Letter from the President and Chief Executive Officer

Dear Fellow Stockholders,

I am delighted to share with you the remarkable achievements and milestones that defined Wabash’s journey throughout 2023. It was a year marked not only by unprecedented financial success but also by significant strides in our strategic initiatives, setting the stage for a future fueled by innovation and growth.

During 2023, we achieved many new financial records, capped by earnings of $4.81 per share. Last year’s earnings per share (EPS) surpassed our 2025 goal set in 2022 by an extraordinary 39%.

Along with record financial results, we were pleased to receive external recognition again, including Forbes’ award for America’s Most Successful Small-Cap Companies (2023 and 2024), and Newsweek’s awards for America’s Most Responsible Companies (2024) and America’s Greatest Workplaces for Job Starters (2023).

Connections, relationships, and networks have been a central theme guiding our trajectory in 2023, and one that will continue to propel us forward. As we have evolved into a more customer-centric organization, we have intensified our efforts to enhance connections with our customers. This shift allowed us to create more touchpoints with customers in 2023, offering enhanced dry van capacity, a focus on parts and services, and innovative offerings such as Trailers as a Service (TaaS)SM. These initiatives deepen our engagement while creating value for our customers.

In addition to strengthening customer relationships, we have deepened collaborations with our supplier and technology partners. By understanding both our customers’ challenges and opportunities, we can share valuable insights with our strategic suppliers, contributing to enhanced supply base performance. Emphasizing our commitment to tech-enabled innovation, we are advancing our digital capabilities, revolutionizing the online experience for our ecosystem across the transportation and logistics landscape.

At the core of our success is our commitment to employees. Recognizing that strong engagement is integral to superior financial performance, we focus on cultivating a work environment that prioritizes respect, empowerment and innovative thinking. We are dedicated to fostering an atmosphere where every individual feels valued, respected and part of something bigger.

Looking ahead, we are confident in our strategic positioning as a visionary leader within the transportation, logistics and distribution ecosystem. Our expanding ecosystem, driven by our tech-enabled initiatives, will continue to scale, creating enhanced value for all stakeholders.

As we reflect on the accomplishments of 2023, I express my gratitude to our dedicated team; the strategic oversight of our board of directors; the trust and support of our customers, dealers and suppliers; and the confidence of our stockholders. Together, we are shaping the future of Wabash as a tech-enabled industrial company, ready to embrace the opportunities that lie ahead.

With appreciation,

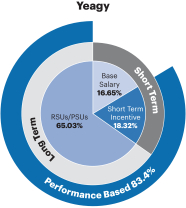

Brent L. Yeagy

President and Chief Executive Officer