us-gaap:DepositAccountMemberus-gaap:DepositAccountMemberus-gaap:DepositAccountMemberus-gaap:AccountingStandardsUpdate201802Memberus-gaap:AccountingStandardsUpdate201613MemberP6MP2YP6Mus-gaap:OtherAssetsus-gaap:AccountsPayableAndOtherAccruedLiabilitiesP3YP6YP3YP1YFALSE2020FY0000936528--09-30iso4217:USD0000936528us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-09-3000009365282020-09-3000009365282019-09-30iso4217:USDxbrli:sharesxbrli:shares00009365282019-10-012020-09-3000009365282018-10-012019-09-3000009365282017-10-012018-09-300000936528us-gaap:CommonStockMember2017-09-300000936528us-gaap:AdditionalPaidInCapitalMember2017-09-300000936528us-gaap:RetainedEarningsMember2017-09-300000936528us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-09-300000936528us-gaap:TreasuryStockMember2017-09-3000009365282017-09-300000936528us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2017-09-300000936528us-gaap:AccumulatedOtherComprehensiveIncomeMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2017-09-300000936528srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2017-09-300000936528us-gaap:RetainedEarningsMember2017-10-012018-09-300000936528us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-10-012018-09-300000936528us-gaap:CommonStockMember2017-10-012018-09-300000936528us-gaap:AdditionalPaidInCapitalMember2017-10-012018-09-300000936528us-gaap:TreasuryStockMember2017-10-012018-09-300000936528us-gaap:CommonStockMember2018-09-300000936528us-gaap:AdditionalPaidInCapitalMember2018-09-300000936528us-gaap:RetainedEarningsMember2018-09-300000936528us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-09-300000936528us-gaap:TreasuryStockMember2018-09-3000009365282018-09-300000936528us-gaap:RetainedEarningsMember2018-10-012019-09-300000936528us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-10-012019-09-300000936528us-gaap:CommonStockMember2018-10-012019-09-300000936528us-gaap:AdditionalPaidInCapitalMember2018-10-012019-09-300000936528us-gaap:TreasuryStockMember2018-10-012019-09-300000936528us-gaap:CommonStockMember2019-09-300000936528us-gaap:AdditionalPaidInCapitalMember2019-09-300000936528us-gaap:RetainedEarningsMember2019-09-300000936528us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-09-300000936528us-gaap:TreasuryStockMember2019-09-300000936528srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-09-300000936528us-gaap:RetainedEarningsMember2019-10-012020-09-300000936528us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-10-012020-09-300000936528us-gaap:CommonStockMember2019-10-012020-09-300000936528us-gaap:AdditionalPaidInCapitalMember2019-10-012020-09-300000936528us-gaap:TreasuryStockMember2019-10-012020-09-300000936528us-gaap:CommonStockMember2020-09-300000936528us-gaap:AdditionalPaidInCapitalMember2020-09-300000936528us-gaap:RetainedEarningsMember2020-09-300000936528us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-09-300000936528us-gaap:TreasuryStockMember2020-09-30wfsl:branchxbrli:pure0000936528srt:MinimumMember2019-10-012020-09-300000936528srt:MaximumMember2019-10-012020-09-30wfsl:payment0000936528srt:MinimumMemberwfsl:StockOptionsandRestrictedStockMember2019-10-012020-09-300000936528srt:MaximumMemberwfsl:StockOptionsandRestrictedStockMember2019-10-012020-09-30wfsl:segment00009365282013-10-090000936528us-gaap:SubsequentEventMember2020-10-270000936528us-gaap:MortgageBackedSecuritiesMemberus-gaap:AccountingStandardsUpdate201904Member2020-01-0100009365282020-01-010000936528us-gaap:AccountingStandardsUpdate201904Member2020-01-010000936528us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-10-010000936528us-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMember2019-09-300000936528us-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-09-300000936528srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMember2019-10-010000936528us-gaap:CommercialRealEstateMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:CommercialRealEstateMemberus-gaap:CommercialPortfolioSegmentMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-09-300000936528us-gaap:CommercialRealEstateMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:CommercialPortfolioSegmentMember2019-10-010000936528wfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528wfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-09-300000936528wfsl:CommercialandIndustrialMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:CommercialPortfolioSegmentMember2019-10-010000936528us-gaap:ConstructionLoansMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:CommercialPortfolioSegmentMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-09-300000936528us-gaap:ConstructionLoansMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:CommercialPortfolioSegmentMember2019-10-010000936528wfsl:LandAcquisitionAndDevelopmentMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528wfsl:LandAcquisitionAndDevelopmentMemberus-gaap:CommercialPortfolioSegmentMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-09-300000936528wfsl:LandAcquisitionAndDevelopmentMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:CommercialPortfolioSegmentMember2019-10-010000936528us-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:CommercialPortfolioSegmentMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-09-300000936528srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:CommercialPortfolioSegmentMember2019-10-010000936528srt:SingleFamilyMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528srt:SingleFamilyMemberus-gaap:ConsumerPortfolioSegmentMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-09-300000936528srt:SingleFamilyMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:ConsumerPortfolioSegmentMember2019-10-010000936528us-gaap:ConstructionLoansMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:ConsumerPortfolioSegmentMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-09-300000936528us-gaap:ConstructionLoansMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:ConsumerPortfolioSegmentMember2019-10-010000936528wfsl:LandConsumerLotLoansMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:ConsumerPortfolioSegmentMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-09-300000936528wfsl:LandConsumerLotLoansMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:ConsumerPortfolioSegmentMember2019-10-010000936528us-gaap:HomeEquityMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:HomeEquityMemberus-gaap:ConsumerPortfolioSegmentMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-09-300000936528us-gaap:HomeEquityMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:ConsumerPortfolioSegmentMember2019-10-010000936528us-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-09-300000936528srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2019-10-010000936528us-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:ConsumerPortfolioSegmentMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-09-300000936528srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:ConsumerPortfolioSegmentMember2019-10-010000936528srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2019-10-010000936528wfsl:RetainedEarningsPreTaxMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-09-300000936528wfsl:RetainedEarningsTaxMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-09-300000936528us-gaap:AccountingStandardsUpdate201602Member2019-10-010000936528us-gaap:RetainedEarningsMemberus-gaap:AccountingStandardsUpdate201602Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-10-010000936528us-gaap:USTreasuryAndGovernmentMember2020-09-300000936528us-gaap:AssetBackedSecuritiesMember2020-09-300000936528us-gaap:CorporateDebtSecuritiesMember2020-09-300000936528us-gaap:MunicipalBondsMember2020-09-300000936528us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2020-09-300000936528us-gaap:CommercialMortgageBackedSecuritiesMember2020-09-300000936528us-gaap:USTreasuryAndGovernmentMember2019-09-300000936528us-gaap:AssetBackedSecuritiesMember2019-09-300000936528us-gaap:CorporateDebtSecuritiesMember2019-09-300000936528us-gaap:MunicipalBondsMember2019-09-300000936528us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2019-09-300000936528us-gaap:CommercialMortgageBackedSecuritiesMember2019-09-30wfsl:security0000936528us-gaap:CorporateBondSecuritiesMember2020-09-300000936528us-gaap:USGovernmentAgenciesDebtSecuritiesMember2020-09-300000936528us-gaap:MortgageBackedSecuritiesMember2020-09-300000936528us-gaap:CorporateBondSecuritiesMember2019-09-300000936528us-gaap:USGovernmentAgenciesDebtSecuritiesMember2019-09-300000936528us-gaap:MortgageBackedSecuritiesMember2019-09-300000936528us-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMember2020-09-300000936528us-gaap:CommercialRealEstateMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528wfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528wfsl:LandAcquisitionAndDevelopmentMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:CommercialPortfolioSegmentMember2020-09-300000936528srt:SingleFamilyMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:HomeEquityMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528wfsl:SmallBusinessAdministrationSBACARESActPayrollProtectionProgramMemberwfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528wfsl:WithinOneYearMember2020-09-300000936528wfsl:MoreThanOneWithinThreeYearsMember2020-09-300000936528wfsl:MoreThanThreeWithinFiveYearsMember2020-09-300000936528wfsl:MoreThanFiveWithinTenYearsMember2020-09-300000936528wfsl:MoreThanTenWithinTwentyYearsMember2020-09-300000936528wfsl:MoreThanTwentyYearsMember2020-09-300000936528wfsl:FinancingReceivableFromRelatedPartyIncludingUnfundedLoanCommitmentMember2019-10-012020-09-300000936528wfsl:FinancingReceivableFromRelatedPartyIncludingUnfundedLoanCommitmentMember2018-10-012019-09-300000936528us-gaap:FinancialAssetOriginatedMemberus-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMember2020-09-300000936528us-gaap:FinancialAssetOriginatedMemberus-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMember2019-09-300000936528us-gaap:CommercialRealEstateMemberus-gaap:FinancialAssetOriginatedMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:CommercialRealEstateMemberus-gaap:FinancialAssetOriginatedMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:FinancialAssetOriginatedMemberwfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:FinancialAssetOriginatedMemberwfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:FinancialAssetOriginatedMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:FinancialAssetOriginatedMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528wfsl:LandAcquisitionAndDevelopmentMemberus-gaap:FinancialAssetOriginatedMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528wfsl:LandAcquisitionAndDevelopmentMemberus-gaap:FinancialAssetOriginatedMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:FinancialAssetOriginatedMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:FinancialAssetOriginatedMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528srt:SingleFamilyMemberus-gaap:FinancialAssetOriginatedMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528srt:SingleFamilyMemberus-gaap:FinancialAssetOriginatedMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:FinancialAssetOriginatedMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:FinancialAssetOriginatedMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:FinancialAssetOriginatedMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:FinancialAssetOriginatedMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:HomeEquityMemberus-gaap:FinancialAssetOriginatedMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:HomeEquityMemberus-gaap:FinancialAssetOriginatedMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:FinancialAssetOriginatedMemberus-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:FinancialAssetOriginatedMemberus-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:FinancialAssetOriginatedMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:FinancialAssetOriginatedMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:FinancialAssetOriginatedMember2020-09-300000936528us-gaap:FinancialAssetOriginatedMember2019-09-300000936528us-gaap:FinancingReceivables1To29DaysPastDueMemberus-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMember2020-09-300000936528us-gaap:FinancingReceivables30To59DaysPastDueMemberus-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMember2020-09-300000936528us-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2020-09-300000936528us-gaap:FinancingReceivables1To29DaysPastDueMemberus-gaap:CommercialRealEstateMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:FinancingReceivables30To59DaysPastDueMemberus-gaap:CommercialRealEstateMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:CommercialRealEstateMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2020-09-300000936528us-gaap:FinancingReceivables1To29DaysPastDueMemberwfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:FinancingReceivables30To59DaysPastDueMemberwfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528wfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2020-09-300000936528us-gaap:FinancingReceivables1To29DaysPastDueMemberus-gaap:ConstructionLoansMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:FinancingReceivables30To59DaysPastDueMemberus-gaap:ConstructionLoansMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2020-09-300000936528us-gaap:FinancingReceivables1To29DaysPastDueMemberwfsl:LandAcquisitionAndDevelopmentMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:FinancingReceivables30To59DaysPastDueMemberwfsl:LandAcquisitionAndDevelopmentMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528wfsl:LandAcquisitionAndDevelopmentMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2020-09-300000936528us-gaap:FinancingReceivables1To29DaysPastDueMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:FinancingReceivables30To59DaysPastDueMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2020-09-300000936528us-gaap:FinancingReceivables1To29DaysPastDueMembersrt:SingleFamilyMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:FinancingReceivables30To59DaysPastDueMembersrt:SingleFamilyMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528srt:SingleFamilyMemberus-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2020-09-300000936528us-gaap:FinancingReceivables1To29DaysPastDueMemberus-gaap:ConstructionLoansMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:FinancingReceivables30To59DaysPastDueMemberus-gaap:ConstructionLoansMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2020-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:FinancingReceivables1To29DaysPastDueMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:FinancingReceivables30To59DaysPastDueMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2020-09-300000936528us-gaap:HomeEquityMemberus-gaap:FinancingReceivables1To29DaysPastDueMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:HomeEquityMemberus-gaap:FinancingReceivables30To59DaysPastDueMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:HomeEquityMemberus-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2020-09-300000936528us-gaap:FinancingReceivables1To29DaysPastDueMemberus-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:FinancingReceivables30To59DaysPastDueMemberus-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2020-09-300000936528us-gaap:FinancingReceivables1To29DaysPastDueMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:FinancingReceivables30To59DaysPastDueMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2020-09-300000936528us-gaap:FinancingReceivables1To29DaysPastDueMember2020-09-300000936528us-gaap:FinancingReceivables30To59DaysPastDueMember2020-09-300000936528us-gaap:FinancingReceivables60To89DaysPastDueMember2020-09-300000936528us-gaap:FinancingReceivables1To29DaysPastDueMemberus-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMember2019-09-300000936528us-gaap:FinancingReceivables30To59DaysPastDueMemberus-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMember2019-09-300000936528us-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2019-09-300000936528us-gaap:FinancingReceivables1To29DaysPastDueMemberus-gaap:CommercialRealEstateMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:FinancingReceivables30To59DaysPastDueMemberus-gaap:CommercialRealEstateMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:CommercialRealEstateMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2019-09-300000936528us-gaap:FinancingReceivables1To29DaysPastDueMemberwfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:FinancingReceivables30To59DaysPastDueMemberwfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528wfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2019-09-300000936528us-gaap:FinancingReceivables1To29DaysPastDueMemberus-gaap:ConstructionLoansMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:FinancingReceivables30To59DaysPastDueMemberus-gaap:ConstructionLoansMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2019-09-300000936528us-gaap:FinancingReceivables1To29DaysPastDueMemberwfsl:LandAcquisitionAndDevelopmentMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:FinancingReceivables30To59DaysPastDueMemberwfsl:LandAcquisitionAndDevelopmentMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528wfsl:LandAcquisitionAndDevelopmentMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2019-09-300000936528us-gaap:FinancingReceivables1To29DaysPastDueMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:FinancingReceivables30To59DaysPastDueMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2019-09-300000936528us-gaap:FinancingReceivables1To29DaysPastDueMembersrt:SingleFamilyMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:FinancingReceivables30To59DaysPastDueMembersrt:SingleFamilyMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528srt:SingleFamilyMemberus-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2019-09-300000936528us-gaap:FinancingReceivables1To29DaysPastDueMemberus-gaap:ConstructionLoansMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:FinancingReceivables30To59DaysPastDueMemberus-gaap:ConstructionLoansMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2019-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:FinancingReceivables1To29DaysPastDueMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:FinancingReceivables30To59DaysPastDueMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2019-09-300000936528us-gaap:HomeEquityMemberus-gaap:FinancingReceivables1To29DaysPastDueMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:HomeEquityMemberus-gaap:FinancingReceivables30To59DaysPastDueMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:HomeEquityMemberus-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2019-09-300000936528us-gaap:FinancingReceivables1To29DaysPastDueMemberus-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:FinancingReceivables30To59DaysPastDueMemberus-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2019-09-300000936528us-gaap:FinancingReceivables1To29DaysPastDueMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:FinancingReceivables30To59DaysPastDueMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2019-09-300000936528us-gaap:FinancingReceivables1To29DaysPastDueMember2019-09-300000936528us-gaap:FinancingReceivables30To59DaysPastDueMember2019-09-300000936528us-gaap:FinancingReceivables60To89DaysPastDueMember2019-09-300000936528wfsl:SmallBusinessAdministrationSBACARESActPayrollProtectionProgramMember2019-10-012020-09-30wfsl:loan0000936528us-gaap:ConsumerPortfolioSegmentMember2020-09-302020-09-300000936528us-gaap:CommercialPortfolioSegmentMember2020-09-302020-09-300000936528us-gaap:CommercialPortfolioSegmentMemberus-gaap:PassMembersrt:MultifamilyMember2020-09-300000936528us-gaap:SpecialMentionMemberus-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMember2020-09-300000936528us-gaap:SubstandardMemberus-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMember2020-09-300000936528us-gaap:CommercialRealEstateMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:PassMember2020-09-300000936528us-gaap:SpecialMentionMemberus-gaap:CommercialRealEstateMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:CommercialRealEstateMemberus-gaap:SubstandardMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528wfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:PassMember2020-09-300000936528us-gaap:SpecialMentionMemberwfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528wfsl:CommercialandIndustrialMemberus-gaap:SubstandardMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:PassMember2020-09-300000936528us-gaap:SpecialMentionMemberus-gaap:ConstructionLoansMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:SubstandardMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528wfsl:LandAcquisitionAndDevelopmentMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:PassMember2020-09-300000936528us-gaap:SpecialMentionMemberwfsl:LandAcquisitionAndDevelopmentMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:CommercialPortfolioSegmentMemberus-gaap:PassMember2020-09-300000936528us-gaap:SpecialMentionMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:SubstandardMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMembersrt:SingleFamilyMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:HomeEquityMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMemberus-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMember2019-10-012020-09-300000936528us-gaap:CommercialRealEstateMemberus-gaap:CommercialPortfolioSegmentMember2019-10-012020-09-300000936528wfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMember2019-10-012020-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:CommercialPortfolioSegmentMember2019-10-012020-09-300000936528wfsl:LandAcquisitionAndDevelopmentMemberus-gaap:CommercialPortfolioSegmentMember2019-10-012020-09-300000936528us-gaap:CommercialPortfolioSegmentMember2019-10-012020-09-300000936528srt:SingleFamilyMemberus-gaap:ConsumerPortfolioSegmentMember2019-10-012020-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:ConsumerPortfolioSegmentMember2019-10-012020-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:ConsumerPortfolioSegmentMember2019-10-012020-09-300000936528us-gaap:HomeEquityMemberus-gaap:ConsumerPortfolioSegmentMember2019-10-012020-09-300000936528us-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2019-10-012020-09-300000936528us-gaap:ConsumerPortfolioSegmentMember2019-10-012020-09-300000936528us-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMember2018-09-300000936528us-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMember2018-10-012019-09-300000936528us-gaap:CommercialRealEstateMemberus-gaap:CommercialPortfolioSegmentMember2018-09-300000936528us-gaap:CommercialRealEstateMemberus-gaap:CommercialPortfolioSegmentMember2018-10-012019-09-300000936528wfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMember2018-09-300000936528wfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMember2018-10-012019-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:CommercialPortfolioSegmentMember2018-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:CommercialPortfolioSegmentMember2018-10-012019-09-300000936528wfsl:LandAcquisitionAndDevelopmentMemberus-gaap:CommercialPortfolioSegmentMember2018-09-300000936528wfsl:LandAcquisitionAndDevelopmentMemberus-gaap:CommercialPortfolioSegmentMember2018-10-012019-09-300000936528us-gaap:CommercialPortfolioSegmentMember2018-09-300000936528us-gaap:CommercialPortfolioSegmentMember2018-10-012019-09-300000936528srt:SingleFamilyMemberus-gaap:ConsumerPortfolioSegmentMember2018-09-300000936528srt:SingleFamilyMemberus-gaap:ConsumerPortfolioSegmentMember2018-10-012019-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:ConsumerPortfolioSegmentMember2018-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:ConsumerPortfolioSegmentMember2018-10-012019-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:ConsumerPortfolioSegmentMember2018-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:ConsumerPortfolioSegmentMember2018-10-012019-09-300000936528us-gaap:HomeEquityMemberus-gaap:ConsumerPortfolioSegmentMember2018-09-300000936528us-gaap:HomeEquityMemberus-gaap:ConsumerPortfolioSegmentMember2018-10-012019-09-300000936528us-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2018-09-300000936528us-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2018-10-012019-09-300000936528us-gaap:ConsumerPortfolioSegmentMember2018-09-300000936528us-gaap:ConsumerPortfolioSegmentMember2018-10-012019-09-300000936528us-gaap:NonperformingFinancingReceivableMember2020-09-300000936528us-gaap:NonperformingFinancingReceivableMember2019-09-300000936528wfsl:LoansSubjectToQuantitativeEvaluationMember2020-09-300000936528wfsl:LoansSubjectToManagementQualitativeEvaluationMember2020-09-300000936528us-gaap:DoubtfulMemberus-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMember2020-09-300000936528wfsl:LossMemberus-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMember2020-09-300000936528us-gaap:DoubtfulMemberus-gaap:CommercialRealEstateMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:CommercialRealEstateMemberwfsl:LossMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:DoubtfulMemberwfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528wfsl:LossMemberwfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:DoubtfulMemberus-gaap:ConstructionLoansMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528wfsl:LossMemberus-gaap:ConstructionLoansMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528wfsl:LandAcquisitionAndDevelopmentMemberus-gaap:SubstandardMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:DoubtfulMemberwfsl:LandAcquisitionAndDevelopmentMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528wfsl:LandAcquisitionAndDevelopmentMemberwfsl:LossMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:DoubtfulMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528wfsl:LossMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528srt:SingleFamilyMemberus-gaap:PassMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:SpecialMentionMembersrt:SingleFamilyMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528srt:SingleFamilyMemberus-gaap:SubstandardMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:DoubtfulMembersrt:SingleFamilyMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528wfsl:LossMembersrt:SingleFamilyMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:PassMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:SpecialMentionMemberus-gaap:ConstructionLoansMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:SubstandardMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:DoubtfulMemberus-gaap:ConstructionLoansMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528wfsl:LossMemberus-gaap:ConstructionLoansMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:PassMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:SpecialMentionMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:SubstandardMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:DoubtfulMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528wfsl:LandConsumerLotLoansMemberwfsl:LossMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:HomeEquityMemberus-gaap:PassMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:SpecialMentionMemberus-gaap:HomeEquityMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:HomeEquityMemberus-gaap:SubstandardMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:DoubtfulMemberus-gaap:HomeEquityMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:HomeEquityMemberwfsl:LossMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:ConsumerLoanMemberus-gaap:PassMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:SpecialMentionMemberus-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:SubstandardMemberus-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:DoubtfulMemberus-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528wfsl:LossMemberus-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:PassMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:SpecialMentionMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:SubstandardMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:DoubtfulMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528wfsl:LossMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:PassMember2020-09-300000936528us-gaap:SpecialMentionMember2020-09-300000936528us-gaap:SubstandardMember2020-09-300000936528us-gaap:DoubtfulMember2020-09-300000936528wfsl:LossMember2020-09-300000936528us-gaap:AccountsReceivableMemberus-gaap:CreditConcentrationRiskMemberus-gaap:PassMember2019-10-012020-09-300000936528us-gaap:SpecialMentionMemberus-gaap:AccountsReceivableMemberus-gaap:CreditConcentrationRiskMember2019-10-012020-09-300000936528us-gaap:AccountsReceivableMemberus-gaap:SubstandardMemberus-gaap:CreditConcentrationRiskMember2019-10-012020-09-300000936528us-gaap:DoubtfulMemberus-gaap:AccountsReceivableMemberus-gaap:CreditConcentrationRiskMember2019-10-012020-09-300000936528us-gaap:AccountsReceivableMemberwfsl:LossMemberus-gaap:CreditConcentrationRiskMember2019-10-012020-09-300000936528us-gaap:CommercialPortfolioSegmentMemberus-gaap:PassMembersrt:MultifamilyMember2019-09-300000936528us-gaap:SpecialMentionMemberus-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMember2019-09-300000936528us-gaap:SubstandardMemberus-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMember2019-09-300000936528us-gaap:DoubtfulMemberus-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMember2019-09-300000936528wfsl:LossMemberus-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMember2019-09-300000936528us-gaap:CommercialRealEstateMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:PassMember2019-09-300000936528us-gaap:SpecialMentionMemberus-gaap:CommercialRealEstateMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:CommercialRealEstateMemberus-gaap:SubstandardMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:DoubtfulMemberus-gaap:CommercialRealEstateMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:CommercialRealEstateMemberwfsl:LossMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528wfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:PassMember2019-09-300000936528us-gaap:SpecialMentionMemberwfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528wfsl:CommercialandIndustrialMemberus-gaap:SubstandardMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:DoubtfulMemberwfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528wfsl:LossMemberwfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:PassMember2019-09-300000936528us-gaap:SpecialMentionMemberus-gaap:ConstructionLoansMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:SubstandardMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:DoubtfulMemberus-gaap:ConstructionLoansMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528wfsl:LossMemberus-gaap:ConstructionLoansMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528wfsl:LandAcquisitionAndDevelopmentMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:PassMember2019-09-300000936528us-gaap:SpecialMentionMemberwfsl:LandAcquisitionAndDevelopmentMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528wfsl:LandAcquisitionAndDevelopmentMemberus-gaap:SubstandardMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:DoubtfulMemberwfsl:LandAcquisitionAndDevelopmentMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528wfsl:LandAcquisitionAndDevelopmentMemberwfsl:LossMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:CommercialPortfolioSegmentMemberus-gaap:PassMember2019-09-300000936528us-gaap:SpecialMentionMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:SubstandardMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:DoubtfulMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528wfsl:LossMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528srt:SingleFamilyMemberus-gaap:PassMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:SpecialMentionMembersrt:SingleFamilyMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528srt:SingleFamilyMemberus-gaap:SubstandardMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:DoubtfulMembersrt:SingleFamilyMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528wfsl:LossMembersrt:SingleFamilyMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:PassMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:SpecialMentionMemberus-gaap:ConstructionLoansMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:SubstandardMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:DoubtfulMemberus-gaap:ConstructionLoansMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528wfsl:LossMemberus-gaap:ConstructionLoansMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:PassMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:SpecialMentionMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:SubstandardMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:DoubtfulMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528wfsl:LandConsumerLotLoansMemberwfsl:LossMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:HomeEquityMemberus-gaap:PassMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:SpecialMentionMemberus-gaap:HomeEquityMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:HomeEquityMemberus-gaap:SubstandardMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:DoubtfulMemberus-gaap:HomeEquityMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:HomeEquityMemberwfsl:LossMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:ConsumerLoanMemberus-gaap:PassMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:SpecialMentionMemberus-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:SubstandardMemberus-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:DoubtfulMemberus-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528wfsl:LossMemberus-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:PassMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:SpecialMentionMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:SubstandardMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:DoubtfulMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528wfsl:LossMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:PassMember2019-09-300000936528us-gaap:SpecialMentionMember2019-09-300000936528us-gaap:SubstandardMember2019-09-300000936528us-gaap:DoubtfulMember2019-09-300000936528wfsl:LossMember2019-09-300000936528us-gaap:AccountsReceivableMemberus-gaap:CreditConcentrationRiskMemberus-gaap:PassMember2018-10-012019-09-300000936528us-gaap:SpecialMentionMemberus-gaap:AccountsReceivableMemberus-gaap:CreditConcentrationRiskMember2018-10-012019-09-300000936528us-gaap:AccountsReceivableMemberus-gaap:SubstandardMemberus-gaap:CreditConcentrationRiskMember2018-10-012019-09-300000936528us-gaap:DoubtfulMemberus-gaap:AccountsReceivableMemberus-gaap:CreditConcentrationRiskMember2018-10-012019-09-300000936528us-gaap:AccountsReceivableMemberwfsl:LossMemberus-gaap:CreditConcentrationRiskMember2018-10-012019-09-300000936528us-gaap:PerformingFinancingReceivableMemberus-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMember2020-09-300000936528us-gaap:CommercialPortfolioSegmentMemberus-gaap:NonperformingFinancingReceivableMembersrt:MultifamilyMember2020-09-300000936528us-gaap:PerformingFinancingReceivableMemberus-gaap:CommercialRealEstateMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:CommercialRealEstateMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:NonperformingFinancingReceivableMember2020-09-300000936528us-gaap:PerformingFinancingReceivableMemberwfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528wfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:NonperformingFinancingReceivableMember2020-09-300000936528us-gaap:PerformingFinancingReceivableMemberus-gaap:ConstructionLoansMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:NonperformingFinancingReceivableMember2020-09-300000936528us-gaap:PerformingFinancingReceivableMemberwfsl:LandAcquisitionAndDevelopmentMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528wfsl:LandAcquisitionAndDevelopmentMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:NonperformingFinancingReceivableMember2020-09-300000936528us-gaap:PerformingFinancingReceivableMemberus-gaap:CommercialPortfolioSegmentMember2020-09-300000936528us-gaap:CommercialPortfolioSegmentMemberus-gaap:NonperformingFinancingReceivableMember2020-09-300000936528us-gaap:PerformingFinancingReceivableMembersrt:SingleFamilyMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528srt:SingleFamilyMemberus-gaap:NonperformingFinancingReceivableMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:PerformingFinancingReceivableMemberus-gaap:ConstructionLoansMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:NonperformingFinancingReceivableMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:PerformingFinancingReceivableMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:NonperformingFinancingReceivableMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:HomeEquityMemberus-gaap:PerformingFinancingReceivableMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:HomeEquityMemberus-gaap:NonperformingFinancingReceivableMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:PerformingFinancingReceivableMemberus-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:NonperformingFinancingReceivableMemberus-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:PerformingFinancingReceivableMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:NonperformingFinancingReceivableMemberus-gaap:ConsumerPortfolioSegmentMember2020-09-300000936528us-gaap:PerformingFinancingReceivableMember2020-09-300000936528us-gaap:NonperformingFinancingReceivableMember2020-09-300000936528us-gaap:PerformingFinancingReceivableMemberus-gaap:CommercialPortfolioSegmentMembersrt:MultifamilyMember2019-09-300000936528us-gaap:CommercialPortfolioSegmentMemberus-gaap:NonperformingFinancingReceivableMembersrt:MultifamilyMember2019-09-300000936528us-gaap:PerformingFinancingReceivableMemberus-gaap:CommercialRealEstateMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:CommercialRealEstateMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:NonperformingFinancingReceivableMember2019-09-300000936528us-gaap:PerformingFinancingReceivableMemberwfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528wfsl:CommercialandIndustrialMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:NonperformingFinancingReceivableMember2019-09-300000936528us-gaap:PerformingFinancingReceivableMemberus-gaap:ConstructionLoansMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:NonperformingFinancingReceivableMember2019-09-300000936528us-gaap:PerformingFinancingReceivableMemberwfsl:LandAcquisitionAndDevelopmentMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528wfsl:LandAcquisitionAndDevelopmentMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:NonperformingFinancingReceivableMember2019-09-300000936528us-gaap:PerformingFinancingReceivableMemberus-gaap:CommercialPortfolioSegmentMember2019-09-300000936528us-gaap:CommercialPortfolioSegmentMemberus-gaap:NonperformingFinancingReceivableMember2019-09-300000936528us-gaap:PerformingFinancingReceivableMembersrt:SingleFamilyMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528srt:SingleFamilyMemberus-gaap:NonperformingFinancingReceivableMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:PerformingFinancingReceivableMemberus-gaap:ConstructionLoansMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:ConstructionLoansMemberus-gaap:NonperformingFinancingReceivableMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:PerformingFinancingReceivableMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528wfsl:LandConsumerLotLoansMemberus-gaap:NonperformingFinancingReceivableMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:HomeEquityMemberus-gaap:PerformingFinancingReceivableMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:HomeEquityMemberus-gaap:NonperformingFinancingReceivableMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:PerformingFinancingReceivableMemberus-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:NonperformingFinancingReceivableMemberus-gaap:ConsumerLoanMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:PerformingFinancingReceivableMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:NonperformingFinancingReceivableMemberus-gaap:ConsumerPortfolioSegmentMember2019-09-300000936528us-gaap:PerformingFinancingReceivableMember2019-09-300000936528us-gaap:NonperformingFinancingReceivableMember2019-09-300000936528wfsl:NonSingleFamilyMember2019-09-300000936528srt:SingleFamilyMember2019-09-300000936528us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryAndGovernmentMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryAndGovernmentMember2020-09-300000936528us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryAndGovernmentMember2020-09-300000936528us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryAndGovernmentMember2020-09-300000936528us-gaap:FairValueInputsLevel1Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-09-300000936528us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528us-gaap:FairValueInputsLevel1Memberus-gaap:MunicipalBondsMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:MunicipalBondsMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528us-gaap:MunicipalBondsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-09-300000936528us-gaap:MunicipalBondsMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-09-300000936528us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528us-gaap:FairValueInputsLevel1Memberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-09-300000936528us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-09-300000936528us-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528us-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateContractMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateContractMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528us-gaap:InterestRateContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-09-300000936528us-gaap:InterestRateContractMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528us-gaap:FairValueInputsLevel1Memberwfsl:CommercialLoanHedgeMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberwfsl:CommercialLoanHedgeMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528wfsl:CommercialLoanHedgeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-09-300000936528wfsl:CommercialLoanHedgeMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528us-gaap:FairValueInputsLevel1Memberwfsl:MortgageLoanHedgeMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberwfsl:MortgageLoanHedgeMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528wfsl:MortgageLoanHedgeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-09-300000936528wfsl:MortgageLoanHedgeMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528wfsl:LongTermBorrowingHedgeMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528wfsl:LongTermBorrowingHedgeMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528wfsl:LongTermBorrowingHedgeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-09-300000936528wfsl:LongTermBorrowingHedgeMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300000936528us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryAndGovernmentMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryAndGovernmentMember2019-09-300000936528us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryAndGovernmentMember2019-09-300000936528us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryAndGovernmentMember2019-09-300000936528us-gaap:FairValueInputsLevel1Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-09-300000936528us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528us-gaap:FairValueInputsLevel1Memberus-gaap:MunicipalBondsMemberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:MunicipalBondsMemberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528us-gaap:MunicipalBondsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-09-300000936528us-gaap:MunicipalBondsMemberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-09-300000936528us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528us-gaap:FairValueInputsLevel1Memberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-09-300000936528us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-09-300000936528us-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528us-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateContractMemberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateContractMemberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528us-gaap:InterestRateContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-09-300000936528us-gaap:InterestRateContractMemberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528us-gaap:FairValueInputsLevel1Memberwfsl:MortgageLoanHedgeMemberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberwfsl:MortgageLoanHedgeMemberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528wfsl:MortgageLoanHedgeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-09-300000936528wfsl:MortgageLoanHedgeMemberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528us-gaap:FairValueInputsLevel1Memberwfsl:CommercialLoanHedgeMemberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberwfsl:CommercialLoanHedgeMemberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528wfsl:CommercialLoanHedgeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-09-300000936528wfsl:CommercialLoanHedgeMemberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528wfsl:LongTermBorrowingHedgeMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528wfsl:LongTermBorrowingHedgeMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528wfsl:LongTermBorrowingHedgeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-09-300000936528wfsl:LongTermBorrowingHedgeMemberus-gaap:FairValueMeasurementsRecurringMember2019-09-300000936528wfsl:ImpairedLoansMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsNonrecurringMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberwfsl:ImpairedLoansMemberus-gaap:FairValueMeasurementsNonrecurringMember2020-09-300000936528wfsl:ImpairedLoansMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2020-09-300000936528wfsl:ImpairedLoansMemberus-gaap:FairValueMeasurementsNonrecurringMember2020-09-300000936528wfsl:ImpairedLoansMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:ChangeDuringPeriodFairValueDisclosureMember2019-10-012020-09-300000936528us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsNonrecurringMemberwfsl:RealEstateOwnedMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMemberwfsl:RealEstateOwnedMember2020-09-300000936528us-gaap:FairValueMeasurementsNonrecurringMemberwfsl:RealEstateOwnedMemberus-gaap:FairValueInputsLevel3Member2020-09-300000936528us-gaap:FairValueMeasurementsNonrecurringMemberwfsl:RealEstateOwnedMember2020-09-300000936528us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:ChangeDuringPeriodFairValueDisclosureMemberwfsl:RealEstateOwnedMember2019-10-012020-09-300000936528us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsNonrecurringMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMember2020-09-300000936528us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2020-09-300000936528us-gaap:FairValueMeasurementsNonrecurringMember2020-09-300000936528us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:ChangeDuringPeriodFairValueDisclosureMember2019-10-012020-09-300000936528wfsl:ImpairedLoansMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsNonrecurringMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberwfsl:ImpairedLoansMemberus-gaap:FairValueMeasurementsNonrecurringMember2019-09-300000936528wfsl:ImpairedLoansMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2019-09-300000936528wfsl:ImpairedLoansMemberus-gaap:FairValueMeasurementsNonrecurringMember2019-09-300000936528wfsl:ImpairedLoansMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:ChangeDuringPeriodFairValueDisclosureMember2018-10-012019-09-300000936528us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsNonrecurringMemberwfsl:RealEstateOwnedMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMemberwfsl:RealEstateOwnedMember2019-09-300000936528us-gaap:FairValueMeasurementsNonrecurringMemberwfsl:RealEstateOwnedMemberus-gaap:FairValueInputsLevel3Member2019-09-300000936528us-gaap:FairValueMeasurementsNonrecurringMemberwfsl:RealEstateOwnedMember2019-09-300000936528us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:ChangeDuringPeriodFairValueDisclosureMemberwfsl:RealEstateOwnedMember2018-10-012019-09-300000936528us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsNonrecurringMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMember2019-09-300000936528us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2019-09-300000936528us-gaap:FairValueMeasurementsNonrecurringMember2019-09-300000936528us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:ChangeDuringPeriodFairValueDisclosureMember2018-10-012019-09-300000936528us-gaap:FairValueInputsLevel1Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-09-300000936528us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-09-300000936528us-gaap:FairValueInputsLevel1Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2019-09-300000936528us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:USTreasuryAndGovernmentMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:USTreasuryAndGovernmentMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:USTreasuryAndGovernmentMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:USTreasuryAndGovernmentMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:AssetBackedSecuritiesMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:AssetBackedSecuritiesMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:MunicipalBondsMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:MunicipalBondsMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:MunicipalBondsMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:MunicipalBondsMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:CorporateDebtSecuritiesMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:CorporateDebtSecuritiesMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2019-09-300000936528us-gaap:CarryingReportedAmountFairValueDisclosureMember2020-09-300000936528us-gaap:EstimateOfFairValueFairValueDisclosureMember2020-09-300000936528us-gaap:CarryingReportedAmountFairValueDisclosureMember2019-09-300000936528us-gaap:EstimateOfFairValueFairValueDisclosureMember2019-09-300000936528us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:CommercialMortgageBackedSecuritiesMember2020-09-300000936528us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:CommercialMortgageBackedSecuritiesMember2020-09-300000936528us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:CommercialMortgageBackedSecuritiesMember2019-09-300000936528us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:CommercialMortgageBackedSecuritiesMember2019-09-300000936528us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Member2020-09-300000936528us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Member2020-09-300000936528us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Member2019-09-300000936528us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Member2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:InterestRateContractMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:InterestRateContractMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:InterestRateContractMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:InterestRateContractMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberwfsl:MortgageLoanHedgeMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberwfsl:MortgageLoanHedgeMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberwfsl:MortgageLoanHedgeMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberwfsl:MortgageLoanHedgeMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberwfsl:CommercialLoanHedgeMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberwfsl:CommercialLoanHedgeMember2020-09-300000936528us-gaap:FairValueInputsLevel2Memberwfsl:CommercialLoanHedgeMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2019-09-300000936528us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberwfsl:CommercialLoanHedgeMember2019-09-300000936528wfsl:LongTermBorrowingHedgeMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-09-300000936528wfsl:LongTermBorrowingHedgeMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-09-300000936528wfsl:LongTermBorrowingHedgeMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2019-09-300000936528wfsl:LongTermBorrowingHedgeMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-09-300000936528us-gaap:InterestRateContractMemberus-gaap:OtherAssetsMember2020-09-300000936528us-gaap:OtherLiabilitiesMemberus-gaap:InterestRateContractMember2020-09-300000936528wfsl:CommercialLoanHedgeMemberus-gaap:OtherAssetsMember2020-09-300000936528wfsl:CommercialLoanHedgeMemberus-gaap:OtherLiabilitiesMember2020-09-300000936528wfsl:MortgageLoanHedgeMemberus-gaap:OtherAssetsMember2020-09-300000936528us-gaap:OtherLiabilitiesMemberwfsl:MortgageLoanHedgeMember2020-09-300000936528wfsl:LongTermBorrowingHedgeMemberus-gaap:OtherAssetsMember2020-09-300000936528wfsl:LongTermBorrowingHedgeMemberus-gaap:OtherLiabilitiesMember2020-09-300000936528us-gaap:OtherAssetsMember2020-09-300000936528us-gaap:OtherLiabilitiesMember2020-09-300000936528us-gaap:InterestRateContractMemberus-gaap:OtherAssetsMember2019-09-300000936528us-gaap:OtherLiabilitiesMemberus-gaap:InterestRateContractMember2019-09-300000936528wfsl:CommercialLoanHedgeMemberus-gaap:OtherAssetsMember2019-09-300000936528wfsl:CommercialLoanHedgeMemberus-gaap:OtherLiabilitiesMember2019-09-300000936528wfsl:MortgageLoanHedgeMemberus-gaap:OtherAssetsMember2019-09-300000936528us-gaap:OtherLiabilitiesMemberwfsl:MortgageLoanHedgeMember2019-09-300000936528wfsl:LongTermBorrowingHedgeMemberus-gaap:OtherAssetsMember2019-09-300000936528wfsl:LongTermBorrowingHedgeMemberus-gaap:OtherLiabilitiesMember2019-09-300000936528us-gaap:OtherAssetsMember2019-09-300000936528us-gaap:OtherLiabilitiesMember2019-09-300000936528us-gaap:LoansReceivableMember2020-09-300000936528us-gaap:LoansReceivableMemberwfsl:MortgageLoanHedgeMember2020-09-300000936528wfsl:MortgageLoanHedgeMember2020-09-300000936528wfsl:CommercialLoanHedgeMemberus-gaap:LoansReceivableMember2020-09-300000936528wfsl:CommercialLoanHedgeMember2020-09-300000936528us-gaap:LoansReceivableMember2019-09-300000936528us-gaap:LoansReceivableMemberwfsl:MortgageLoanHedgeMember2019-09-300000936528wfsl:MortgageLoanHedgeMember2019-09-300000936528wfsl:CommercialLoanHedgeMemberus-gaap:LoansReceivableMember2019-09-300000936528wfsl:CommercialLoanHedgeMember2019-09-300000936528srt:WeightedAverageMember2019-10-012020-09-300000936528us-gaap:CashFlowHedgingMemberwfsl:InterestRateContractPayFixedReceiveFloatingSwapMember2019-10-012020-09-300000936528us-gaap:CashFlowHedgingMemberwfsl:InterestRateContractPayFixedReceiveFloatingSwapMember2018-10-012019-09-300000936528us-gaap:CashFlowHedgingMember2019-10-012020-09-300000936528us-gaap:CashFlowHedgingMember2018-10-012019-09-300000936528us-gaap:InterestRateContractMemberwfsl:InterestIncomeLoansReceivableMemberus-gaap:FairValueHedgingMember2019-10-012020-09-300000936528us-gaap:InterestRateContractMemberwfsl:InterestIncomeLoansReceivableMemberus-gaap:FairValueHedgingMember2018-10-012019-09-300000936528us-gaap:CashFlowHedgingMemberus-gaap:InterestRateContractMemberwfsl:InterestExpenseFHLBAdvancesMember2019-10-012020-09-300000936528us-gaap:CashFlowHedgingMemberus-gaap:InterestRateContractMemberwfsl:InterestExpenseFHLBAdvancesMember2018-10-012019-09-300000936528wfsl:RelatedPartyLoanMember2020-09-300000936528wfsl:NoninterestIncomeOtherOperatingIncomeMemberwfsl:InterestRateContractPayFixedReceiveFloatingSwapMember2019-10-012020-09-300000936528wfsl:NoninterestIncomeOtherOperatingIncomeMemberwfsl:InterestRateContractPayFixedReceiveFloatingSwapMember2018-10-012019-09-300000936528wfsl:NoninterestIncomeOtherOperatingIncomeMemberwfsl:InterestRateContractReceiveFixedPayFloatingSwapMember2019-10-012020-09-300000936528wfsl:NoninterestIncomeOtherOperatingIncomeMemberwfsl:InterestRateContractReceiveFixedPayFloatingSwapMember2018-10-012019-09-300000936528us-gaap:InterestRateContractMember2019-10-012020-09-300000936528us-gaap:InterestRateContractMember2018-10-012019-09-300000936528us-gaap:FinanceReceivablesMember2020-09-300000936528us-gaap:FinanceReceivablesMember2019-09-300000936528us-gaap:MortgageBackedSecuritiesMember2020-09-300000936528us-gaap:MortgageBackedSecuritiesMember2019-09-300000936528us-gaap:DebtSecuritiesMember2020-09-300000936528us-gaap:DebtSecuritiesMember2019-09-300000936528us-gaap:LandMember2020-09-300000936528us-gaap:LandMember2019-09-300000936528us-gaap:BuildingMembersrt:MinimumMember2019-10-012020-09-300000936528us-gaap:BuildingMembersrt:MaximumMember2019-10-012020-09-300000936528us-gaap:BuildingMember2020-09-300000936528us-gaap:BuildingMember2019-09-300000936528us-gaap:LeaseholdImprovementsMembersrt:MinimumMember2019-10-012020-09-300000936528us-gaap:LeaseholdImprovementsMembersrt:MaximumMember2019-10-012020-09-300000936528us-gaap:LeaseholdImprovementsMember2020-09-300000936528us-gaap:LeaseholdImprovementsMember2019-09-300000936528wfsl:FurnitureFixturesAndEquipmentMembersrt:MinimumMember2019-10-012020-09-300000936528wfsl:FurnitureFixturesAndEquipmentMembersrt:MaximumMember2019-10-012020-09-300000936528wfsl:FurnitureFixturesAndEquipmentMember2020-09-300000936528wfsl:FurnitureFixturesAndEquipmentMember2019-09-300000936528srt:FederalHomeLoanBankOfDesMoinesMember2019-10-012020-09-3000009365282018-01-012020-09-3000009365282018-10-012020-09-300000936528wfsl:A2020IncentivePlanMember2020-09-300000936528us-gaap:EmployeeStockOptionMember2019-10-012020-09-300000936528us-gaap:EmployeeStockOptionMember2020-09-300000936528srt:MinimumMemberus-gaap:RestrictedStockMember2019-10-012020-09-300000936528srt:MaximumMemberus-gaap:RestrictedStockMember2019-10-012020-09-300000936528us-gaap:RestrictedStockMember2020-09-300000936528us-gaap:RestrictedStockMember2019-10-012020-09-300000936528us-gaap:RestrictedStockMember2019-09-300000936528us-gaap:RestrictedStockMember2018-09-300000936528us-gaap:RestrictedStockMember2017-09-300000936528us-gaap:RestrictedStockMember2018-10-012019-09-300000936528us-gaap:RestrictedStockMember2017-10-012018-09-300000936528srt:ParentCompanyMember2020-09-300000936528srt:SubsidiariesMember2020-09-300000936528srt:ParentCompanyMember2019-09-300000936528srt:SubsidiariesMember2019-09-300000936528srt:WeightedAverageMember2018-10-012019-09-300000936528us-gaap:WarrantMember2019-10-012020-09-300000936528us-gaap:WarrantMember2018-10-012019-09-300000936528us-gaap:WarrantMember2017-10-012018-09-300000936528us-gaap:StockOptionMember2019-10-012020-09-300000936528us-gaap:StockOptionMember2018-10-012019-09-300000936528us-gaap:StockOptionMember2017-10-012018-09-300000936528srt:ParentCompanyMember2019-10-012020-09-300000936528srt:ParentCompanyMember2018-10-012019-09-300000936528srt:ParentCompanyMember2017-10-012018-09-300000936528srt:ParentCompanyMember2018-09-300000936528srt:ParentCompanyMember2017-09-3000009365282019-10-012019-12-3100009365282020-01-012020-03-3100009365282020-04-012020-06-3000009365282020-07-012020-09-3000009365282018-10-012018-12-3100009365282019-01-012019-03-3100009365282019-04-012019-06-3000009365282019-07-012019-09-3000009365282020-03-3100009365282020-11-17

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

2020 ANNUAL REPORT

Table of Contents

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

2020 ANNUAL REPORT

BUSINESS DESCRIPTION

Washington Federal Bank, National Association, a federally-insured national bank dba WaFd Bank (the “Bank” or “WaFd Bank”), was founded on April 24, 1917 in Ballard, Washington and is engaged primarily in providing lending, depository, insurance and other banking services to consumers, mid-sized to large businesses, and owners and developers of commercial real estate. Washington Federal, Inc., a Washington corporation (the “Company”), was formed as the Bank’s holding company in November, 1994. As used throughout this document, the terms “Washington Federal” or the “Company” refer to the Company and its consolidated subsidiaries, including the Bank, and the term “Bank” refers to the operating subsidiary, Washington Federal Bank, National Association. The Company is headquartered in Seattle, Washington.

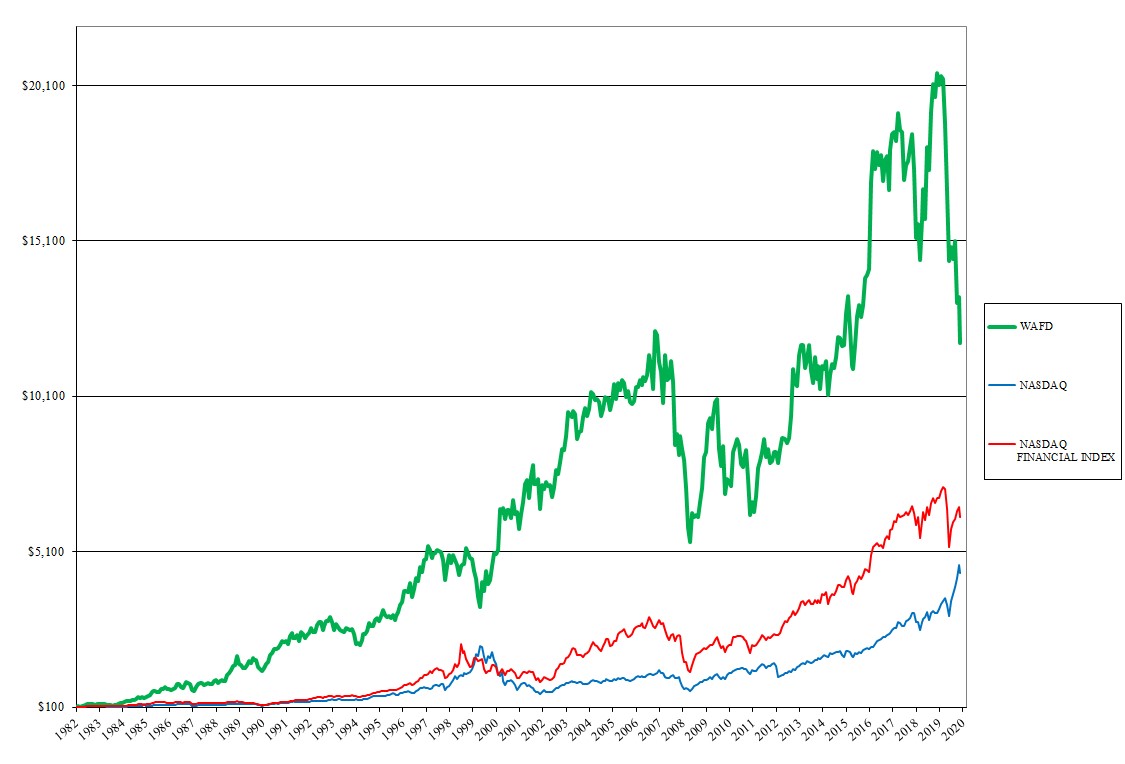

On November 9, 1982 the Company listed and began trading on the NASDAQ. Profitable operations have been recorded every year since and the Company ranks in the top 15% of the 100 largest publicly traded U.S. banks in terms of common equity tier 1 capital strength. As of September 30, 2020, the stock traded at 56 times its original 1982 offering price, has paid 150 consecutive quarterly cash dividends and has returned 10,114% total shareholder return to those who invested 37 years ago.

Over the years, the Company has expanded to serve banking clients across much of the western United States. While much has changed since its founding, one constant has been the commitment to doing business with integrity, serving our communities and treating employees, clients and investors fairly.

We strive toward having a powerful and diverse team of employees, knowing we are better together with our combined wisdom and intellect. With a commitment to equality, inclusion and workplace diversity, we focus on understanding, accepting, and valuing the differences between people. To accomplish this, we have established a Diversity & Inclusion Advisory Council made up of 15 employee representatives throughout our footprint. We continued our commitment to equal employment opportunity through a robust affirmative action plan which includes annual compensation analyses and ongoing reviews of our selection and hiring practices alongside a continued focus on building and maintaining a diverse workforce.

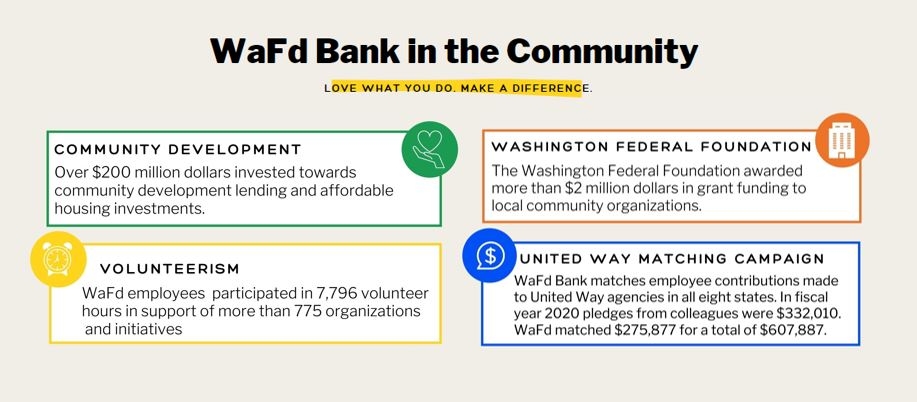

Corporate Social and Environmental Responsibility