UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

Form 10-K

[X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2019 | ||

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to | ||

Commission File No. 001-12079

______________________

Calpine Corporation

(A Delaware Corporation)

I.R.S. Employer Identification No. 77-0212977

717 Texas Avenue, Suite 1000, Houston, Texas 77002

Telephone: (713) 830-2000

Not Applicable

(Former Address)

Securities registered pursuant to Section 12(b) or 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [X] No [ ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ ] No [X]

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer, “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [ ] | Accelerated filer [ ] | |

Non-accelerated filer [X] | Smaller reporting company [ ] | |

(Do not check if a smaller reporting company) | Emerging growth company [ ] | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2019, the last business day of the registrant’s most recently completed second fiscal quarter: $0.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: Calpine Corporation: 105.2 shares of common stock, par value $0.001, were outstanding as of February 24, 2020.

DOCUMENTS INCORPORATED BY REFERENCE

CALPINE CORPORATION AND SUBSIDIARIES

FORM 10-K

ANNUAL REPORT

For the Year Ended December 31, 2019

TABLE OF CONTENTS

Page | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

Item 16. | ||

i

DEFINITIONS

As used in this annual report for the year ended December 31, 2019, the following abbreviations and terms have the meanings as listed below. Additionally, the terms “Calpine,” “we,” “us” and “our” refer to Calpine Corporation and its consolidated subsidiaries, unless the context clearly indicates otherwise. The term “Calpine Corporation” refers only to Calpine Corporation and not to any of its subsidiaries. Unless and as otherwise stated, any references in this Report to any agreement means such agreement and all schedules, exhibits and attachments in each case as amended, restated, supplemented or otherwise modified to the date of filing this Report.

ABBREVIATION | DEFINITION | |

2019 First Lien Term Loan | The $400 million first lien senior secured term loan, dated February 3, 2017, among Calpine Corporation, as borrower, the lenders party thereto, Morgan Stanley Senior Funding, Inc., as administrative agent and MUFG Union Bank, N.A., as collateral agent, repaid on April 5, 2019 | |

2022 First Lien Notes | The $750 million aggregate principal amount of 6.0% senior secured notes due 2022, issued October 31, 2013, repaid on December 20, 2019 and January 21, 2020 | |

2023 First Lien Term Loans | The $550 million first lien senior secured term loan, dated December 15, 2015, among Calpine Corporation, as borrower, the lenders party thereto, Morgan Stanley Senior Funding, Inc., as administrative agent and Goldman Sachs Credit Partners L.P., as collateral agent, repaid on April 5, 2019, and the $562 million first lien senior secured term loan, dated May 31, 2016, among Calpine Corporation, as borrower, the lenders party thereto, Citibank, N.A., as administrative agent and MUFG Union Bank, N.A., as collateral agent, repaid on August 12, 2019 | |

2023 Senior Unsecured Notes | The $1.25 billion aggregate principal amount of 5.375% senior unsecured notes due 2023, issued July 22, 2014, repaid on December 27, 2019 and January 21, 2020 | |

2024 First Lien Notes | The $490 million aggregate principal amount of 5.875% senior secured notes due 2024, issued October 31, 2013, repaid on December 20, 2019 and January 21, 2020 | |

2024 First Lien Term Loan | The $1.6 billion first lien senior secured term loan, dated May 28, 2015 (as amended December 21, 2016), among Calpine Corporation, as borrower, the lenders party thereto, Morgan Stanley Senior Funding, Inc., as administrative agent and Goldman Sachs Credit Partners L.P., as collateral agent | |

2024 Senior Unsecured Notes | The $650 million aggregate principal amount of 5.5% senior unsecured notes due 2024, issued February 3, 2015 | |

2025 Senior Unsecured Notes | The $1.55 billion aggregate principal amount of 5.75% senior unsecured notes due 2025, issued July 22, 2014 | |

2026 First Lien Notes | Collectively, the $625 million aggregate principal amount of 5.25% senior secured notes due 2026, issued May 31, 2016, and the $560 million aggregate principal amount of 5.25% senior secured notes due 2026, issued on December 15, 2017 | |

2026 First Lien Term Loans | Collectively, the $950 million first lien senior secured term loan, dated April 5, 2019, among Calpine Corporation, as borrower, the lenders party thereto, Morgan Stanley Senior Funding, Inc., as administrative agent and MUFG Union Bank, N.A., as collateral agent and the $750 million first lien senior secured term loan, dated August 12, 2019, among Calpine Corporation, as borrower, the lending party thereto, Credit Suisse AG, Cayman Islands Branch, as administrative agent and MUFG Union Bank, N.A., as collateral agent | |

2028 First Lien Notes | The $1.25 billion aggregate principal amount of 4.5% senior secured notes due 2028, issued December 20, 2019 | |

2028 Senior Unsecured Notes | The $1.4 billion aggregate principal amount of 5.125% senior unsecured notes due 2028, issued December 27, 2019 | |

AB 32 | California Assembly Bill 32 | |

ii

ABBREVIATION | DEFINITION | |

Accounts Receivable Sales Program | Receivables purchase agreement between Calpine Solutions and Calpine Receivables and the purchase and sale agreement between Calpine Receivables and an unaffiliated financial institution, both which allows for the revolving sale of up to $250 million in certain trade accounts receivables to third parties | |

AOCI | Accumulated Other Comprehensive Income | |

Average availability | Represents the total hours during the period that our plants were in-service or available for service as a percentage of the total hours in the period | |

Average capacity factor, excluding peakers | A measure of total actual power generation as a percent of total potential power generation. It is calculated by dividing (a) total MWh generated by our power plants, excluding peakers, by (b) the product of multiplying (i) the average total MW in operation, excluding peakers, during the period by (ii) the total hours in the period | |

Board of Directors | Calpine Corporation Board of Directors | |

Btu | British thermal unit(s), a measure of heat content | |

CAA | Federal Clean Air Act, U.S. Code Title 42, Chapter 85 | |

CAISO | California Independent System Operator which is an entity that manages the power grid and operates the competitive power market in California | |

CARB | California Air Resources Board | |

Calpine Equity Incentive Plans | Calpine’s equity plans in place prior to the Merger, which provided for grants of equity awards to Calpine non-union employees and non-employee members of our Board of Directors | |

Calpine Receivables | Calpine Receivables, LLC, an indirect, wholly-owned subsidiary of Calpine, which was established as bankruptcy remote, special purpose subsidiary and is responsible for administering the Accounts Receivable Sales Program | |

Calpine Solutions | Calpine Energy Solutions, LLC, an indirect, wholly-owned subsidiary of Calpine, which is a supplier of power to commercial and industrial retail customers in the United States with customers in 20 states, including presence in California, Texas, the Mid-Atlantic and the Northeast | |

Cap-and-Trade | A government imposed emissions reduction program that would place a cap on the amount of emissions that can be emitted from certain sources, such as power plants. In its simplest form, the cap amount is set as a reduction from the total emissions during a base year and for each year over a period of years the cap amount would be reduced to achieve the targeted overall reduction by the end of the period. Allowances or credits for emissions in an amount equal to the cap would be issued or auctioned to companies with facilities, permitting them to emit up to a certain amount of emissions during each applicable period. After allowances have been distributed or auctioned, they can be transferred or traded | |

CCA | Community Choice Aggregators which are local governments that procure power on behalf of their residents, businesses and municipal accounts from an alternative supplier while still receiving transmission and distribution service from their existing utility | |

CCFC | Calpine Construction Finance Company, L.P., an indirect, wholly-owned subsidiary of Calpine | |

CCFC Term Loan | The $1.0 billion first lien senior secured term loan entered into on December 15, 2017 among CCFC as borrower, the lenders party thereto, and Credit Suisse AG, Cayman Islands Branch, as administrative agent and collateral agent | |

iii

ABBREVIATION | DEFINITION | |

CCFC Term Loans | Collectively, the $900 million first lien senior secured term loan and the $300 million first lien senior secured term loan entered into on May 3, 2013, and the $425 million first lien senior secured term loan entered into on February 26, 2014, between CCFC, as borrower, and Goldman Sachs Lending Partners, LLC, as administrative agent and as collateral agent, and the lenders party thereto, repaid on December 15, 2017 | |

CDHI | Calpine Development Holdings, Inc., an indirect, wholly-owned subsidiary of Calpine | |

CFTC | Commodities Futures Trading Commission | |

Champion Energy | Champion Energy Marketing, LLC, an indirect, wholly owned subsidiary of Calpine, which owns a retail electric provider that serves residential, governmental, commercial and industrial customers in deregulated electricity markets in 14 states and the District of Columbia, including presence in California, Texas, the Mid-Atlantic and Northeast | |

Chapter 11 | Chapter 11 of the U.S. Bankruptcy Code | |

Class B Interests | Partnership interests in CPN Management having the rights and obligations with respect to Class B Interests as set forth in the Second Amended and Restated Limited Partnership Agreement of CPN Management dated August 29, 2018 | |

CO2 | Carbon dioxide | |

Cogeneration | Using a portion or all of the steam generated in the power generating process to supply a customer with steam for use in the customer’s operations | |

Commodity expense | The sum of our expenses from fuel and purchased energy expense, commodity transmission and transportation expense, environmental compliance expenses, ancillary retail expense and realized settlements from our marketing, hedging and optimization activities including natural gas and fuel oil transactions hedging future power sales | |

Commodity Margin | Measure of profit that includes revenue recognized on our wholesale and retail power sales activity, electric capacity sales, REC sales, steam sales, realized settlements associated with our marketing, hedging, optimization and trading activities, fuel and purchased energy expenses, commodity transmission and transportation expenses, environmental compliance expenses and ancillary retail expense. Commodity Margin is a measure of segment profit or loss under FASB Accounting Standards Codification 280 used by our chief operating decision maker to make decisions about allocating resources to the relevant segments and assessing their performance | |

Commodity revenue | The sum of our revenues recognized on our wholesale and retail power sales activity, electric capacity sales, REC sales, steam sales and realized settlements from our marketing, hedging, optimization and trading activities | |

Company | Calpine Corporation, a Delaware corporation, and its subsidiaries | |

Corporate Revolving Facility | The approximately $2.0 billion aggregate amount revolving credit facility credit agreement, dated as of December 10, 2010, as amended on June 27, 2013, July 30, 2014, February 8, 2016, December 1, 2016, September 15, 2017, October 20, 2017, March 8, 2018, May 18, 2018, April 5, 2019 and August 12, 2019 among Calpine Corporation, the Bank of Tokyo-Mitsubishi UFJ, Ltd., as successor administrative agent, MUFG Union Bank, N.A., as successor collateral agent, the lenders party thereto and the other parties thereto | |

CPN Management | CPN Management, LP, which owns 100% of the common stock of Calpine Corporation | |

CSAPR | Cross-State Air Pollution Rule | |

EIA | Energy Information Administration of the U.S. Department of Energy | |

EPA | U.S. Environmental Protection Agency | |

iv

ABBREVIATION | DEFINITION | |

ERCOT | Electric Reliability Council of Texas which is an entity that manages the flow of electric power to Texas customers representing approximately 90 percent of the state’s electric load | |

Exchange Act | U.S. Securities Exchange Act of 1934, as amended | |

FASB | Financial Accounting Standards Board | |

FDIC | U.S. Federal Deposit Insurance Corporation | |

FERC | U.S. Federal Energy Regulatory Commission | |

First Lien Notes | Collectively, the 2022 First Lien Notes, the 2024 First Lien Notes, the 2026 First Lien Notes and the 2028 First Lien Notes | |

First Lien Term Loans | Collectively, the 2019 First Lien Term Loan, the 2023 First Lien Term Loans, the 2024 First Lien Term Loan and the 2026 First Lien Term Loans | |

GE | General Electric International, Inc. | |

Geysers Assets | Our geothermal power plant assets, including our steam extraction and gathering assets, located in northern California consisting of 13 operating power plants | |

GHG(s) | Greenhouse gas(es), primarily carbon dioxide (CO2), and including methane (CH4), nitrous oxide (N2O), sulfur hexafluoride (SF6), hydrofluorocarbons (HFCs) and perfluorocarbons (PFCs) | |

Greenfield LP | Greenfield Energy Centre LP, a 50% partnership interest between certain of our subsidiaries and a third party which operates the Greenfield Energy Centre, a 1,038 MW natural gas-fired, combined-cycle power plant in Ontario, Canada | |

Heat Rate(s) | A measure of the amount of fuel required to produce a unit of power | |

IRC | Internal Revenue Code | |

IRS | U.S. Internal Revenue Service | |

ISO(s) | Independent System Operator(s) which is an entity that coordinates, controls and monitors the operation of an electric power system | |

ISO-NE | ISO New England Inc., an independent nonprofit RTO serving states in the New England area, including Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island and Vermont | |

KWh | Kilowatt hour(s), a measure of power produced, purchased or sold | |

LIBOR | London Inter-Bank Offered Rate | |

LTSA(s) | Long-Term Service Agreement(s) | |

Lyondell | LyondellBasell Industries N.V. | |

Market Heat Rate(s) | The regional power price divided by the corresponding regional natural gas price | |

Merger | Merger of Volt Merger Sub, Inc. with and into Calpine pursuant to the terms of the Merger Agreement, which was consummated on March 8, 2018 | |

v

ABBREVIATION | DEFINITION | |

Merger Agreement | Agreement and Plan of Merger, dated August 17, 2017, by and among Calpine Corporation, Volt Parent, LP and Volt Merger Sub, Inc. | |

MMBtu | Million Btu | |

MRO | Midwest Reliability Organization | |

MW | Megawatt(s), a measure of plant capacity | |

MWh | Megawatt hour(s), a measure of power produced, purchased or sold | |

NAAQS | National Ambient Air Quality Standards | |

NERC | North American Electric Reliability Council | |

NOL(s) | Net operating loss(es) | |

North American Power | North American Power & Gas, LLC, an indirect, wholly-owned subsidiary of Calpine, which was acquired on January 17, 2017 and is a retail energy supplier for homes and small businesses primarily concentrated in the Northeast U.S. | |

NOx | Nitrogen oxides | |

NPCC | Northeast Power Coordinating Council | |

NYISO | New York ISO which operates competitive wholesale markets to manage the flow of electricity across New York | |

NYMEX | New York Mercantile Exchange | |

OCI | Other Comprehensive Income | |

OMEC | Otay Mesa Energy Center, LLC, an indirect, wholly-owned subsidiary that owns the Otay Mesa Energy Center, a 608 MW power plant located in San Diego County, California | |

OTC | Over-the-Counter | |

PG&E | Pacific Gas & Electric Company | |

PJM | PJM Interconnection is a RTO that coordinates the movement of wholesale electricity in all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia | |

PPA(s) | Any term power purchase agreement or other contract for a physically settled sale (as distinguished from a financially settled future, option or other derivative or hedge transaction) of any power product, including power, capacity and/or ancillary services, in the form of a bilateral agreement or a written or oral confirmation of a transaction between two parties to a master agreement, including sales related to a tolling transaction in which the purchaser provides the fuel required by us to generate such power and we receive a variable payment to convert the fuel into power and steam | |

PSD | Prevention of Significant Deterioration | |

PUCT | Public Utility Commission of Texas | |

PUHCA 2005 | U.S. Public Utility Holding Company Act of 2005 | |

PURPA | U.S. Public Utility Regulatory Policies Act of 1978 | |

vi

ABBREVIATION | DEFINITION | |

QF(s) | Qualifying facility(ies), which are cogeneration facilities and certain small power production facilities eligible to be “qualifying facilities” under PURPA, provided that they meet certain power and thermal energy production requirements and efficiency standards. QF status provides an exemption from the books and records requirement of PUHCA 2005 and grants certain other benefits to the QF | |

REC(s) | Renewable energy credit(s) | |

Report | This Annual Report on Form 10-K for the year ended December 31, 2019, filed with the SEC on February 24, 2020 | |

Reserve margin(s) | The measure of how much the total generating capacity installed in a region exceeds the peak demand for power in that region | |

RFC | Reliability First Corporation | |

RGGI | Regional Greenhouse Gas Initiative | |

Risk Management Policy | Calpine’s policy applicable to all employees, contractors, representatives and agents, which defines the risk management framework and corporate governance structure for commodity risk, interest rate risk, currency risk and other risks | |

RMR Contract(s) | Reliability Must Run contract(s) | |

RPS | Renewable Portfolio Standard | |

RTO(s) | Regional Transmission Organization which is an entity that coordinates, controls and monitors the operation of an electric power system and administers the transmission grid on a regional basis | |

SDG&E | San Diego Gas & Electric Company | |

SEC | U.S. Securities and Exchange Commission | |

Securities Act | U.S. Securities Act of 1933, as amended | |

Senior Unsecured Notes | Collectively, the 2023 Senior Unsecured Notes, the 2024 Senior Unsecured Notes, the 2025 Senior Unsecured Notes and the 2028 Senior Unsecured Notes | |

SERC | Southeastern Electric Reliability Council | |

SO2 | Sulfur dioxide | |

Spark Spread(s) | The difference between the sales price of power per MWh and the cost of natural gas to produce it | |

Steam Adjusted Heat Rate | The adjusted Heat Rate for our natural gas-fired power plants, excluding peakers, calculated by dividing (a) the fuel consumed in Btu reduced by the net equivalent Btu in steam exported to a third party by (b) the KWh generated. Steam Adjusted Heat Rate is a measure of fuel efficiency, so the lower our Steam Adjusted Heat Rate, the lower our cost of generation | |

Stockholders Agreement | Stockholders Agreement, dated March 8, 2018, by and between Calpine Corporation and CPN Management | |

TRE | Texas Reliability Entity, Inc. | |

U.S. GAAP | Generally accepted accounting principles in the U.S. | |

VAR | Value-at-risk | |

vii

ABBREVIATION | DEFINITION | |

VIE(s) | Variable interest entity(ies) | |

WECC | Western Electricity Coordinating Council | |

Whitby | Whitby Cogeneration Limited Partnership, a 50% partnership interest, which we sold on November 20, 2019, between certain of our subsidiaries and a third party which operates Whitby, a 50 MW natural gas-fired, simple-cycle cogeneration power plant located in Ontario, Canada | |

viii

Forward-Looking Statements

This Report contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act, and Section 21E of the Exchange Act. Forward-looking statements may appear throughout this Report, including without limitation, the “Management’s Discussion and Analysis” section. We use words such as “believe,” “intend,” “expect,” “anticipate,” “plan,” “may,” “will,” “should,” “estimate,” “potential,” “project” and similar expressions to identify forward-looking statements. Such statements include, among others, those concerning our expected financial performance and strategic and operational plans, as well as all assumptions, expectations, predictions, intentions or beliefs about future events. We believe that the forward-looking statements are based upon reasonable assumptions and expectations. However, you are cautioned that any such forward-looking statements are not guarantees of future performance and that a number of risks and uncertainties could cause actual results to differ materially from those anticipated in the forward-looking statements. Such risks and uncertainties include, but are not limited to:

• | Financial results that may be volatile and may not reflect historical trends due to, among other things, seasonality of demand, fluctuations in prices for commodities such as natural gas and power, changes in U.S. macroeconomic conditions, fluctuations in liquidity and volatility in the energy commodities markets and our ability and extent to which we hedge risks; |

• | Laws, regulations and market rules in the wholesale and retail markets in which we participate and our ability to effectively respond to changes in laws, regulations or market rules or the interpretation thereof including those related to the environment, derivative transactions and market design in the regions in which we operate; |

• | Our ability to manage our liquidity needs, access the capital markets when necessary and comply with covenants under our Senior Unsecured Notes, First Lien Term Loans, First Lien Notes, Corporate Revolving Facility, CCFC Term Loan and other existing financing obligations; |

• | Risks associated with the operation, construction and development of power plants, including unscheduled outages or delays and plant efficiencies; |

• | Risks related to our geothermal resources, including the adequacy of our steam reserves, unusual or unexpected steam field well and pipeline maintenance requirements, variables associated with the injection of water to the steam reservoir and potential regulations or other requirements related to seismicity concerns that may delay or increase the cost of developing or operating geothermal resources; |

• | Extensive competition in our wholesale and retail businesses, including from renewable sources of power, interference by states in competitive power markets through subsidies or similar support for new or existing power plants, lower prices and other incentives offered by retail competitors, and other risks associated with marketing and selling power in the evolving energy markets; |

• | Structural changes in the supply and demand of power, resulting from the development of new fuels or technologies and demand-side management tools (such as distributed generation, power storage and other technologies); |

• | The expiration or early termination of our PPAs and the related results on revenues; |

• | Future capacity revenue may not occur at expected levels; |

• | Natural disasters, such as hurricanes, earthquakes, droughts and floods, acts of terrorism, cyber attacks or wildfires that may affect our power plants or the markets our power plants or retail operations serve and our corporate offices; |

• | Disruptions in or limitations on the transportation of natural gas or fuel oil and the transmission of power; |

• | Our ability to manage our counterparty and customer exposure and credit risk, including our commodity positions or if a significant customer were to seek bankruptcy protection under Chapter 11; |

• | Our ability to attract, motivate and retain key employees; |

• | Present and possible future claims, litigation and enforcement actions that may arise from noncompliance with market rules promulgated by the SEC, CFTC, FERC and other regulatory bodies; and |

• | Other risks identified in this Report. |

Given the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. Many of these factors are beyond our ability to control or predict. Our forward-looking statements speak only as of the date of this Report. Other than as required by law, we undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

1

Where You Can Find Other Information

Our website is www.calpine.com. Information contained on our website is not part of this Report. Information that we furnish or file with the SEC, including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to, or exhibits included in, these reports are available for download, free of charge, through our website. Our SEC filings, including exhibits filed therewith, are also available directly on the SEC’s website at www.sec.gov.

2

PART I

Item 1. | Business |

BUSINESS AND STRATEGY

We are a premier competitive power company with 77 power plants, including one under construction, primarily in the U.S. We sell power and related services to our wholesale customers who include commercial and industrial end-users, state and regional wholesale market operators, and our retail customers. We measure our success by delivering long-term value. We accomplish this through our focus on operational excellence at our power plants and in our customer and commercial activity, as well as through our disciplined approach to capital allocation.

Our capital allocation philosophy seeks to maximize levered cash returns to equity while maintaining a strong balance sheet. We seek to enhance value through a diverse and balanced capital allocation approach that includes portfolio management including select asset sales, organic or acquisitive growth, returning capital to owners and debt reduction. The mix of this activity shifts over time given the external market environment and the opportunity set. During the year ended December 31, 2019, we paid cash distributions to our parent, CPN Management, totaling $1.15 billion. Since the beginning of 2017 through the end of January 2020, we have reduced our total debt by approximately $1.6 billion and funded approximately $350 million of expansion/growth projects. We further optimized our capital structure by refinancing, redeeming, repricing or amending several of our debt instruments during the year ended December 31, 2019 achieving substantial annual interest savings.

We are one of the largest power generators in the U.S. measured by power produced. We own and operate primarily natural gas-fired and geothermal power plants in North America and have a significant presence in major competitive wholesale and retail power markets in California, Texas and the Northeast and Mid-Atlantic regions of the U.S. Since our inception in 1984, we have been a leader in environmental stewardship. We have invested in clean power generation to become a recognized leader in developing, constructing, owning and operating an environmentally responsible portfolio of flexible and reliable power plants. Our portfolio is primarily comprised of two types of power generation technologies: efficient combined-cycle power plants, which use natural gas-fired combustion turbines, and renewable geothermal conventional steam turbines. We are among the world’s largest owners and operators of industrial gas turbines as well as cogeneration power plants. Our Geysers Assets located in northern California represent the largest geothermal power generation portfolio in the U.S. as well as the largest single producing power generation asset of all renewable energy in the state of California.

We sell power, steam, capacity, renewable energy credits and ancillary services to our customers, which include utilities, independent electric system operators and industrial companies, retail power providers, municipalities, CCAs and other governmental entities, power marketers as well as retail commercial, industrial, governmental and residential customers. We continue to focus on providing products and services that are beneficial to our wholesale and retail customers. We purchase primarily natural gas and some fuel oil as fuel for our power plants and engage in related natural gas transportation and storage transactions. We also purchase power and related products for sale to our customers and purchase electric transmission rights to deliver power to our customers. Additionally, consistent with our Risk Management Policy, we enter into natural gas, power, environmental product, fuel oil and other physical and financial commodity contracts to hedge certain business risks and optimize our portfolio of power plants. Seasonality and weather can have a significant effect on our results of operations and are also considered in our hedging and optimization activities.

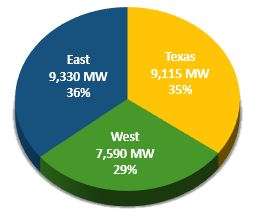

We assess our wholesale business on a regional basis due to the effect on our financial performance of the differing characteristics of these regions, particularly with respect to competition, regulation and other factors affecting supply and demand. Our geographic reportable segments for our wholesale business are West (including geothermal), Texas and East (including Canada) and we have a separate reportable segment for our retail business.

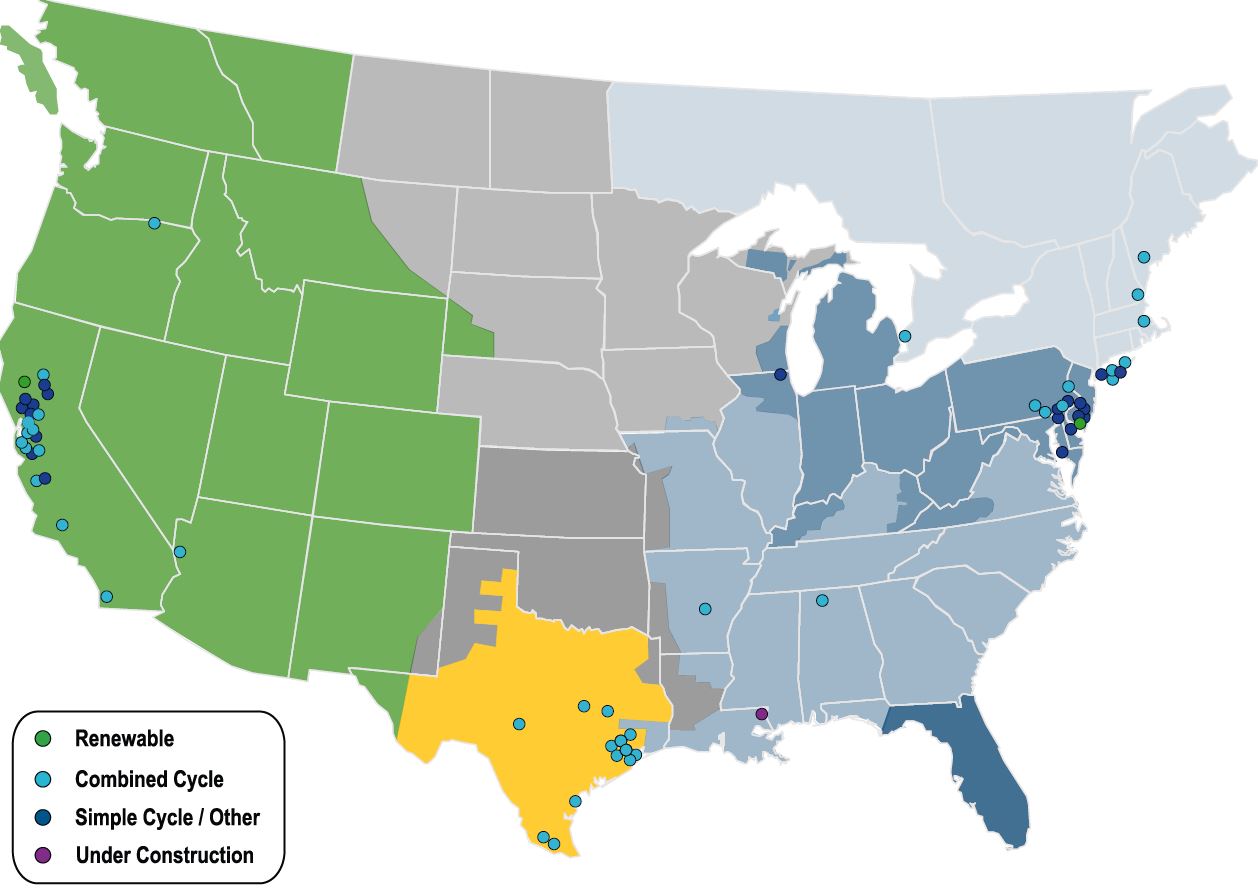

Our wholesale power plant portfolio, including partnership interests, consists of 77 power plants, including one under construction, with an aggregate current generation capacity of 26,035 MW and 361 MW under construction. In March 2019, our York 2 Energy Center commenced commercial operations, bringing online approximately 828 MW of combined cycle, natural gas-fired capacity with dual-fuel capability. Our fleet consists of 62 natural gas-fired combustion turbine-based plants, one natural gas and fuel oil-fired steam-based plant, 13 geothermal steam turbine-based plants and one photovoltaic solar plant. Our wholesale geographic segments have an aggregate generation capacity of 7,590 MW in the West, 9,115 MW in Texas and 9,330 MW with an additional 361 MW under construction in the East. Inclusive of our power generation portfolio and our retail sales platforms, we serve customers in 23 states in the U.S. and in Canada and Mexico.

3

Our goal is to be recognized as the premier competitive power company in the U.S. as viewed by our employees, owners, customers and policy-makers as well as the communities in which our facilities are located. We seek to deliver long-term value through operational excellence at our power plants and in our customer and commercial activity, as well as through our disciplined approach to capital allocation.

THE MARKET FOR POWER

Our Power Markets and Market Fundamentals

The power industry represents one of the largest industries in the U.S. and affects nearly every aspect of our economy, with an estimated end-user market of approximately $398 billion in power sales in 2019 according to the EIA. Although different regions of the country have very different models and rules for competition, the markets in which we operate have some form of wholesale or retail market competition. California (included in our West segment), Texas (included in our Texas segment) and the Northeast and Mid-Atlantic regions (included in our East segment), which are the markets in which we have our largest presence, have emerged as among the most competitive wholesale and retail power markets in the U.S. We also operate, to a lesser extent, in competitive wholesale power markets in the Southeast. In addition to our sales of electrical power to wholesale and retail customers, our power plants produce and our customers require several other products. A description of the products we provide to our customers is below:

• | First, we provide power to utilities, independent electric system operators and industrial companies, retail power providers, municipalities, CCAs and other governmental entities, power marketers as well as retail commercial, industrial, governmental and residential customers. Our power sales occur in several different product categories including baseload (around the clock generation), intermediate (generation typically more expensive than baseload and utilized during higher demand periods to meet shifting demand needs), and peaking energy (most expensive variable cost and utilized during the highest demand periods), for which the latter is provided by some of our stand-alone peaking power plants/units and from our combined-cycle power plants by using technologies such as steam injection or duct firing additional burners in the heat recovery steam generators. |

• | Second, we provide capacity for sale to utilities, independent electric system operators and retail power providers. In various markets, retail power providers, including our affiliates, (or independent electric system operators on their behalf) are required to demonstrate adequate resources to meet their power sales commitments. To meet this obligation, they procure a market product known as capacity from power plant owners or resellers. Capacity auctions are held in the Northeast, Mid-Atlantic and certain Midcontinent regional markets. California has a bilateral capacity program. Texas does not presently have a capacity market or a requirement for retailers to ensure adequate resources. |

• | Third, we produce RECs primarily from our Geysers Assets in northern California. California has an RPS that requires load serving entities to have RECs for a certain percentage of their demand for the purpose of guaranteeing a certain level of renewable generation in the state or in neighboring areas. Because geothermal is a renewable source of energy, we receive a REC for each MWh we produce and are able to sell our RECs to load serving entities. We also purchase RECs from other sources for resale to our customers. |

• | Fourth, our cogeneration power plants produce steam, in addition to electricity, for sale to industrial customers for use in their manufacturing processes or heating, ventilation and air conditioning operations. |

• | Fifth, we provide ancillary service products to wholesale power markets. These products include the right for the purchaser to call on our generation to provide flexibility to the market and support operation of the electric grid. |

• | Of the five products above, we are active not only in production but also in the procurement of four of the five (excluding steam) on behalf of our retail customers. |

We also buy and sell emission allowances and credits, including those under California’s AB 32 GHG reduction program, Massachusetts’ CO2 reduction program, RGGI, the federal Acid Rain and CSAPR programs, and emission reduction credits under the federal Nonattainment New Source Review program.

Although all of the products mentioned above contribute to our financial performance and are the primary components of our Commodity Margin, the most important are our sales of wholesale power and capacity. We utilize long-term customer contracts for our power and steam sales where possible. For power and capacity that are not sold under customer contracts or longer-dated capacity auctions, we use our hedging program and retail channels and sell power into shorter term markets throughout the regions in which we participate.

4

The Price and Supply of Natural Gas

Approximately 96%, or 24,915 MW, of our generating capability’s fuel requirements are met with natural gas. We have approximately 725 MW of baseload capacity from our Geysers Assets and our expectation is that the steam reservoir at our Geysers Assets will be able to supply economic quantities of steam for the foreseeable future as our steam flow decline rates have become very small over the past several years. We also have approximately 391 MW of capacity from power plants where we purchase fuel oil to meet generation requirements, but generally do not expect fuel oil requirements to be material to our portfolio of power plants. In our East segment, where the supply of natural gas can be constrained under some weather circumstances, we have approximately 6,100 MW of dual-fueled capable power plants. Additionally, we have 4 MW of capacity from solar power generation technology with no fuel requirement.

We procure natural gas from multiple suppliers and transportation and storage sources. Although availability is generally not an issue, localized shortages (especially in extreme weather conditions in and around population centers), transportation availability and supplier financial stability issues can and do occur. When natural gas supply is constrained, some of our power plants benefit from the ability to operate on fuel oil instead of natural gas.

The price of natural gas, economic growth and environmental regulations affect our Commodity Margin and liquidity. The effect of changes in natural gas prices differs according to the time horizon and regional market conditions and depends on our hedge levels and other factors discussed below.

Much of our generating capacity is located in California (included in our West segment), Texas (included in our Texas segment) and the Northeast and Mid-Atlantic (included in our East segment) where natural gas-fired units set power prices during many hours. When natural gas is the price-setting fuel (i.e., when electricity demand exceeds available renewable generation and natural gas prices exceed the cost of available coal generation), increases in natural gas prices may increase our unhedged Commodity Margin because our combined-cycle power plants in those markets are more fuel-efficient than conventional natural gas-fired technologies and peaking power plants. Conversely, decreases in natural gas prices may decrease our unhedged Commodity Margin. In these instances, our cost of production advantage relative to less efficient natural gas-fired generation is diminished on an absolute basis until the point we are cheaper than any available coal on marginal economics. Additionally, in the Northeast and Mid-Atlantic regions, we have generating units capable of burning either natural gas or fuel oil. For these units, on the rare occasions when the cost of consuming natural gas is excessively high relative to fuel oil, our unhedged Commodity Margin may increase as a result of our ability to use the lower cost fuel.

Where we operate under long-term contracts, changes in natural gas prices can have a neutral effect on us in the short-term. This tends to be the case where we have entered into tolling agreements under which the customer provides the natural gas and we convert it to power for a fee, or where we enter into indexed-based agreements with a contractual Heat Rate at or near our actual Heat Rate for a monthly payment.

Changes in natural gas prices or power prices may also affect our liquidity. During periods of high or volatile natural gas or power prices, we could be required to post additional cash collateral or letters of credit.

Weather Patterns and Natural Events

Weather generally has a significant short-term effect on supply and demand for power and natural gas. Historically, demand for and the price of power is higher in the summer and winter seasons when temperatures are more extreme, and therefore, our unhedged revenues and Commodity Margin could be negatively affected by relatively cool summers or mild winters. However, our geographically diverse portfolio mitigates the effect on our Commodity Margin of weather in specific regions of the U.S. Additionally, a disproportionate amount of our total revenue is usually realized during the summer months of our third fiscal quarter. We expect this trend to continue in the future as U.S. demand for power generally peaks during this time.

Operating Heat Rate and Availability

Our fleet is modern and more efficient than the average generation fleet; accordingly, we run more and earn incremental margin in markets where less efficient natural gas units frequently set the power price. In such cases, our unhedged Commodity Margin is positively correlated with how much more efficient our fleet is than our competitors’ fleets and with higher natural gas prices. Efficient operation of our fleet creates the opportunity to capture Commodity Margin in a cost effective manner. However, unplanned outages during periods when Commodity Margin is positive could result in a loss of that opportunity. We generally measure our fleet performance based on our availability factors, operating Heat Rate and operating and maintenance expense. The higher our availability factor, the better positioned we are to capture Commodity Margin. The lower our operating Heat Rate compared to the Market Heat Rate, the more favorable the effect on our Commodity Margin.

5

Regulatory and Environmental Trends

For a discussion of federal, state and regional legislative and regulatory initiatives and how they might affect us, see “— Governmental and Regulatory Matters.” It is very difficult to predict the continued evolution of our markets due to the uncertainty of various risk factors which could affect our business. A description of these risk factors is included under Item 1A. “Risk Factors.”

Competition

Wholesale power generation is a capital-intensive, commodity-driven business with numerous industry participants. We compete against other independent power producers, power marketers and trading companies, including those owned by financial institutions, retail load aggregators, municipalities, retail power providers, cooperatives and regulated utilities to supply power and power-related products to our customers in major markets in the U.S. and Canada. In addition, in some markets, we compete against some of our customers.

In markets with centralized ISOs, such as California, Texas, the Northeast and Mid-Atlantic, our natural gas-fired power plants compete directly with all other sources of power. The EIA estimates that in 2019, 38% of the power generated in the U.S. was fueled by natural gas, 24% by coal, 20% by nuclear facilities and the remaining 18% of power generated by hydroelectric, fuel oil, geothermal and other energy sources. We are subject to complex and stringent energy, environmental and other governmental laws and regulations at the federal, state and local levels in connection with the development, ownership and operation of our power plants. For a further discussion of the environmental and other governmental regulations that affect us, see “— Governmental and Regulatory Matters.”

Competition from renewable generation and energy storage is likely to continue to increase in the future. Federal and state financial incentives and RPS requirements continue to foster renewables development.

Retail electricity and natural gas is similarly a commodity-driven business with numerous industry participants. We compete against other integrated power companies, regulated utilities, other retail power providers, brokers, trading companies including those owned by financial institutions, retail load aggregators, municipalities and cooperatives to supply power and power-related products to our customers in major markets in the U.S. and Canada.

MARKETING, HEDGING AND OPTIMIZATION ACTIVITIES

Our commercial hedging and optimization strategies are designed to maximize our risk-adjusted Commodity Margin by leveraging our knowledge, experience and fundamental views on natural gas and power. Additionally, we seek strong bilateral relationships with load serving entities that can benefit us and our customers. Our retail portfolio has been established to provide an additional source of liquidity for our generation fleet as we hedge retail load from our wholesale generation assets as appropriate.

The majority of our risk exposures arise from our ownership and operation of power plants. Our primary risk exposures are Spark Spread, power prices, natural gas prices, capacity prices, locational price differences in power and in natural gas, natural gas transportation, electric transmission, REC prices, carbon allowance prices in California and the Northeast and other emissions credit prices. In addition to the direct risk exposure to commodity prices, we also have general market risks such as risk related to performance of our counterparties and customers and plant operating performance risk.

Our operations are commodity intensive. We produced approximately 103 billion KWh of electricity in 2019 across North America and consumed approximately 790 Bcf of natural gas, making us one of the largest producers of electricity and consumers of natural gas in North America. Additionally, our retail affiliates provided approximately 60 billion KWh to customers in 2019. We actively manage our commodity risk exposures with a variety of physical and financial instruments with varying time horizons. These instruments include PPAs, tolling arrangements, Heat Rate swaps and options, retail power sales including through our retail subsidiaries, steam sales, buying and selling standard physical power and natural gas products, buying and selling exchange traded instruments, buying and selling environmental and capacity products, natural gas transportation and storage arrangements, electric transmission service and other contracts for the sale and purchase of power products. We utilize these instruments to maximize the risk-adjusted returns for our Commodity Margin.

At any point in time, the relative quantity of our products hedged or sold under longer-term contracts is determined by the availability of forward product sales opportunities and our view of the attractiveness of the pricing available for forward sales. We have economically hedged a portion of our expected generation and natural gas portfolio as well as retail load supply obligations, where appropriate, mostly through power and natural gas forward physical and financial transactions including retail power sales; however, we currently remain susceptible to significant price movements for 2020 and beyond. When we elect to enter into these transactions, we are able to economically hedge a portion of our Spark Spread at pre-determined generation and price levels.

We conduct our hedging and optimization activities within a structured risk management framework based on controls, policies and procedures. We monitor these activities through active and ongoing management and oversight, defined roles and

6

responsibilities, and daily risk estimates and reporting. Additionally, we seek to manage the associated risks through diversification, by controlling position sizes, by using portfolio position limits, and by actively managing hedge positions to lock in margin. We are exposed to commodity price movements (both profits and losses) in connection with these transactions. These positions are included in and subject to our consolidated risk management portfolio position limits and controls structure. Our future hedged status and marketing and optimization activities are subject to change as determined by our commercial operations group, Chief Risk Officer, senior management and Board of Directors. For control purposes, we have VAR limits that govern the overall risk of our portfolio of power plants, energy contracts, financial hedging transactions and other contracts. Our VAR limits, transaction approval limits and other risk related controls are dictated by our Risk Management Policy which is approved by our Board of Directors and by a committee comprised of members of our senior management and administered by our Chief Risk Officer’s organization. The Chief Risk Officer’s organization is segregated from the commercial operations and retail units and reports directly to our Audit Committee and Chief Financial Officer. Our Risk Management Policy is primarily designed to provide us with a degree of protection from significant downside commodity price risk exposure to our cash flows.

We have historically used interest rate hedging instruments to adjust the mix between our fixed and variable rate debt. To the extent eligible, our interest rate hedging instruments have been designated as cash flow hedges, and changes in fair value are recorded in OCI with gains and losses reclassified into earnings in the same period during which the hedged forecasted transaction affects earnings.

SEGMENT AND SIGNIFICANT CUSTOMER INFORMATION

See Note 18 of the Notes to Consolidated Financial Statements for a discussion of financial information by reportable segment and geographic area and significant customer information for the years ended December 31, 2019, 2018 and 2017.

7

DESCRIPTION OF OUR OPERATIONS

Geographic Diversity | Dispatch Technology |

| |

| |

8

Power Plants in Operation

We own 77 power plants, including one under construction, with an aggregate generation capacity of 26,035 MW and 361 MW under construction.

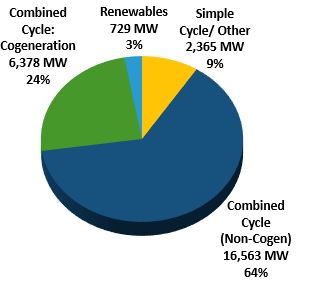

Natural Gas-Fired Fleet

Our natural gas-fired power plants primarily utilize two types of designs: 1,640 MW of simple-cycle combustion turbines and 22,941 MW of combined-cycle combustion turbines and a small portion from conventional natural gas/oil-fired boilers with steam turbines. Simple-cycle combustion turbines burn natural gas or fuel oil to spin an electric generator to produce power. A combined-cycle unit combusts fuel like a simple-cycle combustion turbine and the exhaust heat is captured by a heat recovery boiler to create steam which can then spin a steam turbine. Simple-cycle turbines are easier to maintain, but combined-cycle turbines operate with much higher efficiency. Each of our power plants currently in operation is capable of producing power for sale to a utility, another third-party end user, our retail customers or an intermediary such as a marketing company. At 12 of our power plants, we also produce thermal energy (primarily steam and chilled water), which can be sold to industrial and governmental users. These plants are called combined heat and power facilities.

Our Steam Adjusted Heat Rate for 2019 for the power plants we operate was 7,326 Btu/KWh which results in a power conversion efficiency of approximately 47%. The power conversion efficiency is a measure of how efficiently a fossil fuel power plant converts thermal energy to electrical energy. Our Steam Adjusted Heat Rate includes all fuel required to dispatch our power plants including “start-up” and “shut-down” fuel, as well as all non-steady state operations. Once our power plants achieve steady state operations, our combined-cycle power plants achieve an average power conversion efficiency of approximately 50%. Additionally, we also sell steam from our combined heat and power plants, which improves our power conversion efficiency in steady state operations from these power plants to an average of approximately 53%. Due to our modern combustion turbine fleet, our power conversion efficiency is significantly better than that of older technology natural gas-fired power plants and coal-fired power plants, which typically have power conversion efficiencies that range from 28% to 36%.

Our natural gas fleet is relatively young with a weighted average age, based upon MW capacities in operation, of approximately 19 years.

Geothermal Fleet

Our Geysers Assets are a 725 MW fleet of 13 operating power plants in northern California. Geothermal power is considered renewable energy because the steam harnessed to power our turbines is produced inside the Earth and does not require burning fuel. The steam is produced below the Earth’s surface from reservoirs of hot water, both naturally occurring and injected. The steam is piped directly from the underground production wells to the power plants and used to spin turbines to generate power. Unlike other renewable resources such as wind or sunlight, which depend on intermittent sources to generate power, geothermal power provides a consistent source of energy as evidenced by our Geysers Assets’ availability of approximately 86% in 2019, which reflects the impact of a third-party transmission outage at our Geysers Assets associated with a wildfire during the fourth quarter of 2019. The sale of RECs to customers is an important separate income stream for our Geysers Assets.

We inject water back into the steam reservoir, which extends the useful life of the resource and helps to maintain the output of our Geysers Assets. The water we inject comes from the condensate associated with the steam extracted to generate power, wells and creeks, as well as water purchase agreements for reclaimed water. We receive and inject an average of approximately 15 million gallons of reclaimed water per day into the geothermal steam reservoir at The Geysers where the water is naturally heated by the Earth, creating additional steam to fuel our Geysers Assets. Approximately 12 million gallons per day are received from the Santa Rosa Geysers Recharge Project, which we developed jointly with the City of Santa Rosa, and we receive, on average, approximately three million gallons a day from The Lake County Recharge Project from Lake County. As a result of these recharge projects, MWh production has been relatively constant. We expect that, as a result of the water injection program, the reservoir at our Geysers Assets will be able to supply economic quantities of steam for the foreseeable future.

We periodically review our geothermal studies to help us assess the economic life of our geothermal reserves. Our most recent geothermal reserve study was conducted in 2019. Our evaluation of our geothermal reserves, including our review of any applicable independent studies conducted, indicated that our Geysers Assets should continue to supply sufficient steam to generate positive cash flows at least through 2079. In reaching this conclusion, our evaluation, consistent with the due diligence study of 2019, assumes that defined “proved reserves” are those quantities of geothermal energy which, by analysis of geological and engineering data, can be estimated with reasonable certainty to be commercially recoverable, from a given date forward, from known reservoirs and under current economic conditions, operating methods and government regulations.

We lease the geothermal steam fields from which we extract steam for our Geysers Assets. We have leasehold mineral interests in 105 leases comprising approximately 28,000 acres of federal, state and private geothermal resource lands in The

9

Geysers region of northern California. Our leases cover one contiguous area of property that comprises approximately 45 square miles in the northwest corner of Sonoma County and southeast corner of Lake County. The approximate breakout by volume of steam removed under the above leases for the year ended 2019 is:

• | 26% related to leases with the federal government via the Office of Natural Resources Revenue, |

• | 31% related to leases with the California State Lands Commission and |

• | 43% related to leases with private landowners/leaseholders. |

In general, our geothermal leases grant us the exclusive right to drill for, produce and sell geothermal resources from these properties and the right to use the surface for all related purposes. Each lease requires the payment of annual rent until commercial quantities of geothermal resources are established. After such time, the leases require the payment of minimum advance royalties or other payments until production commences, at which time production royalties are payable on a monthly basis from 10 to 31 days (depending upon the lease terms) following the close of the production month. Such royalties and other payments are payable to landowners, state and federal agencies and others, and vary widely as to the particular lease. In general, royalties payable are calculated based upon a percentage of total gross revenue received by us associated with our geothermal leases. Each lease’s royalty calculation is based upon its percentage of revenue as calculated by its steam generated relative to the total steam generated by our Geysers Assets as a whole.

Our geothermal leases are generally for initial terms varying from five to 20 years and for so long thereafter as geothermal resources are produced and sold. Most of our geothermal leases were signed in excess of 30 years ago. Our federal leases are, in general, for an initial 10-year period with renewal clauses for an additional 40 years for a maximum of 50 years. The 50-year term expires in 2024 for four of our federal leases. However, our federal leases allow for a preferential right to renewal for a second 40-year term on such terms and conditions as the lessor deems appropriate if, at the end of the initial 40-year term, geothermal steam is being produced or utilized in commercial quantities. The majority of our other leases run through the economic life of our Geysers Assets and provide for renewals so long as geothermal resources are being produced or utilized, or are capable of being produced or utilized, in commercial quantities from the leased land or from land unitized with the leased land. Although we believe that we will be able to renew our leases through the economic life of our Geysers Assets on terms that are acceptable to us, it is possible that certain of our leases may not be renewed, or may be renewable only on less favorable terms.

In addition, we hold 40 geothermal leases comprising approximately 43,840 acres of federal geothermal resource lands in the Glass Mountain area in northern California, which is separate from The Geysers region. Four test production wells were drilled prior to our acquisition of these leases and we have drilled one test well since their acquisition, which produced commercial quantities of steam during flow tests. However, the properties subject to these leases have not been developed and there can be no assurance that these leases will ultimately be developed.

Other Power Generation Technologies

We also have 725 MW of older, less efficient technology at our Edge Moor Energy Center which has conventional steam turbine technology and 4 MW of capacity from solar power generation technology at our Vineland Solar Energy Center in New Jersey.

Retail Operations

Our retail segment provides energy and related services to commercial, industrial, governmental and residential customers through our retail subsidiaries which consist of Calpine Solutions and Champion Energy (including North American Power). Our retail operations have an overlapping presence with our wholesale business in California, Texas and the Northeast and Mid-Atlantic regions of the U.S and provided approximately 60 billion KWh to customers in 2019 consisting of approximately 6 million annualized residential customer equivalents. Thus, our retail segment geographically and strategically complements our wholesale generation fleet providing access to forward market liquidity through both direct and mass market retail sales channels.

10

Table of Operating Power Plants and Project Under Construction

Set forth below is certain information regarding our operating power plants and project under construction at January 28, 2020.

SEGMENT / Power Plant | NERC Region | U.S. State or Canadian Province | Technology | Calpine Interest Percentage | Calpine Net Interest Baseload (MW)(1)(3) | Calpine Net Interest With Peaking (MW)(2)(3) | 2019 Total MWh Generated(4) | |||||||||||

WEST | ||||||||||||||||||

Geothermal | ||||||||||||||||||

McCabe #5 & #6 | WECC | CA | Renewable | 100 | % | 84 | 84 | 635,462 | ||||||||||

Ridge Line #7 & #8 | WECC | CA | Renewable | 100 | % | 76 | 76 | 546,804 | ||||||||||

Calistoga | WECC | CA | Renewable | 100 | % | 69 | 69 | 400,526 | ||||||||||

Eagle Rock | WECC | CA | Renewable | 100 | % | 68 | 68 | 606,753 | ||||||||||

Big Geysers | WECC | CA | Renewable | 100 | % | 61 | 61 | 351,745 | ||||||||||

Lake View | WECC | CA | Renewable | 100 | % | 54 | 54 | 491,695 | ||||||||||

Quicksilver | WECC | CA | Renewable | 100 | % | 53 | 53 | 368,140 | ||||||||||

Sonoma | WECC | CA | Renewable | 100 | % | 53 | 53 | 350,221 | ||||||||||

Cobb Creek | WECC | CA | Renewable | 100 | % | 51 | 51 | 350,775 | ||||||||||

Socrates | WECC | CA | Renewable | 100 | % | 50 | 50 | 299,620 | ||||||||||

Sulphur Springs | WECC | CA | Renewable | 100 | % | 47 | 47 | 456,099 | ||||||||||

Grant | WECC | CA | Renewable | 100 | % | 41 | 41 | 244,322 | ||||||||||

Aidlin | WECC | CA | Renewable | 100 | % | 18 | 18 | 106,159 | ||||||||||

Natural Gas-Fired | ||||||||||||||||||

Delta Energy Center | WECC | CA | Combined Cycle | 100 | % | 835 | 857 | 3,540,562 | ||||||||||

Pastoria Energy Center | WECC | CA | Combined Cycle | 100 | % | 780 | 759 | 4,061,160 | ||||||||||

Hermiston Power Project | WECC | OR | Combined Cycle | 100 | % | 566 | 635 | 4,303,231 | ||||||||||

Russell City Energy Center(5) | WECC | CA | Combined Cycle | 100 | % | 572 | 619 | 662,160 | ||||||||||

Otay Mesa Energy Center | WECC | CA | Combined Cycle | 100 | % | 513 | 608 | 751,810 | ||||||||||

Metcalf Energy Center | WECC | CA | Combined Cycle | 100 | % | 564 | 605 | 2,566,516 | ||||||||||

Sutter Energy Center | WECC | CA | Combined Cycle | 100 | % | 542 | 578 | 653,076 | ||||||||||

Los Medanos Energy Center | WECC | CA | Cogen | 100 | % | 518 | 572 | 2,707,147 | ||||||||||

South Point Energy Center | WECC | AZ | Combined Cycle | 100 | % | 520 | 530 | 1,883,597 | ||||||||||

Los Esteros Critical Energy Facility | WECC | CA | Combined Cycle | 100 | % | 243 | 309 | 216,237 | ||||||||||

Gilroy Energy Center | WECC | CA | Simple Cycle | 100 | % | — | 141 | 26,680 | ||||||||||

Gilroy Cogeneration Plant | WECC | CA | Cogen | 100 | % | 109 | 130 | 89,536 | ||||||||||

King City Cogeneration Plant | WECC | CA | Cogen | 100 | % | 120 | 120 | 161,388 | ||||||||||

Wolfskill Energy Center | WECC | CA | Simple Cycle | 100 | % | — | 48 | 7,008 | ||||||||||

Yuba City Energy Center | WECC | CA | Simple Cycle | 100 | % | — | 47 | 28,995 | ||||||||||

Feather River Energy Center | WECC | CA | Simple Cycle | 100 | % | — | 47 | 12,321 | ||||||||||

Creed Energy Center | WECC | CA | Simple Cycle | 100 | % | — | 47 | 11,763 | ||||||||||

Lambie Energy Center | WECC | CA | Simple Cycle | 100 | % | — | 47 | 12,245 | ||||||||||

Goose Haven Energy Center | WECC | CA | Simple Cycle | 100 | % | — | 47 | 11,509 | ||||||||||

Riverview Energy Center | WECC | CA | Simple Cycle | 100 | % | — | 47 | 20,042 | ||||||||||

King City Peaking Energy Center | WECC | CA | Simple Cycle | 100 | % | — | 44 | 6,038 | ||||||||||

Agnews Power Plant | WECC | CA | Combined Cycle | 100 | % | 28 | 28 | 6,613 | ||||||||||

Subtotal | 6,635 | 7,590 | 26,947,955 | |||||||||||||||

11

SEGMENT / Power Plant | NERC Region | U.S. State or Canadian Province | Technology | Calpine Interest Percentage | Calpine Net Interest Baseload (MW)(1)(3) | Calpine Net Interest With Peaking (MW)(2)(3) | 2019 Total MWh Generated(4) | |||||||||||

TEXAS | ||||||||||||||||||

Deer Park Energy Center | TRE | TX | Cogen | 100 | % | 1,103 | 1,204 | 6,775,720 | ||||||||||

Guadalupe Energy Center | TRE | TX | Combined Cycle | 100 | % | 1,009 | 1,000 | 5,481,210 | ||||||||||

Baytown Energy Center | TRE | TX | Cogen | 100 | % | 810 | 896 | 4,746,868 | ||||||||||

Channel Energy Center | TRE | TX | Cogen | 100 | % | 732 | 817 | 4,172,535 | ||||||||||

Pasadena Power Plant(6) | TRE | TX | Cogen/Combined Cycle | 100 | % | 763 | 781 | 4,266,517 | ||||||||||

Bosque Energy Center | TRE | TX | Combined Cycle | 100 | % | 760 | 782 | 4,257,071 | ||||||||||

Freestone Energy Center | TRE | TX | Combined Cycle | 75 | % | 779 | 746 | 5,536,148 | ||||||||||

Magic Valley Generating Station | TRE | TX | Combined Cycle | 100 | % | 682 | 712 | 2,865,506 | ||||||||||

Jack A. Fusco Energy Center(7) | TRE | TX | Combined Cycle | 100 | % | 523 | 609 | 2,343,664 | ||||||||||

Corpus Christi Energy Center | TRE | TX | Cogen | 100 | % | 426 | 500 | 2,047,276 | ||||||||||

Texas City Power Plant | TRE | TX | Cogen | 100 | % | 400 | 453 | 1,743,106 | ||||||||||

Hidalgo Energy Center | TRE | TX | Combined Cycle | 78.5 | % | 397 | 379 | 2,136,301 | ||||||||||

Freeport Energy Center(8) | TRE | TX | Cogen | 100 | % | 210 | 236 | 1,092,978 | ||||||||||

Subtotal | 8,594 | 9,115 | 47,464,900 | |||||||||||||||

EAST | ||||||||||||||||||

Bethlehem Energy Center | RFC | PA | Combined Cycle | 100 | % | 960 | 1,130 | 4,721,711 | ||||||||||

Hay Road Energy Center | RFC | DE | Combined Cycle | 100 | % | 931 | 1,130 | 1,473,514 | ||||||||||

York 2 Energy Center | RFC | PA | Combined Cycle | 100 | % | 668 | 828 | 4,073,106 | ||||||||||

Morgan Energy Center | SERC | AL | Cogen | 100 | % | 720 | 807 | 3,121,040 | ||||||||||

Fore River Energy Center | NPCC | MA | Combined Cycle | 100 | % | 750 | 731 | 4,403,186 | ||||||||||

Edge Moor Energy Center | RFC | DE | Steam Cycle | 100 | % | — | 725 | 146,670 | ||||||||||

Granite Ridge Energy Center | NPCC | NH | Combined Cycle | 100 | % | 745 | 695 | 3,025,593 | ||||||||||

York Energy Center | RFC | PA | Combined Cycle | 100 | % | 464 | 565 | 1,379,992 | ||||||||||

Westbrook Energy Center | NPCC | ME | Combined Cycle | 100 | % | 552 | 552 | 958,466 | ||||||||||

Greenfield Energy Centre(9) | NPCC | ON | Combined Cycle | 50 | % | 422 | 519 | 1,075,167 | ||||||||||

Zion Energy Center | RFC | IL | Simple Cycle | 100 | % | — | 503 | 663,766 | ||||||||||

Pine Bluff Energy Center | SERC | AR | Cogen | 100 | % | 184 | 215 | 1,169,631 | ||||||||||

Cumberland Energy Center | RFC | NJ | Simple Cycle | 100 | % | — | 191 | 95,697 | ||||||||||

Kennedy International Airport Power Plant | NPCC | NY | Cogen | 100 | % | 110 | 121 | 483,081 | ||||||||||

Sherman Avenue Energy Center | RFC | NJ | Simple Cycle | 100 | % | — | 92 | 24,265 | ||||||||||

Bethpage Energy Center 3 | NPCC | NY | Combined Cycle | 100 | % | 60 | 80 | 111,104 | ||||||||||

Carll’s Corner Energy Center | RFC | NJ | Simple Cycle | 100 | % | — | 73 | 5,911 | ||||||||||

Mickleton Energy Center | RFC | NJ | Simple Cycle | 100 | % | — | 67 | 60 | ||||||||||

Bethpage Power Plant | NPCC | NY | Combined Cycle | 100 | % | 55 | 56 | 195,701 | ||||||||||

Christiana Energy Center | RFC | DE | Simple Cycle | 100 | % | — | 53 | 189 | ||||||||||

Bethpage Peaker | NPCC | NY | Simple Cycle | 100 | % | — | 48 | 45,293 | ||||||||||

Stony Brook Power Plant | NPCC | NY | Cogen | 100 | % | 45 | 47 | 288,650 | ||||||||||

Tasley Energy Center | RFC | VA | Simple Cycle | 100 | % | — | 33 | 657 | ||||||||||

Delaware City Energy Center | RFC | DE | Simple Cycle | 100 | % | — | 23 | 157 | ||||||||||

West Energy Center | RFC | DE | Simple Cycle | 100 | % | — | 20 | 78 | ||||||||||

12

SEGMENT / Power Plant | NERC Region | U.S. State or Canadian Province | Technology | Calpine Interest Percentage | Calpine Net Interest Baseload (MW)(1)(3) | Calpine Net Interest With Peaking (MW)(2)(3) | 2019 Total MWh Generated(4) | |||||||||||

Bayview Energy Center | RFC | VA | Simple Cycle | 100 | % | — | 12 | 2,585 | ||||||||||

Crisfield Energy Center | RFC | MD | Simple Cycle | 100 | % | — | 10 | 657 | ||||||||||

Vineland Solar Energy Center | RFC | NJ | Renewable | 100 | % | — | 4 | 5,348 | ||||||||||

Subtotal | 6,666 | 9,330 | 27,471,275 | |||||||||||||||

Total operating power plants | 76 | 21,895 | 26,035 | 101,884,130 | ||||||||||||||

Power plants sold during 2019 | ||||||||||||||||||

RockGen Energy Center | MRO | WI | Simple Cycle | 100 | % | n/a | n/a | 152,712 | ||||||||||

Garrison Energy Center | RFC | DE | Combined Cycle | 100 | % | n/a | n/a | 976,547 | ||||||||||

Whitby Cogeneration(10) | NPCC | ON | Cogen | 50 | % | n/a | n/a | 75,260 | ||||||||||

Subtotal | 1,204,519 | |||||||||||||||||

Total operating and sold power plants | 103,088,649 | |||||||||||||||||

Project Under Construction | ||||||||||||||||||

Washington Parish Energy Center(11) | SERC | LA | Simple Cycle | 100 | % | — | 361 | n/a | ||||||||||

Total operating power plants and project under construction | 21,895 | 26,396 | ||||||||||||||||

___________

(1) | Natural gas-fired fleet capacities are generally derived on as-built as-designed outputs, including upgrades, based on site specific annual average temperatures and average process steam flows for cogeneration power plants, as applicable. Geothermal capacities are derived from historical generation output and steam reservoir modeling under average ambient conditions (temperatures and rainfall). |

(2) | Natural gas-fired fleet peaking capacities are primarily derived on as-built as-designed peaking outputs based on site specific average summer temperatures and include power enhancement features such as heat recovery steam generator duct-firing, gas turbine power augmentation, and/or other power augmentation features. For certain power plants with definitive contracts, capacities at contract conditions have been included. Oil-fired capacities reflect capacity test results. |

(3) | These outputs do not factor in the typical MW loss and recovery profiles over time, which natural gas-fired turbine power plants display associated with their planned major maintenance schedules. |

(4) | MWh generation is shown here as our net operating interest. |

(5) | On January 28, 2020 we purchased the 25% interest in Russell City Energy Center owned by a third party. MWh generation for 2019 reflects our net interest at the time of generation. Subsequent to the acquisition, we will reflect 100% of the results of our 619 MW Russell City Energy Center in our earnings. |

(6) | Pasadena is comprised of 260 MW of cogen technology and 521 MW of combined cycle (non-cogen) technology. |

(7) | Formerly our Brazos Valley Power Plant, which was renamed in December 2017. |

(8) | Freeport Energy Center is owned by Calpine; however, it is contracted and operated by The Dow Chemical Company. |

(9) | Calpine holds a 50% partnership interest in Greenfield LP through its subsidiaries; however, it is operated by a third party. |

(10) | On November 20, 2019, we sold our 50% partnership interest in Whitby Cogeneration. |

(11) | A third party will purchase a 100% ownership interest in this power plant upon achieving commercial operation. |

Substantially all of the power plants in which we have an interest are located on sites which we either own or lease on a long-term basis.

GOVERNMENTAL AND REGULATORY MATTERS

We are subject to complex and stringent energy, environmental and other laws and regulations at the federal, state and local levels as well as within the RTO and ISO markets in which we participate in connection with the development, ownership and operation of our power plants. Federal and state legislative and regulatory actions, including those by ISO/RTOs, continue to have an effect on our business. Some of the more significant governmental and regulatory matters that affect our business are discussed below.

13

Power and Natural Gas Matters

Federal Regulation of Power

FERC Jurisdiction

The Federal Power Act (“FPA”) grants the federal government broad authority over electric utilities and independent power producers, and vests its authority in the FERC. Unless otherwise exempt, any person that owns or operates facilities used for the wholesale sale or transmission of power in interstate commerce is a public utility subject to FERC’s jurisdiction. The FERC governs, among other things, the disposition of certain utility property, the issuance of securities by public utilities, the rates, the terms and conditions for the transmission or wholesale sale of power in interstate commerce, the interlocking directorates, and the uniform system of accounts and reporting requirements for public utilities.

Our power plants, outside of ERCOT, are subject to FERC’s jurisdiction as either exempt wholesale generators (“EWGs”) under the FPA or QFs under PURPA. Most of our affiliates have been granted authority to sell power at market-based rates and have been granted certain waivers of FERC reporting and accounting regulations. However, we cannot assure that such authorities or waivers will not be revoked in the future for these affiliates.

The FERC has civil penalty authority over violations of any provision of Part II of the FPA, as well as any rule or order issued thereunder. The FERC is authorized to assess a maximum civil penalty of approximately $1.29 million per violation for each day that the violation continues. The FPA also provides for the assessment of criminal fines and imprisonment for violations under Part II of the FPA. This penalty authority was enhanced in the Energy Policy Act of 2005 (“EPAct 2005”).

Pursuant to EPAct 2005, NERC has been certified by the FERC as the Electric Reliability Organization to develop and enforce reliability standards and critical infrastructure protection standards, which protect the bulk power system against potential disruptions from cyber and physical security breaches. The NERC standards are applicable throughout the U.S. and are subject to FERC review and approval. FERC-approved reliability standards may be enforced by the FERC independently, or, alternatively, by the NERC and the regional reliability organizations with frontline responsibility for auditing, investigating and otherwise ensuring compliance with reliability standards, subject to the FERC’s oversight. The critical infrastructure protection standards focus on controlling access to critical physical and cybersecurity assets, including supervisory control and data acquisition systems for the electric grid. Compliance with these standards is mandatory. Monetary penalties of approximately $1.29 million per day per violation may be assessed for violations of the reliability and critical infrastructure protection standards.

State Regulation of Power

State Public Utility Commissions, or PUC(s), have historically had broad authority to regulate both the rates charged by, and the financial activities of, electric utilities operating in their states and to promulgate regulation for implementation of PURPA. Since all of our generation affiliates are either QFs or EWGs, none of them are currently subject to direct rate regulation by a state PUC. However, states may assert jurisdiction over the siting and construction of power generating facilities including QFs and EWGs and, with the exception of QFs, over the issuance of securities and the sale or other transfer of assets by these facilities. State PUCs also maintain extensive control over the procurement of wholesale power by the utilities that they regulate. Many of these utilities are our customers, and agreements between us and these counterparties often require approval by state PUCs.