UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________________

FORM 20-F

____________________________________

(Mark One)

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or (g) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

OR

| ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2021

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

OR

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

Date of event requiring this shell company report

For the transition period from to

Commission file number 1-12874

____________________________________

(Exact name of Registrant as specified in its charter)

____________________________________

(Jurisdiction of incorporation or organization)

Not Applicable

(Translation of Registrant’s name into English)

Telephone: (441) 298-2530

(Address and telephone number of principal executive offices)

Telephone: (441 ) 298-2530

Fax: (441) 292-3931

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered, or to be registered, pursuant to Section 12(b) of the Act.

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Securities registered, or to be registered, pursuant to Section 12(g) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

____________________________________

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant (1) has submitted electronically, if any, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer", "accelerated filer,” and "emerging growth company" in Rule 12b-2 of the Exchange Act:

Large Accelerated Filer ¨ Accelerated Filer ý Non-Accelerated Filer ¨ Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ¨

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ý No ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| x | International Financial Reporting Standards as issued by the International Accounting Standards Board | ¨ | Other | ¨ | |||||||||||||

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ý

Auditor Name: KPMG LLP Auditor Location: Vancouver BC, Canada Auditor Firm ID: 85

TEEKAY CORPORATION

INDEX TO REPORT ON FORM 20-F

INDEX

| PAGE | |||||||||||||||||

| Item 1. | |||||||||||||||||

| Item 2. | |||||||||||||||||

| Item 3. | |||||||||||||||||

| Item 4. | |||||||||||||||||

| A. | |||||||||||||||||

| B. | |||||||||||||||||

| C. | |||||||||||||||||

| D. | |||||||||||||||||

| E. | |||||||||||||||||

| 1. | |||||||||||||||||

| 2. | |||||||||||||||||

| 3. | |||||||||||||||||

| Item 4A. | |||||||||||||||||

| Item 5. | |||||||||||||||||

| Item 6. | |||||||||||||||||

| Item 7. | |||||||||||||||||

| Item 8. | |||||||||||||||||

| Item 9. | |||||||||||||||||

| Item 10. | |||||||||||||||||

3

| Item 11. | |||||||||||||||||

| Item 12. | |||||||||||||||||

| Item 13. | |||||||||||||||||

| Item 14. | |||||||||||||||||

| Item 15. | |||||||||||||||||

| Item 16A. | |||||||||||||||||

| Item 16B. | |||||||||||||||||

| Item 16C. | |||||||||||||||||

| Item 16D. | |||||||||||||||||

| Item 16E. | |||||||||||||||||

| Item 16F. | |||||||||||||||||

| Item 16G. | |||||||||||||||||

| Item 16H. | |||||||||||||||||

| Item 17. | |||||||||||||||||

| Item 18. | |||||||||||||||||

| Item 19. | |||||||||||||||||

4

PART I

This annual report of Teekay Corporation on Form 20-F for the year ended December 31, 2021 (or Annual Report) should be read in conjunction with the consolidated financial statements and accompanying notes included in this Annual Report.

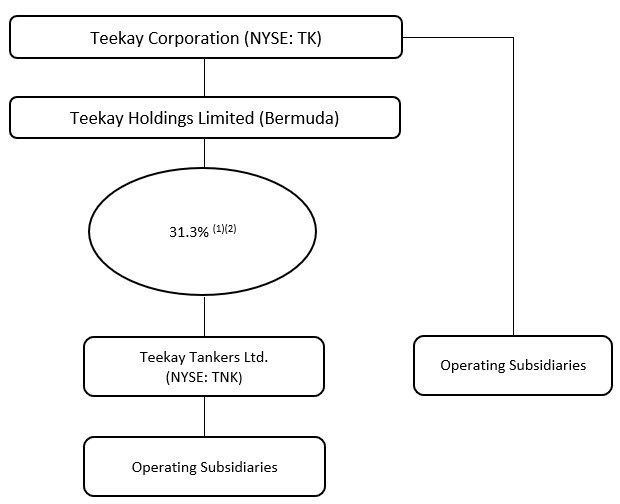

Unless otherwise indicated, references in this Annual Report to “Teekay,” “the Company,” “we,” “us” and “our” and similar terms refer to Teekay Corporation and its subsidiaries. References in this Annual Report to "Teekay Tankers" refer to Teekay Tankers Ltd. (NYSE: TNK). In addition, references in this Annual Report to "Altera" refer to Altera Infrastructure L.P., previously known as Teekay Offshore Partners L.P. (NYSE: TOO), which was a subsidiary of Teekay Corporation until September 2017, and an equity-accounted investment until May 2019, and to "Seapeak" refer to Seapeak LLC (NYSE: SEAL), previously known as Teekay LNG Partners L.P. (NYSE: TGP) (or Teekay LNG Partners), which was a subsidiary of Teekay Corporation until January 2022. References to the “Teekay Gas Business” refer to the following, prior to their sale by Teekay to Stonepeak Partners L.P. and Seapeak in January 2022: Teekay’s general partner interest in Teekay LNG Partners; all of Teekay LNG Partners’ common units held by Teekay; and certain subsidiaries of Teekay that collectively contained the shore-based management operations of Teekay LNG Partners and certain of its joint ventures.

The sale of the Teekay Gas Business by Teekay occurred on January 13, 2022. The presentation of certain information in the Company’s consolidated financial statements included in this Annual Report reflect that the Teekay Gas Business is a discontinued operation of the Company. See "Item 18 – Financial Statements: Note 23 - Discontinued Operations” and "Item 18 – Financial Statements: Note 24 - Subsequent Events” for further information.

In addition to historical information, this Annual Report contains forward-looking statements that involve risks and uncertainties. Such forward-looking statements relate to future events and our operations, objectives, expectations, performance, financial condition and intentions. When used in this Annual Report, the words “expect,” “intend,” “plan,” “believe,” “anticipate,” “estimate” and variations of such words and similar expressions are intended to identify forward-looking statements. Forward-looking statements in this Annual Report include, in particular, statements regarding:

•our future financial condition and results of operations and our future revenues, expenses and capital expenditures, and our expected financial flexibility and sources of liquidity to pursue capital expenditures, acquisitions and other expansion opportunities, including vessel acquisitions;

•our dividend policy and our ability to pay cash dividends on our shares of common stock or any increases in quarterly distributions, and the distribution and dividend policies of our publicly-listed subsidiary, Teekay Tankers, including any increases in distribution or dividend levels of Teekay Tankers;

•our liquidity needs and meeting our going concern requirements, including our working capital deficit, anticipated funds and sources of financing for liquidity needs and the sufficiency of cash flows, and our estimation that we will have sufficient liquidity for at least the next 12 months;

•our ability and plans to obtain financing for new projects and commitments, refinance existing debt obligations and fulfill our debt obligations;

•our plans for Teekay Parent, which excludes our interests in Teekay Tankers and includes Teekay Corporation and its remaining subsidiaries, to reduce or eliminate operational risk in any floating production, storage and offloading (or FPSO) units and to increase its intrinsic value per share;

•the expected scope, duration and effects of the novel coronavirus pandemic and the unfolding geopolitical crisis between Ukraine and Russia, including its impact on global supply and demand for crude oil and petroleum products and fleet utilization, and the consequences of any future epidemic or pandemic crises or geopolitical tensions;

•conditions and fundamentals of the markets in which we operate, including the balance of supply and demand in these markets and charter and spot rates, estimated growth in world fleets and vessel scrapping, and oil production, refinery capacity and competition for providing services;

•our expectations regarding tax liabilities, including whether applicable tax authorities may agree with our tax positions, including whether or not we qualify as a passive foreign investment company;

•our expectations regarding the effect of economic substance regulations in the Marshall Islands and Bermuda and their future status under those regulations;

•our expectations as to the useful lives of our vessels;

•our future growth prospects and competitive position;

•the impact of future changes in the demand for and price of oil;

•expected costs, capabilities, acquisitions and conversions, and the commencement of any related charters or other contracts;

•our ability to maximize the use of our vessels, including the re-deployment or disposition of vessels no longer under long-term time charter or on short-term charter contracts;

•our expectations regarding customer payments, including the ability of our customers to make charter payments to us;

•the status and outcome of any pending legal claims, actions or disputes;

•Teekay Tankers’ expected recovery of fuel price increases from the charterers of its vessels through higher rates for voyage charters;

•the future valuation or impairment of our assets, including goodwill;

•our expectations and estimates regarding future charter business, with respect to minimum charter hire payments, revenues and our vessels' ability to perform to specifications and maintain their hire rates in the future;

5

•our compliance with financing agreements and the expected effect of restrictive covenants in such agreements;

•operating expenses, availability of crew and crewing costs, number of off-hire days, drydocking requirements and durations and the adequacy and cost of insurance, and expectations as to cost-saving initiatives;

•the effectiveness of our risk management policies and procedures and the ability of the counterparties to our derivative and other contracts to fulfill their contractual obligations;

•the impact on us and the shipping industry of environmental liabilities and developments, including climate change;

•the impact of any sanctions on our operations and our ongoing compliance with such sanctions;

•the impact of the invasion of Ukraine by Russia on the economy, our industry and our business, including as the result of sanctions on Russian companies and individuals;

•the expected impact of the cessation of the London Inter-Bank Offered Rate (or LIBOR) or the adoption of the “Poseidon Principles” by financial institutions;

•the impact and expected cost of, and our ability to comply with, new and existing governmental regulations and maritime self-regulatory organization standards applicable to our business, including, among others, the expected cost to install ballast water treatment systems (or BWTS) on our vessels;

•the impact of increasing scrutiny and changing expectations from investors, lenders, customers and other stakeholders with respect to environmental, social and governance (or ESG) policies and practices, and the Company’s ability to meet its corporate ESG goals;

•our ability to obtain all permits, licenses and certificates with respect to the conduct of our operations;

•the expectations as to the chartering of unchartered vessels;

•our entering into joint ventures or partnerships with companies;

•our hedging activities relating to foreign exchange, interest rate and spot market risks, and the effects of fluctuations in foreign currency exchange, interest rate and spot market rates on our business and results of operations;

•the potential impact of new accounting guidance or the adoption of new accounting standards;

•our potential need to renew portions of our tanker fleet; and

•our business strategy and other plans and objectives for future operations, including, among others, our pursuit of investment opportunities in the shipping sector and potentially in new and adjacent markets.

Forward-looking statements involve known and unknown risks and are based upon a number of assumptions and estimates that are inherently subject to significant uncertainties and contingencies, many of which are beyond our control. Actual results may differ materially from those expressed or implied by such forward-looking statements. Important factors that could cause actual results to differ materially include, but are not limited to, those factors discussed below in “Item 3 – Key Information – Risk Factors” and other factors detailed from time to time in other reports we file with the U.S. Securities and Exchange Commission (or the SEC).

We do not intend to revise any forward-looking statements in order to reflect any change in our expectations or events or circumstances that may subsequently arise. You should carefully review and consider the various disclosures included in this Annual Report and in our other filings made with the SEC that attempt to advise interested parties of the risks and factors that may affect our business, prospects and results of operations.

Item 1.Identity of Directors, Senior Management and Advisors

Not applicable.

Item 2.Offer Statistics and Expected Timetable

Not applicable.

Item 3.Key Information

Risk Factors

Some of the risks summarized below and discussed in greater detail in the following pages relate principally to the industries in which we operate and to our business in general. Other risks relate principally to the securities market and to ownership of our common stock. The occurrence of any of the events described in this section could materially and adversely affect our business, financial condition, operating results and ability to pay dividends on, and the trading price of our public debt and common stock.

Risk Factor Summary

Risks Related to Our Industry

•Changes in the oil markets could result in decreased demand for our vessels and services.

•The cyclical nature of the tanker industry may lead to volatile changes in charter rates and significant fluctuations in the utilization of our vessels.

6

•High oil prices could negatively impact tanker freight rates.

•A decline in oil prices may adversely affect our growth prospects and results of operations.

•Marine transportation is inherently risky, and an incident involving loss or damage to a vessel, significant loss of product or environmental contamination by any of our vessels could harm our reputation and business.

•The novel coronavirus (or COVID-19) pandemic is dynamic. The continuation of this pandemic, and the emergence of other epidemic or pandemic crises, could have material adverse effects on our business, results of operations, or financial condition.

•Terrorist attacks, increased hostilities, political change, or war, including the unfolding war and geopolitical crisis between Ukraine and Russia, could lead to further economic instability, increased costs and business disruption.

•Acts of piracy on ocean-going vessels continue to be a risk, which could adversely affect our business.

Risks Related to Our Business

•Economic downturns, including disruptions in the global credit markets, could adversely affect our ability to grow.

•Economic downturns may affect our customers’ ability to charter our vessels and pay for our services and may adversely affect our business and results of operations.

•The intense competition in our markets may lead to reduced profitability or reduced expansion opportunities.

•The loss of any key customer or its inability to pay for our services could result in a significant loss of revenue in a given period.

•Our ability to repay or refinance debt obligations and to fund capital expenditures will depend on certain financial, business and other factors, many of which are beyond our control. We will need to obtain additional financing, which financing may limit our ability to make cash dividends and distributions, increase our financial leverage and result in dilution to our equityholders.

•Charter rates for conventional oil and product tankers may fluctuate substantially over time and may be lower when we are attempting to re-charter these vessels.

•Changes in market conditions may limit our access to capital and our growth.

•Declining market values of our vessels could adversely affect our liquidity and result in breaches of our financing agreements.

•Over time, the value of our vessels may decline, which could result in both write-downs and an adverse effect on our operating results.

•We have recognized asset impairments in the past and we may recognize additional impairments in the future.

•Teekay Tankers anticipates that it may need to accelerate its fleet renewal in coming years, the success of any such program will depend on newbuilding and second-hand vessel availability and prices, market conditions and available financing, and which it anticipates will require significant expenditures.

•Our insurance may be insufficient to cover losses that may occur to our property or result from our operations.

•We are green-recycling one FPSO unit and plan to decommission and/or green-recycle our remaining FPSO units, which are scheduled to generate limited additional revenue and for which we may be required to incur significant costs.

•Teekay Tankers has substantial debt levels and may incur additional debt.

•Exposure to interest rate fluctuations will result in fluctuations in our cash flows and operating results.

•Use of LIBOR is currently scheduled to cease, and interest rates on our LIBOR-based obligations may increase in the future.

•Financing agreements containing operating and financial restrictions may restrict our business and financing activities.

•Our and many of our customers’ substantial operations outside the United States expose us and them to political, governmental and economic instability.

•Maritime claimants could arrest, or port authorities could detain, our vessels, which could interrupt our cash flow.

•Many of our seafaring employees are covered by collective bargaining agreements and the failure to renew those agreements or any future labor agreements may disrupt operations and adversely affect our cash flows.

•We may be unable to attract and retain qualified, skilled employees or crew to operate our business.

•Exposure to currency exchange rate fluctuations results in fluctuations in our cash flows and operating results.

•Our operating results are subject to seasonal fluctuations.

•We may be unable to realize benefits from acquisitions and growth through acquisitions may harm our financial condition and performance.

•Teekay Tankers may expend substantial sums during the construction of future potential newbuildings or upgrades to their existing vessels, without earning revenue and without assurance that they will be completed.

•Teekay Tankers’ U.S. Gulf lightering business competes with alternative methods of delivering crude oil to ports, which may limit its earnings in this area of its operations.

•Teekay Tankers’ full service lightering operations are subject to specific risks that could lead to accidents, oil spills or property damage.

7

Legal and Regulatory Risks

•We are bound to adhere to sanctions from many jurisdictions, including the United States, United Kingdom, European Union and Canada, due to our domicile and location of offices.

•Past port calls by our vessels or third-party vessels participating in Revenue Sharing Agreements (or RSAs) to countries that are subject to sanctions imposed by the United States, European Union and the United Kingdom could harm our business.

•Failure to comply with the U.S. Foreign Corrupt Practices Act, the UK Bribery Act, the UK Criminal Finances Act and similar laws in other jurisdictions could result in fines, criminal penalties, contract terminations and an adverse effect on our business.

•The shipping industry is subject to substantial environmental and other regulations, which may significantly limit operations and increase expenses.

•Climate change and greenhouse gas restrictions may adversely impact our operations and markets.

•Increasing scrutiny and changing expectations from investors, lenders, customers and other market participants with respect to ESG policies and practices may impose additional costs on us or expose us to additional risks.

•Regulations relating to ballast water discharge may adversely affect our operational results and financial condition.

•Our operations may be subject to economic substance requirements in the Marshall Islands and other offshore jurisdictions.

Information and Technology Risks

•A cyber-attack could materially disrupt our business.

•Our failure to comply with data privacy laws could damage our customer relationships and expose us to litigation risks and potential fines.

Risks Related to an Investment in Our Securities

•Because we are organized under the laws of the Marshall Islands, it may be difficult to serve us with legal process or enforce judgments against us, our directors or our management.

Tax Risks

•U.S. tax authorities could treat us as a “passive foreign investment company,” which could have adverse U.S. federal income tax consequences to U.S. shareholders.

•We are subject to taxes. The imposition of taxes, including as a result of a change in tax law or accounting requirements, may reduce our cash available for distribution to shareholders.

Risks Related to Our Industry

Changes in the oil markets could result in decreased demand for our vessels and services.

Demand for our vessels and services in transporting oil depends upon world and regional oil markets. Any decrease in shipments of crude oil in those markets could have a material adverse effect on our business, financial condition and results of operations. Historically, those markets have been volatile as a result of the many conditions and events that affect the price, production and transport of oil, including competition from alternative energy sources. Past slowdowns of the U.S. and world economies have resulted in reduced consumption of oil products and decreased demand for our vessels and services, which reduced vessel earnings. Additional slowdowns could have similar effects on our operating results and may limit our ability to expand our fleet.

The cyclical nature of the tanker industry and inflation may adversely affect our earnings and profitability. The cyclical nature may also lead to volatile changes in charter rates and significant fluctuations in the utilization of our vessels.

Historically, the tanker industry has been cyclical, experiencing volatility in profitability due to changes in the supply of and demand for tanker capacity and changes in the supply of and demand for oil and oil products. The cyclical nature of the tanker industry, as well as inflation, may cause significant increases or decreases in our earnings and profitability we earn from our vessels. The cyclical nature of the tanker industry may also cause significant increases or decreases in the value of our vessels. If the tanker market is depressed, our earnings may decrease, particularly with respect to the conventional tanker vessels owned by Teekay Tankers, which accounted for approximately 79% and 77% of our consolidated revenues from continuing operations during 2021 and 2020, respectively. These vessels are primarily employed on the spot-charter market, which is highly volatile and fluctuates based upon tanker and oil supply and demand. Declining spot rates in a given period generally will result in corresponding declines in operating results for that period. The successful operation of our vessels in the spot-charter market depends upon, among other things, obtaining profitable spot charters and minimizing, to the extent possible, time spent waiting for charters and time spent traveling unladen to pick up cargo. Future spot rates may not be sufficient to enable our vessels trading in the spot tanker market to operate profitably or to provide sufficient cash flow to service our debt obligations. The factors affecting the supply of and demand for tankers are outside of our control, and the nature, timing and degree of changes in industry conditions are unpredictable.

Factors that influence demand for tanker capacity include:

•demand for oil and oil products;

•supply of oil and oil products;

•regional availability of refining capacity;

•global and regional economic and political conditions;

8

•the distance oil and oil products are to be moved by sea;

•demand for floating storage of oil; and

•changes in seaborne and other transportation patterns.

Factors that influence the supply of tanker capacity include:

•the number of newbuilding deliveries;

•the scrapping rate of older vessels;

•conversion of tankers to other uses;

•the number of vessels that are out of service; and

•environmental concerns and regulations.

Changes in demand for transportation of oil over longer distances and in the supply of tankers to carry that oil may materially affect our revenues, profitability and cash flows. Following our sale of the Teekay Gas Business, which operated primarily under long-term, fixed-rate charter contracts, our revenues will be more volatile and dependent on revenues generated by our tanker fleet.

High oil prices could negatively impact tanker freight rates.

Global crude oil prices increased through the course of 2021 and reached a seven-year high in January 2022. High oil prices could negatively impact tanker freight rates due to reduced oil demand, higher operating costs as a result of increased bunker prices, and weaker refining margins.

A decline in oil prices may adversely affect our growth prospects and results of operations.

Low oil prices may adversely affect energy and capital markets and available sources of financing for our capital expenditures and debt repayment obligations. A sustained low energy price environment may adversely affect our business, results of operations and financial condition and our ability to make cash distributions, as a result of a number of factors, some of which may be beyond our control, including:

•the termination of production of oil at the fields we service;

•lower demand for vessels of the types we own and operate, which may reduce available charter rates and revenue to us upon redeployment of our vessels following expiration or termination of existing contracts or upon the initial chartering of vessels, or which may result in extended periods of our vessels being idle between contracts;

•customers potentially seeking to renegotiate or terminate existing vessel contracts, failing to extend or renew contracts upon expiration, or seeking to negotiate cancelable contracts;

•the inability or refusal of customers to make charter payments to us due to financial constraints or otherwise; or

•declines in vessel values, which may result in losses to us upon vessel sales or impairment charges against our earnings.

Marine transportation is inherently risky, and an incident involving loss or damage to a vessel, significant loss of product or environmental contamination by any of our vessels could harm our reputation and business.

Our vessels, crew and cargoes are at risk of being damaged, injured or lost because of events such as:

•marine disasters;

•bad weather or natural disasters;

•mechanical or electrical failures;

•grounding, capsizing, fire, explosions and collisions;

•piracy (hijacking and kidnapping);

•cyber-attack;

•acute-onset illness in connection with global or regional pandemics or similar public health crises;

•mental health of crew members;

•human error; and

•war and terrorism.

An accident involving any of our vessels could result in any of the following:

•significant litigation with our customers or other third parties;

•death or injury to persons, loss of property or damage to the environment and natural resources;

•delays in the delivery of cargo;

9

•liabilities or costs to recover any spilled oil and to restore the environment affected by the spill;

•loss of revenues from charters;

•governmental fines, penalties or restrictions on conducting business;

•higher insurance rates; and

•damage to our reputation and customer relationships generally.

Any of these events could have a material adverse effect on our business, financial condition and operating results. In addition, any damage to, or environmental contamination involving, oil production facilities serviced by our vessels could result in the suspension or curtailment of operations by our customers, which would in turn result in loss of revenues.

The COVID-19 pandemic is dynamic. The continuation of this pandemic, and the emergence of other epidemic or pandemic crises, could have material adverse effects on our business, results of operations, or financial condition.

The novel coronavirus pandemic is dynamic, including the development of variants of the virus, and its ultimate scope, duration and effects are uncertain. We expect that this pandemic, and any future epidemic or pandemic crises, will result in direct and indirect adverse effects on our industry and customers, which in turn may impact our business, results of operations and financial condition. The pandemic has resulted and may continue to result in a significant decline in global demand for crude oil and petroleum products. As our business includes the transportation of oil and petroleum products on behalf of our customers, any significant decrease in demand for the cargo we transport could adversely affect demand for our vessels and services. COVID-19 has been a contributing factor to the decline in spot tanker rates and short-term time charter rates since May 2020 and has also increased certain crewing-related costs, which has reduced our cash flows, and was a contributing factor to the non-cash write-down of certain tankers owned by Teekay Tankers and one FPSO unit, as described in "Item 18 – Financial Statements: Note 18 - (Write-down) and Gain (Loss) on Sale".

Other effects of the current pandemic include, or may include, among others:

•disruptions to our operations as a result of the potential health impact on our employees and crew, and on the workforces of our customers and business partners;

•disruptions to our business from, or additional costs related to, new regulations, directives or practices implemented in response to the pandemic, such as travel restrictions (including for any of our onshore personnel or any of our crew members to timely embark or disembark from our vessels), increased inspection regimes, hygiene measures (such as quarantining and physical distancing) or increased implementation of remote working arrangements;

•supply chain and other business disruptions from, or additional costs related to, a limited supply of labor, parts or goods;

•potential delays in the loading and discharging of cargo on or from our vessels, and any related off hire due to quarantine, worker health, or regulations, which in turn could disrupt our operations and result in a reduction of revenue;

•potential shortages or a lack of access to required spare parts for our vessels, or potential delays in any repairs to, scheduled or unscheduled maintenance or modifications, or dry docking of, our vessels (including the currently scheduled dry docks for 10 of Teekay Tankers' vessels in 2022), as a result of a lack of berths available by shipyards from a shortage in labor or due to other business disruptions;

•potential delays in vessel inspections and related certifications by class societies, customers or government agencies;

•potential reduced cash flows and financial condition, including potential liquidity constraints;

•reduced access to capital, including the ability to refinance any existing obligations, as a result of any credit tightening generally or due to declines in global financial markets, including to the prices of publicly-traded equity securities of us, our peers and of listed companies generally;

•a reduced ability to opportunistically sell any of our vessels on the second-hand market, either as a result of a lack of buyers or a general decline in the value of second-hand vessels;

•a decline in the market value of our vessels, which may cause us to (a) incur additional impairment charges or (b) breach certain covenants under our financing agreements (including our secured credit facility agreements and financial leases) relating to vessel-to-loan covenants; and

•potential deterioration in the financial condition and prospects of our customers or the third-party owners whose ships we commercially manage, or attempts by charterers, suppliers or receivers to invoke force majeure contractual clauses as a result of delays or other disruptions.

Although disruption and effects from the COVID-19 pandemic may be moderated by vaccines, given the dynamic nature of these circumstances and the worldwide nature of our business and operations, the duration of any potential business disruption and the related potential financial impact to us cannot be reasonably estimated at this time but could materially affect our business, results of operations and financial condition in the future.

Terrorist attacks, increased hostilities, political change, or war could lead to further economic instability, increased costs, and business disruption.

Terrorist attacks, and current or future conflicts in Ukraine, the Middle East, Libya, East Asia, South East Asia, West Africa and elsewhere, and political change, may adversely affect our business, operating results, financial condition, and ability to raise capital and fund future growth. Recent hostilities in Ukraine, the Middle East - especially among Qatar, Saudi Arabia, the United Arab Emirates, Yemen (Red Sea and Gulf of Aden Area), or Iran - and elsewhere may lead to additional armed conflicts or to further acts of terrorism and civil disturbance in the United States or elsewhere,

10

which may contribute further to economic instability and disruption of oil production and distribution, which could result in reduced demand for our services and have an adverse impact on our operations and our ability to conduct business.

Furthermore, Russia’s recent invasion of Ukraine, in addition to sanctions announced in February and March 2022 by President Biden and several European and world leaders and nations against Russia and any further sanctions, may also adversely impact our business given Russia’s role as a major global exporter of crude oil. Our business could be harmed by trade tariffs, trade embargoes or other economic sanctions by the United States or other countries against Russia, companies with Russian connections or the Russian energy sector and harmed by any retaliatory measures by Russia or other countries in response. While much uncertainty remains regarding the global impact of Russia’s invasion of Ukraine, it is possible that such tensions could adversely affect our business, financial condition, results of operation and cash flows. In addition, it is possible that third parties with which we have charter contracts may be impacted by events in Russia and Ukraine, which could adversely affect our operations and financial condition.

In addition, oil facilities, shipyards, vessels, pipelines, oil fields or other infrastructure could be targets of future terrorist attacks or warlike operations and our vessels could be targets of hijackers, terrorists, or warlike operations; the conflict in Ukraine has recently resulted in missile attacks on commercial vessels in the Black Sea. Any such attacks could lead to, among other things, bodily injury or loss of life, vessel or other property damage, increased vessel operational costs, including insurance costs, and the inability to transport oil to or from certain locations. Terrorist attacks, war, hijacking or other events beyond our control that adversely affect the distribution, production or transportation of oil to be shipped by us could entitle customers to terminate charters which would harm our cash flow and business.

Acts of piracy on ocean-going vessels continue to be a risk, which could adversely affect our business.

Acts of piracy have historically affected ocean-going vessels trading in regions of the world such as the South China Sea, Gulf of Guinea and the Indian Ocean off the coast of Somalia. While there continues to be a significant risk of piracy incidents in the Southern Red Sea, Gulf of Aden and Indian Ocean, recently there have been increases in the frequency and severity of piracy incidents off the coast of West Africa and a resurgent risk of piracy and/or armed robbery in the Straits of Malacca, Sulu & Celebes Sea, Gulf of Mexico and surrounding waters. If these piracy attacks result in regions in which our vessels are deployed being named on the Joint War Committee Listed Areas, war risk insurance premiums payable for such coverage may increase significantly and such insurance coverage may be more difficult to obtain. In addition, crew costs, including costs which are incurred to the extent we employ on-board security guards and escort vessels, could increase in such circumstances. We may not be adequately insured to cover losses from these incidents, which could have a material adverse effect on us. In addition, hijacking as a result of an act of piracy against our vessels, or an increase in cost or unavailability of insurance for our vessels, could have a material adverse impact on our business, financial condition and results of operations.

Risks Related to Our Business

Economic downturns, including disruptions in the global credit markets, could adversely affect our ability to grow.

Economic downturns and financial crises in the global markets could produce illiquidity in the capital markets, market volatility, heightened exposure to interest rate and credit risks, and reduced access to capital markets. If global financial markets and economic conditions significantly deteriorate in the future, we may face restricted access to the capital markets or bank lending, which may make it more difficult and costly to fund future growth. Decreased access to such resources could have a material adverse effect on our business, financial condition and results of operations.

Economic downturns may affect our customers’ ability to charter our vessels and pay for our services and may adversely affect our business and results of operations.

Economic downturns in the global financial markets or economy generally may lead to a decline in our customers’ operations or ability to pay for our services, which could result in decreased demand for our vessels and services. Our customers’ inability to pay could also result in their default on our current contracts and charters. A decline in the amount of services requested by our customers or their default on our contracts with them could have a material adverse effect on our business, financial condition and results of operations.

The intense competition in our markets may lead to reduced profitability or reduced expansion opportunities.

Our vessels operate in highly competitive markets. Competition arises primarily from other vessel owners, including major oil companies and independent companies. We also compete with owners of other size vessels. Our market share is insufficient to enforce any degree of pricing discipline in the markets in which we operate, and our competitive position may erode in the future. Any new markets that we enter could include participants that have greater financial strength and capital resources than we have. We may not be successful in entering new markets.

The loss of any key customer or its inability to pay for our services could result in a significant loss of revenue in a given period.

We have derived, and believe that we will continue to derive, a significant portion of our revenues from a limited number of customers. No customer accounted for over 10% of our consolidated revenues from continuing operations during 2021 and 2020 (2019 – one customer for 13% or $160 million). The loss of any significant customer or a substantial decline in the amount of services requested by a significant customer, or the inability of a significant customer to pay for our services, could have a material adverse effect on our business, financial condition and results of operations.

We could lose a customer or the benefits of a contract if:

•the customer fails to make payments because of its financial inability, disagreements with us or otherwise;

•we agree to reduce the payments due to us under a contract because of the customer’s inability to continue making the original payments;

•upon our breach of the relevant contract, the customer exercises certain rights to terminate the contract;

11

•the customer terminates the contract because we fail to deliver the vessel within a fixed period of time, the vessel is lost or damaged beyond repair, there are serious deficiencies in the vessel or prolonged periods of off-hire, or we default under the contract;

•under some of our contracts, the customer terminates the contract because of the termination of the customer's sales agreement or a prolonged force majeure affecting the customer, including damage to or destruction of relevant facilities, war or political unrest preventing us from performing services for that customer; or

•the customer becomes subject to applicable sanctions laws which prohibit our ability to lawfully charter our vessel to such customer.

If we lose a key customer, we may be unable to obtain replacement long-term charters. If a customer exercises its right under some charters to purchase the vessel, or terminate the charter, we may be unable to acquire an adequate replacement vessel or charter. Any replacement newbuilding would not generate revenues during its construction and we may be unable to charter any replacement vessel on terms as favorable to us as those of the terminated charter.

The loss of any of our significant customers or a reduction in revenues from them could have a material adverse effect on our business, results of operations and financial condition and our ability to pay dividends and service our debt.

Our ability to repay or refinance debt obligations and to fund capital expenditures will depend on certain financial, business and other factors, many of which are beyond our control. We will need to obtain additional financing, which financing may limit our ability to make cash dividends and distributions, increase our financial leverage and result in dilution to our equityholders.

To fund existing and future debt obligations and capital expenditures and to meet the minimum liquidity requirements under the financial covenants in our credit facilities, we may be required to obtain additional sources of financing, in addition to amounts generated from operations. These anticipated sources of financing include raising additional debt and capital, including equity issuances.

Our ability to obtain external financing may be limited by our financial condition at the time of any such financing as well as by adverse market conditions in general. Even if we are successful in obtaining necessary funds, the terms of such financings could limit our ability to pay cash dividends or distributions to security holders or operate our businesses as currently conducted. In addition, issuing additional equity securities may result in significant equityholder dilution and would increase the aggregate amount of cash required to maintain quarterly dividends and distributions. The sale of certain assets will reduce cash from operations and the cash available for distribution to equityholders. For more information on our liquidity requirements, please read “Item 18 – Financial Statements: Note 16a – Commitments and Contingencies – Liquidity".

Charter rates for conventional oil and product tankers may fluctuate substantially over time and may be lower when we are attempting to re-charter these vessels, which could adversely affect our operating results.

Our ability to re-charter our conventional oil and product tankers following expiration of existing time-charter contracts and the rates payable upon any renewal or replacement charters will depend upon, among other things, the state of the conventional tanker market. Conventional oil and product tanker trades are highly competitive and have experienced significant fluctuations in charter rates based on, among other things, oil, refined petroleum product and vessel demand. For example, an oversupply of conventional oil tankers can significantly reduce their charter rates.

Changes in market conditions may limit our access to capital and our growth.

We have relied primarily upon bank financing and debt and equity offerings to fund our growth. Changes in market conditions in the energy and shipping sectors may reduce our and Teekay Tankers' access to capital, particularly equity capital. Issuing additional common equity is more dilutive and costly than it has been in the past. Lack of access to debt or equity capital at reasonable rates would adversely affect our growth prospects and our ability to refinance debt and pay dividends to our equityholders.

Declining market values of our vessels could adversely affect our liquidity and result in breaches of our financing agreements.

Market values of vessels fluctuate depending upon general economic and market conditions affecting relevant markets and industries and competition from other shipping companies and other modes of transportation. In addition, as vessels become older, they generally decline in value. Declining vessel values could adversely affect our liquidity by limiting our ability to raise cash by refinancing vessels. Declining vessel values could also result in a breach of our loans and obligations under finance lease covenants and cause events of default under certain of our credit facilities that require us to maintain certain loan-to-value ratios. If we are unable to cure any such breach within the prescribed cure period in a particular financing facility, the lenders under these facilities could accelerate our debt or obligations under our finance leases and foreclose on our vessels pledged as collateral or require an early termination of the applicable credit facility or finance lease. In certain circumstances, such a breach could result in cross-defaults under our other financing agreements. As of December 31, 2021, the total outstanding debt credit facilities and obligations under finance leases with this type of loan-to-value covenant tied to conventional tanker values was $620.3 million. We have two credit facilities and 14 obligations related to finance leases that require us to maintain vessel value to outstanding loan and lease principal balance ratios ranging from 100% to 125%. As of December 31, 2021, we were in compliance with these required ratios.

Over time, the value of our vessels may decline, which could adversely affect our operating results.

Vessel values for oil and product tankers can fluctuate substantially over time due to a number of different factors, including:

•prevailing economic conditions in oil and energy markets;

•a substantial or extended decline in demand for oil;

•increases in the supply of vessel capacity;

•the age of the vessel relative to other alternative vessels that are available in the market;

•competition from more technologically advanced vessels; and

12

•the cost of retrofitting or modifying existing vessels, as a result of technological advances in vessel design or equipment, changes in applicable environmental or other regulations or standards, or otherwise.

Vessel values may decline from existing levels. If operation of a vessel is not profitable, or if we cannot redeploy a chartered vessel at attractive rates upon charter termination, rather than continue to incur costs to maintain and finance the vessel, we may seek to dispose of it. Our inability to dispose of the vessel at a fair market value or the disposal of the vessel at a fair market value that is lower than its book value could result in a loss on its sale and adversely affect our results of operations and financial condition.

Further, if we determine at any time that a vessel’s future useful life and earnings require us to impair its value on our financial statements, we may need to recognize a significant impairment charge against our earnings. Such a determination involves numerous assumptions and estimates, some of which require more discretion and are less predictable. We recognized asset impairment charges of $92.4 million, $149.2 million and $183.9 million in 2021, 2020, and 2019, respectively, in relation to continuing operations. The 2021 charge included impairments of $66.9 million, $18.4 million, and $6.4 million for four Suezmax tankers, three LR2 tankers and four Aframax tankers, respectively, of Teekay Tankers' vessels. The 2020 charge included impairments of $70.7 million for two of our FPSO units, the Petrojarl Banff and Sevan Hummingbird, and impairments of $67.0 million for nine of Teekay Tankers' Aframax tankers, and the 2019 charge included impairments of $178.3 million for three of our FPSO units, the Petrojarl Banff, Sevan Hummingbird and Petrojarl Foinaven.

We have recognized asset impairments in the past and we may recognize additional impairments in the future, which will reduce our earnings and net assets.

If we determine at any time that an asset has been impaired, we may need to recognize an impairment charge that will reduce our earnings and net assets. We review our vessels for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets may not be recoverable, which occurs when an asset's carrying value is greater than the estimated undiscounted future cash flows the asset is expected to generate over its remaining useful life. We review our goodwill for impairment annually and if a reporting unit's goodwill carrying value is greater than the estimated fair value, the goodwill attributable to that reporting unit is impaired. We evaluate our investments in equity-accounted joint ventures for impairment when events or circumstances indicate that the carrying value of such investment may have experienced an other-than-temporary decline in value below its carrying value.

Teekay Tankers anticipates that it may need to accelerate its fleet renewal in coming years, the success of any such program will depend on newbuilding and second-hand vessel availability and prices, market conditions and available financing, and which it anticipates will require significant expenditures.

As approximately 30% of Teekay Tankers' fleet is currently aged 15 years and older, we anticipate Teekay Tankers may need to accelerate its fleet renewal in coming years. Teekay Tankers' ability to successfully execute a renewal program will depend on the availability and prices of newbuilding and second-hand vessels, market conditions and charter rates (primarily spot tanker rates), and access to sufficient financing at acceptable rates. The cost of newbuilding or second-hand vessels will be significant, which could affect our consolidated financial condition and results of operations.

Our insurance may be insufficient to cover losses that may occur to our property or result from our operations.

The operation of oil tankers, lightering support vessels, transfer of oil and FPSO units is inherently risky. Although we carry hull and machinery (marine and war risks) and protection and indemnity insurance, and other liability insurance, all risks may not be adequately insured against, and any particular claim may not be paid or paid in full. In addition, we do not carry insurance on our vessels covering the loss of revenues resulting from vessel off-hire time. Any significant unpaid claims or off-hire time of our vessels could harm our business, operating results and financial condition. Any claims covered by insurance would be subject to deductibles, and since it is possible that a large number of claims may be brought, the aggregate amount of these deductibles could be material. Certain of our insurance coverage is maintained through mutual protection and indemnity associations, and as a member of such associations, we may be required to make additional payments over and above budgeted premiums if member claims exceed association reserves. In addition, the cost of this protection and indemnity coverage has significantly increased and may continue to increase. Even if our insurance coverage is adequate to cover our losses, we may not be able to obtain a timely replacement vessel in the event of a total loss of a vessel.

We may be unable to procure adequate insurance coverage at commercially reasonable rates in the future. For example, more stringent environmental regulations have led to increased costs for, and in the future may result in the lack of availability of, insurance against risks of environmental damage or pollution. A catastrophic oil spill, marine disasters or natural disasters could exceed the insurance coverage, which could harm our business, financial condition and operating results. Any uninsured or underinsured loss could harm our business and financial condition. In addition, the insurance may be voidable by the insurers as a result of certain actions, such as vessels failing to maintain certification with applicable maritime regulatory organizations.

Changes in the insurance markets attributable to structural changes in insurance and reinsurance markets and risk appetite, economic factors, the impact of the COVID-19 global pandemic, outbreaks of other communicable diseases, war, terrorist attacks, environmental catastrophes or political changes may also make certain types of insurance more difficult to obtain. In addition, the insurance that may be available may be significantly more expensive than existing coverage or be available only with restrictive terms. With the recent sale of our Teekay Gas Business, we now own a smaller fleet, which may impact our buying power and could lead to us having increased insurance coverage costs.

We are green-recycling one FPSO unit and plan to decommission and/or green-recycle our remaining FPSO units, which are scheduled to generate limited additional revenue and for which we may be required to incur significant costs.

In February 2022, Spirit Energy, the charterer of the Sevan Hummingbird FPSO unit, provided a formal notice of termination of the FPSO charter contract, indicating an expected cessation of production on March 31, 2022 and a charter termination date of approximately May 16, 2022. In conjunction with Spirit Energy, Teekay is currently planning for the decommissioning of the unit from the Chestnut Field. Our estimates of decommissioning costs may change and differ from actual costs required to decommission and recycle the unit.

13

In April 2021, BP plc announced its decision to suspend production from the Foinaven oil fields and permanently remove the Petrojarl Foinaven FPSO unit from the site. In February 2022, BP plc provided formal redelivery notice to us, indicating an expected redelivery date of August 3, 2022, after which Teekay intends to recycle the unit in accordance with EU ship recycling regulations. Upon redelivery of the FPSO unit, we will receive a fixed lump sum payment of $11.6 million from BP, which we expect will cover the majority of the cost of green-recycling the FPSO unit.

In the first quarter of 2020, CNR International (U.K.) Limited (or CNRI) provided formal notice to us of its intention to decommission the Banff field and remove the Petrojarl Banff FPSO unit and the Apollo Spirit FSO from the field in June 2020. The oil production under the existing contract for the Petrojarl Banff FPSO unit ceased in June 2020, and Teekay commenced decommissioning activities during the second quarter of 2020 and into 2021. In May 2021, as a result of the Decommissioning Services Agreement (or DSA) with CNRI, Teekay was deemed to have fulfilled its prior decommissioning obligations associated with the Banff field. In May 2021, Teekay sold the Petrojarl Banff FPSO unit to an EU-approved shipyard for recycling and the unit is currently in the latter stages of green-recycling.

As a result of our strategy to wind down our FPSO business, we do not anticipate significant revenue to be generated from our FPSO units in the future and we will need to incur decommissioning and recycling costs, which may be significant.

Teekay Tankers has substantial debt levels and may incur additional debt.

As of December 31, 2021, our consolidated short-term debt, long-term debt and obligations related to finance leases totaled $991.0 million and we had the capacity to borrow an additional $73.8 million under our revolving credit facilities. These credit facilities may be used by us for general corporate purposes. In addition to our consolidated debt, our total proportionate interest in debt of a joint venture we do not control was $28.1 million as of December 31, 2021, of which Teekay Tankers has guaranteed 50%. Our consolidated debt, finance lease obligations and joint venture debt could increase substantially. We will continue to have the ability to incur additional debt, subject to limitations in our credit facilities. Our level of debt could have important consequences to us, including:

•our ability to obtain additional financing, if necessary, for working capital, capital expenditures, acquisitions or other purposes, and our ability to refinance our credit facilities may be impaired or such financing may not be available on favorable terms, if at all;

•we will need to use a substantial portion of our cash flow to make principal and interest payments on our debt, reducing the funds that would otherwise be available for operations, future business opportunities, repurchases of equity securities and dividends to shareholders;

•our debt level may make us more vulnerable than our competitors with less debt to competitive pressures or a downturn in our industry or the economy generally; and

•our debt level may limit our flexibility in obtaining additional financing, pursuing other business opportunities and responding to changing business and economic conditions.

Our ability to service our debt and obligations related to finance leases depends upon, among other things, our financial and operating performance, which is affected by prevailing economic conditions and financial, business, regulatory and other factors, many of which are beyond our control. If our operating results are not sufficient to service our current or future indebtedness and obligations related to finance leases, we will be forced to take actions such as reducing or delaying our business activities, acquisitions, investments or capital expenditures, selling assets, restructuring or refinancing our debt, or seeking additional equity capital or bankruptcy protection. We may not be able to effect any of these remedies on satisfactory terms, or at all.

Exposure to interest rate fluctuations will result in fluctuations in our cash flows and operating results.

We are exposed to the impact of interest rate changes primarily through certain of our borrowings that require us to make interest payments based on LIBOR or Secured Overnight Finance Rate (or SOFR). Significant increases in interest rates could adversely affect our profit margins, results of operations and our ability to service our debt. In accordance with our risk management policy, we use interest rate swaps on certain of our debt to reduce our exposure to market risk from changes in interest rates. The principal objective of these contracts is to minimize the risks and costs associated with our floating rate debt. However, any hedging activities entered into by us may not be effective in fully mitigating our interest rate risk from our variable rate indebtedness.

In addition, we are exposed to credit loss in the event of non-performance by the counterparties to the interest rate swap agreements. For further information about our financial instruments at December 31, 2021 that are sensitive to changes in interest rates, please read "Item 11 - Quantitative and Qualitative Disclosures About Market Risk".

Use of LIBOR is currently scheduled to cease, and interest rates on our LIBOR-based obligations may increase in the future.

LIBOR is the subject of recent national, international and other regulatory guidance and proposals for reform. As of December 31, 2021, LIBOR is no longer published on a representative basis, with the exception of the most commonly used tenors of U.S. dollar LIBOR, which will no longer be published on a representative basis after June 30, 2023. The U.S. Federal Reserve, in conjunction with the Alternative Reference Rates Committee, a steering committee comprised of large U.S. financial institutions has selected SOFR as an alternative, which is a new index calculated by short-term repurchase agreements backed by Treasury securities. SOFR is observed and backward-looking, which stands in contrast with LIBOR under the current methodology, which is an estimated forward-looking rate and relies, to some degree, on the expert judgment of submitting panel members. Whether or not SOFR attains market acceptance as a LIBOR replacement tool remains in question and there can be no assurance that the transition to a new benchmark rate or other financial metric will be an adequate alternative to LIBOR or produce the economic equivalent of LIBOR. As a result, it is not possible at this time to know the ultimate impact that the phase-out of LIBOR may have.

While some of the agreements governing our revolving credit facilities, term loan facilities, interest rate swaps and finance lease facilities provide for an alternate method of calculating interest rates in the event that a LIBOR rate is unavailable, if LIBOR ceases to exist or if the methods of calculating LIBOR change from their current form, there may be adverse impacts on the financial markets generally and interest rates on borrowings under our revolving credit facilities, term loan facilities, interest rate swaps and finance lease facilities may be materially adversely affected.

14

In addition, we may need to renegotiate certain LIBOR-based credit facilities or interest rate derivatives agreements, which could adversely impact our cost of debt. There can be no assurance that we will be able to modify existing documentation or renegotiate existing transactions before the discontinuation of LIBOR.

As at December 31, 2021, our revolving credit facilities, term loan facilities, interest rate swaps and finance lease facilities continued to use LIBOR. In January 2022, we amended one working capital loan facility to daily SOFR. We anticipate that new financings and interest rate swaps will require utilization of an alternative reference rate. Some of our existing facilities and interest rate swaps will likely be amended to SOFR or an alternative reference rate during 2022 prior to LIBOR ceasing on June 30, 2023.

Financing agreements containing operating and financial restrictions may restrict our business and financing activities.

The operating and financial restrictions and covenants in our revolving credit facilities, working capital loan facility, term loans, lease obligations, indentures and in any of our future financing agreements could adversely affect our ability to finance future operations or capital needs or to pursue and expand our business activities. For example, these financing arrangements may restrict our ability to:

•incur additional indebtedness and guarantee indebtedness;

•pay dividends or make other distributions or repurchase or redeem our capital stock;

•prepay, redeem or repurchase certain debt;

•issue certain preferred shares or similar equity securities;

•make loans and investments;

•enter into a new line of business;

•incur or permit certain liens to exist;

•enter into transactions with affiliates;

•create unrestricted subsidiaries;

•transfer, sell, convey or otherwise dispose of assets;

•make certain acquisitions and investments;

•enter into agreements restricting our subsidiaries’ ability to pay dividends; and

•consolidate, merge or sell all or substantially all of our assets.

In addition, certain of our debt agreements and lease obligations require us to comply with certain financial covenants. Our ability to comply with covenants and restrictions contained in debt instruments and finance lease obligations may be affected by events beyond our control, including prevailing economic, financial and industry conditions. If any such events were to occur, we may fail to comply with these covenants. If we breach any of the restrictions, covenants, ratios or tests in our financing agreements or indentures and we are unable to cure such breach within the prescribed cure period, our obligations may, at the election of the relevant lender, become immediately due and payable, and the lenders’ commitment under our credit facilities, if any, to make further loans available to us may terminate. In certain circumstances, this could lead to cross-defaults under our other financing agreements which in turn could result in obligations becoming due and commitments being terminated under such agreements. A default under our financing agreements could also result in foreclosure on any of our vessels and other assets securing related loans and finance leases or our need to sell assets or take other actions in order to meet our debt obligations.

Furthermore, the termination of any of our charter contracts by our customers could result in the repayment of the debt facilities to which the chartered vessels relate.

Our and many of our customers' substantial operations outside the United States expose us and them to political, governmental, and economic instability, which could harm our operations.

Because our operations and the operations of our customers are primarily conducted outside of the United States, they may be affected by economic, political and governmental conditions in the countries where we or our customers engage in business or where our vessels are registered. Any disruption caused by these factors could harm our business, including by reducing the levels of oil exploration, development, and production activities in these areas or restricting the pool of customers. We derive some of our revenues from shipping oil from politically unstable regions. Conflicts in these regions have included attacks on ships and other efforts to disrupt shipping. Hostilities or other political instability in regions where we operate or where we may operate could have a material adverse effect on the growth of our business, results of operations and financial condition and ability to pay dividends.

In addition, tariffs, trade embargoes and other economic sanctions by the United States or other countries against countries in which we operate, to which we trade, or to which we or any of our customers, joint venture partners or business partners become subject, may limit trading activities with those countries or with customers, which could also harm our business and ability to pay dividends. For example, the United States imposed sanctions on Russia starting in 2014 based on Russia’s involvement in divesting control by Ukraine of the Crimea region. Beginning in February 2022, the United States and numerous other nations imposed substantial additional sanctions on Russia for its invasion of Ukraine. In addition, general trade tensions between the United States and China escalated in 2018 and continued through much of 2019, with the United States imposing a series of tariffs on China and China responding by imposing tariffs on United States products; during the last quarter of 2019, the United States and China negotiated an agreement to reduce trade tensions which became effective in February 2020. Our business could be harmed by increasing trade protectionism or trade tensions between the United States and China, or trade embargoes or other economic sanctions by the United States or other countries against countries in the Middle East or Asia, Russia or elsewhere as a result of terrorist attacks, hostilities, or diplomatic or political pressures that limit trading activities with those countries.

15

In addition, a government could requisition one or more of our vessels, which is most likely during war or national emergency. Any such requisition would cause a loss of the vessel and could harm our cash flows and financial results.

Maritime claimants could arrest, or port authorities could detain, our vessels, which could interrupt our cash flow.

Crew members, suppliers of goods and services to a vessel, shippers of cargo and other parties may be entitled to a maritime lien against that vessel for unsatisfied debts, claims or damages. In many jurisdictions, a maritime lienholder may enforce its lien by arresting a vessel through foreclosure proceedings. The arrest or attachment of one or more of our vessels could interrupt our cash flow and require us to pay large sums of funds to have the arrest or attachment lifted. In addition, in some jurisdictions, such as South Africa, under the “sister ship” theory of liability, a claimant may arrest both the vessel that is subject to the claimant’s maritime lien and any “associated” vessel, which is any vessel owned or controlled by the same owner. Claimants could try to assert “sister ship” liability against one vessel in our fleet or the RSAs in which we operate for claims relating to another of our ships. Also, port authorities may seek to detain our vessels in port, which could adversely affect our operating results or relationships with customers.

Many of our seafaring employees are covered by collective bargaining agreements and the failure to renew those agreements or any future labor agreements may disrupt operations and adversely affect our cash flows.

A significant portion of our seafarers are employed under collective bargaining agreements. We may become subject to additional labor agreements in the future. We may suffer labor disruptions if relationships deteriorate with the seafarers or the unions that represent them. Our collective bargaining agreements may not prevent labor disruptions, particularly when the agreements are being renegotiated. Salaries are typically renegotiated annually or bi-annually for seafarers and annually for onshore operational staff and may increase our cost of operation. Any labor disruptions could harm our operations and could have a material adverse effect on our business, results of operations and financial condition.

We may be unable to attract and retain qualified, skilled employees or crew necessary to operate our business.

Our success depends in large part on our ability to attract and retain highly skilled and qualified personnel. In crewing our vessels, we require technically skilled employees with specialized training who can perform physically demanding work. Any inability we experience in the future to hire, train and retain a sufficient number of qualified employees could impair our ability to manage, maintain and grow our business.

Exposure to currency exchange rate fluctuations results in fluctuations in our cash flows and operating results.

Substantially all of our revenues are earned in U.S. Dollars, although we are paid in Australian Dollars and British Pounds under some of our charters. A portion of our operating costs are incurred in currencies other than U.S. Dollars. This partial mismatch in operating revenues and expenses leads to fluctuations in net income due to changes in the value of the U.S. Dollar relative to other currencies, in particular the British Pound, the Euro, the Singapore Dollar, Australian Dollar, and Canadian Dollar.

Because we report our operating results in U.S. Dollars, changes in the value of the U.S. Dollar relative to other currencies also result in fluctuations of our reported revenues and earnings. Under U.S. accounting guidelines, all foreign currency-denominated monetary assets and liabilities, such as cash and cash equivalents, accounts receivable, restricted cash, accounts payable, accrued liabilities, advances from affiliates and long-term debt are revalued and reported based on the prevailing exchange rate at the end of the applicable period. This revaluation historically has caused us to report significant unrealized foreign currency exchange gains or losses each period.

Our operating results are subject to seasonal fluctuations.

Our tankers operate in markets that have historically exhibited seasonal variations in tanker demand and, therefore, in spot-charter rates. This seasonality may result in quarter-to-quarter volatility in our results of operations. Tanker markets are typically stronger in the winter months as a result of increased oil consumption in the northern hemisphere but weaker in the summer months as a result of lower oil consumption in the northern hemisphere and refinery maintenance. In addition, unpredictable weather patterns during the winter months tend to disrupt vessel scheduling, which historically has increased oil price volatility and oil trading activities in the winter months. As a result, revenues generated by the tankers in our fleet have historically been weaker during our fiscal quarters ended June 30 and September 30, and stronger in our fiscal quarters ended December 31 and March 31.

We may be unable to make or realize expected benefits from acquisitions and growth through acquisitions may harm our financial condition and performance.

A principal component of our long-term strategy is to continue to grow by expanding our business both in the geographic areas and markets where we have historically focused as well as into new geographic areas, market segments and services. We may not be successful in expanding our operations and any expansion may not be profitable. In order to achieve growth, we may acquire new companies or businesses which transactions may involve business risks commonly encountered in acquisitions of companies, including:

•interruption of, or loss of momentum in, the activities of one or more of an acquired company’s businesses and our businesses;

•additional demands on members of our senior management while integrating acquired businesses, which would decrease the time they have to manage our existing business, service existing customers and attract new customers;

•difficulties identifying suitable acquisition candidates;

•difficulties integrating the operations, personnel and business culture of acquired companies;

•difficulties coordinating and managing geographically separate organizations;

•adverse effects on relationships with our existing suppliers and customers, and those of the companies acquired;

16

•difficulties entering geographic markets or new market segments in which we have no or limited experience; and

•loss of key officers and employees of acquired companies.