UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

(Exact Name of Registrant as Specified in its Charter)

| |

|

| ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

|

|

|

| |||

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number including area code: (

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| |

|

| ||

| |

|

| ||

| |

|

| ||

| |

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 | Entry into a Material Definitive Agreement. |

Underwriting Agreement

On November 7, 2019, Stanley Black & Decker, Inc. (the “Company”) entered into an underwriting agreement (the “Underwriting Agreement”) with Citigroup Global Markets Inc., Credit Suisse Securities (USA) LLC and Wells Fargo Securities, LLC, as representatives of the underwriters named therein, related to the offering, issuance and sale of 7,500,000 of its equity units (the “Equity Units”), including 750,000 Equity Units pursuant to the underwriters’ exercise of their over-allotment option in full. Pursuant to the terms of the Underwriting Agreement, the Company sold the Equity Units to the underwriters at a price of 98% of the initial public offering price. The Underwriting Agreement contains customary terms, conditions, representations and warranties and indemnification provisions.

The offering of the Equity Units was made under the Company’s Registration Statement on Form S-3ASR (Registration No. 333-221127), which was originally filed with the Securities and Exchange Commission on October 26, 2017, and closed on November 13, 2019. The Company intends to use the net proceeds from the offering, together with cash on hand, to redeem in full its 5.75% Junior Subordinated Debentures due 2052. This Current Report on Form 8-K does not constitute a notice of redemption of the 5.75% Junior Subordinated Debentures due 2052. The Company also used approximately $19 million of the net proceeds from the offering, together with cash on hand, to enter into the capped call transactions with counterparties, including certain of the underwriters or their affiliates.

The Underwriting Agreement is filed as Exhibit 1.1 to this Current Report on Form 8-K and is incorporated herein by reference. The description of the terms of the Underwriting Agreement is qualified in its entirety by reference to such exhibit.

Purchase Contract Agreement

On November 13, 2019, the Company entered into the Purchase Contract and Pledge Agreement (the “Purchase Contract Agreement”), among the Company, The Bank of New York Mellon Trust Company, N.A., as purchase contract agent, and HSBC Bank USA, National Association, as collateral agent, custodial agent and securities intermediary, pursuant to which the Equity Units were issued. Each Equity Unit initially consists of a unit referred to as a Corporate Unit (as defined below) with a stated amount of $100 comprised of (i) a contract to purchase from the Company, on November 15, 2022, for a price of $100, a number of newly-issued shares of the Company’s common stock, par value $2.50 per share (the “Common Stock”), equal to the applicable settlement rate (each a “Purchase Contract” and collectively the “Purchase Contracts”) and (ii) a 10% undivided beneficial interest in one share of 0% Series D Cumulative Perpetual Convertible Preferred Stock, without par value, with a liquidation preference of $1,000 (the “Convertible Preferred Stock” and, each 10% undivided interest thereof together with a Purchase Contract, a “Corporate Unit”). The Convertible Preferred Stock is pledged to the Company to secure the Equity Unit holders’ obligations under the Purchase Contract Agreement to purchase the Common Stock. The Purchase Contract Agreement includes customary agreements and covenants by the Company.

Holders of Corporate Units may create “Treasury Units” or “Cash Settled Units” from their Corporate Units as provided in the Purchase Contract Agreement by substituting Treasury securities or cash, respectively, for the Convertible Preferred Stock comprising a part of the Corporate Units. Holders of Equity Units will be entitled to receive, quarterly in arrears on February 15, May 15, August 15 and November 15 of each year, commencing on February 15, 2020, distributions consisting of contract adjustment payments of 5.25% per year on the stated amount of $100 per Equity Unit, which will accrue from November 13, 2019 and will be payable by the Company in cash, shares of Common Stock or a combination of cash and shares of Common Stock, at the Company’s election, unless the Company has previously irrevocably elected a settlement method to apply, subject to the Company’s right to defer contract adjustment payments in certain instances.

The Purchase Contract Agreement and the forms of Corporate Unit, Treasury Unit and Cash Settled Unit representing the Equity Units are filed as Exhibits 4.1, 4.2, 4.3 and 4.4 to this Current Report on Form 8-K, respectively, and are incorporated by reference herein. The descriptions of the material terms of the Purchase Contract Agreement and the forms of Corporate Unit, Treasury Unit and Cash Settled Unit representing the Equity Units are qualified in their entirety by reference to such exhibits.

HSBC Bank USA, National Association and The Bank of New York Mellon Trust Company, National Association are each the trustee for certain of the Company’s outstanding notes, and HSBC Bank USA, National Association is the collateral agent for the Company’s equity units issued in May 2017. HSBC Bank USA, National Association, The Bank of New York Mellon Trust Company, National Association and their respective affiliates have, from time to time, performed, and may in the future perform, other financial, banking and other services for the Company, for which they received or will receive customary fees and expenses.

| Item 3.03 | Material Modification to Rights of Security Holders. |

The information included in Item 5.03 below is incorporated herein by reference.

| Item 5.03 | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On November 13, 2019, the Company filed a Certificate of Amendment to its Restated Certificate of Incorporation (the “Certificate of Amendment”), providing for the designation and terms of the Convertible Preferred Stock. The Certificate of Amendment became effective on November 13, 2019.

Pursuant to the Certificate of Amendment, the Convertible Preferred Stock will have an initial conversion rate of 5.2263 shares of Common Stock per share of the Convertible Preferred Stock, equivalent to an initial conversion price of approximately $191.34, subject to adjustment. The initial conversion price represents a premium of approximately 20% above the closing price of the Common Stock on November 7, 2019. The Convertible Preferred Stock will initially not bear any dividends and the liquidation preference of the Convertible Preferred Stock will not accrete. Each share of Convertible Preferred Stock may be converted only after being separated from the Equity Units and, prior to November 15, 2022, only in connection with the occurrence of fundamental change events if such fundamental change events occur prior to a successful remarketing (such right of conversion, the “fundamental change conversion right”). Upon any such conversion, the Company will pay or deliver, as the case may be, cash, shares of Common Stock or a combination of cash and shares of Common Stock, at the Company’s election, unless the Company has previously irrevocably elected a settlement method to apply.

However, on and after a successful remarketing, there will be no fundamental change conversion right. The Company may, in connection with a remarketing, nonetheless elect for the fundamental change conversion right to apply to the terms of the Convertible Preferred Stock, but is not obligated to do so.

The Convertible Preferred Stock is expected to be remarketed in November 2022, unless the Company elects to remarket the Convertible Preferred Stock earlier, during a period beginning on and including August 10, 2022 and ending on and including October 27, 2022, at which time the conversion rate and/or the dividend rate may be increased and certain other terms (including whether the fundamental change conversion right applies) of the Convertible Preferred Stock may change.

The Company may pay any dividend payments on the Convertible Preferred Stock (if the dividend rate of the Convertible Preferred Stock is increased upon successful remarketing) in cash, shares of Common Stock or a combination of cash and shares of Common Stock, at the Company’s election, unless the Company has previously irrevocably elected a dividend payment method to apply, subject to the Company’s right to defer dividend payments in certain instances. The Convertible Preferred Stock is perpetual, but the Company may redeem all or any portion of the outstanding Convertible Preferred Stock on or after December 22, 2022, at a redemption price equal to 100% of the liquidation preference thereof, plus any accumulated and unpaid dividends (whether or not authorized or declared), which will only accrue if the dividend rate of the Convertible Preferred Stock is increased upon successful remarketing.

Upon any voluntary or involuntary liquidation, dissolution or winding up of the Company, before any distribution or payment shall be made to holders of Common Stock or any other class or series of capital stock ranking junior to the Convertible Preferred Stock, holders of the Convertible Preferred Stock are entitled to be paid out of the Company’s assets legally available for distribution to its stockholders, after payment of or provision for the Company’s debts and other liabilities, a liquidation preference of $1,000 per share of the Convertible Preferred Stock, plus an amount equal to any accumulated and unpaid dividends (whether or not declared) (which will only accrue if the dividend rate of the Convertible Preferred Stock is increased upon successful remarketing) up to but excluding the date of payment, but subject to the prior payment in full of all of the Company’s liabilities and the payment of its senior stock.

The Certificate of Amendment and form of Certificate for the Convertible Preferred Stock are filed as Exhibits 3.1 and 4.5, respectively, to this Current Report on Form 8-K and incorporated herein by reference. The descriptions of the material terms of the Convertible Preferred Stock and the Certificate of Amendment are qualified in their entirety by reference to such exhibits.

2

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit |

Description | |||

| 1.1 |

||||

| 3.1 |

Certificate of Amendment to the Restated Certificate of Incorporation, dated November 13, 2019. | |||

| 4.1 |

||||

| 4.2 |

Form of Corporate Unit (included as part of Exhibit 4.1 hereto). | |||

| 4.3 |

Form of Treasury Unit (included as part of Exhibit 4.1 hereto). | |||

| 4.4 |

Form of Cash Settled Unit (included as part of Exhibit 4.1 hereto). | |||

| 4.5 |

||||

| 5.1 |

||||

| 5.2 |

||||

| 5.3 |

||||

| 23.1 |

Consent of Donald J. Riccitelli (included as part of Exhibit 5.1). | |||

| 23.2 |

Consent of Skadden, Arps, Slate, Meagher & Flom LLP (included as part of Exhibit 5.2). | |||

| 23.3 |

Consent of Day Pitney LLP (included as part of Exhibit 5.3). | |||

| 104 |

Cover Page Interactive Data File (formatted as inline XBRL). | |||

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| STANLEY BLACK & DECKER, INC. | ||

| By: |

/s/ Janet M. Link | |

| Name: |

Janet M. Link | |

| Title: |

Senior Vice President, General Counsel and Secretary | |

Dated: November 13, 2019

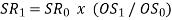

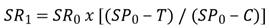

= the Maximum Settlement Rate in effect immediately prior to the close of business on the Record Date for such dividend or distribution or immediately prior to the open of business on the Effective Date for such share

split or share combination, as the case may be;

= the Maximum Settlement Rate in effect immediately prior to the close of business on the Record Date for such dividend or distribution or immediately prior to the open of business on the Effective Date for such share

split or share combination, as the case may be;  = the Maximum Settlement Rate in effect immediately after the close of business on such Record Date or such Effective Date, as the case may be;

= the Maximum Settlement Rate in effect immediately after the close of business on such Record Date or such Effective Date, as the case may be;  = the number of shares of Common Stock outstanding immediately prior to the close of business on such Record Date or such Effective Date, as the case may be, in each case, prior to giving effect to such event; and

= the number of shares of Common Stock outstanding immediately prior to the close of business on such Record Date or such Effective Date, as the case may be, in each case, prior to giving effect to such event; and  = the number of shares of Common Stock that would be outstanding immediately after, and solely as a result of, such event.

= the number of shares of Common Stock that would be outstanding immediately after, and solely as a result of, such event.

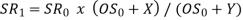

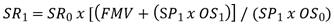

= the total number of shares of Common Stock issuable pursuant to such rights, options or warrants; and

= the total number of shares of Common Stock issuable pursuant to such rights, options or warrants; and  = the number of shares of Common Stock equal to the quotient of (A) the aggregate price payable to exercise such rights, options or warrants divided by (B) the average of the Closing Prices of the

Common Stock for the 10 consecutive Trading Days ending on, and including, the Trading Day immediately preceding date of announcement for the issuance of such rights, options or warrants.

= the number of shares of Common Stock equal to the quotient of (A) the aggregate price payable to exercise such rights, options or warrants divided by (B) the average of the Closing Prices of the

Common Stock for the 10 consecutive Trading Days ending on, and including, the Trading Day immediately preceding date of announcement for the issuance of such rights, options or warrants.

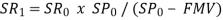

= the Closing Price of the Common Stock on the Trading Day immediately preceding the Ex-Dividend Date for such distribution; and

= the Closing Price of the Common Stock on the Trading Day immediately preceding the Ex-Dividend Date for such distribution; and  = the fair market value (as determined in good faith by the Board of Directors), on the Record Date for such dividend or distribution, of the shares of capital stock, evidences of indebtedness, assets or property so

distributed, expressed as an amount per share of Common Stock.

= the fair market value (as determined in good faith by the Board of Directors), on the Record Date for such dividend or distribution, of the shares of capital stock, evidences of indebtedness, assets or property so

distributed, expressed as an amount per share of Common Stock.

= the average of the closing price of the capital stock or similar equity interests distributed to holders of Common Stock applicable to one share of Common Stock over each of the 10 consecutive Trading Days commencing

on, and including, the third Trading Day immediately following the Ex-Dividend Date for such dividend or distribution with respect to the Common Stock on the NYSE or such other U.S. national or regional

exchange or market that is at that time the principal exchange or market for the Common Stock (the “Valuation Period”); and

= the average of the closing price of the capital stock or similar equity interests distributed to holders of Common Stock applicable to one share of Common Stock over each of the 10 consecutive Trading Days commencing

on, and including, the third Trading Day immediately following the Ex-Dividend Date for such dividend or distribution with respect to the Common Stock on the NYSE or such other U.S. national or regional

exchange or market that is at that time the principal exchange or market for the Common Stock (the “Valuation Period”); and  = the average of the Closing Price of the Common Stock over the Valuation Period.

= the average of the Closing Price of the Common Stock over the Valuation Period.

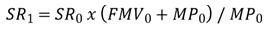

= the Closing Price of the Common Stock on the Record Date for such distribution;

= the Closing Price of the Common Stock on the Record Date for such distribution;  = the amount in Cash per share the Company distributes to holders of Common Stock; and

= the amount in Cash per share the Company distributes to holders of Common Stock; and  = the Reference Dividend; provided that if the dividend or distribution is not a regular quarterly Cash dividend, the Reference Dividend shall be deemed to be zero.

= the Reference Dividend; provided that if the dividend or distribution is not a regular quarterly Cash dividend, the Reference Dividend shall be deemed to be zero.

= the number of shares of Common Stock outstanding immediately prior to the last time tenders or exchanges may be made pursuant to such tender or exchange offer (prior to giving effect to the purchase or exchange of

shares pursuant to such tender or exchange offer);

= the number of shares of Common Stock outstanding immediately prior to the last time tenders or exchanges may be made pursuant to such tender or exchange offer (prior to giving effect to the purchase or exchange of

shares pursuant to such tender or exchange offer);  = the number of shares of Common Stock outstanding immediately after the last time tenders or exchanges may be made pursuant to such tender or exchange offer (after giving effect to the purchase or exchange of shares

pursuant to such tender or exchange offer); and

= the number of shares of Common Stock outstanding immediately after the last time tenders or exchanges may be made pursuant to such tender or exchange offer (after giving effect to the purchase or exchange of shares

pursuant to such tender or exchange offer); and  = the Closing Price of the Common Stock for the Trading Day next succeeding the date such tender or exchange offer expires.

= the Closing Price of the Common Stock for the Trading Day next succeeding the date such tender or exchange offer expires.