00008504602019FYfalse--12-31P5YP10Y00008504602019-01-012019-12-31iso4217:USD00008504602019-06-30xbrli:shares00008504602020-02-20xbrli:pure00008504602018-01-012018-12-3100008504602017-01-012017-12-3100008504602019-12-3100008504602018-12-31iso4217:USDxbrli:shares0000850460us-gaap:CommonStockMember2016-12-310000850460us-gaap:AdditionalPaidInCapitalMember2016-12-310000850460us-gaap:TreasuryStockMember2016-12-310000850460us-gaap:RetainedEarningsMember2016-12-3100008504602016-12-310000850460us-gaap:RetainedEarningsMember2017-01-012017-12-310000850460us-gaap:CommonStockMember2017-01-012017-12-310000850460us-gaap:AdditionalPaidInCapitalMember2017-01-012017-12-310000850460us-gaap:CommonStockMember2017-12-310000850460us-gaap:AdditionalPaidInCapitalMember2017-12-310000850460us-gaap:TreasuryStockMember2017-12-310000850460us-gaap:RetainedEarningsMember2017-12-3100008504602017-12-310000850460us-gaap:RetainedEarningsMember2018-01-012018-12-310000850460us-gaap:CommonStockMember2018-01-012018-12-310000850460us-gaap:AdditionalPaidInCapitalMember2018-01-012018-12-310000850460us-gaap:CommonStockMember2018-12-310000850460us-gaap:AdditionalPaidInCapitalMember2018-12-310000850460us-gaap:TreasuryStockMember2018-12-310000850460us-gaap:RetainedEarningsMember2018-12-310000850460us-gaap:RetainedEarningsMember2019-01-012019-12-310000850460us-gaap:CommonStockMember2019-01-012019-12-310000850460us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310000850460us-gaap:CommonStockMember2019-12-310000850460us-gaap:AdditionalPaidInCapitalMember2019-12-310000850460us-gaap:TreasuryStockMember2019-12-310000850460us-gaap:RetainedEarningsMember2019-12-31wire:segment0000850460us-gaap:ShippingAndHandlingMember2019-01-012019-12-310000850460us-gaap:ShippingAndHandlingMember2018-01-012018-12-310000850460us-gaap:ShippingAndHandlingMember2017-01-012017-12-310000850460us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310000850460srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2019-01-012019-12-310000850460srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2019-01-012019-12-310000850460srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2019-01-012019-12-310000850460srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2019-01-012019-12-310000850460srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2019-01-012019-12-310000850460srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2019-01-012019-12-3100008504602019-01-01wire:bank0000850460wire:CreditAgreementInterestRateOptionOneMembersrt:MinimumMemberus-gaap:LondonInterbankOfferedRateLIBORMemberwire:CreditAgreementMember2019-01-012019-12-310000850460wire:CreditAgreementInterestRateOptionOneMembersrt:MaximumMemberus-gaap:LondonInterbankOfferedRateLIBORMemberwire:CreditAgreementMember2019-01-012019-12-310000850460wire:CreditAgreementInterestRateOptionTwoMemberus-gaap:FederalFundsEffectiveSwapRateMemberwire:CreditAgreementMember2019-01-012019-12-310000850460wire:CreditAgreementInterestRateOptionTwoMemberus-gaap:LondonInterbankOfferedRateLIBORMemberwire:CreditAgreementMember2019-01-012019-12-310000850460wire:CreditAgreementInterestRateOptionTwoMembersrt:MinimumMemberwire:CreditAgreementMember2019-01-012019-12-310000850460wire:CreditAgreementInterestRateOptionTwoMembersrt:MaximumMemberwire:CreditAgreementMember2019-01-012019-12-310000850460srt:MinimumMemberwire:CreditAgreementMember2019-01-012019-12-310000850460srt:MaximumMemberwire:CreditAgreementMember2019-01-012019-12-310000850460us-gaap:EmployeeStockOptionMember2019-01-012019-12-310000850460us-gaap:EmployeeStockOptionMember2018-01-012018-12-310000850460us-gaap:EmployeeStockOptionMember2017-01-012017-12-310000850460us-gaap:StockAppreciationRightsSARSMember2019-01-012019-12-310000850460us-gaap:StockAppreciationRightsSARSMember2018-01-012018-12-310000850460us-gaap:StockAppreciationRightsSARSMember2017-01-012017-12-310000850460us-gaap:RestrictedStockMember2019-01-012019-12-310000850460us-gaap:RestrictedStockMember2018-01-012018-12-310000850460us-gaap:RestrictedStockMember2017-01-012017-12-310000850460wire:EmployeeStockGrantMember2019-01-012019-12-310000850460wire:EmployeeStockGrantMember2018-01-012018-12-310000850460wire:EmployeeStockGrantMember2017-01-012017-12-310000850460us-gaap:StockAppreciationRightsSARSMember2019-12-310000850460us-gaap:StockAppreciationRightsSARSMember2018-12-310000850460us-gaap:RestrictedStockMember2019-12-310000850460us-gaap:RestrictedStockMember2018-12-3100008504602019-06-012019-06-30wire:director00008504602018-05-012018-05-3100008504602017-05-012017-05-3100008504602019-01-012019-03-3100008504602019-04-012019-06-3000008504602019-07-012019-09-3000008504602019-10-012019-12-3100008504602018-01-012018-03-3100008504602018-04-012018-06-3000008504602018-07-012018-09-3000008504602018-10-012018-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-20278

| | |

|

ENCORE WIRE CORPORATION (Exact name of registrant as specified in its charter) |

|

| | | | | | | | | | | |

| Delaware | | | 75-2274963 |

(State or other jurisdiction of incorporation or organization) | | | (I.R.S. Employer Identification No.) |

| | | |

| 1329 Millwood Road | | | |

| McKinney, | Texas | | 75069 |

| (Address of principal executive offices) | | | (Zip Code) |

Registrant’s telephone number, including area code: (972) 562-9473

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $.01 per share | WIRE | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes ý No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes ý No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ý Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | | ☒ | Accelerated filer | ☐ |

| | | | |

| Non-accelerated filer | | ☐ | Smaller reporting company | ☐ |

| | | | |

| | | Emerging growth company | ☐ |

| | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | | | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ý No

The aggregate market value of the Common Stock held by non-affiliates of the registrant computed by reference to the price at which the Common Stock was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter was $1,000,071,726 (Note: The aggregate market value of Common Stock held by the Company’s directors, executive officers, immediate family members of such directors and executive officers, 10% or greater stockholders and other stockholders deemed to be affiliates was excluded from the computation of the foregoing amount. The characterization of such persons as “affiliates” should not be construed as an admission that any such person is an affiliate of the Registrant for any other purpose).

Number of shares of Common Stock outstanding as of February 20, 2020: 20,998,461

DOCUMENTS INCORPORATED BY REFERENCE

Listed below are documents, parts of which are incorporated herein by reference, and the part of this report into which the document is incorporated:

(1)Proxy statement for the 2020 annual meeting of stockholders – Part III

ENCORE WIRE CORPORATION

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2019

Table of Contents

PART I

Item 1. Business.

General

Encore Wire Corporation is a Delaware corporation, incorporated in 1989, with its principal executive office and manufacturing plants located at 1329 Millwood Road, McKinney, Texas 75069. The Company’s telephone number is (972) 562-9473. As used in this annual report, unless otherwise required by the context, the terms “we,” “our,” “Company,” “Encore” and “Encore Wire” refer to Encore Wire Corporation.

Encore believes it is a low-cost manufacturer of electrical building wire and cable. The Company is a significant supplier of building wire for interior electrical wiring in commercial and industrial buildings, homes, apartments, manufactured housing, and data centers.

The principal customers for Encore’s wire are wholesale electrical distributors, who sell building wire and a variety of other products to electrical contractors. The Company sells its products primarily through independent manufacturers’ representatives located throughout the United States and, to a lesser extent, through its own direct in-house marketing efforts.

Strategy

Encore’s strategy is to further expand its share of the building wire market primarily by emphasizing a high level of customer service and the addition of new products that complement its current product line, while maintaining and enhancing its low-cost production capabilities. Encore’s low-cost production capability features an efficient plant design incorporating highly automated manufacturing equipment, an integrated production process and a highly-motivated work force. Encore's plants are all located on one large campus. This single-site campus enables and enhances low-cost manufacturing, distribution and administration, as well as helping to build and maintain a cohesive company culture.

Customer Service: Encore is highly focused on responding to customer needs, with an emphasis on building and maintaining strong customer relationships. Encore seeks to establish customer loyalty by achieving an industry-leading order fill rate and rapidly handling customer orders, shipments, inquiries and returns. The Company maintains product inventories sufficient to meet anticipated customer demand and believes that the speed and completeness with which it fills orders are key competitive advantages critical to marketing its products.

Product Innovation: Encore has been a leader in bringing new ideas to a commodity product. Encore pioneered the widespread use of color feeder sizes of commercial wire and colors in residential non-metallic cable. The colors have improved on-the-job safety, reduced installation times for contractors and enabled building inspectors to rapidly and accurately inspect construction projects. Encore Wire’s patented SmartColor ID® system for metal-clad and armor-clad cables allows for quick and accurate identification of gauge, number of conductors, wire and jacket type. Our spool-free PullPro® is a lightweight, durable case weighing less than thirty pounds that requires no additional tools for a tangle-free wire pull. We believe our Reel Payoff® is the industry's first self-spinning wooden reel, which allows pulling on or off the pallet with no additional tools. Additionally, Encore currently has multiple patents and patent-pending innovations that range from process improvements to packaging solutions.

Low-Cost Production: Encore’s low-cost production capability features an efficient plant design and an incentivized work force.

Efficient Plant Design: Encore’s highly automated wire manufacturing equipment is integrated in an efficient design that reduces material handling, labor and in-process inventory.

Incentivized Work Force: The Company has a stock option plan and a stock appreciation rights plan that enhance the motivation of its salaried manufacturing supervisors. The Company also has a comprehensive safety program creating a world-class culture by engaging employees, identifying and eliminating risk, and training employees to be successful. The Company provides a 401(k) retirement savings plan to all employees.

Products

Encore offers an electrical building wire product line that consists primarily of NM-B cable, UF-B cable, THHN/THWN-2, XHHW-2, RHH/RHW-2 and other types of wire products, including tray cable, metal-clad and armored cable. All of these products are manufactured with copper or aluminum as the current-carrying component of the conductor. The principal bases for differentiation among stock-keeping units are product type, conductor type, diameter, insulation, length, color and packaging.

Manufacturing

The efficiency of Encore’s highly automated manufacturing facility is a key element of its low-cost production capability. Encore’s wire manufacturing lines have been integrated so that the handling of product is substantially reduced throughout the production process. The manufacturing process for the Company’s various products involves multiple steps, including: casting, drawing, stranding, compounding, insulating, cabling, jacketing and armoring.

Encore manufactures and tests all of its products in accordance with the Underwriters Laboratories (UL) standards, a nationally recognized testing and standards agency. Additionally, UL representatives routinely visit and test products from each area of manufacturing.

Customers

Encore sells its wire to wholesale electrical distributors throughout the United States. Most distributors supply products to electrical contractors. Encore’s customers are numerous and diversified. Encore has three customers, each of whom slightly exceeds 10% of the Company's total sales. Encore has no customer, the loss of which would have a material adverse effect on the Company.

Encore believes that the speed and completeness with which it fills customers’ orders is crucial to its ability to expand the market share for its products. The Company also believes that, for a variety of reasons, many customers strive to maintain lean inventories. Because of this trend, the Company seeks to maintain sufficient inventories to satisfy customers’ prompt delivery requirements.

Marketing and Distribution

Encore markets its products throughout the United States primarily through independent manufacturers’ representatives and, to a lesser extent, through its own direct marketing efforts.

Encore maintains the majority of its finished product inventory at its plant in McKinney, Texas. In order to provide flexibility in handling customer requests for immediate delivery, additional product inventories are maintained at warehouses owned and operated by some of the Company's independent manufacturers’ representatives located strategically across the country.

Finished goods are typically delivered to customers by trucks operated by common carriers. The decision regarding the carrier to be used is based primarily on availability and cost.

The Company invoices its customers directly for products purchased and, if an order has been obtained through a manufacturer’s representative, pays the representative a commission based on pre-established rates. The Company determines customer credit limits. The Company recorded no bad debt expense in 2019, 2018, and 2017. The manufacturers’ representatives have no discretion to determine prices charged for the Company’s products, and all sales are subject to Company approval.

Employees

Encore believes that its hourly employees are highly motivated and that their motivation contributes significantly to Encore’s efficient operation. The Company believes that competitive hourly compensation coupled with sound management practices focuses its employees on maintaining high production standards and product quality.

As of December 31, 2019, Encore had 1,380 employees, 1,148 of whom were paid hourly wages and were primarily engaged in the operation and maintenance of the Company’s manufacturing and warehouse facilities. The Company’s remaining employees were executive, supervisory, administrative, sales and clerical personnel. The Company considers its relations with its employees to be good. The Company has no collective bargaining agreements with any of its employees.

Raw Materials

The principal raw materials used by Encore in manufacturing its products are copper cathode, copper scrap, PVC thermoplastic compounds, XLPE compounds, aluminum, steel, paper and nylon, all of which are readily available from a number of suppliers. Copper is the principal raw material used by the Company in manufacturing its products, constituting 81.4% of the dollar value of all raw materials used by the Company during 2019. Copper requirements are purchased primarily from miners and commodity brokers at prices determined each month primarily based on the average daily COMEX closing prices for copper for that month, plus a negotiated premium. The Company also purchases raw materials necessary to manufacture various PVC thermoplastic compounds. These raw materials include PVC resin, clay and plasticizer.

The Company produces copper rod from purchased copper cathode and copper scrap in its own rod fabrication facility. The Company reprocesses copper scrap generated by its operations as well as copper scrap purchased from others. In 2019, the Company’s copper rod fabrication facility manufactured virtually all of the Company’s copper rod requirements. The Company purchases aluminum rod from various suppliers for aluminum wire production.

The Company also compounds its own wire jacket and insulation compounds. The process involves the mixture of PVC raw material components to produce the PVC used to insulate the Company’s wire and cable products. The raw materials include PVC resin, clay and plasticizer. During the last year, the Company’s plastic compounding facility produced the vast majority of the Company’s PVC requirements.

Competition

The electrical wire and cable industry is highly competitive. The Company competes with several companies who manufacture and sell wire and cable products beyond the building wire segment in which the Company competes. The Company’s primary competitors include Southwire Company, Cerro Wire LLC, General Cable (a company of the Prysmian Group) and AFC Cable Systems, Inc.

For our copper products, the Company believes that it is competitive with respect to all relevant factors, including order fill rate, quality, pricing, and, in some instances, breadth of product line.

In aluminum wire, which represented 8.1% of our net sales in 2019, we successfully enforced our rights under the U.S. trade remedy laws. As a result of the International Trade Commission’s final affirmative decision, U.S. importers of aluminum wire and cable from China will be required to pay antidumping duties at rates ranging from 47.83% to 52.79%, plus countervailing duties at rates ranging from 33.44% to 165.63%, depending upon the Chinese exporter/supplier.

Compliance with Environmental Regulations

The Company is subject to federal, state and local environmental protection laws and regulations governing the Company’s operations and the use, handling, disposal and remediation of hazardous substances currently or formerly used by the Company. Management believes the Company is in compliance with all such rules including permitting and reporting requirements. Historically, compliance with such laws and regulations has not had a material impact on the capital expenditures, earnings and competitive position of the Company.

Intellectual Property Matters

From time to time, the Company files patent applications with the United States Patent and Trademark Office. The Company currently owns several patents and pending patent applications. The Company also owns several registered trademarks and pending trademark applications with the U.S. Patent and Trademark Office. The current registrations for the marks will expire on various dates from 2020 to 2027, but each registration can be renewed indefinitely as long as the respective mark continues to be used in commerce and the requisite proof of continued use or renewal application, as applicable, is filed. These trademarks provide source identification for the goods manufactured and sold by the Company and allow the Company to achieve brand recognition within the industry.

Internet Address/SEC Filings

The Company’s Internet address is https://www.encorewire.com. Under the “Investors” section of our website, the Company provides a link to our electronic Securities and Exchange Commission (“SEC”) filings, including our annual report on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, director and officer beneficial ownership reports filed pursuant to Section 16 of the Securities Exchange Act of 1934, as amended, and any amendments to these reports. All such reports are available free of charge and are available as soon as reasonably practicable after the Company files such material with, or furnishes it to, the SEC.

The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at https://www.sec.gov.

Information about our Executive Officers

Information regarding Encore’s executive officers including their respective ages as of February 21, 2020, is set forth below:

| | | | | | | | | | | |

| Name | Age | | Position with Company |

| Daniel L. Jones | 56 | | | Chairman of the Board of Directors, President and Chief Executive Officer |

| | | |

| Bret J. Eckert | 53 | | | Vice President – Finance, Treasurer, Secretary, and Chief Financial Officer |

Mr. Jones has held the office of President and Chief Executive Officer of the Company since February 2006. He performed the duties of the Chief Executive Officer in an interim capacity from May 2005 to February 2006. From May 1998 until February 2005, Mr. Jones was President and Chief Operating Officer of the Company. He previously held the positions of Chief Operating Officer from October 1997 until May 1998, Executive Vice President from May 1997 to October 1997, Vice President-Sales and Marketing from 1992 to May 1997, after serving as Director of Sales since joining the Company in November 1989. He has also served as a member of the Board of Directors since May 1992, and was named Chairman of the Board in 2014.

Mr. Eckert has served as Vice President-Finance, Treasurer, Secretary and Chief Financial Officer of Encore since January 2020. He joined the Company in August 2019 as Vice President-Finance. Prior to joining the Company, Bret served as Executive Managing Director for the Houston office of Riveron Consulting LLC, a business advisory firm, from June 2018 to August 2019. Previously he was Senior Vice President and Chief Financial Officer of Atmos Energy Corporation in Dallas for approximately five years. He spent the first twenty-two years of his career with Ernst & Young LLP where he was a partner for ten years.

All executive officers are elected annually by the Board of Directors to serve until the next annual meeting of the Board or until their respective successors are chosen and qualified.

Item 1A. Risk Factors.

The following are risk factors that could affect the Company’s business, financial results and results of operations. These risk factors should be considered in connection with evaluating the forward-looking statements contained in this Annual Report on Form 10-K because these factors could cause the actual results and conditions to differ materially from those projected in forward-looking statements. Before purchasing the Company’s stock, an investor should know that making such an investment involves some risks, including the risks described below. If any of the risks mentioned below or other unknown risks actually occur, the Company’s business, financial condition or results of operations could be negatively affected. In that case, the trading price of its stock could fluctuate significantly.

Product Pricing and Volatility of Copper Market

Price competition for copper electrical wire and cable is significant, and the Company sells its products in accordance with prevailing market prices. Wire prices can, and frequently do, change on a daily basis. This competitive pricing market for wire does not always mirror changes in copper prices, making margins highly volatile. Copper, a commodity product, is the principal raw material used in the Company’s manufacturing operations. Copper accounted for approximately 69.9%, 73.0% and 69.7% of the costs of goods sold by the Company during 2019, 2018 and 2017, respectively, and the Company expects that copper will continue to account for a significant portion of these costs in the future. The price of copper fluctuates depending on general economic conditions and in relation to supply and demand and other factors, and it causes monthly variations in the cost of copper purchased by the Company. The SEC allows shares of physically backed copper exchange traded funds (“ETFs”) to be listed and publicly traded. Such funds and other copper ETFs like them hold copper cathode as collateral against their shares. The acquisition of copper cathode by copper ETFs may materially decrease or interrupt the availability of copper for immediate

delivery in the United States, which could materially increase the Company’s cost of copper. In addition to rising copper prices and potential supply shortages, we believe that ETFs and similar copper-backed derivative products could lead to increased copper price volatility. The Company cannot predict future copper prices or the effect of fluctuations in the costs of copper on the Company’s future operating results. Consequently, fluctuations in copper prices caused by market forces can significantly affect the Company’s financial results.

Operating Results May Fluctuate

Encore’s results of operations may fluctuate as a result of a number of factors, including fluctuation in the demand for and shipments of the Company’s products. Therefore, comparisons of results of operations have been and will be impacted by the volume of such orders and shipments. In addition, the Company's operating results could be adversely affected by the following factors, among others, such as variations in the mix of product sales, price changes in response to competitive factors, increases in raw material costs, freight costs, and other significant costs, the loss of key manufacturer’s representatives who sell the Company’s product line, increases in utility costs (particularly electricity and natural gas) and various types of insurance coverage and interruptions in plant operations resulting from the interruption of raw material supplies and other factors.

Reliance on Senior Management

Encore’s future operating results depend, in part, upon the continued service of its senior management, including, Mr. Daniel L. Jones, Chairman, President and Chief Executive Officer, and Mr. Bret J. Eckert, the Company’s Vice President and Chief Financial Officer (neither of whom is bound by an employment agreement). The Company’s future success will depend upon its continuing ability to attract and retain highly qualified managerial and technical personnel. Competition for such personnel is intense, and there can be no assurance that the Company will retain its key managerial and technical employees or that it will be successful in attracting, assimilating or retaining other highly qualified personnel in the future.

Industry Conditions and Cyclicality

The residential, commercial and industrial construction industry, which is the end user of the Company’s products, is cyclical and is affected by a number of factors, including the general condition of the economy, market demand and changes in interest rates. Industry sales of electrical wire and cable products tend to parallel general construction activity, which includes remodeling. Construction began to pick up strongly in 2013 after five to seven years of recession, and continued doing well through 2019. Data on remodeling is not as readily available. However, remodeling activity historically trends up when new construction slows down.

Deterioration in the financial condition of the Company’s customers due to industry and economic conditions may result in reduced sales, an inability to collect receivables and payment delays or losses due to a customer’s bankruptcy or insolvency. Although the Company’s bad debt experience has been low in recent years, the Company’s inability to collect receivables may increase the amounts the Company must expense against its bad debt reserve, decreasing the Company’s profitability. A downturn in the residential, commercial or industrial construction industries and general economic conditions may have a material adverse effect on the Company.

Environmental Liabilities

The Company is subject to federal, state and local environmental protection laws and regulations governing the Company’s operations and the use, handling, disposal and remediation of hazardous substances currently or formerly used by the Company. A risk of environmental liability is inherent in the Company’s current manufacturing activities in the event of a release or discharge of a hazardous substance generated by the Company. Under certain environmental laws, the Company could be held jointly and severally responsible for the remediation of any hazardous substance contamination at the Company’s facilities and at third party waste disposal sites and could also be held liable for any consequences arising out of human exposure to such substances or other environmental damage. There can be no assurance that the costs of complying with environmental, health and safety laws and requirements in the Company’s current operations or the liabilities arising from past releases of, or exposure to, hazardous substances, will not result in future expenditures by the Company that could materially and adversely affect the Company’s financial results, cash flow or financial condition.

Competition

The electrical wire and cable industry is highly competitive. The Company competes with several manufacturers of wire and cable products that have substantially greater resources than the Company. Some of these competitors are owned and operated by large, diversified companies. The principal elements of competition in the wire and cable industry are, in the opinion of the Company, pricing, product availability and quality and, in some instances, breadth of product line. The Company believes that it is competitive with respect to all of these factors. While the number of firms producing wire and cable has declined in the past, there can be no assurance that new competitors will not emerge or that existing producers will not employ or improve upon the Company’s manufacturing and marketing strategy.

Patent and Intellectual Property Disputes

Disagreements about patents and intellectual property rights occur in the wire and cable industry. The unfavorable resolution of a patent or intellectual property dispute could preclude the Company from manufacturing and selling certain products or could require the Company to pay a royalty on the sale of certain products. Patent and intellectual property disputes could also result in substantial legal fees and other costs.

Common Stock Price May Fluctuate

Future announcements concerning Encore or its competitors or customers, quarterly variations in operating results, announcements of technological innovations, the introduction of new products or changes in product pricing policies by the Company or its competitors, developments regarding proprietary rights, changes in earnings estimates by analysts or reports regarding the Company or its industry in the financial press or investment advisory publications, among other factors, could cause the market price of the common stock to fluctuate substantially. These fluctuations, as well as general economic, political and market conditions, such as recessions, world events, military conflicts or market or market-sector declines, may materially and adversely affect the market price of the common stock.

Beneficial Ownership of the Company’s Common Stock by a Small Number of Stockholders

A small number of significant stockholders beneficially own greater than 42% of the Company’s outstanding common stock. Depending on stockholder turnout for a stockholder vote, these stockholders, acting together, could be able to control the election of directors and certain matters requiring majority approval by the Company’s stockholders. The interests of this group of stockholders may not always coincide with the Company’s interests or the interests of other stockholders.

In the future, these stockholders could sell large amounts of common stock over relatively short periods of time. The Company cannot predict if, when or in what amounts stockholders may sell any of their shares. Sales of substantial amounts of the Company’s common stock in the public market by existing stockholders or the perception that these sales could occur, may adversely affect the market price of our common stock by creating a public perception of difficulties or problems with the Company’s business.

Future Sales of Common Stock Could Affect the Price of the Common Stock

No prediction can be made as to the effect, if any, that future sales of shares or the availability of shares for sale will have on the market price of the common stock prevailing from time to time. Sales of substantial amounts of common stock, or the perception that such sales might occur, could adversely affect prevailing market prices of the common stock.

Cybersecurity Breaches and other Disruptions to our Information Technology Systems

The efficient operation of our business is dependent on our information technology systems to process, transmit and store sensitive electronic data, including employee, distributor and customer records, and to manage and support our business operations and manufacturing processes. The secure maintenance of this information is critical to our operations. Despite our security measures, our information technology system may be vulnerable to attacks by hackers or breaches due to errors or malfeasance by employees and others who have access to our system, or other disruptions during the process of upgrading or replacing computer software or hardware, power outages, computer viruses, telecommunication or utility failures or natural disasters. Any such event could compromise our information technology system, expose our customers, distributors and employees to risks of misuse of confidential information, impair our ability to effectively and timely operate our business and manufacturing processes, and cause other disruptions, which could result in legal claims or proceedings, disrupt our operations

and the services we provide to customers, damage our reputation, and cause a loss of confidence in our products and services, any of which could adversely affect our results of operations and competitive position.

Regulations Related to Conflict-free Minerals May Force Us to Incur Additional Expenses.

In August 2012, the SEC adopted disclosure requirements related to certain minerals sourced from the Democratic Republic of Congo or adjoining countries, as required by Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”). The SEC rules implementing Section 1502 of the Dodd-Frank Act require us to perform due diligence, and report whether “conflict minerals,” which are defined as tin, tantalum, tungsten and gold, necessary to the functionality of a product we purchase originated from the Democratic Republic of Congo or an adjoining country. Since 2014, we have been required to file with the SEC on an annual basis a specialized disclosure report on Form SD regarding such matters. As our supply chain is complex, we may incur significant costs to determine the source and custody of conflict minerals that are used in the manufacture of our products in order to comply with these regulatory requirements in the future. We may also face reputation challenges if we are unable to verify the origins for all conflict minerals used in our products, or if we are unable to conclude that our products are “conflict free.” Over time, conflict minerals reporting requirements may affect the sourcing, price and availability of our products, and may affect the availability and price of conflict minerals that are certified as conflict free. Accordingly, we may incur significant costs as a consequence of regulations related to conflict-free minerals, which may adversely affect our business, financial condition or results of operations.

Changes in Tax Laws

On December 22, 2017, the Tax Cuts and Jobs Act of 2017 (the “2017 Tax Act”) was signed into law. The 2017 Tax Act is a comprehensive tax reform bill that significantly reforms the Internal Revenue Code. The 2017 Tax Act, among other things, contains significant changes to corporate taxation, including a reduction of the corporate income tax rate, a partial limitation on the deductibility of business interest expense, limitation of the deduction for certain net operating losses to 80% of current year taxable income, an indefinite net operating loss carryforward, immediate deductions for certain new investments (instead of deductions for depreciation expense over time) and the modification or repeal of many business deductions and credits. While we expect a beneficial impact from the 2017 Tax Act from the reduction in corporate tax rates and immediate deductions for certain new investments, we continue to examine the 2017 Tax Act, as its overall impact is uncertain, and note that certain provisions of the 2017 Tax Act or its interaction with existing law could adversely affect the Company's business and financial condition. The impact of the 2017 Tax Act on our stockholders is also uncertain and could be adverse.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

Encore maintains its corporate office and manufacturing plants in McKinney, Texas, approximately 32 miles north of downtown Dallas. The Company’s facilities are located on a combined site of approximately 445 acres and consist of buildings containing approximately 2.1 million square feet of floor space. The corporate office, plants and equipment are owned by the Company and are not mortgaged to secure any of the Company’s existing indebtedness. Encore believes that its plants and equipment are suited to its present needs, comply with applicable federal, state and local laws and regulations, and are properly maintained and adequately insured.

Item 3. Legal Proceedings.

For information on the Company’s legal proceedings see Note 9 to the Company’s financial statements included in Item 8 to this report and incorporated herein by reference.

Item 4. Mine Safety Disclosures.

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

The Company’s common stock is traded and quoted on the NASDAQ Stock Market’s Global Select Market under the symbol “WIRE.” As of February 20, 2020, there were 28 holders of record of the Company’s common stock.

Aside from periodic cash dividends, which the Company currently expects to continue to make consistent with its historical practice, management and the Board currently intend to retain the majority of future earnings for the operation and expansion of the Company’s business.

Issuer Purchases of Equity Securities

On November 10, 2006, the Board of Directors approved a stock repurchase program authorizing the Company to repurchase up to an authorized number of shares of its common stock on the open market or through privately negotiated transactions at prices determined by the President of the Company during the term of the program. The Company’s Board of Directors has authorized several increases and annual extensions of this stock repurchase program, and, as of December 31, 2019, 1,132,946 shares remained authorized for repurchase through March 31, 2021. The Company did not repurchase any shares of its stock in 2019, 2018 or 2017. The Company also has a broker agreement to repurchase stock in the open market at certain trigger points pursuant to a Rule 10b5-1 plan announced on November 28, 2007.

Equity Compensation Plan Information

The following table provides information about the Company’s equity compensation plans as of December 31, 2019.

| | | | | | | | | | | | | | | | | | | | |

| Number of securities to be issued upon exercise of outstanding options, warrants and rights | | Weighted-average exercise price of outstanding options, warrants and rights | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |

| PLAN CATEGORY | (a) | | (b) | | (c) | |

| Equity compensation plans approved by security holders (1) | 393,500 | | | $ | 42.36 | | | 399,800 | | (2) | |

(1) Pursuant to SEC rules and the reporting requirements for this table, we have not included in (a) above 50,000 shares of restricted stock that are issued and outstanding.

(2) Represents securities remaining available for issuance under our 2010 Stock Option Plan as of December 31, 2019 that may be granted in the form of unrestricted common stock, restricted common stock, or options to purchase shares of common stock.

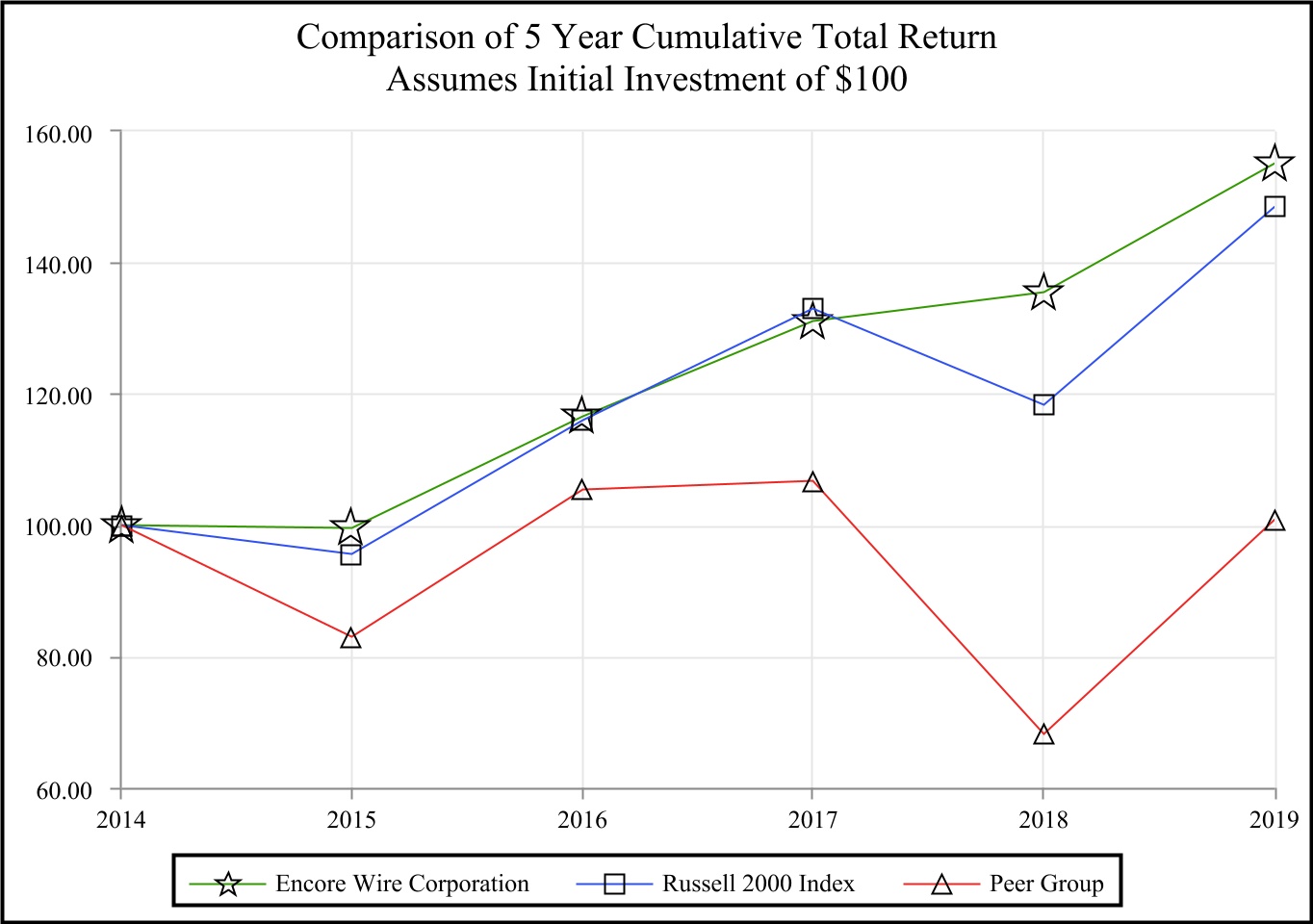

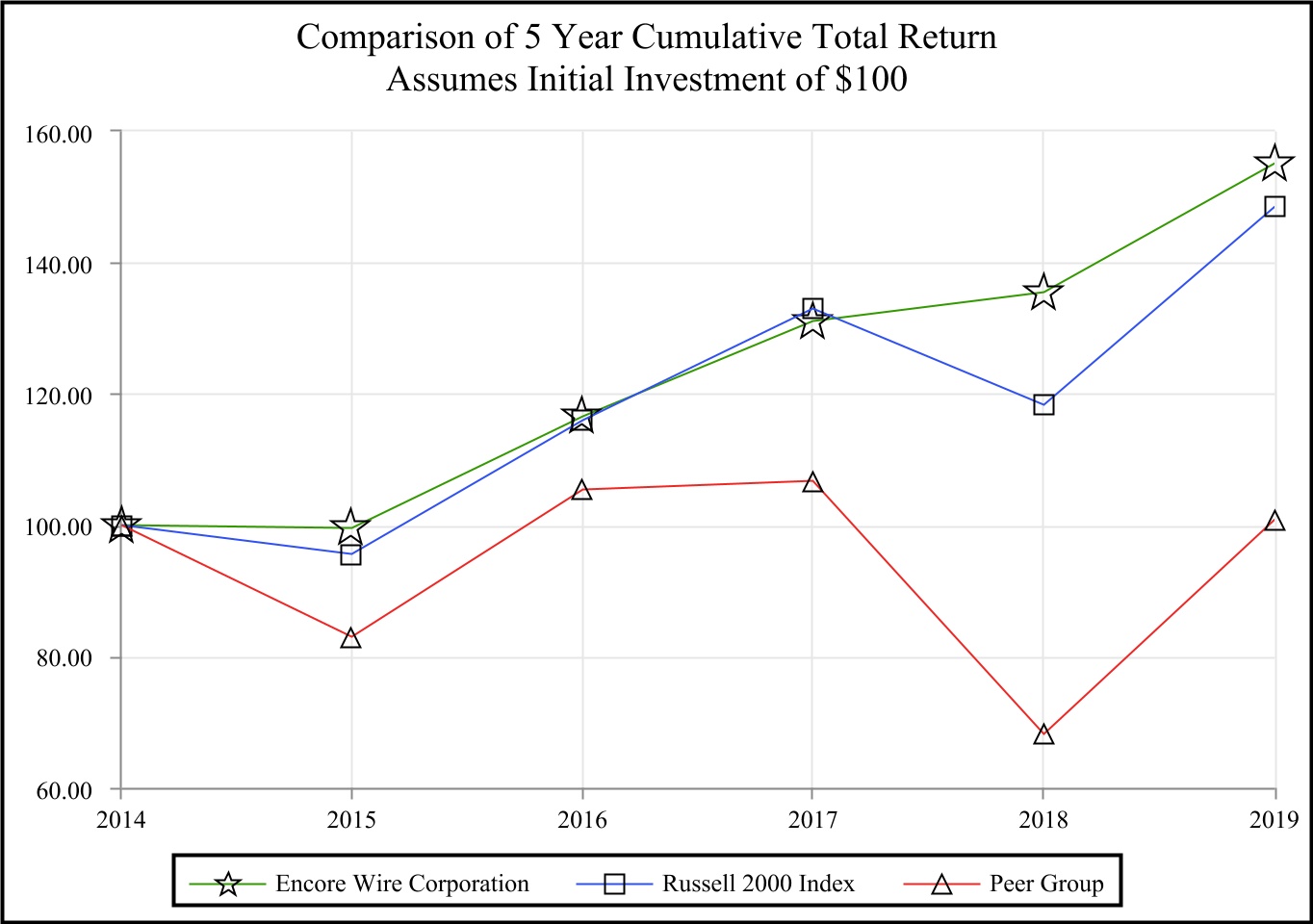

Performance Graph

The following graph is not “soliciting material,” is not deemed filed with the SEC, and is not to be incorporated by reference into any of the Company’s filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, as amended, respectively.

The graph below sets forth the cumulative total stockholder return, which assumes reinvestment of dividends, of a $100 investment in the Company’s common stock, the Russell 2000 Index, and the Company’s self-determined peer group (the “Peer Group”)for the five years ended December 31, 2019.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | As of December 31, | | | | | |

| Symbol | | Total Return For: | | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| Û | | Encore Wire Corporation | | 100.00 | | 99.52 | | 116.56 | | 131.05 | | 135.39 | | 155.09 | |

| £ | | Russell 2000 Index | | 100.00 | | 95.59 | | 115.95 | | 132.94 | | 118.30 | | 148.49 | |

| r | | Peer Group | | 100.00 | | 82.92 | | 105.43 | | 106.70 | | 68.11 | | 100.81 | |

Notes

(1)Data presented in the performance graph is complete through December 31, 2019.

(2)The Peer Group is self-determined and consists of the following companies: Belden, Inc., Apogee Enterprises, Inc., Quanex Building Products Corporation, Atkore International Group, Inc., and Masonite International Corporation. The performance graph presented in our Annual Report on Form 10-K for the year ended December 31, 2018, filed with the SEC on February 25, 2019, consisted of this peer group. However, the description of the "New Peer Group" included in footnote (3) to the performance graph inadvertently

omitted Masonite International Corporation, and inadvertently included Patrick Industries, Inc. and Gibraltar Industries, Inc.

(3)The peer group index uses only the Peer Group’s performance and excludes the performance of the Company. The peer group index uses beginning of period market capitalization weighting.

(4)Each data line represents annual index levels derived from compounded daily returns that include all dividends.

(5)The index level for all data lines was set to $100.00 on December 31, 2014.

Item 6. Selected Financial Data.

The following financial data should be read in conjunction with Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and Item 8, “Financial Statements and Supplementary Data.” The table below presents, as of and for the dates indicated, selected historical financial information for the Company.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, | | | | | | | | |

| | 2019 | | 2018 | | 2017 | | 2016 | | 2015 |

| | (in thousands, except per share data) | | | | | | | | |

| Statement of Income Data: | | | | | | | | | |

| Net sales | $ | 1,274,994 | | | $ | 1,288,683 | | | $ | 1,164,248 | | | $ | 940,790 | | | $ | 1,017,622 | |

| Cost of goods sold | 1,109,023 | | | 1,098,961 | | | 1,008,073 | | | 820,673 | | | 880,900 | |

| Gross profit | 165,971 | | | 189,722 | | | 156,175 | | | 120,117 | | | 136,722 | |

| Selling, general and administrative expenses | 94,442 | | | 90,212 | | | 76,726 | | | 69,351 | | | 64,493 | |

| Operating income | 71,529 | | | 99,510 | | | 79,449 | | | 50,766 | | | 72,229 | |

| Net interest and other income | 4,199 | | | 2,174 | | | 427 | | | 48 | | | 155 | |

| Income before income taxes | 75,728 | | | 101,684 | | | 79,876 | | | 50,814 | | | 72,384 | |

| Provision for income taxes | 17,599 | | | 23,534 | | | 12,859 | | | 16,975 | | | 24,779 | |

| Net income | $ | 58,129 | | | $ | 78,150 | | | $ | 67,017 | | | $ | 33,839 | | | $ | 47,605 | |

| Earnings per common and common equivalent shares – basic | $ | 2.78 | | | $ | 3.75 | | | $ | 3.23 | | | $ | 1.63 | | | $ | 2.30 | |

| Weighted average common and common equivalent shares – basic | 20,904 | | | 20,845 | | | 20,767 | | | 20,704 | | | 20,713 | |

| Earnings per common and common equivalent shares – diluted | $ | 2.77 | | | $ | 3.74 | | | $ | 3.21 | | | $ | 1.63 | | | $ | 2.29 | |

| Weighted average common and common equivalent shares – diluted | 20,990 | | | 20,910 | | | 20,847 | | | 20,773 | | | 20,787 | |

| Annual dividends declared per common share | $ | 0.08 | | | $ | 0.08 | | | $ | 0.08 | | | $ | 0.08 | | | $ | 0.08 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of December 31, | | | | | | | | |

| | 2019 | | 2018 | | 2017 | | 2016 | | 2015 |

| | (in thousands) | | | | | | | | |

| Balance Sheet Data: | | | | | | | | | |

| Working capital | $ | 473,942 | | | $ | 445,665 | | | $ | 375,353 | | | $ | 325,500 | | | $ | 315,913 | |

| Total assets | 883,154 | | | 818,060 | | | 733,975 | | | 657,964 | | | 628,116 | |

| Long-term debt | — | | | — | | | — | | | — | | | — | |

| Stockholders’ equity | 779,096 | | | 720,456 | | | 641,345 | | | 573,109 | | | 538,639 | |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Introduction

The following management’s discussion and analysis is intended to provide a better understanding of key factors, drivers and risks regarding the Company and the building wire industry.

Executive Overview

Encore Wire sells a commodity product in a highly competitive market. Management believes that the historical strength of the Company’s growth and earnings is in large part attributable to the following main factors:

•industry-leading order fill rates and responsive customer service

•product innovations and product line expansions based on listening to and understanding customer needs and market trends

•low cost manufacturing operations, resulting from a state-of-the-art manufacturing complex

•low distribution and freight costs due in large part to the “one campus” business model

•a focused management team leading an incentivized work force

•low general and administrative overhead costs, and

•a team of experienced independent manufacturers’ representatives with strong customer relationships across the United States.

These factors, and others, have allowed Encore Wire to grow from a startup in 1989 to what management believes is one of the largest electric building wire companies in the United States of America. Encore has built a loyal following of customers throughout the United States. These customers have developed a brand preference for Encore Wire in a commodity product line due to the reasons noted above, among others. The Company prides itself on striving to grow sales by expanding its product offerings where profit margins are acceptable. Senior management monitors gross margins daily, frequently extending down to the individual order level. Management strongly believes that this “hands-on” focused approach to the building wire business has been an important factor in the Company's success, and will lead to continued success.

The construction and remodeling industries drive demand for building wire. In 2019, unit sales were up 4.1% in copper wire versus 2018. In 2018, unit sales increased 4.5% in copper wire versus 2017. In 2017, unit sales of copper wire sold increased 5.6% versus 2016.

General

The Company’s operating results are driven by several key factors, including the volume of product produced and shipped, the cost of copper and other raw materials, the competitive pricing environment in the wire industry and the resulting influence on gross margins and the efficiency with which the Company’s plants operate during the period, among others. Price competition for electrical wire and cable is significant, and the Company sells its products in accordance with prevailing market prices. Copper, a commodity product, is the principal raw material used by the Company in manufacturing its products. Copper accounted for approximately 69.9%, 73.0% and 69.7% of the Company’s cost of goods sold during 2019, 2018 and 2017, respectively. The price of copper fluctuates, depending on general economic conditions and in relation to supply and demand and other factors, which causes monthly variations in the cost of copper purchased by the Company. Additionally, the SEC allows shares of physically backed copper exchange traded funds (“ETFs”) to be listed and publicly traded. Such funds and other copper ETFs like it hold copper cathode as collateral against their shares. The acquisition of copper cathode by Copper ETFs may materially decrease or interrupt the availability of copper for immediate delivery in the United States, which could materially increase the Company’s cost of copper. In addition to rising copper prices and potential supply shortages, we believe that ETFs and similar copper-backed derivative products could lead to increased price volatility for copper. The Company cannot predict copper prices in the future or the effect of fluctuations in the cost of copper on the Company’s future operating results. Wire prices can, and frequently do change on a daily basis. This competitive pricing market for wire does not always mirror changes in copper prices, making margins highly volatile. Historically, the cost of aluminum has been much lower and less volatile than copper. The tables below highlight the range of closing prices of copper on the Comex exchange for the periods shown.

COMEX COPPER CLOSING PRICE 2019

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| October

2019 | | November

2019 | | December

2019 | | Quarter Ended

Dec. 31, 2019 | | Year Ended

Dec. 31, 2019 |

| High | $ | 2.68 | | | $ | 2.72 | | | $ | 2.86 | | | $ | 2.86 | | | $ | 2.98 | |

| Low | 2.55 | | | 2.62 | | | 2.61 | | | 2.55 | | | 2.51 | |

| Average | 2.61 | | | 2.65 | | | 2.77 | | | 2.68 | | | 2.72 | |

COMEX COPPER CLOSING PRICE 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | October

2018 | | November

2018 | | December

2018 | | Quarter Ended

Dec. 31, 2018 | | Year Ended

Dec. 31, 2018 |

| High | $ | 2.82 | | | $ | 2.80 | | | $ | 2.80 | | | $ | 2.82 | | | $ | 3.29 | |

| Low | 2.66 | | | 2.68 | | | 2.63 | | | 2.63 | | | 2.56 | |

| Average | 2.76 | | | 2.75 | | | 2.72 | | | 2.75 | | | 2.92 | |

COMEX COPPER CLOSING PRICE 2017

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| October

2017 | | November

2017 | | December

2017 | | Quarter Ended

Dec. 31, 2017 | | Year Ended

Dec. 31, 2017 |

| High | $ | 3.22 | | | $ | 3.17 | | | $ | 3.29 | | | $ | 3.29 | | | $ | 3.29 | |

| Low | 2.94 | | | 3.04 | | | 2.92 | | | 2.92 | | | 2.48 | |

| Average | 3.10 | | | 3.09 | | | 3.10 | | | 3.10 | | | 2.81 | |

COMEX COPPER CLOSING PRICE 2019 by Quarter

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended Mar. 31, 2019 | | Quarter Ended June 30, 2019 | | Quarter Ended Sept. 30, 2019 | | Quarter Ended

Dec. 31, 2019 | | Year Ended

Dec. 31, 2019 |

| High | $ | 2.96 | | | $ | 2.98 | | | $ | 2.74 | | | $2.86 | | $2.98 |

| Low | 2.57 | | | 2.63 | | | 2.51 | | | 2.55 | | | 2.51 | |

| Average | 2.81 | | | 2.78 | | | 2.62 | | | 2.68 | | | 2.72 | |

Results of Operations

The following table presents certain items of income and expense as a percentage of net sales for the periods indicated.

| | | | | | | | | | | | | | | | | |

| | Year Ended December 31, | | | | |

| | 2019 | | 2018 | | 2017 |

| Net sales | 100.0 | % | | 100.0 | % | | 100.0 | % |

| Cost of goods sold: | | | | | |

| Copper | 60.8 | % | | 62.3 | % | | 60.3 | % |

| Other raw materials | 14.0 | % | | 12.8 | % | | 12.9 | % |

| Depreciation | 1.2 | % | | 1.1 | % | | 1.2 | % |

| Labor and overhead | 11.0 | % | | 9.6 | % | | 10.5 | % |

| LIFO adjustment | — | % | | (0.5) | % | | 1.7 | % |

| | | | | |

| 87.0 | % | | 85.3 | % | | 86.6 | % |

| | | | | |

| Gross profit | 13.0 | % | | 14.7 | % | | 13.4 | % |

| Selling, general and administrative expenses | 7.4 | % | | 7.0 | % | | 6.6 | % |

| Operating income | 5.6 | % | | 7.7 | % | | 6.8 | % |

| Net interest and other income | 0.4 | % | | 0.2 | % | | 0.1 | % |

| | | | | |

| Income before income taxes | 6.0 | % | | 7.9 | % | | 6.9 | % |

| Provision for income taxes | 1.4 | % | | 1.8 | % | | 1.1 | % |

| | | | | |

| Net income | 4.6 | % | | 6.1 | % | | 5.8 | % |

The following discussion and analysis relate to factors that have affected the operating results of the Company for the years ended December 31, 2019, 2018 and 2017. Reference should also be made to the Financial Statements and the related notes included under “Item 8. Financial Statements and Supplementary Data” of this Annual Report.

Net sales were $1.275 billion in 2019 compared to $1.289 billion in 2018 and $1.164 billion in 2017. The 1.1% decrease in net sales dollars in 2019 versus 2018 is primarily the result of a 2.0% decrease in copper wire sales. Sales dollars were driven lower primarily by a 5.8% decrease in average selling price of copper wire, partially offset by a 4.1% increase in copper wire pounds shipped. Average selling prices for wire sold were primarily driven lower by falling copper commodity prices.

In the fourth quarter of 2019, net sales dollars decreased 5.5% versus the fourth quarter of 2018. The decrease in net sales was due to a 7.3% decrease in copper net sales, driven by an average selling price decrease of 5.8% in copper wire, coupled with a 1.6% decrease in unit sales volume of copper in the fourth quarter of 2019 versus the fourth quarter of 2018. Net income dropped 57.9% in fourth quarter of 2019 versus the fourth quarter of 2018, fueled by an 11.2% decrease in copper wire spreads. It should be noted that the spreads in the fourth quarter of 2018 were the highest in over a decade.

On a sequential quarter comparison, net sales dollars in the fourth quarter of 2019 decreased 5.9% versus the third quarter of 2019, due primarily to an 8.1% decrease in copper wire unit volumes, offset slightly by a 1.0% increase the average selling price of copper wire. Unit sales generally decline in the fourth quarter.

Comparing the full year of 2019 to 2018, the decrease in gross profit margin percentage was primarily the result of a decrease in the spread between the average price paid for a pound of raw copper and the average sales price for a pound of copper. The copper spread decreased 4.9%. The spread decreased as a result of the 5.8% decrease in the average sales price per copper pound sold in building wire while the per pound cost of raw copper decreased 6.2%. Fluctuations in sales prices are primarily a result of changing copper and other raw material prices and product price competition.

Comparing the full year of 2018 to 2017, the increase in gross profit margin percentage was primarily the result of an increase in the spread between the average price paid for a pound of raw copper and the average sales price for a pound of copper in 2018 versus 2017, due primarily to improved industry pricing. Fluctuations in sales prices are primarily a result of changing copper raw material prices and product price competition. The increased margins were due primarily to the competitive pricing environment in the building wire industry. We believe that a strong construction environment in the United States during the year helped the building wire industry increase margin through price increases during 2018. As the number two player in the industry, the Company tried to lead or quickly follow prices up. However, a financially stressed competitor who had been acting erratically in the aluminum wire market, was purchased by a large foreign based company. This competitor had

previously appeared to readily follow pricing downward from some imported aluminum wire. For aluminum products, which represented 7.3% of net sales in 2018, the Company has encountered significant price-based import competition from aluminum wire imports from China, which are sold through U.S. based distributors. In September 2018, the Company joined with another U.S. producer in filing petitions with the U.S. Commerce Department and International Trade Commission (ITC), requesting that they investigate whether aluminum wire and cable imports into the United States are being illegally dumped and subsidized. The Commerce Department initiated these investigations in October 2018, and the ITC issued preliminary affirmative determinations in November 2018. As a result of the International Trade Commission’s final affirmative decision in November 2019, U.S. importers of aluminum wire and cable from China will be required to pay antidumping duties at rates ranging from 47.83% to 52.79%, plus countervailing duties at rates ranging from 33.44% to 165.63%, depending upon the Chinese exporter/supplier. The copper spread increased 9.8% in 2018 versus 2017. The spread increased as a result of the 7.0% increase in the average sales price per copper pound sold in building wire while the per pound cost of raw copper increased 5.7%. Fluctuations in sales prices are primarily a result of changing copper and other raw material prices and product price competition.

Cost of goods sold was $1.109 billion in 2019, compared to $1.099 billion in 2018 and $1.008 billion in 2017. The copper costs included in cost of goods sold were $775.0 million in 2019 compared to $802.7 million in 2018 and $702.6 million in 2017. Copper costs as a percentage of net sales were 60.8% in 2019 compared to 62.3% in 2018 and 60.3% in 2017. The decrease from 2018 to 2019 of copper costs as a percentage of net sales was due to copper costs decreasing 6.2%. As noted above, copper costs are the largest component of costs and therefore the most significant driver of sales prices of copper wire. Accordingly, the decrease in copper prices in 2019 caused most of the other costs to increase slightly in terms of their percentage of net sales dollars. The cost of other raw materials as a percentage of net sales increased from 12.9% in 2017 and 12.8% in 2018 to 14.0% in 2019. Material cost percentages in 2019 were decreased by a marginal LIFO credit (income), and decreased in 2018 by a 0.5% LIFO credit (income), and also increased in 2017 by a 1.7% LIFO debit (expense). Adding the LIFO adjustment to the cost of copper and other materials, the total materials cost in 2019 was 74.8% of net sales versus 74.6% in 2018 and 74.9% in 2017.

Depreciation, labor and overhead costs as a percentage of net sales were 12.2% in 2019 compared to 10.7% in 2018 and 11.7% in 2017. The percentage changes of depreciation, labor and overhead costs are due primarily to the changes in copper driven sales dollars providing the denominator by which these costs are divided. These changes in percentages are also somewhat due to the fact that depreciation, labor and overhead costs have fixed and semi-fixed components that do not vary directly with sales dollars or unit volumes.

Inventories consist of the following at December 31 (in thousands):

| | | | | | | | | | | | | | | | | |

| 2019 | | 2018 | | 2017 |

| Raw materials | $ | 25,882 | | | $ | 28,455 | | | $ | 32,928 | |

| Work-in-process | 25,381 | | | 30,529 | | | 22,753 | |

| Finished goods | 83,222 | | | 88,708 | | | 88,497 | |

| Total | 134,485 | | | 147,692 | | | 144,178 | |

| Adjust to LIFO cost | (44,801) | | | (45,325) | | | (51,813) | |

| | | | | |

| Inventory | $ | 89,684 | | | $ | 102,367 | | | $ | 92,365 | |

The quantity of total copper inventory on hand decreased somewhat in 2019, compared to 2018. The other materials category, which includes a large number of raw materials, had quantity changes that included increases and decreases in various other materials. These factors resulted in the 2019 year-end inventory value of all inventories using the LIFO method being $44.8 million less than the FIFO value, and the 2019 year-end LIFO reserve balance being $0.5 million lower than at the end of 2018. This resulted in a LIFO adjustment decreasing cost of sales by $0.5 million in 2019.

In 2018, copper steadily declined during the year, while exhibiting some volatility as shown in the COMEX copper closing price tables above. The quantity of total copper inventory on hand increased somewhat in 2018, compared to 2017. The other materials category, which includes a large number of raw materials, had quantity changes that included increases and decreases in various other materials. These factors resulted in the 2018 year-end inventory value of all inventories using the LIFO method being $45.3 million less than the FIFO value, and the 2018 year-end LIFO reserve balance being $6.5 million lower than at the end of 2017. This resulted in a LIFO adjustment decreasing cost of sales by $6.5 million in 2018.

Based on the current copper and other raw material prices, there is no LCM adjustment necessary in the periods presented above. Future reductions in the price of copper and other raw materials could require the Company to record an LCM adjustment against the related inventory balance, which would result in a negative impact on net income.

Gross profit was $166.0 million, or 13.0% of net sales, in 2019 compared to $189.7 million, or 14.7% of net sales, in 2018 and $156.2 million, or 13.4% of net sales, in 2017. The changes in gross profit were due to the factors discussed above.

Selling expenses, which are made up of freight and sales commissions, were $66.0 million in 2019, $67.0 million in 2018 and $55.0 million in 2017. As a percentage of net sales, selling expenses were 5.2% in 2019 versus 5.2% in 2018 and 4.7% in 2017. General and administrative expenses, as a percentage of net sales, were 2.2% in 2019 versus 1.8% in 2018 and 1.9% in 2017. Accounts receivable write-offs were $230,000 in 2019, $0 in 2018 and $11,000 in 2017. The Company did not increase the bad debt reserve in 2019, 2018 and 2017.

Net interest and other income was $4.2 million in 2019, $2.2 million in 2018 and $0.4 million in 2017. The increase in 2019 reflects higher cash balances used for our purchase of certificates of deposit during the year and the resulting interest earned.

The 2017 Tax Act was signed into law on December 22, 2017. The 2017 Tax Act significantly revised the U.S. corporate income tax by, among other things, lowering the statutory corporate income tax rate from 35% to 21%, eliminating certain deductions and introducing new tax regimes. The 2017 Tax Act also enhanced and extended through 2026 the option to claim accelerated depreciation deductions on qualified property. The impact of the 2017 Tax Act on the Company's tax accruals of $13.5 million was primarily comprised of the remeasurement of federal net deferred tax liabilities resulting from the permanent reduction in the U.S. statutory corporate tax rate to 21% from 35%.

Our effective tax rate was 23.2% in 2019, 23.1% in 2018 and 16.1% in 2017. The differences between the provisions for income taxes and the income taxes computed using the federal income tax statutory rate are primarily due to changes in tax laws and state taxes. The provisional favorable impact of the 2017 Tax Act reduced the 2017 effective tax rate by 16.9%. The domestic production activity deduction reduced the effective tax rate by approximately 3.1% in 2017. The 2017 Tax Act eliminated the qualified domestic production activities deduction beginning in 2018.

As a result of the foregoing factors, the Company’s net income was $58.1 million in 2019, $78.2 million in 2018 and $67.0 million in 2017.

Off-Balance Sheet Arrangements

The Company does not currently have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on the Company’s financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

Liquidity and Capital Resources

The following table summarizes the Company’s cash flow activities (in thousands):

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, | | | | |

| 2019 | | 2018 | | 2017 |

| Net cash provided by operating activities | $ | 106,121 | | | $ | 81,590 | | | $ | 48,013 | |

| Net cash used in investing activities | (52,456) | | | (26,065) | | | (20,690) | |

| Net cash provided by (used in) financing activities | (1,105) | | | (482) | | | 286 | |

| Net increase in cash and cash equivalents | $ | 52,560 | | | $ | 55,043 | | | $ | 27,609 | |

| Annual dividends paid | $ | 1,673 | | | $ | 1,668 | | | $ | 1,661 | |

The Company maintains a substantial inventory of finished products to satisfy customers’ prompt delivery requirements. As is customary in the industry, the Company provides payment terms to most of its customers that exceed terms that it receives from its suppliers. In general, the Company’s standard payment terms result in the collection of a significant majority of net sales within approximately 75 days of the date of the invoice. Therefore, the Company’s liquidity needs have generally consisted of working capital necessary to finance receivables and inventory. Capital expenditures have historically been necessary to expand and update the production capacity of the Company’s manufacturing operations. The Company has historically satisfied its liquidity and capital expenditure needs with cash generated from operations, borrowings under its various debt arrangements and sales of its common stock.

At December 31, 2019 and 2018, the Company had no debt outstanding.

The Company is party to a Credit Agreement (as amended, the “Credit Agreement”) with two banks, Bank of America, N.A., as administrative agent and letter of credit issuer, and Wells Fargo Bank, National Association as syndication agent. The Credit Agreement extends through October 1, 2021, and provides for maximum borrowings of $150.0 million. In the third quarter of 2016, the Company signed a Third Amendment to the Credit Agreement, which, along with other minor changes, eliminated the

restriction of maximum borrowings based on the amount of eligible accounts receivable plus the amount of eligible finished goods and raw materials, less any reserves established by the banks. Additionally, at our request and subject to certain conditions, the commitments under the Credit Agreement may be increased by a maximum of up to $100.0 million as long as existing or new lenders agree to provide such additional commitments. Borrowings under the line of credit bear interest, at the Company’s option, at either (1) LIBOR plus a margin that varies from 0.875% to 1.75% depending upon the Leverage Ratio (as defined in the Credit Agreement), or (2) the base rate (which is the highest of the federal funds rate plus 0.5%, the prime rate, or LIBOR plus 1.0%) plus 0% to 0.25% (depending upon the Leverage Ratio). A commitment fee ranging from 0.15% to 0.30% (depending upon the Leverage Ratio) is payable on the unused line of credit. At December 31, 2019, there were no borrowings outstanding under the Credit Agreement, and letters of credit outstanding in the amount of $1.5 million left $148.5 million of credit available under the Credit Agreement. Obligations under the Credit Agreement are the only contractual borrowing obligations or commercial borrowing commitments of the Company. Obligations under the Credit Agreement are unsecured and contain customary covenants and events of default. The Company was in compliance with the covenants as of December 31, 2019.

The Company paid interest totaling $0.2 million, $0.3 million and $0.2 million in 2019, 2018 and 2017, respectively, none of which was capitalized.

On November 10, 2006, the Board of Directors approved a stock repurchase program authorizing the Company to repurchase up to an authorized number of shares of its common stock on the open market or through privately negotiated transactions at prices determined by the President of the Company during the term of the program. The Company’s Board of Directors has authorized several increases and annual extensions of this stock repurchase program, and, as of December 31, 2019, 1,132,946 shares remained authorized for repurchase through March 31, 2021. The Company did not repurchase any shares of its stock in 2019, 2018 or 2017. The Company also has a broker agreement to repurchase stock in the open market at certain trigger points pursuant to a Rule 10b5-1 plan announced on November 28, 2007.

Net cash provided by operations increased $24.5 million to $106.1 million in 2019 compared to $81.6 million in 2018 and $48.0 million in 2017. The increase in cash provided by operations of $24.5 million in 2019 versus 2018 was due to several factors. Net income decreased to $58.1 million in 2019 from $78.2 million in 2018. Accounts receivable decreased in 2019, resulting in cash provided of $12.3 million versus cash used of $6.5 million in 2018, an increase in operating cash flow of $18.8 million. Accounts receivable generally fluctuates in proportion to dollar sales and, to a lesser extent, are affected by the timing of when sales occur during a given quarter. Additionally, accounts receivable can fluctuate based upon the payment timing patterns of certain large customers, although increases in accounts receivable at the end of quarterly reporting periods for this reason have not historically raised collectability issues. Changes in inventory resulted in cash provided of $12.7 million in 2019 versus cash used of $10.0 million in 2018, a $22.7 million increase in cash provided. Changes in trade accounts payable and accrued liabilities resulted in cash provided of $2.0 million in 2019 versus cash provided of $0.2 million in 2018, a positive swing of $1.8 million. These changes in cash flow were the primary drivers of the $24.5 million increase in net cash flow provided by operations in 2019 versus 2018.

Net cash provided by operations was $81.6 million in 2018 compared to $48.0 million in 2017. The increase in cash provided by operations of $33.6 million in 2018 versus 2017 was due to several factors. The Company had increased net income of $78.2 million in 2018 versus $67.0 million of net income in 2017. Accounts receivable increased in 2018, resulting in cash used of $6.5 million versus cash used of $44.0 million in 2017, an increase in operating cash flow of $37.5 million. Accounts receivable generally fluctuate in proportion to dollar sales and, to a lesser extent, are affected by the timing of when sales occur during a given quarter. Additionally, accounts receivable can fluctuate based upon the payment timing patterns of certain large customers, although increases in accounts receivable at the end of quarterly reporting periods for this reason have not historically raised collectability issues. Changes in current and deferred taxes resulted in $1.3 million of cash provided in 2018 versus cash used of $17.0 million in 2017, a positive swing of $18.3 million in 2018 versus 2017. Changes in inventory resulted in cash used of $10.0 million in 2018 versus cash provided of $0.9 million in 2017, a $10.9 million decrease in cash provided. Changes in trade accounts payable and accrued liabilities resulted in cash provided of $0.2 million in 2018 versus cash provided of $25.0 million in 2017, a negative swing of $24.8 million. These changes in cash flow were the primary drivers of the $33.6 million increase in net cash flow provided by operations in 2018 versus 2017.

Net cash used in investing activities was $52.5 million in 2019 versus $26.1 million in 2018 and $20.7 million in 2017. In 2019 and 2018, capital expenditures were used primarily for the purchase and installation of machinery and equipment throughout the Company. In 2017, capital expenditures were used primarily for the expansion of an existing wire plant and the purchase and installation of machinery and equipment throughout the Company.

The net cash used by financing activities of $1.1 million in 2019 consisted primarily of dividend payments of $1.7 million, partially offset by $0.6 million proceeds from issuance of Company stock related to employees exercising stock options. The net cash used by financing activities of $0.5 million in 2018 consisted primarily of $1.7 million in dividend payments offset by

$1.2 million proceeds from issuance of Company stock related to employees exercising stock options. The net cash provided by financing activities of $0.3 million in 2017 consisted primarily of $1.7 million in dividend payments, offset by $1.9 million proceeds from issuance of Company stock related to employees exercising stock options.

We recently announced our continued expansion plans, which we expect to proceed in two phases. Phase one will begin late in the first quarter of 2020 with the construction of a new 720,000 square foot facility located at the north end of our existing campus. This facility will act as a service center, modernizing our logistics to allow for increased throughput and provide the bandwidth necessary to capture incremental sales volumes. Phase one will allow us to compete at a higher level in the marketplace while further strengthening our industry-leading customer service and order fill rates. We expect to complete construction in the second quarter of 2021. Phase two of our expansion plans will commence following phase one and will focus on repurposing our existing distribution center to expand manufacturing capacity significantly and extend our market reach. Phase two completion is anticipated in 2022. We anticipate total capital expenditures to range from $85 - $95 million in 2020, $70 - $90 million in 2021, and $60 - $80 million in 2022. Our strong balance sheet and ability to generate high levels of operating cash flow consistently should provide ample allowance to fund planned capital expenditures.

Contractual Obligations

As shown below, the Company had the following contractual obligations as of December 31, 2019.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Payments Due by Period ($ in Thousands) | | | | | | | | |

| Contractual Obligations | Total | | Less Than

1 Year | | 1-3 Years | | 3-5 Years | | More Than

5 Years |

| Purchase Obligations | $ | 63,836 | | | $ | 63,836 | | | — | | | — | | | — | |

Note: Amounts listed as purchase obligations consist of open purchase orders for major raw material purchases and $12.4 million of capital equipment and construction purchase orders open as of December 31, 2019.

Critical Accounting Policies and Estimates

Management’s discussion and analysis of its financial condition and results of operations are based upon the Company’s financial statements, which have been prepared in accordance with accounting principles generally accepted in the U.S. The preparation of these financial statements requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates. See Note 1 to the Financial Statements included under “Item 8. Financial Statements and Supplementary Data” of this annual report. Management believes the following critical accounting policies affect its more significant estimates and assumptions used in the preparation of its financial statements.