UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended: | December 31, 2016 | |

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to |

Commission file number: 0-14948

Fiserv, Inc.

(Exact Name of Registrant as Specified in Its Charter)

Wisconsin (State or Other Jurisdiction of Incorporation or Organization) | 39-1506125 (I.R.S. Employer Identification No.) | |

255 Fiserv Dr., Brookfield, WI 53045

(Address of Principal Executive Offices, Including Zip Code)

Registrant’s telephone number, including area code: (262) 879-5000

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, par value $0.01 per share | The NASDAQ Stock Market LLC | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer þ Accelerated Filer ¨ Non-Accelerated Filer ¨ Smaller Reporting Company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the common stock of the registrant held by non-affiliates as of June 30, 2016 (the last trading day of the second fiscal quarter) was $23,949,604,597 based on the closing price of the registrant’s common stock on the NASDAQ Global Select Market on that date. The number of shares of the registrant’s common stock, $0.01 par value per share, outstanding at February 16, 2017 was 214,563,950.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this report incorporates information by reference to the registrant’s proxy statement for its 2017 annual meeting of shareholders, which proxy statement will be filed with the Securities and Exchange Commission no later than 120 days after the close of the fiscal year ended December 31, 2016.

TABLE OF CONTENTS

Page | ||

PART I | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

PART II | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

PART III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

PART IV | ||

Item 15. | ||

Item 16. | ||

i

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements” intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include those that express a plan, belief, expectation, estimation, anticipation, intent, contingency, future development or similar expression, and can generally be identified as forward-looking because they include words such as “believes,” “anticipates,” “expects,” “could,” “should” or words of similar meaning. Statements that describe our future plans, objectives or goals are also forward-looking statements. The forward-looking statements in this report involve significant risks and uncertainties, and a number of factors, both foreseen and unforeseen, could cause actual results to differ materially from our current expectations. The factors that may affect our results include, among others: pricing and other actions by competitors; the capacity of our technology to keep pace with a rapidly evolving marketplace; the impact of market and economic conditions on the financial services industry; the impact of a security breach or operational failure on our business; the effect of legislative and regulatory actions in the United States and internationally; our ability to comply with government regulations; our ability to successfully identify, complete and integrate acquisitions, and to realize the anticipated benefits associated with the same; the impact of our strategic initiatives; and other factors discussed in this report under the heading “Risk Factors.” You should consider these factors carefully in evaluating forward-looking statements and are cautioned not to place undue reliance on such statements, which speak only as of the date of this report. We undertake no obligation to update forward-looking statements to reflect events or circumstances occurring after the date of this report. We are not including the information provided on the websites referenced herein as part of, or incorporating such information by reference into, this Annual Report on Form 10-K.

PART I

In this report, all references to “we,” “us” and “our” refer to Fiserv, Inc. (“Fiserv”), a Wisconsin corporation, and, unless the context otherwise requires, its consolidated subsidiaries.

Item 1. Business

Overview

Fiserv, Inc. is a leading global provider of financial services technology. We are publicly traded on the NASDAQ Global Select Market and part of the S&P 500 Index. We serve over 12,000 clients worldwide, including banks, thrifts, credit unions, investment management firms, leasing and finance companies, retailers, merchants, mutual savings banks, and building societies. We provide account processing systems; electronic payments processing products and services, such as electronic bill payment and presentment services, card-based transaction processing and network services, ACH transaction processing, account-to-account transfers, and person-to-person payments; internet and mobile banking systems; and related services including document and payment card production and distribution, check processing and imaging, source capture systems, and lending and risk management products and services. Most of the services we provide are necessary for our clients to operate their businesses and are, therefore, non-discretionary in nature. Our operations are principally located in the United States where we operate data and transaction processing centers, provide technology support, develop software and payment solutions, and offer consulting services. We also own a 49% interest in StoneRiver Group, L.P. (“StoneRiver”), which is comprised of our former insurance services businesses.

In 2016, we had $5.5 billion in total revenue, $1.4 billion in operating income and $1.4 billion of net cash provided by operating activities from continuing operations. Processing and services revenue, which in 2016 represented 84% of our total revenue, is primarily generated from account- and transaction-based fees under contracts that generally have terms of three to five years and high renewal rates. Revenue from clients outside the United States comprised approximately 5% of total revenue in 2016 and 6% in each of 2015 and 2014.

We have grown our business by developing highly specialized services and product enhancements, extending our capabilities through innovation, adding new clients, selling additional products and services to existing clients, and acquiring businesses that complement ours, which has enabled us to deliver a wide range of integrated products and services and has created new opportunities for growth.

We originally incorporated in Delaware in 1984 and reincorporated as a Wisconsin corporation in 1992. Our headquarters are located at 255 Fiserv Drive, Brookfield, Wisconsin 53045, and our telephone number is (262) 879-5000.

Our operations are reported in the Payments and Industry Products (“Payments”) and Financial Institution Services (“Financial”) business segments. Financial information regarding our business segments is included in Note 8 to the consolidated financial statements.

1

Payments

The businesses in our Payments segment provide financial institutions and other companies with the products and services required to process electronic payment transactions and to offer their customers access to financial services and transaction capability through digital channels. Financial institutions and other companies have increasingly relied on third-party providers for those products and services, either on a licensed software or outsourced basis, as an increasing number of payment transactions are completed electronically as our clients’ customers seek the convenience of 24-hour digital access to their financial accounts. Within the Payments segment, we primarily provide electronic bill payment and presentment services, internet and mobile banking software and services, person-to-person payment services, debit and credit card processing and services, and other electronic payments software and services. Our businesses in this segment also provide card and print personalization services, investment account processing services for separately managed accounts, and fraud and risk management products and services. Our solutions in the Payments segment include:

Electronic Payments

Our electronic payments business is comprised of electronic bill payment and presentment services and other electronic payment services for businesses and consumers, such as person-to-person payments, account-to-account transfers, account opening and funding, and small business invoicing and payments. Our principal electronic bill payment and presentment product, CheckFree® RXP®, allows our clients’ customers: to manage household bills via an easy-to-use, online tool; to view billing and payment information; to pay and manage all of their bills in one place; for certain billers, to experience speed comparable to payment at a biller’s site via same-day bill payment; and to make convenient next-day payments to many of the companies with which they do business. We use our systems to process the vast majority of the payment transactions that we handle, which enables us to improve our economies of scale. Once a consumer has accessed the system through a financial institution, he or she can elect to pay an electronic bill delivered by us or can instruct the system to pay individuals or companies that have bank accounts located within the U.S.

Our person-to-person payments solution, Popmoney®, allows consumers a convenient way to send and receive money while offering financial institutions the opportunity to generate new transaction-based revenue, attract new accounts and increase loyalty among existing customers. Popmoney Instant Payments extends the functionality of the Popmoney personal payment service by enabling near real-time exchange of funds. Popmoney can be accessed through the www.popmoney.com website, our mobile applications for iPhone® and Android™, or the websites and mobile banking applications of participating financial institutions. As of December 31, 2016, more than 2,500 financial institutions have agreed to offer our person-to-person payments services to their customers.

Digital Channels

Our principal digital consumer and business banking products are Architect™, Corillian Online®, Corillian® Business Online and Mobiliti™. Our Corillian product suite supports multiple lines of banking businesses and has been designed to be highly scalable to meet the evolving needs of our clients. This structure enables our clients to deploy new services by adding and integrating applications, such as electronic bill payment, person-to-person payments and personal financial management tools, to any internet connected point-of-presence. Our Mobiliti product suite provides a variety of mobile banking and payments services to our clients and their customers, including balance inquiry, transaction history, bill payment, person-to-person payments and transfers, via mobile browser, downloadable application for smart phones and tablets, and text message. We also provide the advanced capabilities of Corillian Online and Mobiliti as an outsourced service, known as Corillian Online ASP and Mobiliti ASP. As of December 31, 2016, we had approximately 2,400 mobile banking clients.

In the first quarter of 2016, we completed our purchase of the Community Financial Services business of ACI Worldwide, Inc., adding a suite of digital banking and payments solutions, including Architect, which supports online, mobile and tablet banking for retail and small business customers on a single platform.

Card Services

Our card services business is a leader in electronic funds transfer and provides a total payments solution through a variety of products and services. We provide thousands of financial institution clients with a full range of credit and debit processing services, including: ATM monitoring, tokenization, loyalty and reward programs, real-time person-to-person payments, customized authorization processing, direct access and settlement for networks, and risk management solutions. We own and operate the Accel® network, which serves over 3,200 financial institutions with funds access at over 400,000 ATMs and incorporates CardFree CashSM access as well as EMV™ chip and traditional magnetic stripe cards. Our Accel network point of sale support delivers comprehensive coverage of PIN and signature authentication support at physical and electronic commerce merchants across the country. Our digital enablement capability provides our clients’ consumers with mobile-based,

2

customizable card management and alert tools that drive engagement and revenue for our issuers, and our risk management tools and portfolio management services are integrated with real-time fraud decisioning.

Biller Solutions

Our biller business provides electronic billing and payment services to companies that deliver bills to their customer base, such as utilities, telephone and cable companies, consumer lending institutions, and insurance providers, enabling our biller clients to reduce costs, collect payments faster, increase customer satisfaction, and provide customers flexible, easy-to-use ways to view and pay their bills. In the first quarter of 2016, we acquired the Convenience Pay Services business of Hewlett Packard Enterprise Company, which enables providers to accept electronic payments from their consumers through multiple channels, thereby expanding our biller solution offerings.

Consumers use our electronic billing and payment systems by viewing or paying a bill through a financial institution’s bill payment application, use of a biller’s website, mobile application or automated phone system, www.mycheckfree.com, or by paying in person at one of more than 24,000 nationwide walk-in payment locations. These diverse services allow our clients’ customers to view and pay bills wherever, whenever and however they feel most comfortable. Furthermore, because our biller clients are able to receive all of these services from us, we can eliminate the operational complexity and expense of supporting multiple vendor systems or in-house developed systems.

Output Solutions

Our output solutions business provides business communication solutions to clients across a wide variety of industries, including financial services, healthcare, retail, utilities, and travel and entertainment. Our products and services include: electronic document management through our electronic document delivery products and services; card manufacturing, personalization and mailing; statement production and mailing; design and fulfillment of direct mail solutions; forms distribution; laser printing and mailing; branded merchandise; and office supplies.

Investment Services

Our investment services business provides technology solutions that enable financial planning, portfolio management and trading, model management, performance measurement, and reporting products and services to approximately 300 financial service organizations, including broker dealers, registered investment advisors, banks, asset managers and insurance companies that deliver financial advice and managed account products to U.S. retail investors. Our investment services business also supports global institutional asset managers and asset servicers with portfolio accounting, performance analytics, fee billing and revenue management, and post-trade processing technology. Our primary product, the Unified Wealth Platform, is a real-time portfolio management, trading and reporting system used by some of the largest brokerage firms and asset managers in the U.S. offering managed accounts, based on assets under management.

Risk Management Solutions

Our risk management solutions business provides financial and risk management products and services that deliver operating efficiencies and management insight which enable our clients to protect and grow their businesses. Our Enterprise Performance Management and Financial Control Solutions offerings include budgeting and planning, financial accounting, and automated reconciliation and account certification tools to facilitate a robust assessment environment and efficient close process for our clients. These solutions are further complemented by fraud detection and mitigation through our predictive analytics solution, Fraud Risk and Anti-Money Laundering Compliance Management.

Financial

The businesses in our Financial segment provide financial institutions with the products and services they need to run their operations. Many financial institutions that previously developed their own software systems and maintained their own data processing operations now license software from third parties or outsource their data processing requirements by contracting with third-party processors. This has allowed them to reduce costs and enhance their products, services, capacity and capabilities. The licensing of software reduces the need for costly technical expertise within a financial institution, and outsourcing data processing operations reduces the infrastructure and other costs required to operate systems internally. Within the Financial segment, we provide banks, thrifts, credit unions, and leasing and finance companies with account processing services, item processing and source capture services, loan origination and servicing products, cash management and consulting services, and other products and services that support numerous types of financial transactions. Many of the products and services that we sell are integrated with solutions from our Payments segment such as electronic bill payment and presentment, internet and mobile banking, debit processing and network services, and person-to-person payments. Our solutions in the Financial segment include:

3

Account Processing

We provide account servicing and management technology solutions to our bank, thrift and credit union clients, as well as a range of integrated, value-added banking products and services. Account processing solutions are the principal systems that enable a financial institution to operate systems that process customer deposit and loan accounts, an institution’s general ledger, central information files and other financial information. These solutions also include extensive security, report generation and other features that financial institutions need to process transactions for their customers, as well as to comply with applicable regulations. Although many of our clients contract to obtain a majority of their processing requirements from us, our software design allows clients to start with one application and, as needed, add applications and features developed by us or by third parties. We support a broad range of client-owned peripheral devices manufactured by a variety of vendors, which reduces a new client’s initial conversion expenses, enhances existing clients’ ability to change technology and broadens our market opportunity.

The principal account processing solutions used by our bank and thrift clients are Cleartouch®, DNA®, Precision®, Premier®, Signature® and TotalPlus®. The principal account processing solutions primarily used by our credit union clients are Advantage™, CharlotteSM, CubicsPlus®, CUnify™, CUSA®, DataSafe®, DNA, Galaxy®, OnCU®, Portico®, Reliance®, Spectrum® and XP2®. The Signature and DNA systems are available both domestically and internationally. In addition, we offer Agiliti™ as a software-as-a-service solution to the UK financial services industry. Account processing solutions are generally offered as an outsourced service or as licensed software for installation on client-owned or hosted computer systems.

Item Processing

Our item processing business offers products and services to financial institutions and intermediaries. Through the Fiserv Clearing Network, we provide complete check clearing and image exchange services. Other solutions include image archive with online retrieval, in-clearings, exceptions and returns, statements and fraud detection. We also provide consulting services, business operations services and related software products that facilitate the transformation of our clients’ check capture environments from paper-based to electronic.

Lending and Other Solutions

Our lending business offers life-of-loan digital products and services to financial institutions and market intermediaries including loan originations, servicing and default systems primarily for auto, consumer and real estate. In addition, our lending solutions include a full complement of professional services, such as customization, business process outsourcing, training, consulting and implementation services.

Other businesses in this segment provide solutions for ACH, cash and treasury management, case management and resolution, and source capture optimization to the financial services industry. Our offerings include Immediate FundsSM, PEP+®, Integrated Currency Manager™, Device Manager™, CorPoint®, and our remote deposit capture solutions branded as Source Capture Solutions®.

Our Strategy

Our vision is to be a global leader in transaction-based technology solutions. Our mission is to provide integrated technology and services solutions that enable best-in-class results for our clients. We are focused on operating businesses where we have: deep industry expertise that enables us to serve the market with high effectiveness; a strong competitive position, currently or via a clear path in the foreseeable future; long-term, trusted client relationships that are based on recurring services and transactions; differentiated solutions that deliver value to our clients through integration and innovation; and strong management to execute strategies in a disciplined manner. Consistent with this focus, we continue to operate our business in accordance with the following strategic framework:

• | Portfolio Management. We expect to acquire businesses when we identify: a compelling strategic need, such as a product, service or technology that helps meet client demand; an opportunity to change industry dynamics; a way to achieve business scale; or similar considerations. We expect to divest businesses that are not in line with our market, product or financial strategies. |

• | Client Relationship Value. We plan to increase the number and breadth of our client relationships by, among other actions: continuing to integrate our products and services; introducing new products and services that are aligned with market needs; combining products and services to deliver enhanced, integrated value propositions; and improving the quality of our client service and support. |

4

• | Operational Effectiveness. We believe we can improve the quality of our client delivery while reducing our costs by using the opportunities created by our size and scale. For example, we are using our consolidated buying power and optimizing our facilities to create cost savings. |

• | Capital Discipline. We intend to make capital allocation decisions that offer the best prospects for our long-term growth and profitability, which may include, among other matters, internal investment, repayment of debt, repurchases of our own shares or acquisitions. |

• | Innovation. We seek to be an innovation leader, utilizing our assets and capabilities to be at the forefront of our industry and enable our clients to deliver best-in-class results. |

Servicing the Market

The markets for our account and transaction processing services have specific needs and requirements, with strong emphasis placed by clients on flexibility, quality, comprehensiveness and integration of product lines, service reliability, timely introduction of new products and features, and cost effectiveness. We believe that our financial strength and primary focus on the financial services industry enhances our ability to meet these needs and service our clients. In addition, we believe that our dedication to providing excellent client service and support no matter the size of the client and our commitment of substantial resources to training and technical support helps us to identify and fulfill the needs of our clients.

Product Development

To meet the changing technology needs of our clients, we continually develop, maintain and enhance our products and systems. Product development expenditures represented approximately 8% of our total revenue in 2016 and 9% in each of 2015 and 2014. Our development and technology centers apply the expertise of multiple teams to design, develop and maintain specialized processing systems. Our account processing systems are designed to meet the preferences and diverse requirements of the international, national, regional or local market-specific financial service environments of our clients. In developing our products, we use current software development principles, such as service-oriented architecture, to create efficiencies, and we stress interaction with and responsiveness to the needs of our clients.

Intellectual Property

We regard our software, transaction processing services and related products as proprietary, and we utilize a combination of patent, copyright, trademark and trade secret laws, internal security practices, and employee and third party non-disclosure agreements to protect our intellectual property assets. Our patents cover innovations relating to numerous financial software products and services, and we continue, where appropriate, to seek and secure patents with respect to our ongoing innovations. We believe that we possess all proprietary rights necessary to conduct our business.

Competition

The market for technology products and services in the financial industry is highly competitive. Our principal competitors include other vendors of financial services technology, data processing affiliates of large companies, and processing centers owned and operated as user cooperatives. Outside the U.S., our primary competitors include global and local IT product and services companies, as well as payment service providers and processors. Furthermore, we expect competition to continue to increase as new companies enter our markets and existing competitors expand their product lines and services. Some of these competitors possess substantially greater financial, sales and marketing resources than we do and have substantial flexibility in competing with us, including through the use of integrated product offerings and through pricing. Competitive factors for our business include product quality, security, service reliability, product line comprehensiveness and integration, timely introduction of new products and features, and price. We believe that we compete favorably in each of these categories. Additional information about competition in our segments is provided below.

Payments

We compete with a number of competitors in our bill payment, digital channels, card services and biller businesses, including ACI Worldwide, Inc., Fidelity National Information Services, Inc. (“FIS”), First Data Corporation, Jack Henry and Associates Inc. (“Jack Henry”), MasterCard Incorporated, NCR Corporation, Q2 Holdings, Inc., Total System Services, Inc.,Vantiv, Inc., Visa Inc. and The Western Union Company. In addition to traditional payments competitors, large technology, media and other providers are increasingly seeking to provide or facilitate a wide range of point of sale and non-point of sale payments. These newer competitors include, but are not limited to, Alphabet Inc., Amazon.com, Inc., Apple Inc., Facebook, Inc., Intuit Inc., PayPal Holdings, Inc., Samsung Group, Starbucks Corporation and Wal-Mart Stores, Inc. Certain existing and potential financial institution and biller clients also have the ability to develop and use their own in-house systems instead of our

5

products and services. In addition, many companies that provide solutions to the financial services industry are consolidating, creating larger competitors with greater resources and broader product lines.

Financial

Our products and services in the Financial segment compete in several different market segments and geographies, including with large, diversified software and service companies and independent suppliers of software products. Certain existing and potential financial institution clients also have the ability to develop and use their own in-house systems. In addition, we compete with vendors that offer similar transaction processing products and services to financial institutions, including Computer Services, Inc., DH Corporation, FIS, Infosys Ltd., International Business Machines Corporation, Jack Henry, Oracle Corporation, SAP SE and Temenos Group AG.

Government Regulation

The regulations that apply to the delivery of financial services are complex and evolve continuously. Fiserv and its subsidiaries are generally not directly subject to federal or state regulations specifically applicable to financial institutions such as banks, thrifts and credit unions. However, as a provider of services to these financial institutions, our operations are examined on a regular basis by various state and federal regulatory authorities and representatives of the Federal Financial Institutions Examination Council, which is a formal interagency body empowered to prescribe uniform principles, standards and report forms for the federal examination of financial institutions and to make recommendations to promote uniformity in the supervision of financial institutions. Also, state and federal regulations require our financial institution clients to include certain provisions in their contracts with service providers like us, such as those related to security and privacy, and to conduct ongoing monitoring and risk management for third party relationships. In addition, independent auditors annually review many of our operations to provide internal control evaluations for our clients and their auditors.

In conducting our direct-to-consumer businesses, including our walk-in bill payment, online bill payment and Popmoney person-to-person payment services, we are directly subject to various federal and state laws, rules and regulations including those relating to the movement of money. In order to comply with our obligations under applicable laws, we are required, among other matters, to comply with licensing and reporting requirements, to implement operating policies and procedures necessary to comply with anti-money laundering laws, to comply with capital requirements, to protect the privacy and security of our clients’ information, and to undergo periodic audits and examinations.

Since the enactment of the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”), there have been substantial reforms to the supervision and operation of the financial services industry, including numerous new regulations that have imposed compliance costs and, in some cases, limited revenue sources for us and our clients. Among other things, the Dodd-Frank Act established the Consumer Financial Protection Bureau (“CFPB”), which is empowered to conduct rule-making and supervision related to, and enforcement of, federal consumer financial protection laws. The CFPB has issued guidance that applies to “supervised service providers,” which the CFPB has defined to include service providers, like us, to CFPB supervised banks and nonbanks. In addition, federal and state agencies have recently begun to propose cybersecurity regulations, such as the Proposed Cybersecurity Requirements for Financial Services Companies issued by the New York State Department of Financial Services in September 2016 and the Advance Notice of Proposed Rulemaking on Enhanced Cyber Risk Management Standards issued by The Board of Governors of the Federal Reserve System, the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation in October 2016. New regulations could, among other things, require us to make significant additional investments to comply with them, modify our products or services or the manner in which they are provided, or limit or change the amount or types of revenue we are able to generate.

Employees

We have approximately 23,000 employees globally, many of whom are specialists in our information management centers and related product and service businesses. This service support network includes employees with backgrounds in computer science and the financial industry, as well as employees with direct experience in payments, financial institutions and other financial services environments. Our employees provide expertise in: programming, software development, modification and maintenance; computer operations, network control and technical support; client services and training; business process outsourcing; item and mortgage processing; system conversions; sales and marketing; and account management.

The service nature of our business makes our employees an important corporate asset. Although the market for qualified personnel is competitive, we have not experienced significant difficulty with hiring or retaining our staff of top industry professionals. In assessing a potential acquisition candidate, we emphasize the quality and stability of the acquisition candidate’s employees.

6

Available Information

Our website address is www.fiserv.com. We are not including the information provided on our website as a part of, or incorporating it by reference into, this Annual Report on Form 10-K. We make available free of charge (other than an investor’s own internet access charges) through our website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to these reports, as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the Securities and Exchange Commission.

Item 1A. Risk Factors

You should carefully consider each of the risks described below, together with all of the other information contained in this Annual Report on Form 10-K, before making an investment decision with respect to our securities. If any of the following risks develop into actual events, our business, financial condition or results of operations could be materially and adversely affected and you may lose all or part of your investment.

We operate in a competitive business environment and may not be able to compete effectively.

The markets for our services are highly competitive from new and existing competitors. Our competitors vary in size and in the scope and breadth of the services they offer. Many of our larger existing and potential clients have historically developed their key applications in-house. As a result, we often compete against our existing or potential clients’ in-house capabilities. We also expect that the markets in which we compete will continue to attract new well-funded competitors and new technologies, including large technology, media and other companies not historically in the financial services industry, start-ups and international providers of similar products and services to ours. We cannot provide any assurance that we will be able to compete successfully against current or future competitors or that competitive pressures faced by us in the markets in which we operate will not materially and adversely affect our business, results of operations and financial condition.

If we fail to adapt our products and services to changes in technology or in the marketplace, or if our ongoing efforts to upgrade our technology are not successful, we could lose clients or have trouble attracting new clients, and our ability to grow may be limited.

The markets for our products and services are characterized by constant technological changes, frequent introductions of new products and services, and evolving industry standards. Our ability to enhance our current products and services and to develop and introduce innovative products and services that address the increasingly sophisticated needs of our clients and their customers will significantly affect our future success. We may not be successful in developing, marketing or selling new products and services that meet these changing demands. In addition, we may experience difficulties that could delay or prevent the successful development, introduction or marketing of these services, or our new services and enhancements may not adequately meet the demands of the marketplace or achieve market acceptance. If we are unsuccessful in offering products or services that gain market acceptance, it would likely have a material adverse effect on our ability to retain existing clients, to attract new ones and to grow profitably.

The market for our electronic transaction services continues to evolve and may not continue to develop or grow rapidly enough to sustain profitability.

If the number of electronic transactions does not continue to grow, or if consumers or businesses do not continue to adopt our services, it could have a material adverse effect on our business, results of operations and financial condition. We believe future growth in the electronic transactions market will be driven by a combination of factors including speed, cost, ease-of-use, security and quality of products and services offered to consumers and businesses. In addition, we may face challenges meeting local political, regulatory, business and economic conditions as we grow internationally, particularly in emerging market economies, and we may find it difficult to manage and oversee operations far from our headquarters. In order to consistently increase and maintain our profitability, consumers and businesses must continue to adopt our services. The success of our electronic commerce businesses also relies in part on financial institutions, billers and other third parties to market our services to their customers. If any of these third parties abandons, curtails or insufficiently increases its marketing efforts, it could have a material adverse effect on our business, results of operations and financial condition.

If we are unable to renew client contracts at favorable terms, we could lose clients and our results of operations and financial condition may be adversely affected.

Failure to achieve favorable renewals of client contracts could negatively impact our business. Our contracts with clients generally run for a period of three to five years. At the end of the contract term, clients have the opportunity to renegotiate their contracts with us or to consider whether to engage one or more of our competitors to provide products and services. If we are

7

not successful in achieving high renewal rates and favorable contract terms, our results of operations and financial condition may be materially and adversely affected.

Our business may be adversely impacted by U.S. and global market and economic conditions.

For the foreseeable future, we expect to continue to derive most of our revenue from products and services we provide to the financial services industry. Given this concentration, we are exposed to the global economic conditions in the financial services industry. A prolonged poor economic environment could result in significant decreases in demand by current and potential clients for our products and services and in the number and dollar amount of transactions we process, which could have a material adverse effect on our business, results of operations and financial condition.

Consolidations in the banking and financial services industry could adversely affect our revenue by eliminating existing or potential clients and making us more dependent on fewer clients.

Failures, mergers and consolidations of financial institutions reduce the number of our clients and potential clients, which could adversely affect our revenue. Further, if our clients fail or merge with or are acquired by other entities that are not our clients, or that use fewer of our services, they may discontinue or reduce their use of our services. It is also possible that the larger financial institutions that result from mergers or consolidations could have greater leverage in negotiating terms with us or could decide to perform in-house some or all of the services which we currently provide or could provide. Any of these developments could have a material adverse effect on our business, results of operations and financial condition.

Security breaches, computer malware or other “cyber attacks” could harm our business by disrupting our delivery of services and damaging our reputation.

Our operations depend on receiving, storing, processing and transmitting sensitive information pertaining to our business, our associates, our clients and their customers. Any unauthorized intrusion, malicious software infiltration, network disruption, denial of service or similar act by a malevolent party could disrupt the integrity, continuity, security and trust of our systems or data, or the systems or data of our clients or vendors. These events could create costly litigation, significant financial liability, increased regulatory scrutiny, financial sanctions and a loss of confidence in our ability to serve clients and cause current or potential clients to choose another service provider, all of which could have a material adverse impact on our business. In addition, as these threats continue to evolve, we may be required to invest significant additional resources to modify and enhance our information security and controls or to investigate and remediate any security vulnerabilities. Although we believe that we maintain a robust program of information security and controls and none of the threats that we have encountered to date have materially impacted us, we may not be able to prevent a material event in the future, and the impact of a material event could have a material adverse effect on our business, results of operations and financial condition.

Operational failures could harm our business and reputation.

An operational failure in our transaction processing businesses, including our business continuity and disaster recovery capabilities, could harm our business or cause us to lose clients. An operational failure could be caused by the failure of third party networks and systems upon which we rely to deliver our services and over which we have limited or no control. Interruptions of service could damage our relationship with clients and could cause us to incur substantial expenses, including those related to the payment of service credits or other liabilities. A prolonged interruption of our services or network could cause us to experience data loss or a reduction in revenue. In addition, a significant interruption of service could have a negative impact on our reputation and could cause our current and potential clients to choose another service provider. Any of these developments could have a material adverse impact on our business, results of operations and financial condition.

We may experience software defects, development delays or installation difficulties, which would harm our business and reputation and expose us to potential liability.

Our services are based on sophisticated software and computing systems, and we may encounter delays when developing new applications and services. Further, the software underlying our services may contain undetected errors or defects when first introduced or when new versions are released. In addition, we may experience difficulties in installing or integrating our technology on systems used by our clients. Defects in our software, errors or delays in the processing of electronic transactions or other difficulties could result in interruption of business operations, delay in market acceptance, additional development and remediation costs, diversion of technical and other resources, loss of clients, negative publicity or exposure to liability claims. Although we attempt to limit our potential liability through disclaimers and limitation of liability provisions in our license and client agreements, we cannot be certain that these measures will successfully limit our liability.

8

A heightened regulatory environment in the financial services industry, including the implementation of the Dodd-Frank Wall Street Reform and Consumer Protection Act and related regulations, may have an adverse impact on our clients and our business.

Since the enactment of the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”), there have been substantial regulations affecting the supervision and operation of the financial services industry within the United States, including the establishment of a new federal bureau called the Consumer Financial Protection Bureau (“CFPB”). The CFPB has issued guidance that applies to “supervised service providers,” which the CFPB has defined to include service providers, like us, to CFPB supervised banks and nonbanks. It is difficult to predict with certainty the extent to which the Dodd-Frank Act, the CFPB or the resulting regulations will impact our business or the businesses of our current and potential clients over the long term. In addition, federal and state agencies are pursuing additional cybersecurity regulations and are expected to continue to seek to impact client contract terms with service providers like us. If government agencies, including the CFPB, adopt additional rules and exercise supervisory authority over service providers like us, we could be subject to a greater degree of direct federal and state oversight than in the past, which could slow our ability to adapt to a rapidly changing industry, require us to make compliance investments and/or limit our fees or other revenue sources. To the extent these regulations negatively impact the business, operations or financial condition of our clients, our business and results of operations could be materially and adversely affected because, among other matters, our clients could have less capacity to purchase products and services from us, could decide to avoid or abandon certain lines of business, or could seek to pass on increased costs to us by negotiating price reductions. We could be required to invest a significant amount of time and resources to comply with additional regulations or oversight or to modify the manner in which we contract with or provide products and services to our clients; and such regulations could directly or indirectly limit how much we can charge for our services. We may not be able to update our existing products and services, or develop new ones, to satisfy our clients’ needs. Any of these events, if realized, could have a material adverse effect on our business, results of operations and financial condition.

If we fail to comply with applicable regulations our businesses could be harmed.

We are generally not directly subject to federal or state regulations specifically applicable to financial institutions such as banks, thrifts and credit unions. However, as a provider of services to these financial institutions, we are subject to contractual requirements imposed by the financial institutions with respect to a number of state and federal regulations, including privacy laws, and our operations are examined on a regular basis by various state and federal regulatory authorities. Also, regulators are signaling interest in enforcing regulations directly against service providers to financial institutions, and any such direct enforcement could result in increased operating costs for us and additional restrictions on our business processes. If we fail to comply with any applicable regulations, we could be exposed to litigation or regulatory proceedings, our client relationships and reputation could be harmed, and we could be inhibited in our ability to obtain new clients, which could have a material adverse impact on our business, results of operations and financial condition. In addition, the future enactment of more restrictive laws or rules on the federal or state level, or, with respect to our international operations, in foreign jurisdictions on the national, provincial, state or other level, could have a material adverse impact on our business, results of operations and financial condition.

Our failure to comply with a series of complex regulations in our payments businesses could subject us to liability.

Certain of our subsidiaries are licensed as money transmitters in those states where such licensure is required. In connection with such licensure, we are required to demonstrate and maintain certain levels of net worth and liquidity and to file periodic reports. In addition, our direct-to-consumer payments businesses, including our walk-in bill payment, online bill payment and Popmoney person-to-person payment services, are subject to federal regulation in the United States, including anti-money laundering regulations and certain restrictions on transactions to or from certain individuals or entities. The complexity of these regulations will continue to increase our cost of doing business. In addition, any violations of law may result in civil or criminal penalties against us and our officers, or the prohibition against us providing money transmitter services in particular jurisdictions.

If we fail to comply with the applicable requirements of the payment card networks, they could seek to fine us, suspend us or terminate our registrations which could adversely affect our business.

We are subject to card association and network rules governing Visa, MasterCard, American Express, Discover or other similar organizations, including the Payment Card Industry Data Security Standard enforced by the major card brands. The rules of the card networks are set by their boards which may be influenced by card issuers, some of which offer competing transaction processing services. If we fail to comply with these rules, we could be fined, our certifications could be suspended, or our certifications could be terminated. The suspension or termination of our certifications, or any changes to the card association and network rules, that we do not successfully address, could limit our ability to provide transaction processing services to

9

clients and result in a reduction of revenue or increased costs of operation, which, in either case, could have a material adverse effect on our business and results of operations.

We may be sued for infringing the intellectual property rights of others.

Third parties may claim that we are infringing their intellectual property rights. We may expose ourselves to additional liability if we agree to indemnify our clients against third party infringement claims. If the owner of intellectual property establishes that we are, or a client which we are obligated to indemnify is, infringing its intellectual property rights, we may be forced to change our products or services, and such changes may be expensive or impractical, or we may need to seek royalty or license agreements from the owner of such rights. If we are unable to agree on acceptable terms, we may be required to discontinue the sale of key products or halt other aspects of our operations. We may also be liable for financial damages for a violation of intellectual property rights, and we may incur expenses in connection with indemnifying our clients against losses suffered by them. Any adverse result related to violation of third party intellectual property rights could materially and adversely harm our business, results of operations and financial condition. Even if intellectual property claims brought against us are without merit, they may result in costly and time consuming litigation and may require significant attention from our management and key personnel.

Misappropriation of our intellectual property and proprietary rights could impair our competitive position.

Our ability to compete depends upon proprietary systems and technology. We actively seek to protect our proprietary rights. Nevertheless, unauthorized parties may attempt to copy aspects of our services or to obtain and use information that we regard as proprietary. The steps we have taken may not prevent misappropriation of technology. Agreements entered into for that purpose may not be enforceable or provide us with an adequate remedy. Effective patent, trademark, service mark, copyright and trade secret protection may not be available in every country in which our applications and services are made available. Misappropriation of our intellectual property or potential litigation concerning such matters could have a material adverse effect on our business, results of operations and financial condition.

Acquisitions subject us to risks, including increased debt, assumption of unforeseen liabilities and difficulties in integrating operations.

A major contributor to our growth in revenue and earnings since our inception has been our ability to identify, acquire and integrate complementary businesses. We anticipate that we will continue to seek to acquire complementary businesses, products and services. We may not be able to identify suitable acquisition candidates or complete acquisitions in the future, which could adversely affect our future growth, or businesses that we acquire may not perform as well as expected or may be more difficult to integrate and manage than expected, which could adversely affect our business and results of operations. We may not be able to integrate all aspects of acquired businesses successfully or realize the potential benefits of bringing them together. In addition, the process of integrating these acquisitions may disrupt our business and divert our resources.

These risks may arise for a number of reasons: we may not be able to find suitable businesses to acquire at affordable valuations or on other acceptable terms; we face competition for acquisitions from other potential acquirers; we may need to borrow money or sell equity or debt securities to the public to finance future acquisitions and the terms of these financings may be adverse to us; changes in accounting, tax, securities or other regulations could increase the difficulty or cost for us to complete acquisitions; we may incur unforeseen obligations or liabilities in connection with acquisitions; we may need to devote unanticipated financial and management resources to an acquired business; we may not realize expected operating efficiencies or product integration benefits from an acquisition; we could enter markets where we have minimal prior experience; and we may experience decreases in earnings as a result of non-cash impairment charges.

We may be obligated to indemnify the purchasers of businesses pursuant to the terms of the relevant purchase and sale agreements.

We have in the past and may in the future sell businesses. In connection with sales of businesses, we may make representations and warranties about the businesses and their financial affairs and agree to retain certain liabilities associated with our operation of the businesses prior to their sale. Our obligation to indemnify the purchasers and agreement to retain liabilities could have a material adverse effect on our business, results of operations and financial condition.

The failure to attract and retain key personnel could have a material adverse effect on our business.

We depend on the experience, skill and contributions of our senior management and other key employees. If we fail to attract, motivate and retain highly qualified management, technical, compliance and sales personnel, our future success could be harmed. Our senior management provides strategic direction for our company, and if we lose members of our leadership team, our management resources may have to be diverted from other priorities to address this loss. Our products and services require

10

sophisticated knowledge of the financial services industry, applicable regulatory and industry requirements, computer systems, and software applications, and if we cannot hire or retain the necessary skilled personnel, we could suffer delays in new product development, experience difficulty complying with applicable requirements or otherwise fail to satisfy our clients’ demands.

Our balance sheet includes significant amounts of goodwill and intangible assets. The impairment of a significant portion of these assets would negatively affect our results of operations.

Our balance sheet includes goodwill and intangible assets that represent 74% of our total assets at December 31, 2016. These assets consist primarily of goodwill and identified intangible assets associated with our acquisitions. On at least an annual basis, we assess whether there have been impairments in the carrying value of goodwill. In addition, we review intangible assets for impairment whenever events or changes in circumstances indicate the carrying amount of the asset may not be recoverable. If the carrying value of the asset is determined to be impaired, then it is written down to fair value by a charge to operating earnings. An impairment of a significant portion of goodwill or intangible assets could have a material negative effect on our results of operations.

Increased leverage may harm our financial condition and results of operations.

As of December 31, 2016, we had approximately $4.6 billion of long-term debt, including current maturities. We and our subsidiaries may incur additional indebtedness in the future. Our indebtedness could: decrease our ability to obtain additional financing for working capital, capital expenditures, general corporate or other purposes; limit our flexibility to make acquisitions; increase our cash requirements to support the payment of interest; limit our flexibility in planning for, or reacting to, changes in our business and our industry; and increase our vulnerability to adverse changes in general economic and industry conditions. Our ability to make payments of principal and interest on our indebtedness depends upon our future performance, which will be subject to general economic conditions and financial, business and other factors affecting our consolidated operations, many of which are beyond our control. In addition, if our outstanding senior notes are downgraded to below investment grade, we may incur additional interest expense. If we are unable to generate sufficient cash flow from operations in the future to service our debt and meet our other cash requirements, we may be required, among other things: to seek additional financing in the debt or equity markets; to refinance or restructure all or a portion of our indebtedness; or to reduce or delay planned capital or operating expenditures. Such measures might not be sufficient to enable us to service our debt and meet our other cash requirements. In addition, any such financing, refinancing or sale of assets might not be available at all or on economically favorable terms.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

As of December 31, 2016, we operated data, development, item processing and support centers in approximately 110 cities. We owned six buildings, and the more than 120 remaining locations where we operated our businesses are subject to leases. We believe our facilities and equipment are well maintained and are in good operating condition. We believe that the computer equipment that we own and lease and our various facilities are adequate for our present and foreseeable business needs. We maintain our own, and contract with multiple service providers to provide, processing back-up in the event of a disaster. We also maintain copies of data and software used in our business in locations that are separate from our facilities.

Item 3. Legal Proceedings

In the normal course of business, we or our subsidiaries are named as defendants in lawsuits in which claims are asserted against us. In the opinion of management, the liabilities, if any, which may ultimately result from such lawsuits are not expected to have a material adverse effect on our consolidated financial statements.

Item 4. Mine Safety Disclosures

Not applicable.

11

EXECUTIVE OFFICERS OF THE REGISTRANT

The names of our executive officers as of February 16, 2017, together with their ages, positions and business experience are described below:

Name | Age | Title |

Jeffery W. Yabuki | 56 | President, Chief Executive Officer and Director |

Mark A. Ernst | 58 | Chief Operating Officer |

Kevin P. Gregoire | 49 | Group President, Financial Institutions Group |

Robert W. Hau | 51 | Chief Financial Officer and Treasurer |

Lynn S. McCreary | 57 | Chief Legal Officer and Secretary |

Devin B. McGranahan | 47 | Group President, Billing and Payments Group |

Kevin J. Schultz | 59 | Group President, Digital Banking Group |

Steven Tait | 57 | Chief Sales Officer and Group President, International Group |

Byron C. Vielehr | 53 | Group President, Depository Institution Services Group |

Mr. Yabuki has been a director and our President and Chief Executive Officer since 2005. Before joining Fiserv, Mr. Yabuki served as executive vice president and chief operating officer of H&R Block, Inc., a financial services firm, from 2002 to 2005. From 2001 to 2002, he served as executive vice president of H&R Block and from 1999 to 2001, he served as the president of H&R Block International. From 1987 to 1999, Mr. Yabuki held various executive positions with the American Express Company, a financial services firm, including president and chief executive officer of American Express Tax and Business Services, Inc.

Mr. Ernst has served as Chief Operating Officer since 2011. Prior to joining Fiserv, he served as deputy commissioner for operations support for the Internal Revenue Service from 2009 to 2010, where he was responsible for technology, operations, shared services, human resources and the chief financial office. From 2008 to 2009, he was chief executive officer of Bellevue Capital LLC, a private investment firm; from 2001 to 2007, he served as chairman, president and chief executive officer of H&R Block, Inc., a financial services firm; and from 1998 to 2000, he served as its chief operating officer. His experience, which includes executive positions with the American Express Company, a financial services firm, spans more than 25 years in the financial services industry.

Mr. Gregoire has served as Group President, Financial Institutions Group since 2014. Mr. Gregoire joined Fiserv in 2002 as part of its acquisition of EDS Consumer Network Services, which he joined in 1996. Mr. Gregoire has served in a number of leadership roles at Fiserv including as chief operating officer and then president of our Card Services business from 2010 to 2014. His background includes a number of diverse leadership roles in product development and management, sales and account management, settlement operations, risk management, and security and compliance.

Mr. Hau has served as Chief Financial Officer since March 2016. Before joining Fiserv, Mr. Hau served as executive vice president and chief financial officer at TE Connectivity Ltd., a global technology company that designs and manufactures highly engineered connectivity and sensor products, from 2012 to 2016. From 2009 to 2012, he served as executive vice president and chief financial officer at Lennox International Inc., a provider of products and services in the heating, air conditioning, and refrigeration markets; and from 2006 to 2009, he served as vice president and chief financial officer for the aerospace business group of Honeywell International, Inc., a technology and manufacturing company. Mr. Hau joined Honeywell (initially AlliedSignal) in 1987 and served in a variety of senior financial leadership positions, including vice president and chief financial officer for the company’s aerospace electronic systems unit and for its specialty materials business group.

Ms. McCreary has served as Chief Legal Officer and Secretary since 2013. Ms. McCreary joined Fiserv in 2010 as senior vice president and deputy general counsel. Prior to joining Fiserv, Ms. McCreary was an attorney with the law firm of Bryan Cave LLP from 1996 to 2010, including serving as managing partner of its San Francisco, California office from its opening in 2008 to 2010. Ms. McCreary began her career in financial services with positions at Citicorp Person-to-Person and Metropolitan Life Insurance Company’s mortgage subsidiary, Metmor Financial, Inc.

Mr. McGranahan has served as Group President, Billing and Payments Group since November 2016. Before joining Fiserv, Mr. McGranahan served as a senior partner at McKinsey & Company, a global management consulting firm, from 2006 to 2016. Most recently, he also held a variety of senior management roles at the firm, including leader of the global insurance practice from 2013 to 2016 and co-chair of the global senior partner election committee from 2013 to 2015. In addition, Mr. McGranahan served as co-leader of the North America financial services practice from 2009 to 2016. He joined McKinsey in

12

1992 and served in a variety of other leadership positions prior to 2009, including leader of the North American property and casualty practice and managing partner of the Pittsburgh office.

Mr. Schultz has served as Group President, Digital Banking Group since 2014. Prior to joining Fiserv, Mr. Schultz served as president of global financial services at First Data Corporation, a global payment processing company, from 2009 to 2011, and as global head of processing services at Visa Inc. from 2007 to 2009. He has more than 30 years of experience in the payments and financial services industry, including a variety of other senior leadership roles at Visa Inc. and Global Payments Inc., an electronic transaction processing service provider.

Mr. Tait assumed the role of Chief Sales Officer on January 1, 2017 and continues to serve as Group President, International Group, a position he has held since 2012. He joined Fiserv in 2009 as an executive vice president and served as Group President, Depository Institution Services Group from 2010 to 2011. Prior to joining Fiserv, Mr. Tait served as president of RSM McGladrey, a subsidiary of H&R Block Inc., from 2003 to 2009, and executive vice president, sales and client operations of Gartner, Inc. from 2001 to 2003.

Mr. Vielehr has served as Group President, Depository Institution Services Group since 2013. Prior to joining Fiserv, Mr. Vielehr served in a succession of senior executive positions with The Dun & Bradstreet Corporation, a provider of commercial information and business insight solutions, from 2005 to 2013, most recently as president of international and global operations, and as president and chief operating officer of Northstar Systems International, Inc., a developer of wealth management software and now part of SEI Investments Company, from 2004 to 2005.

13

PART II

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Market Price Information

Our common stock is traded on the NASDAQ Global Select Market under the symbol “FISV.” Set forth below is the high and low sales price of our common stock during the periods presented.

2016 | 2015 | |||||||||||||||

Quarter Ended | High | Low | High | Low | ||||||||||||

March 31 | $ | 102.88 | $ | 85.63 | $ | 80.97 | $ | 69.13 | ||||||||

June 30 | 108.85 | 96.34 | 86.39 | 76.92 | ||||||||||||

September 30 | 111.51 | 97.73 | 90.54 | 77.96 | ||||||||||||

December 31 | 109.11 | 92.81 | 97.76 | 85.41 | ||||||||||||

At December 31, 2016, our common stock was held by 2,016 shareholders of record and by a significantly greater number of shareholders who hold shares in nominee or street name accounts with brokers. The closing price of our common stock on February 16, 2017 was $111.25 per share. We have never paid dividends on our common stock, and we do not anticipate paying dividends in the foreseeable future. For additional information regarding our expected use of capital, refer to the discussion in this report under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources.”

Issuer Purchases of Equity Securities

The table below sets forth information with respect to purchases made by or on behalf of us or any “affiliated purchaser” (as defined in Rule 10b-18(a)(3) under the Securities Exchange Act of 1934) of shares of our common stock during the three months ended December 31, 2016:

Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (1) | Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs (1) | |||||||||

October 1-31, 2016 | 1,168,000 | $ | 99.31 | 1,168,000 | 6,914,000 | ||||||||

November 1-30, 2016 | 806,000 | 101.63 | 806,000 | 21,108,000 | |||||||||

December 1-31, 2016 | 630,000 | 106.19 | 630,000 | 20,478,000 | |||||||||

Total | 2,604,000 | 2,604,000 | |||||||||||

_____

(1) | On each of November 18, 2015 and November 16, 2016, our board of directors authorized the purchase of up to 15.0 million shares of our common stock. These authorizations do not expire. |

14

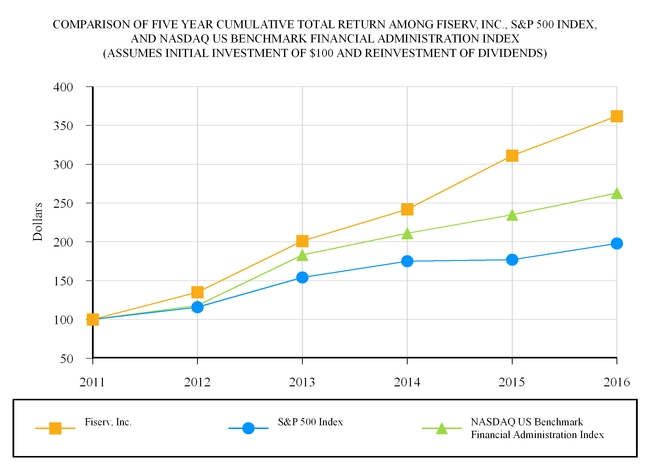

Stock Performance Graph

The stock performance graph and related information presented below is not deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission or subject to Regulation 14A or 14C under the Securities Exchange Act of 1934 or to the liabilities of Section 18 of the Securities Exchange Act of 1934 and will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent we specifically incorporate it by reference into such a filing.

The following graph compares the cumulative total shareholder return on our common stock for the five years ended December 31, 2016 with the S&P 500 Index and the NASDAQ US Benchmark Financial Administration Index. The graph assumes that $100 was invested on December 31, 2011 in our common stock and each index and that all dividends were reinvested. No cash dividends have been declared on our common stock. The comparisons in the graph are required by the Securities and Exchange Commission and are not intended to forecast or be indicative of possible future performance of our common stock.

December 31, | |||||||||||||||||||||||

2011 | 2012 | 2013 | 2014 | 2015 | 2016 | ||||||||||||||||||

Fiserv, Inc. | $ | 100 | $ | 135 | $ | 201 | $ | 242 | $ | 311 | $ | 362 | |||||||||||

S&P 500 Index | 100 | 116 | 154 | 175 | 177 | 198 | |||||||||||||||||

NASDAQ US Benchmark Financial Administration Index | 100 | 118 | 183 | 211 | 235 | 263 | |||||||||||||||||

15

Item 6. Selected Financial Data

The following data, which has been affected by acquisitions and dispositions including certain transactional gains recorded by our unconsolidated affiliate, should be read in conjunction with the consolidated financial statements and accompanying notes included elsewhere in this Annual Report on Form 10-K. All per share amounts are presented on a split-adjusted basis to retroactively reflect the two-for-one stock split that was completed in the fourth quarter of 2013. Total assets and long-term debt have been adjusted on a retrospective basis for the adoption of Accounting Standards Update ("ASU") No. 2015-17, Balance Sheet Classification of Deferred Taxes, and ASU No. 2015-03, Simplifying the Presentation of Debt Issuance Costs effective December 31, 2015. Accordingly, current deferred tax assets have been reclassified to noncurrent assets and liabilities, and certain debt issuance costs previously included within other long-term assets have been reclassified as a reduction in long-term debt.

(In millions, except per share data) | 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||

Total revenue | $ | 5,505 | $ | 5,254 | $ | 5,066 | $ | 4,814 | $ | 4,436 | |||||||||

Income from continuing operations | $ | 930 | $ | 712 | $ | 754 | $ | 650 | $ | 592 | |||||||||

(Loss) income from discontinued operations | — | — | — | (2 | ) | 19 | |||||||||||||

Net income | $ | 930 | $ | 712 | $ | 754 | $ | 648 | $ | 611 | |||||||||

Net income (loss) per share - basic: | |||||||||||||||||||

Continuing operations | $ | 4.22 | $ | 3.04 | $ | 3.04 | $ | 2.48 | $ | 2.18 | |||||||||

Discontinued operations | — | — | — | (0.01 | ) | 0.07 | |||||||||||||

Total | $ | 4.22 | $ | 3.04 | $ | 3.03 | $ | 2.47 | $ | 2.25 | |||||||||

Net income (loss) per share - diluted: | |||||||||||||||||||

Continuing operations | $ | 4.15 | $ | 2.99 | $ | 2.99 | $ | 2.44 | $ | 2.15 | |||||||||

Discontinued operations | — | — | — | (0.01 | ) | 0.07 | |||||||||||||

Total | $ | 4.15 | $ | 2.99 | $ | 2.98 | $ | 2.44 | $ | 2.22 | |||||||||

Total assets | $ | 9,743 | $ | 9,340 | $ | 9,308 | $ | 9,466 | $ | 8,542 | |||||||||

Long-term debt (including current maturities) | 4,562 | 4,293 | 3,790 | 3,831 | 3,213 | ||||||||||||||

Shareholders’ equity | 2,541 | 2,660 | 3,295 | 3,585 | 3,417 | ||||||||||||||

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Management’s discussion and analysis of financial condition and results of operations is provided as a supplement to our consolidated financial statements and accompanying notes to help provide an understanding of our financial condition, the changes in our financial condition and our results of operations. Our discussion is organized as follows:

• | Overview. This section contains background information on our company and the services and products that we provide, our enterprise priorities and the trends affecting our industry in order to provide context for management’s discussion and analysis of our financial condition and results of operations. |

• | Critical accounting policies and estimates. This section contains a discussion of the accounting policies that we believe are important to our financial condition and results of operations and that require judgment and estimates on the part of management in their application. In addition, all of our significant accounting policies, including critical accounting policies, are summarized in Note 1 to the accompanying consolidated financial statements. |

• | Results of operations. This section contains an analysis of our results of operations presented in the accompanying consolidated statements of income by comparing the results for the year ended December 31, 2016 to the results for the year ended December 31, 2015 and by comparing the results for the year ended December 31, 2015 to the results for the year ended December 31, 2014. |

• | Liquidity and capital resources. This section provides an analysis of our cash flows and a discussion of our outstanding debt and commitments at December 31, 2016. |

16

Overview

Company Background

We are a leading global provider of financial services technology. We provide account processing systems, electronic payments processing products and services, internet and mobile banking systems, and related services. We serve over 12,000 clients worldwide, including banks, thrifts, credit unions, investment management firms, leasing and finance companies, retailers, merchants, mutual savings banks, and building societies. The majority of our revenue is generated from recurring account- and transaction-based fees under contracts that generally have terms of three to five years and high renewal rates. Most of the services we provide are necessary for our clients to operate their businesses and are, therefore, non-discretionary in nature.