EX-99.5

Exhibit 99.5

August 7, 2017

Automatic Data Processing, Inc.

1 ADP Boulevard

Roseland, NJ 07068

Attention:

Michael Bonarti

Corporate Vice President,

General Counsel and Secretary

| Re: |

Notice of Stockholder Proposal and Nomination of Candidates for Election to the Board of Directors to be Presented, in each case, at the 2017 Annual Meeting of Stockholders of Automatic Data Processing, Inc.

|

Dear Mr. Bonarti:

This notice (including all exhibits and the schedule attached hereto, this “Notice”) of the decision of

Pershing Square, L.P., a Delaware limited partnership (“Stockholder”), record holder of one (1) share of common stock, par value of $0.10 per share (the “Shares”), of Automatic Data Processing, Inc., a Delaware

corporation (the “Corporation”), (a) to propose the repeal of each provision of or amendment to the By-Laws, as amended and restated on August 2, 2016, of the Corporation (the “By-Laws”), adopted without the approval of the stockholders of the Corporation after August 2, 2016, which is the date of the last publicly available By-Laws,

and up to and including the date of the 2017 annual meeting of stockholders of the Corporation (including any adjournments or postponements thereof, or any special meeting that may be called in lieu thereof, the “2017 Annual

Meeting”) (the “Stockholder Proposal”), and (b) to propose the nomination of and nominate candidates for election to the board of directors (the “Board”) of the Corporation (the “Nomination

Proposal”), in each case, at the 2017 Annual Meeting, is being delivered in accordance with the requirements set forth under the By-Laws.

This Notice attaches (a) as Exhibit A hereto proof of the Stockholder’s record ownership, (b) as

Exhibit B hereto a copy of signed consents executed by each of the Nominees (as defined below) to serve as directors of the Corporation, if so elected, as required by Section 2.04(f) of Article II of the

By-Laws and (c) as Exhibit C hereto a representation and agreement (in the form provided by the Corporation) executed by each of the Nominees, as required by Section 2.04(h) of Article II of

the By-Laws.

| I. |

Notice of Stockholder Proposal |

As required by Section 1.01 of Article I of the By-Laws (the “Stockholder

Notice Requirements”), the following information, which together with the information contained elsewhere in this Notice, constitutes all of the information required to be set forth in this Notice pursuant to the Stockholder Notice

Requirements.

| |

A. |

Information Pursuant to Section 1.01(a) of Article I of the By-Laws |

| |

1. |

Description in Reasonable Detail of the Business Desired to be Brought Before the Annual Meeting

|

Stockholder intends to present a resolution that would repeal each provision of the By-Laws or amendment to the By-Laws that the Board adopted or adopts without the approval of the stockholders of the Corporation after August 2, 2016 and up to and

including the date of the 2017 Annual Meeting. Section 8.01 of Article II of the By-Laws provides that, subject to the provisions of the Amended and Restated Certificate of Incorporation of the

Corporation (the “Charter”), the By-Laws may be amended, altered or repealed (a) by resolution adopted by a majority of the Board at any special or regular meeting of the Board if, in the

case of such special meeting only, notice of such amendment, alteration or repeal is contained in the notice or waiver of notice of such meeting; or (b) at any regular or special meeting of the stockholders if, in the case of such special

meeting only, notice of such amendment, alteration or repeal is contained in the notice or waiver of notice of such meeting. Pursuant to Section 2 of Article Fifth of the Charter, the Board may from time to time make, alter, or repeal the By-Laws of the Corporation; provided, that any By-Laws made, amended, or repealed by the Board may be amended or repealed, and new

By-Laws may be made, by the stockholders of the Corporation. Pursuant to Section 216 of the Delaware General Corporation Law (the “DGCL”), adoption of the Stockholder Proposal requires

the affirmative vote of the majority of Shares present in person or represented by proxy at the 2017 Annual Meeting and entitled to vote on the Stockholder Proposal.

Stockholder intends to present the following resolution for a vote of stockholders at the 2017 Annual Meeting:

RESOLVED, that each provision of or amendment to the By-Laws, adopted by the Board

without the approval of the Corporation’s stockholders after August 2, 2016 (the date of the most recent publicly disclosed By-Laws) and up to and including the date of the 2017 annual meeting of

stockholders of the Corporation be, and they hereby are, repealed.

Stockholder intends to propose the Stockholder

Proposal at the commencement of the 2017 Annual Meeting before any other matter is addressed or voted upon by the stockholders of the Corporation at the 2017 Annual Meeting, including the election of directors.

| |

2. |

The Reasons for Conducting Such Business at the Annual Meeting |

The Pershing Square Parties (as defined below) believe that in order to ensure that the will of the Corporation’s

stockholders with respect to this proxy solicitation is upheld, no effect should be given to any provision of or amendment to the By-Laws, unilaterally adopted by the Board after the date of the most recent

publicly disclosed By-Laws, which is August 2, 2016. Stockholder therefore intends to present a resolution that would repeal any provision of the By-

-2-

Laws or amendment to the By-Laws that the Board adopted or adopts without the approval of the stockholders of the Corporation after August 2, 2016 and

up to and including the date of the 2017 Annual Meeting, including, without limitation, any amendments the Board has adopted or might adopt without public disclosure in an effort to impede the effectiveness of the Pershing Square Parties’

nomination of its Nominees, negatively impact the Pershing Square Parties’ ability to solicit and/or obtain proxies from stockholders, contravene the will of the stockholders expressed in those proxies or modify the Corporation’s corporate

governance regime. The Pershing Square Parties are not currently aware of any specific provision of or amendment to the By-Laws that would be repealed by the adoption of the Stockholder Proposal.

| |

B. |

Information Pursuant to Section 1.01(b) of Article I of the By-Laws |

The name and address of Stockholder, as it appears on the Corporation’s books at its transfer agent, is set forth below:

Pershing Square, L.P.

888 Seventh Avenue, 42nd Floor

New York, New York 10019

In light of the unclear scope of the phrase “beneficial owner, if any, on whose behalf the proposal is made as well

as…any affiliate or associate of any such person” as set forth in Section 1.01(b) of Article I of the By-Laws, we are also including below the names and addresses of Pershing Square II, L.P.

(“PS II”), Pershing Square International, Ltd. (“PS International”), Pershing Square Holdings, Ltd. (“PSH”), Pershing Square VI Master, L.P. (“PS VI Master” and, together with

Stockholder, PS II, PS International and PSH, the “Pershing Square Funds”), Pershing Square GP, LLC (“PS GP”), Pershing Square VI, L.P. (“PS VI LP”), Pershing Square VI International, L.P.

(“PS VI International”), Pershing Square VI GP (“PS VI GP”), Pershing Square Capital Management, L.P. (“Pershing Square”), PS Management GP, LLC (“PS Management”), and William A.

Ackman (Mr. Ackman, collectively with the Pershing Square Funds, PS GP, PS VI LP, PS VI International, PS VI GP, Pershing Square and PS Management, the “Pershing Square Parties”).

Pershing Square II, L.P.

888 Seventh Avenue, 42nd Floor

New York, New York 10019

Pershing Square International, Ltd.

888 Seventh Avenue, 42nd Floor

New York, New York 10019

Pershing Square Holdings, Ltd.

888 Seventh Avenue, 42nd Floor

New York, New York 10019

Pershing Square VI Master, L.P.

888 Seventh Avenue, 42nd Floor

New York, New York 10019

-3-

Pershing Square GP, LLC

888 Seventh Avenue, 42nd Floor

New York, New York 10019

Pershing Square VI, L.P.

888 Seventh Avenue, 42nd Floor

New York, New York 10019

Pershing Square VI International, L.P.

888 Seventh Avenue, 42nd Floor

New York, New York 10019

Pershing Square VI GP, LLC

888 Seventh Avenue, 42nd Floor

New York, New York 10019

Pershing Square Capital Management, L.P.

888 Seventh Avenue, 42nd Floor

New York, New York 10019

PS Management GP, LLC

888 Seventh Avenue, 42nd Floor

New York, New York 10019

William A. Ackman

888 Seventh Avenue, 42nd Floor

New York, New York 10019

In addition, each of the entities set forth on Schedule 1 (the “Schedule 1 Entities”) may be deemed to be

“associates” or “affiliates” (as such terms are defined in Rule 12b-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) of

Mr. Ackman and certain other of the Pershing Square Parties and their affiliates. The Schedule 1 Entities are not “participants in a solicitation” (as such term is defined in Instruction 3 to Item 4 of Schedule 14A) by the Pershing

Square Parties with respect to the Stockholder Proposal and Mr. Ackman and the other Pershing Square Parties disclaim status as “associates” or “affiliates” of such entities for all purposes. Mr. Ackman also holds, in

his personal capacity, interests in corporations, limited liability companies, trusts and other entities for personal investment purposes which may be deemed to be “associates” or “affiliates” of Mr. Ackman. None of such

entities are “participants in a solicitation” with respect to the Stockholder Proposal.

| |

C. |

Information Pursuant to Section 1.01(c) of Article I of the By-Laws |

Set forth below are the classes and number of shares of the Corporation that are owned beneficially or of record by the

Pershing Square Parties as of the date hereof:

-4-

Stockholder:

| |

• |

|

holds 1 Share of record; |

| |

• |

|

holds 409,496 Shares in “street name”; and |

| |

• |

|

holds over-the-counter and

listed American-style call options providing for the purchase of 4,734,424 Shares; |

PS II:

| |

• |

|

holds 0 Shares of record; |

| |

• |

|

holds 12,267 Shares in “street name”; |

| |

• |

|

holds over-the-counter forward

purchase contracts providing for the purchase of 15,383 Shares; and |

| |

• |

|

holds over-the-counter and

listed American-style call options providing for the purchase of 188,706 Shares; |

PS International:

| |

• |

|

holds 0 Shares of record; |

| |

• |

|

holds 499,764 Shares in “street name”; and |

| |

• |

|

holds over-the-counter and

listed American-style call options providing for the purchase of 5,777,193 Shares; |

PSH:

| |

• |

|

holds 0 Shares of record; |

| |

• |

|

holds 829,339 Shares in “street name”; and |

| |

• |

|

holds over-the-counter and

listed American-style call options providing for the purchase of 10,536,865 Shares; and |

-5-

PS VI Master:

| |

• |

|

holds 0 Shares of record; |

| |

• |

|

holds over-the-counter forward

purchase contracts providing for the purchase of 4,029,425 Shares; and |

| |

• |

|

holds over-the-counter and

listed American-style call options providing for the purchase of 9,770,812 Shares. |

Pershing Square, as

the investment adviser to the Pershing Square Funds, may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the Shares owned by the Pershing Square Funds (the

“Subject Shares”) and, therefore, Pershing Square may be deemed to be a “beneficial owner” (as such term is used in the By-Laws) of the Subject Shares. As the general partner of

Pershing Square, PS Management may be deemed to have the shared power to vote or to direct the vote of (and the shared power to dispose or direct the disposition of) the Subject Shares and, therefore, PS Management may be deemed to be a beneficial

owner of the Subject Shares. By virtue of William A. Ackman’s position as the Chief Executive Officer of Pershing Square and managing member of PS Management, William A. Ackman may be deemed to have the shared power to vote or direct the vote

of (and the shared power to dispose or direct the disposition of) the Subject Shares and, therefore, William A. Ackman may be deemed to be a beneficial owner of the Subject Shares.

PS GP is the general partner of Stockholder and PS II. Mr. Ackman is the managing member of PS GP and, accordingly, PS GP

may be deemed to be a “Proposing Person” (as such term is defined in the By-Laws). PS GP does not have the power to vote or direct the vote of (or the power to dispose or direct the disposition of)

any of the Subject Shares and, accordingly, is not the beneficial owner of any of the Subject Shares.

Stockholder is a

limited partner of PS VI LP. PS International and PSH are limited partners of PS VI International. PS VI LP and PS VI International are limited partners of PS VI Master. PS VI GP is the general partner of PS VI LP and PS VI International.

Mr. Ackman is the managing member of PS VI GP. Accordingly, each of PS VI LP, PS VI International and PS VI GP may be deemed to be Proposing Persons. Neither PS VI LP, PS VI International nor PS VI GP have the power to vote or to direct the

vote (or the power to dispose or direct the disposition of) of any of the Subject Shares and accordingly, is not the beneficial owner of any of the Subject Shares.

Further detail relating to the securities which are owned beneficially and of record by the Pershing Square Parties can be

found in Exhibit F.

-6-

| |

D. |

Information Pursuant to Section 1.01(d) of Article I of the By-Laws |

Other than as set forth in this Notice, there is no agreement, arrangement or understanding (including any derivative or short

positions, profit interests, options, hedging transactions or borrowed or loaned shares) that has been entered into, directly or indirectly, by, or on behalf of, any Pershing Square Party, the effect or intent of which is to mitigate loss to, manage

risk or benefit of share price changes for, or increase or decrease the voting power of any Pershing Square Party with respect to shares of stock of the Corporation.

| |

E. |

Information Pursuant to Section 1.01(e) of Article I of the By-Laws |

Other than as set forth in this Notice, there is no proxy (including any revocable proxy), contract, arrangement or

understanding pursuant to which a Pershing Square Party has or may have a right to vote any shares of any security of the Corporation or pursuant to which a Pershing Square Party has or may have granted a right to vote any shares of any security of

the Corporation, including the number of shares of any security of the Corporation subject to such proxy, contract, arrangement or understanding.

| |

F. |

Information Pursuant to Section 1.01(f) of Article I of the By-Laws |

The response to Item 5(b)(1) of Schedule 14A as set forth in Section II(E) of this Notice with respect to the Nomination

Proposal is incorporated herein by reference mutatis mutandis with respect to the Stockholder Proposal.

To the

extent that the adoption of the Stockholder Proposal could have the effect of counteracting any unilateral adoption, amendment or repeal of the By-Laws by the Board that purports to impede the effectiveness of

the Nomination Proposal, negatively impact the Pershing Square Parties’ ability to solicit and/or obtain proxies from stockholders of the Corporation, contravene the will of the stockholders of the Corporation expressed in those proxies or

modify the Corporation’s corporate governance regime, the Pershing Square Parties could be considered to have an interest in the Stockholder Proposal. The Pershing Square Parties intend to vote the Subject Shares in favor of the Stockholder

Proposal.

Other than as set forth in this Notice, the Pershing Square Parties have no material interest in the Stockholder

Proposal.

| |

G. |

Information Pursuant to Section 1.01(g) of Article I of the By-Laws |

Set forth below is all other information relating to each Pershing Square Party that would be required to be disclosed in a

proxy statement or other filings required to be made in connection with solicitations of proxies for the election of directors, or would otherwise be required, in each case pursuant to Section 14 of the Exchange Act, and the rules and

regulations promulgated thereunder.

-7-

Item 4 of Schedule 14A. Persons Making the Solicitation.

Item 4(a)(1) of Schedule 14A. This provision of Item 4 of Schedule 14A is not applicable to the Pershing

Square Parties.

Item 4(a)(2) of Schedule 14A. The solicitation in connection with the Stockholder Proposal

will be made by certain of the Pershing Square Parties. By virtue of Instruction 3 of Item 4 of Schedule 14A, certain of the Pershing Square Parties may be considered “participants in a solicitation”.

Item 4(a)(3) of Schedule 14A. The information included under the heading “Item 4 of Schedule 14A.

Persons Making the Solicitation” in Section II(E) of this Notice regarding the methods of solicitation to be employed, the material features of any contract or arrangement for such solicitation with specially engaged employees or paid

solicitors and the cost or anticipated cost thereof, is incorporated herein by reference.

Item 4(a)(4) of Schedule

14A. The information included under the heading “Item 4 of Schedule 14A. Persons Making the Solicitation” in Section II(E) of this Notice regarding the names of persons by whom the cost of solicitation will be borne,

directly or indirectly, is incorporated herein by reference.

Item 5 of Schedule 14A. Interest of Certain Persons in Matters to be Acted Upon.

Item 5(a)(1) of Schedule 14A. This provision of Item 5 of Schedule 14A is not applicable to the Pershing

Square Parties.

Item 5(a)(2) of Schedule 14A. Information as to any substantial interest, direct or

indirect, by security holdings or otherwise, in the Stockholder Proposal with respect to the Pershing Square Parties is described in the response to Item 5(b)(1) of Schedule 14A as set forth in Section II(E) of this Notice with respect to the

Nomination Proposal and is incorporated herein by reference mutatis mutandis with respect to the Stockholder Proposal. Other than as set forth in this Notice, none of the Pershing Square Parties and no associate of the Pershing Square Parties

has any substantial interest, direct or indirect, by security holdings or otherwise, in the Stockholder Proposal.

Item 5(a)(3) of Schedule 14A. Information as to any substantial interest, direct or indirect, by security

holdings or otherwise, in the Stockholder Proposal with respect to the Nominees is described in the response to Item 5(b)(1) of Schedule 14A as set forth in Section II(E) of this Notice with respect to the Nomination Proposal and is

incorporated herein by reference mutatis mutandis with respect to the Stockholder Proposal. Other than as set forth in this Notice, none of the Nominees and no associates of the Nominees has any substantial interest, direct or indirect, by

security holdings or otherwise, in the Stockholder Proposal.

Item 5(a)(4) of Schedule 14A. Other

than as set forth in this Notice, no associate of the Pershing Square Parties or any of the Nominees has any substantial interest, direct or indirect, by security holdings or otherwise, in the Stockholder Proposal.

Item 5(a)(5) of Schedule 14A. This provision of Item 5 of Schedule 14A is not applicable to the Pershing

Square Parties.

-8-

Item 19 of Schedule 14A. Amendment of Charter, By-Laws

or Other Documents.

Section 8.01 of Article II of the By-Laws provides

that, subject to the provisions of the Charter, the By-Laws may be amended, altered or repealed (a) by resolution adopted by a majority of the Board at any special or regular meeting of the Board if, in

the case of such special meeting only, notice of such amendment, alteration or repeal is contained in the notice or waiver of notice of such meeting; or (b) at any regular or special meeting of the stockholders if, in the case of such special

meeting only, notice of such amendment, alteration or repeal is contained in the notice or waiver of notice of such meeting. Pursuant to Section 2 of Article Fifth of the Charter, the Board may from time to time make, alter, or repeal the By-Laws of the Corporation; provided, that any By-Laws made, amended, or repealed by the Board may be amended or repealed, and new

By-Laws may be made, by the stockholders of the Corporation.

The Pershing Square

Parties believe that in order to ensure that the will of the Corporation’s stockholders with respect to this proxy solicitation is upheld, no effect should be given to any provision of or amendment to the

By-Laws unilaterally adopted by the Board after the date of the most recent publicly disclosed By-Laws, which is August 2, 2016. Stockholder therefore intends to

present a resolution that would repeal any provision of or amendment to the By-Laws that the Board adopted or adopts without the approval of the stockholders of the Corporation after August 2, 2016 and up

to and including the date of the 2017 Annual Meeting, including, without limitation, any amendments the Board has adopted without public disclosure or might adopt in an effort to impede the effectiveness of the Pershing Square Parties’

nomination of its Nominees, negatively impact the Pershing Square Parties’ ability to solicit and/or obtain proxies from stockholders, contravene the will of the stockholders expressed in those proxies or modify the Corporation’s corporate

governance regime. The Pershing Square Parties are not currently aware of any specific By-Law provisions that would be repealed by the adoption of the Stockholder Proposal.

| |

H. |

Information Pursuant to Section 1.01(h) of Article I of the By-Laws |

The Pershing Square Parties represent that they intend to solicit proxies in support of the Stockholder Proposal.

| II. |

Notice of Nomination of Candidates for Election to the Board |

As required by Section 2.04 of Article II of the By-Laws (the “Nomination

Requirements”), the following information, which together with the information contained elsewhere in this Notice, constitutes all of the information required to be set forth in this Notice pursuant to the Nomination Requirements.

| |

A. |

Information Pursuant to Section 2.04(a) of Article II of the By-Laws |

| |

1. |

Stockholder’s Intent to Nominate One or More Persons for Election as a Director of the Corporation

and the Name of Each Such Nominee Proposed by the Stockholder |

-9-

As a record holder of Shares of the Corporation, Stockholder hereby notifies the

Corporation of its intent to propose the nomination of and nominate the following individuals (the “Nominees”) for election to the Board at the 2017 Annual Meeting:

| |

2. |

The Reason for Making Such Nomination at the Annual Meeting |

The information set forth in Pershing Square’s Schedule 13D with respect to the Corporation is set forth in

Exhibit G attached hereto and is incorporated herein by reference. Stockholder believes that the Nominees would help create value for stockholders if they were elected to the Board because the Nominees have extensive

operating, strategic and financial expertise and will bring fresh perspectives and robust oversight to the Board. Importantly, the Nominees are proven business leaders who are committed to working with the incumbent directors and creating value for

all stockholders of the Corporation.

| |

B. |

Information Pursuant to Section 2.04(b) of Article II of the By-Laws |

| |

1. |

Information Pursuant to Section 1.01(b) of Article I of the By-Laws with Respect to each Pershing Square Party |

The name

and address of Stockholder, as it appears on the Corporation’s books at its transfer agent, is set forth below:

Pershing Square, L.P.

888 Seventh Avenue, 42nd Floor

New York, New York 10019

In light of the unclear scope of the phrase “any beneficial owner on whose behalf the nomination is being made and their

associates and affiliates” as set forth in Section 2.04(a) of Article II of the By-Laws, we are also including below the names and addresses of the Pershing Square Parties.

Pershing Square II, L.P.

888 Seventh Avenue, 42nd Floor

New York, New York 10019

Pershing Square International, Ltd.

888 Seventh Avenue, 42nd Floor

New York, New York 10019

-10-

Pershing Square Holdings, Ltd.

888 Seventh Avenue, 42nd Floor

New York, New York 10019

Pershing Square VI Master, L.P.

888 Seventh Avenue, 42nd Floor

New York, New York 10019

Pershing Square GP, LLC

888 Seventh Avenue, 42nd Floor

New York, New York 10019

Pershing Square VI, L.P.

888 Seventh Avenue, 42nd Floor

New York, New York 10019

Pershing Square VI International, L.P.

888 Seventh Avenue, 42nd Floor

New York, New York 10019

Pershing Square VI GP, LLC

888 Seventh Avenue, 42nd Floor

New York, New York 10019

Pershing Square Capital Management, L.P.

888 Seventh Avenue, 42nd Floor

New York, New York 10019

PS Management GP, LLC

888 Seventh Avenue, 42nd Floor

New York, New York 10019

William A. Ackman

888 Seventh Avenue, 42nd Floor

New York, New York 10019

In addition, each of the Schedule 1 Entities may be deemed to be “associates” or “affiliates” of

Mr. Ackman and certain other of the Pershing Square Parties and their affiliates. The Schedule 1 Entities are not “participants in a solicitation” (as such term is defined in Instruction 3 to Item 4 of Schedule 14A) by the Pershing

Square Parties with respect to the Nomination Proposal and Mr. Ackman and the other Pershing Square Parties disclaim status as “associates” or “affiliates” of such entities for all purposes. Mr. Ackman also holds, in

his personal capacity, interests in corporations, limited liability companies, trusts and other entities for personal investment purposes which may be deemed to be “associates” or “affiliates” of Mr. Ackman. None of such

entities are “participants in a solicitation” with respect to the Nomination Proposal.

-11-

| |

2. |

Information Pursuant to Section 1.01(c) of Article I of the By-Laws with Respect to each Pershing Square Party |

Set forth

below are the classes and number of shares of the Corporation that are owned beneficially or of record by the Pershing Square Parties as of the date hereof:

Stockholder:

| |

• |

|

holds 1 Share of record; |

| |

• |

|

holds 409,496 Shares in “street name”; and |

| |

• |

|

holds over-the-counter and

listed American-style call options providing for the purchase of 4,734,424 Shares; |

PS II:

| |

• |

|

holds 0 Shares of record; |

| |

• |

|

holds 12,267 Shares in “street name”; |

| |

• |

|

holds over-the-counter forward

purchase contracts providing for the purchase of 15,383 Shares; and |

| |

• |

|

holds over-the-counter and

listed American-style call options providing for the purchase of 188,706 Shares; |

PS International:

| |

• |

|

holds 0 Shares of record; |

| |

• |

|

holds 499,764 Shares in “street name”; and |

| |

• |

|

holds over-the-counter and

listed American-style call options providing for the purchase of 5,777,193 Shares; |

PSH:

| |

• |

|

holds 0 Shares of record; |

-12-

| |

• |

|

holds 829,339 Shares in “street name”; and |

| |

• |

|

holds over-the-counter and

listed American-style call options providing for the purchase of 10,536,865 Shares; and |

PS VI Master:

| |

• |

|

holds 0 Shares of record; |

| |

• |

|

holds over-the-counter forward

purchase contracts providing for the purchase of 4,029,425 Shares; and |

| |

• |

|

holds over-the-counter and

listed American-style call options providing for the purchase of 9,770,812 Shares. |

Pershing Square, as

the investment adviser to the Pershing Square Funds, may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the Subject Shares and, therefore, Pershing Square may be deemed

to be a “beneficial owner” (as such term is used in the By-Laws) of the Subject Shares. As the general partner of Pershing Square, PS Management may be deemed to have the shared power to vote or to

direct the vote of (and the shared power to dispose or direct the disposition of) the Subject Shares and, therefore, PS Management may be deemed to be a beneficial owner of the Subject Shares. By virtue of William A. Ackman’s position as the

Chief Executive Officer of Pershing Square and managing member of PS Management, William A. Ackman may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the Subject Shares

and, therefore, William A. Ackman may be deemed to be a beneficial owner of the Subject Shares.

PS GP is the general

partner of Stockholder and PS II. Mr. Ackman is the managing member of PS GP and, accordingly, PS GP may be deemed to be a “Proposing Person” (as such term is defined in the By-Laws). PS GP does

not have the power to vote or direct the vote of (or the power to dispose or direct the disposition of) any of the Subject Shares and, accordingly, is not the beneficial owner of any of the Subject Shares.

Stockholder is a limited partner of PS VI LP. PS International and PSH are limited partners of PS VI International. PS VI LP

and PS VI International are limited partners of PS VI Master. PS VI GP, is the general partner of PS VI LP and PS VI International. Mr. Ackman is the managing member of PS VI GP. Accordingly, each of PS VI LP, PS VI International and PS VI GP

may be deemed to be Proposing Persons. Neither PS VI LP, PS VI International nor PS VI GP has the power to vote or to direct the vote (or the power to dispose or direct the disposition of) of any of the Subject Shares and accordingly, is not the

beneficial owner of any of the Subject Shares.

-13-

Further detail relating to the securities which are owned beneficially and of

record by the Pershing Square Parties can be found in Exhibit F.

| |

3. |

Information Pursuant to Section 1.01(d) of Article I of the By-Laws with Respect to each Pershing Square Party |

Other than

as set forth in this Notice, there is no agreement, arrangement or understanding (including any derivative or short positions, profit interests, options, hedging transactions or borrowed or loaned shares) that has been entered into, directly or

indirectly, by, or on behalf of, any Pershing Square Party, the effect or intent of which is to mitigate loss to, manage risk or benefit of share price changes for, or increase or decrease the voting power of any Pershing Square Party with respect

to shares of stock of the Corporation.

| |

4. |

Information Pursuant to Section 1.01(e) of Article I of the By-Laws with Respect to each Pershing Square Party |

Other than

as set forth in this Notice, there is no proxy (including any revocable proxy), contract, arrangement or understanding pursuant to which a Pershing Square Party has or may have a right to vote any shares of any security of the Corporation or

pursuant to which a Pershing Square Party has or may have granted a right to vote any shares of any security of the Corporation, including the number of shares of any security of the Corporation subject to such proxy, contract, arrangement or

understanding.

| |

C. |

Information Pursuant to Section 2.04(c) of Article II of the

By-Laws |

The response to Item 5(b)(1) of Schedule 14A as set

forth in Section II(E) hereof is incorporated herein by reference.

Other than as set forth in

this Notice, no Pershing Square Party has any material interest in the Nomination Proposal.

| |

D. |

Information Pursuant to Section 2.04(d) of Article II of the By-Laws |

Other than as set forth in this Notice, there are no arrangements or understandings between or among any of (1) the

Pershing Square Parties, (2) each Nominee and (3) any other person or persons (naming such person or persons) pursuant to which the Nomination Proposal is to be made by a Pershing Square Party.

| |

E. |

Information Pursuant to Section 2.04(e) of Article II of the By-Laws |

Set forth below is all information relating to the Nominees that would be required to be disclosed in solicitations of proxies

for election of directors in an election contest or would be otherwise required, in each case pursuant to Regulation 14A under the Exchange Act.

Item 4 of Schedule 14A. Persons Making the Solicitation.

Item 4(b)(1) of Schedule 14A. The solicitation for the election of the Nominees will be made by certain of

the Pershing Square Parties. Proxies may be solicited by mail, facsimile, telephone, telegraph, electronic mail, internet, television, radio, in person and by advertisements. By virtue of Instruction 3 of Item 4 of Schedule 14A, certain of the

Pershing Square Parties and the Nominees (collectively, the “Nomination Participants”) may be considered “participants in a solicitation”.

-14-

Item 4(b)(2) of Schedule 14A. Solicitations may also be made

by certain of the respective directors, officers, members and employees of the Pershing Square Parties, none of whom will receive additional compensation for such solicitation. The Nominees may make solicitations of proxies but, except as described

in the response to Item 5(b)(2) of Schedule 14A as set forth in this Section II(E), will not receive compensation for acting as nominees.

Item 4(b)(3) of Schedule 14A. The Pershing Square Parties intend to retain a proxy solicitor to provide

solicitation and advisory services in connection with the 2017 Annual Meeting. The Pershing Square Parties expect that such proxy solicitor will receive a fee and reimbursement of reasonable out-of-pocket expenses for its services to the Pershing Square Parties in connection with the solicitation. Neither the amount of such fee nor the number of people that may be employed by the proxy solicitor

to solicit proxies from the Corporation’s stockholders for the 2017 Annual Meeting are yet determinable. The Pershing Square Parties also expect that the proxy solicitor will be indemnified in its capacity as solicitation agent against certain

liabilities and expenses in connection with the solicitation. Arrangements will also be made with custodians, nominees and fiduciaries for forwarding proxy solicitation materials to beneficial owners of Shares held as of the record date. Pershing

Square will reimburse such custodians, nominees and fiduciaries for reasonable expenses incurred in connection therewith.

Item 4(b)(4) of Schedule 14A. The total amount to be spent in furtherance of, or in connection with, the

solicitation of proxies for the 2017 Annual Meeting is not yet determinable, and approximately $250,000 has been spent to date.

Item 4(b)(5) of Schedule 14A. The entire expense of soliciting proxies for the 2017 Annual Meeting by the

Pershing Square Parties or on the Pershing Square Parties’ behalf is being borne by the Pershing Square Parties. The Pershing Square Parties have not yet determined whether they intend to seek reimbursement of such solicitation expenses and may

submit the question of such reimbursement to a vote of the Corporation’s security holders.

Item 4(b)(6) of

Schedule 14A. Item 4(b)(6) is not applicable at the time of this Notice.

Item 5 of Schedule 14A. Interest of Certain Persons in

Matters to be Acted Upon.

Item 5(b)(1) of Schedule 14A. Information as to any substantial interest,

direct or indirect, by virtue of security holdings or otherwise, in the Nomination Proposal, as specified in this Notice, with respect to the Nomination Participants, is set forth herein.

Other than as set forth in this Notice, none of the Nomination Participants beneficially owns any securities of the

Corporation or has any personal ownership interest, direct or indirect, in any securities of the Corporation.

-15-

Pershing Square, as the investment adviser to the Pershing Square Funds, may be

deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the Subject Shares and, therefore, Pershing Square may be deemed to be a “beneficial owner” (as such term is used

in the By-Laws) of the Subject Shares. As the general partner of Pershing Square, PS Management may be deemed to have the shared power to vote or to direct the vote of (and the shared power to dispose or

direct the disposition of) the Subject Shares and, therefore, PS Management may be deemed to be a beneficial owner of the Subject Shares. By virtue of William A. Ackman’s position as the Chief Executive Officer of Pershing Square and managing

member of PS Management, William A. Ackman may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the Subject Shares and, therefore, William A. Ackman may be deemed to be a

beneficial owner of the Subject Shares.

The names and addresses of the Nomination Participants are set forth in

Exhibit D and Exhibit E. The number of Shares set forth in this Notice includes Shares underlying forward purchase contracts and call options to purchase Shares pursuant to which the applicable Pershing Square Fund has the right to

acquire the underlying Shares within the next 60 days.

Mr. Ackman could be considered to have an indirect interest

in the Nomination Proposal as described below. Mr. Ackman is the managing member of PS Management, which is the general partner of Pershing Square. Pershing Square is the investment manager of the Pershing Square Funds. PS VI Master is a

special purpose vehicle formed for the purpose of investing in securities of the Corporation and related derivatives alongside the other Pershing Square Funds. Through this role, Mr. Ackman controls the investment and voting decisions of the

Pershing Square Funds with respect to any securities held by the Pershing Square Funds, including the Subject Shares held by the Pershing Square Funds. Pershing Square is, pursuant to an investment management agreement with the Pershing Square

Funds, entitled to management fees that are customary in the investment management industry from Stockholder and from the Pershing Square Funds, which fees are based in part on the value of the Pershing Square Funds’ investment portfolio, of

which the Subject Shares form a part as of the date of this Notice. Pershing Square, PS GP, and PS VI GP, each controlled by Mr. Ackman, are also entitled to performance-based fees that are customary in the investment management industry from

the Pershing Square Funds, which are based on the increase in value of the Pershing Square Funds’ investment portfolio, of which the Subject Shares form a part as of the date of this Notice. Mr. Ackman is entitled to portions of such fees

through his direct or indirect equity interests in such fee recipients, and as such could be considered to have an interest in the Nomination Proposal.

The Nominees may be deemed to have an interest in their nominations for election to the Board by virtue of compensation the

Nominees will receive from the Corporation as a director, if elected to the Board, and as described elsewhere in this Notice.

Item 5(b)(1)(i) of Schedule 14A. Set forth in Exhibit D and Exhibit E of this Notice are the names

and business addresses of each of the Nomination Participants, which information is incorporated herein by reference.

-16-

Item 5(b)(1)(ii) of Schedule 14A. Set forth in Exhibit D and

Exhibit E of this Notice are (a) the present principal occupation or employment of each of the Nomination Participants and (b) the name, principal business and address of any corporation or other organization in which such

employment is carried on, in each case, with respect to each of the Nominees, which information is incorporated herein by reference.

Item 5(b)(1)(iii) of Schedule 14A. During the past ten years, no Nomination Participant has been convicted in a

criminal proceeding (excluding traffic violations or similar misdemeanors).

Item 5(b)(1)(iv) of Schedule

14A. As of the date hereof:

Stockholder:

| |

• |

|

holds 1 Share of record; |

| |

• |

|

holds 409,496 Shares in “street name”; and |

| |

• |

|

holds over-the-counter and

listed American-style call options providing for the purchase of 4,734,424 Shares; |

PS II:

| |

• |

|

holds 0 Shares of record; |

| |

• |

|

holds 12,267 Shares in “street name”; |

| |

• |

|

holds over-the-counter forward

purchase contracts providing for the purchase of 15,383 Shares; and |

| |

• |

|

holds over-the-counter and

listed American-style call options providing for the purchase of 188,706 Shares; |

PS International:

| |

• |

|

holds 0 Shares of record; |

| |

• |

|

holds 499,764 Shares in “street name”; and |

| |

• |

|

holds over-the-counter and

listed American-style call options providing for the purchase of 5,777,193 Shares; |

-17-

PSH:

| |

• |

|

holds 0 Shares of record; |

| |

• |

|

holds 829,339 Shares in “street name”; and |

| |

• |

|

holds over-the-counter and

listed American-style call options providing for the purchase of 10,536,865 Shares; and |

PS VI Master:

| |

• |

|

holds 0 Shares of record; |

| |

• |

|

holds over-the-counter forward

purchase contracts providing for the purchase of 4,029,425 Shares; and |

| |

• |

|

holds over-the-counter and

listed American-style call options providing for the purchase of 9,770,812 Shares. |

The amount of each

class of securities of the Corporation which each of the Nomination Participants and other Pershing Square Parties own beneficially, directly or indirectly, is set forth below:

|

|

|

| Name |

|

Beneficial Ownership |

| Pershing Square, L.P. |

|

5,143,921 Shares |

| Pershing Square II, L.P. |

|

216,356 Shares |

| Pershing Square International, Ltd. |

|

6,276,957 Shares |

| Pershing Square Holdings, Ltd. |

|

11,366,204 Shares |

| Pershing Square VI Master, L.P. |

|

13,800,237 Shares |

| Pershing Square GP, LLC |

|

0 Shares |

| Pershing Square VI, L.P. |

|

0 Shares |

| Pershing Square VI International, L.P. |

|

0 Shares |

| Pershing Square VI GP, LLC |

|

0 Shares |

| Pershing Square Capital Management, L.P. |

|

36,803,675 Shares |

| PS Management GP, LLC |

|

36,803,675 Shares |

| William A. Ackman |

|

36,803,675 Shares |

| Veronica M. Hagen |

|

0 Shares |

| V. Paul Unruh |

|

0 Shares |

Additional information relating to the Shares beneficially owned by the Nomination

Participants is set forth on Exhibit F and is incorporated herein by reference.

-18-

Item 5(b)(1)(v) of Schedule 14A. Other than as set forth in this

Notice, none of the Nomination Participants owns any securities of the Corporation of record but not beneficially.

Item 5(b)(1)(vi) of Schedule 14A. A list of all securities of the Corporation purchased or sold by the

Nomination Participants within the past two years, as well as the dates on which they were purchased or sold and the amount purchased or sold on each such date, is set forth in Exhibit F and is incorporated herein by

reference.

Item 5(b)(1)(vii) of Schedule 14A. The purchase prices for the Subject Shares held by each

Pershing Square Fund were obtained from the working capital of the respective Pershing Square Funds. Other than as set forth in the response to this Item 5(b)(1), no part of the purchase price or market value of any securities of the Corporation

described in Exhibit F are represented by funds that were borrowed or otherwise obtained for the purpose of acquiring or holding such securities by any Nomination Participants.

Item 5(b)(1)(viii) of Schedule 14A. Other than as set forth in this Notice, no Nomination Participant is,

or has been within the past year, a party to any contract, arrangements or understandings with any person with respect to any securities of the Corporation, including, but not limited to, joint ventures, loan or option arrangements, puts or calls,

guarantees against loss or guarantees of profit, division of losses or profit, or the giving or withholding of proxies. The Shares which Stockholder holds in “street name” may be held in brokerage custodian accounts which, from time to

time in the ordinary course, may permit shares to be loaned to third parties and which accounts may utilize margin borrowing in connection with purchasing, borrowing or holding of securities, and such Shares may thereby have been, or in the future

may become, subject to the terms and conditions of such lending provisions or margin debt and terms, together with all other securities held therein.

Item 5(b)(1)(ix) of Schedule 14A. Other than as set forth in this Notice, no associates of any Nomination

Participant own any securities of the Corporation beneficially, directly or indirectly.

Item 5(b)(1)(x) of Schedule

14A. Other than as set forth in this Notice, no Nomination Participant owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Corporation.

Item 5(b)(1)(xi) of Schedule 14A. Item 5(b)(1)(xi) of Schedule 14A cross-references the information

required by Item 404(a) of Regulation S-K of the Exchange Act (“Regulation S-K”) with respect to each Nomination Participant in the solicitation or

any associates of such Nomination Participant. Such information is set forth below:

Item 404(a) of Regulation S-K. Other than as set forth in this Notice, no Nomination Participant and no associate of any Nomination Participant has had or will have a direct or indirect material interest in any transaction since the

beginning of the Corporation’s last fiscal year or any currently proposed transactions in which the Corporation was or is to be a participant and the amount involved exceeds $120,000.

-19-

Item 5(b)(1)(xii) of Schedule 14A. The information set forth in

Pershing Square’s Schedule 13D with respect to the Corporation is set forth in Exhibit G attached hereto and is incorporated herein by reference.

According to the Corporation’s public filings, each non-employee director

receives an annual retainer of $290,000, $175,000 of which is paid in the form of deferred stock units and $115,000 of which may, at the election of each director, be paid in cash or in deferred stock units. In addition, the Board chair receives an

incremental retainer of $165,000, $82,500 of which is paid in the form of deferred stock units and $82,500 of which may, at the election of the Board chair, be paid in cash or in deferred stock units. The additional retainer for chair of the Audit

Committee is $20,000, the additional retainer for chair of the Compensation Committee is $15,000, the additional retainer for the chair of the Nominating and Governance Committee is $15,000 and the additional retainer for the chair of the Corporate

Development and Technology Advisory Committee is $15,000. Meeting fees are not paid in respect of the first seven meetings of the Board or of any individual committee, but non-employee directors receive $2,000

for each Board meeting attended and $1,500 for each committee meeting attended beginning with the eighth meeting of the Board or any individual committee, as applicable. Meeting fees and the additional annual retainer may, at the election of each

director, be paid in cash, deferred, or paid in deferred stock units.

The Pershing Square Parties believe that the

Corporation maintains, at its expense, a policy of insurance which insures its directors and officers. The By-Laws also contain a provision that provides for the indemnification of any person who was or is a

party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, by reason of the fact that he or she is or was or has agreed to become a director

or officer of the Corporation against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by him or her or on his or her behalf in connection with such action, suit or

proceeding and any appeal therefrom, if he or she (x) acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the Corporation and, in the case of any such employee or agent, in a manner

he or she reasonably believed to be not in violation of any policies or directives of the Corporation and (y) with respect to any criminal action or proceeding had no reasonable cause to believe his or her conduct was unlawful; except that in

the case of an action or suit by or in the right of the Corporation to procure a judgment in its favor (i) such indemnification shall be limited to expenses (including attorneys’ fees) actually and reasonably incurred by such person in the

defense or settlement of such action or suit and (ii) no indemnification shall be made in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable to the Corporation unless and only to the extent that

the Delaware Court of Chancery or the court in which such action or suit was brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably

entitled to indemnity for such expenses which the Delaware Court of Chancery or such other court shall deem proper. The Charter also contains a provision that provides for indemnification of officers and directors to the fullest extent permitted

under the DGCL (and in particular Paragraph 145 thereof), as from time to time amended. The Charter also contains a provision eliminating the personal liability of a director for monetary damages for breach of fiduciary duty as a director; except

for liability (i) for breach of the director’s duty of loyalty to the Corporation or its stockholders, (ii) for acts or

-20-

omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) under Section 174 of the DGCL, or (iv) for any transaction from which the

director derived an improper personal benefit. The Pershing Square Parties expect that the Nominees, if elected, will be indemnified for service as directors of the Corporation to the same extent indemnification is provided to the current directors

of the Corporation under the By-laws and the Charter and be covered by the policy of insurance which insures the Corporation’s directors and officers.

The Nomination Participants disclaim any responsibility for the accuracy of the foregoing information extracted from the

Corporation’s public filings.

Other than as set forth in this Notice, the Nominees will not receive any compensation

from the Pershing Square Parties to serve as nominees for election or as a director, if elected, of the Corporation.

Each

Nominee has executed a written consent agreeing to be a nominee for election as a director of the Corporation and to serve as a director if so elected, which consents are attached hereto as Exhibit B.

Other than as set forth in this Notice, no Nomination Participant and no associate of any Nomination Participant has any

arrangements or understandings with any person or persons with respect to any future employment by the Corporation or its affiliates or with respect to any future transactions to which the Corporation or any of its affiliates will or may be a party.

Item 5(b)(2) of Schedule 14A. Pershing Square, on behalf of the funds it advises, and each Nominee (other

than Mr. Ackman) have entered into an Engagement and Indemnification Agreement, pursuant to which each such Nominee has agreed to be named as a nominee in the proxy soliciting materials related to the 2017 Annual Meeting. Pursuant to the

Engagement and Indemnification Agreement, Pershing Square has agreed to indemnify each such Nominee against any losses suffered, incurred or sustained by such Nominee in connection with such Nominee’s being a member of the slate of nominees of

Stockholder for election to the Board (the “Slate”) or the solicitation of proxies in connection therewith. Pershing Square has further agreed to reimburse each such Nominee for reasonable, documented,

out-of-pocket expenses incurred as a result of such Nominee’s being a member of Slate, including, without limitation, travel expenses and expenses in connection

with legal counsel retained to represent such Nominee in connection with being a member of the Slate. The foregoing is qualified in its entirety by reference to the form of Engagement and Indemnification Agreement, a form of which is attached hereto

as Exhibit H.

Other than as set forth in this Notice, there are no arrangements or understandings between or among

the Pershing Square Parties and any other person pursuant to which any of the Nominees are proposed to be elected.

Item 5(b)(3) of Schedule 14A. This provision of Item 5 of Schedule 14A is not applicable to the Nomination

Participants.

-21-

Item 7 of Schedule 14A. Directors and Executive Officers.

Item 7(a) of Schedule 14A. Item 7(a) of Schedule 14A cross-references the information required by instruction 4

to Item 103 of Regulation S-K with respect to nominees of the persons making the solicitation. Such information is set forth below:

Instruction 4 of Item 103 of Regulation S-K. There are no material proceedings

to which the Nominees or any of their respective associates is a party adverse to the Corporation or any of its subsidiaries, or material proceedings in which such Nominee or any such associate has a material interest adverse to the Corporation or

any of its subsidiaries.

Item 7(b) of Schedule 14A. Item 7(b) of Schedule 14A cross-references the

information required by Item 401, Items 404(a) and (b), Item 405, and Items 407(d)(4), (d)(5) and (h) of Regulation S-K with respect to the nominees of the person making the solicitation. Such

information is set forth below:

Item 401(a) of Regulation S-K. The

following information is set forth in Exhibit E of this Notice: name, age, any position and office with the Corporation held by each such Nominee, and the term thereof. Each Nominee has executed a consent to serve as a director of the

Corporation, if so elected. Copies of such consents are attached hereto as Exhibit B. Pershing Square has entered into the Engagement and Indemnification Agreements with each of the Nominees (other than Mr. Ackman) as

described in the response to Item 5(b)(2) of Schedule 14A as set forth in this Section II(E) of this Notice. A copy of the form Engagement and Indemnification Agreement is attached hereto as Exhibit H. The initial

term of each Nominee, if elected, would be until the 2018 annual meeting of the stockholders of the Corporation and until his or her successor has been duly elected and qualified, or until his or her earlier death, resignation or removal. Other than

as set forth in this Notice, there are no arrangements or understandings between the Nominees and any other party pursuant to which any such nominee was or is to be selected as a director or nominee.

Items 401(b) and (c) of Regulation S-K. These provisions of

Item 401 of Regulation S-K are not applicable to the Nominees.

Item 401(d)

of Regulation S-K. There exist no family relationships between any Nominee and any director or executive officer of the Corporation.

Items 401(e)(1) and (2) of Regulation S-K. The following

information is set forth on Exhibit E of this Notice: (1) name, age, any position and office with the Corporation held by each such Nominee, and the term thereof, business experience during the past five years (including principal

occupation and employment during the past five years and the name and principal business of any corporation or other organization in which such occupation or employment was carried on), a brief discussion of the specific experience, qualifications,

attributes or skills that led to the conclusion that the Nominee should serve as a director for the Corporation as of the date hereof, in light of the Corporation’s business and structure (including such material information beyond

-22-

the past five years and information on the Nominee’s particular area of expertise or other relevant qualifications), and (2) any directorships held by such person during the past five

years in any company with a class of securities registered pursuant to Section 12 of the Exchange Act or subject to the requirements of Section 15(d) of the Exchange Act or any company registered as an investment company under the

Investment Company Act of 1940, as amended. No occupation or employment is or was, during such period, carried on by any Nominee with the Corporation or any corporation or organization which is or was a parent, subsidiary or other affiliate of

the Corporation, and none of the Nominees has ever served on the Board.

Item 401(f) of Regulation S-K. During the last ten years, the Nominees have not been involved in any of the events described in Item 401(f) of Regulation S-K and that are material to an evaluation

of the ability or integrity of any such nominee to become a director of the Corporation.

Item 401(g) of Regulation S-K. This provision of Item 401 of Regulation S-K is not applicable to the Nominees.

Item 404(a) of Regulation S-K. Other than as set forth in this Notice, no

Nomination Participant and no associate of any Nomination Participant has had or will have a direct or indirect material interest in any transaction since the beginning of the Corporation’s last fiscal year or any currently proposed

transactions in which the Corporation was or is to be a participant and the amount involved exceeds $120,000.

Item

404(b) of Regulation S-K. This provision of Item 404 of Regulation S-K is not applicable to the Nominees.

Item 405 of Regulation S-K. This provision of Regulation S-K is not applicable to the Nominees because the Nominees are not directors, officers or ten percent holders of the Corporation.

Items 407(d)(4), (d)(5) and (h) of Regulation S-K. These

provisions of Item 407 of Regulation S-K are not applicable to the Nominees.

Item 7(c) of Schedule 14A. Item 7(c) of Schedule 14A cross-references the information required by

Item 407(a) of Regulation S-K.

Item 407(a) of Regulation S-K. The corporate governance principles of the Corporation (the “Governance Principles”), which are available on the Corporation’s website at http://s21.q4cdn.com/221597763/files/doc_downloads/corporate_governance/Principles-of-Corporate-Governance-as-adopted-4.5.17.pdf

, provide that a director who meets all of the enumerated categorical standards (which include a standard that a director does not own more than 5% of the Shares) shall be presumed to be

“independent.” No member of the Pershing Square Parties has any knowledge of any facts that would prevent the determination that each of the Nominees is independent under the applicable standards; although Mr. Ackman may be deemed to

beneficially own more than 5% of the Shares as described elsewhere in this Notice. No member of the Pershing Square Parties has any knowledge of any facts that would prevent the determination that Mr. Ackman is independent under the applicable

standards of the Nasdaq Stock Market or the Securities and Exchange Commission.

-23-

Item 7(d) of Schedule 14A. Item 7(d) of Schedule 14A

cross-references the information required by Item 407(b), (c)(1), (c)(2), (d)(1), (d)(2), (d)(3), (e)(1), (e)(2), (e)(3) and (f) of Regulation S-K. These provisions of Item 407 of Regulation S-K are not applicable to the Nominees.

Item 7(e) of Schedule 14A.

Item 7(e) of Schedule 14A is not applicable to the Nominees.

Item 7(f) of Schedule 14A. Item 7(f) of

Schedule 14A is not applicable to the Nominees.

Item 7(g) of Schedule 14A. Item 7(g) of Schedule 14A

is not applicable to the Nominees.

Item 8 of Schedule 14A. Compensation of Directors and Executive Officers.

Item 8 of Schedule 14A cross-references the information required by Item 402 of Regulation

S-K and paragraphs (e)(4) and (e)(5) of Item 407 of Regulation S-K with respect to each nominee of the person making the solicitation and associates of such

nominee. Such information is set forth below:

Item 402(a)-(j) of Regulation

S-K. None of the Nominees or any of their respective associates has received any cash compensation, cash bonuses, deferred compensation, compensation pursuant to plans, or other compensation, from, or in

respect of, services rendered on behalf of the Corporation that is required to be disclosed under, or is subject to any arrangement described in, these paragraphs of Item 402 of Regulation S-K.

Item 402(k) of Regulation S-K. Other than as set forth in this Notice, no

Pershing Square Party is aware of any other arrangements pursuant to which any director of the Corporation was to be compensated for services during the Corporation’s last fiscal year.

Items 402(l)-(s) of Regulation S-K. Item 8 of Regulation S-K cross references the information required by paragraphs (l) through (s) of Item 402 of Regulation S-K. These provisions are not applicable to the Nominees.

Item 407(e)(4) of Regulation S-K. Other than as set forth in this Notice, there

are no interlocking relationships that would have required disclosure under these paragraphs of Item 407 of Regulation S-K had the Nominees been directors of the Corporation.

Item 407(e)(5) of Regulation S-K. This provision of Item 407 of Regulation S-K is not applicable to the Nominees.

-24-

F. Information Pursuant to Section 2.04(f) of Article II of the By-Laws

Set forth in Exhibit B of this Notice are signed consents executed by each of the

Nominees to serve as a director of the Corporation if so elected.

G. Information Pursuant to Section 2.04(g) of Article II of the

By-Laws

The Pershing Square Parties represent that they intend to solicit

proxies in support of the Nominees.

H. Information Pursuant to Section 2.04(h) of Article II of the By-Laws

The representation and agreement of each proposed Nominee, as required under

Section 2.04(h) of Article II of the By-Laws, is attached hereto as Exhibit C and incorporated herein by reference.

* * *

Disclosure in any section of this Notice (including all exhibits and the schedule attached hereto) shall be deemed to apply to

all other sections of this Notice. Stockholder believes that this Notice satisfies the requirements set forth in the By-Laws. Certain information set forth in this Notice is additional information which may

not be required by the By-Laws but which is included for completeness. The fact that any item of information not expressly required by the By-Laws is disclosed in this

Notice shall not be construed to mean that such information is required to be disclosed herein.

The information included

herein represents the best knowledge of Stockholder and the other Pershing Square Parties as of the date hereof. All information set forth herein relating to the Nominees has been furnished to Stockholder by the Nominees. Stockholder reserves the

right, in the event such information shall be or become inaccurate, to provide corrective information to the Corporation as soon as reasonably practicable, although except as otherwise stated herein, Stockholder does not commit to update any

information which may change from and after the date hereof. If there are no changes to the information set forth herein as of (a) the voting record date for the 2017 Annual Meeting and (b) the date that is ten (10) days prior to the

2017 Annual Meeting, then in each case this Notice shall serve as the updates and supplements contemplated by Section 1.01 of Article I of the By-laws and Section 2.04 of Article II the By-Laws, and no further updates or supplements shall need to be provided.

If this

Notice shall be deemed for any reason by a court of competent jurisdiction to be ineffective with respect to the nomination of any of the Nominees at the 2017 Annual Meeting, or if any individual nominee shall be unable or hereafter becomes unable

for any reason to serve as a director, this Notice shall continue to be effective with respect to any and all other Nominees, including any replacement nominees, nominated by Stockholder on behalf of the Pershing Square Parties.

Stockholder reserves the right to give further notice of additional nominations or any business to be made or conducted at the

2017 Annual Meeting or any other meeting of the Corporation’s stockholders. In addition to the foregoing, Stockholder reserves the right to further

-25-

nominate, substitute or add additional persons in the event (a) the Corporation purports to increase the number of directorships, (b) the Corporation makes or announces any changes to

the By-Laws or takes or announces any other action that purports to have, or if consummated would purport to have, the effect of disqualifying any of the Nominees or any additional nominee nominated pursuant

to the foregoing, and/or (c) any Nominee is unable or hereafter becomes unwilling for any reason to serve as a director. Additional nominations made pursuant to the preceding clauses (a) and/or (b) are without prejudice to the

position of Stockholder that any attempt to change the size of the Board or disqualify any of the Nominees through By-Law amendments or otherwise would constitute unlawful manipulation of the

Corporation’s corporate machinery. Stockholder further reserves the right to (i) withdraw any or all of the Nominees and/or (ii) nominate fewer than all of the Nominees listed herein and/or to

re-designate one or more of such individuals as alternate nominees.

The Pershing

Square Parties may elect in their proxy statement to seek authority in accordance with Rule 14a-4(d) of the Exchange Act to vote for nominees named in the Corporation’s proxy statement; provided,

that any such election by the Pershing Square Parties shall, pursuant to Rule 14a-4(d) of the Exchange Act, include the following: (a) the Pershing Square Parties shall seek authority to vote in the

aggregate for the number of director positions then subject to election; (b) the Pershing Square Parties shall represent that they will vote for all the Corporation’s nominees, other than those Corporation nominees specified in the

Pershing Square Parties’ proxy statement; (c) the Pershing Square Parties shall provide each Corporation security holder an opportunity to withhold authority with respect to any other Corporation nominee by writing the name of that nominee

on the form of proxy; and (d) the Pershing Square Parties shall state on the form of proxy and in the proxy statement that there is no assurance that the Corporation’s nominees will serve if elected with any of the Nominees.

Please be advised that, notwithstanding the compliance by the Pershing Square Parties with the

By-Laws and with applicable law, neither the delivery of this Notice nor the delivery of additional information, if any, provided by or on behalf of the Pershing Square Parties to the Corporation from and

after the date hereof shall be deemed to constitute an admission by the Pershing Square Parties that this Notice is in any way defective or as to the legality, validity or enforceability of any particular requirement or provision of the By-Laws or any other matter or a waiver by the Pershing Square Parties of their right to, in any way, contest or challenge the enforceability thereof or of any other matter.

The Pershing Square Parties understand that certain information regarding the 2017 Annual Meeting (including, but not limited

to, the record date, voting shares outstanding and date, time and place of the 2017 Annual Meeting), the Corporation (including, but not limited to, its various committees and proposal deadlines) and the beneficial ownership of the

Corporation’s securities will be set forth in the Corporation’s proxy statement on Schedule 14A, to be filed with the SEC by the Corporation with respect to the 2017 Annual Meeting, and in certain other SEC filings made or to be made by

the Corporation, and potentially third parties, under the Exchange Act. To the extent the Corporation believes any such information is required to be set forth herein, the Pershing Square Parties hereby refer the Corporation to such filings and

incorporate them herein by reference. The Pershing Square Parties accept no responsibility for any information set forth in any such filings not made by the Pershing Square Parties.

-26-

This Notice has been prepared and delivered in accordance with the requirements

of the By-Laws. If, for any reason, the Corporation, its executive officers, the Secretary, or any officer designated as the chairperson of the 2017 Annual Meeting or the Board believes otherwise, Stockholder

requests that it be notified of such belief immediately so that Stockholder may consider such matters and supplement and/or amend this Notice as may be appropriate or take any other action available to Stockholder under applicable law. In such an

event, please immediately call Richard M. Brand at (212) 504-5757 or Jason M. Halper at (212) 504-6300.

Please direct any questions regarding the information contained in this Notice to Richard M. Brand, Esq., Cadwalader,

Wickersham & Taft LLP, 200 Liberty Street, New York, New York 10281, (212) 504-5757 (Phone), (212) 504-6666 (Facsimile) or Jason M. Halper, Esq., Cadwalader,

Wickersham & Taft LLP, 200 Liberty Street, New York, New York 10281, (212) 504-6300 (Phone), (212) 504-6666 (Facsimile).

[Remainder of Page Intentionally Left Blank]

-27-

IN WITNESS WHEREOF, the undersigned has caused this Notice to be duly executed on

the date first above written.

|

|

|

| PERSHING SQUARE, L.P. |

|

|

| By: |

|

Pershing Square Capital Management, L.P., |

|

|

its investment advisor |

|

|

| By: |

|

PS Management GP, LLC,

its general partner |

|

|

| By: |

|

/s/ William A. Ackman |

|

|

William A. Ackman |

|

|

Managing Member |

[Signature Page to Automatic Data Processing, Inc. Notification Letter]

SCHEDULE 1

Deemed Associates or Affiliates

[Submitted separately to the Corporation]

Schedule 1

EXHIBIT A

Proof of Stockholder Record Ownership

[Submitted separately to the Corporation]

Exhibit A

EXHIBIT B

Form of Consent

Consent to Serve as a Director of Automatic Data Processing, Inc.

To: Secretary of Automatic Data Processing, Inc.

The undersigned hereby consents to serve as a director of Automatic Data Processing, Inc. if so elected.

Dated: August , 2017

Exhibit B

EXHIBIT C

Form of Representation and Agreement

AUTOMATIC DATA PROCESSING, INC.

REPRESENTATION AND AGREEMENT

Dated: _____, 2017

This representation and agreement is being delivered to Automatic Data Processing, Inc. (the “Corporation”)

pursuant to Section 2.04(h) of the Amended and Restated Bylaws of the Corporation.

The undersigned,

, hereby:

1. represents and agrees that he or she is not and will not become a party to any agreement, arrangement or understanding with,

and has not given any commitment or assurance to, any person or entity as to how he or she, if elected as a director, will act or vote on any issue or question that has not been disclosed to the Corporation (a “Voting Commitment”),

including any Voting Commitment that could reasonably be expected to limit or interfere with his or her ability to comply, if elected as a director, with his or her fiduciary duties under applicable law;

2. represents and agrees that he or she is not and will not become a party to any agreement, arrangement or understanding with

any person or entity other than the Corporation with respect to any direct or indirect compensation, reimbursement or indemnification in connection with service or action as a director that has not been disclosed to the Corporation; and

3. represents and agrees that he or she would be in compliance, if elected as a director of the Corporation, and will comply,

with applicable law and all applicable publicly disclosed corporate governance, conflict of interest, corporate opportunities, confidentiality and stock ownership and trading policies and guidelines of the Corporation relating to his or her

membership on the Board of Directors of the Corporation.

IN WITNESS WHEREOF, the undersigned has executed this

representation and agreement as of the date first written above.

Exhibit C

EXHIBIT D

Additional Information

Certain Information Relating to the Pershing Square Parties

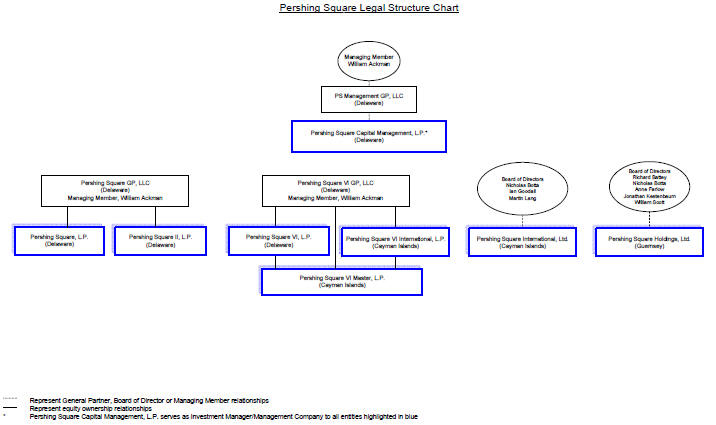

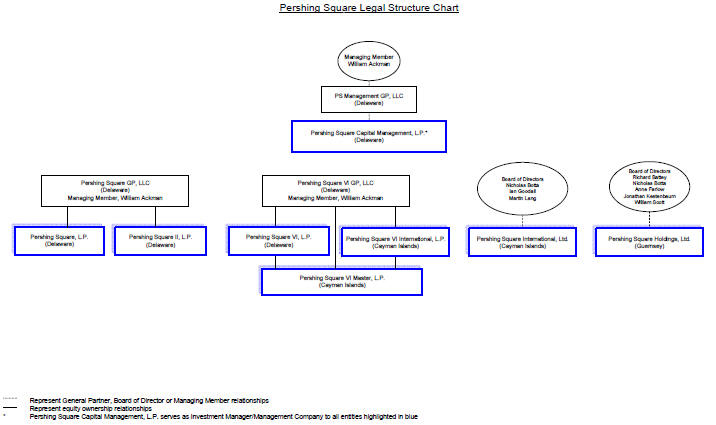

Below please find certain information relating to the Pershing Square Parties. In addition, we are providing for your

convenience a structure chart of the Pershing Square Parties. The initial public offering prospectus and the most recent annual report for Pershing Square Holdings, Ltd. are available at www.pershingsquareholdings.com. Pershing Square

Holdings, Ltd.’s public shares trade on the Premium Segment of the Main Market of the London Stock Exchange and on Euronext Amsterdam.

PERSHING

SQUARE, L.P.

Pershing Square, L.P. is a Delaware limited partnership, whose principal business address is 888 Seventh

Avenue, 42nd Floor, New York, New York 10019. The principal business of Pershing Square, L.P. is to purchase, sell, trade and invest in securities.

PERSHING SQUARE II, L.P.

Pershing Square II, L.P. is a Delaware limited partnership, whose principal business address is 888 Seventh Avenue, 42nd Floor,

New York, New York 10019. The principal business of Pershing Square II, L.P. is to purchase, sell, trade and invest in securities.

PERSHING SQUARE

INTERNATIONAL, LTD.

Pershing Square International, Ltd. is a Cayman Islands exempted company, whose principal business

address is 888 Seventh Avenue, 42nd Floor, New York, New York 10019. The principal business of Pershing Square International, Ltd. is to purchase, sell, trade and invest in securities.

PERSHING SQUARE HOLDINGS, LTD.

Pershing Square Holdings, Ltd. is a closed-end investment company incorporated in

Guernsey, whose principal business address is 888 Seventh Avenue, 42nd Floor, New York, New York 10019. The principal business of Pershing Square Holdings, Ltd. is to purchase, sell, trade and invest in securities. Pershing Square Holdings,

Ltd.’s public shares trade on the Premium Segment of the Main Market of the London Stock Exchange and on Euronext Amsterdam.

PERSHING SQUARE VI

MASTER, L.P.

Pershing Square VI Master, L.P. is a Cayman Islands limited partnership, whose principal business address

is 888 Seventh Avenue, 42nd Floor, New York, New York 10019. The principal business of Pershing Square VI Master, L.P. is to purchase, sell, trade and invest in securities of the Corporation and related derivatives.

Exhibit D-1

PERSHING SQUARE GP, LLC