PART I

Cautionary Statement for Purposes of the “Safe Harbor” Provisions of the Private Securities Litigation Reform Act of 1995

This document includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to analyses and other information that are

based on forecasts of future results and estimates of amounts not yet determinable. These statements also relate to the Kaspien Holdings Inc.’s (“the Company’s”) future prospects, developments and business strategies. The statements contained in

this document that are not statements of historical fact may include forward-looking statements that involve a number of risks and uncertainties.

We have used the words “anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”, “may”, “plan”, “predict”, “project”, “mission”, “vision” and similar terms and phrases, including

references to assumptions, in this document to identify forward-looking statements. These forward-looking statements are made based on management’s expectations and beliefs concerning future events and are subject to uncertainties and factors

relating to our operations and business environment, all of which are difficult to predict and many of which are beyond the Company’s control, that could cause actual results to differ materially from those matters expressed in or implied by these

forward-looking statements. The following factors are among those that may cause actual results to differ materially from the Company’s forward-looking statements:

|

|

•

|

continued operating losses;

|

|

•

|

the ability of the Company to satisfy its liabilities and to continue as a going concern;

|

|

•

|

maintaining Kaspien’s relationship with Amazon;

|

|

•

|

continued revenue declines;

|

|

•

|

decline in the Company’s stock price;

|

|

•

|

the limited public float and trading volume for our Common Stock;

|

|

•

|

new product introductions;

|

|

•

|

advancements in technology;

|

|

•

|

dependence on key employees, the ability to hire new employees and pay competitive wages;

|

|

•

|

the Company’s level of debt and related restrictions and limitations;

|

|

•

|

future cash flows;

|

|

•

|

vendor terms;

|

|

•

|

interest rate fluctuations;

|

|

•

|

access to third party digital marketplaces;

|

|

•

|

adverse publicity;

|

|

•

|

product liability claims;

|

|

•

|

changes in laws and regulations;

|

|

•

|

breach of data security;

|

|

•

|

increase in Amazon Marketplace fulfillment and storage fees;

|

|

•

|

limitation on our acquisition and growth strategy as a result of our inability to raise necessary funding;

|

|

•

|

the Company’s ability to meet the continued listing standards of the NASDAQ; and

|

|

•

|

the other matters set forth under Item 1A “Risk Factors,” Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, and other sections of this Annual Report on Form

10-K.

|

The reader should keep in mind that any forward-looking statement made by us in this document, or elsewhere, pertains only as of the date on which we make it. New risks and uncertainties come up

from time-to-time and it is impossible for us to predict these events or how they may affect us. In light of these risks and uncertainties, you should keep in mind that any forward-looking statements made in this report or elsewhere might not

occur.

1

In addition, the preparation of financial statements in accordance with accounting principles generally accepted in the United States (“GAAP”) requires us to make estimates and assumptions. These

estimates and assumptions affect:

| • |

the reported amounts and timing of revenue and expenses,

|

| • |

the reported amounts and classification of assets and liabilities, and

|

| • |

the disclosure of contingent assets and liabilities.

|

Actual results may vary from our estimates and assumptions. These estimates and assumptions are based on historical results, assumptions that we make, as well as assumptions by third parties.

2

| Item 1. |

BUSINESS

|

Company Background

Kaspien Holdings Inc. (f/k/a Trans World Entertainment Corporation) (“Kaspien”), which, together with its consolidated subsidiaries, is referred to herein as the “Company”, “we”, “us” and “our”, was

incorporated in New York in 1972. We own 100% of the outstanding Common Stock of Kaspien Inc. See below for additional information.

Kaspien provides software and services to empower brands to grow their online distribution channels on digital marketplaces such as Amazon.com and Target.com. The Company helps brands achieve their

online retail goals through innovative technology, custom-tailored strategies, and mutually beneficial partnerships.

Five core principles guide us:

| • |

We are partner obsessed. Our customers are our partners. Every decision is focused on building mutually beneficial relationships that deliver results.

|

| • |

We are insights driven. We make data actionable. Our curiosity drives us to discover opportunities early and often.

|

| • |

We create simplicity. We challenge the status quo. We take the complicated and simplify it.

|

| • |

We take ownership. We make things happen. We hold ourselves accountable and have a bias for action.

|

| • |

We empower each other. We welcome and learn from diverse experiences. Our empathy ignites innovation and empowers meaningful change.

|

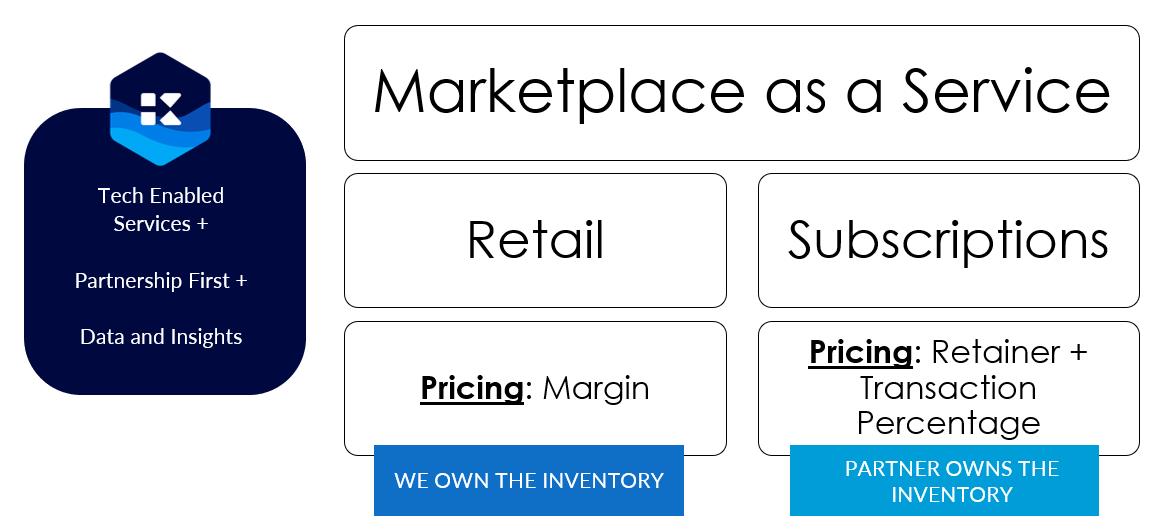

Business Overview

Kaspien aims to accelerate partner brand growth on today’s leading online marketplaces. Our vision is to become the global leader in the brand accelerator industry by improving marketplace selling

efficiency and profitability. We are a technology-enabled retailer that delivers results for our brand partners across Amazon.com US, Amazon.com Canada, Target.com, and Walmart.com online marketplaces.

Kaspien leverages its 15 years of e-commerce and online brand management experience to provide data driven, partner-specific recommendations—resulting in a clear action plan, pricing, and timeline.

Our team of e-commerce experts use proprietary and external software to deliver insights and results through listing creation, content optimization, paid advertising, campaign management, and supply chain / logistical support.

We are focused on delivering sustainable profitability to our partners. Our approach allows for a diversified go-to-market approach, enabling economies of scale for multiple operations.

| • |

Retail business model: We buy inventory and use our expertise, technology, and services to generate revenue through marketplace transactions. Kaspien provides account

management, brand communication, listings management, data reporting, joint business planning, and comprehensive marketing support services. Our target partners are enterprise-level large growth brands that derive margins based on pricing.

|

| • |

Agency business model: We use our expertise, technology, and services to manage our partners’ marketplace presence through channel management with no inventory position.

Kaspien provides support services for account management, media planning, media analytics, search strategy, business planning, and data reporting. Our target partners in this space range from medium size to enterprise-level brands. We

derive margin based on a retainer plus a percentage of transactions and/or specific service fees.

|

Kaspien provides all the software and services required to drive brand growth and achieve a brand’s online goals on Amazon.com, Walmart.com, and Target.com through multiple business models—namely,

Retail and Agency services. We are a technology-enabled services company built to drive marketplace growth. A high-level visualization of our business model is shown in Figure 1 below.

3

Partners

Kaspien views our retail customers as our partners. Our partners include brands, suppliers, and distributors. Our categories of focus include but are not limited to: Baby, Pets & Sporting Goods,

Tools/Office/Outdoors, and Health & Personal Care. In fiscal 2022, these top categories accounted for approximately 83% of our total revenue. To accelerate the growth of our businesses, we have defined an operating model by segmenting our

businesses into teams, with a single-threaded leader or “Partner Success Manager” runs. A cross-functional team, including a marketing specialist and a buyer, supports each Partner Success Manager, collectively called a “business POD.”

Kaspien uses leading online tools to identify brands that would be good strategic fits for its services. We utilize content marketing to strengthen visibility within the e-commerce industry. The

Company’s public relations efforts consist of press releases, articles in industry publications, and articles on its website to build its brand. Kaspien also has an aggressive business development outreach program and attends several industry

tradeshows annually.

Partnership Models

Kaspien can be leveraged and engaged via two primary and distinct business models.

Retail Partnership: We own the inventory. We sell it.

In this model, Kaspien buys and sells inventory on marketplaces such as Amazon.com, Walmart.com and Target.com as a third-party seller. Kaspien supports private label and dropship integrations with

various suppliers and distributors. Kaspien has also developed four incubated brands – Jumpoff Jo, Brilliant Bee, Big Betty, and Domestic Corner.

Agency Partnership: Partner owns the inventory. We sell it.

In this model, Kaspien serves as an extension of our partner’s e-commerce team, providing full service inventory management, marketing management, creative services, content optimization, brand

protection, compliance protection, fee recovery, and other marketplace growth services. Kaspien charges a retainer and receives a percentage of the revenue generated.

Primary Agency services include:

| • |

Ad management

|

| • |

Brand protection and seller tracking

|

| • |

Cost recovery and case management

|

| • |

Dropship automation

|

| • |

Inventory & supply chain management

|

| • |

Creative services

|

As of January 28, 2023, we had over 100 active retail partners and 12 subscriptions partners.

4

Technology and Integrations

The Company’s marketplace knowledge and expertise is built on fifteen years of selling data and constantly evolving marketplace experience. The company utilizes a variety of automated and

artificial intelligence powered solutions supporting brand protection services, logistics optimization, automated pricing, budget forecasting, campaign bid automation, dayparting, and much more.

The Company uses an insight-driven approach to digital marketplace retailing using both proprietary and licensed software. Using data collected from marketplaces, optimal inventory thresholds and

purchasing trends are calculated within its advanced inventory management software developed in-house. Kaspien also leverages best in class software to automate pricing, advertisement management, marketplace seller tracking, and channel auditing.

Additionally, Kaspien partners with enterprise-level software providers that are synergistic to Kaspien. This enables a network of partner integrations that can be extended and expanded upon.

Kaspien has formed strategic partnerships with NetSuite to power our ERP, MyFBAPrep for their logistics and fulfillment network, IPSecure for brand protection, Seller Investigators and Charge Guard for fee recovery services, Helium10 for keyword

research, Vantage for content optimization, and many others.

Business Environment

Digital marketplaces allow consumers to shop from various merchants in one place and have become an integral part of many brand manufacturers’ businesses.

According to the U.S. Census Bureau, total U.S. e-commerce sales in 2022 were $1.0 billion, up 7.7% from 2021. e-commerce sales ended the year accounting for 14.6% of total sales, the same level as

2021.

In the United States, we sell on marketplaces that represent greater than 50% of national e-commerce visits and sales including Amazon.com US, Amazon.com CA, Walmart.com, and Target.com.

Competition and Strategic Positioning

Kaspien operates in a category within e-commerce called “Marketplace Growth Services”. Businesses in this category provide services to brands and other sellers to facilitate growth on marketplaces.

The market is fragmented, and most providers focus on only a few areas where sellers need support. Subcategories in this market include Account and Marketing Services, Supply Chain and Logistics Providers, Manufacturers and Product Suppliers, Legal

Services and Accounting, Tax and Financial Services. The Account and Marketing Services subcategory divides services into retail and agency services. This is analogous to our business models – Retail and Agency.

Kaspien is a comprehensive and fully customizable offering of services tailored toward online marketplace growth. Kaspien’s core focus is on the Account and Marketing Services subcategory, which

competes with Software Providers, Agencies, and Retailers.

Revenue Distribution

Kaspien’s primary source of revenue is through its Retail business, specifically as a third-party seller on the Amazon US marketplace. Retail revenues represented 98.6% of total revenue in fiscal

2022, the same level as fiscal 2021. In fiscal 2022, the share of our retail revenues generated from our Amazon US business was 94.8%, as compared to 93.3% in fiscal 2021. Our international retail business represented 2.5% of retail sales in fiscal

2022 compared to 3.9% in fiscal year 2021. The remaining retail revenue is generated from other marketplaces, including Amazon.com CA, Walmart.com, eBay.com, and Target.com.

Kaspien focuses on various categories, including pets and sporting goods, baby, tools / office / outdoor, health & personal care, and home / kitchen. In fiscal year 2022, these categories

represented approximately 83% of our total revenue. Kaspien analyzes our operations by category, developing a deep understanding and subject matter expertise in these areas, enabling us to drive better results across these categories.

5

Human Capital

As of January 28, 2023, the Company employed approximately 80 full-time people. At the end of fiscal 2022, the Company had department heads in marketing, supply chain, private label, business

development, account management, human resources, accounting, FP&A, warehouse operations, compliance, and technology. Employee levels are managed to align with the pace of business, and management believes it has sufficient human capital to

operate its business successfully.

The Company believes its success depends on attracting, developing, retaining, and incentivizing new and existing employees. It also believes that its employees' skills, experience, and

industry knowledge significantly benefit the operation, performance, and competitiveness within the industry. The principal purposes of equity and cash incentive plans are to attract, retain, and reward personnel by granting stock-based and

cash-based compensation awards. This results in a best-in-class employee experience, which ultimately increases shareholder value and the success of our company by motivating such individuals to perform to the best of their abilities and achieve

our objectives.

Customer Acquisition

Kaspien engages its partners through brand building, inbound digital marketing, outbound sales techniques, and its proprietary data platform to identify brands that would be a strategic fit for

its services. Kaspien utilizes tradeshows and content marketing to strengthen its visibility within the industry. Kaspien’s public relations efforts consist of press releases, articles in industry publications, and articles on its website to build

its brand.

Trademarks

The trademark Kaspien is registered with the U.S. Patent and Trademark Office and is owned by Kaspien. We believe that our rights to this trademark is adequately protected. We hold no material

patents, licenses, franchises, or concessions; however, our established trademark is essential to maintaining our competitive position.

Available Information

The Company’s headquarters are located at 2818 N. Sullivan Road, Suite 130, Spokane Valley, WA 99216, and its telephone number is (855)-300-2710. The Company’s corporate website address is

www.kaspien.com. The Company makes available, free of charge, its Exchange Act Reports (Forms 10-K, 10-Q, 8-K and any amendments thereto) on its web site as soon as practical after the reports are filed with the Securities and Exchange Commission

(“SEC”). The public may read and copy any materials the Company files with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by

calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. This information can be obtained from the

site http://www.sec.gov. The Company’s Common Stock, $0.01 par value, is listed on the NASDAQ Capital Market under the trading symbol “KSPN”.

6

| Item 1A. |

RISK FACTORS

|

The following is a discussion of certain factors, which could affect the financial results of the Company.

Risks Related to Our Business

If we cannot successfully implement our business strategy our growth and profitability could be adversely impacted.

Our future results will depend, among other things, on our success in implementing our business strategy. The ability of the Company to meet its liabilities and to continue as a going concern is

dependent on improved profitability, the continued implementation of the strategic initiative to reposition Kaspien as a platform of software and services and the availability of future funding.

There can be no assurance that we will be successful in further implementing our business strategy or that the strategy, including the completed initiatives, will be successful in sustaining

acceptable levels of sales growth and profitability. Based on recurring losses from operations, negative cash flows from operations, the expectation of continuing operating losses for the foreseeable future, and uncertainty with respect to any

available future funding, the Company has concluded that there is substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this

uncertainty.

Continued increases in Amazon Marketplace fulfillment and storage fees could have an adverse impact on our profit margin and results of operations.

The Company utilizes Amazon’s Freight by Amazon (“FBA”) platform to store their products at the Amazon fulfillment center and to pack and distribute these products to customers. If Amazon

continues to increase its FBA fees, our profit margin could be adversely affected.

Our business depends on our ability to build and maintain strong product listings on e-commerce platforms. We may not be able to maintain and enhance our product listings if we receive unfavorable

customer complaints, negative publicity, or otherwise fail to live up to consumers’ expectations, which could materially adversely affect our business, results of operations and growth prospects.

Maintaining and enhancing our product listings is critical in expanding and growing our business. However, a significant portion of our perceived performance to the customer depends on third

parties outside of our control, including suppliers and third-party delivery agents as well as online retailers such as Amazon and Walmart. Because our agreements with our online retail partners are generally terminable at will, we may be unable to

maintain these relationships, and our results of operations could fluctuate significantly from period to period. Because we rely on third parties to deliver our products, we are subject to shipping delays or disruptions caused by inclement weather,

natural disasters, labor activism, health epidemics or bioterrorism. We may also experience shipping delays or disruptions due to other carrier-related issues relating to their own internal operational capabilities. Further, we rely on the business

continuity plans of these third parties to operate during pandemics, like the COVID-19 pandemic, and we have limited ability to influence their plans, prevent delays, and/or cost increases due to reduced availability and capacity and increased

required safety measures.

Customer complaints or negative publicity about our products, delivery times, or marketing strategies, even if not accurate, especially on blogs, social media websites and third-party market

sites, could rapidly and severely diminish consumer view of our product listings and result in harm to our brands. Customers may also make safety-related claims regarding products sold through our online retail partners, such as Amazon, which may

result in an online retail partner removing the product from its marketplace. We have from time to time experienced such removals and such removals may materially impact our financial results depending on the product that is removed and length of

time that it is removed. We also use and rely on other services from third parties, such as our telecommunications services, and those services may be subject to outages and interruptions that are not within our control.

7

A change in one or more of the Company’s partners’ policies or the Company’s relationship with those partners could adversely affect the Company’s results of operations.

The Company is dependent on its partners to supply merchandise in a timely and efficient manner. If a partner fails to deliver on its commitments, whether due to financial difficulties or other

reasons, the Company could experience merchandise shortages that could lead to lost sales.

Historically, the Company has not experienced difficulty in obtaining satisfactory sources of supply and management believes that it will continue to have access to adequate sources of supply.

The Company had one partner that represented 20.4% of net revenue in fiscal 2022.

Our revenue is dependent upon maintaining our relationship with Amazon and failure to do so, or any restrictions on our ability to offer products on the Amazon Marketplace, could have an adverse impact

on our business, financial condition and results of operations.

The Company generates substantially all of its revenue through the Amazon Marketplace. Therefore, we depend in large part on our relationship with Amazon for growth. In particular, we depend on

our ability to offer products on the Amazon Marketplace. We also depend on Amazon for the timely delivery of products to customers. Any adverse change in our relationship with Amazon, including restrictions on the ability to offer products or

termination of the relationship, could adversely affect our continued growth and financial condition and results of operations.

We have substantial indebtedness, which could adversely affect our business.

We have a significant amount of debt and we may continue to incur additional debt in the future. As of January 28, 2023, the Company had borrowings of $8.8 million under our credit

facility with Eclipse. We also had borrowings of $5.3 million under our Subordinated Debt facility, with interest accruing at the rate of twelve percent (12%) per annum and compounded on the last day of each

calendar quarter by becoming a part of the principal amount. In addition, we have $4.5 million under our Subordinated Debt Facility, with interest accruing at the rate of fifteen percent (15%) per annum and

compounded on the last day of each calendar quarter by becoming a part of the principal amount. Substantially all of our assets, including the capital stock of Kaspien is pledged to secure our indebtedness. This leverage also exposes us

to significant risk by limiting our flexibility in planning for, or reacting to, changes in our business (whether through competitive pressure or otherwise), our industry and the economy at large. In addition, our ability to make payments on, or

repay or refinance, such debt, and to fund our operating and capital expenditures, depends largely upon our future operating performance. Our future operating performance, to a certain extent, is subject to general economic, financial, competitive,

regulatory and other factors that are beyond our control.

The terms of our asset-based revolving credit agreement and subordinated debt agreement impose certain restrictions on us that may impair our ability to respond to changing business and economic

conditions, which could have a significant adverse impact on our business. Additionally, our business could suffer if our ability to acquire financing is reduced or eliminated.

On February 20, 2020, Kaspien entered into a Loan and Security Agreement (the “Loan Agreement”) with Eclipse, as administrative agent, under which the lenders committed to provide up to $25

million in loans under a four-year, secured revolving credit facility (the “Credit Facility”). On March 30, 2020, we entered into a Subordinated Loan and Security Agreement (the “Subordinated Loan Agreement”) with the lenders party thereto from

time to time (the “Lenders”) and TWEC Loan Collateral Agent, LLC (“Collateral Agent”), as collateral agent for the Lenders, pursuant to which the Lenders made a $5.2 million secured term loan (the “Subordinated Loan”) to Kaspien. We subsequently

amended the Subordinated Loan to add an additional $5.0 million secured term loan.

Among other things, the Loan Agreement and Subordinated Loan Agreement limit Kaspien’s ability to incur additional indebtedness, create liens, make investments, make restricted payments or

specified payments and merge or acquire assets. The Loan Agreement also requires Kaspien to comply with a financial maintenance covenant.

The Loan Agreement and Subordinated Loan Agreement contains customary events of default, including, but not limited to, payment defaults, breaches of representations and warranties, covenant

defaults, cross-defaults to other obligations, customary ERISA defaults, certain events of bankruptcy and insolvency, judgment defaults, the invalidity of liens on collateral, change in control, cessation of business or the liquidation of material

assets of the borrowers and guarantors taken as a whole, the occurrence of an uninsured loss to a material portion of collateral and, in the case of the Credit Facility, failure of the obligations to constitute senior indebtedness under any

applicable subordination or intercreditor agreements, including our Subordinated Debt.

8

Risks Related to Information Technology and Intellectual Property

Breach of data security could harm our business and standing with our customers.

The protection of our partner, employee and business data is critical to us. Our business, like that of most companies, involves confidential information about our employees, our suppliers and

our Company. We rely on commercially available systems, software, tools and monitoring to provide security for processing, transmission and storage of all such data, including confidential information. Despite the security measures we have in

place, our facilities and systems, and those of our third-party service providers, may be vulnerable to security breaches, acts of vandalism, computer viruses, misplaced or lost data, programming or human errors, or other similar events.

Unauthorized parties may attempt to gain access to our systems or information through fraud or other means, including deceiving our employees or third-party service providers. The methods used to obtain unauthorized access, disable or degrade

service, or sabotage systems are also constantly changing and evolving, and may be difficult to anticipate or detect. We have implemented and regularly review and update our control systems, processes and procedures to protect against unauthorized

access to or use of secured data and to prevent data loss. However, the ever-evolving threats mean we must continually evaluate and adapt our systems and processes, and there is no guarantee that they will be adequate to safeguard against all data

security breaches or misuses of data. Any security breach involving the misappropriation, loss or other unauthorized disclosure of customer payment card or personal information or employee personal or confidential information, whether by us or our

vendors, could damage our reputation, expose us to risk of litigation and liability, disrupt our operations, harm our business and have an adverse impact upon our net sales and profitability. As the regulatory environment related to information

security, data collection and use, and privacy becomes increasingly rigorous, with new and changing requirements applicable to our business, compliance with those requirements could also result in additional costs. Further, if we are unable to

comply with the security standards established by banks and the credit card industry, we may be subject to fines, restrictions and expulsion from card acceptance programs, which could adversely affect our retail operations.

Our hardware and software systems are vulnerable to damage, theft or intrusion that could harm our business.

Any failure of our computer hardware or software systems that causes an interruption in our operations or a decrease in inventory tracking could result in reduced net sales and profitability.

Additionally, if any data intrusion, security breach, misappropriation or theft were to occur, we could incur significant costs in responding to such event, including responding to any resulting claims, litigation or investigations, which could

harm our operating results.

Our inability or failure to protect our intellectual property rights, or any claimed infringement by us of third-party intellectual rights, could have a negative impact on our operating results.

Our trademark, trade secrets and other intellectual property, including proprietary software, are valuable assets that are critical to our success. The unauthorized reproduction or other

misappropriation of our intellectual property could cause a decline in our revenue. In addition, any infringement or other intellectual property claim made against us could be time-consuming to address, result in costly litigation, cause product

delays, require us to enter into royalty or licensing agreements or result in our loss of ownership or use of the intellectual property.

Risks Related to Human Capital

Loss of key personnel or the inability to attract, train and retain qualified employees could adversely affect the Company’s results of operations.

The Company believes that its future prospects depend, to a significant extent, on the services of its executive officers. Our future success will also depend on our ability to attract and retain

qualified key personnel. The loss of the services of certain of the Company’s executive officers and other key management personnel could adversely affect the Company’s results of operations.

9

In addition to our executive officers, the Company’s business is dependent on our ability to attract, train and retain qualified team members. Our ability to meet our labor needs while

controlling our costs is subject to external factors such as unemployment levels, health care costs and changing demographics. If we are unable to attract and retain adequate numbers of qualified team members, our operations and support functions

could suffer. Those factors, together with increased wage and benefit costs, could adversely affect our results of operations.

We may face difficulties in meeting our labor needs to effectively operate our business.

We are heavily dependent upon our labor workforce. Our compensation packages are designed to provide benefits commensurate with our level of expected service. However, we face the challenge of

filling many positions at wage scales that are appropriate to the industry and competitive factors. We also face other risks in meeting our labor needs, including competition for qualified personnel and overall unemployment levels. Changes in any

of these factors, including a shortage of available workforce, could interfere with our ability to adequately service our customers and could result in increasing labor costs.

Our business could be adversely affected by increased labor costs, including costs related to an increase in minimum wage and health care.

Labor is one of the primary components in the cost of operating our business. Increased labor costs, whether due to competition, unionization, increased minimum wage, state unemployment rates,

health care, or other employee benefits costs may adversely impact our operating expenses. Additionally, there is no assurance that future health care legislation will not adversely impact our results or operations.

Risks Related to Ownership of Our Common Stock.

The ownership of our Common Stock is concentrated, and entities affiliated with members of our Board of Directors have influence over the outcome of any vote of the Company’s shareholders and may have

competing interests.

The Robert J. Higgins TWMC Trust (the “Trust”) owns approximately 14.4% of the outstanding Common Stock and Neil Subin owns approximately 9.1% of the outstanding Common Stock, and as a result

each can influence the outcome of most actions requiring shareholder approval. In addition, entities affiliated with each of the Trust and Mr. Subin, as well as one of our directors, Mr. Simpson, and certain of his affiliated entities,

collectively hold approximately 25.3% of the outstanding Common Stock, and as a result can influence the outcome of most actions requiring shareholder approval.

If all of the outstanding warrants described in “Related Party Transactions” were exercised, the Trust would own approximately 13.5% of the outstanding Common Stock and Neil Subin and his

affiliated entities would own approximately 14.6% of the outstanding Common Stock, and as a result each can influence the outcome of most actions requiring shareholder approval. If all of the outstanding warrants described in “Related Party

Transactions” were exercised, entities affiliated with each of the Trust, Mr. Subin, as well as one of our directors, Mr. Simpson, and certain of his affiliated entities, would collectively hold approximately 29.8% of the outstanding Common Stock,

and as a result can significantly influence the outcome of nearly all actions requiring shareholder approval,

These shareholders entered into a voting agreement (as described in “Related Party Transactions”) and agreed to how their respective shares of the Company’s Common Stock held by the parties will

be voted with respect to the designation, election, removal, and replacement of members of the Board. Pursuant to the voting agreement, Messrs. Marcus and Simpson were appointed as directors of the Company, and Mr. Reickert, a trustee of the

Trust, remained as a director of the Company. Mr. Subin was also granted board observer rights.

Entities affiliated with the Trust and Messrs. Marcus and Simpson are also lenders under our subordinated loan and security agreement, have received warrants to purchase shares of the Company’s

Common Stock and received contingent value rights (“CVRs”) representing the contractual right to receive cash payments from the Company in an amount equal, in the aggregate, to 19.9% of the proceeds received by the Company in respect of certain

intercompany indebtedness owing to it by Kaspien and/or its equity interest in Kaspien, each as described in “Related Party Transactions”. In addition, entities affiliated with Mr. Marcus received an additional CVR representing the contractual

right to receive cash payments from the Company in an amount equal to 9.0% of the proceeds received by the Company in respect of certain distributions by the Company or Kaspien; recapitalizations or financings of the Company or Kaspien (with

appropriate carve out for trade financing in the ordinary course); repayment of intercompany indebtedness owing to the Company by Kaspien; or sale or transfer of any stock of the Company or Kaspien, as described in “Related Party Transactions”. As

a result, there may be instances in which the interest of Mr. Reickert, the Trust and its affiliated entities, Messrs. Marcus and Subin and their respective affiliated entities, and Mr. Simpson and his affiliated entities may conflict or be

perceived as being in conflict with the interest of a holder of our securities or the interest of the Company.

10

The holders of our common stock could suffer substantial dilution due to our corporate financing practices.

The holders of our common stock could suffer substantial dilution due to our corporate financing practices, which, in the past few years, have included a registered direct offering, the issuance of warrants and the

issuance of contingent value rights.

If all of the outstanding warrants were exercised, an additional 2,782,286 shares of common stock would be issued and outstanding. This additional issuance of shares of common stock would cause immediate and

substantial dilution to our existing shareholders and could cause a significant reduction in the market price of our common stock.

Additionally, lenders under our subordinated loan and security agreement, have received contingent value rights (“CVRs”) representing the contractual right to receive cash payments from the

Company in an amount equal, in the aggregate, to 19.9% of the proceeds received by the Company in respect of certain intercompany indebtedness owing to it by Kaspien and/or its equity interest in Kaspien, each as described in “Related Party

Transactions”. In addition, certain lenders received an additional CVR representing the contractual right to receive cash payments from the Company in an amount equal to 9.0% of the proceeds received by the Company in respect of certain

distributions by the Company or Kaspien; recapitalizations or financings of the Company or Kaspien (with appropriate carve out for trade financing in the ordinary course); repayment of intercompany indebtedness owing to the Company by Kaspien; or

sale or transfer of any stock of the Company or Kaspien, as described in “Related Party Transactions”. If events triggering these payments occur, the amount of consideration received by the Company will be reduced, thereby reducing any amounts

distributable or attributable to shareholders or their shares.

The issuance of any securities for acquisition or financing efforts, upon exercise of warrants, pursuant to our equity compensation plans, or otherwise may result in a reduction of the market

price of the outstanding shares of our common stock. If we issue any such additional securities, such issuance will cause a reduction in the proportionate ownership and voting power of all current shareholders. Further, such issuance may result in

a change in control of our Company.

The Company’s stock price has experienced and could continue to experience volatility and could decline, resulting in a substantial loss on your investment.

Our stock price has experienced, and could continue to experience in the future, substantial volatility as a result of many factors, including global economic conditions, broad market

fluctuations and public perception of the prospects for the industries in which we operate and the value of our assets. We are reliant on the performance of Kaspien, and a failure to meet market expectations, particularly with respect to net

revenues, operating margins and earnings per share, would likely result in a further decline in the market price of our stock.

We do not currently meet continued listing standards of the NASDAQ, and as a result our Common Stock could be delisted from trading, which could limit investors’ ability to make transactions in our

Common Stock and subject us to additional trading restrictions.

Our common stock is listed on The NASDAQ Stock Market LLC (“the NASDAQ”), which imposes continued listing requirements with respect to listed shares. On December 14, 2022, we received written notice

from the NASDAQ that the closing bid price for our common stock had been below $1.00 for the previous 30 consecutive business days, and that the Company therefore was not in compliance with the minimum bid price requirement for continued listing on

The Nasdaq Capital Market under Nasdaq Listing Rule 5550(a)(2). In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company has been provided a period of 180 calendar days, or until June 12, 2023, to regain compliance. In order to regain

compliance with the minimum closing bid price rule, the closing bid price of the Company’s common stock must be at least $1.00 for a minimum of ten consecutive business days during the compliance period. If the Company does not regain compliance

during the initial compliance period, the Company may be eligible for additional time to regain compliance. If the Company is not eligible, the Company expects that at that time the NASDAQ will provide written notice to the Company that the

Company’s common stock will be subject to delisting.

11

The notice has no immediate impact on the listing of the Company’s common stock, which will continue to trade on The Nasdaq Capital Market. The Company intends to monitor its closing bid price for its

common stock between now and June 12, 2023 and will consider available options to resolve the Company’s noncompliance with the minimum bid price requirement, as may be necessary. There can be no assurance, however, that we will be able to regain

compliance or that we will otherwise be in compliance with other NASDAQ listing criteria. If we fail to regain and maintain compliance with the minimum bid requirement or to meet the other applicable continued listing requirements in the future and

NASDAQ determines to delist our common stock, the delisting could adversely affect the market price and liquidity of our common stock, and reduce our ability to raise additional capital.

The limited public float and trading volume for our Common Stock may have an adverse impact and cause significant fluctuation of market price.

Historically, ownership of a significant portion of our outstanding shares of Common Stock has been concentrated in a small number of shareholders. Consequently, our Common Stock has a relatively

small float and low average daily trading volume, which could affect a shareholder’s ability to sell our stock or the price at which it can be sold. In addition, future sales of substantial amounts of our Common Stock in the public market by those

larger shareholders, or the perception that these sales could occur, may adversely impact the market price of the stock and our stock could be difficult for a shareholder to liquidate.

Failure to remediate a material weakness related to our ability to perform adequate independent reviews and maintain effective controls related to account analyses, account summaries and account reconciliations, could result in material misstatements in our financial statements.

Our management has identified a material weakness related to our ability to perform adequate independent reviews and maintain effective controls

related to account analyses, account summaries and account reconciliations and has concluded that, due to such material weakness, each of our disclosure controls and procedures and internal control over financial reporting were not effective

as of January 28, 2023. While remediation is in process, our failure to establish and maintain effective disclosure controls and procedures and internal control over financial reporting could result in material misstatements in our financial

statements, and a failure to meet our reporting and financial obligations, each of which could have a material adverse effect on our financial condition and the trading price of our common stock.

General Risk Factors

The Company’s business is influenced by general economic conditions.

The Company’s performance is subject to general economic conditions and their impact on levels of discretionary consumer spending. General economic conditions impacting discretionary consumer

spending include, among others, wages and employment, consumer debt, reductions in net worth, residential real estate and mortgage markets, taxation, fuel and energy prices, interest rates, consumer confidence and other macroeconomic factors.

Consumer purchases of discretionary items generally decline during recessionary periods and other periods where disposable income is adversely affected. A downturn in the economy affects

retailers disproportionately, as consumers may prioritize reductions in discretionary spending, which could have a direct impact on purchases of our products and services and adversely impact our results of operations. In addition, reduced consumer

spending may drive us and our competitors to offer additional products at promotional prices, which would have a negative impact on gross profit.

Disruption of global capital and credit markets may have a material adverse effect on the Company’s liquidity and capital resources.

Distress in the financial markets has in the past and can in the future result in extreme volatility in security prices, diminished liquidity and credit availability. There can be no assurance that our liquidity will not

be affected by changes in the financial markets and the global economy or that our capital resources will at all times be sufficient to satisfy our liquidity needs.

Because of our floating rate credit facility, we may be adversely affected by interest rate changes.

Our financial position may be affected by fluctuations in interest rates, as the Credit Facility is subject to floating interest rates. Interest rates are highly sensitive to many factors,

including governmental monetary policies, domestic and international economic and political conditions and other factors beyond our control. As we borrow against our credit facility, a significant increase in interest rates could have an adverse

effect on our financial position and results of operations.

The Company is dependent upon access to capital, including bank credit facilities and short-term vendor financing, for its liquidity needs.

The Company must have sufficient sources of liquidity to fund its working capital requirements and indebtedness. The future availability of financing will depend on a variety of factors, such as

economic and market conditions, permissibility under our existing financing arrangements, the availability of credit and the Company’s credit rating, as well as the Company’s reputation with potential lenders. These factors could materially

adversely affect the Company’s ability to fund its working capital requirements, costs of borrowing, and the Company’s financial position and results of operations would be adversely impacted.

12

We may complete a future significant strategic transaction that may not achieve intended results or could increase the number of our outstanding shares or amount of outstanding

debt or result in a change of control.

We will evaluate and may in the future enter into strategic transactions. Any such transaction could happen at any time following the closing of the merger, could be material to our business and

could take any number of forms, including, for example, an acquisition, merger or a sale of all or substantially all of our assets.

Evaluating potential transactions and integrating completed ones may divert the attention of our management from ordinary operating matters. The success of these potential transactions will

depend, in part, on our ability to realize the anticipated growth opportunities and cost synergies through the successful integration of the businesses we acquire with our existing business. Even if we are successful in integrating the acquired

businesses, we cannot assure you that these integrations will result in the realization of the full benefit of any anticipated growth opportunities or cost synergies or that these benefits will be realized within the expected time frames. In

addition, acquired businesses may have unanticipated liabilities or contingencies.

If we complete an acquisition, investment or other strategic transaction, we may require additional financing that could result in an increase in the number of our outstanding shares or the

aggregate principal amount of our debt. A strategic transaction may result in a change in control of our company or otherwise materially and adversely affect our business.

Historically, we have experienced declines, and we may continue to experience fluctuation in our level of sales and results from operations.

A variety of factors has historically affected, and will continue to affect, our sales results and profit margins. These factors include general economic conditions; competition; actions taken by

our competitors; consumer trends and preferences; access to third party marketplaces; and new product introductions and changes in our product mix.

There is no assurance that we will achieve positive levels of sales and earnings growth, and any decline in our future growth or performance could have a material adverse effect on our business

and results of operations.

The ability of the Company to satisfy its liabilities and to continue as a going concern will continue to be dependent on the implementation of several items, the success of which is not certain.

The Company has suffered recurring losses from operations and the Company’s primary sources of liquidity are borrowing capacity under its revolving credit facility, available cash and cash

equivalents, all of which are limited. Therefore, the ability of the Company to meet its liabilities and to continue as a going concern is dependent on, among other things, improved profitability, the continued implementation of the strategic

initiative to reposition Kaspien as a platform of software and services, the availability of future funding, implementation of one or more corporate initiatives to reduce costs at the parent company level and other strategic alternatives, including

selling all or part of the remaining business or assets of the Company.

There can be no assurance that we will be successful in further implementing our business strategy or that the strategy, including the completed initiatives, will be successful in sustaining

acceptable levels of sales growth and profitability. Based on recurring losses from operations, negative cash flows from operations, the expectation of continuing operating losses for the foreseeable future, and uncertainty with respect to any

available future funding, the Company has concluded that there is substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this

uncertainty.

13

Parties with whom the Company does business may be subject to insolvency risks or may otherwise become unable or unwilling to perform their obligations to the Company.

The Company is a party to contracts, transactions and business relationships with various third parties, including partners, vendors, suppliers, service providers and lenders, pursuant to which

such third parties have performance, payment and other obligations to the Company. In some cases, the Company depends upon such third parties to provide essential products, services or other benefits, including with respect to merchandise,

advertising, software development and support, logistics, other agreements for goods and services in order to operate the Company’s business in the ordinary course, extensions of credit, credit card accounts and related receivables, and other vital

matters. Economic, industry and market conditions could result in increased risks to the Company associated with the potential financial distress or insolvency of such third parties. If any of third parties were to become subject to bankruptcy,

receivership or similar proceedings, the rights and benefits of the Company in relation to its contracts, transactions and business relationships with such third parties could be terminated, modified in a manner adverse to the Company, or otherwise

impaired. The Company cannot make any assurances that it would be able to arrange for alternate or replacement contracts, transactions or business relationships on terms as favorable as the Company’s existing contracts, transactions or business

relationships, if at all. Any inability on the part of the Company to do so could negatively affect the Company’s cash flows, financial condition and results of operations.

Failure to comply with legal and regulatory requirements could adversely affect the Company’s results of operations.

The Company’s business is subject to a wide array of laws and regulations. Significant legislative changes that impact our relationship with our workforce (none of which is represented by unions)

could increase our expenses and adversely affect our operations. Examples of possible legislative changes impacting our relationship with our workforce include changes to an employer’s obligation to recognize collective bargaining units, the

process by which collective bargaining units are negotiated or imposed, minimum wage requirements, health care mandates, and changes in overtime regulations.

Our policies, procedures and internal controls are designed to comply with all applicable laws and regulations, including those imposed by the Securities and Exchange Commission and the NASDAQ

Capital Market, as well as applicable employment laws. Additional legal and regulatory requirements increase the complexity of the regulatory environment in which we operate and the related cost of compliance. Failure to comply with such laws and

regulations may result in damage to our reputation, financial condition and market price of our stock.

Litigation may adversely affect our business, financial condition and results of operations.

Our business is subject to the risk of litigation by employees, consumers, partners, suppliers, competitors, stockholders, government agencies or others through private actions, class actions,

administrative proceedings, regulatory actions or other litigation. The outcome of litigation, particularly class action lawsuits and regulatory actions, is difficult to assess or quantify. We may incur losses relating to these claims, and in

addition, these proceedings could cause us to incur costs and may require us to devote resources to defend against these claims that could adversely affect our results of operations. For a description of current legal proceedings, see “Part I, Item

3, Legal Proceedings.”

The effects of natural disasters, terrorism, acts of war, and public health issues may adversely affect our business.

Natural disasters, including earthquakes, hurricanes, floods, and tornadoes may affect store and distribution center operations. In addition, acts of terrorism, acts of war, and military action

both in the United States and abroad can have a significant effect on economic conditions and may negatively affect our ability to purchase merchandise from suppliers for sale to our customers. Public health issues, such as flu or other pandemics,

whether occurring in the United States or abroad, could disrupt our operations and result in a significant part of our workforce being unable to operate or maintain our infrastructure or perform other tasks necessary to conduct our business.

Additionally, public health issues may disrupt, or have an adverse effect on, our suppliers’ operations, our operations, our customers, or customer demand. Our ability to mitigate the adverse effect of these events depends, in part, upon the

effectiveness of our disaster preparedness and response planning as well as business continuity planning. However, we cannot be certain that our plans will be adequate or implemented properly in the event of an actual disaster. We may be required

to suspend operations in some or all our locations, which could have a material adverse effect on our business, financial condition, and results of operations. Any significant declines in public safety or uncertainties regarding future economic

prospects that affect customer spending habits could have a material adverse effect on customer purchases of our products.

A pandemic, epidemic or outbreak of an infectious disease, such as COVID-19, may materially and adversely affect our business.

Our business, results of operations, and financial condition may be materially adversely impacted if a public health outbreak, including the recent COVID-19 pandemic, interferes with our ability, or

the ability of our employees, contractors, suppliers, and other business partners to perform our and their respective responsibilities and obligations relative to the conduct of our business.

14

| Item 1B. |

UNRESOLVED SEC COMMENTS

|

None.

15

| Item 2. |

PROPERTIES

|

Corporate Offices and Distribution Center Facility

As of January 28, 2023, we leased the following office and distribution facilities:

|

Location

|

Square

Footage

|

Owned or

Leased

|

Use

|

|||

|

Spokane, WA

|

30,700

|

Leased

|

Office administration

|

|||

|

Spokane, WA

|

32,000

|

Leased

|

Distribution center

|

The distribution center supports the distribution to outside distribution facilities for sale on third-party marketplaces for Kaspien.

| Item 3. |

LEGAL PROCEEDINGS

|

The Company is subject to legal proceedings and claims that have arisen in the ordinary course of its business and have not been finally adjudicated. Although there can be no assurance as to the

ultimate disposition of these matters, it is management’s opinion, based upon the information available at this time, that the expected outcome of these matters, individually and in the aggregate, will not have a material adverse effect on the

results of operations and financial condition of the Company.

Retailer Agreement Dispute

On June 18, 2021, Vijuve Inc. filed a lawsuit against Kaspien Inc. in the United States District Court for the Eastern District of Washington (Case No. 2:21-cv-00192-SAB) concerning a Retailer

Agreement that the parties entered into in September of 2020. Vijuve manufactures skin care products and face massagers. The parties agreed that Kaspien would sell Vijuve’s products on Amazon. The complaint alleged that Kaspien breached the

Retailer Agreement when it declined to acquiesce to Vijuve’s demand that Kaspien purchase over $700,000 of products. In total, Vijuve appears to be seeking more than $1,000,000 in damages. Kaspien denies that it breached the agreement and denies

that it has any liability to Vijuve. Moreover, on July 19, 2021, Kaspien filed counterclaims and alleged that Vijuve breached the contract, including by refusing to buy back inventory from Kaspien upon termination of the Retailer Agreement. On

July 18, 2022, Kaspien filed additional counterclaims against VIjuve for fraud and negligent misrepresentation. Kaspien is seeking at least $229,000 from Vijuve for breach of contract and/or specific performance, as well as fraud and negligent

misrepresentation. A trial on all of the parties’ claims is scheduled for September 18, 2023.

On February 17, 2022, CA Washington, LLC (“CA”) filed a lawsuit against Kaspien Inc. in Wake County, North Carolina Superior Court (court file 22 CVS 2051). CA

claims that Kaspien Inc. breached the contract between the parties by using CA’s technology platform to facilitate sales by third parties and by using CA’s technology to develop a competing platform. The lawsuit also includes an alternative claim

for unjust enrichment and a claim for breach of North Carolina’s Unfair and Deceptive Trade Practices Act. CA seeks an unspecified amount of damages. Kaspien removed the lawsuit to federal court in the Eastern District of North Carolina (case

number 5:22-cv-00111), filed an Answer denying CA’s claims, and asserted a counterclaim against CA for breach of contract and breach of the covenant of good faith and fair dealing. There is no determination of outcome, thus no contingencies are

recognized as of the reporting date. The parties have agreed to resolve the lawsuit and are finalizing the necessary settlement documents.

| Item 4. |

MINE SAFETY DISCLOSURES

|

Not applicable.

16

PART II

| Item 5. |

MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

Market Information: The Company’s Common Stock trades on the NASDAQ Capital Market under the symbol “KSPN.” As of April 15, 2023, there were 77

shareholders of record.

On December 14, 2022, we received written notice from the NASDAQ that the closing bid price for our common stock had been below $1.00 for the previous 30 consecutive business days, and that the

Company therefore was not in compliance with the minimum bid price requirement for continued listing on The Nasdaq Capital Market under Nasdaq Listing Rule 5550(a)(2). In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company has been

provided a period of 180 calendar days, or until June 12, 2023, to regain compliance. In order to regain compliance with the minimum closing bid price rule, the closing bid price of the Company’s common stock must be at least $1.00 for a minimum of

ten consecutive business days during the compliance period. If the Company does not regain compliance during the initial compliance period, the Company may be eligible for additional time to regain compliance. If the Company is not eligible, the

Company expects that at that time the NASDAQ will provide written notice to the Company that the Company’s common stock will be subject to delisting.

The notice has no immediate impact on the listing of the Company’s common stock, which will continue to trade on The Nasdaq Capital Market. The Company intends to monitor its closing bid price

for its common stock between now and June 12, 2023 and will consider available options to resolve the Company’s noncompliance with the minimum bid price requirement, as may be necessary.

Dividend Policy: The Company did not pay cash dividends in fiscal 2022 and fiscal 2021. The declaration and

payment of any dividends is at the sole discretion of the board of directors and is not guaranteed.

Issuer Purchases of Equity Securities during the Quarter Ended January 28, 2023

During the three-month period ended January 28, 2023, the Company did not repurchase any shares under a share repurchase program.

| Item 6. |

[Reserved]

|

17

| Item 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

Overview

Management’s Discussion and Analysis of Financial Condition and Results of Operations provide information that the Company’s management believes necessary to achieve an understanding of its

financial condition and results of operations. To the extent that such analysis contains statements which are not of a historical nature, such statements are forward-looking statements, which involve risks and uncertainties. These risks include,

but are not limited to, changes in the competitive environment for the Company’s products and services; general economic factors in markets where the Company’s products and services are sold; and other factors including, but not limited to: cost of

goods, consumer disposable income, consumer debt levels and buying patterns, consumer credit availability, interest rates, customer preferences, unemployment, labor costs, inflation, fuel and energy prices, weather patterns, climate change,

catastrophic events, competitive pressures and insurance costs discussed in the Company’s filings with the Securities and Exchange Commission.

Key Performance Indicators

Management monitors a number of key performance indicators to evaluate its performance, including:

Net Revenue: The Company measures total year over year sales growth. Net sales performance is measured through several key performance indicators including

number of partners and active product listings and sales per listing.

Cost of Sales and Gross Profit: Gross profit is calculated based on the cost of product in relation to its retail selling value. Changes in gross profit

are impacted primarily by net sales levels, mix of products sold, obsolescence and distribution costs. Distribution expenses include those costs associated with receiving, inspecting & warehousing merchandise, Amazon fulfillment fees, and

costs associated with product returns to vendors.

Selling, General and Administrative (“SG&A”) Expenses: Included in SG&A expenses are payroll and related costs, general operating and overhead

expenses and depreciation charges. SG&A expenses also include miscellaneous income and expense items, other than interest.

Balance Sheet and Ratios: The Company views cash, merchandise inventory, accounts payable leverage, and working capital

as key indicators of its financial position. See “Liquidity and Capital Resources” for further discussion of these items.

Gross Merchandise Value (“GMV”): The total value of merchandise sold over a given time period through a customer-to-customer exchange site. It is the measurement of merchandise

value sold across all channels and partners within our platform.

18

Fiscal Year Ended January 28, 2023 (“fiscal 2022”)

Compared to Fiscal Year Ended January 29, 2022 (“fiscal 2021”)

The Company’s fiscal year is a 52 or 53-week period ending the Saturday nearest to January 31. Fiscal 2022 and fiscal 2021 ended January 28, 2023 and January 29, 2022, respectively. Both fiscal 2022

and fiscal 2021 had 52 weeks.

Net Revenue. Net revenue decreased 10.8% to $128.2 million compared to $143.7 million in fiscal 2021. The primary source of revenue is the Retail as a Service

(“RaaS”) model, which represented 98.7% of net revenue. Net revenue from Walmart, Target and Other Marketplaces decreased to 1.3% in fiscal 2022 from 1.5% in fiscal 2021. Subscriptions and Other share of net revenue increased to 1.4% of net revenue

from 1.3% of net revenue in the comparable period from the prior year The following table sets forth net revenue by marketplace as a percentage of total net revenue:

|

January 28,

2023

|

% to

Total

|

January 29,

2022

|

% to

Total

|

Change

|

||||||||||||||||

|

Amazon US

|

$

|

121,561

|

94.8

|

%

|

$

|

134,125

|

93.3

|

%

|

$

|

(12,564

|

)

|

|||||||||

|

Amazon International

|

3,241

|

2.5

|

%

|

5,576

|

3.9

|

%

|

(2,335

|

)

|

||||||||||||

|

Walmart, Target & Other Marketplaces

|

1,645

|

1.3

|

%

|

2,172

|

1.5

|

%

|

(527

|

)

|

||||||||||||

|

Subtotal Retail

|

126,447

|

98.6

|

%

|

141,873

|

98.7

|

%

|

(15,426

|

)

|

||||||||||||

|

Subscriptions & Other

|

1,781

|

1.4

|

%

|

1,840

|

1.3

|

%

|

(59

|

)

|

||||||||||||

|

Total

|

$

|

128,228

|

100.0

|

%

|

$

|

143,713

|

100.0

|

%

|

$

|

(15,485

|

)

|

|||||||||

The Company generates revenue across a broad array of product lines primarily through the Amazon Marketplace. Categories include apparel, baby, beauty, electronics, health & personal care,

home/kitchen/grocery, pets, sporting goods, toys & art.

Annual platform GMV for fiscal year 2022 was $271.0 million, the same level as fiscal 2021. Retail GMV decreased 9.2% to $137.1 million or 50.6% of total GMV, compared to $151.0 million or 55.7%

of total GMV in fiscal 2021. Subscription GMV increased 15.7% to $133.9 million or 49.4% of total GMV, compared to $120.0 million or 44.3% of total GMV in fiscal 2021.

Gross Profit. Gross profit as a percentage of revenue was 19.0% in fiscal 2022 as compared to 22.8% in fiscal 2021. The decrease in the gross profit rate was

primarily due to a decrease in merchandise margin to 41.2% in fiscal 2022 as compared to 44.8% in fiscal 2021 and a $0.6 million increase in warehousing and freight expenses. The following table sets forth a year-over-year comparison of the

Company’s gross profit:

|

Change

|

||||||||||||||||

|

(amounts in thousands)

|

January 28,

2023

|

January 29,

2022

|

$ |

|

%

|

|||||||||||

|

Merchandise margin

|

$

|

52,893

|

$

|

64,410

|

(11,517

|

)

|

(17.9

|

)%

|

||||||||

|

% of net revenue

|

41.2

|

%

|

44.8

|

%

|

(3.6

|

)%

|

||||||||||

|

Fulfillment fees

|

(17,940

|

)

|

(21,655

|

)

|

3,715

|

17.2

|

%

|

|||||||||

|

Warehousing and freight

|

(10,563

|

)

|

(9,982

|

)

|

(581

|

)

|

(5.8

|

)%

|

||||||||

|

Gross profit

|

$

|

24,390

|

$

|

32,773

|

(8,383

|

)

|

(25.6

|

)%

|

||||||||

|

% of net revenue

|

19.0

|

%

|

22.8

|

%

|

||||||||||||

19

Selling, General and Administrative Expenses. The following table sets forth a

year-over-year comparison of the Company’s SG&A expenses:

|

Change

|

||||||||||||||||

|

(amounts in thousands)

|

January 28,

2023

|

January 29,

2022

|

$ |

|

%

|

|||||||||||

|

Selling expenses

|

$

|

18,427

|

$

|

20,794

|

$

|

(2,367

|

)

|

(11.3

|

)%

|

|||||||

|

General and administrative expenses

|

20,154

|

19,501

|

653

|

|

3.3

|

%

|

||||||||||

|

Depreciation and amortization expenses

|

1,233

|

2,096

|

(863

|

)

|

(41.2

|

)%

|

||||||||||

|

Total SG&A expenses

|

$

|

39,814

|

$

|

42,391

|

$

|

(2,577

|

)

|

(8.0

|

)%

|

|||||||

|

As a % of total revenue

|

31.0

|

%

|

29.5

|

%

|

||||||||||||

SG&A expenses decreased $2.6 million, or 6.1%, primarily due to an 11.3% reduction in in Selling expenses. The decline in Selling expenses was attributable to the decline in Net revenue.

General and administrative expenses increased $0.7 million.

SG&A expenses as a percentage of net revenue increased to 30.4% as compared to 29.5% in fiscal 2021. The increase in the rate as a percentage of net revenue was primarily due to lost leverage

on the general and administrative expenses.

Depreciation and amortization expense. Consolidated depreciation and amortization expense for fiscal 2022 was $1.2 million as compared to $2.1 million in fiscal

2021.

Interest Expense. Interest expense in fiscal 2022 was $3.6 million, compared to interest expense of $1.9 million in fiscal 2021. The increase in interest

expense was attributable to higher average borrowings on the Credit Facility and the Additional Subordinated Debt.

Income Tax Expense. The following table sets forth a year-over-year comparison of the Company’s income tax expense:

|

(amounts in thousands)

|

Change

|

|||||||||||

|

January 28,

2023

|

January 29,

2022

|

$ |

||||||||||

|

Income tax expense

|

$

|

43

|

$

|

27

|

$

|

16

|

||||||

|

Effective tax rate

|

0.2

|

%

|

0.3

|

%

|

-

|

%

|

||||||

The fiscal 2022 and fiscal 2021 income tax expense includes state taxes.

20

Net Loss. The following table sets forth a year-over-year comparison of the Company’s net loss:

|

(amounts in thousands)

|

Change

|

|||||||||||

|

January 28,

2023

|

January 29,

2022

|

$ |

||||||||||

|

Net loss

|

$

|

(19,044

|

)

|

$

|

(8,031

|

)

|

$

|

(11,013

|

)

|

|||

|

Net loss as a percentage of Net revenue

|

(14.9

|

)%

|

(5.6

|

)%

|

(9.3

|

)%

|

||||||

Net loss was $19.0 million for fiscal 2022, compared to $8.0 million for fiscal 2021. The increase in net loss was primarily due to lower net revenue and a lower gross margin rate.

LIQUIDITY AND CAPITAL RESOURCES

Liquidity and Cash Flows:

The consolidated financial statements for the year ended January 28, 2023 were prepared on the basis of a going concern which contemplates that the Company will be able to realize assets and

satisfy liabilities and commitments in the normal course of business. The ability of the Company to meet its liabilities and to continue as a going concern is dependent on improved profitability, the continued implementation of the strategic

initiative to reposition the Company as a platform of software and services and the availability of future funding.

The audited consolidated financial statements do not include any adjustments that might result from the outcome of these uncertainties.

The Company incurred net losses of $19.0 million and $8.0 million for the fiscal 2022 and fiscal 2021, respectively, and has an accumulated deficit of $139.9 million as of January 28, 2023. In

addition, net cash used in operating activities during fiscal 2022 was $11.3 million. Net cash used in operating activities during fiscal 2021 was $14.5 million.

There can be no assurance that we will be successful in further implementing our business strategy or that the strategy, including the completed initiatives, will be successful in sustaining

acceptable levels of sales growth and profitability. Based on recurring losses from operations, negative cash flows from operations, the expectation of continuing operating losses for the foreseeable future, and uncertainty with respect to any

available future funding, the Company has concluded that there is substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this

uncertainty.

The Company’s primary sources of liquidity are its borrowing capacity under its Credit Facility, available cash and cash equivalents, and to a lesser extent, cash generated from operations. Our

cash requirements relate primarily to working capital needed to operate Kaspien, including funding operating expenses, the purchase of inventory and capital expenditures. Our ability to achieve profitability and meet future liquidity needs and