UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10 - K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended June 30, 2012

or

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ___________ to __________

Commission file number: 001-15543

PALATIN TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

95-4078884

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

4B Cedar Brook Drive

Cranbury, New Jersey

|

08512

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(609) 495-2200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

|

Common Stock, par value $.01 per share

|

NYSE MKT

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer o

Non-accelerated filer o Smaller reporting company x

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates, computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter (December 31, 2011): $13,870,532.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date (September 7, 2012): 38,947,912.

PALATIN TECHNOLOGIES, INC.

Table of Contents

|

Page

|

||

|

PART I

|

||

|

Item 1.

|

2

|

|

|

Item 1A.

|

12

|

|

|

Item 1B.

|

24

|

|

|

Item 2.

|

24

|

|

|

Item 3.

|

24

|

|

|

Item 4.

|

24

|

|

|

PART II

|

||

|

Item 5.

|

25

|

|

|

Item 6.

|

25

|

|

|

Item 7.

|

25

|

|

|

Item 7A.

|

30

|

|

|

Item 8.

|

31

|

|

|

Item 9.

|

50

|

|

|

Item 9A.

|

50

|

|

|

Item 9B.

|

50

|

|

|

PART III

|

||

|

Item 10.

|

51

|

|

|

Item 11.

|

55

|

|

|

Item 12.

|

60

|

|

|

Item 13.

|

65

|

|

|

Item 14.

|

66

|

|

|

PART IV

|

||

|

Item 15.

|

67

|

|

PART I

Item 1. Business.

Forward-looking statements

Statements in this Annual Report on Form 10-K (this Annual Report), as well as oral statements that may be made by us or by our officers, directors, or employees acting on our behalf, that are not historical facts constitute “forward-looking statements,” which are made pursuant to the safe harbor provisions of Section 21E of the Securities Exchange Act of 1934 (the Exchange Act). The forward-looking statements in this Annual Report do not constitute guarantees of future performance. Investors are cautioned that statements which are not strictly historical statements contained in this Annual Report, including, without limitation, current or future financial performance, management’s plans and objectives for future operations, ability to raise capital or repay debt, if required, clinical trials and results, uncertainties associated with product research and development, product plans and performance, management’s assessment of market factors, as well as statements regarding our strategy and plans and those of our strategic partners, constitute forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause our actual results to be materially different from our historical results or from any results expressed or implied by such forward-looking statements. Our future operating results are subject to risks and uncertainties and are dependent upon many factors, including, without limitation, the risks identified under the caption “Risk Factors” and elsewhere in this Annual Report, as well as in our other Securities and Exchange Commission (SEC) filings.

In this Annual Report, references to “we,” “our,” “us” or “Palatin” means Palatin Technologies, Inc. and its subsidiary.

Overview

We are a biopharmaceutical company developing targeted, receptor-specific peptide therapeutics for the treatment of diseases with significant unmet medical need and commercial potential. Our programs are based on molecules that modulate the activity of the melanocortin and natriuretic peptide receptor systems. Our primary product in clinical development is bremelanotide for the treatment of female sexual dysfunction (FSD). In addition, we have drug candidates or development programs for obesity, erectile dysfunction, pulmonary diseases, cardiovascular diseases and inflammatory diseases.

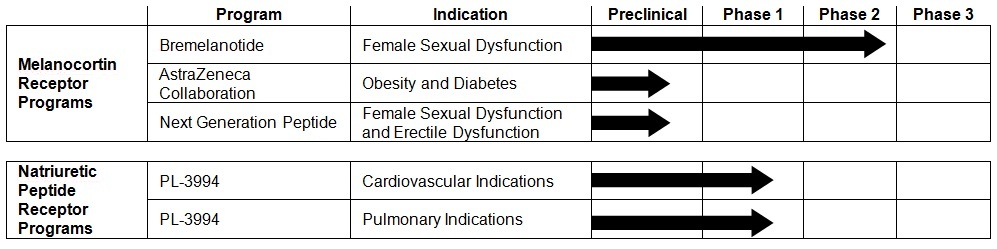

The following drug development programs are actively under development:

|

·

|

Bremelanotide, a peptide melanocortin receptor agonist, for treatment of FSD. This drug candidate is in Phase 2B clinical trials.

|

|

·

|

Melanocortin receptor-based compounds for treatment of obesity, under development by AstraZeneca AB (AstraZeneca) pursuant to our research collaboration and license agreement.

|

|

·

|

PL-3994, a peptide mimetic natriuretic peptide receptor A (NPR-A) agonist, for treatment of cardiovascular and pulmonary indications.

|

The following chart shows the status of our drug development programs.

We have initiated preclinical studies with new peptide drug candidates for a number of indications, primarily inflammatory disease related, and are continuing preclinical development with a next generation peptide for FSD and erectile dysfunction.

On July 3, 2012, we closed on a private placement of 3,873,000 shares of our common stock, Series A 2012 warrants to purchase up to 31,988,151 shares of our common stock, and Series B 2012 warrants to purchase up to 35,488,380 shares of our common stock. Aggregate gross proceeds to us were $35,000,000, with net proceeds, after deducting estimated offering expenses, of approximately $34,500,000. The Series B 2012 warrants are exercisable only if our stockholders increase the number of our authorized shares of common stock, and we have certain contractual obligations, including an obligation to pay interest on Series B 2012 warrants and to redeem Series B 2012 warrants, in the event that the number of our authorized shares of common stock is not increased by specified dates. See “Risk Factors” below.

2

Key elements of our business strategy include: using our technology and expertise to develop and commercialize innovative therapeutic products; entering into alliances and partnerships with pharmaceutical companies to facilitate the development, manufacture, marketing, sale and distribution of product candidates that we are developing; and, partially funding our product development programs with the cash flow generated from our license agreement with AstraZeneca and any other companies.

We incorporated in Delaware in 1986 and commenced operations in the biopharmaceutical area in 1996. Our corporate offices are located at 4B Cedar Brook Drive, Cranbury, New Jersey 08512 and our telephone number is (609) 495-2200. We maintain an Internet site at http://www.palatin.com, where among other things, we make available free of charge on and through this website our Forms 3, 4 and 5, annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) and Section 16 of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Our website and the information contained in it or connected to it are not incorporated into this Annual Report.

Melanocortin Receptor-Specific Programs

The melanocortin system is involved in a large and diverse number of physiologic functions, and therapeutic agents modulating this system may have the potential to treat a variety of conditions and diseases, including sexual dysfunction, obesity and related disorders, pigmentation disorders and inflammation-related diseases.

Bremelanotide for Female Sexual Dysfunction (FSD). We are developing subcutaneously administered bremelanotide for the treatment of FSD in premenopausal women. Bremelanotide, which is a melanocortin agonist (a compound which binds to a cell receptor and activates a response), is a synthetic peptide analog of the naturally occurring hormone alpha-MSH (melanocyte-stimulating hormone).

Ongoing Clinical Trials. The last patient has completed treatment in our ongoing Phase 2B clinical trial with bremelanotide for treatment of FSD. We anticipate database lock by the end of September and completing primary data analysis and announcing top-line results in the first-half of the fourth quarter of calendar 2012. This multicenter study is a placebo-controlled, randomized, parallel group, dose-finding trial testing three dose levels of subcutaneously administered bremelanotide in premenopausal women diagnosed with female sexual arousal disorder and/or hypoactive sexual desire disorder. The study enrolled premenopausal women across 66 sites within the United States and Canada, with patients randomized to one of three treatment arms and a placebo arm for 16 weeks of treatment. The objective of the Phase 2B trial is to measure safety and efficacy of subcutaneous doses intended for on-demand, home use. The primary efficacy endpoint is change from baseline to end of study in the number of satisfying sexual events. We can provide no assurance that the results of the Phase 2B trial will warrant continued development of bremelanotide as a treatment for FSD.

Medical Need - FSD. FSD is a multifactorial condition that has anatomical, physiological, medical, psychological and social components. FSD includes four disorders, hypoactive sexual desire disorder, female sexual arousal disorder, sexual pain disorder and orgasmic disorder. To establish a diagnosis of FSD, these syndromes must be associated with personal distress, as determined by the affected women. The 1992 National Health and Social Life Survey, a probability sample study of sexual behavior in a demographically representative cohort of United States adults ages 18 to 59, found that approximately 43% of women have symptoms associated with FSD, with up to about 15% having associated personal distress required to establish a diagnosis of FSD.

There are no drugs in the United States approved for FSD indications.

Subcutaneous Bremelanotide. Bremelanotide, which is believed to act through activation of melanocortin receptors in the central nervous system, is a first-in-class pharmaceutical agent in development as a treatment of FSD.

Bremelanotide is intended for “on-demand” use and is self-administered by the patient approximately one hour prior to anticipated sexual activity. We have evaluated delivery devices and believe that bremelanotide can be used with simple and patient-friendly disposable auto-injector device. If Phase 2 clinical trials for FSD are successful, we anticipate that Phase 3 clinical trials will be conducted with a delivery device intended for commercialization.

3

Clinical Trials with Intranasal Formulations. We extensively studied bremelanotide for sexual dysfunction using an intranasal formulation, administered as a single spray in one nostril. Increases in blood pressure were observed in some patients receiving nasally administered bremelanotide, and this observed increase was a significant factor leading us to discontinue work on nasally administered bremelanotide. We believe that the amount of increase in blood pressure, as well as the rate of nausea and emesis (vomiting), was due, at least partially, to high doses resulting from variability in drug uptake with nasal administration. Studies showed wide variation in plasma levels of bremelanotide in patients receiving nasally administered bremelanotide.

While we are no longer developing intranasal formulations of bremelanotide for commercialization, trials with intranasal formulations of bremelanotide did demonstrate potential utility of bremelanotide. Preliminary Phase 2A clinical trials of FSD patients showed statistically significant increases in the level of sexual desire and genital arousal in post-menopausal subjects receiving nasal bremelanotide and increases in the level of sexual desire and genital arousal in premenopausal subjects receiving nasal bremelanotide, although interpretation of results with premenopausal subjects was confounded by a significant placebo effect, which is often seen in such studies. Phase 2B double-blind, placebo-controlled, parallel doses clinical trials evaluating intranasal bremelanotide for erectile dysfunction (ED), conducted in 726 non-diabetic and 294 diabetic patients, showed that over 30% of ED patients were restored to a normal level of function. In trials conducted to date, almost 2,000 patients received at least one dose of bremelanotide, with about 1,500 receiving multiple doses.

Prior Clinical Trials with Subcutaneous Administration. We have completed several Phase 1 clinical studies in which blood pressure effects of subcutaneously administered bremelanotide were studied. These studies suggest that transient elevations of blood pressure are dependent on both the specific patient population and the dose administered. Our ongoing Phase 2B clinical trial, which assesses the magnitude and duration of blood pressure effect, addresses whether subcutaneous administration of selected doses of bremelanotide for treatment of FSD in premenopausal women will provide acceptable control of blood pressure effects.

Peptide Melanocortin Receptor Agonists for Treatment of Sexual Dysfunction. We have developed a series of next generation highly selective melanocortin receptor-specific peptides for treatment of sexual dysfunction. In developing these peptides, we examined effectiveness in animal models of sexual response and also determined cardiovascular effects, primarily looking at changes in blood pressure. Results of these studies suggest that certain of these peptides may have significant commercial potential for treatment of FSD and ED.

Obesity. In 2007, we entered into an exclusive research collaboration and license agreement with AstraZeneca to discover, develop and commercialize compounds that target melanocortin receptors for the treatment of obesity, diabetes and related metabolic syndrome. In June and December 2008 and in September 2009, the agreement was amended to include additional compounds and associated intellectual property that we developed and to modify royalty rates and milestone payments. Active work under the collaboration portion of the agreement concluded in January 2010.

AstraZeneca has discontinued development of AZD2820, a subcutaneously-administered peptide melanocortin receptor partial agonist that was being developed as a single-agent therapy for the treatment of obesity. The decision to discontinue development was made after a Phase 1 clinical trial of AZD2820 was halted following a serious adverse event. Based on an investigation, it could not be excluded that the serious adverse event was linked to AZD2820, but it was determined that it was unlikely that the serious adverse event was related to melanocortin agonists as a target for treatment of obesity. AstraZeneca has a number of collaboration compounds in various stages of preclinical testing, and remains committed to the research collaboration and continued advancement of melanocortin compounds for treatment of obesity.

Obesity is a multifactorial condition with numerous biochemical components relating to satiety (feeling full), energy utilization and homeostasis. A number of different metabolic and hormonal pathways are being evaluated by companies around the world in efforts to develop better treatments for obesity. Scientific research has established that melanocortin receptors have a role in eating behavior and energy homeostasis, and that melanocortin receptor agonists can decrease food intake and induce weight loss.

Obesity is a significant healthcare issue, often associated with co-morbidities such as cardiovascular disease and diabetes. According to a 2011 fact sheet from the World Health Organization, more than 1.5 billion adults worldwide are overweight, with over 500 million categorized as obese. Overweight and obesity is the fifth leading risk for global deaths and the second leading cause of preventable death in the United States. About one-third of Americans are obese and another one-third are overweight. Medical costs in the United States associated with obesity were estimated at $147 billion for 2008.

4

We developed classes of small molecule and peptide compounds targeting melanocortin receptors which are effective in the treatment of obesity in animal models. Certain of these compounds have shown activity in animal models of both diet-induced and genetically derived obesity. These compounds appear to decrease food intake and body weight without increases in sexual response in normal animals at the same or higher dose levels. Pursuant to clinical trial agreements with AstraZeneca, we have conducted proof-of-principle clinical trials on the effects of a melanocortin receptor-specific compound on food intake, obesity and other metabolic parameters.

Our agreement with AstraZeneca remains in effect as long as AstraZeneca is developing a compound covered by the agreement or commercializing a product for which a royalty is owed. The agreement may be terminated by AstraZeneca at any time upon notice to us, or by either party upon notice in the event of a material breach. Upon termination by AstraZeneca without cause or by us for cause, all rights and licenses we granted to AstraZeneca terminate, but AstraZeneca remains obligated to pay royalties and milestones on compounds developed during the collaboration portion of the agreement. In the event AstraZeneca terminates the agreement because we breached the agreement, rights and licenses we granted under the agreement become permanent, with financial terms, including royalties, to be determined by arbitration.

We have received up-front and other licensing payments totaling $15 million from AstraZeneca under the agreement. We are eligible for milestone payments totaling up to $145 million, with up to $85 million contingent upon development and regulatory milestones and the balance on achievement of sales targets, plus mid to high single digit royalties on sales of approved products. AstraZeneca has responsibility for product commercialization, product discovery and development costs.

Other Melanocortin Programs. We have initiated preclinical development programs on a number of programs utilizing peptide compounds we have developed. These programs include highly selective melanocortin-1 receptor agonists for treatment of inflammation-related diseases and disorders and melanocortin-4 receptor agonists for treatment of obesity and other indications outside the sexual dysfunction field.

Natriuretic Peptide Receptor-Specific Programs

The natriuretic peptide receptor system has numerous cardiovascular functions, and therapeutic agents modulating this system may be useful in treatment of acute asthma, other pulmonary diseases, heart failure and hypertension. While the therapeutic potential of modulating this system is well appreciated, development of therapeutic agents has been difficult due, in part, to the short biological half-life of native peptide agonists.

PL-3994. PL-3994 is a synthetic mimetic of the neuropeptide hormone atrial natriuretic peptide (ANP), and is a natriuretic peptide receptor-A (NPR-A) agonist. PL-3994 is in development for treatment of acute exacerbations of asthma, heart failure and refractory hypertension. PL-3994 activates NPR-A, a receptor known to play a role in cardiovascular homeostasis. Consistent with being an NPR-A agonist, PL-3994 increases plasma cyclic guanosine monophosphate (cGMP) levels, a pharmacological response consistent with the effects of endogenous (naturally produced) natriuretic peptides on cardiovascular function and smooth muscle relaxation. PL-3994 also decreases activity of the renin-angiotensin-aldosterone system (RAAS), a hormone system that regulates blood pressure and fluid balance. The RAAS system is frequently over-activated in heart failure patients, leading to worsening of cardiovascular function.

PL-3994 is one of a number of natriuretic peptide receptor agonist compounds we have developed. PL-3994 is a synthetic molecule incorporating a novel and proprietary amino acid mimetic structure, and has an extended circulation half-life compared to endogenous ANP.

PL-3994 for Acute Exacerbations of Asthma. Research over the past two decades has demonstrated potent bronchodilator effects with both systemic and inhalation administration of natriuretic peptides. NPR-A agonism is known to relax smooth muscles in airways and works through a pathway independent of the beta-2 adrenergic receptor. Preclinical testing demonstrated potent airway smooth muscle relaxation in guinea pig and human tissues using PL-3994, and animal studies in sensitized guinea pigs have demonstrated a bronchodilator effect with PL-3994 using both subcutaneous and inhalation administration.

Acute exacerbations of asthma, also called acute severe asthma, is an ongoing, unremitting asthma episode in which asthma symptoms do not adequately respond to initial bronchodilator therapy. Inhaled beta-2 adrenergic receptor agonists, such as albuterol, inhaled anticholinergic drugs, such as ipratropium, and systemic corticosteroids are primary treatments for episodes of acute exacerbations of asthma. Some patients with acute exacerbations of asthma become unresponsive to beta-2 adrenergic receptor agonists, significantly limiting treatment options and increasing risk. Patients who do not respond to initial therapy are at risk of severe complications. We intend to initially target PL-3994 as a treatment for those at risk unresponsive patients.

5

Emergency room visits and hospitalizations due to asthma have remained stable from 2001 to 2009, with almost 1.7 million emergency room visits and 440,000 hospitalizations attributed to asthma in 2006. In 2008, approximately 23.3 million Americans had asthma, with a projected 2010 economic cost in the United States of $20.7 billion, of which the largest single direct medical expenditure, $5.9 billion, is for prescription drugs.

Endogenous natriuretic peptides have a very short half-life, due primarily to degradation by neutral endopeptidase and clearance through the natriuretic peptide clearance receptor. PL-3994 is resistant to neutral endopeptidase and clears from the body much more slowly than endogenous natriuretic peptides. PL-3994 has a blood-plasma half-life of at least three hours in humans when administered by subcutaneous injection, with biological effects seen for over eight hours post-administration.

We are exploring development of an inhalation formulation of PL-3994, including preclinical inhalation toxicity and other studies that are required to start clinical trials with an inhaled formulation of PL-3994.

PL-3994 for Heart Failure. Heart failure is an illness in which the heart is unable to pump blood efficiently, and includes acutely decompensated heart failure with dyspnea (shortness of breath) at rest or with minimal activity. Endogenous natriuretic peptides have a number of beneficial effects, including vasodilation (relaxation of blood vessels), natriuresis (excretion of sodium), and diuresis (excretion of fluids).

Patients who have been admitted to the hospital with an episode of worsening heart failure have an increased risk of either death or hospital readmission in the three months following discharge. Up to 15% of patients die in this period and as many as 30% need to be readmitted to the hospital. We believe that decreasing mortality and hospital readmission in patients discharged following hospitalization for worsening heart failure is a large unmet medical need for which PL-3994 may be effective. PL-3994 could potentially be utilized as an adjunct to existing heart failure medications, and may, if successfully developed, be self-administered by patients as a subcutaneous injection following hospital discharge. We believe that PL-3994, through activation of NPR-A, may, if successful, reduce cardiac hypertrophy (increase in heart size due to disease), which is an independent risk factor for cardiovascular morbidity and mortality.

Over 5.7 million Americans suffer from heart failure, with 670,000 new cases of heart failure diagnosed each year, with disease incidence expected to increase with the aging of the American population. Despite the treatment of heart failure with multiple drugs, almost all heart failure patients will experience at least one episode of acute heart failure that requires treatment with intravenous medications in the hospital. Heart failure has tremendous human and financial costs. For 2010 the estimated direct costs in the United States for heart failure were $39.2 billion, with heart failure constituting the leading cause of hospitalization in people over 65 years of age and with over 1.1 million hospital discharges for heart failure in 2006. Heart failure is also a high mortality disease, with approximately one-half of heart failure patients dying within five years of initial diagnosis.

We have planned a repeat dose Phase 2 clinical trial in patients hospitalized with heart failure to evaluate safety profiles in patients given repeat doses of PL-3994 as well as pharmacokinetic (period to metabolize or excrete the drug) and pharmacodynamic (period of action or effect of the drug) endpoints, but do not presently intend to initiate this trial unless we reach agreement with a partner to develop PL-3994 for this indication.

Clinical Studies with PL-3994. Human clinical studies of PL-3994 commenced with a Phase 1 trial which concluded in the first quarter of calendar year 2008. This was a randomized, double-blind, placebo-controlled study in 26 healthy volunteers who received either PL-3994 or a placebo subcutaneously. The evaluations included safety, tolerability, pharmacokinetics and several pharmacodynamic endpoints, including levels of cGMP, a natural messenger nucleotide. Dosing concluded with the successful achievement of the primary endpoint of the study, a prespecified reduction in systemic blood pressure. No volunteer experienced a serious or severe adverse event. Elevations in plasma cGMP levels, increased diuresis and increased natriuresis were all observed for several hours after single subcutaneous doses.

In the second quarter of calendar year 2008, we conducted a Phase 2A trial in volunteers with controlled hypertension who were receiving one or more conventional antihypertensive medications. In this trial, which was a randomized, double-blind, placebo-controlled, single ascending dose study in 21 volunteers, the objective was to demonstrate that PL-3994 can be given safely to patients taking antihypertensive medications commonly used in heart failure and hypertension patients. Dosing concluded with the successful achievement of the primary endpoint of the study, a prespecified reduction in systemic blood pressure. No volunteer experienced a serious or severe adverse event. Elevations in plasma cGMP levels were observed for several hours after single subcutaneous doses.

6

Administration of PL-3994. For asthma indications we believe that inhalation administration of PL-3994 may be preferable to subcutaneous or other systemic administration. For heart failure and refractory hypertension indications we believe that subcutaneous administration of PL-3994 may be preferable. PL-3994 is well absorbed through the subcutaneous route of administration. In human studies, the pharmacokinetic and pharmacodynamic half-lives were on the order of hours, significantly longer than the comparable half-lives of endogenous natriuretic peptides. We believe that subcutaneous PL-3994, if successful, will be amenable to self-administration by patients, similar to insulin and other self-administered drugs.

Other Natriuretic Peptide Receptor-Specific Programs. We have initiated preclinical development programs on several early stage research and discovery programs in the natriuretic peptide receptor field.

Other Programs

We previously marketed NeutroSpec®, a radiolabeled monoclonal antibody product for imaging and diagnosing infection, which is the subject of a strategic collaboration agreement with the Mallinckrodt division of Covidien Ltd. In 2007 we suspended marketing, clinical trials and securing regulatory approvals of NeutroSpec, and do not anticipate conducting any substantive work or incurring substantial expenditures on NeutroSpec over the next twelve months.

Technologies We Use

We used a rational drug design approach to discover and develop proprietary peptide, peptide mimetic and small molecule agonist compounds, focusing on melanocortin and natriuretic peptide receptor systems. Computer-aided drug design models of receptors are optimized based on experimental results obtained with peptides and small molecules that we develop, supported by conformational analyses of peptides in solution utilizing nuclear magnetic resonance spectroscopy. By integrating both technologies, we believe we are developing an advanced understanding of the factors which drive agonism.

We have developed a series of proprietary technologies used in our drug development programs. One technology employs novel amino acid mimetics in place of selected amino acids. These mimetics provide the receptor-binding functions of conventional amino acids while providing structural, functional and physiochemical advantages. The amino acid mimetic technology is employed in PL-3994, our compound in development for treatment of acute exacerbations of asthma, heart failure and refractory hypertension.

Some compound series have been derived using our proprietary and patented platform technology, called MIDAS™ (Metal Ion-induced Distinctive Array of Structures). This technology employs metal ions to fix the three-dimensional configuration of peptides, forming conformationally rigid molecules that remain folded specifically in their active state. These MIDAS molecules are generally simple to synthesize, are chemically and proteolytically stable, and have the potential to be orally bioavailable. In addition, MIDAS molecules are information-rich and provide data on structure-activity relationships that may be used to design small molecule, non-peptide drugs.

Estimate of Amount Spent on Research and Development Activities

Research and development expenses were $13.8 million for the fiscal year ended June 30, 2012 (fiscal 2012) and $10.4 million for the fiscal year ended June 30, 2011 (fiscal 2011), of which $0.1 and $0.5 million, respectively, were borne by AstraZeneca pursuant to the research collaboration and license agreement.

Competition

General. Our products under development will compete on the basis of quality, performance, cost effectiveness and application suitability with numerous established products and technologies. We have many competitors, including pharmaceutical, biopharmaceutical and biotechnology companies. Furthermore, there are several well-established products in our target markets that we will have to compete against. Products using new technologies which may be competitive with our proposed products may also be introduced by others. Most of the companies selling or developing competitive products have financial, technological, manufacturing and distribution resources significantly greater than ours and may represent significant competition for us.

The pharmaceutical and biotechnology industries are characterized by extensive research efforts and rapid technological change. Many biopharmaceutical companies have developed or are working to develop products similar to ours or that address the same markets. Such companies may succeed in developing technologies and products that are more effective or less costly than any of those that we may develop. Such companies may be more successful than us in developing, manufacturing and marketing products.

7

We cannot guarantee that we will be able to compete successfully in the future or that developments by others will not render our proposed products under development or any future product candidates obsolete or non-competitive or that our collaborators or customers will not choose to use competing technologies or products.

Bremelanotide for Treatment of Female Sexual Dysfunction. There is competition and financial incentive to develop, market and sell drugs for the treatment of FSD, for which there is no approved drug in the United States. We are aware of one drug utilizing a testosterone transdermal patch which completed two Phase 3 efficacy trials for treatment of FSD in surgically post-menopausal women, but which did not show statistical separation from placebo in those trials. The company developing this drug has announced plans to initiate new Phase 3 efficacy trials. We are also aware of a non-hormone oral drug, flibanserin, investigated for treatment of premenopausal women with hypoactive sexual desire disorder. Development of this drug was terminated following failure of the FDA to approve the drug for marketing. However, this drug has been licensed to a third party, which intends to seek FDA approval. There are other companies reported to be developing new drugs for FSD indications, some of which may be in clinical trials in the United States or elsewhere. We are not aware of any company actively developing a melanocortin receptor agonist drug for FSD.

Melanocortin Receptor Agonists for Treatment of Erectile Dysfunction. Leading drugs approved for ED indications are PDE-5 inhibitors which target the vascular system, such as sildenafil (sold under the trade name Viagra®), vardenafil (sold under the trade name Levitra®) and tadalafil (sold under the trade name Cialis®). In addition, we are aware of other PDE-5 inhibitors under development. Other drugs approved for ED indications include alprostadil for injection (sold under the trade name Caverject Impulse® among others), which is injected directly into the penis, and alprostadil in urethral suppository format (sold under the trade name MUSE®). In addition, a variety of devices, including vacuum devices and surgical penile implants, have been approved for ED indications. We are aware of a number of companies developing new drugs for ED indications, including at least one company developing a new drug for treatment of ED not sufficiently responsive to PDE-5 inhibitors, some of which are in clinical trials in the United States and elsewhere. We are not aware of any company actively developing a melanocortin receptor agonist drug for ED.

PL-3994 for Acute Exacerbations of Asthma Indications. The asthma market is intensively competitive, with substantial competition and financial incentive to develop, market and sell drugs for treatment of asthma, with projected costs of prescription drugs of $5.9 billion in the United States in 2010. We are aware of companies developing drugs for the specific indications of either acute exacerbations of asthma or acute severe asthma, including at least one company with a drug reported to be currently in clinical trials. Certain of these drugs under development work by mechanisms of action different from the mechanisms of action of currently approved products. In addition, a number of clinical trials are conducted by hospitals, research institutes and others exploring various methods and combinations of drugs to treat acute exacerbations of asthma. There are a number of drugs and therapies currently used to treat acute exacerbations of asthma, including administration of oral or intravenous systemic steroids, use of oxygen or heliox, a mixture of helium and oxygen, nebulized short-acting beta-2 adrenergic receptor agonists, intravenous or nebulized anticholinergic agents and, for patients in or approaching respiratory arrest, intubation and mechanical ventilation. However, each of these drugs or therapies has recognized limitations or liabilities, and we believe that there remains an unmet medical need for a safe and effective treatment for acute exacerbations of asthma. We are not aware of any other company actively developing a drug to treat asthma using a natriuretic peptide receptor pathway.

PL-3994 for Heart Failure Indications. Nesiritide (sold under the trade name Natrecor®), a recombinant human B-type natriuretic peptide drug, is marketed in the United States by Scios Inc., a Johnson & Johnson company. Nesiritide is approved for treatment of acutely decompensated congestive heart failure patients who have dyspnea at rest or with minimal activity. Other peptide drugs, including carperitide, a recombinant human atrial natriuretic peptide drug, and ularitide, a synthetic form of urodilatin, a naturally occurring human natriuretic peptide related to atrial natriuretic peptide, have been investigated for treatment of congestive heart failure, but are not believed to be in active development in the United States. We are aware of other companies developing intravenously administered natriuretic peptide drugs, with at least one reported to be in Phase 2 clinical trials for acute heart failure. One product is under investigation for continuous and extended infusion through a subcutaneous pump. In addition, there are a number of approved drugs and drugs in development for treatment of heart failure through mechanisms or pathways other than agonism of NPR-A.

Obesity. There are several FDA-approved drugs and medical devices for the treatment of obesity, and a large number of products in clinical development by other companies, including products which target melanocortin receptors. Clinical trials for obesity are lengthy, time-consuming and expensive. See the discussion under the heading “We do not control the development of compounds licensed to third parties and, as a result, we may not realize a significant portion of the potential value of any such license arrangements” in Item 1A, “Risk Factors” in this Annual Report.

8

Patents and Proprietary Information

Patent Protection. Our success will depend in substantial part on our ability to obtain, defend and enforce patents, maintain trade secrets and operate without infringing upon the proprietary rights of others, both in the United States and abroad. We own a number of issued United States patents and have pending United States patent applications, many with issued or pending counterpart patents in selected foreign countries. We seek patent protection for our technologies and products in the United States and those foreign countries where we believe patent protection is commercially important.

We own two issued United States patents claiming the bremelanotide substance; issued patents claiming the bremelanotide substance in Japan, Mexico, Austria, Belgium, Cyprus, Denmark, Finland, France, Germany, Greece, Ireland, Korea, Luxembourg, Monaco, Netherlands, Portugal, Spain, Sweden, Switzerland, United Kingdom, Italy, Australia and New Zealand; and pending patent applications claiming the bremelanotide substance in Brazil and Canada. The issued United States patents have a term until 2020, which term may be subject to extension for a maximum period of up to five years as compensation for patent term lost during drug development and the FDA regulatory review process, pursuant to the Drug Price Competition and Patent Term Restoration Act of 1984 (the Hatch-Waxman Amendments). Whether we will be able to obtain patent term extensions under the Hatch-Waxman Amendments and the length of the extension to which we may be entitled cannot be determined until the FDA approves for marketing, if ever, a product in which bremelanotide is the active ingredient. In addition, the claims of issued patents covering bremelanotide may not provide meaningful protection. Further, third parties may challenge the validity or scope of any issued patent.

We also own an issued United States patent claiming non-oral administration of bremelanotide in combination with oral administration of a PDE-5 inhibitor. This patent has a term until 2025. However, this patent would apply only if we develop bremelanotide for use in combination therapy with a PDE-5 inhibitor. If we obtain regulatory approval for bremelanotide for use in combination therapy with a PDE-5 inhibitor, which may never occur, then the patent term may be subject to extension under the Hatch-Waxman Amendments, but we cannot presently evaluate the duration of any potential patent term extension.

We own patent applications on one class of alternative melanocortin receptor-specific peptides for treatment of sexual dysfunction which are pending in the United States, Australia, Brazil, Canada, China, India, Israel, Japan, Korea, Mexico and South Africa and before the European and Eurasian patent offices. If any patent issues in the United States, the presumptive term will be until 2029. We also own patent applications for a second class of alternative melanocortin receptor-specific peptides for treatment of sexual dysfunction which are pending in the United States, Australia, Brazil, Canada, China, India, Israel, Japan, Korea, Mexico and South Africa and before the European and Eurasian patent offices. If any patent issues in the United States, the presumptive term will be until 2030. Until one or more product candidates covered by a claim of one of these patent applications are developed for commercialization, which may never occur, we cannot evaluate the duration of any potential patent term extension under the Hatch-Waxman Amendments.

We own patent applications on two classes of highly selective melanocortin-1 receptor agonist peptides for treatment of inflammation-related diseases and disorders and related indications which are pending in the United States, Australia, Brazil, Canada, China, India, Israel, Japan, Korea, Mexico and South Africa and before the European and Eurasian patent offices. If any patent issues in the United States, the presumptive term will be until 2030. Until one or more product candidates covered by a claim of one of these patent applications are developed for commercialization, which may never occur, we cannot evaluate the duration of any potential patent term extension under the Hatch-Waxman Amendments.

We own an issued United States patent claiming the PL-3994 substance and other natriuretic peptide receptor agonist compounds that we have developed and an issued United States patent claiming a precursor molecule to the PL-3994 substance, both of which have a term until 2027. Patent applications claiming the PL-3994 substance and other compounds, including precursor molecules, are pending in Australia, Brazil, Canada, China, India, Israel, Japan, Korea, Mexico, Philippines and South Africa and before the European and Eurasian patent offices. We do not know the full scope of patent coverage we will obtain, or whether any patents will issue other than the United States patent claiming PL-3994 and the United States patent claiming a precursor molecule. We also own a patent application under the Patent Cooperation Treaty claiming use of PL-3994 for treatment of airway diseases, including asthma, and we intend to continue prosecution only in the United States. Until one or more product candidates covered by a claim of the issued patents or one of these patent applications are developed for commercialization, which may never occur, we cannot evaluate the duration of any potential patent term extension under the Hatch-Waxman Amendments.

9

We additionally have twenty-seven issued United States patents on melanocortin receptor specific peptides and small molecules, but we are not actively developing any product candidate covered by a claim of any of these patents or applications.

Under our research collaboration and license agreement with AstraZeneca, AstraZeneca is responsible for prosecution of licensed patent applications and maintenance of issued patents in the United States and other countries. AstraZeneca is prosecuting a patent application before the European and Eurasian patent offices and in the United States, Argentina, Australia, Canada, China, Cuba, the Dominican Republic, Israel, Mexico, Peru, Singapore, South Korea, Taiwan and Uruguay, among others, in its name resulting from its collaboration with us. Our employees are inventors and royalties would be payable under our agreement with AstraZeneca if a compound covered by a claim of this application is developed for commercialization. If any patent issues in the United States, the presumptive term will be until 2030. This patent application has not been examined, and we do not know the scope of patent claims that will be allowed, or whether any patents will issue. Additionally, until one or more compounds subject to the agreement with AstraZeneca are developed for commercialization, which may never occur, we cannot evaluate the duration of any potential patent term extension under the Hatch-Waxman Amendments.

In the event that a third party has also filed a patent application relating to an invention we claimed in a patent application, we may be required to participate in an interference proceeding adjudicated by the United States Patent and Trademark Office to determine priority of invention. The possibility of an interference proceeding could result in substantial uncertainties and cost, even if the eventual outcome is favorable to us. An adverse outcome could result in the loss of patent protection for the subject of the interference, subjecting us to significant liabilities to third parties, the need to obtain licenses from third parties at undetermined cost, or requiring us to cease using the technology.

Future Patent Infringement. We do not know for certain that our commercial activities will not infringe upon patents or patent applications of third parties, some of which may not even have been issued. Although we are not aware of any valid United States patents which are infringed by bremelanotide or PL-3994, we cannot exclude the possibility that such patents might exist or arise in the future. We may be unable to avoid infringement of any such patents and may have to seek a license, defend an infringement action, or challenge the validity of such patents in court. Patent litigation is costly and time consuming. If such patents are valid and we do not obtain a license under any such patents, or we are found liable for infringement, we may be liable for significant monetary damages, may encounter significant delays in bringing products to market, or may be precluded from participating in the manufacture, use or sale of products or methods of treatment covered by such patents.

Proprietary Information. We rely on proprietary information, such as trade secrets and know-how, which is not patented. We have taken steps to protect our unpatented trade secrets and know-how, in part through the use of confidentiality and intellectual property agreements with our employees, consultants and certain contractors. If our employees, scientific consultants, collaborators or licensees develop inventions or processes independently that may be applicable to our product candidates, disputes may arise about the ownership of proprietary rights to those inventions and processes. Such inventions and processes will not necessarily become our property, but may remain the property of those persons or their employers. Protracted and costly litigation could be necessary to enforce and determine the scope of our proprietary rights.

If trade secrets are breached, our recourse will be solely against the person who caused the secrecy breach. This might not be an adequate remedy to us because third parties other than the person who causes the breach will be free to use the information without accountability to us. This is an inherent limitation of the law of trade secret protection.

Governmental Regulation

The FDA, comparable agencies in other countries and state regulatory authorities have established regulations and guidelines which apply to, among other things, the clinical testing, manufacturing, safety, efficacy, labeling, storage, record keeping, advertising, promotion, marketing and distribution of our proposed products. Noncompliance with applicable requirements can result in fines, recalls or seizures of products, total or partial suspension of production, refusal of the regulatory authorities to approve marketing applications, withdrawal of approvals and criminal prosecution.

10

Before a drug product is approved by the FDA for commercial marketing, three phases of human clinical trials are usually conducted to test the safety and effectiveness of the product. Phase 1 clinical trials most typically involve testing the drug on a small number of healthy volunteers to assess the safety profile of the drug at different dosage levels. Phase 2 clinical trials, which may also enroll a relatively small number of patient volunteers, are designed to further evaluate the drug’s safety profile and to provide preliminary data as to the drug’s effectiveness in humans. Phase 3 clinical trials consist of larger, well-controlled studies that may involve several hundred or thousand patient volunteers representing the drug’s targeted population. During any of these phases, the FDA can place the clinical trial on clinical hold, or temporarily or permanently stop the clinical trials for a variety of reasons, principally for safety concerns.

After approving a product for marketing, the FDA may require post-marketing testing, including extensive Phase 4 studies, and surveillance to monitor the safety and effectiveness of the product in general use. The FDA may withdraw product approvals if compliance with regulatory standards is not maintained or if problems occur following initial marketing. In addition, the FDA may impose restrictions on the use of a drug that may limit its marketing potential. The failure to comply with applicable regulatory requirements in the United States and in other countries in which we conduct development activities could result in a variety of fines and sanctions, such as warning letters, product recalls, product seizures, suspension of operations, fines and civil penalties or criminal prosecution.

In addition to obtaining approval of a New Drug Application (an NDA) from the FDA for any of our proposed products, any facility that manufactures such a product must comply with current good manufacturing practices (GMPs). This means, among other things, that the drug manufacturing establishment must be registered with, and subject to inspection by, the FDA. Foreign manufacturing establishments must also comply with GMPs and are subject to periodic inspection by the FDA or by corresponding regulatory agencies in such other countries under reciprocal agreements with the FDA. In complying with standards established by the FDA, manufacturing establishments must continue to expend time, money and effort in the areas of production and quality control to ensure full technical compliance. We will use contract manufacturing establishments, in the United States or in foreign countries, to manufacture our proposed products, and will depend on those establishments to comply with GMPs and other regulatory requirements.

Third-Party Reimbursements

Successful sales of our proposed products in the United States and other countries may depend, in large part, on the availability of adequate reimbursement from third-party payors such as governmental entities, managed care organizations, health maintenance organizations (HMOs) and private insurance plans. Reimbursement by a third-party payor may depend on a number of factors, including the payor’s determination that the product has been approved by the FDA for the indication for which the claim is being made, that it is neither experimental nor investigational, and that the use of the product is safe and efficacious, medically necessary, appropriate for the specific patient and cost effective. Since reimbursement by one payor does not guarantee reimbursement by another, we or our licensees may be required to seek approval from each payor individually. Seeking such approvals is a time-consuming and costly process. Third-party payors routinely limit the products that they will cover and the amount of money that they will pay and, in many instances, are exerting significant pressure on medical suppliers to lower their prices. There is significant uncertainty concerning third-party reimbursement for the use of any pharmaceutical product incorporating new technology and we are not sure whether third-party reimbursement will be available for our proposed products once approved, or that the reimbursement, if obtained, will be adequate. There are no approved products for treating FSD, and thus is significant uncertainty concerning the extent and scope of third-party reimbursement for products treating FSD. Based on third-party reimbursement for approved products treating ED, we believe reimbursement will be limited for bremelanotide for treatment of FSD, assuming the product is approved by the FDA. Less than full reimbursement by governmental and other third-party payors for our proposed products may adversely affect the market acceptance of bremelanotide and other of our proposed products. Further, healthcare reimbursement systems vary from country to country, and we are not sure whether third-party reimbursement will be made available for our proposed products under any other reimbursement system.

Manufacturing and Marketing

To be successful, our proposed products will need to be manufactured in commercial quantities under GMPs prescribed by the FDA and at acceptable costs. We do not have the facilities to manufacture any of our proposed products under GMPs. We intend to rely on collaborators, licensees or contract manufacturers for the commercial manufacture of our proposed products.

11

Our bremelanotide product candidate is a synthetic peptide. While the production process involves well-established technology, there are few manufacturers capable of scaling up to commercial quantities under GMPs at acceptable costs. We have identified one third-party manufacturer for the production of bremelanotide, and have validated manufacturing of the bremelanotide drug substance under GMPs with that manufacturer. However, we have not negotiated a long-term supply agreement with the third-party manufacturer, and may not be able to enter into a supply agreement on acceptable terms, if at all.

Our bremelanotide product candidate will be a combination product, incorporating both the bremelanotide drug substance and a delivery device. We will rely on a third-party manufacturer to make the delivery device and the final product combination product. We have not yet selected a delivery device. Once a delivery device is selected, we will need to negotiate a long-term supply and manufacturing agreement, and may not be able to enter into such an agreement on acceptable terms, if at all.

Our PL-3994 product candidate is a peptide mimetic molecule, incorporating a proprietary amino acid mimetic structure and amino acids. We have identified a manufacturer which made the product in quantities sufficient for Phase 1 and some anticipated Phase 2 clinical trials, and are in the process of evaluating commercial-scale manufacturers. Scaling up to commercial quantities may involve production, purification, formulation and other problems not present in the scale of manufacturing done to date.

Certain of our melanocortin receptor agonist product candidates are synthetic peptides, which we have primarily manufactured in-house. We have not contracted with a third-party manufacturer to produce these synthetic peptides for either clinical trials or commercial purposes. While the production process involves well-established technology, there are few manufacturers capable of scaling up to commercial quantities under GMPs at acceptable costs. Additionally, scaling up to commercial quantities may involve production, purification, formulation and other problems not present in the scale of manufacturing done to date.

The failure of any manufacturer or supplier to comply with FDA GMPs, or to supply the drug substance and services as agreed, would force us to seek alternative sources of supply and could interfere with our ability to deliver product on a timely and cost effective basis or at all. Establishing relationships with new manufacturers or suppliers, any of whom must be FDA-approved, is a time-consuming and costly process.

Product Liability and Insurance

Our business may be affected by potential product liability risks which are inherent in the testing, manufacturing, marketing and use of our proposed products. We have liability insurance providing up to $10 million coverage in the aggregate as to certain clinical trial risks.

Employees

As of September 7, 2012, we employed 16 persons full time, of whom 9 are engaged in research and development activities and 7 are engaged in administration and management. While we have been successful in attracting skilled and experienced scientific personnel, competition for personnel in our industry is intense. None of our employees are covered by a collective bargaining agreement. All of our employees have executed confidentiality and intellectual property agreements. We consider relations with our employees to be good.

We rely on contractors and scientific consultants to work on specific research and development programs. We also rely on independent organizations, advisors and consultants to provide services, including aspects of manufacturing, testing, preclinical evaluation, clinical management, regulatory strategy and market research. Our independent advisors, contractors and consultants sign agreements that provide for confidentiality of our proprietary information and that we have the rights to any intellectual property developed while working for us.

Risks Relating to Our Company

We will continue to incur substantial losses over the next few years and we may never become profitable.

We have never been profitable and we may never become profitable. As of June 30, 2012, we had an accumulated deficit of $239.2 million. We expect to incur additional losses as we continue our development of bremelanotide, PL-3994 and other product candidates. Unless and until we receive approval from the FDA or other equivalent regulatory authorities outside the United States, we cannot sell our products and will not have product revenues from them. Therefore, for the foreseeable future, we will have to fund all of our operations and capital expenditures from reimbursements and other contract revenue under collaborative development agreements, existing cash balances and outside sources of financing, which may not be available on acceptable terms, if at all.

12

We will need to continue to raise funds in the future, and funds may not be available on acceptable terms, or at all.

As of June 30, 2012, and giving effect to the private placement with net proceeds of $34.5 million which closed on July 3, 2012, we had cash and cash equivalents of $38.3 million, with current liabilities of $3.5 million. We believe we have sufficient currently available working capital to fund our currently planned operations through at least calendar year 2013, but our currently available working capital is not sufficient to complete required clinical trials for any of our product candidates. We will need additional funding to complete required clinical trials and, assuming those clinical trials are successful, as to which there can be no assurance, complete submission of required regulatory applications to the FDA for any of our product candidates. We expect that the Phase 3 bremelanotide clinical trial program for FSD will require significant additional resources and capital.

We do not have any source of significant recurring revenue, and must depend on financing or partnering to sustain our operations. We may raise additional funds through public or private equity financings, debt financings, collaborative arrangements on our product candidates or other sources. However, additional funding may not be available on acceptable terms, or at all. To obtain additional funding, we may need to enter into arrangements that require us to develop only certain of our product candidates or relinquish rights to certain technologies, product candidates and/or potential markets.

If we are unable to raise sufficient additional funds when needed, we may be required to curtail operations significantly, cease clinical trials and further decrease staffing levels. We may seek to license, sell or otherwise dispose of our product candidates, technologies and contractual rights, including rights under our research collaboration and license agreement with AstraZeneca, on the best possible terms available. Even if we are able to license, sell or otherwise dispose of our product candidates, technologies and contractual rights, it is likely to be on unfavorable terms and for less value than if we had the financial resources to develop or otherwise advance our product candidates, technologies and contractual rights ourselves.

We have a limited operating history upon which to base an investment decision.

Our operations are primarily focused on acquiring, developing and securing our proprietary technology, conducting preclinical and clinical studies and formulating and manufacturing on a small-scale basis our principal product candidates. These operations provide a limited basis for stockholders to assess our ability to commercialize our product candidates.

We have not yet demonstrated our ability to perform the functions necessary for the successful commercialization of any of our current product candidates. The successful commercialization of our product candidates will require us to perform a variety of functions, including:

|

·

|

continuing to conduct preclinical development and clinical trials;

|

|

·

|

participating in regulatory approval processes;

|

|

·

|

formulating and manufacturing products, or having third parties formulate and manufacture products;

|

|

·

|

post-approval monitoring and surveillance of our products;

|

|

·

|

conducting sales and marketing activities, either alone or with a partner; and

|

|

·

|

obtaining additional capital.

|

If we are unable to obtain regulatory approval of any of our product candidates, to successfully commercialize any products for which we receive regulatory approval or to obtain additional capital, we may not be able to recover our investment in our development efforts.

We may not be able to obtain regulatory approval of bremelanotide for FSD even if the product is effective in treating FSD.

Approval of bremelanotide for treatment of FSD in premenopausal women requires determination by the FDA that the product is both safe and effective. Increases in blood pressure observed in some patients receiving nasally administered bremelanotide was a significant factor leading us to discontinue work on nasally administered bremelanotide for sexual dysfunction. Studies we have conducted with subcutaneously administered bremelanotide suggest that transient elevations of blood pressure are dependent on both the specific patient population and the dose administered. Based on these studies, we believe that bremelanotide will be effective in treating FSD at doses that do not result in unacceptable increases in blood pressure or other unacceptable adverse events. However, results obtained in later phases of clinical trials, including our Phase 2B clinical trial and any future Phase 3 clinical trial, may be inconsistent with results obtained in earlier studies, and may demonstrate an unacceptable safety profile. It is also possible that safety or efficacy results obtained in later phases of clinical trials will be inconclusive. It is not possible to predict, with any assurance, whether the FDA will approve bremelanotide for any indications. The FDA may deny or delay approval of any application for bremelanotide if the FDA determines that the clinical data do not adequately establish the safety of the drug even if efficacy is established. Bremelanotide could take a significantly longer time to obtain approval than we expect and it may never gain approval. If regulatory approval of bremelanotide is delayed or never obtained, our business and our liquidity would be adversely affected.

13

Development and commercialization of our product candidates involves a lengthy, complex and costly process, and we may never successfully develop or commercialize any product.

Our product candidates are at various stages of research and development, will require regulatory approval, and may never be successfully developed or commercialized. Our product candidates will require significant further research, development and testing before we can seek regulatory approval to market and sell them.

We must demonstrate that our product candidates are safe and effective for use in patients in order to receive regulatory approval for commercial sale. Preclinical studies in animals, using various doses and formulations, must be performed before we can begin human clinical trials. Even if we obtain favorable results in the preclinical studies, the results in humans may be different. Numerous small-scale human clinical trials may be necessary to obtain initial data on a product candidate’s safety and efficacy in humans before advancing to large-scale human clinical trials. We face the risk that the results of our trials in later phases of clinical trials may be inconsistent with those obtained in earlier phases. Adverse or inconclusive results could delay the progress of our development programs and may prevent us from filing for regulatory approval of our product candidates. Additional factors that can cause delay or termination of our human clinical trials include:

|

·

|

the availability of sufficient capital to sustain operations and clinical trials;

|

|

·

|

timely completion of clinical site protocol approval and obtaining informed consent from subjects;

|

|

·

|

the rate of patient enrollment in clinical studies;

|

|

·

|

adverse medical events or side effects in treated patients; and

|

|

·

|

lack of effectiveness of the product being tested.

|

You should evaluate us in light of these uncertainties, delays, difficulties and expenses commonly experienced by early stage biopharmaceutical companies, as well as unanticipated problems and additional costs relating to:

|

·

|

product approval or clearance;

|

|

·

|

regulatory compliance;

|

|

·

|

good manufacturing practices;

|

|

·

|

intellectual property rights;

|

|

·

|

product introduction; and

|

|

·

|

marketing and competition.

|

The regulatory approval process is lengthy, expensive and uncertain, and may prevent us from obtaining the approvals we require.

Government authorities in the United States and other countries extensively regulate the advertising, labeling, storage, record-keeping, safety, efficacy, research, development, testing, manufacture, promotion, marketing and distribution of drug products. Drugs are subject to rigorous regulation by the FDA and similar regulatory bodies in other countries. The steps ordinarily required by the FDA before a new drug may be marketed in the United States include:

|

·

|

completion of non-clinical tests including preclinical laboratory and formulation studies and animal testing and toxicology;

|

|

·

|

submission to the FDA of an IND application, which must become effective before clinical trials may begin;

|

14

|

·

|

performance of adequate and well-controlled Phase 1, 2 and 3 human clinical trials to establish the safety and efficacy of the drug for each proposed indication;

|

|

·

|

submission to the FDA of an NDA;

|

|

·

|

FDA review and approval of the NDA before any commercial marketing or sale; and

|

|

·

|

Compliance with post-approval commitments and requirements.

|

Satisfaction of FDA pre-market approval requirements for new drugs typically takes a number of years and the actual time required for approval may vary substantially based upon the type, complexity and novelty of the product or disease. The results of product development, preclinical studies and clinical trials are submitted to the FDA as part of an NDA. The NDA also must contain extensive manufacturing information. Once the submission has been accepted for filing, the FDA generally has ten months to review the application and respond to the applicant. The review process is often significantly extended by FDA requests for additional information or clarification. Success in early stage clinical trials does not assure success in later stage clinical trials. Data obtained from clinical trials is not always conclusive and may be susceptible to varying interpretations that could delay, limit or prevent regulatory approval. The FDA may refer the NDA to an advisory committee for review, evaluation and recommendation as to whether the application should be approved, but the FDA is not bound by the recommendation of the advisory committee. The FDA may deny or delay approval of applications that do not meet applicable regulatory criteria or if the FDA determines that the clinical data do not adequately establish the safety and efficacy of the drug. Therefore, our proposed products could take a significantly longer time than we expect or may never gain approval. If regulatory approval is delayed or never obtained, our business and our liquidity would be adversely affected.

Upon approval, a product candidate may be marketed only in those dosage forms and for those indications approved by the FDA. Once approved, the FDA may withdraw the product approval if compliance with regulatory requirements is not maintained or if problems occur after the product reaches the marketplace. In addition, the FDA may require post-marketing studies, referred to as Phase 4 studies, to monitor the approved products in a larger number of patients than were required for product approval and may limit further marketing of the product based on the results of these post-market studies. The FDA has broad post-market regulatory and enforcement powers, including the ability to seek injunctions, levy fines and civil penalties, criminal prosecution, withdraw approvals and seize products or request recalls.

If regulatory approval of any of our product candidates is granted, it will be limited to certain disease states or conditions. Adverse experiences with the product must be reported to the FDA and could result in the imposition of market restriction through labeling changes or in product removal. Product approvals may be withdrawn if compliance with regulatory requirements is not maintained or if problems concerning safety or efficacy of the product occur following approval.

Outside the United States, our ability to market our product candidates will also depend on receiving marketing authorizations from the appropriate regulatory authorities. The foreign regulatory approval process generally includes all of the risks associated with FDA approval described above. The requirements governing the conduct of clinical trials and marketing authorization vary widely from country to country. At present, foreign marketing authorizations are applied for at a national level, although within the European Community, or EC, registration procedures are available to companies wishing to market a product to more than one EC member state. If the regulatory authority is satisfied that adequate evidence of safety, quality and efficiency has been presented, a marketing authorization will be granted. If we do not obtain, or experience difficulties in obtaining, such marketing authorizations, our business and liquidity may be adversely affected.

If any approved product does not achieve market acceptance, our business will suffer.

Regulatory approval for the marketing and sale of any of our product candidates does not assure the product’s commercial success. Any approved product will compete with other products manufactured and marketed by major pharmaceutical and other biotechnology companies. The degree of market acceptance of any such product will depend on a number of factors, including:

|

·

|

perceptions by members of the healthcare community, including physicians, about its safety and effectiveness;

|

|

·

|

cost-effectiveness relative to competing products and technologies;

|

15

|

·

|

availability of reimbursement for our products from third party payors such as health insurers, health maintenance organizations and government programs such as Medicare and Medicaid; and

|

|

·

|

advantages over alternative treatment methods.

|

If any approved product does not achieve adequate market acceptance, our business, financial condition and results of operations will be adversely affected.

We rely on third parties to conduct clinical trials for our product candidates and their failure to timely perform their obligations could significantly harm our product development.

We rely on outside scientific collaborators such as researchers at clinical research organizations and universities in certain areas that are particularly relevant to our research and product development plans, such as the conduct of clinical trials and associated tests. There is competition for these relationships, and we may not be able to maintain our relationships with them on acceptable terms. These outside collaborators generally may terminate their engagements with us at any time. As a result, we can control their activities only within certain limits, and they will devote only a certain amount of their time to conduct research on our product candidates and develop them. If they do not successfully carry out their duties under their agreements with us, fail to inform us if these trials fail to comply with clinical trial protocols or fail to meet expected deadlines, our ability to develop our product candidates and obtain regulatory approval on a timely basis, if at all, may be adversely affected.

Our drug development programs depend on contract research organizations and other third parties over whom we have no control.