UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

☑ |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 29, 2019

or

|

☐ |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-4224

Avnet, Inc.

(Exact name of registrant as specified in its charter)

|

New York (State or other jurisdiction of incorporation or organization) |

|

11-1890605 (I.R.S. Employer Identification No.) |

|

|

|

|

|

2211 South 47th Street, Phoenix, Arizona (Address of principal executive offices) |

|

85034 (Zip Code) |

Registrant’s telephone number, including area code (480) 643-2000

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Trading Symbol |

|

Name of Each Exchange on Which registered: |

|

Common stock, par value $1.00 per share |

|

AVT |

|

Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☑ |

|

Accelerated filer ☐ |

|

Non-accelerated filer ☐

|

|

Smaller reporting company ☐ |

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value (approximate) of the registrant’s common equity held by non-affiliates based on the closing price of a share of the registrant’s common stock for Nasdaq Global Select Market composite transactions on December 28, 2018 (the last business day of the registrant’s most recently completed second fiscal quarter) was $3,868,372,764.

As of July 26, 2019, the total number of shares outstanding of the registrant’s Common Stock was 103,619,871 shares, net of treasury shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement (to be filed pursuant to Reg. 14A) relating to the Annual Meeting of Shareholders anticipated to be held on November 19, 2019, are incorporated herein by reference in Part III of this Report.

2

Avnet, Inc. (the “Company” or “Avnet”), is a global technology solutions company with an extensive ecosystem delivering design, product, marketing and supply chain expertise for customers at every stage of the product lifecycle. Avnet transforms ideas into intelligent solutions, reducing the time, cost and complexities of bringing electronic products to market around the world. Founded in 1921 and incorporated in New York in 1955, the Company works with over 1,400 technology suppliers to serve 2.1 million customers in more than 140 countries.

For nearly a century, Avnet has helped its customers and suppliers realize the transformative possibilities of technology while continuously expanding the breadth and depth of its capabilities. Today, as technologies like the Internet of Things (“IoT”) continue to increase the complexity in product development, Avnet is once again redefining itself by offering what customers need to bring their product to life through one partner. Over the past few years, Avnet significantly enhanced its expertise in design, supply chain and logistics by acquiring the capabilities to better serve customers in the earlier stages of product development—encompassing research, prototyping and manufacturing—as well as acquiring expertise in software development, a critical component of an end-to-end IoT solution. These capabilities were acquired through the purchase of Premier Farnell (“Farnell”) (fiscal 2017), Hackster.io (fiscal 2017), Dragon Innovation (fiscal 2018) and Softweb Solutions (fiscal 2019). Avnet’s ecosystem, which combines these newly acquired capabilities with Avnet’s historical design, supply chain and integrated solutions capabilities, is designed to match its customers’ needs along their entire product development journey, providing both end-to-end and à la carte support options, as well as digital tools, to meet varying needs and buying preferences.

Avnet can support every stage of the electronic product lifecycle and serves a wide range of customers: from startups and mid-sized businesses to enterprise-level original equipment manufacturers (“OEMs”), electronic manufacturing services (“EMS”) providers and original design manufacturers (“ODMs”). Avnet works with customers of every size, in every corner of the world, to guide today’s ideas into tomorrow’s technology.

Organizational Structure

Avnet has two primary operating groups — Electronic Components (“EC”) and Farnell. Both operating groups have operations in each of the three major economic regions of the world: (i) the Americas, Europe, (ii) Middle East and Africa (“EMEA”) and (iii) Asia/Pacific (“Asia”). Each operating group has its own management team that includes senior executives and leadership both at the global and regional levels, who manage various functions within such businesses. Each operating group also has distinct financial reporting that is evaluated at the executive level on which operating decisions and strategic planning and resource allocation for the Company as a whole are made. Divisions (“business units”) exist within each operating group that serve primarily as sales and marketing units to further streamline the sales efforts within each operating group and enhance each operating group’s ability to work with its customers and suppliers, generally along more specific geographies or product lines. However, each business unit relies heavily on the support services provided by the operating groups as well as centralized support at the corporate level.

3

A description of each operating group is presented below. Further financial information by operating group is provided in Note 17 “Segment information” to the consolidated financial statements appearing in Item 15 of this Annual Report on Form 10-K.

Electronic Components

Avnet’s EC operating group primarily supports high-volume customers. It markets, sells and distributes electronic components including semiconductors, interconnect, passive and electromechanical, or “IP&E,” components and other integrated components from the world’s leading electronic component manufacturers.

EC serves a variety of markets ranging from automotive to medical to defense and aerospace. It offers an array of customer support options throughout the entire product lifecycle, including both turnkey and customized design, new product introduction, production, supply chain, logistics and post-sales services.

Design Chain Solutions

EC offers design chain support that provides engineers with a host of technical design solutions, which helps EC support a broad range of customers seeking complex products and technologies. With access to a suite of design tools and engineering support from any point in the design cycle, customers can get product specifications along with evaluation kits and reference designs that enable a broad range of applications from concept through detailed design including new product introduction. EC also offers engineering and technical resources deployed globally to support product design, bill of materials development, and technical education and training. By utilizing EC’s design chain support, customers can optimize their component selection and accelerate their time to market. EC’s extensive product line card provides customers access to a diverse range of products from a complete spectrum of electronic component manufacturers.

Supply Chain Solutions

EC’s supply chain solutions provide support and logistical services to OEMs, EMS providers and electronic component manufacturers, enabling them to optimize supply chains on a local, regional or global basis. By combining internal competencies in global warehousing and logistics, information technology and asset management with its global footprint and extensive partner relationships, EC’s supply chain solutions provide for a deeper level of engagement with its customers. These customers can manage their supply chains to meet the demands of a competitive global environment without a commensurate investment in physical assets, systems and personnel. With supply chain planning tools and a variety of inventory management solutions, EC provides solutions that meet a customer’s just-in-time requirements and minimize risk in a variety of scenarios including lean manufacturing, demand flow and outsourcing.

Avnet Integrated

EC provides integrated solutions including technical design, integration and assembly of embedded products, systems and solutions primarily for industrial applications. EC also provides integrated solutions for intelligent and innovative embedded display solutions, including touch and passive displays. In addition, EC develops and produces standard board and industrial subsystems and application-specific devices that enable it to produce specialized systems tailored to specific customer requirements. EC serves OEMs that require embedded systems and solutions, including engineering, product prototyping, integration and other value-added services in the medical, telecommunications, industrial and digital editing markets.

4

Farnell

Avnet’s Farnell operating group supports primarily lower-volume customers that need electronic components quickly to develop, prototype and test their products. It distributes a comprehensive portfolio of kits, tools, electronic components and industrial automation components, as well as test and measurement products to both engineers and entrepreneurs. Farnell brings the latest products, services and development trends all together in element14, an industry-leading online community where engineers collaborate to solve one another’s design challenges. In element14, members get consolidated information on new technologies as well as access to experts and product specifications. Members can see what other engineers are working on, learn from online training and get the help they need to optimize their own designs.

Major Products

One of Avnet’s competitive strengths is the breadth and quality of the suppliers whose products it distributes. Texas Instruments products accounted for approximately 10% of the Company’s sales during fiscal 2019, and 11% of the Company’s sales during fiscal 2018 and 2017, and was the only supplier from which sales of its products exceeded 10% of consolidated sales. Listed in the table below are the major product categories and the Company’s approximate sales of each during the past three fiscal years. Certain prior year amounts have been reclassified between major product categories to conform to the fiscal 2019 classification. Other consists primarily of test and measurement as well as maintenance, repair and operations (MRO) products.

|

|

|

Years Ended |

|

|||||||

|

|

|

June 29, |

|

June 30, |

|

July 1, |

|

|||

|

|

|

2019 |

|

2018 |

|

2017 |

|

|||

|

|

|

(Millions) |

|

|||||||

|

Semiconductors |

|

$ |

14,973.3 |

|

$ |

14,890.9 |

|

$ |

13,537.9 |

|

|

Interconnect, passive & electromechanical (IP&E) |

|

|

3,516.0 |

|

|

3,227.0 |

|

|

2,736.1 |

|

|

Computers |

|

|

533.1 |

|

|

461.9 |

|

|

504.2 |

|

|

Other |

|

|

496.2 |

|

|

457.1 |

|

|

661.8 |

|

|

Sales |

|

$ |

19,518.6 |

|

$ |

19,036.9 |

|

$ |

17,440.0 |

|

Competition & Markets

The electronic components industry continues to be extremely competitive. The Company’s major competitors include: Arrow Electronics, Inc., Future Electronics, World Peace Group, Mouser Electronics and Digi-Key Electronics. There are also certain smaller, specialized competitors who generally focus on narrower regions, markets, products or particular sectors. As a result of these factors, Avnet must remain competitive in its pricing of products.

A key competitive factor in the electronic component distribution industry is the need to carry a sufficient amount and selection of inventory to meet customers’ rapid delivery requirements. To minimize its exposure related to inventory on hand, the majority of the Company’s products are purchased pursuant to non-exclusive distributor agreements, which typically provide certain protections for product obsolescence and price erosion. These agreements are generally cancelable upon 30 to 180 days’ notice and, in most cases, provide for or require inventory return privileges upon cancellation. In fiscal 2017, certain suppliers terminated their distribution agreements with the Company, which did not result in any significant inventory write-downs as a result of such terminations. In addition, the Company enhances its competitive position by offering a variety of value-added services, which are tailored to individual customer specifications and business needs, such as point of use replenishment, testing, assembly, supply chain management and materials management.

5

A competitive advantage is the breadth of the Company’s supplier product line card. Because of the number of Avnet’s suppliers, many customers can simplify their procurement process and make all of their required purchases from Avnet, rather than purchasing from several different parties.

Seasonality

Historically, Avnet’s business and continuing operations has not been materially impacted by seasonality, with the exception of an impact on consolidated results from shifts in regional sales trends from Asia in the first half of a fiscal year to the Americas and EMEA regions in the second half of a fiscal year.

Number of Employees

At June 29, 2019, Avnet had approximately 15,500 employees compared to 15,400 employees at June 30, 2018, and 15,700 employees at July 1, 2017.

Available Information

The Company files its annual report on Form 10-K, quarterly reports on Form 10-Q, Current Reports on Form 8-K, proxy statements and other documents, including registration statements, with the U.S. Securities and Exchange Commission (“SEC”) under the Securities Exchange Act of 1934 or the Securities Act of 1933, as applicable. The Company’s SEC filings are available to the public on the SEC’s website at http://www.sec.gov and through The Nasdaq Global Select Market (“Nasdaq”), 165 Broadway, New York, New York 10006, on which the Company’s common stock is listed.

A copy of any of the Company’s filings with the SEC, or any of the agreements or other documents that constitute exhibits to those filings, can be obtained by request directed to the Company at the following address and telephone number:

Avnet, Inc.

2211 South 47th Street

Phoenix, Arizona 85034

(480) 643-2000

Attention: Corporate Secretary

The Company also makes these filings available, free of charge, through its website (see “Avnet Website” below).

Avnet Website

In addition to the information about the Company contained in this Report, extensive information about the Company can be found at http://www.avnet.com, including information about its management team, products and services and corporate governance practices.

The corporate governance information on the Company’s website includes the Company’s Corporate Governance Guidelines, the Code of Conduct and the charters for each of the committees of its Board of Directors. In addition, amendments to these documents and waivers granted to directors and executive officers under the Code of Conduct, if any, will be posted in this area of the website. These documents can be accessed at http://www.avnet.com under the “Company — Investor Relations — Documents & Charters” caption. Printed versions can be obtained, free of charge, by writing to the Company at the address listed above in “Available Information.”

6

In addition, the Company’s filings with the SEC, as well as Section 16 filings made by any of the Company’s executive officers or directors with respect to the Company’s common stock, are available on the Company’s website (http://www.avnet.com under the “Company — Investor Relations — SEC Filings” caption) as soon as reasonably practicable after the filing is electronically filed with, or furnished to, the SEC.

These details about the Company’s website and its content are only for information. The contents of the Company’s website are not, nor shall they be deemed to be, incorporated by reference in this Report.

Forward-Looking Statements and Risk Factors

This Report contains forward-looking statements with respect to the financial condition, results of operations and business of Avnet. These statements are generally identified by words like “believes,” “plans,” “expects,” “anticipates,” “should,” “will,” “may,” “estimates” or similar expressions. Forward-looking statements are subject to numerous assumptions, risks and uncertainties. Except as required by law, Avnet does not undertake any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. Factors that may cause actual results to differ materially from those contained in the forward-looking statements include those discussed below.

The factors discussed below make the Company’s operating results for future periods difficult to predict and, therefore, prior results are not necessarily indicative of results to be expected in future periods. Any of the below factors, or any other factors discussed elsewhere in this Report, may have an adverse effect on the Company’s financial results, operations, prospects and liquidity. The Company’s operating results have fluctuated in the past and likely will continue to do so. If the Company’s operating results fall below its forecasts and the expectations of public market analysts and investors, the trading price of the Company’s common stock will likely decrease.

Economic weakness and geopolitical uncertainty could adversely affect the Company’s results and prospects.

The Company’s financial results, operations and prospects depend significantly on worldwide economic and geopolitical conditions, the demand for its products and services, and the financial condition of its customers and suppliers. Economic weakness and geopolitical uncertainty, including the uncertainty caused by the United Kingdom’s planned exit from the European Union commonly referred to as “Brexit,” have in the past resulted, and may result in the future, in decreased sales, margins and earnings. Economic weakness and geopolitical uncertainty may also lead the Company to impair assets, including goodwill, intangible assets and other long-lived assets, take restructuring actions and reduce expenses in response to decreased sales or margins. The Company may not be able to adequately adjust its cost structure in a timely fashion, which may adversely impact its profitability. Uncertainty about economic conditions may increase foreign currency volatility in markets in which the Company transacts business, which may negatively impact the Company’s results. Economic weakness and geopolitical uncertainty also make it more difficult for the Company to manage inventory levels and/or collect customer receivables, which may result in provisions to create reserves, write-offs, reduced access to liquidity and higher financing costs.

The Company is monitoring the Brexit negotiations and developing contingency plans, including changes to its logistics operations and shipment routes and preparing for changes in trade facilitation regulations. While the specific terms and impact of Brexit are not yet known, Brexit may adversely impact the United Kingdom and/or the European Union and therefore may have an adverse effect on the Company’s trade operations and financial results.

The Company experiences significant competitive pressure, which may negatively impact its results.

The market for the Company’s products and services is very competitive and subject to rapid technological advances, new market entrants, non-traditional competitors, changes in industry standards and changes in customer needs and

7

consumption models. Not only does the Company compete with other global distributors, it also competes for customers with regional distributors and some of the Company’s own suppliers that maintain direct sales efforts. In addition, as the Company expands its offerings and geographies, the Company may encounter increased competition from current or new competitors. The Company’s failure to maintain and enhance its competitive position could adversely affect its business and prospects. Furthermore, the Company’s efforts to compete in the marketplace could cause deterioration of gross profit margins and, thus, overall profitability.

The size of the Company’s competitors vary across market sectors, as do the resources the Company has allocated to the sectors and geographic areas in which it does business. Therefore, some competitors may have greater resources or a more extensive customer or supplier base than the Company has in one or more of its market sectors and geographic areas, which may result in the Company not being able to effectively compete in certain markets which could impact the Company’s profitability and prospects.

Changes in customer needs and consumption models could significantly affect the Company’s operating results.

Changes in customer needs and consumption models may cause a decline in the Company’s billings, which would have a negative impact on the Company’s financial results. While the Company attempts to identify changes in market conditions as soon as possible, the dynamics of these industries make prediction of, and timely reaction to such changes difficult. Future downturns in the semiconductor and embedded solutions industries could adversely affect the Company’s operating results and negatively impact the Company’s ability to maintain its current profitability levels. In addition, the semiconductor industry has historically experienced periodic fluctuations in product supply and demand, often associated with changes in economic conditions, technology and manufacturing capacity. During fiscal years 2019, 2018, and 2017, sales of semiconductors represented approximately 77%, 78%, and 78% of the Company's consolidated sales, respectively, and the Company’s sales closely follow the strength or weakness of the semiconductor industry.

Due to the Company’s increased online sales, system interruptions and delays that make its websites and services unavailable or slow to respond may reduce the attractiveness of its products and services to its customers. If the Company is unable to continually improve the efficiency of its systems, it could cause systems interruptions or delays and adversely affect the Company’s operating results.

Failure to maintain or develop new relationships with key suppliers could adversely affect the Company’s sales.

One of the Company’s competitive strengths is the breadth and quality of the suppliers whose products the Company distributes. However, billings of products and services from one of the Company’s suppliers, Texas Instruments (“TI”), accounted for approximately 10% of the Company’s consolidated billings in fiscal 2019. Management expects TI’s products and services to continue to account for roughly a similar percentage of the Company’s consolidated billings in fiscal 2020. The Company’s contracts with its suppliers vary in duration and are generally terminable by either party at will upon notice. To the extent any primary suppliers terminate or significantly reduce their volume of business with the Company in the future, because of a product shortage, an unwillingness to do business with the Company, changes in strategy or otherwise, the Company’s business and relationships with its customers could be negatively affected because its customers depend on the Company’s distribution of technology hardware and software from the industry’s leading suppliers. In addition, suppliers’ strategy shifts or performance issues may negatively affect the Company’s financial results. The competitive landscape has also experienced a consolidation among suppliers, which could negatively impact the Company’s profitability and customer base. Further, to the extent that any of the Company’s key suppliers modify the terms of their contracts including, without limitation, the terms regarding price protection, rights of return, rebates or other terms that protect or enhance the Company’s gross margins, it could negatively affect the Company’s results of operations, financial condition or liquidity.

8

The Company’s non-U.S. locations represent a significant portion of its sales and, consequently, the Company is exposed to risks associated with operating internationally that could adversely affect the Company’s operating results.

During fiscal 2019, 2018, and 2017 approximately 75%, 76% and 72%, respectively, of the Company’s sales came from its operations outside the United States. As a result of the Company’s international operations, in particular those in emerging and developing economies, the Company’s operations are subject to a variety of risks that are specific to international operations, including, but not limited to, the following:

|

· |

potential restrictions on the Company’s ability to repatriate funds from its foreign subsidiaries; |

|

· |

foreign currency and interest rate fluctuations and the impact on the Company’s results of operations; |

|

· |

compliance with foreign and domestic import and export regulations, data privacy regulations, business licensing requirements, environmental regulations and anti-corruption laws, the failure of which could result in severe penalties including monetary fines, criminal proceedings and suspension of import or export privileges; |

|

· |

adoption or expansion of trade restrictions, including technology transfer restrictions, specific company sanctions, new and higher duties, tariffs or surcharges, or other import/export controls, unilaterally or bilaterally; |

|

· |

complex and changing tax laws and regulations; |

|

· |

regulatory requirements and prohibitions that differ between jurisdictions; |

|

· |

economic and political instability (including the uncertainty caused by Brexit), terrorism and potential military conflicts or civilian unrest; |

|

· |

fluctuations in freight costs, limitations on shipping and receiving capacity, and other disruptions in the transportation and shipping infrastructure; |

|

· |

natural disasters and health concerns; |

|

· |

differing environmental regulations and employment practices and labor issues; and |

|

· |

the risk of non-compliance with local laws. |

In addition to the cost of compliance, the potential criminal penalties for violations of import or export regulations and anti-corruption laws by the Company or its third-party agents create heightened risks for the Company’s international operations. In the event that a governing regulatory body determines that the Company has violated applicable import or export regulations or anti-corruption laws, the Company could be fined significant sums, incur sizable legal defense costs and/or its import or export capabilities could be restricted, which could have a material and adverse effect on the Company’s business. Additionally, allegations that the Company has violated a governmental regulation may negatively impact the Company’s reputation, which may result in customers or suppliers being unwilling to do business with the Company. While the Company has adopted measures and controls designed to ensure compliance with these laws, the Company cannot be assured that such measures will be adequate or that its business will not be materially and adversely impacted in the event of an alleged violation.

The Company transacts sales, pays expenses, owns assets and incurs liabilities in countries using currencies other than the U.S. Dollar. Because the Company’s consolidated financial statements are presented in U.S. Dollars, the Company must translate sales, income and expenses, as well as assets and liabilities, into U.S. Dollars at exchange rates in effect during each reporting period. Therefore, increases or decreases in the exchange rates between the U.S. Dollar and other currencies affect the Company’s reported amounts of sales, operating income, assets and liabilities denominated in foreign currencies. In addition, unexpected and dramatic changes in foreign currency exchange rates may negatively affect the Company’s earnings from those markets. While the Company may use derivative financial instruments to further reduce

9

its net exposure to foreign currency exchange rate fluctuations, there can be no assurance that fluctuations in foreign currency exchange rates will not materially affect the Company’s financial results. Further, foreign currency instability and disruptions in the credit and capital markets may increase credit risks for some of the Company’s customers and may impair its customers’ ability to repay existing obligations.

Recently, the U.S. government imposed new or higher tariffs on certain products imported into the U.S., and the Chinese government imposed new or higher tariffs on certain products imported into China, which have increased the costs of procuring certain products the Company purchases from its suppliers. The higher tariffs, along with any additional tariffs or trade restrictions that may be implemented by the U.S. or by other countries on U.S. goods in the future, may result in further increased costs and other related expenses. While the Company intends to reflect such increased costs in its selling prices, such price increases may impact the Company’s sales and customer demand for certain products. In addition, increased operational expenses incurred in minimizing the number of products subject to the tariffs could adversely affect the operating profits for certain of its business units. Neither such U.S. tariffs nor any retaliatory tariffs imposed by other countries on U.S. goods have yet had a significant impact, but there can be no assurance that future actions or escalations that affect trade relations will not occur or will not materially affect the Company’s sales and results of operations. To the extent that Company sales or profitability are negatively affected by any such tariffs or other trade actions, the Company’s business and results of operations may be materially adversely affected.

If the Company’s internal information systems fail to function properly, or if the Company is unsuccessful in the implementation, integration or upgrade of information systems, its business operations could suffer.

The Company is dependent on its information systems to facilitate the day-to-day operations of the business and to produce timely, accurate and reliable information on financial and operational results. Currently, the Company’s global operations are tracked with multiple information systems, some of which are subject to ongoing IT projects designed to streamline or optimize the Company’s global information systems. These IT projects are extremely complex, in part, because of a wide range of processes, the multiple legacy systems used and the Company’s business operations. There is no guarantee that the Company will be successful at all times in these efforts or that there will not be implementation or integration difficulties that will adversely affect the Company’s ability to complete business transactions and ensure accurate recording and reporting of financial data. In addition, the Company may be unable to achieve the expected efficiencies and cost savings as a result of the IT projects, thus negatively impacting the Company’s financial results. A failure of any of these information systems in a way described above or material difficulties in upgrading these information systems could have an adverse effect on the Company’s business, internal controls and reporting obligations under federal securities laws.

The Company’s acquisition strategy may not produce the expected benefits, which may adversely affect the Company’s results of operations.

Avnet has made, and expects to continue to make, strategic acquisitions or investments in companies around the world to further its strategic objectives and support key business initiatives. Acquisitions and investments involve risks and uncertainties, some of which may differ from those associated with Avnet’s historical operations. The risks relating to such acquisitions and investments include, but are not limited to, risks relating to expanding into emerging markets and business areas, adding additional product lines and services, impacting existing customer and supplier relationships, incurring costs or liabilities associated with the companies acquired, incurring potential impairment charges on acquired goodwill and other intangible assets and diverting management’s attention from existing business operations. As a result, the Company’s profitability may be negatively impacted. In addition, the Company may not be successful in integrating the acquired businesses or the integration may be more difficult, costly or time-consuming than anticipated. Further, any litigation relating to a potential acquisition will result in an increase in the expenses associated with the acquisition or cause a delay in completing the acquisition, thereby impacting the Company’s profitability. The Company may experience disruptions that could, depending on the size of the acquisition, have an adverse effect on its business, especially where an

10

acquisition target may have pre-existing compliance issues or pre-existing deficiencies or material weaknesses in internal controls over financial reporting. Furthermore, the Company may not realize all of the anticipated benefits from its acquisitions, which could adversely affect the Company’s financial performance.

Major disruptions to the Company’s logistics capability could have an adverse impact on the Company’s operations.

The Company’s global logistics services are operated through specialized, centralized or outsourced distribution centers around the globe. The Company also depends almost entirely on third-party transportation service providers for the delivery of products to its customers. A major interruption or disruption in service at one or more of its distribution centers for any reason (such as information technology upgrades and operating issues, warehouse modernization and relocation efforts, natural disasters, pandemics, or significant disruptions of services from the Company’s third-party transportation providers) could cause cancellations or delays in a significant number of shipments to customers and, as a result, could have an adverse impact on the Company’s business partners, and on the Company’s business, operations and financial performance.

If the Company sustains cyber-attacks or other privacy or data security incidents that result in security breaches, it could suffer a loss of sales and increased costs, exposure to significant liability, reputational harm and other negative consequences.

The Company’s information technology may be subject to cyber-attacks, security breaches or computer hacking. Experienced computer programmers and hackers may be able to penetrate the Company’s security controls and misappropriate or compromise sensitive personal, proprietary or confidential information, create system disruptions or cause shutdowns. They also may be able to develop and deploy malicious software programs that attack the Company’s systems or otherwise exploit any security vulnerabilities. The Company’s systems and the data stored on those systems may also be vulnerable to security incidents or security attacks, acts of vandalism or theft, coordinated attacks by activist entities, misplaced or lost data, human errors, or other similar events that could negatively affect the Company’s systems and its data, as well as the data of the Company’s business partners. Further, outside parties may attempt to fraudulently induce employees, customers or suppliers to disclose sensitive information in order to gain access to the Company’s data and information technology systems, otherwise known as phishing. Lastly, third parties, such as hosted solution providers, that provide services to the Company, could also be a source of security risk in the event of a failure of their own security systems and infrastructure.

The costs to eliminate or address the foregoing security threats and vulnerabilities before or after a cyber-incident could be significant. The Company’s remediation efforts may not be successful and could result in interruptions, delays or cessation of service, and loss of existing or potential suppliers or customers. In addition, breaches of the Company’s security measures and the unauthorized dissemination of sensitive personal, proprietary or confidential information about the Company, its business partners or other third parties could expose the Company to significant potential liability and reputational harm. As threats related to cyber-attacks develop and grow, the Company may also find it necessary to make further investments to protect its data and infrastructure, which may impact the Company’s profitability. Although the Company has insurance coverage for protecting against cyber-attacks, it may not be sufficient to cover all possible claims, and the Company may suffer losses that could have a material adverse effect on its business. As a global enterprise, the Company could also be negatively impacted by existing and proposed laws and regulations, as well as government policies and practices related to cybersecurity, data privacy, data localization and data protection.

Declines in the value of the Company’s inventory or unexpected order cancellations by the Company’s customers could adversely affect its business, results of operations, financial condition and liquidity.

The electronic components and integrated products industries are subject to rapid technological change, new and

11

enhanced products, changes in customer needs and changes in industry standards and regulatory requirements, which can contribute to a decline in value or obsolescence of inventory. Regardless of the general economic environment, it is possible that prices will decline due to a decrease in demand or an oversupply of products and, as a result of the price declines, there may be greater risk of declines in inventory value. Although it is the policy of many of the Company’s suppliers to offer certain protections from the loss in value of inventory (such as price protection and limited rights of return), the Company cannot be assured that such policies will fully compensate for the loss in value, or that the suppliers will choose to, or be able to, honor such agreements, some of which are not documented and, therefore, subject to the discretion of the supplier. In addition, the majority of the Company’s sales are made pursuant to individual purchase orders, rather than through long-term sales contracts. Where there is a contract, such contract is generally terminable at will upon notice. The Company cannot be assured that unforeseen new product developments, declines in the value of the Company’s inventory or unforeseen order cancellations by its customers will not adversely affect the Company’s business, results of operations, financial condition or liquidity.

Substantial defaults by the Company’s customers or suppliers on its accounts receivable or the loss of significant customers could have a significant negative impact on the Company’s business, results of operations, financial condition or liquidity.

A significant portion of the Company’s working capital consists of accounts receivable. If entities responsible for a significant amount of accounts receivable were to cease doing business, direct their business elsewhere, become insolvent or unable to pay the amount they owe the Company, or were to become unwilling or unable to make such payments in a timely manner, the Company’s business, results of operations, financial condition or liquidity could be adversely affected. An economic or industry downturn could adversely affect the collectability of these accounts receivable, which could result in longer payment cycles, increased collection costs and defaults in excess of management’s expectations. A significant deterioration in the Company’s ability to collect on accounts receivable in the United States could also impact the cost or availability of financing under its accounts receivable securitization program.

The Company may not have adequate or cost-effective liquidity or capital resources which could adversely affect the Company’s operations.

The Company’s ability to satisfy its cash needs and implement its capital allocation strategy depends on its ability to generate cash from operations and to access the financial markets, both of which are subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond the Company’s control.

The Company may need to satisfy its cash needs through external financing. However, external financing may not be available on acceptable terms or at all. As of June 29, 2019, Avnet had total debt outstanding of approximately $1.72 billion under various notes, secured borrowings and committed and uncommitted lines of credit with financial institutions. The Company needs cash to make interest payments on, and to repay, this indebtedness and for general corporate purposes, such as funding its ongoing working capital and capital expenditure needs. Under the terms of any external financing, the Company may incur higher than expected financing expenses and become subject to additional restrictions and covenants. Any material increase in the Company’s financing costs could have an adverse effect on its profitability.

Under certain of its credit facilities, the Company is required to maintain certain specified financial ratios and pass certain financial tests. If the Company fails to meet these financial ratios and/or pass these tests, it may be unable to continue to utilize these facilities. If the Company is unable to utilize these facilities, it may not have sufficient cash available to make interest payments, to repay indebtedness or for general corporate needs. General economic or business conditions, domestic and foreign, may be less favorable than management expects and could adversely impact the Company’s sales or its ability to collect receivables from its customers, which may impact access to the Company’s accounts receivable securitization program.

12

In order to be successful, the Company must attract, retain, train, motivate and develop key employees, and failure to do so could adversely impact the Company’s results and strategic initiatives.

Identifying, developing internally or hiring externally, training and retaining qualified employees are critical to the Company’s future, and competition for experienced employees in the Company’s industry can be intense. Changing demographics and labor work force trends may result in a loss of knowledge and skills as experienced workers leave the Company. In addition, as global opportunities and industry demand shifts, and as the Company expands its offerings, realignment, training and hiring of skilled personnel may not be sufficiently rapid. From time to time the Company has effected restructurings, which eliminate a number of positions. Even if such personnel are not directly affected by the restructuring effort, such terminations can have a negative impact on morale and the Company’s ability to attract and hire new qualified personnel in the future. If the Company loses existing qualified personnel or is unable to hire new qualified personnel, as needed, the Company’s business, financial condition and results of operations could be seriously harmed.

The agreements governing some of the Company’s financings contain various covenants and restrictions that limit management’s discretion in operating the business and could prevent management from engaging in some activities that may be beneficial to the Company’s business.

The agreements governing the Company’s financing, including its credit facility, accounts receivable securitization program and the indentures governing the Company’s outstanding notes, contain various covenants and restrictions that, in certain circumstances, limit the Company’s ability, and the ability of certain subsidiaries, to:

|

· |

grant liens on assets; |

|

· |

make restricted payments (including, under certain circumstances, paying dividends on common stock or redeeming or repurchasing common stock); |

|

· |

make certain investments; |

|

· |

merge, consolidate or transfer all or substantially all of the Company’s assets; |

|

· |

incur additional debt; or |

|

· |

engage in certain transactions with affiliates. |

As a result of these covenants and restrictions, the Company may be limited in the future in how it conducts its business and may be unable to raise additional debt, repurchase common stock, pay a dividend, compete effectively or make further investments.

The Company may become involved in legal proceedings that could cause it to incur substantial costs, divert management’s efforts or require it to pay substantial damages or licensing fees.

From time to time, the Company may become involved in legal proceedings, including government investigations, that arise out of the ordinary conduct of the Company’s business, including matters involving intellectual property rights, commercial matters, merger-related matters, product liability and other actions. The Company may be obligated to indemnify and defend its customers if the products or services the Company sells are alleged to infringe any third party’s intellectual property rights. While the Company may be able to seek indemnification from its suppliers for itself and its customers against such claims, there is no assurance that it will be successful in realizing such indemnification or that the Company will be fully protected against such claims. However, the Company is exposed to potential liability for technology and products that it develops for which it has no indemnification protections. If an infringement claim against the Company is successful, the Company may be required to pay damages or seek royalty or license arrangements, which may not be available on commercially reasonable terms. The Company may have to stop selling certain products or

13

services, which could affect its ability to compete effectively. In addition, the Company’s expanding business activities may include the assembly or manufacture of electronic component products and systems. Product defects, whether caused by a design, assembly, manufacture or component failure or error, or manufacturing processes not in compliance with applicable statutory and regulatory requirements may result in product liability claims, product recalls, fines and penalties. Product liability risks could be particularly significant with respect to aerospace, automotive and medical applications because of the risk of serious harm to users of such products. Legal proceedings could result in substantial costs and diversion of management’s efforts and other resources and could have an adverse effect on the Company’s operations and business reputation.

Changes in tax rules and regulations, changes in interpretation of tax rules and regulations, changes in business performance or unfavorable assessments from tax audits could adversely affect the Company’s effective tax rates, deferred taxes, financial condition and results of operations.

As a multinational corporation, the Company is subject to the tax laws and regulations of the United States and many foreign jurisdictions. From time to time, regulations may be enacted that could adversely affect the Company’s tax positions. There can be no assurance that the Company’s cash flow, and in some cases the effective tax rate, will not be adversely affected by these potential changes in regulations or by changes in the interpretation of existing tax law and regulations.

On December 22, 2017, the U.S. federal government enacted tax legislation (the “Tax Cuts and Jobs Act” or the “Act”) which includes provisions to lower the corporate income tax rate, impose new taxes on certain foreign earnings, limit deductibility of certain U.S. costs and levy a one-time deemed repatriation tax on accumulated offshore earnings, among others. The Act is subject to interpretation and implementation guidance by both federal and state tax authorities, as well as amendments and technical corrections. Any or all of these could impact the Company unfavorably.

Many countries are adopting provisions to align their international tax rules with the Base Erosion and Profit Shifting Project, led by the Organisation for Economic Co-operation and Development, to standardize and modernize global corporate tax policy. These provisions, individually or as a whole, may negatively impact taxation of international business.

The tax laws and regulations of the various countries where the Company has operations are extremely complex and subject to varying interpretations. Although the Company believes that its historical tax positions are sound and consistent with applicable laws, regulations and existing precedent, there can be no assurance that these tax positions will not be challenged by relevant tax authorities or that the Company would be successful in defending against any such challenge.

The Company’s future income tax expense could also be favorably or adversely affected by changes in the mix of earnings in countries with differing statutory tax rates, changes in the valuation of deferred tax assets and liabilities and changes to its operating structure.

If the Company fails to maintain effective internal controls, it may not be able to report its financial results accurately or timely, or prevent or detect fraud, which could have an adverse effect on the Company’s business or the market price of the Company’s securities.

Effective internal controls over financial reporting are necessary for the Company to provide reliable financial reports and to effectively prevent or detect fraud. If the Company cannot provide reliable financial reports and effectively prevent or detect fraud, its brand and operating results could be harmed. Internal controls over financial reporting may not prevent or detect misstatements because such controls are inherently limited; such limitations include the possibility of human error, the circumvention or overriding of controls, or fraud. Therefore, even effective internal controls cannot provide absolute assurance with respect to the preparation and fair presentation of financial statements. In addition, if not properly maintained and updated, internal controls over financial reporting may become inadequate. If the Company fails

14

to maintain the adequacy of its internal controls, including any failure to implement required new or improved internal controls, or if the Company experiences difficulties in their implementation, the Company’s business and operating results could be harmed. Additionally, the Company may be subject to sanctions or investigations by regulatory authorities, and the Company could fail to meet its reporting obligations, all of which could have an adverse effect on its business or the market price of the Company’s securities.

Failure to comply with the requirements of environmental regulations could adversely affect the Company’s business.

The Company is subject to various federal, state, local and foreign laws and regulations addressing environmental and other impacts from product disposal, use of hazardous materials in products, recycling of products at the end of their useful life and other related matters. While the Company strives to ensure it is in full compliance with all applicable regulations, certain of these regulations impose liability without fault. Additionally, the Company may be held responsible for the prior activities of an entity it acquired. Failure to comply with these regulations could result in substantial costs, fines and civil or criminal sanctions, as well as third-party claims for property damage or personal injury. Further, environmental laws may become more stringent over time, imposing greater compliance costs and increasing risks and penalties associated with violations.

Item 1B. Unresolved Staff Comments

Not applicable.

The Company owns and leases approximately 2.1 million and 4.9 million square feet of space, respectively, of which approximately 26% is located in the United States. The following table summarizes certain of the Company’s key facilities:

|

|

|

Approximate |

|

Leased |

|

|

|

|

|

|

Square |

|

or |

|

|

|

|

Location |

|

Footage |

|

Owned |

|

Primary Use |

|

|

Chandler, Arizona |

|

400,000 |

|

Owned |

|

EC warehousing and value-added operations |

|

|

Tongeren, Belgium |

|

390,000 |

|

Owned |

|

EC warehousing and value-added operations |

|

|

Leeds, United Kingdom |

|

330,000 |

|

Owned |

|

Current Farnell warehousing and value-added operations |

|

|

Leeds, United Kingdom |

|

360,000 |

|

Leased |

|

Future Farnell warehousing and value-added operations |

|

|

Poing, Germany |

|

300,000 |

|

Owned |

|

EC warehousing and value-added operations |

|

|

Chandler, Arizona |

|

150,000 |

|

Leased |

|

EC warehousing, integration and value-added operations |

|

|

Gaffney, South Carolina |

|

220,000 |

|

Owned |

|

Farnell warehousing |

|

|

Hong Kong, China |

|

210,000 |

|

Leased |

|

EC warehousing |

|

|

Phoenix, Arizona |

|

180,000 |

|

Leased |

|

Corporate and EC Americas headquarters |

|

15

Pursuant to SEC regulations, including but not limited to Item 103 of Regulation S-K, the Company regularly assesses the status of and developments in pending environmental and other compliance related legal proceedings to determine whether any such proceedings should be identified specifically in this discussion of legal proceedings, and has concluded that no particular pending legal proceeding requires public disclosure. Based on the information known to date, management believes that the Company has appropriately accrued in its consolidated financial statements for its share of the estimable costs of environmental and other compliance related matters.

The Company is also currently subject to various pending and potential legal matters and investigations relating to compliance with governmental laws and regulations, including import/export and environmental matters. The Company currently believes that the resolution of such matters will not have a material adverse effect on the Company’s financial position or liquidity, but could possibly be material to its results of operations in any one reporting period.

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

The Company’s common stock is listed on the Nasdaq Global Select Market under the symbol AVT since May 2018 and was traded on the New York Stock Exchange prior to that date.

Dividends

The declaration and payment of future dividends will be at the discretion of the Board of Directors and will be dependent upon the Company’s financial condition, results of operations, capital requirements, and other factors the Board of Directors considers relevant. In addition, certain of the Company’s debt facilities may restrict the declaration and payment of dividends, depending upon the Company’s then current compliance with certain covenants.

Record Holders

As of July 26, 2019, there were 1,738 registered holders of record of Avnet’s common stock.

16

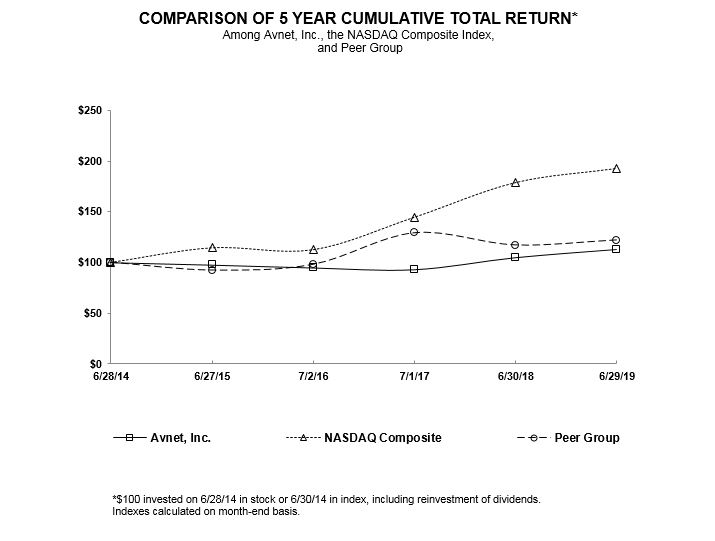

Stock Performance Graphs and Cumulative Total Returns

The graph below matches the cumulative 5-year total return of holders of Avnet’s common stock with the cumulative total returns of the Nasdaq Composite index and a customized peer group of seven companies that includes: Agilysys Inc., Anixter International Inc., Arrow Electronics Inc., Insight Enterprises Inc., Scansource Inc., Synnex Corp and Tech Data Corp. The graph assumes that the value of the investment in Avnet’s common stock, in each index, and in the peer group (including reinvestment of dividends) was $100 on 6/28/2014 and tracks it through 6/29/2019.

|

|

|

6/28/2014 |

|

6/27/2015 |

|

7/2/2016 |

|

7/1/2017 |

|

6/30/2018 |

|

6/29/2019 |

|

||||||

|

Avnet, Inc. |

|

$ |

100 |

|

$ |

97.69 |

|

$ |

94.98 |

|

$ |

93.24 |

|

$ |

104.75 |

|

$ |

112.60 |

|

|

Nasdaq Composite |

|

|

100 |

|

|

114.44 |

|

|

112.51 |

|

|

144.35 |

|

|

178.42 |

|

|

192.30 |

|

|

Peer Group |

|

|

100 |

|

|

92.18 |

|

|

97.84 |

|

|

129.12 |

|

|

117.09 |

|

|

122.06 |

|

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

17

Issuer Purchases of Equity Securities

In August 2018, the Company’s Board of Directors amended the Company’s existing share repurchase program to authorize the repurchase of up to $2.45 billion of common stock in the open market or through privately negotiated transactions. The timing and actual number of shares repurchased will depend on a variety of factors such as share price, corporate and regulatory requirements, and prevailing market conditions. The following table includes the Company’s monthly purchases of Avnet’s common stock during the fourth fiscal quarter ended June 29, 2019, under the share repurchase program, which is part of a publicly announced plan:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Number of |

|

Approximate Dollar |

|

|

|

|

|

Total |

|

Average |

|

Shares Purchased |

|

Value of Shares That |

|

||

|

|

|

Number |

|

Price |

|

as Part of Publicly |

|

May Yet Be |

|

||

|

|

|

of Shares |

|

Paid per |

|

Announced Plans |

|

Purchased under the |

|

||

|

Period |

|

Purchased |

|

Share |

|

or Programs |

|

Plans or Programs |

|

||

|

April 1 – April 26 |

|

571,322 |

|

$ |

46.16 |

|

571,322 |

|

$ |

296,530,000 |

|

|

April 29 – May 24 |

|

901,400 |

|

$ |

43.90 |

|

901,400 |

|

$ |

256,955,000 |

|

|

May 27 – June 28 |

|

1,199,579 |

|

$ |

42.95 |

|

1,199,579 |

|

$ |

205,429,000 |

|

18

Item 6. Selected Financial Data

The following selected financial data has been derived from the Company’s consolidated financial statements. The data set forth below should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations and the consolidated financial statements and notes thereto.

|

|

|

Years Ended |

|

|||||||||||||

|

|

|

June 29, |

|

June 30, |

|

July 1, |

|

July 2, |

|

June 27, |

|

|||||

|

|

|

2019 |

|

2018 |

|

2017 |

|

2016 |

|

2015 |

|

|||||

|

|

|

(Millions, except for per share and ratio data) |

|

|||||||||||||

|

Consolidated Statements of Operations: (a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales |

|

$ |

19,518.6 |

|

$ |

19,036.9 |

|

$ |

17,440.0 |

|

$ |

16,740.6 |

|

$ |

17,655.3 |

|

|

Gross profit |

|

|

2,486.1 |

|

|

2,527.2 |

|

|

2,369.4 |

|

|

2,077.9 |

|

|

2,210.1 |

|

|

Operating income (b)(c)(d) |

|

|

365.9 |

|

|

209.2 |

|

|

443.7 |

|

|

565.1 |

|

|

646.1 |

|

|

Income tax expense |

|

|

62.2 |

|

|

288.0 |

|

|

47.1 |

|

|

87.1 |

|

|

86.1 |

|

|

Income (loss) from continuing operations |

|

|

180.1 |

|

|

(142.9) |

|

|

263.4 |

|

|

390.9 |

|

|

485.4 |

|

|

Income (loss) from discontinued operations |

|

|

(3.8) |

|

|

(13.5) |

|

|

261.9 |

|

|

115.6 |

|

|

86.5 |

|

|

Net income (loss) (e) |

|

|

176.3 |

|

|

(156.4) |

|

|

525.3 |

|

|

506.5 |

|

|

571.9 |

|

|

Per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings - diluted: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) from continuing operations |

|

$ |

1.63 |

|

$ |

(1.19) |

|

$ |

2.05 |

|

$ |

2.93 |

|

$ |

3.50 |

|

|

Earnings (loss) from discontinued operations |

|

|

(0.04) |

|

|

(0.11) |

|

|

2.03 |

|

|

0.87 |

|

|

0.62 |

|

|

Earnings (loss) per share - diluted |

|

$ |

1.59 |

|

$ |

(1.30) |

|

$ |

4.08 |

|

$ |

3.80 |

|

$ |

4.12 |

|

|

Cash dividends per share |

|

$ |

0.80 |

|

$ |

0.74 |

|

$ |

0.70 |

|

$ |

0.68 |

|

$ |

0.64 |

|

|

Weighted-average shares outstanding - diluted |

|

|

110,798 |

|

|

119,909 |

|

|

128,651 |

|

|

133,173 |

|

|

138,791 |

|

|

Consolidated Balance Sheets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Working capital (f) |

|

$ |

4,297.8 |

|

$ |

4,641.1 |

|

$ |

5,080.0 |

|

$ |

4,061.5 |

|

$ |

4,312.6 |

|

|

Total assets |

|

|

8,564.6 |

|

|

9,596.8 |

|

|

9,699.6 |

|

|

11,239.8 |

|

|

10,800.0 |

|

|

Long-term debt |

|

|

1,419.9 |

|

|

1,489.2 |

|

|

1,729.2 |

|

|

1,339.2 |

|

|

1,646.5 |

|

|

Shareholders’ equity |

|

|

4,140.5 |

|

|

4,685.1 |

|

|

5,182.1 |

|

|

4,691.3 |

|

|

4,685.0 |

|

|

Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income as a percentage of sales |

|

|

1.9 |

% |

|

1.1 |

% |

|

2.5 |

% |

|

3.4 |

% |

|

3.7 |

% |

|

Net income (loss) as a percentage of sales |

|

|

0.9 |

% |

|

(0.8) |

% |

|

3.0 |

% |

|

3.0 |

% |

|

3.2 |

% |

|

Quick ratio |

|

|

1.4:1 |

|

|

1.4:1 |

|

|

1.8:1 |

|

|

0.8:1 |

|

|

0.9:1 |

|

|

Current ratio |

|

|

2.7:1 |

|

|

2.6:1 |

|

|

3.1:1 |

|

|

1.8:1 |

|

|

2.0:1 |

|

|

Total debt to capital ratio |

|

|

29.4 |

% |

|

26.1 |

% |

|

25.6 |

% |

|

34.7 |

% |

|

29.7 |

% |

|

(a) |

In February 2017, the Company completed the sale of its TS business and as such, the results of that business are classified as discontinued operations in all periods presented. |

|

(b) |

The summary consolidated financial data for fiscal 2018 and prior has been retrospectively restated to reflect the Company’s adoption of Accounting Standards Update No. 2017-07, Compensation - Retirement Benefits (Topic 715)- Improving the Presentation of Net Periodic Cost and Net Periodic Postretirement Benefit Cost ("ASU No. 2017-07"). |

|

(c) |

All fiscal years presented include restructuring, integration and other expenses from continuing operations, which totaled $108.1 million in fiscal 2019, $145.1 million in fiscal 2018, $137.4 million in fiscal 2017, $44.8 million in fiscal 2016, and $41.8 million in fiscal 2015. |

19

|

(d) |

All fiscal years presented include amortization of acquired intangible assets and other, which totaled $84.3 million in 2019, $91.9 million in fiscal 2018, $54.5 million in fiscal 2017, $9.8 million in fiscal 2016, and $18.1 million in fiscal 2015. |

|

(e) |

Certain fiscal years presented were impacted by expense or income amounts that impact the comparability between years including a goodwill impairment expense of $137.4 million in fiscal 2019, a goodwill impairment expense of $181.4 million and a one-time mandatory deemed repatriation tax expense of $230.0 million in fiscal 2018, and a gain on disposal of the TS business of $222.4 million after tax in fiscal 2017. |

|

(f) |

This calculation of working capital is defined as current assets less current liabilities. See the “Liquidity” section contained in Item 7 of this Annual Report on Form 10-K for further discussion on liquidity. |

Summary of quarterly results:

|

|

|

First |

|

Second |

|

Third |

|

Fourth |

|

Fiscal |

|

|||||

|

|

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

|

Year(a) |

|

|||||

|

|

|

(Millions, except per share amounts) |

|

|||||||||||||

|

2019(b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales |

|

$ |

5,089.9 |

|

$ |

5,049.0 |

|

$ |

4,698.8 |

|

$ |

4,680.9 |

|

$ |

19,518.6 |

|

|

Gross profit |

|

|

636.8 |

|

|

630.0 |

|

|

624.2 |

|

|

595.1 |

|

|

2,486.1 |

|

|

Net income (loss) |

|

|

83.7 |

|

|

36.4 |

|

|

88.0 |

|

|

(31.8) |

|

|

176.3 |

|

|

Diluted earnings (loss) per share |

|

|

0.72 |

|

|

0.33 |

|

|

0.81 |

|

|

(0.30) |

|

|

1.59 |

|

|

2018(c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales |

|

$ |

4,660.9 |

|

$ |

4,521.6 |

|

$ |

4,795.1 |

|

$ |

5,059.2 |

|

$ |

19,036.9 |

|

|

Gross profit |

|

|

612.6 |

|

|

602.5 |

|

|

653.5 |

|

|

658.6 |

|

|

2,527.2 |

|

|

Net income (loss) |

|

|

58.3 |

|

|

46.7 |

|

|

(320.1) |

|

|

58.6 |

|

|

(156.4) |

|

|

Diluted earnings (loss) per share |

|

|

0.47 |

|

|

0.39 |

|

|

(2.68) |

|

|

0.50 |

|

|

(1.30) |

|

|

(a) |

Quarters may not total to the fiscal year due to rounding and differences in diluted share count. |

|

(b) |

First quarter of fiscal 2019 net income was impacted by restructuring, integration and other expenses of $11.5 million after tax, and a discrete income tax expense of $8.2 million. Second quarter results were impacted by restructuring, integration and other expenses of $46.6 million after tax and a discrete income tax expense of $16.7 million. Third quarter results were impacted by restructuring, integration and other expenses of $2.6 million after tax and a discrete income tax expense of $4.1 million. Fourth quarter results were impacted by restructuring, integration and other expenses of $20.7 million after tax, a goodwill impairment of $118.8 million after tax and a discrete income tax benefit of $20.9 million. |

|

(c) |

First quarter of fiscal 2018 net income was impacted by restructuring, integration and other expenses of $29.6 million after tax, foreign currency gain and other expense of $6.5 million after tax and a discrete income tax benefit of $6.9 million. Second quarter results were impacted by restructuring, integration and other expenses of $27.8 million after tax and a discrete income tax benefit of $8.0 million. Third quarter results were impacted by restructuring, integration and other expenses of $19.4 million after tax, a goodwill impairment of $181.4 million and a discrete income tax expense of $218.8 million. Fourth quarter results were impacted by restructuring, integration and other expenses of $26.9 million after tax and a discrete income tax expense of $14.5 million. |

20

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

For an understanding of Avnet and the significant factors that influenced the Company’s performance during the past three fiscal years, the following discussion should be read in conjunction with the description of the business appearing in Item 1 of this Report and the consolidated financial statements, including the related notes and schedule, and other information appearing in Item 15 of this Report. The Company operates on a “52/53 week” fiscal year. Fiscal years 2019, 2018 and 2017 all contain 52 weeks.

There are references to the impact of foreign currency translation in the discussion of the Company’s results of operations. When the U.S. Dollar strengthens and the stronger exchange rates of the current year are used to translate the results of operations of Avnet’s subsidiaries denominated in foreign currencies, the resulting impact is a decrease in U.S. Dollars of reported results. Conversely, when the U.S. Dollar weakens and the weaker exchange rates of the current year are used to translate the results of operations of Avnet’s subsidiaries denominated in foreign currencies, the resulting impact is an increase in U.S. Dollars of reported results. In the discussion that follows, results excluding this impact, primarily for subsidiaries in EMEA and Asia, are referred to as “constant currency.”

In addition to disclosing financial results that are determined in accordance with generally accepted accounting principles in the U.S. (“GAAP”), the Company also discloses certain non-GAAP financial information, including:

|

· |

Sales adjusted for certain items that impact the year-over-year analysis, which includes the impact of certain acquisitions by adjusting Avnet’s prior periods to include the sales of acquired businesses, as if the acquisitions had occurred at the beginning of the earliest period presented. In addition, the prior year sales are adjusted for divestitures by adjusting Avnet’s prior periods to exclude the sales of divested businesses as if the divestitures had occurred at the beginning of the earliest period presented. Sales taking into account these adjustments are referred to as “organic sales.” |

|

· |

Operating income excluding (i) restructuring, integration and other expenses (see Restructuring, Integration and Other Expenses in this MD&A), (ii) goodwill impairment expense and (iii) amortization of acquired intangible assets and other is referred to as “adjusted operating income.” Adjusted operating income excludes the TS business, which is reported within discontinued operations for all periods presented. |

The reconciliation of operating income to adjusted operating income is presented in the following table:

|

|

|

Years Ended |

|||||||

|

|

|

June 29, |

|

June 30, |

|

July 1, |

|||

|

|

|

2019 |

|

2018 |

|

2017 |

|||

|

|

|

(Thousands) |

|||||||

|

Operating income |

|

$ |

365,911 |

|

$ |

209,218 |

|

$ |

443,697 |

|

Restructuring, integration and other expenses |

|

|

108,144 |

|

|

145,125 |

|

|

137,415 |

|

Goodwill impairment expense |

|

|

137,396 |

|

|

181,440 |

|

|

— |

|

Amortization of acquired intangible assets and other |

|

|

84,257 |

|

|

91,923 |

|

|

54,526 |

|

Adjusted operating income |

|

$ |

695,708 |

|

$ |

627,706 |

|

$ |

635,638 |