FALSE00000086706/302021FYP5YP3YP3YP3Yus-gaap:AccruedLiabilitiesCurrentus-gaap:AccruedLiabilitiesCurrentP5DP1Y00000086702020-07-012021-06-30iso4217:USD00000086702020-12-31xbrli:shares00000086702021-07-3000000086702021-06-300000008670adp:RevenuesOtherThanInterestOnFundsHeldForClientsAndPEORevenuesMember2020-07-012021-06-300000008670adp:RevenuesOtherThanInterestOnFundsHeldForClientsAndPEORevenuesMember2019-07-012020-06-300000008670adp:RevenuesOtherThanInterestOnFundsHeldForClientsAndPEORevenuesMember2018-07-012019-06-300000008670adp:InterestOnFundsHeldForClientsMember2020-07-012021-06-300000008670adp:InterestOnFundsHeldForClientsMember2019-07-012020-06-300000008670adp:InterestOnFundsHeldForClientsMember2018-07-012019-06-300000008670adp:PEORevenuesMember2020-07-012021-06-300000008670adp:PEORevenuesMember2019-07-012020-06-300000008670adp:PEORevenuesMember2018-07-012019-06-3000000086702019-07-012020-06-3000000086702018-07-012019-06-300000008670us-gaap:RetainedEarningsMember2020-07-012021-06-30iso4217:USDxbrli:shares00000086702020-06-300000008670us-gaap:CommonStockMember2018-06-300000008670us-gaap:AdditionalPaidInCapitalMember2018-06-300000008670us-gaap:RetainedEarningsMember2018-06-300000008670us-gaap:TreasuryStockMember2018-06-3000000086702018-06-300000008670us-gaap:RetainedEarningsMember2018-07-012019-06-300000008670us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-07-012019-06-300000008670us-gaap:AdditionalPaidInCapitalMember2018-07-012019-06-300000008670us-gaap:TreasuryStockMember2018-07-012019-06-300000008670us-gaap:CommonStockMember2019-06-300000008670us-gaap:AdditionalPaidInCapitalMember2019-06-300000008670us-gaap:RetainedEarningsMember2019-06-300000008670us-gaap:TreasuryStockMember2019-06-3000000086702019-06-300000008670us-gaap:RetainedEarningsMember2019-07-012020-06-300000008670us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-07-012020-06-300000008670us-gaap:AdditionalPaidInCapitalMember2019-07-012020-06-300000008670us-gaap:TreasuryStockMember2019-07-012020-06-300000008670us-gaap:CommonStockMember2020-06-300000008670us-gaap:AdditionalPaidInCapitalMember2020-06-300000008670us-gaap:RetainedEarningsMember2020-06-300000008670us-gaap:TreasuryStockMember2020-06-300000008670us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-06-300000008670us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-07-012021-06-300000008670us-gaap:AdditionalPaidInCapitalMember2020-07-012021-06-300000008670us-gaap:TreasuryStockMember2020-07-012021-06-300000008670us-gaap:CommonStockMember2021-06-300000008670us-gaap:AdditionalPaidInCapitalMember2021-06-300000008670us-gaap:RetainedEarningsMember2021-06-300000008670us-gaap:TreasuryStockMember2021-06-300000008670us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-06-30adp:segment0000008670srt:MinimumMember2020-07-012021-06-300000008670srt:MaximumMember2020-07-012021-06-300000008670srt:MinimumMember2021-06-300000008670srt:MaximumMember2021-06-30xbrli:pure0000008670adp:NotesDueOn2028Member2020-07-012021-06-300000008670adp:NotesDueOn2030Member2020-07-012021-06-300000008670adp:NotesDueOn2028And2030Member2021-06-300000008670adp:Notesdueon2025Member2015-07-012016-06-300000008670adp:Notesdueon2025Member2016-06-300000008670adp:DataProcessingEquipmentMembersrt:MinimumMember2020-07-012021-06-300000008670srt:MaximumMemberadp:DataProcessingEquipmentMember2020-07-012021-06-300000008670us-gaap:BuildingMembersrt:MinimumMember2020-07-012021-06-300000008670srt:MaximumMemberus-gaap:BuildingMember2020-07-012021-06-300000008670us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2020-07-012021-06-300000008670srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2020-07-012021-06-300000008670adp:InternalUseSoftwareMembersrt:MinimumMember2020-07-012021-06-300000008670srt:MaximumMemberadp:InternalUseSoftwareMember2020-07-012021-06-300000008670adp:InternalUseSoftwareMember2020-07-012021-06-300000008670us-gaap:SubsequentEventMember2021-07-012021-07-310000008670adp:HCMMember2020-07-012021-06-300000008670adp:HCMMember2019-07-012020-06-300000008670adp:HCMMember2018-07-012019-06-300000008670adp:HROMember2020-07-012021-06-300000008670adp:HROMember2019-07-012020-06-300000008670adp:HROMember2018-07-012019-06-300000008670adp:PEOMember2020-07-012021-06-300000008670adp:PEOMember2019-07-012020-06-300000008670adp:PEOMember2018-07-012019-06-300000008670adp:GlobalMember2020-07-012021-06-300000008670adp:GlobalMember2019-07-012020-06-300000008670adp:GlobalMember2018-07-012019-06-300000008670adp:ClientfundinterestMember2020-07-012021-06-300000008670adp:ClientfundinterestMember2019-07-012020-06-300000008670adp:ClientfundinterestMember2018-07-012019-06-300000008670adp:HCMMemberadp:EmployerServicesSegmentMember2020-07-012021-06-300000008670adp:HCMMemberadp:ProfessionalEmployeeOrganizationServicesSegmentMember2020-07-012021-06-300000008670adp:HCMMemberus-gaap:AllOtherSegmentsMember2020-07-012021-06-300000008670adp:EmployerServicesSegmentMemberadp:HROMember2020-07-012021-06-300000008670adp:HROMemberadp:ProfessionalEmployeeOrganizationServicesSegmentMember2020-07-012021-06-300000008670adp:HROMemberus-gaap:AllOtherSegmentsMember2020-07-012021-06-300000008670adp:PEOMemberadp:EmployerServicesSegmentMember2020-07-012021-06-300000008670adp:PEOMemberadp:ProfessionalEmployeeOrganizationServicesSegmentMember2020-07-012021-06-300000008670adp:PEOMemberus-gaap:AllOtherSegmentsMember2020-07-012021-06-300000008670adp:EmployerServicesSegmentMemberadp:GlobalMember2020-07-012021-06-300000008670adp:ProfessionalEmployeeOrganizationServicesSegmentMemberadp:GlobalMember2020-07-012021-06-300000008670us-gaap:AllOtherSegmentsMemberadp:GlobalMember2020-07-012021-06-300000008670adp:ClientfundinterestMemberadp:EmployerServicesSegmentMember2020-07-012021-06-300000008670adp:ClientfundinterestMemberadp:ProfessionalEmployeeOrganizationServicesSegmentMember2020-07-012021-06-300000008670adp:ClientfundinterestMemberus-gaap:AllOtherSegmentsMember2020-07-012021-06-300000008670adp:EmployerServicesSegmentMember2020-07-012021-06-300000008670adp:ProfessionalEmployeeOrganizationServicesSegmentMember2020-07-012021-06-300000008670us-gaap:AllOtherSegmentsMember2020-07-012021-06-300000008670adp:HCMMemberadp:EmployerServicesSegmentMember2019-07-012020-06-300000008670adp:HCMMemberadp:ProfessionalEmployeeOrganizationServicesSegmentMember2019-07-012020-06-300000008670adp:HCMMemberus-gaap:AllOtherSegmentsMember2019-07-012020-06-300000008670adp:EmployerServicesSegmentMemberadp:HROMember2019-07-012020-06-300000008670adp:HROMemberadp:ProfessionalEmployeeOrganizationServicesSegmentMember2019-07-012020-06-300000008670adp:HROMemberus-gaap:AllOtherSegmentsMember2019-07-012020-06-300000008670adp:PEOMemberadp:EmployerServicesSegmentMember2019-07-012020-06-300000008670adp:PEOMemberadp:ProfessionalEmployeeOrganizationServicesSegmentMember2019-07-012020-06-300000008670adp:PEOMemberus-gaap:AllOtherSegmentsMember2019-07-012020-06-300000008670adp:EmployerServicesSegmentMemberadp:GlobalMember2019-07-012020-06-300000008670adp:ProfessionalEmployeeOrganizationServicesSegmentMemberadp:GlobalMember2019-07-012020-06-300000008670us-gaap:AllOtherSegmentsMemberadp:GlobalMember2019-07-012020-06-300000008670adp:ClientfundinterestMemberadp:EmployerServicesSegmentMember2019-07-012020-06-300000008670adp:ClientfundinterestMemberadp:ProfessionalEmployeeOrganizationServicesSegmentMember2019-07-012020-06-300000008670adp:ClientfundinterestMemberus-gaap:AllOtherSegmentsMember2019-07-012020-06-300000008670adp:EmployerServicesSegmentMember2019-07-012020-06-300000008670adp:ProfessionalEmployeeOrganizationServicesSegmentMember2019-07-012020-06-300000008670us-gaap:AllOtherSegmentsMember2019-07-012020-06-300000008670adp:HCMMemberadp:EmployerServicesSegmentMember2018-07-012019-06-300000008670adp:HCMMemberadp:ProfessionalEmployeeOrganizationServicesSegmentMember2018-07-012019-06-300000008670adp:HCMMemberus-gaap:AllOtherSegmentsMember2018-07-012019-06-300000008670adp:EmployerServicesSegmentMemberadp:HROMember2018-07-012019-06-300000008670adp:HROMemberadp:ProfessionalEmployeeOrganizationServicesSegmentMember2018-07-012019-06-300000008670adp:HROMemberus-gaap:AllOtherSegmentsMember2018-07-012019-06-300000008670adp:PEOMemberadp:EmployerServicesSegmentMember2018-07-012019-06-300000008670adp:PEOMemberadp:ProfessionalEmployeeOrganizationServicesSegmentMember2018-07-012019-06-300000008670adp:PEOMemberus-gaap:AllOtherSegmentsMember2018-07-012019-06-300000008670adp:EmployerServicesSegmentMemberadp:GlobalMember2018-07-012019-06-300000008670adp:ProfessionalEmployeeOrganizationServicesSegmentMemberadp:GlobalMember2018-07-012019-06-300000008670us-gaap:AllOtherSegmentsMemberadp:GlobalMember2018-07-012019-06-300000008670adp:ClientfundinterestMemberadp:EmployerServicesSegmentMember2018-07-012019-06-300000008670adp:ClientfundinterestMemberadp:ProfessionalEmployeeOrganizationServicesSegmentMember2018-07-012019-06-300000008670adp:ClientfundinterestMemberus-gaap:AllOtherSegmentsMember2018-07-012019-06-300000008670adp:EmployerServicesSegmentMember2018-07-012019-06-300000008670adp:ProfessionalEmployeeOrganizationServicesSegmentMember2018-07-012019-06-300000008670us-gaap:AllOtherSegmentsMember2018-07-012019-06-300000008670adp:DeferredcoststoobtainacontractMember2021-06-300000008670adp:DeferredcoststoobtainacontractMember2020-06-300000008670adp:DeferredcoststofulfillacontractMember2021-06-300000008670adp:DeferredcoststofulfillacontractMember2020-06-300000008670us-gaap:PropertyPlantAndEquipmentMember2019-07-012020-06-300000008670country:US2019-07-012020-06-300000008670us-gaap:MoneyMarketFundsMember2021-06-300000008670us-gaap:CorporateDebtSecuritiesMember2021-06-300000008670us-gaap:USTreasurySecuritiesMember2021-06-300000008670us-gaap:AssetBackedSecuritiesMember2021-06-300000008670us-gaap:ForeignGovernmentDebtSecuritiesMember2021-06-300000008670us-gaap:USGovernmentAgenciesDebtSecuritiesMember2021-06-300000008670adp:CanadianProvincialBondsMember2021-06-300000008670us-gaap:CommercialMortgageBackedSecuritiesMember2021-06-300000008670us-gaap:OtherDebtSecuritiesMember2021-06-300000008670adp:CorporateInvestmentsMember2021-06-300000008670adp:FundsHeldForClientsMember2021-06-300000008670us-gaap:MoneyMarketFundsMember2020-06-300000008670us-gaap:CorporateDebtSecuritiesMember2020-06-300000008670us-gaap:AssetBackedSecuritiesMember2020-06-300000008670us-gaap:USTreasurySecuritiesMember2020-06-300000008670us-gaap:USGovernmentAgenciesDebtSecuritiesMember2020-06-300000008670us-gaap:ForeignGovernmentDebtSecuritiesMember2020-06-300000008670us-gaap:CommercialMortgageBackedSecuritiesMember2020-06-300000008670adp:CanadianProvincialBondsMember2020-06-300000008670us-gaap:OtherDebtSecuritiesMember2020-06-300000008670adp:CorporateInvestmentsMember2020-06-300000008670adp:FundsHeldForClientsMember2020-06-300000008670us-gaap:FairValueInputsLevel1Member2021-06-300000008670us-gaap:FairValueInputsLevel3Member2021-06-300000008670adp:AssetBackedAutoLoanReceivablesMember2021-06-300000008670adp:FixedRateCreditCardMember2021-06-300000008670adp:AssetBackedEquipmentLeaseReceivableMember2021-06-300000008670adp:RateReductionReceivableMember2021-06-300000008670adp:FederalFarmCreditBanksMember2021-06-300000008670us-gaap:FederalHomeLoanBankCertificatesAndObligationsFHLBMember2021-06-300000008670us-gaap:MunicipalBondsMember2021-06-300000008670us-gaap:ForeignCorporateDebtSecuritiesMember2021-06-300000008670adp:CurrentMember2021-06-300000008670adp:CurrentMember2020-06-300000008670adp:NoncurrentMember2021-06-300000008670adp:NoncurrentMember2020-06-300000008670us-gaap:LandAndBuildingMember2021-06-300000008670us-gaap:LandAndBuildingMember2020-06-300000008670adp:DataProcessingEquipmentMember2021-06-300000008670adp:DataProcessingEquipmentMember2020-06-300000008670us-gaap:FurnitureAndFixturesMember2021-06-300000008670us-gaap:FurnitureAndFixturesMember2020-06-300000008670us-gaap:PropertyPlantAndEquipmentMember2021-06-300000008670us-gaap:PropertyPlantAndEquipmentMember2020-06-300000008670adp:EmployerServicesSegmentMember2019-06-300000008670adp:PeoServicesSegmentMember2019-06-300000008670adp:PeoServicesSegmentMember2019-07-012020-06-300000008670adp:EmployerServicesSegmentMember2020-06-300000008670adp:PeoServicesSegmentMember2020-06-300000008670adp:PeoServicesSegmentMember2020-07-012021-06-300000008670adp:EmployerServicesSegmentMember2021-06-300000008670adp:PeoServicesSegmentMember2021-06-300000008670us-gaap:ComputerSoftwareIntangibleAssetMember2021-06-300000008670us-gaap:ComputerSoftwareIntangibleAssetMember2020-06-300000008670us-gaap:CustomerListsMember2021-06-300000008670us-gaap:CustomerListsMember2020-06-300000008670us-gaap:OtherIntangibleAssetsMember2021-06-300000008670us-gaap:OtherIntangibleAssetsMember2020-06-300000008670us-gaap:ComputerSoftwareIntangibleAssetMember2020-07-012021-06-300000008670us-gaap:CustomerListsMember2020-07-012021-06-300000008670us-gaap:OtherIntangibleAssetsMember2020-07-012021-06-300000008670adp:ThreeHundredAndSixtyFourDayCreditFacilityMember2021-06-300000008670adp:ThreeHundredAndSixtyFourDayCreditFacilityMember2020-07-012021-06-300000008670adp:CreditFacilityExpiringInJuneTwoThousandTwentyFourMember2021-06-300000008670adp:CreditFacilityExpiringInJuneTwoThousandTwentyFourMember2020-07-012021-06-300000008670adp:CreditFacilityExpiringInJuneTwoThousandTwentySixMember2020-07-012021-06-300000008670adp:CreditFacilityExpiringInJuneTwoThousandTwentySixMember2021-06-300000008670us-gaap:CommercialPaperMember2021-06-300000008670us-gaap:CommercialPaperMember2020-07-012021-06-300000008670us-gaap:CommercialPaperMember2019-07-012020-06-300000008670adp:ReverseRepurchaseAgreementsMember2020-07-012021-06-300000008670adp:ReverseRepurchaseAgreementsMember2019-07-012020-06-300000008670adp:Notesdueon2020Member2020-08-012020-08-310000008670adp:Notesdueon2020Member2021-06-3000000086702020-08-1300000086702019-07-012021-06-300000008670adp:Notesdueon2020Member2020-06-300000008670adp:Notesdueon2025Member2021-06-300000008670adp:Notesdueon2025Member2020-06-300000008670adp:NotesDueOn2030Member2021-06-300000008670adp:NotesDueOn2030Member2020-06-300000008670adp:NotesDueOn2028Member2021-06-300000008670adp:NotesDueOn2028Member2020-06-300000008670us-gaap:OtherDebtSecuritiesMember2021-06-300000008670us-gaap:OtherDebtSecuritiesMember2020-06-300000008670adp:TimeBasedRestricedStockGrantedDuringOrAfterSeptember12018Member2020-07-012021-06-300000008670adp:PerformanceBasedRestrictedStockAndUnitsMembersrt:MinimumMember2020-07-012021-06-300000008670srt:MaximumMemberadp:PerformanceBasedRestrictedStockAndUnitsMember2020-07-012021-06-300000008670adp:PerformanceBasedRestrictedStockAndUnitsMember2020-07-012021-06-300000008670us-gaap:EmployeeStockMember2020-07-012021-06-300000008670adp:OperatingExpensesMember2020-07-012021-06-300000008670adp:OperatingExpensesMember2019-07-012020-06-300000008670adp:OperatingExpensesMember2018-07-012019-06-300000008670us-gaap:SellingGeneralAndAdministrativeExpensesMember2020-07-012021-06-300000008670us-gaap:SellingGeneralAndAdministrativeExpensesMember2019-07-012020-06-300000008670us-gaap:SellingGeneralAndAdministrativeExpensesMember2018-07-012019-06-300000008670adp:SystemDevelopmentAndProgrammingCostsMember2020-07-012021-06-300000008670adp:SystemDevelopmentAndProgrammingCostsMember2019-07-012020-06-300000008670adp:SystemDevelopmentAndProgrammingCostsMember2018-07-012019-06-300000008670adp:NonvestedStockOptionsMember2021-06-300000008670us-gaap:RestrictedStockUnitsRSUMember2021-06-300000008670adp:NonvestedRestrictedStockMember2021-06-300000008670adp:NonvestedStockOptionsMember2020-07-012021-06-300000008670us-gaap:RestrictedStockUnitsRSUMember2020-07-012021-06-300000008670adp:NonvestedRestrictedStockMember2020-07-012021-06-300000008670adp:TimeBasedRestrictedStockMember2020-06-300000008670adp:TimeBasedRestrictedStockUnitsMember2020-06-300000008670adp:TimeBasedRestrictedStockMember2020-07-012021-06-300000008670adp:TimeBasedRestrictedStockUnitsMember2020-07-012021-06-300000008670adp:TimeBasedRestrictedStockMember2021-06-300000008670adp:TimeBasedRestrictedStockUnitsMember2021-06-300000008670adp:PerformanceBasedRestrictedStockMember2020-06-300000008670adp:PerformanceBasedRestrictedStockUnitMember2020-06-300000008670adp:PerformanceBasedRestrictedStockMember2020-07-012021-06-300000008670adp:PerformanceBasedRestrictedStockUnitMember2020-07-012021-06-300000008670adp:PerformanceBasedRestrictedStockMember2021-06-300000008670adp:PerformanceBasedRestrictedStockUnitMember2021-06-300000008670adp:PerformanceBasedRestrictedStockMember2019-07-012020-06-300000008670adp:PerformanceBasedRestrictedStockMember2018-07-012019-06-300000008670adp:TimeBasedRestrictedStockMember2019-07-012020-06-300000008670adp:TimeBasedRestrictedStockMember2018-07-012019-06-3000000086702019-07-012019-07-010000008670us-gaap:CashAndCashEquivalentsMember2021-06-300000008670us-gaap:CashAndCashEquivalentsMember2020-06-300000008670us-gaap:FixedIncomeSecuritiesMember2021-06-300000008670us-gaap:FixedIncomeSecuritiesMember2020-06-300000008670us-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2021-06-300000008670us-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2020-06-300000008670us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2021-06-300000008670us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2020-06-300000008670adp:GlobalEquitySecuritiesMember2021-06-300000008670adp:GlobalEquitySecuritiesMember2020-06-300000008670country:USus-gaap:FixedIncomeSecuritiesMembersrt:MinimumMember2021-06-300000008670country:USsrt:MaximumMemberus-gaap:FixedIncomeSecuritiesMember2021-06-300000008670country:USus-gaap:DefinedBenefitPlanEquitySecuritiesUsMembersrt:MinimumMember2021-06-300000008670country:USsrt:MaximumMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2021-06-300000008670country:USus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMembersrt:MinimumMember2021-06-300000008670country:USsrt:MaximumMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2021-06-300000008670country:USadp:GlobalEquitySecuritiesMembersrt:MinimumMember2021-06-300000008670country:USsrt:MaximumMemberadp:GlobalEquitySecuritiesMember2021-06-300000008670adp:ComingledTrustsMemberus-gaap:FairValueInputsLevel1Member2021-06-300000008670us-gaap:FairValueInputsLevel2Memberadp:ComingledTrustsMember2021-06-300000008670us-gaap:FairValueInputsLevel3Memberadp:ComingledTrustsMember2021-06-300000008670adp:ComingledTrustsMember2021-06-300000008670us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryAndGovernmentMember2021-06-300000008670us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMember2021-06-300000008670us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryAndGovernmentMember2021-06-300000008670us-gaap:USTreasuryAndGovernmentMember2021-06-300000008670adp:MutualFundsMemberus-gaap:FairValueInputsLevel1Member2021-06-300000008670adp:MutualFundsMemberus-gaap:FairValueInputsLevel2Member2021-06-300000008670us-gaap:FairValueInputsLevel3Memberadp:MutualFundsMember2021-06-300000008670adp:MutualFundsMember2021-06-300000008670us-gaap:FairValueInputsLevel1Memberadp:CorporateAndMunicipalBondsMember2021-06-300000008670us-gaap:FairValueInputsLevel2Memberadp:CorporateAndMunicipalBondsMember2021-06-300000008670us-gaap:FairValueInputsLevel3Memberadp:CorporateAndMunicipalBondsMember2021-06-300000008670adp:CorporateAndMunicipalBondsMember2021-06-300000008670us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:FairValueInputsLevel1Member2021-06-300000008670us-gaap:FairValueInputsLevel2Memberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2021-06-300000008670us-gaap:FairValueInputsLevel3Memberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2021-06-300000008670us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2021-06-300000008670adp:TotalPensionAssetsExcludingCashMemberus-gaap:FairValueInputsLevel1Member2021-06-300000008670adp:TotalPensionAssetsExcludingCashMemberus-gaap:FairValueInputsLevel2Member2021-06-300000008670us-gaap:FairValueInputsLevel3Memberadp:TotalPensionAssetsExcludingCashMember2021-06-300000008670adp:TotalPensionAssetsExcludingCashMember2021-06-300000008670us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Member2021-06-300000008670adp:ComingledTrustsMemberus-gaap:FairValueInputsLevel1Member2020-06-300000008670us-gaap:FairValueInputsLevel2Memberadp:ComingledTrustsMember2020-06-300000008670us-gaap:FairValueInputsLevel3Memberadp:ComingledTrustsMember2020-06-300000008670adp:ComingledTrustsMember2020-06-300000008670us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryAndGovernmentMember2020-06-300000008670us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMember2020-06-300000008670us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryAndGovernmentMember2020-06-300000008670us-gaap:USTreasuryAndGovernmentMember2020-06-300000008670adp:MutualFundsMemberus-gaap:FairValueInputsLevel1Member2020-06-300000008670adp:MutualFundsMemberus-gaap:FairValueInputsLevel2Member2020-06-300000008670us-gaap:FairValueInputsLevel3Memberadp:MutualFundsMember2020-06-300000008670adp:MutualFundsMember2020-06-300000008670us-gaap:FairValueInputsLevel1Memberadp:CorporateAndMunicipalBondsMember2020-06-300000008670us-gaap:FairValueInputsLevel2Memberadp:CorporateAndMunicipalBondsMember2020-06-300000008670us-gaap:FairValueInputsLevel3Memberadp:CorporateAndMunicipalBondsMember2020-06-300000008670adp:CorporateAndMunicipalBondsMember2020-06-300000008670us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMemberus-gaap:FairValueInputsLevel1Member2020-06-300000008670us-gaap:FairValueInputsLevel2Memberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2020-06-300000008670us-gaap:FairValueInputsLevel3Memberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2020-06-300000008670us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2020-06-300000008670adp:TotalPensionAssetsExcludingCashMemberus-gaap:FairValueInputsLevel1Member2020-06-300000008670adp:TotalPensionAssetsExcludingCashMemberus-gaap:FairValueInputsLevel2Member2020-06-300000008670us-gaap:FairValueInputsLevel3Memberadp:TotalPensionAssetsExcludingCashMember2020-06-300000008670adp:TotalPensionAssetsExcludingCashMember2020-06-300000008670us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Member2020-06-3000000086702020-01-012020-12-3100000086702019-01-012019-12-3100000086702018-01-012018-12-310000008670us-gaap:OtherAssetsMember2021-06-300000008670us-gaap:OtherAssetsMember2020-06-300000008670us-gaap:ForeignCountryMember2021-06-300000008670us-gaap:DomesticCountryMember2021-06-300000008670us-gaap:StateAndLocalJurisdictionMember2021-06-300000008670adp:IncomeTaxesPayableMember2021-06-300000008670adp:IncomeTaxesPayableMember2020-06-300000008670us-gaap:EarliestTaxYearMemberstpr:IL2020-07-012021-06-300000008670stpr:ILus-gaap:LatestTaxYearMember2020-07-012021-06-300000008670us-gaap:EarliestTaxYearMemberstpr:MA2020-07-012021-06-300000008670us-gaap:LatestTaxYearMemberstpr:MA2020-07-012021-06-300000008670stpr:TXus-gaap:EarliestTaxYearMember2020-07-012021-06-300000008670stpr:TXus-gaap:LatestTaxYearMember2020-07-012021-06-300000008670us-gaap:EarliestTaxYearMemberstpr:MI2020-07-012021-06-300000008670stpr:MIus-gaap:LatestTaxYearMember2020-07-012021-06-300000008670stpr:NYus-gaap:EarliestTaxYearMember2020-07-012021-06-300000008670stpr:NYus-gaap:LatestTaxYearMember2020-07-012021-06-300000008670adp:NewYorkCityMemberus-gaap:EarliestTaxYearMember2020-07-012021-06-300000008670adp:NewYorkCityMemberus-gaap:LatestTaxYearMember2020-07-012021-06-300000008670country:INus-gaap:EarliestTaxYearMember2020-07-012021-06-300000008670country:INus-gaap:LatestTaxYearMember2020-07-012021-06-3000000086702021-06-012021-06-30adp:claim00000086702020-05-012020-05-310000008670us-gaap:AccumulatedTranslationAdjustmentMember2018-06-300000008670us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2018-06-300000008670us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2018-06-300000008670us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-06-300000008670us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-06-300000008670us-gaap:AccumulatedTranslationAdjustmentMember2018-07-012019-06-300000008670us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2018-07-012019-06-300000008670us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2018-07-012019-06-300000008670us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-07-012019-06-300000008670us-gaap:AccumulatedTranslationAdjustmentMember2019-06-300000008670us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-06-300000008670us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-06-300000008670us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-06-300000008670us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-06-300000008670us-gaap:AccumulatedTranslationAdjustmentMember2019-07-012020-06-300000008670us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-07-012020-06-300000008670us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-07-012020-06-300000008670us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-07-012020-06-300000008670us-gaap:AccumulatedTranslationAdjustmentMember2020-06-300000008670us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-06-300000008670us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-06-300000008670us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-06-300000008670us-gaap:AccumulatedTranslationAdjustmentMember2020-07-012021-06-300000008670us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-07-012021-06-300000008670us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-07-012021-06-300000008670us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-07-012021-06-300000008670us-gaap:AccumulatedTranslationAdjustmentMember2021-06-300000008670us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-06-300000008670us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-06-300000008670us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-06-300000008670us-gaap:OperatingSegmentsMemberadp:EmployerServicesSegmentMember2020-07-012021-06-300000008670us-gaap:OperatingSegmentsMemberadp:ProfessionalEmployeeOrganizationServicesSegmentMember2020-07-012021-06-300000008670us-gaap:CorporateNonSegmentMember2020-07-012021-06-300000008670us-gaap:OperatingSegmentsMemberadp:EmployerServicesSegmentMember2021-06-300000008670us-gaap:OperatingSegmentsMemberadp:ProfessionalEmployeeOrganizationServicesSegmentMember2021-06-300000008670us-gaap:CorporateNonSegmentMember2021-06-300000008670us-gaap:OperatingSegmentsMemberadp:EmployerServicesSegmentMember2019-07-012020-06-300000008670us-gaap:OperatingSegmentsMemberadp:ProfessionalEmployeeOrganizationServicesSegmentMember2019-07-012020-06-300000008670us-gaap:CorporateNonSegmentMember2019-07-012020-06-300000008670us-gaap:OperatingSegmentsMemberadp:EmployerServicesSegmentMember2020-06-300000008670us-gaap:OperatingSegmentsMemberadp:ProfessionalEmployeeOrganizationServicesSegmentMember2020-06-300000008670us-gaap:CorporateNonSegmentMember2020-06-300000008670us-gaap:OperatingSegmentsMemberadp:EmployerServicesSegmentMember2018-07-012019-06-300000008670us-gaap:OperatingSegmentsMemberadp:ProfessionalEmployeeOrganizationServicesSegmentMember2018-07-012019-06-300000008670us-gaap:CorporateNonSegmentMember2018-07-012019-06-300000008670us-gaap:OperatingSegmentsMemberadp:EmployerServicesSegmentMember2019-06-300000008670us-gaap:OperatingSegmentsMemberadp:ProfessionalEmployeeOrganizationServicesSegmentMember2019-06-300000008670us-gaap:CorporateNonSegmentMember2019-06-300000008670country:US2020-07-012021-06-300000008670srt:EuropeMember2020-07-012021-06-300000008670country:CA2020-07-012021-06-300000008670adp:OtherGeographicalPlacesMember2020-07-012021-06-300000008670country:US2021-06-300000008670srt:EuropeMember2021-06-300000008670country:CA2021-06-300000008670adp:OtherGeographicalPlacesMember2021-06-300000008670srt:EuropeMember2019-07-012020-06-300000008670country:CA2019-07-012020-06-300000008670adp:OtherGeographicalPlacesMember2019-07-012020-06-300000008670country:US2020-06-300000008670srt:EuropeMember2020-06-300000008670country:CA2020-06-300000008670adp:OtherGeographicalPlacesMember2020-06-300000008670country:US2018-07-012019-06-300000008670srt:EuropeMember2018-07-012019-06-300000008670country:CA2018-07-012019-06-300000008670adp:OtherGeographicalPlacesMember2018-07-012019-06-300000008670country:US2019-06-300000008670srt:EuropeMember2019-06-300000008670country:CA2019-06-300000008670adp:OtherGeographicalPlacesMember2019-06-300000008670us-gaap:AllowanceForCreditLossMemberadp:CurrentMember2020-06-300000008670us-gaap:AllowanceForCreditLossMemberadp:CurrentMember2020-07-012021-06-300000008670us-gaap:AllowanceForCreditLossMemberadp:CurrentMember2021-06-300000008670us-gaap:AllowanceForCreditLossMemberadp:NoncurrentMember2020-06-300000008670us-gaap:AllowanceForCreditLossMemberadp:NoncurrentMember2020-07-012021-06-300000008670us-gaap:AllowanceForCreditLossMemberadp:NoncurrentMember2021-06-300000008670us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-06-300000008670us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-07-012021-06-300000008670us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-06-300000008670us-gaap:AllowanceForCreditLossMemberadp:CurrentMember2019-06-300000008670us-gaap:AllowanceForCreditLossMemberadp:CurrentMember2019-07-012020-06-300000008670us-gaap:AllowanceForCreditLossMemberadp:NoncurrentMember2019-06-300000008670us-gaap:AllowanceForCreditLossMemberadp:NoncurrentMember2019-07-012020-06-300000008670us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-06-300000008670us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-07-012020-06-300000008670us-gaap:AllowanceForCreditLossMemberadp:CurrentMember2018-06-300000008670us-gaap:AllowanceForCreditLossMemberadp:CurrentMember2018-07-012019-06-300000008670us-gaap:AllowanceForCreditLossMemberadp:NoncurrentMember2018-06-300000008670us-gaap:AllowanceForCreditLossMemberadp:NoncurrentMember2018-07-012019-06-300000008670us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2018-06-300000008670us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2018-07-012019-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 10-K

_________________ | | | | | | | | | | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Year Ended June 30, 2021

OR | | | | | | | | | | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period From to

Commission File Number 1-5397

AUTOMATIC DATA PROCESSING, INC.

(Exact name of registrant as specified in its charter) | | | | | | | | |

| Delaware | 22-1467904 |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

| One ADP Boulevard | |

| Roseland, | NJ | 07068 |

| (Address of principal executive offices) | (Zip Code) |

| |

| | |

| | |

| | |

|

Registrant's telephone number, including area code: (973)-974-5000 | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $0.10 Par Value

(voting) | ADP | NASDAQ Global Select Market

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ý

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days. Yes ý No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ý No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | |

| Large Accelerated Filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒ | | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | Yes | ☐ | No | ☒ |

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant as of the last business day of the Registrant’s most recently completed second fiscal quarter was approximately $75,329,818,310. On July 30, 2021 there were 423,080,556 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE | | | | | |

| Portions of the Registrant's Proxy Statement for its 2021 Annual Meeting of Stockholders. | Part III |

Table of Contents

| | | | | | | | |

| | | |

| | | Page |

| Part I | | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| Part II | | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| | |

| Part III | | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| Part IV. | | |

| Item 15. | | |

| Signatures | | |

| | |

| | |

Part I

Item 1. Business

CORPORATE BACKGROUND

General

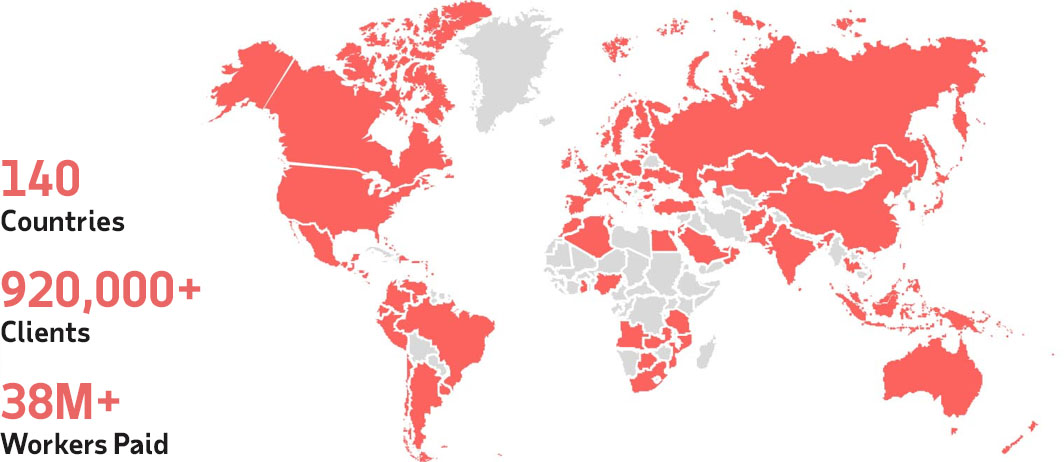

In 1949, our founders established ADP to shape the world of work with a simple, innovative idea: help clients focus on their business by freeing them up from certain non-core tasks such as payroll. Today, we are one of the world’s leading providers of cloud-based human capital management (HCM) solutions to employers, offering solutions to businesses of all sizes, whether they have simple or complex needs. We serve over 920,000 clients and pay over 38 million workers in 140 countries and territories. Our common stock is listed on the NASDAQ Global Select Market® under the symbol “ADP.”

When we refer to “we,” “us,” “our,” “ADP,” or the “Company” in this Annual Report on Form 10-K, we mean Automatic Data Processing, Inc. and its consolidated subsidiaries.

BUSINESS OVERVIEW

ADP’s Mission

As digital technology, globalization, new business models and other significant events and disruptions reshape the way people work, our mission is to power organizations with insightful solutions that meet the changing needs of our clients and their workers. Our HCM technology, industry and compliance expertise and data insights deliver measurable results, peace-of-mind and an engaged, productive workforce. Our leading technology and commitment to service excellence is at the core of our relationship with each one of our clients, whether it's a small, mid-sized or large organization operating in one or multiple countries around the world. We are constantly designing better ways to work through cutting-edge products, premium services and exceptional experiences that enable people to reach their full potential.

ADP’s Strategy

Our Strategic Pillars. Our business strategy is based on three strategic pillars, which are designed to position us as the global market leader in HCM technology and services:

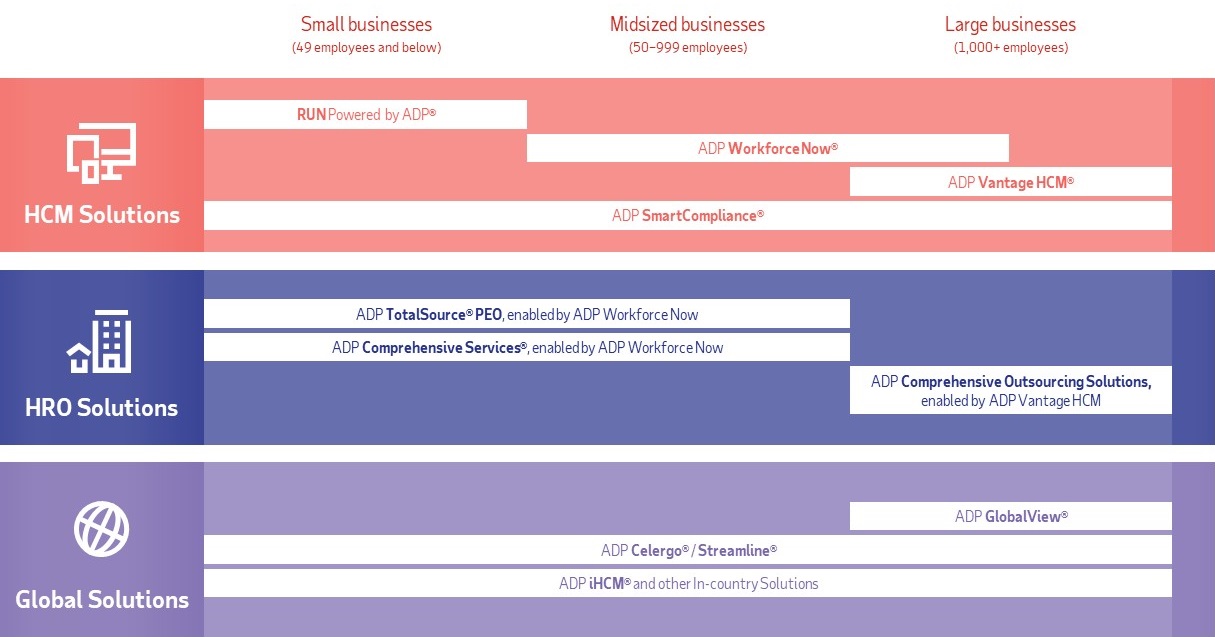

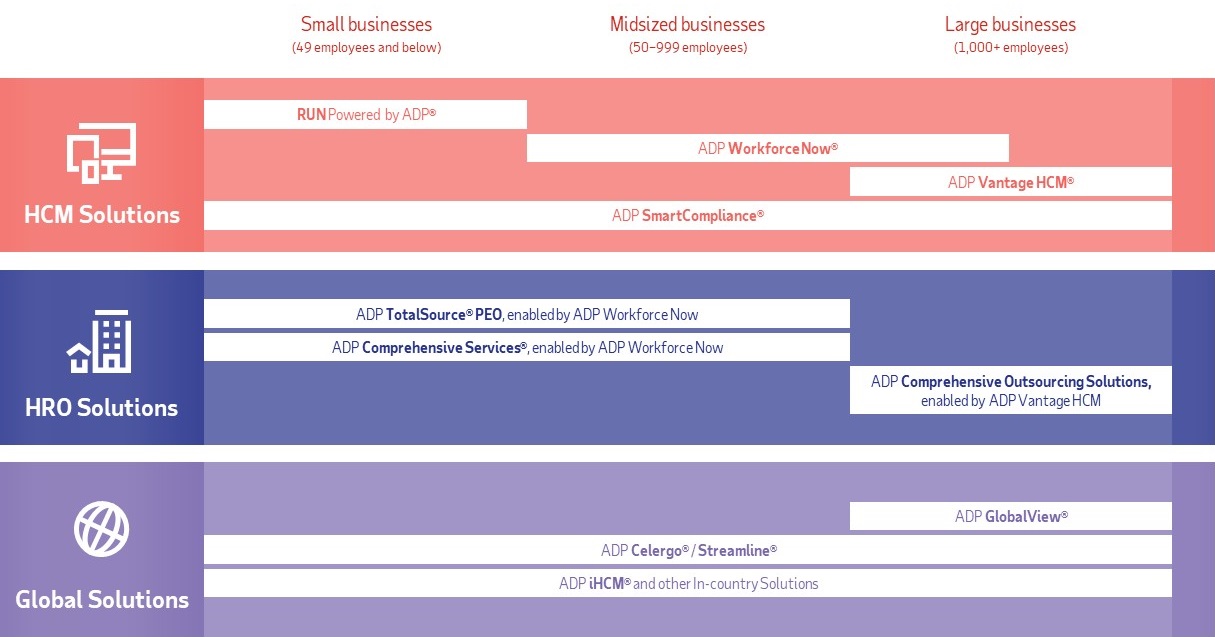

• Grow a complete suite of cloud-based HCM solutions (HCM Solutions). We develop cloud-based software and offer comprehensive solutions that assist employers of all types and sizes in managing the entire worker spectrum and employment cycle — from full-time to freelancer and from hire to retire.

• Grow and scale our market-leading HR Outsourcing solutions (HRO Solutions). We offer comprehensive HRO solutions in which we provide complete management solutions for HR administration, payroll administration, talent management, employee benefits, benefits administration, employer liability management, and other HCM and employee benefits functions.

• Leverage our global presence to offer clients HCM solutions wherever they do business (Global Solutions). We are expanding our international HCM and HRO businesses, comprised of our established local, in-country solutions and our market-leading, cloud-based multi-country solutions.

With a large and growing addressable market, we are strongly positioned to continue delivering sustainable long-term value across our strategic pillars. We are doing this by successfully executing on product and technology innovation, providing industry-leading service and compliance expertise, and enhancing our world-class distribution.

We are focused on, and investing in, our world-class and next-gen platforms that are built for the future of work, and on providing market-leading HCM product and technology solutions that solve the needs of our clients today, and anticipate the needs of our clients tomorrow. Our world-class platforms and multi-national solutions provide our clients with comprehensive HR and payroll capabilities that drive productivity and enable compliance globally. Our cloud-based next-gen platforms are built to be person-centric, serve all worker types, support flexible work and on-demand pay, and deliver seamless global capabilities to dynamic, team-based organizations.

Digital technology is transforming today's workplace and workforce. We are accelerating our own digital transformation and leveraging digital technology to change how we engage with our clients and how their workers engage with us — and an important part of this includes delivering solutions wherever they are, whether at work or on the go.

We offer the broadest suite of complete HRO solutions coupled with dedicated and strategic HR services and deep local expertise. These offerings can be tailored to meet the increasingly complex and sophisticated needs of our clients and their workers.

Our global footprint in the HCM industry is unmatched and, together with world-class technology and deep in-country compliance expertise, we are strongly positioned to continue to drive growth by delivering solutions to clients of all sizes wherever they do business.

Innovation at ADP

Innovation is in our DNA. For over 70 years, we have reimagined the world of work by designing cutting-edge products, robust services and exceptional experiences that touch millions of people’s lives daily. We pioneered HCM automation, HCM in the cloud, mobile HCM and a digital HCM marketplace. As the business and digital technology landscape rapidly evolves, what “work” means, how and where it gets done, and how workers are paid is changing as well. We innovate by anticipating the future of work, the future of HCM and the future of pay in order to meet the evolving and unique needs of our clients and their workers.

Our next-gen platforms are built for the ever-changing world of work. Designed from the ground up to be cloud-native, global, scalable and secure, our next-gen platforms provide our clients with the flexibility they need to address today’s and tomorrow’s workplace challenges. Our award winning next-gen HCM platform enables our clients to personalize their experience based on their needs. Built for dynamic teams, our next-gen HCM platform provides our clients with visibility into where work actually happens rather than into rigid organizational hierarchies and worker types. With our “HR your way” approach, clients can easily tailor the solution to their needs by deploying low-code applications.

In 2020, our next-gen payroll solution was named “Top HR Product” at the annual HR Technology Conference, marking the sixth consecutive year ADP has been honored for its innovative technology, an unprecedented achievement. Recently expanded across North America to Canada and Mexico, this next-gen payroll solution supports workers of all types and enables real-time, transparent, continuous payroll calculations. Our next-gen payroll solution also unlocks flexible pay choices for our clients so they can provide the best pay experience for their workers. As the regulatory environment rapidly changes, making it harder for companies to navigate the complexities of payroll, our next-gen payroll solution’s built-in compliance capabilities enable our clients to focus on managing their business. Our next-gen platforms are designed to meet the needs of our clients in an ever-changing world of work.

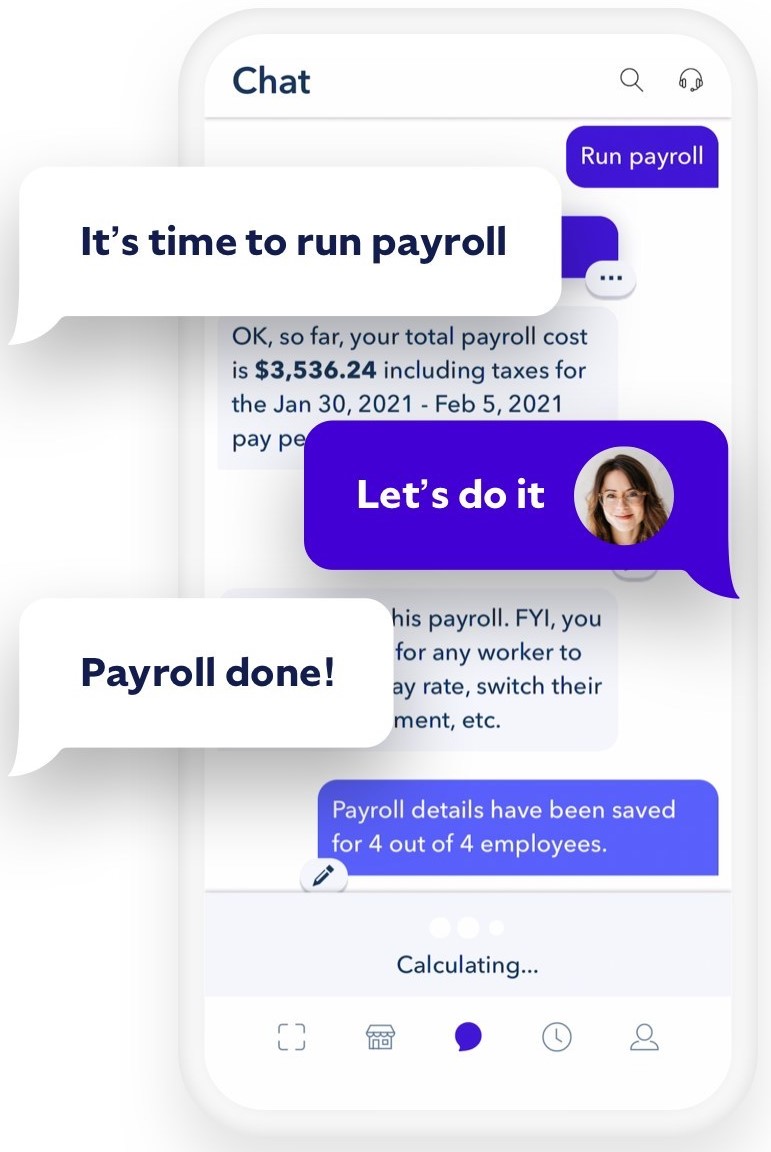

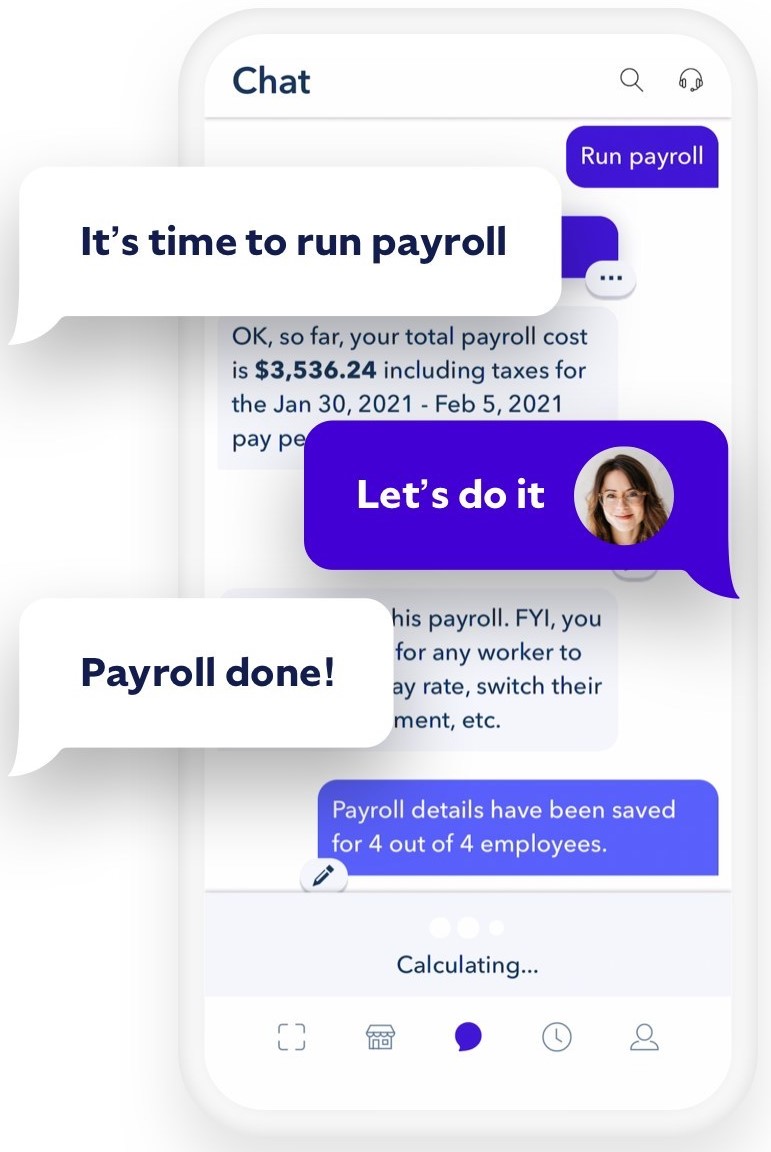

In February 2021, we launched the “Roll™ by ADP” mobile-first solution - reimagining how small businesses do payroll. This groundbreaking payroll solution utilizes an AI-powered chat interface to turn traditional payroll management into an intuitive conversation that can complete payroll in under a minute. Leveraging ADP’s long-standing payroll expertise and data security, small business owners can download and self-purchase Roll and run payroll anywhere, anytime, quickly and compliantly, with no experience or training needed. The conversational experience runs off simple chat prompts such as “Run my payroll,” offering a frictionless experience that also allows

clients to confidently handle compliance matters like tax filing and deposits.

Today, big data provides a real competitive advantage. That is why we have accelerated the deployment of machine learning (ML) against our unmatched HCM dataset – the same HCM dataset that drives our renowned ADP National Employment Report®. We are leading this innovation effort with ADP® DataCloud, our award-winning ML and workforce analytics platform which is by far one of the largest repositories of payroll information available. DataCloud analyzes aggregated, anonymized and timely HCM and compensation data from more than 920,000 organizations across the country, powering solutions that provide clients with in-depth workforce and business insights that enable critical HR decisions. ADP DataCloud's Skills Graph, our proprietary data structure, is based on more than 30 million employee records, 50 million resumes and 5 million job postings across more than 20 industries and 500 geographic areas, and extracts, aligns and normalizes key information such as skills, job titles and levels, education and qualifications from non-structured data and infers missing skills and qualifications from context. Skills Graph powers ADP’s Candidate Profile Relevancy tool to help score, assess and predict candidates who are the best fit for a job opening, as well as our new Organizational Benchmarking Dashboard which enables companies to decide how best to deploy their workers by comparing organizational metrics like headcount, labor costs and turnover against other similar businesses. We offer similar solutions to clients outside the United States.

ADP’s Model-Based Benchmarks, powered by Skills Graph, also extend benchmarks to include compensation for up to 150 million workers. Model-Based Benchmarks are driven by a set of deep learning models that extract patterns and knowledge from millions of payroll records and job profiles to provide accurate information that reflects the reality of the position being shown. ADP’s Pay Equity Storyboard combines analytics and benchmarking to help employers better understand potential pay gaps and provide them with real, up-to-date, aggregated and anonymized market data to understand how their compensation for a particular job compares to other similar employers. We continue to leverage the powerful DataCloud platform to provide clients with relevant, actionable insights. These insights are particularly important with respect to Diversity and Inclusion and, as part of our commitment to Diversity and Inclusion, this year we introduced the Diversity, Equity and Inclusion (DEI) Dashboard which can help businesses focus on the DEI issues that are most important to them by analyzing their diversity landscape through a simple question-and-answer format and easy-to-navigate user interface that allows them to better set, track and expand their DEI goals. These innovative offerings combine HR expertise and data transparency in a way that connects HR to the bottom line. In harnessing the power of big data through ML, ADP recognizes the importance of accountability, transparency, privacy, explainability and governance, and in furtherance of those goals has established an active AI & Data Ethics Committee, comprised of both industry leaders and ADP experts, which advises on emerging industry trends and concerns and provides guidance with respect to compliance with the principles that ADP should follow while developing products, systems and applications that involve artificial intelligence, ML and big data.

WorkMarket, a cloud-based workforce management solution, provides robust freelancer management functionality and reporting insights, enabling clients to organize, manage and pay their extended workforce.

Our innovative Wisely® payment offerings support an employer’s need for flexible payment solutions in order to meet the individual needs of its workers. The Wisely® Pay payroll card is a network-branded payroll card and digital account that enables employers to pay their employees, and enables employees to access their payroll funds immediately, including via a network member bank or an ATM, make purchases or pay bills, load additional funds onto the card, such as tax refunds and military pensions, and transfer funds to a bank account in the United States. We also offer Wisely® Direct, a network-branded general purpose reloadable card and digital account, which provides similar features and functionality as Wisely Pay but is offered directly to consumers. Our digital card offerings are true banking alternatives that feature innovative services such as savings, budgeting and cash-back rewards, are digital wallet-enabled and, through the companion myWisely app, offer other personal financial management features.

In addition, our ADP Mobile apps simplify how work gets done by enabling clients to process their payroll anywhere, and giving millions of their employees worldwide convenient access to their payroll and HR information in 28 languages.

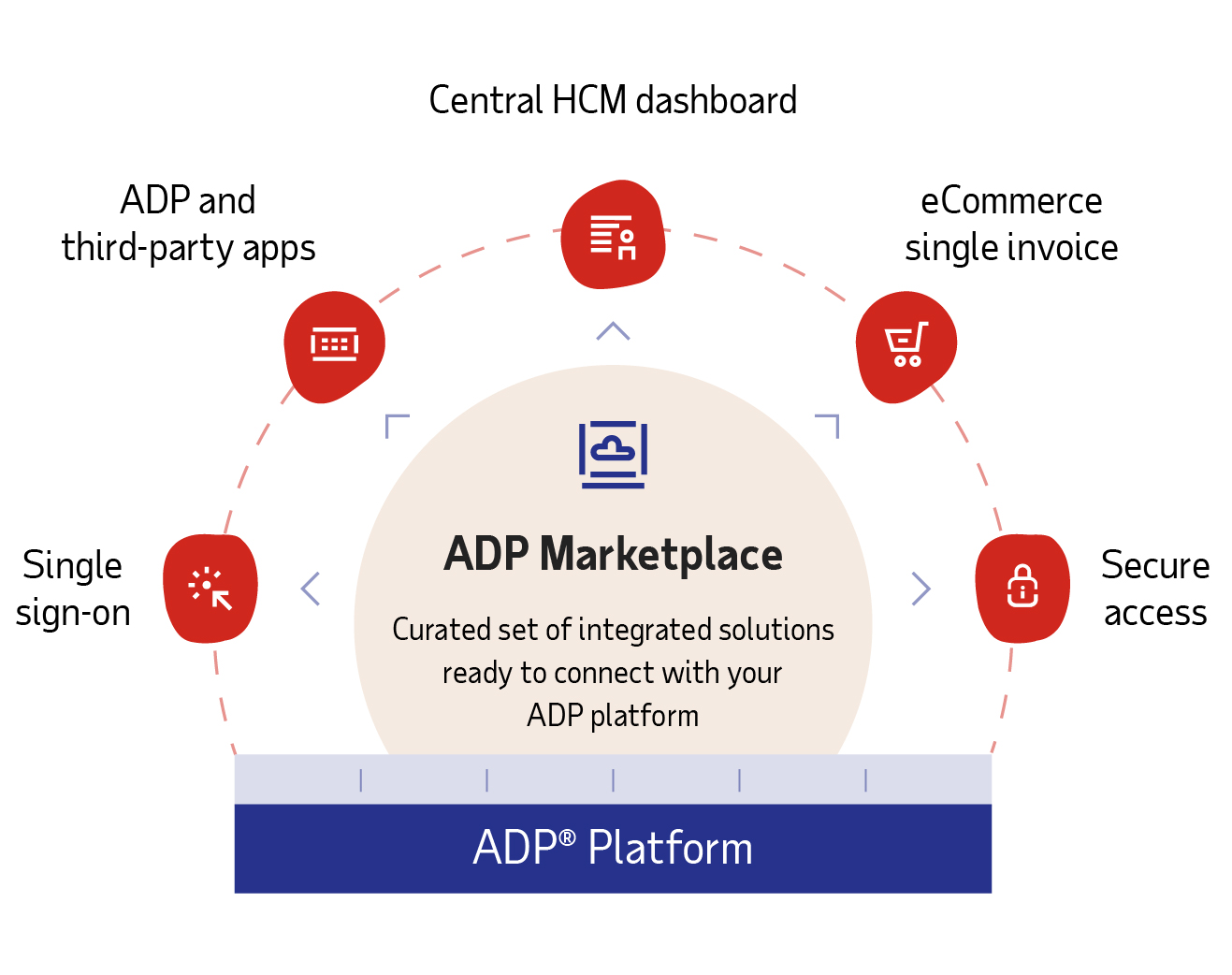

We have also given third-party developers and system integrators access to some of our platforms’ API (application programming interface) libraries through ADP Marketplace in order to enable secure data sharing between ADP and other solutions across the HR and business ecosystem. ADP Marketplace is a digital HR storefront where clients can discover the best-fit apps for their industry; browse by solution-types such as learning management, financial wellness, time and attendance, and benefits administration; or connect HR software they already use. The pre-built integrations help clients simplify their processes, create a single system of record, and reduce data errors, freeing up time and resources to focus on growing their business and taking care of their people. With approximately 600 apps and integrations to choose from, ADP Marketplace offers ADP clients a modern HR experience that they can tailor to their specific needs.

Helping Clients and their Employees Emerge Stronger from the COVID-19 Global Pandemic

The COVID-19 global pandemic has continued to create extremely challenging circumstances for our clients and their employees, and our priority has been to provide the support they need to navigate these challenges. As they pivot their focus from seeking essential relief to evolving their business models and operations to address changes in the economy and workplace, we continue to provide trusted solutions, data and expertise to help them emerge stronger.

At the onset of the pandemic, we quickly developed and provided – at no charge – reporting capabilities designed to provide clients around the world with data they needed to benefit from legislation providing financial assistance to enable them to stay in business. We were one of the first HCM companies to provide tools and reports that enabled our clients to apply for Paycheck Protection Program loans under the Coronavirus Aid, Relief and Economic Security (CARES) Act of more than $115 billion – ultimately helping approximately 400,000 employers apply for this essential assistance. To help employers confidently manage compliance, our teams analyzed more than 2,000 legislative updates associated with COVID-19 across the globe in order to provide them with easy to understand and actionable guidance and updated reporting tools.

As COVID-19 restrictions ease, many employers are returning to the workplace and designing new policies that reflect the demand for remote and hybrid work models, we are supporting their efforts by providing our clients with tools that can help them manage compliance confidently, achieve business continuity, and support employee wellness and engagement.

Our Return to Workplace dashboard powered by ADP DataCloud uses data analytics and employee surveys to allow clients to monitor workforce trends including availability, health attestation results, and worker readiness and sentiment toward returning to the workplace; identify and schedule workers based on availability, location, job title and other attributes; track vaccination status; and facilitate contact tracing, in order to help transition workers back to workplaces with more clarity and confidence.

With ADP® Compliance on Demand, clients can easily tap into a knowledge base for compliance — from new leave laws and time tracking requirements, to record-keeping and more.

The new ADP Time Kiosk helps employers manage safe levels of occupancy by equipping workers with time & attendance tracking without touching a device. The Time Kiosk uses optional facial recognition to log workers in compliantly and voice activation to start/end a shift, take a meal break, transfer jobs and more.

As the economy recovers and the way people work is reshaped, our teams continue to swiftly adapt and adjust workflows to deliver the content, resources and support that employers and their workforce need, when they need it. Our expertise, innovative technology and data, as well as established financial relationships with our clients, financial institutions and employees, make ADP the partner that clients trust as they adapt to new world of work and create workplaces where everyone can thrive.

Reportable Segments

Our two reportable business segments are Employer Services and Professional Employer Organization (“PEO”). For financial data by segment and by geographic area, see Note 16 to the “Consolidated Financial Statements” contained in this Annual Report on Form 10-K.

Employer Services. Our Employer Services segment serves clients ranging from single-employee small businesses to large enterprises with tens of thousands of employees around the world, offering a comprehensive range of technology-based HCM solutions, including our strategic, cloud-based platforms, and HRO (other than PEO) solutions. These solutions address critical client needs and include: Payroll Services, Benefits Administration, Talent Management, HR Management, Workforce Management, Compliance Services, Insurance Services and Retirement Services.

Professional Employer Organization. Our PEO business, called ADP TotalSource®, provides clients with comprehensive employment administration outsourcing solutions through a relationship in which employees who work for a client (referred to as “worksite employees”) are co-employed by us and the client.

Our reportable segments are based on the way that management reviews the performance of, and makes decisions about, our business. Our strategic pillars represent the strategic growth areas for our business. The results of our business related to products and solutions within the HCM Solutions pillar, the HRO Solutions pillar (other than PEO products and solutions) and the Global Solutions pillar are contained within our Employer Services segment. The results of our business within the HRO Solutions pillar related to our PEO products and solutions are contained within our PEO segment.

In order to serve the unique needs of diverse types of businesses and workforce models, we provide a range of solutions which businesses of all types and sizes and across geographies can use to recruit, pay, manage, and retain their workforce. We address these broad market needs with our cloud-based strategic platforms: RUN Powered by ADP®, serving approximately 750,000 small businesses; ADP Workforce Now®, serving over 75,000 mid-sized and large businesses across our strategic pillars; and ADP Vantage HCM®, serving over 500 large enterprise businesses. All of these solutions can be combined with ADP SmartCompliance® to address the increasingly broad and complex needs of employers. Outside the United States, we address the needs of over 60,000 clients with premier global solutions consisting of in-country solutions and multinational offerings, including ADP GlobalView®, ADP Celergo®/Streamline® and ADP iHCM.

Strategic Cloud-based Products and Solutions Across Client Size and Geography

HCM Solutions

Integrated HCM Solutions. Our premier suite of HCM products offers complete solutions that assist employers of all types and sizes in all stages of the employment cycle, from recruitment to retirement.

Our suite of HCM solutions are powered by our strategic, cloud-based, award-winning platforms:

• RUN Powered by ADP combines a software platform for small business payroll, HR management and tax compliance administration, with 24/7 service and support from our team of small business experts. RUN Powered by ADP also integrates with other ADP solutions, such as workforce management, workers’ compensation insurance premium payment plans, and retirement plan administration systems.

• ADP Workforce Now is a flexible HCM solution used across mid-sized and large businesses in North America to manage their employees. More businesses use ADP Workforce Now in North America than any other HCM solution designed for both mid-sized and large businesses.

• ADP Vantage HCM is a solution for large enterprises in the United States. It offers a comprehensive set of HCM capabilities within a single solution that unifies the five major areas of HCM: HR management, benefits administration, payroll services, time and attendance management, and talent management.

Payroll Services. We pay over 23 million (approximately 1 out of every 6) workers in the United States. We provide flexible payroll services to employers of all sizes, including the preparation of employee paychecks, pay statements, supporting journals, summaries, and management reports.

We provide employers with a wide range of payroll options, including using mobile technology, connecting their major enterprise resource planning (“ERP”) applications with ADP’s payroll services or outsourcing their entire payroll process to us. Employers can choose a variety of payroll payment options including ADP’s electronic wage payment and, in the United States, payroll card solutions and digital accounts. On behalf of our clients in the United States, we prepare and file federal, state and local payroll tax returns, and quarterly and annual Social Security, Medicare, and federal, state and local income tax withholding reports.

Benefits Administration. In the United States, we provide powerful and agile solutions for employee benefits administration. These options include health and welfare administration services, leave administration services, insurance carrier enrollment services, employee communication services, and dependent verification services. In addition, ADP benefits administration solutions offer employers a simple and flexible cloud-based eligibility and enrollment system that provides their employees with tools, communications, and other resources they need to understand their benefits options and make informed choices.

Talent Management. ADP’s Talent Management solutions simplify and improve the talent acquisition, management, and activation process from recruitment to ongoing employee engagement and development. Employers can also outsource their internal recruitment function to ADP. Our solutions provide performance, learning, succession and compensation management tools that help employers align goals to outcomes, and enable managers to identify and mitigate potential retention risks. Our talent activation solutions include StandOut® powered by ADP, which provides team leaders with data and

insights to drive employee engagement and leadership development, which in turn help drive employee performance.

Workforce Management. ADP’s Workforce Management offers a range of solutions to over 100,000 employers of all sizes, including time and attendance, absence management and scheduling tools. Time and attendance solutions include time capture via online timesheets, timeclocks with badge readers, biometrics and touch-screens, telephone/interactive voice response, and mobile smartphones and tablets. These tools automate the calculation and reporting of hours worked, helping employers prepare payroll, control costs and overtime, and manage compliance with wage and hour regulations. Absence management tools include accrued time off, attendance policy and leave case management modules. Our employee scheduling tools simplify visibility, offer shift-swapping capabilities and can assist managers with optimizing schedules to boost productivity and minimize under- and over-staffing. We also offer analytics and reporting tools that provide clients with insights, benchmarks and performance metrics so they can better manage their workforce. In addition, industry-specific modules are available for labor forecasting, budgeting, activity and task management, grant and project tracking, and tips management.

Compliance Solutions. ADP’s Compliance Solutions provides industry-leading expertise in payment compliance and employment-related tax matters that complement the payroll, HR and ERP systems of its clients. In our fiscal year ended June 30, 2021, in the United States, we processed and delivered more than 69 million employee year-end tax statements, and moved more than $2.3 trillion in client funds to taxing and other agencies and to our clients’ employees and other payees.

• ADP SmartCompliance. In the United States, ADP SmartCompliance integrates client data delivered from our integrated HCM platforms or third-party payroll, HR and financial systems into a single, cloud-based solution. Our specialized teams use the data to work with clients to help them manage changing and complex regulatory landscapes and improve business processes. ADP SmartCompliance includes HCM-related compliance solutions such as Employment Tax and Wage Payments, as well as Tax Credits, Health Compliance, Wage Garnishments, Employment Verifications, Unemployment Claims and W-2 Management.

• ADP SmartCompliance Employment Tax. As part of our full-service employment tax services in the United States, we prepare and file employment tax returns on our clients’ behalf and, in connection with these stand-alone services, collect employment taxes from clients and remit these taxes to more than 8,000 federal, state and local tax agencies.

• ADP SmartCompliance Wage Payments. In the United States, we offer compliant pay solutions for today's workforce, including electronic payroll disbursement options such as payroll cards, digital accounts and direct deposit, as well as traditional payroll checks, which can be integrated with clients’ ERP and payroll systems.

Human Resources Management. Commonly referred to as Human Resource Information Systems, ADP’s Human Resources Management Solutions provide employers with a single system of record to support the entry, validation, maintenance, and reporting of data required for effective HR management, including employee names, addresses, job types, salary grades, employment history, and educational background.

Insurance Services. ADP’s Insurance Services business, in conjunction with our licensed insurance agency,

Automatic Data Processing Insurance Agency, Inc., facilitates access in the United States to workers’ compensation and group health insurance for small and mid-sized clients through a variety of insurance carriers. Our automated Pay-by-Pay® premium payment program calculates and collects workers’ compensation premium payments each pay period, simplifying this task for employers.

Retirement Services. ADP Retirement Services helps employers in the United States administer various types of retirement plans, such as traditional and Roth 401(k)s, profit sharing (including new comparability), SIMPLE and SEP IRAs, and executive deferred compensation plans. ADP Retirement Services offers a full service 401(k) plan program which provides recordkeeping and administrative services, combined with an investment platform offered through ADP Broker-Dealer, Inc. that gives our clients’ employees access to a wide range of non-proprietary investment options and online tools to monitor the performance of their investments. In addition, ADP Retirement Services offers investment management services to retirement plans through ADP Strategic Plan Services, LLC, an SEC registered investment adviser under the Investment Advisers Act of 1940. ADP Retirement Services also offers trustee services through a third party.

HRO Solutions

As a leader in the growing HR Outsourcing market, we partner with our clients to offer a full range of seamless technology and service solutions for HR administration, workforce management, payroll services, benefits administration and talent management. From small businesses to enterprises with thousands of employees, with HRO our clients gain proven technology and processes and robust service and support. Whether a client chooses our PEO or other HR Outsourcing solutions, we offer solutions tailored to a client’s specific needs and preferences – designed to meet the client’s needs today, and as its business and needs evolve.

Professional Employer Organization. ADP TotalSource is enabled by ADP Workforce Now and offers small and mid-sized businesses a comprehensive HR outsourcing solution through a co-employment model. With a PEO, both ADP and the client have a co-employment relationship with the client’s employees. We assume certain employer responsibilities such as payroll processing and tax filings, and the client maintains control of its business and all management responsibilities. ADP TotalSource clients are able to offer their employees services and benefits on par with those of much larger enterprises, without the need to staff a full HR department. With our cloud-based HCM software at the core, we serve more than 14,500 clients and

more than 620,000 worksite employees in all 50 U.S. states. ADP TotalSource is the largest PEO certified by the Internal Revenue Service as meeting the requirements to operate as a Certified Professional Employer Organization under the Internal Revenue Code. As a full-service PEO, ADP TotalSource provides a broad range of HR administrative services, including payroll and payroll tax, employer compliance, HR guidance, employee benefits and benefit administration, talent strategies, and workers’ compensation insurance including risk and claims management. Some of the rich offerings available through ADP TotalSource to address today’s workplace challenges include:

• Better Employee Benefits: Through our PEO, many of our clients discover that they can offer a richer overall benefits package than they could afford to offer on their own. We give clients access to a new patent-pending approach to help them target the best benefit plan offerings for their employees. They can compare plan options and make more educated decisions about what plan offering is best for their company and budget. In addition, ADP TotalSource integrates with our award-winning ADP Marketplace to further tailor offerings, such as helping employees pay off student loans with payroll contributions and integrating a client’s U.S. PEO population with its global workforce’s HR system of record.

• Protection and Compliance: ADP TotalSource HR experts help clients manage the risks of being an employer by advising how to handle properly a range of issues - from HR and safety compliance to employee-relations. This includes access to workers' compensation coverage and expertise designed to help them handle both routine and unexpected incidents, including discrimination and harassment claims.

• Talent Engagement: Featuring a talent blueprint, ADP TotalSource HR experts work with clients to help them better engage and retain their workforce through solutions that support the core needs of an employee at work. In addition, our full-service recruitment team is dedicated to helping our clients find and hire new talent, while reducing the stress of uncovering top talent.

• Expertise: Each client is assigned a designated HR specialist for day-to-day and strategic guidance. Clients can also access data-driven benchmarks in areas such as turnover and overtime, staffing and understanding profit leaks, and have their ADP HR expert help tailor recommendations to continue to drive their business forward. A payroll specialist is also available to clients to help them ensure their workers are paid correctly, on time and in compliance.

ADP Comprehensive Services. Leveraging our market-leading ADP Workforce Now platform, ADP Comprehensive Services partners with clients of all types and sizes to tackle their HR, talent, benefits administration

and pay challenges with help from our proven expertise, deep experience and best practices. ADP Comprehensive Services is flexible – enabling clients to partner with us for managed services for one, some or all areas across HR, talent, benefits administration and pay. We provide outsourced execution that combines processes, technology and a robust service and support team that acts as an extension of our client’s in-house resources – so their HCM and pay operations are executed with confidence.

ADP Comprehensive Outsourcing Services (ADP COS). Enabled by ADP Vantage HCM, ADP COS is designed for large business outsourcing for payroll, HR administration, workforce management, benefits administration and talent management. With COS, the day-to-day payroll process becomes our responsibility, freeing up clients to address critical issues like employee engagement and retention. The combination of technology, deep expertise and data-driven insights that COS offers is powerful, allowing clients to focus on strategy and results.

ADP Recruitment Process Outsourcing Services (ADP RPO®). ADP RPO provides deep talent insights to help drive targeted recruitment strategies for attracting top talent. With global, customizable recruitment services, ADP RPO enables organizations to find and hire the best candidates for hourly, professional or executive positions. In addition, we also deliver market analytics, sourcing strategies, candidate screening, selection and on-boarding solutions to help organizations connect their talent strategy to their business's priorities.

Global Solutions

Our premier global solutions consist of multi-country and local in-country solutions for employers of any type or size. We partner with clients to help them navigate the most complex HR and payroll scenarios using tailored and scalable technology supported by our deep compliance expertise.

ADP Global Payroll is a solution for multinational organizations of all sizes, empowering them to harmonize HCM strategies in 140 countries globally. This improves visibility, control and operational efficiency, giving organizations the insight and confidence to adapt to changing local needs, while helping to drive overall organizational agility and engagement.

We also offer comprehensive, country-specific HCM solutions that combine innovative technology with deep local expertise. By operating a flexible service model, we help customers manage various combinations of payroll services, HR management, time and attendance management, talent management and benefits management, depending on the country in which the solution is provided.

We pay over 14 million workers outside the United States with our in-country solutions and with ADP GlobalView, ADP Celergo/Streamline and ADP iHCM – our simplified and intuitive multi-country payroll solutions. As part of our global payroll services, we supply year-end regulatory and legislative tax statements and other forms to our clients’ employees. Our global talent management solutions elevate the employee experience, from recruitment to ongoing employee engagement and development. Our comprehensive HR solutions combined with our deep expertise make our clients’ global HR management strategies a reality. Our configurable, automated time and attendance tools help global clients understand the work being performed and the resources being used, and help ensure the right people are in the right place at the right time.

MARKETS AND SALES

Our HCM solutions are offered in 140 countries and territories across North America, Latin America, Europe, Asia and Africa. The most material markets for HCM Solutions, Global Solutions and HRO Solutions (other than PEO) are the United States, Canada and Europe. In each market, we have both country-specific solutions and multi-country solutions, for employers of all sizes and complexities. The major components of our offerings throughout these geographies are payroll, HR outsourcing and time and attendance management. In addition, we offer wage and tax collection and/or remittance services in the United States, Canada, the United Kingdom, Australia, India and China. Our PEO business offers services exclusively in the United States.

We market our solutions primarily through our direct sales force. We also market HCM Solutions, Global Solutions and HRO Solutions through indirect sales channels, such as marketing relationships with certified public accountants and banks, among others. None of our major business units has a single homogeneous client base or market. While concentrations of clients exist in specific industries, no one client, industry or industry group is material to our overall

revenues. We are a leader in each of our major service offerings and do not believe any of our major services or business units is subject to unique market risk.

COMPETITION

The industries in which we operate are highly competitive. We know of no reliable statistics by which we can determine the number of our competitors, but we believe that we are one of the largest providers of HCM solutions in the world. HCM Solutions, Global Solutions and HRO Solutions (other than PEO) compete with other business outsourcing companies, companies providing ERP services, providers of cloud-based HCM solutions and financial institutions. Our PEO business competes with other PEOs providing similar services, as well as business outsourcing companies, companies providing ERP services and providers of cloud-based HCM solutions. Other competitive factors include a company’s in-house function, whereby a company installs and operates its own HCM system.

Competition for business outsourcing solutions is primarily based on product and service quality, reputation, ease of use and accessibility of technology, breadth of offerings, and price. We believe that we are competitive in each of these areas and that our leading-edge technology, together with our commitment to service excellence, distinguishes us from our competitors.

INDUSTRY REGULATION

Our business is subject to a wide range of complex U.S. and foreign laws and regulations. In addition, many of our solutions are designed to assist clients with their compliance with certain U.S. and foreign laws and regulations that apply to them. We have, and continue to enhance, compliance programs and policies to monitor and address the legal and regulatory requirements applicable to our operations and client solutions, including dedicated compliance personnel and training programs.

As one of the world’s largest providers of HCM solutions, our systems contain a significant amount of sensitive data related to clients, employees of our clients, vendors and our employees. We are, therefore, subject to compliance obligations under federal, state and foreign privacy, data protection and cybersecurity-related laws, including federal, state and foreign security breach notification laws with respect to both client employee data and our own employee data. The changing nature of these comprehensive laws in the United States, Europe and elsewhere, including the European Union’s (the “EU”) General Data Protection Regulation (the “GDPR”) and the California Consumer Privacy Act (the “CCPA”), which will be replaced by the voter-approved California Privacy Rights Act of 2020 (the “CPRA”), impact our processing of personal information of our employees and on behalf of our clients. The GDPR imposes strict and comprehensive requirements on us as both a data controller and a data processor. As part of our overall data protection compliance program, including with respect to data protection laws in the EU, we are one of the few companies in the world to have implemented Binding Corporate Rules (“BCRs”). Compliance with our BCRs permits us to process and transfer personal data across borders in accordance with the GDPR and other data protection laws in the EU. The CCPA and CPRA require companies to provide new data disclosure, access, deletion and opt-out rights to consumers in California. In addition, in the United States, the Health Insurance Portability and Accountability Act of 1996 applies to our insurance services businesses and ADP TotalSource.

As part of our payroll and payroll tax management services, we move client funds to taxing authorities, our clients’ employees and other payees via electronic transfer, direct deposit, prepaid access and ADPCheck. In 2019, the Office of the Comptroller of Currency (the “OCC”) authorized us to open ADP Trust Company, National Association (the “ADP Trust Bank”), via a national trust bank charter pursuant to the National Bank Act. The ADP Trust Bank is the sole trustee of ADP Client Trust, our grantor trust which holds client funds, and is responsible for the oversight and management of those client funds. The ADP Trust Bank, and all of its fiduciary activities including the U.S. money movement it oversees and manages via ADP Client Trust, is subject to comprehensive ongoing oversight and regulation by the OCC. We have surrendered all state money transmitter licenses as the activity previously managed through those licenses was moved into the ADP Client Trust managed by ADP Trust Bank, which is federally exempt from state money transmitter regulation with respect to the client money movement activity that it manages. In addition, our U.S. money movement managed by the ADP Trust Bank and our U.S. prepaid access offering are subject to the anti-money laundering and reporting provisions of The Bank Secrecy Act of 1970, as amended by the USA PATRIOT Act of 2001 (the “BSA”). Elements of our money

movement activities outside of the United States are subject to licensing and similar anti-money laundering and reporting laws and requirements in the countries in which we provide such services. Our employee screening and selection services business offers background checking services that are subject to the Fair Credit Reporting Act. ADP TotalSource is subject to various state licensing requirements and maintains certifications with the Internal Revenue Service. Because ADP TotalSource is a co-employer with respect to its clients’ worksite employees, we may be subject to limited obligations and responsibilities of an employer under federal and state tax, insurance and employment laws. Our registered investment adviser provides certain investment management and advisory services to retirement plan administrators under a heightened “fiduciary” standard and is regulated by the SEC and the U.S. Department of Labor. ADP Broker-Dealer, Inc., which supports our Retirement Services business, is a registered broker-dealer regulated by the SEC and the Financial Industry Regulatory Authority (FINRA).

In addition, many of our businesses offer solutions that assist our clients in complying with certain U.S. and foreign laws and regulations that apply to them. Although these laws and regulations apply to our clients and not to ADP, changes in such laws or regulations may affect our operations, products and services. For example, our payroll services are designed to facilitate compliance with state laws and regulations applicable to the payment of wages. In addition, our HCM solutions help clients manage their compliance with certain requirements of the Affordable Care Act in the United States. Similarly, our Tax Credit Services business, which helps clients in the United States take advantage of tax credit opportunities in connection with the hiring of new employees and certain other activities, is based on federal, state or local tax laws and regulations allowing for tax credits, which are subject to renewal, amendment or rescission.

We believe that key components of our compliance programs provide real competitive differentiators. For instance, our BCRs have enabled ADP to apply a global standard of data protection, simplifying data transfer processes and assisting our clients in meeting the demanding standards of data protection expected in Europe – a solution that most competitors cannot provide. Similarly, the ADP Client Trust and ADP Trust Bank provide client funds with a level of protection that most competitors cannot offer. We continue to expand our approach to compliance and are adopting “Compliance by design” as a tenet that prioritizes compliance in designing and developing new solutions to support our clients.