January 22, 2021

U.S. Securities and Exchange Commission

Division of Investment Management

100 F Street, NE

Washington, DC 20549-0504

Attention: Elena Stojic, Esq.

VIA EDGAR

| Re: | Registrant: | Loomis Sayles Funds I | ||

| File No.: | 811-08282 | |||

| Filing Type: | Form N-1A |

Dear Ms. Stojic:

This letter responds to comments of the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) received by Webex on January 11, 2021, regarding the post-effective amendment to Loomis Sayles Funds I (the “Registrant”) registration statement on Form N-1A for the Loomis Sayles Bond Fund and Loomis Sayles Fixed Income Fund (each a “Fund” and together the “Funds”), which was filed with the Commission on November 24, 2020 (the “Registration Statement”). For your convenience, we have summarized each comment below, followed by the Registrant’s response. Any term that is used, but not defined, in this letter retains the same meaning as used by the Registrant in the Registration Statement. Unless otherwise noted, comments and responses relate to each Fund.

Please note that the Registration Statement is scheduled to become effective automatically on February 1, 2021.

Prospectus

| 1. | Comment. Please provide the Staff with completed “Annual Fund Operating Expenses” tables and expense “Examples” for each Fund before the effective date of the Registration Statement. |

Response. Below, please find completed “Annual Fund Operating Expenses” tables and expense “Examples”:

Loomis Sayles Bond Fund

| Annual Fund Operating Expenses | ||||||||||||||||

| (expenses that you pay each year as a percentage of the value of your investment) |

Institutional Class |

Retail Class |

Admin Class |

Class N | ||||||||||||

| Management fees |

0.53 | % | 0.53 | % | 0.53 | % | 0.53 | % | ||||||||

| Distribution and/or service (12b-1) fees |

0.00 | % | 0.25 | % | 0.25 | % | 0.00 | % | ||||||||

| Other expenses1 |

0.14 | % | 0.14 | % | 0.39 | %2 | 0.07 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total annual fund operating expenses |

0.67 | % | 0.92 | % | 1.17 | % | 0.60 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Fee waiver and/or expense reimbursement3 |

0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total annual fund operating expenses after fee waiver and/or expense reimbursement |

0.67 | % | 0.92 | % | 1.17 | % | 0.60 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 1 | Other expenses include acquired fund fees and expenses of less than 0.01%. |

| 2 | Other expenses include an administrative services fee of 0.25% for Admin Class shares. |

| 3 | Loomis, Sayles & Company, L.P. (“Loomis Sayles” or the “Adviser”) has given a binding contractual undertaking to the Fund to limit the amount of the Fund’s total annual fund operating expenses to 0.67%, 0.92%, 1.17% and 0.62% of the Fund’s average daily net assets for Institutional Class shares, Retail Class shares, Admin Class shares and Class N shares, respectively, exclusive of brokerage expenses, interest expense, taxes, acquired fund fees and expenses, organizational and extraordinary expenses, such as litigation and indemnification expenses. This undertaking is in effect through January 31, 2022 and may be terminated before then only with the consent of the Fund’s Board of Trustees. The Adviser will be permitted to recover, on a class by class basis, management fees waived and/or expenses reimbursed to the extent that expenses in later periods fall below the applicable expense limitations for Institutional Class shares, Retail Class shares, Admin Class shares and Class N shares. The Fund will not be obligated to repay any such waived/reimbursed fees and expenses more than one year after the end of the fiscal year in which the fees or expenses were waived/reimbursed. |

Example

The example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The example does not take into account brokerage commissions and other fees to financial intermediaries that you may pay on your purchases and sales of shares of the Fund. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 year | 3 years | 5 years | 10 years | |||||||||||||

| Institutional Class |

$ | 68 | $ | 214 | $ | 373 | $ | 835 | ||||||||

| Retail Class |

$ | 94 | $ | 293 | $ | 509 | $ | 1,131 | ||||||||

| Admin Class |

$ | 119 | $ | 372 | $ | 644 | $ | 1,420 | ||||||||

| Class N |

$ | 61 | $ | 192 | $ | 335 | $ | 750 | ||||||||

Loomis Sayles Fixed Income Fund

| Annual Fund Operating Expenses | ||||

| (expenses that you pay each year as a percentage of the value of your investment) |

Institutional Class |

|||

| Management fees |

0.50 | % | ||

| Distribution and/or service (12b-1) fees |

0.00 | % | ||

| Other expenses |

0.08 | % | ||

|

|

|

|||

| Total annual fund operating expenses |

0.58 | % | ||

|

|

|

|||

| Fee waiver and/or expense reimbursement1 |

0.00 | % | ||

|

|

|

|||

| Total annual fund operating expenses after fee waiver and/or expense reimbursement |

0.58 | % | ||

|

|

|

|||

| 1 | Loomis, Sayles & Company, L.P. (“Loomis Sayles” or the “Adviser”) has given a binding contractual undertaking to the Fund to limit the amount of the Fund’s total annual fund operating expenses to 0.65% of the Fund’s average daily net assets, exclusive of brokerage expenses, interest expense, taxes, acquired fund fees and expenses, organizational and extraordinary expenses, such as litigation and indemnification expenses. This undertaking is in effect through January 31, 2022 and may be terminated before then only with the consent of the Fund’s Board of Trustees. The Adviser will be permitted to recover, on a class-by-class basis, management fees waived and/or expenses reimbursed to the extent that expenses in later periods fall below the applicable expense limitations. The Fund will not be obligated to repay any such waived/reimbursed fees and expenses more than one year after the end of the fiscal year in which the fees or expenses were waived/reimbursed. |

Example

The example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The example does not take into account brokerage commissions and other fees to financial

intermediaries that you may pay on your purchases and sales of shares of the Fund. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 year | 3 years | 5 years | 10 years | |||||||||||||

| Institutional Class |

$ | 59 | $ | 186 | $ | 324 | $ | 726 | ||||||||

| 2. | Comment. Footnote 2 to the Loomis Sayles Bond Fund’s “Annual Fund Operating Expenses” table states that “Other expenses” include an administrative services fee of 0.25% for Admin Class Shares. Please explain supplementally the differences between the administrative service fee and Rule 12b-1 fees. Please also explain supplementally why such administrative service fee should be included as “Other expenses” and not “Distribution and/or service (12b-1) fees” within the table. |

Response.

As disclosed in the “Distribution Plans and Administrative Services and Other Fees” section of the Fund’s prospectus, the 0.25% administrative services fee for Admin Class Shares is paid to Natixis Distribution, L.P. and/or securities dealers or financial intermediaries for providing personal service and account maintenance for their customers who hold these shares. These services are not intended to result in the sale of Admin Class Shares, which distinguishes them from services that are paid pursuant to the Admin Class’s Rule 12b-1 plan. Accordingly, the Registrant believes that the administrative services fee is appropriately included within the table as “Other expenses” and not “Distribution and/or service (12b-1) fees.”

| 3. | Comment. Please revise the expense recoupment disclosure in the footnotes to each Fund’s “Annual Fund Operating Expenses” table to reflect that the Adviser will be able to recover the waived fees and/or expenses only if the repayment of such fees and/or expenses does not cause the Fund to exceed (1) the expense limitation in place at the time such amounts were waived and (2) the Fund’s then current expense limitation. |

Response.

The Registrant confirms that the Adviser will be permitted to recover waived fees and/or expenses only to the extent the expenses in later periods remain below both the expense limitation at the time of the repayment and the expense limitation that was in effect at the time the expenses were waived. The Registrant respectfully submits that the referenced footnotes accurately describe the related expense limitation agreements. The Registrant will monitor amounts subject to recoupment against both the original expense limitation in effect at the time the expenses were waived and/or reimbursed, as well as against the current expense limitation. Accordingly, no changes to the disclosure have been made.

| 4. | Comment. Please provide the bracketed percentage in the last sentence of the “Portfolio Turnover” sections of the prospectus. |

Response. The Registrant has revised the last sentence of the “Portfolio Turnover” sections of the prospectus as follows:

Loomis Sayles Bond Fund

“During its most recently ended fiscal year the Fund’s portfolio turnover rate was 25% of the average value of its portfolio.”

Loomis Sayles Fixed Income Fund

“During its most recently ended fiscal year the Fund’s portfolio turnover rate was 29% of the average value of its portfolio.”

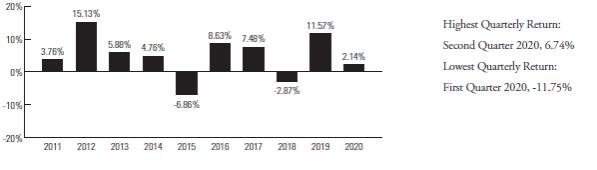

| 5. | Please provide updated information for the “Average Annual Total Return” table and bar chart in the “Risk/Return Bar Chart and Table” sections of the prospectus. |

Response. Below, please find the completed “Average Annual Total Return” tables and bar charts.

Loomis Sayles Bond Fund

Risk/Return Bar Chart and Table

The following bar chart and table give an indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual returns for the one-year, five-year, ten-year and life-of- class periods (as applicable) compare to those of a broad measure of market performance. The Fund’s past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. Updated performance information is available online at www.loomissayles.com and/or by calling the Fund toll-fee at 800-633-3330.

Total Returns for Institutional Class Shares

| Average Annual Total Returns | ||||||||||||||||

| (for the periods ended December 31, 2020) | Past 1 Year |

Past 5 Years |

Past 10 Years |

Life of Class N (2/1/13) |

||||||||||||

| Institutional Class - Return Before Taxes |

2.14 | % | 5.26 | % | 4.78 | % | — | |||||||||

| Return After Taxes on Distributions |

0.66 | % | 3.72 | % | 2.88 | % | — | |||||||||

| Return After Taxes on Distributions and Sale of Fund Shares |

1.37 | % | 3.49 | % | 3.00 | % | — | |||||||||

| Retail Class - Return Before Taxes |

1.89 | % | 5.00 | % | 4.50 | % | — | |||||||||

| Admin Class - Return Before Taxes |

1.63 | % | 4.75 | % | 4.24 | % | — | |||||||||

| Class N - Return Before Taxes |

2.21 | % | 5.36 | % | — | 3.55 | % | |||||||||

| Bloomberg Barclays U.S. Government/Credit Bond Index |

8.93 | % | 4.98 | % | 4.19 | % | 3.70 | % | ||||||||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their shares through tax-advantaged arrangements, such as 401(k) plans, qualified plans, education savings accounts, such as 529 plans, or individual retirement accounts. The after-tax returns are shown for the Institutional Class of the Fund. After-tax returns for the other classes of the Fund will vary. Index performance reflects no deduction for fees, expenses or taxes.

Loomis Sayles Fixed Income Fund

Risk/Return Bar Chart and Table

The following bar chart and table give an indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual returns for the one-year, five-year and ten-year periods compare to those of a broad measure of market performance. The Fund’s past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. Updated performance information is available online at www.loomissayles.com and/or by calling the Fund toll-fee at 800-633-3330.

Total Returns for Institutional Class Shares

| Average Annual Total Returns | ||||||||||||

| (for the periods ended December 31, 2020) | Past 1 Year |

Past 5 Years |

Past 10 Years |

|||||||||

| Institutional Class - Return Before Taxes |

5.38 | % | 6.69 | % | 5.73 | % | ||||||

| Return After Taxes on Distributions |

3.10 | % | 4.73 | % | 3.54 | % | ||||||

| Return After Taxes on Distributions and Sale of Fund Shares |

3.43 | % | 4.40 | % | 3.59 | % | ||||||

| Bloomberg Barclays U.S. Government/Credit Bond Index |

8.93 | % | 4.98 | % | 4.19 | % | ||||||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their shares through tax-advantaged arrangements, such as 401(k) plans, qualified plans, education savings accounts, such as 529 plans, or individual retirement accounts. The after-tax returns are shown for the Institutional Class of the Fund. Index performance reflects no deduction for fees, expenses or taxes.

If you have any questions or require any clarification concerning the foregoing, please call me at 617-449-2818.

| Very truly yours, | ||

| /s/ John M. DelPrete | ||

| John M. DelPrete Assistant Secretary Loomis Sayles Funds I | ||

| cc: | Russell L. Kane, Esq. |

Michael G. Doherty, Esq.

John M. Loder, Esq.