Management's Discussion and Analysis (“MD&A”)

Quarterly Report on the Second Quarter of 2023

This portion of the Quarterly Report provides management’s discussion and analysis (“MD&A”) of the financial condition and results of operations, to enable a reader to assess material changes in financial condition and results of operations as at, and for the three and six month periods ended June 30, 2023, in comparison to the corresponding prior-year periods. The MD&A is intended to help the reader understand Barrick Gold Corporation (“Barrick”, “we”, “our”, the “Company” or the “Group”), our operations, financial performance as well as our present and future business environment. This MD&A, which has been prepared as of August 7, 2023, is intended to supplement and complement the condensed unaudited interim consolidated financial statements and notes thereto, prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board (“IASB”), including International Accounting Standard 34 Interim Financial Reporting (“IAS 34”), for the three and six month periods ended June 30, 2023 (collectively, the “Financial Statements”), which are included in this Quarterly Report on pages 85 to 89. You are encouraged to review the Financial Statements in conjunction with your review of this MD&A. This MD&A should be read in conjunction with both the

annual audited consolidated financial statements for the two years ended December 31, 2022, the related annual MD&A included in the 2022 Annual Report, and the most recent Form 40–F/Annual Information Form on file with the U.S. Securities and Exchange Commission (“SEC”) and Canadian provincial securities regulatory authorities. These documents and additional information relating to the Company are available on SEDAR at www.sedar.com and EDGAR at www.sec.gov. Certain notes to the Financial Statements are specifically referred to in this MD&A and such notes are incorporated by reference herein. All dollar amounts in this MD&A are in millions of United States dollars (“$” or “US$”), unless otherwise specified.

For the purposes of preparing our MD&A, we consider the materiality of information. Information is considered material if: (i) such information results in, or would reasonably be expected to result in, a significant change in the market price or value of our shares; (ii) there is a substantial likelihood that a reasonable investor would consider it important in making an investment decision; or (iii) it would significantly alter the total mix of information available to investors. We evaluate materiality with reference to all relevant circumstances, including potential market sensitivity.

Abbreviations

|

|

|

|

|

|

|

|

| BAP |

Biodiversity Action Plans |

|

|

| BLM |

Bureau of Land Management |

| BMSZ |

Bambadji Main Shear Zone |

| BNL |

Barrick Niugini Limited |

|

|

| CDCs |

Community Development Committees |

| CHUG |

Cortez Hills Underground |

|

|

| CIL |

Carbon-in-leach |

| Commencement Agreement |

Detailed Porgera Project Commencement Agreement between PNG and BNL |

|

|

|

|

|

|

|

|

| DRC |

Democratic Republic of Congo |

| DOI |

Department of the Interior |

| E&S Committee |

Environmental and Social Oversight Committee |

|

|

|

|

|

|

|

|

| ESG |

Environmental, Social and Governance |

| ESG & Nominating Committee |

Environmental, Social, Governance & Nominating Committee |

| ESIA |

Environmental and Social Impact Assessment |

|

|

|

|

| FEIS |

Final Environmental Impact Statement |

|

|

| GHG |

Greenhouse Gas |

| GISTM |

Global Industry Standard for Tailings Management |

| GoT |

Government of Tanzania |

|

|

| IASB |

International Accounting Standards Board |

| ICMM |

International Council on Mining and Metals |

| IFRS |

International Financial Reporting Standards |

|

|

|

|

|

|

| IRC |

Internal Revenue Commission |

| ISSB |

International Sustainability Standards Board |

| KCD |

Karagba, Chauffeur and Durba |

|

|

|

|

|

|

| Kumul Minerals |

Kumul Minerals Holdings Limited |

|

|

|

|

|

|

|

|

| LTI |

Lost Time Injury |

| LTIFR |

Lost Time Injury Frequency Rate |

|

|

| MRE |

Mineral Resources Enga Limited |

|

|

|

|

| MVA |

Megavolt-amperes |

| MW |

Megawatt |

| NOA |

Notice of Availability |

| NGM |

Nevada Gold Mines |

| NSR |

Net Smelter Return |

| OECD |

Organisation for Economic Co-operation and Development |

|

|

| PFS |

Prefeasibility Study |

| PNG |

Papua New Guinea |

|

|

| Randgold |

Randgold Resources Limited |

| RC |

Reverse Circulation |

| RIL |

Resin-in-leach |

| ROD |

Record of Decision |

| Roundtable |

Environmental, Social and Governance Raters Roundtable |

| SDG |

Sustainable Development Goals |

| SML |

Special Mining Lease |

| TCFD |

Task Force for Climate-related Financial Disclosures |

| TRIFR |

Total Recordable Injury Frequency Rate |

| TSF |

Tailings Storage Facilities |

| TW |

True Width |

|

|

|

|

|

|

|

|

| WGC |

World Gold Council |

| WTI |

West Texas Intermediate |

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2023 |

1 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Cautionary Statement on Forward-Looking Information

Certain information contained or incorporated by reference in this MD&A, including any information as to our strategy, projects, plans or future financial or operating performance, constitutes “forward-looking statements”. All statements, other than statements of historical fact, are forward-looking statements. The words “believe”, “expect”, “anticipated”, “vision”, “aim”, “strategy”, “target”, “plan”, “opportunities”, “guidance”, “forecast”, “outlook”, “objective”, “intend”, “project”, “pursue”, “progress”, “continue”, “committed”, “budget”, “estimate”, “potential”, “prospective”, “future”, “focus”, “during”, “ongoing”, “following”, “subject to”, “scheduled”, “may”, “will”, “can”, “could”, “would”, “should” and similar expressions identify forward-looking statements. In particular, this MD&A contains forward-looking statements including, without limitation, with respect to: Barrick’s forward-looking production guidance; estimates of future cost of sales per ounce for gold and per pound for copper, total cash costs per ounce and C1 cash costs per pound, and all-in-sustaining costs per ounce/pound; cash flow forecasts; projected capital, operating and exploration expenditures; the share buyback program and performance dividend policy, including the criteria for dividend payments; mine life and production rates; projected capital estimates and anticipated permitting timelines related to the Goldrush Project; our plans and expected completion and benefits of our growth and capital projects, including the Goldrush Project and expected timing for commercial production, Fourmile, Pueblo Viejo plant expansion and mine life extension project, including expected timing for changes to the estimated capital costs of that facility and the completion of the feasibility study, the Reko Diq project, solar power projects at NGM and Loulo-Gounkoto, the Jabal Sayid Lode 1 project and new mobile equipment fleet at Lumwana; the planned updating of the historical Reko Diq feasibility study and targeted first production; the potential for Lumwana to extend its life of mine through the development of a Super Pit; capital expenditures related to upgrades and ongoing management initiatives; our ability to identify new Tier One assets and the potential for existing assets to attain Tier One status; Barrick’s global exploration strategy and planned exploration activities; the timeline for execution and effectiveness of definitive agreements to implement the Commencement Agreement between PNG and BNL; the duration of the temporary suspension of operations at Porgera, the conditions for the reopening of the mine and the timeline to recommence operations; our pipeline of high confidence projects at or near existing operations; potential mineralization and metal or mineral recoveries; our ability to convert resources into reserves; asset sales, joint ventures and partnerships; Barrick’s strategy, plans and targets in respect of environmental and social governance issues, including climate change, GHG emissions reduction targets (including with respect to our Scope 3 emissions), safety performance, responsible water use, TSF management, community development, biodiversity and human rights initiatives; and expectations regarding future price assumptions, financial performance and other outlook or guidance.

Forward-looking statements are necessarily based upon a number of estimates and assumptions including material estimates and assumptions related to the factors set forth below that, while considered reasonable by the

Company as at the date of this MD&A in light of management’s experience and perception of current conditions and expected developments, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements and undue reliance should not be placed on such statements and information. Such factors include, but are not limited to: fluctuations in the spot and forward price of gold, copper or certain other commodities (such as silver, diesel fuel, natural gas and electricity); risks associated with projects in the early stages of evaluation and for which additional engineering and other analysis is required; risks related to the possibility that future exploration results will not be consistent with the Company’s expectations, that quantities or grades of reserves will be diminished, and that resources may not be converted to reserves; risks associated with the fact that certain of the initiatives described in this MD&A are still in the early stages and may not materialize; changes in mineral production performance, exploitation and exploration successes; risks that exploration data may be incomplete and considerable additional work may be required to complete further evaluation, including but not limited to drilling, engineering and socioeconomic studies and investment; the speculative nature of mineral exploration and development; lack of certainty with respect to foreign legal systems, corruption and other factors that are inconsistent with the rule of law; changes in national and local government legislation, taxation, controls or regulations and/or changes in the administration of laws, policies and practices; the potential impact of proposed changes to Chilean law on the status of value added tax refunds received in Chile in connection with the development of the Pascua-Lama project; expropriation or nationalization of property and political or economic developments in Canada, the United States or other countries in which Barrick does or may carry on business in the future; risks relating to political instability in certain of the jurisdictions in which Barrick operates; timing of receipt of, or failure to comply with, necessary permits and approvals, including the issuance of a ROD for the Goldrush Project and/or whether the Goldrush Project will be permitted to advance as currently designed under its Feasibility Study, the environmental license for the construction and operation of the El Naranjo tailings storage facility for Pueblo Viejo, and permitting activities required to optimize Long Canyon’s life of mine; non-renewal of key licenses by governmental authorities, including the new SML for Porgera; failure to comply with environmental and health and safety laws and regulations; increased costs and physical and transition risks related to climate change, including extreme weather events, resource shortages, emerging policies and increased regulations relating to related to greenhouse gas emission levels, energy efficiency and reporting of risks; contests over title to properties, particularly title to undeveloped properties, or over access to water, power and other required infrastructure; the liability associated with risks and hazards in the mining industry, and the ability to maintain insurance to cover such losses; damage to the Company’s reputation due to the actual or perceived occurrence of any number of

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2023 |

2 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

events, including negative publicity with respect to the Company’s handling of environmental matters or dealings with community groups, whether true or not; risks related to operations near communities that may regard Barrick’s operations as being detrimental to them; litigation and legal and administrative proceedings; operating or technical difficulties in connection with mining or development activities, including geotechnical challenges, tailings dam and storage facilities failures, and disruptions in the maintenance or provision of required infrastructure and information technology systems; increased costs, delays, suspensions and technical challenges associated with the construction of capital projects; risks associated with working with partners in jointly controlled assets; risks related to disruption of supply routes which may cause delays in construction and mining activities, including disruptions in the supply of key mining inputs due to the invasion of Ukraine by Russia; risk of loss due to acts of war, terrorism, sabotage and civil disturbances; risks associated with artisanal and illegal mining; risks associated with Barrick’s infrastructure, information technology systems and the implementation of Barrick’s technological initiatives, including risks related to cyber-attacks, cybersecurity breaches, or similar network or system disruptions; the impact of global liquidity and credit availability on the timing of cash flows and the values of assets and liabilities based on projected future cash flows; the impact of inflation, including global inflationary pressures driven by supply chain disruptions caused by the ongoing Covid-19 pandemic, global energy cost increases following the invasion of Ukraine by Russia and country-specific political and economic factors in Argentina; adverse changes in our credit ratings; fluctuations in the currency markets; changes in U.S. dollar interest rates; risks arising from holding derivative instruments (such as credit risk, market liquidity risk and mark-to-market risk); risks related to the demands placed on the Company’s management, the ability of management to implement its business strategy and enhanced political risk in certain jurisdictions; uncertainty whether some or all of Barrick's targeted investments and projects will meet the Company’s capital allocation objectives and internal hurdle rate; whether

benefits expected from recent transactions are realized; business opportunities that may be presented to, or pursued by, the Company; our ability to successfully integrate acquisitions or complete divestitures; risks related to competition in the mining industry; employee relations including loss of key employees; availability and increased costs associated with mining inputs and labor; risks associated with diseases, epidemics and pandemics, including the effects and potential effects of the global Covid-19 pandemic; risks related to the failure of internal controls; and risks related to the impairment of the Company’s goodwill and assets. Barrick also cautions that its 2023 guidance may be impacted by the ongoing business and social disruption caused by the spread of Covid-19.

In addition, there are risks and hazards associated with the business of mineral exploration, development and mining, including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding and gold bullion, copper cathode or gold or copper concentrate losses (and the risk of inadequate insurance, or inability to obtain insurance, to cover these risks).

Many of these uncertainties and contingencies can affect our actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, us. Readers are cautioned that forward-looking statements are not guarantees of future performance. All of the forward-looking statements made in this MD&A are qualified by these cautionary statements. Specific reference is made to the most recent Form 40-F/Annual Information Form on file with the SEC and Canadian provincial securities regulatory authorities for a more detailed discussion of some of the factors underlying forward-looking statements and the risks that may affect Barrick’s ability to achieve the expectations set forth in the forward-looking statements contained in this MD&A. We disclaim any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2023 |

3 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Use of Non-GAAP Financial Measures

We use the following non-GAAP financial measures in our MD&A:

■"adjusted net earnings"

■"free cash flow"

■"EBITDA"

■"adjusted EBITDA"

■"minesite sustaining capital expenditures"

■"project capital expenditures"

■"total cash costs per ounce"

■"C1 cash costs per pound"

■"all-in sustaining costs per ounce/pound"

■"all-in costs per ounce" and

■"realized price"

For a detailed description of each of the non-GAAP financial measures used in this MD&A and a detailed reconciliation to the most directly comparable measure under IFRS, please refer to the Non-GAAP Financial Measures section of this MD&A on pages 58 to 75. Each non-GAAP financial measure has been annotated with a reference to an endnote on page 76. The non-GAAP financial measures set out in this MD&A are intended to provide additional information to investors and do not have any standardized meaning under IFRS, and therefore may not be comparable to other issuers, and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Index

|

|

|

|

|

|

|

|

|

|

Overview |

|

|

|

|

|

Financial and Operating Highlights |

|

|

Key Business Developments |

|

|

Environmental, Social and Governance |

|

|

Outlook |

|

|

Production and Cost Summary |

|

|

|

|

Operating Performance |

|

|

|

|

|

Nevada Gold Mines |

|

|

Carlin |

|

|

Cortez |

|

|

Turquoise Ridge |

|

|

Other Mines - Nevada Gold Mines |

|

|

Pueblo Viejo |

|

|

Loulo-Gounkoto |

|

|

Kibali |

|

|

|

|

|

|

|

|

North Mara |

|

|

Bulyanhulu |

|

|

Other Mines - Gold |

|

|

Lumwana |

|

|

Other Mines - Copper |

|

|

|

|

Growth Projects |

|

|

|

|

Exploration and Mineral Resource Management |

|

|

|

|

Review of Financial Results |

|

|

|

|

|

Revenue |

|

|

Production Costs |

|

|

Capital Expenditures |

|

|

General and Administrative Expenses |

|

|

Exploration, Evaluation and Project Expenses |

|

|

Finance Costs, Net |

|

|

Additional Significant Statement of Income Items |

|

|

Income Tax Expense |

|

|

|

|

Financial Condition Review |

|

|

|

|

|

Balance Sheet Review |

|

|

Shareholders’ Equity |

|

|

Financial Position and Liquidity |

|

|

Summary of Cash Inflow (Outflow) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and Contingencies |

|

|

|

|

Review of Quarterly Results |

|

|

|

|

Internal Control over Financial Reporting and

Disclosure Controls and Procedures |

|

|

|

|

IFRS Critical Accounting Policies and Accounting Estimates |

|

|

|

|

Non-GAAP Financial Measures |

|

|

|

|

Technical Information |

|

|

|

|

Endnotes |

|

|

|

|

Financial Statements |

|

|

|

|

Notes to Consolidated Financial Statements |

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2023 |

4 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Overview

Financial and Operating Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended |

|

For the six months ended |

| |

6/30/23 |

3/31/23 |

% Change |

|

6/30/22 |

% Change |

|

6/30/23 |

6/30/22 |

% Change |

Financial Results ($ millions) |

|

|

|

|

|

|

|

|

|

|

| Revenues |

2,833 |

2,643 |

7 |

% |

|

2,859 |

(1) |

% |

|

5,476 |

5,712 |

(4) |

% |

| Cost of sales |

1,937 |

1,941 |

0 |

% |

|

1,850 |

5 |

% |

|

3,878 |

3,589 |

8 |

% |

Net earningsa |

305 |

120 |

154 |

% |

|

488 |

(38) |

% |

|

425 |

926 |

(54) |

% |

Adjusted net earningsb |

336 |

247 |

36 |

% |

|

419 |

(20) |

% |

|

583 |

882 |

(34) |

% |

Adjusted EBITDAb |

1,368 |

1,183 |

16 |

% |

|

1,527 |

(10) |

% |

|

2,551 |

3,172 |

(20) |

% |

Adjusted EBITDA marginc |

48 |

% |

45 |

% |

7 |

% |

|

53 |

% |

(9) |

% |

|

47 |

% |

56 |

% |

(16) |

% |

Minesite sustaining capital expendituresb,d |

524 |

454 |

15 |

% |

|

523 |

0 |

% |

|

978 |

943 |

4 |

% |

Project capital expendituresb,d |

238 |

226 |

5 |

% |

|

226 |

5 |

% |

|

464 |

412 |

13 |

% |

Total consolidated capital expendituresd,e |

769 |

688 |

12 |

% |

|

755 |

2 |

% |

|

1,457 |

1,366 |

7 |

% |

| Net cash provided by operating activities |

832 |

776 |

7 |

% |

|

924 |

(10) |

% |

|

1,608 |

1,928 |

(17) |

% |

Net cash provided by operating activities marginf |

29 |

% |

29 |

% |

0 |

% |

|

32 |

% |

(9) |

% |

|

29 |

% |

34 |

% |

(15) |

% |

Free cash flowb |

63 |

88 |

(28) |

% |

|

169 |

(63) |

% |

|

151 |

562 |

(73) |

% |

| Net earnings per share (basic and diluted) |

0.17 |

0.07 |

143 |

% |

|

0.27 |

(37) |

% |

|

0.24 |

0.52 |

(54) |

% |

Adjusted net earnings (basic)b per share |

0.19 |

0.14 |

36 |

% |

|

0.24 |

(21) |

% |

|

0.33 |

0.50 |

(34) |

% |

| Weighted average diluted common shares (millions of shares) |

1,755 |

1,755 |

0 |

% |

|

1,777 |

(1) |

% |

|

1,755 |

1,778 |

(1) |

% |

| Operating Results |

|

|

|

|

|

|

|

|

|

|

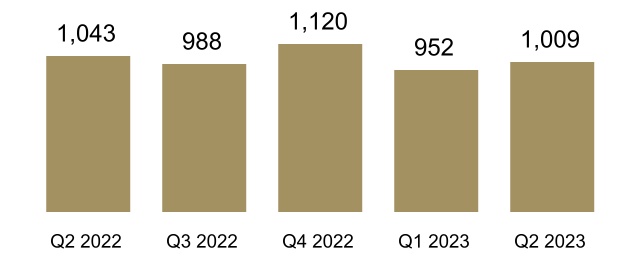

Gold production (thousands of ounces)g |

1,009 |

952 |

6 |

% |

|

1,043 |

(3) |

% |

|

1,961 |

2,033 |

(4) |

% |

Gold sold (thousands of ounces)g |

1,001 |

954 |

5 |

% |

|

1,040 |

(4) |

% |

|

1,955 |

2,033 |

(4) |

% |

| Market gold price ($/oz) |

1,976 |

1,890 |

5 |

% |

|

1,871 |

6 |

% |

|

1,932 |

1,874 |

3 |

% |

Realized gold priceb,g ($/oz) |

1,972 |

1,902 |

4 |

% |

|

1,861 |

6 |

% |

|

1,938 |

1,868 |

4 |

% |

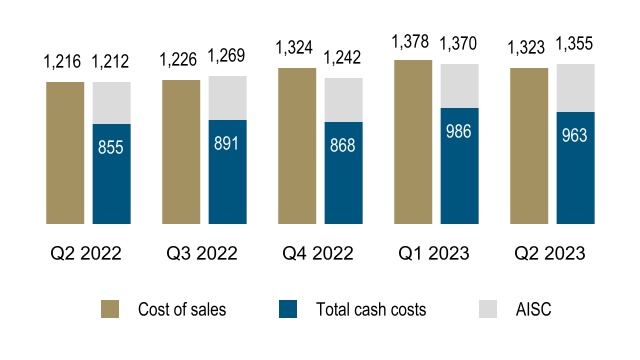

Gold cost of sales (Barrick’s share)g,h ($/oz) |

1,323 |

1,378 |

(4) |

% |

|

1,216 |

9 |

% |

|

1,350 |

1,203 |

12 |

% |

Gold total cash costsb,g ($/oz) |

963 |

986 |

(2) |

% |

|

855 |

13 |

% |

|

974 |

844 |

15 |

% |

Gold all-in sustaining costsb,g ($/oz) |

1,355 |

1,370 |

(1) |

% |

|

1,212 |

12 |

% |

|

1,362 |

1,188 |

15 |

% |

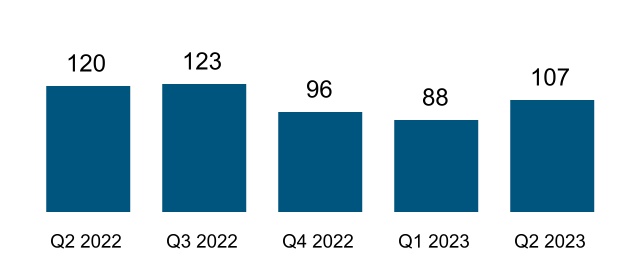

Copper production (millions of pounds)g |

107 |

88 |

22 |

% |

|

120 |

(11) |

% |

|

195 |

221 |

(12) |

% |

Copper sold (millions of pounds)g |

101 |

89 |

13 |

% |

|

113 |

(11) |

% |

|

190 |

226 |

(16) |

% |

| Market copper price ($/lb) |

3.84 |

4.05 |

(5) |

% |

|

4.32 |

(11) |

% |

|

3.95 |

4.43 |

(11) |

% |

Realized copper priceb,g ($/lb) |

3.70 |

4.20 |

(12) |

% |

|

3.72 |

(1) |

% |

|

3.93 |

4.20 |

(6) |

% |

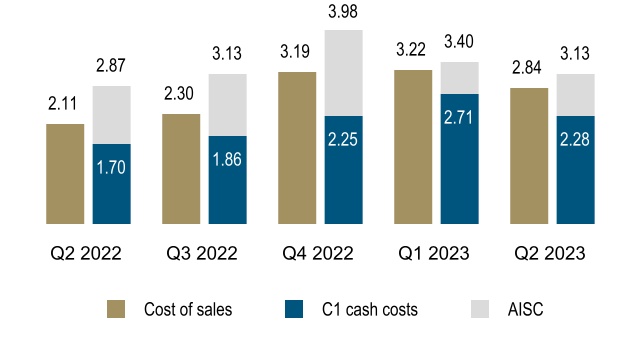

Copper cost of sales (Barrick’s share)g,i ($/lb) |

2.84 |

3.22 |

(12) |

% |

|

2.11 |

35 |

% |

|

3.02 |

2.16 |

40 |

% |

Copper C1 cash costsb,g ($/lb) |

2.28 |

2.71 |

(16) |

% |

|

1.70 |

34 |

% |

|

2.48 |

1.75 |

42 |

% |

Copper all-in sustaining costsb,g ($/lb) |

3.13 |

3.40 |

(8) |

% |

|

2.87 |

9 |

% |

|

3.26 |

2.86 |

14 |

% |

|

|

|

|

|

|

|

|

|

|

|

| |

As at 6/30/23 |

As at 3/31/23 |

% Change |

|

As at 6/30/22 |

% Change |

|

|

|

|

Financial Position ($ millions) |

|

|

|

|

|

|

|

|

|

|

| Debt (current and long-term) |

4,774 |

4,777 |

0 |

% |

|

5,144 |

(7) |

% |

|

|

|

|

| Cash and equivalents |

4,157 |

4,377 |

(5) |

% |

|

5,780 |

(28) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Debt, net of cash |

617 |

400 |

54 |

% |

|

(636) |

197 |

% |

|

|

|

|

a.Net earnings represents net earnings attributable to the equity holders of the Company.

b.Further information on these non-GAAP financial measures, including detailed reconciliations, is included on pages 58 to 75 of this MD&A.

c.Represents adjusted EBITDA divided by revenue.

d.Amounts presented on a consolidated cash basis. Project capital expenditures are included in our calculation of all-in costs, but not included in our calculation of all-in sustaining costs.

e.Total consolidated capital expenditures also includes capitalized interest of $7 million and $15 million, respectively, for the three and six month periods ended June 30, 2023 (March 31, 2023: $8 million and June 30, 2022: $6 million and $11 million, respectively).

f.Represents net cash provided by operating activities divided by revenue.

g.On an attributable basis.

h.Gold cost of sales per ounce is calculated as cost of sales across our gold operations (excluding sites in closure or care and maintenance) divided by ounces sold (both on an attributable basis using Barrick's ownership share).

i.Copper cost of sales per pound is calculated as cost of sales across our copper operations divided by pounds sold (both on an attributable basis using Barrick's ownership share).

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2023 |

5 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

|

|

|

|

|

|

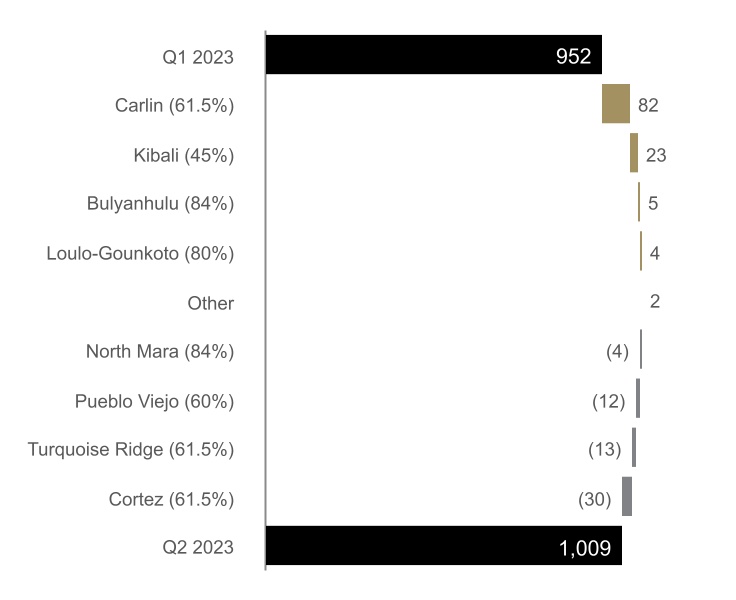

GOLD PRODUCTIONa (thousands of ounces) |

COPPER PRODUCTIONa (millions of pounds) |

|

|

|

|

|

|

GOLD COST OF SALESb, TOTAL CASH COSTSc, |

COPPER COST OF SALESb, C1 CASH COSTSc, |

AND ALL-IN SUSTAINING COSTSc ($ per ounce) |

AND ALL-IN SUSTAINING COSTSc ($ per pound) |

|

|

|

|

|

|

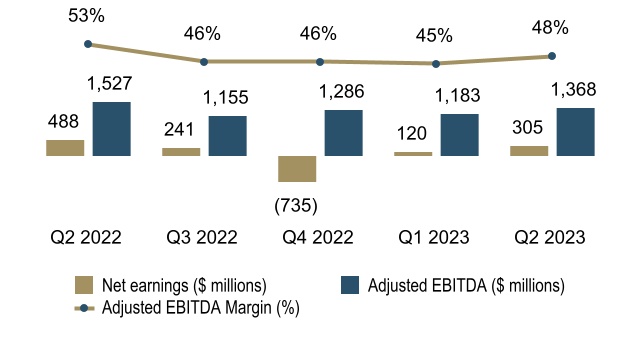

NET EARNINGS, ADJUSTED EBITDAc AND |

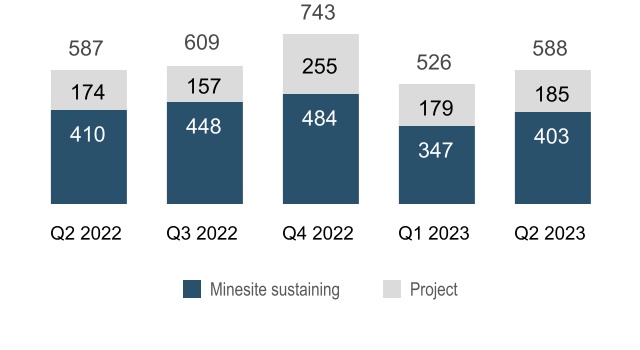

ATTRIBUTABLE CAPITAL EXPENDITURESe

|

ADJUSTED EBITDA MARGINd |

($ millions) |

|

|

|

|

|

|

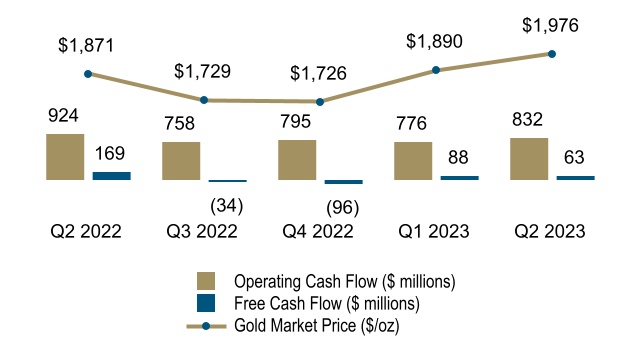

OPERATING CASH FLOW AND FREE CASH FLOWc |

DIVIDENDSf (cents per share) |

a.On an attributable basis.

b.Gold cost of sales per ounce is calculated as cost of sales across our gold operations (excluding sites in closure or care and maintenance) divided by ounces sold (both on an attributable basis using Barrick's ownership share). Copper cost of sales per pound is calculated as cost of sales across our copper operations divided by pounds sold (both on an attributable basis using Barrick's ownership share).

c.Further information on these non-GAAP financial measures, including detailed reconciliations, is included on pages 58 to 75 of this MD&A.

d.Represents adjusted EBITDA divided by revenue.

e.Total attributable capital expenditures also includes capitalized interest. Minesite sustaining and project capital expenditures are non-GAAP financial measures. Further information on non-GAAP financial measures, including detailed reconciliations, is included on pages 58 to 75 of this MD&A.

f.Dividend per share declared in respect of the stated period, inclusive of the performance dividend.

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2023 |

6 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Factors affecting net earnings and adjusted net earnings1 - three months ended June 30, 2023 versus March 31, 2023

Net earnings attributable to equity holders of Barrick ("net earnings") for the three months ended June 30, 2023 were $305 million compared to $120 million in the prior quarter. Among the drivers of the increase was a loss on currency translation of $38 million occurring in the prior quarter, primarily related to the devaluation of the Zambian kwacha resulting from high inflation levels in the country and concerns regarding ongoing negotiations related to the restructuring of the country’s debt. This devaluation reversed in the current quarter following the finalization of a debt restructuring deal which resulted in a gain on currency translation of $12 million. This was combined with the $30 million commitment made towards the expansion of education infrastructure in Tanzania per our community investment obligations under the Twiga partnership occurring in the prior quarter.

After adjusting for items that are not indicative of future operating earnings, adjusted net earnings1 of $336 million for the three months ended June 30, 2023 was $89 million higher than the prior quarter. The increase was primarily due to a higher realized gold price1, lower gold and copper cost of sales per ounce2, and increased gold and copper sales volumes. This was partially offset by a lower realized copper price1. The realized gold and copper prices1 were $1,972 per ounce and $3.70 per pound, respectively, in the three months ended June 30, 2023, compared to $1,902 per ounce and $4.20 per pound, respectively, in the prior quarter. Higher gold sales volume was primarily due to a stronger performance from Carlin following significant planned maintenance activity undertaken in the first four months of the year. This was combined with higher grades at Kibali in line with the mine plan. This was partially offset by lower production at Cortez due to mine sequencing; Turquoise Ridge due to planned autoclave maintenance; and Pueblo Viejo, where tie-in work and commissioning of the plant expansion project impacted production. The increase in copper sales volumes was driven by higher grades processed at Lumwana which was due to improved mining rates resulting from the new fleet.

Factors affecting net earnings and adjusted net earnings1 - three months ended June 30, 2023 versus June 30, 2022

Net earnings for the second quarter of 2023 were $305 million compared to $488 million in the same prior year period. Among the drivers of the decrease was a smaller gain of $13 million compared to a gain of $128 million in the same prior year period resulting from a smaller increase in the market real risk-free rate used to discount the closure provision.

After adjusting for items that are not indicative of future operating earnings, adjusted net earnings1 of $336 million in the second quarter of 2023 were $83 million lower than the same prior year period. One of the drivers of the decrease was lower gold and copper sales volumes. The decrease in gold sales volume was primarily due to lower production at Pueblo Viejo due to lower grades processed combined with tie-in work and commissioning of the plant expansion project, as well as the completion of Phase 1 mining in May 2022 at Long Canyon. This was partially offset by higher production at Cortez, driven by higher oxide mill and heap leach production from the Crossroads open pit and higher underground production. The lower copper sales volume was primarily at Lumwana due to lower grades processed and lower recoveries, partially offset by

higher throughput. These impacts were combined with higher gold cost of sales per ounce2, mainly due to lower sales volumes, combined with higher contractor and maintenance costs, specifically at NGM where maintenance in the prior year was completed in a different quarter; and higher copper cost of sales per ounce2,primarily due to lower grades processed and decreased capitalized waste stripping at Lumwana. Adjusted net earnings1 were further impacted by a higher realized gold price1. The realized gold price1 was $1,972 per ounce in the three months ended June 30, 2023 compared to $1,861 per ounce in the same prior year period.

The significant adjusting items in the three months ended June 30, 2023 include:

■$33 million in significant tax adjustments, mainly related to the settlement agreement to resolve the tax dispute at Porgera, adjustments in respect of prior years and the re-measurement of deferred tax balances; and

■$15 million ($22 million before tax and non-controlling interests) in net impairment charges relating to miscellaneous assets; partially offset by

■$12 million (no tax or non-controlling interests impact) in a gain on currency translation, primarily due to the appreciation of the Zambian kwacha.

Refer to page 59 for a full list of reconciling items between net earnings and adjusted net earnings1 for the current and previous periods.

Factors affecting net earnings and adjusted net earnings1 - six months ended June 30, 2023 versus June 30, 2022

Net earnings for the six months ended June 30, 2023 were $425 million compared to $926 million in the same prior year period. Among the drivers of the decrease was an expense of $9 million in the current period compared to a gain of $125 million in the same prior year period resulting from changes in the market real risk-free rate used to discount the closure provision.

After adjusting for items that are not indicative of future operating earnings, adjusted net earnings1 of $583 million for the six months ended June 30, 2023 were $299 million lower than the same prior year period. The decrease in adjusted net earnings was primarily due to a higher gold and copper cost of sales per ounce2 and lower gold and copper sales volumes. The increase in gold cost of sales per ounce2 compared to the same prior year period was primarily due to the impact of lower grades processed, as well as increased contractor and maintenance costs, while the increase in copper cost of sales per ounce2 was mainly due to higher operating costs resulting from lower grades processed and lower capitalized waste stripping at Lumwana. The lower gold sales volume was primarily at Carlin resulting from the conversion of the Goldstrike autoclave to a conventional CIL process in the first quarter of 2023 and the closure of the Gold Quarry concentrator at the beginning of the second quarter; at Long Canyon as Phase 1 mining was completed in May 2022; as well as at Pueblo Viejo due to lower grades processed and lower throughput. That was partially offset by higher oxide ore tonnes mined from Crossroads and Cortez Hills underground, combined with higher heap leach production at Cortez. The decrease in copper sales volume is mainly at Lumwana due to lower grades processed and lower recoveries, partially offset by higher throughput. These impacts were combined with a decrease in the realized copper price1, partially offset by a higher realized gold

1Numerical annotations throughout the text of this document refer to the endnotes found starting on page 76.

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2023 |

7 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

price1. The realized gold and copper prices1 were $1,938 per ounce and $3.93 per pound, respectively, in the six months ended June 30, 2023, compared to $1,868 per ounce and $4.20 per pound, respectively, in the same prior year period.

The significant adjusting items in the six months ended June 30, 2023 include:

■$81 million in significant tax adjustments, mainly related to the settlement agreement to resolve the tax dispute at Porgera, adjustments in respect of prior years and the re-measurement of deferred tax balances;

■$55 million ($60 million before tax and non-controlling interests) in other expense (income) adjustments in the current year, primarily related to the $30 million commitment made towards the expansion of education infrastructure in Tanzania per our community investment obligations under the Twiga partnership, changes in our closed mine rehabilitation as a result of lower discount rate assumptions and care and maintenance expenses at Porgera; and

■$15 million ($23 million before tax and non-controlling interests) in net impairment charges, mainly relating to miscellaneous assets.

Refer to page 59 for a full list of reconciling items between net earnings and adjusted net earnings1 for the current and previous periods.

Factors affecting Operating Cash Flow and Free Cash Flow1 - three months ended June 30, 2023 versus March 31, 2023

In the three months ended June 30, 2023, we generated $832 million in operating cash flow, compared to $776 million in the prior quarter. The increase of $56 million was primarily due to an increase in realized gold prices1, lower total cash costs/C1 cash costs per ounce/pound1, as well as higher gold and copper sales volumes, partially offset by a decrease in realized copper prices1. Operating cash flow was further affected by a reduction in the unfavorable movement in working capital, mainly due to a favorable movement in accounts payable and inventory, partially offset by an unfavorable movement in other current assets and accounts receivable. These results were further impacted by an increase in cash taxes paid and higher interest paid as a result of the timing of semi-annual interest payments on our bonds.

For the three months ended June 30, 2023, we recorded free cash flow1 of $63 million, compared to $88 million in the prior quarter, mainly reflecting higher capital expenditures. In the second quarter of 2023, capital expenditures on a cash basis were $769 million compared to $688 million in the prior quarter, due to an increase in both minesite sustaining capital expenditures1 and project capital expenditures1. Minesite sustaining capital expenditures1 increased mainly at Loulo-Gounkoto due to higher capitalized underground development following the commencement of production at the Gounkoto underground mine, at Carlin due to increased capitalized waste stripping, and at Lumwana due to the replacement of mining fleet. The increase in project capital expenditures1 was primarily driven by higher expenditures at the TS Solar project at NGM, combined with the plant expansion and mine life extension project at Pueblo Viejo. This was largely offset by delayed spending on the TSF at Loulo-Gounkoto.

Factors affecting Operating Cash Flow and Free Cash Flow1 - three months ended June 30, 2023 versus June 30, 2022

In the second quarter of 2023, we generated $832 million in operating cash flow, compared to $924 million in the same prior year period. The decrease of $92 million was primarily due to lower gold and copper sales volumes, higher gold and copper total cash costs/C1 cash costs per ounce/pound1 and a lower realized copper price1, partially offset by a higher realized gold price1. Operating cash flow was also positively impacted by higher interest received as a result of an increase in market interest rates and lower cash taxes paid.

In the second quarter of 2023, we generated free cash flow1 of $63 million compared to $169 million in the same prior year period. The decrease primarily reflects lower operating cash flows as explained above and slightly higher capital expenditures. In the second quarter of 2023, capital expenditures on a cash basis were $769 million compared to $755 million in the second quarter of 2022. The increase in capital expenditures of $14 million was due to an increase in project capital expenditures1, while minesite sustaining capital expenditures1 remained in line with the same prior year period. The increase in project capital expenditures1 is primarily due to higher expenditures at the TS Solar project at NGM as construction began in the fourth quarter of 2022, combined with the continued investment in the new owner mining fleet at Lumwana. This was partially offset by the completion of the initial development of the Gounkoto underground mine in the first quarter of 2023. Minesite sustaining capital expenditures1 were in line with the same prior year period, as increased expenditures on the tailings buttressing project and new equipment purchases in the underground at Loulo-Gounkoto, and an increase in projects related to processing and underground facilities at Carlin was offset by decreased capitalized waste stripping at both Lumwana and Cortez.

Factors affecting Operating Cash Flow and Free Cash Flow1 - six months ended June 30, 2023 versus June 30, 2022

For the six months ended June 30, 2023, we generated $1,608 million in operating cash flow, compared to $1,928 million in the same prior year period. The decrease of $320 million was primarily due to higher total cash costs/C1 cash costs per ounce/pound1, lower gold and copper sales volumes, and a lower realized copper price1, partially offset by a higher realized gold price1. This was combined with an unfavorable movement in working capital, mainly in accounts receivable, accounts payable and other current liabilities, partially offset by a favorable movement in other current assets. These results were further impacted by lower cash taxes paid and an increase in interest received as a result of higher market interest rates.

For the six months ended June 30, 2023, we generated free cash flow1 of $151 million compared to $562 million in the same prior year period. The decrease of $411 million primarily reflects lower operating cash flows as explained above and higher capital expenditures. In the six months ended June 30, 2023, capital expenditures on a cash basis were $1,457 million compared to $1,366 million in the same prior year period resulting from an increase in both project capital expenditures1 and minesite sustaining capital expenditures1. The increase in project capital expenditures1 was primarily the result of the investment in the new owner mining fleet at Lumwana, combined with higher expenditures at the TS Solar project at NGM as

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2023 |

8 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

construction began in the fourth quarter of 2022. This was partially offset by lower project capital expenditures1 incurred on the plant expansion at Pueblo Viejo. Higher minesite sustaining capital expenditures1 is mainly due to increased expenditures on the tailings buttressing project and new equipment purchases in the underground at Loulo-Gounkoto, higher capitalized waste stripping at North Mara, and an increase in project spend on processing and underground facilities at Carlin. This was partially offset by lower capitalized waste stripping at Lumwana and Cortez.

Key Business Developments

Share Buyback Program

At the February 14, 2023 meeting, the Board of Directors authorized a new share buyback program for the purchase of up to $1 billion of Barrick’s outstanding shares over the next 12 months. As at June 30, 2023, we have not purchased any shares under this program in 2023.

The actual number of common shares that may be purchased, and the timing of any such purchases, will be determined by Barrick based on a number of factors, including the Company’s financial performance, the availability of cash flows, and the consideration of other uses of cash, including capital investment opportunities, returns to shareholders, and debt reduction.

The repurchase program does not obligate the Company to acquire any particular number of common shares, and the repurchase program may be suspended or discontinued at any time at the Company’s discretion.

Porgera Special Mining Lease

On April 9, 2021, BNL signed a binding Framework Agreement with the Independent State of PNG and Kumul Minerals, a state-owned mining company, setting out the terms and conditions for the reopening of the Porgera mine. On February 3, 2022, the Framework Agreement was replaced by the Commencement Agreement. The Commencement Agreement was signed by PNG, Kumul Minerals, BNL and its affiliate Porgera (Jersey) Limited on October 15, 2021, and it became effective on February 3, 2022, following signature by MRE, the holder of the remaining 5% of the original Porgera joint venture. The Commencement Agreement reflects the commercial terms previously agreed to under the Framework Agreement, namely that PNG stakeholders will receive a 51% equity stake in the Porgera mine, with the remaining 49% to be held by BNL or an affiliate. BNL is jointly owned on a 50/50 basis by Barrick and Zijin Mining Group. Accordingly, following the implementation of the Commencement Agreement, Barrick’s current 47.5% interest in the Porgera mine is expected to be reduced to a 24.5% interest as reflected in Barrick’s reserve and resource estimates for Porgera. BNL will retain operatorship of the mine. The Commencement Agreement also provides that PNG stakeholders and BNL and its affiliates will share the economic benefits derived from the reopened Porgera mine on a 53% and 47% basis over the remaining life of mine, respectively, and that the Government of PNG will retain the option to acquire BNL’s or its affiliate’s 49% equity participation at fair market value after 10 years.

On April 21, 2022, the PNG National Parliament passed legislation to provide, among other things, certain agreed tax exemptions and tax stability for the new Porgera joint venture. This legislation was certified on May 30, 2022. Six out of the seven pieces of legislation took effect as of April 11 and 14, 2023, respectively, when they were

published in the National Gazette, as required under PNG Law. The remaining act awaits publication to take effect.

On September 13, 2022, the Shareholders’ Agreement for the new Porgera joint venture company was executed by Porgera (Jersey) Limited, which is an affiliate of BNL, the state-owned Kumul Minerals (Porgera) Limited and MRE. New Porgera Limited, the new Porgera joint venture company, was incorporated on September 22, 2022 and became a party to the Commencement Agreement and the Shareholders’ Agreement on October 13, 2023.

On March 31, 2023, BNL, the Independent State of PNG and New Porgera Limited signed the New Porgera Progress Agreement whereby the parties reiterated their commitment to reopening the Porgera mine in line with the terms of the Commencement Agreement and the Shareholders’ Agreement. The provisions of the Commencement Agreement will be fully implemented, and work to recommence full mine operations at Porgera will begin, following the execution of the remaining definitive agreements and satisfaction of a number of conditions. These include an Operatorship Agreement pursuant to which BNL will operate the Porgera mine, as well as a Mining Development Contract between New Porgera Limited and the Independent State of PNG which is required to be in place to enable the grant of a new SML to New Porgera Limited under the PNG Mining Act. Under the terms of the Commencement Agreement, BNL will remain in possession of the site and maintain the mine on care and maintenance.

On June 13, 2023, in accordance with the Commencement Agreement, New Porgera Limited lodged an application with the Mineral Resources Authority for a new SML. The application is now subject to a review process under the PNG Mining Act.

On June 20, 2023, the PNG IRC, the Commissioner General, Barrick and BNL entered into a settlement agreement to resolve a dispute regarding tax assessments issued by the IRC against BNL. The resolution of this tax dispute satisfies one of the conditions to the reopening of the Porgera mine under the Commencement Agreement, and has allowed the parties to work toward the reopening of the mine by the end of 2023.

The parties to the Commencement Agreement are continuing to progress the remaining conditions for the reopening of the mine.

Porgera was excluded from our 2023 guidance. We expect to update our guidance following both the execution of all of the definitive agreements to implement the binding Commencement Agreement and the finalization of a timeline for the resumption of full mine operations. Refer to notes 12 and 16 to the Financial Statements for more information.

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2023 |

9 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Environmental, Social and Governance ("ESG")

Sustainability is entrenched in our DNA: our sustainability strategy is our business plan.

Barrick’s vision to sustainability is underpinned by the knowledge that sustainability aspects are interconnected and must be tackled in conjunction with, and reference to, each other. We call this approach Holistic and Integrated Sustainability Management. Although we integrate our sustainability management, we discuss our sustainability strategy within four overarching pillars: (1) respecting human rights; (2) protecting the health and safety of our people and local communities; (3) sharing the benefits of our operations; and (4) managing our impacts on the environment.

We implement this strategy by blending top-down accountability with bottom-up responsibility. This means we place the day-to-day ownership of sustainability, and the associated risks and opportunities, in the hands of individual sites. In the same way that each site must manage its geological, operational and technical capabilities to meet business objectives, it must also manage and identify programs, metrics, and targets that measure progress and deliver real value for the business and our stakeholders, including our host countries and local communities. The Group Sustainability Executive, supported by regional sustainability leads, provides oversight and direction over this site-level ownership, to ensure alignment with the strategic priorities of the overall business.

Governance

The bedrock of our sustainability strategy is strong governance. Our most senior management-level body dedicated to sustainability is the E&S Committee, which connects site-level ownership of our sustainability strategy with the leadership of the Group. It is chaired by the President and Chief Executive Officer and includes: (1) regional Chief Operating Officers; (2) minesite General Managers; (3) Health, Safety, Environment and Closure Leads; (4) the Group Sustainability Executive; (5) in-house legal counsel; and (6) an independent sustainability consultant in an advisory role. The E&S Committee meets on a quarterly basis to review our performance across a range of key performance indicators, and to provide independent oversight and review of sustainability management.

The President and Chief Executive Officer reviews the reports of the E&S Committee at every quarterly meeting of the Board's ESG & Nominating Committee. The reports are reviewed to ensure the implementation of our sustainability policies and to drive performance of our environmental, health and safety, community relations and development, and human rights programs.

This is supplemented by weekly meetings, at a minimum, between the Regional Sustainability Leads and the Group Sustainability Executive. These meetings examine the sustainability-related risks and opportunities facing the business in real time, as well as the progress and issues integrated into weekly Executive Committee review meetings.

Our industry-first Sustainability Scorecard accounts for 25% of the long-term incentive awards for senior leaders as part of the Barrick Partnership Plan. As we strive for ongoing strong performance, the Sustainability Scorecard targets and metrics are updated annually. The

results of the 2022 Sustainability Scorecard, and updated metrics and targets for 2023, were disclosed in our 2022 Sustainability Report, published in April 2023. The E&S Committee tracks our progress against all metrics.

We also note the issuance of the first two standards by the ISSB on June 26, 2023 and will continue to monitor their adoption by national regulators.

Human rights

Our commitment to respect human rights is codified in our standalone Human Rights Policy and informed by the expectations of the United Nations Guiding Principles on Business and Human Rights, the Voluntary Principles on Security and Human Rights and the OECD Guidelines for Multinational Enterprises. This commitment is fulfilled on the ground via our Human Rights Program, the fundamental principles of which include: monitoring and reporting, due diligence, training, as well as disciplinary action and remedy.

We continue to assess and manage security and human rights risks at all our operations and provide security and human rights training to security forces across our sites.

Safety

We are committed to the safety, health and well-being of our people, their families and the communities in which we operate. Our safety vision is “Everyone to go home safe and healthy every day.”

We continue to roll out our rebranded “Journey to Zero” initiative which commenced with a phase of honest reflection, and the review and update of our global safety standards, and alignment of our fatal risks and controls.

We report our safety performance quarterly as part of both our E&S Committee meetings and to the ESG & Nominating Committee. Our safety performance is a regular standing agenda item on our weekly Executive Committee review meeting.

In terms of other key performance indicators, for the second quarter of 2023, our LTIFR3 was 0.26, an 8% increase from the first quarter, and our TRIFR3 was 1.01, a significant reduction of 39% from the first quarter.

Social

We regard our host communities and countries as important partners in our business. Our sustainability policies commit us to transparency in our relationships with host communities, government authorities, the public and other key stakeholders. Through these policies, we commit to conducting our business with integrity and with absolute opposition to corruption. We require our suppliers to operate ethically and responsibly as a condition of doing business with us.

Community and economic development

Our commitment to social and economic development is set out in our overarching Sustainable Development and Social Performance policies. Mining has been identified as vital for the achievement of the United Nations SDGs, not only for its role in providing the minerals needed to enable the transition to a lower carbon intensive economy, but more importantly because of its ability to drive socio-economic development and build resilience. Creating long-term value and sharing economic benefits is at the heart of our approach to sustainability, as well as community

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2023 |

10 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

development. This approach is encapsulated in three concepts:

The primacy of partnership: this means that we invest in real partnerships with mutual responsibility. Partnerships include local communities, suppliers, government, and organizations, and this approach is epitomized through our CDCs with development initiatives and investments.

Sharing the benefits: We hire and buy local wherever possible as this injects money into and keeps it in our local communities and host countries. By doing this, we build capacity, community resilience and create opportunity. We also invest in community development through our CDCs. Sharing the benefits also means paying our fair share of taxes, royalties and dividends and doing so transparently, primarily through the reporting mechanism of the Canadian Extractive Sector Transparency Measures Act. Our annual Tax Contribution Report sets out, in detail, our economic contributions to host governments.

Engaging and listening to stakeholders: We develop tailored stakeholder engagement plans for every operation and the business as a whole. These plans guide and document how often we engage with various stakeholder groups and allow us to proactively deal with issues before they escalate into significant risks.

We continued our community development initiatives through our CDCs. Notably, we established a second CDC for the Reko Diq project in Balochistan, Pakistan. These CDCs provide community development for both the nearest communities (named the Par-e-Koh CDC), as well as the nearest town of Nok Kundi. The CDCs are comprised of elected members from the communities.

Our community development spend during the second quarter was $10 million, and $17 million in the year to date.

Environment

We know the environment in which we work and our host communities are inextricably linked, and we apply a holistic and integrated approach to sustainability management. Being responsible stewards of the environment by applying the highest standards of environmental management, using natural resources and energy efficiently, recycling and reducing waste as well as working to protect biodiversity, we can deliver significant cost savings to our business, reduce future liabilities and help build stronger stakeholder relationships. Environmental matters such as how we use water, prevent incidents, manage tailings, respond to changing climate, and protect biodiversity are key areas of focus.

We maintained our strong track record of stewardship and did not record any Class 14 environmental incidents during the first half of 2023.

Climate Change

The ESG & Nominating Committee is responsible for overseeing Barrick’s policies, programs and performance relating to sustainability and the environment, including climate change. The Audit & Risk Committee assists the Board in overseeing the Group’s management of enterprise risks as well as the implementation of policies and standards for monitoring and mitigating such risks. Climate change is built into our formal risk management process, outputs of which are regularly reviewed by the Audit & Risk Committee.

Barrick’s climate change strategy has three pillars: (1) identify, understand and mitigate the risks associated with climate change; (2) measure and reduce our GHG emissions across our operations and value chain; and (3) improve our disclosure on climate change. The three pillars of our climate change strategy do not focus solely on the development of emissions reduction targets, rather, we integrate and consider aspects of biodiversity protection, water management and community resilience in our approach.

We are acutely aware of the impacts that climate change and extreme weather events have on our host communities and countries, particularly developing nations which are often the most vulnerable. As the world economy transitions to renewable power, it is imperative that developing nations are not left behind. As a responsible business, we have focused our efforts on building resilience in our host communities and countries, just as we do for our business. Our climate disclosure is based on the recommendations of the TCFD.

Identify, understand and mitigate the risks associated with climate change

We identify and manage risks, build resilience to a changing climate and extreme weather events, as well as position ourselves for new opportunities. These factors continue to be incorporated into our formal risk assessment process. We have identified several risks and opportunities for our business including: physical impacts of extreme weather events; an increase in regulations that seek to address climate change; and an increase in global investment in innovation and low-carbon technologies.

The risk assessment process includes scenario analysis, which is being rolled out to all sites with an initial focus on our Tier One Gold Assets5, to assess site-specific climate related risks and opportunities. The key findings and summary of this asset-level physical and transitional risk assessment at Loulo-Gounkoto and Kibali were disclosed as part of our CDP (formerly known as the Carbon Disclosure Project) Climate Change and Water Security questionnaires, submitted to CDP in July 2023.

In addition, climate scenario analysis and risk assessments were completed for Carlin (physical risks) and NGM (transitional risks) during the second quarter.

Measure and reduce the Group’s impact on climate change

Mining is an energy-intensive business, and we understand the important link between energy use and GHG emissions. By measuring and effectively managing our energy use, we can reduce our GHG emissions, achieve more efficient production, and reduce our costs.

We have climate champions at each site who are tasked with identifying roadmaps and assessing feasibility for our GHG emissions reductions and carbon offsets for hard-to-abate emissions. Any carbon offsets that we pursue must have appropriate socio-economic and/or biodiversity benefits. We have published an achievable emissions reduction roadmap and continue to assess further reduction opportunities across our operations. The detailed roadmap was first published in our 2021 Sustainability Report and includes committed-capital projects and projects under investigation that rely on technological advances, with a progress summary contained in the 2022 Sustainability Report.

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2023 |

11 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

We continue to progress our extensive work across our value chain in understanding our Scope 3 (indirect value chain) emissions and implementing our engagement roadmap to enable our key suppliers to set meaningful and measurable reduction targets, in line with the commitments made through the ICMM Climate Position Paper.

Improve our disclosure on climate change

Our disclosure on climate change, including in our Sustainability Report and on our website, is developed in line with the TCFD recommendations. Barrick continues to monitor the various regulatory climate disclosure standards being developed around the world, including the ISSB’s recently issued S2 Climate-related Disclosures. In addition, we complete the annual CDP Climate Change and Water Security questionnaires. This ensures our investor-relevant water use, emissions and climate data is widely available.

Emissions

Barrick’s interim GHG emissions reduction target is for a minimum 30% reduction by 2030 against our 2018 baseline, while maintaining a steady production profile. The basis of this reduction is against a 2018 baseline of 7,541 kt CO2-e.

Our GHG emissions reduction target is grounded in science and has a detailed pathway for achievement. Our target is not static and will be updated as we continue to identify and implement new GHG reduction opportunities.

Ultimately, our vision is net zero GHG emissions by 2050, achieved primarily through GHG reductions, with some offsets for hard-to-abate emissions. Site-level plans to improve energy efficiency, integrate clean and renewable energy sources and reduce GHG emissions will also be strengthened. We plan to supplement our corporate emissions reduction target with context-based site-specific emissions reduction targets.

During the second quarter of 2023, the Group's total Scope 1 and 2 (location-based) GHG emissions were 1,525 kt CO2-e. Year to date emissions are approximately 12% less than the GHG emissions for the same period in 2022.

Water

Water is a vital and increasingly scarce global resource. Managing and using water responsibly is one of the most critical parts of our sustainability strategy. Our commitment to responsible water use is codified in our Environmental Policy. Steady, reliable access to water is critical to the effective operation of our mines. Access to water is also a fundamental human right.

Understanding the water stress in the regions we operate enables us to better understand the risks and manage our water resources through site-specific water balances, based on the ICMM Water Accounting Framework, aimed at minimizing our water withdrawal and maximizing water reuse and recycling within our operations.

We include each mine’s water risks in its operational risk register. These risks are then aggregated

and incorporated into the corporate risk register. Our identified water-related risks include: (1) managing excess water in regions with high rainfall; (2) maintaining access to water in arid areas and regions prone to water scarcity; and (3) regulatory risks related to permitting limits as well as municipal and national regulations for water use.

We set an annual water recycling and reuse target of 80%. Our water recycling and reuse rate for the second quarter of 2023 was approximately 82%, in line with our performance for the same period in 2022.

Tailings

We are committed to having our TSFs meet global best practices for safety. Our TSFs are carefully engineered and regularly inspected, particularly those in regions with high rainfall and seismic events.

We continue to progress with our conformance to the GISTM, with all of our sites that are classified as Very High or Extreme consequence now in conformance with the GISTM and disclosed on Barrick’s website. We continue to progress with our conformance for lower consequence facilities in accordance with the GISTM.

Biodiversity

Biodiversity underpins many of the ecosystem services on which our mines and their surrounding communities depend. If improperly managed, mining and exploration activities have the potential to negatively affect biodiversity and ecosystem services. Protecting biodiversity and preventing nature loss is also critical and inextricably linked to the fight against climate change. We work to proactively manage our impact on biodiversity and strive to protect the ecosystems in which we operate. Wherever possible, we aim to achieve a net neutral biodiversity impact, particularly for ecologically sensitive environments.

We continue to work to implement our BAPs. The BAPs outline our strategy to achieve net-neutral impacts for all key biodiversity features and their associated management plans.

In June 2023, Barrick worked with key partners, including African Parks, the Institut Congolais pour la Conservation de la Nature, the Congolese government and the & Beyond Phinda Private Reserve, on the successful reintroduction of 16 white rhinos to the Garamba National Park in the northeast of the DRC, where the species was last seen in 2006. The introduction of the near-threatened southern sub-species promotes the long-term conservation of rhino in Africa by extending their range and creating another breeding node for the species in a safe environment. The rhino will also play an important role in regulating the structure and functioning of the park’s ecosystem, creating and maintaining grazing lawns that support other fauna and flora and provides important ecosystem services.

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2023 |

12 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Full Year 2023 Outlook

We continue to expect 2023 gold production to be in the range of 4.2 to 4.6 million ounces. We expect stronger year-over-year performance from Cortez, Pueblo Viejo and Turquoise Ridge, together with consistent delivery across the remaining Tier One Gold Assets5 as detailed further below. Notably at Turquoise Ridge, the commissioning of the Third Shaft in the fourth quarter of 2022, combined with increased availability and reliability of the Sage autoclave, is expected to deliver stronger production in 2023 relative to the prior year.

As previously guided, the Company's gold production is expected to increase over the course of the year, with the first quarter being the lowest. This was mainly due to lower grades at Kibali due to mine sequencing in the first quarter, roaster maintenance and the completion of the autoclave carbon-in-leach conversion at Goldstrike also in the first quarter. In the second quarter, major maintenance for the Gold Quarry roaster at Carlin occurred in April 2023, as planned, and maintenance on the Sage autoclave at Turquoise Ridge occurred in the latter part of the quarter. The ramp up of the plant expansion at Pueblo Viejo is anticipated to positively impact the third quarter of 2023 as well as higher grades from Cortez and Carlin open pits due to mine sequencing. As a result, we expect the Company’s gold production in the second half of 2023 to be stronger than the first half.

Our 2023 gold guidance continues to exclude Porgera. We expect to update our guidance to include Porgera following both the execution of all of the definitive agreements to implement the Commencement Agreement and the finalization of a timeline for the resumption of full mine operations.

Our 2023 gold cost guidance remains unchanged, including cost of sales of $1,170 to $1,250 per ounce2, total cash costs of $820 to $880 per ounce1 and all-in sustaining costs of $1,170 to $1,250 per ounce1. These ranges were based on a gold price assumption of $1,650 per ounce. We have previously disclosed a sensitivity of approximately $5 per ounce on our 2023 gold cost guidance metrics for every $100 per ounce change in the gold price and based on the realized gold price for the six months to June 30, 2023, the impact of the higher gold price flowing into higher royalty costs has been approximately $15/oz.

We continue to expect 2023 copper production to be in the range of 420 to 470 million pounds. Production in the second half of 2023 is expected to be stronger than the first half, mainly due to steadily increasing throughput at Lumwana as we execute on our owner-miner strategy and commission the new mining fleet. Separately, major maintenance at Zaldívar is scheduled in the third quarter of 2023 as reported by the operator, Antofagasta. Our copper cost guidance metrics for 2023 remain unchanged, which are based on a copper price assumption of $3.50 per pound.

Taking into account the risks and sensitivities as discussed above, 2023 Company guidance is detailed below, inclusive of the key assumptions that were used as the basis for this guidance as released on February 15, 2023.

|

|

|

|

|

|

Company Guidance ($ millions, except per ounce/pound data) |

2023

Estimate |

| Gold production (millions of ounces) |

4.20 - 4.60 |

| Gold cost metrics |

|

| Cost of sales - gold ($/oz) |

1,170 - 1,250 |

Total cash costs ($/oz)a |

820 - 880 |

| Depreciation ($/oz) |

320 - 350 |

All-in sustaining costs ($/oz)a |

1,170 - 1,250 |

| Copper production (millions of pounds) |

420 - 470 |

| Copper cost metrics |

|

| Cost of sales - copper ($/lb) |

2.60 - 2.90 |

C1 cash costs ($/lb)a |

2.05 - 2.25 |

| Depreciation ($/lb) |

0.80 - 0.90 |

All-in sustaining costs ($/lb)a |

2.95 - 3.25 |

| Exploration and project expenses |

400 - 440 |

| Exploration and evaluation |

180 - 200 |

| Project expenses |

220 - 240 |

| General and administrative expenses |

~180 |

| Corporate administration |

~130 |

Share-based compensationb |

~50 |

|

|

| Other expense |

70 - 90 |

| Finance costs, net |

280 - 320 |

| Attributable capital expenditures: |

|

Attributable minesite sustaininga |

1,450 - 1,700 |

Attributable projecta |

750 - 900 |

| Total attributable capital expenditures |

2,200 - 2,600 |

Effective income tax ratec |

27% - 32% |

| Key assumptions (used for guidance) |

| Gold Price ($/oz) |

1,650 |

|

| Copper Price ($/lb) |

3.50 |

|

| Oil Price (WTI) ($/barrel) |

90 |

|

| AUD Exchange Rate (AUD:USD) |

0.75 |

|

| ARS Exchange Rate (USD:ARS) |

170 |

|

| CAD Exchange Rate (USD:CAD) |

1.30 |

|

| CLP Exchange Rate (USD:CLP) |

900 |

|

| EUR Exchange Rate (EUR:USD) |

1.20 |

|

|

|

a.Further information on these non-GAAP financial measures, including detailed reconciliations, is included on pages 58 to 75 of this MD&A.

b.Based on a one-month trailing average ending December 31, 2022 of US$17.04 per share.

c.Based on key assumptions included in this table.

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2023 |

13 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Operating Division Guidance

Our 2023 forecast gold and copper production, cost of salesa, total cash costsb, all-in sustaining costsb, and C1 cash costsb ranges by operating division are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Division |

2023 forecast attributable production (000s ozs) |

2023 forecast cost of salesa ($/oz) |

2023 forecast total cash costsb ($/oz) |

2023 forecast all-in sustaining costsb ($/oz) |

| Gold |

|

|

|

|

| Carlin (61.5%) |

910 - 1,000 |

1,030 - 1,110 |

820 - 880 |

1,250 - 1,330 |

Cortez (61.5%)c |

580 - 650 |

1,080 - 1,160 |

680 - 740 |

930 - 1,010 |

Turquoise Ridge (61.5%) |