UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017

OR

o TRANSACTION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO .

Commission File Number 0-26068

____________________

(Exact name of registrant as specified in its charter)

DELAWARE | 95-4405754 |

(State or other jurisdiction of | (I.R.S. Employer |

incorporation organization) | Identification No.) |

520 NEWPORT CENTER DRIVE, 12TH FLOOR | |

NEWPORT BEACH, CA | 92660 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (949) 480-8300

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered |

Common Stock, $0.001 par value | The NASDAQ Stock Market, LLC |

Securities registered pursuant to Section 12(g) of the Act: None

____________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act. Yes £ No R

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes £ No R

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to filing requirements for the past 90 days. Yes R No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes R No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. R

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer o | Accelerated filer x | ||

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o | ||

Emerging growth company o | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes £ No R

The aggregate market value of the registrant’s voting and non-voting common stock held by non-affiliates of the registrant on June 30, 2017, the last business day of the registrant’s most recently completed second fiscal quarter, computed by reference to the last sale price of the registrant’s common stock as reported by The Nasdaq Global Select Market on such date, was approximately $202,307,000. This computation assumes that all executive officers and directors are affiliates of the registrant. Such assumption should not be deemed conclusive for any other purpose.

As of March 1, 2018, 50,637,882 shares of common stock were issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

In accordance with General Instruction G(3) to Form 10-K, portions of the registrant’s Definitive Proxy Statement on Schedule 14A for its Annual Meeting of Stockholders to be filed with the Commission within 120 days after the close of the fiscal year covered by this Annual Report on Form 10-K are incorporated by reference into Part III of this Annual Report on Form 10-K. Only those portions of the proxy statement that are specifically incorporated by reference herein shall constitute a part of this Annual Report on Form 10-K.

ACACIA RESEARCH CORPORATION

ANNUAL REPORT ON FORM 10-K

FISCAL YEAR ENDED DECEMBER 31, 2017

TABLE OF CONTENTS

Page | ||

PART I | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

PART II | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

PART III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

PART IV | ||

Item 15. | ||

2

PART I

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

As used in this Annual Report on Form 10-K, “we,” “us” and “our” refer to Acacia Research Corporation and/or its wholly and majority-owned operating subsidiaries. All patent portfolio investments, development, licensing and enforcement activities are conducted solely by certain of our wholly owned operating subsidiaries.

This Annual Report on Form 10-K, or the annual report, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which include, without limitation, statements about our future business operations and results, our strategies and competition, and other forward-looking statements included in this annual report. Such statements may be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “believe,” “estimate,” “anticipate,” “intend,” “continue,” or similar terms, variations of such terms or the negative of such terms. Such statements are based on management’s current expectations and are subject to a number of risks and uncertainties, which could cause actual results to differ materially from those described in the forward-looking statements. Such statements address future events and conditions concerning earnings, capital expenditures, litigation, competition, regulatory matters, stock price volatility, liquidity and capital resources, accounting matters and investments. Actual results in each case could differ materially from those anticipated in such statements by reason of factors such as future economic conditions, legislative, regulatory and competitive developments in markets in which we and our subsidiaries operate, and other circumstances affecting anticipated revenues and costs, as more fully disclosed in our discussion of “Risk Factors” in Item 1A of Part I of this annual report. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Additional factors that could cause such results to differ materially from those described in the forward-looking statements are set forth in connection with the forward-looking statements.

ITEM 1. BUSINESS

General

We partner with inventors and patent owners, applying our legal and technology expertise to patent assets to unlock the financial value in their patented inventions. We are an intermediary in the patent marketplace, bridging the gap between invention and application, and facilitating efficiency in connection with the monetization of patent assets. We also identify opportunities to partner with high-growth and potentially disruptive technology companies. These partnerships usually involve an equity or debt investment by us, along with entering into intellectual property, or IP, related agreements where we provide IP and other patent related services to these companies. We leverage our experience, expertise, data and relationships developed as a leader in the IP industry to pursue these opportunities. In some cases, these opportunities will complement, and/or supplement our primary licensing and enforcement business.

We generate revenues and related cash flows from the granting of intellectual property rights for the use of patented technologies that our operating subsidiaries control or own. We assist patent owners with the prosecution and development of their patent portfolios, the protection of their patented inventions from unauthorized use, the generation of licensing revenue from users of their patented technologies and, where necessary, with the enforcement against unauthorized users of their patented technologies through the filing of patent infringement litigation. Currently, on a consolidated basis, our operating subsidiaries own or control the rights to multiple patent portfolios, which include U.S. patents and certain foreign counterparts, covering technologies used in a variety of industries.

We have established a proven track record of licensing and enforcement success with over 1,550 license agreements executed to date, across 193 patent portfolio licensing and enforcement programs. To date, we have generated gross licensing revenue of approximately $1.4 billion, and have returned more than $731 million to our patent partners.

Corporate Information

We were originally incorporated in California in January 1993 and reincorporated in Delaware in December 1999. Our website address is www.acaciaresearch.com. Reference in this annual report to this website address does not constitute incorporation by reference of the information contained on or accessed through our website and references to our website address in this annual report are inactive textual references only. We make our filings with the Securities and Exchange Commission, or the SEC, including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form

3

8-K, other reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, and amendments to the foregoing reports, available free of charge on or through our website as soon as reasonably practicable after we file these reports with, or furnish such reports to, the SEC. In addition, we post the following information on our website:

• | our corporate code of conduct, our code of conduct for our board of directors and our fraud policy; |

• | our insider trading policy; |

• | charters for our audit committee, nominating and corporate governance committee, disclosure committee and compensation committee; and |

• | applicable dividend related tax forms. |

The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

Also, the SEC maintains an Internet website that contains reports, proxy and information statements, and other information regarding issuers, including us, that file electronically with the SEC. The public can obtain any documents that we file with the SEC at http://www.sec.gov.

Patent Licensing and Enforcement Business

We invest in, license and enforce patented technologies. We partner with inventors and patent owners, applying our legal and technology expertise to patent assets to unlock the financial value in their patented inventions. We are an intermediary in the patent marketplace, bridging the gap between invention and application, and facilitating efficiency in connection with the monetization of patent assets.

We generate revenues and related cash flows from the granting of intellectual property rights for the use of patented technologies that our operating subsidiaries control or own. We assist patent owners with the prosecution and development of their patent portfolios, the protection of their patented inventions from unauthorized use, the generation of licensing revenue from users of their patented technologies and, where necessary, with the enforcement against unauthorized users of their patented technologies through the filing of patent infringement litigation.

Refer to the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” below for a partial summary of patent portfolios owned or controlled by certain of our operating subsidiaries.

Patents are an important asset class worldwide. Due to legislative and regulatory changes, licensing and enforcing patents has become increasingly difficult for patent holders, necessitating an experienced, well-capitalized, licensing partner. We have partnered with patent owners, including individual inventors, universities, and large multi-national corporations in a variety of technology sectors. These patent owners may have possessed limited internal resources and/or expertise to effectively address the unauthorized use of their patented technologies, or may seek to effectively and efficiently monetize their portfolio of patented technologies on an outsourced basis.

Under U.S. law, a patent owner has the right to exclude others from making, selling or using their patented invention. A third-party infringes a patent by making, offering for sale, selling, or using a patented invention without a license from the patent owner. Unfortunately, in the majority of cases, infringers are generally unwilling, at least initially, to negotiate or pay reasonable license fees for their unauthorized use of third-party patents and will typically indiscriminately challenge any allegations of patent infringement. Inventors and/or patent holders without sufficient legal, financial and/or expert technical resources to bring and continue the pursuit of costly and complex patent infringement actions are often effectively ignored.

As a result of the common reluctance of patent infringers to negotiate and ultimately take a patent license for the use of patented technologies without at least the threat of legal action, patent licensing and enforcement often begins with the filing of patent infringement litigation. However, most patent infringement litigation settles out of court at amounts that are related to the strength of the patent portfolio and the value of the invention or inventions in the infringer’s products or services. We execute agreements that grant rights in our patents to users of our patented technologies. Our agreements can be negotiated without the filing of patent litigation, or negotiated within the context of ongoing patent litigation, depending on the specific facts and circumstances.

We are a principal in the licensing and enforcement effort, with our operating subsidiaries obtaining control of the rights in the patent portfolio, or control of the patent portfolio outright. Our relationship with patent owners is the cornerstone of our corporate strategy. We assume all responsibility for advancing operational expenses while pursuing a patent licensing

4

and enforcement program, and then, when applicable, share net licensing revenue with our patent partners as that program matures, on a pre-arranged and negotiated basis. We may also provide upfront capital to patent owners as an advance against future licensing revenue.

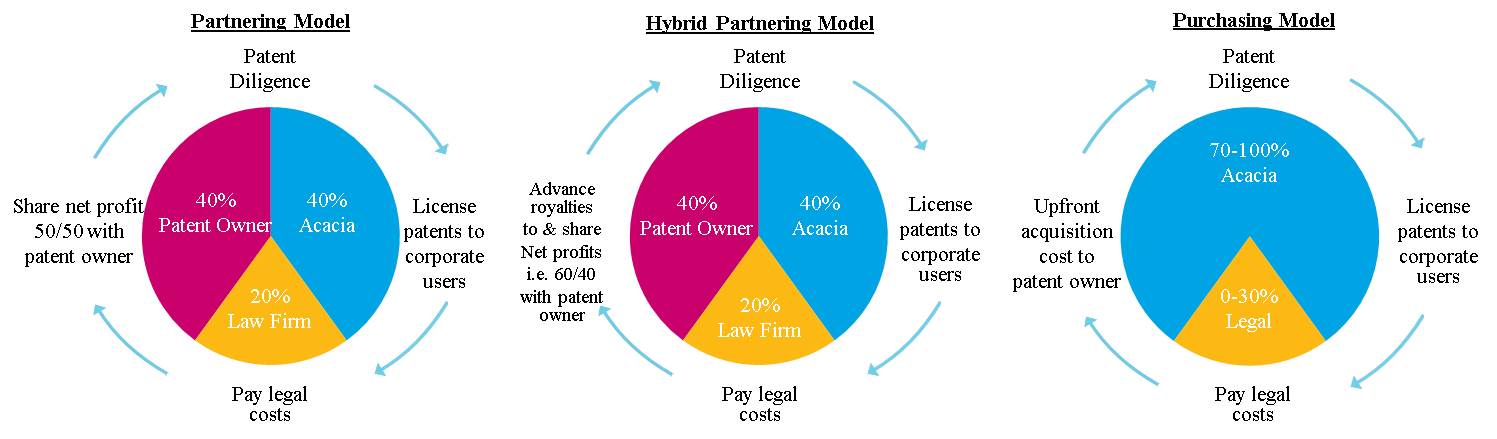

Patent Licensing Business Model and Strategy - Overview

We have the flexibility to structure arrangements in a number of ways to address the needs and specific sets of circumstances presented by each of our unique patent partners, examples of which include the following:

Generally, we maintain a 100% preferred rate of return until all deployed capital and advanced operational costs are recovered by us. After recovery of these costs, the net profit revenue share with patent partner commences, if applicable.

Key Elements of Business Strategy

Patent licensing and enforcement can be an effective and efficient way to maximize the profit potential of a patent, or patents, that are being practiced by third-parties without authorization. A patent license agreement grants a third-party user of an invention specific patent rights to the patented invention in exchange for patent license fees. Our patent licensing business provides patent holders with an opportunity to generate income from their patented inventions being practiced by third-parties without authorization and from third-parties that desire to practice their patented inventions with authorization. Our patent licensing and enforcement business strategy includes three fundamental elements, as follows:

• | Patent Discovery - Discover potentially valuable patents or patent portfolios. |

• | Assessment of Economic Value - Work internally and with external experts to evaluate the use of the patented invention(s) in the relevant marketplace and assess a patents or patent portfolios’ expected economic value. |

• | Licensing and Enforcement - License those users wanting to utilize the patented invention with authorization. For unauthorized users of the patented invention, enter into license negotiations and, if necessary, litigation to monetize the patent based on its assessed value. |

Patent Discovery. The patent process breeds, encourages and sustains innovation and invention by granting a limited monopoly to the inventor in exchange for sharing the invention with the public. Certain technologies, become core technologies in the way products and services are manufactured, sold or delivered by companies across a wide array of industries. Patent discovery involves identifying core, patented technologies that have been or are anticipated to be widely adopted by third-parties in connection with the manufacture, sale or use of products and services.

Assessment of Economic Value. Subsequent to the patent discovery process, our executives work internally and/or with external industry experts in the specific technology field, to evaluate the patented invention and its adoption and implementation in the marketplace. There are a number of factors to consider when analyzing a patent and determining a patent’s value including, (i) infringement, (ii) validity and (iii) enforceability.

To determine infringement, we must first identify third-parties that are practicing the invention(s) covered by the patent without obtaining permission from the patent owner to do so. A key tool in determining whether or not a company is infringing a patent is a claim chart, which demonstrates how the manufacture, sale, or use of an existing product compares against the claims of the patent.

5

The three main factors analyzed to determine validity are: (1) anticipation, which occurs when the claims of the patent are entirely revealed within a single piece of prior art, (2) obviousness which considers whether the differences between prior art and the patented invention are so slight that they would have been obvious at the time of invention to one who is skilled in the subject matter being patented, and (3) the existence of non-patentable subject matter, which considers whether the subject matter includes naturally occurring things, abstract concepts, or algorithms that perform an ordinary function.

To determine enforceability, a number of factors are analyzed, including whether or not there has been patent misuse, or whether or not there are antitrust violations associated with the patent. Due to the inherently complex nature of patent law, only a court or specific administrative body, such as the International Trade Commission, can make a decision whether a patent is infringed, valid and enforceable; however, we employ our wealth of expertise to make the best assessment possible given a specific fact pattern and set of circumstances.

We estimate a patent’s economic value by evaluating the expected value of the license revenue stream based on past, present and future revenue of infringing products or services, and the risk that a court will disagree with our infringement, validity or enforcement assessments of the patent. The processes and procedures employed in connection with the evaluation of a specific patent portfolio for future investment, licensing and enforcement are tailored and unique to each specific situation and can vary widely based on the specific facts and circumstances of a specific patent portfolio, such as the related technology, related industry and other factors.

Neither we nor our operating subsidiaries invent new technologies or products; rather, we depend upon the identification and investment in patents, inventions and companies that own intellectual property through our relationships with inventors, universities, research institutions, technology companies and others. If our operating subsidiaries are unable to maintain those relationships and identify and grow new relationships, then we may not be able to identify new technology-based patent opportunities for sustainable revenue and /or revenue growth.

Our current or future relationships may not provide the volume or quality of technologies necessary to sustain our licensing, enforcement and overall business. In some cases, universities and other technology sources compete against us as they seek to develop and commercialize technologies. Universities may receive financing for basic research in exchange for the exclusive right to commercialize resulting inventions. These and other strategies employed by potential partners may reduce the number of technology sources and potential clients to whom we can market our solutions. If we are unable to maintain current relationships and sources of technology or to secure new relationships and sources of technology, such inability may have a material adverse effect on our revenues, operating results, financial condition and ability to maintain our licensing and enforcement business.

For example, we obtained control of only one, two and three new patent portfolios during fiscal years 2017, 2016 and 2015, respectively, compared to 6 new patent portfolios and 25 new patent portfolios in fiscal years 2014 and 2013, respectively. This decrease in our patent portfolio intake reflects in part our strategic decision in 2013 to shift the focus of our operating business to serving a smaller number of customers, each having higher quality patent portfolios. As a result, our gross number of patent portfolio acquisitions has decreased significantly. This decrease in our patent portfolio intake also reflects in part industry trends impacting our ability to acquire patent portfolios. For example, legislative and legal changes have increased the complexity of patent enforcement actions and may significantly affect the market availability of suitable patent portfolios for acquisition. As a result of these continuing industry trends, our recent and future patent portfolio intake has been and may continue to be negatively impacted, resulting in further decreases in future revenue generating opportunities, and continued negative adverse impacts on the sustainability of our licensing and enforcement business. We continue to experience significant adverse challenges with respect to our patent intake efforts, and if these adverse challenges continue, our licensing and enforcement revenues will continue to decline and we will be unable to profitably sustain our licensing and enforcement business going forward.

As a result of the foregoing, we continue to evaluate other business opportunities which compliment, or supplement, our primary licensing and enforcement business and leverage our intellectual property expertise, as described below, including our continued efforts to identify and partner with potentially high-growth and disruptive technology companies.

Licensing and Enforcement. The final step in the patent licensing and enforcement process is to seek to monetize the patent portfolio by securing license agreements based on the patents use in the marketplace and estimated value. While we prefer to convince unauthorized users of our patented inventions of the value of the patented invention and secure a license agreement in a non-litigious manner, many infringers refuse to take such licenses even when confronted with substantial and persuasive evidence of infringement, validity, enforceability and significant economic value. As a result, often we must resort to litigation to demonstrate and prove infringement and ultimately induce infringers to take a license from us. We have found it

6

effective to negotiate licenses concurrently with litigation due to the fact that litigation necessitates and facilitates an information exchange that helps both sides assess the value of a patent and make informed decisions. Also, litigation eventually leads to a court’s judgment. When a court agrees with our assessment of a patent, this judgment stops recalcitrant infringers from utilizing our patented technology indefinitely, without appropriate authorization.

We engage highly competent and experienced patent lawyers to prosecute our patent portfolio litigation. It is imperative for us to be persistent and patient throughout the litigation process as it typically takes 18-36 months from the filing date of a lawsuit to yield a license agreement from a potential licensee. Often, it takes longer to secure a final court judgment.

Patent license negotiations and litigation initiated by our operating subsidiaries usually lead to serious and thoughtful discussions with the unauthorized users of the patented inventions. The result can be quite favorable with the user being granted rights under the patents for the patented invention in its products and services in exchange for financial remuneration.

Partnership Opportunities

Our team’s expertise in identifying and evaluating complex IP, and in developing and cultivating long-term business relationships, provides us a unique window into innovation and technological advancement. We have increased our efforts to leverage our expertise and experience to create new avenues which we believe will lead to increased shareholder value.

In this regard, we leverage our experience, expertise, data and relationships developed as a leader in the IP industry to pursue opportunities to partner with high-growth companies in potentially disruptive technology areas. Examples of some of these technology areas include Artificial Intelligence, or AI, and machine learning, machine vision, robotics and blockchain technologies. Examples of our initial execution of this strategy are our partnerships with Veritone, Inc., or Veritone (Nasdaq: VERI), and Miso Robotics, Inc., or Miso Robotics.

In June 2017, we partnered with Miso Robotics, an innovative leader in robotics and AI solutions, which included an equity investment totaling $2.25 million, as part of Miso Robotics’ closing of $3.1 million in Series A funding. In addition, in February 2018, we made an additional strategic equity investment totaling $6.0 million in the Series B financing round for Miso Robotics. Miso Robotics will use the capital to expand its suite of collaborative, adaptable robotic kitchen assistants and to broaden applications for Miso AI, the company’s machine learning cloud platform. In addition, we also entered into an IP services agreement with Miso Robotics to help the company drive AI-based solutions for the restaurant industry. Our partnership with Miso Robotics represents our second partnership with companies seeking to transform the marketplace through Artificial Intelligence.

In August 2016, we announced the formation of a partnership with Veritone, a leading cloud-based Artificial Intelligence technology company that is pioneering next generation search and analytics through their proprietary Cognitive Media Platform™. Under the partnership, we have the ability to leverage our intellectual property expertise to assist Veritone with building its patent portfolio and executing upon its overall intellectual property strategy. In order to enhance Veritone’s leadership position in the field of machine learning and AI, we provided a total of $53.3 million in funding to Veritone pursuant to an investment agreement executed in August 2016, as amended. Upon Veritone’s consummation of its initial public offering on May 17, 2017, or IPO, our loans and accrued interest were automatically converted into shares of Veritone common stock, and we were issued an additional warrant to purchase additional shares of Veritone common stock as described elsewhere herein.

Subsequent to the year ended December 31, 2017, in January 2018, we entered into a Joint Venture and Services Agreement, or Joint Venture Agreement, with Bitzumi, a company developing macro opportunities in the cryptocurrency and blockchain industries, including a next generation decentralized exchange. Bitzumi recently filed a Regulation A Offering Statement with the Securities and Exchange Commission and a listing application with NASDAQ. We made an initial $1.0 million equity investment in Bitzumi in January 2018. Under the Joint Venture Agreement, we will provide various patent-related services to Bitzumi and have the option to invest up to an additional $9.0 million to acquire Bitzumi common stock. In connection with our initial investment, we received a short-term warrant to purchase $4.0 million of Bitzumi common shares. Under the Joint Venture Agreement, we have a right to acquire up to an aggregate of $10.0 million of Bitzumi common shares (inclusive of our initial $1.0 million equity investment and exercise of our short-term warrant) at a price, except as paid by us for the initial investment and the exercise price of our short-term warrant, of $2.50 per share. Upon meeting certain conditions set forth in the Joint Venture Agreement, Bitzumi will also issue us a warrant for 30,000,000 shares of Bitzumi’s common stock. Our Joint Venture Agreement with Bitzumi represents our first venture in the cryptocurrency and blockchain marketplaces.

7

Patented Technologies

Currently, on a consolidated basis, our operating subsidiaries own or control the rights to patent portfolios with future patent expiration dates ranging from 2018 to approximately 2033, covering technologies used in a number of industries, including: transportation and automotive, telecommunications / smartphones, communications, memory, consumer electronics, energy efficiency, wireless and imaging and diagnostics.

Refer to Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Overview” for a summary of patent portfolios generating revenues for the applicable periods presented.

Competition

We encounter competition in the area of patent portfolio investment opportunities and enforcement. This includes an increase in the number of competitors seeking to invest in the same or similar patents and technologies that we may seek to invest in. Existing non-practicing entities compete in acquiring rights to intellectual property assets, and more entities may enter the market in future periods.

We also compete with financial firms, corporate buyers and others acquiring IP and investing in other technology opportunities. Many of these competitors may have more financial and human resources than us. We may find more companies entering the market for similar technology opportunities, which may reduce our market share in one or more technology industries that we currently or in the future may rely upon to generate future revenue.

Companies or other entities may develop competing technologies that offer better or less expensive alternatives to our patented technologies or technology partnerships. Many potential competitors may have significantly greater resources than the resources that we or our operating subsidiaries possess. Such technological advances or entirely different approaches developed by one or more of our competitors could render certain of the technologies owned or controlled by us obsolete and/or uneconomical.

Employees

As of December 31, 2017, on a consolidated basis, we had 13 full-time employees. Neither we, nor any of our subsidiaries, are a party to any collective bargaining agreement. We believe we have good relations with our employees.

ITEM 1A. RISK FACTORS

An investment in our common stock involves risks. You should carefully consider the risks described below, together with all of the other information included in this annual report, as well as in our other filings with the SEC, in evaluating our business. The risks described below are not the only risks we face. Additional risks that we do not yet know of or that we currently believe are immaterial may also impair our business operations. If any of the following risks actually occur, our business, financial condition and results of operations could be materially adversely affected, and the trading price of our common stock could decline significantly. Certain statements below may be considered forward-looking statements. For additional information, see “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to Our Business

We have a history of losses and may incur additional losses in the future.

We reported net income of $22.2 million (includes $42.2 million of unrealized equity investment gains), a net loss of $54.1 million (includes $42.3 million of noncash patent impairment charges) and a net loss of $160.0 million (includes $104.9 million of noncash goodwill and patent impairment charges) for the years ended December 31, 2017, 2016 and 2015, respectively, and on a cumulative basis, we have sustained substantial losses since our inception. As of December 31, 2017, our accumulated deficit was $320.0 million. As of December 31, 2017, we had approximately $136.6 million in cash and cash equivalents and short-term investments and working capital of $130.1 million. Although we believe that our current cash and cash equivalents and investments will be sufficient to finance our anticipated capital and operating requirements for at least the next twelve months, we expect to continue incurring significant legal, general and administrative expenses in connection with our operations. As a result, we anticipate that we may incur losses in the future. Additional increases in our expenses without commensurate increases in revenues could significantly increase our operating losses. Any additional operating losses may have a material adverse effect on our stockholders’ equity and overall financial condition.

8

Our ability to use net operating losses and certain other tax attributes is uncertain and may be limited.

Our ability to use our federal and state net operating losses to offset potential future taxable income and related income taxes that would otherwise be due is dependent upon our generation of future taxable income before the expiration dates of the net operating losses, and we cannot predict with certainty when, or whether, we will generate sufficient taxable income to use all or any portion of our net operating losses. In addition, utilization of net operating losses to offset potential future taxable income and related income taxes that would otherwise be due is subject to annual limitations under the “ownership change” provisions of Sections 382 and 383 of the Internal Revenue Code of 1986, as amended, or the Code, and similar state provisions, which may result in the expiration of net operating losses before future utilization. In general, under the Code, if a corporation undergoes an “ownership change,” generally defined as a greater than 50% change (by value) in its equity ownership over a three-year period, the corporation’s ability to use its pre-change net operating losses and other pre-change tax attributes (such as research and development credit carryforwards) to offset its post-change taxable income or taxes may be limited. Changes in our stock ownership, some of which may be outside of our control, could in the future result in an ownership change. Although we have completed studies to provide reasonable assurance that an ownership change limitation would not apply, we cannot be certain that a taxing authority would reach the same conclusion. If, after a review or audit, an ownership change limitation were to apply, utilization of our domestic net operating losses and tax credit carryforwards could be limited in future periods and a portion of the carryforwards could expire before being available to reduce future income tax liabilities.

On December 22, 2017, new tax legislation was signed into law. Among other things, it will reduce the maximum federal corporate income tax rate to 21% in future periods. It has also limited or eliminated certain deductions to which the Company has been entitled in past years and has reduced the value of the Company’s deferred tax assets as described elsewhere herein. Given the full valuation allowance provided for net deferred tax assets as of December 31, 2017, we do not expect the change in tax law to have a material impact on our consolidated financial statements provided herein. However, in the absence of guidance on various uncertainties and ambiguities in the application of certain provisions of the new legislation, we will use what we believe are reasonable interpretations and assumptions in applying the new legislation, but it is possible that the IRS could issue subsequent guidance or take positions on audit that differ from our prior interpretations and assumptions, which could have a material adverse effect on our cash tax liabilities, results of operations, and financial condition.

If we encounter unforeseen difficulties with our business or operations in the future that require us to obtain additional working capital, and we cannot obtain additional working capital on favorable terms, or at all, our business may suffer.

Our consolidated cash and cash equivalents and short-term investments totaled $136.6 million and $158.5 million at December 31, 2017 and 2016, respectively. To date, we have relied primarily upon net cash flows from our operations and from the public and private sale of equity securities to generate the working capital needed to finance our operations. We may encounter unforeseen difficulties with our business or operations in the future that may deplete our capital resources more rapidly than anticipated. As a result, we may be required to obtain additional working capital in the future through bank credit facilities, public or private debt or equity financings, or otherwise. If we are required to raise additional working capital in the future, such financing may be unavailable to us on favorable terms, if at all, or may be dilutive to our existing stockholders. If we fail to obtain additional working capital, as and when needed, such failure could have a material adverse impact on our business, results of operations and financial condition.

Failure to effectively manage our operational changes could strain our managerial, operational and financial resources and could adversely affect our business and operating results.

Our recent operational changes have placed, and are expected to continue to place, a strain on our managerial, operational and financial resources and systems. Operational changes primarily relate to the reductions in employee headcount across our licensing, business development and engineering functions during the three year period ended December 31, 2017. Reductions in headcount in these functions may impact our ability to effectively and efficiently allocate resources in a timely manner in connection with the licensing and enforcement of our existing patent portfolios. In addition, we have increased our focus on opportunities to partner with high-growth and potentially disruptive technology companies. As our businesses evolve, we will be required to continue to manage multiple relationships. Any further change by us, or increases in the number of our strategic relationships, may place additional strain on our managerial, operational and financial resources and systems. If we fail to manage our operational changes effectively or to develop, expand or otherwise modify our managerial, operational and financial resources and systems, our business and financial results will be materially harmed.

9

Patent portfolio investments may present risks, and we may be unable to achieve the financial or other goals intended at the time of any potential investment.

Our licensing and enforcement business has depended, in part, on our ability to invest in patented technologies, patent portfolios, or companies holding such patented technologies and patent portfolios. Accordingly, historically we have engaged in patent portfolio investments in an effort to expand our patent portfolio assets. Such investments and potential investments are subject to numerous risks, including the following:

• | our inability to enter into a definitive agreement with respect to any potential patent portfolio investment, or if we are able to enter into such agreement, our inability to consummate the potential investment transaction; |

• | difficulty integrating the operations, technology and personnel of the acquired entity; |

• | our inability to achieve the anticipated financial and other benefits of the specific patent portfolio investment; |

• | our inability to retain key personnel from the acquired company, if necessary; |

• | difficulty in maintaining controls, procedures and policies during the transition and integration process; |

• | diversion of our management’s attention from other business concerns; and |

• | failure of our due diligence process to identify significant issues, including issues with respect to patented technologies and patent portfolios, and other legal and financial contingencies. |

If we are unable to manage these risks effectively as part of any patent portfolio investment, our business could be adversely affected.

Our revenues are unpredictable, and this may harm our financial condition.

Due to the nature of our licensing business and uncertainties regarding the amount and timing of the receipt of license and other fees from potential infringers, stemming primarily from uncertainties regarding the outcome of enforcement actions, rates of adoption of our patented technologies, the growth rates of our existing licensees and certain other factors, our revenues may vary significantly from quarter to quarter and period to period, which could make our business difficult to manage, adversely affect our business and operating results, cause our quarterly and periodic results to fall below market expectations and adversely affect the market price of our common stock.

Our operating subsidiaries depend upon relationships with others to provide technology-based opportunities that can develop into profitable royalty-bearing licenses, and if they are unable to maintain and generate new relationships, then they may not be able to sustain existing levels of revenue or increase revenue.

Neither we nor our operating subsidiaries invent new technologies or products; rather, we depend upon the identification and investment in patents, inventions and companies that own intellectual property through our relationships with inventors, universities, research institutions, technology companies and others. If our operating subsidiaries are unable to maintain those relationships and identify and grow new relationships, then we may not be able to identify new technology-based patent opportunities for sustainable revenue and /or revenue growth.

Our current or future relationships may not provide the volume or quality of technologies necessary to sustain our licensing, enforcement and overall business. In some cases, universities and other technology sources compete against us as they seek to develop and commercialize technologies. Universities may receive financing for basic research in exchange for the exclusive right to commercialize resulting inventions. These and other strategies employed by potential partners may reduce the number of technology sources and potential clients to whom we can market our solutions. If we are unable to maintain current relationships and sources of technology or to secure new relationships and sources of technology, such inability may have a material adverse effect on our revenues, operating results, financial condition and ability to maintain our licensing and enforcement business.

For example, we obtained control of only one, two and three new patent portfolios during fiscal years 2017, 2016 and 2015, respectively, compared to 6 new patent portfolios and 25 new patent portfolios in fiscal years 2014 and 2013, respectively. This decrease in our patent portfolio intake reflects in part our strategic decision in 2013 to shift the focus of our operating business to serving a smaller number of customers, each having higher quality patent portfolios. As a result, our gross

10

number of patent portfolio acquisitions has decreased significantly. This decrease in our patent portfolio intake also reflects in part industry trends impacting our ability to acquire patent portfolios. For example, legislative and legal changes have increased the complexity of patent enforcement actions and may significantly affect the market availability of suitable patent portfolios for acquisition. As a result of these continuing industry trends, our recent and future patent portfolio intake has been and may continue to be negatively impacted, resulting in further decreases in future revenue generating opportunities, and continued negative adverse impacts on the sustainability of our licensing and enforcement business. We continue to experience significant adverse challenges with respect to our patent intake efforts, and if these adverse challenges continue, our licensing and enforcement revenues will continue to decline and we will be unable to profitably sustain our licensing and enforcement business going forward.

The success of our operating subsidiaries depends in part upon their ability to retain the best legal counsel to represent them in patent enforcement litigation in order to achieve favorable outcomes from such litigation. The outcome of such litigation is uncertain.

The success of our licensing business depends upon our operating subsidiaries’ ability to retain the best legal counsel to prosecute patent infringement litigation. As our operations evolve and industry conditions increase in complexity, it will become more difficult to find the best legal counsel to handle all of our cases. This is due in part to many of the best law firms having conflicts of interest that prevents their representation of our subsidiaries.

We spend a significant amount of our financial and management resources to pursue our current litigation matters. We believe that these litigation matters and others that we may in the future determine to pursue could continue for years and continue to consume significant financial and management resources. The counterparties to our litigation are sometimes large, well-financed companies with substantially greater resources than us. We cannot assure you that any of our current or future litigation matters will result in a favorable outcome for us. In addition, in part due to the appeals process and other legal processes, even if we obtain favorable interim rulings or verdicts in particular litigation matters, they may not be predictive of the ultimate resolution of the dispute. Also, we cannot assure you that we will not be exposed to claims or sanctions against us which may be costly or impossible for us to defend. The inability to retain the best legal counsel to represent our operating subsidiaries in infringement actions may result in unfavorable or adverse outcomes, which may result in losses, exhaustion of financial resources or other adverse effects which could encumber our ability to effectively operate our business or execute our business strategy.

Our operating subsidiaries, in certain circumstances, rely on representations, warranties and opinions made by third-parties that, if determined to be false or inaccurate, may expose us and our operating subsidiaries to certain material liabilities.

From time to time, our operating subsidiaries may rely upon representations and warranties made by third-parties from whom our operating subsidiaries acquired patents or the exclusive rights to license and enforce patents. We also may rely upon the opinions of purported experts. In certain instances, we may not have the opportunity to independently investigate and verify the facts upon which such representations, warranties, and opinions are made. By relying on these representations, warranties and opinions, our operating subsidiaries may be exposed to liabilities in connection with the licensing and enforcement of certain patents and patent rights which could have a material adverse effect on our operating results and financial condition.

In connection with patent enforcement actions conducted by certain of our subsidiaries, a court may rule that we or our subsidiaries have violated certain statutory, regulatory, federal, local or governing rules or standards, which may expose us and our operating subsidiaries to certain material liabilities.

In connection with any of our patent enforcement actions, it is possible that a defendant may request and/or a court may rule that we have violated statutory authority, regulatory authority, federal rules, local court rules, or governing standards relating to the substantive or procedural aspects of such enforcement actions. In such event, a court may issue monetary sanctions against us or our operating subsidiaries or award attorney’s fees and/or expenses to a defendant(s), which could be material, and if we or our operating subsidiaries are required to pay such monetary sanctions, attorneys’ fees and/or expenses, such payment could materially harm our operating results and our financial position.

In connection with patent enforcement actions conducted by certain of our subsidiaries, a court may find the patents invalid, not infringed or unenforceable and/or the U.S. Patent and Trademark Office, or the USPTO, or other relevant patent office, may either invalidate the patents or materially narrow the scope of their claims during the course of a reexamination, opposition or other such proceeding.

Patent litigation is inherently risky and the outcome is uncertain. Some of the parties that we believe infringe on our patents are large and well-financed companies with substantially greater resources than ours. We believe that these parties

11

would devote a substantial amount of resources in an attempt to avoid or limit a finding that they are liable for infringing on our patents or, in the event liability is found, to avoid or limit the amount of associated damages. In addition, there is a risk that these parties may file reexaminations or other proceedings with the USPTO or other government agencies in the United States or abroad in an attempt to invalidate, narrow the scope or render unenforceable the patents we own or control. If this were to occur, it may have a material adverse effect on our operations.

In addition, it is difficult to predict the outcome of patent enforcement litigation at any level. In the United States, there is a higher rate of appeals in patent enforcement litigation than standard business litigation. The defendant to any case we bring, may file as many appeals as allowed by right, including to the first, second and/or final courts of appeal (in the United States those courts would be the Federal Circuit and Supreme Court, respectively). Such appeals are expensive and time-consuming, and the outcomes of such appeals are sometimes unpredictable, resulting in increased costs and reduced or delayed revenue which could have a material adverse effect on our operating results and financial condition.

Our licensing cycle is lengthy and costly, and our legal and sales efforts may be unsuccessful.

We expect our operating subsidiaries to incur significant general and administrative and legal expenses prior to entering into license agreements and generating license revenues. We also spend considerable resources educating prospective licensees on the benefits of a license arrangement with us. As such, we may incur significant losses in any particular period before any associated revenue stream begins.

If our efforts to educate prospective licensees on the benefits of a license arrangement are unsuccessful, we may need to pursue litigation or other enforcement action to protect our patent rights. We may also need to litigate to enforce the terms of our existing license agreements, protect our trade secrets, or determine the validity and scope of the proprietary rights of others. Enforcement proceedings are typically protracted and complex. The costs are typically substantial, and the outcomes are unpredictable. Enforcement actions will divert our managerial, technical, legal and financial resources from business operations and there are no assurances that such enforcement actions will result in favorable results for us.

Failure to maintain effective internal control over our financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act could cause our financial reports to be inaccurate.

We are required pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, or Section 404, to maintain internal control over financial reporting and to assess and report on the effectiveness of those controls. This assessment includes disclosure of any material weaknesses identified by our management in our internal control over financial reporting.

Our management concluded that our internal control over financial reporting was effective as of December 31, 2017. However, there are inherent limitations on effectiveness of controls. Our management, including our chief executive officer and chief financial officer, does not expect that our disclosure controls or our internal control over financial reporting will prevent or detect all errors and all fraud. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the control system’s objectives will be met. The design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Further, because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that misstatements due to error or fraud will not occur or that all control issues and instances of fraud, if any, have been detected. The design of any system of controls is based in part on certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Projections of any evaluation of the effectiveness of controls to future periods are subject to risks. Over time, controls may become inadequate because of changes in conditions or deterioration in the degree of compliance with policies or procedures.

If we are not able to maintain effective internal control over financial reporting, our financial statements, including related disclosures, may be inaccurate, which could have a material adverse effect on our business. Refer to Item 9A. “Controls and Procedures” for additional information related to the current period.

Our partnerships are subject to risks and we may experience significant financial losses on our related existing equity investments.

As described herein, in August 2016, we formed a partnership with Veritone pursuant to which we have the ability to leverage our expertise in intellectual property licensing and enforcement to assist Veritone with building its patent portfolio and execute upon its overall intellectual property strategy. As a part of this partnership, we entered into an investment agreement and bridge financing with Veritone, investing approximately $53.3 million in Veritone, comprised of common stock and warrants as of December 31, 2017.

12

In addition, in June 2017, we partnered with Miso Robotics, an innovative leader in robotics and AI solutions, which included an equity investment totaling $2.25 million, as part of Miso Robotics’ closing of $3.1 million in Series A funding. In addition, in February 2018, we made an additional strategic equity investment totaling $6.0 million in the Series B financing round for Miso Robotics. Miso Robotics will use the new capital to expand its suite of collaborative, adaptable robotic kitchen assistants and to broaden applications for Miso AI, the company’s machine learning cloud platform. In addition, we also entered into an intellectual property services agreement with Miso Robotics to help Miso Robotics drive AI-based solutions for the restaurant industry.

Our current partnerships and related equity investments are subject to a high degree of risk and could diminish our financial condition. Currently, none of our investees are profitable and have limited financial resources. The overall sustained economic uncertainty, as well as financial, operational and other difficulties encountered by certain companies in which we have equity investments increases the risk that the actual amounts realized in the future on our debt and equity investments will differ significantly from the fair values currently assigned to them. In addition, the companies in which we have equity investments or with whom we partner may not be able to compete effectively or there may be insufficient demand for the services and products offered by these companies. These partnerships could also expose us to significant financial losses and may restrict our ability to execute other partnerships or limit alternative uses of our capital resources. If our partnerships suffer losses, our financial condition could be materially adversely affected. In addition, applicable securities law restrictions and other factors may result in an inability to liquidate any equity components of our equity investments. Our Veritone common shares are subject to a lock-up agreement that expired on February 15, 2018, subsequent to which the shares may be sold pursuant to Rule 144, subject to volume limitations and Rule 144 filing requirements, as well as other restrictions under applicable securities laws.

Our initiative to identify partnerships may not be successfully implemented.

We intend to continue to selectively explore opportunities to partner with potentially high-growth and disruptive technology companies that we believe will allow us to leverage our experience, expertise, data and relationships to increase shareholder value. We may allocate significant resources for long-term initiatives that may not have a short or medium-term or any positive impact on our revenue, results of operations, or cash flow.

The successful implementation of our initiative to identify partnerships requires an investment of time, talent and money and is dependent upon a number of factors, some of which are not within our control. Those factors include the ability to effectively execute such initiatives in new and existing markets and market conditions in the various technology industries we pursue. We may allocate significant resources for long-term initiatives that may not have a short or medium-term or any positive impact on our revenue, results of operations, or cash flow. If we fail to properly identify successful companies to partner with and invest in, it may have an adverse effect on our financial condition. There can be no assurance that we will successfully implement this strategic initiative or that, if successfully pursued, this initiative will have the desired effect on our business or results of operations. Additionally, these new partnerships could expose us to significant financial losses and may restrict our ability to enter future partnerships or limit alternative uses of our capital resources. If our partnership related equity investments suffer losses, our financial condition could be materially adversely affected.

Recent U.S. tax legislation may materially adversely affect our financial condition, results of operations and cash flows.

Recently-enacted U.S. tax legislation has significantly changed the U.S. federal income taxation of U.S. corporations, including the reduction of the U.S. corporate income tax rate, the limiting of interest deductions, adopting elements of a territorial tax system, imposing a one-time transition tax (or “repatriation tax”) on all undistributed earnings and profits of certain U.S.-owned foreign corporations, revising the rules governing net operating losses and the rules governing foreign tax credits, and introducing new anti-base erosion provisions. Many of these changes are effective immediately, without any transition periods or grandfathering for existing transactions. The legislation is unclear in many respects and could be subject to potential amendments and technical corrections, as well as interpretations and implementing regulations by the Treasury and Internal Revenue Service, or IRS, any of which could lessen or increase certain adverse impacts of the legislation. In addition, it is unclear how these U.S. federal income tax changes will affect state and local taxation, which often uses federal taxable income as a starting point for computing state and local tax liabilities.

While our analysis and interpretation of this legislation is ongoing, based on our current evaluation, we have reflected a write-down of our deferred income tax assets (including the value of our net operating loss carryforwards and our tax credit carryforwards for financial statement purposes) due to the reduction of the U.S. corporate income tax rate. Based on currently available information, we recorded a reduction of approximately $25.3 million in the fourth quarter of 2017 related to the revaluation of our deferred tax assets, which will not result in additional tax expense in the quarter as our deferred tax assets are

13

fully valued. This amount may be subject to further adjustment in subsequent periods throughout 2018 in accordance with subsequent interpretive guidance issued by the SEC or the IRS. Further, there may be other material adverse effects resulting from the legislation that we have not yet identified.

While some of the changes made by the tax legislation may adversely affect the Company in one or more reporting periods and prospectively, other changes may be beneficial on a going forward basis. We continue to work with our tax advisors to determine the full impact that the recent tax legislation as a whole will have on us. We urge our investors to consult with their legal and tax advisors with respect to such legislation.

Risks Related to Our Industry

Our exposure to uncontrollable outside influences, including new legislation, court rulings or actions by the USPTO, could adversely affect our licensing and enforcement business and results of operations.

Our licensing and enforcement business is subject to numerous risks from outside influences, including the following:

New legislation, regulations or rules related to obtaining patents or enforcing patents could significantly increase our operating costs and decrease our revenue.

Our operating subsidiaries invest in patents with enforcement opportunities and spend a significant amount of resources to enforce those patents. If new legislation, regulations or rules are implemented by Congress, the USPTO or the courts that impact the patent application process, the patent enforcement process or the rights of patent holders, such changes could negatively affect our business. United States patent laws were amended with the enactment of the Leahy-Smith America Invents Act, or the America Invents Act, which took effect on March 16, 2013. The America Invents Act includes a number of significant changes to U.S. patent law. In general, the legislation attempts to address issues surrounding the enforceability of patents and the increase in patent litigation by, among other things, establishing new procedures for patent litigation. For example, the America Invents Act changes the way that parties may be joined in patent infringement actions, increasing the likelihood that such actions will need to be brought against individual allegedly-infringing parties by their respective individual actions or activities. In addition, the America Invents Act enacted a new inter-partes review process, or IPR process, at the USPTO which can be, and often is, used by defendants, and other individuals and entities, to separately challenge the validity of any patent. The IPR process of the America Invents Act has in many instances increased costs for licensing and litigation and has resulted in the loss of certain portfolio patents which, in some cases, may have negatively impacted the value of those portfolios. The America Invents Act and its implementation has increased the uncertainties and costs surrounding the enforcement of our patented technologies, which in certain circumstances could have a material adverse effect on our business and financial condition.

The U.S. Department of Justice, or the DOJ, has conducted reviews of the patent system to evaluate the impact of patent assertion entities on industries in which those patents relate. It is possible that the findings and recommendations of the DOJ could impact the ability to effectively license and enforce standards-essential patents and could increase the uncertainties and costs surrounding the enforcement of any such patented technologies. Also, in 2014, the Federal Trade Commission, or FTC, initiated a study under Section 6(b) of the Federal Trade Commission Act to evaluate the patent assertion practice and market impact of Patent Assertion Entities, or PAEs. The FTC’s initial notice and request for public comment relating to the PAE study appeared in the Federal Register on October 3, 2013. We received and responded to a request for information as part of this FTC study. The FTC study entitled, “Patent Assertion Entity Activity” was released in October 2016.

Finally, new rules regarding the burden of proof in patent enforcement actions could significantly increase the cost of our enforcement actions, and new standards or limitations on liability for patent infringement could negatively impact our revenue derived from such enforcement actions. In addition, recent federal court decisions have lowered the threshold for obtaining attorneys’ fees in patent infringement cases and increased the level of deference given to a district court’s fee-shifting determination. These decisions may make it easier for district courts to shift a prevailing party’s attorneys’ fees to a non-prevailing party if the district court believes that the case was weak or conducted in an abusive manner. As a result, defendants in patent infringement actions brought by non-practicing entities may elect not to settle because these decisions make it much easier for defendants to get attorneys’ fees.

Changes in patent law could adversely impact our business.

Patent laws may continue to change, and may alter the historically consistent protections afforded to owners of patent rights. Such changes may not be advantageous for us and may make it more difficult to obtain adequate patent protection to

14

enforce our patents against infringing parties. Increased focus on the growing number of patent-related lawsuits may result in legislative changes which increase our costs and related risks of asserting patent enforcement actions. For instance, the United States Congress has considered a bill that would require, among other things, non-practicing entities that bring patent infringement lawsuits to pay legal costs of the defendants, if the lawsuits are unsuccessful and certain standards are not met.

Trial judges and juries often find it difficult to understand complex patent enforcement litigation, and as a result, we may need to appeal adverse decisions by lower courts in order to successfully enforce our patents.

It is difficult to predict the outcome of patent enforcement litigation at the trial level. It is often difficult for juries and trial judges to understand complex, patented technologies, and as a result, there is a higher rate of successful appeals in patent enforcement litigation than more standard business litigation. Such appeals are expensive and time consuming, resulting in increased costs and delayed revenue. Although we diligently pursue enforcement litigation, we cannot predict with significant reliability the decisions made by juries and trial courts.

More patent applications are filed each year resulting in longer delays in getting patents issued by the USPTO.

Certain of our operating subsidiaries hold and continue to invest in pending patents. We have identified a trend of increasing patent applications each year, which we believe is resulting in longer delays in obtaining approval of pending patent applications. The application delays could cause delays in recognizing revenue from these patents and could cause us to miss opportunities to license patents before other competing technologies are developed or introduced into the market.

Federal courts are becoming more crowded, and as a result, patent enforcement litigation is taking longer.

Our patent enforcement actions are almost exclusively prosecuted in federal court. Federal trial courts that hear our patent enforcement actions also hear criminal cases. Criminal cases always take priority over our actions. As a result, it is difficult to predict the length of time it will take to complete an enforcement action. Moreover, we believe there is a trend in increasing numbers of civil lawsuits and criminal proceedings before federal judges and, as a result, we believe that the risk of delays in our patent enforcement actions will have a greater negative effect on our business in the future unless this trend changes.

Any reductions in the funding of the USPTO could have an adverse impact on the cost of processing pending patent applications and the value of those pending patent applications.

The assets of our operating subsidiaries consist of patent portfolios, including pending patent applications before the USPTO. The value of our patent portfolios is dependent upon the issuance of patents in a timely manner, and any reductions in the funding of the USPTO could negatively impact the value of our assets. Further, reductions in funding from Congress could result in higher patent application filing and maintenance fees charged by the USPTO, causing an increase in our expenses.

Competition is intense in the industries in which our subsidiaries do business and as a result, we may not be able to grow or maintain our market share for our technologies and patents.

We expect to encounter competition in the area of patent portfolio investments and enforcement. This includes competitors seeking to invest in the same or similar patents and technologies that we may seek to invest in. As new technological advances occur, many of our patented technologies may become obsolete before they are completely monetized. If we are unable to replace obsolete technologies with more technologically advanced patented technologies, then this obsolescence could have a negative effect on our ability to generate future revenues.

Our licensing business also competes with venture capital firms and various industry leaders for patent licensing opportunities. Many of these competitors may have more financial and human resources than we do. As we become more successful, we may find more companies entering the market for similar technology opportunities, which may reduce our market share in one or more technology industries that we currently rely upon to generate future revenue.

Our patented technologies face uncertain market value.

Our operating subsidiaries have invested in patents and technologies that may be in the early stages of adoption in the commercial and consumer markets. Demand for some of these technologies is untested and is subject to fluctuation based upon the rate at which our licensees will adopt our patents and technologies in their products and services.

15

Further, significant judgment is required in connection with estimates of the recoverability of the carrying value of our intangible patent assets, including estimates of market values, estimates of the amount and timing of future cash flows, and estimates of other factors that are used to determine the fair value and recoverability of the respective patent asset values. Developments with respect to ongoing patent litigation, patent challenges and re-exams, legislative and judicial decisions and other factors outside of our control, may unfavorably impact the validity, applicability, and enforceability of our patent assets, and therefore, negatively impact the future value of our patent portfolios. If certain of these unfavorable events occur, our estimates or related projections may change materially in future periods, and future intangible asset impairment tests may result in material charges to earnings.

As patent enforcement litigation becomes more prevalent, it may become more difficult for us to voluntarily license our patents.

We believe that the more prevalent patent enforcement actions become, the more difficult it will be for us to voluntarily license our patents. As a result, we may need to increase the number of our patent enforcement actions to cause infringing companies to license the patent or pay damages for lost royalties. This may increase the risks associated with an investment in our company.

Patent litigation trials and scheduled trial dates are subject to routine delay, and any such delays could adversely impact our business, results of operations and financial condition.

Patent infringement trials are components of our overall patent licensing process and are one of many factors that contribute to the existence of possible future revenue opportunities for us. Patent litigation schedules in general, and in particular trial dates, are subject to routine adjustment, and in most cases delay, as courts adjust their calendars or respond to requests from one or more parties. Trial dates often are rescheduled by the court for various reasons that are often unrelated to the underlying patent assets and typically for reasons that are beyond our control. As a result, to the extent such events are an indicator of possible future revenue opportunities for us, or other outcome determinative events, they may and often do change which can result in delay of the expected scheduled event. Any such delay could be significant and could affect the corresponding future revenue opportunities, thus adversely impacting our business, results of operations and financial condition.

The markets served by our operating subsidiaries are subject to rapid technological change, and if our operating subsidiaries are unable to develop and invest in new technologies and patents, our ability to generate revenues could be substantially impaired.

The markets served by our operating subsidiaries and their licensees frequently undergo transitions in which products rapidly incorporate new features and performance standards on an industry-wide basis. Products for communications applications and high-speed computing applications, as well as other applications covered by our operating subsidiaries’ intellectual property, are based on continually evolving industry standards. In addition, the communications industry is intensely competitive and has been impacted by price erosion, rapid technological change, short product life cycles, cyclical market patterns and increasing foreign and domestic competition. Our ability to compete in the future will depend on our ability to identify and ensure compliance with evolving industry standards. This will require our continued efforts and success in acquiring new patent portfolios with licensing and enforcement opportunities. If we are unable to invest in new patented technologies and patent portfolios, or to identify and ensure compliance with evolving industry standards, our ability to generate revenues could be substantially impaired and our business and financial condition could be materially harmed.

Uncertainty in global economic conditions could negatively affect our business, results of operations and financial condition.

Our revenue-generating opportunities depend on the use of our patented technologies by existing and prospective licensees, the overall demand for the products and services of our licensees, and on the overall economic and financial health of our licensees. If economic conditions do not continue to improve, or if they deteriorate, many of our licensees’ customers, which may rely on credit financing, may delay or reduce their purchases of our licensees’ products and services. In addition, the use or adoption of our patented technologies is often based on current and forecasted demand for our licensees’ products and services in the marketplace and may require companies to make significant initial commitments of capital and other resources. If negative conditions in the global credit markets delay or prevent our licensees’ and their customers’ access to credit, overall consumer spending on the products and services of our licensees may decrease and the adoption or use of our patented technologies may slow, respectively. Further, if the markets in which our licensees’ participate do not continue to improve, or deteriorate further, this could negatively impact our licensees’ long-term sales and revenue generation, margins and operating expenses, which could in turn have an adverse effect on our business, results of operations and financial condition.

16