||||||||||||

|

| ||||||||||||||||

|

Total Adjusted NICS Background Checks |

5,626,000 |

5,165,000 |

5,452,000 |

4,841,000 | ||||||||||||

|

| ||||||||||||||||

|

Average Unit Sales Price |

$ |

342 |

$ |

337 |

$ |

328 |

$ |

285 | ||||||||

|

| ||||||||||||||||

|

Units – Backlog |

1,511,900 |

1,271,700 |

767,200 |

415,700 | ||||||||||||

|

| ||||||||||||||||

|

Units – Company Inventory |

8,800 |

10,700 |

11,100 |

31,900 | ||||||||||||

|

| ||||||||||||||||

|

Units – Distributor Inventory (5) |

39,200 |

59,300 |

86,000 |

192,500 | ||||||||||||

|

2019 | ||||||||||||||||

|

Q4 |

Q3 |

Q2 |

Q1 | |||||||||||||

|

| ||||||||||||||||

|

Units Ordered |

413,900 |

362,200 |

257,900 |

327,100 | ||||||||||||

|

| ||||||||||||||||

|

Units Produced |

355,000 |

286,500 |

297,900 |

374,000 | ||||||||||||

|

| ||||||||||||||||

|

Units Shipped |

387,500 |

328,400 |

288,300 |

322,000 | ||||||||||||

|

| ||||||||||||||||

|

Estimated Units Sold from Distributors to Retailers |

397,000 |

295,100 |

316,300 |

347,100 | ||||||||||||

|

| ||||||||||||||||

|

Total Adjusted NICS Background Checks |

4,001,000 |

2,956,000 |

2,828,000 |

3,414,000 | ||||||||||||

|

| ||||||||||||||||

|

Average Unit Sales Price |

$ |

269 |

$ |

286 |

$ |

329 |

$ |

351 | ||||||||

|

| ||||||||||||||||

|

Units – Backlog |

187,900 |

161,500 |

127,700 |

158,100 | ||||||||||||

|

| ||||||||||||||||

|

Units – Company Inventory |

67,400 |

100,000 |

141,900 |

132,300 | ||||||||||||

|

| ||||||||||||||||

|

Units – Distributor Inventory (5) |

270,400 |

280,000 |

246,700 |

274,700 | ||||||||||||

|

(5) |

Distributor ending inventory as provided by the independent distributors of the Company’s products. |

(in millions except average sales price, net of Federal Excise Tax)

|

2020 | ||||||||||||||||

|

Q4 |

Q3 |

Q2 |

Q1 | |||||||||||||

|

| ||||||||||||||||

|

Orders Received |

$ |

277.1 |

$ |

284.0 |

$ |

228.8 |

$ |

203.0 | ||||||||

|

| ||||||||||||||||

|

Average Sales Price of Orders Received |

$ |

352 |

$ |

304 |

$ |

306 |

$ |

324 | ||||||||

|

| ||||||||||||||||

|

Ending Backlog |

$ |

516.6 |

$ |

410.1 |

$ |

255.6 |

$ |

142.7 | ||||||||

|

| ||||||||||||||||

|

Average Sales Price of Ending Backlog |

$ |

342 |

$ |

322 |

$ |

333 |

$ |

343 | ||||||||

|

2019 | ||||||||||||||||

|

Q4 |

Q3 |

Q2 |

Q1 | |||||||||||||

|

| ||||||||||||||||

|

Orders Received |

$ |

121.5 |

$ |

102.3 |

$ |

70.3 |

$ |

104.3 | ||||||||

|

| ||||||||||||||||

|

Average Sales Price of Orders Received |

$ |

294 |

$ |

283 |

$ |

273 |

$ |

319 | ||||||||

|

| ||||||||||||||||

|

Ending Backlog |

$ |

57.8 |

$ |

44.7 |

$ |

37.8 |

$ |

58.9 | ||||||||

|

| ||||||||||||||||

|

Average Sales Price of Ending Backlog |

$ |

308 |

$ |

277 |

$ |

296 |

$ |

372 | ||||||||

Fourth Quarter Gross Profit Analysis