UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended February 28, 2021

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from .................... to ....................

Commission file number 0-17249

AURA SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 95-4106894 | |

| (State or other

jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

20431 North Sea

Lake Forest, CA 92630

(Address of principal executive offices, zip code)

Registrant’s telephone number, including area code: (310) 643-5300

Name of each exchange on which registered: None

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☐ No ☒

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of the “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |

| Emerging growth company | ☐ | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

On August 31, 2020, the aggregate market value of the voting stock held by non-affiliates of the Registrant was $4,784,000. The aggregate market value has been computed by reference to the last sale price of the stock as quoted on the Pink Sheets quotation system on August 30, 2020. For purposes of this calculation, voting stock held by officers, directors, and affiliates has been excluded.

On May 18, 2021, the Registrant had 74,013,394 shares of common stock outstanding.

Documents incorporated by reference: None.

TABLE OF CONTENTS

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report contains forward-looking statements within the meaning of the federal securities laws. Statements other than statements of historical fact included in this Report, including the statements under the headings “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business” and elsewhere in this Report regarding future events or prospects are forward-looking statements. The words “approximates,” “believes,” “forecast,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “would,” “could,” “should,” “seek,” “may,” or other similar expressions in this Report, as well as other statements regarding matters that are not historical fact, constitute forward-looking statements. We caution investors that any forward-looking statements presented in this Report are based on the beliefs of, assumptions made by, and information currently available to, us. Such statements are based on assumptions and the actual outcome will be affected by known and unknown risks, trends, uncertainties and factors that are beyond our control or ability to predict. Although we believe that our assumptions are reasonable, they are not guarantees of future performance and some may prove to be incorrect. As a result, our actual future results may differ from our expectations, and those differences may be material. Accordingly, investors should use caution in relying on forward-looking statements to anticipate future results or trends.

Some of the risks and uncertainties that may cause our actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include the following:

| ● | Our ability to generate positive cash flow from operations; |

| ● | Our ability to obtain additional financing to fund our operations; |

| ● | The impact of economic, political and market conditions on us and our customers; |

| ● | The impact of unfavorable results of legal proceedings; |

| ● | Our exposure to potential liability arising from possible errors and omissions, breach of fiduciary duty, breach of duty of care, waste of corporate assets and/or similar claims that may be asserted against us; |

| ● | Our ability to compete effectively against competitors offering different technologies; |

| ● | Our business development and operating development; |

| ● | Our expectations of growth in demand for our products; and |

| ● | Other risks described under the heading “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K |

We do not intend to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise except to the extent required by law. You should interpret all subsequent written or oral forward-looking statements attributable to us or persons acting on our behalf as being expressly qualified by the cautionary statements in this Report. As a result, you should not place undue reliance on these forward-looking statements.

References in this Report to “we”, “us”, “the Company,” “Aura” or “Aura Systems” means Aura Systems, Inc. As used herein, reference to “Fiscal 2021” refers to the fiscal year ending February 28, 2021, reference to “Fiscal 2020” refers to the fiscal year ended February 29, 2020, reference to “Fiscal 2019” refers to the fiscal year ended February 28, 2019, reference to “Fiscal 2018” refers to the fiscal year ended February 28, 2018, reference to “Fiscal 2017” refers to the Fiscal year ended February 28, 2017, reference to “Fiscal 2016” refers to the fiscal year ended February 29, 2016, and reference to “Fiscal 2015” refers to the fiscal year ended February 28, 2015.

ii

Introduction

Aura Systems, Inc., is a Delaware corporation that was founded in 1987. The Company designs, assembles, tests and sells our proprietary and patented axial flux (“AF”) induction machines known as the AuraGen® for industrial and commercial applications and the AuraGen® VIPER for military applications (collectively referred to as the “AuraGen®”). The AuraGen® can be used either as an electric motor or generator depending on the rotational speed of the rotor relative to the rotational speed of the magnetic field produced by the stator; when the rotor rotates slower than the magnetic field the AuraGen® acts as an electric motor and when the rotor rotates faster than the magnetic field, the AuraGen® acts as a generator.

Traditional induction machines use a radial flux (“RF”) design as opposed to the axial flux design of the AuraGen®. These traditional RF machines have been the conventional workhorses of industry due to their robustness, attractive cost, and ease of control. However, RF machines are both heavy and bulky making them ill-suited for a variety of applications in which size and weight are paramount considerations, including most mobile applications. Although axial flux technology has long been recognized as having a higher energy density (more energy per unit volume) than traditional RF induction machines, for many years, however, RF technology was considered the only solution because of perceived insurmountable technological impediments to the creation of a viable axial flux equivalent including: (i) challenges controlling the strong axial magnetic attraction force between the stator and the rotor, (ii) fabrication difficulties such as cutting the slots in laminated cores, (iii) high cost involved in manufacturing the laminated stator core, (iv) difficulties in assembling the machine and maintaining a uniform air gap and (v) providing a laminated rotor that can stand the large centrifugal forces. Aura, however, has overcome these barriers through a variety of technological innovations.

The issue of a strong axial magnetic attraction force between the stator and the rotor was addressed by Aura’s patented approach of using a topology of two stators and a rotor sandwiched between them or two rotors and a stator sandwiched between. The issues related to the fabrication and the high cost of manufacturing of the laminated stator cores were resolved by Aura using a unique technique involving punching the slots while rolling the steel, resulting in a continuous punched steel ribbon at a cost less than traditional punched laminates. Using various modern techniques and instruments, Aura has also overcome the difficulties in assembling the machine and maintaining a uniform air gap. Aura has also developed a patented cast rotor that does not require any laminates and provides the structural integrity to withstand large centrifugal forces, while at the same time provides the proper electric and magnetic properties. Thus, although the general operating principals of the AuraGen® are the same as a traditional RF machine, the novel design of the AuraGen® and its unique performance characteristics offer perceivable advantages over traditional RF technology.

| ● | A Smaller Footprint and a Lighter Weight Makes the AuraGen® Uniquely Suited for Applications in which Fit, and Weight are Critical Factors. On average, the AuraGen® system is approximately 50 percent lighter than comparable RF systems. Likewise, on average the AuraGen® has a volume of approximately 35% only. As a result, the AuraGen® is uniquely able to be installed in locations traditional RF technology cannot possibly fit or that the significant weight of traditional RF technology otherwise makes prohibitive. The use of an AuraGen® motor or generator with a disc rotor can thus be adopted in the construction of various devices with advantages in size, weight, and function. In addition, Aura’s axial flux design readily lends itself to stacking multiple rotors and stators on the same shaft, thus designing a relatively compact system capable of very large outputs. |

| ● | AuraGen® Provides Greater Output Efficiency as Compared to Traditional RF Technology. Aura’s Axial Flux rotor design has significantly less inertia than the rotor used in equivalent traditional RF machines. As a result, Aura’s systems require less input horsepower to rotate at the required rpm, resulting in an increase in output efficiency. In addition, Aura’s stators require approximately 60% less copper than used in equivalent RF machines with much shorter stator coil end turns and shorter flux return paths. As a result, Aura’s design provides lower copper losses (additional increase in output efficiency) and lower manufacturing cost. In addition, specific AuraGen geometry/symmetry results in magnetic flux paths that inherently avoid parasitic eddy currents without need for laminates. |

1

| ● | Unlike Other electrical machines that are Dependent on Foreign Rare Earth Metals, the AuraGen® is Not. The AuraGen®, being an induction machine, does not use any permanent magnets (“PM”). Typical PM machines use NeFeB magnets (rare earths) that are mostly produced in China. In an article titled U.S. Needs a Strong Defense Against China’s Rare Earth weapon, written by James Stavridis of Bloomberg opinion March 4, 2021 “China controls roughly 80% of the rare-earths market, between what it mines itself and processes in raw material from elsewhere. If it decided to wield the weapon of restricting the supply — something it has repeatedly threatened to do — it would create a significant challenge for manufacturers and a geopolitical predicament for the industrialized world. … In 2010, Beijing threatened to cut off exports to Japan over the disputed Senkaku Islands. Two years ago, Beijing was reportedly considering restrictions on exports to the U.S. generally, as well as against specific companies (such as defense giant Lockheed Martin Corp.) that it deemed in violation of its policies against selling advanced weapons to Taiwan. In applications that require variable speed and variable loads, such as in EV applications, the magnetic B field should be adjusted such that the sum of the eddy-current, hysteresis, and I² losses are minimized. Generally bucking B fields are required to adjust for the B field produced by the Permanent magnets. In contrast, Aura’s induction machines do not have any PM and B fields are easily adjustable. This means that at light loads the controller can reduce voltage such that magnetic losses are reduced, and efficiency is maximized. Thus, Aura’ induction machine when operated with an Aura’s smart controller has an advantage over a PM machine – magnetic and conduction losses can be traded such that efficiency is optimized. This advantage. becomes increasingly important as performance is increased. |

After a lengthy development period, the Company first began commercializing the AuraGen® in late 1999 and early 2000. In 2001, the first commercial AuraGen® product was a 4-pole machine which, when combined with our proprietary and patented electronic control unit (“ECU”), generated 5 kW of exportable 120/240 VAC power. We subsequently added a 6-pole configuration and introduced our patented bi-directional power supply that provided for 8.5 kW watts of exportable power with the capability of providing both alternating (“AC”) and direct (“DC”) power simultaneously. In Fiscal 2008, the Company introduced an AuraGen® system that generated up to 17 kW of continuous power by combining two 8.5 kW systems on a single shaft. Starting in July 2019, we began to redesign and upgrade the ECU and develop new axial flux generator configurations. As a result of such efforts, our redesigned ECU allows us to replace the old 5 kW solution with a 6.5 kW solution using the same 4-pole generator as well as to upgrade the output of the 6-pole machine from 8.5 kW to 12.5 kW. Our recent efforts have also resulted in the development of a 15-kW solution specifically designed to address cell tower needs of 240 VAC and simultaneously 48 VDC as well as a new 4 kW solution targeting micro-mobility applications that is 7.5 inches in diameter and 5 inches deep that is being configured both as a motor and automotive alternator.

To date, the Company has sold approximately 10,000 AuraGen® solutions for numerous applications.

During the first half of Fiscal 2016, the Company significantly reduced operations due to lack of financial resources. During the second half of Fiscal 2016, the Company’s operations were further disrupted when the Company was forced to move from its facilities in Redondo Beach, California to a smaller shared facility in Stanton, California. During Fiscal 2017, the Company curtailed much of its engineering, manufacturing, sales, and marketing activities to focus on renegotiating numerous financial obligations. During Fiscal 2018, the Company successfully restructured in excess of $30 million of debt and held its first stockholder meeting since 2011. During Fiscal 2019, the Company continued to focus on seeking new sources of financing and utilized a contract manufacturer for very limited manufacturing. During fiscal 2019 the Company sold 11 systems.

In March 2019, stockholders of the Company represented a majority of the outstanding shares of the Company’s common stock delivered signed written consents to the Company removing Ronald Buschur, William Anderson and Si Ryong Yu as members of the Company’s Board and electing Ms. Cipora Lavut, Mr. David Mann, and Dr. Robert Lempert as directors of the Company in their stead. Because of Aura’s refusal to recognize the legal effectiveness of the consents, in April 2019 the stockholders filed suit in the Court of Chancery of the State of Delaware pursuant to Section 225 of the Delaware General Corporations Law, seeking an order confirming the validity of the consents. On July 8, 2019 the Court of Chancery entered final judgment in favor of the stockholder plaintiffs, confirming that (a) Ronald Buschur, Si Ryong Yu and William Anderson had been validly removed by the holders of a majority of the Company’s outstanding stock acting by written consent (b) Ms. Lavut, Mr. Mann and Dr. Lempert had been validly elected by the holders of a majority of the Company’s outstanding stock acting by written consent, and (c) the Company’s Board of Directors validly consists of Cipora Lavut, David Mann, Robert Lempert, Gary Douglas and Salvador Diaz-Versón, Jr. See Item 3, Legal Proceedings for more information. Following this ruling by the Court of Chancery, the newly confirmed Board of Directors terminated the employment of Melvin Gagerman, who had served as CEO and CFO of the Company since 2006, and installed Ms. Lavut as President, Mr. Mann as Chief Financial Officer and Dr. Lempert as Secretary of the Company.

Upon assuming control in the second half of Fiscal 2020, the Company’s new management team began significantly increasing its engineering, manufacturing and marketing activities as well as rebuilding relationships with its vendors and suppliers. Through these efforts, since July 8, 2019, the Company has shipped more than one-hundred and forty units (a greater than ten-fold increase over Fiscal 2019) and recorded approximately $0.9 million in revenue. During Fiscal 2021, the Company’s revenues and operations were adversely affected by the COVID-19 pandemic which resulted in a decline in revenues and shipments to customers.

2

Impact of the COVID-19 Pandemic

The COVID-19 global pandemic has negatively affected the global economy, disrupted global supply chains, and created extreme volatility and disruptions to capital and credit markets in the global financial markets. We began to see the impact of COVID-19 during our fourth quarter of Fiscal 2020 with our Chinese joint venture’s manufacturing facilities being required to close and many of our customers suspending their own operations due to the COVID-19 pandemic. As a result, net sales and production levels during the fourth quarter of Fiscal 2020 and the entirety of Fiscal 2021 were significantly reduced, thus impacting our results of operations during these fiscal periods.

In response to the COVID-19 pandemic and business disruption, we implemented certain measures to manage costs, preserve liquidity and enhance employee safety. These measures included the following:

| ● | Careful monitoring of operating expenses including wages and salaries; |

| ● | Enhanced cleaning and disinfection procedures at our facilities, promotion of social distancing at our facilities and requirements for employees to work from home where possible; | |

| ● | Reduction of capital expenditures; and |

As of the filing of this Annual Report on Form 10-K, the extent of the impact of the COVID-19 pandemic on our business, financial results and liquidity will depend largely on future developments, including the effectiveness of vaccination programs globally, the impact on capital and financial markets and the related impact on our customers, especially in the commercial vehicle markets. These future developments are outside of our control, are highly uncertain and cannot be predicted. If the impact is prolonged due, for example, to variant strains of the Covid-19 having an adverse impact, then it can further increase the difficulty of planning for operations and may require us to take further actions as it relates to costs and liquidity. These and other potential impacts of the COVID-19 pandemic will adversely impact our results for the current year, Fiscal 2022, and that impact could be material.

Business Arrangements

During Fiscal 2018 and Fiscal 2019, the Company’s engineering, manufacturing, sales, and marketing activities were reduced while we focused on renegotiating numerous financial obligations. During this time, the Company’s agreements with numerous customers, third party vendors, and organizations and entities material to the operation of the Company business were canceled, delayed or terminated. During Fiscal 2018, the Company successfully restructured in excess of $30 million of debt. Also, during Fiscal 2018, the Company signed a joint venture agreement with a Chinese company to build, service and distribute AuraGen® products in China. Under the Jiangsu Shengfeng joint venture agreement, the Chinese partner owns 51% of the joint venture and the Company owns 49%. The Chinese partner contributed a total of approximately $9.75 million to the venture principally in the form of facilities, equipment, and approximately $500,000 of working capital while the Company contributed $250,000 in cash as well as a limited license. The limited license sold to the joint venture, however, does not permit the venture to manufacture the AuraGen® rotor; rather, the joint venture is required to purchase all rotor subassemblies as well as certain software elements directly from the Company. During Fiscal 2018, Jiangsu Shengfeng placed a $1,000,000 order with the Company including a $700,000 advance payment of which the Company has failed to deliver product in accordance with the order received. On November 20, 2019, the Company reached a preliminary agreement with Jiangsu Shengfeng regarding the return of $700,000 previously advanced to the Company. The preliminary agreement reached consists of a non-interest-bearing promissory note and a payment plan pursuant to which the $700,000 is to be paid over a 11-month period beginning March 15, 2020 through February 15, 2021. The preliminary agreement was subject to the JV continuous operation. However, starting in January 2020 the JV was shut down by the Chinese authority due to the COVID-19 virus, and as of the date of this filing, the JV operation has not restarted. In the Balance Sheet as of February 29, 2020, the unpaid balance of $700,000 was reclassified as part of notes payable. During Fiscal 2020, the Company recorded an impairment expense of $250,000 to fully write-off the Jiangsu Shengfeng investment due to the uncertainty of the operation as of this time. During Fiscal 2019, the Company continued to address its financial needs and began utilizing an outside contractor to manufacture the AuraGen® product. Utilizing contractors, the Company shipped 11 units to customers during Fiscal 2019.

In Fiscal 2020 stockholders of the Company successfully removed Ronald Buschur, William Anderson and Si Ryong Yu from the Company’s Board of Directors and elected Ms. Cipora Lavut, Mr. David Mann and Dr. Robert Lempert as directors of the Company in their stead. See Item 3, Legal Proceedings for more information. Also, in Fiscal 2020, Melvin Gagerman, Aura’s CEO and CFO since 2006, was replaced. In July 2019 Ms. Lavut succeeded Mr. Gagerman as President and Mr. Mann succeeded Mr. Gagerman as CFO. Dr. Lempert was appointed as Secretary of the Company by the Board of Directors also in July 2019. In the second half of Fiscal 2020, the Company began significantly increasing its engineering, manufacturing and marketing activities. From July 8, 2019 through the end of Fiscal year 2021 (February 28, 2021), we shipped more than 140 units to customers (more than a ten-fold increase over Fiscal 2019).

3

Recent Developments.

Beginning in Fiscal 2020, a novel strain of coronavirus commonly referred to as COVID-19 emerged and spread rapidly across the globe, including throughout all major geographies in which we operate (North America, Europe, and Asia), resulting in adverse economic conditions and business disruptions, as well as significant volatility in global financial markets. Governments worldwide have imposed varying degrees of preventative and protective actions, such as temporary travel bans, forced business closures, and stay-at-home orders, all in an effort to reduce the spread of the virus. Such factors, among others, have resulted in a significant decline in spending and resource availability. Additionally, during this period of uncertainty, companies across a wide array of industries have implemented various initiatives to reduce operating expenses and preserve cash balances, including work furloughs, reduced pay, and severance actions, which could lower consumers’ disposable income levels or willingness to purchase discretionary items.

As a result of the COVID-19 pandemic, we have experienced varying degrees of business disruptions and periods of closure of our corporate facilities as have our customers, suppliers, and vendors, resulting in significant adverse impacts to our operating results. Resurgences in certain parts of the world resulted in further business disruptions periodically throughout Fiscal 2021. Such disruptions have continued into the first quarter of Fiscal 2022, impacting our business.

Despite the introduction of COVID-19 vaccines, the pandemic remains highly volatile and continues to evolve. Accordingly, we cannot predict for how long and to what extent the pandemic will impact our business operations or the global economy as a whole.

The AuraGen®/VIPER Product Overview:

Markets Served by the AuraGen®/VIPER

Induction Motor Applications

Aura’s axial flux induction machine can be used as either an electric motor or generator as described above. Due to the inherit advantages of Aura’s axial flux induction machine, such as (i) no rare earth or any other kind of permanent magnets, (ii) significantly less copper (60% less) than equivalent traditional induction motors (iii) higher energy density and (iv) fewer overall materials, we believe Aura’s axial flux induction motor can be used across a wide range of industries and applications. Because even a small percent increase in motor efficiency translates to a market-wide savings of tens of billions of dollars per year and because Aura’s axial flux motor design is more efficient than equivalent radial flux induction motors, we believe that with the proper financial resources, over time, we can capture a reasonable share of the global electric motor market.

Electric motors account for 45% of all the global electric usage every year and are currently widely used in a range of applications including fans, pumps, compressors, machine tools, domestic appliances, electric vehicles (both two wheels and 4 wheels), HVAC applications, power tools, and automated robots. In recent years, high-efficiency electric motors have continued to gain importance for their longer operating life, lower maintenance and environmental benefit (i.e., better and cleaner energy consumption) when compared to traditional common solutions.

Electric vehicles “EVs” are a prime example of a rapidly expanding global market for electric induction motors. EVs are manufactured with a goal of reducing operational costs and carbon footprint and increases in production of EVs is expected to provide a positive impact on the demand for electric motors as they are used in variety of applications ranging from locomotion to comfort components of the vehicle. Aura’s axial flux machine with its pancake topology, its reduced size and weight, lends itself to integration into EVs. Indeed, the global induction electric motor market is expected to reach $37.72 billion by 2027 (Inkwood research global induction motors market forecast 2019-2027). The market is driven by: (i) the rising demand for electric vehicles across the globe; (ii) increasing affordability of induction motors; (iii) low maintenance cost as compared to other motors; (iv) technological advancements in induction motors, (v) surging automation industries; and (vi) growing demand for energy-efficient motors. The United States as well as countries such as Brazil, Argentina, China, and India are major markets, with a high adoption rate for energy efficient products in both the industrial and agricultural sectors.

4

Mobile and Remote Power Applications

The global generator sales market was $20.3 billion in 2019 and is estimated to reach $27.16 billion by 2027 (Fortune Business Insight). Most industries dealing with construction and infrastructure rely on mobile generators to support modern computers, digital sensors and instruments as well as electrical driven tools. Current automotive alternators cannot supply the existing demanded power for many such applications and thus the common solution is the use of stand-alone gensets (often referred to a “Auxiliary Power Units” or simply “APUs”). These APUs, however, (i) consume large amounts of fuel, (ii) are heavy and bulky and accordingly must often be towed on trailers, and (iii) require constant maintenance. Additionally, traditional APUs are generally not considered to be environmentally friendly power solutions based on their high fuel consumption, loud operating noise levels, and the emissions they secrete into the air. In comparison, the AuraGen® system is small and light enough to generally be integrated directly into existing vehicles, does not require significant maintenance, nor does not require any set-up or tear-down time. In addition, there are no heavy lifting required and to contact with hot surfaces. The AuraGen® operation when integrated in a vehicle or a boat is completely seamless and transparent to the user

Likewise, for law enforcement, emergency responders and militaries alike, mobile power is generally a necessity. Indeed, one of the fastest growing segments for mobile power is the military marketplace for On-Board-Exportable-Power (OBEP), which is electric power on vehicles that can be used to support non-vehicle functions such as weapon systems and C4I functions (command, control, communication, computers and information). Currently, most on-board power is provided by APUs. Given the drawbacks of APUs, however, militaries, law enforcement and first responders all over the world are seeking more efficient integrated power solutions for their vehicles.

In addition, numerous leisure users are increasingly demanding mobile power for use of air-conditioning, appliances and other amenities.

Beside stand-alone gensets (often referred to “auxiliary power units” or simply “APU”s), all automotive users rely on integrated alternators in their vehicles for such things as navigation systems, electric seating, electric windows, sound/ phone systems and lights. In 2019 alone, 87.9 million passenger vehicles were sold globally (Motor Intelligence. Automotive alternator market growth trends forecast 2021-2026); each one used an alternator. The market for automotive alternators is presently dominated mainly by four companies: Denso, Valeo, Mitsubishi Electric, and Hitachi Automotive. These companies jointly control nearly 80% of the global market. The compact size and significant increase in efficiency of the AuraGen® provides an ideal replacement (fit and form) for high output automotive alternators while offering higher efficiency, longer lifetime and the flexibility of multiple types of voltage both AC and DC.

The AuraGen® solution increase in efficiency over traditional generators, when combined with our load following architecture and the ability to provide both AC and -48VDC simultaneously makes our solution very attractive to cell towers operators that depend on diesel power. Our solution has the potential for a significant reduction in diesel fuel consumption for such an application.

Transport refrigeration is also an ideal market for the AuraGen® mobile power solution since it enables the electrification of the system by eliminating the small diesel engine used to run the onboard refrigeration system. The Aura solution significantly reduces fuel consumption and eliminates the harmful emissions generated by the traditional small engine used in such applications.

Competition

The Company is involved in the application of its AuraGen® technology to electric motors and mobile power. Therefore, it faces substantial competition from companies offering different technologies.

Electric Motors

There are four (4) basic approaches for electrical machines: (i) the rotor can be electrically excited such that it creates a magnetic field with constant orientation (as in synchronous machines) and usually uses brushes and or commutators; (ii) the shape of the rotor can induce reluctance variations in the stator (as in switched reluctance machines); (iii) the rotor can be permanently magnetized with permanent magnets (“PM “) as in brushless DC machines; and (iv) the rotor field can be induced from the stator due to the rotor’s structure as in induction machines. Our axial flux technology is geared toward the induction machine market.

5

Brushed machines are machines in which the rotor coil is supplied with current through brushes. Unlike commutators, brushes only transfer electric current to a moving rotor; commutators also provide switching of the current direction. Large, brushed machines which are run with DC to the stator windings at synchronous speed are the most common generator in power plants because they also supply reactive power to the grid. They can be started by the turbine and can generate power at constant speed without a controller. This type of machine is often referred to in the literature as a “synchronous machine”.

Reluctance machines have no windings in the rotor, only a ferromagnetic material shaped so that “electromagnets” in the stator can “grab” the teeth in the rotor resulting in a slight movement. The electromagnets are then turned off, while another set of electromagnets is turned on to move the stator further. Reluctance machines are also sometimes referred to as “step motors” as a result of the step-like movement. These machines are suited for low speed and accurate position control. Reluctance machines can be supplied with PMs in the stator to improve performance. The “electromagnet” is then “turned off” by sending a negative current to the coil. When the current is positive the magnet and the current cooperate to create a stronger magnetic field, which will improve the reluctance machine’s maximum torque without increasing the currents maximum absolute value.

PM machines have permanent magnets in the rotor which set up a magnetic field. The magnetic field is created by modern PMs (Neodymium Iron Boron magnets “NeFeB”), which means that PM machines have a higher torque/volume and torque/weight ratio than machines with rotor coils under continuous operation. In general, it is usually possible to overload electric machines for a short time until the current in the coils heats parts of the machine to a temperature which cause damage. However, PM machines are very sensitive to such overloads because too high of a current in the coils can create a magnetic field strong enough to demagnetize the magnets. The majority (85%) NeFeB magnets are produced in China. Magnax and many other are examples of Companies using such an approach.

AC induction machine (no PM) is the most common electrical machine in use today. A changing magnetic field in the stator induces a current in the rotor. The current in the rotor produces its own magnetic field, which then interacts with the magnetic field of the stator, causing the rotor to turn. The name induction comes from the fact that current is induced in the rotor by the changing magnetic field of the stator. Radial flux induction machines have been the workhorse of industry due to their robustness, attractive cost, and easy of control; however, they are relatively, heavy and bulky. On the other hand, Aura’s axial flux (“AF”) induction machines, have all of the advantages of the radial flux machines but with the advantage of higher energy density resulting in a smaller and lighter machine with equivalent or better performance. Unlike the PM machines, induction machines do not use any permanent magnets and therefore the controller can change the B fields since B is proportionate to the voltage divided by the frequency (V/f).

Although our axial flux induction technology provides significant advantages in both cost (significant less copper, steel and aluminum), size/weight and performance, most of our competitors in induction technology have far greater financial, technical, and marketing resources than we have. They have larger budgets for research, new product development and marketing, and have long-standing customer relationships.

Key players in the market are (i) Nidec Motor Corporation, (ii) ABB Ltd., (iii) Siemens AG, (iv) WEG Electric Corp, (v) Regal Beloit Corporation, (vi) Wolong, and (vii)Teco Westinghouse.

Generators

There are five basic approaches used in mobile generators

Gensets AKA APU. Portable generators meet the large market need for auxiliary power. Millions of units per year are sold in North America alone, and millions more are sold across the world to meet market demands for 1 to 20 Kilowatts of portable power. The market for these power levels addresses the commercial, leisure and residential markets, and is essentially divided into: (a) higher power, higher quality and higher price commercial level units; and (b) lower power, lower quality and lower price level units. Gensets provide the strongest competition across the widest marketplace for auxiliary power. Onan, Honda and Kohler, among others, are well established and respected brand names in the genset market for higher reliability auxiliary power generation. There are over 40 registered genset-manufacturing companies in the United States.

Some of the key suppliers are Caterpillar (US), Cummins (US), Rolls-Royce Holdings (UK), Atlas Copco (Sweden), Mitsubishi Heavy Industries, Ltd. (Japan), Yanmar (Japan), Generac (US), ABB (Switzerland), Siemens Energy (Germany), Weichai Group (China), Kohler Co. (US), Kirloskar Oil Engines Ltd. (India), Denyo (Japan), and Sterling & Wilson (India).

6

High Output Alternators. There are many High Output Alternator manufacturers. Some of the better-known ones are: Delco-Remy, Bosh, Nippon Densu, Hitachi, Mitsubishi and Prestolite. All alternators provide their rated power at very high RPM and significantly less power at lower RPM. In addition, alternators are generally only 30% efficient at the low RPM range and increase to 50% efficiency at the high RPM range.

Inverters. There are many inverter manufacturers across the globe; the best known one is Xentrex. The pricing of industrial grade sine wave inverters is approximately $400 per kilowatt plus the cost of a high output alternator (estimated at $1,000) and a good throttle controller (estimated in the range of $250-500).

Permanent-Magnet Alternators. A number of companies have introduced alternators using exotic rare earth Neodymium (NdFeB) magnets. These alternators tend to have higher power generation capabilities than regular alternators at lower RPM. Unfortunately, PM machines with NdFeB magnets are very sensitive to temperature and, unlike the AuraGen®, cannot survive the typical under-the-hood environment (200oF+). In order to apply such devices for automotive applications one must add an active cooling system to keep the magnets from demagnetizing at approximately (176oF). In addition, most of the rare earth magnets (NeFeB) are manufactured in china and are subject to potential political and economic pressure.

In addition to the temperature challenges of such machines, there are other issues involving active control of the magnetic field. The main disadvantage of PM generators is the difficulty of output voltage regulation to compensate for speed and load variation due to the lack of a simple means of field control.

Fuel Cells. Fuel cells are solid-state, devices that produce electricity by combining a fuel containing hydrogen with oxygen. They have a wide range of applications and can be used in place of the internal combustion engine and traditional lead-acid and lithium-ion batteries. These systems are generally more expensive. The most widely deployed fuel cells are estimated to cost significantly more per kilowatt than alternative solutions.

Others

Evans Electric in Australia has introduced an axial flux machine with a complete conductive rotor. Such a machine was first introduced by Brinner more than 20 years ago and was abandoned because the rotor lacked the required rigidity to withstand the magnetic and centrifugal forces. The Brinner machine is cited in Aura’s issued patents.

Numerous companies are introducing axial flux machines; however, they generally use rare earth NeFeB magnets (made in China) and are thus not induction machines but rather permanent magnet machines. Some of the better-known companies are EVO, Magnax and Phi Power.

Transport Refrigeration (“TRU”). The main competitors for the all-electric TRU are traditional diesel-based solutions provided by Thermo-king and Carrier. The diesel based comparable systems provided by Thermo-king and Carrier are somewhat less expensive than our AuraGen® all-electric solution, however the diesel solutions require frequent maintenance and the utilization of a separate diesel engine. The separate diesel engine consumes additional fuel every operating hour. In addition, the diesel solution emits harmful emissions that have been recognized by the U.S. Environmental Protection Agency, California’s Air Resource Board and others as dangerous pollutants and are increasingly subject to federal and state regulations.

Diesel based Cell Towers. In many parts of the world typically cell towers require 240VAC for cooling and -48V for the communication equipment. The traffic load in cell towers can vary drastically throughout a 24-hours cycle and thus the power requirement varies accordingly. Our AuraGen® solution is designed to be a load following system that automatically adjusts the input power required as the load varies. For example, during busy hours the load to support the traffic may be 15kW, compared to the middle of the night, the traffic load may be significantly lower. The diesel engines used in such cell towers are sized to support the maximum load and are significantly less efficient at partial loads thus using more fuel. The AuraGen load following architecture maintains the same efficiency regardless of the immediate load and therefore results in considerable fuel savings through the 24-hour cycle.

7

Most of our competitors have far greater financial, technical, and marketing resources than we have. They have larger budgets for research, new product development and marketing, and have long-standing customer relationships. We also compete with many larger and more established companies in the hiring and retention of qualified personnel. Our financial condition has limited our ability to market the AuraGen®.

The AuraGen® uses a different technology and because our product is radically different from traditionally available mobile power solutions, users may require lengthy evaluation periods to gain confidence in the product. OEMs and large fleet users also typically require considerable time to make changes to their planning and production.

Competitive Advantages of the AuraGen® Axial Flux Induction technology

As a motor-Aura’s Axial Flux (“AF”) induction motor/generator is increasingly attracting attention from high impact potential users seeking advantages over conventional motors, particularly for Electric Vehicle applications. These advantages include (i) compact construction, (ii) better power to weight ratio, (iii) shorter axial length, (iv) better efficiency, (v) better torque to volume and weight ratio, (vi) very high utilization of active materials (less than 50% of the copper) and (vii) excellent ventilation and cooling. Induction machines (i) do not use any rare earth elements and have no permanent magnets. Due to their flat shape, lower weight and compact construction, Aura’s axial flux motors are ideal for pumps, fans, food processors, HVHC, etc. An axial flux machine is also preferred in applications where the rotor can be integrated with the rotating part of mechanical loads.

The AuraGen® motor’s operational range is between -40 and 340 degrees F; therefore, it is suitable to operate in a harsh environment.

As an alternator. Aura’s induction machine provides significant advantages in power generation, particularly in mobile applications. Its smaller volume and higher efficiency, when combined with the geometric shape means it can be integrated with existing vehicles and boats. Such integrated solutions do not require set up time. There are no heavy weights to lift (gensets), usable cargo space is optimized and there is no need for separate fuel/containers. Remarkably, there is no scheduled maintenance required.

The AuraGen® alternator’s operational range is between -40- and 340-degrees F; therefore, it is suitable for operating under the hood of a vehicle where the ambient temperature can easily be above 200 degrees F.

Earth-Forward, Green Technology. The AuraGen® system is significantly more environmentally friendly than traditional motors and generator. Because of its extreme efficiency and smaller size, the AuraGen® system utilizes fewer resources and materials to manufacture (in particular less than 60% of the copper). When used in power generation, the AuraGen® uses a vehicle’s primary automotive engine, which is already highly regulated for environmental protection. Traditional mobile power solutions, in comparison, use small, less efficient, auxiliary engines that produce significantly higher levels of emissions per unit of power output than the automobile engine.

Durability; No Scheduled Maintenance. The AuraGen® motor/generator solution does not require any scheduled maintenance. The historical failure rate over a 20-year period is less than 0.5%. The bearings are rated for 28,000 hours.

Targeted Market

The Company is re-examining and identifying new key markets to focus on as the Company expands operations.

The global drive for electrification is in search of better more effective electric motors. The recent realization by many potential users of such motors that permanent magnet motors are depending on NeFeB rare earth magnets from China has created a need for alternative to the PM motors. Our axial flux induction machine is a solution that does not use any magnets and has the required performance characteristic as well as fit and form for numerous applications.

Electric motors

Electric motors for micro mobility. Our axial flux machine due to its topology and pancake design is an ideal hub motor for scooters, mopeds and other 2-wheel electric vehicles. We are currently designing a 3.5-4 kW motor to be integrated in the hub of a specific scooter customer. This machine will use a 48V battery as the input power source. The global market segment for micro mobility is projected to be very large.

8

Electric motors for electric delivery trucks. We are exploring the use of our axial flux induction machine to be integrated into electric delivery trucks. This application would require a 70-kW machine that will use 600-800VDC battery system. In the physics of the AuraGen, the power is proportional to the radius cubed of the machine. For example, a machine with a rotor radius of 6 inches will have the power and torque required for small to medium delivery trucks. The power and torque requirements have been confirmed recently during a discussion with a delivery truck manufacturer.

Electric motors for flywheels. Our axial flux machine lends itself to multi stacking of rotors and stators on a single shaft to create motors in the 250-750kW range with a diameter of approximately 13-14 inches. Due to the solid rotor disk of our axial flux machine one can operate such machines safely in the 15,000 RPM range. We are exploring some opportunities with a flywheel manufacturing company for such applications.

Drive motors for electric boats- We started to explore the possibility of using our axial flux induction machine as a drive motor for small to medium electric boats. We have received a number of RFI (request for information) from boat manufacturers.

Drones- We started discussions with a drone manufacturer for potential applications of our axial flux induction motor for medium to large drones.

Mobile power generation

Military market. One focused market for the Company’s VIPER solution is military applications. The global military land vehicles market is expected to grow by 29% through 2022, increasing to $30.33 billion by 2022, according to market researcher (John Keller July 10, 2014 Military and Aerospace Electronics). While traditional markets for military vehicles such as the U.S. are choosing to upgrade and maintain existing fleets rather than replace aging vehicles, other regions are looking to purchase new units, which also provides maintenance and upgrade opportunities. The active number of military vehicles was estimated at over 408,000 in 2012 and is expected to increase to slightly over 418,000 by 2021. New vehicle procurement is expected to decline in western defense and increase in emerging markets of APAC and the Middle East.

Automotive alternators. In 2019, 87.9 million units of passenger cars were sold globally (Motor Intelligence. Automotive alternator market growth trends forecast 2021-2026) each one used an alternator. The market for automotive alternators is dominated mainly by four companies: Denso, Valeo, Mitsubishi Electric, and Hitachi Automotive. These companies jointly control nearly 80% of the global market. The compact size and significant increase in efficiency of the AuraGen® provides an ideal replacement (fit and form) for high output automotive alternators

Diesel based cell towers. According to Statista (Technology and telecommunication Thomas Alsop, September22, 2020), in 2019, there were 395,562 mobile wireless cell sites in the United States, with a large amount of investment going toward 5G-ready cell sites and antennas as per the source. Phil Marshall, chief research officer at Tolaga Research, estimates the global number of base stations at 6.5 million sites, while Chinese equipment vendor Huawei puts the number at 7 million. Many of the cell sites are powered by diesel generators. The AuraGen® solution increase in efficiency over traditional generators, when combined with our load following architecture and the ability to provide both AC and -48VDC simultaneously makes our solution very attractive to cell towers operators that depend on diesel power. Our solution has the potential for significant diesel fuel savings in such an application. We have received some levels of interest in usage of our solution in cell towers from users in African and the Philippines.

Transport Refrigeration (“TRU”). The main competitors for the all-electric TRU are traditional diesel-based solutions provided by Thermo-king and Carrier. The diesel based comparable systems provided by Thermo-king and Carrier are somewhat less expensive than our AuraGen® all-electric solution, however the diesel solutions require frequent maintenance and the utilization of a separate diesel engine that consumes additional fuel every operating hour. In addition, the diesel solution emits harmful emissions that have been recognized by the U.S. Environmental Protection Agency, California’s Air Resource Board and others as dangerous pollutants and are increasingly subject to federal and state regulations.

The Company is in discussions with a group in South Africa for the utilization of our transport refrigeration mobile power solution in approximately 1,000 trucks.

9

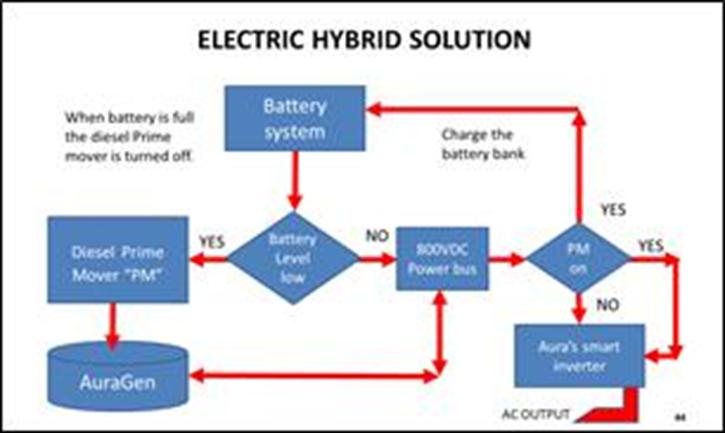

Hybrid APU Market

Aura’s technology can provide for a significant fuel savings for users that operate diesel APUs with the potential introduction of an Aura-designed hybrid APU solution. The logic for a hybrid solution is based on the following advantages (i) significant reduction in diesel fuel usage, (ii) significant reduction in diesel engine usage provides for longer life and lower maintenance costs, (iii) ability to start inductive loads without the need to oversize the diesel engine, (iv) ability to seamlessly deal with power spikes and (v) significant reduction in noise.

Facilities, Manufacturing Process and Suppliers

During Fiscal 2020 and 2021, our facilities consisted primarily of approximately 20,000 square feet in Stanton, California that we shared with ECS Corporation and an additional storage facility in Santa Clarita, California. The Stanton facility was under a month-to-month rental agreement for $10,000 per month. The monthly rent for the Santa Clara storage facility was also under a month-to-month rental agreement for $5,000 per month and was terminated effective July 31, 2020. Following exit from the Santa Clarita facility in July 2020 through February 28, 2021, we rented temporary storage space for approximately $2,500 per month. In early Fiscal 2022 we consolidated all administrative offices and operations in a new modern stand-alone facility consisting of approximately 18,000 square feet in Lake Forest, California. This Lake Forest facility is subject to a lease agreement with a 66-month lease period spanning from March 1, 2021 through August 31, 2026. The monthly base lease rate for the Lake Forest Facility is $22,183 per month.

As the Company continues to expand operations, we will need to renew relationships and contracts with our suppliers or locate suitable new suppliers for subassemblies and other components.

10

Research and Development

We believe that ongoing research and development is important to the success of our product in order to utilize the most recent technology, develop additional products and additional uses for existing products, stay current with changes in vehicle manufacture and design and maintain an advantage over potential competition. Our engineering, research and development costs for Fiscal 2021 was approximately $0.2 million compared to approximately $0.1 million in Fiscal 2020.

In Fiscal 2019 we began redesign work on our Electronic Control Unit (“ECU”) to include state-of-the-art power electronics and processors. Work on this redesign was temporarily suspended in mid-2019 when the Company’s then-management team reallocated significant resources to unsuccessfully oppose shareholders controlling a majority of the outstanding shares of the Company’s common stock who sought to replace certain members of the Company’s Board of Directors. On July 8, 2019 the Delaware Court of Chancery entered final judgment confirming the validity of this stockholder action. With the new management team installed, starting in July 2019 work on the ECU redesign resumed and, in September 2019, we successfully tested and implemented this newly designed ECU. As a result of such efforts, our redesigned ECU allows us to replace the old 5 kW solution with a 6.5 kW solution using the same 4-pole generator as well as to upgrade the output of the 6-pole machine from 8.5 kW to 12.5 kW. Our recent efforts have also resulted in the development of a 15 kW solution specifically designed to address cell tower needs of 240 VAC and simultaneously 48 VDC as well as a new 4 kW solution that is 7.5 inches in diameter and 5 inches deep that is being configured both as a motor and automotive alternator. In Fiscal 2022 we plan to begin delivering the new ECU solution.

Patents and Intellectual Property

Our intellectual property portfolio consists of trademarks, proprietary know-how, trade secrets, and patents.

In the area of electromagnetic technology, we have developed numerous magnetic systems and designs that result in a significant increase of magnetic field density per unit volume that can be converted into useful power energy or work. This increase in field density is a factor of three to four, which, when incorporated into mechanical devices, could result in a significant reduction in size and cost of production for the same performance.

The applications of these technological advances are in machines used every day by industrial, commercial, and consumers. We have applied technology to numerous applications in industrial machines, such as generators, motors, actuators, and linear motors.

We hold the following patents: Nos. 6,157,175; 6,700,214; 6,700,802; 8,955,624; with expiration dates in 2020, 2024, 2024 and 2033 respectively.

At the end of Fiscal 2013 and the first quarter of Fiscal 2014, we filed five new patent applications related to the AuraGen®. These new patent applications are specifically designed to cover the (i) integration of the AuraGen® power solution with transport refrigeration, (ii) the interface kit of the AuraGen® with prime movers, (iii) a water cooled AuraGen® solution for situations where ventilation is not available, (iv) a unique cable system with safety protection to transfer high power between two moving objects, and (v) a unique clamping of power electronic components to heat sink to ensure good thermal conductivity.

The patent application for the integration of the AuraGen® power solution with transport refrigeration was specifically geared for U.S. truck manufactured prior to 2015. This application was abandoned, and we expect to reexamine the patent ideas over the next 12 months as applied to both U.S. and foreign truck for more up-to-date required configurations. The patent application for interface kit of the AuraGen® with prime mover patent was issued (8,955,624). A provisional Patent (502,246,733) was issued for the water cooled AuraGen® solution in 2013.

The patent application for a unique cable system with safety protection to transfer high power between two moving objects was abandoned during the 2015-2019 period. The patent application for a unique clamping of power electronic components to heat sink to ensure good thermal conductivity was abandoned since Aura’s power electronic solution has been completely redesigned and the old design issues are no longer relevant.

11

Government Regulation

We are subject to laws and regulations that affect the Company’s activities, which include, but are not limited to, the areas of labor, intellectual property and ownership and infringement, tax, import and export requirements, environmental, and health and safety. As we recommence operations, our operations will again be subject to federal, state and local laws and regulations governing the occupational health and safety of our employees and wage regulations. For example, we are subject to the requirements of the federal Occupational Safety and Health Act, as amended, or OSHA, and comparable state laws that protect and regulate employee health and safety. We expect to expend resources to maintain compliance with OSHA requirements and industry best practices.

Employees

As of the date of this filing, the Company has a total of nine full-time employees in research and development, sales, operations and administration. Additionally, the Company engages independent contractors, on an as-needed basis, to support various areas of the business. During fiscal 2021 we engaged three independent contractors, two to support engineering developments, and one for accounting support.

Significant Customers

As of the date of the filing of this Annual Report on Form 10-K, CBOL Corporation of Chatsworth, California is a significant customer representing more than 90% of our annual revenues since July 2019.

Backlog

As of the date of the filing of this Annual Report on Form 10-K, the Company has no significant backlog of orders.

Raw Materials

The most important raw materials we use in manufacturing our products are steel, copper, and aluminum. Raw materials are purchased both domestically and outside the United States. We have no significant long-term supply contracts. When possible, we maintain a number of sources for our raw materials, which we believe contribute to our ability to obtain competitive pricing. The cost of some of our raw materials and shipping costs are dependent on petroleum cost. Higher material prices, cost of petroleum, and costs of sourced products could have an adverse effect on margins.

We enter into standard purchase agreements with certain foreign and domestic suppliers to source selected products. The terms of these arrangements are customary for the industry and do not contain any long-term contractual obligations on our behalf.

Available Information

We file annual, quarterly and current reports and other information with the Securities and Exchange Commission (the “SEC” or the “Commission”). These materials can be inspected and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Copies of these materials may also be obtained by mail at prescribed rates from the SEC’s Public Reference Room at the above address. Information about the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

On our website, www.aurasystems.com, we provide free of charge our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments thereto, as soon as reasonably practicable after they have been electronically filed or furnished to the SEC. Information contained on our website is not part of this Annual Report on Form 10-K or our other filings with the SEC.

12

We have been a party to litigation, a consent solicitation and a proxy contest with shareholders controlling a majority of the Company’s stock, which is costly and time-consuming and has had a material adverse effect on our business, results of operations and financial condition and could adversely affect our stock price.

In March 2019, stockholders of the Company representing a majority of the outstanding shares of the Company’s common stock delivered signed written consents to the Company removing Ronald Buschur, William Anderson and Si Ryong Yu as members of the Company’s Board and electing Ms. Cipora Lavut, Mr. David Mann and Dr. Robert Lempert as directors of the Company. Because of Aura’s refusal to recognize the legal effectiveness of the consents, on April 8, 2019 the stockholders filed suit in the Court of Chancery of the State of Delaware pursuant to Section 225 of the Delaware General Corporations Law, seeking an order confirming the validity of the consents. On July 8, 2019 the Court of Chancery entered final judgment in favor of the stockholder plaintiffs, confirming that (a) Ronald Buschur, Si Ryong Yu and William Anderson had been validly removed by the holders of a majority of the Company’s outstanding stock acting by written consent (b) Ms. Lavut, Mr. Mann and Dr. Lempert had been validly elected by the holders of a majority of the Company’s outstanding stock acting by written consent, and (c) the Company’s Board of Directors validly consists of Cipora Lavut, David Mann, Robert Lempert, Gary Douglas and Salvador Diaz-Versón, Jr. Aura’s refusal to recognize the legal effectiveness of the consents and the decision by the Company’s former leadership team to utilize corporate resources to vigorously contest the shareholder action has consumed significant financial resources, temporarily stagnated operations, and resulted in substantial costs, all of which had a material adverse effect on our business, operating results and financial condition.

We have a history of losses, and we may not be profitable in any future period.

Except for Fiscal 2018 and Fiscal 2021, in each fiscal year since our reorganization in 2006, we have reported losses. For Fiscal years 2019 and 2020, we recorded net losses of $2.5 million and $2.6 million, respectively. Since the Company’s Chapter 11 bankruptcy reorganization in 2006, we have spent considerable amounts on, among other things, building market awareness and infrastructure for sales and distribution, enhancing our engineering capabilities, perfecting an all-electric refrigeration transport system for midsize trucks, developing a 18-kW product, and developing an eight-inch system capable of delivering approximately 4.5- kW of power. We continue to need substantial funds for the development of new products, enhancement of existing products and in order to expand sales. However, sales of our products have not increased as we expected them to, and may never increase to the level that we need to expand our operations, or even to sustain them. We can provide no assurance as to when, or if, we will be profitable in the future. Even if we achieve profitability, we may not be able to sustain it.

The effects of a pandemic or widespread outbreak of an illness, such as the COVID-19 pandemic, has had and could continue to have a material adverse impact on our business, results of operations and financial condition.

The outbreak of COVID-19 was declared a pandemic by the World Health Organization (“WHO”) during our fourth quarter of Fiscal 2020 and continues to impact our operations and cash flows up to the filing date of this Annual Report on Form 10-K for Fiscal 2021. While we have implemented measures to mitigate the impact of the COVID-19 pandemic, we expect our Fiscal 2022 results of operations to continue to be adversely affected by the COVID-19 pandemic.

As a result of the COVID-19 pandemic, we have experienced varying degrees of business disruptions and periods of closure of our corporate facilities, as have our customers, partners, suppliers, and vendors, as described in Item 1 — “Business — Recent Developments.” Collectively, these disruptions have had a material adverse impact on our business throughout Fiscal 2021. Despite the introduction of COVID-19 vaccines, the pandemic remains highly volatile and continues to evolve. Accordingly, we cannot predict for how long and to what extent this crisis will continue to impact our business operations or the global economy as a whole. Potential impacts to our business include, but are not limited to:

| ● | our ability to successfully execute our long-term growth strategy; |

| ● | potential declines in the level of purchases of products, including our products, caused by higher unemployment and lower disposal income levels, travel and social gathering restrictions, work-from-home arrangements, or other factors beyond our control; |

| ● | our ability to generate sufficient cash flows to support our operations, including repayment of our debt obligations as they become due; |

13

| ● | the potential loss of one or more of our significant customers or partners, or the loss of a large number of smaller customers or partners, if they are not able to withstand prolonged periods of adverse economic conditions, and our ability to collect outstanding receivables; |

| ● | temporary closures or other operational restrictions of our facilities; |

| ● | supply chain disruptions resulting from closed factories, reduced workforces, scarcity of raw materials, and scrutiny or embargoing of goods produced in infected areas, including any related cost increases; |

| ● | our ability to access capital markets and maintain compliance with covenants associated with our existing debt instruments, as well as the ability of our key customers, suppliers, and vendors to do the same with regard to their own obligations; |

| ● | additional costs to protect the health and safety of our employees, customers, and communities, such as more frequent and thorough cleanings of our facilities and supplying personal protection equipment; |

| ● | diversion of management attention and resources from ongoing business activities and/or a decrease in employee morale; and |

| ● | our ability to maintain an effective system of internal controls and compliance with the requirements under the Sarbanes-Oxley Act of 2002. |

Additional discussion related to the various risks and uncertainties described above is included elsewhere within the “Risk Factors” section of this Annual Report on Form 10-K.

We derive a substantial portion of our revenues from customers in industries susceptible to trends and factors affecting those industries, including the COVID-19 pandemic.

Our AuraGen® system is geared toward end-markets such as commercial vehicles, communications, transportation industries, and consumer and industrial equipment markets. Factors negatively affecting these industries also negatively affect our business, financial condition and results of operations. Any adverse occurrence, including industry slowdown, recession, costly or constraining regulations, excessive inflation, prolonged disruptions in one or more of our customers’ production schedules or labor disturbances, that results in significant decline in the volume of sales in these industries, or in an overall downturn in the business and operations of our customers in these industries, could materially adversely affect our business, financial condition and results of operations.

As a result of the COVID-19 pandemic, global vehicle production has decreased, and some manufacturers have completely shut down manufacturing operations in some countries and regions, including the United States and Europe. As a result, we have experienced, and are likely to continue to experience, delays in the production and distribution of our products and the loss of sales. If the global economic effects caused by the COVID-19 pandemic continue or increase, overall customer demand may continue to decrease which could have a further adverse effect on our business, results of operations and financial condition.

We will need additional capital in the future to meet our obligations and financing may not be available. During Fiscal 2020 and 2021, the Company attempted to increase its engineering and manufacturing activities, but it still struggled with meeting its financial requirements. If we cannot obtain additional capital, we will not be able to continue our operations.

As a result of our operating losses, we have largely financed our operations through sales of our equity securities. Beginning with Fiscal 2017, the Company significantly reduced its engineering, manufacturing, sales, and marketing activities to focus on renegotiating numerous financial obligations and conserving cash. For Fiscal 2021, we had approximately $1.9 million negative cash flows from operations as compared to negative $0.8 million in Fiscal 2020 due primarily to the impact of Covid-19 pandemic. The Company’s engineering and manufacturing activities remained limited due to our inability to increase sales and raise significant amounts of new financing. Our ability to continue as a going concern is directly dependent upon our ability to obtain additional operating capital and generating sufficient operating cash flow. The impacts of the COVID-19 pandemic have caused significant uncertainty and volatility in the credit markets and there can be no assurance that lenders or investors will make additional commitments to provide financing to us under current circumstances. As a result of the impacts of the COVID-19 pandemic, we may be required to raise additional capital and our access to and cost of financing will depend on, among other things, global economic conditions, conditions in the global financing markets, the availability of sufficient amounts of financing, and our prospects. If we are unable to obtain additional funding as and when we need it, we will not be able to recommence operations or undertake our planned expansion.

14

If we do not receive additional financing when and as needed, we may not be able to continue the research, development and commercialization of our technology and products. In that case, our business and results of operations would be materially and adversely affected.

Our capital requirements have been and will continue to be significant. We will require substantial additional funds in excess of our current financial resources for research, development and commercialization of products, to obtain and maintain patents and other intellectual property rights in these technologies and products, and for working capital and other purposes, the timing and amount of which are difficult to ascertain. When we need additional funds, such funds may not be available on commercially reasonable terms or at all. If we cannot obtain additional funding when needed, our business and results of operation would be materially and adversely affected.

Our intellectual property rights are valuable, and any inability or failure to protect them could reduce the value of our products, services and brand, which would have a material adverse effect on our business.

Our patents, trademarks, and all of our other intellectual property rights are important assets for us. There are events that are outside of our control that pose a threat to our intellectual property rights. For example, effective intellectual property protection may not be available in every country in which our products and services are distributed or made available. Also, the efforts we have taken to protect our proprietary rights may not be sufficient or effective. Due to our lack of financial resources, we may not be able to adequately protect our technology portfolio or apply for new patents to extend our intellectual property portfolio. The expiration of patents in our patent portfolio may also have an adverse effect on our business. Any significant impairment of our intellectual property rights could harm our business and or our ability to compete. Protecting our intellectual property rights is costly and time consuming and we may need to resort to litigation to enforce our patent rights or to determine the scope and validity of third-party intellectual property rights and we may not have the financial resources to pay for such litigation. Some of our competitors may be able to sustain the costs of complex patent litigation more effectively than we can because they have substantially greater resources.

We seek to obtain patent protection for our innovations. It is possible, however, that some of these innovations may not be protectable. In addition, given the costs of obtaining patent protection, we may choose not to protect certain innovations that later turn out to be important. Furthermore, there is always the possibility, despite our efforts, that the scope of the protection gained will be insufficient or that an issued patent may be deemed invalid or unenforceable. Our inability or failure to protect our intellectual property rights could have a material adverse effect on our business by reducing the value of our products, services and brand.

We occasionally become subject to commercial disputes that could harm our business by distracting our management from the operation of our business, by increasing our expenses and, if we do not prevail, by subjecting us to potential monetary damages and other remedies.

From time to time, we are engaged in disputes regarding our commercial transactions. These disputes could result in monetary damages or other remedies that could adversely impact our financial position or operations. Even if we prevail in these disputes, they may distract our management from operating our business and the cost of defending these disputes would reduce our operating results.

We have been named as a party in various legal proceedings, and we may be named in additional litigation, all of which will require significant management time and attention, result in significant legal expenses and may result in an unfavorable outcome, which could have a material adverse effect on our business, operating results and financial condition.

We are and may become subject to various legal proceedings and claims that arise in or outside the ordinary course of business. Certain current lawsuits and pending proceedings are described under Part I, Item 3. “Legal Proceedings.”

The results of these lawsuits and future legal proceedings cannot be predicted with certainty. Also, our insurance coverage may be insufficient or not provide any coverage at all for certain claims, our assets may be insufficient to cover any amounts that exceed our insurance coverage, and we may have to pay damage awards or otherwise may enter into settlement arrangements in connection with such claims. Any such payments or settlement arrangements in current or future litigation could have a material adverse effect on our business, operating results or financial condition. Even if the plaintiffs’ claims are not successful, current future litigation could result in substantial costs and significantly and adversely impact our reputation and divert management’s attention and resources, which could have a material adverse effect on our business, operating results or financial condition. In addition, such lawsuits may make it more difficult to finance our operations.

15

We are currently party to litigation with a former director relating to approximately $11.3 million and approximately 3.33 million warrants which the director claims are owed to him and his affiliates. An adverse ruling on these claims in this litigation would materially and adversely affect our business results or operating and financial condition, dilute our shareholders’ equity interests in the Company and could adversely affect our stock price.