UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM _____________ TO _____________

Commission File Number 001-11476

———————

VERTEX ENERGY, INC.

(Exact name of registrant as specified in its charter)

———————

NEVADA | 94-3439569 |

(State or other jurisdiction of | (I.R.S. Employer Identification No.) |

incorporation or organization) | |

1331 GEMINI STREET, SUITE 250 HOUSTON, TEXAS | 77058 |

(Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: 866-660-8156

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbols(s) | Name of each exchange on which registered |

Common Stock, $0.001 Par Value Per Share | VTNR | The NASDAQ Stock Market LLC (Nasdaq Capital Market) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer o |

Non-accelerated filer x | Smaller reporting company x |

Emerging growth ¨ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.

Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $48,536,718.

State the number of shares of the issuer’s common stock outstanding, as of the latest practicable date: 45,554,841 shares of common stock issued and outstanding as of March 3, 2020.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement relating to its 2020 annual meeting of shareholders (the “2020 Proxy Statement”) are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. The 2020 Proxy Statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2019

TABLE OF CONTENTS

Part I | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Part II | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Part III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Part IV | ||

Item 15. | ||

Item 16. | ||

PART I

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This Report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by the following words: “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. Forward-looking statements are not a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity, performance or achievements to be materially different from the information expressed or implied by the forward-looking statements in this Report. These factors include:

• | risks associated with our outstanding credit facilities, including amounts owed, restrictive covenants, security interests thereon and our ability to repay such facilities and amounts due thereon when due; |

• | risks associated with our outstanding preferred stock, including redemption obligations in connection therewith, restrictive covenants and our ability to redeem such securities when required pursuant to the terms of such securities and applicable law; |

• | the level of competition in our industry and our ability to compete; |

• | our ability to respond to changes in our industry; |

• | the loss of key personnel or failure to attract, integrate and retain additional personnel; |

• | our ability to protect our intellectual property and not infringe on others’ intellectual property; |

• | our ability to scale our business; |

• | our ability to maintain supplier relationships and obtain adequate supplies of feedstocks; |

• | our ability to obtain and retain customers; |

• | our ability to produce our products at competitive rates; |

• | our ability to execute our business strategy in a very competitive environment; |

• | trends in, and the market for, the price of oil and gas and alternative energy sources; |

• | our ability to maintain our relationship with KMTEX; |

• | the impact of competitive services and products; |

• | our ability to integrate acquisitions; |

• | our ability to complete future acquisitions; |

• | our ability to maintain insurance; |

• | potential future litigation, judgments and settlements; |

• | rules and regulations making our operations more costly or restrictive, including IMO 2020 (defined below); |

• | changes in environmental and other laws and regulations and risks associated with such laws and regulations; |

• | economic downturns both in the United States and globally; |

• | risk of increased regulation of our operations and products; |

• | negative publicity and public opposition to our operations; |

• | disruptions in the infrastructure that we and our partners rely on; |

• | an inability to identify attractive acquisition opportunities and successfully negotiate acquisition terms; |

• | our ability to effectively integrate acquired assets, companies, employees or businesses; |

• | liabilities associated with acquired companies, assets or businesses; |

• | interruptions at our facilities; |

• | unexpected changes in our anticipated capital expenditures resulting from unforeseen required maintenance, repairs, or upgrades; |

• | our ability to acquire and construct new facilities; |

• | certain events of default which have occurred under our debt facilities and previously been waived; |

• | prohibitions on borrowing and other covenants of our debt facilities; |

• | our ability to effectively manage our growth; |

• | repayment of and covenants in our debt facilities; |

• | the lack of capital available on acceptable terms to finance our continued growth; and |

• | other risk factors included under “Risk Factors” in this Report. |

You should read the matters described in “Risk Factors” and the other cautionary statements made in this Report as being applicable to all related forward-looking statements wherever they appear in this Report. We cannot assure you that the forward-looking statements in this Report will prove to be accurate and therefore prospective investors are encouraged not to place undue reliance on forward-looking statements. Other than as required by law, we undertake no obligation to update or revise these forward-looking statements, even though our situation may change in the future.

Please see the “Glossary of Selected Terms” incorporated by reference as Exhibit 99.1 hereto, for a list of abbreviations and definitions used throughout this report.

In this Annual Report on Form 10-K, we may rely on and refer to information regarding the refining, re-refining, used oil and oil and gas industries in general from market research reports, analyst reports and other publicly available information. Although we believe that this information is reliable, we cannot guarantee the accuracy and completeness of this information, and we have not independently verified any of it.

Unless the context requires otherwise, references to the "Company," "we," "us," "our," "Vertex," "Vertex Energy" and "Vertex Energy, Inc." refer specifically to Vertex Energy, Inc. and its consolidated subsidiaries.

In addition, unless the context otherwise requires and for the purposes of this report only:

“Base Oil” means the lubrication grade oils initially produced from refining crude oil (mineral base oil) or through chemical synthesis (synthetic base oil). In general, only 1% to 2% of a barrel of crude oil is suitable for refining into base oil. The majority of the barrel is used to produce gasoline and other hydrocarbons;

“Cutterstock” means fuel oil used as a blending agent added to other fuels. For example, to lower viscosity;

“Crack” means breaking apart crude oil into its component products, including gases like propane, heating fuel, gasoline, light distillates like jet fuel, intermediate distillates like diesel fuel and heavy distillates like grease;

"Exchange Act" refers to the Securities Exchange Act of 1934, as amended;

"Feedstock” means a product or a combination of products derived from crude oil and destined for further processing in the refining or re-refining industries. It is transformed into one or more components and/or finished products;

“Gasoline Blendstock” means naphthas and various distillate products used for blending or compounding into finished motor gasoline. These components can include reformulated gasoline blendstock for oxygenate blending (RBOB) but exclude oxygenates (alcohols and ethers), butane, and pentanes (an organic compound with properties similar to a butane);

“Hydrotreating” means the process of reacting oil fractions with hydrogen in the presence of a catalyst to produce high-value clean products;

“MDO” means marine diesel oil, which is a type of fuel oil and is a blend of gasoil and heavy fuel oil, with less gasoil than intermediate fuel oil used in the maritime field;

“Naphthas” means any of various volatile, highly flammable liquid hydrocarbon mixtures used chiefly as solvents and diluents and as raw materials for conversion to gasoline;

“Pygas” means pyrolysis gasoline, an aromatics-rich gasoline stream produced in sizeable quantities by an ethylene plant. These plants are designed to crack a number of feedstocks, including ethane, propane, naphtha, and gasoil. Pygas can serve as a high-octane blendstock for motor gasoline or as a feedstock for an aromatics extraction unit;

"SEC" or the "Commission" refers to the United States Securities and Exchange Commission;

"Securities Act" refers to the Securities Act of 1933, as amended; and

"VGO" refers to Vacuum Gas Oil (also known as cat feed) - a feedstock for a fluid catalytic cracker typically found in a crude oil refinery and used to make gasoline No. 2 oil and other byproducts.

Where You Can Find Other Information

We file annual, quarterly, and current reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”). Our SEC filings are available to the public over the Internet at the SEC’s website at www.sec.gov and are available for download, free of charge, soon after such reports are filed with or furnished to the SEC, on the “Investor Relations,” “SEC Filings” page of our website at www.vertexenergy.com. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC like us at http://www.sec.gov. Our internet address is www.vertexnergy.com. Information on our website is not part of this Report, and we do not desire to incorporate by reference such information herein. Copies of documents filed by us with the SEC are also available from us without charge, upon oral or written request to our Secretary, who can be contacted at the address and telephone number set forth on the cover page of this Report.

Item 1. Business

Corporate History:

We were formed as a Nevada corporation on May 14, 2008. Pursuant to an Amended and Restated Agreement and Plan of Merger dated May 19, 2008, by and between Vertex Holdings, L.P. (formerly Vertex Energy, L.P.), a Texas limited partnership (“Holdings”), us, World Waste Technologies, Inc., a California corporation (“WWT” or “World Waste”), Vertex Merger Sub, LLC, a California limited liability company and our wholly-owned subsidiary (“Merger Subsidiary”), and Benjamin P. Cowart, our Chief Executive Officer, as agent for our shareholders (as amended from time to time, the “Merger Agreement”). Effective on April 16, 2009, World Waste merged with and into Merger Subsidiary, with Merger Subsidiary continuing as the surviving corporation and becoming our wholly-owned subsidiary (the “Merger”). In connection with the Merger, (i) each outstanding share of World Waste common stock was cancelled and exchanged for 0.10 shares of our common stock; (ii) each outstanding share of World Waste Series A preferred stock was cancelled and exchanged for 0.4062 shares of our Series A preferred stock; and (iii) each outstanding share of World Waste Series B preferred stock was cancelled and exchanged for 11.651 shares of our Series A preferred stock.

Additionally, as a result of the Merger, as the successor entity of World Waste, we assumed World Waste’s filing obligations with the Securities and Exchange Commission and our common stock began trading on the Over-The-Counter Bulletin Board under the symbol “VTNR.OB” effective May 4, 2009. Subsequently, effective February 13, 2013, our common stock began trading on the NASDAQ Capital Market under the symbol “VTNR”, where it has continued to trade.

Prior Material Acquisitions and Transactions

Effective as of August 31, 2012, we acquired 100% of the outstanding equity interests of Vertex Acquisition Sub, LLC (“Acquisition Sub”), a special purpose entity consisting of substantially all of the assets of Holdings and real-estate properties of B & S Cowart Family L.P. (“B&S LP” and the “Acquisition”). Prior to closing the Acquisition, Holdings contributed to Acquisition Sub substantially all of its assets and liabilities relating to the business of transporting, storing, processing and re-refining petroleum products, crudes and used lubricants, including all of the outstanding equity interests in Holdings’ wholly-owned operating subsidiaries, Cedar Marine Terminals, L.P. (“CMT” or "Cedar Marine Terminals"), which operates a 19-acre bulk liquid storage facility and terminal on the Houston Ship Channel, which serves as a truck-in, barge-out facility and provides throughput terminal operations and which terminal is also the site of our proprietary, patented, Thermal Chemical Extraction Process ("TCEP") (described below); Crossroad Carriers, L.P. (“Crossroad”) is a common carrier that provides transportation and logistical services for liquid petroleum products, as well as other hazardous materials and product streams; Vertex Recovery, L.P. (“Vertex Recovery”), is a generator solutions company for the recycling and collection of used oil and oil-related residual materials from large regional and national customers throughout the U.S. and Canada, which it facilitates through a network of independent recyclers and franchise collectors; and H&H Oil, L.P. (“H&H Oil”), which collects and recycles used oil and residual materials from customers based in Austin, Baytown, Dallas, San Antonio and Corpus Christi, Texas and B&S LP contributed real estate associated with the operations of H&H Oil.

Benjamin P. Cowart, our Chief Executive Officer, President, Chairman and largest shareholder directly or indirectly owned a 77% interest in Holdings and a 100% interest in B&S LP at the time of the acquisition. Additionally, Chris Carlson, our Chief Financial Officer, owned a 10% interest in Holdings at the time of the acquisition.

In October, 2013, January 2014 and September 2014, we completed various transactions whereby we acquired 100% of E-Source Holdings, LLC (“E-Source”), a company that leased and operated a facility located in Houston, Texas, and provides dismantling, demolition, decommission and marine salvage services at industrial facilities throughout the Gulf Coast. E-Source also owns and operates a fleet of trucks and other vehicles used for shipping and handling equipment and scrap materials. E-Source falls under our Recovery segment. As of December 31, 2019 and 2018, E-Source is no longer in operations and we no longer undertake dismantling, demolition, decommission and marine salvage services.

In May, 2014, we acquired certain of the assets of Omega Refining, LLC (“Omega Refining”), Bango Refining NV, LLC (“Bango Refining”) and Omega Holdings Company LLC (“Omega Holdings” and collectively with Omega Refining and Bango Refining, “Omega” or the “sellers”) related to (1) the operation of oil re-refineries and, in connection therewith, purchasing used lubricating oils and re-refining such oils into processed oils and other products for the distribution, supply and sale to end-customers and (2) the provision of related products and support services. The assets included Omega’s Marrero, Louisiana plant which produces vacuum gas oil (VGO) and a Bango, Nevada plant which produces base lubricating oils. We acquired the assets in the name of our indirect wholly-owned subsidiary, Vertex Refining LA, LLC. The assets and operations acquired from Omega fall under our Black Oil segment. Bango Refining operations were sold in January 2016.

1

In December, 2014, we acquired substantially all of the assets of Warren Ohio Holdings Co., LLC, f/k/a Heartland Group Holdings, LLC (“Heartland”) related to and used in an oil re-refinery and, in connection with the collecting, aggregating and purchasing of used lubricating oils and the re-refining of such oils into processed oils and other products for the distribution, supply and sale to end-customers, including raw materials, finished products and work-in-process, equipment and other fixed assets, customer lists and marketing information, the name ‘Heartland’ and other related trade names, Heartland’s real property relating to its used oil refining facility located in Columbus, Ohio, the ownership of 65% of which was transferred to Tensile in connection with the Heartland SPV (discussed below under “Recent Material Transactions”), effective January 1, 2020, used oil storage and transfer facilities located in Columbus, Zanesville and Norwalk, Ohio, and leases related to storage and transfer facilities located in Zanesville, Ohio, Mount Sterling, Kentucky, and Ravenswood, West Virginia (collectively, the “Heartland Assets”). The Heartland Assets were acquired by our indirect wholly-owned subsidiary, Vertex Refining OH, LLC ("Vertex OH"). The assets and operations acquired from Heartland fall under our Black Oil segment.

Recent Material Transactions:

Myrtle Grove Share Purchase and Subscription Agreement

On July 26, 2019 (the “MG Closing Date”), Vertex Refining Myrtle Grove LLC, a Delaware limited liability company, which entity was formed as a special purpose vehicle in connection with the transactions, described in greater detail below (“MG SPV”), Vertex Operating, Tensile-Myrtle Grove Acquisition Corporation (“Tensile-MG”), an affiliate of Tensile Capital Partners Master Fund LP, an investment fund based in San Francisco, California (“Tensile”), and solely for the purposes of the MG Guaranty (defined below), the Company, entered into and closed the transactions contemplated by a Share Purchase and Subscription Agreement (the “MG Share Purchase”).

Prior to entering into the MG Share Purchase, Vertex Operating’s wholly-owned subsidiary, Vertex Refining LA, LLC, (“Vertex LA”), transferred all of the operating assets owned by it and related to the planned development of the MG Refinery (as defined below), which the parties agreed had a fair market value of $22,666,667, to MG SPV in consideration for 21,667 Class A Units and 1,000 Class B Units of MG SPV, which units were distributed to Vertex Operating. At the closing of the MG Share Purchase (on the MG Closing Date), Vertex Operating sold 1,000 of the Class B Units to Tensile-MG in consideration of the payment to it of $1 million by Tensile-MG, and Tensile-MG purchased an additional 3,000 Class B Units directly from MG SPV for $3 million (less Tensile’s fees and expenses incurred in connection with the transaction, not to exceed $850,000).

As a result of the transaction, Tensile, through Tensile-MG, acquired an approximate 15.58% ownership interest in MG SPV, which in turn now owns the Company’s former Belle Chasse, Louisiana, re-refining complex (the “MG Refinery”).

We were required to use all proceeds we received from the sale of the Class B Units to pay down an equal amount of indebtedness then owing under our EBC Credit Agreement and Revolving Credit Agreement, defined and described below under “Part II” - “Item 8. Financial Statements and Supplementary Data” - “Note 9. Line of Credit and Long-Term Debt” (collectively, the “Credit Agreements”), which amount we have paid to date.

MG SPV Limited Liability Company Agreement

As discussed above, after the consummation of the transactions set forth in the MG Share Purchase, MG SPV is owned 84.42% by Vertex Operating and 15.58% by Tensile-MG. The Class B Units held by Tensile-MG are convertible into Class A Units at the option of Tensile-MG, as provided in the Limited Liability Company Agreement of MG SPV dated July 25, 2019 (the “MG Company Agreement”), based on a conversion price (initially one-for-one) which may be reduced from time to time if new Units of MG SPV are issued, and automatically convert into Series A Units upon certain events described in the MG Company Agreement.

Additionally, the Class B Unit holders may force MG SPV to redeem the outstanding Class B Units at any time on or after the earlier of (a) July 26, 2024 and (ii) the occurrence of an MG Triggering Event (defined below)(an “MG Redemption”). The cash purchase price for such redeemed Class B Units is the greater of (y) the fair market value of such units (without discount for illiquidity, minority status or otherwise) as determined by a qualified third party agreed to in writing by a majority of the holders seeking an MG Redemption and Vertex Operating (provided that Vertex Operating still owns Class A Units on such date) and (z) the original per-unit price for such Class B Units plus fifty percent (50%) of the aggregate capital invested by the Class B Unit holders through such MG Redemption date. “MG Triggering Events” mean (a) any dissolution, winding up or liquidation of the Company, Vertex Operating or any significant subsidiary of Vertex Operating, (b) any sale, lease, license or disposition of any material assets of the Company, Vertex Operating or any significant subsidiary of Vertex Operating, (c) any transaction or series of related transactions (whether by merger, exchange, contribution, recapitalization, consolidation, reorganization, combination

2

or otherwise) involving the Company, Vertex Operating or any significant subsidiary of Vertex Operating, the result of which is that the holders of the voting securities of the relevant entity as of the MG Closing Date are no longer the beneficial owners, in the aggregate, after giving effect to such transaction or series of transactions, directly or indirectly, of more than fifty percent (50%) of the voting power of the outstanding voting securities of the entity, subject to certain other requirements set forth in the MG Company Agreement, (d) the failure of Vertex Operating to operate MG SPV in good faith with appropriate resources, or (e) the material failure of the Company and its affiliates to comply with the terms of the contribution agreement, whereby the Company contributed assets and operations to MG SPV.

Distributions of available cash of MG SPV pursuant to the MG Company Agreement (including pursuant to liquidations of MG SPV), subject to certain exemptions and exemptions set forth therein, are to be made (a) first, to the holders of the Class B Units, in an amount equal to the greater of (A) the aggregate unpaid “Class B Yield” (equal to an annual return of 22.5% per annum) and (B) an amount equal to fifty percent (50%) of the aggregate capital invested by the Class B Unit holders (initially Tensile-MG)(such aggregate capital invested by the Class B Unit holders, the “MG Invested Capital”, which totals $3 million as of the Closing Date), less prior distributions (the greater amount of (A) and (B), the “Class B Priority Distributions”); (b) second, the Class B Unitholders, together as a separate and distinct class, are entitled to receive an amount equal to the aggregate MG Invested Capital; (c) third, the Class A Unitholders (other than Class A Unitholders which received Class A Units upon conversion of Class B Units), together as a separate and distinct class, are entitled to receive all or a portion of any distribution equal to the sum of all distributions made under sections (a) and (b) above; and (d) fourth, to the holders of Units who are eligible to receive such distributions in proportion to the number of Units held by such holders

On or after July 26, 2022, the Company or any of its subsidiaries, may elect to purchase all of the outstanding units of MG SPV held by Tensile-MG (or any assignee of Tensile-MG) as discussed in the MG Company Agreement.

Right of First Offer Letter Agreement

On the MG Closing Date, Tensile-MG, Vertex Operating and the Company entered into a right of first offer letter agreement (the “ROFO Agreement”), whereby we agreed that if we, at any time, propose to issue, sell, transfer, assign, pledge, encumber or otherwise directly or indirectly dispose of any equity or debt securities of (x) MG SPV and/or (y) Cedar Marine Terminals, L.P., or any other entity formed or designated to operate the Cedar Marine Terminal in Baytown, Texas, we would provide Tensile-MG written notice of such, and Tensile-MG would have thirty days to purchase the amount of securities offered on terms at least as favorable as those in the original proposal. The rights under the ROFO Agreement continue to apply until such time, if ever, as Tensile-MG has acquired $50 million of securities pursuant to the terms thereof.

Subscription Agreement; Common Stock Purchase Warrant and Registration Rights and Lock-Up Agreement

On the MG Closing Date, and as a required term of the closing of the MG Share Purchase, Tensile entered into a Subscription Agreement dated July 25, 2019, in favor of the Company (the “Subscription Agreement”), pursuant to which, on the MG Closing Date, it subscribed to purchase (a) 1,500,000 shares of our common stock (the “Tensile Shares”), and (b) warrants to purchase 1,500,000 shares of our common stock with an exercise price of $2.25 per share and a term of ten years, which were documented by a Common Stock Purchase Warrant (the “Warrants” and the shares of common stock issuable upon exercise thereof, the “Warrant Shares”) in consideration for $2.22 million or $1.48 per share and warrant.

Letter Agreement and Heartland Option

On the MG Closing Date, Tensile-Heartland Acquisition Corporation (“Tensile-Heartland”), an affiliate of Tensile, Vertex Operating and the Company entered into a letter agreement, whereby the Company and Vertex Operating provided Tensile an option (the “Heartland Option”), exercisable at any time prior to June 30, 2020, to the extent certain pilot studies to be conducted by MG SPV meet the standards of Tensile-Heartland, in its sole discretion, or the outcome of such studies are waived by Tensile-Heartland, to execute and close the transactions contemplated by a Share Purchase and Subscription Agreement between the parties and HPRM LLC, which are described below. Tensile-Heartland subsequently exercised the Heartland Option as discussed below.

Heads of Agreement

On January 10, 2020, Vertex Operating entered into a Heads of Agreement (the “Heads of Agreement”) with Bunker One (USA) Inc., which is owned by Bunker Holding, a Danish holding company (“Bunker One”). Pursuant to the Heads of Agreement, the Company and Bunker One agreed to form a joint decision-making body (the “JDMB”) to focus on strategic matters related to the overall cooperation of the parties and to establish rules and procedures for identifying and undertaking joint projects. The JDMB has six members, three each from the Company and Bunker One.

3

The goal of the parties, pursuant to the Heads of Agreement and the JDMB, is to jointly develop and acquire direct or indirect equity or equity-related interests in projects and companies in the marine fuel sector in North America, with Bunker One focusing on opportunities related to the supply and optimization of marine fuels or components and the Company focusing on business opportunities relating to refining of bunker fuels.

For each project that the parties agree to pursue, the parties will enter into a form of Co-Operation and Joint Supply and Marketing Agreement (each a “Co-Operation JSMA”). The principal objective of each such Co-Operation JSMA will be the expansion of the business of each party by cooperating in the sourcing, storing, transportation, marketing and selling of products, where: (a) Vertex is primarily responsible for the sourcing and storing of the product (bunker fuels); (b) Bunker One is primarily responsible for the transporting, blending, marketing, selling and delivering of the product (bunker fuels); (c) Bunker One is responsible for the risk management/exposure (e.g. hedging) of the bunker fuels; and (d) Bunker One is the exclusive seller of the product to third parties.

The Heads of Agreement also allows for certain projects outside of the scope of Co-Operation JSMA’s which will be subject to separate Authorization for Expenditures agreed to by the JDMB.

The Heads of Agreement has a term of ten years, beginning effective on January 1, 2020, and continuing through April 30, 2029, provided that the agreement extends for additional five year periods thereafter unless either party provides the other at least 120 days’ notice of non-renewal before any such automatic renewal date. The agreement can also be terminated by either party upon an event of default (as described in the Heads of Agreement), subject to required thirty days’ notice of such event of default and the opportunity for the breaching party to cure. The Heads of Agreement contains standard and customary events of default, including failure to pay amounts when due, failure to comply with the terms of the agreement, insolvency and the occurrence of a Change of Control, each subject to the terms of the agreement. A Change of Control is defined in the agreement as any party (a) engaged in the bunkering business (i.e., the supplying of fuel used by ships), as to Bunker One, or (b) engaged in the refining business, as to Vertex, obtaining control of such applicable party by way of any transaction or series of transactions.

The Heads of Agreement also contains a right of first refusal provision, whereby if at any time Bunker One, or any of its U.S. affiliates (each a “Bunker One Party”), proposes to issue, sell, transfer, assign, or otherwise directly or indirectly dispose of (x) all or any substantial portion of its bunkering business in the United States, or, if mutually agreed, outside of the United States and/or (y) the controlling equity interests in any corporation, limited liability company or partnership that owns all or any substantial portion of the bunkering business, held by such Bunker One Party for value, the Bunker One Party is required to provide the Company written notice of such event and the Company is provided the right to make an offer to purchase such entity/assets, from such Bunker One Party, subject to the terms of the Heads of Agreement.

Additionally, under the Heads of Agreement, at any time Bunker One determines to extend its existing bunkering business to any port in North America that is not served by Bunker One as of August 1, 2019, Bunker One is required to extend to the Company the right to elect to expand the terms and conditions of the Heads of Agreement to include any such new port.

Finally, under the Heads of Agreement, if at any time the Company acquires a supply of material that the Company intends to sell in Texas, Louisiana or Alabama and that is suitable for use in Bunker One’s bunkering business in such area from a third party, or produces additional material for sale in such area, the Company is required to provide Bunker One the right to purchase such supply/material pursuant to the terms and conditions of the Heads of Agreement.

JSMA

Also on January 10, 2020, Vertex Operating entered into a Joint Supply and Marketing Agreement (the “JSMA”), with Bunker One. The JSMA is effective as of May 1, 2020, and provides for Bunker One to acquire 100% of the production from the Company’s Marrero, Louisiana re-refining facility (which produces approximately 100,000 barrels per month of a bunker suitable fuel for offshore use and use as a marine vessel’s propulsion system (“Bunker Fuel”)) at the arithmetic mean of Platts #2 USGC Pipe and Platt’s ULSD USGC Waterborne on agreed pricing days less an agreed upon discount, adjusted every three months.

Pursuant to the JSMA, the parties agreed to the percentages pursuant to which net profit will be split between the parties, relating to the sale of such Bunker Fuel by Bunker One, which is to be sold in Texas, Louisiana, Alabama and areas immediately adjacent thereto if mutually agreed (collectively, the “Area”).

Pursuant to the JSMA, (i) the Company is primarily responsible for the sourcing and storing of the feedstock which is used to produce the Bunker Fuel, (ii) Bunker One is primarily responsible for the transporting, blending, marketing, selling and delivering of the Bunker Fuel, (iii) Bunker One is responsible for the risk management/exposure (e.g. hedging) of the Bunker Fuel, and (iv) Bunker One is the exclusive seller of the Bunker Fuel to third parties.

4

The Bunker Fuel is meant for blending by Bunker One into other products for the purpose of being transformed into bunker suitable fuel for a marine vessel’s propulsion system and/or marketable wholesale products in various other markets for sale by Bunker One to customers in the Area.

Pursuant to the JSMA, the Company agreed that during the term of the agreement, neither the Company, nor any affiliate of the Company, would sell any Bunker Fuel to any customers for their use as bunker fuel other than pursuant to the terms of the Agreement.

Payment for the Bunker Fuel is required to be made by Bunker One within three days after invoiced by the Company, and at the end of each three months during the term of the agreement, Bunker One is required to provide a detailed accounting to the Company setting forth the consideration due to the Company and the calculation of such amounts. The agreement also provides for a yearly accounting by Bunker One and true up of amounts paid and due throughout such year.

The JSMA has a term from May 1, 2020 to April 30, 2029, provided that the term is automatically renewable for additional five year periods thereafter unless either party provides the other at least 120 days prior written notice of non-renewal, prior to any automatic renewal date. The agreement can also be terminated by either party upon an event of default (as described in the JSMA), subject to required ten days’ notice of such event of default and the opportunity for the breaching party to cure. The Heads of Agreement contains standard and customary events of default, including failure to pay amounts when due, failure to comply with the terms of the agreement and insolvency, each subject to the terms of the agreement. In the event that the individual or group of individuals who ultimately own or control each party or such party’s parent as of May 1, 2020 no longer has the right or ability to control or cause the direction of the management and policies of such entity, the agreement can be terminated immediately by the party not subject to such change of control.

The JSMA prohibits either party from promoting activities which compete against the other party’s business in the Area for the term of the agreement and for two years thereafter.

The JSMA also provides, during the term of such agreement, for Bunker One to be allowed to have a representative attend meetings of the Board of Directors of the Company and the committees of the Board (in a non-voting observer capacity)(the “Board Observer Right”). The Board Observer Right was provided partially in connection with Bunker One’s agreement to acquire up to $5 million of the Company’s securities which it did through the purchase of shares of Series B1 Preferred Stock (which shares have since been converted into common stock) and common stock, in privately negotiated purchases, with holders of the Company’s Series B1 Preferred Stock.

Heartland Share Purchase and Subscription Agreement

On January 17, 2020 (the “Heartland Closing Date”), the parties entered into a Share Purchase and Subscription Agreement (the “Heartland Share Purchase”) by and among HPRM LLC, a Delaware limited liability company, which entity was formed as a special purpose vehicle in connection with the transactions, described in greater detail below (“Heartland SPV”), Vertex Operating, Tensile-Heartland, and solely for the purposes of the Heartland Guaranty (defined below), the Company.

Prior to entering into the Heartland Share Purchase, the Company transferred 100% of the ownership of Vertex Refining OH, LLC, its indirect wholly-owned subsidiary (“Vertex OH”) to Heartland SPV in consideration for 13,500 Class A Units, 13,500 Class A-1 Preferred Units and 11,300 Class B Units of Heartland SPV and immediately thereafter contributed 248 Class B Units to Vertex Splitter, as a contribution to capital.

Vertex OH owns the Company’s Columbus, Ohio, Heartland facility, which produces a base oil product that is sold to lubricant packagers and distributors.

Pursuant to the Heartland Share Purchase, Vertex Operating sold Tensile-Heartland the 13,500 Class A Units and 13,500 Class A-1 Preferred Units of Heartland SPV in consideration for $13.5 million. Also, on the Heartland Closing Date, Tensile-Heartland purchased 7,500 Class A Units and 7,500 Class A-1 Units in consideration for $7.5 million (less the expenses of Tensile-Heartland in connection with the transaction) directly from Heartland SPV.

We agreed to use $7 million of the amount received in connection with the sale of the Class A-1 Preferred Units to paydown amounts owed under the Credit Agreements, and to maintain at least $350,000 of cash on our balance sheet for working capital (less amounts required to be applied to Tensile-Heartland’s expenses associated with the transaction).

5

The approximate $7.5 million purchase amount and future free cash flows from the operation of Heartland SPV are planned to be available for investments at the Heartland facility to increase self-collections, maximize the throughput of the refinery, enhance the quality of the output and complete other projects.

Concurrently with the closing of the transactions described above, and pursuant to the terms of the Heartland Share Purchase, the Company, through Vertex Operating, purchased 1,000 newly issued Class A Units from MG SPV at a cost of $1,000 per unit ($1 million in aggregate).

The Heartland Share Purchase provides Tensile-Heartland an option, exercisable at its election, any time after the Heartland Closing Date, subject to the terms of the Heartland Share Purchase, to purchase up to an additional 7,000 Class A-2 Preferred Units at a cost of $1,000 per Class A-2 Preferred Unit from Heartland SPV.

The Heartland Share Purchase also provided for a guarantee by the Company to Tensile-Heartland of the payment obligations of Vertex Operating as set forth in the Heartland Share Purchase (the “Heartland Guaranty”).

The Heartland Share Purchase had an effective date of January 1, 2020.

Administrative Services Agreement

Pursuant to an Administrative Services Agreement, entered into on the Heartland Closing Date, Heartland SPV engaged Vertex Operating and the Company to provide administrative/management services and day-to-day operational management services of Heartland SPV in connection with the collection, storage, transportation, transfer, refining, re-refining, distilling, aggregating, processing, blending, sale of used motor oil, used lubricants, wholesale lubricants, recycled fuel oil, or related products and services such as vacuum gas oil, base oil, and asphalt flux, in consideration for a monthly fee. The Administrative Services Agreement has a term continuing until the earlier of (a) the date terminated with the mutual consent of the parties; (b) a liquidation of Heartland SPV; (c) a Heartland Redemption (defined below); (d) the determination of Heartland SPV to terminate following a change of control (as described in the Administrative Services Agreement) of Heartland SPV or the Company; or (e) written notice from the non-breaching party upon the occurrence of a breach which is not cured within the cure period set forth in the Administrative Services Agreement.

The Administrative Services Agreement also provides that in the event that Heartland SPV is unable to procure used motor-oil (“UMO”) through its ordinary course operations, subject to certain conditions, Vertex Operating and the Company are required to use their best efforts to sell (or cause an affiliate to sell) UMO to Heartland SPV, at the lesser of the (i) then-current market price for UMO sold in the same geography area and (ii) price paid by such entity for such UMO. Finally, the Administrative Services Agreement provides that in the event that the Heartland SPV is unable to procure vacuum gas oil (“VGO”) feedstock through its ordinary course operations, subject to certain conditions, Vertex Operating and the Company are required to use their best efforts to sell (or cause an affiliate to sell) VGO to Heartland SPV, at the lesser of the (i) then-current market price for VGO sold in the same geographic area and (ii) price paid for such VGO.

Advisory Agreement

On the Heartland Closing Date, Heartland SPV entered into an Advisory Agreement with Tensile, pursuant to which Tensile agreed to provide advisory and consulting services to Heartland SPV and Heartland SPV agreed to reimburse and indemnify Tensile and its representatives, in connection therewith.

Heartland Limited Liability Company Agreement

The Heartland SPV is currently owned 35% by Vertex Operating and 65% by Tensile-Heartland. The Class A Units held by Tensile-Heartland are convertible into Class B Units as provided in the Limited Liability Company Agreement of Heartland SPV (the “Heartland Company Agreement”), based on a conversion price (initially one-for-one) which may be reduced from time to time if new Units of Heartland SPV are issued and will automatically convert into Series A Units upon certain events described in the Heartland Company Agreement.

6

The Class A-1 and A-2 Preferred Units (“Class A Preferred Units”), which are 100% owned by Tensile-Heartland, accrue a 22.5% per annum preferred return subject to terms of the Heartland Company Agreement (the “Class A Yield”).

Additionally, the Class A Unit holders (common and preferred) may force Heartland SPV to redeem the outstanding Class A Units at any time on or after the earlier of (a) January 17, 2025 and (ii) the occurrence of a Heartland Triggering Event (defined below)(a “Heartland Redemption”). The cash purchase price for such redeemed Class A Unit will be the greater of (y) the fair market value of such units (without discount for illiquidity, minority status or otherwise) as determined by a qualified third party agreed to in writing by a majority of the holders seeking Heartland Redemption and Vertex Operating (provided that Vertex Operating still owns Class B Units on such date) and (z) the original per-unit price for such Class A Units plus fifty percent (50%) of the aggregate capital invested by the Class A Unit holders through such Heartland Redemption date. “Heartland Triggering Events” include (a) any termination of the Administrative Services Agreement pursuant to its terms and/or any material breach by us of the environmental remediation and indemnity agreement, (b) any dissolution, winding up or liquidation of the Company, Vertex Operating or any significant subsidiary of Vertex Operating, (c) any sale, lease, license or disposition of any material assets of the Company, Vertex Operating or any significant subsidiary of Vertex Operating, or (d) any transaction or series of related transactions (whether by merger, exchange, contribution, recapitalization, consolidation, reorganization, combination or otherwise) involving the Company, Vertex Operating or any significant subsidiary of Vertex Operating, the result of which is that the holders of the voting securities of the relevant entity as of the Heartland Closing Date are no longer the beneficial owners, in the aggregate, after giving effect to such transaction or series of transactions, directly or indirectly, of more than fifty percent (50%) of the voting power of the outstanding voting securities of the entity, subject to certain other requirements set forth in the Heartland Company Agreement.

In the event that Heartland SPV fails to redeem such Class A Units within 180 days after a redemption is triggered, the Class A Yield is increased to 25% until such time as such redemption is completed (with such increase being effective back to the original date of a notice of redemption). In addition, in such event, the Class A Unit holders may cause Heartland SPV to initiate a process intended to result in a sale of Heartland SPV.

Distributions of available cash of Heartland SPV pursuant to the Heartland Company Agreement (including pursuant to liquidations of Heartland SPV), subject to certain exceptions set forth therein, are to be made (a) first, to the holders of the Class A Preferred Units, in amount equal to the greater of (A) the aggregate unpaid Class A Yield and (B) an amount equal to fifty percent (50%) of the aggregate capital invested by the Class A Preferred Unit holders (initially Tensile-Heartland)(such aggregate capital invested by the Class A Preferred Unit holders, the “Heartland Invested Capital”, which totaled approximately $21 million as of the Heartland Closing Date, subject to adjustment as provided in the Heartland Share Purchase), less prior distributions (such greater amount of (A) and (B), the “Class A Preferred Priority Distributions”); (b) second, the Class A Preferred Unitholders, together as a separate and distinct class, are entitled to receive an amount equal to the aggregate Heartland Invested Capital; (c) third, the Class B Unitholders (other than Class B Unitholders which received Class B Units upon conversion of Class A Preferred Units), together as a separate and distinct class, are entitled to receive all or a portion of any distribution equal to the sum of all distributions made under sections (a) and (b) above; and (d) fourth, to the holders of Units who are eligible to receive such distributions in proportion to the number of Units held by such holders.

On or after January 17, 2023, the Company (through Vertex Operating) may elect to purchase all of the outstanding units of Heartland SPV held by Tensile-Heartland at the greatest of (i) the amount of the Class A Priority Distributions and the amount of the Heartland Invested Capital, had the Class A Yield accrued at 30% per annum (instead of the original stated 22.5% per annum), (ii) two hundred and seventy-five percent (275%) of the total Heartland Invested Capital, and (iii) a calculation based on the greater of six (6) times the trailing twelve (12) months’ adjusted EBITDA and (B) six (6) times the next twelve (12) months’ projected adjusted EBITDA, each as described in further detail in the Heartland Company Agreement.

Upon the occurrence of a Heartland Triggering Event (described above), the Class A Unitholders (initially Tensile-Heartland) may elect, by a majority vote, to (a) terminate the Administrative Services Agreement and appoint new management of Heartland SPV, (b) trigger a Heartland Redemption, and/or (c) purchase the Class B Units from the Class B Unitholders (initially Vertex Operating) at the fair market value of such units as determined by a qualified third party agreed to in writing by the parties.

7

Description of Business Activities:

We are an environmental services company that recycles industrial waste streams and off-specification commercial chemical products. Our primary focus is recycling used motor oil and other petroleum by-products. We are engaged in operations across the entire petroleum recycling value chain including collection, aggregation, transportation, storage, re-refinement, and sales of aggregated feedstock and re-refined products to end users. We operate in three segments:

(1) Black Oil,

(2) Refining and Marketing, and

(3) Recovery.

We currently provide our services in 15 states, primarily in the Gulf Coast, Midwest and Mid-Atlantic regions of the United States. For the rolling twelve month period ending December 31, 2019, we aggregated approximately 94.1 million gallons of used motor oil and other petroleum by-product feedstocks and managed the re-refining of approximately 77.6 million gallons of used motor oil with our proprietary TCEP, VGO and Base Oil processes.

Our Black Oil segment collects and purchases used motor oil directly from third-party generators, aggregates used motor oil from an established network of local and regional collectors, and sells used motor oil to our customers for use as a feedstock or replacement fuel for industrial burners. We operate a refining facility that uses our proprietary TCEP and we also utilize third-party processing facilities. TCEP’s original purpose was to re-fine used oil into marine cutterstock; however, in the third quarter of fiscal 2015, that use ceased to be economically accretive, and instead, we operated TCEP for the purposes of pre-treating our used motor oil feedstock prior to shipping to our facility in Marrero, Louisiana from the third quarter of fiscal 2015 to the third quarter of 2019. During the fourth quarter of 2019, the original purpose of TCEP once again became economically viable and at that time we switched to using TCEP to re-fine used oil into marine cutterstock. We also operate a facility in Marrero, Louisiana, which facility re-refines used motor oil and also produces VGO and owns 84.42% of an entity which owns a re-refining complex in Belle Chasse, Louisiana, which we call our Myrtle Grove facility.

Our Refining and Marketing segment aggregates and manages the re-refinement of used motor oil and other petroleum by-products and sells the re-refined products to end customers.

Our Recovery segment includes a generator solutions company for the proper recovery and management of hydrocarbon streams as well as metals.

Black Oil Segment

Our Black Oil segment is engaged in operations across the entire used motor oil recycling value chain including collection, aggregation, transportation, storage, refinement, and sales of aggregated feedstock and re-refined products to end users. We collect and purchase used oil directly from generators such as oil change service stations, automotive repair shops, manufacturing facilities, petroleum refineries, and petrochemical manufacturing operations. We own a fleet of 41 collection vehicles, which routinely visit generators to collect and purchase used motor oil. We also aggregate used oil from a diverse network of approximately 50 suppliers who operate similar collection businesses to ours.

We manage the logistics of transport, storage and delivery of used oil to our customers. We own a fleet of 30 transportation trucks and more than 80 aboveground storage tanks with over 8.6 million gallons of storage capacity. These assets are used by both the Black Oil segment and the Refining and Marketing segment. In addition, we also utilize third parties for the transportation and storage of used oil feedstocks. Typically, we sell used oil to our customers in bulk to ensure efficient delivery by truck, rail, or barge. In many cases, we have contractual purchase and sale agreements with our suppliers and customers, respectively. We believe these contracts are beneficial to all parties involved because it ensures that a minimum volume is purchased from collectors and generators, a minimum volume is sold to our customers, and we are able to minimize our inventory risk by a spread between the costs to acquire used oil and the revenues received from the sale and delivery of used oil. We also have historically used our proprietary TCEP technology to re-refine used oil into marine fuel cutterstock and a higher-value feedstock for further processing (as discussed above, between the third quarter of fiscal 2015 and the fourth quarter of 2019, we utilized TCEP to pre-treat our used motor oil feedstock prior to shipping to our facility in Marrero, Louisiana; but did not operate our TCEP for the purpose of producing finished cutterstock, due to market conditions). During the fourth quarter of 2019, we once again began using TCEP to re-refine used oil into marine fuel cutterstock. In addition, at our Marrero, Louisiana facility we produce a Vacuum Gas Oil (VGO) product that is sold to refineries as well as to the marine fuels market. At our Columbus, Ohio facility (Heartland Petroleum),

8

the ownership of 65% of which was transferred to Tensile in connection with the Heartland SPV (discussed above), effective January 1, 2020, we produce a base oil product that is sold to lubricant packagers and distributors.

Refining and Marketing Segment

Our Refining and Marketing segment is engaged in the aggregation of feedstock, re-refining it into higher value end products, and selling these products to our customers, as well as related transportation and storage activities. We aggregate a diverse mix of feedstocks including used motor oil, petroleum distillates, transmix and other off-specification chemical products. These feedstock streams are purchased from pipeline operators, refineries, chemical processing facilities and third-party providers, and are also transferred from our Black Oil segment. We have a toll-based processing agreement in place with KMTEX to re-refine feedstock streams, under our direction, into various end products that we specify. KMTEX uses industry standard processing technologies to re-refine our feedstocks into pygas, gasoline blendstock and marine fuel cutterstock. We sell all of our re-refined products directly to end-customers or to processing facilities for further refinement.

Recovery Segment

The Recovery segment is a generator solutions company for the proper recovery and management of hydrocarbon streams. The Company (through this segment) owns and operates a fleet of trucks and heavy equipment used for processing, shipping and handling of reusable process equipment and other scrap commodities.

Thermal Chemical Extraction Process

We own the intellectual property for our patented TCEP. TCEP is a technology which utilizes thermal and chemical dynamics to extract impurities from used oil which increases the value of the feedstock. We intend to continue to develop our TCEP technology and design with the goal of producing additional re-refined products, including lubricating base oil.

TCEP differs from conventional re-refining technologies, such as vacuum distillation and hydrotreatment, by relying more heavily on chemical processes to remove impurities rather than temperature and pressure. Therefore, the capital requirements to build a TCEP plant are typically much less than a traditional re-refinery because large feed heaters, vacuum distillation columns, and a hydrotreating unit are not required. The end product currently produced by TCEP is used as fuel oil cutterstock. Conventional re-refineries produce lubricating base oils or product grades slightly lower than base oil that can be used as industrial fuels or transportation fuel blendstocks.

We currently estimate the cost to construct a new, fully-functional, commercial facility using our TCEP technology, with annual processing capacity of between 25 and 50 million gallons at another location would be approximately $10 - $15 million, which could fluctuate based on throughput capacity. The facility infrastructure would require additional capitalized expenditures which would depend on the location and site specifics of the facility. From the third quarter of 2015 to the fourth quarter of 2019, we utilized TCEP to pre-treat our used motor oil feedstocks prior to shipping to our facility in Marrero, Louisiana; however, beginning in the fourth quarter of 2019, we once again began using TCEP for the purpose of producing finished cutterstock. We have no current plans to construct any other TCEP facilities at this time. Our TCEP technology converts feedstock into a low sulfur marine fuel that can be sold into the new 0.5% low sulfur marine fuel specification mandated under International Maritime Organization (IMO) rules which went into effect on January 1, 2020.

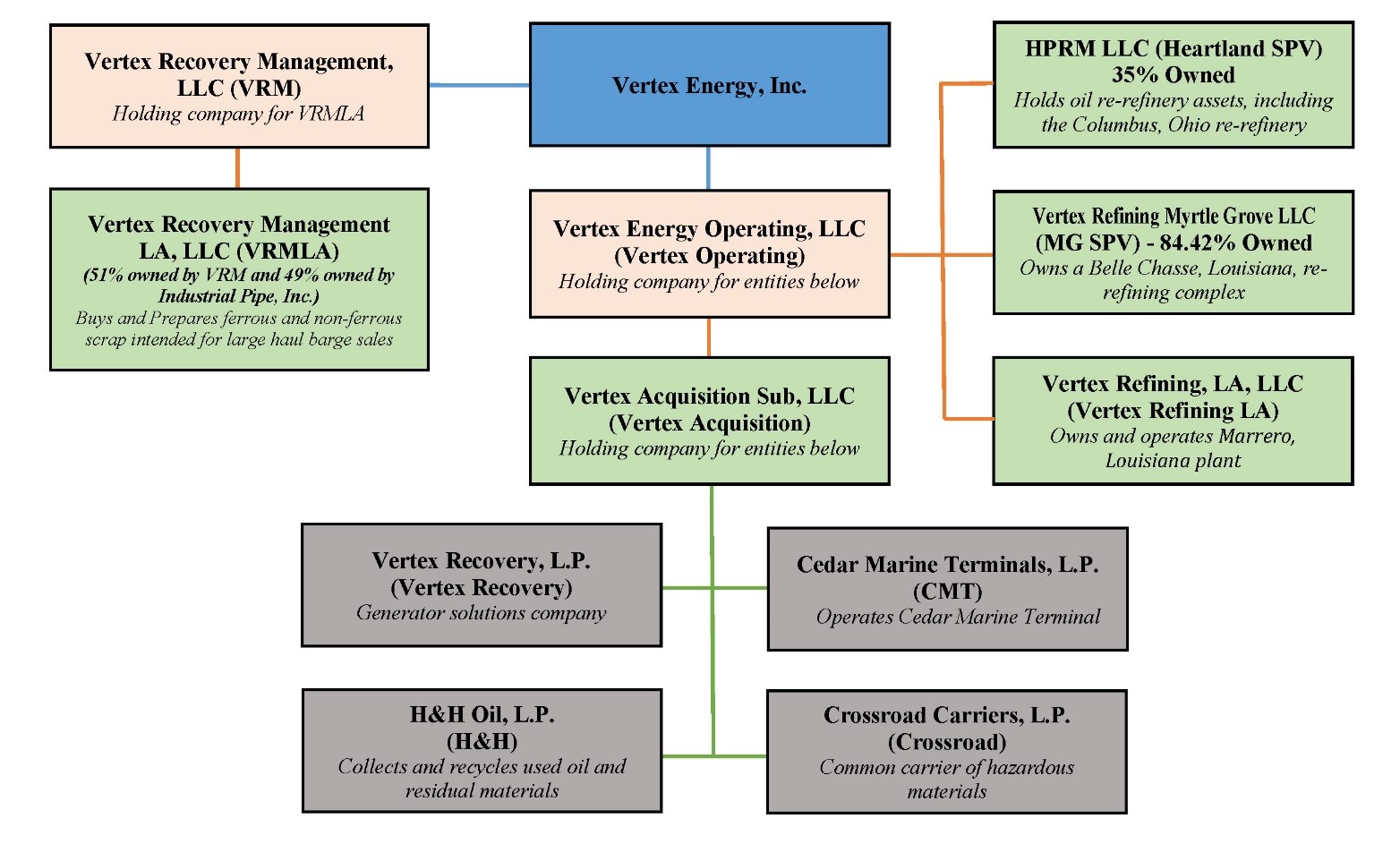

Organizational Structure

The following chart reflects our current organization structure, including significant subsidiaries (all of which are wholly-owned, except as discussed below):

9

Our Industry

The used oil recycling industry is comprised of multiple participants including generators, collectors, aggregators, processors, and end users. Generators are entities that generate used oil through their daily operations such as automotive businesses conducting oil changes on consumer and commercial vehicles and industrial users changing lubricants on machinery and heavy equipment. Collectors are typically local businesses that purchase used oil from generators and provide on-site collection services. The collection market is highly fragmented and we believe there are more than 400 used oil collectors in the United States. Aggregators are specialized businesses that purchase used oil and petroleum by-products from multiple collectors and sell and deliver it as feedstock to processors. Processors, or re-refineries, utilize a processing technology to convert the used oil or petroleum by-product into a higher-value feedstock or end-product. Used oil is any oil that has been refined from crude oil or any synthetic oil that has been used and, as a result of such use, is contaminated by physical or chemical impurities. Physical impurities could include contamination by metal shavings, sawdust, or dirt. Chemical impurities could include contamination by water or benzene, or degradation of lubricating additives.

Conventional re-refineries typically employ vacuum distillation and hydrotreating processes to transform used oil into various grades of base oil. Vacuum distillation is a process that removes emulsified contaminated water and separates used oil into vacuum gas oil and light fuels. The vacuum gas oil is then hydrotreated to produce lubricating base oil. Hydrotreating is a process which combines chemical catalysts, heat, and pressure to remove impurities such as sulfur, chlorine, and oxygen and to stabilize the end product. A re-refined lubricating base oil is of equal quality and will last as long as a virgin base oil. In addition, other re-refining processes transform used oil into product grades slightly lower than base oil. These products, along with vacuum gas oil and the end product produced by TCEP, are commonly referred to as intermediate products and are used as industrial fuels or transportation fuel blendstocks.

The petroleum by-products industry is driven by the financial and environmental benefits of recycling, as well as by the amount of petroleum by-product generated each year. Used oil is typically used: (a) as an industrial burner oil, where the used oil is dewatered, filtered and demineralized for use in industrial burners; (b) as hydraulic oil; (c) as bitumen based products (for road surfacing and roofing); (d) as an additive in manufactured products; or (e) as a re-refined base oil for use as a lubricant, hydraulic or transformer oil - which is how the Company uses such used oil. The market value of recycled oil is based, in large part, on its end use. In general, the market price for used motor oil that is burned as an industrial fuel is driven by the cost of competing fuels, including natural gas, while the market value of re-refined used motor oil is driven by competing petroleum products. The extent

10

to which the financial benefits of recycling used oil are realized is driven by operating efficiency in aggregating, storing and transporting used oil supply; the extent to which the used oil is re-refined; and the price spread between natural gas and crude oil.

In the U.S., we believe that of the approximately 1.3 billion gallons of used oil generated annually approximately 200 million gallons are improperly disposed (per the EPA), 200 - 250 million gallons are re-refined into lubricating base oils, 150 - 200 million gallons are re-refined into intermediate products with grades slightly lower than base oil, and 650 - 750 million gallons are burned as an industrial fuel source. We also believe that each year the U.S. generates 425 million used automotive oil filters containing 160,000 tons of iron units and 18 million gallons of oil (per data provided by the Steel Recycling Institute). We believe that the amount of used oil being re-refined into base oils and intermediate products in the U.S. will stay basically unchanged in 2018 as no additional re-refining capacity is scheduled to come on-line. As of the date of this Report, the approximate market price for used oil at the generator level is approximately $0.00 to $0.20 per gallon (which is required to be paid to acquire such used oil), the approximate market price of intermediate re-refined products ranges from $0.75 to $1.35 per gallon, and the approximate price for lubricating base oil ranges from $2.00 to $2.50 per gallon, representing a U.S. market size of approximately $1.0 - $1.75 billion for recycled oil.

As with the financial benefits of recycling used oil, the environmental benefits are also driven by its end use. Environmental regulations prohibit the disposal of used oil in sewers or landfills because used motor oil is insoluble and contains heavy metals and other contaminants that make it detrimental to the environment if improperly disposed; one gallon of used oil can contaminate up to 1 million gallons of fresh drinking water. Additionally, according to the Environmental Protection Agency, it takes 42 gallons of crude oil, but only 1 gallon of used oil, to produce 2.5 quarts of new, high-quality lubricating oil. Compared to burning used oil as an industrial fuel, re-refined oil significantly reduces the amount of toxic heavy metals and greenhouse gases and other pollutants introduced into the environment. In addition, the use of re-refined motor oil conserves petroleum that would have otherwise been refined into virgin base stock oil.

We believe that the used oil recycling market has significant growth potential through increasing the percentage of recycled oil that is re-refined rather than burned as a low cost industrial fuel. We believe that the financial and environmental benefits of re-refining used oil combined with consumer and commercial demand for high-quality, environmentally responsible products will drive growth in demand for re-refined oil and re-refining capacity in the United States. Furthermore, we believe that increasing consumer and industrial awareness of the environmental impact of improperly disposing used oil may drive additional market growth as approximately 200 million gallons of used oil generated each year are improperly disposed rather than recycled.

Used motor oil is burned by various users such as asphalt companies, paper mills and industrial facilities as an alternative to their base fuels, to offset operational costs. Therefore, the commercial price of used oil is typically slightly less than the base fuels for the burners. Similarly, re-refined oil is used as a substitute for various virgin petroleum-based products with pricing driven by the market price of crude oil. Since there is not an active marketplace for used and re-refined oil prices, we use the prices of natural gas and crude as benchmarks in our industry. Typically, the spread between crude and natural gas prices is an accurate proxy for the potential incremental value of re-refining used oil.

Our Competitive Strengths

Large, Diversified Feedstock Supply Network.

We obtain our feedstock supply through a combination of direct collection activities and purchases from third-party suppliers. We believe our balanced direct and indirect approach to obtaining feedstock is highly advantageous because it enables us to maximize total supply and reduce our reliance on any single supplier and the risk of not fulfilling our minimum feedstock sale quotas. We collect feedstock directly from over 4,500 generators including oil change service stations, automotive repair shops, manufacturing facilities, petroleum refineries and petrochemical manufacturing operations, as well as brokers. We aggregate used oil from a diverse network of approximately 50 suppliers who operate similar collection businesses to ours.

Strategic Relationships.

We have established relationships with key feedstock suppliers, storage and transportation providers, oil re-refineries, and end-user customers. We believe our relationships with these parties are strong, in part due to our high level of customer service, competitive prices, and our ability to contract (for purchase or sale) long-term, minimum monthly feedstock commitments. We believe that our strategic relationships could lead to contract extensions and expanded feedstock supply or purchase agreements.

Proprietary Technology.

11

Our proprietary TCEP technology produces a fuel oil cutterstock for the fuel oil market or a refining feedstock. We believe we are able to build TCEP re-refining facilities at a significantly lower cost than conventional re-refineries. We estimate the cost to build a TCEP plant with capacity of up to 50 million gallons at approximately $10 - $15 million, whereas a similar sized base oil plant with vacuum distillation towers and a hydrotreater can cost in excess of $50 million. Notwithstanding the lower cost of TCEP plants, with oil at its current prices, we do not believe that it makes economic sense to expand our TCEP technology at this time due to the fixed operating costs involved.

Logistics Capabilities.

We have extensive expertise and experience managing and operating feedstock supply chain logistics and multimodal transportation services for customers who purchase our feedstock or higher-value, re-refined products. We believe that our scale, infrastructure, expertise, and contracts enable us to cost effectively transport product and consistently meet our customers’ volume, quality and delivery schedule requirements.

Scale of Operations.

We believe that the size and scale of our operations is a significant competitive advantage when competing for new business and maintaining existing customer relationships. Price is one of the main competitive factors in the feedstock collection industry and because we are able to effectively leverage our fixed operating costs and economies of scale, we believe that our prices are competitive. Through our network of suppliers and customers, we aggregate a large amount of feedstock, which enables us to enter into minimum purchase and sale contracts as well as accept large volume orders year-round. We believe this is a competitive advantage because it minimizes our suppliers’ inventory risk and ensures our customers’ minimum order volumes are satisfied. In addition, we believe our end customers prefer to work with an exclusive supplier rather than manage multiple customer relationships.

Diversified End Product Sales.

We believe that the diversity of the products we sell reduces our overall risk and exposure to price fluctuations. Prices for petroleum-based products can be impacted significantly by supply and demand fluctuations which are not correlated with general commodity price changes. For instance, in a rising commodity price environment with a significant over-supply of base oil, the price of base oil may fall precipitously while the price of gasoline increases. We offer a diversified product mix consisting of used motor oil, fuel oil, pygas, and gasoline blendstock. We can also control our mix of end products by choosing to either resell collected feedstock or re-refine it into a higher-value product.

Management Team.

We are led by a management team with expertise in petroleum recycling, finance, operations, and re-refinement technology. Each member of our senior management team has more than 20 years of industry experience. We believe the strength of our management team will help our success in the marketplace.

Our Business Strategy

The principal elements of our strategy include:

Pursue Strategic Acquisitions and Partnerships

We plan to grow market share by consolidating feedstock supply through partnering with or acquiring collection and aggregation assets. Our executive team has a proven ability to evaluate resource potential and identify acquisition targets. The acquisitions and/or partnerships could increase our revenue and provide better control over the quality and quantity of feedstock available for resale and/or upgrading as well as providing additional locations for the potential future implementation of TCEP (assuming favorable market conditions). We also intend to diversify our revenue by acquiring complementary recycling service businesses, refining assets and technologies, and other vertically integrated businesses or assets. We believe we can realize synergies on acquisitions by leveraging our customer and vendor relationships, infrastructure, and personnel, and by eliminating duplicative overhead costs.

12

Expand Feedstock Supply Volume

We intend to expand our feedstock supply volume by growing our collection and aggregation operations. We plan to increase the volume of feedstock we collect directly by developing new relationships with generators and working to displace incumbent collectors; increasing the number of collection personnel, vehicles, equipment, and geographical areas we serve; and acquiring collectors in new or existing territories. We intend to increase the volume of feedstock we aggregate from third-party collectors by expanding our existing relationships and developing new vendor relationships. We believe that our ability to acquire large feedstock volumes will help to cultivate new vendor relationships because collectors often prefer to work with a single, reliable customer rather than manage multiple relationships and the uncertainty of excess inventory.

Broaden Existing Customer Relationships and Secure New Large Accounts

We intend to broaden our existing customer relationships by increasing sales of used motor oil and re-refined products to these accounts. In some cases, we may also seek to serve as our customers’ primary or exclusive supplier. We also believe that as we increase our supply of feedstock and re-refined products, we will have the opportunity to secure larger customer accounts that require a partner who can consistently deliver high volumes.

Re-Refine Higher Value End Products

We intend to develop, lease, or acquire technologies to re-refine our feedstock supply into higher value end products, including assets or technologies which complement TCEP. From the third quarter of 2015 to the fourth quarter of 2019, we utilized TCEP to pre-treat our used motor oil feedstocks prior to shipping to our facility in Marrero, Louisiana; however, beginning in the fourth quarter of 2019, we once again began using TCEP for the purpose of producing finished cutterstock. We hope that continued improvements in our technologies and investments in additional technologies will enable us to upgrade feedstock into higher value end products, such as fuels and lubricating base oil that command higher market prices.

Products and Services

We generate substantially all of our revenue from the sale of six product categories. All of these products are commodities that are subject to various degrees of product quality and performance specifications.

Used Motor Oil

Used motor oil is a petroleum-based or synthetic lubricant that contains impurities such as dirt, sand, water, and chemicals.

Fuel Oil

Fuel Oil is a distillate fuel which is typically blended with lower quality fuel oils. The distillation of used oil and other petroleum by-products creates a fuel with low viscosity, as well as low sulfur, ash, and heavy metal content, making it an ideal blending agent.

Pygas

Pygas, or pyrolysis gasoline, is a product that can be blended with gasoline as an octane booster or that can be distilled and separated into its components, including benzene and other hydrocarbons.

Gasoline Blendstock

Naphthas and various distillate products used for blending or compounding into finished motor gasoline. These components can include reformulated gasoline blendstock for oxygenate blending (RBOB) but exclude oxygenates (alcohols and ethers), butane, and pentanes plus.

Base Oil

An oil to which other oils or substances are added to produce a lubricant. Typically the main substance in lubricants, base oils, are refined from crude oil.

Scrap Metal(s)

13

Consists of recoverable ferrous and non-ferrous recyclable metals from manufacturing and consumption. Scrap metal can be recovered from pipes, barges, boats, building supplies, surplus equipment, tanks, and other items consisting of metal composition. These materials are segregated, processed, cut-up and sent back to a steel mill for re-purposing.

Suppliers

We conduct business with a number of used oil generators, as well as a large network of suppliers that collect used oil from used oil generators. In our capacity as a collector of used oil, we purchase feedstock from approximately 4,500 businesses, such as oil change service stations, automotive repair shops, manufacturing facilities, petroleum refineries, and petrochemical manufacturing operations, which generate used oil through their operations.

In our capacity as a broker of used oil, we work with approximately 50 suppliers that collect used oil from businesses such as those mentioned above.

Customers

The Black Oil segment sells used oil, VGO, base oil and other petroleum feedstocks to numerous customers in the Gulf Coast and Midwest regions of the United States. The primary customers of its products are packagers, distributers, blenders and industrial burners, as described above as well as re-refiners of the feedstock. The Black Oil segment is party to various feedstock sale agreements whereby we sell used oil feedstock to third parties. The agreements provide for us to sell certain minimum gallons of used oil feedstock per month at a price per barrel equal to our direct costs, plus certain commissions, based on the quality and quantity of the used oil we supply.

The Recovery segment does not rely solely on contracts, but mainly on the spot market as well as a strategic network of customers and vendors to support the purchase and sale of its products which are commodities. It also relies on project-based work which it bids on from time to time of which there is no guarantee or assurance of repeat business.

KMTEX Tolling Agreement

On or around April 17, 2013, and effective June 1, 2012, we entered into a new Tolling Agreement with KMTEX, Ltd. (“KMTEX” and the agreement as amended to date, the “Tolling Agreement”). The Company was previously party to a tolling agreement with KMTEX which expired pursuant to its terms on June 30, 2010, provided that the parties had continued to operate under the terms of the expired agreement until their entry into the April 2013 Tolling Agreement.