mtn-20230131false2023Q20000812011--07-3100008120112022-08-012023-01-3100008120112023-03-06xbrli:shares00008120112023-01-31iso4217:USD00008120112022-07-3100008120112022-01-31iso4217:USDxbrli:shares00008120112022-11-012023-01-3100008120112021-11-012022-01-3100008120112021-08-012022-01-310000812011us-gaap:CommonStockMember2021-10-310000812011mtn:ExchangeableSharesMember2021-10-310000812011us-gaap:AdditionalPaidInCapitalMember2021-10-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-10-310000812011us-gaap:RetainedEarningsMember2021-10-310000812011us-gaap:TreasuryStockMember2021-10-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2021-10-310000812011us-gaap:NoncontrollingInterestMember2021-10-3100008120112021-10-310000812011us-gaap:RetainedEarningsMember2021-11-012022-01-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2021-11-012022-01-310000812011us-gaap:NoncontrollingInterestMember2021-11-012022-01-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-11-012022-01-310000812011us-gaap:AdditionalPaidInCapitalMember2021-11-012022-01-310000812011us-gaap:CommonStockMember2021-11-012022-01-310000812011us-gaap:CommonStockMember2022-01-310000812011mtn:ExchangeableSharesMember2022-01-310000812011us-gaap:AdditionalPaidInCapitalMember2022-01-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-310000812011us-gaap:RetainedEarningsMember2022-01-310000812011us-gaap:TreasuryStockMember2022-01-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2022-01-310000812011us-gaap:NoncontrollingInterestMember2022-01-310000812011us-gaap:CommonStockMember2022-10-310000812011mtn:ExchangeableSharesMember2022-10-310000812011us-gaap:AdditionalPaidInCapitalMember2022-10-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-310000812011us-gaap:RetainedEarningsMember2022-10-310000812011us-gaap:TreasuryStockMember2022-10-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2022-10-310000812011us-gaap:NoncontrollingInterestMember2022-10-3100008120112022-10-310000812011us-gaap:RetainedEarningsMember2022-11-012023-01-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2022-11-012023-01-310000812011us-gaap:NoncontrollingInterestMember2022-11-012023-01-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-11-012023-01-310000812011us-gaap:AdditionalPaidInCapitalMember2022-11-012023-01-310000812011us-gaap:CommonStockMember2022-11-012023-01-310000812011us-gaap:CommonStockMember2023-01-310000812011mtn:ExchangeableSharesMember2023-01-310000812011us-gaap:AdditionalPaidInCapitalMember2023-01-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-310000812011us-gaap:RetainedEarningsMember2023-01-310000812011us-gaap:TreasuryStockMember2023-01-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2023-01-310000812011us-gaap:NoncontrollingInterestMember2023-01-310000812011us-gaap:CommonStockMember2021-07-310000812011mtn:ExchangeableSharesMember2021-07-310000812011us-gaap:AdditionalPaidInCapitalMember2021-07-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-07-310000812011us-gaap:RetainedEarningsMember2021-07-310000812011us-gaap:TreasuryStockMember2021-07-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2021-07-310000812011us-gaap:NoncontrollingInterestMember2021-07-3100008120112021-07-310000812011us-gaap:RetainedEarningsMember2021-08-012022-01-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2021-08-012022-01-310000812011us-gaap:NoncontrollingInterestMember2021-08-012022-01-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-08-012022-01-310000812011us-gaap:AdditionalPaidInCapitalMember2021-08-012022-01-310000812011us-gaap:CommonStockMember2021-08-012022-01-310000812011us-gaap:CommonStockMember2022-07-310000812011mtn:ExchangeableSharesMember2022-07-310000812011us-gaap:AdditionalPaidInCapitalMember2022-07-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-310000812011us-gaap:RetainedEarningsMember2022-07-310000812011us-gaap:TreasuryStockMember2022-07-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2022-07-310000812011us-gaap:NoncontrollingInterestMember2022-07-310000812011us-gaap:RetainedEarningsMember2022-08-012023-01-310000812011mtn:TotalVailResortsIncStockholdersEquityMember2022-08-012023-01-310000812011us-gaap:NoncontrollingInterestMember2022-08-012023-01-310000812011us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-08-012023-01-310000812011us-gaap:AdditionalPaidInCapitalMember2022-08-012023-01-310000812011us-gaap:CommonStockMember2022-08-012023-01-310000812011mtn:A6.25NotesMember2023-01-310000812011mtn:A00ConvertibleNotesMember2023-01-310000812011mtn:EPRSecuredNotesMember2023-01-310000812011srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate202006Member2022-08-0100008120112022-08-010000812011mtn:LiftTicketsMember2022-11-012023-01-310000812011mtn:LiftTicketsMember2021-11-012022-01-310000812011mtn:LiftTicketsMember2022-08-012023-01-310000812011mtn:LiftTicketsMember2021-08-012022-01-310000812011mtn:SkiSchoolMember2022-11-012023-01-310000812011mtn:SkiSchoolMember2021-11-012022-01-310000812011mtn:SkiSchoolMember2022-08-012023-01-310000812011mtn:SkiSchoolMember2021-08-012022-01-310000812011mtn:DiningMember2022-11-012023-01-310000812011mtn:DiningMember2021-11-012022-01-310000812011mtn:DiningMember2022-08-012023-01-310000812011mtn:DiningMember2021-08-012022-01-310000812011mtn:RetailRentalMember2022-11-012023-01-310000812011mtn:RetailRentalMember2021-11-012022-01-310000812011mtn:RetailRentalMember2022-08-012023-01-310000812011mtn:RetailRentalMember2021-08-012022-01-310000812011mtn:OtherMountainRevenueMember2022-11-012023-01-310000812011mtn:OtherMountainRevenueMember2021-11-012022-01-310000812011mtn:OtherMountainRevenueMember2022-08-012023-01-310000812011mtn:OtherMountainRevenueMember2021-08-012022-01-310000812011mtn:OwnedHotelRevenueMember2022-11-012023-01-310000812011mtn:OwnedHotelRevenueMember2021-11-012022-01-310000812011mtn:OwnedHotelRevenueMember2022-08-012023-01-310000812011mtn:OwnedHotelRevenueMember2021-08-012022-01-310000812011mtn:ManagedcondominiumroomsMember2022-11-012023-01-310000812011mtn:ManagedcondominiumroomsMember2021-11-012022-01-310000812011mtn:ManagedcondominiumroomsMember2022-08-012023-01-310000812011mtn:ManagedcondominiumroomsMember2021-08-012022-01-310000812011mtn:TransportationMember2022-11-012023-01-310000812011mtn:TransportationMember2021-11-012022-01-310000812011mtn:TransportationMember2022-08-012023-01-310000812011mtn:TransportationMember2021-08-012022-01-310000812011mtn:GolfMember2022-11-012023-01-310000812011mtn:GolfMember2021-11-012022-01-310000812011mtn:GolfMember2022-08-012023-01-310000812011mtn:GolfMember2021-08-012022-01-310000812011mtn:OtherLodgingRevenueMember2022-11-012023-01-310000812011mtn:OtherLodgingRevenueMember2021-11-012022-01-310000812011mtn:OtherLodgingRevenueMember2022-08-012023-01-310000812011mtn:OtherLodgingRevenueMember2021-08-012022-01-310000812011mtn:LodgingrevenueexcludingpayrollcostreimbursementsMember2022-11-012023-01-310000812011mtn:LodgingrevenueexcludingpayrollcostreimbursementsMember2021-11-012022-01-310000812011mtn:LodgingrevenueexcludingpayrollcostreimbursementsMember2022-08-012023-01-310000812011mtn:LodgingrevenueexcludingpayrollcostreimbursementsMember2021-08-012022-01-310000812011mtn:PayrollcostreimbursementsMember2022-11-012023-01-310000812011mtn:PayrollcostreimbursementsMember2021-11-012022-01-310000812011mtn:PayrollcostreimbursementsMember2022-08-012023-01-310000812011mtn:PayrollcostreimbursementsMember2021-08-012022-01-31xbrli:pure0000812011us-gaap:CommonStockMember2016-10-172016-10-170000812011mtn:ExchangeableSharesMember2016-10-172016-10-170000812011us-gaap:ConvertibleDebtMember2020-12-180000812011srt:ScenarioForecastMember2023-03-072023-03-070000812011us-gaap:SubsequentEventMember2023-03-072023-03-070000812011srt:ScenarioForecastMember2023-04-112023-04-110000812011srt:ScenarioForecastMember2023-03-272023-03-270000812011mtn:TermLoanMember2022-08-012023-01-310000812011mtn:TermLoanMember2023-01-310000812011mtn:TermLoanMember2022-07-310000812011mtn:TermLoanMember2022-01-310000812011us-gaap:LineOfCreditMember2022-08-012023-01-310000812011us-gaap:LineOfCreditMember2023-01-310000812011us-gaap:LineOfCreditMember2022-07-310000812011us-gaap:LineOfCreditMember2022-01-310000812011mtn:A6.25NotesMember2022-08-012023-01-310000812011mtn:A6.25NotesMember2022-07-310000812011mtn:A6.25NotesMember2022-01-310000812011us-gaap:ConvertibleNotesPayableMember2022-08-012023-01-310000812011us-gaap:ConvertibleNotesPayableMember2023-01-310000812011us-gaap:ConvertibleNotesPayableMember2022-07-310000812011us-gaap:ConvertibleNotesPayableMember2022-01-310000812011mtn:WhistlerCreditAgreementrevolverMember2022-08-012023-01-310000812011mtn:WhistlerCreditAgreementrevolverMember2023-01-310000812011mtn:WhistlerCreditAgreementrevolverMember2022-07-310000812011mtn:WhistlerCreditAgreementrevolverMember2022-01-310000812011srt:MinimumMembermtn:EPRSecuredNotesMember2022-08-012023-01-310000812011srt:MaximumMembermtn:EPRSecuredNotesMember2022-08-012023-01-310000812011mtn:EPRSecuredNotesMember2022-07-310000812011mtn:EPRSecuredNotesMember2022-01-310000812011mtn:AndermattSedrunMember2022-08-012023-01-310000812011mtn:AndermattSedrunMember2023-01-310000812011mtn:AndermattSedrunMember2022-07-310000812011mtn:AndermattSedrunMember2022-01-310000812011srt:MinimumMembermtn:EmployeeHousingBondsMember2022-08-012023-01-310000812011srt:MaximumMembermtn:EmployeeHousingBondsMember2022-08-012023-01-310000812011mtn:EmployeeHousingBondsMember2023-01-310000812011mtn:EmployeeHousingBondsMember2022-07-310000812011mtn:EmployeeHousingBondsMember2022-01-310000812011mtn:CanyonsObligationMember2022-08-012023-01-310000812011mtn:CanyonsObligationMember2023-01-310000812011mtn:CanyonsObligationMember2022-07-310000812011mtn:CanyonsObligationMember2022-01-310000812011mtn:WhistlerEmployeeHousingLeasesMember2022-08-012023-01-310000812011mtn:WhistlerEmployeeHousingLeasesMember2023-01-310000812011mtn:WhistlerEmployeeHousingLeasesMember2022-07-310000812011mtn:WhistlerEmployeeHousingLeasesMember2022-01-310000812011srt:MinimumMembermtn:OtherDebtMember2022-08-012023-01-310000812011srt:MaximumMembermtn:OtherDebtMember2022-08-012023-01-310000812011mtn:OtherDebtMember2023-01-310000812011mtn:OtherDebtMember2022-07-310000812011mtn:OtherDebtMember2022-01-310000812011us-gaap:LineOfCreditMember2022-11-012023-01-3100008120112020-12-180000812011mtn:WhistlerCreditAgreementrevolverMember2022-11-012023-01-31iso4217:CAD0000812011mtn:WhistlerCreditAgreementrevolverMember2022-08-012023-01-310000812011mtn:AlpineValleySecuredNoteMember2023-01-310000812011mtn:BostonMillsBrandywineSecuredNoteMember2023-01-310000812011mtn:JackFrostBigBoulderSecuredNoteMember2023-01-310000812011mtn:MountSnowSecuredNoteMember2023-01-310000812011mtn:HunterMountainSecuredNoteMember2023-01-310000812011mtn:EPRSecuredNotesMember2022-08-012023-01-3100008120112022-08-03iso4217:CHF0000812011mtn:AndermattSedrunNRPLoan2023-01-310000812011mtn:AndermattSedrunMember2022-08-0300008120112022-08-012022-10-310000812011mtn:AndermattSedrunMember2022-08-032022-08-0300008120112022-08-032022-08-030000812011mtn:SevenSpringsMember2021-12-312021-12-3100008120112021-12-312021-12-310000812011mtn:SevenSpringsMember2021-12-310000812011mtn:SevenSpringsMember2021-08-012022-07-310000812011mtn:MountainMember2022-07-310000812011mtn:LodgingMember2022-07-310000812011mtn:MountainMember2022-08-012023-01-310000812011mtn:LodgingMember2022-08-012023-01-310000812011mtn:MountainMember2023-01-310000812011mtn:LodgingMember2023-01-310000812011us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2023-01-310000812011us-gaap:CommercialPaperMember2023-01-310000812011us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMember2023-01-310000812011us-gaap:CertificatesOfDepositMember2023-01-310000812011us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMember2023-01-310000812011us-gaap:FairValueInputsLevel2Member2023-01-310000812011us-gaap:FairValueInputsLevel3Member2023-01-310000812011us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2022-07-310000812011us-gaap:CommercialPaperMember2022-07-310000812011us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMember2022-07-310000812011us-gaap:CertificatesOfDepositMember2022-07-310000812011us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMember2022-07-310000812011us-gaap:FairValueInputsLevel2Member2022-07-310000812011us-gaap:FairValueInputsLevel3Member2022-07-310000812011us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2022-01-310000812011us-gaap:CommercialPaperMember2022-01-310000812011us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMember2022-01-310000812011us-gaap:CertificatesOfDepositMember2022-01-310000812011us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMember2022-01-310000812011us-gaap:FairValueInputsLevel2Member2022-01-310000812011us-gaap:FairValueInputsLevel3Member2022-01-310000812011mtn:CanyonsObligationMember2022-08-012023-01-310000812011mtn:HollandCreekMetropolitanDistrictMember2022-08-012023-01-310000812011mtn:HollandCreekMetropolitanDistrictMember2023-01-310000812011mtn:RedSkyRanchMetropolitanDistrictMember2023-01-310000812011mtn:RedSkyRanchMetropolitanDistrictMember2022-07-310000812011mtn:RedSkyRanchMetropolitanDistrictMember2022-01-310000812011mtn:RedSkyRanchMetropolitanDistrictMember2022-08-012023-01-310000812011mtn:EmployeeHousingBondsMember2023-01-310000812011mtn:WorkersCompensationAndGeneralLiabilityRelatedToConstructionAndDevelopmentActivitiesMember2023-01-310000812011mtn:MountainMember2022-11-012023-01-310000812011mtn:MountainMember2021-11-012022-01-310000812011mtn:MountainMember2021-08-012022-01-310000812011mtn:LodgingMember2022-11-012023-01-310000812011mtn:LodgingMember2021-11-012022-01-310000812011mtn:LodgingMember2021-08-012022-01-310000812011mtn:ResortMember2022-11-012023-01-310000812011mtn:ResortMember2021-11-012022-01-310000812011mtn:ResortMember2022-08-012023-01-310000812011mtn:ResortMember2021-08-012022-01-310000812011mtn:RealEstateSegmentMember2022-11-012023-01-310000812011mtn:RealEstateSegmentMember2021-11-012022-01-310000812011mtn:RealEstateSegmentMember2022-08-012023-01-310000812011mtn:RealEstateSegmentMember2021-08-012022-01-3100008120112006-03-0900008120112008-07-1600008120112015-12-040000812011srt:ScenarioForecastMember2023-03-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended January 31, 2023

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-09614

Vail Resorts, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | |

| Delaware | | 51-0291762 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

| | |

| 390 Interlocken Crescent | | |

| Broomfield, | Colorado | | 80021 |

| (Address of Principal Executive Offices) | | (Zip Code) |

| | | | | |

| (303) | 404-1800 |

| (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.01 par value | MTN | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☒ | | Accelerated filer | | ☐ |

| | | |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | | | | |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

As of March 6, 2023, 40,330,446 shares of the registrant’s common stock were outstanding.

Table of Contents

| | | | | | | | |

| | |

| PART I | FINANCIAL INFORMATION | Page |

| | |

| Item 1. | Financial Statements (unaudited). | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| PART II | OTHER INFORMATION | |

| | |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Item 5. | | |

| Item 6. | | |

Vail Resorts, Inc.

Consolidated Condensed Balance Sheets

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | January 31, 2023 | | July 31, 2022 | | January 31, 2022 |

| Assets | | | | | | |

| Current assets: | | | | | | |

| Cash and cash equivalents | | $ | 1,295,252 | | | $ | 1,107,427 | | | $ | 1,407,019 | |

| Restricted cash | | 24,103 | | | 18,680 | | | 15,643 | |

| Trade receivables, net | | 160,393 | | | 383,425 | | | 167,088 | |

| Inventories, net | | 122,088 | | | 108,723 | | | 104,573 | |

| Other current assets | | 158,295 | | | 173,277 | | | 73,104 | |

| Total current assets | | 1,760,131 | | | 1,791,532 | | | 1,767,427 | |

Property, plant and equipment, net (Note 7) | | 2,421,395 | | | 2,118,052 | | | 2,190,332 | |

| Real estate held for sale or investment | | 90,354 | | | 95,983 | | | 95,331 | |

Goodwill, net (Note 7) | | 1,723,019 | | | 1,754,928 | | | 1,764,106 | |

| Intangible assets, net | | 310,666 | | | 314,058 | | | 318,078 | |

| Operating right-of-use assets | | 200,667 | | | 192,070 | | | 198,672 | |

| Other assets | | 58,730 | | | 51,405 | | | 35,796 | |

| Total assets | | $ | 6,564,962 | | | $ | 6,318,028 | | | $ | 6,369,742 | |

| Liabilities and Stockholders’ Equity | | | | | | |

| Current liabilities: | | | | | | |

Accounts payable and accrued liabilities (Note 7) | | $ | 1,144,795 | | | $ | 942,830 | | | $ | 1,067,137 | |

| Income taxes payable | | 73,559 | | | 104,275 | | | 24,153 | |

Long-term debt due within one year (Note 5) | | 69,582 | | | 63,749 | | | 63,746 | |

| Total current liabilities | | 1,287,936 | | | 1,110,854 | | | 1,155,036 | |

Long-term debt, net (Note 5) | | 2,789,827 | | | 2,670,300 | | | 2,695,589 | |

| Operating lease liabilities | | 184,298 | | | 174,567 | | | 188,797 | |

| Other long-term liabilities | | 237,478 | | | 246,359 | | | 254,209 | |

| Deferred income taxes, net | | 288,072 | | | 268,464 | | | 282,427 | |

| Total liabilities | | 4,787,611 | | | 4,470,544 | | | 4,576,058 | |

Commitments and contingencies (Note 9) | | | | | | |

| Stockholders’ equity: | | | | | | |

Preferred stock, $0.01 par value, 25,000 shares authorized, no shares issued and outstanding | | — | | | — | | | — | |

Common stock, $0.01 par value, 100,000 shares authorized, 46,795, 46,744 and 46,713 shares issued, respectively | | 468 | | | 467 | | | 467 | |

Exchangeable shares, $0.01 par value, 0, 3 and 33 shares issued and outstanding, respectively (Note 4) | | — | | | — | | | — | |

| Additional paid-in capital | | 1,112,519 | | | 1,184,577 | | | 1,172,595 | |

| Accumulated other comprehensive (loss) income | | (8,565) | | | 10,923 | | | 10,418 | |

| Retained earnings | | 837,573 | | | 895,889 | | | 786,473 | |

Treasury stock, at cost, 6,466, 6,466 and 6,161 shares, respectively (Note 11) | | (479,417) | | | (479,417) | | | (404,411) | |

| Total Vail Resorts, Inc. stockholders’ equity | | 1,462,578 | | | 1,612,439 | | | 1,565,542 | |

| Noncontrolling interests | | 314,773 | | | 235,045 | | | 228,142 | |

| Total stockholders’ equity | | 1,777,351 | | | 1,847,484 | | | 1,793,684 | |

| Total liabilities and stockholders’ equity | | $ | 6,564,962 | | | $ | 6,318,028 | | | $ | 6,369,742 | |

The accompanying Notes are an integral part of these unaudited consolidated condensed financial statements.

Vail Resorts, Inc.

Consolidated Condensed Statements of Operations

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended January 31, | | Six Months Ended January 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net revenue: | | | | | | | |

| Mountain and Lodging services and other | $ | 901,837 | | | $ | 770,300 | | | $ | 1,112,223 | | | $ | 892,160 | |

| Mountain and Lodging retail and dining | 192,182 | | | 136,055 | | | 261,130 | | | 189,456 | |

| Resort net revenue | 1,094,019 | | | 906,355 | | | 1,373,353 | | | 1,081,616 | |

| Real Estate | 7,699 | | 180 | | | 7,812 | | | 495 | |

| Total net revenue | 1,101,718 | | | 906,535 | | | 1,381,165 | | | 1,082,111 | |

| Operating expense (exclusive of depreciation and amortization shown separately below): | | | | | | | |

| Mountain and Lodging operating expense | 507,216 | | | 364,336 | | | 749,502 | | | 548,061 | |

| Mountain and Lodging retail and dining cost of products sold | 75,431 | | | 53,715 | | | 110,516 | | | 77,944 | |

| General and administrative | 116,616 | | | 91,261 | | | 215,415 | | | 168,495 | |

| Resort operating expense | 699,263 | | | 509,312 | | | 1,075,433 | | | 794,500 | |

| Real Estate operating expense | 6,310 | | | 1,511 | | | 7,692 | | | 2,981 | |

| Total segment operating expense | 705,573 | | | 510,823 | | | 1,083,125 | | | 797,481 | |

| Other operating (expense) income: | | | | | | | |

| Depreciation and amortization | (65,989) | | | (62,070) | | | (130,603) | | | (123,559) | |

| Gain on sale of real property | 757 | | | 931 | | | 757 | | | 962 | |

Change in estimated fair value of contingent consideration (Note 8) | (1,100) | | | (16,780) | | | (1,736) | | | (18,780) | |

| (Loss) gain on disposal of fixed assets and other, net | (1,780) | | | 7,347 | | | (1,786) | | | 16,214 | |

| Income from operations | 328,033 | | | 325,140 | | | 164,672 | | | 159,467 | |

| Mountain equity investment income, net | 42 | | | 818 | | | 388 | | | 2,332 | |

| Investment income and other, net | 7,108 | | | 257 | | | 9,994 | | | 756 | |

Foreign currency gain (loss) on intercompany loans (Note 5) | 2,338 | | | (2,870) | | | (3,797) | | | (2,039) | |

| Interest expense, net | (38,370) | | | (37,366) | | | (73,672) | | | (76,911) | |

| Income before (provision for) benefit from income taxes | 299,151 | | | 285,979 | | | 97,585 | | | 83,605 | |

| (Provision for) benefit from income taxes | (79,032) | | | (52,049) | | | (21,026) | | | 7,804 | |

| Net income | 220,119 | | | 233,930 | | | 76,559 | | | 91,409 | |

| Net income attributable to noncontrolling interests | (11,440) | | | (10,539) | | | (4,851) | | | (7,350) | |

| Net income attributable to Vail Resorts, Inc. | $ | 208,679 | | | $ | 223,391 | | | $ | 71,708 | | | $ | 84,059 | |

Per share amounts (Note 4): | | | | | | | |

| Basic net income per share attributable to Vail Resorts, Inc. | $ | 5.17 | | | $ | 5.51 | | | $ | 1.78 | | | $ | 2.08 | |

| Diluted net income per share attributable to Vail Resorts, Inc. | $ | 5.16 | | | $ | 5.47 | | | $ | 1.77 | | | $ | 2.06 | |

| Cash dividends declared per share | $ | 1.91 | | | $ | 0.88 | | | $ | 3.82 | | | $ | 1.76 | |

The accompanying Notes are an integral part of these unaudited consolidated condensed financial statements.

Vail Resorts, Inc.

Consolidated Condensed Statements of Comprehensive Income

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended January 31, | | Six Months Ended January 31, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Net income | | $ | 220,119 | | | $ | 233,930 | | | $ | 76,559 | | | $ | 91,409 | |

| Foreign currency translation adjustments | | 82,468 | | | (48,857) | | | (35,340) | | | (33,720) | |

| Change in estimated fair value of hedging instruments, net of tax | | (2,787) | | | 4,483 | | | 5,220 | | | 8,828 | |

| Comprehensive income | | 299,800 | | | 189,556 | | | 46,439 | | | 66,517 | |

| Comprehensive (income) loss attributable to noncontrolling interests | | (30,778) | | | (436) | | | 5,781 | | | 161 | |

| Comprehensive income attributable to Vail Resorts, Inc. | | $ | 269,022 | | | $ | 189,120 | | | $ | 52,220 | | | $ | 66,678 | |

The accompanying Notes are an integral part of these unaudited consolidated condensed financial statements.

Vail Resorts, Inc.

Consolidated Condensed Statements of Stockholders’ Equity

(In thousands)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | Additional Paid in Capital | Accumulated Other Comprehensive Income (Loss) | Retained Earnings | Treasury Stock | Total Vail Resorts, Inc. Stockholders’ Equity | Noncontrolling Interests | Total Stockholders’ Equity |

| | Vail Resorts | Exchangeable | | | | | | | |

| Balance, October 31, 2021 | | $ | 466 | | $ | — | | $ | 1,192,901 | | $ | 44,689 | | $ | 598,796 | | $ | (404,411) | | $ | 1,432,441 | | $ | 233,989 | | $ | 1,666,430 | |

| Comprehensive income: | | | | | | | | | | |

| Net income | | — | | — | | — | | — | | 223,391 | | — | | 223,391 | | 10,539 | | 233,930 | |

| Foreign currency translation adjustments | | — | | — | | — | | (38,754) | | — | | — | | (38,754) | | (10,103) | | (48,857) | |

| Change in estimated fair value of hedging instruments, net of tax | | — | | — | | — | | 4,483 | | — | | — | | 4,483 | | — | | 4,483 | |

| Total comprehensive income | | | | | | | | 189,120 | | 436 | | 189,556 | |

| Stock-based compensation expense | | — | | — | | 6,479 | | — | | — | | — | | 6,479 | | — | | 6,479 | |

| Issuance of shares under share award plans, net of shares withheld for employee taxes | | 1 | | — | | (26,785) | | — | | — | | — | | (26,784) | | — | | (26,784) | |

| | | | | | | | | | |

Dividends (Note 4) | | — | | — | | — | | — | | (35,714) | | — | | (35,714) | | — | | (35,714) | |

| Distributions to noncontrolling interests, net | | — | | — | | — | | — | | — | | — | | — | | (6,283) | | (6,283) | |

| Balance, January 31, 2022 | | $ | 467 | | $ | — | | $ | 1,172,595 | | $ | 10,418 | | $ | 786,473 | | $ | (404,411) | | $ | 1,565,542 | | $ | 228,142 | | $ | 1,793,684 | |

| | | | | | | | | | |

| Balance, October 31, 2022 | | $ | 468 | | $ | — | | $ | 1,106,813 | | $ | (68,908) | | $ | 705,923 | | $ | (479,417) | | $ | 1,264,879 | | $ | 286,839 | | $ | 1,551,718 | |

| Comprehensive income: | | | | | | | | | | |

| Net income | | — | | — | | — | | — | | 208,679 | | — | | 208,679 | | 11,440 | | 220,119 | |

| Foreign currency translation adjustments | | — | | — | | — | | 63,130 | | — | | — | | 63,130 | | 19,338 | | 82,468 | |

| Change in estimated fair value of hedging instruments, net of tax | | — | | — | | — | | (2,787) | | — | | — | | (2,787) | | — | | (2,787) | |

| Total comprehensive income | | | | | | | | 269,022 | | 30,778 | | 299,800 | |

| Stock-based compensation expense | | — | | — | | 6,844 | | — | | — | | — | | 6,844 | | — | | 6,844 | |

| Issuance of shares under share award plans, net of shares withheld for employee taxes | | — | | — | | (1,138) | | — | | — | | — | | (1,138) | | — | | (1,138) | |

| | | | | | | | | | |

Dividends (Note 4) | | — | | — | | — | | — | | (77,029) | | — | | (77,029) | | — | | (77,029) | |

| | | | | | | | | | |

| | | | | | | | | | |

| Distributions to noncontrolling interests, net | | — | | — | | — | | — | | — | | — | | — | | (2,844) | | (2,844) | |

| Balance, January 31, 2023 | | $ | 468 | | $ | — | | $ | 1,112,519 | | $ | (8,565) | | $ | 837,573 | | $ | (479,417) | | $ | 1,462,578 | | $ | 314,773 | | $ | 1,777,351 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | Additional Paid in Capital | Accumulated Other Comprehensive Income (Loss) | Retained Earnings | Treasury Stock | Total Vail Resorts, Inc. Stockholders’ Equity | Noncontrolling Interests | Total Stockholders’ Equity |

| | Vail Resorts | Exchangeable | | | | | | | |

| Balance, July 31, 2021 | | $ | 466 | | $ | — | | $ | 1,196,993 | | $ | 27,799 | | $ | 773,752 | | $ | (404,411) | | $ | 1,594,599 | | $ | 234,469 | | $ | 1,829,068 | |

| Comprehensive income: | | | | | | | | | | |

| Net income | | — | | — | | — | | — | | 84,059 | | — | | 84,059 | | 7,350 | | 91,409 | |

| Foreign currency translation adjustments | | — | | — | | — | | (26,209) | | — | | — | | (26,209) | | (7,511) | | (33,720) | |

| Change in estimated fair value of hedging instruments, net of tax | | — | | — | | — | | 8,828 | | — | | — | | 8,828 | | — | | 8,828 | |

| Total comprehensive income | | | | | | | | 66,678 | | (161) | | 66,517 | |

| | | | | | | | | | |

| Stock-based compensation expense | | — | | — | | 12,904 | | — | | — | | — | | 12,904 | | — | | 12,904 | |

| Issuance of shares under share award plans, net of shares withheld for employee taxes | | 1 | | — | | (37,302) | | — | | — | | — | | (37,301) | | — | | (37,301) | |

| | | | | | | | | | |

Dividends (Note 4) | | — | | — | | — | | — | | (71,338) | | — | | (71,338) | | — | | (71,338) | |

| Distributions to noncontrolling interests, net | | — | | — | | — | | — | | — | | — | | — | | (6,166) | | (6,166) | |

| Balance, January 31, 2022 | | $ | 467 | | $ | — | | $ | 1,172,595 | | $ | 10,418 | | $ | 786,473 | | $ | (404,411) | | $ | 1,565,542 | | $ | 228,142 | | $ | 1,793,684 | |

| | | | | | | | | | |

| Balance, July 31, 2022 | | $ | 467 | | $ | — | | $ | 1,184,577 | | $ | 10,923 | | $ | 895,889 | | $ | (479,417) | | $ | 1,612,439 | | $ | 235,045 | | $ | 1,847,484 | |

| Comprehensive income: | | | | | | | | | | |

| Net income | | — | | — | | — | | — | | 71,708 | | — | | 71,708 | | 4,851 | | 76,559 | |

| Foreign currency translation adjustments | | — | | — | | — | | (24,708) | | — | | — | | (24,708) | | (10,632) | | (35,340) | |

| Change in estimated fair value of hedging instruments | | — | | — | | — | | 5,220 | | — | | — | | 5,220 | | — | | 5,220 | |

| Total comprehensive income | | | | | | | | 52,220 | | (5,781) | | 46,439 | |

| Stock-based compensation expense | | — | | — | | 13,189 | | — | | — | | — | | 13,189 | | — | | 13,189 | |

| Issuance of shares under share award plans, net of shares withheld for employee taxes | | 1 | | — | | (5,181) | | — | | — | | — | | (5,180) | | — | | (5,180) | |

| | | | | | | | | | |

| Dividends | | — | | — | | — | | — | | (154,047) | | — | | (154,047) | | — | | (154,047) | |

Cumulative effect of adoption of ASU 2020-06 (Notes 2 & 5) | | — | | — | | (80,066) | | — | | 24,023 | | — | | (56,043) | | — | | (56,043) | |

Estimated acquisition date fair value of noncontrolling interests (Note 6) | | — | | — | | — | | — | | — | | — | | — | | 91,524 | | 91,524 | |

| Distributions to noncontrolling interests, net | | — | | — | | — | | — | | — | | — | | — | | (6,015) | | (6,015) | |

| Balance, January 31, 2023 | | $ | 468 | | $ | — | | $ | 1,112,519 | | $ | (8,565) | | $ | 837,573 | | $ | (479,417) | | $ | 1,462,578 | | $ | 314,773 | | $ | 1,777,351 | |

The accompanying Notes are an integral part of these unaudited consolidated condensed financial statements.

Vail Resorts, Inc.

Consolidated Condensed Statements of Cash Flows

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | |

| | Six Months Ended January 31, |

| | | 2023 | | 2022 |

| Cash flows from operating activities: | | | | |

| Net income | | $ | 76,559 | | | $ | 91,409 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 130,603 | | | 123,559 | |

| | | | |

| Stock-based compensation expense | | 13,189 | | | 12,904 | |

| Deferred income taxes, net | | 19,947 | | | 9,214 | |

| Change in estimated fair value of contingent consideration | | 1,736 | | | 18,780 | |

| | | | |

| Other non-cash expense (income), net | | 866 | | | (602) | |

| Changes in assets and liabilities: | | | | |

| Trade receivables, net | | 226,796 | | | 178,252 | |

| Inventories, net | | (12,962) | | | (23,627) | |

| Accounts payable and accrued liabilities | | 96,247 | | | 89,502 | |

| Deferred revenue | | 104,996 | | | 147,614 | |

| | | | |

| Income taxes payable | | (31,166) | | | (7,581) | |

| Other assets and liabilities, net | | (21,318) | | | (28,095) | |

| Net cash provided by operating activities | | 605,493 | | | 611,329 | |

| Cash flows from investing activities: | | | | |

| Capital expenditures | | (206,554) | | | (128,854) | |

| Return of deposit for acquisition of business | | 114,506 | | | — | |

| Acquisition of businesses, net of cash acquired | | (38,567) | | | (118,099) | |

| Investments in short-term deposits | | (86,756) | | | — | |

| Other investing activities, net | | 11,346 | | | 21,421 | |

| Net cash used in investing activities | | (206,025) | | | (225,532) | |

| Cash flows from financing activities: | | | | |

| | | | |

| | | | |

| | | | |

| Repayments of borrowings under Vail Holdings Credit Agreement | | (31,250) | | | (31,250) | |

| Repayments of borrowings under Whistler Credit Agreement | | — | | | (23,145) | |

| Repayment of EB-5 Development Notes | | — | | | (51,500) | |

| Employee taxes paid for share award exercises | | (5,181) | | | (37,302) | |

| Dividends paid | | (154,047) | | | (71,338) | |

| | | | |

| Other financing activities, net | | (10,899) | | | (6,158) | |

| Net cash used in financing activities | | (201,377) | | | (220,693) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | | (4,843) | | | (1,016) | |

| Net increase in cash, cash equivalents and restricted cash | | 193,248 | | | 164,088 | |

| Cash, cash equivalents and restricted cash: | | | | |

| Beginning of period | | 1,126,107 | | | 1,258,574 | |

| End of period | | $ | 1,319,355 | | | $ | 1,422,662 | |

| | | | |

| Non-cash investing activities: | | | | |

| Accrued capital expenditures | | $ | 49,091 | | | $ | 17,388 | |

The accompanying Notes are an integral part of these unaudited consolidated condensed financial statements.

Vail Resorts, Inc.

Notes to Consolidated Condensed Financial Statements

(Unaudited)

1.Organization and Business

Vail Resorts, Inc. (“Vail Resorts”) is organized as a holding company and operates through various subsidiaries. Vail Resorts and its subsidiaries (collectively, the “Company”) operate in three business segments: Mountain, Lodging and Real Estate. The Company refers to “Resort” as the combination of the Mountain and Lodging segments.

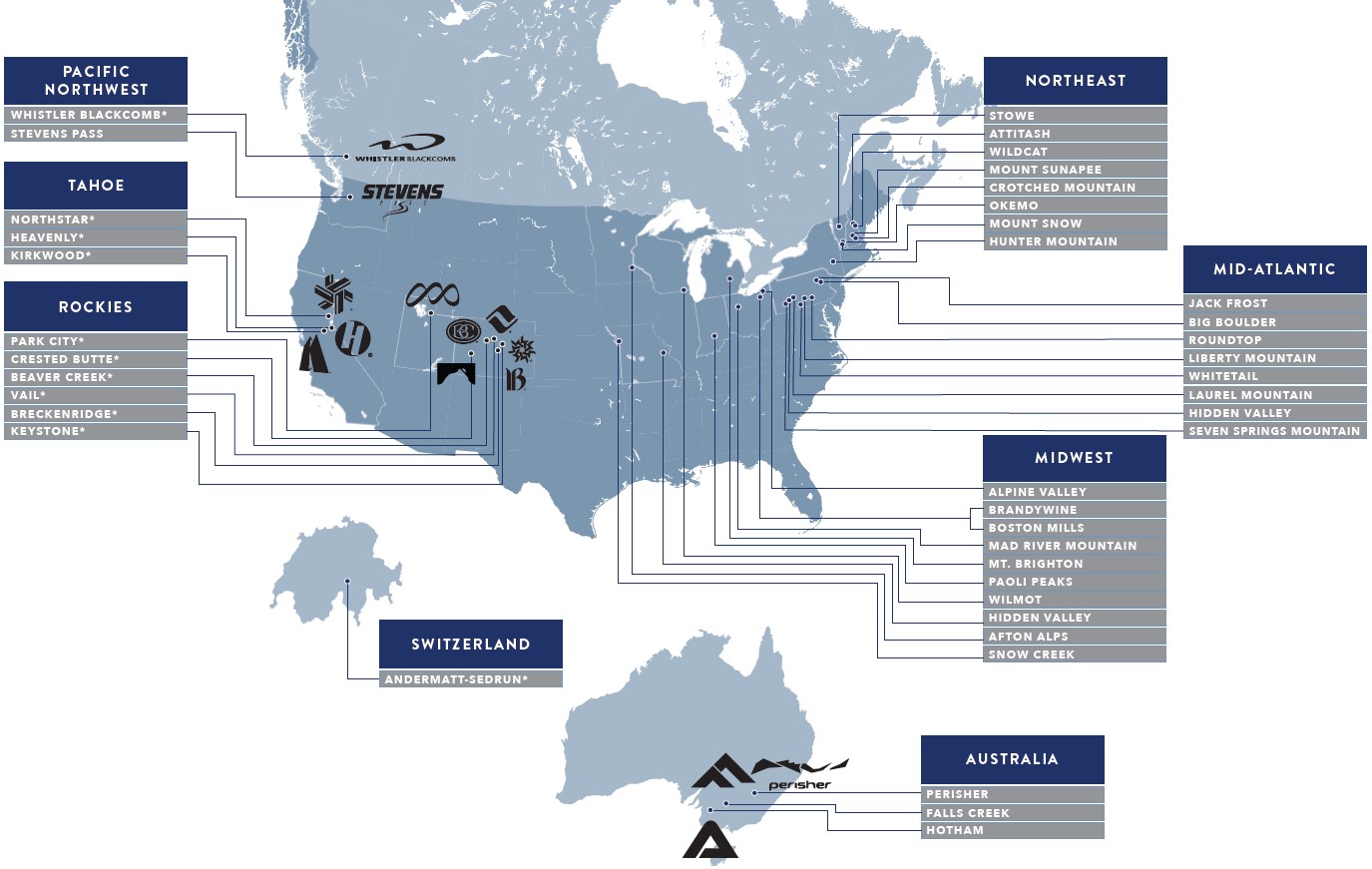

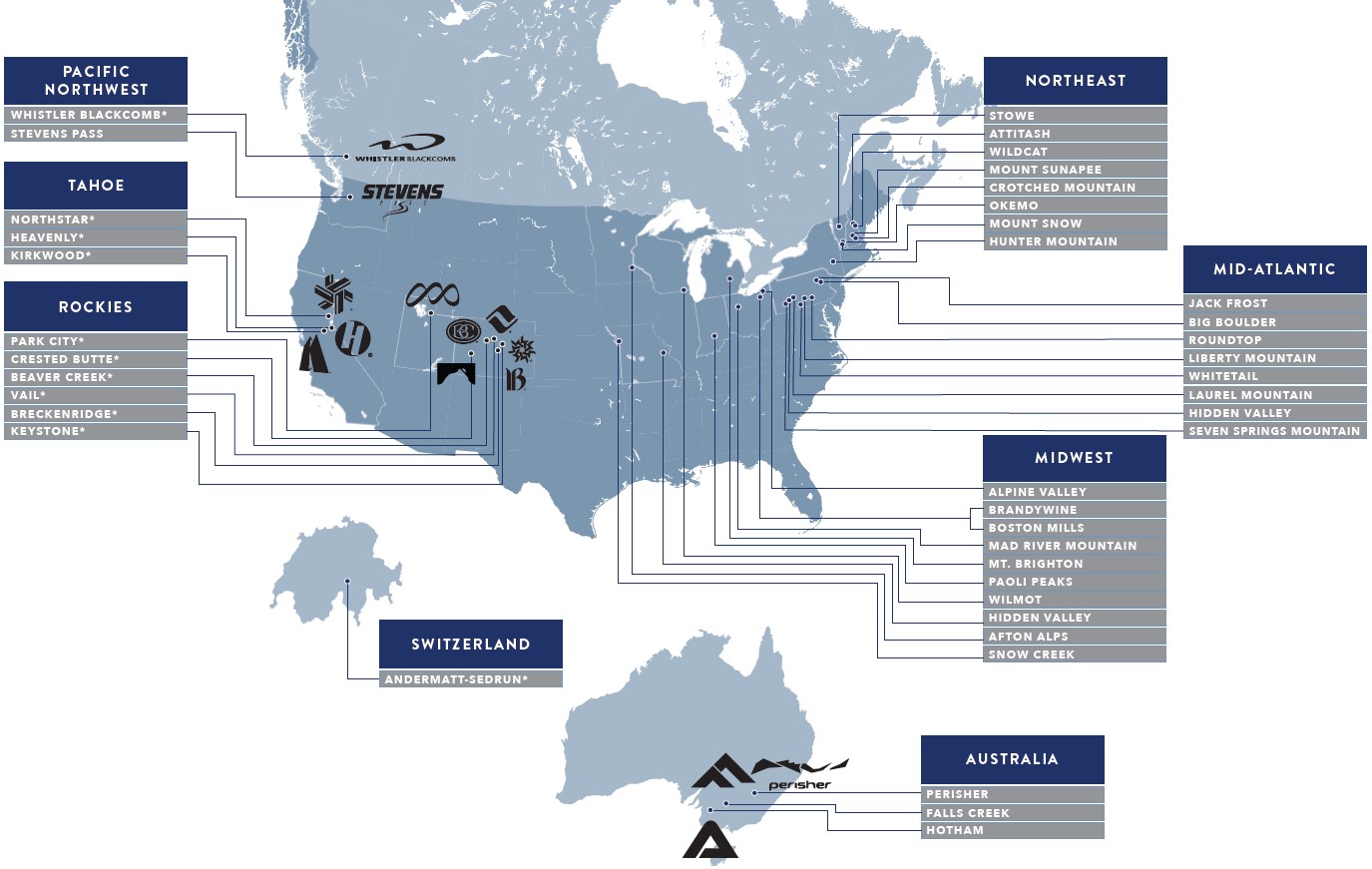

In the Mountain segment, the Company operates the following 41 destination mountain resorts and regional ski areas:

*Denotes a destination mountain resort, which generally receives a meaningful portion of skier visits from long-distance travelers, as opposed to the Company’s regional ski areas, which tend to generate skier visits predominantly from their respective local markets.

Additionally, the Mountain segment includes ancillary services, primarily including ski school, dining and retail/rental operations, and for the Company’s Australian ski areas, including lodging and transportation operations.

In the Lodging segment, the Company owns and/or manages a collection of luxury hotels and condominiums under its RockResorts brand; other strategic lodging properties and a large number of condominiums located in proximity to the Company’s North American mountain resorts; National Park Service (“NPS”) concessioner properties including the Grand Teton Lodge Company, which operates destination resorts in Grand Teton National Park; a Colorado resort ground transportation company and mountain resort golf courses.

Vail Resorts Development Company, a wholly-owned subsidiary, conducts the operations of the Company’s Real Estate segment, which owns, develops and sells real estate in and around the Company’s resort communities.

The Company’s mountain business and its lodging properties at or around the Company’s mountain resorts are seasonal in nature, and typically experience their peak operating seasons primarily from mid-December through mid-April in North America and Europe. The peak operating season at the Company’s Australian resorts, NPS concessioner properties and golf courses generally occurs from June to early October.

2. Summary of Significant Accounting Policies

Basis of Presentation

Consolidated Condensed Financial Statements — In the opinion of the Company, the accompanying Consolidated Condensed Financial Statements reflect all adjustments necessary to state fairly the Company’s financial position, results of operations and cash flows for the interim periods presented. All such adjustments are of a normal recurring nature. Results for interim periods are not indicative of the results for the entire fiscal year, particularly given the significant seasonality to the Company’s operating cycle. The accompanying Consolidated Condensed Financial Statements should be read in conjunction with the audited Consolidated Financial Statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended July 31, 2022. Certain information and footnote disclosures, including significant accounting policies, normally included in fiscal year financial statements prepared in accordance with accounting principles generally accepted in the U.S. (“GAAP”) have been condensed or omitted. The Consolidated Condensed Balance Sheet as of July 31, 2022 was derived from audited financial statements.

Use of Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the balance sheet date and the reported amounts of revenue and expenses during the reporting periods. Actual results could differ from those estimates.

Fair Value of Financial Instruments — The recorded amounts for cash and cash equivalents, restricted cash, trade receivables, other current assets, accounts payable and accrued liabilities approximate fair value due to their short-term nature. The fair value of amounts outstanding under the Company’s credit agreements and the Employee Housing Bonds (as defined in Note 5, Long-Term Debt) approximate book value due to the variable nature of the interest rate associated with the debt. The recorded amount outstanding under the Company’s NRP Loan (as defined in Note 5, Long-Term Debt), which was assumed by the Company during the six months ended January 31, 2023 approximates fair value as the debt obligation was recorded at estimated fair value in conjunction with the preliminary purchase accounting for the Andermatt-Sedrun acquisition (see Note 6, Acquisitions). The estimated fair values of the 6.25% Notes and the 0.0% Convertible Notes (each as defined in Note 5, Long-Term Debt) are based on quoted market prices (a Level 2 input). The estimated fair value of the EPR Secured Notes (as defined in Note 5, Long-Term Debt) has been estimated using analyses based on current borrowing rates for debt with similar remaining maturities and ratings (a Level 2 input). The carrying values, including any unamortized premium or discount, and estimated fair values of the 6.25% Notes, 0.0% Convertible Notes and EPR Secured Notes as of January 31, 2023 are presented below (in thousands):

| | | | | | | | | | | |

| January 31, 2023 |

| Carrying Value | | Estimated Fair Value |

| 6.25% Notes | $ | 600,000 | | | $ | 604,062 | |

| 0.0% Convertible Notes | $ | 575,000 | | | $ | 547,339 | |

| EPR Secured Notes | $ | 133,305 | | | $ | 161,156 | |

Recently Issued Accounting Standards

Adopted Standards

In March 2020, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2020-04, “Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting.” The ASU provides optional transition guidance, for a limited time, to companies that have contracts, hedging relationships or other transactions that reference the London Inter-bank Offered Rate (“LIBOR”) or another reference rate which is expected to be discontinued because of reference rate reform. The amendments provide optional expedients and exceptions for applying GAAP to contracts, hedging relationships, and other transactions if certain criteria are met. The amendments of ASU 2020-04 were effective as of March 12, 2020. In December 2022, the FASB issued ASU 2022-06, “Reference Rate Reform (Topic 848): Deferral of the Sunset Date of Topic 848,” which extended the effective date of the provisions of ASU 2020-04 to December 31, 2024. The amendments in this update may be applied as of any date from the beginning of an interim period that includes or

is subsequent to March 12, 2020, or prospectively from a date within an interim period that includes or is subsequent to March 12, 2020, up to the date that the financial statements are available to be issued. All other amendments should be applied on a prospective basis.

The Company is party to various interest rate swap agreements that hedge the variable interest rate component of underlying cash flows of $400.0 million in principal amount of its Vail Holdings Credit Agreement (as defined in Note 5, Long-Term Debt), which are designated as cash flow hedges. During the six months ended January 31, 2023, the Company entered into an amendment to its Vail Holdings Credit Agreement (the “Fifth Amendment”) to modify the calculation of interest under the Vail Holdings Credit Agreement from being calculated based on LIBOR to being calculated based on SOFR (see Note 5, Long-Term Debt, for additional information). Subsequent to the Fifth Amendment, the interest rate swaps were also amended to transition from a hedge of LIBOR to a hedge of SOFR. The Company elected certain optional expedients provided by Topic 848, which allowed the Company to not apply certain modification accounting requirements or reassess the previous accounting designation of the interest rate swap agreements as cash flow hedges.

In August 2020, the FASB issued ASU 2020-06, “Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity” which simplifies the guidance in Accounting Standards Codifications (“ASC”) 470-20, “Debt – Debt with Conversion and Other Options.” The guidance removes certain rules which required separation of the embedded conversion features from the host contract for convertible instruments. The updated guidance requires bifurcation only if the convertible debt feature qualifies as a derivative under ASC 815, “Derivatives and Hedging”, or for convertible debt issued at a substantial premium. The guidance also amends the guidance in ASC 815-40, “Derivatives and Hedging – Contracts in Entity’s Own Equity” for certain contracts in an entity’s own equity that are currently accounted for as derivatives. This standard is effective for fiscal years beginning after December 15, 2021, including interim periods within those fiscal years (the Company’s first quarter of the fiscal year ending July 31, 2023). This standard allows for a modified retrospective or fully retrospective method of transition. The Company adopted ASU 2020-06 on August 1, 2022 using the modified retrospective method, and therefore prior period financial information has not been retrospectively adjusted and continues to be reported under the accounting standards in effect for those periods.

Upon adoption of the standard, the Company reclassified the previously bifurcated equity component of its 0.0% Convertible Notes (as defined in Note 5, Long-Term Debt) to long-term debt, net, as the convertible option on the 0.0% Convertible Notes does not qualify as a derivatives under ASC 815 nor were the 0.0% Convertible Notes issued at a substantial premium. This reclassification was partially offset by an increase to retained earnings for the previously recognized non-cash interest expense, net of tax that had been recorded as a result of amortization of the previously recorded debt discount. The adoption of this new guidance eliminates the recognition of non-cash interest expense to be recognized in future periods due to removal of the debt discount associated with the 0.0% Convertible Notes.

The impact of adoption of ASU 2020-06 on the Consolidated Condensed Balance Sheet as of adoption date was as follows (in thousands):

| | | | | | | | | | | |

| As of August 1, 2022 |

| Balance Sheet | Balances without the Adoption of ASU 2020-06 | Adjustments | Balances with the adoption of ASU 2020-06 |

| Liabilities | | | |

| Long term debt, net | $ | 2,670,300 | | $ | 74,822 | | $ | 2,745,122 | |

| Deferred income taxes, net | $ | 268,464 | | $ | (18,779) | | $ | 249,685 | |

| Stockholders’ equity | | | |

| Additional paid-in capital | $ | 1,184,577 | | $ | (80,066) | | $ | 1,104,511 | |

| Retained earnings | $ | 895,889 | | $ | 24,023 | | $ | 919,912 | |

ASU 2020-06 also prohibits the use of the treasury stock method for convertible instruments for the purposes of calculating diluted earnings per share (“EPS”) and instead requires application of the if-converted method. Under the if-converted method, diluted EPS will generally be calculated assuming that all of the convertible debt instruments were converted solely into shares of common stock at the beginning of the reporting period unless the result would be anti-dilutive. Pursuant to the terms of the 0.0% Convertible Notes, the principal amount of the 0.0% Convertible Notes is required to be paid in cash and only the premium due upon conversion, if any, is permitted to be settled in shares, cash or a combination of shares and cash. Consequently, for the Company the if-converted method would produce a similar result as the treasury stock method, which was utilized for the calculation of diluted EPS prior to the adoption of ASU 2020-06 for the 0.0% Convertible Notes.

3. Revenues

Disaggregation of Revenues

The following table presents net revenues disaggregated by segment and major revenue type for the three and six months ended January 31, 2023 and 2022 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended January 31, | | Six Months Ended January 31, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Mountain net revenue: | | | | | | | | |

| Lift | | $ | 592,603 | | | $ | 521,582 | | | $ | 652,143 | | | $ | 535,911 | |

| Ski School | | 123,451 | | | 92,072 | | | 132,378 | | | 93,545 | |

| Dining | | 85,828 | | | 54,049 | | | 105,270 | | | 66,569 | |

| Retail/Rental | | 159,932 | | | 126,831 | | | 200,276 | | | 155,207 | |

| Other | | 51,628 | | | 39,841 | | | 125,092 | | | 92,443 | |

| Total Mountain net revenue | | $ | 1,013,442 | | | $ | 834,375 | | | $ | 1,215,159 | | | $ | 943,675 | |

| Lodging net revenue: | | | | | | | | |

| Owned hotel rooms | | $ | 13,479 | | | $ | 13,584 | | | $ | 37,044 | | | $ | 35,067 | |

| Managed condominium rooms | | 31,336 | | | 33,125 | | | 44,195 | | | 46,209 | |

| Dining | | 13,184 | | | 8,375 | | | 30,013 | | | 18,650 | |

| Transportation | | 5,888 | | | 5,766 | | | 7,348 | | | 7,559 | |

| Golf | | — | | | — | | | 5,939 | | | 5,118 | |

| Other | | 11,700 | | | 9,269 | | | 24,988 | | | 21,736 | |

| | 75,587 | | | 70,119 | | | 149,527 | | | 134,339 | |

| Payroll cost reimbursements | | 4,990 | | | 1,861 | | | 8,667 | | | 3,602 | |

| Total Lodging net revenue | | $ | 80,577 | | | $ | 71,980 | | | $ | 158,194 | | | $ | 137,941 | |

| Total Resort net revenue | | $ | 1,094,019 | | | $ | 906,355 | | | $ | 1,373,353 | | | $ | 1,081,616 | |

| Total Real Estate net revenue | | 7,699 | | | 180 | | | 7,812 | | | 495 | |

| Total net revenue | | $ | 1,101,718 | | | $ | 906,535 | | | $ | 1,381,165 | | | $ | 1,082,111 | |

Contract Balances

Deferred revenue balances of a short-term nature were $619.5 million and $511.3 million as of January 31, 2023 and July 31, 2022, respectively. For the three and six months ended January 31, 2023, the Company recognized approximately $220.1 million and $274.6 million, respectively, of revenue that was included in the deferred revenue balance as of July 31, 2022. Deferred revenue balances of a long-term nature, comprised primarily of long-term private club initiation fee revenue, were $113.3 million, $117.2 million and $120.6 million as of January 31, 2023, July 31, 2022 and January 31, 2022, respectively. As of January 31, 2023, the weighted average remaining period over which revenue for unsatisfied performance obligations on long-term private club contracts will be recognized was approximately 15 years. Trade receivables, net were $160.4 million and $383.4 million as of January 31, 2023 and July 31, 2022, respectively.

Costs to Obtain Contracts with Customers

As of January 31, 2023, $13.0 million of costs to obtain contracts with customers were recorded within other current assets on the Company’s Consolidated Condensed Balance Sheet. The amounts capitalized are subject to amortization generally beginning in the second quarter of fiscal 2023, commensurate with the revenue recognized for related pass products. The Company recorded amortization of $12.3 million for these costs during both the three and six months ended January 31, 2023, which was recorded within Mountain and Lodging operating expenses on the Company’s Consolidated Condensed Statement of Operations.

4. Net Income per Share

Earnings per Share

Basic EPS excludes dilution and is computed by dividing net income attributable to Vail Resorts stockholders by the weighted-average shares outstanding during the period. Diluted EPS reflects the potential dilution that could occur if securities or other contracts to issue common stock were exercised, resulting in the issuance of shares of common stock that would then share in the earnings of Vail Resorts.

In connection with the Company’s acquisition of Whistler Blackcomb in October 2016, the Company issued consideration in the form of shares of Vail Resorts common stock (the “Vail Shares”), redeemable preferred shares of the Company’s wholly-owned Canadian subsidiary Whistler Blackcomb Holdings Inc. (“Exchangeco”) or cash (or a combination thereof). Whistler Blackcomb shareholders elected to receive 3,327,719 Vail Shares and 418,095 shares of Exchangeco (the “Exchangeco Shares”). The Exchangeco Shares could be redeemed for Vail Shares at any time until October 2023 or until the Company elected to convert any remaining Exchangeco Shares to Vail Shares, which the Company had the ability to do once total Exchangeco Shares outstanding fell below 20,904 shares (or 5% of the total Exchangeco Shares originally issued). In July 2022, the number of outstanding Exchangeco Shares fell below such threshold and on August 25, 2022, the Company elected to redeem all outstanding Exchangeco Shares, effective September 26, 2022. As of January 31, 2023, all Exchangeco Shares have been exchanged for Vail Shares. Both Vail Shares and Exchangeco Shares have a par value of $0.01 per share, and Exchangeco Shares, while they were outstanding, were substantially the economic equivalent of the Vail Shares. The Company’s calculation of weighted-average shares outstanding includes the Exchangeco Shares.

Presented below is basic and diluted EPS for the three months ended January 31, 2023 and 2022 (in thousands, except per share amounts):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | Three Months Ended January 31, |

| | | 2023 | | 2022 |

| | | Basic | | Diluted | | Basic | | Diluted |

| Net income per share: | | | | | | | | |

| Net income attributable to Vail Resorts | | $ | 208,679 | | | $ | 208,679 | | | $ | 223,391 | | | $ | 223,391 | |

| Weighted-average Vail Shares outstanding | | 40,327 | | | 40,327 | | | 40,505 | | | 40,505 | |

| Weighted-average Exchangeco Shares outstanding | | — | | | — | | | 33 | | | 33 | |

| Total Weighted-average shares outstanding | | 40,327 | | | 40,327 | | | 40,538 | | | 40,538 | |

| Effect of dilutive securities | | — | | | 107 | | | — | | | 282 | |

| Total shares | | 40,327 | | | 40,434 | | | 40,538 | | | 40,820 | |

| Net income per share attributable to Vail Resorts | | $ | 5.17 | | | $ | 5.16 | | | $ | 5.51 | | | $ | 5.47 | |

The Company computes the effect of dilutive securities using the treasury stock method and average market prices during the period. The number of shares issuable upon the exercise of share-based awards excluded from the calculation of diluted EPS because the effect of their inclusion would have been anti-dilutive totaled approximately 25,000 and zero for the three months ended January 31, 2023 and 2022, respectively.

Presented below is basic and diluted EPS for the six months ended January 31, 2023 and 2022 (in thousands, except per share amounts):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | Six Months Ended January 31, |

| | | 2023 | | 2022 |

| | | Basic | | Diluted | | Basic | | Diluted |

| Net income per share: | | | | | | | | |

| Net income attributable to Vail Resorts | | $ | 71,708 | | | $ | 71,708 | | | $ | 84,059 | | | $ | 84,059 | |

| Weighted-average Vail Shares outstanding | | 40,312 | | | 40,312 | | | 40,460 | | | 40,460 | |

| Weighted-average Exchangeco Shares outstanding | | 1 | | | 1 | | | 33 | | | 33 | |

| Total Weighted-average shares outstanding | | 40,313 | | | 40,313 | | | 40,493 | | | 40,493 | |

| Effect of dilutive securities | | — | | | 95 | | | — | | | 344 | |

| Total shares | | 40,313 | | | 40,408 | | | 40,493 | | | 40,837 | |

| Net income per share attributable to Vail Resorts | | $ | 1.78 | | | $ | 1.77 | | | $ | 2.08 | | | $ | 2.06 | |

The number of shares issuable upon the exercise of share-based awards excluded from the calculation of diluted EPS because the effect of their inclusion would have been anti-dilutive totaled approximately 26,000 and 1,000 for the six months ended January 31, 2023 and 2022, respectively.

In December 2020, the Company completed an offering of $575.0 million in aggregate principal amount of 0.0% Convertible Notes (as defined in Note 5, Long-Term Debt). The Company is required to settle the principal amount of the 0.0% Convertible Notes in cash and has the option to settle the conversion spread in cash or shares. The Company uses the if-converted method to calculate the impact of convertible instruments on diluted EPS when the instruments may be settled in cash or shares. If the conversion value of the 0.0% Convertible Notes exceeds their conversion price, then the Company will calculate its diluted EPS as if all the notes were converted into common stock at the beginning of the period. However, if reflecting the 0.0% Convertible Notes in diluted EPS in this manner is anti-dilutive, or if the conversion value of the notes does not exceed their conversion price for a reporting period, then the shares underlying the notes will not be reflected in the Company’s calculation of diluted EPS. For the three and six months ended January 31, 2023 and 2022, the price of Vail Shares did not exceed the conversion price and therefore there was no impact to diluted EPS during those periods.

Dividends

During the three and six months ended January 31, 2023, the Company paid cash dividends of $1.91 and $3.82 per share, respectively ($77.0 million and $154.0 million, respectively). During the three and six months ended January 31, 2022, the Company paid cash dividends of $0.88 and $1.76 per share, respectively ($35.7 million and $71.3 million, respectively, including cash dividends paid to Exchangeco shareholders). On March 7, 2023, the Company’s Board of Directors approved a cash dividend of $2.06 per share payable on April 11, 2023 to stockholders of record as of March 27, 2023.

5. Long-Term Debt

Long-term debt, net as of January 31, 2023, July 31, 2022 and January 31, 2022 is summarized as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Maturity | | January 31, 2023 | | July 31, 2022 | | January 31, 2022 |

Vail Holdings Credit Agreement term loan (a) | | 2026 | | $ | 1,046,875 | | | $ | 1,078,125 | | | $ | 1,109,375 | |

Vail Holdings Credit Agreement revolver (a) | | 2026 | | — | | | — | | | — | |

| 6.25% Notes | | 2025 | | 600,000 | | | 600,000 | | | 600,000 | |

0.0% Convertible Notes (b) | | 2026 | | 575,000 | | | 575,000 | | | 575,000 | |

Whistler Credit Agreement revolver (c) | | 2026 | | 11,275 | | | 11,717 | | | 21,243 | |

| | | | | | | | |

EPR Secured Notes (d) | | 2034-2036 | | 114,162 | | | 114,162 | | | 114,162 | |

| | | | | | | | |

NRP Loan (e) | | 2036 | | 39,967 | | | — | | | — | |

| Employee housing bonds | | 2027-2039 | | 52,575 | | | 52,575 | | | 52,575 | |

| Canyons obligation | | 2063 | | 360,497 | | | 357,607 | | | 354,713 | |

Whistler Blackcomb employee housing leases (f) | | 2042 | | 29,346 | | | — | | | — | |

| Other | | 2023-2036 | | 37,633 | | | 17,860 | | | 17,562 | |

| Total debt | | | | 2,867,330 | | | 2,807,046 | | | 2,844,630 | |

Less: Unamortized premiums, discounts and debt issuance costs (b) | | | | 7,921 | | | 72,997 | | | 85,295 | |

Less: Current maturities (g) | | | | 69,582 | | | 63,749 | | | 63,746 | |

| Long-term debt, net | | | | $ | 2,789,827 | | | $ | 2,670,300 | | | $ | 2,695,589 | |

(a)On August 31, 2022, Vail Holdings, Inc. (“VHI”) entered into the Fifth Amendment to the Vail Holdings Credit Agreement, which extended the maturity date to September 23, 2026. Additionally, the Fifth Amendment contains customary LIBOR replacement language, including, but not limited to, the use of rates based on the secured overnight financing rate (“SOFR”). SOFR is a broad measure of the cost of borrowing cash in the overnight U.S. Treasury repo market and is administered by the Federal Reserve Bank of New York. The Fifth Amendment modified the calculation of interest under the Vail Holdings Credit Agreement from being calculated based on LIBOR to being calculated based on SOFR. No other material terms of the Vail Holdings Credit Agreement were amended.

The Company is party to various interest rate swap agreements which hedge the cash flows associated with the SOFR-based variable interest rate component of $400.0 million in principal amount of its Vail Holdings Credit Agreement until September 23, 2024. Subsequent to the Fifth Amendment, these interest rate swaps were amended to transition from a hedge of LIBOR to a hedge of SOFR.

As of January 31, 2023, the Vail Holdings Credit Agreement consists of a $500.0 million revolving credit facility and a term loan facility with $1.0 billion outstanding. The term loan facility is subject to quarterly amortization of principal of approximately $15.6 million, in equal installments, for a total of 5% of principal payable in each year and the final payment of all amounts outstanding, plus accrued and unpaid interest due in September 2026. The proceeds of the loans made under the Vail Holdings Credit Agreement may be used to fund the Company’s working capital needs, capital expenditures, acquisitions, investments and other general corporate purposes, including the issuance of letters of credit. Borrowings under the Vail Holdings Credit Agreement, including the term loan facility, bear interest annually at SOFR plus a spread of 1.35% as of January 31, 2023 (5.91% as of January 31, 2023). Interest rate margins may fluctuate based upon the ratio of the Company’s Net Funded Debt to Adjusted EBITDA on a trailing four-quarter basis. The Vail Holdings Credit Agreement also includes a quarterly unused commitment fee, which is equal to a percentage determined by the Net Funded Debt to Adjusted EBITDA ratio, as each such term is defined in the Vail Holdings Credit Agreement, multiplied by the daily amount by which the Vail Holdings Credit Agreement commitment exceeds the total of outstanding loans and outstanding letters of credit (0.25% as of January 31, 2023).

(b)The Company issued $575.0 million in aggregate principal amount of 0.0% Convertible Notes due 2026 (the “0.0% Convertible Notes) under an indenture dated December 18, 2020. Under previous accounting guidance, the Company bifurcated the proceeds of the 0.0% Convertible Notes by estimating the fair value of the 0.0% Convertible Notes at issuance and allocating that portion to long-term debt, net, with the excess being recorded within additional paid-in capital. The Company adopted ASU 2020-06 on August 1, 2022 using the modified retrospective method, and as a result, the Company reclassified the equity component of its 0.0% Convertible Notes to long-term debt, net, and will no longer record non-cash interest expense related to the amortization of the debt discount. Refer to Note 2, Summary of Significant Accounting Policies, for further information on ASU 2020-06. As of January 31, 2023, the conversion price of the 0.0% Convertible Notes, adjusted for cash dividends paid since the issuance date, was $391.99.

(c)Whistler Mountain Resort Limited Partnership (“Whistler LP”) and Blackcomb Skiing Enterprises Limited Partnership (“Blackcomb LP”), together “The WB Partnerships,” are party to a credit agreement, dated as of November 12, 2013 (as amended, the “Whistler Credit Agreement”), by and among Whistler LP, Blackcomb LP, certain subsidiaries of Whistler LP and Blackcomb LP party thereto as guarantors (the “Whistler Subsidiary Guarantors”), the financial institutions party thereto as lenders and The Toronto-Dominion Bank, as administrative agent. The Whistler Credit Agreement consists of a C$300.0 million revolving credit facility. As of January 31, 2023, all borrowings under the Whistler Credit Agreement were made in Canadian dollars and by way of the issuance of bankers’ acceptances plus 1.75% (approximately 6.68% as of January 31, 2023). The Whistler Credit Agreement also includes a quarterly unused commitment fee based on the Consolidated Total Leverage Ratio, which as of January 31, 2023 is equal to 0.39% per annum.

(d)On September 24, 2019, in conjunction with the acquisition of Peak Resorts, Inc. (”Peak Resorts”), the Company assumed various secured borrowings (the “EPR Secured Notes”) under the master credit and security agreements and other related agreements, as amended, (collectively, the “EPR Agreements”) with EPT Ski Properties, Inc. and its affiliates (“EPR”). The EPR Secured Notes include the following:

i.The Alpine Valley Secured Note. The $4.6 million Alpine Valley Secured Note provides for interest payments through its maturity on December 1, 2034. As of January 31, 2023, interest on this note accrued at a rate of 11.72%.

ii.The Boston Mills/Brandywine Secured Note. The $23.3 million Boston Mills/Brandywine Secured Note provides for interest payments through its maturity on December 1, 2034. As of January 31, 2023, interest on this note accrued at a rate of 11.24%.

iii.The Jack Frost/Big Boulder Secured Note. The $14.3 million Jack Frost/Big Boulder Secured Note provides for interest payments through its maturity on December 1, 2034. As of January 31, 2023, interest on this note accrued at a rate of 11.24%.

iv.The Mount Snow Secured Note. The $51.1 million Mount Snow Secured Note provides for interest payments through its maturity on December 1, 2034. As of January 31, 2023, interest on this note accrued at a rate of 12.14%.

v.The Hunter Mountain Secured Note. The $21.0 million Hunter Mountain Secured Note provides for interest payments through its maturity on January 5, 2036. As of January 31, 2023, interest on this note accrued at a rate of 8.88%.

In addition, Peak Resorts is required to maintain a debt service reserve account which amounts are applied to fund interest payments and other amounts due and payable to EPR. As of January 31, 2023, the Company had funded the EPR debt service reserve account in an amount equal to approximately $3.2 million, which was included in other current assets in the Company’s Consolidated Condensed Balance Sheet.

(e)On August 3, 2022 in conjunction with the acquisition of Andermatt-Sedrun (see Note 6, Acquisitions), the Company assumed the New Regional Policy loan between Andermatt-Sedrun and the Canton of Uri and Canton of Graubünden dated June 24, 2016 (the “NRP Loan”), with an initial principal balance of CHF 40.0 million. Amounts outstanding under the NRP Loan bear interest at 0.63% per annum until the maturity date, which is September 30, 2036, with semi-annual required payments of principal amortization and accrued interest. In addition, the NRP Loan agreement includes restrictive covenants requiring certain minimum financial results (as defined in the agreement).

(f)During the three and six months ended January 31, 2023, the Company entered into new finance lease agreements for employee housing units at Whistler Blackcomb, resulting in an incremental finance lease liability on the commencement date of $28.6 million, which represents the minimum lease payments of $56.4 million, net of $27.8 million of amounts representing interest, for the initial 20 year term of the lease discounted at the estimated incremental borrowing rate. The Company recorded $28.6 million finance lease right-of-use assets in connection with these leases, which have a value of $28.2 million as of January 31, 2023, net of $0.4 million accumulated amortization, and are included within property, plant and equipment, net in the Company’s Consolidated Condensed Balance Sheet.

(g)Current maturities represent principal payments due in the next 12 months.

Aggregate maturities of debt outstanding as of January 31, 2023 reflected by fiscal year (August 1 through July 31) are as follows (in thousands):

| | | | | |

| Total |

| 2023 (February 2023 through July 2023) | $ | 41,163 | |

| 2024 | 69,711 | |

| 2025 | 669,136 | |

| 2026 | 643,580 | |

| 2027 | 856,182 | |

| Thereafter | 587,558 | |

Total debt | $ | 2,867,330 | |

The Company recorded interest expense of $38.4 million and $37.4 million for the three months ended January 31, 2023 and 2022, respectively, of which $1.6 million and $1.5 million, respectively, was amortization of deferred financing costs. The Company recorded interest expense of $73.7 million and $76.9 million for the six months ended January 31, 2023 and 2022, respectively, of which $3.2 million and $2.9 million, respectively, was amortization of deferred financing costs. The Company was in compliance with all of its financial and operating covenants required to be maintained under its debt instruments for all periods presented.

In connection with the acquisition of Whistler Blackcomb, VHI funded a portion of the purchase price through an intercompany loan to Whistler Blackcomb of $210.0 million, which was effective as of November 1, 2016, and requires foreign currency remeasurement to Canadian dollars, the functional currency for Whistler Blackcomb. As a result, foreign currency fluctuations associated with the loan are recorded within the Company’s results of operations. The Company recognized approximately $2.3 million and $(3.8) million, respectively, of non-cash foreign currency gains (losses) on the intercompany loan to Whistler Blackcomb for the three and six months ended January 31, 2023 on the Company’s Consolidated Condensed Statements of Operations. The Company recognized approximately $2.9 million and $2.0 million, respectively, of non-cash foreign currency losses on the intercompany loan to Whistler Blackcomb for the three and six months ended January 31, 2022 on the Company’s Consolidated Condensed Statements of Operations.

6. Acquisitions

Andermatt-Sedrun

On August 3, 2022, through a wholly-owned subsidiary, the Company acquired a 55% controlling interest in Andermatt-Sedrun Sport AG (“Andermatt-Sedrun”) from Andermatt Swiss Alps AG (“ASA”). The consideration paid consisted of an investment of $114.4 million (CHF 110.0 million) into Andermatt-Sedrun for use in capital investments to enhance the guest experience on mountain (which was prepaid to fund the acquisition and was recorded in other current assets on the Company’s Consolidated Condensed Balance Sheet as of July 31, 2022) and $41.3 million (CHF 39.3 million) paid to ASA (which was paid on August 3, 2022, commensurate with closing). As of August 3, 2022 the total fair value of the consideration paid was $155.4 million (CHF 149.3 million).

Andermatt-Sedrun operates mountain and ski-related assets, including lifts, most of the restaurants and a ski school operation at the ski area. Ski operations are conducted on land owned by ASA as freehold or leasehold properties, land owned by Usern Corporation, land owned by the municipality of Tujetsch and land owned by private property owners. ASA retained a 40% ownership stake, with a group of existing shareholders comprising the remaining 5% ownership stake. ASA and the other noncontrolling economic interests contain certain protective rights pursuant to a shareholder agreement (the “Andermatt Agreement”) and no ability to participate in the day-to-day operations of Andermatt-Sedrun. The Andermatt Agreement provides that no dividend distributions be made by Andermatt-Sedrun until the end of the fiscal year ending July 31, 2026, after which time there shall be annual distributions of 50% of the available cash (as defined in the Andermatt Agreement) for the most recently completed fiscal year. In addition, the distribution rights are non-transferable and transfer of the noncontrolling interests are limited.

The following summarizes the purchase consideration and the preliminary purchase price allocation to estimated fair values of the identifiable assets acquired and liabilities assumed at the date the transaction was effective (in thousands):

| | | | | |

| Acquisition Date Estimated Fair Value |

| Total cash consideration paid by Vail Resorts, Inc. | $ | 155,365 | |

| Estimated fair value of noncontrolling interests | 91,524 | |

| Total estimated purchase consideration | $ | 246,889 | |

| |

| Allocation of total estimated purchase consideration: | |

| Current assets | $ | 119,867 | |

| Property, plant and equipment | 176,805 | |

| Goodwill | 3,750 | |

| Identifiable intangible assets and other assets | 7,476 | |

| Assumed long-term debt | (44,130) | |

| Other liabilities | (16,879) | |

| Net assets acquired | $ | 246,889 | |

Identifiable intangible assets acquired in the transaction were primarily related to a trade name. The process of estimating the fair value of the property, plant, and equipment includes the use of certain estimates and assumptions related to replacement cost and physical condition at the time of acquisition. The excess of the purchase price over the aggregate estimated fair values of the assets acquired and liabilities assumed was recorded as goodwill. The goodwill recognized is attributable primarily to expected synergies, the assembled workforce of the resort and other factors, and is not expected to be deductible for income tax purposes. The operating results of Andermatt-Sedrun are reported within the Mountain segment prospectively from the date of acquisition.

The estimated fair values of assets acquired and liabilities assumed in the acquisition of Andermatt-Sedrun are preliminary and are based on the information that was available as of the acquisition date. The Company believes that this information provides a reasonable basis for estimating the fair values of assets acquired and liabilities assumed; however, the Company is obtaining additional information necessary to finalize those estimated fair values. Therefore, the preliminary measurements of estimated fair values reflected are subject to change. The Company expects to finalize the valuation and complete the purchase consideration allocation no later than one year from the acquisition date.

Seven Springs Mountain Resort, Hidden Valley Resort & Laurel Mountain Ski Area

On December 31, 2021, the Company, through a wholly-owned subsidiary, acquired Seven Springs Mountain Resort, Hidden Valley Resort and Laurel Mountain Ski Area (together, the “Seven Springs Resorts”) in Pennsylvania from Seven Springs Mountain Resort, Inc. and its affiliates for a cash purchase price of approximately $116.5 million, after adjustments for certain agreed-upon terms, which the Company funded with cash on hand. The acquisition included the mountain operations of the resorts, including base area skier services (food and beverage, retail and rental, lift ticket offices and ski and snowboard school facilities), as well as a hotel, conference center and other related operations.

The following summarizes the purchase consideration and the purchase price allocation to estimated fair values of the identifiable assets acquired and liabilities assumed at the date the transaction was effective (in thousands):

| | | | | |

| Acquisition Date Estimated Fair Value |

| Current assets | $ | 2,932 | |

| Property, plant and equipment | 118,415 | |

| Goodwill | 5,041 | |

| Identifiable intangible assets and other assets | 5,335 | |

| Liabilities | (15,222) | |

| Net assets acquired | $ | 116,501 | |

Identifiable intangible assets acquired in the transaction were primarily related to advanced lodging bookings and trade names. The process of estimating the fair value of the property, plant, and equipment includes the use of certain estimates and assumptions related to replacement cost and physical condition at the time of acquisition. The excess of the purchase price over the aggregate estimated fair values of the assets acquired and liabilities assumed was recorded as goodwill. The goodwill recognized is attributable primarily to expected synergies, the assembled workforce of the resorts and other factors, and is not expected to be deductible for income tax purposes. The Company recognized $2.8 million of acquisition related expenses associated with the transaction within Mountain and Lodging operating expense for the year ended July 31, 2022. The operating results of the acquired resorts are reported within the Mountain and Lodging segments prospectively from the date of acquisition.

7. Supplementary Balance Sheet Information

The composition of property, plant and equipment follows (in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | January 31, 2023 | | July 31, 2022 | | January 31, 2022 |

| Land and land improvements | | $ | 793,271 | | | $ | 763,432 | | | $ | 767,433 | |

| Buildings and building improvements | | 1,635,700 | | | 1,545,571 | | | 1,564,845 | |

| Machinery and equipment | | 1,769,052 | | | 1,505,236 | | | 1,504,991 | |

| Furniture and fixtures | | 330,257 | | | 307,867 | | | 318,434 | |

| Software | | 141,595 | | | 138,058 | | | 126,742 | |

| Vehicles | | 85,329 | | | 81,927 | | | 82,710 | |

| Construction in progress | | 135,903 | | | 127,282 | | | 114,165 | |

| Gross property, plant and equipment | | 4,891,107 | | | 4,469,373 | | | 4,479,320 | |

| Accumulated depreciation | | (2,469,712) | | | (2,351,321) | | | (2,288,988) | |

| Property, plant and equipment, net | | $ | 2,421,395 | | | $ | 2,118,052 | | | $ | 2,190,332 | |

The composition of accounts payable and accrued liabilities follows (in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | January 31, 2023 | | July 31, 2022 | | January 31, 2022 |

| Trade payables | | $ | 179,221 | | | $ | 151,263 | | | $ | 137,895 | |

| Deferred revenue | | 619,511 | | | 511,306 | | | 611,477 | |

| Accrued salaries, wages and deferred compensation | | 66,275 | | | 64,570 | | | 59,008 | |

| Accrued benefits | | 54,129 | | | 45,202 | | | 46,894 | |

| Deposits | | 81,612 | | | 37,731 | | | 80,547 | |

| Operating lease liabilities | | 36,667 | | | 34,218 | | | 35,438 | |

| Other liabilities | | 107,380 | | | 98,540 | | | 95,878 | |

| Total accounts payable and accrued liabilities | | $ | 1,144,795 | | | $ | 942,830 | | | $ | 1,067,137 | |

The changes in the net carrying amount of goodwill by segment for the six months ended January 31, 2023 are as follows (in thousands):

| | | | | | | | | | | | | | | | | |

| Mountain | | Lodging | | Goodwill, net |

| Balance at July 31, 2022 | $ | 1,709,922 | | | $ | 45,006 | | | $ | 1,754,928 | |

| Acquisition (including measurement period adjustments) | 3,800 | | | — | | | 3,800 | |

| | | | | |

| Effects of changes in foreign currency exchange rates | (35,709) | | | — | | | (35,709) | |