This Amendment No. 1 on Form 10-Q/A (the “Amendment”) of Plantronics, Inc. (the “Company”) amends the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2019, originally filed with the Securities and Exchange Commission on August 6, 2019 (the “Original Report”). The Original Report inadvertently excluded certain XBRL information in portions of the financial statements and accompanying notes to the condensed consolidated financial statements.

This Amendment No. 1 includes the XBRL information and does not reflect events that may have occurred subsequent to the original filing date, and does not modify or update in any way disclosures made in the Original Report. No other changes have been made to the Original Report.

As required by Rule 12b-15 of the Securities Exchange Act of 1934, as amended, this Amendment contains new certifications by the Company’s principal executive officer and principal financial officer, which are being filed as exhibits to the Amendment.

true--03-31Q120200000914025PLANTRONICS INC /CA/P6MP11MP6MP3M0

0000914025

2019-04-01

2019-06-30

0000914025

2019-07-31

0000914025

2019-06-30

0000914025

2019-03-31

0000914025

us-gaap:ProductMember

2018-04-01

2018-06-30

0000914025

2018-04-01

2018-06-30

0000914025

us-gaap:ProductMember

2019-04-01

2019-06-30

0000914025

us-gaap:ServiceMember

2018-04-01

2018-06-30

0000914025

us-gaap:ServiceMember

2019-04-01

2019-06-30

0000914025

2018-03-31

0000914025

2018-06-30

0000914025

us-gaap:RetainedEarningsMember

2018-04-01

2018-06-30

0000914025

us-gaap:TreasuryStockMember

2018-04-01

2018-06-30

0000914025

us-gaap:CommonStockMember

2018-04-01

2018-06-30

0000914025

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-04-01

0000914025

2018-04-01

0000914025

us-gaap:RetainedEarningsMember

2018-06-30

0000914025

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-06-30

0000914025

us-gaap:AdditionalPaidInCapitalMember

2018-03-31

0000914025

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-03-31

0000914025

us-gaap:TreasuryStockMember

2018-03-31

0000914025

us-gaap:AdditionalPaidInCapitalMember

2018-06-30

0000914025

us-gaap:CommonStockMember

2018-03-31

0000914025

us-gaap:TreasuryStockMember

2018-06-30

0000914025

us-gaap:AdditionalPaidInCapitalMember

2018-04-01

2018-06-30

0000914025

us-gaap:CommonStockMember

2018-06-30

0000914025

us-gaap:RetainedEarningsMember

2018-04-01

0000914025

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-04-01

2018-06-30

0000914025

us-gaap:RetainedEarningsMember

2018-03-31

0000914025

us-gaap:RetainedEarningsMember

2019-04-01

2019-06-30

0000914025

us-gaap:CommonStockMember

2019-04-01

2019-06-30

0000914025

us-gaap:RetainedEarningsMember

2019-03-31

0000914025

us-gaap:TreasuryStockMember

2019-04-01

2019-06-30

0000914025

us-gaap:TreasuryStockMember

2019-06-30

0000914025

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-03-31

0000914025

us-gaap:AdditionalPaidInCapitalMember

2019-03-31

0000914025

us-gaap:AdditionalPaidInCapitalMember

2019-04-01

2019-06-30

0000914025

us-gaap:AdditionalPaidInCapitalMember

2019-06-30

0000914025

us-gaap:CommonStockMember

2019-06-30

0000914025

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-04-01

2019-06-30

0000914025

us-gaap:CommonStockMember

2019-03-31

0000914025

us-gaap:TreasuryStockMember

2019-03-31

0000914025

us-gaap:RetainedEarningsMember

2019-06-30

0000914025

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-06-30

0000914025

plt:OtherLongTermLiabilitiesMember

2019-03-31

0000914025

us-gaap:OtherAssetsMember

2019-03-31

0000914025

us-gaap:AccruedLiabilitiesMember

2019-03-31

0000914025

plt:PolycomMember

2018-07-02

2018-07-02

0000914025

plt:PolycomMember

2019-04-01

2019-06-30

0000914025

plt:PolycomMember

plt:DeferredRevenueAdjustmentMember

2018-04-01

2018-06-30

0000914025

plt:PolycomMember

us-gaap:AcquisitionRelatedCostsMember

2018-04-01

2018-06-30

0000914025

plt:TriangleMember

2018-07-02

0000914025

plt:PolycomMember

2018-07-02

0000914025

plt:PolycomMember

us-gaap:FairValueAdjustmentToInventoryMember

2018-04-01

2018-06-30

0000914025

plt:PolycomMember

us-gaap:TechnologyBasedIntangibleAssetsMember

2018-07-02

2018-07-02

0000914025

plt:PolycomMember

us-gaap:TrademarksAndTradeNamesMember

2018-07-02

2018-07-02

0000914025

plt:PolycomMember

us-gaap:TechnologyBasedIntangibleAssetsMember

2019-04-01

2019-06-30

0000914025

plt:PolycomMember

us-gaap:CustomerRelationshipsMember

2019-04-01

2019-06-30

0000914025

plt:PolycomMember

us-gaap:OrderOrProductionBacklogMember

2018-07-02

2018-07-02

0000914025

plt:PolycomMember

us-gaap:CustomerRelationshipsMember

2018-07-02

2018-07-02

0000914025

plt:PolycomMember

us-gaap:TrademarksAndTradeNamesMember

2019-04-01

2019-06-30

0000914025

plt:PolycomMember

us-gaap:OrderOrProductionBacklogMember

2019-04-01

2019-06-30

0000914025

plt:PolycomMember

us-gaap:InProcessResearchAndDevelopmentMember

2018-07-02

2018-07-02

0000914025

plt:PolycomMember

2018-04-01

2018-06-30

0000914025

plt:SeniorNotes5.50PercentMember

us-gaap:SeniorNotesMember

2019-06-30

0000914025

us-gaap:CashMember

2019-03-31

0000914025

us-gaap:FairValueInputsLevel1Member

plt:MutualFundsMember

2019-03-31

0000914025

us-gaap:FairValueInputsLevel1Member

plt:MutualFundsMember

2019-06-30

0000914025

us-gaap:CashMember

2019-06-30

0000914025

us-gaap:OtherNoncurrentLiabilitiesMember

2019-06-30

0000914025

us-gaap:ShortTermInvestmentsMember

plt:MutualFundsMember

2019-06-30

0000914025

us-gaap:OtherNoncurrentLiabilitiesMember

2019-03-31

0000914025

plt:ProvisionForPromotionsRebatesAndOtherMember

2019-06-30

0000914025

plt:ProvisionForDoubtfulAccountsAndSalesAllowancesMember

2019-06-30

0000914025

plt:ProvisionForPromotionsRebatesAndOtherMember

2019-03-31

0000914025

plt:ProvisionForDoubtfulAccountsAndSalesAllowancesMember

2019-03-31

0000914025

us-gaap:TradeNamesMember

2019-03-31

0000914025

us-gaap:TechnologyBasedIntangibleAssetsMember

2019-03-31

0000914025

us-gaap:InProcessResearchAndDevelopmentMember

2019-03-31

0000914025

us-gaap:InProcessResearchAndDevelopmentMember

2019-06-30

0000914025

us-gaap:CustomerRelationshipsMember

2019-03-31

0000914025

us-gaap:CustomerRelationshipsMember

2019-06-30

0000914025

us-gaap:TechnologyBasedIntangibleAssetsMember

2019-06-30

0000914025

us-gaap:TradeNamesMember

2019-06-30

0000914025

us-gaap:TechnologyBasedIntangibleAssetsMember

2019-04-01

2019-06-30

0000914025

us-gaap:CustomerRelationshipsMember

2019-04-01

2019-06-30

0000914025

us-gaap:TrademarksAndTradeNamesMember

2019-04-01

2019-06-30

0000914025

us-gaap:InProcessResearchAndDevelopmentMember

2019-06-30

0000914025

2018-12-10

2018-12-10

0000914025

plt:GNNetcomInc.vs.PlantronicsInc.Member

plt:PunitiveSanctionsMember

2017-11-01

2017-11-30

0000914025

plt:GNNetcomInc.vs.PlantronicsInc.Member

plt:PunitiveSanctionsMember

2016-07-01

2016-07-31

0000914025

plt:SeniorNotes5.50PercentMember

us-gaap:SeniorNotesMember

2015-05-01

2015-05-31

0000914025

plt:SeniorNotes5.50PercentMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:SeniorNotesMember

2019-03-31

0000914025

us-gaap:RevolvingCreditFacilityMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:LineOfCreditMember

2019-06-30

0000914025

us-gaap:RevolvingCreditFacilityMember

us-gaap:FairValueInputsLevel2Member

us-gaap:CarryingReportedAmountFairValueDisclosureMember

us-gaap:LineOfCreditMember

2019-03-31

0000914025

us-gaap:RevolvingCreditFacilityMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:LineOfCreditMember

2019-03-31

0000914025

plt:SeniorNotes5.50PercentMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:SeniorNotesMember

2019-06-30

0000914025

plt:SeniorNotes5.50PercentMember

us-gaap:FairValueInputsLevel2Member

us-gaap:CarryingReportedAmountFairValueDisclosureMember

us-gaap:SeniorNotesMember

2019-03-31

0000914025

us-gaap:RevolvingCreditFacilityMember

us-gaap:FairValueInputsLevel2Member

us-gaap:CarryingReportedAmountFairValueDisclosureMember

us-gaap:LineOfCreditMember

2019-06-30

0000914025

plt:SeniorNotes5.50PercentMember

us-gaap:FairValueInputsLevel2Member

us-gaap:CarryingReportedAmountFairValueDisclosureMember

us-gaap:SeniorNotesMember

2019-06-30

0000914025

us-gaap:SecuredDebtMember

2018-07-02

0000914025

2018-07-02

2018-07-02

0000914025

us-gaap:SecuredDebtMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2019-04-01

2019-06-30

0000914025

us-gaap:SecuredDebtMember

plt:FederalFundsRateMember

2019-04-01

2019-06-30

0000914025

plt:SeniorNotes5.50PercentMember

us-gaap:SeniorNotesMember

2015-05-31

0000914025

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2019-06-30

0000914025

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2018-04-01

2018-12-31

0000914025

srt:MinimumMember

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2019-04-01

2019-06-30

0000914025

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2018-07-02

2018-07-02

0000914025

srt:ScenarioForecastMember

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2021-04-04

2021-04-04

0000914025

srt:MinimumMember

plt:SeniorNotes5.50PercentMember

us-gaap:SeniorNotesMember

2015-05-01

2015-05-31

0000914025

srt:ScenarioForecastMember

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2020-03-29

2021-04-03

0000914025

srt:MaximumMember

plt:SeniorNotes5.50PercentMember

us-gaap:SeniorNotesMember

2015-05-01

2015-05-31

0000914025

srt:MaximumMember

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2019-04-01

2019-06-30

0000914025

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2018-07-02

0000914025

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2018-12-29

2019-06-29

0000914025

srt:ScenarioForecastMember

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2019-07-01

2020-03-28

0000914025

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2019-04-01

2019-06-30

0000914025

us-gaap:EmployeeSeveranceMember

plt:FiscalYear2020RestructuringPlansMember

2019-06-30

0000914025

us-gaap:AccountingStandardsUpdate201602Member

us-gaap:OtherRestructuringMember

plt:FiscalYear2019RestructuringPlansMember

2019-03-31

0000914025

us-gaap:OtherRestructuringMember

plt:FiscalYear2020RestructuringPlansMember

2019-03-31

0000914025

us-gaap:OtherRestructuringMember

2019-04-01

2019-06-30

0000914025

us-gaap:EmployeeSeveranceMember

2019-04-01

2019-06-30

0000914025

us-gaap:EmployeeSeveranceMember

plt:FiscalYear2019RestructuringPlansMember

2019-03-31

0000914025

plt:FiscalYear2020RestructuringPlansMember

2019-04-01

2019-06-30

0000914025

us-gaap:AccountingStandardsUpdate201602Member

plt:FiscalYear2020RestructuringPlansMember

2019-03-31

0000914025

us-gaap:OtherRestructuringMember

plt:FiscalYear2020RestructuringPlansMember

2019-06-30

0000914025

us-gaap:FacilityClosingMember

2019-04-01

2019-06-30

0000914025

us-gaap:AccountingStandardsUpdate201602Member

us-gaap:EmployeeSeveranceMember

plt:FiscalYear2019RestructuringPlansMember

2019-03-31

0000914025

us-gaap:OtherRestructuringMember

plt:FiscalYear2020RestructuringPlansMember

2019-04-01

2019-06-30

0000914025

us-gaap:EmployeeSeveranceMember

plt:FiscalYear2020RestructuringPlansMember

2019-04-01

2019-06-30

0000914025

us-gaap:OtherRestructuringMember

2019-03-31

0000914025

us-gaap:AccountingStandardsUpdate201602Member

us-gaap:FacilityClosingMember

plt:FiscalYear2019RestructuringPlansMember

2019-03-31

0000914025

us-gaap:OtherRestructuringMember

plt:FiscalYear2019RestructuringPlansMember

2019-03-31

0000914025

us-gaap:AccountingStandardsUpdate201602Member

us-gaap:OtherRestructuringMember

plt:FiscalYear2020RestructuringPlansMember

2019-03-31

0000914025

us-gaap:AccountingStandardsUpdate201602Member

plt:FiscalYear2019RestructuringPlansMember

2019-03-31

0000914025

plt:FiscalYear2019RestructuringPlansMember

2019-04-01

2019-06-30

0000914025

us-gaap:OtherRestructuringMember

plt:FiscalYear2019RestructuringPlansMember

2019-06-30

0000914025

plt:FiscalYear2019RestructuringPlansMember

2019-06-30

0000914025

us-gaap:FacilityClosingMember

plt:FiscalYear2019RestructuringPlansMember

2019-03-31

0000914025

us-gaap:EmployeeSeveranceMember

plt:FiscalYear2020RestructuringPlansMember

2019-03-31

0000914025

us-gaap:AccountingStandardsUpdate201602Member

us-gaap:EmployeeSeveranceMember

2019-03-31

0000914025

us-gaap:EmployeeSeveranceMember

plt:FiscalYear2019RestructuringPlansMember

2019-06-30

0000914025

us-gaap:EmployeeSeveranceMember

plt:FiscalYear2019RestructuringPlansMember

2019-04-01

2019-06-30

0000914025

us-gaap:AccountingStandardsUpdate201602Member

us-gaap:OtherRestructuringMember

2019-03-31

0000914025

us-gaap:OtherRestructuringMember

2019-06-30

0000914025

plt:FiscalYear2020RestructuringPlansMember

2019-06-30

0000914025

us-gaap:FacilityClosingMember

plt:FiscalYear2019RestructuringPlansMember

2019-04-01

2019-06-30

0000914025

us-gaap:EmployeeSeveranceMember

2019-03-31

0000914025

us-gaap:FacilityClosingMember

2019-03-31

0000914025

us-gaap:AccountingStandardsUpdate201602Member

2019-03-31

0000914025

us-gaap:EmployeeSeveranceMember

2019-06-30

0000914025

us-gaap:AccountingStandardsUpdate201602Member

us-gaap:FacilityClosingMember

2019-03-31

0000914025

us-gaap:FacilityClosingMember

plt:FiscalYear2019RestructuringPlansMember

2019-06-30

0000914025

plt:FiscalYear2019RestructuringPlansMember

2019-03-31

0000914025

us-gaap:AccountingStandardsUpdate201602Member

us-gaap:EmployeeSeveranceMember

plt:FiscalYear2020RestructuringPlansMember

2019-03-31

0000914025

us-gaap:FacilityClosingMember

2019-06-30

0000914025

us-gaap:OtherRestructuringMember

plt:FiscalYear2019RestructuringPlansMember

2019-04-01

2019-06-30

0000914025

plt:FiscalYear2020RestructuringPlansMember

2019-03-31

0000914025

plt:SellingGeneralAndAdministrativeMember

2018-04-01

2018-06-30

0000914025

us-gaap:OperatingExpenseMember

2019-04-01

2019-06-30

0000914025

us-gaap:CostOfSalesMember

2018-04-01

2018-06-30

0000914025

us-gaap:ResearchAndDevelopmentExpenseMember

2018-04-01

2018-06-30

0000914025

us-gaap:ResearchAndDevelopmentExpenseMember

2019-04-01

2019-06-30

0000914025

us-gaap:CostOfSalesMember

2019-04-01

2019-06-30

0000914025

us-gaap:OperatingExpenseMember

2018-04-01

2018-06-30

0000914025

plt:SellingGeneralAndAdministrativeMember

2019-04-01

2019-06-30

0000914025

us-gaap:ShareBasedCompensationAwardTrancheTwoMember

2019-04-01

2019-06-30

0000914025

us-gaap:ShareBasedCompensationAwardTrancheOneMember

2019-04-01

2019-06-30

0000914025

2018-11-28

0000914025

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2019-03-31

0000914025

us-gaap:AccumulatedTranslationAdjustmentMember

2019-03-31

0000914025

us-gaap:AccumulatedTranslationAdjustmentMember

2019-06-30

0000914025

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2019-03-31

0000914025

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2019-06-30

0000914025

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2019-06-30

0000914025

us-gaap:NondesignatedMember

2018-04-01

2018-06-30

0000914025

us-gaap:NondesignatedMember

2019-04-01

2019-06-30

0000914025

us-gaap:OtherLiabilitiesMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-03-31

0000914025

us-gaap:OtherLiabilitiesMember

2019-06-30

0000914025

us-gaap:OtherLiabilitiesMember

us-gaap:NondesignatedMember

2019-03-31

0000914025

us-gaap:OtherLiabilitiesMember

us-gaap:InterestRateSwapMember

2019-06-30

0000914025

us-gaap:OtherCurrentAssetsMember

us-gaap:NondesignatedMember

2019-03-31

0000914025

us-gaap:OtherLiabilitiesMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-06-30

0000914025

us-gaap:OtherCurrentAssetsMember

2019-03-31

0000914025

us-gaap:OtherLiabilitiesMember

us-gaap:InterestRateSwapMember

2019-03-31

0000914025

us-gaap:OtherCurrentAssetsMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-06-30

0000914025

us-gaap:OtherCurrentAssetsMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-03-31

0000914025

us-gaap:OtherLiabilitiesMember

us-gaap:NondesignatedMember

2019-06-30

0000914025

us-gaap:OtherLiabilitiesMember

2019-03-31

0000914025

us-gaap:OtherCurrentAssetsMember

us-gaap:NondesignatedMember

2019-06-30

0000914025

us-gaap:OtherCurrentAssetsMember

2019-06-30

0000914025

plt:ForeignExchangeForwardEuroMember

2019-06-30

0000914025

plt:ForeignExchangeForwardAudMember

2019-06-30

0000914025

plt:ForeignExchangeForwardGbpMember

2019-06-30

0000914025

plt:ForeignExchangeForwardEuroMember

2019-04-01

2019-06-30

0000914025

plt:ForeignExchangeForwardAudMember

2019-04-01

2019-06-30

0000914025

plt:ForeignExchangeForwardGbpMember

2019-04-01

2019-06-30

0000914025

plt:ForeignCurrencySwapContractMember

2019-03-31

0000914025

us-gaap:InterestRateSwapMember

2018-07-30

0000914025

plt:ForeignCurrencySwapContractMember

2019-06-30

0000914025

us-gaap:InterestRateSwapMember

2018-07-30

2018-07-30

0000914025

us-gaap:ForeignExchangeOptionMember

2019-06-30

0000914025

us-gaap:ForeignExchangeOptionMember

2019-03-31

0000914025

us-gaap:ForeignExchangeForwardMember

2019-06-30

0000914025

us-gaap:ForeignExchangeForwardMember

2019-03-31

0000914025

plt:ForeignCurrencySwapContractMember

2019-04-01

2019-06-30

0000914025

srt:MaximumMember

us-gaap:OptionMember

us-gaap:CashFlowHedgingMember

2018-04-01

2018-12-31

0000914025

us-gaap:ForwardContractsMember

us-gaap:CashFlowHedgingMember

2018-04-01

2018-12-31

0000914025

srt:MinimumMember

us-gaap:OptionMember

us-gaap:CashFlowHedgingMember

2018-04-01

2018-12-31

0000914025

srt:MinimumMember

2019-04-01

2019-06-30

0000914025

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2019-06-30

0000914025

plt:IngramMicroMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2019-04-01

2019-06-30

0000914025

plt:ScanSourceMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2018-04-01

2019-03-31

0000914025

plt:IngramMicroMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2019-04-01

2019-06-30

0000914025

plt:ScanSourceMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2019-04-01

2019-06-30

0000914025

plt:IngramMicroMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2018-04-01

2019-03-31

0000914025

plt:ScanSourceMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2019-04-01

2019-06-30

0000914025

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2019-03-31

0000914025

plt:DHDistributorsMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2018-04-01

2019-03-31

0000914025

srt:MaximumMember

2019-04-01

2019-06-30

0000914025

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2019-06-30

0000914025

plt:ConsumerHeadsetMember

2019-04-01

2019-06-30

0000914025

plt:VideoMember

2019-04-01

2019-06-30

0000914025

plt:VoiceMember

2018-04-01

2018-06-30

0000914025

plt:VideoMember

2018-04-01

2018-06-30

0000914025

plt:ConsumerHeadsetMember

2018-04-01

2018-06-30

0000914025

plt:EnterpriseHeadsetMember

2019-04-01

2019-06-30

0000914025

plt:EnterpriseHeadsetMember

2018-04-01

2018-06-30

0000914025

plt:VoiceMember

2019-04-01

2019-06-30

0000914025

country:US

2018-04-01

2018-06-30

0000914025

us-gaap:EMEAMember

2018-04-01

2018-06-30

0000914025

country:US

2019-04-01

2019-06-30

0000914025

plt:AllCountriesExceptUnitedStatesMember

2019-04-01

2019-06-30

0000914025

srt:AsiaPacificMember

2018-04-01

2018-06-30

0000914025

plt:AmericasexcludingUnitedStatesMember

2019-04-01

2019-06-30

0000914025

srt:AsiaPacificMember

2019-04-01

2019-06-30

0000914025

plt:AllCountriesExceptUnitedStatesMember

2018-04-01

2018-06-30

0000914025

us-gaap:EMEAMember

2019-04-01

2019-06-30

0000914025

plt:AmericasexcludingUnitedStatesMember

2018-04-01

2018-06-30

0000914025

us-gaap:SubsequentEventMember

2019-08-07

xbrli:pure

iso4217:EUR

iso4217:USD

xbrli:shares

plt:letter_of_credit

iso4217:MXN

iso4217:GBP

iso4217:AUD

plt:financial_institution

plt:Customer

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q/A

(Amendment No. 1)

(Mark One)

|

| |

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 29, 2019

or

|

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________to _________

Commission File Number: 001-12696

Plantronics, Inc.

(Exact name of registrant as specified in its charter)

|

| |

Delaware | 77-0207692 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

345 Encinal Street

Santa Cruz, California 95060

(Address of principal executive offices)

(Zip Code)

(831) 426-5858

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act

|

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $0.01 par value | PLT | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of July 31, 2019, 39,575,910 shares of the registrant's common stock were outstanding.

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-Q/A (the “Amendment”) of Plantronics, Inc. (the “Company”) amends the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2019, originally filed with the Securities and Exchange Commission on August 6, 2019 (the “Original Report”). The Original Report inadvertently excluded certain XBRL information in portions of the financial statements and accompanying notes to the condensed consolidated financial statements.

This Amendment No. 1 includes the XBRL information and does not reflect events that may have occurred subsequent to the original filing date, and does not modify or update in any way disclosures made in the Original Report. No other changes have been made to the Original Report.

As required by Rule 12b-15 of the Securities Exchange Act of 1934, as amended, this Amendment contains new certifications by the Company’s principal executive officer and principal financial officer, which are being filed as exhibits to the Amendment.

Plantronics, Inc.

FORM 10-Q

TABLE OF CONTENTS

|

| |

PART I. FINANCIAL INFORMATION | Page No. |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

PART II. OTHER INFORMATION | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Plantronics®, Poly®, Simply Smarter Communications® , and the propeller design are trademarks or registered trademarks of Plantronics, Inc. All other trademarks are the property of their respective owners.

DECT™ is a trademark of ETSI registered for the benefit of its members in France and other jurisdictions.

The Bluetooth name and the Bluetooth® trademarks are owned by Bluetooth SIG, Inc. and are used by Plantronics, Inc. under license. All other trademarks are the property of their respective owners.

Part I -- FINANCIAL INFORMATION

Management’s Discussion and Analysis of Financial Condition and Results of Operations

CERTAIN FORWARD-LOOKING INFORMATION:

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 ("Securities Act") and Section 21E of the Securities Exchange Act of 1934 ("Exchange Act"). Forward-looking statements may generally be identified by the use of such words as "anticipate," "believe," “could,” "expect," "intend," “may,” "plan," "potential," "shall," "will," “would,” or variations of such words and similar expressions, or the negative of these terms. Specific forward-looking statements contained within this Form 10-Q include, but are not limited to, statements regarding (i) our beliefs regarding the UC&C market, market dynamics and opportunities, and customer and partner behavior as well as our position in the market, (ii) our expectations for the impact of the Acquisition as it relates to our strategic vision and additional market opportunities for our combined hardware and services offerings, as well as our plans and expectation for the integration of the operations of Polycom, (iii) our beliefs regarding future enterprise growth drivers, (iv) our expectations regarding the impact of UC&C on headset adoption and how it may impact our investment and partnering activities, (v) our expectations for new and next generation product and services offerings, (vi) our intentions regarding the focus of our sales, marketing and customer services and support teams, (vii) our expenses, including research, development and engineering expenses and selling, general and administrative expenses, (xi) fluctuations in our cash provided by operating activities as a result of various factors, including fluctuations in revenues and operating expenses, the timing of compensation-related payments including stock based compensation, timing of product shipments, accounts receivable collections, inventory and supply chain management, and the timing and amount of taxes and other payments, (xii) our future tax rate and payments related to unrecognized tax benefits, (xiii) our anticipated range of capital expenditures for the remainder of Fiscal Year 2020 and the sufficiency of our cash, cash equivalents, and cash from operations to sustain future operations and discretionary cash requirements, (xiv) our ability to pay future stockholder dividends, (xv) our ability to draw funds on our credit facility as needed, (xvi) the sufficiency of our capital resources to fund operations, and other statements regarding our future operations, financial condition and prospects, and business strategies. Such forward-looking statements are based on current expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from the forward-looking statements. Factors that could cause actual results and events to differ materially from such forward-looking statements are included, but not limited to, those discussed in this Quarterly Report on Form 10-Q; in Part I, "Item 1A. Risk Factors" of our Annual Report on Form 10-K for the fiscal year ended March 31, 2019, filed with the Securities and Exchange Commission (“SEC”) on May 17, 2019; and other documents we have filed with the SEC. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by applicable law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

OVERVIEW

We are a leading global designer, manufacturer, and marketer of integrated communications and collaboration solutions that span headsets, open SIP desktop phones, audio and video conferencing, cloud management and analytics software solutions, and services. Our major product categories are Enterprise Headsets, which includes corded and cordless communication headsets; Consumer Headsets, which includes Bluetooth and corded products for mobile device applications, personal computer and gaming; Voice, Video, and Content Sharing Solutions, which includes open SIP desktop phones, conference room phones, and video endpoints, including cameras, speakers and microphones. All of our solutions are designed to work in a wide range of Unified Communications & Collaboration ("UC&C"), Unified Communication as a Service ("UCaaS"), and Video as a Service ("VaaS") environments. Our RealPresence collaboration solutions range from infrastructure to endpoints and allow people to connect and collaborate globally and naturally. In addition, we offer comprehensive support services including support for our solutions and hardware devices, as well as professional, hosted, and managed services. We continue to operate under a single operating segment.

We sell our Enterprise products through a high-touch sales team and a well-developed global network of distributors and channel partners including value-added resellers, integrators, direct marketing resellers, service providers, and resellers. We sell our Consumer products through both traditional and online consumer electronics retailers, consumer product retailers, office supply distributors, wireless carriers, catalog and mail order companies, and mass merchants. We have well-established distribution channels in the Americas, Europe, Middle East, Africa, and Asia Pacific where use of our products is widespread.

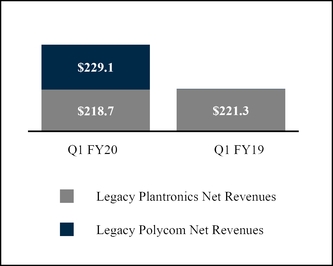

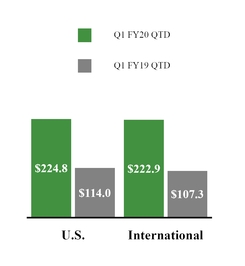

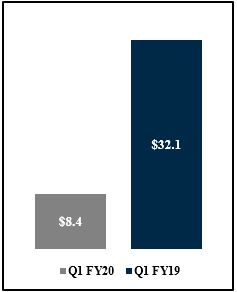

Total Net Revenues (in millions)

Compared to the first quarter of Fiscal Year 2019 total net revenues increased 102% to $447.8 million; the increase in total net revenues is primarily related to our acquisition of Polycom, Inc. ("the Acquisition") which was completed on July 2, 2018. As a result of purchase accounting, a total of $12.2 million of deferred revenue that otherwise would have been recognized in the first quarter of Fiscal Year 2020 was excluded from first quarter revenue of $447.8 million.

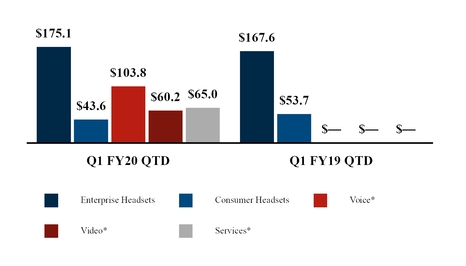

The table below summarizes net revenues for the three months ended June 30, 2019 and 2018 by product categories:

|

| | | | | | | | | | | | | | | |

(in thousands, except percentages) | | Three Months Ended | | | | |

| June 30, | | Increase |

| 2019 | | 2018 | | (Decrease) |

Enterprise Headsets | | $ | 175,084 |

| | $ | 167,642 |

| | $ | 7,442 |

| | 4.4 | % |

Consumer Headsets | | 43,566 |

| | 53,667 |

| | (10,101 | ) | | (18.8 | )% |

Voice 1 | | 103,847 |

| | — |

| | 103,847 |

| | 100.0 | % |

Video 1 | | 60,248 |

| | — |

| | 60,248 |

| | 100.0 | % |

Services 2 | | 65,022 |

| | — |

| | 65,022 |

| | 100.0 | % |

Total | | $ | 447,767 |

| | $ | 221,309 |

| | $ | 226,458 |

| | 102.3 | % |

1 Voice and Video product net revenues presented net of fair value adjustments to deferred revenue of $0.6 million.

2 Services net revenues presented net of fair value adjustments to deferred revenue of $11.6 million.

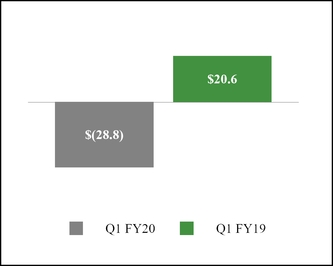

Operating Income (Loss) (in millions)

We reported a net loss of $44.9 million and an operating loss of $28.8 million for the first quarter of Fiscal Year 2020. We reported a net income of $14.5 million and an operating income of $20.6 million for the first quarter of Fiscal Year 2019. The decrease in our results from operations is primarily due to $45.3 million of amortization of purchased intangibles and $20.4 million of post-Acquisition integration related expenses incurred during the first quarter of Fiscal Year 2020. We will continue to work on integrating Polycom into our business in order to streamline our operations and realize synergies from the combined companies.

Our strategic initiatives are primarily focused on driving long-term growth through our end-to-end portfolio of audio and video endpoints, including headsets, desktop phones, conference room phones, and video collaboration solutions. The Acquisition positions us as a global leader in communications and collaboration endpoints, target the faster-growing market categories, such as the Huddle Room for video collaboration, allows us to capture additional opportunities through data analytics and insight services across a broad range of communications endpoints, and better positions us with our channel partners, customers and strategic alliance partners to pursue comprehensive solutions to communications challenges in the marketplace, each of which we believe will drive long-term revenue growth.

During the quarter we focused on integration activities which included various systems integrations for the combined company. We also rationalized our sales channel and introduced a new consolidated distribution agreement with our partners globally. These efforts are expected to decrease redundancies and leverage our competitive advantages for the benefit of our partners and end customers. We believe the changes have resulted in short-term disruptions in our operations which will be resolved as sales and supply partners adjust to the changes.

Within the market for our Enterprise Headsets, we anticipate the key driver of growth over the next few years will be the continued adoption of UC&C solutions. We believe enterprises are increasing their adoption of UC&C systems to reduce costs, improve collaboration, and migrate to more capable and flexible technology. We expect the growth of UC&C solutions will increase overall headset adoption in enterprise environments, and we believe most of the growth in our Enterprise Headsets product category over the next three years will come from headsets designed for UC&C.

Revenues from our Consumer Headsets are seasonal and typically strongest in our third fiscal quarter, which includes the holiday shopping season. Other factors that directly impact performance in the product category include product life cycles (including the introduction and pace of adoption of new technology), market acceptance of new product introductions, consumer preferences and the competitive retail environment, changes in consumer confidence and other macroeconomic factors. In addition, the timing or non-recurrence of retailer product placements can cause volatility in quarter-to-quarter results.

In an effort to align our strategy and focus on our core enterprise markets, we announced on May 7, 2019 that we intend to evaluate strategic alternatives for our Consumer Headset products. We have not yet determined the timing, structure, or financial impact of any potential transaction.

We remain cautious about the macroeconomic environment, based on uncertainty around trade and fiscal policy in the U.S. and internationally and broader economic uncertainty in many parts of Europe and Asia Pacific, which makes it difficult for us to gauge the economic impacts on our future business. We continue to monitor our expenditures and prioritize expenditures that further our strategic long-term growth opportunities.

RESULTS OF OPERATIONS

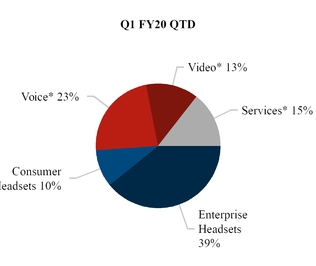

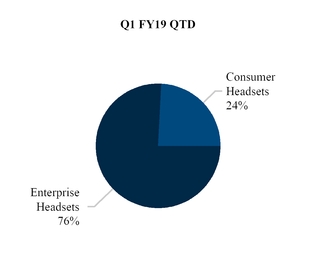

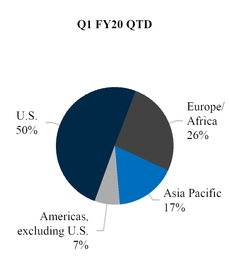

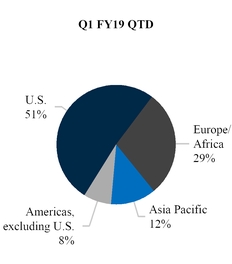

The following graphs display net revenues by product category for the three months ended June 30, 2019 and 2018:

Net Revenues (in millions)

Revenue by Product Category (percent)

* These product categories were created as a result of the Acquisition, See Note 3, Acquisition, of the accompanying notes to condensed consolidated financial statements.

Total net revenues increased in the three months ended June 30, 2019 compared to the prior year periods due primarily to the Acquisition as well as higher revenues within our Enterprise Headset product category partially offset by declines in our Consumer Headset product category. The growth in our Enterprise Headset category was driven by UC&C product revenues and the decline in our Consumer Headset category was driven by Gaming and Mono product revenues.

Geographic Information (in millions) Revenue by Region (percent)

Compared to the same prior year period, U.S. net revenues for the three months ended June 30, 2019 increased due primarily to the Acquisition, as well as higher revenues within our Enterprise Headsets product category driven by growth in UC&C revenues partially offset by continued declines in our non-UC&C product revenues. Consumer Headsets product revenues were down, driven by declines in sales of our Gaming products.

International net revenues for the three months ended June 30, 2019 increased from the same prior year period due primarily to the Acquisition as well as growth in our Enterprise Headsets category driven by UC&C product sales. This growth was partially offset by declines in our Consumer Headset product revenues as a result of declines in sales of our Gaming and Mono products.

During the three months ended June 30, 2019, changes in foreign exchange rates negatively impacted net revenues by $3.9 million, net of the effects of hedging, compared to a $6 million favorable impact on net revenues in the prior year period.

COST OF REVENUES AND GROSS PROFIT

Cost of revenues consists primarily of direct and contract manufacturing costs, warranty, freight, depreciation, duties, charges for excess and obsolete inventory, royalties, and overhead expenses.

|

| | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | June 30, | | Increase |

(in thousands, except percentages) | | 2019 | | 2018 | | (Decrease) |

Total net revenues | | $ | 447,767 |

| | $ | 221,309 |

| | $ | 226,458 |

| | 102.3 | % |

Cost of revenues | | 235,121 |

| | 111,466 |

| | 123,655 |

| | 110.9 | % |

Gross profit | | $ | 212,646 |

| | $ | 109,843 |

| | $ | 102,803 |

| | 93.6 | % |

Gross profit % | | 47.5 | % | | 49.6 | % | |

|

| | |

Compared to the same prior year period, gross profit as a percentage of net revenues decreased in the three months ended June 30, 2019, due primarily to $30.0 million of amortization of purchased intangibles and $12.2 million of deferred revenue fair value adjustment, respectively. See Note 3, Acquisition, accompanying notes to condensed consolidated financial statements. These increased costs were partially offset by material cost reductions.

There are significant variances in gross profit percentages between our higher and lower margin products including Polycom products acquired through the Acquisition; therefore, small variations in product mix, which can be difficult to predict, can have a significant impact on gross profit as a percentage of net revenues. Gross profit percentages may also vary based on distribution channels, return rates, and other factors.

OPERATING EXPENSES

Operating expenses consists primarily of research, development and engineering; selling, general and administrative; gain, net of litigation settlements and restructuring and other related charges (credits) expenses which are summarized in the table below for the three months ended June 30, 2019 and 2018:

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | | |

| | June 30, | | Increase | |

(in thousands, except percentages) | | 2019 | | 2018 | | (Decrease) | |

Research, development, and engineering | | $ | 59,524 |

| | $ | 23,701 |

| | $ | 35,823 |

| | 151 | % | |

Selling, general and administrative | | 163,608 |

| | 64,203 |

| | 99,405 |

| | 155 | % | |

Gain, net of litigation settlements | | (1,162 | ) | | (30 | ) | | (1,132 | ) | | 3,773 | % | |

Restructuring and other related charges | | 19,525 |

| | 1,320 |

| | 18,205 |

| | 1,379 | % | |

Total Operating Expenses | | $ | 241,495 |

| | $ | 89,194 |

| | $ | 152,301 |

| | 171 | % | |

% of net revenues | | 53.9 | % | | 40.3 | % | |

| | | |

Our Research, development, and engineering expenses and selling, general and administrative expenses increased during the three months ended June 30, 2019, primarily due to the inclusion of Polycom operating expenses after the Acquisition, as well as $19.5 million of Acquisition-related integration costs and $15.3 million of amortization of purchased intangibles incurred during the period.

Compared to the prior year period, restructuring and other related charges increased in the three months ended June 30, 2019, due primarily to restructuring actions initiated during the period to streamline the global workforce and achieve planned synergies. For more information regarding restructuring activities. See Note 10, Restructuring and Other Related Charges, of the accompanying notes to condensed consolidated financial statements.

INTEREST EXPENSE

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | | |

| | June 30, | | Increase | |

(in thousands, except percentages) | | 2019 |

| 2018 | | (Decrease) | |

Interest expense | | $ | (23,932 | ) | | $ | (7,327 | ) | | $ | 16,605 |

| | 226.6 | % | |

% of net revenues | | (5.3 | )% | | (1.6 | )% | | | | | |

Interest expense increased for the three months ended June 30, 2019 primarily due to interest incurred on our Credit Facility Agreement entered into in connection with the Acquisition. See Note 9, Debt, of the accompanying notes to condensed consolidated financial statements.

OTHER NON-OPERATING INCOME, NET

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | | |

| | June 30, | | Increase | |

(in thousands, except percentages) | | 2019 | | 2018 | | (Decrease) | |

Other non-operating income, net | | $ | 333 |

| | $ | 1,996 |

| | $ | (1,663 | ) | | (83.3 | )% | |

% of net revenues | | 0.1 | % | | 0.9 | % | | | | | |

Other non-operating income, net for the three months ended June 30, 2019 decreased primarily due to lower interest income as our investment portfolios were liquidated during the First Quarter of Fiscal Year 2019 to facilitate the Acquisition.

INCOME TAX EXPENSE (BENEFIT)

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | | |

| | June 30, | | Increase | |

(in thousands except percentages) | | 2019 |

| 2018 | | (Decrease) | |

Income (loss) before income taxes | | $ | (52,448 | ) | | $ | 15,318 |

| | $ | (67,766 | ) | | (442.4 | )% | |

Income tax expense (benefit) | | (7,577 | ) | | 847 |

| | (8,424 | ) | | (994.6 | )% | |

Net income (loss) | | $ | (44,871 | ) | | $ | 14,471 |

| | $ | (59,342 | ) | | (410.1 | )% | |

Effective tax rate | | 14.4 | % | | 5.5 | % | |

|

| |

| |

The Company and its subsidiaries are subject to taxation in the U.S. and in various foreign and state jurisdictions. Our tax provision or benefit is determined using an estimate of our annual effective tax rate and adjusted for discrete items that are taken into account in the relevant period. The effective tax rates for the three months ended June 30, 2019 and 2018 were 14.4% and 5.5%, respectively.

The annual effective tax rates as of June 30, 2019 and 2018 varied from the statutory tax rate of 21% primarily due to our jurisdictional mix of income, state taxes, U.S. taxation of foreign earnings, and R&D credits.

During the quarter ended June 30, 2019, we recognized a discrete $11.6 million tax benefit related to an intra-entity transfer of an intangible asset that will have a deferred future benefit, for which we established a deferred tax asset.

On June 7, 2019, a Ninth Circuit panel reversed the United States Tax Court’s holding in Altera Corp. v. Commissioner and upheld the portion of the Treasury regulations issued under IRC Section 482 requiring related-party participants in a cost sharing arrangement to share stock-based compensation costs. At this time, the taxpayer is still eligible to protest the decision. We have considered the issue and have recorded a $8.6 million discrete tax charge resulting from the cost sharing of prior stock-based compensation, partially offset by a reduction to the 2017 Tax Cuts and Jobs Act toll charge accrued in prior periods. We will continue to monitor developments related to the case and the potential impact on its consolidated financial statements.

FINANCIAL CONDITION

|

| | |

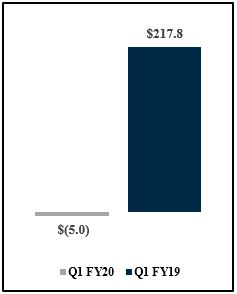

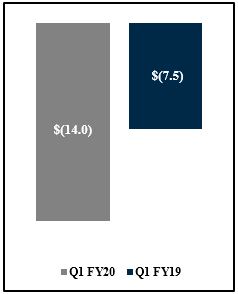

Operating Cash Flow (in millions) | Investing Cash Flow (in millions) | Financing Cash Flow (in millions) |

| | |

We use cash provided by operating activities as our primary source of liquidity. We expect that cash provided by operating activities will fluctuate in future periods as a result of a number of factors, including fluctuations in our revenues, the timing of compensation-related payments such as our annual bonus/variable compensation plan and Employee Stock Purchase Plan ("ESPP"), integration costs related to the Acquisition, product shipments during the quarter, accounts receivable collections, inventory and supply chain management, and the timing and amount of tax and other payments.

Operating Activities

Compared to the same year ago period, net cash provided by operating activities during the three months ended June 30, 2019 decreased primarily due to cash paid for interest payments on long-term debt, integration related expenses, and restructuring activities that did not occur in the comparative period. The decrease was partially offset by higher cash collections from customers as a result of increased revenue.

Investing Activities

Net cash used for investing activities during the three months ended June 30, 2019 was primarily used for the purchase of personal property, plant and equipment.

We estimate total capital expenditures for Fiscal Year 2020 will be approximately $40 million to $50 million. We expect capital expenditures for the remainder of Fiscal Year 2020 to consist primarily of new information technology investments, capital investment in our manufacturing capabilities, including tooling for new products, and facilities upgrades.

Financing Activities

Net cash used for financing activities during the three months ended June 30, 2019, consisted primarily of taxes paid on behalf of employees related to net share settlements of vested employee equity awards and payment of the quarterly dividend on our common stock.

Liquidity and Capital Resources

Our primary sources of liquidity as of June 30, 2019, consisted of cash, cash equivalents, and short-term investments, cash we expect to generate from operations, and a $100 million revolving credit facility. At June 30, 2019, we had working capital of $214.2 million, including $206.1 million of cash, cash equivalents, and short-term investments, compared with working capital of $252.9 million, including $215.8 million of cash, cash equivalents, and short-term investments at March 31, 2019. The decrease in working capital at June 30, 2019 compared to March 31, 2019 resulted from the net decrease in cash and cash equivalents and a net increase in accounts payable due to payment timing.

Our cash and cash equivalents as of June 30, 2019 consisted of bank deposits with third party financial institutions. We monitor bank balances in our operating accounts and adjust the balances as appropriate. Cash balances are held throughout the world, including substantial amounts held outside of the U.S. As of June 30, 2019, of our $206.1 million of cash, cash equivalents, and short-term investments, $60.6 million was held domestically while $145.5 million was held by foreign subsidiaries, and approximately 61% was based in USD-denominated instruments. During the quarter ended June 30, 2018, we sold most of our short-term investments to generate cash to fund the Acquisition on July 2, 2018. As of June 30, 2019, our remaining investments were composed of Mutual Funds.

During Fiscal Year 2019, in connection with the Acquisition, we entered into a Credit Agreement with Wells Fargo Bank, National Association, as administrative agent, and the lenders party thereto (the “Credit Agreement”). The Credit Agreement replaced our prior revolving credit facility in its entirety. The Credit Agreement provides for (i) a revolving credit facility with an initial maximum aggregate amount available of $100 million that matures in July 2023 and (ii) a $1.275 billion term loan facility that matures in July 2025. On July 2, 2018, the Company borrowed the full amount available under the term loan facility of $1.245 billion, net of approximately $30 million of discounts and issuance costs. Borrowings under the Credit Agreement bear interest due on a monthly basis at a variable rate equal to (i) LIBOR plus a specified margin, or (ii) the base rate (which is the highest of (a) the prime rate publicly announced from time to time by Wells Fargo Bank, National Association, (b) the federal funds rate plus 0.50% or (c) the sum of 1% plus one-month LIBOR) plus a specified margin. See Note 9, Debt, in the accompanying notes to the condensed consolidated financial statements.

On July 30, 2018, we entered into a 4-year amortizing interest rate swap agreement with Bank of America, NA. The swap has an initial notional amount of $831 million and matures on July 31, 2022. The purpose of this swap is to hedge against changes in cash flows (interest payments) attributable to fluctuations in the contractually specified LIBOR interest rate associated with our credit facility agreement. The swap involves the receipt of floating-rate amounts for fixed interest rate payments over the life of the agreement. We have designated this interest rate swap as a cash flow hedge. The derivative is valued based on prevailing LIBOR rate curves on the date of measurement. We also evaluate counterparty credit risk when we calculate the fair value of the swap. For additional details, see Note 14, Derivatives, of the accompanying notes to condensed consolidated financial statements.

During Fiscal Year 2016, we obtained $488.4 million from debt financing, net of issuance costs. The debt matures on May 31, 2023 and bears interest at a rate of 5.50% per annum, payable semi-annually on May 15 and November 15 of each year. See Note 9, Debt, in the accompanying notes to the condensed consolidated financial statements.

From time to time, our Board of Directors ("the Board") authorizes programs under which we may repurchase shares of our common stock in the open market or through privately negotiated transactions, including accelerated stock repurchase agreements. On November 28, 2018, the Board approved a 1 million share repurchase program expanding our capacity to repurchase shares to approximately 1.7 million shares. During the first quarter of Fiscal Year 2020, we did not repurchase any shares of our common stock. As of June 30, 2019, there remained 1,369,014 shares authorized for repurchase under the existing stock repurchase program. See Note 12, Common Stock Repurchases, in the accompanying notes to the condensed consolidated financial statements.

Our liquidity, capital resources, and results of operations in any period could be affected by repurchases of our common stock, the payment of cash dividends, the exercise of outstanding stock options, restricted stock grants under stock plans, and the issuance of common stock under our Employee Stock Purchase Plan ("ESPP"). The Acquisition has negatively affected our liquidity and leverage ratios. To reduce our debt leverage ratios, we expect to prioritize the repayment of the debt under the Credit Agreement.

Additionally, the Acquisition impacted our cash conversion cycle due to Polycom's use of third-party partner financing and early payment discounts to drive down cash collection cycles.

We also receive cash from the exercise of outstanding stock options under our stock plan and the issuance of shares under our ESPP. However, the resulting increase in the number of outstanding shares from these equity grants and issuances could affect our earnings per share. We cannot predict the timing or amount of proceeds from the sale or exercise of these securities or whether they will be exercised, forfeited, canceled, or expire.

On August 6, 2019, we announced that the Audit Committee of our Board declared a cash dividend of $0.15 per share, payable on September 10, 2019 to stockholders of record at the close of business on August 20, 2019.

We believe that our current cash and cash equivalents, cash provided by operations, and the availability of additional funds under the Credit Agreement will be sufficient to fund operations for at least the next 12 months; however, any projections of future financial needs and sources of working capital are subject to uncertainty. Readers are cautioned to review the risks, uncertainties, and assumptions set forth in this Quarterly Report on Form 10-Q, including the section entitled "Certain Forward-Looking Information" and the risk factors set forth in our Annual Report on Form 10-K for the fiscal year ended March 31, 2019, filed with the SEC on May 17, 2019, and other periodic filings with the SEC, any of which could affect our estimates for future financial needs and sources of working capital.

OFF BALANCE SHEET ARRANGEMENTS AND CONTRACTUAL OBLIGATIONS

We have not entered into any transactions with unconsolidated entities whereby we have financial guarantees, subordinated retained interests, derivative instruments, or other contingent arrangements that expose us to material continuing risks, contingent liabilities, or any other obligation under a variable interest in an unconsolidated entity that provides us with financing and liquidity support, market risk, or credit risk support.

A substantial portion of the raw materials, components, and subassemblies used in our products are provided by our suppliers on a consignment basis. These consigned inventories are not recorded on our consolidated balance sheet until we take title to the raw materials, components, and subassemblies, which occurs when they are consumed in the production process. Prior to consumption in the production process, our suppliers bear the risk of loss and retain title to the consigned inventory. The terms of the agreements allow us to return parts in excess of maximum order quantities to the suppliers at the supplier’s expense. Returns for other reasons are negotiated with the suppliers on a case-by-case basis and to date have been immaterial. If our suppliers were to discontinue financing consigned inventory, it would require us to make cash outlays and we could incur expenses which, if material, could negatively affect our business and financial results. As of June 30, 2019, and March 31, 2019, we had off-balance sheet consigned inventories of $48.2 million and $47.1 million, respectively.

Unconditional Purchase Obligations

We use several contract manufacturers to manufacture raw materials, components, and subassemblies for our products. We provide these contract manufacturers with demand information that typically covers periods up to 13 weeks, and they use this information to acquire components and build products. We also obtain individual components for our products from a wide variety of individual suppliers. Consistent with industry practice, we acquire components through a combination of purchase orders, supplier contracts, and open orders based on projected demand information. As of June 30, 2019, we had outstanding off-balance sheet third-party manufacturing, component purchase, and other general and administrative commitments of $406.4 million, including the off-balance sheet consigned inventories of $48.2 million discussed above, of which we expect to consume in the normal course of business.

Except as described above, there have been no material changes in our contractual obligations as described in our Annual Report on Form 10-K for the fiscal year ended March 31, 2019.

CRITICAL ACCOUNTING ESTIMATES

For a complete description of what we believe to be the critical accounting estimates used in the preparation of our condensed consolidated financial statements, refer to our Annual Report on Form 10-K for the fiscal year ended March 31, 2019, filed with the SEC on May 17, 2019.

Except as described above, there have been no changes to our critical accounting estimates during the three months ended June 30, 2019.

Recent Accounting Pronouncements

For more information regarding the Recent Accounting Pronouncements that may impact us, see Note 2, Recent Accounting Pronouncements, of the accompanying notes to the condensed consolidated financial statements.

Financial Statements (Unaudited)

PLANTRONICS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

(Unaudited) |

| | | | | | | |

| June 30,

2019 | | March 31,

2019 |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 191,904 |

| | $ | 202,509 |

|

Short-term investments | 14,169 |

| | 13,332 |

|

Accounts receivable, net | 318,235 |

| | 337,671 |

|

Inventory, net | 217,424 |

| | 177,146 |

|

Other current assets | 47,430 |

| | 50,488 |

|

Total current assets | 789,162 |

| | 781,146 |

|

Property, plant, and equipment, net | 196,376 |

| | 204,826 |

|

Goodwill | 1,279,897 |

| | 1,278,380 |

|

Purchased intangibles, net | 780,348 |

| | 825,675 |

|

Deferred tax assets | 3,182 |

| | 5,567 |

|

Other assets | 73,066 |

| | 20,941 |

|

Total assets | $ | 3,122,031 |

| | $ | 3,116,535 |

|

| | | |

LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | |

|

Current liabilities: | |

| | |

|

Accounts payable | $ | 166,618 |

| | $ | 129,514 |

|

Accrued liabilities | 408,306 |

| | 398,715 |

|

Total current liabilities | 574,924 |

| | 528,229 |

|

Long term debt, net of issuance costs | 1,642,163 |

| | 1,640,801 |

|

Long-term income taxes payable | 95,573 |

| | 83,121 |

|

Other long-term liabilities | 139,873 |

| | 142,697 |

|

Total liabilities | 2,452,533 |

| | 2,394,848 |

|

Commitments and contingencies (Note 8) |

|

| |

|

|

Stockholders' equity: | |

| | |

|

Common stock | 887 |

| | 884 |

|

Additional paid-in capital | 1,445,097 |

| | 1,431,607 |

|

Accumulated other comprehensive loss | (6,628 | ) | | (475 | ) |

Retained earnings | 92,437 |

| | 143,344 |

|

Total stockholders' equity before treasury stock | 1,531,793 |

| | 1,575,360 |

|

Less: Treasury stock, at cost | (862,295 | ) | | (853,673 | ) |

Total stockholders' equity | 669,498 |

| | 721,687 |

|

Total liabilities and stockholders' equity | $ | 3,122,031 |

| | $ | 3,116,535 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

PLANTRONICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(Unaudited)

|

| | | | | | | |

| Three Months Ended June 30, |

| 2019 | | 2018 |

Net revenues | | | |

Net product revenues | $ | 382,745 |

| | $ | 221,309 |

|

Net service revenues | 65,022 |

| | — |

|

Total net revenues | 447,767 |

| | 221,309 |

|

Cost of revenues | | | |

Cost of product revenues | 208,616 |

| | 111,466 |

|

Cost of service revenues | 26,505 |

| | — |

|

Total cost of revenues | 235,121 |

| | 111,466 |

|

Gross profit | 212,646 |

| | 109,843 |

|

Operating expenses: | | | |

Research, development, and engineering | 59,524 |

| | 23,701 |

|

Selling, general, and administrative | 163,608 |

| | 64,203 |

|

Gain, net from litigation settlements | (1,162 | ) | | (30 | ) |

Restructuring and other related charges | 19,525 |

| | 1,320 |

|

Total operating expenses | 241,495 |

| | 89,194 |

|

Operating income (loss) | (28,849 | ) | | 20,649 |

|

Interest expense | (23,932 | ) | | (7,327 | ) |

Other non-operating income, net | 333 |

| | 1,996 |

|

Income (loss) before income taxes | (52,448 | ) | | 15,318 |

|

Income tax expense (benefit) | (7,577 | ) | | 847 |

|

Net income (loss) | $ | (44,871 | ) | | $ | 14,471 |

|

| | | |

Income (loss) per common share: | | | |

Basic | $ | (1.14 | ) | | $ | 0.43 |

|

Diluted | $ | (1.14 | ) | | $ | 0.42 |

|

| | | |

Shares used in computing loss per common share: | | | |

Basic | 39,239 |

| | 32,594 |

|

Diluted | 39,239 |

| | 33,534 |

|

| | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

PLANTRONICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in thousands)

(Unaudited)

|

| | | | | | | |

| Three Months Ended June 30, |

| 2019 | | 2018 |

Net income (loss) | $ | (44,871 | ) | | $ | 14,471 |

|

Other comprehensive income (loss): | | | |

Foreign currency translation adjustments | (219 | ) | | — |

|

Unrealized gains (losses) on cash flow hedges: | | | |

Unrealized cash flow hedge gains (losses) arising during the period | (6,704 | ) | | 3,956 |

|

Net (gains) losses reclassified into income for revenue hedges | (1,359 | ) | | (249 | ) |

Net (gains) losses reclassified into income for cost of revenue hedges | (104 | ) | | (79 | ) |

Net (gains) losses reclassified into income for interest rate swaps | 652 |

| | — |

|

Net unrealized gains (losses) on cash flow hedges | (7,515 | ) | | 3,628 |

|

Unrealized gains (losses) on investments: | | | |

Unrealized holding gains (losses) during the period | — |

| | 198 |

|

| | | |

Aggregate income tax benefit (expense) of the above items | 1,581 |

| | (110 | ) |

Other comprehensive income (loss) | (6,153 | ) | | 3,716 |

|

Comprehensive income (loss) | $ | (51,024 | ) | | $ | 18,187 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

PLANTRONICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(Unaudited) |

| | | | | | | |

| Three Months Ended |

| June 30, |

| 2019 | | 2018 |

CASH FLOWS FROM OPERATING ACTIVITIES | | | |

Net income (loss) | $ | (44,871 | ) | | $ | 14,471 |

|

Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

Depreciation and amortization | 57,698 |

| | 5,248 |

|

Amortization of debt issuance costs | 1,361 |

| | 362 |

|

Stock-based compensation | 12,904 |

| | 8,150 |

|

Deferred income taxes | (33,145 | ) | | 4,632 |

|

Provision for excess and obsolete inventories | 1,760 |

| | 612 |

|

Restructuring and related charges (credits) | 19,525 |

| | 1,320 |

|

Cash payments for restructuring charges | (17,658 | ) | | (835 | ) |

Other operating activities | 1,965 |

| | (274 | ) |

Changes in assets and liabilities, net of acquisition: | | | |

|

Accounts receivable, net | 21,445 |

| | 5,302 |

|

Inventory, net | (42,309 | ) | | (400 | ) |

Current and other assets | 15,498 |

| | 2,981 |

|

Accounts payable | 36,392 |

| | 5,688 |

|

Accrued liabilities | (43,784 | ) | | (7,300 | ) |

Income taxes | 21,568 |

| | (7,875 | ) |

Cash provided by operating activities | 8,349 |

| | 32,082 |

|

CASH FLOWS FROM INVESTING ACTIVITIES | | | |

|

Proceeds from sales of investments | 170 |

| | 124,640 |

|

Proceeds from maturities of investments | — |

| | 131,017 |

|

Purchase of investments | (651 | ) | | (394 | ) |

Cash paid for acquisition, net of cash acquired | — |

| | (33,550 | ) |

Capital expenditures | (4,507 | ) | | (3,868 | ) |

Cash (used for) provided by investing activities | (4,988 | ) | | 217,845 |

|

CASH FLOWS FROM FINANCING ACTIVITIES | | | |

|

Employees' tax withheld and paid for restricted stock and restricted stock units | (8,621 | ) | | (13,035 | ) |

Proceeds from issuances under stock-based compensation plans | 589 |

| | 10,558 |

|

Payment of cash dividends | (5,940 | ) | | (5,014 | ) |

Cash (used for) by financing activities | (13,972 | ) | | (7,491 | ) |

Effect of exchange rate changes on cash and cash equivalents | 6 |

| | (2,055 | ) |

Net increase (decrease) in cash and cash equivalents | (10,605 | ) | | 240,381 |

|

Cash and cash equivalents at beginning of period | 202,509 |

| | 390,661 |

|

Cash and cash equivalents at end of period | $ | 191,904 |

| | $ | 631,042 |

|

SUPPLEMENTAL DISCLOSURES | | | |

Cash paid for income taxes | $ | 2,755 |

| | $ | 30,902 |

|

Cash paid for interest | $ | 29,203 |

| | $ | 54,386 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

PLANTRONICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

(in thousands)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional Paid-In | | Accumulated Other Comprehensive | | Retained | | Treasury | | Total Stockholders' |

| Shares | | Amount | | Capital | | Income | | Earnings | | Stock | | Equity |

Balances at March 31, 2018 | 33,251 |

| | 816 |

| | 876,645 |

| | 2,870 |

| | 299,066 |

| | (826,427 | ) | | 352,970 |

|

Net income | — |

| | — |

| | — |

| | — |

| | 14,471 |

| | — |

| | 14,471 |

|

Net unrealized gains (losses) on cash flow hedges, net of tax | — |

| | — |

| | — |

| | 3,839 |

| | — |

| | — |

| | 3,839 |

|

Proceeds from issuances under stock-based compensation plans | 361 |

| | 3 |

| | 10,555 |

| | — |

| | — |

| | — |

| | 10,558 |

|

Repurchase of restricted common stock | (53 | ) | | | | | | — |

| | — |

| | — |

| | — |

|

Cash dividends | — |

| | — |

| | | | — |

| | (5,014 | ) | | — |

| | (5,014 | ) |

Stock-based compensation | — |

| | — |

| | 8,150 |

| | | | — |

| | — |

| | 8,150 |

|

Employees' tax withheld and paid for restricted stock and restricted stock units | (187 | ) | | — |

| | — |

| | — |

| | — |

| | (13,035 | ) | | (13,035 | ) |

Impact of new accounting standards adoption | — |

| | — |

| | — |

| | (124 | ) | | 2,718 |

| | — |

| | 2,594 |

|

Balances at June 30, 2018 | 33,372 |

| | $ | 819 |

| | $ | 895,350 |

| | $ | 6,585 |

| | $ | 311,241 |

| | $ | (839,462 | ) | | 374,533 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional Paid-In | | Accumulated Other Comprehensive | | Retained | | Treasury | | Total Stockholders' |

| Shares | | Amount | | Capital | | Income | | Earnings | | Stock | | Equity |

Balances at March 31, 2019 | 39,518 |

| | 884 |

| | 1,431,608 |

| | (475 | ) | | 143,344 |

| | (853,674 | ) | | 721,687 |

|

Net loss | — |

| | — |

| | — |

| | — |

| | (44,871 | ) | | — |

| | (44,871 | ) |

Foreign currency translation adjustments | — |

| | — |

| | — |

| | (219 | ) | | — |

| | — |

| | (219 | ) |

Net unrealized gains (losses) on cash flow hedges, net of tax | — |

| | — |

| | — |

| | (5,934 | ) | | — |

| | — |

| | (5,934 | ) |

Proceeds from issuances under stock-based compensation plans | 271 |

| | 3 |

| | 586 |

| | — |

| | — |

| | — |

| | 589 |

|

Repurchase of restricted common stock | (20 | ) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

Cash dividends | — |

| | — |

| | — |

| | — |

| | (5,940 | ) | | — |

| | (5,940 | ) |

Stock-based compensation | — |

| | — |

| | 12,904 |

| | — |

| | — |

| | — |

| | 12,904 |

|

Employees' tax withheld and paid for restricted stock and restricted stock units | (191 | ) | | — |

| | — |

| | — |

| | — |

| | (8,622 | ) | | (8,622 | ) |

Impact of new accounting standards adoption | — |

| | — |

| | — |

| | — |

| | (89 | ) | | — |

| | (89 | ) |

Other equity changes | — |

| | — |

| | — |

| | — |

| | (7 | ) | | — |

| | (7 | ) |

Balances at June 30, 2019 | 39,578 |

| | $ | 887 |

| | $ | 1,445,098 |

| | $ | (6,628 | ) | | $ | 92,437 |

| | $ | (862,296 | ) | | 669,498 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

PLANTRONICS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. BASIS OF PRESENTATION

In the opinion of management, with the exception of the adoption of ASC 842, Leases as discussed below, the accompanying unaudited condensed consolidated financial statements ("financial statements") of Plantronics, Inc. ("the Company") have been prepared on a basis materially consistent with the Company's March 31, 2019 audited consolidated financial statements and include all adjustments, consisting of normal recurring adjustments, necessary to fairly state the information set forth herein. Certain information and footnote disclosures normally included in financial statements prepared pursuant to the rules and regulations of the Securities and Exchange Commission ("SEC") applicable to interim financial information and in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP") have been condensed or omitted pursuant to such rules and regulations. The financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Company's Annual Report on Form 10-K for the fiscal year ended March 31, 2019, which was filed with the SEC on May 17, 2019. The results of operations for the interim period ended June 30, 2019 are not necessarily indicative of the results to be expected for the entire fiscal year or any future period.

The financial results of Polycom have been included in the Company's consolidated financial statements from the date of acquisition on July 2, 2018, see Note 3, Acquisition for details.

The financial statements include the accounts of the Company and its wholly owned subsidiaries. All intercompany balances and transactions have been eliminated.