UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | ||||

For the fiscal year ended | For the transition period from to | ||||

Commission File Number 1-9210

Occidental Petroleum Corporation

(Exact name of registrant as specified in its charter)

State or other jurisdiction of incorporation or organization | |||||

I.R.S. Employer Identification No. | |||||

Address of principal executive offices | |||||

Zip Code | |||||

Registrant’s telephone number, including area code | |||||

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

☑ | Accelerated Filer | ☐ | Emerging Growth Company | ||

Non-Accelerated Filer | ☐ | Smaller Reporting Company | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the registrant’s Common Stock held by nonaffiliates of the registrant was approximately $45.0 billion, computed by reference to the closing price on the New York Stock Exchange composite tape of $50.28 per share of Common Stock on June 28, 2019.

At January 31, 2020, there were 895,224,961 shares of Common Stock outstanding, par value $0.20 per share.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement, relating to its 2020 Annual Meeting of Stockholders, are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS | PAGE | |

Part I | ||

Items 1 and 2. | ||

Marketing and Midstream Operations | ||

Item 1A. | ||

Item 1B. | ||

Item 3. | ||

Item 4. | ||

Information About Our Executive Officers | ||

Part II | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Part III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Part IV | ||

Item 15. | ||

Item 16. | ||

| BUSINESS AND PROPERTIES | |

Part I

ITEMS 1 AND 2. BUSINESS AND PROPERTIES

In this report, “Occidental” means Occidental Petroleum Corporation, a Delaware corporation (OPC) incorporated in 1986, or OPC and one or more entities in which it owns a controlling interest (subsidiaries). Occidental conducts its operations through its various subsidiaries and affiliates. Occidental’s executive offices are located at 5 Greenway Plaza, Suite 110, Houston, Texas 77046; telephone (713) 215-7000.

On August 8, 2019, pursuant to the Agreement and Plan of Merger, dated as of May 9, 2019, among Occidental, Baseball Merger Sub 1, Inc., a Delaware corporation and an indirect, wholly owned subsidiary of Occidental (Merger Subsidiary), and Anadarko Petroleum Corporation (Anadarko), Occidental acquired all of the outstanding shares of Anadarko through a transaction in which Merger Subsidiary merged with and into Anadarko (the Acquisition), with Anadarko continuing as the surviving entity and as an indirect, wholly owned subsidiary of Occidental.

GENERAL |

Occidental’s principal businesses consist of three reporting segments: oil and gas, chemical, and marketing and midstream. The oil and gas segment explores for, develops and produces oil and condensate, natural gas liquids (NGL) and natural gas. The chemical segment (OxyChem) mainly manufactures and markets basic chemicals and vinyls. The marketing and midstream segment purchases, markets, gathers, processes, transports and stores oil, condensate, NGL, natural gas, carbon dioxide (CO2) and power. It also trades around its assets, including transportation and storage capacity, and invests in entities that conduct similar activities such as Western Midstream Partners, L.P. (WES).

The marketing and midstream segment also includes Oxy Low Carbon Ventures (OLCV). OLCV seeks to capitalize on Occidental’s enhanced oil recovery (EOR) leadership by developing carbon capture, utilization and storage projects that source anthropogenic CO2 and promote innovative technologies that drive cost efficiencies and economically grow Occidental’s business while reducing emissions.

For further information regarding Occidental’s segments, geographic areas of operation and current developments, see the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (MD&A) section of this report and Note 18 - Industry Segments and Geographic Areas in the Notes to Consolidated Financial Statements.

EMPLOYEES |

Occidental employed approximately 14,400 people at December 31, 2019, which included approximately 1,000 employees who have been seconded to WES. Occidental has 10,000 employees located in the United States. Occidental employed approximately 10,400 people in the oil and gas and marketing and midstream segments and 3,000 people in the chemical segment. An additional 1,000 people were employed in administrative and corporate functions. Approximately 500 U.S.-based employees and 900 international-based employees are represented by labor unions.

AVAILABLE INFORMATION |

Occidental’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports are available free of charge on its website, www.oxy.com, as soon as reasonably practicable after Occidental electronically files the material with, or furnishes it to, the Securities and Exchange Commission (SEC). In addition, copies of our annual report will be made available, free of charge, upon written request.

Information contained on Occidental’s website is not part of this report or any other filings with the SEC.

2 | OXY 2019 FORM 10-K |

| BUSINESS AND PROPERTIES | |

OIL AND GAS OPERATIONS |

GENERAL

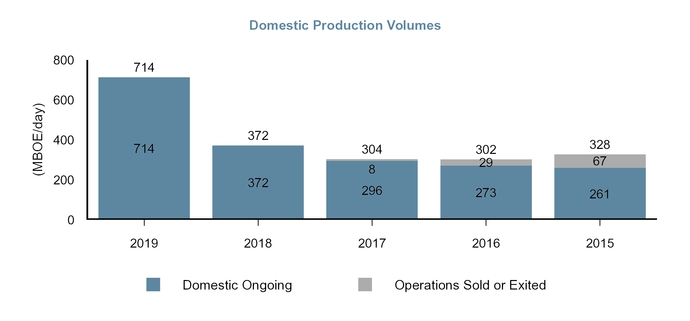

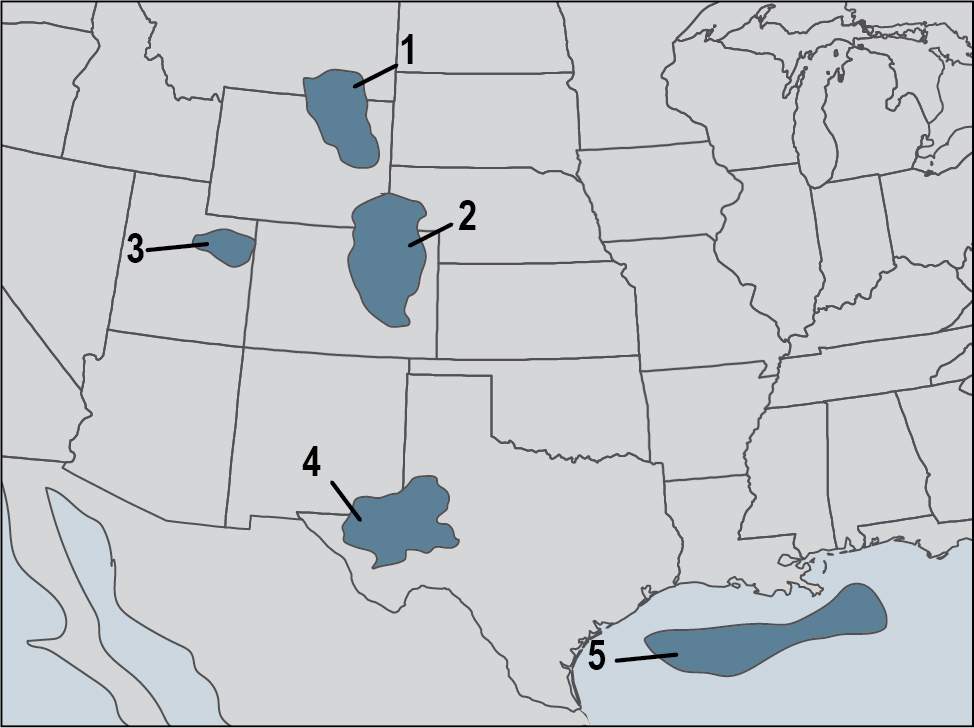

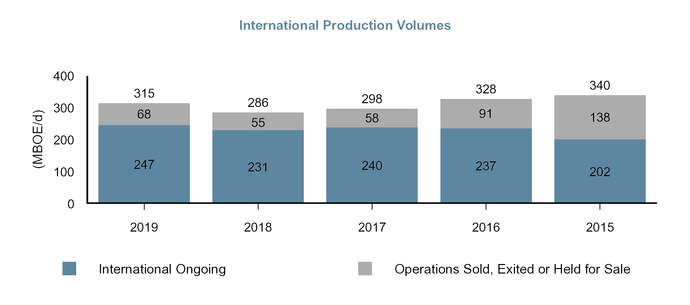

Occidental’s oil and gas assets are located in some of the world’s highest-margin basins and are characterized by an advantaged mix of short- and long-cycle high-return development opportunities. Occidental conducts its ongoing exploration and production activities in the United States, the Middle East and Latin America. Within the United States, Occidental has operations in Texas, New Mexico, Colorado, Wyoming and Utah, as well as offshore operations in the Gulf of Mexico. Internationally, Occidental conducts operations in Oman, United Arab Emirates (UAE), Qatar and Colombia. Refer to the Supplemental Oil and Gas Information - Oil and Gas Acreage under Item 8 of this Form 10-K for further disclosure of Occidental’s holdings of developed and undeveloped oil and gas acreage.

In connection with the Acquisition, Occidental agreed to sell to TOTAL S.A. (Total) all of the assets, liabilities, businesses and operations of Anadarko’s operations in Algeria, Ghana, Mozambique and South Africa (collectively, the Africa Assets). Occidental completed the sale of Mozambique LNG assets for approximately $4.2 billion in September 2019. The remaining Africa Assets are classified as held-for-sale and not considered part of Occidental’s ongoing international operations as of December 31, 2019. In January 2020, Occidental completed the sale of South Africa assets to Total. The closing of the sale of the remaining Africa Assets is conditioned on the receipt of required regulatory and government approvals, as well as other customary closing conditions.

COMPETITION

As a producer of oil, condensate, NGL and natural gas, Occidental competes with numerous other domestic and international public, private and government producers. Oil, NGL and natural gas are sensitive to prevailing global and local, current and anticipated market conditions. Occidental competes for capacity and infrastructure for the gathering, processing, transportation, storage and delivery of its products, which are sold at current market prices or on a forward basis to refiners, end users and other market participants. Occidental’s competitive strategy relies on increasing production through developing conventional and unconventional fields, utilizing primary and EOR techniques and strategic acquisitions in areas where Occidental has a competitive advantage as a result of its successful operations or investments in shared infrastructure. Occidental also competes to develop and produce its worldwide oil and gas reserves safely and cost-effectively, maintain a skilled workforce and obtain quality services.

PROVED RESERVES AND SALES VOLUMES

The table below shows Occidental’s year-end oil, NGL and natural gas proved reserves, including reserves acquired in the Acquisition, but excluding reserves related to the Africa Assets. Year-to-date sales volumes exclude Anadarko sales prior to the date of the Acquisition and all sales related to the Africa Assets. See “MD&A — Oil and Gas Segment,” and the information under the caption “Supplemental Oil and Gas Information” for details regarding Occidental’s proved reserves, the reserves estimation process, sales and production volumes, production costs and other reserves-related data.

COMPARATIVE OIL AND GAS PROVED RESERVES AND SALES VOLUMES

Oil (which includes condensate) and NGL are in millions of barrels; natural gas is in billions of cubic feet (Bcf); barrels of oil equivalent (BOE) are in millions.

2019 | 2018 | 2017 | |||||||||||||||||||||||||

Oil | NGL | Gas | BOE | (a) | Oil | NGL | Gas | BOE | (a) | Oil | NGL | Gas | BOE | (a) | |||||||||||||

Proved Reserves (b) | |||||||||||||||||||||||||||

United States | 1,570 | 540 | 4,128 | 2,798 | 1,186 | 284 | 1,445 | 1,711 | 1,107 | 247 | 1,205 | 1,555 | |||||||||||||||

International (c) | 400 | 200 | 2,572 | 1,029 | 397 | 202 | 2,650 | 1,041 | 408 | 198 | 2,626 | 1,043 | |||||||||||||||

Total | 1,970 | 740 | 6,700 | 3,827 | 1,583 | 486 | 4,095 | 2,752 | 1,515 | 445 | 3,831 | 2,598 | |||||||||||||||

Sales Volumes | |||||||||||||||||||||||||||

United States | 155 | 52 | 326 | 261 | 91 | 25 | 119 | 136 | 73 | 20 | 108 | 111 | |||||||||||||||

International (c) | 56 | 12 | 204 | 102 | 62 | 11 | 189 | 104 | 66 | 11 | 188 | 109 | |||||||||||||||

Total | 211 | 64 | 530 | 363 | 153 | 36 | 308 | 240 | 139 | 31 | 296 | 220 | |||||||||||||||

(a) | Natural gas volumes are converted to barrels of oil equivalence (BOE) at six thousand cubic feet (Mcf) of gas per one barrel of oil. Barrels of oil equivalence does not necessarily result in price equivalence. |

(b) | The detailed proved reserves information presented in accordance with Item 1202(a)(2) to Regulation S-K under the Securities Exchange Act of 1934 (Exchange Act) is provided under the heading “Supplemental Oil and Gas Information”. Proved reserves are stated on a net basis after applicable royalties. |

(c) | Excluded reserves of 125 MMBOE and sales of 12 MMBOE related to the Africa Assets. |

OXY 2019 FORM 10-K | 3 |

| BUSINESS AND PROPERTIES | |

CHEMICAL OPERATIONS |

GENERAL

OxyChem owns and operates manufacturing plants at 22 domestic sites in Alabama, Georgia, Illinois, Kansas, Louisiana, Michigan, New Jersey, New York, Ohio, Tennessee and Texas and at two international sites in Canada and Chile.

COMPETITION

OxyChem competes with numerous other domestic and international chemical producers. OxyChem’s market position was first or second in the United States in 2019 for the principal basic chemical products it manufactures and markets as well as for vinyl chloride monomer (VCM). OxyChem ranks in the top three producers of polyvinyl chloride (PVC) in the United States. OxyChem’s competitive strategy is to be a low-cost producer of its products in order to compete on price.

OxyChem produces the following products:

Principal Products | Major Uses | Annual Capacity |

Basic Chemicals | ||

Chlorine | Raw material for ethylene dichloride (EDC), water treatment and pharmaceuticals | 3.4 million tons |

Caustic soda | Pulp, paper and aluminum production | 3.5 million tons |

Chlorinated organics | Refrigerants(a), silicones and pharmaceuticals | 1.0 billion pounds |

Potassium chemicals | Fertilizers, batteries, soaps, detergents and specialty glass | 0.4 million tons |

EDC | Raw material for VCM | 2.1 billion pounds |

Chlorinated isocyanurates | Swimming pool sanitation and disinfecting products | 131 million pounds |

Sodium silicates | Catalysts, soaps, detergents and paint pigments | 0.6 million tons |

Calcium chloride | Ice melting, dust control, road stabilization and oil field services | 0.7 million tons |

Vinyls | ||

VCM | Precursor for PVC | 6.2 billion pounds |

PVC | Piping, building materials and automotive and medical products | 3.7 billion pounds |

Ethylene | Raw material for VCM | 1.2 billion pounds (b) |

(a) | Includes 4CPe, a raw material used in making next-generation, climate-friendly refrigerants with low global-warming and zero ozone-depletion potential. |

(b) | Amount is gross production capacity for 50/50 joint venture with Orbia (formerly Mexichem). |

4 | OXY 2019 FORM 10-K |

| BUSINESS AND PROPERTIES | |

MARKETING AND MIDSTREAM OPERATIONS |

GENERAL

Occidental’s marketing and midstream operations primarily support and enhance its oil and gas and chemical businesses and also provide similar services for third parties. The marketing and midstream segment strives to maximize realized value by optimizing the use of its gathering, processing, transportation, storage and terminal commitments and by providing access to domestic and international markets. To generate returns, the segment evaluates opportunities across the value chain and uses its assets to provide services to Occidental subsidiaries, as well as third parties. The marketing and midstream segment operates gathering systems, gas plants, co-generation facilities and storage facilities and invests in entities that conduct similar activities. Also included in the marketing and midstream segment is OLCV.

Included in the marketing and midstream segment is Occidental’s equity method investment in WES. WES owns gathering systems, plants and pipelines and earns revenue from fee-based and service-based contracts with Occidental and third parties.

COMPETITION

Occidental’s marketing and midstream businesses operate in competitive and highly regulated markets. From the date of the Acquisition to December 31, 2019, WES was a consolidated subsidiary in Occidental’s financial statements. Occidental’s marketing business competes with other market participants on exchange platforms and through other bilateral transactions with direct counterparties.

Occidental’s marketing and midstream operations are conducted in the locations described below as of December 31, 2019:

Location | Description | Capacity |

Gas Plants | ||

Texas, New Mexico and Colorado | Occidental and third-party-operated natural gas gathering, compression and processing systems, and CO2 processing and capturing | 2.7 Bcf per day |

Rocky Mountains, Pennsylvania, Texas and New Mexico | Equity investment in WES - gas processing facilities | 5.7 Bcf per day |

UAE | Natural gas processing facilities for Al Hosn Gas | 1.3 Bcf of natural gas per day |

Pipelines and Gathering Systems | ||

Texas, New Mexico and Colorado | CO2 fields and pipeline systems transporting CO2 to oil and gas producing locations | 2.8 Bcf per day |

Qatar, UAE and Oman | Equity investment in the Dolphin Energy Ltd natural gas pipeline | 3.2 Bcf of natural gas per day |

United States | Equity investment in WES involved in gathering and transportation | 15,819 miles of pipeline(a) |

Power Generation | ||

Texas and Louisiana | Occidental-operated power and steam generation facilities | 1,218 megawatts of electricity and 1.6 million pounds of steam per hour |

(a) | Amounts are gross, including interests held by third parties. |

ENVIRONMENTAL REGULATION |

For environmental regulation information, including associated costs, see the information under the heading “Environmental Liabilities and Expenditures” in the MD&A section of this report and “Risk Factors.”

OXY 2019 FORM 10-K | 5 |

| RISK FACTORS | |

ITEM 1A. | RISK FACTORS |

Risks related to Occidental’s business and operations

Volatile global and local commodity pricing strongly affect Occidental’s results of operations.

Occidental’s financial results correlate closely to the prices it obtains for its products, particularly oil and, to a lesser extent, natural gas and NGL, and its chemical products.

Prices for oil, natural gas and NGL fluctuate widely. Historically, the markets for oil, natural gas and NGL have been volatile and may continue to be volatile in the future. If the prices of oil, natural gas, or NGL continue to be volatile or decline, Occidental’s operations, financial condition, cash flows, level of expenditures and the quantity of estimated proved reserves that may be attributed to our properties may be materially and adversely affected. Prices are set by global and local market forces which are not in Occidental’s control. These factors include, among others:

Ø | Worldwide and domestic supplies of, and demand for, oil, natural gas, NGL and refined products; |

Ø | The cost of exploring for, developing, producing, refining and marketing oil, natural gas, NGL and refined products; |

Ø | Operational impacts such as production disruptions, technological advances and regional market conditions, including available transportation capacity and infrastructure constraints in producing areas; |

Ø | Changes in weather patterns and climate; |

Ø | The impacts of the members of OPEC and other non-OPEC member-producing nations that may agree to and maintain production levels; |

Ø | The worldwide military and political environment, including uncertainty or instability resulting from an escalation or outbreak of armed hostilities or acts of terrorism in the United States, or elsewhere; |

Ø | The price and availability of alternative and competing fuels; |

Ø | Technological advances affecting energy consumption and supply; |

Ø | Domestic and foreign governmental regulations and taxes; |

Ø | Shareholder activism or activities by non-governmental organizations to restrict the exploration, development and production of oil, natural gas and NGL; |

Ø | Additional or increased nationalization and expropriation activities by foreign governments; |

Ø | The impact and uncertainty of world health events; |

Ø | Volatility in commodity futures markets; |

Ø | The effect of energy conservation efforts; and |

Ø | Global inventory levels and general economic conditions. |

The long-term effects of these and other conditions on the prices of oil, natural gas, NGL and refined products are uncertain, and there can be no assurance that the demand or pricing for Occidental’s products will follow historic patterns or recover meaningfully in the near term. Prolonged or substantial decline, or sustained market uncertainty, in these commodity prices may have the following effects on Occidental’s business:

Ø | Adversely affect Occidental’s financial condition, liquidity, ability to reduce debt, pay dividends, finance planned capital expenditures, ability to repurchase shares and results of operations; |

Ø | Reduce the amount of oil, natural gas and NGLs that Occidental can produce economically; |

Ø | Cause Occidental to delay or postpone some of its capital projects; |

Ø | Reduce Occidental’s revenues, operating income or cash flows; |

Ø | Reduce the amounts of Occidental’s estimated proved oil, natural gas and NGL reserves; |

Ø | Reduce the carrying value of Occidental’s oil and natural gas properties due to recognizing impairments of proved properties, unproved properties and exploration assets; |

Ø | Reduce the standardized measure of discounted future net cash flows relating to oil, natural gas and NGL reserves; |

Ø | Limit Occidental’s access to, or increase the cost of, sources of capital such as equity and long-term debt; and |

Ø | Adversely affect the ability of Occidental’s partners to fund their working interest capital requirements. |

Generally, Occidental’s historical practice has been to remain exposed to the market prices of commodities. In 2019, management elected to hedge a portion of Occidental’s expected 2020 oil production to enhance cash flow stability following the Acquisition. In the future, management may elect to hedge some of the risk of oil, natural gas and NGL price fluctuations. Past or future commodity price risk management activities may prevent us from fully benefiting from price increases and may expose us to regulatory and other risks.

The prices obtained for Occidental’s chemical products correlate to the health of the United States and global economies, as well as chemical industry expansion and contraction cycles. Occidental also depends on feedstocks and energy to produce chemicals, which are commodities subject to significant price fluctuations.

6 | OXY 2019 FORM 10-K |

| RISK FACTORS | |

Occidental may experience delays, cost overruns, losses or other unrealized expectations in development efforts and exploration activities.

Oil, natural gas and NGL exploration and production activities are subject to numerous risks beyond our control, including the risk that drilling will not result in commercially viable oil, natural gas and NGL production. In its development and exploration activities, Occidental bears the risks of:

Ø | Equipment failures; |

Ø | Construction delays; |

Ø | Escalating costs or competition for services, materials, supplies or labor; |

Ø | Property or border disputes; |

Ø | Disappointing drilling results or reservoir performance; |

Ø | Title problems and other associated risks that may affect its ability to profitably grow production, replace reserves and achieve its targeted returns; |

Ø | Actions by third-party operators of our properties; |

Ø | Delays and costs of drilling wells on lands subject to complex development terms and circumstances; and |

Ø | Oil, natural gas or NGL gathering, transportation and processing availability, restrictions or limitations. |

Exploration is inherently risky and is subject to delays, misinterpretation of geologic or engineering data, unexpected geologic conditions or finding reserves of disappointing quality or quantity, which may result in significant losses.

Governmental actions and political instability may affect Occidental’s results of operations.

Occidental’s businesses are subject to the actions and decisions of many federal, state, local and foreign governments and political interests. As a result, Occidental faces risks of:

Ø | New or amended laws and regulations, or new or different applications or interpretations of existing laws and regulations, including those related to drilling, manufacturing or production processes (including well stimulation techniques such as hydraulic fracturing and acidization), pipelines, labor and employment, taxes, royalty rates, permitted production rates, entitlements, import, export and use of raw materials, equipment or products, use or increased use of land, water and other natural resources, safety, the manufacturing of chemicals, asset integrity management, the marketing or export of commodities, security and environmental protection, all of which may restrict or prohibit activities of Occidental or its contractors, increase Occidental’s costs or reduce demand for Occidental’s products. In addition, violation of certain governmental laws and regulations may result in strict, joint and several liability and the imposition of significant civil and criminal fines and penalties; |

Ø | Refusal of, or delay in, the extension or grant of exploration, development or production contracts; and |

Ø | Development delays and cost overruns due to approval delays for, or denial of, drilling, construction, environmental and other regulatory approvals, permits and authorizations. |

As an example of local governmental actions, some counties in Colorado have amended their land use regulations to impose new requirements on oil and gas development while other local governments have entered memoranda of agreement with oil and gas producers to accomplish the same objective. Further, voters in Colorado have proposed or advanced ballot initiatives restricting or banning oil and gas development in Colorado. In the event that these ballot initiatives are adopted or the county-level regulations are implemented in areas where we conduct operations, we may incur significant costs to comply with such requirements or may experience delays or curtailment in the permitting or pursuit of exploration, development or production activities.

In addition, Occidental has and may continue to experience adverse consequences, such as risk of loss or production limitations, because certain of its international operations are located in countries affected by political instability, nationalizations, corruption, armed conflict, terrorism, insurgency, civil unrest, security problems, labor unrest, OPEC production restrictions, equipment import restrictions and sanctions. Exposure to such risks may increase if a greater percentage of Occidental’s future oil and gas production or revenue comes from international sources.

Occidental’s oil and gas business operates in highly competitive environments, which affect, among other things, its ability to make acquisitions to grow production and replace reserves.

Results of operations, reserves replacement and growth in oil and gas production depend, in part, on Occidental’s ability to profitably acquire additional reserves. Occidental has many competitors (including national oil companies), some of which: (i) are larger and better funded; (ii) may be willing to accept greater risks; (iii) have greater access to capital; (iv) have substantially larger staffs; or (v) have special competencies. Competition for reserves may make it more difficult to find attractive investment opportunities or require delay of reserve replacement efforts. Further, during periods of low product prices, any cash conservation efforts may delay production growth and reserve replacement efforts. Also, there is substantial competition for capital available for investment in the oil and natural gas industry. Our failure to acquire properties, grow production, replace reserves and attract and retain qualified personnel could have a material adverse effect on our cash flows and results of operations.

OXY 2019 FORM 10-K | 7 |

| RISK FACTORS | |

In addition, Occidental’s acquisition activities carry risks that it may: (i) not fully realize anticipated benefits due to less-than-expected reserves or production or changed circumstances, such as declines in oil, NGL, and natural gas prices; (ii) bear unexpected integration costs or experience other integration difficulties; (iii) experience share price declines based on the market’s evaluation of the activity; or (iv) be subject to liabilities that are greater than anticipated.

Occidental’s oil and gas reserves are estimates based on professional judgments and may be subject to revision.

Reported oil and gas reserves are an estimate based on periodic review of reservoir characteristics and recoverability, including production decline rates, operating performance and economic feasibility at the prevailing commodity prices, assumptions concerning future oil and natural gas prices, future operating costs and capital expenditures, workover and remedial costs, assumed effects of regulation by governmental agencies, the quantity, quality and interpretation of relevant data, taxes and availability of funds. The procedures and methods for estimating the reserves by our internal engineers were reviewed by independent petroleum consultants; however, there are inherent uncertainties in estimating reserves. Actual production, revenues, expenditures, oil, NGL and natural gas prices and taxes with respect to our reserves may vary from estimates, and the variance may be material. If Occidental were required to make significant negative reserve revisions, its results of operations and stock price could be adversely affected.

In addition, the discounted cash flows included in this Form 10-K should not be construed as the fair value of the reserves attributable to our properties. The estimated discounted future net cash flows from proved reserves are based on an unweighted 12-month average first-day-of-the-month prices in accordance with SEC regulations. Actual future prices and costs may differ materially from SEC regulation-compliant prices and costs used for purposes of estimating future discounted net cash flows from proved reserves. Also, actual future net cash flows may differ from these discounted net cash flows due to the amount and timing of actual production, availability of financing for capital expenditures necessary to develop our undeveloped reserves, supply and demand for oil, NGL and natural gas, increases or decreases in consumption of oil, natural gas and NGL and changes in governmental regulations or taxation.

Climate change and further regulation of greenhouse gas emissions may adversely affect Occidental’s operations or results.

Continuing political and social attention to the issue of climate change has resulted in both existing and pending international agreements and national, regional and local legislation and regulatory programs to reduce greenhouse gas emissions. In December 2009, the Environmental Protection Agency (EPA) determined that emissions of carbon dioxide, methane and other greenhouse gases endanger public health and the environment because emissions of such gases are, according to the EPA, contributing to warming of the Earth’s atmosphere and other climatic changes. Based on these findings, the EPA began adopting and implementing regulations to restrict emissions of greenhouse gases under existing provisions of the Clean Air Act (CAA). For example, the EPA issued rules restricting methane emissions from hydraulically fractured and refractured gas wells, compressors, pneumatic controls, storage vessels, and natural gas processing plants. In addition, in August 2019, the EPA issued the Affordable Clean Energy rule that designates heat rate improvement, or efficiency improvement, as the best system of emissions reduction for carbon dioxide from existing coal-fired electric utility generating units.

In the absence of federal legislation to significantly reduce emissions of greenhouse gases to date, many state governments have established rules aimed at reducing greenhouse gas emissions, including greenhouse gas cap and trade programs. Most of these cap and trade programs work by requiring major sources of emissions, such as electric power plants, or major producers of fuels, including refineries and natural gas processing plants, to acquire and surrender emission allowances. In the future, the United States may also choose to adhere to international agreements targeting greenhouse gas reductions. These and other government actions relating to greenhouse gas emissions could require Occidental to incur increased operating and maintenance costs, such as costs to purchase and operate emissions control systems, to acquire emissions allowances, pay carbon taxes, or comply with new regulatory or reporting requirements, or they could promote the use of alternative sources of energy and thereby decrease demand for oil, natural gas, NGL and other products that Occidental’s businesses produce. Any such legislation or regulatory programs could also increase the cost of consuming, and thereby reduce demand for, oil, natural gas, NGL and other products produced by Occidental’s businesses and lower the value of its reserves. Consequently, government actions designed to reduce emissions of greenhouse gases could have an adverse effect on Occidental’s business, financial condition, results of operations, cash flows and reserves.

It is difficult to predict the timing and certainty of such government actions and their ultimate effect on Occidental, which could depend on, among other things, the type and extent of greenhouse gas reductions required, the availability and price of emissions allowances or credits, the availability and price of alternative fuel sources, the energy sectors covered, and Occidental’s ability to recover the costs incurred through its operating agreements or the pricing of its oil, natural gas, NGL and other products.

There also have been efforts in the investment community, including investment advisers and certain sovereign wealth, pension and endowment funds, as well as other stakeholders, promoting divestment of fossil fuel equities and pressuring lenders to limit funding to companies engaged in the extraction of fossil fuel reserves. Such environmental activism and initiatives aimed at limiting climate change and reducing air pollution could interfere with our business activities, operations and ability to access capital. Such initiatives could cause the market value of our securities to decrease, our cost of capital to

8 | OXY 2019 FORM 10-K |

| RISK FACTORS | |

increase and adversely affect our reputation. Finally, increasing attention to climate change risks has resulted in an increased possibility of governmental investigations and additional private litigation against Occidental without regard to causation or our contribution to the asserted damage, which could increase our costs or otherwise adversely affect our business. Occidental has been named in certain private litigation relating to these matters.

Occidental’s businesses may experience catastrophic events.

The occurrence of events such as hurricanes, floods, droughts, earthquakes or other acts of nature, well blowouts, pandemics, fires, explosions, pipeline ruptures, chemical releases, oil releases, including maritime releases, releases into navigable waters, and groundwater contamination, material or mechanical failure, industrial accidents, physical attacks, abnormally pressured or structured formations and other events that cause operations to cease or be curtailed may negatively affect Occidental’s businesses and the communities in which it operates. Coastal operations are particularly susceptible to disruption from extreme weather events. Any of these risks could adversely affect our ability to conduct operations or result in substantial losses to us as a result of:

Ø | Damage to and destruction of property and equipment; |

Ø | Damage to natural resources; |

Ø | Pollution and other environmental damage, including spillage or mishandling of recovered chemicals or fluids; |

Ø | Regulatory investigations and penalties; |

Ø | Loss of well location, acreage, expected production and related reserves; |

Ø | Suspension or delay of our operations; |

Ø | Substantial liability claims; and |

Ø | Repair and remediation costs. |

Third-party insurance may not provide adequate coverage or Occidental may be self-insured with respect to the related losses. In addition, under certain circumstances, we may be liable for environmental damage caused by previous owners or operators of properties that we own, lease or operate. As a result, we may incur substantial liabilities to third parties or governmental entities for environmental matters for which we do not have insurance coverage, which could reduce or eliminate funds available for exploration, development or acquisitions or cause us to incur losses.

Occidental uses CO2 for its enhanced oil recovery (EOR) operations, and its production from these operations may decline if Occidental is not able to obtain sufficient amounts of CO2.

Occidental’s CO2 EOR operations are critical to Occidental’s long-term strategy. Oil production from Occidental’s EOR projects depends largely on having access to sufficient amounts of naturally occurring or anthropogenic CO2. Occidental’s ability to produce oil from its EOR projects would be hindered if the supply of CO2 was limited due to, among other things, problems with current CO2 producing wells and facilities, including compression equipment, catastrophic pipeline failure or the ability to economically purchase naturally occurring or anthropogenic CO2. This could have a material adverse effect on Occidental’s financial condition, results of operations or cash flows. Future oil production from its EOR operations is dependent on the timing, volumes and location of CO2 injections and, in particular, Occidental’s ability to obtain sufficient volumes of CO2. Market conditions may cause the delay or cancellation of the development of naturally occurring CO2 sources or construction of plants that produce anthropogenic CO2 as a byproduct that can be purchased, thus limiting the amount of CO2 available for use in Occidental’s EOR operations.

Occidental is exposed to cyber-related risks.

The oil and gas industry is increasingly dependent on digital and industrial control technologies to conduct certain exploration, development and production activities. Occidental relies on digital and industrial control systems, related infrastructure, technologies and networks to run its business and to control and manage its oil and gas, chemicals, marketing and pipeline operations. Use of the internet, cloud services, mobile communication systems and other public networks exposes Occidental’s business and that of other third parties with whom Occidental does business to cyber-attacks. Cyber-attacks on businesses have escalated in recent years.

Information and industrial control technology system failures, network disruptions and breaches of data security could disrupt our operations by causing delays, impeding processing of transactions and reporting financial results, resulting in the unintentional disclosure of company, partner, customer or employee information or could damage our reputation. A cyber-attack involving our information or industrial control systems and related infrastructure, or that of our business associates, could negatively impact our operations in a variety of ways, including but not limited to, the following:

Ø | Unauthorized access to seismic data, reserves information, strategic information, or other sensitive or proprietary information could have a negative impact on our ability to compete for oil and natural gas resources; |

Ø | Data corruption, communication or systems interruption or other operational disruption during drilling activities could result in delays and failure to reach the intended target or cause a drilling incident; |

OXY 2019 FORM 10-K | 9 |

| RISK FACTORS | |

Ø | Data corruption, communication or systems interruption or operational disruptions of production-related infrastructure could result in a loss of production or accidental discharge; |

Ø | A cyber-attack on our chemical operations could result in a disruption of the manufacturing and marketing of our products or a potential environmental hazard; |

Ø | A cyber-attack on a vendor or service provider could result in supply chain disruptions, which could delay or halt our construction and development projects; |

Ø | A cyber-attack on third-party gathering, pipeline, processing, or other infrastructure systems could delay or prevent us from transporting, processing and marketing our production; |

Ø | A cyber-attack involving commodities exchanges or financial institutions could slow or halt commodities trading, thus preventing us from marketing our production or engaging in hedging activities; |

Ø | A cyber-attack that halts activities at a power generation facility or refinery using natural gas as feedstock could have a significant impact on the natural gas market; |

Ø | A cyber-attack on a communications network or power grid could cause operational disruption; |

Ø | A cyber-attack on our automated and surveillance systems could cause a loss in production and potential environmental hazards; |

Ø | A deliberate corruption of our financial or operating data could result in events of non-compliance which could then lead to regulatory fines or penalties; and |

Ø | A cyber-attack resulting in the loss or disclosure of, or damage to, our or any of our customer’s or supplier’s data or confidential information could harm our business by damaging our reputation, subjecting us to potential financial or legal liability, and requiring us to incur significant costs, including costs to repair or restore our systems and data or to take other remedial steps. |

Even though Occidental has implemented controls and multiple layers of security to mitigate the risks of a cyber-attack that it believes are reasonable, there can be no assurance that such cyber security measures will be sufficient to prevent security breaches of its systems from occurring, and if a breach occurs, it may remain undetected for an extended period of time. Further, Occidental has no control over the comparable systems of the third parties with whom it does business. While Occidental has experienced cyber-attacks in the past, Occidental has not suffered any material losses. However, if in the future Occidental’s cyber security measures are compromised or prove insufficient, the potential consequences to Occidental’s businesses and the communities in which it operates could be significant. As cyber-attacks continue to evolve in magnitude and sophistication, Occidental may be required to expend additional resources in order to continue to enhance Occidental’s cyber security measures and to investigate and remediate any digital and operational systems, related infrastructure, technologies and network security vulnerabilities, which would increase our costs. A system failure or data security breach, or a series of such failures or breaches, could have a material adverse effect on our financial condition, results of operations or cash flows.

Occidental’s oil and gas reserve additions may not continue at the same rate and a failure to replace reserves may negatively affect Occidental’s business.

Producing oil and natural gas reservoirs generally are characterized by declining production rates that vary depending upon reservoir characteristics and other factors. Unless Occidental conducts successful exploration or development activities, acquires properties containing proved reserves, or both, proved reserves will generally decline and negatively impact our business. The value of our securities and our ability to raise capital will be adversely impacted if we are not able to replace reserves that are depleted by production or replace our declining production with new production. Management expects improved recovery, extensions and discoveries to continue as main sources for reserve additions but factors such as geology, government regulations and permits, the effectiveness of development plans and the ability to make the necessary capital investments or acquire capital are partially or fully outside management’s control and could cause results to differ materially from expectations.

Occidental’s commodity-price risk management may prevent us from fully benefiting from price increases and may expose us to regulatory and other risks.

To the extent that we engage in activities to protect Occidental’s cash flows from commodity-price declines, we may be prevented from realizing the full benefits of price increases above the levels of the derivative instruments used to manage price risk. In addition, Occidental’s commodity-price risk management may expose us to the risk of financial loss in certain circumstances, including instances in which the following occur:

Ø | Occidental’s production is less than the notional volume; |

Ø | The counterparties to Occidental’s hedging or other price risk management contracts fail to perform under those arrangements; or |

Ø | A sudden, unexpected event materially impacts oil, natural gas or NGL prices. |

10 | OXY 2019 FORM 10-K |

| RISK FACTORS | |

Occidental’s operations and financial results could be significantly negatively impacted by its offshore operations.

Occidental is vulnerable to risks associated with our offshore operations that could negatively impact our operations and financial results. Occidental conducts offshore operations in the Gulf of Mexico and Ghana. Occidental’s operations and financial results could be significantly impacted by conditions in some of these areas and are also vulnerable to certain unique risks associated with operating offshore, including those relating to the following:

Ø Hurricanes and other adverse weather conditions;

Ø Geological complexities and water depths associated with such operations;

Ø Limited number of partners available to participate in projects;

Ø Oilfield service costs and availability;

Ø Compliance with environmental, safety, and other laws and regulations;

Ø Terrorist attacks or piracy;

Ø Remediation and other costs and regulatory changes resulting from oil spills or releases of hazardous materials;

Ø Failure of equipment or facilities; and

Ø Response capabilities for personnel, equipment, or environmental incidents.

In addition, Occidental conducts some of its exploration in deep waters (greater than 1,000 feet) where operations, support services, and decommissioning activities are more difficult and costly than in shallower waters. The deep waters in the Gulf of Mexico, as well as international deepwater locations, lack the physical and oilfield service infrastructure present in shallower waters. As a result, deepwater operations may require significant time between a discovery and the time that Occidental can market its production, thereby increasing the risk involved with these operations.

Additional domestic and international deepwater drilling laws, regulations and other restrictions, delays in the processing and approval of drilling permits and exploration, development, oil spill response and decommissioning plans and other offshore-related developments may have a material adverse effect on Occidental’s business, financial condition or results of operations.

The Bureau of Ocean Energy Management (BOEM) and the Bureau of Safety and Environmental Enforcement have imposed more stringent permitting procedures and regulatory safety and performance requirements for new wells to be drilled in federal waters. In addition, these governmental agencies are continuing to evaluate, develop and implement new, more restrictive regulatory requirements, which could result in additional costs, delays, restrictions or obligations with respect to oil exploration and production operations conducted offshore. For example, the BOEM has considered, and may adopt, supplemental bonding procedures for the decommissioning of offshore wells, platforms, pipelines and other facilities, which may be material. Compliance with these more stringent regulatory requirements and with existing environmental and oil spill regulations, together with any uncertainties or inconsistencies in decisions and rulings by governmental agencies, delays in the processing and approval of drilling permits or exploration, development, oil spill-response and decommissioning plans, and possible additional regulatory initiatives could result in difficult and more costly actions and adversely affect or delay new drilling and ongoing development efforts.

Occidental’s indebtedness may make it more vulnerable to economic downturns and adverse developments in its business. A downgrade in Occidental’s credit ratings or future increases in interest rates may negatively impact Occidental’s cost of and ability to access the capital markets.

Occidental incurred indebtedness and other payment obligations in connection with the Acquisition. Occidental’s higher level of indebtedness could increase Occidental’s vulnerability to adverse changes in general economic and industry conditions, economic downturns and adverse developments in its business and/or limit Occidental’s flexibility in planning for or reacting to changes in its business and the industries in which it operates. From time to time, Occidental has relied on access to the capital markets for funding, including in connection with the Acquisition. There can be no assurance that additional debt or equity financing will be available to Occidental in the future on acceptable terms, or at all. Occidental’s ability to obtain additional financing or refinancing will be subject to a number of factors, including general economic and market conditions, Occidental’s performance, investor sentiment and its existing debt compliance requirements. If Occidental is unable to generate sufficient funds from its operations to satisfy its capital requirements, including its existing debt obligations, or to raise additional capital on acceptable terms, Occidental’s business could be adversely affected. In addition, a downgrade in the credit rating of Occidental could negatively impact its cost of and ability to access capital and to effectively execute aspects of its strategy, and may require Occidental to provide collateral, letters of credit, or other forms of security under certain contractual agreements, which would increase Occidental’s operating costs. As a result, a downgrade below investment grade in Occidental’s credit ratings could have a material adverse impact on Occidental’s financial condition, operating results, or liquidity.

Further, a portion of Occidental’s indebtedness bears interest at fluctuating interest rates, some of which is tied to the London Interbank Offered Rate (“LIBOR”). LIBOR tends to fluctuate based on general interest rates, rates set by the Federal Reserve and other central banks, the supply of and demand for credit in the London interbank market and general economic conditions. In July 2017, the United Kingdom Financial Conduct Authority, which regulates LIBOR, announced that it intends to stop compelling banks

OXY 2019 FORM 10-K | 11 |

| RISK FACTORS | |

to submit rates for the calculation of LIBOR after 2021. The U.S. Federal Reserve, in conjunction with the Alternative Reference Rates Committee, is considering replacing U.S. dollar LIBOR with a newly created index, calculated based on repurchase agreements backed by treasury securities. It is not possible to predict the effect of these changes, other reforms or the establishment of alternative reference rates in the United Kingdom, the United States or elsewhere. These reforms and other pressures may cause LIBOR to disappear entirely or to perform differently than in the past. The consequences of these developments cannot be entirely predicted, but may include an increase in the cost of Occidental’s variable rate indebtedness, including floating rate notes and interest rate swaps, which may have an adverse effect on Occidental’s financial condition, operating results or cash flows.

Risks related to Occidental’s Acquisition of Anadarko

Occidental may not be able to integrate Anadarko successfully, and many of the anticipated benefits of combining Occidental and Anadarko may not be realized.

Occidental acquired Anadarko with the expectation that the Acquisition will result in various benefits, including, among other things, operating efficiencies. Achieving those anticipated benefits is subject to a number of uncertainties, including whether Occidental can integrate the business of Anadarko in an efficient and effective manner. Occidental cannot ensure that those benefits will be realized as quickly as expected or at all. If Occidental does not achieve anticipated benefits, costs could increase, expected net income could decrease, the stock price could decline, and future business, financial condition, operating results and prospects could suffer.

The integration process could take longer than anticipated and involve unanticipated costs. Disruptions of each company’s ongoing businesses, processes and systems or inconsistencies in standards, controls, procedures, practices, policies and compensation arrangements could adversely affect the combined company. Occidental may also have difficulty addressing differences in corporate cultures and management philosophies and harmonizing other systems and business practices. Although Occidental expects that the elimination of certain duplicative costs, as well as the realization of other efficiencies related to the integration of the two businesses, will over time offset the substantial incremental transaction and Acquisition-related costs, Occidental may not achieve this net benefit in the near term, or at all.

Moreover, even if the integration of Anadarko is successful, the integration process places a significant burden on Occidental’s management and internal resources. The diversion of management’s attention away from day-to-day business concerns and any difficulties encountered in the integration process could adversely affect our financial condition, results of operations or cash flows.

Future results will be negatively impacted if Occidental does not effectively manage its expanded operations.

With completion of the Acquisition, the size of Occidental’s business has increased significantly. Occidental’s continued success depends, in part, upon its ability to manage this expanded business, which poses substantial challenges for management, including challenges related to the management and monitoring of new operations and associated increased costs and complexity. Occidental cannot assure that it will be successful or that it will realize the expected operating efficiencies, cost savings and other benefits from the combination currently anticipated.

Anadarko’s Tronox settlement may not be deductible for income tax purposes, and Occidental may be required to repay the tax refund Anadarko received in 2016 related to the deduction of the Tronox settlement payment, which may have a material adverse effect on Occidental’s results of operations, liquidity and financial condition.

In April 2014, Anadarko and Kerr-McGee Corporation and certain of its subsidiaries (collectively, Kerr-McGee) entered into a settlement agreement for $5.15 billion, resolving all claims that were or could have been asserted in connection with the May 2009 lawsuit filed by Tronox against Anadarko and Kerr-McGee Corporation (and certain of its subsidiaries) in the U.S. Bankruptcy Court for the Southern District of New York. After the settlement became effective in January 2015, Anadarko paid $5.2 billion and deducted this payment on its 2015 federal income tax return. Due to the deduction, Anadarko had a net operating loss carryback for 2015, which resulted in a tentative tax refund of $881 million in 2016. Occidental’s consolidated financial statements include an uncertain tax position greater than the amount of the tentative tax refund received.

The IRS has audited Anadarko’s tax position regarding the deductibility of the payment and in September 2018 issued a statutory notice of deficiency rejecting Anadarko’s refund claim. Anadarko disagreed and filed a petition with the U.S. Tax Court to dispute the disallowance in November 2018. It is possible that Occidental may not ultimately succeed in defending this deduction. If the payment is ultimately determined not to be deductible, Occidental would be required to repay the tentative refund received plus interest totaling approximately $1.1 billion as of December 31, 2019, which could have a material adverse effect on our statement of operations, liquidity and consolidated balance sheets. This amount is not covered by insurance. For additional information on income taxes, see Note 11 - Lawsuits, Claims, Commitments and Contingencies in the Notes to Consolidated Financial Statements.

12 | OXY 2019 FORM 10-K |

| RISK FACTORS | |

Occidental may not be able to complete its planned divestitures of certain assets on favorable terms or at all.

Occidental announced a $15 billion divestiture program in connection with the Acquisition. The completion of these divestitures is subject to customary closing conditions, and certain of the divestitures are conditioned on the receipt of required government and regulatory approvals. Occidental may not be able to complete its planned divestitures on favorable terms, in a timely manner or at all. Any difficulties with respect to the completion of the planned divestitures could have a material adverse effect on Occidental’s business, financial condition, results of operations, cash flows and/or stock price. See Note 4 - Acquisitions, Dispositions and Other Transactions in the Notes to Consolidated Financial Statements in Part II Item 8 of this Form 10-K for information about the Total transaction.

ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

ITEM 3. | LEGAL PROCEEDINGS |

On July 17, 2019, an Occidental subsidiary received a draft consent agreement and final order from the EPA regarding alleged violations under the CAA and various sections of the EPA’s Chemical Accident Prevention Provisions at the Convent, Louisiana facility. The EPA’s order includes allegations associated with process reviews, procedures and recordkeeping. The EPA’s revised draft settlement proposal includes a civil penalty of $121,457. Occidental is currently negotiating a resolution of this matter with the EPA.

On September 13, 2019, an Occidental subsidiary received a draft consent agreement and final order from the EPA regarding alleged violations under the CAA and various sections of the EPA’s Chemical Accident Prevention Provisions at the Geismar, Louisiana facility. The EPA’s order includes allegations associated with operating procedures, inspections, contractor reviews, medical protocols in the emergency response plan, administrative updates and four historical on-site incidents. The EPA’s revised draft settlement proposal includes a civil penalty of $734,182. Occidental is currently negotiating a resolution of this matter with the EPA.

For information regarding legal proceedings, see the information under the caption “Lawsuits, Claims, Commitments and Contingencies” in the MD&A section of this report and in Note 11 - Lawsuits, Claims, Commitments and Contingencies in the Notes to Consolidated Financial Statements.

ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

OXY 2019 FORM 10-K | 13 |

| OTHER INFORMATION | |

INFORMATION ABOUT OUR EXECUTIVE OFFICERS |

Each executive officer holds his or her office from the date of election by the Board of Directors until the first board meeting held after the next Annual Meeting of Stockholders or until his or her removal or departure or a successor is duly elected, if earlier.

The following table sets forth the executive officers of Occidental as of February 27, 2020:

Name Current Title | Age at February 27, 2020 | Positions with Occidental and Employment History | |

Marcia E. Backus Senior Vice President | 65 | Senior Vice President, General Counsel and Chief Compliance Officer since December 2016; Senior Vice President, General Counsel, Chief Compliance Officer and Corporate Secretary, 2015-2016; Vice President, General Counsel and Corporate Secretary, 2014-2015; Vice President and General Counsel, 2013-2014; Vinson & Elkins: Partner, 1990-2013. | |

Oscar K. Brown Senior Vice President | 49 | Senior Vice President - Strategy, Business Development and Supply Chain since November 2018; Senior Vice President - Corporate Strategy and Development, 2017 - 2018; Senior Vice President - Business Development, 2016 - 2017; Bank of America Merrill Lynch: Managing Director and co-head of Americas Energy Investment Banking, 2010 - 2016. | |

Cedric W. Burgher Chief Financial Officer and Senior Vice President | 59 | Senior Vice President and Chief Financial Officer since May 2017; EOG Resources: Senior Vice President, Investor and Public Relations, 2014-2017; QR Energy L.P.: Chief Financial Officer, 2010-2014. | |

Christopher O. Champion Vice President | 50 | Vice President, Chief Accounting Officer and Controller since August 2019; Anadarko Petroleum Corporation: Senior Vice President, Chief Accounting Officer and Controller, 2017-2019; Vice President, Chief Accounting Officer and Controller 2015-2017; KPMG LLP: Audit Partner, 2003-2015. | |

Kenneth Dillon Senior Vice President | 60 | Senior Vice President since December 2016; President - International Oil and Gas Operations since June 2016; Senior Vice President - Operations and Major Projects, 2014-2016; Senior Vice President - Major Projects, 2012-2014. | |

Vicki Hollub President and Chief Executive Officer | 60 | President, Chief Executive Officer and Director since April 2016; President, Chief Operating Officer and Director, 2015-2016; Senior Executive Vice President and President, Oxy Oil and Gas, 2015; Executive Vice President and President Oxy Oil and Gas - Americas, 2014-2015; Vice President and Executive Vice President, U.S. Operations, Oxy Oil and Gas, 2013-2014. | |

Edward A. “Sandy” Lowe Executive Vice President | 68 | Executive Vice President since 2015; Group Chairman - Middle East since 2016; Senior Vice President, 2008-2015; President - Oxy Oil & Gas International, 2009-2016. | |

Robert Palmer Senior Vice President | 64 | Senior Vice President since July 2017; President - Domestic Onshore Oil and Gas Operations, Oxy Oil and Gas since June 2019; Senior Vice President - Technical Support, 2017-2019; President and General Manager - Colombia, 2012-2017. | |

Glenn M. Vangolen Senior Vice President | 61 | Senior Vice President, Business Support since February 2015; Executive Vice President, Business Support, 2014-2015; Senior Vice President - Oxy Oil & Gas Middle East, 2010-2014. | |

14 | OXY 2019 FORM 10-K |

| OTHER INFORMATION | |

Part II

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

MARKET INFORMATION, HOLDERS AND DIVIDEND POLICY |

Occidental’s common stock is listed and traded on the New York Stock Exchange under the ticker symbol “OXY.” The common stock was held by approximately 27,700 stockholders of record at January 31, 2020, which does not include beneficial owners for whom Cede and Co. or others act as nominees.

Occidental’s current annualized dividend rate of $3.16 per share has increased by over 500% since 2002. The declaration of future dividends is a business decision made by the Board of Directors from time to time, and will depend on Occidental’s financial condition and other factors deemed relevant by the Board.

SHARE REPURCHASE ACTIVITIES |

Occidental’s share repurchase activities for the year ended December 31, 2019, were as follows:

Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs | ||||||||||||||

First Quarter 2019 | 2,690,000 | $ | 66.94 | 2,690,000 | ||||||||||||||

Second Quarter 2019 | — | $ | — | — | ||||||||||||||

Third Quarter 2019 | — | $ | — | — | ||||||||||||||

Fourth Quarter 2019 | — | (a) | $ | — | — | |||||||||||||

Total 2019 | 2,690,000 | (a) | $ | 66.94 | 2,690,000 | 44,206,787 | (b) | |||||||||||

(a) | There were no purchases from the trustee of Occidental’s defined contribution savings plan in the fourth quarter of 2019. |

(b) | Represents the total number of shares remaining at year end under Occidental’s share repurchase program of 185 million shares. The program was initially announced in 2005. The program does not obligate Occidental to acquire any specific number of shares and may be discontinued at any time. |

OXY 2019 FORM 10-K | 15 |

| OTHER INFORMATION | |

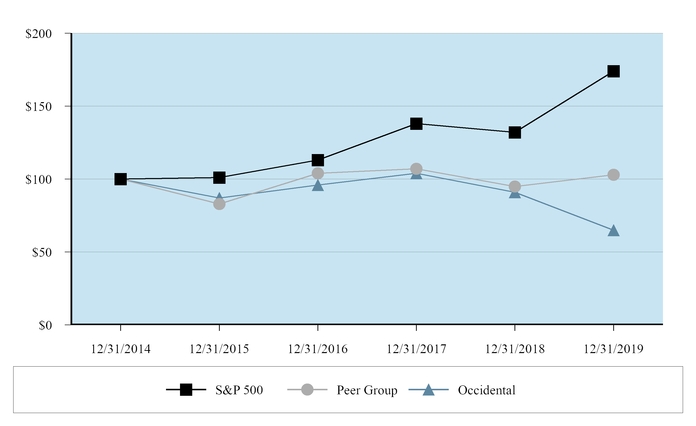

PERFORMANCE GRAPH |

The following graph compares the yearly percentage change in Occidental’s cumulative total return on its common stock with the cumulative total return of the Standard & Poor’s 500 Stock Index (S&P 500), which includes Occidental, and with that of Occidental’s peer group over the five-year period ended December 31, 2019. The graph assumes that $100 was invested at the beginning of the five-year period shown in the graph below in: (i) Occidental common stock, (ii) the stock of the companies in the S&P 500, and (iii) each of the peer group companies’ common stock weighted by their relative market capitalization within the peer group, and that all dividends were reinvested. The cumulative total return of the peer group companies’ common stock includes the cumulative total return of Occidental’s common stock.

Occidental’s peer group consists of Apache Corporation, Canadian Natural Resources Limited, Chevron Corporation, ConocoPhillips, Devon Energy Corporation, EOG Resources Inc., ExxonMobil Corporation, Hess Corporation, Marathon Oil Corporation, Total S.A. and Occidental.

Fiscal Year Ended December 31 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |||||||||||||||||

Occidental | $ | 100 | $ | 87 | $ | 96 | $ | 104 | $ | 91 | $ | 65 | |||||||||||

Peer Group | $ | 100 | $ | 83 | $ | 104 | $ | 107 | $ | 95 | $ | 103 | |||||||||||

S&P 500 | $ | 100 | $ | 101 | $ | 113 | $ | 138 | $ | 132 | $ | 174 | |||||||||||

The information provided in this Performance Graph shall not be deemed “soliciting material” or “filed” with the SEC or subject to Regulation 14A or 14C under the Exchange Act, other than as provided in Item 201 to Regulation S-K under the Exchange Act, or subject to the liabilities of Section 18 of the Exchange Act and shall not be deemed incorporated by reference into any filing under the Securities Act of 1933 or the Exchange Act except to the extent Occidental specifically requests that it be treated as soliciting material or specifically incorporates it by reference.

16 | OXY 2019 FORM 10-K |

| OTHER INFORMATION | |

ITEM 6. | SELECTED FINANCIAL DATA |

millions, except per-share amounts | 2019 (a) | 2018 | 2017 | 2016 | 2015 | ||||||||||||||

RESULTS OF OPERATIONS (b,c) | |||||||||||||||||||

Net sales | $ | 20,393 | $ | 17,824 | $ | 12,508 | $ | 10,090 | $ | 12,480 | |||||||||

Income (loss) from continuing operations | $ | (507 | ) | $ | 4,131 | $ | 1,311 | $ | (1,002 | ) | $ | (8,146 | ) | ||||||

Net income (loss) attributable to common stockholders | $ | (985 | ) | $ | 4,131 | $ | 1,311 | $ | (574 | ) | $ | (7,829 | ) | ||||||

Net income (loss) from continuing operations attributable to common stockholders - basic per common share | $ | (1.20 | ) | $ | 5.40 | $ | 1.71 | $ | (1.31 | ) | $ | (10.64 | ) | ||||||

Net income (loss) attributable to common stockholders - basic per common share | $ | (1.22 | ) | $ | 5.40 | $ | 1.71 | $ | (0.75 | ) | $ | (10.23 | ) | ||||||

Net income (loss) attributable to common stockholders - diluted per common share | $ | (1.22 | ) | $ | 5.39 | $ | 1.70 | $ | (0.75 | ) | $ | (10.23 | ) | ||||||

FINANCIAL POSITION (b) | |||||||||||||||||||

Total assets | $ | 109,330 | $ | 43,854 | $ | 42,026 | $ | 43,109 | $ | 43,409 | |||||||||

Long-term debt, net | $ | 38,537 | $ | 10,201 | $ | 9,328 | $ | 9,819 | $ | 6,855 | |||||||||

Stockholders’ equity | $ | 34,232 | $ | 21,330 | $ | 20,572 | $ | 21,497 | $ | 24,350 | |||||||||

MARKET CAPITALIZATION (d) | $ | 36,846 | $ | 45,998 | $ | 56,357 | $ | 54,437 | $ | 51,632 | |||||||||

CASH FLOW FROM CONTINUING OPERATIONS (b,c) | |||||||||||||||||||

Operating: | |||||||||||||||||||

Cash flow from continuing operations | $ | 7,203 | $ | 7,669 | $ | 4,861 | $ | 2,520 | $ | 3,251 | |||||||||

Investing: | |||||||||||||||||||

Capital expenditures | $ | (6,355 | ) | $ | (4,975 | ) | $ | (3,599 | ) | $ | (2,717 | ) | $ | (5,272 | ) | ||||

Payments for purchases of assets and businesses | $ | (28,088 | ) | $ | (928 | ) | $ | (1,064 | ) | $ | (2,044 | ) | $ | (109 | ) | ||||

Sales of assets, net | $ | 6,143 | $ | 2,824 | $ | 1,403 | $ | 302 | $ | 819 | |||||||||

Cash provided (used) by all other investing activities, net | $ | (573 | ) | $ | (127 | ) | $ | 181 | $ | (284 | ) | $ | (858 | ) | |||||

Financing: | |||||||||||||||||||

Cash dividends paid | $ | (2,624 | ) | $ | (2,374 | ) | $ | (2,346 | ) | $ | (2,309 | ) | $ | (2,264 | ) | ||||

Purchases of treasury stock | $ | (237 | ) | $ | (1,248 | ) | $ | (25 | ) | $ | (22 | ) | $ | (593 | ) | ||||

Proceeds from long-term debt, net - Occidental | $ | 21,557 | $ | 978 | $ | — | $ | 4,203 | $ | 1,478 | |||||||||

Payment of long-term debt, net - Occidental | $ | (6,959 | ) | $ | (500 | ) | $ | — | $ | (2,710 | ) | $ | — | ||||||

Proceeds from issuance of common and preferred stock | $ | 10,028 | $ | 33 | $ | 28 | $ | 36 | $ | 37 | |||||||||

Cash provided (used) by all other financing activities, net | $ | 431 | $ | 9 | $ | — | $ | — | $ | — | |||||||||

DIVIDENDS PER COMMON SHARE | $ | 3.14 | $ | 3.10 | $ | 3.06 | $ | 3.02 | $ | 2.97 | |||||||||

WEIGHTED-AVERAGE BASIC SHARES OUTSTANDING | 810 | 762 | 765 | 764 | 766 | ||||||||||||||

(a) | Summary financial information included the impact of the Acquisition, see Note 3 - The Acquisition in the Notes to Consolidated Financial Statements. Summary results of operations from the date of the Acquisition to December 31, 2019 included the results of WES, a previously consolidated subsidiary. The summary results of operations also included a loss as a result of no longer consolidating WES of approximately $1 billion. See Note 1 - Summary of Significant Accounting Policies in the Notes to Consolidated Financial Statements. |

(b) | See the MD&A section of this report and the Notes to Consolidated Financial Statements for information regarding acquisitions and dispositions, discontinued operations and other charges affecting comparability. |

(c) | The 2019 results include results of operations and cash flows related to the Acquisition for the period beginning August 8, 2019 through December 31, 2019. |

(d) | Market capitalization is calculated by multiplying the year-end total shares of common stock outstanding, net of shares held as treasury stock, by the year-end closing stock price. |

OXY 2019 FORM 10-K | 17 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS | |

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (MD&A) |

The following discussion should be read together with the Consolidated Financial Statements and the Notes to Consolidated Financial Statements, which are included in this Form 10-K in Item 8, and the information set forth in Risk Factors under Item 1A.

INDEX | PAGE |

Segment Results of Operations and Items Affecting Comparability | |

Income Taxes | |

Commitments and Obligations | |

Global Investments | |

18 | OXY 2019 FORM 10-K |

| MANAGEMENT’S DISCUSSION AND ANALYSIS | |

STRATEGY |

GENERAL

Occidental is focused on delivering a unique shareholder value proposition through continual enhancements to its asset quality, organizational capability and innovative technical applications that provide competitive advantages. Occidental’s integrated business provides conventional and unconventional opportunities through which to grow value. Occidental aims to maximize shareholder returns through a combination of:

Ø | Maintaining a sustainable and sector-leading dividend; |

Ø | Allocating capital to high-return, short-cycle and long-cycle, cash-flow generating opportunities across its integrated business; |

Ø | Generating free cash flow growth to reduce debt and return cash to shareholders; |

Ø | Achieving production growth rates of up to 5% over the long-term; and |

Ø | Maintaining a strong balance sheet to secure business and enhance shareholder value. |

Occidental conducts its operations with a focus on sustainability, health, safety and environmental and social responsibility. Capital is employed to operate all assets in a safe and environmentally sound manner. Price volatility is inherent in the oil and gas business, and Occidental’s strategy is to position the business to thrive in an up- or down-cycle commodity price environment.

On August 8, 2019, Occidental closed on its acquisition of Anadarko. The Acquisition added to Occidental’s oil and gas portfolio, primarily in the Permian Basin, DJ Basin and Gulf of Mexico, as well as a significant economic interest in WES. Post-Acquisition, Occidental’s diversified portfolio provides numerous competitive advantages. Occidental is now the largest oil and gas leaseholder in the United States on a net acreage basis with ample opportunities in the Permian Basin, DJ Basin, Powder River Basin and the Gulf of Mexico with the ability to selectively deploy capital in a way that optimizes capital intensity. As the acquired assets are integrated and developed, Occidental will utilize its subsurface and operating expertise to improve productivity and reduce full cycle costs.

KEY PERFORMANCE INDICATORS

Occidental seeks to meet its strategic goals by continually measuring its success against key performance metrics that drive total stockholder return. In addition to efficient capital allocation and deployment discussed below, Occidental believes the following are its most significant metrics:

Ø | Health, safety and environmental and sustainability-related performance measures; |

Ø | Achieving debt reduction targets; |

Ø | Total shareholder return, including dividends; |

Ø | Maintaining investment grade credit metrics; |

Ø | Return on capital employed (ROCE) and cash return on capital employed (CROCE); |

Ø | Specific measures such as earnings per share, per-unit profit, production cost, cash flow, finding and development costs and reserves replacement percentages; and |

Ø | Acquisition-related synergy and divestiture targets. |

OIL AND GAS SEGMENT | ||||

BUSINESS STRATEGY

Occidental’s oil and gas segment focuses on long-term value creation and leadership in sustainability, health, safety and the environment. In each core operating area, Occidental’s operations benefit from scale, technical expertise, decades of high-margin inventory, environmental and safety leadership, and commercial and governmental collaboration. These attributes allow Occidental to bring additional production quickly to market, extend the life of older fields at lower costs, and provide low-cost returns-driven growth opportunities with advanced technology.

With the completion of the Acquisition, Occidental became the largest U.S. producer of oil and liquids in the second half of 2019, allowing Occidental to maximize cash margins on a BOE basis. Through the Acquisition, Occidental acquired modern 3D seismic data pertaining to approximately 450,000 square miles of core domestic development areas. This resulted in a 40% increase in Occidental’s Permian seismic inventory. The advantages that Occidental’s diversified portfolio provides, coupled with unmatched subsurface characterization ability and the proven ability to execute, ensures that Occidental is positioned for full-cycle success in the years ahead. The oil and gas segment continues to focus on integration of the newly acquired assets and efforts to realize synergies at an early stage to deliver lower breakeven costs and generate excess free cash flow.

OXY 2019 FORM 10-K | 19 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS | |

As a result of Occidental’s strategic positioning, Occidental’s assets provide current production and a future portfolio of projects that are flexible and have short-cycle investment paybacks. Together with Occidental’s technical capabilities, the oil and gas segment strives to achieve low development and operating costs to maximize full-cycle value of the assets.

The oil and gas business implements Occidental’s strategy primarily by:

Ø Operating and developing areas where reserves are known to exist and optimizing capital intensity in core areas, primarily in the Permian Basin, DJ Basin, Gulf of Mexico, UAE, Oman, Qatar and Colombia;

Ø Maintaining a disciplined and prudent approach to capital expenditures with a focus on high-return, short-cycle, cash-flow-generating opportunities and an emphasis on creating value and further enhancing Occidental’s existing positions;

Ø Focusing Occidental’s subsurface characterization and technical activities on unconventional opportunities, primarily in the Permian Basin;

Ø Using enhanced oil recovery techniques, such as CO2, water and steam floods in mature fields; and