As filed with the U.S. Securities and Exchange Commission on August 14, 2019

Registration No. 333-[ ]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AMERI Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

95-4484725

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

5000 Research Court, Suite 750,

Suwanee, Georgia, 30024

(770) 935-4152

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Brent Kelton

Chief Executive Officer

5000 Research Court, Suite 750,

Suwanee, Georgia, 30024

(770) 935-4152

(Name, address including zip code, and telephone number, including area code, of agent for service)

With copies to:

Richard A. Friedman, Esq.

Sheppard, Mullin, Richter & Hampton LLP

30 Rockefeller Plaza, 39th Floor

New York, NY 10112-0015

Telephone: (212) 653-8700

Fax: (212) 655-1729

Approximate date of commencement of proposed sale to the public: From time to time, after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment

plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following

box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the

following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated

filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Non-accelerated filer ☒

|

Smaller reporting company ☒

|

|

Emerging growth company ☒

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities

Act. ☐

CALCULATION OF REGISTRATION FEE

|

Title of each class of

securities to be registered

|

Amount

to be

registered

|

Proposed

maximum

offering price

per share

|

Proposed

maximum

aggregate

offering price(3)

|

Amount of

registration fee(3)

|

|||||||

|

Common Stock, $0.01 par value per share

|

|||||||||||

|

Preferred Stock, $0.01 par value per share

|

|||||||||||

|

Debt Securities

|

|||||||||||

|

Warrants

|

|||||||||||

|

Units

|

|||||||||||

|

Total

|

(1)

|

(2)

|

$

|

25,000,000

|

$

|

3,030

|

|||||

| (1) |

An indeterminate number of securities or aggregate principal amount, as the case may be, of common stock and preferred stock, such indeterminate principal amount of debt securities, such indeterminate number of warrants to purchase

common stock, preferred stock or debt securities, and such indeterminate number of units, as shall have an aggregate initial offering price not to exceed $25,000,000. If any debt securities are issued at an original issue discount, then the

offering price of such debt securities shall be in such greater principal amount as shall result in an aggregate offering price not to exceed $25,000,000, less the aggregate offering price of any securities previously issued hereunder. Any

securities issued hereunder may be sold separately or as units with other securities issued hereunder. The proposed maximum initial offering price per unit will be determined, from time to time, by the registrant in connection with the

issuance by the registrant of the securities registered hereunder. The securities registered also include such indeterminate amounts and numbers of debt securities, common stock and preferred stock as may be issuable upon conversion,

redemption, exchange, exercise or settlement of any securities registered hereunder, including under any applicable antidilution provisions. Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this

Registration Statement shall be deemed to cover any additional number of securities as may be offered or issued from time to time upon stock splits, stock dividends, recapitalizations or similar transactions.

|

| (2) |

The proposed maximum aggregate offering price per unit will be determined from time to time by the Registrant in connection with the sale and issuance by the Registrant of the securities registered hereunder and is not specified as to

each class of security pursuant to General Instruction II.D. of Form S-3 under the Securities Act.

|

| (3) |

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act.

|

| (4) |

The registration fee has been calculated in accordance with Rule 457(o) under the Securities Act.

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this

Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may

determine.

- 2 -

The information in this prospectus is not complete and may be changed. We may not sell these securities or accept an offer to buy these securities until the registration statement filed with the U.S.

Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

Subject to completion, dated August 14, 2019

AMERI Holdings, Inc.

Common Stock

Preferred Stock

Debt Securities

Warrants

Units

We may offer and sell, from time to time in one or more offerings, any combination of common stock, preferred stock, debt securities, warrants to purchase common stock, preferred stock or debt securities, or any

combination of the foregoing, either individually or as units comprised of one or more of the other securities, having an aggregate initial offering price not exceeding $25,000,000.

This prospectus provides a general description of the securities we may offer. Each time we sell a particular class or series of securities, we will provide specific terms of the securities offered in a supplement to this

prospectus. The prospectus supplement and any related free writing prospectus may also add, update or change information contained in this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in connection with

these offerings. You should read carefully this prospectus, the applicable prospectus supplement and any related free writing prospectus, as well as any documents incorporated by reference herein or therein before you invest in any of our securities.

The specific terms of any securities to be offered, and the specific manner in which they may be offered, will be described in one or more supplements to this prospectus. This prospectus may not be used to consummate sales

of any of these securities unless it is accompanied by a prospectus supplement. Before investing, you should carefully read this prospectus and any related prospectus supplement.

Our common stock is presently listed on The Nasdaq Capital Market under the symbol “AMRH.” On August 12, 2019, the last reported sale price of our common stock was $0.3234 per share. The applicable prospectus supplement

will contain information, where applicable, as to any other listing on The Nasdaq Capital Market or any securities market or other exchange of the securities, if any, covered by the prospectus supplement. Prospective purchasers of our securities are

urged to obtain current information as to the market prices of our securities, where applicable.

These securities may be sold directly by us, through dealers or agents designated from time to time, to or through underwriters, dealers, or through a combination of these methods on a continuous or delayed basis. See “Plan of Distribution” in this prospectus. We may also describe the plan of distribution for any particular offering of our securities in a prospectus supplement. If any agents, underwriters or dealers are involved

in the sale of any securities in respect of which this prospectus is being delivered, we will disclose their names and the nature of our arrangements with them in a prospectus supplement. The price to the public of such securities and the net proceeds

we expect to receive from any such sale will also be included in a prospectus supplement.

- 3 -

The aggregate market value of our outstanding common stock held by non-affiliates was approximately $17,887,017 which was calculated based on 45,982,047 shares of outstanding common stock held by non-affiliates as of

August 9, 2019, and a price per share of $0.389, the closing price of our common stock on June 17, 2019. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities pursuant to this registration statement with a value more

than one-third of the aggregate market value of our common stock held by non-affiliates in any 12-month period, so long as the aggregate market value of our common stock held by non-affiliates is less than $75.0 million. In the event that subsequent to

the effective date of this registration statement, the aggregate market value of our outstanding common stock held by non-affiliates equals or exceeds $75.0 million, then the one-third limitation on sales shall not apply to additional sales made

pursuant to this registration statement. We have sold no securities pursuant to General Instruction I.B.6 of Form S-3 during the 12 calendar months prior to, and including, the date of this registration statement.

Investing in our securities involves various risks. See “Risk Factors” contained herein for more information on these risks. Additional risks will be described

in the related prospectus supplements under the heading “Risk Factors.” You should review that section of the related prospectus supplements for a discussion of matters that investors in our securities should

consider.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the adequacy or accuracy of this prospectus or any

accompanying prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2019.

- 4 -

|

Page

|

|

| 6 |

|

| 16 |

|

| 17 | |

| 18 | |

| 19 |

|

| 21 | |

| 29 | |

| 31 | |

| 32 | |

| 36 | |

| 38 | |

| 38 | |

| 39 | |

| 39 |

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission, or SEC, using a “shelf” registration process. Under this shelf registration statement, we may sell from

time to time in one or more offerings of common stock and preferred stock, various series of debt securities and/or warrants to purchase any of such securities, either individually or as units comprised of a combination of one or more of the other

securities in one or more offerings up to a total dollar amount of $25,000,000. This prospectus provides you with a general description of the securities we may offer. Each time we sell any type or series of securities under this prospectus, we will

provide a prospectus supplement that will contain more specific information about the terms of that offering.

This prospectus does not contain all of the information included in the registration statement. For a more complete understanding of the offering of the securities, you should refer to the registration statement, including

its exhibits. We may add, update or change in a prospectus supplement or free writing prospectus any of the information contained in this prospectus or in the documents we have incorporated by reference into this prospectus. We may also authorize one

or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. This prospectus, together with the applicable prospectus supplement, any related free writing prospectus and the documents

incorporated by reference into this prospectus and the applicable prospectus supplement, will include all material information relating to the applicable offering. You should carefully read both this prospectus and the applicable prospectus supplement

and any related free writing prospectus, together with the additional information described under “Where You Can Find More Information,” before buying any of the securities being offered.

We have not authorized any dealer, agent or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus, any accompanying prospectus

supplement or any related free writing prospectus that we may authorize to be provided to you. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus or an accompanying prospectus

supplement, or any related free writing prospectus that we may authorize to be provided to you. This prospectus, the accompanying prospectus supplement and any related free writing prospectus, if any, do not constitute an offer to sell or the

solicitation of an offer to buy any securities other than the registered securities to which they relate, nor do this prospectus, the accompanying prospectus supplement or any related free writing prospectus, if any, constitute an offer to sell or the

solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus, any applicable

prospectus supplement or any related free writing prospectus is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the date

of the document incorporated by reference (as our business, financial condition, results of operations and prospects may have changed since that date), even though this prospectus, any applicable prospectus supplement or any related free writing

prospectus is delivered or securities are sold on a later date.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus were made solely for the

benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations,

warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

This prospectus may not be used to consummate sales of our securities, unless it is accompanied by a prospectus supplement. To the extent there are inconsistencies between any prospectus supplement, this prospectus and any

documents incorporated by reference, the document with the most recent date will control.

As permitted by the rules and regulations of the SEC, the registration statement, of which this prospectus forms a part, includes additional information not contained in this prospectus. You may read the registration

statement and the other reports we file with the SEC at the SEC’s web site or at the SEC’s offices described below under the heading “Where You Can Find Additional Information.”

Company References

In this prospectus “the Company,” “we,” “us,” and “our” refer to AMERI Holdings Inc., and its subsidiaries together, unless the context indicates otherwise.

SUMMARY

Our Company

We specialize in delivering SAP cloud, digital and enterprise services to clients worldwide. SAP is a leader in providing enterprise resource planning (“ERP”) software and

technologies to enterprise customers worldwide. We deliver a wide range of solutions and services across multiple domains and industries. Our services center around SAP and include technology consulting, business intelligence, cloud services,

application development/integration and maintenance, implementation services, infrastructure services, and independent validation services, all of which can be delivered as a set of managed services or on an on-demand service basis, or a combination of

both.

Our SAP focus allows us to provide technological solutions to a broad base of clients. We are headquartered in Suwanee, Georgia, and have offices across the United States, which

are supported by offices in India and Canada. Our model inverts the conventional global delivery model wherein offshore information technology (“IT”) service providers are based abroad and maintain a minimal presence in the United States. With a strong

SAP focus, our client partnerships anchor around SAP cloud and digital services. In 2018, we signed a strategic partnership agreement with Google Cloud to offer SAP S/4 HANA (a next generation enterprise system) migration services. This partnership

will allow us to offer our clients a broader spectrum of services.

Our primary business objective is to provide our clients with a competitive advantage by enhancing their business capabilities and technologies with our expanding consulting services

portfolio. Our strategic acquisitions allow us to bring global service delivery, SAP S/4 HANA, SAP Business Intelligence, SAP Success Factors, SAP Hybris and high-end SAP consulting capabilities to a broader geographic market and customer base. We

continue to leverage our growing geographical footprint and technical expertise to simultaneously expand our service and product offering. Our goal is to identify business synergies that will allow us to bring new services and products from one

subsidiary to customers at our other subsidiaries. While we generate revenues from the consulting businesses of each of our acquired subsidiaries, we believe that additional revenues will be generated through new business relationships and services

developed through our business combinations.

Background

We were incorporated under the laws of the State of Delaware in February 1994 as Spatializer Audio Laboratories, Inc., which was a shell company immediately prior to our completion of

a “reverse merger” transaction on May 26, 2015, in which we caused Ameri100 Acquisition, Inc., a Delaware corporation and our newly created, wholly owned subsidiary, to be merged with and into Ameri and Partners Inc. (“Ameri and Partners”), a

Delaware corporation (the “Merger”). As a result of the Merger, Ameri and Partners became our wholly owned subsidiary with Ameri and Partners’ former stockholders acquiring a majority of the outstanding shares of our common stock. The Merger was

consummated under Delaware law, pursuant to an Agreement of Merger and Plan of Reorganization, dated as of May 26, 2015 (the “Merger Agreement”), and in connection with the Merger we changed our name to AMERI Holdings, Inc. and do business under the

brand name “Ameri100”.

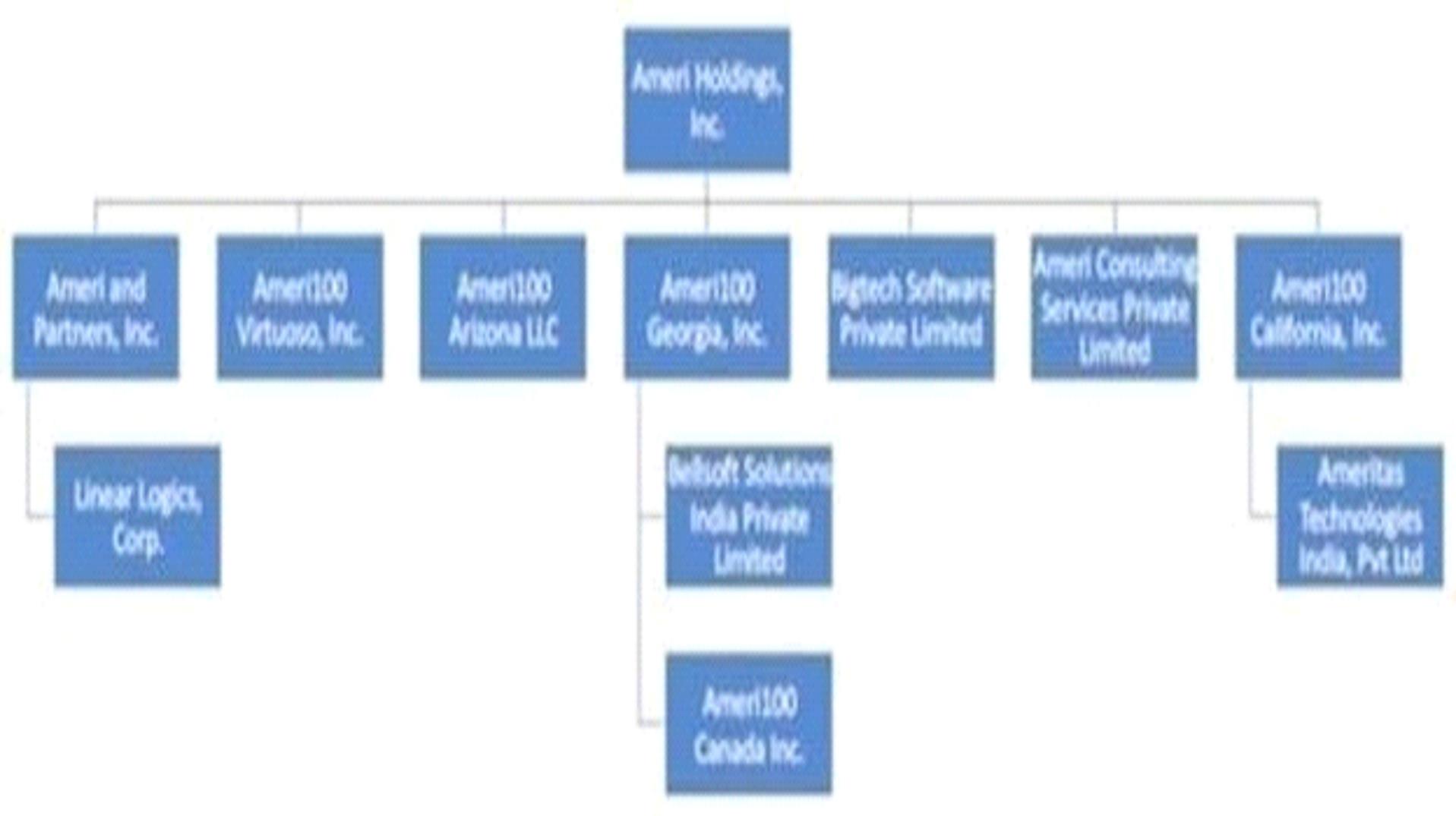

Ameri Holdings, Inc., along with its eleven subsidiaries, Ameri and Partners, Ameri Consulting Service Private Ltd., Ameri100 Georgia Inc. (“Ameri Georgia”), Bellsoft India Solutions

Private Ltd., Ameri100 Canada Inc. (formerly BSI Global IT Solutions Inc.), Linear Logics, Corp., Ameri100 Virtuoso Inc. (“Virtuoso”), Ameri100 Arizona LLC (“Ameri Arizona”), Bigtech Software Private Limited (“Bigtech”), Ameri100 California Inc.

(“Ameri California) and Ameritas Technologies India Private Limited, provides SAP cloud, digital and enterprise services to clients worldwide.

Organizational Chart

Our Industry

Background

We operate in an intensely competitive IT outsourcing services industry, which competes on quality, service and costs. Though we are able to differentiate our company on all of these

axes, our India-based capabilities ensure that labor arbitrage is our fundamental differentiator. Most offshore IT services providers have undertaken a “forward integration” to boost their capabilities and presence in their client geographies (large

offshore presence with a small local presence). Conversely, large U.S. system integrators focus on “backward integration” to scale and boost their offshore narrative (offshore being the “back office” for the local operations). Today, the IT services

industry is marked by the following characteristics:

|

Characteristic

|

Description

|

|

|

Mature Market

|

•

|

Most large global companies have already outsourced what they wanted to outsource.

|

|

Commoditized Business Model

|

•

|

North America and Europe continue to be the markets with attractive spending potential. However, increased regulations and visa dependencies prove to be a major drawback of the model.

|

|

•

|

The benefits realized from the business model are largely based on labor arbitrage, productivity benefits and portfolio restructuring. These contours have changed due to commoditization.

|

|

|

Insourcing

|

•

|

Extremely rapid changes in technology are forcing IT services–traditionally an outsourcing business—to adopt an insourcing model.

|

|

Rapid Technology Shifts

|

•

|

Cloud services, robotic process automation, artificial intelligence and internet of things are increasingly in demand as part of outsourcing engagements. Smart robots increasingly operate in the cloud, and a ‘labor-as-a-service’ approach has

emerged, as clients and providers find that intelligent tools and virtual agents can be easily and flexibly hosted on cloud platforms.

|

|

•

|

Social media, cloud computing, mobility and big data will continue to be mainstays for any IT ecosystem.

|

|

|

•

|

The convergence of cloud computing, virtualization (applications and infrastructure) and utility computing is around the corner. The ability of a vendor to offer an integrated basket of services on a SaaS model, will be a key differentiator.

|

|

|

•

|

Enterprises are becoming more digital. There is a strong convergence of human and machine intelligence thanks to drivers like advanced sensors and machine learning. Operations and technology are converging.

|

|

|

Contracts & Decision Making

|

•

|

Large multi-year contracts will be renegotiated and broken down into shorter duration contracts and will involve multiple vendors rather than sole sourcing.

|

|

•

|

The ability to demonstrate value through Proof of Concepts (POCs) and willingness to offer outcome based pricing are becoming critical considerations for decision making, Requests for Proposal (RFP)-driven decisions are increasingly rare.

|

|

The SAP Industry

SAP as an ERP and Cloud product has become an industry by itself. The core SAP enterprise offering has been reinforced with cloud-based products that make the entire SAP ecosystem

extremely attractive from our perspective due to the following attributes:

|

•

|

The alignment of SAP to enterprises is extremely strong. Given the reliance of enterprises on applications, clients tend to make long-term bets on SAP as an enterprise solution.

|

|

•

|

According to the September 2014 “HfS Blueprint Report” from by HfS Research Ltd., the SAP market is a multi-billion-dollar market that is very fragmented (there are over 5,000 consulting firms), with

the three largest service providers capturing an increasing share of the market.

|

|

•

|

A significant number of SAP customers must move to S/4 HANA by 2025.

|

Our Approach

Our solutions deliver significant business efficiency outcomes through turnkey projects, consulting and offshore services. We believe that our strategic service portfolio, deep industry experience and

strong global talent pool offer a compelling proposition to clients. In 2017 we acquired ATCG Technology Solutions, Inc., which has become our wholly-owned subsidiary Ameri California. In 2016, we acquired three companies: Virtuoso, L.L.C. and DC&M Partners, L.L.C.in the U.S. (now Virtuoso and Ameri Arizona, respectively) and Bigtech in India. These strategic acquisitions have brought offshore

delivery, SAP S/4 HANA, SAP SuccessFactors, SAP Hybris and high-end SAP consulting capabilities to our service portfolio.

Our Portfolio of Service Offerings

Our portfolio of service offerings expanded significantly since 2016 with our acquisitions of Ameri Georgia, Ameri Arizona, Ameri California, Virtuoso and Bigtech.

Our current portfolio of services is divided into three categories:

Cloud Services

An increasing trend in the IT services market is the adoption of cloud services. Historically, clients have resorted to on-premise software solutions, which required capital

investments in infrastructure and data centers. Cloud services enable clients to build and host their applications at much lower costs. Our services offerings leverage the low cost and flexibility of cloud computing.

We have expertise in deploying SAP’s public, private and hybrid cloud services, as well as SAP S/4 HANA, SAP SuccessFactors and SAP Hybris cloud migration services. Our teams are

experienced in the rapid delivery of cloud services. We perform SAP application and cloud support and SAP cloud development. Additionally, we provide cloud automation solutions that focus on business objectives and organizational growth.

Digital Services

We have developed several cutting-edge mobile solutions, including Simple Advance Planning and Optimization (“APO”) and SAP IBP/S&OP Mobile Analytics App. The Simple APO

mobile application (app) provides sales professionals with real-time collaboration capabilities and customer data, on their mobile devices. It increases the efficiency of the sales process and the accuracy of customer needs forecasting. The

SAP IBP mobile app enables the real-time management and analysis of sales and operations planning (S&OP) related data from mobile devices. SAP is an implementation partner for this app. SAP has recognized the app’s value to the ecosystem,

as S&OP apps are complex and difficult to design.

We are also active in robotic process automation (“RPA”), which leverages the capability of artificially intelligent software agents for business process automation. We have

expertise in automating disparate and redundant data entry tasks by configuring software robots that seamlessly integrate with existing software systems. We also provide RPA solutions for reporting and analysis and deliver insights into

business functions by translating large data into structured reports. Lastly, we have a working partnership with Blue Prism, a leading RPA solutions provider, which makes it possible for us to automate up to one-third of all standard

back-office operations.

Enterprise Services

We design, implement and manage Business Intelligence (“BI”) and analytics solutions. BI helps our clients navigate the market better by identifying new trends and by

targeting top-selling products. We also enable clients to use BI for generating instant financial reports and analytics of customer, product and cost information over time. In addition, we provide solutions for metadata repository,

master data management and data quality. Finally, we determine BI demands across various platforms.

Other key enterprise services that we offer include consulting services for global and regional SAP implementations, SAP/IT solution advisory and architectural services,

project management services, IT/ERP strategy and vendor selection services. Often clients have relied on us to deliver services in non-SAP packages, as well.

Strategy

The integration of each of our acquisitions into our business enterprise requires establishing our company’s standard operating procedures at each acquired entity,

seamlessly transitioning each acquired entity’s branding to the “Ameri100” brand and assessing any necessity to transition account management. The integration process also requires us to evaluate any product-line expansions made

possible by the acquired entity and how to bring new product lines to the broader customer base of the entire Company. With the integration of each acquisition, we face challenges of maintaining cross-company visibility and

cooperation, creating a cohesive corporate culture, handling unexpected customer reactions and changes and aligning the interests of the acquired entity’s leadership with the interests of the Company.

Sales and Marketing

We combine traditional sales with our strength in industries and technology. Our sales function is composed of direct sales and inside sales professionals. Both

work closely with our solutions directors to identify potential opportunities within each account. We currently have over 100+ active clients. Using a consultative selling methodology (working with clients to prescribe a solution

that suits their need in terms of efficiency, cost and timelines), target prospects are identified and a pursuit plan is developed for each key account. We utilize a blended sales model that combines consultative selling with

traditional sales methods. Once the customer has engaged us, the sales, solutions and marketing teams monitor and manage the relationship with the help of customer relationship management software.

Our marketing strategy is to build a strong, sustainable brand image for our company, position us in the SAP arena and facilitate business opportunities. We use a variety of marketing

programs across traditional and social channels to target our prospective and current customers, including webinars, targeted email campaigns, co-sponsoring customer events with SAP to create customer and prospect awareness, search engine marketing

and advertising to drive traffic to our web properties, and website development to engage and educate prospects and generate interest through white papers, case studies and marketing collateral.

Revenues and Customers

We generate revenue primarily through consulting services performed in the fulfillment of written service contracts. The service contracts we enter into generally fall into two

categories: (1) time-and-materials contracts and (2) fixed-price contracts.

When a customer enters into a time-and-materials or fixed-price, (or a periodic retainer-based) contract, we recognize revenue in accordance with an evaluation of the deliverables

in each contract. If the deliverables represent separate units of accounting, we then measure and allocate the consideration from the arrangement to the separate units, based on vendor-specific objective evidence of the value for each

deliverable.

The revenue under time-and-materials contracts is recognized as services are rendered and performed at contractually agreed upon rates. Revenue pursuant to fixed-price contracts

is recognized under the proportional performance method of accounting. We routinely evaluate whether revenue and profitability should be recognized in the current period. We estimate the proportional performance on our fixed-price contracts on a

monthly basis utilizing hours incurred to date as a percentage of total estimated hours to complete the project.

For the twelve months ended December 31, 2018 and December 31, 2017, sales to five major customers accounted for approximately 39% and 43% of our total revenue, respectively.

Technology Research and Development

We regard our services and solutions and related software products as proprietary. We rely primarily on a combination of copyright, trademark and trade secret laws of general

applicability, employee confidentiality and invention assignment agreements, distribution and software protection agreements and other intellectual property protection methods to safeguard our technology and software products. We have not

applied for patents on any of our technology. We also rely upon our efforts to design and produce new applications and upon improvements to existing software products to maintain a competitive position in the marketplace.

We did not make any material expenditures on research or development activities for the twelve months ended December 31, 2018 and December 31, 2017.

Strategic Alliances

Through our Lean Enterprise Architecture Partnership (“LEAP”) methodology, we have strategic alliances with technology specialists who perform services on an as-needed basis

for clients. We partner with niche specialty firms globally to obtain specialized resources to meet client needs. Our business partners include executive recruiters, staffing firms and niche technology companies. The terms of each strategic

alliance arrangement depend on the nature of the particular partnership. Such alliance arrangements typically set forth deliverables, scope of the services to be delivered, costs of services and terms and conditions of payment (generally 45

to 90 days for payment to be made). Each alliance arrangement also typically includes terms for indemnification of our company, non-solicitation of each partner’s employees by the other partner and dispute resolution by arbitration.

Alliances and partnerships broaden our offerings and make us a one-stop solution for clients. Our team constantly produces services that complement our portfolio and build

strategic partnerships. Our partner companies range from digital marketing strategy consulting firms to large infrastructure players.

On any given project we evaluate a client’s needs and make our best effort to meet them with our full-time specialists. However, in certain circumstances, we may need to go outside

the Company, and in this case we approach our strategic partners to tap into their pools of technology specialists. Project teams are usually composed of a mix of our full time employees and outside technology specialists. Occasionally, a project

team may consist of a Company manager and a few outside technology specialists. While final accountability for any of our projects rests with the Company, the outside technology specialists are incentivized to successfully complete a project with

project completion payments that are in addition to hourly billing rates we pay the outside technology specialists.

Competition

The large number of competitors and the speed of technology change make IT services and outsourcing a challenging business. Competitors in this market include systems integration

firms, contract programming companies, application software companies, traditional large consulting firms, professional services groups of computer equipment companies and facilities management and outsourcing companies. Examples of our competitors

in the IT services industry include Accenture, Cartesian Inc., Cognizant, Hexaware Technologies Limited, Infosys Technologies Limited, Mindtree Limited, RCM Technologies Inc., Tata Consultancy Services Limited, Virtusa, Inc. and Wipro Limited.

We believe that the principal factors for success in the IT services and outsourcing market include performance and reliability; quality of technical support, training and services;

responsiveness to customer needs; reputation and experience; financial stability and strong corporate governance; and competitive pricing.

Some of our competitors have significantly greater financial, technical and marketing resources and/or greater name recognition, but we believe we are well positioned to capitalize

on the following competitive strengths to achieve future growth:

|

•

|

well-developed recruiting, training and retention model;

|

|

•

|

successful service delivery model;

|

|

•

|

broad referral base;

|

|

•

|

continual investment in process improvement and knowledge capture;

|

|

•

|

investment in research and development;

|

|

•

|

strong corporate governance; and

|

The Securities We May Offer

We may offer shares of our common stock and preferred stock, various series of debt securities and warrants to purchase any of such securities, either individually or in units, from time to time under this prospectus,

together with any applicable prospectus supplement and related free writing prospectus, at prices and on terms to be determined by market conditions at the time of offering. If we issue any debt securities at a discount from their original stated

principal amount, then, for purposes of calculating the total dollar amount of all securities issued under this prospectus, we will treat the initial offering price of the debt securities as the total original principal amount of the debt securities.

Each time we offer securities under this prospectus, we will provide offerees with a prospectus supplement that will describe the specific amounts, prices and other important terms of the securities being offered, including, to the extent applicable:

|

•

|

designation or classification;

|

|

•

|

aggregate principal amount or aggregate offering price;

|

|

•

|

maturity, if applicable;

|

|

•

|

original issue discount, if any;

|

|

•

|

rates and times of payment of interest or dividends, if any;

|

|

•

|

redemption, conversion, exchange or sinking fund terms, if any;

|

|

•

|

conversion or exchange prices or rates, if any, and, if applicable, any provisions for changes to or adjustments in the conversion or exchange prices or rates and in the securities or other property receivable upon conversion or exchange;

|

|

•

|

ranking;

|

|

•

|

restrictive covenants, if any;

|

|

•

|

voting or other rights, if any; and

|

|

•

|

important United States federal income tax considerations.

|

A prospectus supplement and any related free writing prospectus that we may authorize to be provided to you may also add, update, or change information contained in this prospectus or in documents we have incorporated by

reference. However, no prospectus supplement or free writing prospectus will offer a security that is not registered and described in this prospectus at the time of the effectiveness of the registration statement of which this prospectus is a part.

We may sell the securities to or through underwriters, dealers or agents or directly to purchasers. We, as well as any agents acting on our behalf, reserve the sole right to accept and to reject in whole or in part any

proposed purchase of securities. Each prospectus supplement will set forth the names of any underwriters, dealers or agents involved in the sale of securities described in that prospectus supplement and any applicable fee, commission or discount

arrangements with them, details regarding any over-allotment option granted to them, and net proceeds to us. The following is a summary of the securities we may offer with this prospectus.

Common Stock

We currently have authorized 100,000,000 shares of common stock, par value $0.01 per share. As of August 9, 2019, 52,417,688 shares of common stock were issued and outstanding. We may offer shares of our common stock

either alone or underlying other registered securities convertible into or exercisable for our common stock. Holders of our common stock are entitled to such dividends as our board of directors (the “Board of Directors” or “Board”) may declare from

time to time out of legally available funds, subject to the preferential rights of the holders of any shares of our preferred stock that are outstanding or that we may issue in the future. Currently, we do not pay any dividends on our common stock.

Each holder of our common stock is entitled to one vote per share. In this prospectus, we provide a general description of, among other things, the rights and restrictions that apply to holders of our common stock.

Preferred Stock

We currently have authorized 1,000,000 shares of preferred stock, par value $0.01. 700,000 shares are designated as Series A Convertible Preferred Stock, of which 424,938 shares are outstanding as of August 9, 2019. Any

authorized and undesignated shares of preferred stock may be issued from time to time in one or more additional series pursuant to a resolution or resolutions providing for such issue duly adopted by our Board of Directors (authority to do so being

hereby expressly vested in the Board of Directors). The Board of Directors is further authorized, subject to limitations prescribed by law, to fix by resolution or resolutions the designations, powers, preferences and rights, and the qualifications,

limitations or restrictions thereof, of any wholly unissued series of preferred stock, including without limitation authority to fix by resolution or resolutions the dividend rights, dividend rate, conversion rights, voting rights, rights and terms of

redemption (including sinking fund provisions), redemption price or prices, and liquidation preferences of any such series, and the number of shares constituting any such series and the designation thereof, or any of the foregoing.

The rights, preferences, privileges, and restrictions granted to or imposed upon any series of preferred stock that we offer and sell under this prospectus and applicable prospectus supplements will be set forth in a

certificate of designation relating to the series. We will incorporate by reference into the registration statement of which this prospectus is a part the form of any certificate of designation that describes the terms of the series of preferred stock

we are offering before the issuance of shares of that series of preferred stock. You should read any prospectus supplement and any free writing prospectus that we may authorize to be provided to you related to the series of preferred stock being

offered, as well as the complete certificate of designation that contains the terms of the applicable series of preferred stock.

Debt Securities

We may offer general debt obligations, which may be secured or unsecured, senior or subordinated, and convertible into shares of our common stock. In this prospectus, we refer to the senior debt securities and the

subordinated debt securities together as the “debt securities.” We may issue debt securities under a note purchase agreement or under an indenture to be entered between us and a trustee and forms of the senior and subordinated indentures are included

as an exhibit to the registration statement of which this prospectus is a part. The indentures do not limit the amount of securities that may be issued under it and provides that debt securities may be issued in one or more series. The senior debt

securities will have the same rank as all of our other indebtedness that is not subordinated. The subordinated debt securities will be subordinated to our senior debt on terms set forth in the applicable prospectus supplement. In addition, the

subordinated debt securities will be effectively subordinated to creditors and preferred stockholders of our subsidiaries. Our Board of Directors will determine the terms of each series of debt securities being offered. This prospectus contains only

general terms and provisions of the debt securities. The applicable prospectus supplement will describe the particular terms of the debt securities offered thereby. You should read any prospectus supplement and any free writing prospectus that we may

authorize to be provided to you related to the series of debt securities being offered, as well as the complete note agreements and/or indentures that contain the terms of the debt securities. Forms of indentures have been filed as exhibits to the

registration statement of which this prospectus is a part, and supplemental indentures and forms of debt securities containing the terms of debt securities being offered will be incorporated by reference into the registration statement of which this

prospectus is a part from reports we file with the SEC.

Warrants

We may offer warrants for the purchase of shares of our common stock or preferred stock or of debt securities. We may issue the warrants by themselves or together with common stock, preferred stock or debt securities, and

the warrants may be attached to or separate from any offered securities. Any warrants issued under this prospectus may be evidenced by warrant certificates. Warrants may be issued under a separate warrant agreement to be entered into between us and

the investors or a warrant agent. Our Board of Directors will determine the terms of the warrants. This prospectus contains only general terms and provisions of the warrants. The applicable prospectus supplement will describe the particular terms of

the warrants being offered thereby. You should read any prospectus supplement and any free writing prospectus that we may authorize to be provided to you related to the series of warrants being offered, as well as the complete warrant agreements that

contain the terms of the warrants. Specific warrant agreements will contain additional important terms and provisions and will be incorporated by reference into the registration statement of which this prospectus is a part from reports we file with the

SEC.

Units

We may offer units consisting of our common stock or preferred stock, debt securities and/or warrants to purchase any of these securities in one or more series. We may evidence each series of units by unit certificates

that we will issue under a separate agreement. We may enter into unit agreements with a unit agent. Each unit agent will be a bank or trust company that we select. We will indicate the name and address of the unit agent in the applicable prospectus

supplement relating to a particular series of units. This prospectus contains only a summary of certain general features of the units. The applicable prospectus supplement will describe the particular features of the units being offered thereby. You

should read any prospectus supplement and any free writing prospectus that we may authorize to be provided to you related to the series of units being offered, as well as the complete unit agreements that contain the terms of the units. Specific unit

agreements will contain additional important terms and provisions and will be incorporated by reference into the registration statement of which this prospectus is a part from reports we file with the SEC.

An investment in our securities involves a high degree of risk. This prospectus contains, and the prospectus supplement applicable to each offering of our securities will contain, a discussion of the risks applicable to an

investment in our securities. Prior to making a decision about investing in our securities, you should carefully consider the specific factors discussed under the heading “Risk Factors” in this prospectus and

the applicable prospectus supplement, together with all of the other information contained or incorporated by reference in the prospectus supplement or appearing or incorporated by reference in this prospectus. You should also consider the risks,

uncertainties and assumptions discussed under Item 1A, “Risk Factors,” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2018, as amended, and any updates described in our Quarterly

Reports on Form 10-Q, all of which are incorporated herein by reference, and may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future and any prospectus supplement related to a particular

offering. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our operations. The occurrence of any of these

known or unknown risks might cause you to lose all or part of your investment in the offered securities.

This prospectus and any accompanying prospectus supplement, including the documents that we incorporate by reference, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as

amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Any statements in this prospectus and any accompanying prospectus supplement about our expectations, beliefs, plans, objectives,

assumptions or future events or performance are not historical facts and are forward-looking statements. These statements are often, but not always, made through the use of words or phrases such as “believe,” “will,” “expect,” “anticipate,” “estimate,”

“intend,” “plan,” and “would.” For example, statements concerning financial condition, possible or assumed future results of operations, growth opportunities, industry ranking, plans and objectives of management, markets for our common stock and future

management and organizational structure are all forward-looking statements. Forward-looking statements are not guarantees of performance. They involve known and unknown risks, uncertainties and assumptions that may cause actual results, levels of

activity, performance or achievements to differ materially from any results, levels of activity, performance or achievements expressed or implied by any forward-looking statement.

You should read this prospectus and any accompanying prospectus supplement and the documents that we reference herein and therein and have filed as exhibits to the registration statement, of which this prospectus is part,

completely and with the understanding that our actual future results may be materially different from what we expect. You should assume that the information appearing in this prospectus and any accompanying prospectus supplement is accurate as of the

date on the front cover of this prospectus or such prospectus supplement only. Because the risk factors referred to in this prospectus and incorporated herein by reference could cause actual results or outcomes to differ materially from those

expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no

obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for

us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any

forward-looking statements. We qualify all of the information presented in this prospectus and any accompanying prospectus supplement, and particularly our forward-looking statements, by these cautionary statements.

Except as described in any prospectus supplement and any free writing prospectus in connection with a specific offering, we currently intend to use the net proceeds from the sale of the securities offered under this

prospectus for general corporate purposes, including the development and commercialization of our products, research and development, general and administrative expenses, license or technology acquisitions, and working capital and capital expenditures.

We may also use the net proceeds to repay any debts and/or invest in or acquire complementary businesses, products, or technologies, although we have no current commitments or agreements with respect to any such investments or acquisitions as of the

date of this prospectus. We have not determined the amount of net proceeds to be used specifically for the foregoing purposes. As a result, our management will have broad discretion in the allocation of the net proceeds and investors will be relying on

the judgment of our management regarding the application of the proceeds of any sale of the securities. Pending use of the net proceeds, we intend to invest the proceeds in short-term, investment-grade, interest-bearing instruments.

Each time we offer securities under this prospectus, we will describe the intended use of the net proceeds from that offering in the applicable prospectus supplement. The actual amount of net proceeds we spend on a

particular use will depend on many factors, including, our future capital expenditures, the amount of cash required by our operations, and our future revenue growth, if any. Therefore, we will retain broad discretion in the use of the net proceeds.

General

The following description of our capital stock, together with any additional information we include in any applicable prospectus supplement or any related free writing prospectus, summarizes the material terms and

provisions of our common stock and the preferred stock that we may offer under this prospectus. While the terms we have summarized below will apply generally to any future common stock or preferred stock that we may offer, we will describe the

particular terms of any class or series of these securities in more detail in the applicable prospectus supplement. For the complete terms of our common stock and preferred stock, please refer to our amended and restated certificate of incorporation,

as amended and our bylaws that are incorporated by reference into the registration statement of which this prospectus is a part or may be incorporated by reference in this prospectus or any applicable prospectus supplement. The terms of these

securities may also be affected by Delaware General Corporation Law (the “DGCL”). The summary below and that contained in any applicable prospectus supplement or any related free writing prospectus are qualified in their entirety by reference to our

amended and restated certificate of incorporation, as amended, and our bylaws.

As of the date of this prospectus, our authorized capital stock consisted of 100,000,000 shares of common stock, $0.01 par value per share, and 1,000,000 shares of preferred stock, $0.01 par value per share. Our Board may

establish the rights and preferences of the preferred stock from time to time.

Common Stock

We are authorized to issue up to a total of 100,000,000 shares of common stock, par value $0.01 per share. Holders of our common stock are entitled to one vote for each share held on all matters submitted to a vote of our

stockholders. Holders of our common stock have no cumulative voting rights. All shares of common stock offered hereby will, when issued, be fully paid and nonassessable, including shares of common stock issued upon the exercise of common stock warrants

or subscription rights, if any.

Further, holders of our common stock have no preemptive or conversion rights or other subscription rights. Upon our liquidation, dissolution or winding- up, holders of our common stock are entitled to share in all assets

remaining after payment of all liabilities and the liquidation preferences of any of our outstanding shares of preferred stock. Subject to preferences that may be applicable to any outstanding shares of preferred stock, holders of our common stock are

entitled to receive dividends, if any, as may be declared from time to time by our Board of Directors out of our assets which are legally available. Such dividends, if any, are payable in cash, in property or in shares of capital stock.

The holders of a majority of the shares of our capital stock, represented in person or by proxy, are necessary to constitute a quorum for the transaction of business at any meeting. If a quorum is present, an action by

stockholders entitled to vote on a matter is approved if the number of votes cast in favor of the action exceeds the number of votes cast in opposition to the action, with the exception of the election of directors, which requires a plurality of the

votes cast.

Preferred Stock

Our board of directors has the authority, without further action by the stockholders, to issue up to 1,000,000 shares of preferred stock in one or more series and to fix the designations, powers, preferences, privileges,

and relative participating, optional, or special rights as well as the qualifications, limitations, or restrictions of the preferred stock, including dividend rights, conversion rights, voting rights, terms of redemption, and liquidation preferences,

any or all of which may be greater than the rights of the common stock. Our board of directors, without stockholder approval, can issue convertible preferred stock with voting, conversion, or other rights that could adversely affect the voting power

and other rights of the holders of common stock. Preferred stock could be issued quickly with terms calculated to delay or prevent a change of control or make removal of management more difficult. Additionally, the issuance of preferred stock may have

the effect of decreasing the market price of our common stock, and may adversely affect the voting and other rights of the holders of common stock. At present, we have no plans to issue any shares of preferred stock following this offering.

Anti-Takeover Effects of Certain Provisions of our Certificate of Incorporation, Bylaws and the DGCL

Pursuant to our Certificate of Incorporation, we are not subject to the provisions of Section 203 of the Delaware General Corporation Law regulating corporate takeovers through a “business combination” with

a stockholder who owns 15% or more of our outstanding voting stock (otherwise known as an “interested stockholder”).

Listing

Our common stock is listed on The Nasdaq Capital Market under the trading symbol “AMRH.”

Transfer Agent and Registrar

The Transfer Agent and Registrar for our common stock is Corporate Stock Transfer, Inc.

The following description, together with the additional information we include in any applicable prospectus supplements or free writing prospectuses, summarizes the material terms and provisions of the debt securities that

we may offer under this prospectus. We may issue debt securities, in one or more series, as either senior or subordinated debt or as senior or subordinated convertible debt. While the terms we have summarized below will apply generally to any future

debt securities we may offer under this prospectus, we will describe the particular terms of any debt securities that we may offer in more detail in the applicable prospectus supplement or free writing prospectus. The terms of any debt securities we

offer under a prospectus supplement may differ from the terms we describe below. However, no prospectus supplement shall fundamentally change the terms that are set forth in this prospectus or offer a security that is not registered and described in

this prospectus at the time of its effectiveness. As of the date of this prospectus, we have no outstanding registered debt securities. Unless the context requires otherwise, whenever we refer to the “indentures,” we also are referring to any

supplemental indentures that specify the terms of a particular series of debt securities.

We will issue any senior debt securities under the senior indenture that we will enter into with the trustee named in the senior indenture. We will issue any subordinated debt securities under the subordinated indenture

and any supplemental indentures that we will enter into with the trustee named in the subordinated indenture. We have filed forms of these documents as exhibits to the registration statement, of which this prospectus is a part, and supplemental

indentures and forms of debt securities containing the terms of the debt securities being offered will be filed as exhibits to the registration statement of which this prospectus is a part or will be incorporated by reference from reports that we file

with the SEC.

The indentures will be qualified under the Trust Indenture Act of 1939, as amended (the “Trust Indenture Act”). We use the term “trustee” to refer to either the trustee under the senior indenture or the trustee under the

subordinated indenture, as applicable.

The following summaries of material provisions of the senior debt securities, the subordinated debt securities and the indentures are subject to, and qualified in their entirety by reference to, all of the provisions of

the indenture and any supplemental indentures applicable to a particular series of debt securities. We urge you to read the applicable prospectus supplements and any related free writing prospectuses related to the debt securities that we may offer

under this prospectus, as well as the complete indentures that contains the terms of the debt securities. Except as we may otherwise indicate, the terms of the senior indenture and the subordinated indenture are identical.

General

The terms of each series of debt securities will be established by or pursuant to a resolution of our Board of Directors and set forth or determined in the manner provided in an officers’ certificate or by a supplemental

indenture. Debt securities may be issued in separate series without limitation as to aggregate principal amount. We may specify a maximum aggregate principal amount for the debt securities of any series. We will describe in the applicable prospectus

supplement the terms of the series of debt securities being offered, including:

|

•

|

the title;

|

|

•

|

the principal amount being offered, and if a series, the total amount authorized and the total amount outstanding;

|

|

•

|

any limit on the amount that may be issued;

|

|

•

|

whether or not we will issue the series of debt securities in global form, and, if so, the terms and who the depositary will be;

|

|

•

|

the maturity date;

|

|

•

|

whether and under what circumstances, if any, we will pay additional amounts on any debt securities held by a person who is not a United States person for tax purposes, and whether we can redeem the debt

securities if we have to pay such additional amounts;

|

|

•

|

the annual interest rate, which may be fixed or variable, or the method for determining the rate and the date interest will begin to accrue, the dates interest will be payable and the regular record dates for

interest payment dates or the method for determining such dates;

|

|

•

|

whether or not the debt securities will be secured or unsecured, and the terms of any secured debt;

|

|

•

|

the terms of the subordination of any series of subordinated debt;

|

|

•

|

the place where payments will be made;

|

|

•

|

restrictions on transfer, sale or other assignment, if any;

|

|

•

|

our right, if any, to defer payment of interest and the maximum length of any such deferral period;

|

|

•

|

the date, if any, after which, and the price at which, we may, at our option, redeem the series of debt securities pursuant to any optional or provisional redemption provisions and the terms of those redemption

provisions;

|

|

•

|

provisions for a sinking fund purchase or other analogous fund, if any, including the date, if any, on which, and the price at which we are obligated, pursuant thereto or otherwise, to redeem, or at the holder’s

option, to purchase, the series of debt securities and the currency or currency unit in which the debt securities are payable;

|

|

•

|

whether the indenture will restrict our ability or the ability of our subsidiaries, if any, to:

|

|

•

|

incur additional indebtedness;

|

|

•

|

issue additional securities;

|

|

•

|

create liens;

|

|

•

|

pay dividends or make distributions in respect of our capital stock or the capital stock of our subsidiaries;

|

|

•

|

redeem capital stock;

|

|

•

|

place restrictions on our subsidiaries’ ability to pay dividends, make distributions or transfer assets;

|

|

•

|

make investments or other restricted payments;

|

|

•

|

sell or otherwise dispose of assets;

|

|

•

|

enter into sale-leaseback transactions;

|

|

•

|

engage in transactions with stockholders or affiliates;

|

|

•

|

issue or sell stock of our subsidiaries; or

|

|

•

|

effect a consolidation or merger;

|

|

•

|

whether the indenture will require us to maintain any interest coverage, fixed charge, cash flow-based, asset-based or other financial ratios;

|

|

•

|

a discussion of certain material or special United States federal income tax considerations applicable to the debt securities;

|

|

•

|

information describing any book-entry features;

|

|

•

|

the applicability of the provisions in the indenture on discharge;

|

|

•

|

whether the debt securities are to be offered at a price such that they will be deemed to be offered at an “original issue discount” as defined in paragraph (a) of Section 1273 of the Internal Revenue Code of

1986, as amended;

|

|

•

|

the denominations in which we will issue the series of debt securities, if other than denominations of $1,000 and any integral multiple thereof;

|

|

•

|

the currency of payment of debt securities if other than U.S. dollars and the manner of determining the equivalent amount in U.S. dollars; and

|

|

•

|

any other specific terms, preferences, rights or limitations of, or restrictions on, the debt securities, including any additional events of default or covenants provided with respect to the debt securities,

and any terms that may be required by us or advisable under applicable laws or regulations.

|

Conversion or Exchange Rights

We will set forth in the applicable prospectus supplement the terms under which a series of debt securities may be convertible into or exchangeable for our common stock, our preferred stock or other securities

(including securities of a third party). We will include provisions as to whether conversion or exchange is mandatory, at the option of the holder or at our option. We may include provisions pursuant to which the number of shares of our common

stock, our preferred stock or other securities (including securities of a third party) that the holders of the series of debt securities receive would be subject to adjustment.

Consolidation, Merger or Sale

Unless we provide otherwise in the prospectus supplement applicable to a particular series of debt securities, the indentures will not contain any covenant that restricts our ability to merge or consolidate, or sell,

convey, transfer or otherwise dispose of all or substantially all of our assets. However, any successor to or acquirer of such assets must assume all of our obligations under the indentures or the debt securities, as appropriate. If the debt

securities are convertible into or exchangeable for our other securities or securities of other entities, the person with whom we consolidate or merge or to whom we sell all of our property must make provisions for the conversion of the debt

securities into securities that the holders of the debt securities would have received if they had converted the debt securities before the consolidation, merger or sale.

Events of Default under the Indenture

Unless we provide otherwise in the prospectus supplement applicable to a particular series of debt securities, the following are events of default under the indentures with respect to any series of debt securities that

we may issue:

|

•

|

if we fail to pay interest when due and payable and our failure continues for 90 days and the time for payment has not been extended;

|

|

•

|

if we fail to pay the principal, premium or sinking fund payment, if any, when due and payable at maturity, upon redemption or repurchase or otherwise, and the time for payment has not been extended;

|

|

•

|

if we fail to observe or perform any other covenant contained in the debt securities or the indentures, other than a covenant specifically relating to another series of debt securities, and our failure

continues for 90 days after we receive notice from the trustee or we and the trustee receive notice from the holders of at least 25% in aggregate principal amount of the outstanding debt securities of the applicable series; and

|

|

•

|

if specified events of bankruptcy, insolvency or reorganization occur.

|

We will describe in each applicable prospectus supplement any additional events of default relating to the relevant series of debt securities.

If an event of default with respect to debt securities of any series occurs and is continuing, other than an event of default specified in the last bullet point above, the trustee or the holders of at least 25% in

aggregate principal amount of the outstanding debt securities of that series, by notice to us in writing, and to the trustee if notice is given by such holders, may declare the unpaid principal, premium, if any, and accrued interest, if any, due

and payable immediately. If an event of default arises due to the occurrence of certain specified bankruptcy, insolvency or reorganization events, the unpaid principal, premium, if any, and accrued interest, if any, of each issue of debt securities

then outstanding shall be due and payable without any notice or other action on the part of the trustee or any holder.

The holders of a majority in principal amount of the outstanding debt securities of an affected series may waive any default or event of default with respect to the series and its consequences, except defaults or

events of default regarding payment of principal, premium, if any, or interest, unless we have cured the default or event of default in accordance with the indenture. Any waiver shall cure the default or event of default.

Subject to the terms of the indentures, if an event of default under an indenture shall occur and be continuing, the trustee will be under no obligation to exercise any of its rights or powers under such indenture at

the request or direction of any of the holders of the applicable series of debt securities, unless such holders have offered the trustee reasonable indemnity or security satisfactory to it against any loss, liability or expense. The holders of a

majority in principal amount of the outstanding debt securities of any series will have the right to direct the time, method and place of conducting any proceeding for any remedy available to the trustee, or exercising any trust or power conferred

on the trustee, with respect to the debt securities of that series, provided that:

|

•

|

the direction so given by the holder is not in conflict with any law or the applicable indenture; and

|

|

•

|

subject to its duties under the Trust Indenture Act, the trustee need not take any action that might involve it in personal liability or might be unduly prejudicial to the holders not involved in the

proceeding.

|

The indentures will provide that if an event of default has occurred and is continuing, the trustee will be required in the exercise of its powers to use the degree of care that a prudent person would use in the

conduct of its own affairs. The trustee, however, may refuse to follow any direction that conflicts with law or the indenture, or that the trustee determines is unduly prejudicial to the rights of any other holder of the relevant series of debt

securities, or that would involve the trustee in personal liability. Prior to taking any action under the indentures, the trustee will be entitled to indemnification against all costs, expenses and liabilities that would be incurred by taking or

not taking such action.

A holder of the debt securities of any series will have the right to institute a proceeding under the indentures or to appoint a receiver or trustee, or to seek other remedies only if:

|

•

|

the holder has given written notice to the trustee of a continuing event of default with respect to that series;

|

|

•

|

the holders of at least 25% in aggregate principal amount of the outstanding debt securities of that series have made a written request and such holders have offered reasonable indemnity to the trustee or

security satisfactory to it against any loss, liability or expense or to be incurred in compliance with instituting the proceeding as trustee; and

|

|

•

|

the trustee does not institute the proceeding, and does not receive from the holders of a majority in aggregate principal amount of the outstanding debt securities of that series other conflicting directions

within 90 days after the notice, request and offer.

|

These limitations do not apply to a suit instituted by a holder of debt securities if we default in the payment of the principal, premium, if any, or interest on, the debt securities, or other defaults that may be

specified in the applicable prospectus supplement.

We will periodically file statements with the trustee regarding our compliance with specified covenants in the indentures.

The indentures will provide that if a default occurs and is continuing and is actually known to a responsible officer of the trustee, the trustee must mail to each holder notice of the default within the earlier of 90

days after it occurs and 30 days after it is known by a responsible officer of the trustee or written notice of it is received by the trustee, unless such default has been cured or waived. Except in the case of a default in the payment of principal

or premium of, or interest on, any debt security or certain other defaults specified in an indenture, the trustee shall be protected in withholding such notice if and so long as the Board of Directors, the executive committee or a trust committee

of directors, or responsible officers of the trustee, in good faith determine that withholding notice is in the best interests of holders of the relevant series of debt securities.

Modification of Indenture; Waiver