00000086706/302021Q1FALSEP5YP5YP1YP3Y00000086702020-07-012020-09-30xbrli:shares00000086702020-10-27iso4217:USD00000086702019-07-012019-09-300000008670us-gaap:RetainedEarningsMember2020-07-012020-09-300000008670us-gaap:RetainedEarningsMember2019-07-012019-09-30iso4217:USDxbrli:shares00000086702020-09-3000000086702020-06-3000000086702019-06-3000000086702019-09-300000008670adp:HCMMember2020-07-012020-09-300000008670adp:HCMMember2019-07-012019-09-300000008670adp:HROMember2020-07-012020-09-300000008670adp:HROMember2019-07-012019-09-300000008670adp:PEOMember2020-07-012020-09-300000008670adp:PEOMember2019-07-012019-09-300000008670adp:GlobalMember2020-07-012020-09-300000008670adp:GlobalMember2019-07-012019-09-300000008670adp:ClientfundinterestMember2020-07-012020-09-300000008670adp:ClientfundinterestMember2019-07-012019-09-300000008670adp:HCMMemberadp:EmployerServicesSegmentMember2020-07-012020-09-300000008670adp:ProfessionalEmployeeOrganizationServicesSegmentMemberadp:HCMMember2020-07-012020-09-300000008670us-gaap:AllOtherSegmentsMemberadp:HCMMember2020-07-012020-09-300000008670adp:HROMemberadp:EmployerServicesSegmentMember2020-07-012020-09-300000008670adp:ProfessionalEmployeeOrganizationServicesSegmentMemberadp:HROMember2020-07-012020-09-300000008670adp:HROMemberus-gaap:AllOtherSegmentsMember2020-07-012020-09-300000008670adp:PEOMemberadp:EmployerServicesSegmentMember2020-07-012020-09-300000008670adp:ProfessionalEmployeeOrganizationServicesSegmentMemberadp:PEOMember2020-07-012020-09-300000008670us-gaap:AllOtherSegmentsMemberadp:PEOMember2020-07-012020-09-300000008670adp:GlobalMemberadp:EmployerServicesSegmentMember2020-07-012020-09-300000008670adp:ProfessionalEmployeeOrganizationServicesSegmentMemberadp:GlobalMember2020-07-012020-09-300000008670adp:GlobalMemberus-gaap:AllOtherSegmentsMember2020-07-012020-09-300000008670adp:ClientfundinterestMemberadp:EmployerServicesSegmentMember2020-07-012020-09-300000008670adp:ProfessionalEmployeeOrganizationServicesSegmentMemberadp:ClientfundinterestMember2020-07-012020-09-300000008670adp:ClientfundinterestMemberus-gaap:AllOtherSegmentsMember2020-07-012020-09-300000008670adp:EmployerServicesSegmentMember2020-07-012020-09-300000008670adp:ProfessionalEmployeeOrganizationServicesSegmentMember2020-07-012020-09-300000008670us-gaap:AllOtherSegmentsMember2020-07-012020-09-300000008670adp:HCMMemberadp:EmployerServicesSegmentMember2019-07-012019-09-300000008670adp:ProfessionalEmployeeOrganizationServicesSegmentMemberadp:HCMMember2019-07-012019-09-300000008670us-gaap:AllOtherSegmentsMemberadp:HCMMember2019-07-012019-09-300000008670adp:HROMemberadp:EmployerServicesSegmentMember2019-07-012019-09-300000008670adp:ProfessionalEmployeeOrganizationServicesSegmentMemberadp:HROMember2019-07-012019-09-300000008670adp:HROMemberus-gaap:AllOtherSegmentsMember2019-07-012019-09-300000008670adp:PEOMemberadp:EmployerServicesSegmentMember2019-07-012019-09-300000008670adp:ProfessionalEmployeeOrganizationServicesSegmentMemberadp:PEOMember2019-07-012019-09-300000008670us-gaap:AllOtherSegmentsMemberadp:PEOMember2019-07-012019-09-300000008670adp:GlobalMemberadp:EmployerServicesSegmentMember2019-07-012019-09-300000008670adp:ProfessionalEmployeeOrganizationServicesSegmentMemberadp:GlobalMember2019-07-012019-09-300000008670adp:GlobalMemberus-gaap:AllOtherSegmentsMember2019-07-012019-09-300000008670adp:ClientfundinterestMemberadp:EmployerServicesSegmentMember2019-07-012019-09-300000008670adp:ProfessionalEmployeeOrganizationServicesSegmentMemberadp:ClientfundinterestMember2019-07-012019-09-300000008670adp:ClientfundinterestMemberus-gaap:AllOtherSegmentsMember2019-07-012019-09-300000008670adp:EmployerServicesSegmentMember2019-07-012019-09-300000008670adp:ProfessionalEmployeeOrganizationServicesSegmentMember2019-07-012019-09-300000008670us-gaap:AllOtherSegmentsMember2019-07-012019-09-300000008670us-gaap:CorporateDebtSecuritiesMember2020-09-300000008670us-gaap:AssetBackedSecuritiesMember2020-09-300000008670us-gaap:USTreasurySecuritiesMember2020-09-300000008670us-gaap:USGovernmentAgenciesDebtSecuritiesMember2020-09-300000008670us-gaap:ForeignGovernmentDebtSecuritiesMember2020-09-300000008670us-gaap:CommercialMortgageBackedSecuritiesMember2020-09-300000008670adp:CanadianProvincialBondsMember2020-09-300000008670us-gaap:OtherDebtSecuritiesMember2020-09-300000008670adp:CorporateInvestmentsMember2020-09-300000008670adp:FundsHeldForClientsMember2020-09-300000008670us-gaap:CorporateDebtSecuritiesMember2020-06-300000008670us-gaap:AssetBackedSecuritiesMember2020-06-300000008670us-gaap:USTreasurySecuritiesMember2020-06-300000008670us-gaap:USGovernmentAgenciesDebtSecuritiesMember2020-06-300000008670us-gaap:ForeignGovernmentDebtSecuritiesMember2020-06-300000008670us-gaap:CommercialMortgageBackedSecuritiesMember2020-06-300000008670adp:CanadianProvincialBondsMember2020-06-300000008670us-gaap:OtherDebtSecuritiesMember2020-06-300000008670adp:CorporateInvestmentsMember2020-06-300000008670adp:FundsHeldForClientsMember2020-06-300000008670us-gaap:FairValueInputsLevel3Member2020-09-300000008670us-gaap:FairValueInputsLevel1Member2020-09-300000008670adp:AssetBackedAutoLoanReceivablesMember2020-09-300000008670adp:FixedRateCreditCardMember2020-09-300000008670adp:AssetBackedEquipmentLeaseReceivableMember2020-09-300000008670adp:RateReductionReceivableMember2020-09-300000008670adp:FederalFarmCreditBanksMember2020-09-300000008670us-gaap:FederalHomeLoanBankCertificatesAndObligationsFHLBMember2020-09-300000008670us-gaap:MunicipalBondsMember2020-09-300000008670us-gaap:ForeignCorporateDebtSecuritiesMember2020-09-300000008670adp:SovereignBondsMember2020-09-300000008670adp:CurrentMember2020-09-300000008670adp:CurrentMember2020-06-300000008670adp:NoncurrentMember2020-09-300000008670adp:NoncurrentMember2020-06-30xbrli:pure0000008670adp:EmployerServicesSegmentMember2020-06-300000008670adp:PeoServicesSegmentMember2020-06-300000008670adp:PeoServicesSegmentMember2020-07-012020-09-300000008670adp:EmployerServicesSegmentMember2020-09-300000008670adp:PeoServicesSegmentMember2020-09-300000008670us-gaap:ComputerSoftwareIntangibleAssetMember2020-09-300000008670us-gaap:ComputerSoftwareIntangibleAssetMember2020-06-300000008670us-gaap:CustomerListsMember2020-09-300000008670us-gaap:CustomerListsMember2020-06-300000008670us-gaap:OtherIntangibleAssetsMember2020-09-300000008670us-gaap:OtherIntangibleAssetsMember2020-06-300000008670us-gaap:ComputerSoftwareIntangibleAssetMember2020-07-012020-09-300000008670us-gaap:CustomerListsMember2020-07-012020-09-300000008670us-gaap:OtherIntangibleAssetsMember2020-07-012020-09-300000008670adp:ThreeHundredAndSixtyFourDayCreditFacilityMember2020-09-300000008670adp:ThreeHundredAndSixtyFourDayCreditFacilityMember2020-07-012020-09-300000008670adp:CreditFacilityExpiringInJuneTwoThousandTwentyFourMember2020-09-300000008670adp:CreditFacilityExpiringInJuneTwoThousandTwentyFourMember2020-07-012020-09-300000008670adp:CreditFacilityExpiringInJuneTwoThousandTwentyThreeMember2020-07-012020-09-300000008670adp:CreditFacilityExpiringInJuneTwoThousandTwentyThreeMember2020-09-300000008670us-gaap:CommercialPaperMember2020-09-300000008670us-gaap:CommercialPaperMember2020-07-012020-09-300000008670us-gaap:CommercialPaperMember2019-07-012019-09-300000008670adp:ShortTermCommercialPaperProgramMember2020-07-012020-09-300000008670adp:ShortTermCommercialPaperProgramMember2019-07-012019-09-300000008670adp:ReverseRepurchaseAgreementsMember2020-07-012020-09-300000008670adp:ReverseRepurchaseAgreementsMember2019-07-012019-09-300000008670adp:NotesDueOn2030Member2020-09-300000008670adp:Notesdueon2020Member2020-06-3000000086702020-08-130000008670adp:Notesdueon2020Member2020-09-300000008670adp:Notesdueon2025Member2020-09-300000008670adp:Notesdueon2025Member2020-06-300000008670adp:NotesDueOn2030Member2020-06-300000008670us-gaap:OtherDebtSecuritiesMember2020-09-300000008670us-gaap:OtherDebtSecuritiesMember2020-06-300000008670adp:TimeBasedRestrictedStockGrantedFiscal2019Member2020-07-012020-09-300000008670adp:TimeBasedRestrictedStockGrantedFiscal2013Member2020-07-012020-09-300000008670srt:MinimumMember2020-07-012020-09-300000008670srt:MaximumMember2020-07-012020-09-300000008670adp:PerformanceBasedRestrictedStockAndUnitsMembersrt:MaximumMember2020-07-012020-09-300000008670adp:PerformanceBasedRestrictedStockAndUnitsMember2020-07-012020-09-300000008670us-gaap:EmployeeStockMember2020-07-012020-09-300000008670adp:OperatingExpensesMember2020-07-012020-09-300000008670adp:OperatingExpensesMember2019-07-012019-09-300000008670us-gaap:SellingGeneralAndAdministrativeExpensesMember2020-07-012020-09-300000008670us-gaap:SellingGeneralAndAdministrativeExpensesMember2019-07-012019-09-300000008670adp:SystemDevelopmentAndProgrammingCostsMember2020-07-012020-09-300000008670adp:SystemDevelopmentAndProgrammingCostsMember2019-07-012019-09-300000008670adp:TimeBasedRestrictedStockMember2020-06-300000008670adp:TimeBasedRestrictedStockUnitsMember2020-06-300000008670adp:TimeBasedRestrictedStockMember2020-07-012020-09-300000008670adp:TimeBasedRestrictedStockUnitsMember2020-07-012020-09-300000008670adp:TimeBasedRestrictedStockMember2020-09-300000008670adp:TimeBasedRestrictedStockUnitsMember2020-09-300000008670adp:PerformanceBasedRestrictedStockMember2020-06-300000008670adp:PerformanceBasedRestrictedStockUnitsMember2020-06-300000008670adp:PerformanceBasedRestrictedStockMember2020-07-012020-09-300000008670adp:PerformanceBasedRestrictedStockUnitsMember2020-07-012020-09-300000008670adp:PerformanceBasedRestrictedStockMember2020-09-300000008670adp:PerformanceBasedRestrictedStockUnitsMember2020-09-300000008670us-gaap:CommonStockMember2020-06-300000008670us-gaap:AdditionalPaidInCapitalMember2020-06-300000008670us-gaap:RetainedEarningsMember2020-06-300000008670us-gaap:TreasuryStockMember2020-06-300000008670us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-06-300000008670us-gaap:CommonStockMember2020-07-012020-09-300000008670us-gaap:AdditionalPaidInCapitalMember2020-07-012020-09-300000008670us-gaap:TreasuryStockMember2020-07-012020-09-300000008670us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-07-012020-09-300000008670us-gaap:CommonStockMember2020-09-300000008670us-gaap:AdditionalPaidInCapitalMember2020-09-300000008670us-gaap:RetainedEarningsMember2020-09-300000008670us-gaap:TreasuryStockMember2020-09-300000008670us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-09-300000008670us-gaap:CommonStockMember2019-06-300000008670us-gaap:AdditionalPaidInCapitalMember2019-06-300000008670us-gaap:RetainedEarningsMember2019-06-300000008670us-gaap:TreasuryStockMember2019-06-300000008670us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-06-300000008670us-gaap:CommonStockMember2019-07-012019-09-300000008670us-gaap:AdditionalPaidInCapitalMember2019-07-012019-09-300000008670us-gaap:TreasuryStockMember2019-07-012019-09-300000008670us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-07-012019-09-300000008670us-gaap:CommonStockMember2019-09-300000008670us-gaap:AdditionalPaidInCapitalMember2019-09-300000008670us-gaap:RetainedEarningsMember2019-09-300000008670us-gaap:TreasuryStockMember2019-09-300000008670us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-09-300000008670us-gaap:AccumulatedTranslationAdjustmentMember2020-06-300000008670us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-06-300000008670us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-06-300000008670us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-06-300000008670us-gaap:AccumulatedTranslationAdjustmentMember2020-07-012020-09-300000008670us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-07-012020-09-300000008670us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-07-012020-09-300000008670us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-07-012020-09-300000008670us-gaap:AccumulatedTranslationAdjustmentMember2020-09-300000008670us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-09-300000008670us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-09-300000008670us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-09-300000008670us-gaap:AccumulatedTranslationAdjustmentMember2019-06-300000008670us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-06-300000008670us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-06-300000008670us-gaap:AccumulatedTranslationAdjustmentMember2019-07-012019-09-300000008670us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-07-012019-09-300000008670us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-07-012019-09-300000008670us-gaap:AccumulatedTranslationAdjustmentMember2019-09-300000008670us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-09-300000008670us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-09-30adp:segment

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 10-Q

______________

| | | | | | | | | | | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended September 30, 2020

OR

| | | | | | | | | | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period From to

Commission File Number 1-5397

__________________________

AUTOMATIC DATA PROCESSING, INC.

(Exact name of registrant as specified in its charter)

__________________________

| | | | | | | | |

| Delaware | 22-1467904 |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

| One ADP Boulevard | |

| Roseland, | NJ | 07068 |

| (Address of principal executive offices) | (Zip Code) |

| |

| | |

| | |

| | |

|

Registrant's telephone number, including area code: (973) 974-5000

__________________________

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $0.10 Par Value

(voting) | ADP | NASDAQ Global Select Market |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large Accelerated Filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

| | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | Yes | ☐ | No | ☒ |

The number of shares outstanding of the registrant’s common stock as of October 27, 2020 was 428,813,999.

Table of Contents

| | | | | | | | |

| | |

| | | Page |

| | |

| | | |

Item 1. | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Item 2. | | |

| | | |

| Item 3. | | |

| | | |

| Item 4. | | |

| | | |

| | |

| | | |

Item 1. | | |

| | | |

Item 1A. | | |

| | | |

Item 2. | | |

| | |

| | |

| | |

Item 6. | | |

| | |

| | |

Part I. FINANCIAL INFORMATION

Item 1. Financial Statements

Automatic Data Processing, Inc. and Subsidiaries

Statements of Consolidated Earnings

(In millions, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | September 30, |

| | | | | 2020 | | 2019 |

| | | |

| REVENUES: | | | | | | | |

Revenues, other than interest on funds held

for clients and PEO revenues | | | | | $ | 2,269.6 | | | $ | 2,306.2 | |

| Interest on funds held for clients | | | | | 106.5 | | | 133.9 | |

| PEO revenues (A) | | | | | 1,094.6 | | | 1,055.6 | |

| TOTAL REVENUES | | | | | 3,470.7 | | | 3,495.7 | |

| | | | | | | |

| EXPENSES: | | | | | | | |

| Costs of revenues: | | | | | | | |

| Operating expenses | | | | | 1,762.1 | | | 1,787.7 | |

| Systems development and programming costs | | | | | 168.7 | | | 168.2 | |

| Depreciation and amortization | | | | | 103.5 | | | 88.9 | |

| TOTAL COSTS OF REVENUES | | | | | 2,034.3 | | | 2,044.8 | |

| | | | | | | |

| Selling, general, and administrative expenses | | | | | 681.0 | | | 726.5 | |

| Interest expense | | | | | 15.1 | | | 39.9 | |

| TOTAL EXPENSES | | | | | 2,730.4 | | | 2,811.2 | |

| | | | | | | |

| Other (income)/expense, net | | | | | (24.9) | | | (54.6) | |

| | | | | | | |

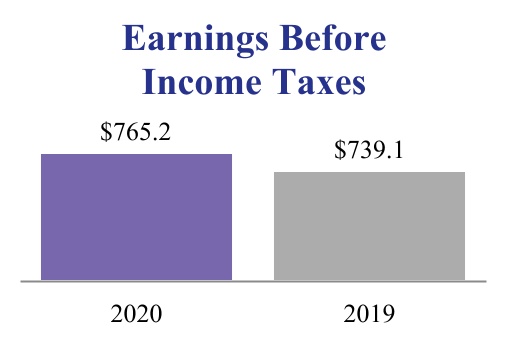

| EARNINGS BEFORE INCOME TAXES | | | | | 765.2 | | | 739.1 | |

| | | | | | | |

| Provision for income taxes | | | | | 163.1 | | | 156.7 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

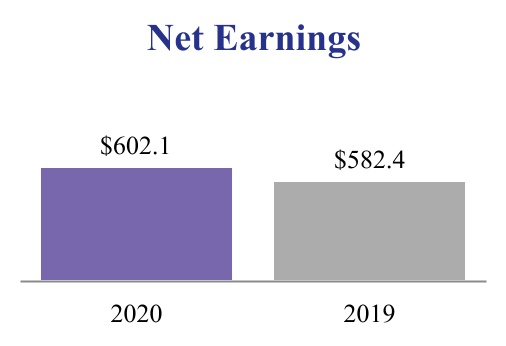

| NET EARNINGS | | | | | $ | 602.1 | | | $ | 582.4 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| BASIC EARNINGS PER SHARE | | | | | $ | 1.40 | | | $ | 1.35 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

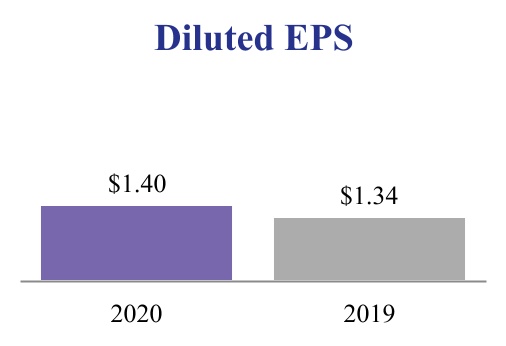

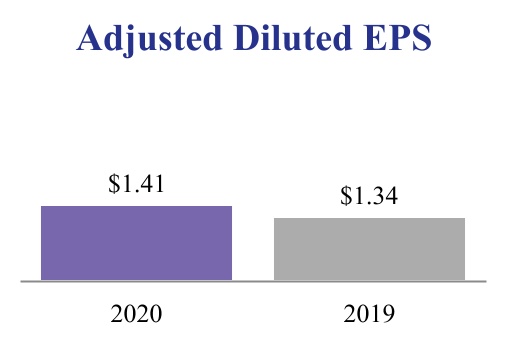

| DILUTED EARNINGS PER SHARE | | | | | $ | 1.40 | | | $ | 1.34 | |

| | | | | | | |

| Basic weighted average shares outstanding | | | | | 428.6 | | | 432.7 | |

| Diluted weighted average shares outstanding | | | | | 430.0 | | | 435.4 | |

| | | | | | | |

| | | | | | | |

(A) Professional Employer Organization (“PEO”) revenues are net of direct pass-through costs, primarily consisting of payroll wages and payroll taxes of $10,925.8 million and $10,510.6 million for the three months ended September 30, 2020 and 2019, respectively.

See notes to the Consolidated Financial Statements.

Automatic Data Processing, Inc. and Subsidiaries

Statements of Consolidated Comprehensive Income

(In millions)

(Unaudited)

| | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | September 30, |

| | | | | 2020 | | 2019 |

| | | |

| Net earnings | | | | | $ | 602.1 | | | $ | 582.4 | |

| | | | | | | |

| Other comprehensive income/(loss): | | | | | | | |

| Currency translation adjustments | | | | | 50.4 | | | (48.9) | |

| | | | | | | |

| Unrealized net gains/(losses) on available-for-sale securities | | | | | (24.6) | | | 96.1 | |

| Tax effect | | | | | 5.5 | | | (20.8) | |

| Reclassification of net (gain)/losses on available-for-sale securities to net earnings | | | | | (0.3) | | | (2.3) | |

| Tax effect | | | | | 0.1 | | | 0.5 | |

| | | | | | | |

| Unrealized loss on cash flow hedging activities | | | | | (3.3) | | | — | |

| Tax effect | | | | | 0.8 | | | — | |

| Amortization of unrealized loss on cash flow hedging activities | | | | | 0.6 | | | — | |

| Tax effect | | | | | — | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Reclassification of pension liability adjustment to net earnings | | | | | 2.5 | | | (1.7) | |

| Tax effect | | | | | (1.0) | | | 0.5 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other comprehensive income, net of tax | | | | | 30.7 | | | 23.4 | |

| Comprehensive income | | | | | $ | 632.8 | | | $ | 605.8 | |

See notes to the Consolidated Financial Statements.

Automatic Data Processing, Inc. and Subsidiaries

Consolidated Balance Sheets

(In millions, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | |

| | September 30, | | June 30, |

| | 2020 | | 2020 |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 1,613.1 | | | $ | 1,908.5 | |

| | | | |

Accounts receivable, net of allowance for doubtful accounts of $89.1 and $92.5, respectively | | 2,489.1 | | | 2,441.3 | |

| Other current assets | | 762.9 | | | 506.2 | |

| | | | |

| | | | |

| Total current assets before funds held for clients | | 4,865.1 | | | 4,856.0 | |

| Funds held for clients | | 29,950.3 | | | 26,708.1 | |

| Total current assets | | 34,815.4 | | | 31,564.1 | |

| | | | |

Long-term receivables, net of allowance for doubtful accounts of $0.6 and $0.5, respectively | | 16.1 | | | 18.6 | |

| Property, plant and equipment, net | | 701.5 | | | 703.9 | |

| Operating lease right-of-use asset | | 479.0 | | | 493.7 | |

| Deferred contract costs | | 2,397.9 | | | 2,401.6 | |

| Other assets | | 438.0 | | | 458.4 | |

| Goodwill | | 2,326.3 | | | 2,309.4 | |

| Intangible assets, net | | 1,215.9 | | | 1,215.8 | |

| Total assets | | $ | 42,390.1 | | | $ | 39,165.5 | |

| Liabilities and Stockholders' Equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 111.2 | | | $ | 102.0 | |

| Accrued expenses and other current liabilities | | 1,900.2 | | | 1,980.7 | |

| Accrued payroll and payroll-related expenses | | 494.7 | | | 557.0 | |

| Dividends payable | | 387.1 | | | 387.3 | |

| Short-term deferred revenues | | 205.0 | | | 212.5 | |

| Obligations under reverse repurchase agreements (A) | | — | | | 13.6 | |

| | | | |

| | | | |

| Short-term debt | | — | | | 1,001.8 | |

| Income taxes payable | | 133.0 | | | 40.1 | |

| | | | |

| Total current liabilities before client funds obligations | | 3,231.2 | | | 4,295.0 | |

| Client funds obligations | | 29,098.4 | | | 25,831.6 | |

| Total current liabilities | | 32,329.6 | | | 30,126.6 | |

| Long-term debt | | 1,993.9 | | | 1,002.8 | |

| Operating lease liabilities | | 330.4 | | | 344.4 | |

| Other liabilities | | 813.9 | | | 837.0 | |

| Deferred income taxes | | 743.0 | | | 731.9 | |

| Long-term deferred revenues | | 370.4 | | | 370.6 | |

| Total liabilities | | 36,581.2 | | | 33,413.3 | |

| | | | |

| Commitments and contingencies (Note 13) | | | | |

| | | | |

| Stockholders' equity: | | | | |

Preferred stock, $1.00 par value: authorized, 0.3 shares; issued, none | | — | | | — | |

Common stock, $0.10 par value: authorized, 1,000.0 shares; issued, 638.7 shares at September 30, 2020 and June 30, 2020; outstanding, 429.3 and 429.9 shares at September 30, 2020 and June 30, 2020, respectively | | 63.9 | | | 63.9 | |

| Capital in excess of par value | | 1,348.4 | | | 1,333.8 | |

| Retained earnings | | 18,644.7 | | | 18,436.3 | |

Treasury stock - at cost: 209.4 and 208.9 shares at September 30, 2020 and June 30, 2020, respectively | | (14,264.0) | | | (14,067.0) | |

| Accumulated other comprehensive income (loss) | | 15.9 | | | (14.8) | |

| Total stockholders’ equity | | 5,808.9 | | | 5,752.2 | |

| Total liabilities and stockholders’ equity | | $ | 42,390.1 | | | $ | 39,165.5 | |

(A) As of June 30, 2020, $13.6 million of long-term marketable securities have been pledged as collateral under the Company's reverse repurchase agreements (see Note 9).

See notes to the Consolidated Financial Statements.

Automatic Data Processing, Inc. and Subsidiaries

Statements of Consolidated Cash Flows

(In millions)

(Unaudited)

| | | | | | | | | | | | | | | |

| | Three Months Ended | |

| | September 30, | |

| | 2020 | | 2019 | |

| | | |

| Cash Flows from Operating Activities: | | | | | |

| Net earnings | | $ | 602.1 | | | $ | 582.4 | | |

| Adjustments to reconcile net earnings to cash flows provided by operating activities: | | | | | |

| Depreciation and amortization | | 131.1 | | | 117.3 | | |

| Amortization of deferred contract costs | | 232.3 | | | 227.3 | | |

| | | | | |

| Deferred income taxes | | 23.5 | | | 44.4 | | |

| Stock-based compensation expense | | 33.8 | | | 37.1 | | |

| | | | | |

| Net pension income | | (11.1) | | | (2.7) | | |

| | | | | |

| Net amortization of premiums and accretion of discounts on available-for-sale securities | | 12.4 | | | 12.2 | | |

| Impairment of assets | | 2.8 | | | — | | |

| Gain on sale of assets | | (0.2) | | | (1.9) | | |

| | | | | |

| Other | | 6.1 | | | 11.9 | | |

| Changes in operating assets and liabilities: | | | | | |

| Increase in accounts receivable | | (78.7) | | | (96.8) | | |

| Increase in other assets | | (454.8) | | | (391.7) | | |

| Increase/(Decrease) in accounts payable | | 5.7 | | | (15.1) | | |

| Decrease in accrued expenses and other liabilities | | (23.1) | | | (91.6) | | |

| | | | | |

| | | | | |

| Net cash flows provided by operating activities | | 481.9 | | | 432.8 | | |

| | | | | |

| Cash Flows from Investing Activities: | | | | | |

| Purchases of corporate and client funds marketable securities | | (812.8) | | | (1,409.9) | | |

| Proceeds from the sales and maturities of corporate and client funds marketable securities | | 1,196.7 | | | 1,653.7 | | |

| | | | | |

| Capital expenditures | | (43.5) | | | (56.8) | | |

| Additions to intangibles | | (76.4) | | | (88.2) | | |

| | | | | |

| Proceeds from sale of property, plant, and equipment and other assets | | 0.2 | | | 23.4 | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Net cash flows provided by investing activities | | 264.2 | | | 122.2 | | |

| | | | | |

| Cash Flows from Financing Activities: | | | | | |

| Net increase/(decrease) in client funds obligations | | 3,203.3 | | | (8,063.3) | | |

| | | | | |

| Payments of debt | | (1,000.6) | | | (0.5) | | |

| Proceeds from the issuance of debt | | 991.1 | | | — | | |

| Settlement of cash flow hedges | | (43.6) | | | — | | |

| Repurchases of common stock | | (213.6) | | | (309.7) | | |

| Net proceeds from stock purchase plan and stock-based compensation plans | | (7.9) | | | (32.1) | | |

| | | | | |

| Dividends paid | | (391.0) | | | (343.3) | | |

| Net (payments)/proceeds related to reverse repurchase agreements | | (13.6) | | | 166.3 | | |

| Net proceeds of commercial paper borrowings | | — | | | 3,536.7 | | |

| | | | | |

| | | | | |

| | | | | |

| Net cash flows provided by/(used in) financing activities | | 2,524.1 | | | (5,045.9) | | |

| | | | | |

| Effect of exchange rate changes on cash, cash equivalents, restricted cash, and restricted cash equivalents | | 37.9 | | | (33.1) | | |

| | | | | |

| Net change in cash, cash equivalents, restricted cash, and restricted cash equivalents | | 3,308.1 | | | (4,524.0) | | |

| | | | | |

| Cash, cash equivalents, restricted cash, and restricted cash equivalents, beginning of period | | 7,053.6 | | | 6,796.2 | | |

| Cash, cash equivalents, restricted cash, and restricted cash equivalents, end of period | | $ | 10,361.7 | | | $ | 2,272.2 | | |

| | | | | |

| | | | | |

| | | | | |

| Reconciliation of cash, cash equivalents, restricted cash, and restricted cash equivalents to the Consolidated Balance Sheets | | | | | |

| Cash and cash equivalents | | $ | 1,613.1 | | | $ | 1,403.9 | | |

| Restricted cash and restricted cash equivalents included in funds held for clients (A) | | 8,748.6 | | | 868.3 | | |

| Total cash, cash equivalents, restricted cash, and restricted cash equivalents | | $ | 10,361.7 | | | $ | 2,272.2 | | |

| | | | | |

| Supplemental disclosures of cash flow information: | | | | | |

| Cash paid for interest | | $ | 27.3 | | | $ | 53.6 | | |

| Cash paid for income taxes, net of income tax refunds | | $ | 45.4 | | | $ | 45.6 | | |

| | | | | |

| | | | | |

| | | | | |

(A) See Note 6 for a reconciliation of restricted cash and restricted cash equivalents in funds held for clients on the Consolidated Balance Sheets.

See notes to the Consolidated Financial Statements.

Automatic Data Processing, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements

(Tabular dollars in millions, except per share amounts or where otherwise stated)

(Unaudited)

Note 1. Basis of Presentation

The accompanying Consolidated Financial Statements and footnotes thereto of Automatic Data Processing, Inc., its subsidiaries and variable interest entity (“ADP” or the “Company”) have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The Consolidated Financial Statements and footnotes thereto are unaudited. In the opinion of the Company’s management, the Consolidated Financial Statements reflect all adjustments, which are of a normal recurring nature, that are necessary for a fair presentation of the Company’s interim financial results.

The Company has a grantor trust, which holds the majority of the funds provided by its clients pending remittance to employees of those clients, tax authorities, and other payees. The Company is the sole beneficial owner of the trust. The trust meets the criteria in Accounting Standards Codification (“ASC”) 810, “Consolidation” to be characterized as a variable interest entity (“VIE”). The Company has determined that it has a controlling financial interest in the trust because it has both (1) the power to direct the activities that most significantly impact the economic performance of the trust (including the power to make all investment decisions for the trust) and (2) the right to receive benefits that could potentially be significant to the trust (in the form of investment returns) and, therefore, consolidates the trust. Further information on these funds and the Company’s obligations to remit to its clients’ employees, tax authorities, and other payees is provided in Note 6, “Corporate Investments and Funds Held for Clients.”

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the assets, liabilities, revenue, expenses, and accumulated other comprehensive income that are reported in the Consolidated Financial Statements and footnotes thereto. Actual results may differ from those estimates. Interim financial results are not necessarily indicative of financial results for a full year. The information included in this Quarterly Report on Form 10-Q should be read in conjunction with the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2020 (“fiscal 2020”).

Note 2. New Accounting Pronouncements

Recently Adopted Accounting Pronouncements

Effective July 1, 2020, the Company adopted accounting standard update (“ASU”) 2018-13, “Fair Value Measurement.” The update modifies the disclosure requirements on fair value measurements. The adoption of ASU 2018-13 modified the disclosures in Note 6 but did not have an impact on the Company's consolidated results of operations, financial condition, or cash flows.

Effective July 1, 2020, the Company adopted ASU 2016-13, “Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments.” This update introduces the current expected credit loss (“CECL”) model, which requires an entity to measure credit losses based on expected losses rather than incurred losses for certain financial instruments and financial assets, including trade receivables. The adoption of ASU 2016-13 did not have a material impact on the Company's consolidated results of operations, financial condition, or cash flows.

Recently Issued Accounting Pronouncements

The following table summarizes recent ASU's issued by the Financial Accounting Standards Board (“FASB”) that could have a material impact on the Company's consolidated results of operations, financial condition, or cash flows.

| | | | | | | | | | | |

| Standard | Description | Effective Date | Effect on Financial Statements or Other Significant Matters |

| | | |

| | | |

| | | |

| ASU 2018-14 Compensation-Retirement Benefits-Defined Benefit Plans | This update modifies the disclosure requirements for employers that sponsor defined benefit pension or other post-retirement plans by removing and adding certain disclosures for these plans. The eliminated disclosures include (a) the amounts in accumulated other comprehensive income expected to be recognized in net periodic benefit costs over the next fiscal year, and (b) the effects of a one percentage point change in assumed health care cost trend rates on the net periodic benefit costs and the benefit obligation for post-retirement health care benefits. Additional disclosures include descriptions of significant gains and losses affecting the benefit obligation for the period. The amendments in ASU 2018-14 would need to be applied on a retrospective basis. | July 1, 2021

(Fiscal 2022) | The adoption of this guidance will modify disclosures but will not have an impact on the Company's consolidated results of operations, financial condition, or cash flows.

|

| | | |

| | | |

| | | |

|

|

| | | |

Note 3. Revenue

Based upon similar operational and economic characteristics, the Company’s revenues are disaggregated by its three strategic pillars: Human Capital Management (“HCM”), HR Outsourcing (“HRO”), and Global (“Global”) Solutions, with separate disaggregation for PEO zero-margin benefits pass-through revenues and client funds interest revenues. The Company believes these revenue categories depict how the nature, amount, timing, and uncertainty of its revenue and cash flows are affected by economic factors.

HCM provides a suite of product offerings that assist employers of all types and sizes in all stages of the employment cycle, from recruitment to retirement. Global is generally consistent with the types of services provided within HCM but represents geographies outside of the United States and includes our multinational offerings. HCM and Global revenues are primarily attributable to fees for providing solutions for payroll, benefits, talent, retirement services and HR processing and fees charged to implement the Company's solutions for clients.

HRO provides a comprehensive human resources outsourcing solution, including offering benefits, providing workers’ compensation insurance, and administering state unemployment insurance, among other human resources functions. This revenue is primarily driven by the PEO. Amounts collected from PEO worksite employers include payroll, fees for benefits, and an administrative fee that also includes payroll taxes, fees for workers’ compensation and state unemployment taxes. The payroll and payroll taxes collected from the worksite employers are presented in revenue net, as the Company does not retain risk and acts as an agent with respect to this aspect of the PEO arrangement. With respect to the payroll and payroll taxes, the worksite employer is primarily responsible for providing the service and has discretion in establishing wages. The fees collected from the worksite employers for benefits (i.e., PEO benefits pass-throughs), workers’ compensation and state unemployment taxes are presented in revenues and the associated costs of benefits, workers’ compensation and state unemployment taxes are included in operating expenses, as the Company acts as a principal with respect to this aspect of the arrangement. With respect to these fees, the Company is primarily responsible for fulfilling the service and has discretion in establishing price. The Company has further disaggregated HRO to separate out its PEO zero-margin benefits pass-through revenues.

The Company recognizes client funds interest revenues on collected but not yet remitted funds held for clients in revenues as earned, as the collection, holding and remittance of these funds are critical components of providing these services.

The following tables provide details of revenue by our strategic pillars with disaggregation for PEO zero-margin benefits pass-throughs and client funds interest, and include a reconciliation to the Company’s reportable segments:

| | | | | | | | | | | | | | | |

| | | | | |

| | | Three Months Ended |

| | | September 30, |

| Types of Revenues | | | | | 2020 | | 2019 |

| HCM | | | | | $ | 1,530.6 | | | $ | 1,568.5 | |

| HRO, excluding PEO zero-margin benefits pass-throughs | | | | | 582.4 | | | 591.1 | |

| PEO zero-margin benefits pass-throughs | | | | | 741.0 | | | 699.1 | |

| Global | | | | | 510.2 | | | 503.1 | |

| Interest on funds held for clients | | | | | 106.5 | | | 133.9 | |

| Total Revenues | | | | | $ | 3,470.7 | | | $ | 3,495.7 | |

Reconciliation of disaggregated revenue to our reportable segments for the three months ended September 30, 2020:

| | | | | | | | | | | | | | | | | | | | | | | |

| Types of Revenues | Employer Services | | PEO | | Other | | Total |

| HCM | $ | 1,532.3 | | | $ | — | | | $ | (1.7) | | | $ | 1,530.6 | |

| HRO, excluding PEO zero-margin benefits pass-throughs | 229.1 | | | 353.6 | | | (0.3) | | | 582.4 | |

| PEO zero-margin benefits pass-throughs | — | | | 741.0 | | | — | | | 741.0 | |

| Global | 510.2 | | | — | | | — | | | 510.2 | |

| Interest on funds held for clients | 105.2 | | | 1.3 | | | — | | | 106.5 | |

| Total Segment Revenues | $ | 2,376.8 | | | $ | 1,095.9 | | | $ | (2.0) | | | $ | 3,470.7 | |

Reconciliation of disaggregated revenue to our reportable segments for the three months ended September 30, 2019:

| | | | | | | | | | | | | | | | | | | | | | | |

| Types of Revenues | Employer Services | | PEO | | Other | | Total |

| HCM | $ | 1,570.0 | | | $ | — | | | $ | (1.5) | | | $ | 1,568.5 | |

| HRO, excluding PEO zero-margin benefits pass-throughs | 235.7 | | | 356.5 | | | (1.1) | | | 591.1 | |

| PEO zero-margin benefits pass-throughs | — | | | 699.1 | | | — | | | 699.1 | |

| Global | 503.1 | | | — | | | — | | | 503.1 | |

| Interest on funds held for clients | 132.6 | | | 1.3 | | | — | | | 133.9 | |

| Total Segment Revenues | $ | 2,441.4 | | | $ | 1,056.9 | | | $ | (2.6) | | | $ | 3,495.7 | |

Contract Balances

The timing of revenue recognition for HCM, HRO and Global Solutions is consistent with the invoicing of clients, as invoicing occurs in the period the services are provided. Therefore, the Company does not recognize a contract asset or liability resulting from the timing of revenue recognition and invoicing.

Changes in deferred revenue related to set up fees for the three months ended September 30, 2020 were as follows:

| | | | | |

| Contract Liability | |

| Contract liability, July 1, 2020 | $ | 522.7 | |

| Recognition of revenue included in beginning of year contract liability | (43.8) | |

| Contract liability, net of revenue recognized on contracts during the period | 30.7 | |

| Currency translation adjustments | 16.2 | |

| Contract liability, September 30, 2020 | $ | 525.8 | |

Note 4. Earnings per Share (“EPS”)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Basic | | Effect of Employee Stock Option Shares | | Effect of

Employee

Restricted

Stock

Shares | | Diluted |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Three Months Ended September 30, 2020 | | | | | | | | |

| Net earnings | | $ | 602.1 | | | | | | | $ | 602.1 | |

| Weighted average shares (in millions) | | 428.6 | | | 0.6 | | | 0.8 | | | 430.0 | |

| EPS | | $ | 1.40 | | | | | | | $ | 1.40 | |

| Three Months Ended September 30, 2019 | | | | | | | | |

| Net earnings | | $ | 582.4 | | | | | | | $ | 582.4 | |

| Weighted average shares (in millions) | | 432.7 | | | 1.3 | | | 1.4 | | | 435.4 | |

| EPS | | $ | 1.35 | | | | | | | $ | 1.34 | |

Options to purchase 2.1 million and 0.7 million shares of common stock for the three months ended September 30, 2020 and 2019, respectively, were excluded from the calculation of diluted earnings per share because their inclusion would have been anti-dilutive.

Note 5. Other (Income)/Expense, Net

| | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | September 30, |

| | | | | 2020 | | 2019 |

| Interest income on corporate funds | | | | | $ | (13.8) | | | $ | (32.3) | |

| | | | | | | |

| | | | | | | |

| Realized (gains) / losses on available-for-sale securities, net | | | | | (0.3) | | | (2.3) | |

| | | | | | | |

| Impairment of assets | | | | | 2.8 | | | — | |

| Gain on sale of assets | | | | | (0.2) | | | (1.9) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Non-service components of pension income, net (see Note 11) | | | | | (13.4) | | | (18.1) | |

| Other (income)/expense, net | | | | | $ | (24.9) | | | $ | (54.6) | |

In fiscal 2021, the Company recorded impairment charges of $2.8 million as a result of recognizing certain owned facilities at fair value given intent to sell and accordingly classified as held for sale.

Note 6. Corporate Investments and Funds Held for Clients

Corporate investments and funds held for clients at September 30, 2020 and June 30, 2020 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2020 |

| Amortized

Cost | | Gross

Unrealized

Gains | | Gross

Unrealized

Losses | | | | Fair Market Value (A) |

| Type of issue: | | | | | | | | | |

| Money market securities, cash and other cash equivalents | $ | 10,361.7 | | | $ | — | | | $ | — | | | | | $ | 10,361.7 | |

| Available-for-sale securities: | | | | | | | | | |

| Corporate bonds | 9,013.1 | | | 458.0 | | | (0.4) | | | | | 9,470.7 | |

| Asset-backed securities | 2,942.7 | | | 98.4 | | | (0.2) | | | | | 3,040.9 | |

| U.S. Treasury securities | 3,581.3 | | | 108.8 | | | — | | | | | 3,690.1 | |

| U.S. government agency securities | 1,341.8 | | | 34.5 | | | (0.8) | | | | | 1,375.5 | |

Canadian government obligations and Canadian government agency obligations | 1,037.0 | | | 22.6 | | | — | | | | | 1,059.6 | |

| Commercial mortgage-backed securities | 810.1 | | | 54.5 | | | — | | | | | 864.6 | |

| Canadian provincial bonds | 652.7 | | | 34.8 | | | — | | | | | 687.5 | |

| Other securities | 974.5 | | | 41.7 | | | — | | | | | 1,016.2 | |

| | | | | | | | | |

| Total available-for-sale securities | 20,353.2 | | | 853.3 | | | (1.4) | | | | | 21,205.1 | |

| | | | | | | | | |

| Total corporate investments and funds held for clients | $ | 30,714.9 | | | $ | 853.3 | | | $ | (1.4) | | | | | $ | 31,566.8 | |

(A) Included within available-for-sale securities are corporate investments with fair values of $3.4 million and funds held for clients with fair values of $21,201.7 million. All available-for-sale securities were included in Level 2 of the fair value hierarchy.

| | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2020 |

| Amortized

Cost | | Gross

Unrealized

Gains | | Gross

Unrealized

Losses | | Fair Market Value (B) |

| Type of issue: | | | | | | | |

| Money market securities, cash and other cash equivalents | $ | 7,053.6 | | | $ | — | | | $ | — | | | $ | 7,053.6 | |

| Available-for-sale securities: | | | | | | | |

| Corporate bonds | 9,188.7 | | | 473.4 | | | — | | | 9,662.1 | |

| Asset-backed securities | 3,274.6 | | | 96.0 | | | (0.5) | | | 3,370.1 | |

| U.S. Treasury securities | 3,580.6 | | | 120.8 | | | — | | | 3,701.4 | |

| U.S. government agency securities | 1,128.2 | | | 35.6 | | | — | | | 1,163.8 | |

Canadian government obligations and Canadian government agency obligations | 1,018.7 | | | 23.1 | | | — | | | 1,041.8 | |

| Commercial mortgage-backed securities | 814.3 | | | 53.9 | | | — | | | 868.2 | |

| Canadian provincial bonds | 676.6 | | | 33.6 | | | — | | | 710.2 | |

| Other securities | 1,018.1 | | | 41.1 | | | (0.2) | | | 1,059.0 | |

| | | | | | | |

| Total available-for-sale securities | 20,699.8 | | | 877.5 | | | (0.7) | | | 21,576.6 | |

| | | | | | | |

| Total corporate investments and funds held for clients | $ | 27,753.4 | | | $ | 877.5 | | | $ | (0.7) | | | $ | 28,630.2 | |

(B) Included within available-for-sale securities are corporate investments with fair values of $13.6 million and funds held for clients with fair values of $21,563.0 million. All available-for-sale securities were included in Level 2 of the fair value hierarchy.

For a description of the fair value hierarchy and the Company's fair value methodologies, including the use of an independent third-party pricing service, see Note 1 “Summary of Significant Accounting Policies” in the Company's Annual Report on Form 10-K for fiscal 2020. The Company concurred with and did not adjust the prices obtained from the independent pricing service. The Company had no available-for-sale securities included in Level 1 or Level 3 at September 30, 2020.

The unrealized losses and fair values of available-for-sale securities that have been in an unrealized loss position for a period of less than and greater than 12 months as of September 30, 2020, are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2020 |

| Securities in Unrealized Loss Position Less Than 12 Months | | Securities in Unrealized Loss Position Greater Than 12 Months | | Total |

| Gross

Unrealized

Losses | | Fair Market

Value | | Gross

Unrealized

Losses | | Fair Market

Value | | Gross

Unrealized

Losses | | Fair

Market Value |

| Corporate bonds | $ | (0.4) | | | $ | 151.5 | | | $ | — | | | $ | — | | | $ | (0.4) | | | $ | 151.5 | |

| Asset-backed securities | (0.2) | | | 77.5 | | | — | | | — | | | (0.2) | | | 77.5 | |

| U.S. Treasury securities | — | | | — | | | — | | | — | | | — | | | — | |

| U.S. government agency securities | (0.8) | | | 320.0 | | | — | | | — | | | (0.8) | | | 320.0 | |

Canadian government obligations and Canadian government agency obligations | — | | | — | | | — | | | — | | | — | | | — | |

| Commercial mortgage-backed securities | — | | | — | | | — | | | 1.5 | | | — | | | 1.5 | |

| Canadian provincial bonds | — | | | — | | | — | | | — | | | — | | | — | |

| Other securities | — | | | 12.9 | | | — | | | — | | | — | | | 12.9 | |

| | $ | (1.4) | | | $ | 561.9 | | | $ | — | | | $ | 1.5 | | | $ | (1.4) | | | $ | 563.4 | |

The unrealized losses and fair values of available-for-sale securities that have been in an unrealized loss position for a period of less than and greater than 12 months as of June 30, 2020, are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| June 30, 2020 |

| Securities in Unrealized Loss Position Less Than 12 Months | | Securities in Unrealized Loss Position Greater Than 12 Months | | Total |

| Gross

Unrealized

Losses | | Fair Market

Value | | Gross

Unrealized

Losses | | Fair Market

Value | | Gross

Unrealized

Losses | | Fair

Market Value |

| Corporate bonds | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Asset-backed securities | (0.5) | | | 43.9 | | | — | | | — | | | (0.5) | | | 43.9 | |

| U.S. Treasury securities | — | | | 2.0 | | | — | | | — | | | — | | | 2.0 | |

| U.S. government agency securities | — | | | — | | | — | | | — | | | — | | | — | |

Canadian government obligations and Canadian government agency obligations | — | | | — | | | — | | | — | | | — | | | — | |

| Commercial mortgage-backed securities | — | | | — | | | — | | | 1.5 | | | — | | | 1.5 | |

| Canadian provincial bonds | — | | | — | | | — | | | — | | | — | | | — | |

| Other securities | (0.2) | | | 17.1 | | | — | | | — | | | (0.2) | | | 17.1 | |

| | $ | (0.7) | | | $ | 63.0 | | | $ | — | | | $ | 1.5 | | | $ | (0.7) | | | $ | 64.5 | |

At September 30, 2020, Corporate bonds include investment-grade debt securities with a wide variety of issuers, industries, and sectors, primarily carry credit ratings of A and above, and have maturities ranging from October 2020 through September 2030.

At September 30, 2020, asset-backed securities include AAA-rated senior tranches of securities with predominantly prime collateral of fixed-rate auto loan, credit card, equipment lease, and rate reduction receivables with fair values of $1,520.8 million, $1,100.4 million, $321.9 million, and $97.1 million, respectively. These securities are collateralized by the cash flows

of the underlying pools of receivables. The primary risk associated with these securities is the collection risk of the underlying receivables. All collateral on such asset-backed securities has performed as expected through September 30, 2020.

At September 30, 2020, U.S. government agency securities primarily include debt directly issued by Federal Farm Credit Banks and Federal Home Loan Banks with fair values of $614.7 million and $590.8 million, respectively. U.S. government agency securities represent senior, unsecured, non-callable debt that primarily carry ratings of Aaa by Moody's, and AA+ by Standard & Poor's, with maturities ranging from October 2020 through December 2029.

At September 30, 2020, other securities and their fair value primarily include municipal bonds of $576.7 million, AA-rated United Kingdom Gilt securities of $197.3 million, and AAA-rated and AA-rated sovereign bonds of $77.2 million.

Classification of corporate investments on the Consolidated Balance Sheets is as follows:

| | | | | | | | | | | | | | |

| | September 30, | | June 30, |

| | 2020 | | 2020 |

| Corporate investments: | | | | |

| Cash and cash equivalents | | $ | 1,613.1 | | | $ | 1,908.5 | |

| Short-term marketable securities (a) | | 3.4 | | | — | |

| Long-term marketable securities (b) | | — | | | 13.6 | |

| Total corporate investments | | $ | 1,616.5 | | | $ | 1,922.1 | |

(a) - Short-term marketable securities are included within Other current assets on the Consolidated Balance Sheets.

(b) - Long-term marketable securities are included within Other assets on the Consolidated Balance Sheets.

Funds held for clients represent assets that, based upon the Company's intent, are restricted for use solely for the purposes of satisfying the obligations to remit funds relating to the Company’s payroll and payroll tax filing services, which are classified as client funds obligations on our Consolidated Balance Sheets.

Funds held for clients have been invested in the following categories:

| | | | | | | | | | | | | | |

| | September 30, | | June 30, |

| | 2020 | | 2020 |

| Funds held for clients: | | | | |

| Restricted cash and cash equivalents held to satisfy client funds obligations | | $ | 8,748.6 | | | $ | 5,145.1 | |

| Restricted short-term marketable securities held to satisfy client funds obligations | | 5,614.4 | | | 5,541.2 | |

| Restricted long-term marketable securities held to satisfy client funds obligations | | 15,587.3 | | | 16,021.8 | |

| Total funds held for clients | | $ | 29,950.3 | | | $ | 26,708.1 | |

Client funds obligations represent the Company's contractual obligations to remit funds to satisfy clients' payroll, tax, and other payee payment obligations and are recorded on the Consolidated Balance Sheets at the time that the Company impounds funds from clients. The client funds obligations represent liabilities that will be repaid within one year of the balance sheet date. The Company has reported client funds obligations as a current liability on the Consolidated Balance Sheets totaling $29,098.4 million and $25,831.6 million at September 30, 2020 and June 30, 2020, respectively. The Company has classified funds held for clients as a current asset since these funds are held solely for the purpose of satisfying the client funds obligations. Of the Company’s funds held for clients at September 30, 2020 and June 30, 2020, $26,805.6 million and $23,740.0 million, respectively, are held in the grantor trust. The liabilities held within the trust are intercompany liabilities to other Company subsidiaries and are eliminated in consolidation.

The Company has reported the cash flows related to the purchases of corporate and client funds marketable securities and related to the proceeds from the sales and maturities of corporate and client funds marketable securities on a gross basis in the investing section of the Statements of Consolidated Cash Flows. The Company has reported the cash and cash equivalents related to client funds investments with original maturities of ninety days or less, within the beginning and ending balances of cash, cash equivalents, restricted cash, and restricted cash equivalents. These amounts have been reconciled to the Consolidated Balance Sheets on the Statements of Consolidated Cash Flows. The Company has reported the cash flows related to the cash received from and paid on behalf of clients on a net basis within net increase / (decrease) in client funds obligations in the financing activities section of the Statements of Consolidated Cash Flows.

Approximately 79% of the available-for-sale securities held a AAA-rating or AA-rating at September 30, 2020, as rated by Moody's, Standard & Poor's, DBRS for Canadian dollar-denominated securities, and Fitch for asset-backed and commercial mortgage-backed securities. All available-for-sale securities were rated as investment grade at September 30, 2020.

Expected maturities of available-for-sale securities at September 30, 2020 are as follows:

| | | | | |

| One year or less | $ | 5,617.8 | |

| One year to two years | 4,283.0 | |

| Two years to three years | 3,817.6 | |

| Three years to four years | 2,932.7 | |

| After four years | 4,554.0 | |

| Total available-for-sale securities | $ | 21,205.1 | |

Note 7. Leases

The Company records leases on the consolidated balance sheets as operating lease right-of-use (“ROU”) assets, records the current portion of operating lease liabilities within accrued expenses and other current liabilities and, separately, records long-term operating lease liabilities.

The Company has entered into operating lease agreements for facilities and equipment. The Company's leases have remaining lease terms of up to approximately eleven years. Operating lease ROU assets and operating lease liabilities are recognized at the lease commencement date based on the present value of the lease payments over the lease term. The lease liabilities are measured by discounting future lease payments at the Company’s collateralized incremental borrowing rate for financing instruments of a similar term, unless the implicit rate is readily determinable. ROU assets also include adjustments related to prepaid or deferred lease payments and lease incentives. The difference between total ROU assets and total lease liabilities are primarily attributable to pre-payments of our obligations and the recognition of various lease incentives.

The components of operating lease expense were as follows:

| | | | | | | | | | | | | | | |

| Three Months Ended | | |

| September 30, | | |

| 2020 | | 2019 | | | | |

| Operating lease cost | $ | 39.1 | | | $ | 44.2 | | | | | |

| Short-term lease cost | 0.4 | | | 2.7 | | | | | |

| Variable lease cost | 2.1 | | | 1.3 | | | | | |

| Total operating lease cost | $ | 41.6 | | | $ | 48.2 | | | | | |

| | | | | | | |

The following table provides supplemental cash flow information related to the Company's leases:

| | | | | | | | | | | |

| Three Months Ended |

| September 30, |

| 2020 | | 2019 |

| Cash paid for operating lease liabilities | $ | 45.3 | | | $ | 40.2 | |

| Operating lease ROU assets obtained in exchange for new operating lease liabilities | $ | 23.2 | | | $ | 6.7 | |

| | | |

| | | |

Other information related to our operating lease liabilities is as follows:

| | | | | | | | | | | |

| September 30, | | June 30, |

| 2020 | | 2020 |

| Weighted-average remaining lease term (in years) | 6 | | 6 |

| Weighted-average discount rate | 2.3 | % | | 2.3 | % |

As of September 30, 2020, maturities of operating lease liabilities are as follows:

| | | | | |

| Nine months ending June 30, 2021 | $ | 77.8 | |

| Twelve months ending June 30, 2022 | 93.7 | |

| Twelve months ending June 30, 2023 | 79.6 | |

| Twelve months ending June 30, 2024 | 59.2 | |

| Twelve months ending June 30, 2025 | 43.5 | |

| Thereafter | 101.2 | |

| Total undiscounted lease obligations | 455.0 | |

| Less: Imputed interest | (29.9) | |

| Net lease obligations | $ | 425.1 | |

Current operating lease liabilities were approximately $94.7 million and $95.5 million as of September 30, 2020 and June 30, 2020, respectively, and are included within Accrued expenses and other current liabilities on the Consolidated Balance Sheets.

Note 8. Goodwill and Intangible Assets, net

Changes in goodwill for the three months ended September 30, 2020 are as follows:

| | | | | | | | | | | | | | | | | | | |

| Employer

Services | | PEO

Services | | | | Total |

| Balance at June 30, 2020 | $ | 2,304.6 | | | $ | 4.8 | | | | | $ | 2,309.4 | |

| Additions and other adjustments | — | | | — | | | | | — | |

| Currency translation adjustments | 16.9 | | | — | | | | | 16.9 | |

| | | | | | | |

| Balance at September 30, 2020 | $ | 2,321.5 | | | $ | 4.8 | | | | | $ | 2,326.3 | |

Components of intangible assets, net, are as follows:

| | | | | | | | | | | | | | |

| | September 30, | | June 30, |

| | 2020 | | 2020 |

| Intangible assets: | | | | |

| Software and software licenses | | $ | 2,776.2 | | | $ | 2,719.1 | |

| Customer contracts and lists | | 1,029.4 | | | 1,021.2 | |

| Other intangibles | | 239.3 | | | 239.2 | |

| | | 4,044.9 | | | 3,979.5 | |

| Less accumulated amortization: | | | | |

| Software and software licenses | | (1,950.4) | | | (1,912.0) | |

| Customer contracts and lists | | (654.1) | | | (628.3) | |

| Other intangibles | | (224.5) | | | (223.4) | |

| | | (2,829.0) | | | (2,763.7) | |

| Intangible assets, net | | $ | 1,215.9 | | | $ | 1,215.8 | |

Other intangibles consist primarily of purchased rights, trademarks and trade names (acquired directly or through acquisitions). All intangible assets have finite lives and, as such, are subject to amortization. The weighted average remaining useful life of the intangible assets is 6 years (6 years for software and software licenses, 5 years for customer contracts and lists, and 3 years for other intangibles). Amortization of intangible assets was $84.2 million and $69.4 million for the three months ended September 30, 2020 and 2019, respectively.

Estimated future amortization expenses of the Company's existing intangible assets are as follows:

| | | | | |

| | Amount |

| Nine months ending June 30, 2021 | $ | 232.1 | |

| Twelve months ending June 30, 2022 | $ | 256.6 | |

| Twelve months ending June 30, 2023 | $ | 212.8 | |

| Twelve months ending June 30, 2024 | $ | 166.8 | |

| Twelve months ending June 30, 2025 | $ | 115.2 | |

| Twelve months ending June 30, 2026 | $ | 65.9 | |

Note 9. Short-term Financing

The Company has a $3.2 billion, 364-day credit agreement that matures in June 2021 with a one year term-out option. The Company also has a $2.75 billion five year credit facility that matures in June 2024 that contains an accordion feature under which the aggregate commitment can be increased by $500 million, subject to the availability of additional commitments. In addition, the Company has a five year $3.75 billion credit facility maturing in June 2023 that also contains an accordion feature under which the aggregate commitment can be increased by $500 million, subject to the availability of additional commitments. The interest rate applicable to committed borrowings is tied to LIBOR, the effective federal funds rate, or the prime rate, depending on the notification provided by the Company to the syndicated financial institutions prior to borrowing. The Company is also required to pay facility fees on the credit agreements. The primary uses of the credit facilities are to provide liquidity to the commercial paper program and funding for general corporate purposes, if necessary. The Company had no borrowings through September 30, 2020 under the credit agreements.

The Company's U.S. short-term funding requirements related to client funds are sometimes obtained on an unsecured basis through the issuance of commercial paper, rather than liquidating previously-collected client funds that have already been invested in available-for-sale securities. This commercial paper program provides for the issuance of up to $9.7 billion in aggregate maturity value. The Company’s commercial paper program is rated A-1+ by Standard & Poor’s and Prime-1 (“P-1”) by Moody’s. These ratings denote the highest quality commercial paper securities. Maturities of commercial paper can range from overnight to up to 364 days. At September 30, 2020 and June 30, 2020, the Company had no commercial paper borrowing outstanding. Details of the borrowings under the commercial paper program are as follows:

| | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | September 30, |

| | | | | 2020 | | 2019 |

| Average daily borrowings (in billions) | | | | | $ | 2.4 | | | $ | 4.0 | |

| Weighted average interest rates | | | | | 0.1 | % | | 2.3 | % |

| Weighted average maturity (approximately in days) | | | | | 1 day | | 2 days |

The Company’s U.S., Canadian and United Kingdom short-term funding requirements related to client funds obligations are sometimes obtained on a secured basis through the use of reverse repurchase agreements, which are collateralized principally by government and government agency securities, rather than liquidating previously-collected client funds that have already been invested in available-for-sale securities. These agreements generally have terms ranging from overnight to up to five business days. At September 30, 2020, there were no outstanding obligations related to reverse repurchase agreements. At June 30, 2020, the Company had $13.6 million of outstanding obligations related to the reverse repurchase agreements. Details of the reverse repurchase agreements are as follows:

| | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | September 30, |

| | | | | 2020 | | 2019 |

| Average outstanding balances | | | | | $ | 152.4 | | | $ | 426.6 | |

| Weighted average interest rates | | | | | 0.3 | % | | 2.0 | % |

Note 10. Debt

The Company has two series of fixed-rate notes with 10-year, staggered maturities for an aggregate principal amount of $2.0 billion (collectively the “Notes”). The Notes are senior unsecured obligations, and interest is payable in arrears, semi-annually.

During the three months ended September 30, 2020, the Company issued $1.0 billion of senior notes due in 2030 bearing a fixed interest rate of 1.250%. The Company also redeemed $1.0 billion of senior notes bearing a fixed interest rate of 2.250%. In connection with the senior notes issuance, the Company also terminated several derivative contracts in place to hedge exposure in changes in benchmark interest rates for the senior notes issued with an aggregate notional amount totaling $1.0 billion (of which $400.0 million were entered into during fiscal year 2020 and $600.0 million were entered into on the day of issuance). Since these derivative contracts were classified as cash flow hedges, the unamortized loss of $43.6 million was deferred in accumulated other comprehensive income and will be amortized to earnings over the life of the Notes as the interest payments are made.

The principal amounts and associated effective interest rates of the Notes and other debt as of September 30, 2020 and June 30, 2020, are as follows:

| | | | | | | | | | | | | | | | | | | | |

| Debt instrument | | Effective Interest Rate | | September 30, 2020 | | June 30, 2020 |

Fixed-rate 2.250% notes due September 15, 2020 | | 2.37% | | $ | — | | | $ | 1,000.0 | |

Fixed-rate 3.375% notes due September 15, 2025 | | 3.47% | | 1,000.0 | | | 1,000.0 | |

Fixed-rate 1.250% notes due September 1, 2030 | | 1.83% | | 1,000.0 | | | — | |

| Other | | | | 8.2 | | | 8.4 | |

| | | | 2,008.2 | | | 2,008.4 | |

| Less: current portion (a) | | | | (1.8) | | | (1,001.8) | |

| Less: unamortized discount and debt issuance costs | | | | (12.5) | | | (3.8) | |

| Total long-term debt | | | | $ | 1,993.9 | | | $ | 1,002.8 | |

(a) - Current portion of long-term debt as of September 30, 2020 is included within Accrued expenses and other current liabilities on the Consolidated Balance Sheets.

The effective interest rates for the Notes include the interest on the Notes and amortization of the discount and debt issuance costs.

As of September 30, 2020, the fair value of the Notes, based on Level 2 inputs, was $2,115.0 million. For a description of the fair value hierarchy and the Company's fair value methodologies, including the use of an independent third-party service, see Note 1 “Summary of Significant Accounting Policies” in the Company's Annual Report on Form 10-K for fiscal 2020.

Note 11. Employee Benefit Plans

A. Stock-based Compensation Plans. Stock-based compensation consists of the following:

•Stock Options. Stock options are granted to employees at exercise prices equal to the fair market value of the Company's common stock on the dates of grant. Stock options generally vest ratably over 4 years and have a term of 10 years. Compensation expense is measured based on the fair value of the stock option on the grant date and recognized on a straight-line basis over the vesting period. Stock options are forfeited if the employee ceases to be employed by the Company prior to vesting. The Company determines the fair value of stock options issued using a binomial option-pricing model. The binomial option-pricing model considers a range of assumptions related to volatility, dividend yield, risk-free interest rate, and employee exercise behavior. Expected volatilities utilized in the binomial option-pricing model are based on a combination of implied market volatilities, historical volatility of the Company's stock price, and other factors. Similarly, the dividend yield is based on historical experience and expected future changes. The risk-free rate is derived from the U.S. Treasury yield curve in effect at the time of grant. The binomial option-pricing model also incorporates exercise and forfeiture assumptions based on an analysis of historical data. The expected life of a stock option grant is derived from the output of the binomial model and represents the period of time that options granted are expected to be outstanding.

•Restricted Stock.

•Time-Based Restricted Stock and Time-Based Restricted Stock Units. Time-based restricted stock and time-based restricted stock units granted September 1, 2018 and after generally vest ratably over 3 years. Time-based restricted stock and time-based restricted stock units granted prior to September 1, 2018 are generally subject to a vesting period of 2 years. Awards are forfeited if the employee ceases to be employed by the Company prior to vesting.

Time-based restricted stock cannot be transferred during the vesting period. Compensation expense relating to the issuance of time-based restricted stock is measured based on the fair value of the award on the grant date and recognized on a straight-line basis over the vesting period. Dividends are paid on shares awarded under the time-based restricted stock program.

Time-based restricted stock units are settled in cash and cannot be transferred during the vesting period. Compensation expense relating to the issuance of time-based restricted stock units is recorded over the vesting period and is initially based on the fair value of the award on the grant date and is subsequently remeasured at each reporting date during the vesting period based on the change in the ADP stock price. No dividend equivalents are paid on units awarded under the time-based restricted stock unit program.

•Performance-Based Restricted Stock and Performance-Based Restricted Stock Units. Performance-based restricted stock and performance-based restricted stock units generally vest over a one to three-year performance period and a subsequent service period of up to 38 months. Under these programs, the Company communicates “target awards” at the beginning of the performance period with possible payouts at the end of the performance period ranging from 0% to 150% of the “target awards.” Awards are generally forfeited if the employee ceases to be employed by the Company prior to vesting.

Performance-based restricted stock cannot be transferred during the vesting period. Compensation expense relating to the issuance of performance-based restricted stock is recognized over the vesting period based on the fair value of the award on the grant date with subsequent adjustments to the number of shares awarded during the performance period based on probable and actual performance against targets. After the performance period, if the performance targets are achieved, employees are eligible to receive dividends during the remaining vesting period on shares awarded under the performance-based restricted stock program.

Performance-based restricted stock units cannot be transferred and are settled in either cash or stock, depending on the employee's home country. Compensation expense relating to the issuance of performance-based restricted stock units settled in cash is recognized over the vesting period initially based on the fair value of the award on the grant date with subsequent adjustments to the number of units awarded during the performance period based on probable and actual performance against targets. In addition, compensation expense is remeasured at each reporting period during the vesting period based on the change in the ADP stock price. Compensation expense relating to the issuance of performance-based restricted stock units settled in stock is recorded over the vesting period based on the fair value of the award on the grant date with subsequent adjustments to the number of units awarded based on the probable and actual performance against targets. Dividend equivalents are paid on awards under the performance-based restricted stock unit program.

•Employee Stock Purchase Plan. The Company offers an employee stock purchase plan that allows eligible employees to purchase shares of common stock at a price equal to 95% of the market value for the Company's common stock on the last day of the offering period. This plan has been deemed non-compensatory and, therefore, no compensation expense has been recorded.

The Company currently utilizes treasury stock to satisfy stock option exercises, issuances under the Company's employee stock purchase plan, and restricted stock awards. From time to time, the Company may repurchase shares of its common stock under its authorized share repurchase program. The Company repurchased 1.7 million and 1.9 million shares in the three months ended September 30, 2020 and 2019, respectively. The Company considers several factors in determining when to execute share repurchases, including, among other things, actual and potential acquisition activity, cash balances and cash flows, issuances due to employee benefit plan activity, and market conditions.

The following table represents pre-tax stock-based compensation expense for the three months ended September 30, 2020 and 2019, respectively:

| | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | September 30, |

| | | | | 2020 | | 2019 |

| Operating expenses | | | | | $ | 3.6 | | | $ | 4.0 | |

| Selling, general and administrative expenses | | | | | 25.3 | | | 28.3 | |

| System development and programming costs | | | | | 4.9 | | | 4.8 | |

| Total stock-based compensation expense | | | | | $ | 33.8 | | | $ | 37.1 | |

| | | | | | | |

| | | | | | | |

During the three months ended September 30, 2020, the following activity occurred under the Company's existing plans:

Stock Options:

| | | | | | | | | | | | | | |

| | Number

of Options

(in thousands) | | Weighted

Average Price

(in dollars) |

| Options outstanding at July 1, 2020 | | 3,510 | | | $ | 126 | |

| Options granted | | 1,153 | | | $ | 139 | |

| Options exercised | | (156) | | | $ | 95 | |

| Options forfeited/cancelled | | (8) | | | $ | 144 | |

| Options outstanding at September 30, 2020 | | 4,499 | | | $ | 130 | |

| | | | |

| | | | |

| | | | |

Time-Based Restricted Stock and Time-Based Restricted Stock Units:

| | | | | | | | | | | | | | |

| | Number of Shares

(in thousands) | | Number of Units

(in thousands) |

| Restricted shares/units outstanding at July 1, 2020 | | 905 | | | 180 | |

| Restricted shares/units granted | | 636 | | | 103 | |

| Restricted shares/units vested | | (340) | | | (73) | |

| Restricted shares/units forfeited | | (9) | | | (1) | |

| Restricted shares/units outstanding at September 30, 2020 | | 1,192 | | | 209 | |

Performance-Based Restricted Stock and Performance-Based Restricted Stock Units:

| | | | | | | | | | | | | | |

| | Number of Shares

(in thousands) | | Number of Units

(in thousands) |

| Restricted shares/units outstanding at July 1, 2020 | | 179 | | | 851 | |

| Restricted shares/units granted | | 156 | | | 167 | |

| Restricted shares/units vested | | (70) | | | (279) | |

| Restricted shares/units forfeited | | (2) | | | (5) | |

| Restricted shares/units outstanding at September 30, 2020 | | 263 | | | 734 | |

The fair value for stock options granted was estimated at the date of grant using the following assumptions:

| | | | | | | | | | | | | |

| Three Months Ended | | |

| September 30, | | |

| | 2020 | | 2019 | | |

| Risk-free interest rate | 0.1 | % | | 1.4 | % | | |

| Dividend yield | 2.6 | % | | 1.9 | % | | |

| Weighted average volatility factor | 25.8 | % | | 19.3 | % | | |

| Weighted average expected life (in years) | 5.4 | | 5.4 | | |

| Weighted average fair value (in dollars) | $ | 21.66 | | | $ | 24.40 | | | |

B. Pension Plans

The components of net pension income were as follows:

| | | | | | | | | | | | | | | | | | | |

| | | | | Three Months Ended |

| | | | | September 30, |

| | | | | | | | | | 2020 | | 2019 |

| Service cost – benefits earned during the period | | | | | | | | | $ | 1.2 | | | $ | 14.9 | |

| Interest cost on projected benefits | | | | | | | | | 12.7 | | | 15.4 | |

| Expected return on plan assets | | | | | | | | | (30.4) | | | (29.5) | |

| Net amortization and deferral | | | | | | | | | 2.5 | | | 1.6 | |

| Settlement charges and special termination benefits | | | | | | | | | 2.9 | | | (5.1) | |

| Net pension income | | | | | | | | | $ | (11.1) | | | $ | (2.7) | |

Note 12. Income Taxes

The effective tax rate for the three months ended September 30, 2020 and 2019 was 21.3% and 21.2%, respectively. The increase in the effective tax rate is primarily due to a decrease in the excess tax benefit on stock-based compensation partially offset by favorable adjustments to prior year tax liabilities in the three months ended September 30, 2020.

Note 13. Commitments and Contingencies

In June 2018, a potential class action complaint was filed against the Company in the Circuit Court of Cook County, Illinois asserting that ADP violated the Illinois Biometric Privacy Act in connection with its collection, use and storage of biometric data of employees of its clients who are residents of Illinois. In addition, similar potential class action complaints have been filed in Illinois state courts against ADP and/or certain of its clients with respect to the collection, use and storage of biometric data of the employees of these clients. In June 2020, the Company reached a settlement of all outstanding claims against ADP for $25.0 million, subject to the court's preliminary approval. The Company does not expect that any of the remaining cases against ADP's clients will result in any material liabilities to the Company.