UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2019

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to .

Commission File Number: 1-9044 (Duke Realty Corporation) 0-20625 (Duke Realty Limited Partnership)

DUKE REALTY CORPORATION

DUKE REALTY LIMITED PARTNERSHIP

(Exact Name of Registrant as Specified in Its Charter)

(Duke Realty Corporation) | (Duke Realty Corporation) | ||||

Indiana | (Duke Realty Limited Partnership) | 35-1898425 | (Duke Realty Limited Partnership) | ||

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) | ||||

(Address of Principal Executive Offices) | (Zip Code) | ||||

Registrant's Telephone Number, Including Area Code:

Securities registered pursuant to Section 12(b) of the Act:

Title of Class | Trading Symbols | Name of Exchange on Which Registered | ||||

Duke Realty Corporation | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Duke Realty Corporation | ☒ | No ☐ | Duke Realty Limited Partnership | Yes ☒ | No ☐ | ||

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Duke Realty Corporation | Yes ☐ | ☒ | Duke Realty Limited Partnership | Yes ☐ | No ☒ | ||

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Duke Realty Corporation | ☒ | No ☐ | Duke Realty Limited Partnership | Yes ☒ | No ☐ | ||

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Duke Realty Corporation | ☒ | No ☐ | Duke Realty Limited Partnership | Yes ☒ | No ☐ | ||

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer", "accelerated filer", "smaller reporting company", and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

Duke Realty Corporation:

☒ | Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company ☐ | Emerging growth company ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Duke Realty Limited Partnership:

Large accelerated filer | ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | Smaller reporting company ☐ | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Duke Realty Corporation | Yes | No ☒ | Duke Realty Limited Partnership | Yes ☐ | No ☒ | ||

The aggregate market value of the voting shares of Duke Realty Corporation's outstanding common shares held by non-affiliates of Duke Realty Corporation is $11.48 billion based on the last reported sale price on June 30, 2019.

The number of common shares of Duke Realty Corporation, $0.01 par value outstanding as of February 20, 2020 was 368,342,908 .

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of Duke Realty Corporation's Definitive Proxy Statement for its 2020 Annual Meeting of Shareholders (the "2020 Proxy Statement") to be filed pursuant to Rule 14a-6 of the Securities Exchange Act of 1934, as amended, are incorporated by reference into this Form 10-K. Other than those portions of the 2020 Proxy Statement specifically incorporated by reference pursuant to Items 10 through 14 of Part III hereof, no other portions of the 2020 Proxy Statement shall be deemed so incorporated.

EXPLANATORY NOTE

This report (the "Report") combines the annual reports on Form 10-K for the year ended December 31, 2019 of both Duke Realty Corporation and Duke Realty Limited Partnership. Unless stated otherwise or the context otherwise requires, references to "Duke Realty Corporation" or the "General Partner" mean Duke Realty Corporation and its consolidated subsidiaries; and references to the "Partnership" mean Duke Realty Limited Partnership and its consolidated subsidiaries. The terms the "Company," "we," "us" and "our" refer to the General Partner and the Partnership, collectively, and those entities owned or controlled by the General Partner and/or the Partnership.

Duke Realty Corporation is a self-administered and self-managed real estate investment trust ("REIT") and is the sole general partner of the Partnership, owning 99.2% of the common partnership interests of the Partnership ("General Partner Units") as of December 31, 2019. The remaining 0.8% of the common partnership interests ("Limited Partner Units" and, together with the General Partner Units, the "Common Units") are owned by limited partners. As the sole general partner of the Partnership, the General Partner has full, exclusive and complete responsibility and discretion in the day-to-day management and control of the Partnership.

The General Partner and the Partnership are operated as one enterprise. The management of the General Partner consists of the same members as the management of the Partnership. As the sole general partner with control of the Partnership, the General Partner consolidates the Partnership for financial reporting purposes, and the General Partner does not have any significant assets other than its investment in the Partnership. Therefore, the assets and liabilities of the General Partner and the Partnership are substantially the same.

We believe combining the annual reports on Form 10-K of the General Partner and the Partnership into this single report results in the following benefits:

• | enhances investors' understanding of the General Partner and the Partnership by enabling investors to view the business as a whole in the same manner as management views and operates the business; |

• | eliminates duplicative disclosure and provides a more streamlined and readable presentation of information since a substantial portion of the Company's disclosure applies to both the General Partner and the Partnership; and |

• | creates time and cost efficiencies through the preparation of one combined report instead of two separate reports. |

We believe it is important to understand the few differences between the General Partner and the Partnership in the context of how we operate as an interrelated consolidated company. The General Partner's only material asset is its ownership of partnership interests in the Partnership. As a result, the General Partner does not conduct business itself, other than acting as the sole general partner of the Partnership and issuing public equity from time to time. The General Partner does not issue any indebtedness, but does guarantee some of the unsecured debt of the Partnership. The Partnership holds substantially all the assets of the business, directly or indirectly, and holds the ownership interests related to certain of the Company's investments. The Partnership conducts the operations of the business and has no publicly traded equity. Except for net proceeds from equity issuances by the General Partner, which are contributed to the Partnership in exchange for General Partner Units or Preferred Units, the Partnership generates the capital required by the business through its operations, its incurrence of indebtedness and the issuance of Limited Partner Units to third parties.

Noncontrolling interests, shareholders' equity and partners' capital are the main areas of difference between the consolidated financial statements of the General Partner and those of the Partnership. The noncontrolling interests in the Partnership's financial statements include the interests in consolidated investees not wholly owned by the Partnership. The noncontrolling interests in the General Partner's financial statements include the same noncontrolling interests at the Partnership level, as well as the common limited partnership interests in the Partnership, which are accounted for as partners' capital by the Partnership.

In order to highlight the differences between the General Partner and the Partnership, there are separate sections in this report, as applicable, that separately discuss the General Partner and the Partnership, including separate financial statements and separate Exhibit 31 and 32 certifications. In the sections that combine disclosure of the General Partner and the Partnership, this report refers to actions or holdings as being actions or holdings of the collective Company.

TABLE OF CONTENTS

Form 10-K

Item No. | Page(s) | |

1. | ||

1A. | ||

1B. | ||

2. | ||

3. | ||

4. | ||

5. | ||

6. | ||

7. | ||

7A. | ||

8. | ||

9. | ||

9A. | ||

9B. | ||

10. | ||

11. | ||

12. | ||

13. | ||

14. | ||

15. | ||

16. | ||

IMPORTANT INFORMATION ABOUT THIS REPORT

Cautionary Notice Regarding Forward-Looking Statements

Certain statements contained in or incorporated by reference into this Report on Form 10-K for the General Partner and the Partnership, including, without limitation, those related to our future operations, constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The words "believe," "estimate," "expect," "anticipate," "intend," "strategy," "continue," "plan," "seek," "could," "may" and similar expressions or statements regarding future periods are intended to identify forward-looking statements, although not all forward-looking statements may contain such words.

These forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any predictions of future results, performance or achievements that we express or imply in this Report or in the information incorporated by reference into this Report. Some of the risks, uncertainties and other important factors that may affect future results include, among others:

• | Changes in general economic and business conditions, including the financial condition of our tenants and the value of our real estate assets; |

• | The General Partner's continued qualification as a REIT for U.S. federal income tax purposes; |

• | Heightened competition for tenants and potential decreases in property occupancy; |

• | Potential changes in the financial markets and interest rates; |

• | Volatility in the General Partner's stock price and trading volume; |

• | Our continuing ability to raise funds on favorable terms, or at all; |

• | Our ability to successfully identify, acquire, develop and/or manage properties on terms that are favorable to us; |

• | Potential increases in real estate construction costs including construction cost increases as the result of trade disputes and tariffs on goods imported in the United States; |

• | Our real estate asset concentration in the industrial sector and potential volatility in this sector; |

• | Our ability to successfully dispose of properties on terms that are favorable to us; |

• | Our ability to successfully integrate our acquired properties; |

• | Our ability to retain our current credit ratings; |

• | Inherent risks related to disruption of information technology networks and related systems and cyber security attacks; |

• | Inherent risks in the real estate business, including, but not limited to, tenant defaults, potential liability relating to environmental matters and liquidity of real estate investments; and |

• | Other risks and uncertainties described herein, as well as those risks and uncertainties discussed from time to time in our other reports and other public filings with the Securities and Exchange Commission ("SEC"). |

Although we presently believe that the plans, expectations and anticipated results expressed in or suggested by the forward-looking statements contained in or incorporated by reference into this Report are reasonable, all forward-looking statements are inherently subjective, uncertain and subject to change, as they involve substantial risks and uncertainties, including those beyond our control. New factors emerge from time to time, and it is not possible for us to predict the nature, or assess the potential impact, of each new factor on our business. Given these uncertainties, we caution you not to place undue reliance on these forward-looking statements. We undertake no

-2-

obligation to update or revise any of our forward-looking statements for events or circumstances that arise after the statement is made, except as otherwise may be required by law.

The above list of risks and uncertainties is only a summary of some of the most important factors and is not intended to be exhaustive. Additional information regarding risk factors that may affect us is included under the caption "Risk Factors" in this Report, and is updated by us from time to time in Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings that we make with the SEC.

PART I

Item 1. Business

Background

The General Partner and Partnership collectively specialize in the ownership, management and development of bulk distribution ("industrial") real estate.

The General Partner is a self-administered and self-managed REIT, which began operations upon completion of an initial public offering in February 1986.

The Partnership was formed in October 1993, when the General Partner contributed all of its properties and related assets and liabilities, together with the net proceeds from an offering of additional shares of its common stock, to the Partnership. Simultaneously, the Partnership completed the acquisition of Duke Associates, a full-service commercial real estate firm operating in the Midwest whose operations began in 1972. The General Partner is the sole general partner of the Partnership, owning 99.2% of the Common Units at December 31, 2019. The remaining 0.8% of the Common Units are owned by limited partners. Limited partners have the right to redeem their Limited Partner Units, subject to certain restrictions. Pursuant to the Fifth Amended and Restated Agreement of Limited Partnership, as amended (the "Partnership Agreement"), the General Partner is obligated to redeem the Limited Partner Units in shares of its common stock, unless it determines in its reasonable discretion that the issuance of shares of its common stock could cause it to fail to qualify as a REIT. Each Limited Partner Unit shall be redeemed for one share of the General Partner's common stock, or, in the event that the issuance of shares could cause the General Partner to fail to qualify as a REIT, cash equal to the fair market value of one share of the General Partner's common stock at the time of redemption, in each case, subject to certain adjustments described in the Partnership Agreement. The Limited Partner Units are not required, per the terms of the Partnership Agreement, to be redeemed in registered shares of the General Partner.

At December 31, 2019, we owned or jointly controlled 519 primarily industrial properties which encompassed 155.3 million rentable square feet (including 38 unconsolidated joint venture in-service properties with 11.0 million square feet, 21 consolidated properties under development with 8.7 million square feet and one unconsolidated joint venture property under development with 133,000 square feet). Our properties are leased by a diverse base of more than 800 tenants whose businesses include e-commerce, manufacturing, retailing, wholesale trade, and distribution. We also owned, including through ownership interests in unconsolidated joint ventures (with acreage not adjusted for our percentage ownership interest), 1,380 acres of land and controlled an additional 1,000 acres through purchase options.

Our headquarters and executive offices are located in Indianapolis, Indiana. We additionally have regional offices or significant operations in 19 other geographic or metropolitan areas including Atlanta, Georgia; Chicago, Illinois; Cincinnati, Ohio; Columbus, Ohio; Dallas, Texas; Houston, Texas; Minneapolis/St. Paul, Minnesota; Nashville, Tennessee; Raleigh, North Carolina; Savannah, Georgia; Seattle, Washington; St. Louis, Missouri; Washington D.C./Baltimore, Maryland; Central Florida; New Jersey; Northern and Southern California; Pennsylvania and South Florida. We had approximately 400 employees at December 31, 2019.

See Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" for information related to our operational, asset and capital strategies.

-3-

Competitive Conditions

As a fully integrated commercial real estate firm, we provide in-house leasing, management, development and construction services which we believe, coupled with our significant base of commercially zoned and unencumbered land in existing business parks, should give us a competitive advantage as a real estate operator and in future development activities.

We believe that the management of real estate opportunities and risks can be done most effectively at regional or on local levels. As a result, we intend to continue our emphasis on increasing our market share, to the extent it is in markets that align with our asset strategy (see Item 7), and effective rents in the primary markets where we own properties. We believe that this regional focus will allow us to assess market supply and demand for real estate more effectively as well as to capitalize on the strong relationships with our tenant base. In addition, we seek to further capitalize on our many strong relationships with customers that operate on a national level. As a fully integrated real estate company, we are able to arrange for or provide to our tenants not only well located and well maintained facilities, but also additional services such as build-to-suit construction, tenant finish construction, and expansion flexibility.

All of our properties are located in areas that include competitive properties. Institutional investors, other REITs or local real estate operators generally own such properties; however, no single competitor or small group of competitors is dominant in our current markets. The supply of and demand for similar available rental properties may affect the rental rates we will receive on our properties. Other competitive factors include the attractiveness of the property location, the quality of the property and tenant services provided, and the reputation of the owner and operator.

Corporate Governance

Since our inception, we not only have strived to be a top-performer operationally, but also to lead in issues important to investors such as disclosure and corporate governance. The General Partner's system of governance reinforces this commitment and, as a limited partnership that has one general partner owning over 90% of the Partnership's common interest, the governance of the Partnership is necessarily linked to the corporate governance of the General Partner. Summarized below are the highlights of the General Partner's Corporate Governance initiatives.

-4-

Board Composition | • The General Partner's board is controlled by a supermajority (92.3%) of "Independent Directors," as such term is defined under the rules of the New York Stock Exchange (the "NYSE") • 31% of the General Partner’s board is female and its compensation and human capital committee is chaired by a female | |

Board Committees | • The General Partner's board committee members are all Independent Directors | |

Lead Director | • The Lead Director serves as the Chairman of the General Partner's corporate governance committee | |

Board Policies | - Proactively amended and restated the General Partner's Bylaws to implement proxy access - Adopted a Board Diversity and Inclusion Policy - No Shareholder Rights Plan (Poison Pill) - Code of Business Ethics applies to all directors and employees of the General Partner, including the Chief Executive Officer and senior financial officers; waivers applied to executive officers require the approval of (i) the General Partner's board of directors or (ii) the General Partner's corporate governance committee - Orientation program for new directors of the General Partner - Independence of directors of the General Partner is reviewed annually - Independent Directors of the General Partner meet at least quarterly in executive sessions - Independent Directors of the General Partner receive no compensation from the General Partner other than as directors - Equity-based compensation plans require the approval of the General Partner's shareholders - Board effectiveness and performance is reviewed annually by the General Partner's corporate governance committee - Individual director evaluations are performed annually - The General Partner's corporate governance committee conducts an annual review of the Chief Executive Officer succession plan - Independent Directors and all board committees of the General Partner may retain outside advisors, as they deem appropriate - Prohibition on repricing of outstanding stock options of the General Partner - Directors of the General Partner required to offer resignation upon job change - Majority voting for election of directors of the General Partner - Human Rights Policy - Shareholder Communications Policy | |

Ownership | Minimum Stock Ownership Guidelines apply to all directors and executive officers of the General Partner | |

The General Partner's Code of Business Ethics (which applies to all directors and employees of the General Partner, including the Chief Executive Officer and senior financial officers) and the Corporate Governance Guidelines are available in the Investor Relations/Corporate Governance section of the General Partner's website at www.dukerealty.com. A copy of these documents may also be obtained without charge by writing to Duke Realty Corporation, 8711 River Crossing Boulevard, Indianapolis, Indiana 46240, Attention: Investor Relations. If we amend our Code of Business Ethics as it applies to the directors and all executive officers of the General Partner or grant a waiver from any provision of the Code of Business Ethics to any such person, we may, rather than filing a current report on Form 8-K, disclose such amendment or waiver in the Investor Relations/Corporate Governance section of the General Partner's website at www.dukerealty.com.

Additional Information

For additional information regarding our investments and operations, see Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" and Item 8, "Financial Statements and Supplementary Data." For additional information about our business segments, see Item 8, "Financial Statements and Supplementary Data - Notes to Consolidated Financial Statements - (9) Segment Reporting."

-5-

Available Information

In addition to this Report, we file quarterly and current reports, proxy statements and other information with the SEC. All documents that are filed with the SEC are available free of charge on the General Partner's corporate website, which is www.dukerealty.com. We are not incorporating the information on the General Partner's website into this Report, and the General Partner's website and the information appearing on the General Partner's website is not included in, and is not part of, this Report. You may also access any document filed through the SEC's home page on the Internet (http://www.sec.gov).

Item 1A. Risk Factors

In addition to the other information contained in this Report, you should carefully consider, in consultation with your legal, financial and other professional advisors, the risks described below, as well as the risk factors and uncertainties discussed in our other public filings with the SEC under the caption "Risk Factors" in evaluating us and our business before making a decision regarding an investment in the General Partner's securities.

The risks contained in this Report are not the only risks that we face. Additional risks that are not presently known, or that we presently deem to be immaterial, also could have a material adverse effect on our financial condition, results of operations, business and prospects. The trading price of the General Partner's securities could decline due to the materialization of any of these risks, and its shareholders and/or the Partnership's unitholders may lose all or part of their investment.

This Report also contains forward-looking statements that may not be realized as a result of certain factors, including, but not limited to, the risks described herein and in our other public filings with the SEC. Please refer to the section in this Report entitled "Cautionary Notice Regarding Forward-Looking Statements" for additional information regarding forward-looking statements.

Risks Related to Our Business

Our use of debt financing could have a material adverse effect on our financial condition.

We are subject to the risks normally associated with debt financing, including the risk that our cash flow will be insufficient to meet required principal and interest payments and the long-term risk that we will be unable to refinance our existing indebtedness, or that the terms of such refinancing will not be as favorable as the terms of existing indebtedness. Additionally, we may not be able to refinance borrowings by our unconsolidated subsidiaries on favorable terms or at all. If our debt cannot be paid, refinanced or extended, we may not be able to make distributions to shareholders and unitholders at expected levels. Further, if prevailing interest rates or other factors at the time of a refinancing result in higher interest rates or other restrictive financial covenants upon the refinancing, then such refinancing would adversely affect our cash flow and funds available for operation, development and distribution.

We also have incurred, and may incur in the future, indebtedness that bears interest at variable rates. Thus, if market interest rates increase, so will our interest expense, which could reduce our cash flow and our ability to make distributions to shareholders and unitholders at expected levels.

Debt financing may not be available and equity issuances could be dilutive to our shareholders and unitholders.

Our ability to execute our business strategy depends on our access to an appropriate blend of debt financing, including unsecured lines of credit and other forms of secured and unsecured debt, and equity financing, including common equity and, at times, preferred equity issued by the General Partner. Debt financing may not be available over a longer period of time in sufficient amounts, on favorable terms or at all. If the General Partner issues additional equity securities, instead of debt, to manage capital needs, the interests of our existing shareholders and unitholders could be diluted.

-6-

Financial and other covenants under existing credit agreements could limit our flexibility and adversely affect our financial condition.

The terms of our various credit agreements and other indebtedness require that we comply with a number of customary financial and other covenants, such as maintaining debt service coverage and leverage ratios and maintaining insurance coverage. These covenants may limit our flexibility in our operations, and breaches of these covenants could result in defaults under the instruments governing the applicable indebtedness even if we have satisfied our payment obligations. As a result, we would also likely be unable to borrow any further amounts under our other debt instruments and other debt obligations may be accelerated, which could adversely affect our ability to fund operations.

Downgrades in our credit ratings could increase our borrowing costs or reduce our access to funding sources in the credit and capital markets.

We have a significant amount of debt outstanding, consisting mostly of unsecured debt. We are currently assigned corporate credit ratings from Moody's Investors Service, Inc. and Standard and Poor's Ratings Group based on their evaluation of our creditworthiness. All of our debt ratings remain investment grade, but there can be no assurance that we will not be downgraded or that any of our ratings will remain investment grade. If our credit ratings are downgraded or other negative action is taken, we could be required, among other things, to pay additional interest and fees on outstanding borrowings under our revolving credit agreement.

Credit rating reductions by one or more rating agencies could also adversely affect our access to funding sources, the cost and other terms of obtaining funding as well as our overall financial condition, operating results and cash flow.

If we are unable to generate sufficient capital and liquidity, then we may be unable to pursue future development projects and other strategic initiatives.

To complete our ongoing and planned development projects, and to pursue our other strategic initiatives, we must continue to generate sufficient capital and liquidity to fund those activities. To generate that capital and liquidity, we rely upon funds from our existing operations, as well as funds that we raise through our capital raising activities. In the event that we are unable to generate sufficient capital and liquidity to meet our long-term needs, or if we are unable to generate capital and liquidity on terms that are favorable to us, then we may not be able to pursue development projects, acquisitions, or our other long-term strategic initiatives.

The General Partner's stock price and trading volume may be volatile, which could result in substantial losses to its shareholders and to the Partnership's unitholders, if and when they convert their Limited Partner Units to shares of the General Partner's common stock.

The market price of the General Partner's common stock could change in ways that may or may not be related to our business, our industry or our operating performance and financial condition. In addition, the trading volume in the General Partner's common stock may fluctuate and cause significant price variations to occur. Some of the factors that could negatively affect the General Partner's share price, or result in fluctuations in the price or trading volume of the General Partner's common stock, include uncertainty in the markets, general market and economic conditions, as well as those factors described in these "Risk Factors" and in other reports that we file with the SEC.

Many of these factors are beyond our control, and we cannot predict their potential effects on the price of the General Partner's common stock. If the market price of the General Partner's common stock declines, then its shareholders and the Partnership's unitholders, respectively, may be unable to resell their shares and units upon terms that are attractive to them. We cannot assure that the market price of the General Partner's common stock will not fluctuate or decline significantly in the future. In addition, the securities markets in general may experience considerable unexpected price and volume fluctuations.

-7-

Our use of joint ventures may negatively impact our jointly-owned investments.

We have, and may continue to develop and acquire properties in joint ventures with other persons or entities when circumstances warrant the use of these structures. Our participation in joint ventures is subject to the risks that:

• | We could become engaged in a dispute with any of our joint venture partners that might affect our ability to develop or operate a property; |

• | Our joint venture partners may have different objectives than we have regarding the appropriate timing and terms of any sale or refinancing of properties; |

• | Our joint venture partners may have competing interests in our markets that could create conflict of interest issues; and |

• | Maturities of debt encumbering our jointly owned investments may not be able to be refinanced at all or on terms that are as favorable as the current terms. |

Our business and operations could suffer in the event of system failures or cyber security attacks.

Our systems are vulnerable to damages from any number of sources, including energy blackouts, natural disasters, terrorism, war, telecommunication failures and cyber security attacks, such as computer viruses, computer hacking, acts of vandalism or theft, malware or other malicious codes, phishing, employee error or malfeasance, or other unauthorized access. Any system failure or accident that causes interruptions in our operations could result in a material disruption to our business. We may also incur additional costs to remedy damages caused by such disruptions. Any future significant compromise or breach of our data security, whether external or internal, or misuse of customer, associate, supplier or company data, could result in significant costs, lost sales, fines, lawsuits, and damage to our reputation. Any compromise of our security could also result in a violation of applicable privacy and other laws, unauthorized access to information of ours and others, significant legal and financial exposure, damage to our reputation, loss or misuse of the information and a loss of confidence in our security measures, which could harm our business.

We have programs in place to detect, contain and respond to data security incidents. However, the ever-evolving threats mean we and our third-party service providers and vendors must continually evaluate and adapt our respective systems and processes and overall security environment. Even the most well protected information, networks, systems and facilities remain potentially vulnerable when considering the rapid pace of change in this area. There can be no assurance that our efforts to maintain the security and integrity of our systems will be effective, or that we will be able to maintain our systems free from security breaches, system compromises, misuses of data, or other operational interruptions. Accordingly, we may be unable to prevent major security breaches or entirely mitigate the risk of other system interruptions or failures.

We could also be negatively impacted by similar disruptions to the operations of our vendors or outsourced service providers.

Risks Related to the Real Estate Industry

Our net earnings available for investment or distribution to shareholders and unitholders could decrease as a result of factors related to the ownership and operation of commercial real estate, many of which are outside of our control.

Our business is subject to the risks incident to the ownership and operation of commercial real estate, many of which involve circumstances not within our control. Such risks include the following:

• | Changes in the general economic climate; |

• | The availability of capital on favorable terms, or at all; |

• | Increases in interest rates; |

-8-

• | Local conditions such as oversupply of property or a reduction in demand; |

• | Competition for tenants; |

• | Changes in market rental rates; |

• | Delay or inability to collect rent from tenants who are bankrupt, insolvent or otherwise unwilling or unable to pay; |

• | Difficulty in leasing or re-leasing space quickly or on favorable terms; |

• | Costs associated with periodically renovating, repairing and reletting rental space; |

• | Our ability to provide adequate maintenance and insurance on our properties; |

• | Our ability to control variable operating costs; |

• | Changes in government regulations; and |

• | Potential liability under, and changes in, environmental, zoning, tax and other laws. |

Any one or more of these factors could result in a reduction in our net earnings available for investment or distribution to shareholders and unitholders.

Many real estate costs are fixed, even if income from properties decreases.

Our financial results depend on leasing space in our real estate to tenants on terms favorable to us. Our income and funds available for distribution to our shareholders and unitholders will decrease if a significant number of our tenants cannot meet their lease obligations to us or we are unable to lease properties on favorable terms. In addition, if a tenant does not pay its rent, we may not be able to enforce our rights as landlord without delays and we may incur substantial legal costs. Costs associated with real estate investment, such as real estate taxes, insurance, maintenance costs and our debt service payments, generally are not reduced when circumstances cause a reduction in income from the investment. As a result, we may have a reduction in our net earnings available for investment or distribution to our shareholders and unitholders.

Our real estate development activities are subject to risks particular to development.

We continue to selectively develop new properties for rental operations in our existing markets when accretive returns are present. These development activities generally require various government and other approvals, which we may not receive. In addition, we also are subject to the following risks associated with development activities:

• | Unsuccessful development opportunities could result in direct expenses to us; |

• | Construction costs could increase as the result of trade disputes and tariffs on goods imported in the United States; |

• | Construction costs of a project may exceed original estimates, possibly making the project less profitable than originally estimated, or possibly unprofitable; |

• | Time required to complete the construction of a project or to lease up the completed project may be greater than originally anticipated, thereby adversely affecting our cash flow and liquidity; |

• | Occupancy rates and rents of a completed project may not be sufficient to make the project profitable; and |

• | Favorable sources to fund our development activities may not be available. |

-9-

We may be unsuccessful in operating completed real estate projects.

We face the risk that the real estate projects we develop or acquire will not perform in accordance with our expectations. This risk exists because of factors such as the following:

• | Prices paid for acquired facilities are based upon a series of market judgments; and |

• | Costs of any improvements required to bring an acquired facility up to standards to establish the market position intended for that facility might exceed budgeted costs. |

As a result, we may develop or acquire projects that are not profitable.

Our investments are concentrated in the industrial sector and our business would be adversely affected by an economic downturn in that sector.

Our investments in real estate assets are concentrated in the industrial sector. This concentration may expose us to the risk of economic downturns in this sector to a greater extent than if our business activities were more diversified.

We are exposed to the risks of defaults by tenants.

Any of our tenants may experience a downturn in their businesses that may weaken their financial condition. In the event of default or the insolvency of a significant number of our tenants, we may experience a substantial loss of rental revenue and/or delays in collecting rent and incur substantial costs in enforcing our rights as landlord. If a tenant files for bankruptcy protection, a court could allow the tenant to reject and terminate its lease with us. Our income and distributable cash flow would be adversely affected if a significant number of our tenants became unable to meet their obligations to us, became insolvent or declared bankruptcy.

We may be unable to renew leases or relet space.

When our tenants decide not to renew their leases upon their expiration, we may not be able to relet the space. Even if our tenants do renew or we are able to relet the space, the terms of renewal or reletting (including the cost of renovations, if necessary) may be less favorable than current lease terms. If we are unable to promptly renew the leases or relet the space, or if the rental rates upon such renewal or reletting are significantly lower than current rates, then our income and distributable cash flow would be adversely affected, especially if we were unable to lease a significant amount of the space vacated by tenants in our properties.

Our insurance coverage on our properties may be inadequate.

We maintain comprehensive insurance on each of our facilities, including property, liability and environmental coverage. We believe this coverage is of the type and amount customarily obtained for real property. However, there are certain types of losses, generally of a catastrophic nature, such as hurricanes, earthquakes and floods or acts of war or terrorism that may be uninsurable or not economically insurable. We use our discretion when determining amounts, coverage limits and deductibles for insurance. These terms are determined based on retaining an acceptable level of risk at a reasonable cost. This may result in insurance coverage that in the event of a substantial loss would not be sufficient to pay the full current replacement cost of the damaged assets. Inflation, changes in building codes and ordinances, environmental considerations, acts of a governmental authority and other factors also may make it unfeasible to collect insurance proceeds to replace a facility after it has been damaged or destroyed. If an uninsured or underinsured loss occurred, we could lose both our investment in and anticipated profits and cash flow from a property, and we would continue to be obligated on any mortgage indebtedness or other obligations related to the property. We are also subject to the risk that our insurance providers may be unwilling or unable to pay our claims when made.

-10-

Our acquisition and disposition activity may lead to long-term dilution.

Our asset strategy is to increase our investment concentration in coastal Tier 1 markets. There can be no assurance that we will be able to execute our strategy or that our execution of such strategy will lead to improved results.

Acquired properties may expose us to unknown liability.

From time to time, we may acquire properties subject to liabilities and without any recourse, or with only limited recourse, with respect to unknown liabilities. As a result, if a liability were asserted against us based upon ownership of those properties, we might have to pay substantial sums to settle or contest it, which could adversely affect our results of operations and cash flow. Unknown liabilities with respect to acquired properties might include:

• | liabilities for clean-up of undisclosed environmental contamination; |

• | claims by tenants, vendors or other persons against the former owners of the properties; |

• | liabilities incurred in the ordinary course of business; and |

• | claims for indemnification by general partners, directors, officers and others indemnified by the former owners of the properties. |

We could be exposed to significant environmental liabilities as a result of conditions of which we currently are not aware.

As an owner and operator of real property, we may be liable under various federal, state and local laws for the costs of removal or remediation of certain hazardous substances released on or in our property. Such laws often impose liability without regard to whether the owner or operator knew of, or was responsible for, the release of the hazardous substances. In addition, we could have greater difficulty in selling real estate on which hazardous substances were present or in obtaining borrowings using such real estate as collateral. It is our general policy to have Phase I environmental audits performed for all of our properties and land by qualified environmental consultants at the time of purchase. These Phase I environmental audits have not revealed any environmental liability that would have a material adverse effect on our business. However, a Phase I environmental audit does not involve invasive procedures such as soil sampling or ground water analysis, and we cannot be sure that the Phase I environmental audits did not fail to reveal a significant environmental liability or that a prior owner did not create a material environmental condition on our properties or land which has not yet been discovered. We could also incur environmental liability as a result of future uses or conditions of such real estate or changes in applicable environmental laws.

We are exposed to the potential impacts of future climate change and climate-change related risks.

We are exposed to potential physical risks from possible future changes in climate. We have a significant investment in properties in coastal markets such as Southern California, Northern California and South Florida and have also targeted those markets for future growth. Those coastal markets have historically experienced severe weather events, such as storms and drought, as well as other natural catastrophes such as wildfires and floods. If the frequency of extreme weather and other natural events increases due to climate change, our exposure to these events could increase. We may also be adversely impacted as a real estate developer in the future by stricter energy and water efficiency standards as well as water access for our buildings.

Risks Related to Our Organization and Structure

If the General Partner were to cease to qualify as a REIT, it would lose significant tax benefits.

The General Partner intends to continue to operate so as to qualify as a REIT under the Internal Revenue Code of 1986, as amended (the "Code"). Qualification as a REIT provides significant tax advantages to the General Partner. However, in order for the General Partner to continue to qualify as a REIT, it must satisfy numerous requirements established under highly technical and complex Code provisions for which there are only limited judicial and administrative interpretations. Satisfaction of these requirements also depends on various factual circumstances not

-11-

entirely within our control. The fact that the General Partner holds its assets through the Partnership further complicates the application of the REIT requirements. Even a technical or inadvertent mistake could jeopardize the General Partner's REIT status. Although we believe that the General Partner can continue to operate so as to qualify as a REIT, we cannot offer any assurance that it will continue to do so or that legislation, new regulations, administrative interpretations or court decisions will not significantly change the qualification requirements or the federal income tax consequences of qualification. If the General Partner were to fail to qualify as a REIT in any taxable year, it would have the following effects:

• | The General Partner would not be allowed a deduction for dividends distributed to shareholders and would be subject to federal corporate income tax (and any applicable state and local income taxes) on its taxable income at regular corporate income tax rates; |

• | Unless the General Partner was entitled to relief under certain statutory provisions, it would be disqualified from treatment as a REIT for the four taxable years following the year during which it ceased to qualify as a REIT; |

• | The General Partner's net earnings available for investment or distribution to its shareholders would decrease due to the additional tax liability for the year or years involved; and |

• | The General Partner would no longer be required to make any distributions to shareholders in order to qualify as a REIT. |

As such, the General Partner's failure to qualify as a REIT would likely have a significant adverse effect on the value of the General Partner's securities and, consequently, the Partnership's Units.

REIT distribution requirements limit the amount of cash we have available for other business purposes, including amounts that we need to fund our future capital needs.

To maintain its qualification as a REIT under the Code, the General Partner must annually distribute to its shareholders at least 90% of its REIT taxable income, determined without regard to the dividends-paid deduction and excluding net capital gains. The General Partner intends to continue to make distributions to its shareholders to comply with the 90% distribution requirement. However, this requirement limits our ability to accumulate capital for use for other business purposes. If we do not have sufficient cash or other liquid assets to meet the distribution requirements of the General Partner, we may have to borrow funds or sell properties on adverse terms in order to meet the distribution requirements. If the General Partner fails to satisfy the distribution requirement, it would cease to qualify as a REIT.

U.S. federal income tax treatment of REITs and investments in REITs may change in a manner that could adversely affect us or shareholders.

Legislative, regulatory or administrative changes could be enacted or promulgated at any time, either prospectively or with retroactive effect, and may adversely affect us and/or shareholders.

We are subject to certain provisions that could discourage change-of-control transactions, which may reduce the likelihood of the General Partner's shareholders receiving a control premium for their shares.

Indiana anti-takeover legislation and certain provisions in our governing documents, as we discuss below, may discourage potential acquirers from pursuing a change-of-control transaction with us. As a result, the General Partner's shareholders may be less likely to receive a control premium for their shares.

Ownership Restriction. Subject to certain exceptions, the General Partner's charter provides that no person or entity may beneficially own, or be deemed to own by virtue of the applicable constructive ownership provisions of the Code, more than 9.8% (in value or by number of shares, whichever is more restrictive) of the General Partner's outstanding common stock or 9.8% in value of its outstanding stock.

-12-

Unissued Preferred Stock. The General Partner's charter permits its board of directors to classify unissued preferred stock by setting the rights and preferences of the shares at the time of issuance. This power enables the General Partner's board to adopt a shareholder rights plan, also known as a poison pill. Although the General Partner has repealed its previously existing poison pill and its current board of directors has adopted a policy not to adopt a shareholder rights plan without shareholder approval, the General Partner's board can change this policy at any time. The adoption of a poison pill would discourage a potential bidder from acquiring a significant position in the General Partner without the approval of its board.

Business-Combination Provisions of Indiana Law. The General Partner has not opted out of the business-combination provisions of the Indiana Business Corporation Law. As a result, potential bidders may have to negotiate with the General Partner's board of directors before acquiring 10% of its stock. Without securing board approval of the proposed business combination before crossing the 10% ownership threshold, a bidder would not be permitted to complete a business combination for five years after becoming a 10% shareholder. Even after the five-year period, a business combination with the significant shareholder would either be required to meet certain per share price minimums as set forth in the Indiana Business Corporation Law or to receive the approval of a majority of the disinterested shareholders.

Control-Share-Acquisition Provisions of Indiana Law. The General Partner has not opted out of the provisions of the Indiana Business Corporation Law regarding acquisitions of control shares. Therefore, those who acquire a significant block (at least 20%) of the General Partner's shares may only vote a portion of their shares unless its other shareholders vote to accord full voting rights to the acquiring person. Moreover, if the other shareholders vote to give full voting rights with respect to the control shares and the acquiring person has acquired a majority of the General Partner's outstanding shares, the other shareholders would be entitled to special dissenters' rights.

Supermajority Voting Provisions. The General Partner's charter prohibits business combinations or significant disposition transactions with a holder of 10% of its shares unless:

• | The holders of 80% of the General Partner's outstanding shares of capital stock approve the transaction; |

• | The transaction has been approved by three-fourths of those directors who served on the General Partner's board before the shareholder became a 10% owner; or |

• | The significant shareholder complies with the "fair price" provisions of the General Partner's charter. |

Among the transactions with large shareholders requiring the supermajority shareholder approval are dispositions of assets with a value greater than or equal to $1,000,000 and business combinations.

Operating Partnership Provisions. The limited partnership agreement of the Partnership contains provisions that could discourage change-of-control transactions, including a requirement that holders of at least 90% of the outstanding Common Units approve:

• | Any voluntary sale, exchange, merger, consolidation or other disposition of all or substantially all of the assets of the Partnership in one or more transactions other than a disposition occurring upon a financing or refinancing of the Partnership; |

• | The General Partner's merger, consolidation or other business combination with another entity unless after the transaction substantially all of the assets of the surviving entity are contributed to the Partnership in exchange for Common Units; |

• | The General Partner's assignment of its interests in the Partnership other than to one of its wholly owned subsidiaries; and |

• | Any reclassification or recapitalization or change of outstanding shares of the General Partner's common stock other than certain changes in par value, stock splits, stock dividends or combinations. |

-13-

We are dependent on key personnel.

The General Partner's executive officers and other senior officers have a significant role in the success of our Company. Our ability to retain our management group or to attract suitable replacements should any members of the management group leave our Company is dependent on the competitive nature of the employment market. The loss of services from key members of the management group or a limitation in their availability could adversely impact our financial condition and cash flow. Further, such a loss could be negatively perceived in the capital markets.

Item 1B. Unresolved Staff Comments

We have no unresolved comments with the SEC staff regarding our periodic or current reports under the Exchange Act.

-14-

Item 2. Properties

Product Review

As of December 31, 2019, we own interests in 519 primarily industrial properties encompassing 155.3 million net rentable square feet (including 38 unconsolidated joint venture in-service properties with 11.0 million square feet, 21 consolidated properties under development with 8.7 million square feet and one unconsolidated joint venture property under development with 133,000 square feet).

Industrial Properties: We own interests in 516 industrial properties encompassing 155.1 million square feet (99.9% of our total square feet). These properties are primarily logistics facilities with clear ceiling heights of 28 feet or more.

Non-reportable: We own interests in three Non-Reportable buildings totaling 211,000 square feet (0.1% of our total square feet).

See Consolidated Financial Statement Schedule III - Real Estate Properties and Accumulated Depreciation for a detailed listing of the Company’s properties and related encumbrances.

Land: We own, including through ownership interests in unconsolidated joint ventures (with acreage not adjusted for our percentage ownership interest), 1,380 acres of land and control an additional 1,000 acres through purchase options. Approximately 700 acres of the 860 acres of land that we directly own, are intended to be used for the development of industrial properties and can support approximately 10.8 million square feet of industrial developments. All of our approximately 520 acres of land held by unconsolidated joint ventures, are also intended to be used for the development of industrial properties. We directly own approximately 160 acres of land that we do not consider strategic and that will be sold to the extent that market conditions permit us to achieve what we believe to be acceptable sale prices.

Property Descriptions

The following tables represent the geographic highlights of consolidated and unconsolidated joint venture in-service properties in our primary markets.

-15-

Consolidated Properties

Square Feet | Annual Net Effective Rent (1) | Annual Net Effective Rent per Square Foot (2) | Percent of Annual Net Effective Rent | ||||||||||||||||||||||

Industrial | Non-Reportable | Overall | Percent of Overall | ||||||||||||||||||||||

Primary Market | |||||||||||||||||||||||||

Chicago | 14,911,460 | — | 14,911,460 | 11.0 | % | $ | 65,496,179 | $ | 4.44 | 10.0 | % | ||||||||||||||

Southern California | 10,449,657 | — | 10,449,657 | 7.7 | % | 64,590,310 | 6.30 | 9.8 | % | ||||||||||||||||

South Florida | 8,364,203 | — | 8,364,203 | 6.2 | % | 64,017,309 | 7.72 | 9.7 | % | ||||||||||||||||

New Jersey | 5,733,983 | — | 5,733,983 | 4.2 | % | 50,835,890 | 8.87 | 7.7 | % | ||||||||||||||||

Atlanta | 12,260,856 | — | 12,260,856 | 9.1 | % | 46,034,396 | 4.01 | 7.0 | % | ||||||||||||||||

Dallas | 10,732,386 | — | 10,732,386 | 7.9 | % | 38,442,503 | 3.74 | 5.8 | % | ||||||||||||||||

Indianapolis | 10,401,828 | — | 10,401,828 | 7.7 | % | 34,255,096 | 3.32 | 5.2 | % | ||||||||||||||||

Houston | 6,579,110 | — | 6,579,110 | 4.9 | % | 31,836,803 | 5.12 | 4.8 | % | ||||||||||||||||

Cincinnati | 9,114,047 | 91,843 | 9,205,890 | 6.8 | % | 31,274,829 | 3.74 | 4.8 | % | ||||||||||||||||

Savannah | 6,998,616 | — | 6,998,616 | 5.2 | % | 29,607,648 | 4.23 | 4.5 | % | ||||||||||||||||

Minneapolis-St. Paul | 5,143,303 | — | 5,143,303 | 3.8 | % | 26,375,585 | 5.28 | 4.0 | % | ||||||||||||||||

Pennsylvania | 5,486,824 | — | 5,486,824 | 4.0 | % | 25,048,592 | 5.58 | 3.8 | % | ||||||||||||||||

St. Louis | 5,721,945 | — | 5,721,945 | 4.2 | % | 23,797,667 | 4.16 | 3.6 | % | ||||||||||||||||

DC-Baltimore | 3,100,696 | — | 3,100,696 | 2.3 | % | 21,487,777 | 6.93 | 3.3 | % | ||||||||||||||||

Central Florida | 4,224,815 | — | 4,224,815 | 3.1 | % | 21,417,767 | 5.29 | 3.2 | % | ||||||||||||||||

Columbus | 5,319,877 | — | 5,319,877 | 3.9 | % | 19,535,183 | 3.67 | 3.0 | % | ||||||||||||||||

Nashville | 3,645,368 | — | 3,645,368 | 2.7 | % | 18,370,335 | 5.41 | 2.8 | % | ||||||||||||||||

Raleigh | 2,909,746 | — | 2,909,746 | 2.1 | % | 17,759,281 | 6.12 | 2.7 | % | ||||||||||||||||

Seattle | 1,876,360 | — | 1,876,360 | 1.4 | % | 13,749,070 | 7.33 | 2.1 | % | ||||||||||||||||

Northern California | 2,264,943 | — | 2,264,943 | 1.7 | % | 11,027,895 | 4.87 | 1.7 | % | ||||||||||||||||

Other (3) | — | 119,030 | 119,030 | 0.1 | % | 3,487,188 | 29.30 | 0.5 | % | ||||||||||||||||

Total | 135,240,023 | 210,873 | 135,450,896 | 100.0 | % | $ | 658,447,303 | $ | 5.03 | 100.0 | % | ||||||||||||||

Percent of Overall | 99.8 | % | 0.2 | % | 100.0 | % | |||||||||||||||||||

Annual Net Effective Rent per Square Foot (2) | $ | 5.00 | $ | 24.29 | $ | 5.03 | |||||||||||||||||||

-16-

Unconsolidated Joint Venture Properties

Square Feet | Annual Net Effective Rent (1) | Annual Net Effective Rent per Square Foot (2) | Percent of Annual Net Effective Rent | ||||||||||||||

Industrial | Percent of Overall | ||||||||||||||||

Primary Market | |||||||||||||||||

Dallas | 6,047,818 | 55.1 | % | $ | 26,504,046 | $ | 4.38 | 59.6 | % | ||||||||

Indianapolis | 4,717,050 | 43.0 | % | 17,045,673 | 3.95 | 38.4 | % | ||||||||||

Cincinnati | 57,886 | 0.5 | % | 398,667 | 6.89 | 0.9 | % | ||||||||||

Other (3) | 152,944 | 1.4 | % | 502,874 | 3.29 | 1.1 | % | ||||||||||

Total | 10,975,698 | 100.0 | % | $ | 44,451,260 | $ | 4.21 | 100.0 | % | ||||||||

Percent of Overall | 100.0 | % | |||||||||||||||

Annual Net Effective Rent per Square Foot (2) | $ | 4.21 | |||||||||||||||

Occupancy % | ||||||||||||||

Consolidated Properties | Unconsolidated Properties | |||||||||||||

Industrial | Non-Reportable | Overall | Industrial | Overall | ||||||||||

Primary Market | ||||||||||||||

Chicago | 99.0 | % | — | 99.0 | % | — | — | |||||||

Southern California | 98.1 | % | — | 98.1 | % | — | — | |||||||

South Florida | 99.2 | % | — | 99.2 | % | — | — | |||||||

New Jersey | 100.0 | % | — | 100.0 | % | — | — | |||||||

Atlanta | 93.6 | % | — | 93.6 | % | — | — | |||||||

Dallas | 95.7 | % | — | 95.7 | % | 100.0 | % | 100.0 | % | |||||

Indianapolis | 99.1 | % | — | 99.1 | % | 91.4 | % | 91.4 | % | |||||

Houston | 94.5 | % | — | 94.5 | % | — | — | |||||||

Cincinnati | 91.2 | % | 55.3 | % | 90.8 | % | 100.0 | % | 100.0 | % | ||||

Savannah | 100.0 | % | — | 100.0 | % | — | — | |||||||

Minneapolis-St. Paul | 97.1 | % | — | 97.1 | % | — | — | |||||||

Pennsylvania | 81.9 | % | — | 81.9 | % | — | — | |||||||

St. Louis | 100.0 | % | — | 100.0 | % | — | — | |||||||

DC-Baltimore | 100.0 | % | — | 100.0 | % | — | — | |||||||

Central Florida | 95.9 | % | — | 95.9 | % | — | — | |||||||

Columbus | 100.0 | % | — | 100.0 | % | — | — | |||||||

Nashville | 93.1 | % | — | 93.1 | % | — | — | |||||||

Raleigh | 99.7 | % | — | 99.7 | % | — | — | |||||||

Seattle | 100.0 | % | — | 100.0 | % | — | — | |||||||

Northern California | 100.0 | % | — | 100.0 | % | — | — | |||||||

Other (3) | — | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | |||||

Total | 96.7 | % | 80.5 | % | 96.6 | % | 96.3 | % | 96.3 | % | ||||

(1) | Represents the average annual base rental payments, on a straight-line basis for the term of each lease, from space leased to tenants as of December 31, 2019, excluding amounts paid by tenants as reimbursement for operating expenses. Unconsolidated joint venture properties are shown at 100% of square feet and net effective rents, without regard to our ownership percentage. |

(2) | Annual net effective rent per leased square foot. |

(3) | Represents properties not located in our primary markets. |

-17-

Item 3. Legal Proceedings

We are not subject to any pending legal proceedings, other than routine litigation arising in the ordinary course of business. We do not expect these legal proceedings to have a material adverse effect on our financial condition, results of operations, or liquidity.

Item 4. Mine Safety Disclosures

Not applicable.

-18-

PART II

Item 5. Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information and Holders

The General Partner's common stock is listed for trading on the NYSE under the symbol "DRE." There is no established trading market for the Partnership's Common Units. As of February 20, 2020, there were 4,872 record holders of the General Partner's common stock and 83 record holders of the Partnership's Common Units.

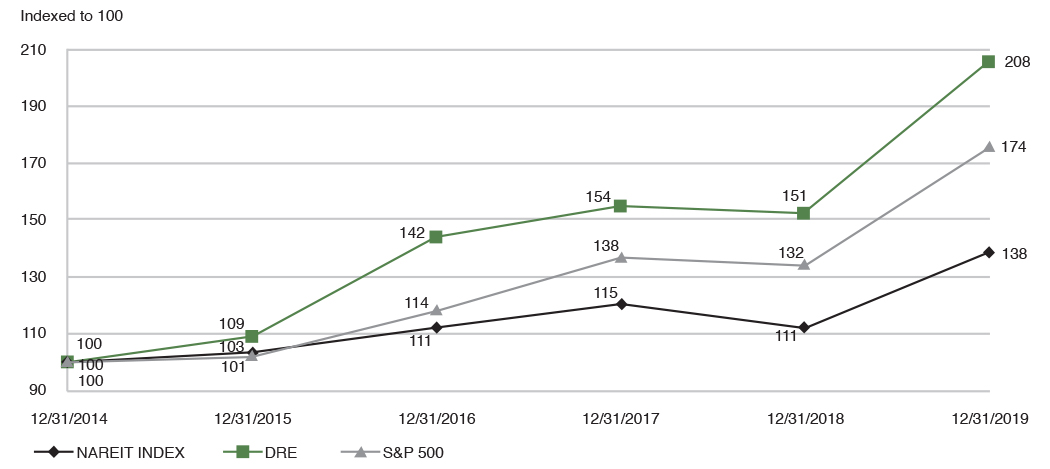

Stock Performance Graph

The following line graph compares the change in the General Partner's cumulative total shareholders' return on shares of its common stock to the cumulative total return of the Standard and Poor's 500 Stock Index ("S&P 500") and the FTSE NAREIT Equity REITs Index ("NAREIT Index") from December 31, 2014 to December 31, 2019. The graph assumes an initial investment of $100 in the common stock of the General Partner and each of the indices on December 31, 2014, and the reinvestment of all dividends. The performance graph is not necessarily indicative of future performance.

This graph and the accompanying text are not “soliciting material,” are not deemed filed with the SEC and are not to be incorporated by reference in any filing by the company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

Tax Characterization of Dividends

A summary of the tax characterization of the dividends paid per common share of the General Partner for the years ended December 31, 2019, 2018 and 2017 follows:

2019 | 2018 | 2017 | |||||||||

Dividends paid per share | $ | 0.88 | $ | 0.815 | $ | 0.77 | |||||

Dividends paid per share - special | — | — | 0.85 | ||||||||

Total Dividends paid per share | $ | 0.88 | $ | 0.815 | $ | 1.62 | |||||

Ordinary income | 80.7 | % | 78.4 | % | 23.7 | % | |||||

Capital gains | 19.3 | % | 21.6 | % | 76.3 | % | |||||

100.0 | % | 100.0 | % | 100.0 | % | ||||||

-19-

Sales of Unregistered Securities

The General Partner did not sell any of its securities during the year ended December 31, 2019 that were not registered under the Securities Act.

Issuer Purchases of Equity Securities

From time to time, we may repurchase our securities under a repurchase program that initially was approved by the General Partner's board of directors and publicly announced in October 2001 (the "Repurchase Program").

During 2019 we did not repurchase any equity securities under the Repurchase Program.

On January 29, 2020 the General Partner's board of directors adopted a resolution that amended and restated the Repurchase Program and delegated authority to management to repurchase a maximum of $300.0 million of the General Partner's common shares, $750.0 million of the Partnership's debt securities and $500.0 million of the General Partner's preferred shares, subject to the prior notification of the Chairperson of the finance committee of the board of directors of planned repurchases within these limits.

-20-

Item 6. Selected Financial Data

The following table sets forth selected financial and operating information on a historical basis for each of the years in the five-year period ended December 31, 2019. The following information should be read in conjunction with Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" and Item 8, "Financial Statements and Supplementary Data" included in this Form 10-K (in thousands, except per share or per Common Unit data):

2019 | 2018 | 2017 | 2016 | 2015 | |||||||||||||||

Results of Operations: | |||||||||||||||||||

General Partner and Partnership | |||||||||||||||||||

Revenues: | |||||||||||||||||||

Rental and related revenue from continuing operations | $ | 855,833 | $ | 785,319 | $ | 686,514 | $ | 641,701 | $ | 658,809 | |||||||||

General contractor and service fee revenue | 117,926 | 162,551 | 94,420 | 88,810 | 133,367 | ||||||||||||||

Total revenues from continuing operations | $ | 973,759 | $ | 947,870 | $ | 780,934 | $ | 730,511 | $ | 792,176 | |||||||||

Income from continuing operations | $ | 432,199 | $ | 383,368 | $ | 290,592 | $ | 298,421 | $ | 188,248 | |||||||||

General Partner | |||||||||||||||||||

Net income attributable to common shareholders | $ | 428,972 | $ | 383,729 | $ | 1,634,431 | $ | 312,143 | $ | 615,310 | |||||||||

Partnership | |||||||||||||||||||

Net income attributable to common unitholders | $ | 432,650 | $ | 387,257 | $ | 1,649,607 | $ | 315,232 | $ | 621,714 | |||||||||

General Partner | |||||||||||||||||||

Per Share Data: | |||||||||||||||||||

Basic income per common share: | |||||||||||||||||||

Continuing operations | $ | 1.18 | $ | 1.06 | $ | 0.80 | $ | 0.84 | $ | 0.53 | |||||||||

Discontinued operations | — | 0.01 | 3.78 | 0.05 | 1.24 | ||||||||||||||

Diluted income per common share: | |||||||||||||||||||

Continuing operations | 1.18 | 1.06 | 0.80 | 0.84 | 0.53 | ||||||||||||||

Discontinued operations | — | 0.01 | 3.76 | 0.04 | 1.24 | ||||||||||||||

Distributions paid per common share | $ | 0.88 | $ | 0.815 | $ | 0.77 | $ | 0.73 | $ | 0.69 | |||||||||

Distributions paid per common share - special | $ | — | $ | — | $ | 0.85 | $ | — | $ | 0.20 | |||||||||

Weighted average common shares outstanding | 362,234 | 357,569 | 355,762 | 349,942 | 345,057 | ||||||||||||||

Weighted average common shares and potential dilutive securities | 367,339 | 363,297 | 362,011 | 357,076 | 352,197 | ||||||||||||||

Balance Sheet Data (at December 31): | |||||||||||||||||||

Total Assets | $ | 8,420,562 | $ | 7,804,024 | $ | 7,388,196 | $ | 6,772,002 | $ | 6,895,515 | |||||||||

Total Debt | 2,914,765 | 2,658,501 | 2,422,891 | 2,908,477 | 3,320,141 | ||||||||||||||

Total Shareholders' Equity | 5,018,115 | 4,658,201 | 4,532,844 | 3,465,818 | 3,181,932 | ||||||||||||||

Total Common Shares Outstanding | 367,950 | 358,851 | 356,361 | 354,756 | 345,285 | ||||||||||||||

Other Data: | |||||||||||||||||||

Funds from Operations attributable to common shareholders (1) | $ | 510,480 | $ | 484,003 | $ | 447,001 | $ | 416,370 | $ | 307,331 | |||||||||

Partnership | |||||||||||||||||||

Per Unit Data: | |||||||||||||||||||

Basic income per Common Unit: | |||||||||||||||||||

Continuing operations | $ | 1.18 | $ | 1.06 | $ | 0.80 | $ | 0.84 | $ | 0.53 | |||||||||

Discontinued operations | — | 0.01 | 3.78 | 0.05 | 1.24 | ||||||||||||||

Diluted income per Common Unit: | |||||||||||||||||||

Continuing operations | 1.18 | 1.06 | 0.80 | 0.84 | 0.53 | ||||||||||||||

Discontinued operations | — | 0.01 | 3.76 | 0.04 | 1.24 | ||||||||||||||

Distributions paid per Common Unit | $ | 0.88 | $ | 0.815 | $ | 0.77 | $ | 0.73 | $ | 0.69 | |||||||||

Distributions paid per Common Unit - special | $ | — | $ | — | $ | 0.85 | $ | — | $ | 0.20 | |||||||||

Weighted average Common Units outstanding | 365,352 | 360,859 | 359,065 | 353,423 | 348,639 | ||||||||||||||

Weighted average Common Units and potential dilutive securities | 367,339 | 363,297 | 362,011 | 357,076 | 352,197 | ||||||||||||||

Balance Sheet Data (at December 31): | |||||||||||||||||||

Total Assets | $ | 8,420,562 | $ | 7,804,024 | $ | 7,388,196 | $ | 6,772,002 | $ | 6,895,515 | |||||||||

Total Debt | 2,914,765 | 2,658,501 | 2,422,891 | 2,908,477 | 3,320,141 | ||||||||||||||

Total Partners' Equity | 5,075,690 | 4,708,786 | 4,573,407 | 3,490,509 | 3,201,964 | ||||||||||||||

Total Common Units Outstanding | 370,979 | 361,771 | 359,644 | 358,164 | 348,772 | ||||||||||||||

Other Data: | |||||||||||||||||||

Funds from Operations attributable to common unitholders (1) | $ | 514,860 | $ | 488,454 | $ | 451,154 | $ | 420,496 | $ | 310,538 | |||||||||

(1) Funds from operations ("FFO") is a non-GAAP measure used in the real estate industry and is computed in accordance with standards established by the National Association of Real Estate Investment Trusts ("NAREIT"). In addition to net income (loss) computed in accordance with GAAP, we assess and measure the overall operating results of the General Partner and the Partnership based upon NAREIT FFO, which management believes is a useful indicator of consolidated operating performance. NAREIT FFO is also used by industry analysts and investors as a supplemental operating performance measure of a REIT.

-21-

NAREIT FFO is calculated as net income (loss) in accordance with GAAP excluding depreciation and amortization related to real estate, gains and losses on sales of real estate assets (including real estate assets incidental to our business) and related taxes, gains and losses from change in control, impairment charges related to real estate assets (including real estate assets incidental to our business) and similar adjustments for unconsolidated partnerships and joint ventures.

The most comparable GAAP measure is net income (loss) attributable to common shareholders or common unitholders. NAREIT FFO attributable to common shareholders or common unitholders should not be considered as a substitute for net income (loss) attributable to common shareholders or common unitholders or any other measures derived in accordance with GAAP and may not be comparable to other similarly titled measures of other companies. Historical cost accounting for real estate assets in accordance with GAAP implicitly assumes that the value of real estate assets diminishes predictably over time. Since real estate values instead have historically risen or fallen with market conditions, many industry analysts and investors have considered presentation of operating results for real estate companies that use historical cost accounting to be insufficient by themselves. Management believes that the use of NAREIT FFO attributable to common shareholders or common unitholders, combined with net income (which remains the primary measure of performance), improves the understanding of operating results of REITs among the investing public and makes comparisons of REIT operating results more meaningful. Management believes that the use of NAREIT FFO as a performance measure enables investors and analysts to readily identify the operating results of the long-term assets that form the core of a REIT's activity and assist them in comparing these operating results between periods or between different companies.

See a reconciliation of NAREIT FFO to net income attributable to common shareholders under "Year in Review" under Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations." NAREIT-defined reconciling items between net income and NAREIT FFO totaled $104,227 and $(307,979) for the General Partner, and $105,264 and $(311,176) for the Partnership, in 2016 and 2015, respectively.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

Business Overview

The General Partner and Partnership collectively specialize in the ownership, management and development of industrial real estate.

The General Partner is a self-administered and self-managed REIT that began operations in 1986 and is the sole general partner of the Partnership. The Partnership is a limited partnership formed in 1993, at which time all of the properties and related assets and liabilities of the General Partner, as well as proceeds from a secondary offering of the General Partner's common shares, were contributed to the Partnership. Simultaneously, the Partnership completed the acquisition of Duke Associates, a full-service commercial real estate firm operating in the Midwest whose operations began in 1972. We operate the General Partner and the Partnership as one enterprise, and therefore, our discussion and analysis refers to the General Partner and its consolidated subsidiaries, including the Partnership, collectively.

At December 31, 2019, we:

• | Owned or jointly controlled 519 primarily industrial properties, of which 497 properties with 146.4 million square feet were in service and 22 properties with 8.9 million square feet were under development. The 497 in-service properties were comprised of 459 consolidated properties with 135.5 million square feet and 38 unconsolidated joint venture properties with 11.0 million square feet. The 22 properties under development consisted of 21 consolidated properties with 8.7 million square feet and one unconsolidated joint venture property with 133,000 square feet. |

• | Owned directly, or through ownership interests in unconsolidated joint ventures (with acreage not adjusted for our percentage ownership interest), approximately 1,380 acres of land and controlled approximately 1,000 acres through purchase options. |

Our overall strategy is to continue to increase our investment in quality industrial properties primarily through development, on both a speculative and build-to-suit basis, supplemented with acquisitions in higher barrier markets with the highest growth potential.

Operational Strategy

Our operational focus is to drive profitability by maximizing cash from operations as well as NAREIT FFO through (i) maintaining property occupancy and increasing rental rates, while also keeping lease-related capital costs contained, by effectively managing our portfolio of existing properties; (ii) selectively developing new build-to-suit, substantially pre-leased and, in select markets, speculative development projects; and (iii) providing a full line of real estate services to our tenants and to third parties.

-22-

Asset Strategy