00009142082023FYFALSEP3YP5YP2Yhttp://www.invesco.com/20231231#TotalTransactionAndIntegrationChargeshttp://www.invesco.com/20231231#TotalTransactionAndIntegrationChargeshttp://fasb.org/us-gaap/2023#OtherAssetshttp://fasb.org/us-gaap/2023#AccountsPayableAndAccruedLiabilitiesCurrentAndNoncurrenthttp://fasb.org/us-gaap/2023#AccountsPayableAndAccruedLiabilitiesCurrentAndNoncurrent00009142082023-01-012023-12-3100009142082023-06-30iso4217:USD00009142082024-01-31xbrli:shares00009142082023-12-3100009142082022-12-31iso4217:USDxbrli:shares0000914208us-gaap:InvestmentAdviceMember2023-01-012023-12-310000914208us-gaap:InvestmentAdviceMember2022-01-012022-12-310000914208us-gaap:InvestmentAdviceMember2021-01-012021-12-310000914208us-gaap:DistributionAndShareholderServiceMember2023-01-012023-12-310000914208us-gaap:DistributionAndShareholderServiceMember2022-01-012022-12-310000914208us-gaap:DistributionAndShareholderServiceMember2021-01-012021-12-310000914208us-gaap:InvestmentPerformanceMember2023-01-012023-12-310000914208us-gaap:InvestmentPerformanceMember2022-01-012022-12-310000914208us-gaap:InvestmentPerformanceMember2021-01-012021-12-310000914208us-gaap:FinancialServiceOtherMember2023-01-012023-12-310000914208us-gaap:FinancialServiceOtherMember2022-01-012022-12-310000914208us-gaap:FinancialServiceOtherMember2021-01-012021-12-3100009142082022-01-012022-12-3100009142082021-01-012021-12-310000914208us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000914208us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310000914208us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310000914208us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-01-012023-12-310000914208us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-01-012022-12-310000914208us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-01-012021-12-3100009142082021-12-3100009142082020-12-310000914208us-gaap:PreferredStockMember2022-12-310000914208us-gaap:CommonStockMember2022-12-310000914208us-gaap:AdditionalPaidInCapitalMember2022-12-310000914208us-gaap:TreasuryStockCommonMember2022-12-310000914208us-gaap:RetainedEarningsMember2022-12-310000914208us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000914208us-gaap:ParentMember2022-12-310000914208us-gaap:NoncontrollingInterestMember2022-12-310000914208us-gaap:RetainedEarningsMember2023-01-012023-12-310000914208us-gaap:ParentMember2023-01-012023-12-310000914208us-gaap:NoncontrollingInterestMember2023-01-012023-12-310000914208us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310000914208us-gaap:TreasuryStockCommonMember2023-01-012023-12-310000914208us-gaap:PreferredStockMember2023-12-310000914208us-gaap:CommonStockMember2023-12-310000914208us-gaap:AdditionalPaidInCapitalMember2023-12-310000914208us-gaap:TreasuryStockCommonMember2023-12-310000914208us-gaap:RetainedEarningsMember2023-12-310000914208us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000914208us-gaap:ParentMember2023-12-310000914208us-gaap:NoncontrollingInterestMember2023-12-310000914208us-gaap:PreferredStockMember2021-12-310000914208us-gaap:CommonStockMember2021-12-310000914208us-gaap:AdditionalPaidInCapitalMember2021-12-310000914208us-gaap:TreasuryStockCommonMember2021-12-310000914208us-gaap:RetainedEarningsMember2021-12-310000914208us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000914208us-gaap:ParentMember2021-12-310000914208us-gaap:NoncontrollingInterestMember2021-12-310000914208us-gaap:RetainedEarningsMember2022-01-012022-12-310000914208us-gaap:ParentMember2022-01-012022-12-310000914208us-gaap:NoncontrollingInterestMember2022-01-012022-12-310000914208us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000914208us-gaap:TreasuryStockCommonMember2022-01-012022-12-310000914208us-gaap:PreferredStockMember2020-12-310000914208us-gaap:CommonStockMember2020-12-310000914208us-gaap:AdditionalPaidInCapitalMember2020-12-310000914208us-gaap:TreasuryStockCommonMember2020-12-310000914208us-gaap:RetainedEarningsMember2020-12-310000914208us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000914208us-gaap:ParentMember2020-12-310000914208us-gaap:NoncontrollingInterestMember2020-12-310000914208us-gaap:RetainedEarningsMember2021-01-012021-12-310000914208us-gaap:ParentMember2021-01-012021-12-310000914208us-gaap:NoncontrollingInterestMember2021-01-012021-12-310000914208us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310000914208us-gaap:TreasuryStockCommonMember2021-01-012021-12-310000914208us-gaap:BuildingMember2023-12-310000914208ivz:ComputerAndOtherEquipmentMembersrt:MinimumMember2023-12-310000914208ivz:ComputerAndOtherEquipmentMembersrt:MaximumMember2023-12-310000914208srt:MinimumMemberus-gaap:SoftwareDevelopmentMember2023-12-310000914208us-gaap:SoftwareDevelopmentMembersrt:MaximumMember2023-12-310000914208srt:MinimumMember2023-12-310000914208srt:MaximumMember2023-12-31ivz:reporting_unitxbrli:pure0000914208us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000914208us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310000914208us-gaap:TotalReturnSwapMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000914208us-gaap:TotalReturnSwapMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310000914208us-gaap:MoneyMarketFundsMember2023-12-310000914208us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2023-12-310000914208us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2023-12-310000914208us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2023-12-310000914208ivz:SeedCapitalMember2023-12-310000914208ivz:SeedCapitalMemberus-gaap:FairValueInputsLevel1Member2023-12-310000914208us-gaap:FairValueInputsLevel2Memberivz:SeedCapitalMember2023-12-310000914208us-gaap:FairValueInputsLevel3Memberivz:SeedCapitalMember2023-12-310000914208ivz:DeferredCompensationArrangementsMember2023-12-310000914208ivz:DeferredCompensationArrangementsMemberus-gaap:FairValueInputsLevel1Member2023-12-310000914208ivz:DeferredCompensationArrangementsMemberus-gaap:FairValueInputsLevel2Member2023-12-310000914208us-gaap:FairValueInputsLevel3Memberivz:DeferredCompensationArrangementsMember2023-12-310000914208us-gaap:FairValueInputsLevel1Member2023-12-310000914208us-gaap:FairValueInputsLevel2Member2023-12-310000914208us-gaap:FairValueInputsLevel3Member2023-12-310000914208us-gaap:LiabilityMember2023-12-310000914208us-gaap:LiabilityMemberus-gaap:FairValueInputsLevel1Member2023-12-310000914208us-gaap:LiabilityMemberus-gaap:FairValueInputsLevel2Member2023-12-310000914208us-gaap:LiabilityMemberus-gaap:FairValueInputsLevel3Member2023-12-310000914208us-gaap:MoneyMarketFundsMember2022-12-310000914208us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2022-12-310000914208us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2022-12-310000914208us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2022-12-310000914208ivz:SeedCapitalMember2022-12-310000914208ivz:SeedCapitalMemberus-gaap:FairValueInputsLevel1Member2022-12-310000914208us-gaap:FairValueInputsLevel2Memberivz:SeedCapitalMember2022-12-310000914208us-gaap:FairValueInputsLevel3Memberivz:SeedCapitalMember2022-12-310000914208ivz:DeferredCompensationArrangementsMember2022-12-310000914208ivz:DeferredCompensationArrangementsMemberus-gaap:FairValueInputsLevel1Member2022-12-310000914208ivz:DeferredCompensationArrangementsMemberus-gaap:FairValueInputsLevel2Member2022-12-310000914208us-gaap:FairValueInputsLevel3Memberivz:DeferredCompensationArrangementsMember2022-12-310000914208us-gaap:EquitySecuritiesMember2022-12-310000914208us-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2022-12-310000914208us-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMember2022-12-310000914208us-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMember2022-12-310000914208us-gaap:FairValueInputsLevel1Member2022-12-310000914208us-gaap:FairValueInputsLevel2Member2022-12-310000914208us-gaap:FairValueInputsLevel3Member2022-12-310000914208us-gaap:LiabilityMember2022-12-310000914208us-gaap:LiabilityMemberus-gaap:FairValueInputsLevel1Member2022-12-310000914208us-gaap:LiabilityMemberus-gaap:FairValueInputsLevel2Member2022-12-310000914208us-gaap:LiabilityMemberus-gaap:FairValueInputsLevel3Member2022-12-310000914208us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:TotalReturnSwapMember2023-12-310000914208us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:TotalReturnSwapMember2022-12-310000914208us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:TotalReturnSwapMember2023-01-012023-12-310000914208us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:TotalReturnSwapMember2022-01-012022-12-310000914208us-gaap:FairValueMeasurementsNonrecurringMembersrt:MinimumMemberus-gaap:MeasurementInputLongTermRevenueGrowthRateMember2023-12-31ivz:percentage0000914208us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:MeasurementInputLongTermRevenueGrowthRateMembersrt:MaximumMember2023-12-310000914208us-gaap:FairValueMeasurementsNonrecurringMemberivz:LongTermGrowthRateMember2023-12-310000914208us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:MeasurementInputDiscountRateMember2023-12-310000914208ivz:SeedCapitalMember2023-12-310000914208ivz:SeedCapitalMember2022-12-310000914208ivz:DeferredCompensationArrangementsMember2023-12-310000914208ivz:DeferredCompensationArrangementsMember2022-12-310000914208us-gaap:EquitySecuritiesMember2023-12-310000914208ivz:HuanengInvescoWLRInvestmentConsultingCompanyLimitedMembercountry:CNivz:HuanengInvescoWLRInvestmentConsultingCompanyLimitedMember2023-12-310000914208ivz:InvescoGreatWallFundManagementCompanyLimitedMembercountry:CNivz:InvescoGreatWallFundManagementCompanyLimitedMember2023-12-310000914208ivz:PocztylionArkaMemberivz:PocztylionArkaMembercountry:PL2023-12-310000914208us-gaap:TechnologyEquipmentMember2023-12-310000914208us-gaap:TechnologyEquipmentMember2022-12-310000914208us-gaap:ComputerSoftwareIntangibleAssetMember2023-12-310000914208us-gaap:ComputerSoftwareIntangibleAssetMember2022-12-310000914208us-gaap:LandAndBuildingMember2023-12-310000914208us-gaap:LandAndBuildingMember2022-12-310000914208us-gaap:LeaseholdImprovementsMember2023-12-310000914208us-gaap:LeaseholdImprovementsMember2022-12-310000914208us-gaap:ConstructionInProgressMember2023-12-310000914208us-gaap:ConstructionInProgressMember2022-12-310000914208us-gaap:CustomerContractsMember2023-12-310000914208us-gaap:CustomerContractsMember2023-12-310000914208us-gaap:DevelopedTechnologyRightsMember2023-12-310000914208us-gaap:OtherIntangibleAssetsMember2023-12-310000914208us-gaap:CustomerContractsMember2022-12-310000914208us-gaap:CustomerContractsMember2022-12-310000914208us-gaap:DevelopedTechnologyRightsMember2022-12-310000914208us-gaap:OtherIntangibleAssetsMember2022-12-310000914208us-gaap:CustomerContractsMember2023-01-012023-12-310000914208us-gaap:MajorityOwnedSubsidiaryUnconsolidatedMember2023-12-310000914208us-gaap:LineOfCreditMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000914208us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:LineOfCreditMember2023-12-310000914208us-gaap:LineOfCreditMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310000914208us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:LineOfCreditMember2022-12-310000914208us-gaap:UnsecuredDebtMemberivz:SeniorNotesDueJanuary302024Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000914208us-gaap:UnsecuredDebtMemberivz:SeniorNotesDueJanuary302024Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000914208us-gaap:UnsecuredDebtMemberivz:SeniorNotesDueJanuary302024Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310000914208us-gaap:UnsecuredDebtMemberivz:SeniorNotesDueJanuary302024Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310000914208ivz:SeniorNotesDueJanuary152026MemberMemberus-gaap:UnsecuredDebtMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000914208ivz:SeniorNotesDueJanuary152026MemberMemberus-gaap:UnsecuredDebtMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000914208ivz:SeniorNotesDueJanuary152026MemberMemberus-gaap:UnsecuredDebtMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310000914208ivz:SeniorNotesDueJanuary152026MemberMemberus-gaap:UnsecuredDebtMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310000914208us-gaap:UnsecuredDebtMemberivz:SeniorNotesDueNovember302043Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000914208us-gaap:UnsecuredDebtMemberivz:SeniorNotesDueNovember302043Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000914208us-gaap:UnsecuredDebtMemberivz:SeniorNotesDueNovember302043Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310000914208us-gaap:UnsecuredDebtMemberivz:SeniorNotesDueNovember302043Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310000914208us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000914208us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310000914208us-gaap:LineOfCreditMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-04-250000914208us-gaap:LineOfCreditMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-04-260000914208ivz:AdjustedSOFRMemberus-gaap:LineOfCreditMember2023-04-262023-04-260000914208us-gaap:LineOfCreditMemberus-gaap:PrimeRateMember2023-01-012023-12-310000914208ivz:SecuredOvernightFinancingRateSOFRMemberus-gaap:LineOfCreditMember2023-01-012023-12-310000914208ivz:SecuredOvernightFinancingRateSOFRMemberus-gaap:LineOfCreditMember2022-01-012022-12-310000914208us-gaap:BaseRateMemberus-gaap:LineOfCreditMember2022-01-012022-12-310000914208us-gaap:BaseRateMemberus-gaap:LineOfCreditMember2023-01-012023-12-310000914208us-gaap:LineOfCreditMember2023-01-012023-12-310000914208us-gaap:LineOfCreditMember2022-01-012022-12-310000914208ivz:OppenheimerFundsMember2023-12-310000914208ivz:OppenheimerFundsMember2023-01-012023-12-310000914208us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-12-310000914208us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310000914208us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310000914208us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310000914208us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310000914208us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310000914208us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-12-310000914208us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-12-310000914208us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310000914208us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310000914208us-gaap:AccumulatedTranslationAdjustmentMember2021-01-012021-12-310000914208us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-12-310000914208us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310000914208us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-31ivz:award0000914208ivz:AwardDateFebruary2022Memberus-gaap:PerformanceSharesMembersrt:MinimumMember2023-01-012023-12-310000914208us-gaap:PerformanceSharesMembersrt:MinimumMemberivz:AwardDateFebruary2023Member2023-01-012023-12-310000914208us-gaap:PerformanceSharesMemberivz:AwardDateFebruary2021Membersrt:MinimumMember2023-01-012023-12-310000914208us-gaap:PerformanceSharesMemberivz:AwardDateFebruary2021Membersrt:MaximumMember2023-01-012023-12-310000914208ivz:AwardDateFebruary2022Memberus-gaap:PerformanceSharesMembersrt:MaximumMember2023-01-012023-12-310000914208us-gaap:PerformanceSharesMembersrt:MaximumMemberivz:AwardDateFebruary2023Member2023-01-012023-12-310000914208ivz:GlobalEquityIncentivePlan2016Member2016-05-310000914208ivz:GlobalEquityIncentivePlan2010Member2010-05-310000914208ivz:TimeVestedNYSEMember2022-12-310000914208us-gaap:PerformanceSharesMember2022-12-310000914208ivz:TimeVestedNYSEMember2021-12-310000914208us-gaap:PerformanceSharesMember2021-12-310000914208ivz:TimeVestedNYSEMember2020-12-310000914208us-gaap:PerformanceSharesMember2020-12-310000914208ivz:TimeVestedNYSEMember2023-01-012023-12-310000914208us-gaap:PerformanceSharesMember2023-01-012023-12-310000914208ivz:TimeVestedNYSEMember2022-01-012022-12-310000914208us-gaap:PerformanceSharesMember2022-01-012022-12-310000914208ivz:TimeVestedNYSEMember2021-01-012021-12-310000914208us-gaap:PerformanceSharesMember2021-01-012021-12-310000914208ivz:TimeVestedNYSEMember2023-12-310000914208us-gaap:PerformanceSharesMember2023-12-310000914208us-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310000914208us-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310000914208us-gaap:PensionPlansDefinedBenefitMember2021-01-012021-12-310000914208us-gaap:PensionPlansDefinedBenefitMember2023-12-310000914208us-gaap:PensionPlansDefinedBenefitMember2022-12-310000914208us-gaap:PensionPlansDefinedBenefitMember2021-12-310000914208us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310000914208us-gaap:PensionPlansDefinedBenefitMemberivz:FundInvestmentsMember2023-12-310000914208us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2023-12-310000914208us-gaap:PensionPlansDefinedBenefitMemberivz:GovernmentDebtSecuritiesMember2023-12-310000914208us-gaap:PensionPlansDefinedBenefitMemberivz:GuaranteedInvestmentsContractsMember2023-12-310000914208us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherAssetsMember2023-12-310000914208us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2022-12-310000914208us-gaap:PensionPlansDefinedBenefitMemberivz:FundInvestmentsMember2022-12-310000914208us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2022-12-310000914208us-gaap:PensionPlansDefinedBenefitMemberivz:GovernmentDebtSecuritiesMember2022-12-310000914208us-gaap:PensionPlansDefinedBenefitMemberivz:GuaranteedInvestmentsContractsMember2022-12-310000914208us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherAssetsMember2022-12-31ivz:lease_renewal_option0000914208srt:MinimumMember2023-01-012023-12-310000914208srt:MaximumMember2023-01-012023-12-310000914208us-gaap:OtherAssetsMember2023-12-310000914208us-gaap:OtherAssetsMember2022-12-310000914208us-gaap:StateAndLocalJurisdictionMember2023-12-310000914208ivz:FederalAndForeignTaxAuthorityMember2023-12-310000914208country:CA2023-01-012023-12-310000914208us-gaap:TaxYear2023Member2023-12-310000914208us-gaap:TaxYear2022Member2022-12-310000914208us-gaap:TaxYear2021Member2021-12-31ivz:segment0000914208srt:AmericasMember2023-01-012023-12-310000914208srt:AsiaMember2023-01-012023-12-310000914208ivz:EMEAExcludingUnitedKingdomMember2023-01-012023-12-310000914208srt:AmericasMember2023-12-310000914208srt:AsiaMember2023-12-310000914208ivz:EMEAExcludingUnitedKingdomMember2023-12-310000914208srt:AmericasMember2022-01-012022-12-310000914208srt:AsiaMember2022-01-012022-12-310000914208ivz:EMEAExcludingUnitedKingdomMember2022-01-012022-12-310000914208srt:AmericasMember2022-12-310000914208srt:AsiaMember2022-12-310000914208ivz:EMEAExcludingUnitedKingdomMember2022-12-310000914208srt:AmericasMember2021-01-012021-12-310000914208srt:AsiaMember2021-01-012021-12-310000914208ivz:EMEAExcludingUnitedKingdomMember2021-01-012021-12-310000914208srt:AmericasMember2021-12-310000914208srt:AsiaMember2021-12-310000914208ivz:EMEAExcludingUnitedKingdomMember2021-12-310000914208ivz:EquityCommitmentMembersrt:MaximumMember2023-12-310000914208ivz:EquityCommitmentMember2023-12-310000914208us-gaap:BankLoanObligationsMember2023-12-310000914208us-gaap:FairValueInputsLevel1Memberus-gaap:BankLoanObligationsMember2023-12-310000914208us-gaap:FairValueInputsLevel2Memberus-gaap:BankLoanObligationsMember2023-12-310000914208us-gaap:FairValueInputsLevel3Memberus-gaap:BankLoanObligationsMember2023-12-310000914208us-gaap:BankLoanObligationsMemberus-gaap:PortionAtOtherThanFairValueFairValueDisclosureMember2023-12-310000914208us-gaap:CorporateBondSecuritiesMember2023-12-310000914208us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateBondSecuritiesMember2023-12-310000914208us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateBondSecuritiesMember2023-12-310000914208us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateBondSecuritiesMember2023-12-310000914208us-gaap:CorporateBondSecuritiesMemberus-gaap:PortionAtOtherThanFairValueFairValueDisclosureMember2023-12-310000914208us-gaap:EquitySecuritiesMember2023-12-310000914208us-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2023-12-310000914208us-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMember2023-12-310000914208us-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMember2023-12-310000914208us-gaap:EquitySecuritiesMemberus-gaap:PortionAtOtherThanFairValueFairValueDisclosureMember2023-12-310000914208ivz:EquityandFixedincomeMutualFundsMember2023-12-310000914208ivz:EquityandFixedincomeMutualFundsMemberus-gaap:FairValueInputsLevel1Member2023-12-310000914208us-gaap:FairValueInputsLevel2Memberivz:EquityandFixedincomeMutualFundsMember2023-12-310000914208us-gaap:FairValueInputsLevel3Memberivz:EquityandFixedincomeMutualFundsMember2023-12-310000914208ivz:EquityandFixedincomeMutualFundsMemberus-gaap:PortionAtOtherThanFairValueFairValueDisclosureMember2023-12-310000914208us-gaap:PrivateEquityFundsMember2023-12-310000914208us-gaap:FairValueInputsLevel1Memberus-gaap:PrivateEquityFundsMember2023-12-310000914208us-gaap:FairValueInputsLevel2Memberus-gaap:PrivateEquityFundsMember2023-12-310000914208us-gaap:FairValueInputsLevel3Memberus-gaap:PrivateEquityFundsMember2023-12-310000914208us-gaap:PortionAtOtherThanFairValueFairValueDisclosureMemberus-gaap:PrivateEquityFundsMember2023-12-310000914208us-gaap:PortionAtOtherThanFairValueFairValueDisclosureMember2023-12-310000914208us-gaap:BankLoanObligationsMember2022-12-310000914208us-gaap:FairValueInputsLevel1Memberus-gaap:BankLoanObligationsMember2022-12-310000914208us-gaap:FairValueInputsLevel2Memberus-gaap:BankLoanObligationsMember2022-12-310000914208us-gaap:FairValueInputsLevel3Memberus-gaap:BankLoanObligationsMember2022-12-310000914208us-gaap:BankLoanObligationsMemberus-gaap:PortionAtOtherThanFairValueFairValueDisclosureMember2022-12-310000914208us-gaap:CorporateBondSecuritiesMember2022-12-310000914208us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateBondSecuritiesMember2022-12-310000914208us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateBondSecuritiesMember2022-12-310000914208us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateBondSecuritiesMember2022-12-310000914208us-gaap:CorporateBondSecuritiesMemberus-gaap:PortionAtOtherThanFairValueFairValueDisclosureMember2022-12-310000914208us-gaap:EquitySecuritiesMember2022-12-310000914208us-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2022-12-310000914208us-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMember2022-12-310000914208us-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMember2022-12-310000914208us-gaap:EquitySecuritiesMemberus-gaap:PortionAtOtherThanFairValueFairValueDisclosureMember2022-12-310000914208ivz:EquityandFixedincomeMutualFundsMember2022-12-310000914208ivz:EquityandFixedincomeMutualFundsMemberus-gaap:FairValueInputsLevel1Member2022-12-310000914208us-gaap:FairValueInputsLevel2Memberivz:EquityandFixedincomeMutualFundsMember2022-12-310000914208us-gaap:FairValueInputsLevel3Memberivz:EquityandFixedincomeMutualFundsMember2022-12-310000914208ivz:EquityandFixedincomeMutualFundsMemberus-gaap:PortionAtOtherThanFairValueFairValueDisclosureMember2022-12-310000914208us-gaap:PrivateEquityFundsMember2022-12-310000914208us-gaap:FairValueInputsLevel1Memberus-gaap:PrivateEquityFundsMember2022-12-310000914208us-gaap:FairValueInputsLevel2Memberus-gaap:PrivateEquityFundsMember2022-12-310000914208us-gaap:FairValueInputsLevel3Memberus-gaap:PrivateEquityFundsMember2022-12-310000914208us-gaap:PortionAtOtherThanFairValueFairValueDisclosureMemberus-gaap:PrivateEquityFundsMember2022-12-310000914208us-gaap:PortionAtOtherThanFairValueFairValueDisclosureMember2022-12-310000914208us-gaap:BankLoanObligationsMember2023-01-012023-12-310000914208ivz:SeniorSecuredBankLoansAndBondsMember2023-12-310000914208ivz:SeniorSecuredBankLoansAndBondsMember2022-12-310000914208us-gaap:PrivateEquityFundsMember2023-12-310000914208us-gaap:PrivateEquityFundsMember2023-01-012023-12-310000914208us-gaap:PrivateEquityFundsMember2022-12-310000914208us-gaap:PrivateEquityFundsMember2022-01-012022-12-310000914208us-gaap:RealEstateInvestmentMember2023-12-310000914208us-gaap:RealEstateInvestmentMember2022-12-310000914208us-gaap:FairValueInputsLevel3Member2021-12-310000914208us-gaap:FairValueInputsLevel3Member2023-01-012023-12-310000914208us-gaap:FairValueInputsLevel3Member2022-01-012022-12-310000914208us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-12-310000914208us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2022-12-310000914208us-gaap:PreferredStockMemberivz:OppenheimerFundsMemberivz:MassMutualMember2023-12-310000914208us-gaap:PreferredStockMemberivz:OppenheimerFundsMember2023-01-012023-12-310000914208us-gaap:SubsequentEventMember2024-01-232024-01-230000914208us-gaap:SubsequentEventMemberus-gaap:UnsecuredDebtMemberivz:SeniorNotesDueJanuary302024Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-01-300000914208us-gaap:SubsequentEventMemberus-gaap:LineOfCreditMember2024-01-312024-01-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| | | | | | | | |

| ☑ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

| | | | | | | | |

| ☐ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to Commission file number 001-13908

Invesco Ltd.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | | | | |

| Bermuda | | 98-0557567 |

| (State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | | | | |

| 1331 Spring Street, | Suite 2500, | Atlanta, | GA | | 30309 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(404) 892-0896

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.20 par value | IVZ | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known, seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☑ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | | | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes ☐ No ☑

At June 30, 2023, the aggregate market value of the voting stock held by non-affiliates was $6.0 billion, based on the closing price of the registrant's Common Shares, par value U.S. $0.20 per share, on the New York Stock Exchange. At January 31, 2024, the most recent practicable date, the number of Common Shares outstanding was 449,204,268.

DOCUMENTS INCORPORATED BY REFERENCE

The registrant will incorporate by reference information required in response to Part III, Items 10-14 in its definitive Proxy Statement for its annual meeting of shareholders, to be filed with the Securities and Exchange Commission within 120 days after December 31, 2023.

TABLE OF CONTENTS

We include cross references to captions elsewhere in this Annual Report on Form 10-K, which we refer to as this “Report,” where you can find related additional information. The following table of contents tells you where to find these captions.

GLOSSARY OF DEFINED TERMS | | | | | | | | |

| Adjusted SOFR | — | | Secured Overnight Financing Rate plus 0.10% adjustment |

| APAC | — | | Asia-Pacific |

| AUM | — | | Assets under management |

| bps | — | | Basis points |

| CEO | — | | Chief Executive Officer |

| CFTC | — | | Commodity Future Trading Commission |

| CIP | — | | Consolidated investment products |

| CISO | — | | Chief Information Security Officer |

| CLOs | — | | Collateralized loan obligations |

| Companies Act | — | | Companies Act 1981 of Bermuda |

| COSO | — | | Committee of Sponsoring Organizations of the Treadway Commission |

| DOL | — | | The Department of Labor |

| Covenant Adjusted EBITDA | — | | A financial measure set forth in covenants in our credit agreement, which is defined to be earnings before income tax, depreciation, amortization, interest expense, common share-based compensation expense, unrealized (gains)/losses from investments, net, and unusual

or otherwise non-recurring gains and losses

|

| EMEA | — | | Europe, Middle East and Africa |

| EMIR | — | | European Market Infrastructure Regulation |

| EPS | — | | Earnings per share |

ERISA | — | | Employee Retirement Income Security Act of 1974 |

| ESG | — | | Environmental, social and governance |

| ETFs | — | | Exchange-traded funds |

| EU | — | | European Union |

| FASB | — | | Financial Accounting Standards Board |

| FCA | — | | Financial Conduct Authority |

| GDPR | — | | General Data Protection Regulation |

| GCSO | — | | Global Chief Security Officer |

| GEIP ST | — | | 2010 Global Equity Incentive Plan ST |

| IGW or Invesco Great Wall | — | | Invesco Great Wall Fund Management Company Limited |

| LIBOR | — | | The London Inter-Bank Offered Rate |

| MassMutual | — | | Massachusetts Mutual Life Insurance Company |

| NAV | — | | Net asset value |

| NYSE | — | | New York Stock Exchange |

| OECD | — | | Organization for Economic Cooperation and Development |

| PCAOB | — | | Public Company Accounting Oversight Board |

| PIPL | — | | Personal Information Protection Law |

| RIS | — | | Retail Investment Strategy |

| RSAs | — | | Restricted stock awards |

| RSUs | — | | Restricted stock units |

| S&P | — | | Standard & Poor's |

| SEC | — | | U.S. Securities and Exchange Commission |

| SFC | — | | Securities Futures Commission of Hong Kong |

| SFDR | — | | Sustainable Finance Disclosure Regulation |

| SMA | — | | Separately Managed Accounts |

| SOFR | — | | Secured Overnight Financing Rate |

| the company | — | | Invesco Ltd. and its consolidated entities |

| the Parent | — | | Invesco Ltd. |

| Report | — | | this Annual Report on Form 10-K |

| TRS | — | | Total return swap |

| UITs | — | | Unit Investment Trusts |

| U.K. | — | | United Kingdom |

| U.S. | — | | United States |

| U.S. GAAP | — | | U.S. Generally Accepted Accounting Principles |

| UCITS | — | | Undertakings for the Collective Investment in Transferable Securities |

| UTBs | — | | Unrecognized tax benefits |

| VIE | — | | Variable interest entity |

| VOE | — | | Voting interest entity |

SPECIAL CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report, other public filings and oral and written statements by us and our management, may include statements that constitute “forward-looking statements” within the meaning of the United States (U.S.) securities laws. These statements are based on the beliefs and assumptions of our management and on information available to us at the time such statements are made. Forward-looking statements include information concerning future results of our operations, expenses, earnings, liquidity, cash flows, capital expenditures, and assets under management (AUM) which could differ materially from actual results due to known and unknown risks and other important factors, including, but not limited to, industry or market conditions, geopolitical events and pandemics or health crises and their respective potential impact on the company, acquisitions and divestitures, debt and our ability to obtain additional financing or make payments, regulatory developments, demand for and pricing of our products, the prospects for certain legal contingencies, and other aspects of our business or general economic conditions. In addition, when used in this Report or such other documents or statements, words such as “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” “projects,” “forecasts,” and future or conditional verbs such as “will,” “may,” “could,” “should,” and “would,” and any other statement that necessarily depends on future events, are intended to identify forward-looking statements. None of this information should be considered in isolation from, or as a substitute for, historical financial statements.

Forward-looking statements are not guarantees and involve risks, uncertainties and assumptions. There can be no assurance that actual results will not differ materially from our expectations. In most cases, such assumptions will not be expressly stated. We caution investors not to rely unduly on any forward-looking statements.

The following important factors, and other factors described elsewhere in this Report or contained in our other filings with the U.S. Securities and Exchange Commission (SEC), among others, could cause our results to differ materially from any results described in any forward-looking statements:

•significant fluctuations in the performance of capital and credit markets worldwide;

•adverse changes in the global economy;

•the performance of our investment products;

•significant changes in net asset flows into or out of the accounts we manage or declines in market value of the assets in, or redemptions or other withdrawals from, those accounts;

•competitive pressures in the investment management business, including consolidation, which may force us to reduce fees we earn;

•failure to properly address the increased transformative pressures affecting the asset management industry;

•any inability to adjust our expenses quickly enough to match significant deterioration in markets;

•the effect of fluctuations in interest rates, liquidity and credit markets in the U.S. or globally;

•failure to maintain adequate corporate and contingent liquidity;

•exposure through certain investment products to credits losses in excess of our expectations and risks related to early stage real estate-related companies;

•our ability to acquire and integrate other companies into our operations successfully and the extent to which we can realize anticipated product sales, cost savings or synergies from such acquisitions;

•the occurrence of breaches and errors in the conduct of our business, including errors in our quantitative models and index tracking investment solutions, any failure to properly safeguard confidential and sensitive information, cyber-attacks or acts of fraud;

•our ability to attract and retain key personnel, including investment management professionals;

•limitations or restrictions on access to distribution channels for our products;

•our ability to develop, introduce and support new investment products and services;

•our ability to comply with client contractual requirements and/or investment guidelines despite preventative compliance procedures and controls;

•variations in demand for our investment products or services, including termination or non-renewal of our investment management agreements;

•harm to our reputation;

•our ability to maintain our credit ratings and access the capital markets in a timely manner;

•our debt and the limitations imposed by our credit agreement;

•exchange rate fluctuations, especially as against the U.S. Dollar;

•man-made or natural disasters, pandemics or other widespread health crises or other business continuity problems and governmental responses to the same;

•the effect of political, economic or social instability in or involving countries in which we invest or do business (including the effect of terrorist attacks, war and other hostilities);

•impact of climate-change;

•the effect of failures or delays in support systems or customer service functions, and other interruptions of our operations;

•the effect of systems and other technological limitations on our ability to manage and grow our business;

•the effect of non-performance by our counterparties, third-party service providers and other key vendors to fulfill their obligations;

•impairment of goodwill and other intangible assets;

•adverse results in litigation and any other regulatory or other proceedings, governmental investigations and enforcement actions;

•the selling of our common stock by our significant shareholders; and

•enactment of adverse federal, state or foreign legislation or changes in government policy or regulation (including accounting standards) affecting our operations, our capital requirements or the way in which our profits are taxed.

Other factors and assumptions not identified above were also involved in the derivation of these forward-looking statements, and the failure of such other assumptions to be realized may also cause actual results to differ materially from those projected. For more discussion of the risks affecting us, please refer to Item 1A, “Risk Factors.”

You should consider the areas of risk described above in connection with any forward-looking statements that may be made by us and our businesses generally. We expressly disclaim any obligation to update any of the information in this or any other public report if any forward-looking statement later turns out to be inaccurate, whether as a result of new information, future events or otherwise. For all forward-looking statements, we claim the “safe harbor” provided by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

Summary of Risk Factors

The following is a summary of material risks we are exposed to in the course of our business activities and which could have an adverse effect on our business. It does not contain all of the information that may be important to you and should be read together with the more detailed discussion of risks in Item 1A, Risk Factors.

Risks Related to Market Dynamics and Volatility

•Volatility and disruption in global or regional capital and credit markets, as well as adverse changes in the global economy, could negatively affect our AUM, revenues, net income and liquidity.

•Our revenues and net income would likely be adversely affected by any reduction in AUM as a result of either a decline in market value of such assets or net outflows, each of which would reduce the investment management fees we earn.

•Our revenues and net income from money market and other fixed income assets may be harmed by interest rates, liquidity and credit volatility.

•Our financial condition and liquidity would be adversely affected by losses on our seed capital and co-investments.

•As many of our subsidiary operations are located outside of the U.S. and have functional currencies other than the U.S. Dollar, changes in the exchange rates to the U.S. Dollar impact our reported financial results.

Risks Related to Investment Performance and Competition

•Poor investment performance of our products could reduce the level of our AUM or affect our sales, and negatively impact our revenues and net income.

•Failure to properly address the increased transformative pressures affecting the asset management industry could negatively impact our business.

•Competitive pressures may force us to reduce the fees we charge to clients, which could reduce our profitability.

•Our private market products include investments in private credit, real estate, and equity investments in early-stage real estate-related companies which may expose our investment products, clients and us, to the extent of our investment in such investment products, to risks and liabilities, and us to reputational harm.

•Our investment products, clients and us, to the extent of our investment in such investment products, could incur losses if the allowance for credit losses, including loan and lending-related commitment reserves, of portfolio-level investments is inadequate or if our expectations of future economic conditions deteriorate.

•We may be unable to develop new products and services and the development of new products and services may expose us to additional costs or operational risk.

•The failure or negative performance of products offered by competitors may have a negative impact on similar Invesco products irrespective of our performance.

Risks Related to Talent, Operations and Technology

•Our investment management professionals and other key employees are a vital part of our ability to attract and retain clients, and the loss of key individuals or a significant portion of those professionals could result in a reduction of our AUM, revenues and net income.

•Changes in the distribution channels on which we depend could reduce our net income and hinder our growth.

•Failure to comply with client contractual requirements and/or investment guidelines could result in costs of correction, damage awards and/or regulatory fines and penalties against us and loss of revenues due to client terminations.

•Our investment advisory agreements are subject to termination or non-renewal, and our fund and other investors may withdraw their assets at any time.

•The quantitative models we use and our index tracking investment solutions may contain errors, which could result in financial losses or adversely impact product performance and client relationships.

•Climate change-related risks could adversely affect our business, products, operations and clients, which may cause our AUM, revenue and net income to decline.

•If our reputation is harmed, we could suffer losses in our AUM, revenues and net income.

•The lack of soundness of other financial institutions could adversely affect us or the client portfolios we manage.

•We depend on information technology, and any failures of or damage to, attack on or unauthorized access to our information technology systems or facilities, or those of third parties with which we do business or that facilitate our business activities, including as a result of cyber-attacks, could result in significant limits on our ability to conduct our operations and activities, costs and reputational damage.

•Our ability to manage and grow our business successfully can be impeded by systems and other technological limitations.

•If we are unable to successfully recover from a man-made or natural disaster, health crisis or pandemic or other business continuity problem, we could suffer material financial loss, loss of human capital, regulatory actions, reputational harm or legal liability.

•Our business is vulnerable to deficiencies and failures in support systems, including data management, and customer service functions that could lead to breaches and errors or reputational harm, resulting in loss of customers or claims against us or our subsidiaries.

Risks Related to Accounting, Capital Management and Liquidity

•The carrying value of goodwill and other intangible assets on our balance sheet could become impaired, which would adversely affect our results of operations.

•Our credit agreement imposes operating covenants that impact our ability to conduct certain activities and, if amounts borrowed under it were subject to accelerated repayment, we might not have sufficient assets or liquidity to repay such amounts in full.

•We issued perpetual preferred stock having a value of approximately $4 billion, which could adversely affect our ability to raise additional capital and may limit our ability to fund other priorities.

•Failure to maintain adequate corporate and contingent liquidity may cause our AUM, revenues and net income to decline, as well as harm our prospects for growth.

•Distribution of earnings of our subsidiaries may be subject to limitations, including net capital requirements.

Risks Related to Strategic Transactions

•We may engage in strategic transactions that could create risks.

Risks Related to our Significant Shareholders

•Future sales of shares of our common stock could adversely impact the trading price of our common stock.

•Massachusetts Mutual Life Insurance Company (MassMutual) has the ability to significantly influence our business, and MassMutual’s interest in our business may be different from that of other shareholders.

Risks Related to Regulatory and Legal Matters

•We operate in an industry that is highly regulated in most countries, and any enforcement action or significant changes in the laws or regulations governing our business or industry could decrease our AUM, revenues, net income and liquidity.

•Civil litigation and governmental investigations and enforcement actions could adversely affect our AUM and future net income and increase our costs of doing business.

•Legislative and other measures that may be taken by governmental authorities could materially increase our tax burden or otherwise adversely affect our net income or liquidity.

•Examinations and audits by tax authorities could result in additional tax payments for prior periods.

•Bermuda law differs from the laws in effect in the U.S. and may afford less protection to shareholders.

•Because we are incorporated in Bermuda, it may be difficult for shareholders to enforce non-monetary judgments against us or any judgment against us or our directors and officers. Shareholders may have to seek independent advice regarding the commencement of proceedings or service of foreign process in Bermuda.

•We have anti-takeover provisions in our Bye-Laws that may discourage a change of control.

General Risk Factors

•Our ability to maintain our credit ratings and to access the capital markets in a timely manner should we seek to do so depends on a number of factors.

•Insurance may not be available at a reasonable cost to protect us from loss or liability.

PART I

Item 1. Business

Introduction

Invesco Ltd. (the Parent) and its consolidated subsidiaries (collectively, Invesco or the company) is an independent investment management firm dedicated to delivering a superior investment experience. Our comprehensive range of active, passive and alternative investment capabilities has been constructed over many years to help clients achieve their investment objectives. We draw on this comprehensive range of capabilities to provide solutions designed to deliver key outcomes aligned to client needs.

With approximately 8,500 employees and an on-the-ground presence in more than 20 countries, Invesco is well positioned to meet the needs of investors across the globe. We have specialized investment teams managing investments across a broad range of asset classes, investment styles and geographies. For decades, individuals and institutions have viewed Invesco as a trusted partner for a comprehensive set of investment needs. We have a significant presence in the retail and institutional markets within the investment management industry in the Americas, Europe, Middle East and Africa (EMEA) and Asia-Pacific (APAC), serving clients in more than 120 countries. As of December 31, 2023, the firm managed approximately $1.6 trillion in assets for investors around the world.

The key drivers of success for Invesco are long-term investment performance, high-quality client service and effective distribution relationships delivered across a diverse spectrum of investment management capabilities, distribution channels, geographic areas and market exposures. Through our focus on these areas, we seek to deliver better outcomes for clients, generate competitive investment results and positive net flows, and increase AUM and revenues.

We measure relative investment performance by comparing our investment capabilities to competitors' products, industry benchmarks and client investment objectives. Generally, distributors, investment advisors and consultants take into consideration longer-term investment performance (e.g., three-year and five-year performance) in their selection of investment products and recommendations to their clients. Third-party ratings may also influence client investment decisions. We monitor the quality of client service in a variety of ways, including periodic client satisfaction surveys, analysis of response times and redemption rates, competitive benchmarking of services and feedback from investment consultants.

The company is organized under the laws of Bermuda. Our common shares are listed and traded on the New York Stock Exchange (NYSE) under the symbol “IVZ.” We maintain a website at www.invesco.com/corporate. (Information contained on our website shall not be deemed to be part of, or be incorporated into, this document.)

Industry Trends

Trends around the world continue to transform the investment management industry and underscore the need to be well diversified with broad capabilities globally:

Individuals and Institutions expect personalized outcomes and experience.

•Distribution partners are becoming more selective and continuing to maintain fewer relationships and partners, reducing the number of trusted investment managers with whom they work.

•Clients and distribution partners are demanding more from investment managers. While performance remains paramount, competitive pricing, best-in class experience and value-added services (including portfolio analytics and consultative solutions) increasingly differentiate managers.

•The U.S. and China will continue to be the dominant global wealth markets. Global asset management leaders will need a considerable footprint in these markets.

Structural shifts in client portfolio allocations.

•Private market allocations continue to increase and become a meaningful part of retail portfolios, driving industry fee growth as well as innovation and democratization.

•Beta, factor, and index offerings will continue to be core to portfolios in transparent, efficient markets. In this space, clients will demand ease of access and competitive pricing.

•Investors have been selecting active strategies, while placing a high bar on proven superior risk-adjusted returns.

•Investors have been favoring fixed income strategies in response to unpredictable market conditions and the higher interest rate environment.

•Investors have been shifting their investment strategies toward lower fee offerings, and we believe this trend will continue.

Leading asset managers must quickly curate options that solve clients’ problems.

•Investment capabilities will be delivered efficiently and seamlessly using technologies, platforms, and vehicles.

•Investment managers are finding new ways of leveraging data and analytics to create insights that will provide strategic advantage and drive investment, distribution, and operational excellence.

•Winners will invest in talent and skills across new ecosystems, requiring new ways of working and strategic partnerships to drive synergies and scale.

These dynamics are driving fundamental changes within the industry and, we believe, will drive increasing consolidation. We believe the steps we have taken over the past decade strengthened our ability to understand, anticipate and meet client needs and will help ensure Invesco is well-positioned to compete within our industry over the long term.

Strategy

At Invesco, we seek to drive sustainable profitable growth by delivering capabilities that build enduring partnerships and create better outcomes for our clients. The company focuses on four key long-term strategic objectives that are designed to sharpen our focus on client needs, further strengthen our business over time and help ensure our long-term success:

Deliver the excellence our clients expect

•Achieve strong, long-term investment performance.

•Deliver a quality investment process and a frictionless experience with superior engagement.

•Provide advice and solutions to help our clients best manage their portfolios and succeed with their own clients.

Grow high demand investment offerings

•Deliver ahead of clients’ expectations through product innovation, investment styles, and packaging options.

•Focus our offerings at the intersection of high opportunity markets and high demand capabilities.

Create an environment where talented people thrive

•Attract and develop high performing, diverse talent with skills aligned to deliver against business outcomes.

•Create an inclusive and engaging culture that values diversity of thought which enables us to work as one team to deliver better outcomes.

Act like owners for all stakeholders

•Be disciplined stewards of firm resources with a focus on profitable growth.

•Invest in the success of our clients, our shareholders, and ourselves.

As an integrated global investment manager, we are keenly focused on meeting clients' needs and operating effectively and efficiently. We take a unified approach to our business and present our financial statements and other disclosures under the single operating segment “investment management.”

A key focus of our business is fostering a strong investment culture and providing the support that enables our investment teams to maintain well-performing investment capabilities. We believe the ability to leverage the capabilities of our investment teams to help clients across the globe achieve their investment objectives is a significant differentiator for our firm.

Investment Management Capabilities

We believe that the proven strength of our distinct and globally located investment teams and their well-defined investment disciplines and risk management approaches provide us with a robust competitive advantage. There are few independent investment managers with teams as globally diverse as Invesco's and with the same breadth and depth of investment capabilities and vehicles. We offer multiple investment objectives within the various asset classes and products that we manage. Our asset classes, broadly defined, include equity, fixed income, balanced, alternatives and money market.

The following sets forth our major managed investment objectives by asset class:

| | | | | | | | | | | | | | |

Equity | Fixed Income | Balanced | Alternatives | Money Market |

| ● Core/Value/Growth Style | ● Buy and Hold | ● Balanced Risk | ● Absolute Return | ● Cash Plus |

| ● Custom Solutions | ● Convertibles | ● Custom Solutions | ● Commodities | ● Custom Solutions |

| ● Emerging Markets | ● Core/Core Plus | ● ESG | ● Currencies | ● Government/Treasury |

● Environmental, Social and

Governance (ESG) | ● Custom Solutions | ● Global/Regional | ● Custom Solutions | ● Prime |

| ● International/Global | ● Emerging Markets | ● Single Country | ● Direct Lending | ● Taxable |

| ● Large/Mid/Small Cap | ● ESG | ● Target Risk | ● Distressed Debt | ● Tax-Free |

| ● Low Volatility/Defensive | ● Government Bonds | ● Traditional Balanced | ● ESG | |

| ● Passive/Enhanced | ● High-Yield Bonds | | ● Financial Structures | |

| ● Regional/Single Country | ● International/Global | | ● Global Macro | |

| ● Smart Beta/Factor-based | ● Investment Grade Credit | | ● Infrastructure and MLPs | |

| ● Thematic/Sector | ● Multi-Sector | | ● Long/Short Equity | |

| ● Municipal Bonds | | ● Managed Futures | |

| ● Passive/Enhanced | | ● Multi-Alternatives | |

| ● Regional/Single Country | | ● Private Real Estate | |

| ● Short/Ultra-Short Duration | | ● Public Real Estate Securities | |

| ● Smart Beta/Factor-based | | ● Senior Secured Loans | |

| ● Stable Value | | | |

| ● Structured Securities | | | |

Distribution Channels

Retail AUM typically originate from clients investing into funds available to the public in the form of shares or units. Institutional AUM originate from entities such as individual corporate clients, insurance companies, endowments, foundations, government authorities, universities or charities. AUM disclosed as retail channel AUM include AUM distributed by the company's retail sales team. AUM disclosed as institutional channel AUM include AUM distributed by the company's institutional sales team.

The company operates as an integrated global investment manager, presenting itself as a single firm to clients around the world. Dedicated sales forces deliver our investment strategies through a variety of vehicles that meet the needs of retail and institutional clients. Note that not all products sold in the retail distribution channel are in "retail" vehicles, and not all products sold in the institutional channel are in "institutional" vehicles, as described in the table below. This aggregation, however, is viewed as a proxy for presenting AUM in the retail and institutional markets in which we operate.

The following lists our primary investment vehicles by distribution channel:

| | | | | | | | | | | |

Retail | | Institutional | |

| ● Closed-end Mutual Funds | | ● Collective Trust Funds | |

| ● Exchange-traded funds (ETFs) | | ● ETFs | |

| ● Individual Savings Accounts | | ● Institutional Separate Accounts | |

| ● Investment Companies with Variable Capital | | ● Open-end Mutual Funds | |

| ● Investment Trusts | | ● Private Funds | |

| ● Open-end Mutual Funds | | | |

| ● Separately Managed Accounts (SMA) | | | |

| ● Société d'investissement à Capital Variable | | | |

| ● Unit Investment Trusts (UITs) | | | |

| ● Variable Insurance Funds | | | |

Retail

Retail AUM were $1,042.0 billion at December 31, 2023. We offer retail products within all of the major asset classes. Our retail products are primarily distributed through third-party financial intermediaries, including major wire houses, direct wealth platforms, regional broker-dealers, insurance companies, banks and financial planners in the Americas, and independent brokers and financial advisors, banks and direct wealth platforms in EMEA and APAC.

The Americas and EMEA retail operations rank among the largest by AUM in their respective markets. As of December 31, 2023, Invesco's U.S. retail business, including our ETFs franchise, is among the leading asset managers in the U.S., and Invesco's retail business in EMEA is among the largest non-proprietary investment managers in the retail channel. In addition, Invesco Great Wall Fund Management Company Limited (IGW or Invesco Great Wall), our joint venture in China, is one of the largest Sino-foreign managers of equity products in China, with total AUM of approximately $83.6 billion at December 31, 2023. We provide our retail clients with one of the industry's most robust and comprehensive product lines.

Institutional

Institutional AUM were $543.3 billion at December 31, 2023. We offer a broad suite of domestic and global strategies, including traditional and quantitative equities, fixed income (including money market funds for institutional clients), real estate, financial structures and absolute return strategies. Regional sales forces distribute our products and provide services to clients and intermediaries around the world. We have a diversified client base that includes major public and private entities, unions, non-profit organizations, endowments, foundations, pension funds, financial institutions and sovereign wealth funds. Invesco's institutional money market funds serve some of the largest financial institutions, government entities and companies in the world.

AUM Diversification

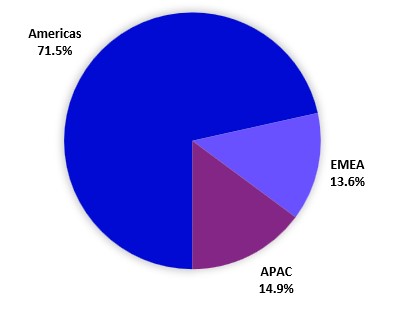

One of Invesco's competitive strengths is the diversification of AUM by client domicile, distribution channel and asset class. We serve clients in more than 120 countries. The following tables present a breakdown of AUM by client domicile, distribution channel and asset class as of December 31, 2023. Additionally, the fourth table below illustrates the split of our AUM as Passive and Active. Passive AUM include index-based ETFs, UITs, non-management fee earning AUM and other passive mandates. Active AUM are total AUM less Passive AUM. See the company's disclosures regarding the changes in AUM for the year ended December 31, 2023 in Part II, Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations - Assets Under Management” for additional information regarding the changes in AUM.

| | | | | | | | | | | | | | |

| By Client Domicile | | | |

| (in billions) | Total | | 1-Yr Change |

c Americas | $ | 1,133.9 | | | 13.5 | % |

| | | |

c EMEA | 215.9 | | | 15.9 | % |

c APAC | 235.5 | | | 5.4 | % |

| Total | $ | 1,585.3 | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

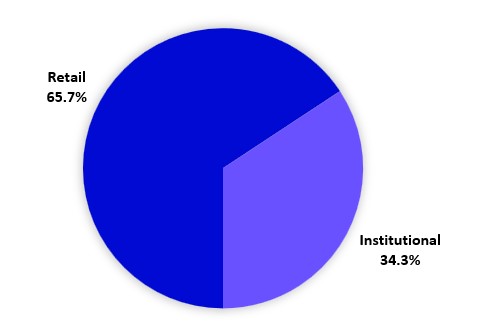

| | | | | | | | | | | | | | |

| | | | |

| By Distribution Channel | |

| (in billions) | Total | | 1-Yr Change |

c Retail | $ | 1,042.0 | | | 19.5 | % |

c Institutional | 543.3 | | | 1.2 | % |

| Total | $ | 1,585.3 | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

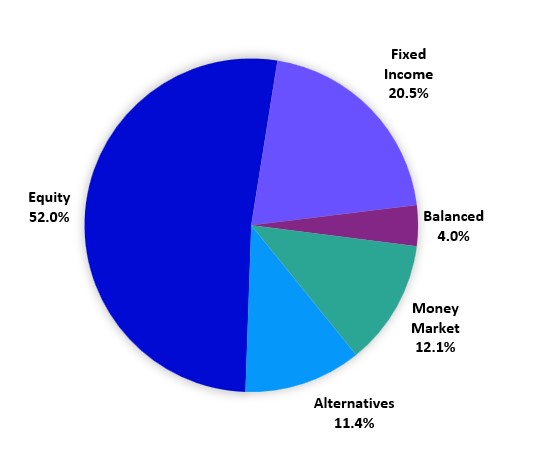

| | | | | | | | | | | | | | |

| By Asset Class | | | | |

| (in billions) | Total | | 1-Yr Change |

c Equity | $ | 823.7 | | | 29.3 | % |

c Fixed Income | 325.7 | | | 3.8 | % |

c Balanced | 62.7 | | | (6.6) | % |

c Money Market | 192.7 | | | (5.3) | % |

c Alternatives | 180.5 | | | (3.9) | % |

| Total | $ | 1,585.3 | | | |

| | | |

| | | |

| | | |

| | | |

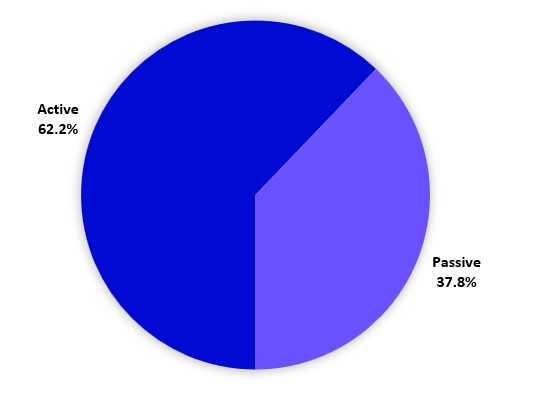

| | | | | | | | | | | | | | |

| Active vs. Passive | | | | |

| (in billions) | Total | | 1-Yr Change |

c Active | $ | 985.3 | | | 0.9 | % |

c Passive | 600.0 | | | 38.6 | % |

| Total | $ | 1,585.3 | | | |

| | | |

| | | |

| | | |

| | | |

Corporate Responsibility and Human Capital

Invesco’s long-term success depends on our ability to retain, develop, engage and attract top talent. Invesco invests significantly in talent development, health and welfare programs, technology and other resources that support our employees in developing their full potential both personally and professionally. We believe that an employee community that is diverse and inclusive, engaged in community involvement and invested in employee well-being will drive positive outcomes for our clients and shareholders.

We believe that diversity and inclusion are good for business. We are committed to further strengthening diversity at all levels and in all functions across our global business. Increasing representation of women and diverse employees remains a focus for Invesco, as does building a more inclusive work environment. All employees are required to take periodic unconscious bias training. Our employees are also encouraged to participate in any of our various employee resource groups

where employees with diverse backgrounds, experiences and perspectives can connect. Our employee resource groups are sponsored by senior leaders and are designed by employees, for employees.

As of December 31, 2023, the company had 8,489 (December 31, 2022: 8,611) employees with an on-the-ground presence in over 20 countries. Our employees are not covered under collective bargaining agreements.

The company is committed to reducing our impact on the environment. Across Invesco offices, we carefully manage our operational activities with a focus on using natural resources wisely, increasing efficiencies wherever possible and providing a safe and healthy workplace for employees and visitors. This is the foundation of our environmental, health and safety management approach.

Competition

The investment management business is highly competitive, with points of differentiation including investment performance, fees, range of products offered, brand recognition, business reputation, financial strength, depth and continuity of relationships and quality of service. We compete with a large number of investment management firms, commercial banks, investment banks, broker-dealers, hedge funds, insurance companies and, increasingly, firms outside the traditional financial services industry, such as technology providers. Many of these competitors have greater financial resources and higher brand recognition than Invesco. However, we believe our experience as a trusted partner to clients, the quality and diversity of our investment capabilities, product types and channels of distribution, and our commitment to innovation enable us to compete effectively in the global investment management business. There are few independent investment managers with teams as globally diverse as Invesco's and the same breadth and depth of investment capabilities and vehicles. We offer multiple investment objectives within the various asset classes and products that we manage. We also believe being an independent investment manager is a competitive advantage, as our business model avoids conflicts that are inherent within institutions that both manage and distribute and/or service those products. Lastly, we believe continued execution against our strategic objectives will further strengthen our long-term competitive position.

Management Contracts

We derive substantially all of our revenues from investment management contracts. Fees vary with the type of assets being managed, with higher fees earned on actively managed equity and balanced accounts, along with real estate and other alternative asset products, and with lower fees earned on fixed income, money market and stable value accounts, and ETFs. Investment management contracts are generally terminable upon thirty or fewer days' notice. Typically, retail investors may withdraw their funds at any time without prior notice and institutional clients may elect to terminate their relationship with investment managers or reduce the aggregate amount of AUM with very short notice periods.

Risk Management

Invesco is committed to continually strengthening and evolving our risk management approach and activities to ensure they keep pace with business change and client expectations. We believe a key factor in our ability to manage through challenging market conditions and significant business change is our integrated and global approach to risk management. We seek to embed risk management in our day-to-day decision-making as well as our strategic planning process, while our global risk management framework seeks to enable consistent and meaningful risk dialogue up, down and across the company.

Our framework leverages two governance structures: (i) our Global Investment Risk and Performance Committee oversees the management of core investment risks; and (ii) our Enterprise Risk Management Committee oversees the management of all other business- and strategy-related risks. A network of regional, business unit and risk-specific management committees, with oversight by the Enterprise Risk Management Committee, provides ongoing identification, assessment, management, monitoring, and reporting of existing and emerging risks across all domains of our business.

Available Information

The SEC maintains a website that contains reports, proxy and information statements and other information regarding issuers at www.sec.gov. We make available free of charge on our website, www.invesco.com/corporate, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statement and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

Item 1A. Risk Factors

Risks Related to Market Dynamics and Volatility

Volatility and disruption in global or regional capital and credit markets, as well as adverse changes in the global economy, could negatively affect our AUM, revenues, net income and liquidity.

In recent years, capital and credit markets have experienced substantial volatility. In this regard:

•In the event of extreme circumstances, including an economic, political or business crisis, such as a widespread systemic failures or disruptions in the global or regional financial systems or failures of firms that have significant obligations as counterparties on financial instruments, we may suffer significant declines in AUM and severe liquidity or valuation issues in managed investment products in which client and company assets are invested, all of which would adversely affect our operating results, financial condition, liquidity, credit ratings, ability to access capital markets and ability to retain and attract key employees. Additionally, these factors could impact our ability to realize the carrying value of our goodwill and other intangible assets.

•Illiquidity and/or volatility of the global or regional risk asset markets could negatively affect our ability to manage investment products in which client and company assets are invested or client inflows and outflows or to timely meet client redemption requests.

•Uncertainties regarding geopolitical developments, such as nation state sovereignty, border disputes, diplomatic developments, social instability or changes in governmental policies, can produce volatility in global financial markets and regulatory environments. This volatility, including volatility arising from tensions between the U.S. and China, may impact the level and composition of our AUM and also negatively impact investor sentiment, which could result in reduced or negative flows.

•Changes to tax, tariff and import/export regulations and economic sanctions may have a negative effect on global or regional economic conditions, financial markets and our business. Any changes with respect to trade policies, treaties, taxes, government regulations and tariffs, or the perception that any of these changes could occur, may have a material adverse effect on global or regional economic conditions and the stability of global financial markets and may significantly reduce global trade or trade between certain nations. Given we are a global business, we could be more adversely affected than others by such market uncertainties.

Our revenues and net income would likely be adversely affected by any reduction in AUM as a result of either a decline in market value of such assets or net outflows, each of which would reduce the investment management fees we earn.

We derive substantially all our revenues from investment management contracts with clients. Under these contracts, the investment management fees paid to us are generally based on the market value of AUM. AUM may decline for various reasons. For any period in which revenues decline, our net income and operating margin would likely decline by a greater proportion because a majority of our expenses remain fixed. Factors that could decrease AUM, revenues, and net income include the following:

Declines in the market value of AUM in client portfolios. We cannot predict whether volatility in the markets will result in substantial or sustained declines in the markets generally or result in price declines in market segments in which our AUM are concentrated. Any of the foregoing could negatively impact the market value of our AUM, revenues and net income.

Redemptions and other withdrawals from, or shifting among, client portfolios. These changes could be caused by investors reducing their investments in client portfolios in general or in the market segments in which we focus; investors taking profits from their investments; and portfolio risk characteristics, which could cause investors to move assets to other investment managers. Furthermore, the fees we earn vary with the types of assets being managed, with higher fees earned on actively managed equity and balanced accounts, alternative asset products, and lower fees earned on fixed income, stable value accounts and passively managed products. Our revenues and net income may decline further if clients continue to shift their investments to lower fee accounts.

Our revenues and net income from money market and other fixed income assets may be harmed by interest rates, liquidity and credit volatility.

Central banks, such as the Federal Reserve, are maintaining relatively high interest rates after numerous hikes in interest rates during 2022 and early 2023 in response to the increase in inflation, which has negatively impacted and may materially and negatively continue to affect the value of the assets that we manage. Certain institutional investors using money market products and other short-term duration fixed income products for cash management purposes may shift these investments to

direct investments in comparable instruments in order to realize higher yields. These redemptions would reduce AUM, thereby reducing our revenues and net income. If securities within a money market portfolio default or investor redemptions force the portfolio to realize losses, there could be negative pressure on its net asset value (NAV). Although money market investments are not guaranteed instruments, the company might decide, under such a scenario, that it is in its best interest to provide support in the form of a support agreement, capital infusion or other methods to help stabilize a declining NAV, which may have an adverse impact on our profitability. Additionally, we have investments in fixed income assets, including collateralized loan obligations (CLOs), real estate-related loans, commercial loans and seed capital in fixed income funds, the valuation of which could change with changes in interest and default rates. Declines in the values of AUM could lead to reduced revenues and net income as management fees are generally calculated based upon the size of AUM.

Our financial condition and liquidity would be adversely affected by losses on our seed capital and co-investments.

The company has investments in managed investment products that invest in a variety of asset classes, including equities, fixed income products, commodities, derivatives, other similar financial instruments, and alternative investment products. Investments in these products are generally made to establish a track record, meet purchase size requirements for trading blocks or demonstrate economic alignment with other investors in our funds. Adverse market conditions may result in the need to write down the value of these seed capital and co-investments, which may adversely affect our results of operations or liquidity. As of December 31, 2023, we had approximately $956.0 million in seed capital and co-investments.

As many of our subsidiary operations are located outside of the U.S. and have functional currencies other than the U.S. Dollar, changes in the exchange rates to the U.S. Dollar impact our reported financial results.

The largest component of our net assets, revenues and expenses, as well as our AUM, is presently denominated in U.S. Dollars. However, we have a large number of subsidiaries outside of the U.S. whose functional currencies are not the U.S. Dollar. As a result, fluctuations in the exchange rates to the U.S. Dollar impact our reported financial results. Consequently, significant strengthening of the U.S. Dollar relative to the United Kingdom (U.K.) Pound Sterling, Euro, Chinese RMB, Japanese Yen or Canadian Dollar, among other currencies, could have a material negative impact on our reported financial results.

Risks Related to Investment Performance and Competition

Poor investment performance of our products could reduce the level of our AUM or affect our sales, and negatively impact our revenues and net income.