10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2015

OR

|

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number 1-9444

CEDAR FAIR, L.P.

(Exact name of registrant as specified in its charter)

|

| | |

DELAWARE | | 34-1560655 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

|

| | |

One Cedar Point Drive | | |

Sandusky, Ohio | | 44870-5259 |

(Address of principal executive offices) | | (Zip Code) |

|

|

Registrant's telephone number, including area code: (419) 626-0830 |

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | |

Title of each class | Name of each exchange on which registered |

Depositary Units (Representing Limited Partner Interests) | New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

|

| | | | | | |

Large accelerated filer | | x | | Accelerated filer | | o |

Non-accelerated filer | | o (Do not check if a smaller reporting company) | | Smaller reporting company | | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of Depositary Units held by non-affiliates of the Registrant based on the closing price of such units on June 26, 2015 of $55.38 per unit was approximately $3,047,889,483.

Number of Depositary Units representing limited partner interests outstanding as of February 19, 2016: 56,019,973

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Form 10-K incorporates by reference certain information from the Registrant's definitive proxy statement to be used in connection with its annual meeting of unitholders to be held in June.

************

The Exhibit Index is located on page 63

Page 1 of 84 pages

CEDAR FAIR, L.P.

INDEX

|

| | | | | |

| | | | |

| | PAGE |

| | |

| | | | 3 |

|

| | |

| | | | 7 |

|

| | |

| | | | 11 |

|

| | |

| | | | 11 |

|

| | | | |

| | | | 12 |

|

| | | | |

| | | | 12 |

|

| |

| | |

| | |

| | | | 12 |

|

| | |

| | | | 14 |

|

| | |

| | | | 15 |

|

| | | | |

| | | | 25 |

|

| | | | |

| | | | 25 |

|

| | | | |

| | | | 56 |

|

| | | | |

| | | | 56 |

|

| | | | |

| | | | 58 |

|

| |

| | |

| | | | |

| | | | 58 |

|

| | | | |

| | | | 58 |

|

| | | | |

| | | | 58 |

|

| | | | |

| | | | 59 |

|

| | | | |

| | | | 59 |

|

| | | | |

| | |

| | | | |

| | | | 59 |

|

| | | | |

| | 62 |

|

| |

| | 63 |

|

| | | | |

Consent | | | | 81 |

|

| | | | |

Certifications | | | 82 |

|

PART I

ITEM 1. BUSINESS.

Introduction

Cedar Fair, L.P. (together with its affiliated companies, the "Partnership") is a publicly traded Delaware limited partnership formed in 1987 and managed by Cedar Fair Management, Inc., an Ohio corporation (the "General Partner"), whose shares are held by an Ohio trust. The Partnership is one of the largest regional amusement park operators in the world and owns eleven amusement parks, three outdoor water parks, one indoor water park and five hotels.

In 2015, the Partnership entertained more than 24 million visitors. All of the Partnership's parks are family-oriented, with recreational facilities for people of all ages, and provide clean and attractive environments with exciting rides and entertainment. The amusement parks include: Cedar Point, located on Lake Erie between Cleveland and Toledo in Sandusky, Ohio; Kings Island near Cincinnati, Ohio; Canada's Wonderland near Toronto, Canada; Dorney Park & Wildwater Kingdom (“Dorney Park”), located near Allentown in South Whitehall Township, Pennsylvania; Valleyfair, located near Minneapolis/St. Paul in Shakopee, Minnesota; Michigan's Adventure located near Muskegon, Michigan; Kings Dominion located near Richmond, Virginia; Carowinds in Charlotte, North Carolina; Worlds of Fun located in Kansas City, Missouri; Knott's Berry Farm, located near Los Angeles in Buena Park, California; and California's Great America (“Great America”) located in Santa Clara, California. Additionally, the Partnership has a contract to manage and operate Gilroy Gardens Family Theme Park in Gilroy, California.

The Partnership also owns and operates the Castaway Bay Indoor Waterpark Resort in Sandusky, Ohio, and three separately gated outdoor water parks. Two of the outdoor water parks are located adjacent to Cedar Point and Knott's Berry Farm, and the third is Wildwater Kingdom located near Cleveland in Aurora, Ohio. With limited exceptions, all rides and attractions at the amusement and water parks are owned and operated by the Partnership.

The Partnership's seasonal amusement parks are generally open during weekends beginning in April or May, and then daily from Memorial Day until Labor Day, after which they are open during weekends in September and, in most cases, October. The three outdoor water parks also operate seasonally, generally from Memorial Day to Labor Day, plus some additional weekends before and after this period. As a result, virtually all of the operating revenues of these parks are generated during an approximately 130- to 140-day operating season. Knott's Berry Farm is open daily on a year-round basis. Castaway Bay is generally open daily from Memorial Day to Labor Day, plus a limited daily schedule for the balance of the year. Each park charges a basic daily admission price, which allows unlimited use of most rides and attractions.

The demographic groups that are most important to the parks are young people ages 12 through 24 and families. Families are believed to be attracted by a combination of rides, live entertainment and the clean, wholesome atmosphere. Young people are believed to be attracted by the action-packed rides. During their operating season, the parks conduct active television, radio, newspaper and internet advertising campaigns in their major market areas geared toward these two groups.

Description of Parks

Cedar Point

Cedar Fair's flagship park, Cedar Point, was first developed as a recreational area in 1870. Located on a peninsula in Sandusky, Ohio bordered by Lake Erie and Sandusky Bay, the park is approximately 60 miles west of Cleveland and 100 miles southeast of Detroit. Cedar Point is believed to be the largest seasonal amusement park in the United States, measured by the number of rides and attractions and the hourly ride capacity. Attractive to both families and thrill-seekers, the park features 15 world-class roller coasters, including many record-breakers, and four children's areas. Cedar Point serves a six-state region which includes nearly all of Ohio and Michigan, western Pennsylvania and New York, northern West Virginia and Indiana, as well as southwestern Ontario, Canada. The park's market area includes Cleveland, Detroit, Toledo, Akron, Columbus, Grand Rapids, Flint and Lansing.

Located adjacent to the park is Soak City, a separately gated water park that features more than 20 water rides and attractions, as well as Challenge Park, which features several extra-charge attractions.

Wildwater Kingdom, located near Cleveland, Ohio, is a seasonal water-park that is operated as a division of Cedar Point. The park offers many water rides and attractions, including numerous water slides, a giant wave pool, a lazy river inner tube ride and two children's areas, as well as various food and merchandise shops.

The Partnership also owns and operates four hotels at Cedar Point. The park's only year-round hotel is Castaway Bay Indoor Waterpark Resort, which is located adjacent to the Causeway entrance to the park. Castaway Bay features a tropical Caribbean theme hotel rooms centered around an indoor water park. The park's largest hotel, the historic Hotel Breakers, has various dining and lounge facilities, a mile-long beach, lake swimming, a conference/meeting center, an indoor pool and two outdoor pools. Located near the Causeway entrance to the park, Breakers Express is a limited-service seasonal hotel. In addition to Hotel Breakers and Breakers Express, Cedar Point offers the lake-front Sandcastle Suites Hotel, which features suites, a courtyard pool, tennis courts and a contemporary waterfront restaurant.

The Partnership also owns and operates the Cedar Point Marina, Castaway Bay Marina and Camper Village. Cedar Point Marina is one of the largest full-service marinas on the Great Lakes and provides dock facilities, including floating docks and full guest amenities. In addition, Cedar

Point Marina features two restaurants accessible by the general public. Castaway Bay Marina is a full-service marina. Camper Village includes RV campsites and Lighthouse Point, which offers lake-front cottages, cabins and full-service RV campsites.

The Partnership, through a wholly owned subsidiary, owns and operates the Cedar Point Causeway across Sandusky Bay. This Causeway is a major access route to Cedar Point. The Partnership also owns dormitory facilities located near the park that housed approximately 6,400 of the park's seasonal and part-time employees.

Knott's Berry Farm

Knott's Berry Farm, located near Los Angeles in Buena Park, California, first opened in 1920 and was acquired by the Partnership in late 1997. The park is one of several year-round theme parks in Southern California and serves a market area centered in Orange County with a large national and international tourism population.

The park is renowned for its seasonal events, including a special Christmas promotion, “Knott's Merry Farm,” and a Halloween event called “Knott's Scary Farm,” which has been held for more than 40 years and is annually rated one of the best Halloween events in the industry by Amusement Today's international survey.

Adjacent to Knott's Berry Farm is “Knott's Soak City-Orange County,” a separately gated seasonal water park that features more than 20 water rides and attractions.

The Partnership also owns and operates the Knott's Berry Farm Hotel, a full-service hotel located adjacent to Knott's Berry Farm, which features a pool, tennis courts and meeting/banquet facilities.

Canada's Wonderland

Canada's Wonderland, a combination amusement and water park located near Toronto in Vaughan, Ontario, first opened in 1981 and was acquired by the Partnership in June of 2006. It contains more than 200 attractions, including 16 roller coasters, and is one of the most attended regional amusement parks in North America. Canada's Wonderland is in a culturally diverse metropolitan market with large populations of different ethnicities and national origins. Each year the park showcases an extensive entertainment and special event line-up, which includes cultural festivals featuring renowned music artists from around the world.

Kings Island

Kings Island, a combination amusement and water park located near Cincinnati, Ohio, first opened in 1972 and was acquired by the Partnership in June of 2006. Kings Island is one of the largest seasonal amusement parks in the United States, measured by the number of rides and attractions and the hourly ride capacity. The park features a children's area that has been consistently named the "Best Kids' Area in the World" by Amusement Today.

The park's market area includes Cincinnati, Dayton and Columbus, Ohio, Louisville and Lexington, Kentucky, and Indianapolis, Indiana.

Dorney Park

Dorney Park, a combination amusement and water park located near Allentown, in South Whitehall Township, Pennsylvania, was first developed as a summer resort area in 1884 and was acquired by the Partnership in 1992. Dorney Park is one of the largest amusement parks in the Northeastern United State and the park's major markets include Philadelphia, Lancaster, Harrisburg, York, Scranton, Wilkes-Barre, Hazleton and the Lehigh Valley, Pennsylvania, New York City, and New Jersey.

Kings Dominion

Kings Dominion, a combination amusement and water park located near Richmond, Virginia, first opened in 1975 and was acquired by the Partnership in June of 2006. The park's market area includes Richmond and Norfolk, Virginia, Raleigh, North Carolina, Baltimore, Maryland and Washington, D.C.

Additionally, the park offers Kings Dominion Camp Wilderness Campground, a camping area featuring luxury cabins, a swimming pool, playground, volleyball courts, miniature golf, and laundry facilities. The campground also offers a free shuttle service between the campground and amusement park.

The Partnership also owns a dormitory facility located adjacent to Kings Dominion that houses up to 300 of the park's seasonal employees.

Carowinds

Carowinds, a combination amusement and water park located in Charlotte, North Carolina, first opened in 1973 and was acquired by the Partnership in June of 2006. Carowinds' major markets include Charlotte, Greensboro, and Raleigh, North Carolina as well as Greenville and Columbia, South Carolina.

The park also offers Camp Wilderness Resort, a camping area that features a convenience and merchandise store, laundry facilities, and a swimming pool. The campground features RV sites, tent and pop-up sites, and luxury cabins. The campground also offers a free shuttle service between the campground and amusement park.

Great America

Great America, a combination amusement and water park located in Santa Clara, California, first opened in 1976 and was acquired by the Partnership in June of 2006. The park draws its visitors primarily from San Jose, San Francisco, Sacramento, Modesto and Monterey, among other cities in northern California.

Valleyfair

Valleyfair, which opened in 1976 and was acquired by the Partnership's predecessor in 1978, is a combination amusement and water park located near Minneapolis-St. Paul in Shakopee, Minnesota. It is the largest amusement park in Minnesota. Valleyfair's market area is centered in Minneapolis-St. Paul, but the park also draws visitors from other areas in Minnesota and surrounding states.

The Partnership also owns a dormitory facility located adjacent to Valleyfair that houses approximately 400 of the park's seasonal employees.

Worlds of Fun

Worlds of Fun, which opened in 1973 and was acquired by the Partnership in 1995, is a combination amusement and water park located in Kansas City, Missouri. Worlds of Fun serves a market area centered in Kansas City, as well as most of Missouri and portions of Kansas and Nebraska.

Worlds of Fun also features Worlds of Fun Village, an upscale camping area that offers overnight guest accommodations next to the park with wood-side cottages, log cabins and deluxe RV sites. Included within the Village is a clubhouse with a swimming pool and arcade games.

Michigan's Adventure

Michigan's Adventure, which was acquired by the Partnership in 2001, is the largest amusement park in Michigan. The combination amusement and water park located near Muskegon, Michigan serves a market area principally from central and western Michigan and eastern Indiana.

CAPITAL EXPENDITURES AND WORKING CAPITAL

The Partnership believes that annual park attendance is influenced by the investment in new attractions from year to year. Capital expenditures are planned on a seasonal basis with the majority of such capital expenditures made in the period from October through May, prior to the beginning of the peak operating season. Capital expenditures made in a calendar year may differ materially from amounts identified with a particular operating season because of timing considerations such as weather conditions, site preparation requirements and availability of ride components, which may result in accelerated or delayed expenditures around calendar year-end.

During the operating season, the Partnership carries significant receivables and inventories of food and merchandise, as well as payables and payroll-related accruals. Amounts are substantially reduced in non-operating periods. Seasonal working capital needs are funded with revolving credit facilities, which are established at levels sufficient to accommodate the Partnership's peak borrowing requirements in April and May as the seasonal parks complete preparations for opening. Revolving credit borrowings are reduced daily with the Partnership's positive cash flow during the seasonal operating period.

COMPETITION

In general, the Partnership competes for discretionary spending with all aspects of the recreation industry within its primary market areas, including several destination and regional amusement parks. The Partnership also competes with other forms of entertainment and recreational activities, including movies, sports events, restaurants and vacation travel.

The principal competitive factors in the amusement park industry include the uniqueness and perceived quality of the rides and attractions in a particular park, its proximity to metropolitan areas, the atmosphere and cleanliness of the park, and the quality and variety of the food and entertainment available. The Partnership believes that its amusement parks feature a sufficient quality and variety of rides and attractions, restaurants, gift shops and family atmosphere to make them highly competitive with other parks and forms of entertainment.

GOVERNMENT REGULATION

The Partnership's properties and operations are subject to a variety of federal, state and local environmental, health and safety laws and regulations. Currently, the Partnership believes it is in substantial compliance with applicable requirements under these laws and regulations. However, such requirements have generally become more strict over time, and there can be no assurance that new requirements, changes in enforcement policies or newly discovered conditions relating to its properties or operations will not require significant expenditures in the future.

All rides are operated and inspected daily by both the Partnership's maintenance and ride operations personnel before being put into operation. The parks are also periodically inspected by the Partnership's insurance carrier and, at all parks except Michigan’s Adventure, Valleyfair, Worlds of Fun, and Carowinds' South Carolina rides, by state or county ride-safety inspectors. Valleyfair, Worlds of Fun and Carowinds each contract with a third party to inspect its rides pursuant to Minnesota, Missouri, and South Carolina law, respectively, and submit the third-party report to the respective state agency. Michigan’s Adventure also contracts an outside third party to inspect their rides even though there is no Michigan law requirement. Additionally, all parks have added ride maintenance and operation inspections done by third party qualified inspectors to make sure our standards are being maintained.

EMPLOYEES

The Partnership has approximately 1,900 full-time employees. During the operating season, the Partnership employs in aggregate approximately 37,800 seasonal and part-time employees, many of whom are high school and college students. Approximately 6,400 of Cedar Point's seasonal employees, 400 of Valleyfair's seasonal employees, and 300 of Kings Dominion's seasonal employees live in dormitories owned by the Partnership. The Partnership maintains training programs for all new employees and believes that its relations with its employees are good.

AVAILABLE INFORMATION

Copies of the Partnership's annual report on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K and all amendments to those reports as filed or furnished with the SEC are available without charge upon written request to the Partnership's Investor Relations Office or through its website (www.cedarfair.com).

We use our website www.cedarfair.com as a channel of distribution of the Partnership's information. The information we post through this channel may be deemed material. Accordingly, investors should monitor this channel, in addition to following our news releases, SEC filings, and public conference calls and webcasts. The contents of our website shall not be deemed to be incorporated herein by reference.

You may read and copy any materials filed with the SEC at the SEC's Public Reference Room at 100 F Street, N.E., Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site at http://www.sec.gov that contains the Partnership's reports, proxy statements and other information. See Item 6 for Selected Financial Data, including net revenues, net income (loss) and total assets.

SUPPLEMENTAL ITEM. Executive Officers of Cedar Fair

|

| | | | | |

Name | | Age | | Position(s) |

| | | | |

Matthew A. Ouimet | | 57 |

| | Matt Ouimet has served as Chief Executive Officer since January 2012 and as President since June 2011. Before joining Cedar Fair, Matt served in multiple roles from 2009 through 2010 at Corinthian Colleges, including President and Chief Executive Officer. Prior to joining Corinthian Colleges, he served as President, Hotel Group for Starwood Hotels and Resorts Worldwide from 2006 through 2008. |

Richard A. Zimmerman | | 55 |

| | Richard Zimmerman has served as Chief Operating Officer since October 2011. Prior to that, he served as Executive Vice President since November 2010, previously serving as Regional Vice President since June 2007 and has been with Cedar Fair since 2006. Richard served as Vice President and General Manager of Kings Dominion from 1998 through 2006. |

Brian C. Witherow | | 49 |

| | Brian Witherow has served as Executive Vice President and Chief Financial Officer since January 2012. Prior to that, Brian served as Vice President and Corporate Controller beginning in July 2005. Brian has been with Cedar Fair in various other positions since 1995. |

H. Philip Bender | | 60 |

| | Phil Bender has served as Executive Vice President, Operations, since November 2010, previously serving as Regional Vice President beginning in June 2006. Prior to being promoted to a corporate executive, he served as Vice President and General Manager of Worlds of Fun / Oceans of Fun from 2000 through 2006. |

Robert A. Decker | | 55 |

| | Rob Decker was promoted to Senior Vice President of Planning & Design in January 2015. Prior to that, Rob served as Corporate Vice President of Planning & Design since the end of 2002, and he has been with Cedar Fair since 1999. Prior to joining Cedar Fair, Rob served as Design Director at Jack Rouse Associates, Inc., a consultant firm to the entertainment industry, from 1989 through 1999. |

Craig J. Freeman | | 62 |

| | Craig Freeman was promoted to Senior Vice President of Administration in January 2015. Prior to that, he served as Corporate Vice President of Administration since September 2005. Craig served as Vice President and General Manager of Knott’s Camp Snoopy at the Mall of America from 1996 through 2005. |

Duffield E. Milkie | | 50 |

| | Duff Milkie was promoted to Executive Vice President and General Counsel in January 2015 and has served as Corporate Secretary since February 2012. He served as Corporate Vice President and General Counsel and served as Corporate Secretary from February 2012 to February 2015. He served as Corporate Vice President and General Counsel from February 2008 to February 2012. Prior to joining Cedar Fair, Duff was a partner in the law firm of Wickens, Herzer, Panza, Cook, & Batista from 1998 through 2008. |

David R. Hoffman | | 47 |

| | Dave Hoffman has served as Senior Vice President and Chief Accounting Officer since January 2012. Prior to that, he served as Vice President of Finance and Corporate Tax since November 2010. He served as Vice President of Corporate Tax from October 2006 until November 2010. Prior to joining Cedar Fair, Dave served as a business advisor with Ernst & Young from 2002 through 2006. |

Kelley Semmelroth | | 51 |

| | Kelley Semmelroth has served as Executive Vice President and Chief Marketing Officer since February 2012. Prior to joining Cedar Fair, Kelley served as Senior Vice President, Marketing Planning Director for TD Bank from 2010 through 2012. Prior to joining TD Bank, she served as Senior Vice President of Brand Strategy and Management at Bank of America from 2005 through 2010. |

ITEM 1A. RISK FACTORS.

We compete for discretionary spending and discretionary free-time with many other entertainment alternatives and are subject to factors that generally affect the recreation and leisure industry, including general economic conditions.

Our parks compete for discretionary spending and discretionary free-time with other amusement, water and theme parks and with other types of recreational activities and forms of entertainment, including movies, sporting events, restaurants and vacation travel. Our business is also subject to factors that generally affect the recreation and leisure industries and are not within our control. Such factors include, but are not limited to, general economic conditions, including relative fuel prices, and changes in consumer tastes and spending habits. Uncertainty regarding regional economic conditions and deterioration in the economy generally may adversely impact attendance figures and guest spending patterns at our parks, and disproportionately affect different demographics of our target customers within our core markets. For example, group sales and season-pass sales, which represent a significant portion of our revenues, are disproportionately affected by general economic conditions. Both attendance and guest per capita spending at our parks are key drivers of our revenues and profitability, and reductions in either can directly and negatively affect revenues and profitability.

Uncertain economic conditions, such as unemployment rates, affect our guests' levels of discretionary spending. A decrease in discretionary spending due to a decline in consumer confidence in the economy, an economic slowdown or deterioration in the economy could adversely affect the frequency with which our guests choose to attend our amusement parks and the amount that our guests spend on our products when they visit. The materialization of these risks could lead to a decrease in our revenues, operating income and cash flows.

The operating season at most of our parks is of limited duration, which can magnify the impact of adverse conditions or events occurring within that operating season.

Ten of our amusement parks are seasonal, generally operating during a portion of April or May, then daily from Memorial Day through Labor Day, and during weekends in September and, in most cases, October. Our outdoor water parks also operate seasonally, generally from Memorial Day through Labor Day and during some additional weekends before and after that period. Most of our revenues are generated during this 130- to 140-day annual operating season. As a result, when conditions or events described as risk factors occur during the operating season, particularly during the peak vacation months of July and August or the important fall season, there is only a limited period of time during which the impact of those conditions or events can be mitigated. Accordingly, the timing of such conditions or events may have a disproportionate adverse effect upon our revenues.

Bad or extreme weather conditions can adversely impact attendance at our parks, which in turn would reduce our revenues.

Because most of the attractions at our parks are outdoors, attendance at our parks can be adversely affected by continuous bad or extreme weather and by forecasts of bad or mixed weather conditions, which would negatively affect our revenues. We believe that our ownership of many parks in different geographic locations reduces, but does not completely eliminate, the effect that adverse weather can have on our consolidated results.

The high fixed cost structure of amusement park operations can result in significantly lower margins if revenues decline.

A large portion of our expenses is relatively fixed because the costs for full-time employees, maintenance, utilities, advertising and insurance do not vary significantly with attendance. These fixed costs may increase at a greater rate than our revenues and may not be able to be reduced at the same rate as declining revenues. If cost-cutting efforts are insufficient to offset declines in revenues or are impractical, we could experience a material decline in margins, revenues, profitability and cash flows. Such effects can be especially pronounced during periods of economic contraction or slow economic growth.

Our business depends on our ability to meet our workforce needs.

Our success depends on our ability to attract, motivate and retain qualified employees to keep pace with our needs. If we are unable to do so, our results of operations and cash flows may be adversely affected. In addition, we employ a significant seasonal workforce. We recruit year-round to fill thousands of seasonal staffing positions each season and work to manage seasonal wages and the timing of the hiring process to ensure the appropriate workforce is in place. There is no assurance that we will be able to recruit and hire adequate seasonal personnel as the business requires or that we will not experience material increases in the cost of securing our seasonal workforce in the future.

Increased costs of labor and employee health and welfare benefits may impact our results of operations.

Labor is a primary component in the cost of operating our business. Increased labor costs, due to competition, increased minimum wage or employee benefit costs, including health care costs, or otherwise, could adversely impact our operating expenses. The Patient Protection and Affordable Care Act of 2010 contains provisions which could impact our future health-care costs. Continued increases to both market wage rates and the statutory minimum wage rates could also materially impact our future seasonal labor rates. It is possible that these changes could significantly increase our labor costs, which would adversely affect our operating results and cash flows.

If we lose key personnel, our business may be adversely affected.

Our success depends in part upon a number of key employees, including our senior management team, whose members have been involved in the leisure and hospitality industries for an average of more than 20 years. The loss of services of our key employees could have a material adverse effect on our business.

Our growth strategy may not achieve the anticipated results.

Our future success will depend on our ability to grow our business, including capital investments to improve our parks through new rides and attractions, as well as in-park product offerings and product offerings outside of our parks. Our growth and innovation strategies require significant commitments of management resources and capital investments and may not grow our revenues at the rate we expect or at all. As a result, we may not be able to recover the costs incurred in developing our new projects and initiatives or to realize their intended or projected benefits, which could have a material adverse effect on our business, financial condition or results of operations.

Cyber-security risks and the failure to maintain the integrity of internal or customer data could result in damages to our reputation and/or subject us to costs, fines or lawsuits.

In the normal course of business, we collect and retain large volumes of internal and customer data, including credit card numbers and other personally identifiable information, which is used for target marketing and promotional purposes, and our various information technology systems enter, process, summarize and report such data. We also maintain personally identifiable information about our employees. The integrity and protection of such data is critical to our business, and our guests and employees have a high expectation that we will adequately protect their personal information. The regulatory environment, as well as the requirements imposed on us by the credit card industry, governing information, security and privacy laws is increasingly demanding and continues to evolve. Maintaining compliance with applicable security and privacy regulations may increase our operating costs and/or adversely impact our ability to market our parks, products and services to our guests. Furthermore, if a person is able to circumvent our security measures, he or she could destroy or steal valuable information or disrupt our operations. Any security breach could expose us to risks of data loss, which could harm our reputation and result in remedial and other costs, fines or lawsuits. Although we carry liability insurance to cover this risk, there can be no assurance that our coverage will be adequate to cover liabilities, or that we will be able to obtain adequate coverage should a catastrophic incident occur.

There is a risk of incidents occurring at amusement parks, which may reduce attendance and negatively impact our revenues.

The safety of our guests and employees is one of our top priorities. All of our amusement parks feature thrill rides. There are inherent risks involved with these attractions, and an accident or a serious injury at any of our amusement parks may result in negative publicity and could

reduce attendance and result in decreased revenues. In addition, accidents or injuries at parks operated by our competitors could influence the general attitudes of amusement park patrons and adversely affect attendance at our amusement parks. Other types of incidents such as food borne illnesses which have either been alleged or proven to be attributable to our parks or our competitors, could adversely affect attendance revenues.

Our operations, our workforce and our ownership of property subject us to various laws and regulatory compliance, which may create uncertainty regarding future expenditures and liabilities.

We may be required to incur costs to comply with regulatory requirements, such as those relating to employment practices, environmental requirements, and other regulatory matters, and the costs of compliance, investigation, remediation, litigation, and resolution of regulatory matters could be substantial. We are subject to extensive federal and state employment laws and regulations, including wage and hour laws and other pay practices and employee record-keeping requirements. We periodically may have to defend against lawsuits asserting non-compliance. Such lawsuits can be costly, time consuming and distract management, and adverse rulings in these types of claims could negatively affect our business, financial condition or results.

We also are subject to federal, state and local environmental laws and regulations such as those relating to water resources; discharges to air, water and land; the handling and disposal of solid and hazardous waste; and the cleanup of properties affected by regulated materials. Under these laws and regulations, we may be required to investigate and clean up hazardous or toxic substances or chemical releases from current or formerly owned or operated facilities or to mitigate potential environmental risks. Environmental laws typically impose cleanup responsibility and liability without regard to whether the relevant entity knew of or caused the presence of the contaminants. The costs of investigation, remediation or removal of regulated materials may be substantial, and the presence of those substances, or the failure to remediate a property properly, may impair our ability to use, transfer or obtain financing regarding our property.

Unanticipated construction delays in completing capital improvement projects in our parks and resort facilities, significant ride downtime, or other unplanned park closures could adversely affect our revenues.

A principal competitive factor for an amusement park is the uniqueness and perceived quality of its rides and attractions in a particular market area. Accordingly, the regular addition of new rides and attractions is important, and a key element of our revenue growth is strategic capital spending on new rides and attractions. Any construction delays or ride down-time can adversely affect our attendance and our ability to realize revenue growth. Further, when rides, attractions, or an entire park, have unplanned downtime and/or closures, our revenue could be adversely affected.

Instability in general economic conditions could impact our profitability and liquidity while increasing our exposure to counter-party risk.

The existence of unfavorable general economic conditions, such as high unemployment rates, constrained credit markets, and higher prices for consumer goods, may hinder the ability of those with which we do business, including vendors, concessionaires and customers, to satisfy their obligations to us. Our exposure to credit losses will depend on the financial condition of our vendors, concessionaires and customers and other factors beyond our control, such as deteriorating conditions in the world economy or in the theme/amusement park industry. The presence of market turmoil, coupled with a reduction of business activity, generally increases our risks related to our status as an unsecured creditor of most of our vendors, concessionaires and customers. Credit losses, if significant, would have a material adverse effect on our business, financial condition and results of operations. Moreover, these issues could also increase the counter-party risk inherent in our business, including with our suppliers, vendors and financial institutions with which we enter into hedging agreements and long-term debt agreements, such as our credit facilities. The soundness of these counter-parties could adversely affect us. Our credit evaluations may be inaccurate and we cannot assure you that credit performance will not be materially worse than anticipated, and, as a result, materially and adversely affect our business, financial position and results of operations.

Our debt agreements contain restrictions that could limit our flexibility in operating our business.

Our credit agreement and the indentures governing our notes contain, and any future indebtedness of ours will likely contain, a number of covenants that could impose significant operating and financial restrictions on us, including restrictions on our and our subsidiaries' ability to, among other things:

| |

• | pay distributions on or make distributions in respect of our capital stock or units or make other restricted payments; |

| |

• | incur additional debt or issue certain preferred equity; |

| |

• | make certain investments; |

| |

• | create restrictions on distributions from restricted subsidiaries; |

| |

• | create liens on certain assets to secure debt; |

| |

• | consolidate, merge, amalgamate, sell or otherwise dispose of all or substantially all of our assets; |

| |

• | enter into certain transactions with our affiliates; and |

| |

• | designate our subsidiaries as unrestricted subsidiaries. |

The 2013 Credit Agreement requires us to maintain specified financial ratios, which if breached for any reason and not cured, could result in an event of default under the agreement. The most restrictive of these ratios is the Consolidated Leverage Ratio. At the end of the fourth quarter of 2015 and 2014, this ratio was set at 5.75x and 6.00x consolidated total debt (excluding the revolving debt)-to-consolidated EBITDA, respectively. The ratio decreased by 0.25x at the beginning of the second quarter and will decrease each second quarter until it reaches 5.25x. As of December 31, 2015 and 2014 , we were in compliance with this ratio and all other covenants under the 2013 Credit Agreement. The 2013 Credit Agreement allows restricted payments of up to $60 million annually so long as no default or event of default has occurred and is continuing

and so long as the Partnership would be in compliance with certain financial ratios after giving effect to the payments. Additional restricted payments are allowed to be made based on an Excess-Cash-Flow formula, should our pro-forma Consolidated Leverage Ratio be less than or equal to 5.00x.

The indentures governing our notes also include annual restricted payment limitations and additional permitted payment formulas. We can make restricted payments of $60 million annually so long as no default or event of default has occurred and is continuing. Our ability to make additional restricted payments is permitted should our pro forma Total Indebtedness-to-Consolidated-Cash-Flow Ratio be less than or equal to 5.00x.

Variable rate indebtedness subjects us to the risk of higher interest rates, which could cause our future debt service obligations to increase.

As of December 31, 2015, after giving consideration to current outstanding interest-rate swap arrangements, most of our indebtedness under our term loan facility accrues interest that is either fixed or swapped to a fixed rate. After the expiration of outstanding interest-rate swap agreements, certain of our borrowings may be at variable rates of interest and expose us to interest rate risk. If interest rates increase, our annual debt service obligations on any variable-rate indebtedness would increase even though the amount borrowed remained the same, and our net income would decrease.

The amount of our indebtedness could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry and prevent us from fulfilling our obligations under our debt agreements.

We had $1,575.2 million of outstanding indebtedness as of December 31, 2015 (after giving effect to $16.3 million of outstanding letters of credit under our revolving credit facility.

The amount of our indebtedness could have important consequences. For example, it could:

| |

• | limit our ability to borrow money for our working capital, capital expenditures, debt service requirements, strategic initiatives or other purposes; |

| |

• | limit our flexibility in planning or reacting to changes in business and future business operations; and |

| |

• | make it more difficult for us to satisfy our obligations with respect to our indebtedness, and any failure to comply with the obligations of any of our debt instruments, including restrictive covenants and borrowing conditions, could result in an event of default under the agreements governing other indebtedness. |

In addition, we may not be able to generate sufficient cash flow from operations, or be able to draw under our revolving credit facility or otherwise, in an amount sufficient to fund our liquidity needs, including the payment of principal and interest on our debt obligations. If our cash flows and capital resources are insufficient to service our indebtedness, we may be forced to reduce or delay capital expenditures, sell assets, seek additional capital or restructure or refinance our indebtedness. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations. Our ability to restructure or refinance our debt in the future will depend on the condition of the capital markets and our financial condition at such time. Any refinancing of our debt could be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations. In addition, the terms of our existing or future debt agreements, including our credit agreement and the indenture governing our notes, may restrict us from adopting some of these alternatives. In the absence of such operating results and resources, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service and other obligations. We may not be able to consummate those dispositions for fair market value or at all. Furthermore, any proceeds that we could realize from any such dispositions may not be adequate to meet our debt service obligations then due.

Despite the amount of our indebtedness, we may be able to incur significant additional amounts of debt, which could further exacerbate the risks associated with the amount of our indebtedness.

Our insurance coverage may not be adequate to cover all possible losses that we could suffer, and our insurance costs may increase.

Companies engaged in the amusement park business may be sued for substantial damages in the event of an actual or alleged accident. An accident occurring at our parks or at competing parks could reduce attendance, increase insurance premiums, and negatively impact our operating results. Although we carry liability insurance to cover this risk, there can be no assurance that our coverage will be adequate to cover liabilities, that we will be able to obtain coverage at commercially reasonable rates, or that we will be able to obtain adequate coverage should a catastrophic incident occur at our parks or at other parks.

Our tax treatment is dependent on our status as a partnership for federal income tax purposes. If the tax laws were to treat us as a corporation or we become subject to a material amount of entity-level taxation, it may substantially reduce the amount of cash available for distribution to our unitholders.

We are a limited partnership under Delaware law and are treated as a partnership for federal income tax purposes. A change in current tax law may cause us to be taxed as a corporation for federal income tax purposes or otherwise subject us to taxation as an entity. If we were treated as a corporation for federal income tax purposes, we would pay federal income tax on our entire taxable income at the corporate tax rate, rather than only on the taxable income from our corporate subsidiaries, and may be subject to additional state taxes at varying rates. Further, unitholder distributions would generally be taxed again as corporate distributions or dividends and no income, gains, losses, or deductions would flow through to unitholders. Because additional entity level taxes would be imposed upon us as a corporation, our cash available for distribution could be substantially reduced. Although we are not currently aware of any legislative proposal that would adversely impact our treatment as a partnership, we are unable to predict whether any changes or other proposals will ultimately be enacted.

Other factors, including local events, natural disasters and terrorist activities, could adversely impact park attendance and our revenues.

Lower attendance may result from various local events, natural disasters or terrorist activities, all of which are outside of our control.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

ITEM 2. PROPERTIES.

Cedar Point and Soak City are located on approximately 365 acres, virtually all of which have been developed, on the Cedar Point peninsula in Sandusky, Ohio. Wildwater Kingdom, located near Cleveland, Ohio, is situated on approximately 670 total acres, of which 65 acres have been developed and are in use at the water park and an additional 65 acres are available for future expansion. The remaining acreage is available for sale.

The Partnership also owns approximately 100 acres of property on the mainland adjoining the approach to the Cedar Point Causeway. The Breakers Express hotel, the Castaway Bay Indoor Waterpark Resort and an adjoining restaurant, Castaway Bay Marina and two seasonal-employee housing complexes are located on this property.

The Partnership controls, through ownership or an easement, a six-mile public highway and owns approximately 40 acres of vacant land adjacent to this highway, which is a secondary access route to Cedar Point and serves about 250 private residences. The roadway is maintained by the Partnership pursuant to deed provisions. The Cedar Point Causeway, a four-lane roadway across Sandusky Bay, is the principal access road to Cedar Point and is owned by a subsidiary of the Partnership.

The Partnership purchased approximately 100 acres of property for development on the mainland located along an approaching public highway to Cedar Point. This land is intended to be used to develop a youth sporting complex.

Knott's Berry Farm and Knott's Soak City-Orange County, located in California, are situated on approximately 170 acres, virtually all of which have been developed.

Kings Island, located in Ohio, is situated on approximately 680 acres, of which 330 acres have been developed and 350 acres remain available for future expansion.

Canada's Wonderland, located near Toronto in Vaughn, Ontario, is situated on approximately 295 acres, virtually all of which have been developed.

Kings Dominion, located in Virginia, is situated on approximately 740 acres, of which 280 acres have been developed and 460 acres remain available for future expansion.

Dorney Park, located in Pennsylvania, is situated on approximately 210 acres, of which 180 acres have been developed and 30 acres remain available for future expansion.

Carowinds, located in Charlotte, North Carolina, is situated on approximately 400 acres, of which 300 acres have been developed and 100 acres remain available for future expansion.

Valleyfair, located in Minnesota, is situated on approximately 190 acres, of which 110 acres have been developed and approximately 80 additional acres remain available for future expansion.

Worlds of Fun / Oceans of Fun, located in Missouri, is situated on approximately 350 acres, of which 250 acres have been developed and 100 acres remain available for future expansion or other uses.

Great America, located in California, is situated on approximately 165 acres, virtually all of which have been developed.

Michigan's Adventure, located in Michigan, is situated on approximately 260 acres, of which 120 acres have been developed and 140 acres remain available for future expansion.

All of the Partnership's property is owned in fee simple, with the exception of Great America in Santa Clara, California, and portions of the six-mile public highway that serves as secondary access route to Cedar Point, and is encumbered by the Partnership's credit agreement. The Partnership leases the land at Great America from the City of Santa Clara through a long-term lease agreement that is renewable in 2039 with options to terminate at the Partnership's discretion. The Partnership considers its properties to be well maintained, in good condition and adequate for its present uses and business requirements.

ITEM 3. LEGAL PROCEEDINGS.

Ortegon, et al vs. Cedar Fair, L.P., Cedar Fair Management Company, et al

The Partnership and Cedar Fair Management, Inc. were defendants in a class action lawsuit filed in Superior Court of the State of California for Santa Clara County on October 3, 2013 by Frank Ortegon-Ramirez seeking damages and injunctive relief for claims related to certain employment and pay practices at our parks in California, including those related to certain check-out, time reporting, discharge and pay statement practices. The defendants filed an answer on November 21, 2013 denying the allegations in the complaint and requesting a dismissal of all claims. On November 12, 2014, the Partnership participated in a mediation relating to the claims alleged in the lawsuit. Following this mediation, the Partnership negotiated a $4.75 million settlement with the named Plaintiff on a class wide basis which was subject to final court approval. On September 28, 2015, the court granted final approval of the proposed settlement and the amounts were paid during the fourth quarter.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

PART II - OTHER INFORMATION

ITEM 5. MARKET FOR REGISTRANT'S DEPOSITARY UNITS, RELATED UNITHOLDER MATTERS AND ISSUER PURCHASES OF DEPOSITARY UNITS.

Cedar Fair, L.P. Depositary Units representing limited partner interests are listed for trading on The New York Stock Exchange under the symbol “FUN.” As of January 31, 2016, there were approximately 5,800 registered holders of Cedar Fair, L.P. Depositary Units, representing limited partner interests. Attention is directed to Item 12 in this Form 10-K for information regarding the Partnership's equity incentive plan, which information is incorporated herein by reference. The cash distributions declared and the high and low prices of the Partnership's units for each quarter of the past two years are shown in the table below:

|

| | | | | | | | | | | |

2015 | Distribution | | High | | Low |

4th quarter | $ | 0.83 |

| | $ | 59.00 |

| | $ | 50.60 |

|

3rd quarter | 0.75 |

| | 58.12 |

| | 48.94 |

|

2nd quarter | 0.75 |

| | 60.64 |

| | 54.78 |

|

1st quarter | 0.75 |

| | 58.94 |

| | 47.00 |

|

| | | | | |

2014 | | | | | |

4th quarter | $ | 0.75 |

| | $ | 48.25 |

| | $ | 42.75 |

|

3rd quarter | 0.70 |

| | 53.15 |

| | 45.05 |

|

2nd quarter | 0.70 |

| | 55.77 |

| | 48.84 |

|

1st quarter | 0.70 |

| | 54.70 |

| | 47.21 |

|

The Partnership's credit agreement includes provisions that allow the Partnership to make restricted payments up to $60 million annually at the discretion of the Board of Directors, so long as no default or event of default has occurred and is continuing and so long as the Partnership would be in compliance with certain financial ratios after giving effect to the payments. Additional restricted payments are allowed to be made based on an Excess-Cash-Flow formula, should the Partnership’s pro-forma Consolidated Leverage Ratio be less than or equal to 5.0x as measured quarterly utilizing trailing twelve month information.

Under the indentures governing our notes, the Partnership can make restricted payments of $60 million annually so long as no default or event of event of default has occurred and is continuing, and additional restricted payments may be made if the Partnership's pro-forma trailing-twelve-month Total Indebtedness-to-consolidated-Cash-Flow ratio would be less than or equal to 5.00x.

Issuer Purchases of Equity Securities

The following table presents information about repurchases of Cedar Fair, L.P. Depositary Units representing limited partner interests made by the Partnership during the fourth quarter of fiscal 2015:

|

| | | | | | | | | | | | | | | | |

Period | | (a)

Total Number of Units Purchased (1) | | (b)

Average Price Paid per Unit | | (c)

Total Number of Units Purchased as Part of Publicly Announced Plans or Programs | | (d)

Maximum Number (or Approximate Dollar Value) of Units that May Yet Be Purchased Under the Plans or Programs |

September 28 - October 27 | | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

October 28 - November 29 | | 268 |

| | 57.00 |

| | — |

| | — |

|

November 30 - December 31 | | 15,770 |

| | 55.84 |

| | — |

| | — |

|

| | $ | 16,038 |

| | $ | 55.86 |

| | $ | — |

| | $ | — |

|

| |

(1) | All of the units reported as purchased are attributable to units that were reacquired by the Partnership in satisfaction of tax obligations related to the vesting of restricted units which were granted under the Cedar Fair, L.P. 2008 Omnibus Incentive Plan. |

Unitholder Return Performance Graph

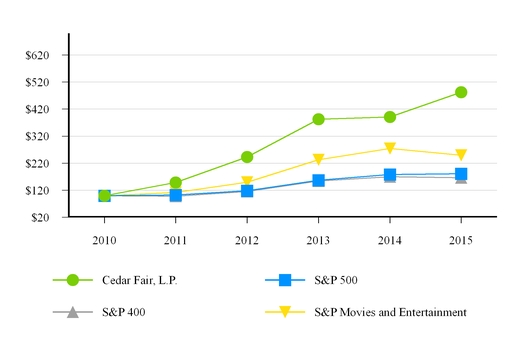

The graph below shows a comparison of the five-year cumulative total return (assuming all distributions/dividends reinvested) on Cedar Fair, L.P. limited partnership units, the S&P 500 Index, the S&P 400 Index and the S&P - Movies and Entertainment Index, assuming investment of $100 on December 31, 2010.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Base Period | | | Return |

| | | 2010 | | | 2011 | | 2012 | | 2013 | | 2014 | | 2015 |

Cedar Fair, L.P. | | | $ | 100.00 |

| | | $ | 148.63 |

| | $ | 243.39 |

| | $ | 382.79 |

| | $ | 391.16 |

| | $ | 482.22 |

|

S&P 500 | | | 100.00 |

| | | 102.11 |

| | 118.45 |

| | 156.81 |

| | 178.28 |

| | 180.78 |

|

S&P 400 | | | 100.00 |

| | | 98.27 |

| | 115.84 |

| | 154.65 |

| | 169.76 |

| | 166.06 |

|

S&P Movies and Entertainment | | | 100.00 |

| | | 111.34 |

| | 149.91 |

| | 233.21 |

| | 274.76 |

| | 249.36 |

|

ITEM 6. SELECTED FINANCIAL DATA.

|

| | | | | | | | | | | | | | | | | | | | |

| | 2015 (1) | | 2014 (2) | | 2013 (3) | | 2012 (4) | | 2011 |

| | (In thousands, except per unit and per capita amounts) |

| | | | | | | | | | |

Statement of Operations | | | | | | | | | | |

Net revenues | | $ | 1,235,778 |

| | $ | 1,159,605 |

| | $ | 1,134,572 |

| | $ | 1,068,454 |

| | $ | 1,028,472 |

|

Operating income | | 295,331 |

| | 278,332 |

| | 301,761 |

| | 233,675 |

| | 227,946 |

|

Income before taxes | | 134,414 |

| | 114,100 |

| | 128,447 |

| | 133,614 |

| | 73,173 |

|

Net income | | 112,222 |

| | 104,215 |

| | 108,204 |

| | 101,857 |

| | 65,296 |

|

Net income per unit - basic | | 2.01 |

| | 1.88 |

| | 1.95 |

| | 1.83 |

| | 1.18 |

|

Net income per unit - diluted | | 1.99 |

| | 1.86 |

| | 1.94 |

| | 1.82 |

| | 1.17 |

|

Balance Sheet Data | | | | | | | | | | |

Total assets | | $ | 1,994,907 |

| | $ | 2,038,319 |

| | $ | 2,014,627 |

| | $ | 2,019,865 |

| | $ | 2,047,168 |

|

Working capital (deficit) | | (2,457 | ) | | 5,498 |

| | 27,698 |

| | 2,904 |

| | (104,928 | ) |

Long-term debt | | 1,556,375 |

| | 1,558,850 |

| | 1,520,632 |

| | 1,532,180 |

| | 1,556,379 |

|

Partners' equity | | 57,009 |

| | 96,217 |

| | 139,131 |

| | 154,451 |

| | 136,350 |

|

Distributions | | | | | | | | | | |

Declared per limited partner unit | | $ | 3.08 |

| | $ | 2.85 |

| | $ | 2.58 |

| | $ | 1.60 |

| | $ | 1.00 |

|

Paid per limited partner unit | | 3.08 |

| | 2.85 |

| | 2.58 |

| | 1.60 |

| | 1.00 |

|

Other Data | | | | | | | | | | |

Depreciation and amortization | | $ | 125,631 |

| | $ | 124,286 |

| | $ | 122,487 |

| | $ | 126,306 |

| | $ | 125,837 |

|

Adjusted EBITDA (5) | | 459,238 |

| | 431,280 |

| | 425,430 |

| | 390,954 |

| | 374,576 |

|

Capital expenditures | | 175,865 |

| | 166,719 |

| | 120,488 |

| | 96,232 |

| | 90,190 |

|

Combined attendance (6) | | 24,448 |

| | 23,305 |

| | 23,519 |

| | 23,300 |

| | 23,386 |

|

Combined in-park guest per capita spending (7) | | $ | 46.20 |

| | $ | 45.54 |

| | $ | 44.15 |

| | $ | 41.95 |

| | $ | 40.03 |

|

| |

(1) | Operating results for 2015 include a non-cash charge of $8.6 million for the impairment of a long-lived asset at Cedar Point. |

| |

(2) | Operating results for 2014 include a charge of $29.3 million for the loss on early debt extinguishment and a non-cash charge of $2.4 million for the impairment of long-lived assets at Wildwater Kingdom. |

| |

(3) | Operating results for 2013 include a non-cash charge of $34.6 million for the loss on early debt extinguishment. |

| |

(4) | Operating results for 2012 include a non-cash charge of $25.0 million for the impairment of long-lived assets at Wildwater Kingdom. |

| |

(5) | Adjusted EBITDA represents earnings before interest, taxes, depreciation, amortization, other non-cash items, and adjustments as defined in our current credit agreement. Adjusted EBITDA is not a measurement of operating performance computed in accordance with GAAP and should not be considered as a substitute for operating income, net income or cash flows from operating activities computed in accordance with GAAP. We believe that Adjusted EBITDA is a meaningful measure of park-level operating profitability and we use it for measuring returns on capital investments, evaluating potential acquisitions, determining awards under incentive compensation plans, and calculating compliance with certain loan covenants. Adjusted EBITDA may not be comparable to similarly titled measures of other companies. A reconciliation of net income to Adjusted EBITDA is provided below. |

| |

(6) | Combined attendance includes attendance figures from the eleven amusement parks and all separately gated outdoor water parks. |

| |

(7) | Combined in-park guest per capita spending ("per capita spending") includes all amusement park, outdoor water park, causeway tolls and parking revenues for the amusement park and water park operating seasons. Revenues from indoor water park, hotel, campground, marina and other out-of-park operations are excluded from per capita statistics. |

We believe that Adjusted EBITDA (earnings before interest, taxes, depreciation, amortization, other non-cash items, and adjustments as defined in our credit agreement) is a meaningful measure of park-level operating profitability and we use it for measuring returns on capital investments, evaluating potential acquisitions, determining awards under incentive compensation plans, and calculating compliance with certain loan covenants. Adjusted EBITDA is provided in the discussion of results of operations that follows as a supplemental measure of our operating results and is not intended to be a substitute for operating income, net income or cash flows from operating activities as defined under generally accepted accounting principles. In addition, Adjusted EBITDA may not be comparable to similarly titled measures of other companies.

Reconciliation of Net Income to Adjusted EBITDA:

|

| | | | | | | | | | | | | | | | | | | | |

| | 2015 | | 2014 | | 2013 | | 2012 | | 2011 |

| | (In thousands ) |

Net income | | $ | 112,222 |

| | $ | 104,215 |

| | $ | 108,204 |

| | $ | 101,857 |

| | $ | 65,296 |

|

Interest expense | | 86,849 |

| | 96,286 |

| | 103,071 |

| | 110,619 |

| | 157,185 |

|

Interest income | | (64 | ) | | (126 | ) | | (154 | ) | | (68 | ) | | (157 | ) |

Provision for taxes | | 22,192 |

| | 9,885 |

| | 20,243 |

| | 31,757 |

| | 7,877 |

|

Depreciation and amortization | | 125,631 |

| | 124,286 |

| | 122,487 |

| | 126,306 |

| | 125,837 |

|

EBITDA | | 346,830 |

| | 334,546 |

| | 353,851 |

| | 370,471 |

| | 356,038 |

|

Loss on early debt extinguishment | | — |

| | 29,261 |

| | 34,573 |

| | — |

| | — |

|

Net effect of swaps | | (6,884 | ) | | (2,062 | ) | | 6,883 |

| | (1,492 | ) | | (13,119 | ) |

Unrealized foreign currency loss (gain) | | 80,946 |

| | 40,883 |

| | 29,085 |

| | (9,181 | ) | | 9,830 |

|

Equity-based compensation | | 15,470 |

| | 12,536 |

| | 5,535 |

| | 3,265 |

| | (239 | ) |

Loss on impairment/retirement of fixed assets, net | | 20,873 |

| | 9,757 |

| | 2,539 |

| | 30,336 |

| | 11,355 |

|

Gain on sale of other assets | | — |

| | (921 | ) | | (8,743 | ) | | (6,625 | ) | | — |

|

Terminated merger costs | | — |

| | — |

| | — |

| | — |

| | 230 |

|

Refinancing costs | | — |

| | — |

| | — |

| | — |

| | 955 |

|

Class action settlement costs | | 259 |

| | 4,953 |

| | — |

| | — |

| | — |

|

Other non-recurring costs (1) | | 1,744 |

| | 2,327 |

| | 1,707 |

| | 4,180 |

| | 9,526 |

|

Adjusted EBITDA | | $ | 459,238 |

| | $ | 431,280 |

| | $ | 425,430 |

| | $ | 390,954 |

| | $ | 374,576 |

|

| | | | | | | | | | |

| |

(1) | The Company's current and prior credit agreements reference certain costs as non-recurring or unusual. These items are excluded in the calculation of Adjusted EBITDA and have included litigation expenses and costs for SEC compliance matters related to Special Meeting requests, costs associated with certain unusual ride abandonment and relocation expenses, and costs associated with the transition to a new advertising agency. |

| |

ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

Business Overview

We generate our revenues primarily from sales of (1) admission to our parks, (2) food, merchandise and games inside our parks, and (3) hotel rooms, food and other attractions outside our parks. Our principal costs and expenses, which include salaries and wages, advertising, maintenance, operating supplies, utilities and insurance, are relatively fixed and do not vary significantly with attendance.

Each of our properties is overseen by a park general manager and operates autonomously. Management reviews operating results, evaluates performance and makes operating decisions, including the allocation of resources, on a property-by-property basis.

Discrete financial information and operating results are prepared at the individual park level for use by the CEO, who is the Chief Operating Decision Maker (CODM), as well as by the Chief Financial Officer, the Chief Operating Officer, the Executive Vice President of Operations, and the park general managers.

The following table presents certain financial data expressed as a percent of total net revenues and selective statistical information for the periods indicated.

|

| | | | | | | | | | | | | | | | | | | | | | |

For the years ended December 31, | | | 2015 | | 2014 | | 2013 |

| | | ( amounts in millions, except attendance, per capita spending and percentages) |

Net revenues: | | | | | | | | | | | | | |

Admissions | | | $ | 687.4 |

| | 55.6 | % | | $ | 661.5 |

| | 57.0 | % | | $ | 647.0 |

| | 57.0 | % |

Food, merchandise and games | | | 398.0 |

| | 32.2 | % | | 365.5 |

| | 31.5 | % | | 356.1 |

| | 31.4 | % |

Accommodations and other | | | 150.3 |

| | 12.2 | % | | 132.6 |

| | 11.4 | % | | 131.5 |

| | 11.6 | % |

Net revenues | | | 1,235.7 |

| | 100.0 | % | | 1,159.6 |

| | 100.0 | % | | 1,134.6 |

| | 100.0 | % |

Operating costs and expenses | | | 793.9 |

| | 64.2 | % | | 748.1 |

| | 64.5 | % | | 716.5 |

| | 63.2 | % |

Depreciation and amortization | | | 125.6 |

| | 10.2 | % | | 124.2 |

| | 10.7 | % | | 122.5 |

| | 10.8 | % |

Loss on impairment / retirement of fixed assets | | 20.9 |

| | 1.7 | % | | 9.8 |

| | 0.8 | % | | 2.5 |

| | 0.2 | % |

Gain on sale of other assets | | | — |

| | — | % | | (0.9 | ) | | (0.1 | )% | | (8.7 | ) | | (0.8 | )% |

Operating income | | | 295.3 |

| | 23.9 | % | | 278.4 |

| | 24.0 | % | | 301.8 |

| | 26.6 | % |

Interest and other expense, net | | | 86.8 |

| | 7.0 | % | | 96.2 |

| | 8.3 | % | | 102.9 |

| | 9.0 | % |

Net effect of swaps | | | (6.9 | ) | | (0.6 | )% | | (2.1 | ) | | (0.2 | )% | | 6.9 |

| | 0.6 | % |

Loss on early debt extinguishment | | | — |

| | — | % | | 29.3 |

| | 2.5 | % | | 34.6 |

| | 3.0 | % |

Unrealized / realized foreign currency loss | | 81.0 |

| | 6.6 | % | | 40.9 |

| | 3.5 | % | | 28.9 |

| | 2.5 | % |

Provision for taxes | | | 22.2 |

| | 1.8 | % | | 9.9 |

| | 0.9 | % | | 20.3 |

| | 1.8 | % |

Net income | | | $ | 112.2 |

| | 9.1 | % | | $ | 104.2 |

| | 9.0 | % | | $ | 108.2 |

| | 9.5 | % |

Other data: | | | | | | | | | | | | | |

Combined attendance (in thousands) | | 24,448 |

| | | | 23,305 |

| | | | 23,519 |

| | |

Combined in-park guest per capita spending | | $ | 46.20 |

| | | | $ | 45.54 |

| | | | $ | 44.15 |

| | |

Critical Accounting Policies

Management's Discussion and Analysis of Financial Condition and Results of Operations is based upon our consolidated financial statements, which were prepared in accordance with accounting principles generally accepted in the United States of America. These principles require us to make judgments, estimates and assumptions during the normal course of business that affect the amounts reported in the Consolidated Financial Statements and related notes. The following discussion addresses our critical accounting policies, which are those that are most important to the portrayal of our financial condition and operating results or involve a higher degree of judgment and complexity (see Note 2 to our Consolidated Financial Statements for a complete discussion of our significant accounting policies). Application of the critical accounting policies described below involves the exercise of judgment and the use of assumptions as to future uncertainties, and, as a result, actual results could differ from these estimates and assumptions.

Impairment of Long-Lived Assets

The carrying values of long-lived assets, including property and equipment, are reviewed whenever events or changes in circumstances indicate that the carrying values of the assets may not be recoverable. An impairment loss may be recognized when estimated undiscounted future cash flows expected to result from the use of the assets, including disposition, are less than the carrying value of the assets. The measurement of the impairment loss to be recognized is based on the difference between the fair value and the carrying amounts of the assets. Fair value is generally determined based on a discounted cash flow analysis. In order to determine if an asset has been impaired, assets are grouped and tested at the lowest level for which identifiable, independent cash flows are available.

The determination of both undiscounted and discounted cash flows requires management to make significant estimates and consider an anticipated course of action as of the balance sheet date. Subsequent changes in estimated undiscounted and discounted cash flows arising from changes in anticipated actions could impact the determination of whether impairment exists, the amount of the impairment charge recorded and whether the effects could materially impact the consolidated financial statements.

At the end of the fourth quarter of 2015, the Partnership decided to permanently remove from service a long-lived asset at Cedar Point. Accordingly, the Partnership recognized and recorded an $8.6 million charge for impairment equal to the remaining net book value of this long-lived asset. The amount was recorded in "Loss on impairment / retirement of fixed assets, net" on the consolidated statement of operations and comprehensive income.

At the end of the fourth quarter of 2014, the Partnership concluded based on 2014 operating results and updated forecasts for the coming years, that a review of the carrying value of operating long-lived assets at Wildwater Kingdom was warranted. After performing its review, the Partnership determined that the park's fixed assets were impaired by $2.4 million. This amount was recorded in "Loss on impairment / retirement of fixed assets, net" on the consolidated statement of operations and comprehensive income.

There was no impairment of any long-lived assets in 2013.

Goodwill and Other Intangible Assets

Goodwill and other indefinite-lived intangible assets, including trade-names, are reviewed for impairment annually, or more frequently if indicators of impairment exist. A significant amount of judgment is involved in determining if an indicator of impairment has occurred. Such indicators may include, among others: a significant decline in expected future cash flows; a sustained, significant decline in equity price and market capitalization; a significant adverse change in legal factors or in the business climate; unanticipated competition; the testing for recoverability of a significant asset group within a reporting unit; and slower growth rates. Any adverse change in these factors could have a significant impact on the recoverability of these assets and could have a material impact on our consolidated financial statements.

An impairment loss may be recognized if the carrying value of the reporting unit is higher than its fair value, which is estimated using both an income (discounted cash flow) and market approach. The amount of impairment is determined by comparing the implied fair value of reporting unit goodwill to the carrying value of the goodwill in the same manner as if the reporting unit was being acquired in a business combination. If the implied fair value of goodwill is less than the recorded goodwill, an impairment charge is recorded for the difference. Goodwill and trade-names have been assigned at the reporting unit, or park level, for purposes of impairment testing.

During 2015, we changed the annual goodwill impairment testing date from the last day of the fourth quarter to the first day of the fourth quarter. We believe this voluntary change is preferable because it better aligns our goodwill impairment testing procedures with the completion of our annual financial and strategic planning process and provides us with adequate time to evaluate goodwill for impairment. This change in accounting principle did not delay, accelerate or avoid an impairment loss, nor did the change have a cumulative effect on net income or loss, or partners' equity. The Partnership determined that it would be impracticable to objectively determine projected cash flows and related valuation estimates that would have been used as of each first day of the fourth quarter for each of our prior reporting periods without the use of hindsight. As such, the Partnership applied the change in annual goodwill impairment testing date prospectively beginning September 28, 2015, the first day of the fourth quarter.

We completed the review of goodwill and other indefinite-lived intangibles as of September 28, 2015, December 31, 2014 and December 31, 2013, respectively, and determined the goodwill and other indefinite-lived intangibles were not impaired at these testing dates. Further, as of the testing dates, all reporting units with goodwill had fair values in excess of their carrying values by greater than 10%.

It is possible that our assumptions about future performance, as well as the economic outlook and related conclusions regarding the valuation of our reporting units (parks), could change adversely, which may result in additional impairment that would have a material effect on our financial position and results of operations in future periods.

Self-Insurance Reserves

Reserves are recorded for the estimated amounts of guest and employee claims and expenses incurred each period that are not covered by insurance. Reserves are established for both identified claims and incurred but not reported (IBNR) claims. Such amounts are accrued for when claim amounts become probable and estimable. Reserves for identified claims are based upon our own historical claims experience and third-party estimates of settlement costs. Reserves for IBNR claims, which are not material to our consolidated financial statements, are based upon our own claims data history. All reserves are periodically reviewed for changes in facts and circumstances and adjustments are made as necessary.

Derivative Financial Instruments