|

Celebrating 25 Years as a Public Company |

|

Form 10-K ♦ Page 1 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number

(Exact name of registrant as specified in its charter)

|

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

(Address of principal executive offices) |

|

(Zip Code) |

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|

MLM |

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

|

|

No ☐ |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

|

|

Yes ☐ |

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

|

|

No ☐ |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

|

|

|

No ☐ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☒ |

Accelerated filer |

☐ |

|

Non-accelerated filer |

|

☐ |

Smaller reporting company |

|

|

|

|

|

Emerging growth company |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

|

Yes |

No ☒ |

As of June 28, 2019, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $

Indicate the number of shares outstanding of each of the issuer’s classes of common stock on the latest practicable date.

|

Class |

|

Outstanding at February 14, 2020 |

|

Common Stock, $.01 par value per share |

|

|

DOCUMENTS INCORPORATED BY REFERENCE

|

Document |

|

Parts Into Which Incorporated |

|

Proxy Statement for the Annual Meeting of Shareholders to be held May 14, 2020 (Proxy Statement) |

|

Part III |

TABLE OF CONTENTS

|

1 |

||

|

|

|

|

|

ITEM 1. |

1 |

|

|

|

|

|

|

ITEM 1A. |

14 |

|

|

|

|

|

|

ITEM 1B. |

25 |

|

|

|

|

|

|

ITEM 2. |

25 |

|

|

|

|

|

|

ITEM 3. |

28 |

|

|

|

|

|

|

ITEM 4. |

28 |

|

|

|

|

|

|

29 |

||

|

|

|

|

|

30 |

||

|

|

|

|

|

ITEM 5. |

30 |

|

|

|

|

|

|

ITEM 6. |

32 |

|

|

|

|

|

|

ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

34 |

|

|

|

|

|

ITEM 7A. |

71 |

|

|

|

|

|

|

ITEM 8. |

72 |

|

|

|

|

|

|

ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

118 |

|

|

|

|

|

ITEM 9A. |

118 |

|

|

|

|

|

|

ITEM 9B. |

119 |

|

|

|

|

|

|

120 |

||

|

|

|

|

|

ITEM 10. |

120 |

|

|

|

|

|

|

ITEM 11. |

120 |

|

|

|

|

|

|

ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

120 |

|

|

|

|

|

ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

120 |

|

|

|

|

|

ITEM 14. |

120 |

|

|

121 |

||

|

|

|

|

|

ITEM 15. |

121 |

|

|

|

|

|

|

ITEM 16. |

126 |

|

|

|

|

|

|

127 |

||

Part I ♦ Item 1 – Business

PART I

ITEM 1 – BUSINESS

General

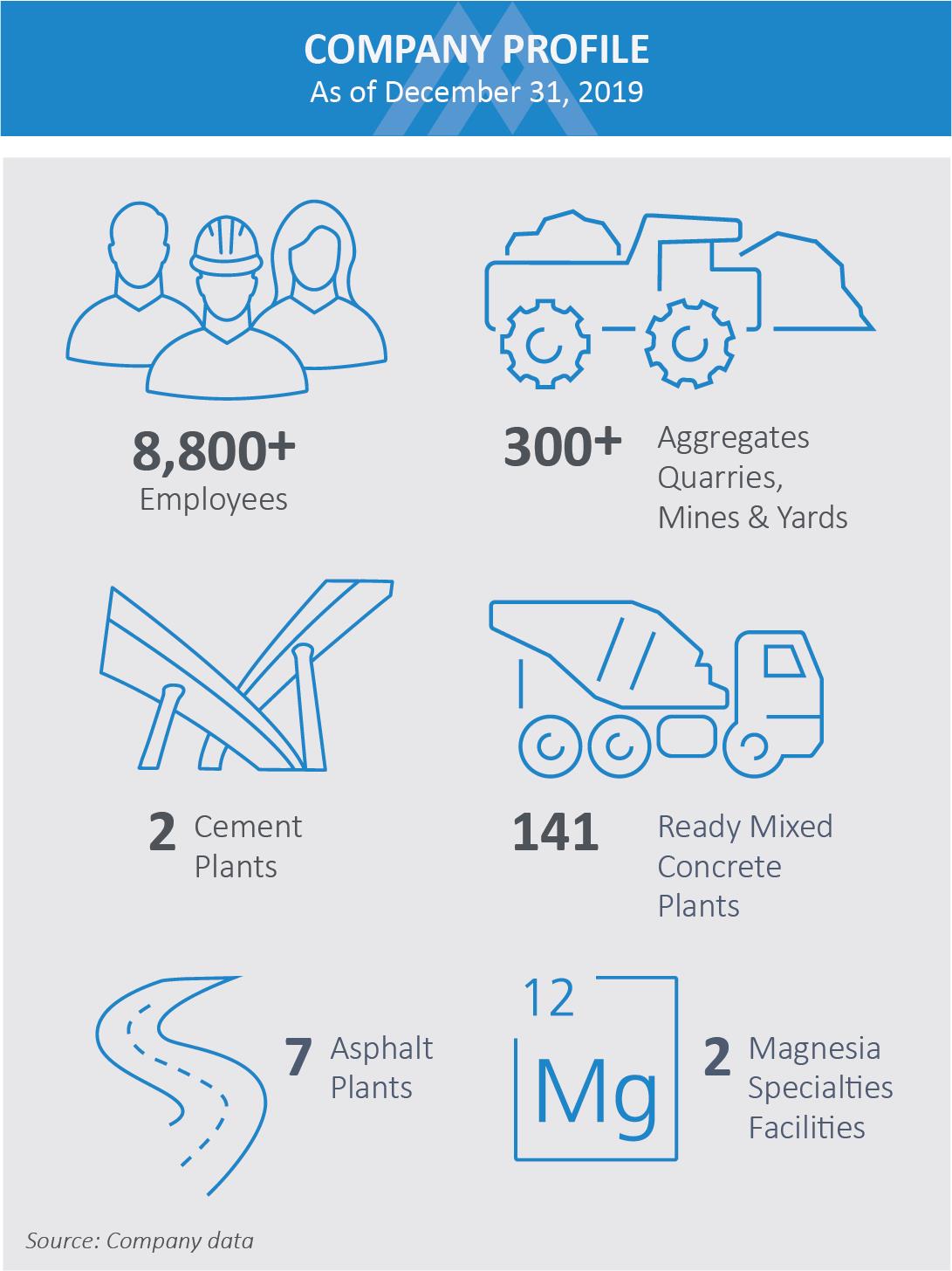

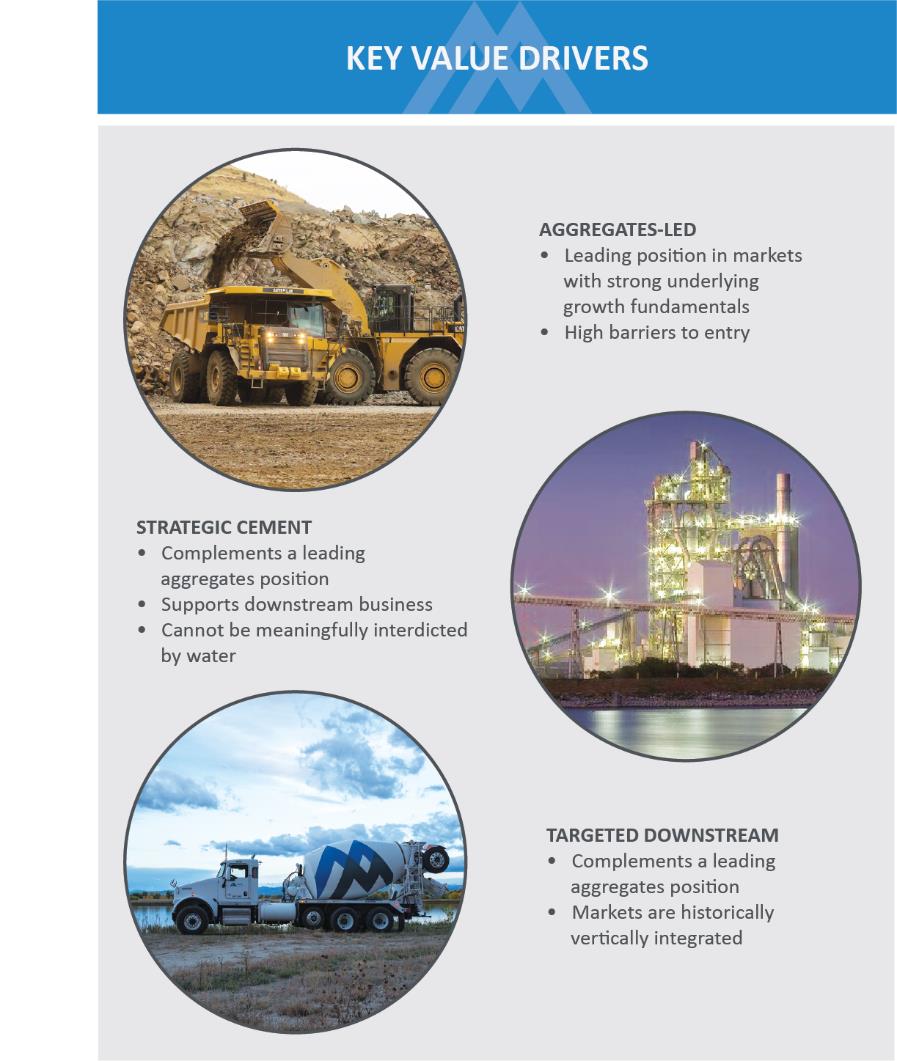

Martin Marietta Materials, Inc. (the “Company” or “Martin Marietta”) is a natural resource-based building materials company. The Company supplies aggregates (crushed stone, sand and gravel) through its network of more than 300 quarries, mines and distribution yards in 27 states, Canada, the Bahamas and the Caribbean Islands. In the western United States, Martin Marietta also provides cement and downstream products, namely, ready mixed concrete, asphalt and paving services in markets where the Company has a leading aggregates position. Specifically, the Company has two cement plants in Texas, and ready mixed concrete and asphalt operations in Texas, Colorado, Louisiana, Arkansas, and Wyoming. Paving services are exclusively in Colorado. The Company’s heavy-side building materials are used in infrastructure, nonresidential and residential construction projects. Aggregates are also used in agricultural, utility and environmental applications and as railroad ballast. The aggregates, cement, ready mixed concrete and asphalt and paving product lines are reported collectively as the “Building Materials” business. The Company also operates a Magnesia Specialties business with production facilities in Michigan and Ohio. The Magnesia Specialties business produces magnesia-based chemical products that are used in industrial, agricultural and environmental applications. It also produces dolomitic lime sold primarily to customers in the steel and mining industries. Magnesia Specialties’ products are shipped to customers worldwide.

The Company was formed in 1993 as a North Carolina corporation to serve as successor to the operations of the materials group of the organization that is now Lockheed Martin Corporation. An initial public offering of a portion of the Company’s common stock was completed in 1994, followed by a tax-free exchange transaction in 1996 that resulted in 100% of the Company’s common stock being publicly traded.

The Company completed over 90 smaller acquisitions from the time of its initial public offering until the present, which allowed the Company to enhance and expand its aggregates-led presence in the building materials marketplace. This included an exchange of certain assets in 2011 with Lafarge North America Inc. (“Lafarge”), pursuant to which it received aggregates quarry sites, ready mixed concrete and asphalt plants, and a road paving business in and around the metropolitan Denver, Colorado, and the I-25 corridor, in exchange for which Lafarge received properties consisting of quarries, an asphalt plant and distribution yards operated by the Company along the Mississippi River (called the Company’s “River District Operations”) and a cash payment.

The business has developed further through the following transactions over the past few years.

In 2014, the Company completed the acquisition of Texas Industries, Inc. (“TXI”), further augmenting its position as a leading supplier of aggregates and heavy building materials. TXI was a major supplier of natural aggregates in Texas, in northern Louisiana and, to a lesser extent, in Oklahoma and Arkansas. TXI was the then largest supplier of cement and ready mixed concrete products in Texas. TXI enhanced the Company’s position as an aggregates-led, low-cost operator in large and fast-growing geographies in the United States, adding 800 million tons of aggregates to the Company’s reserves, and provided high-quality assets in cement and ready mixed concrete.

In connection with the TXI acquisition, the Company acquired nine quarries and six aggregates distribution terminals located in Texas, Louisiana and Oklahoma. The Company also acquired two cement plants in Midlothian, Texas, south of Dallas, and Hunter, Texas, north of San Antonio, and approximately 120 ready mixed concrete plants, situated primarily in three areas of Texas (the Dallas/Fort Worth/Denton area of north Texas; the Austin area of central Texas; and from Beaumont to Texarkana in east Texas), in north and central Louisiana and in Southwestern Arkansas. As part of an agreement in conjunction with the United States Department of Justice’s review of the transaction, the Company divested its North Troy Quarry in Oklahoma and two related rail distribution yards in Dallas and Frisco, Texas.

TXI was also a cement producer in California. In 2015, the Company divested its California cement operations acquired from TXI. These operations were not in close proximity to aggregates and other core assets of the Company and, unlike other marketplace competitors, were not vertically integrated with ready mixed concrete production. The divestiture primarily included a cement plant, two distribution terminals, mobile equipment, intangible assets and inventory. The Company also completed the integration of the TXI operations in 2015, and completed three smaller acquisitions the same year, which included three aggregates operations and related assets.

In 2016, the Company acquired aggregates, ready mixed concrete and asphalt and paving operations in southern Colorado that provided more than 500 million tons of mineral reserves and expanded the Company’s presence along the Front Range

|

Celebrating 25 Years as a Public Company |

|

Form 10-K ♦ Page 1 |

Part I ♦ Item 1 – Business

of the Rocky Mountains, home to 85% of Colorado’s population. The Company also acquired the remaining and controlling interest in a ready mixed concrete company that serves the I-35 corridor in central Texas between Dallas and Austin, which enhanced the Company’s position and provided additional vertical integration benefits with the Company’s cement product line.

In 2018, the Company completed the acquisition of Bluegrass Materials Company (“Bluegrass”), the then largest privately held, pure-play aggregates business in the United States. With a portfolio of 22 active sites acquired by the Company, the operations provided more than 2.2 billion tons, or approximately 125 years, of strategically-located, high-quality reserves, in Georgia, South Carolina, Tennessee, Maryland, Kentucky and Pennsylvania. These operations complemented the Company’s existing southeastern footprint in its Mid-America and Southeast Groups and provided a new growth platform within Maryland and Kentucky.

Between 2001 and 2019, the Company disposed of a number of underperforming operations, including aggregates, ready mixed concrete, trucking, and asphalt and road paving operations of its Building Materials business and the refractories business of its Magnesia Specialties business. In some of its divestitures, the Company concurrently entered into supply agreements to provide aggregates at market rates to certain of these divested businesses. During 2015, the Company disposed of certain non-core asphalt operations in San Antonio, Texas and divested its California cement operations. Divestitures in 2018 also included those required as part of the governmental approval associated with the acquisition of Bluegrass, consisting of one site owned by Bluegrass and one site operated by the Company. The Company will continue to evaluate opportunities to divest underperforming or non-strategic assets, if appropriate, during 2020 consistent with its strategic plan and in an effort to redeploy capital for other opportunities.

Business Segment Information

The Company conducts its Building Materials business through three reportable segments, organized by geography: Mid-America Group, Southeast Group and West Group. The Mid-America and Southeast Groups provide aggregates products only. The West Group provides aggregates, cement and downstream products. Our top ten states accounted for 86% of the Building Materials business total revenues in 2019: Texas, Colorado, North Carolina, Georgia, Iowa, Florida, South Carolina, Indiana, Maryland and Nebraska. The Company also has the Magnesia Specialties segment, which includes its magnesia-based chemicals and dolomitic lime businesses. For more information on the organization and geographic area of the Company’s business segments, see “Note A: Accounting Policies-Organization” and “Note P: Segments” of the “Notes to Financial Statements” of the Company’s consolidated financial statements, which appear in Item 8, “Financial Statements and Supplementary Data,” of this Annual Report on Form 10-K (this “Form 10-K”).

Building Materials Business

This section describes the product lines of the Building Materials business undertaken by the Company within its Mid-America Group, Southeast Group, and West Group. The Company operates its aggregates product line of business in all of these geographic segments within its Building Materials business. In 2019, the aggregates product line represented 62% of the Company’s consolidated total products and services revenues. The Company’s cement, ready mixed concrete, and asphalt and paving operations are conducted within the Company’s West Group, with its two cement plants in Texas, and the remaining ready mixed concrete and asphalt product lines in Texas, Colorado, Louisiana, Arkansas, and Wyoming. Paving services are offered exclusively in Colorado. The Company’s cement product line is described below and in greater detail in the next section.

The Building Materials business serves customers in the construction marketplace. The business’ profitability is sensitive to national, regional and local economic conditions and cyclical swings in construction spending, which are in turn affected by fluctuations in levels of public-sector infrastructure funding; interest rates; access to capital markets; and demographic, geographic, employment and population dynamics. The heavy-side construction business, inclusive of much of the Company’s operations, is conducted outdoors. Therefore, erratic weather patterns, seasonal changes, and other weather-related conditions, including precipitation, flooding, hurricanes, snowstorms, extreme temperatures, and droughts, can significantly affect production schedules, shipments, costs, efficiencies and profitability. Generally, the financial results for the first and fourth quarters are subject to the impacts of winter weather, while the second and third quarters are subject to the impacts of heavy precipitation.

|

Form 10-K ♦ Page 2 |

|

Celebrating 25 Years as a Public Company |

Part I ♦ Item 1 – Business

Aggregates are an engineered, granular material consisting of crushed stone, and sand and gravel, manufactured to specific sizes, grades and chemistry for use primarily in construction applications. The Company’s operations consist primarily of open pit quarries; however, the Company is the largest operator of underground aggregates mines in the United States with 14 active underground mines located in the Mid-America Group. The Company’s aggregates reserves are 89 years on average at current production levels.

Cement is the basic binding agent used to bind water, aggregates and sand, in the production of ready mixed concrete. The Company has a strategic and leading cement position in Texas, with production facilities in Midlothian, Texas, south of Dallas/Fort Worth, and Hunter, Texas, north of San Antonio. These plants produce Portland and specialty cements, have a combined annual capacity of 4.5 million tons, and operated at 80% to 85% utilization in 2019. The Midlothian plant permit allows the Company to expand production by up to 800,000 additional tons. In addition to the two production facilities, the Company operates several cement distribution terminals. Calcium carbonate in the form of limestone is the principal raw material used in the production of cement. The Company owns more than 600 million tons of limestone reserves adjacent to its cement production plants.

Ready mixed concrete, a mixture primarily of cement, water, aggregates, and sand, is measured in cubic yards and specifically batched or produced for customers' construction projects and then transported and poured at the project site. The aggregates used for ready mixed concrete is a washed material with limited amounts of fines (such as dirt and clay). The Company operates 141 ready mix plants in Texas, Colorado, Louisiana, Arkansas, and Wyoming. Asphalt is most commonly used in surfacing roads and parking lots and consists of liquid asphalt, or bitumen, the binding medium, and aggregates. Similar to ready mixed concrete, each asphalt batch is produced to customer specifications. The Company’s asphalt operations are located primarily in Colorado; additionally, paving services are offered in Colorado. Market dynamics for these downstream product lines include a highly competitive environment and lower barriers to entry compared with aggregates and cement.

The Building Materials business markets its products primarily to the construction industry, with 35% of the aggregates product line shipments in 2019 made to contractors in connection with highway and other public infrastructure projects and the balance of its shipments made primarily to contractors in connection with nonresidential and residential construction projects. The Company believes public-works projects have historically accounted for approximately 50% of the total annual aggregates and cement consumption in the United States. Therefore, these businesses benefit from public-works construction projects. The Company also believes exposure to fluctuations in nonresidential and residential, or private-sector, construction spending is lessened by the business’ mix of public sector-related shipments.

As a result of dependence upon the construction industry, the profitability of aggregates and cement producers is sensitive to national, regional and local economic conditions, and particularly to cyclical swings in construction spending, which is affected by fluctuations in interest rates, demographic and population shifts, and changes in the level of infrastructure spending funded by the public sector.

While construction spending in the public and private market sectors is affected by economic cycles, the historic level of spending on public infrastructure projects has been, comparatively, more stable due to predictability of funding from federal, state and local governments, with approximately half of the funding from federal government and half from state and local governments in certain states. The Fixing America’s Surface Transportation Act (the “FAST Act”), signed into law on December 4, 2015, is the first long-term transportation funding bill in nearly a decade and authorizes $305 billion over fiscal years 2016 through 2020. Included with FAST Act funding is $300 million available for loans issued under Transportation Infrastructure Finance and Innovation Act (“TIFIA”). If a successor bill is not passed prior to the September 2020 expiration of the FAST Act, management expects continuing resolutions to be passed to continue federal highway funding at current levels. Public construction projects, once awarded, are seen through to completion. Thus, delays from weather or other factors typically serve to extend the duration of the construction cycle. State and local initiatives that support infrastructure funding, including gas tax increases and other ballot initiatives, are increasing in size and number as these governments recognize the need to play an expanded role in public infrastructure funding. In November 2019, 270 state and local ballot initiatives, 89% of all infrastructure funding measures up for vote, were approved and are estimated to generate over $9.6 billion in one-time and recurring revenues. Namely, Texas, Colorado, Georgia and North Carolina approved measures that will contribute a total of $8.1 billion to infrastructure funding, the majority of which are in Texas. Since 2010, 81% of transportation ballot initiatives have been approved by voters. Funding from the FAST Act, coupled with state and local transportation initiatives has resulted in an acceleration in lettings (making contracts available for bidding) and contract awards in key states, including Texas, Colorado, North Carolina, Georgia and Florida. The pace of construction should accelerate and shipments to the public infrastructure market should return to historical levels as monies from both the federal government and state and local governments become awarded.

|

Celebrating 25 Years as a Public Company |

|

Form 10-K ♦ Page 3 |

Part I ♦ Item 1 – Business

Public-sector construction related to transportation infrastructure can be aggregates intensive and is funded through a combination of federal, state and local sources. The federal highway bill, currently the FAST Act, provides annual funding for public-sector highway construction projects and includes spending authorizations, which represent the maximum financial obligation that will result from the immediate or future outlays of federal funds for highway and transit programs. The federal government’s surface transportation programs are financed mostly through the receipts of highway user taxes placed in the Highway Trust Fund, which is divided into the Highway Account and the Mass Transit Account. Revenues credited to the Highway Trust Fund are primarily derived from a federal gas tax, a federal tax on certain other motor fuels and interest on the accounts’ accumulated balances. Of the currently imposed federal gas tax of $0.184 per gallon, which has been static since 1993, $0.15 is allocated to the Highway Account of the Highway Trust Fund.

Since most states are required to balance their budgets, reductions in revenues generally require a reduction in states’ expenditures. However, the impact of state revenue reductions on highway investment will vary depending on whether the monies come from dedicated revenue sources, such as highway user fees, or whether portions are funded with general funds.

States continue to play an expanding role in infrastructure investment. In addition to federal appropriations, each state funds its infrastructure investment from specifically allocated amounts collected from various user fees, typically gasoline taxes and vehicle fees. Over the past several years, states have taken on a significantly larger role in funding infrastructure investment, including initiating special-purpose taxes and raising gas taxes. Management believes that financing at the state level, such as bond issuances, toll roads and tax initiatives, will grow at a faster rate in the near term than federal funding. State infrastructure spending generally leads to increased growth opportunities for the Company. The level of state public-works spending is varied across the nation and dependent upon individual state economies. The degree to which the Company could be affected by a reduction or slowdown in infrastructure spending varies by state. The state economies of the Building Materials business’ ten largest revenue-generating states may disproportionately affect the Company’s financial performance.

Governmental appropriations and expenditures are typically less interest rate-sensitive than private-sector spending. Obligations of federal funds is a leading indicator of highway construction activity in the United States. Before a state or local department of transportation can solicit bids on an eligible construction project, it enters into an agreement with the Federal Highway Administration to obligate the federal government to pay its portion of the project cost. Federal obligations are subject to annual funding appropriations by Congress.

The need for surface transportation improvements continues to significantly outpace the amount of available funding. A large number of roads, highways and bridges built following the establishment of the Interstate Highway System in 1956 are now in need of major repair or reconstruction. According to The Road Information Program (“TRIP”), a national transportation research group, vehicle travel on United States highways increased 17% from 2000 to 2017, while new lane road mileage increased only 5% over the same period. TRIP also reports that 44% of the nation’s major roads are in poor or mediocre condition and 9% of the nation’s bridges are structurally deficient. According to the 2015 American Association of State Highway and Transportation Officials’ Transportation Bottom Line Report, annual investment in the nation’s roads, highways and bridges needs to increase from $88 billion to $120 billion to improve conditions and meet the nation’s mobility needs. While state DOTs and contractors are addressing their funding and labor constraints, the Company believes that with an enhanced infrastructure bill, those efforts would be more rapidly addressed. However, even in the absence of an enhanced infrastructure bill, strong customer confidence and improving sentiment leads management to believe that infrastructure activity for 2020 and beyond should benefit from the FAST Act and its eventual successor bill, the 2017 Tax Cuts and Jobs Act (“2017 Tax Act”), and additional state and local infrastructure initiatives.

Funding of public infrastructure, the Company’s largest end-use market, is discussed in greater detail under “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Building Materials Business’ Key Considerations—Public Infrastructure, the Company’s largest end-use market, is funded through a combination of federal, state and local sources” in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,’’ of this Form 10-K.

The Company’s Building Materials business covers a wide geographic area. The five largest sales-generating states (Texas, Colorado, North Carolina, Georgia, and Iowa) for the Building Materials business accounted for 72% of total revenues by state of destination in 2019. The Company’s Building Materials business is accordingly affected by the economies in these regions and has been adversely affected in part by recessions and weaknesses in these economies from time to time. Recent improvements in the national economy and in some of the states in which the Company operates have led to improvements in profitability in the Company’s Building Materials business.

|

Form 10-K ♦ Page 4 |

|

Celebrating 25 Years as a Public Company |

Part I ♦ Item 1 – Business

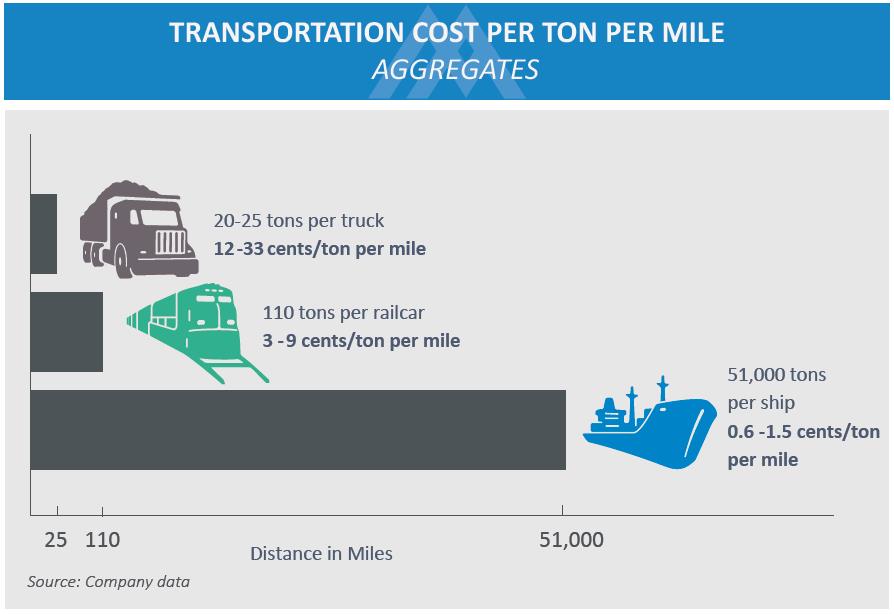

Natural aggregates sources can be found in relatively homogeneous deposits in certain areas of the United States. As a general rule, truck shipments from an individual quarry are limited because the cost of transporting processed aggregates to customers is high in relation to the price of the product itself. As described below, the Company’s distribution system mainly uses trucks, but also has access to a river barge and an ocean vessel network where the per-mile unit cost of transporting aggregates is much lower. In addition, acquisitions have enabled the Company to extend its customer base through increased access to rail transportation. Proximity of quarry facilities to customers or to long-haul transportation corridors is an important factor in competition for aggregates businesses.

Product shipments are moved by rail, water and truck through the Company’s long-haul distribution network. The Company’s rail network primarily serves its Texas, Florida, Colorado and Gulf Coast markets while the Company’s Bahamas and Nova Scotia locations transport materials via oceangoing ships. The Company’s strategic focus includes expanding inland and offshore capacity and acquiring distribution facilities and port locations to offload transported material. At December 31, 2019, the distribution network available to the Company consisted of 86 terminals. The long-haul distribution network can diversify market risk for locations that engage in long-haul transportation of their aggregates products. Particularly where a producing quarry serves a local market and transports products via rail, water and/or truck to be sold in other markets, the risk of a downturn in one market may be somewhat mitigated by other markets served by the location.

The Company generally acquires contiguous property around existing quarry locations. This property can serve as buffer property or additional mineral reserve capacity, assuming the underlying geology supports economical aggregates mining. In either instance, the acquisition of additional property around an existing quarry allows the expansion of the quarry footprint and extension of quarry life. Some locations having limited reserves may be unable to expand.

A long-term capital focus for the Company, primarily in the midwestern United States due to the nature of its indigenous aggregates supply, is underground limestone aggregates mines. The Company operates 14 active underground mines, located in the Mid-America Group, and is the largest operator of underground limestone aggregate mines in the United States. Production costs are generally higher at underground mines than surface quarries since the depth of the aggregate deposits and the access to the reserves result in higher costs related to development, explosives and depreciation costs. However, these locations often possess transportation advantages that can lead to higher average selling prices than more distant surface quarries.

The Company’s acquisitions and capital projects have expanded its ability to move material by rail. The Company has added additional capacity in a number of locations that can now accommodate larger unit train movements. These expansion projects have enhanced the Company’s long-haul distribution network. The Company’s process improvement efforts have also improved operational effectiveness through plant automation, mobile fleet modernization, right-sizing and other cost control improvements. Accordingly, the Company has enhanced its reach through its ability to provide cost-effective coverage of coastal markets on the east and gulf coasts, as well as geographic areas that can be accessed economically by the Company’s expanded distribution system. This distribution network moves aggregates materials from domestic and offshore sources, via rail and water, to markets where aggregates supply is limited.

As the Company continues to move more aggregates by rail and water, associated internal freight costs are expected to reduce gross margin. This typically occurs where the Company transports aggregates from a production location to a distribution location by rail or water, and the customer pays a selling price that includes a freight component. Margins are negatively affected because the Company typically does not charge the customer a profit associated with the transportation component of the selling price of the materials. Moreover, the Company’s expansion of its rail-based distribution network, coupled with the extensive use of rail service in the Southeast and West Groups, increases the Company’s dependence on and exposure to railroad performance, including track congestion, crew availability, railcar availability, and locomotive availability, and the ability to renegotiate favorable railroad shipping contracts. The waterborne distribution network, primarily located within the Southeast Group, also increases the Company’s exposure to certain risks, including, among other items, meeting minimum tonnage requirements of shipping contracts, demurrage costs, fuel costs, ship availability and weather disruptions. The Company has long-term agreements with shipping companies to provide ships to transport the Company’s aggregates to various coastal ports.

The Company’s long-term shipping contracts for shipment by water are generally take-or-pay contracts with minimum and maximum shipping requirements. These contracts have varying expiration dates ranging from 2023 to 2027 and generally contain renewal options. However, there can be no assurance that these contracts can be renewed upon expiration or that terms will continue without significant increases. If the Company fails to ship the annual minimum tonnages under the agreement, it is still obligated to pay the shipping company the contractually-stated minimum amount for that year. In 2019, the Company did not incur these freight costs; however a charge is possible in 2020 if shipment volumes do not meet the contractually-stated minimums.

|

Celebrating 25 Years as a Public Company |

|

Form 10-K ♦ Page 5 |

Part I ♦ Item 1 – Business

From time to time, the Company has experienced rail transportation shortages, particularly in the Southwest and Southeast. These shortages were caused by the downsizing in personnel and equipment by certain railroads during economic downturns. Historically, in response to these issues, rail transportation providers focused on increasing the number of cars per unit train under transportation contracts and generally required customers, through the freight rate structure, to accommodate larger unit train movements. A unit train is a freight train moving large tonnages of a single bulk product between two points without intermediate yarding and switching. Certain of the Company’s sales yards have the system capabilities to meet the unit train requirements. Over the last few years, the Company has made capital improvements to a number of its sales yards in order to better accommodate unit train unloadings. Rail availability is seasonal and can impact aggregates shipments depending on competing demands for rail service.

More recently, railroads have increasingly begun emphasizing Precision Scheduled Railroading (“PSR”), which is focused on minimizing railcar dwell time and utilizing general purpose trains by blending existing train services. The Company does not expect the railroads’ use of PSR to materially impact its operations in 2020. However, if the railroads do not efficiently execute on this change, it could disrupt shipment volumes for the Company.

From time to time, we have also experienced rail and trucking shortages due to competition from other products. If there are material changes in the availability or cost of rail or trucking services, we may not be able to arrange alternative and timely means to ship our products at a reasonable cost, which could lead to interruptions or slowdowns in our businesses or increases in our costs.

The Company’s management expects the multiple transportation modes that have been developed with various rail carriers and via deep-water ships should provide the Company with the flexibility to effectively serve customers in the Southwest and Southeast coastal markets.

The construction aggregates industry has been consolidating, and the Company has actively participated in the industry’s consolidation. When acquired, new locations sometimes do not satisfy the Company’s internal safety, maintenance, pit development, or other standards, and may require additional resources before benefits of the acquisitions are fully realized. Industry consolidation slowed several years ago as the number of suitable small- to mid-sized acquisition targets in high-growth markets declined. During that period of fewer acquisition opportunities, the Company focused on investing in internal expansion or efficiency projects in high-growth markets. The number of acquisition opportunities has increased in the last few years as the economy recovered from the protracted recession. Opportunities include public and larger private, family-owned businesses, as well as asset swaps and divestitures from companies executing their strategic plans, rationalizing non-core assets, and repairing financially-constrained balanced sheets. The Company’s Board of Directors (the “Board of Directors”) and management continue to review and monitor the Company’s strategic long-term plans, which include assessing business combinations and arrangements with other companies engaged in similar businesses, increasing the Company’s presence in its core businesses, investing in internal expansion projects in high-growth markets, and pursuing new opportunities related to the Company’s existing markets.

The Company’s West Group became more vertically integrated through various acquisitions, including the 2014 TXI acquisition, in which the Company acquired not only aggregates locations, but also complementary cement, ready mixed concrete, asphalt and paving construction operations. The Company reports vertically-integrated operations within the Building Materials business segment, and their results are affected by volatile factors, including fuel costs, operating efficiencies, and weather, to an even greater extent than the Company’s aggregates operations. Liquid asphalt and cement serve as key raw materials in the production of hot mix asphalt and ready mixed concrete, respectively. Therefore, fluctuations in prices for these raw materials directly affect the Company’s operating results. Prices for liquid asphalt were higher in 2019 than in 2018. Liquid asphalt prices may not always follow other energy products (e.g., oil or diesel fuel) because of complexities in the refining process, which converts a barrel of oil into other fuels and petrochemical products. We expect the Company’s gross margin to continue to improve for the legacy TXI aggregates-related downstream operations, similar to the pattern experienced at the Colorado aggregates-related downstream operations.

While aggregates-led, the Company continues to review its operational portfolio to determine if there are opportunities to divest underperforming assets in an effort to redeploy capital for other opportunities. The Company also reviews other independent Building Materials operations to determine if they might present attractive acquisition opportunities in the best interest of the Company, either as part of their own independent operations or operations that might be vertically integrated with other operations owned by the Company.

|

Form 10-K ♦ Page 6 |

|

Celebrating 25 Years as a Public Company |

Part I ♦ Item 1 – Business

Environmental and zoning regulations have made it increasingly difficult for the aggregates industry to expand existing quarries and to develop new quarry operations. Although it cannot be predicted what policies will be adopted in the future by federal, state, and local governmental bodies regarding these matters, the Company anticipates that future restrictions will likely make zoning and permitting more difficult, thereby potentially enhancing the value of the Company’s existing mineral reserves.

Management believes the aggregates product line’s raw materials, or aggregates reserves, are sufficient to permit production at present operational levels for the foreseeable future. The Company does not anticipate any material difficulty in obtaining the raw materials that it uses for current production in its aggregates product line. The Company’s aggregates reserves are 89 years on average, based on current production levels. However, certain locations may be subject to more limited reserves and may not be able to expand. Moreover, as noted above, environmental and zoning regulations will likely make it harder for the Company to expand its existing quarries or develop new quarry operations. The Company generally sells its aggregates, ready mixed concrete and asphalt products upon receipt of orders or requests from customers. The Company generally maintains inventories of aggregates products in sufficient quantities to meet the requirements of customers.

Cement Product Line

The cement product line of the Building Materials business produces Portland and specialty cements. Cement is the basic binding agent for concrete, a primary construction material. The principal raw material used in the production of cement is calcium carbonate in the form of limestone. The Company owns more than 600 million tons of limestone reserves adjacent to its two cement production plants in Texas. Similar to aggregates, cement is used in infrastructure projects, nonresidential and residential construction, and the railroad, agricultural, utility and environmental industries. Consequently, the cement industry is cyclical and dependent on the strength of the construction sector.

The Company has a strategic cement position in Texas, with production facilities in Midlothian, Texas, south of Dallas/Fort Worth, and in Hunter, Texas, north of San Antonio. These plants have a combined annual capacity of 4.5 million tons, as well as a current permit that would allow the Company to expand production by up to 800,000 additional tons at the Midlothian plant. In addition to these production facilities, the Company also operates, directly or through third parties, several cement distribution terminals in Texas.

Cement consumption is dependent on the time of year and prevalent weather conditions. According to the Portland Cement Association, nearly two-thirds of U.S. cement consumption occurs in the six months between May and October. Approximately 75% of all cement shipments are sent to ready mix concrete operators. The rest are shipped to manufacturers of concrete-related products, contractors, materials dealers, and oil well/mining/drilling companies, as well as government entities.

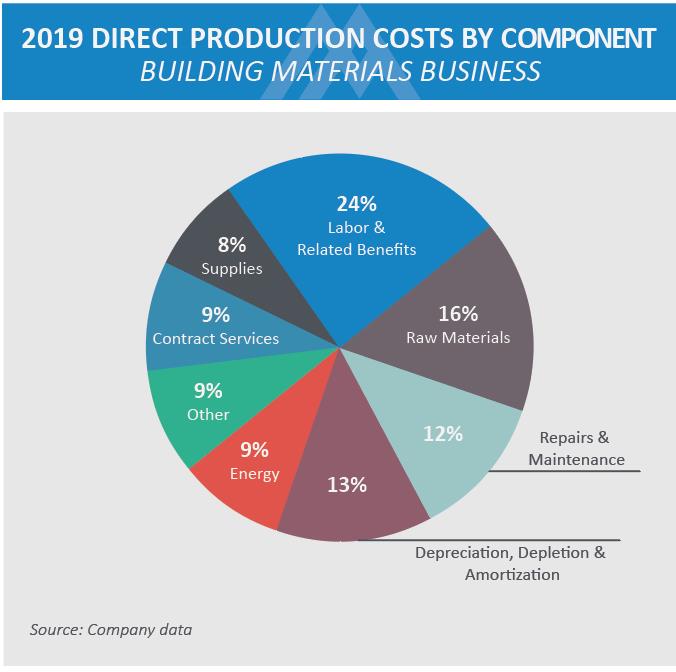

Energy accounted for approximately 22% of the cement production cost profile in 2019. Therefore, profitability of the cement product line is affected by changes in energy prices and the available supply of these products. The Company currently has fixed-price supply contracts for coal but also consumes natural gas, alternative fuel and petroleum coke. Further, profitability of the cement product line is also subject to kiln maintenance, and this process typically requires a plant to be shut down for a period of time as repairs are made.

The limestone reserves used as a raw material for cement are located on property, owned by the Company, adjacent to each of the two cement plants. Management believes that its reserves of limestone are sufficient to permit production at the current operational levels for the foreseeable future.

The cement product line generally delivers its products upon receipt of orders or requests from customers. Inventory for products is generally maintained in sufficient quantities to meet rapid delivery requirements of customers.

Magnesia Specialties Business

The Magnesia Specialties business produces and sells dolomitic lime from its Woodville, Ohio facility. The Magnesia Specialties business manufactures magnesia-based chemical products for industrial, agricultural and environmental applications at its Manistee, Michigan facility. These magnesia-based chemical products have varying uses, including flame retardants, wastewater treatment, pulp and paper production and other environmental applications. In 2019, 69% of Magnesia Specialties’ total revenues were attributable to chemical products, 30% to lime, and 1% to stone sold as construction materials.

|

Celebrating 25 Years as a Public Company |

|

Form 10-K ♦ Page 7 |

Part I ♦ Item 1 – Business

In 2019, 81% of the lime produced was sold to third-party customers, while the remaining 19% was used internally as a raw material in making the business’ chemical products. Dolomitic lime products sold to external customers are used primarily by the steel industry. Products used in the steel industry, either directly as dolomitic lime or indirectly as a component of other industrial products, accounted for 35% of the Magnesia Specialties’ total revenues in 2019, attributable primarily to the sale of dolomitic lime products. Accordingly, a portion of the revenues and profitability of the Magnesia Specialties business is affected by production and inventory trends in the steel industry. These trends are guided by the rate of consumer consumption, the flow of offshore imports, and other economic factors. The dolomitic lime business runs most profitably at 70% or greater steel capacity utilization; domestic capacity utilization averaged 80% in 2019, according to the American Iron and Steel Institute. Average steel production in 2019 increased 1.8% versus 2018.

In the Magnesia Specialties business, a significant portion of costs is of a fixed or semi-fixed nature. The production process requires the use of natural gas, coal and petroleum coke. Therefore, fluctuations in their pricing directly affect operating results. To help mitigate this risk, the Magnesia Specialties business has fixed-price agreements for approximately 62% of its 2020 coal, natural gas, and petroleum coke needs. For 2019, the Company’s average cost per MCF (thousand cubic feet) for natural gas decreased 4.7% versus 2018.

Given high fixed costs, low capacity utilization can negatively affect the segment’s results from operations. Management expects future organic profit growth to result from increased pricing, rationalization of the current product portfolio and/or further cost reductions. Management has shifted the strategic focus of the magnesia-based business to specialty chemicals that can be produced at volume levels that support efficient operations. Accordingly, that product line is not as dependent on the steel industry as the dolomitic lime product line.

The principal raw materials used in the Magnesia Specialties business are dolomitic limestone and magnesium-rich brine. Management believes that its reserves of dolomitic limestone and brine are sufficient to permit production at the current operational levels for the foreseeable future.

After the raw materials are combined to make magnesium hydroxide, the Magnesia Specialties business must dispose of the processed brine. In 2010, Occidental Chemical Corporation (“Occidental”) acquired interests in, and became the counterparty to, a long-term processed brine supply agreement previously entered into by Magnesia Specialties, pursuant to which Occidental purchases processed brine from Magnesia Specialties, at market rates, for use in Occidental’s production of calcium chloride products. Occidental also succeeded as Magnesia Specialties’ partner in a joint venture to own and operate a processed brine supply pipeline between the Magnesia Specialties facility in Manistee, Michigan, and Occidental’s facility in Ludington, Michigan.

Magnesia Specialties generally delivers its products upon receipt of orders or requests from customers. Inventory for products is generally maintained in sufficient quantities to meet rapid delivery requirements of customers. A significant portion of the 275,000 ton dolomitic lime capacity from a lime kiln at Woodville, Ohio is committed under a long-term supply contract.

The Magnesia Specialties business is highly dependent on rail transportation, particularly for movement of dolomitic lime from Woodville to Manistee and direct customer shipments of dolomitic lime and magnesia chemicals products from both Woodville and Manistee. The segment can be affected by the specific transportation and other risks and uncertainties outlined under Item IA, “Risk Factors,” of this Form 10-K.

Patents and Trademarks

As of February 7, 2020, the Company owns, has the right to use, or has pending applications for approximately 23 patents pending or granted by the United States and various countries and approximately 94 trademarks related to business. The Company believes that its rights under its existing patents, patent applications and trademarks are of value to its operations, but no one patent or trademark or group of patents or trademarks is material to the conduct of the Company’s business as a whole.

Customers

No material part of the business of any segment of the Company is dependent upon a single customer or upon a few customers, the loss of any one of which would have a material adverse effect on the segment. The Company’s products are sold principally to commercial customers in private industry. Although large amounts of construction materials are used in public works projects, relatively insignificant sales are made directly to federal, state, county, or municipal governments, or agencies thereof.

|

Form 10-K ♦ Page 8 |

|

Celebrating 25 Years as a Public Company |

Part I ♦ Item 1 – Business

Competition

Because of the impact of transportation costs on the aggregates industry, competition in the aggregates product line tends to be limited to producers in proximity to each of the Company’s facilities. Although all of the Company’s locations experience competition, the Company believes that it is generally a leading producer in 90% of the areas it serves. Competition is based primarily on quarry or distribution location and price, but quality of aggregates and level of customer service are also factors.

There are over 5,000 companies in the United States that produce construction aggregates. These include active crushed stone companies and active sand and gravel companies. The largest ten producers account for approximately 45-47% of the total market. The Company’s ready mixed concrete and asphalt and paving operations are also in markets with numerous operators. A national trade association estimates there are about 5,500 ready mixed concrete plants in the United States owned by over 2,200 companies, with approximately 55,000 mixer trucks delivering ready mixed concrete. Similarly, a national trade association estimates there are approximately 4,000 asphalt plants in the United States owned by over 800 companies. The Company, with its Building Materials business, including its ready mixed concrete and asphalt and paving operations, competes with a number of other large and small producers. The Company believes that its ability to transport materials by ocean vessels and rail have enhanced the Company’s ability to compete in the building materials industry.

The largest U.S. aggregates producers, including global companies, other than the Company, include:

Cemex S.A.B. de C.V.

CRH PLC

Heidelberger Druckmaschinen AG/Heidelberg USA

LafargeHolcim Ltd.

Luck Stone Company

MDU Resources Group, Inc.

Summit Materials, Inc.

Rogers Group Inc.

Vulcan Materials Company

The Company’s Magnesia Specialties business competes with various companies in different geographic and product areas principally on the basis of quality, price, technological advances, and technical support for its products. While the revenues of the Magnesia Specialties business in 2019 were predominantly from North America, a portion was derived from customers located outside the United States.

According to the Portland Cement Association, United States cement production is widely dispersed with the operation of 98 cement plants in 34 states. Cement companies in the United States have annual sales valued at approximately $10.7 billion. The top five companies collectively operate 62.5% of U.S. clinker capacity with the largest company representing 18.8% of all domestic clinker capacity. An estimated 86% of U.S. clinker capacity is owned by companies headquartered outside of the United States. In reporting these figures for cement plants, capacity is often stated in terms of “clinker” capacity. “Clinker” is the initial product of cement production. Cement producers mine materials such as limestone, shale, or other materials, crush and screen the materials, and place them in a cement kiln. After being heated to extremely high temperatures, these materials form marble-sized balls or pellets called “clinker” that are then very finely ground to produce Portland cement.

The Company’s strategic cement product line competes with various companies in different geographic and product areas principally on the basis of proximity, quality and price for its products, but level of customer service is also a factor. The cement product line also competes with imported cement because of the higher value of the product and the existence of major ports or terminals in Texas. Certain of the Company’s competitors in the cement product line have greater financial resources than the Company.

The nature of the Company’s competition varies among its product lines due to the widely differing amounts of capital necessary to build production facilities. Crushed stone production from quarries or mines, or sand and gravel production by dredging, is moderately capital intensive. The Company’s major competitors in the aggregates markets are often large, vertically-integrated companies, with international operations. Ready mixed concrete production requires relatively small amounts of capital to build a concrete batching plant and acquire delivery trucks. Accordingly, economics can lead to lower barriers to entry in some markets. As a result, depending on the local market, the Company may face competition from small producers as well as large, vertically-integrated companies with facilities in many markets. Construction of cement production facilities is highly capital intensive and requires long lead times to complete engineering design, obtain regulatory permits, acquire equipment and construct a plant. Most domestic producers of cement are owned by large foreign companies operating in multiple international markets. Many of these producers maintain the capability to import cement from foreign production facilities.

|

Celebrating 25 Years as a Public Company |

|

Form 10-K ♦ Page 9 |

Part I ♦ Item 1 – Business

Environmental and Governmental Regulations

The Company’s operations are subject to and affected by federal, state, and local laws and regulations relating to zoning, land use, air emissions (including CO2 and other greenhouse gases) and water discharges, waste management, noise and dust exposure control, reclamation and environmental, health and safety, regulatory matters. Certain of the Company’s operations may from time to time involve the use of substances that are classified as toxic or hazardous within the meaning of these laws and regulations. Environmental operating permits are, or may be, required for certain of the Company’s operations, and such permits are subject to modification, renewal and revocation.

The Company regularly monitors and reviews its operations, procedures, and policies for compliance with existing laws and regulations, changes in interpretations of existing laws and enforcement policies, new laws that are adopted, and new laws that the Company anticipates will be adopted that could affect its operations. The Company has a full-time team of environmental engineers and managers that perform these responsibilities. The direct costs of ongoing environmental compliance were approximately $26.0 million in 2019 and $25.3 million in 2018 and are related to the Company’s environmental staff, ongoing monitoring costs for various matters (including those matters disclosed in this Form 10-K), and asset retirement costs. Capitalized costs related to environmental control facilities were approximately $11 million in 2019 and are expected to be approximately $15 million in 2020 and 2021. The Company’s capital expenditures for environmental matters were not material to its results of operations or financial condition in 2019 and 2018. However, the Company’s expenditures for environmental matters generally have increased over time and are likely to increase in the future. Despite the Company’s compliance efforts, risk of environmental liability is inherent in the operation of the Company’s businesses, and environmental liabilities could have a material adverse effect on the Company in the future.

Many of the applicable requirements of environmental laws are satisfied by procedures that the Company adopts as best business practices in the ordinary course of its operations. For example, plant equipment that is used to crush aggregates products may, in the ordinary course of operations, have an attached water spray bar that is used to clean the stone. The water spray bar also serves as a dust control mechanism that complies with applicable environmental laws. Moreover, the Company does not break out the portion of the cost, depreciation, and other financial information relating to the water spray bar that is attributable only to environmental purposes, as such an allocation would be arbitrary. The incremental portion of such operating costs that is attributable to environmental compliance rather than best operating practices is impractical to quantify. Accordingly, the Company expenses costs in that category when incurred as operating expenses.

The environmental accruals recorded by the Company are based on internal studies of the required remediation costs and estimates of potential costs that arise from time to time under federal, state and/or local environmental protection laws. Many of these laws and the regulations promulgated under them are complex, and are subject to challenges and new interpretations by regulators and the courts from time to time. In addition, new laws are adopted from time to time. It is often difficult to accurately and fully quantify the costs to comply with new rules until it is determined to which type of operations they will apply and the manner in which they will be implemented is more accurately defined. This process often takes years to finalize, and the rules often change significantly from the time they are proposed to the time they are final. The Company typically has several appropriate alternatives available to satisfy compliance requirements, which could range from nominal costs to some alternatives that may be satisfied in conjunction with equipment replacement or expansion that also benefits operating efficiencies or capacities and carry significantly higher costs.

Management believes that its current accrual for environmental costs is reasonable, although those amounts may increase or decrease depending on the impact of applicable rules as they are finalized or amended from time to time and changes in facts and circumstances. At this time, the Company believes that any additional costs for ongoing environmental compliance would not have a material adverse effect on the Company’s obligations or financial condition.

The Company is generally required by state or local laws or pursuant to the terms of an applicable lease to reclaim quarry sites after use. Future reclamation costs are estimated using statutory reclamation requirements and management’s experience and knowledge in the industry, and are discounted to their present value using a credit-adjusted, risk-free rate of interest. The future reclamation costs are not offset by potential recoveries. For additional information regarding compliance with legal requirements, see “Note O: Commitments and Contingencies” of the “Notes to Financial Statements” of the Company’s consolidated financial statements included in Item 8, “Financial Statements and Supplemental Data,” of this Form 10-K. The Company performs activities on an ongoing basis, as an integral part of the normal quarrying process, that may reduce the ultimate reclamation obligations. For example, the perimeter and interior walls of an open pit quarry are sloped and benched as they are developed to prevent erosion and provide stabilization. This sloping and benching meets dual objectives -- safety regulations required by the Mine Safety and Health Administration (“MSHA”) for ongoing operations as

|

Form 10-K ♦ Page 10 |

|

Celebrating 25 Years as a Public Company |

Part I ♦ Item 1 – Business

well as final reclamation requirements. Therefore, these types of activities are included in normal operating costs and are not a part of the asset retirement obligation. Historically, the Company has not incurred substantial reclamation costs in connection with the closing of quarries. Reclaimed quarry sites owned by the Company are from time to time available for sale, typically for commercial development or use as reservoirs.

The Company believes that its operations and facilities, both owned or leased, are in substantial compliance with applicable laws and regulations and that any noncompliance is not likely to have a material adverse effect on the Company’s operations or financial condition. See “Legal Proceedings” under Item 3 of this Form 10-K, “Note O: Commitments and Contingencies” of the “Notes to Financial Statements” of the Company’s consolidated financial statements included under Item 8, “Financial Statements and Supplemental Data,” of this Form 10-K, and the “Environmental Regulation and Litigation” section included under Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” of this Form 10-K. However, future events, such as changes in or modified interpretations of existing laws and regulations or enforcement policies, or further investigation or evaluation of the potential health hazards of certain products or business activities, may give rise to additional compliance and other costs that could have a material adverse effect on the Company.

In general, mining and production facilities for aggregates, cement, ready mixed concrete, and asphalt must comply with air quality, water quality, and other environmental regulations, zoning and special use permitting requirements, applicable mining regulations, and federal health and safety requirements. As new quarry and mining sites and production facilities are located and acquired, the Company works closely with local authorities during the zoning and permitting processes to design new quarries, mines and production facilities in such a way as to minimize disturbances. The Company frequently acquires large tracts of land so that quarry, mine, and production facilities can be situated substantial distances from surrounding property owners. Also, in certain markets the Company’s ability to transport material by rail and water allows it to locate its facilities further away from residential areas. The Company has established policies designed to minimize disturbances to surrounding property owners from its operations.

As is the case with other companies in the same industry, some of the Company’s products contain varying amounts of crystalline silica, a common mineral also known as quartz. Excessive, prolonged inhalation of very small-sized particles of crystalline silica has been associated with lung diseases, including silicosis, and several scientific organizations and some states, such as California, have reported that crystalline silica can cause lung cancer. MSHA and the Occupational Safety and Health Administration (“OSHA”) have established occupational thresholds for crystalline silica exposure as respirable dust. The Company monitors occupational exposures at its facilities and implements dust control procedures and/or makes available appropriate respiratory protective equipment to maintain the occupational exposures at or below the appropriate levels. The Company, through safety information sheets and other means, also communicates what it believes to be appropriate warnings and cautions its employees and customers about the risks associated with excessive, prolonged inhalation of mineral dust in general and crystalline silica in particular.

As is the case with others in the cement industry, the Company’s cement operations produce varying quantities of cement kiln dust (“CKD”). This production by-product consists of fine-grained, solid, highly alkaline material removed from cement kiln exhaust gas by air pollution control devices. Since much of the CKD is actually unreacted raw materials, it is generally permissible to recycle the CKD back into the production process, and large amounts often are treated in such manner. CKD that is not returned to the production process or sold as a product itself is disposed in landfills. CKD is currently exempted from federal hazardous waste regulations under Subtitle C of the Resource Conservation and Recovery Act.

Amid concerns that greenhouse gas (“GHG”) emissions are contributing to climate change, a number of governmental bodies, including the U.S. Congress and various U.S. states, have proposed, enacted or are contemplating legislative and regulatory changes to mitigate or address the potential impacts of climate change, including provisions for emissions reporting or reductions, the use of alternative fuels, carbon credits (such as a "cap and trade" system) and a carbon tax. For example, in the U.S., the United States Environmental Protection Agency (“USEPA”) promulgated a rule mandating that sources considered to be large emitters of GHGs report those emissions. The manufacturing operations of the Company’s Magnesia Specialties business release carbon dioxide, methane and nitrous oxides during the production of lime, magnesium oxide and hydroxide products. The Company’s two magnesia-based chemicals facilities, as well as its two cement plants in Texas, file annual reports of their GHG emissions in accordance with the USEPA reporting rule. The primary operations of the Company, however, including its aggregates, ready mixed concrete and asphalt and paving product lines, are not major sources of GHG emissions. In fact, most of the GHG emissions from aggregates plant operations are tailpipe emissions from mobile sources, such as heavy construction and earth-moving equipment.

|

Celebrating 25 Years as a Public Company |

|

Form 10-K ♦ Page 11 |

Part I ♦ Item 1 – Business

In 2010, the USEPA also issued a GHG emissions permitting rule, referred to as the “Tailoring Rule,” which may require some industrial facilities to obtain permits for GHG emissions under the U.S. Clean Air Act’s Prevention of Significant Deterioration (“PSD”) and Title V operating permit programs. The U.S. Supreme Court ruled in June 2014 that the USEPA exceeded its statutory authority in issuing the Tailoring Rule but upheld the Best Available Control Technology (“BACT”) requirements for GHGs emitted by sources already subject to PSD or Title V permitting requirements for other pollutants. Both of our cement plants, as well as our Magnesia Specialties plants, hold Title V Permits, and each (other than the Manistee, Michigan facility) is also subject to PSD requirements. It is not known whether the USEPA will proceed with revisions of its rules in response to the Court’s decision or what the USEPA would require as BACT. In fact, no technologies or methods of operation for reducing or capturing GHGs have been proven successful in large scale applications, other than improvements in fuel efficiency. Thus, if future modifications to our facilities require PSD review for other pollutants, GHG BACT requirements could be triggered and may require significant additional costs. It is not possible, however, to estimate the cost of any such future requirements at this time.

The Company believes that comprehensive federal climate change legislation is not a near-term priority item in a divided Congress and that the primary method that GHGs will be regulated is through the USEPA using its rule-making authority. Various states where the Company has operations are also considering climate change initiatives, and the Company may be subject to state regulations in addition to any federal laws and rules that are passed.

If and when Congress passes additional legislation on GHGs, the Woodville, Ohio and Manistee, Michigan Magnesia Specialties operations, as well as the Company’s two cement plants in Texas, which release CO2 in certain of their processes and use carbon-based fuels for power equipment, kilns and the Company’s mobile fleet, will likely be subject to any new requirements. The Company anticipates that any increased operating costs or taxes relating to GHG emission limitations at the Woodville or cement operations facilities would be passed on to customers. The magnesium oxide products produced at the Manistee operation, however, compete against other products that, due to the form and/or structure of the source material, require less energy in the calcination process, resulting in the generation of fewer GHGs per ton of production. Therefore, the Manistee facility may be required to absorb additional costs due to the regulation of GHG emissions in order to remain competitive in pricing in that market. In light of the various regulatory uncertainties, the Company at this time cannot reasonably predict what the costs of any future compliance requirements may be, but does not believe it will have a material adverse effect on the financial condition or results of the operations of either the Magnesia Specialties or Building Materials businesses. The Company continues to monitor GHG regulations and legislation and its potential impact on our cement business, financial condition and product demand.

In addition to impacts from increased regulation, climate change may result in physical and financial impacts that could have adverse effects on the Company’s operations or financial condition. Physical impacts may include disruptions in production and/or regional supply or product distribution networks due to major storm events, shifts in regional rainfall and temperature patterns and intensities, as well as flooding from sea level changes. In addition, production and shipment levels for the Building Materials business and cement product line correlate with general construction activity, which occurs outdoors and, as a result, is affected by erratic weather patterns, seasonal changes and other unusual or unexpected weather-related conditions, which can significantly affect that business. Excessive rainfall and other severe weather jeopardize production, shipments and profitability in all markets served by the Company. In addition, climate and inclement weather can reduce the useful life of an asset. In particular, the Company’s operations in the southeastern and Gulf Coast regions of the United States and the Bahamas are at risk for hurricane activity, most notably in August, September and October. The last few years brought an unprecedented amount of precipitation to the United States and particularly to Texas and the southeastern United States, notably the Carolinas, Florida, and Georgia, where they impacted the Company’s facilities. In 2019, more cold and wet weather than is typical adversely impacted our Rocky Mountain concrete, asphalt, and paving businesses.

Our businesses also are dependent on reliable sources of electricity and fuels. We could incur increased costs or disruptions in our operations if climate change regulation or severe weather impacts the price or availability of purchased electricity or fuels or other materials used in our operations. These and other climate-related risks also could impact our customers, such as a downturn in the construction sector, which could lead to reduced demand for our products. The Company may not be able to pass on to its customers all the costs relating to these risks.

Notwithstanding the foregoing risks and uncertainties relating to climate change, there may also be opportunities for the Company to increase its business or revenues. For example, warm and/or moderate temperatures in March and November allow the construction season to start earlier and end later, respectively, which could have meaningful positive impacts on the Company’s first- and fourth-quarter results, respectively. In addition, the Company’s magnesium hydroxide products are used to increase fuel efficiency in various industries, including both coal- and gas-fired electricity generation, which has a direct impact on reducing energy use and GHG emissions by more GHG-intense companies.

|

Form 10-K ♦ Page 12 |

|

Celebrating 25 Years as a Public Company |

Part I ♦ Item 1 – Business

In an effort to mitigate the risks to the Company associated with GHG emissions while ensuring and improving financial sustainability, the Company has adopted a corporate-wide management strategy that has resulted in multiple operating initiatives to implement or evaluate GHG reduction processes and technologies that also improve operational efficiencies, including: using alternative fuels such as biodiesel; reducing overall fuel use by converting from quarry trucks to conveyor belt systems, right-sizing quarry trucks to marry the appropriately sized truck with the size of production to reduce the number of required trips, and by replacing older rail cars with more efficient, high-capacity models that reduce the number of required trips; adding rail capacity in lieu of truck movements; and installing emissions monitoring equipment and real-time fleet management software. For example, in 2015, the Company’s Midlothian cement plant was recognized by the USEPA as a high performing, energy efficient facility following investments in innovative air pollution control technologies and usage of alternative fuels.

Employees

As of January 31, 2020, the Company has approximately 8,846 employees, of which 6,703 are hourly employees and 2,143 are salaried employees. Included among these employees are 900 hourly employees represented by labor unions (10.2% of the Company’s employees). Of such amount, 9.8% of our Building Materials business’ hourly employees are members of a labor union and 100% of the Magnesia Specialties segment’s hourly employees are represented by labor unions. The Company’s principal union contracts for the Magnesia Specialties business cover employees at the Manistee, Michigan, magnesia-based chemicals plant and the Woodville, Ohio, lime plant. The Woodville collective bargaining agreement expires in June 2022. The Manistee collective bargaining agreement was renewed in 2019 and extended until August 2023. The Company believes it has good relations with all of its employees, including its unionized employees. While the Company’s management does not expect significant difficulties in renewing these labor contracts, there can be no assurance that a successor agreement will be reached at any of these locations.

Available Information

The Company maintains an Internet address at www.martinmarietta.com. The Company makes available free of charge through its Internet website its Annual Report on Form 10‑K, Quarterly Reports on Form 10‑Q, Current Reports on Form 8‑K, and amendments to those reports, if any, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (“Exchange Act”). These reports and any amendments are accessed via the Company’s web site through a link with the Electronic Data Gathering, Analysis, and Retrieval (“EDGAR”) system maintained by the Securities and Exchange Commission (the “SEC”) at www.sec.gov. Accordingly, the Company’s referenced reports and any amendments are made available as soon as reasonably practicable after the Company electronically files such material with, or furnishes it to, the SEC, once EDGAR places such material in its database.

The Company has adopted a Code of Ethical Business Conduct that applies to all of its directors, officers, and employees. The Company’s code of ethics is available on the Company’s web site at www.martinmarietta.com. The Company will disclose on its Internet web site any waivers of or amendments to its code of ethics as it applies to its directors and executive officers.

The Company has adopted a set of Corporate Governance Guidelines to address issues of fundamental importance relating to the corporate governance of the Company, including director qualifications and responsibilities, responsibilities of key board committees, director compensation, and similar issues. Each of the Audit Committee, the Management Development and Compensation Committee, and the Nominating and Corporate Governance Committee of the Board of Directors has adopted a written charter addressing various issues of importance relating to each committee, including the committee’s purposes and responsibilities, an annual performance evaluation of each committee, and similar issues. These Corporate Governance Guidelines, and the charters of each of these committees, are available on the Company’s web site at www.martinmarietta.com.

The Company’s Chief Executive Officer and Chief Financial Officer are required to file with the SEC each quarter and each year certifications regarding the quality of the Company’s public disclosure of its financial condition. The annual certifications are included as exhibits to this Form 10‑K. The Company’s Chief Executive Officer is also required to certify to the New York Stock Exchange each year that he is not aware of any violation by the Company of the New York Stock Exchange corporate governance listing standards.

|

Celebrating 25 Years as a Public Company |

|

Form 10-K ♦ Page 13 |

Part I ♦ Item 1A – Risk Factors

ITEM 1A – RISK FACTORS