UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTIONS 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2014

Commission file number 1-11071

UGI CORPORATION

(Exact name of registrant as specified in its charter)

Pennsylvania | 23-2668356 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

460 North Gulph Road, King of Prussia, PA 19406

(Address of Principal Executive Offices) (Zip Code)

(610) 337-1000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of each Exchange on Which Registered | |

Common Stock, without par value | New York Stock Exchange, Inc. | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes þ No o

Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

The aggregate market value of UGI Corporation Common Stock held by non-affiliates of the registrant on March 31, 2014 was $5,249,082,631.

At November 18, 2014, there were 172,425,384 shares of UGI Corporation Common Stock issued and outstanding.

Portions of the Proxy Statement for the Annual Meeting of Shareholders to be held on January 29, 2015 are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

Page | |

1

FORWARD-LOOKING INFORMATION

Information contained in this Annual Report on Form 10-K may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such statements use forward-looking words such as “believe,” “plan,” “anticipate,” “continue,” “estimate,” “expect,” “may,” or other similar words. These statements discuss plans, strategies, events or developments that we expect or anticipate will or may occur in the future.

A forward-looking statement may include a statement of the assumptions or bases underlying the forward-looking statement. We believe that we have chosen these assumptions or bases in good faith and that they are reasonable. However, we caution you that actual results almost always vary from assumed facts or bases, and the differences between actual results and assumed facts or bases can be material, depending on the circumstances. When considering forward-looking statements, you should keep in mind the following important factors which could affect our future results and could cause those results to differ materially from those expressed in our forward-looking statements: (1) adverse weather conditions resulting in reduced demand; (2) cost volatility and availability of propane and other liquefied petroleum gases, oil, electricity, and natural gas and the capacity to transport product to our customers; (3) changes in domestic and foreign laws and regulations, including safety, tax, consumer protection and accounting matters; (4) inability to timely recover costs through utility rate proceedings; (5) the impact of pending and future legal proceedings; (6) competitive pressures from the same and alternative energy sources; (7) failure to acquire new customers and retain current customers thereby reducing or limiting any increase in revenues; (8) liability for environmental claims; (9) increased customer conservation measures due to high energy prices and improvements in energy efficiency and technology resulting in reduced demand; (10) adverse labor relations; (11) large customer, counterparty or supplier defaults; (12) liability in excess of insurance coverage for personal injury and property damage arising from explosions and other catastrophic events, including acts of terrorism, resulting from operating hazards and risks incidental to generating and distributing electricity and transporting, storing and distributing natural gas and liquefied petroleum gases (“LPG”); (13) political, regulatory and economic conditions in the United States and in foreign countries, including the current conflicts in the Middle East and those involving Russia, and foreign currency exchange rate fluctuations, particularly the euro; (14) capital market conditions, including reduced access to capital markets and interest rate fluctuations; (15) changes in commodity market prices resulting in significantly higher cash collateral requirements; (16) reduced distributions from subsidiaries; (17) changes in Marcellus Shale gas production; (18) the timing and success of our acquisitions, commercial initiatives and investments to grow our businesses; and (19) our ability to successfully integrate acquired businesses and achieve anticipated synergies.

These factors are not necessarily all of the important factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors could also have material adverse effects on future results. We undertake no obligation to update publicly any forward-looking statement whether as a result of new information or future events except as required by the federal securities laws.

PART I:

ITEMS 1. AND 2. BUSINESS AND PROPERTIES

CORPORATE OVERVIEW

UGI Corporation (the “Company”) is a holding company that, through subsidiaries, distributes, stores, transports and markets energy products and related services. We are a domestic and international retail distributor of propane and butane (which are both LPG); a provider of natural gas and electric service through regulated local distribution utilities; a generator of electricity; a regional marketer of energy commodities; an owner and manager of midstream assets; and a regional provider of heating, ventilation, air conditioning, refrigeration and electrical contracting services. Our subsidiaries and affiliates operate principally in the following six business segments:

• | AmeriGas Propane |

• | UGI International - Antargaz |

• | UGI International - Flaga & Other |

• | Energy Services |

• | Electric Generation |

• | Gas Utility |

2

The AmeriGas Propane segment consists of the propane distribution business of AmeriGas Partners, L.P. (“AmeriGas Partners” or the “Partnership”), which is the nation’s largest retail propane distributor. The Partnership’s sole general partner is our subsidiary, AmeriGas Propane, Inc. (“AmeriGas Propane” or the “General Partner”). The common units of AmeriGas Partners represent limited partner interests in a Delaware limited partnership and trade on the New York Stock Exchange under the symbol “APU.” We have an effective 26% ownership interest in the Partnership and the remaining interest is publicly held. See Note 1 to Consolidated Financial Statements.

The UGI International - Antargaz segment consists of the LPG distribution business of our wholly-owned subsidiary Antargaz, a French société anonyme, and our LPG distribution businesses in the Benelux countries (consisting of Belgium, the Netherlands, and Luxembourg) (collectively, “Antargaz”). Antargaz is one of the largest retail distributors of LPG in France and the Netherlands and the largest retail distributor of LPG in Belgium and Luxembourg.

The UGI International - Flaga & Other segment consists of the LPG distribution businesses of (i) Flaga GmbH, an Austrian limited liability company, and its subsidiaries (collectively, “Flaga”), (ii) AvantiGas Limited, a United Kingdom private limited company (“AvantiGas”), and (iii) ChinaGas Partners, L.P., a majority-owned Delaware limited partnership. Flaga is the largest retail LPG distributor in Austria and Denmark and one of the largest in Poland, the Czech Republic, Hungary, Slovakia, Norway, Sweden, and Finland. Flaga also distributes LPG in Romania and Switzerland. AvantiGas is an LPG distributor in the United Kingdom. ChinaGas Partners is an LPG distributor in the Nantong region of China. The UGI International - Antargaz and UGI International - Flaga & Other segments are collectively referred to as “UGI International.”

The Energy Services segment consists of energy-related businesses conducted by our wholly-owned subsidiary, UGI Energy Services, LLC (formerly known as UGI Energy Services, Inc. prior to its merger with and into UGI Energy Services, LLC, effective October 1, 2013) (“Energy Services”). These businesses include (i) energy marketing in the Mid-Atlantic region of the United States (the “U.S.”), (ii) operating and owning a natural gas liquefaction, storage and vaporization facility and propane-air mixing assets, (iii) managing natural gas pipeline and storage contracts, and (iv) developing, owning and operating pipelines, gathering infrastructure and gas storage facilities in the Marcellus Shale region of Pennsylvania.

The Electric Generation segment consists of electric generation facilities conducted by Energy Services’ wholly-owned subsidiary, UGI Development Company (“UGID”). UGID has an approximate 5.97% (approximately 102 megawatt) ownership interest in a coal-fired generation station in Pennsylvania. UGID also owns and operates (i) a 130 megawatt natural gas-fueled generating station in Pennsylvania, (ii) an 11 megawatt landfill gas-fueled generation plant in Pennsylvania, and (iii) 11.67 megawatts of solar-powered generation capacity in Pennsylvania, Maryland and New Jersey. The Energy Services and Electric Generation segments are collectively referred to as “Midstream & Marketing.”

The Gas Utility segment (“Gas Utility”) consists of the regulated natural gas distribution businesses of our subsidiary, UGI Utilities, Inc. (“UGI Utilities”), and UGI Utilities’ subsidiaries, UGI Penn Natural Gas, Inc. (“PNG”) and UGI Central Penn Gas, Inc. (“CPG”). Gas Utility serves over 600,000 customers in eastern and central Pennsylvania and several hundred customers in portions of one Maryland county. UGI Utilities’ natural gas distribution utility is referred to as “UGI Gas.” Gas Utility is regulated by the Pennsylvania Public Utility Commission (“PUC”) and, with respect to its several hundred customers in Maryland, the Maryland Public Service Commission.

In addition to the segments set forth herein, UGI Corporation also owns and operates (i) a regulated electric distribution business in Pennsylvania through UGI Utilities (“Electric Utility”), and (ii) a heating, ventilation, air-conditioning, refrigeration and electrical contracting service business in portions of eastern Pennsylvania and the Mid-Atlantic region of the U.S. through UGI HVAC Enterprises, Inc. (“HVAC”).

Business Strategy

Our business strategy is to grow the Company by focusing on our core competencies of distributing, storing, transporting and marketing energy products and services. We are utilizing our core competencies from our existing businesses and our national scope, international experience, extensive asset base and access to customers to accelerate both internal growth and growth through acquisitions in our existing businesses, as well as in related and complementary businesses. During Fiscal 2014, we completed a number of transactions in pursuit of this strategy and made progress on larger internally generated capital projects, including infrastructure projects to further support the development of natural gas in the Marcellus Shale region of Pennsylvania. A few of these transactions and projects are described below.

On November 11, 2014, our indirect wholly-owned French subsidiary, UGI Bordeaux Holding, entered into a Share Purchase Agreement with Total Marketing Services, a subsidiary of Total, to acquire all of the outstanding shares of Totalgaz, Total’s LPG distribution business in France (the “Total Acquisition”). Totalgaz distributed over 265 million retail gallons of LPG in 2013,

3

serving residential, commercial, industrial, and autogas customers. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

In the first quarter of Fiscal 2014, Energy Services placed its newly constructed 28-mile gathering pipeline and compressor station into service (Auburn II). The newly constructed pipeline transports locally produced natural gas from Energy Services’ compressor station in the Marcellus Shale region of Pennsylvania to PNG and two interstate pipelines. During Fiscal 2014, Energy Services also announced (i) a pipeline project to further expand its gathering system in the Marcellus Shale region of Pennsylvania (Auburn III), (ii) a pipeline project to transport locally produced natural gas to PNG (the Union Dale Lateral), and (iii) a joint project to develop an approximately 100-mile pipeline from Pennsylvania to New Jersey (the PennEast Pipeline Project). Energy Services also announced a project to increase the liquefaction capacity of its natural gas liquefaction, storage, and vaporization facility in Temple, Pennsylvania (the Temple Facility) in the fiscal year ending September 30, 2015 (“Fiscal 2015”).

In Fiscal 2014, Energy Services also acquired a retail natural gas marketing business from EQT Energy, LLC and expanded its industrial and commercial customer base in western Pennsylvania. See Note 4 to the Consolidated Financial Statements.

Corporate Information

UGI Corporation was incorporated in Pennsylvania in 1991. UGI Corporation is not subject to regulation by the PUC. UGI Corporation is a “holding company” under the Public Utility Holding Company Act of 2005 (“PUHCA 2005”). PUHCA 2005 and the implementing regulations of the Federal Energy Regulatory Commission (“FERC”) give FERC access to certain holding company books and records and impose certain accounting, record-keeping, and reporting requirements on holding companies. PUHCA 2005 also provides state utility regulatory commissions with access to holding company books and records in certain circumstances. Pursuant to a waiver granted in accordance with FERC’s regulations on the basis of UGI Corporation’s status as a single-state holding company system, UGI Corporation is not subject to certain of the accounting, record-keeping, and reporting requirements prescribed by FERC’s regulations.

Our executive offices are located at 460 North Gulph Road, King of Prussia, Pennsylvania 19406, and our telephone number is (610) 337-1000. In this report, the terms “Company” and “UGI,” as well as the terms “our,” “we,” and “its,” are sometimes used as abbreviated references to UGI Corporation or, collectively, UGI Corporation and its consolidated subsidiaries. Similarly, the terms “AmeriGas Partners” and the “Partnership” are sometimes used as abbreviated references to AmeriGas Partners, L.P. or, collectively, AmeriGas Partners, L.P. and its subsidiaries and the term “UGI Utilities” is sometimes used as an abbreviated reference to UGI Utilities, Inc. or, collectively, UGI Utilities, Inc. and its subsidiaries. The terms “Fiscal 2014” and “Fiscal 2013” refer to the fiscal years ended September 30, 2014 and September 30, 2013, respectively.

The Company’s corporate website can be found at www.ugicorp.com. Information on our website is not intended to be incorporated into this report. The Company makes available free of charge at this website (under the “Investor Relations - Financial Reports - SEC Filings and Proxy” caption) copies of its reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, including its Annual Reports on Form 10-K, its Quarterly Reports on Form 10-Q and its Current Reports on Form 8-K. The Company’s Principles of Corporate Governance, Code of Ethics for the Chief Executive Officer and Senior Financial Officers, Code of Business Conduct and Ethics for Directors, Officers and Employees, and charters of the Corporate Governance, Audit, Compensation and Management Development, and Safety, Environmental and Regulatory Compliance Committees of the Board of Directors are also available on the Company’s website, under the captions “Investor Relations - Corporate Governance - Committees.” All of these documents are also available free of charge by writing to Daniel J. Platt, Treasurer, UGI Corporation, P.O. Box 858, Valley Forge, PA 19482.

The Company’s common stock (“Common Stock”) trades on the New York Stock Exchange under the symbol “UGI.” On July 29, 2014, the Company announced that its Board of Directors had approved a three-for-two split of its Common Stock. The additional shares were distributed September 5, 2014 to shareholders of record on August 22, 2014. All shares and per share data provided herein gives effect to this stock split, applied retroactively.

4

AMERIGAS PROPANE

Products, Services and Marketing

Our domestic propane distribution business is conducted through AmeriGas Partners. AmeriGas Propane is responsible for managing the Partnership. The Partnership serves approximately 2 million customers in all 50 states from over 2,000 propane distribution locations. In addition to distributing propane, the Partnership also sells, installs and services propane appliances, including heating systems. Typically, the Partnership’s locations are in suburban and rural areas where natural gas is not readily available. Our district offices generally consist of a business office and propane storage. As part of its overall transportation and distribution infrastructure, the Partnership operates as an interstate carrier in all states throughout the continental U.S.

The Partnership sells propane primarily to residential, commercial/industrial, motor fuel, agricultural and wholesale customers. The Partnership distributed nearly 1.4 billion gallons of propane in Fiscal 2014. Approximately 93% of the Partnership’s Fiscal 2014 sales (based on gallons sold) were to retail accounts and approximately 7% were to wholesale and supply customers. Sales to residential customers in Fiscal 2014 represented approximately 41% of retail gallons sold; commercial/industrial customers 36%; motor fuel customers 13%; and agricultural customers 6%. Transport gallons, which are large-scale deliveries to retail customers other than residential, accounted for 4% of Fiscal 2014 retail gallons. No single customer represents, or is anticipated to represent, more than 5% of the Partnership’s consolidated revenues.

The Partnership continues to expand its AmeriGas Propane Exchange (“Propane Exchange”) program. At September 30, 2014, Propane Exchange cylinders were available at nearly 49,000 retail locations throughout the U.S. Sales of our Propane Exchange cylinders to retailers are included in commercial/industrial sales. The Propane Exchange program enables consumers to purchase or exchange propane cylinders at various retail locations such as home centers, gas stations, mass merchandisers and grocery and convenience stores. We also supply retailers with large propane tanks to enable retailers to replenish customers’ propane cylinders directly at the retailer’s location.

Residential and commercial customers use propane primarily for home heating, water heating and cooking purposes. Commercial users include hotels, restaurants, churches, warehouses, and retail stores. Industrial customers use propane to fire furnaces, as a cutting gas and in other process applications. Other industrial customers are large-scale heating accounts and local gas utility customers who use propane as a supplemental fuel to meet peak load deliverability requirements. As a motor fuel, propane is burned in internal combustion engines that power over-the-road vehicles, forklifts, commercial lawn mowers, and stationary engines. Agricultural uses include tobacco curing, chicken brooding, and crop drying. In its wholesale operations, the Partnership principally sells propane to large industrial end-users and other propane distributors.

Retail deliveries of propane are usually made to customers by means of bobtail and rack trucks. Propane is pumped from the bobtail truck, which generally holds 2,400 to 3,000 gallons of propane, into a stationary storage tank on the customer’s premises. The Partnership owns most of these storage tanks and leases them to its customers. The capacity of these tanks ranges from approximately 120 gallons to approximately 1,200 gallons. The Partnership also delivers propane in portable cylinders, including Propane Exchange cylinders. Some of these deliveries are made to the customer’s location, where cylinders are either picked up or replenished in place.

Propane Supply and Storage

The U.S. propane market has over 250 domestic and international sources of supply, including the spot market. Supplies of propane from the Partnership’s sources historically have been readily available. During Fiscal 2014, over 90% of the Partnership’s propane supply was purchased under supply agreements with terms of 1 to 3 years. The availability of propane supply is dependent upon, among other things, the severity of winter weather, the price and availability of competing fuels such as natural gas and crude oil, and the amount and availability of imported and exported supply. During the winter heating season of Fiscal 2014, there were wholesale supply challenges in certain regions of the U.S. due to industry-wide storage and transportation issues. These issues were exacerbated by prolonged periods of unusually cold winter weather, record volumes during the fall crop drying season that depleted propane storage inventories for the winter heating season, and an increase in demand for domestic propane overseas from the U.S.’ propane export market. The Partnership responded to these issues by instituting supply allocation measures, procuring propane from alternative supply sources, using its extensive transportation network to transport existing propane supplies to areas of the country that were most affected by the winter weather, and deploying employees from areas of the country that were less affected by the weather to those areas in need. Although no assurance can be given that supplies of propane will be readily available in the future, management currently expects to be able to secure adequate supplies during Fiscal 2015. If supply from major sources were interrupted, however, the cost of procuring replacement supplies and transporting those supplies from alternative locations might be materially higher and, at least on a short-term basis, margins could be adversely affected. Enterprise Products Partners, L.P., Plains Marketing, L.P., and Targa Liquids Marketing & Trade LLC supplied approximately 46% of the Partnership’s

5

Fiscal 2014 propane supply. No other single supplier provided more than 10% of the Partnership’s total propane supply in Fiscal 2014. In certain geographical areas, however, a single supplier provides more than 50% of the Partnership’s requirements. Disruptions in supply in these areas could also have an adverse impact on the Partnership’s margins.

The Partnership’s supply contracts typically provide for pricing based upon (i) index formulas using the current prices established at a major storage point such as Mont Belvieu, Texas, or Conway, Kansas, or (ii) posted prices at the time of delivery. In addition, some agreements provide maximum and minimum seasonal purchase volume guidelines. The percentage of contract purchases, and the amount of supply contracted for at fixed prices, will vary from year to year as determined by the General Partner. The Partnership uses a number of interstate pipelines, as well as railroad tank cars, delivery trucks, and barges, to transport propane from suppliers to storage and distribution facilities. The Partnership stores propane at various storage facilities and terminals located in strategic areas across the U.S.

Because the Partnership’s profitability is sensitive to changes in wholesale propane costs, the Partnership generally seeks to pass on increases in the cost of propane to customers. There is no assurance, however, that the Partnership will always be able to pass on product cost increases fully, or keep pace with such increases, particularly when product costs rise rapidly. Product cost increases can be triggered by periods of severe cold weather, supply interruptions, increases in the prices of base commodities such as crude oil and natural gas, or other unforeseen events. The General Partner has adopted supply acquisition and product cost risk management practices to reduce the effect of volatility on selling prices. These practices currently include the use of summer storage, forward purchases and derivative commodity instruments, such as options and propane price swaps. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Market Risk Disclosures.”

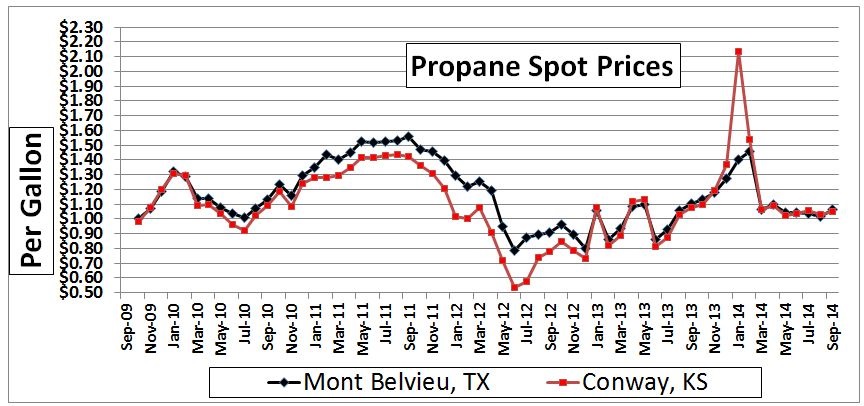

The following graph shows the average prices of propane on the propane spot market during the last five fiscal years at Mont Belvieu, Texas and Conway, Kansas, both major storage areas.

Average Propane Spot Market Prices

General Industry Information

Propane is separated from crude oil during the refining process and also extracted from natural gas or oil wellhead gas at processing plants. Propane is normally transported and stored in a liquid state under moderate pressure or refrigeration for economy and ease of handling in shipping and distribution. When the pressure is released or the temperature is increased, it is usable as a flammable gas. Propane is colorless and odorless; an odorant is added to allow for its detection. Propane is considered a clean alternative fuel under the Clean Air Act Amendments of 1990, producing negligible amounts of pollutants when properly consumed.

6

Competition

Propane competes with other sources of energy, some of which are less costly for equivalent energy value. Propane distributors compete for customers with suppliers of electricity, fuel oil and natural gas, principally on the basis of price, service, availability and portability. Electricity is generally more expensive than propane on a British thermal unit (“Btu”) equivalent basis, but the convenience and efficiency of electricity makes it an attractive energy source for consumers and developers of new homes. Fuel oil is also a major competitor of propane and, although a less environmentally attractive energy source, is currently less expensive than propane. Furnaces and appliances that burn propane will not operate on fuel oil, and vice versa, and, therefore, a conversion from one fuel to the other requires the installation of new equipment. Propane serves as an alternative to natural gas in rural and suburban areas where natural gas is unavailable or portability of product is required. Natural gas is generally a significantly less expensive source of energy than propane, although in areas where natural gas is available, propane is used for certain industrial and commercial applications and as a standby fuel during interruptions in natural gas service. The gradual expansion of the nation’s natural gas distribution systems has resulted in the availability of natural gas in some areas that previously depended upon propane. However, natural gas pipelines are not present in many areas of the country where propane is sold for heating and cooking purposes.

For motor fuel customers, propane competes with gasoline, diesel fuel, electric batteries, fuel cells and, in certain applications, liquefied natural gas and compressed natural gas. Wholesale propane distribution is a highly competitive, low margin business. Propane sales to other retail distributors and large-volume, direct-shipment industrial end-users are price sensitive and frequently involve a competitive bidding process.

Retail propane industry volumes have been declining for several years and no or modest growth in total demand is foreseen in the next several years. Therefore, the Partnership’s ability to grow within the industry is dependent on its ability to acquire other retail distributors and to achieve internal growth, which includes expansion of the Propane Exchange program and the National Accounts program (through which the Partnership encourages multi-location propane users to enter into a supply agreement with it rather than with many suppliers), as well as the success of its sales and marketing programs designed to attract and retain customers. The failure of the Partnership to retain and grow its customer base would have an adverse effect on its long-term results.

The domestic propane retail distribution business is highly competitive. The Partnership competes in this business with other large propane marketers, including other full-service marketers, and thousands of small independent operators. Some farm cooperatives, rural electric cooperatives, and fuel oil distributors include propane distribution in their businesses and the Partnership competes with them as well. The ability to compete effectively depends on providing high quality customer service, maintaining competitive retail prices and controlling operating expenses. The Partnership also offers customers various payment and service options, including guaranteed price programs, fixed price arrangements and pricing arrangements based on published propane prices at specified terminals.

In Fiscal 2014, the Partnership’s retail propane sales totaled nearly 1.3 billion gallons. Based on the most recent annual survey by the American Petroleum Institute, 2012 domestic retail propane sales (annual sales for other than chemical uses) in the U.S. totaled approximately 7.7 billion gallons. Based on LP-GAS magazine rankings, 2012 sales volume of the ten largest propane companies (including AmeriGas Partners) represented approximately 40% of domestic retail sales.

Properties

As of September 30, 2014, the Partnership owned over 91% of its approximately 750 district offices throughout the country. The transportation of propane requires specialized equipment. The trucks and railroad tank cars utilized for this purpose carry specialized steel tanks that maintain the propane in a liquefied state. As of September 30, 2014, the Partnership operated a transportation fleet with the following assets:

Approximate Quantity & Equipment Type | % Owned | % Leased | |

1,040 | Trailers | 82% | 18% |

370 | Tractors | 23% | 77% |

410 | Railroad tank cars | 4% | 96% |

3,900 | Bobtail trucks | 44% | 56% |

465 | Rack trucks | 43% | 57% |

4,000 | Service and delivery trucks | 57% | 43% |

Other assets owned at September 30, 2014 included approximately 1.8 million stationary storage tanks with typical capacities of more than 120 gallons and approximately 4.6 million portable propane cylinders with typical capacities of 1 to 120 gallons.

7

Trade Names, Trade and Service Marks

The Partnership markets propane principally under the “AmeriGas®”, “America’s Propane Company®”, “Heritage Propane®”, and “Relationships Matter®” trade names and related service marks. The Partnership also markets propane under various other trade names throughout the U.S. UGI owns, directly or indirectly, all the right, title and interest in the “AmeriGas” name and related trade and service marks. The General Partner owns all right, title and interest in the “America’s Propane Company” trade name and related service marks. The Partnership has an exclusive (except for use by UGI, AmeriGas, Inc., AmeriGas Polska Sp. z.o.o. and the General Partner), royalty-free license to use these trade names and related service marks. UGI and the General Partner each have the option to terminate its respective license agreement (on 12 months prior notice in the case of UGI), without penalty, if the General Partner is removed as general partner of the Partnership other than for cause. If the General Partner ceases to serve as the general partner of the Partnership for cause, the General Partner has the option to terminate its license agreement upon payment of a fee to UGI equal to the fair market value of the licensed trade names. UGI has a similar termination option; however, UGI must provide 12 months prior notice in addition to paying the fee to the General Partner.

Seasonality

Because many customers use propane for heating purposes, the Partnership’s retail sales volume is seasonal. During Fiscal 2014, approximately 67% of the Partnership’s retail sales volume occurred, and substantially all of the Partnership’s operating income was earned, during the peak heating season from October through March. As a result of this seasonality, sales are typically higher in the Partnership’s first and second fiscal quarters (October 1 through March 31). Cash receipts are generally greatest during the second and third fiscal quarters when customers pay for propane purchased during the winter heating season.

Sales volume for the Partnership traditionally fluctuates from year-to-year in response to variations in weather, prices, competition, customer mix and other factors, such as conservation efforts and general economic conditions. For information on national weather statistics, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Government Regulation

The Partnership is subject to various federal, state and local environmental, health, safety and transportation laws and regulations governing the storage, distribution and transportation of propane and the operation of bulk storage propane terminals. Generally, these laws impose limitations on the discharge of pollutants, establish standards for the handling of solid and hazardous substances, and require the investigation and cleanup of environmental contamination. These laws include, among others, the federal Resource Conservation and Recovery Act, the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), the Clean Air Act, the Occupational Safety and Health Act (“OSHA”), the Homeland Security Act of 2002, the Emergency Planning and Community Right-to-Know Act, the Clean Water Act, and comparable state statutes. We incur expenses associated with compliance with our obligations under federal and state environmental laws and regulations, and we believe that we are in material compliance with all of our obligations. We maintain various permits that are necessary to operate our facilities, some of which may be material to our operations. We continually monitor our operations with respect to potential environmental issues, including changes in legal requirements.

Hazardous Substances and Wastes

The Partnership is investigating and remediating contamination at a number of present and former operating sites in the U.S., including former sites where we or our former subsidiaries operated manufactured gas plants. CERCLA and similar state laws impose joint and several liability on certain classes of persons considered to have contributed to the release or threatened release of a “hazardous substance” into the environment without regard to fault or the legality of the original conduct. Propane is not a hazardous substance within the meaning of federal and most state environmental laws.

Health and Safety

The Partnership is subject to the requirements of OSHA and comparable state laws that regulate the protection of the health and safety of our workers. These laws require the Partnership, among other things, to maintain information about materials, some of which may be hazardous or toxic, that are used, released, or produced in the course of our operations. Certain portions of this information must be provided to employees, state and local governmental authorities and responders, and local citizens in accordance with applicable federal and state Emergency Planning and Community Right-to-Know Act requirements. The Partnership’s operations are also subject to the safety hazard communication requirements and reporting obligations set forth in federal workplace standards.

8

All states in which the Partnership operates have adopted fire safety codes that regulate the storage and distribution of propane. In some states, these laws are administered by state agencies, and in others they are administered on a municipal level. The Partnership conducts training programs to help ensure that its operations are in compliance with applicable governmental regulations. With respect to general operations, National Fire Protection Association (“NFPA”) Pamphlets No. 54 and No. 58 and/or one or more of various international codes (including international fire, building and fuel gas codes) establish rules and procedures governing the safe handling of propane, or comparable regulations, which have been adopted by all states in which the Partnership operates. Management believes that the policies and procedures currently in effect at all of its facilities for the handling, storage and distribution of propane are consistent with industry standards and are in compliance in all material respects with applicable environmental, health and safety laws.

With respect to the transportation of propane by truck, the Partnership is subject to regulations promulgated under federal legislation, including the Federal Motor Carrier Safety Act and the Homeland Security Act of 2002. Regulations under these statutes cover the security and transportation of hazardous materials and are administered by the U.S. Department of Transportation (“DOT”), Pipeline and Hazardous Materials Safety Administration. The Natural Gas Safety Act of 1968 required the DOT to develop and enforce minimum safety regulations for the transportation of gases by pipeline. The DOT's pipeline safety regulations apply, among other things, to a propane gas system that supplies 10 or more residential customers or two or more commercial customers from a single source and to a propane gas system any portion of which is located in a public place. The DOT’s pipeline safety regulations require operators of all gas systems to provide operator qualification standards and training and written instructions for employees and third party contractors working on covered pipelines and facilities, establish written procedures to minimize the hazards resulting from gas pipeline emergencies, and conduct and keep records of inspections and testing. Operators are subject to the Pipeline Safety Improvement Act of 2002. Management believes that the procedures currently in effect at all of the Partnership’s facilities for the handling, storage, transportation and distribution of propane are consistent with industry standards and are in compliance, in all material respects, with applicable laws and regulations.

Climate Change

There continues to be concern, both nationally and internationally, about climate change and the contribution of greenhouse gas (“GHG”) emissions, most notably carbon dioxide, to global warming. Because propane is considered a clean alternative fuel under the federal Clean Air Act Amendments of 1990, we anticipate that this will provide us with a competitive advantage over other sources of energy, such as fuel oil and coal, to the extent new climate change regulations become effective. At the same time, increased regulation of GHG emissions, especially in the transportation sector, could impose significant additional costs on the Partnership, suppliers and customers. The impact of new legislation and regulations will depend on a number of factors, including (i) which industry sectors would be impacted, (ii) the timing of required compliance, (iii) the overall GHG emissions cap level, (iv) the allocation of emission allowances to specific sources, and (v) the costs and opportunities associated with compliance.

Employees

The Partnership does not directly employ any persons responsible for managing or operating the Partnership. The General Partner provides these services and is reimbursed for its direct and indirect costs and expenses, including all compensation and benefit costs. At September 30, 2014, the General Partner had nearly 8,400 employees, including nearly 400 part-time, seasonal and temporary employees, working on behalf of the Partnership. UGI also performs certain financial and administrative services for the General Partner on behalf of the Partnership and is reimbursed by the Partnership.

UGI INTERNATIONAL

ANTARGAZ

Our UGI International - Antargaz LPG distribution business is conducted in France and the Benelux countries (consisting of Belgium, the Netherlands, and Luxembourg). Antargaz also operates a natural gas marketing business in France and Belgium and sold approximately 7.3 million dekatherms of natural gas during Fiscal 2014.

Products, Services and Marketing

During Fiscal 2014, Antargaz sold approximately 235 million gallons of LPG in France and approximately 44 million gallons of LPG in the Benelux countries. Antargaz is one of the largest LPG distributors in France and the Netherlands and the largest LPG distributor in Belgium and Luxembourg. Antargaz’ customer base consists of residential, commercial, agricultural and motor fuel customer accounts that use LPG for space heating, cooking, water heating, process heat, forklift operations, and transportation. Antargaz sells LPG in cylinders, and in small, medium and large tanks. Sales of LPG are also made to service stations to

9

accommodate vehicles that run on LPG. Antargaz sells LPG in cylinders to approximately 15,000 retail outlets, such as supermarkets, individually owned stores and gas stations. Supermarket sales represented approximately 79% of butane cylinder sales volume and approximately 13% of propane cylinder sales volume in Fiscal 2014. At September 30, 2014, Antargaz had approximately 221,000 bulk customers, approximately 16,000 natural gas customers and nearly 10 million cylinders in circulation. Approximately 60% of Antargaz’ Fiscal 2014 sales (based on volumes) were cylinder and small bulk, 17% medium bulk, 20% large bulk and 3% to service stations for automobiles. Antargaz also engages in wholesale sales of LPG and provides logistic, storage and other services to third-party LPG distributors. In addition, Antargaz operates a natural gas marketing business in France and Belgium that services both commercial and residential customers. One wholesale customer represented over 10% of Antargaz’ total revenues in Fiscal 2014. No other customer represents, or is anticipated to represent, more than 10% of total revenues for Antargaz.

Sales to small bulk customers represent the largest segment of Antargaz’ business in terms of volume, revenue and total margin. Small bulk customers are primarily residential and small business users, such as restaurants, that use LPG mainly for heating and cooking. Small bulk customers also include municipalities, which use LPG for heating certain sports facilities and swimming pools, and the poultry industry for use in chicken brooding.

Medium bulk customers use propane only, and consist mainly of large residential developments such as housing developments, hospitals, municipalities and medium-sized industrial enterprises, and poultry brooders. Large bulk customers include agricultural companies and companies that use LPG in their industrial processes.

The principal end-users of cylinders are residential customers who use LPG supplied in this form for domestic applications such as cooking and heating. Butane cylinders accounted for approximately 53% of all LPG cylinders sold in Fiscal 2014, with propane cylinders accounting for the remainder. Propane cylinders are also used to supply fuel for forklift trucks. The market demand for cylinders continues to decline, due primarily to customers gradually changing to other household energy sources for cooking and heating, such as natural gas and electricity.

LPG Supply and Storage

Antargaz currently has an agreement with Totalgaz (currently owned by Total France until the closing of the proposed Total Acquisition) for the supply of butane in France, with pricing based on internationally quoted market prices. Under this agreement, approximately 50% of Antargaz’ requirements for butane are guaranteed until September 2015. Requirements are fixed annually and Antargaz has developed other sources of supply. In Fiscal 2014, Antargaz purchased substantially all of its propane supply for its operations in France from SHV and TOTSA. In the Benelux countries, Antargaz purchased substantially all of its butane and propane requirements from SHV and GUNVOR during Fiscal 2014. From time to time, as needed, Antargaz also purchases propane on the international market and on the domestic spot market.

Antargaz has three primary storage facilities in operation that are located at deep sea harbor facilities, and 29 secondary storage facilities. It also manages an extensive logistics and transportation network. Access to seaborne facilities allows Antargaz to diversify its LPG supplies through imports. LPG stored in primary storage facilities is transported to smaller storage facilities by rail, sea and road. At secondary storage facilities, LPG is filled into cylinders or trucks equipped with tanks and then delivered to customers.

Competition and Seasonality

The LPG markets in France and the Benelux countries are mature, with modest declines in total demand due to competition with other fuels and other energy sources, conservation and the economic climate. Sales volumes are affected principally by the severity of the weather and customer migration to alternative energy forms, including natural gas and electricity. Because Antargaz’ profitability is sensitive to changes in wholesale LPG costs, Antargaz generally seeks to pass on increases in the cost of LPG to customers. There is no assurance, however, that Antargaz will always be able to pass on product cost increases fully when product costs rise rapidly. Product cost increases can be triggered by periods of severe cold weather, supply interruptions, increases in the prices of base commodities such as crude oil and natural gas, or other unforeseen events. High LPG prices may result in slower than expected growth due to customer conservation and customers seeking less expensive alternative energy sources. France derives a significant portion of its electricity from nuclear power plants. Due to the nuclear power plants, as well as the regulation of electricity prices by the French government, electricity prices in France are generally less expensive than LPG. As a result, electricity has increasingly become a more significant competitor to LPG in France than in other countries where we operate. In addition, government policies and incentives that favor alternative energy sources can result in customers migrating to energy sources other than LPG in both France and the Benelux countries.

In Fiscal 2014, Antargaz competed in all of its product markets in France on a national level, principally with three LPG distribution

10

companies, Totalgaz (currently owned by Total France until the closing of the proposed Total Acquisition), Butagaz (owned by Societe des Petroles Shell), and Compagnie des Gaz de Petrole Primagaz (owned by SHV Holding NV), as well as with a regional competitor, Vitogaz. Antargaz also competes with supermarket chains that affiliate with LPG distributors to offer their own brands of cylinders. Antargaz has partnered with two supermarket chains in France in this market. If Antargaz is unsuccessful in expanding its services to other supermarket chains, its market share through supermarket sales may decline in France. In the Benelux countries, Antargaz competes in all of its product markets on a national level, principally with Compagnie des Gaz de Petrole Primagaz, as well as with several regional competitors. In recent years, competition has increased in the Benelux countries as small competitors have reduced their price offerings. In the Netherlands, several LPG distributors offer their own brands of cylinders. Antargaz seeks to increase demand for its butane and propane cylinders through marketing and product innovations. Some of Antargaz’ competitors are affiliates of its LPG suppliers. As a result, its competitors may obtain product at more competitive prices.

Because many of Antargaz’ customers use LPG for heating, sales volume is affected principally by the severity of the temperatures during the heating season months and traditionally fluctuates from year-to-year in response to variations in weather, prices and other factors, such as conservation efforts and the challenging economic climate. Demand for LPG is higher during the colder months of the year. During Fiscal 2014, approximately 66% of Antargaz’ retail sales volume occurred, and substantially all of Antargaz’ operating income was earned, during the six months from October through March. For historical information on weather statistics for Antargaz, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Government Regulation

Antargaz’ business is subject to various laws and regulations at the national and European levels with respect to matters such as protection of the environment, the storage and handling of hazardous materials and flammable substances, the discharge of contaminants into the environment and the safety of persons and property. In Belgium and Luxembourg, Antargaz is also subject to price regulations that permit Antargaz to increase the price of LPG sold to small bulk, medium bulk, large bulk and cylinder customers (up to a defined maximum price) when Antargaz’ costs fluctuate.

Properties

Antargaz has three primary storage facilities in operation. One of these is a refrigerated facility. In addition, Antargaz is able to use 30,000 cubic meters of capacity of a storage facility, Donges, by virtue of Antargaz’ 50% ownership of Donges GIE. The table below sets forth details of Antargaz’ three primary storage facilities:

Ownership % | Antargaz Storage Capacity - Propane (m3) (1) | Antargaz Storage Capacity - Butane (m3) (1) | ||||||

GIE Norgal | 52.7 | 22,600 | 8,900 | |||||

Geogaz-Lavera | 16.7 | 17,400 | 32,500 | |||||

Cobogal | 15.0 | 1,300 | 450 | |||||

_________________

(1) | Cubic meters (1 cubic meter is equivalent to approximately 264 gallons). |

Antargaz has 29 secondary storage facilities, 19 of which are wholly-owned. The others are partially owned through joint ventures.

Employees

At September 30, 2014, Antargaz had approximately 1,040 employees.

FLAGA & OTHER

During Fiscal 2014, our UGI International - Flaga & Other LPG distribution business was conducted principally in Europe through our wholly-owned subsidiaries, Flaga and AvantiGas, and in China through our majority-owned partnership, ChinaGas Partners, L.P. Flaga is referred to in this section collectively with its subsidiaries as “Flaga” unless the context otherwise requires. Flaga operates in Austria, the Czech Republic, Denmark, Finland, Hungary, Norway, Poland, Romania, Slovakia, Sweden and Switzerland. AvantiGas operates in the United Kingdom.

During Fiscal 2014, Flaga sold approximately 340 million gallons of LPG. Flaga is the largest distributor of LPG in Austria and

11

Denmark and one of the largest distributors of LPG in Poland, the Czech Republic, Hungary, Slovakia, Norway, Sweden, and Finland. During Fiscal 2014, AvantiGas sold approximately 150 million gallons of LPG and our majority-owned partnership in China sold approximately 9 million gallons of LPG.

FLAGA

Products, Services and Marketing

During Fiscal 2014, Flaga sold approximately 340 million gallons of LPG (of which approximately 95 million gallons were to wholesale customers). Flaga serves customers that use LPG for residential, commercial, industrial, agricultural, resale, and automobile fuel (“auto gas”) purposes. Flaga’s customers primarily use LPG for heating, cooking, motor fuel (including forklifts), leisure activities, construction work, manufacturing, crop drying, power generation and irrigation. Flaga sells LPG in cylinders and in small, medium, and large bulk tanks. At September 30, 2014, Flaga had nearly 68,000 customers and 4.1 million cylinders in circulation. Approximately 24% of Flaga’s Fiscal 2014 sales (based on volumes) were cylinder and small bulk, 33% auto gas, 39% large bulk, and 4% medium bulk.

Flaga has a total of 18 sales offices throughout the countries it serves, although it does not have sales offices in Norway, Sweden or Finland, largely due to the commercial and industrial nature of Flaga’s business in those countries. Sales offices generally consist of an office location where customers can directly purchase LPG. Except for Poland, no single country represented more than 10% of Flaga’s total LPG gallons sold in Fiscal 2014. Flaga distributes cylinders directly to its customers and through the use of distributors who resell the cylinders to end users under the distributor’s pricing and terms. No single customer represents or is anticipated to represent more than 5% of total revenues for Flaga, with the exception of one auto gas customer that represented approximately 11% of Flaga’s total revenues in Fiscal 2014.

LPG Supply and Storage

Flaga typically enters into an annual LPG supply agreement with TCO/Chevron. During Fiscal 2014, TCO/Chevron supplied approximately 50% of Flaga’s LPG requirements, with pricing based on internationally quoted market prices. Flaga also purchases LPG on the international market and on the domestic markets, under annual term agreements with international oil and gas trading companies, including SIBUR, NOVATEK, LOTOS, and PGNIG, and from domestic refineries, primarily OMV, Shell, MOL, and Statoil. In addition, LPG purchases are made on the spot market from international oil and gas traders. During Fiscal 2014, 8 suppliers accounted for approximately 80% of Flaga’s LPG supply.

Flaga operates 11 main storage facilities, including one in Denmark that is located at a deep sea harbor facility, two LPG import terminals in Poland, and 58 secondary storage facilities. Flaga manages a widespread logistics and transportation network including approximately 300 leased railcars, and also maintains various transloading and filling agreements with third parties. LPG stored in primary storage facilities is transported to smaller storage facilities by rail or truck.

Competition and Seasonality

The retail propane industry in the Western European countries in which Flaga operates is mature, with slight declines in overall demand in recent years, due primarily to the expansion of natural gas, customer conservation and economic conditions. In the Eastern European countries in which Flaga operates, the demand for LPG is expected to grow in certain segments. Competition for customers is based on contract terms as well as on product prices. Flaga competes with other LPG marketers, including competitors located in other European countries, and also competes with providers of other sources of energy, principally natural gas, electricity and wood.

Because many of Flaga’s customers use LPG for heating, sales volumes in Flaga’s sales territories are affected by the severity of the temperatures during the heating season months and traditionally fluctuate from year-to-year in response to variations in weather, prices and other factors, such as conservation efforts and the economic climate. Because Flaga’s profitability is sensitive to changes in wholesale LPG costs, Flaga generally seeks to pass on increases in the cost of LPG to customers. There is no assurance, however, that Flaga will always be able to pass on product cost increases fully when product costs rise. In parts of Flaga’s sales territories, it is particularly difficult to pass on rapid increases in the price of LPG due to the low per capita income of customers in several of its territories and the intensity of competition. Product cost increases can be triggered by periods of severe cold weather, supply interruptions, increases in the prices of base commodities such as crude oil and natural gas, or other unforeseen events. High LPG prices may result in slower than expected growth due to customer conservation and customers seeking less expensive alternative energy sources. In many of Flaga’s sales territories, government policies and incentives that favor alternative energy sources may result in customers migrating to energy sources other than LPG. Rules and regulations applicable to LPG industry operations in many of the Eastern European countries where Flaga operates are still evolving, or are not consistently enforced, causing intensified

12

competitive conditions in those areas.

Government Regulation

Flaga’s business is subject to various laws and regulations at both the national and European levels with respect to matters such as protection of the environment and the storage and handling of hazardous materials and flammable substances.

Employees

At September 30, 2014, Flaga had approximately 950 employees.

AVANTIGAS

Products, Services and Marketing

During Fiscal 2014, AvantiGas sold approximately 150 million gallons of LPG (of which approximately 91 million gallons were wholesale gallons). At September 30, 2014, AvantiGas had over 14,350 customers. AvantiGas serves customers that use LPG for wholesale, aerosol, agricultural, residential, commercial, industrial, and auto gas purposes. AvantiGas’ customers primarily use LPG for heating, cooking, motor fuel (including forklifts), leisure activities, industrial processes and aerosol propellant. AvantiGas sells LPG in small, medium, and large bulk tanks with small bulk sales representing approximately 5% of Fiscal 2014 sales (based on volumes), medium bulk sales representing approximately 34% of Fiscal 2014 sales and large bulk sales representing approximately 61% of Fiscal 2014 sales.

AvantiGas serves its customer base through a centralized customer service center and, therefore, does not have sales offices in the United Kingdom. Sales to wholesale customers represented approximately 61% of gallons sold; aerosol customers 21%; agricultural customers 5%; residential customers 5%; and commercial, industrial and autogas 8%. Three wholesale customers and one aerosol customer collectively represented over 55% of AvantiGas’ total revenues in Fiscal 2014. No other customer represents or is anticipated to represent more than 5% of total revenues for AvantiGas.

LPG Supply and Storage

AvantiGas has five-year agreements, which will terminate during the 2016 fiscal year, with Essar Energy plc’s Stanlow refinery and STASCO’s Mossmorran terminal, and a one-year agreement, which will terminate during Fiscal 2015, with Centrica plc, for the supply of an aggregate of approximately 92% of AvantiGas’ LPG requirements. Pricing for such agreements is based on internationally quoted market prices. AvantiGas purchased the remainder of its LPG requirements from other third party suppliers in Fiscal 2014.

AvantiGas operates eight main storage facilities in England, Scotland and Wales. AvantiGas manages a logistics and transportation network, consisting of approximately 40 trucks, and also maintains various transportation agreements with third parties. LPG stored in primary storage facilities is transported to smaller storage facilities or customers by truck.

Competition and Seasonality

The retail propane industry in the United Kingdom is highly concentrated and is mature, with slight declines in overall demand in recent years, due primarily to the expansion of natural gas, customer conservation and challenging economic conditions. Competition for customers is based on contract terms as well as on product prices. AvantiGas competes with other LPG marketers in the United Kingdom.

Because many of AvantiGas’ customers use gas for heating purposes, sales volumes in AvantiGas’ sales territories are affected principally by the severity of the temperatures during the heating season months and traditionally fluctuate from year-to-year in response to variations in weather, prices and other factors, such as energy conservation efforts and the economic climate. During Fiscal 2014, approximately 56% of AvantiGas’ retail sales volume occurred, and approximately 75% of AvantiGas’ operating income was earned, during the peak heating season where AvantiGas operates. Because AvantiGas’ profitability is sensitive to changes in wholesale LPG costs, AvantiGas generally seeks to pass on increases in the cost of LPG to customers. There is no assurance, however, that AvantiGas will always be able to pass on product cost increases fully when product costs rise. Product cost increases can be triggered by periods of severe cold weather, supply interruptions, increases in the prices of base commodities, such as crude oil and natural gas, or other unforeseen events. High LPG prices may result in slower than expected growth due to customer conservation and customers seeking less expensive alternative energy sources.

13

Government Regulation

AvantiGas’ business is subject to various laws and regulations at both the national and European levels with respect to matters such as competition, protection of the environment and the storage and handling of hazardous materials and flammable substances.

Employees

At September 30, 2014, AvantiGas had approximately 180 employees.

MIDSTREAM & MARKETING

ENERGY SERVICES

Retail Energy Marketing

Energy Services sells natural gas, liquid fuels and electricity to approximately 19,000 residential, commercial, and industrial customers at approximately 43,000 locations. Energy Services serves customers in all or portions of Pennsylvania, New Jersey, Delaware, New York, Ohio, Maryland, Massachusetts, Virginia, North Carolina and the District of Columbia. Energy Services distributes natural gas through the use of the distribution systems of 36 local gas utilities. It supplies power to customers through the use of the transmission systems of 20 utility systems.

Historically, a majority of Energy Services’ commodity sales have been made under fixed-price agreements, which typically contain a take-or-pay arrangement that requires customers to purchase a fixed amount of product for a fixed price during a specified period, and to pay for the product even if the customer does not take delivery of the product. However, a growing number of Energy Services’ commodity sales are currently being made under requirements contracts, under which Energy Services is typically an exclusive supplier and will supply as much product at a fixed price as the customer requires. Energy Services manages supply cost volatility related to these agreements by (i) entering into fixed-price supply arrangements with a diverse group of suppliers, (ii) holding its own interstate pipeline transportation and storage contracts to efficiently utilize gas supplies, (iii) entering into exchange-traded futures contracts on the New York Mercantile Exchange and the Intercontinental Exchange, (iv) entering into over-the-counter derivative arrangements with major international banks and major suppliers, (v) utilizing supply assets that it owns or manages, and (vi) utilizing financial transmission rights to hedge price risk against certain transmission costs. Energy Services also bears the risk for balancing and delivering natural gas and power to its customers under various gas pipeline and utility company tariffs. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Market Risk Disclosures.”

Midstream Assets

Energy Services operates a natural gas liquefaction, storage and vaporization facility in Temple, Pennsylvania (“Temple Facility”), and propane storage and propane-air mixing stations in Bethlehem, Reading, Hunlock Creek, and White Deer, Pennsylvania. It also operates propane storage, rail transshipment terminals, and propane-air mixing stations in Steelton and Williamsport, Pennsylvania. These assets are used in Energy Services’ energy peaking business that provides supplemental energy, primarily liquefied natural gas and propane-air mixtures, to gas utilities on interstate pipelines at times of high demand (generally during periods of coldest winter weather). In recent years, Energy Services expanded its energy peaking services at the Temple Facility and began selling liquefied natural gas to customers for use by trucks, drilling rigs, other motor vehicles and facilities located off the gas grid. Energy Services also manages natural gas pipeline and storage contracts for UGI Utilities, subject to a competitive bid process, as well as storage capacity owned by Energy Services.

A wholly-owned subsidiary of Energy Services owns and operates underground natural gas storage and related high pressure pipeline facilities, which have FERC approval to sell storage services at market-based rates. The storage facilities are located in the Marcellus Shale region of Pennsylvania and have a total storage capacity of 15 million dekatherms and a maximum daily withdrawal quantity of 224,000 dekatherms. In Fiscal 2014, Energy Services leased more than 80% of the capacity at its underground natural gas facilities to third parties. Through its operation of a compressor station, Energy Services also receives natural gas from the Tennessee Gas Pipeline for injection into a storage facility on a firm basis throughout the year.

In Fiscal 2014, Energy Services continued making investments in infrastructure projects to support the development of natural gas in the Marcellus Shale region of Pennsylvania. In the first quarter of Fiscal 2014, Energy Services completed a project to extend its gathering system in Wyoming County, Pennsylvania and placed its newly constructed pipeline from Wyoming County to Luzerne County, Pennsylvania (Auburn II) into service. The expansion of the gathering system provides for (i) expanded capacity through additional compression; and (ii) additional delivery options by connecting the region served by PNG and two

14

interstate pipelines with Marcellus Shale producers. In Fiscal 2014, Energy Services also announced (i) plans to invest capital to further extend the gathering system, providing additional transportation capacity in the Marcellus Shale region (Auburn III); and (ii) a joint project to develop an approximately 100-mile pipeline from Luzerne County, Pennsylvania to the Trenton-Woodbury interconnection in New Jersey that will transport lower cost natural gas to residential and commercial customers (the PennEast Pipeline Project). Energy Services also commenced construction in the third quarter of Fiscal 2014 on a new pipeline project to transport locally produced natural gas to PNG (the Union Dale Lateral) and announced a project to increase the liquefaction capacity of its Temple Facility in Fiscal 2015.

Future planned investments are expected to cover a range of midstream asset opportunities, including interstate pipelines, local gathering systems and gas storage facilities and complementary and related investments in natural gas exploration, production and refining.

Competition

Energy Services competes with other midstream operators to sell gathering, compression, storage, and pipeline transportation services. Energy Services competes in both the regulated and non-regulated environment against interstate and intrastate pipelines that gather, compress, process, transport, and market natural gas. Energy Services sells midstream services primarily to producers, marketers, and utilities on the basis of price, customer service, flexibility, reliability, and operational experience. The competition in the midstream segment is significant and has grown recently in the northeast U.S. as more competitors seek opportunities offered by the development of the Marcellus and Utica Shales.

Energy Services also competes with other marketers, consultants, and local utilities to sell natural gas, liquid fuels, electric power, and related services to customers in its service area principally on the basis of price, customer service, and reliability. Energy Services has faced an increase in competition as new markets for natural gas, liquid fuels, electric power, and related services have emerged.

Government Regulation

FERC has jurisdiction over the rates and terms and conditions of service of wholesale sales of electric capacity and energy, as well as the sales for resale of natural gas and related storage and transportation services. Energy Services has a tariff on file with FERC pursuant to which it may make power sales to wholesale customers at market-based rates. Energy Services also has market-based rate authority for power sales to wholesale customers to the extent that Energy Services purchases power in excess of its retail customer needs. Two subsidiaries of Energy Services operate natural gas storage facilities under FERC certificate approvals and offer services to wholesale customers at FERC-approved market-based rates. Energy Services is also subject to FERC reporting requirements, market manipulation rules and other FERC enforcement and regulatory powers.

Energy Services is subject to various federal, state and local environmental, safety and transportation laws and regulations governing the storage, distribution and transportation of propane and the operation of bulk storage LPG terminals. These laws include, among others, the Resource Conservation and Recovery Act, CERCLA, the Clean Air Act, OSHA, the Homeland Security Act of 2002, the Emergency Planning and Community Right-to-Know Act, the Clean Water Act and comparable state statutes. CERCLA imposes joint and several liability on certain classes of persons considered to have contributed to the release or threatened release of a “hazardous substance” into the environment without regard to fault or the legality of the original conduct. Energy Services also is required to comply with the provisions of the Pipeline Safety Act and the regulations of the U.S. DOT with respect to the operation of natural gas gathering and transportation pipelines.

Employees

At September 30, 2014, Energy Services had approximately 205 employees.

ELECTRIC GENERATION

Products and Services

UGID has an approximate 5.97% (approximately 102 megawatt) ownership interest in the Conemaugh generation station (“Conemaugh”), a 1,711-megawatt, coal-fired generation station located near Johnstown, Pennsylvania. Conemaugh is owned by a consortium of energy companies and operated by a unit of NRG Energy. UGID also owns and operates the Hunlock Station located near Wilkes-Barre, Pennsylvania, a 130-megawatt natural gas-fueled generating station.

UGID also owns and operates a landfill gas-fueled generation plant near Hegins, Pennsylvania, with gross generating capacity of

15

11 megawatts. The plant qualifies for renewable energy credits.

UGID also owns and operates 11.67 megawatts of solar-powered generation capacity in Pennsylvania, Maryland and New Jersey. Several other solar generation projects are in development.

Competition

UGID competes with other generation stations on the interface of PJM Interconnection, LLC (“PJM”), a regional transmission organization that coordinates the movement of wholesale electricity in certain states, including the states in which we operate, and bases sales on bid pricing. Generally, each power generator has a small share of the total market on PJM.

Government Regulation

UGID owns electric generation facilities that are within the control area of PJM and are dispatched in accordance with a FERC-approved open access tariff and associated agreements administered by PJM. UGID receives certain revenues collected by PJM, determined under an approved rate schedule. UGID is also subject to FERC reporting requirements, market manipulation rules and other FERC enforcement and regulatory powers.

Employees

At September 30, 2014, UGID had approximately 25 employees.

GAS UTILITY

Gas Utility consists of the regulated natural gas distribution businesses of our subsidiary, UGI Utilities, and UGI Utilities’ subsidiaries, PNG and CPG. Gas Utility serves over 600,000 customers in eastern and central Pennsylvania and several hundred customers in portions of one Maryland county. Gas Utility is regulated by the PUC and, with respect to its several hundred customers in Maryland, the Maryland Public Service Commission.

Service Area; Revenue Analysis

Gas Utility is authorized to distribute natural gas to over 600,000 customers in portions of 46 eastern and central Pennsylvania counties through its distribution system of approximately 12,000 miles of gas mains. Contemporary materials, such as plastic or coated steel, comprise approximately 87% of Gas Utility’s 12,000 miles of gas mains, with bare steel pipe comprising approximately 10% and cast iron pipe comprising approximately 3% of Gas Utility’s gas mains. In accordance with Gas Utility’s agreement with the PUC, Gas Utility will replace the cast iron portion of its gas mains by March 2027 and the bare steel portion by March 2043. The service area includes the cities of Allentown, Bethlehem, Easton, Harrisburg, Hazleton, Lancaster, Lebanon, Reading, Scranton, Wilkes-Barre, Lock Haven, Pittston, Pottsville, and Williamsport, Pennsylvania, and the boroughs of Honesdale and Milford, Pennsylvania. Located in Gas Utility’s service area are major production centers for basic industries such as specialty metals, aluminum, glass and paper product manufacturing. Gas Utility also distributes natural gas to several hundred customers in portions of one Maryland county.

System throughput (the total volume of gas sold to or transported for customers within Gas Utility’s distribution system) for Fiscal 2014 was approximately 208.8 billion cubic feet (“bcf”). System sales of gas accounted for approximately 31% of system throughput, while gas transported for residential, commercial and industrial customers who bought their gas from others accounted for approximately 69% of system throughput.

Sources of Supply and Pipeline Capacity

Gas Utility is permitted to recover prudently incurred costs of natural gas it sells to its customers. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Market Risk Disclosures” and Note 9 to Consolidated Financial Statements. Gas Utility meets its service requirements by utilizing a diverse mix of natural gas purchase contracts with marketers and producers, along with storage and transportation service contracts. These arrangements enable Gas Utility to purchase gas from Gulf Coast, Mid-Continent, Appalachian and Canadian sources. For the transportation and storage function, Gas Utility has long-term agreements with a number of pipeline companies, including Texas Eastern Transmission Corporation, Columbia Gas Transmission, LLC, Transcontinental Gas Pipeline Company, LLC, Dominion Transmission, Inc., ANR Pipeline Company, and Tennessee Gas Pipeline Company, L.L.C.

16

Gas Supply Contracts

During Fiscal 2014, Gas Utility purchased approximately 84.2 bcf of natural gas for sale to retail core-market customers (principally comprised of firm- residential, commercial and industrial customers that purchase their gas from Gas Utility (“retail core-market”)) and off-system sales customers. Approximately 90% of the volumes purchased were supplied under agreements with 10 suppliers. The remaining 10% of gas purchased by Gas Utility was supplied by approximately 35 producers and marketers. Gas supply contracts for Gas Utility are generally no longer than 16 months. Gas Utility also has long-term contracts with suppliers for natural gas peaking supply during the months of November through March.

Seasonality

Because many of its customers use gas for heating purposes, Gas Utility’s sales are seasonal. During Fiscal 2014, approximately 65% of Gas Utility’s sales volume was supplied, and over 90% of Gas Utility’s operating income was earned, during the peak heating season from October through March.

Competition

Natural gas is a fuel that competes with electricity and oil, and to a lesser extent, with propane and coal. Competition among these fuels is primarily a function of their comparative price and the relative cost and efficiency of the equipment. Natural gas generally benefits from a competitive price advantage over oil, electricity, and propane. Fuel oil dealers compete for customers in all categories, including industrial customers. Gas Utility responds to this competition with marketing and sales efforts designed to retain, expand, and grow its customer base.