UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission file number

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

(State or Other Jurisdiction of |

|

(I.R.S. Employer |

|

|

|

|

|

|

|

|

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant's telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

At June 30, 2019, the last day of the Registrant's most recently completed second fiscal quarter, the aggregate market value of Registrant's common equity held by non-affiliates was approximately $

On February 21, 2020, there were

DOCUMENTS INCORPORATED BY REFERENCE

1

Table of Contents

|

|

|

|

|

|

|

|

|

Item 1. |

3 |

|

|

|

4 |

|

|

|

7 |

|

|

|

8 |

|

|

|

8 |

|

|

|

8 |

|

|

|

8 |

|

|

|

|

|

|

Item 1A. |

10 |

|

|

|

|

|

|

Item 1B. |

14 |

|

|

|

|

|

|

Item 2. |

14 |

|

|

|

|

|

|

Item 3. |

15 |

|

|

|

|

|

|

Item 4. |

15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 5. |

16 |

|

|

|

|

|

|

Item 6. |

18 |

|

|

|

|

|

|

Item 7. |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

19 |

|

|

19 |

|

|

|

19 |

|

|

|

20 |

|

|

|

21 |

|

|

|

21 |

|

|

|

23 |

|

|

|

25 |

|

|

|

26 |

|

|

|

26 |

|

|

|

27 |

|

|

|

28 |

|

|

|

31 |

|

|

|

Reconciliations of Non-GAAP Financial Measures to Reported Amounts |

31 |

|

|

|

|

|

Item 7A. |

33 |

|

|

|

|

|

|

Item 8. |

34 |

|

|

|

|

|

|

Item 9. |

Changes In and Disagreements With Accountants on Accounting and Financial Disclosure |

77 |

|

|

|

|

|

Item 9A. |

77 |

|

|

|

|

|

|

Item 9B. |

77 |

|

|

|

|

|

|

|

||

|

|

|

|

|

Item 10. |

78 |

|

|

|

|

|

|

Item 11. |

78 |

|

|

|

|

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

78 |

|

|

|

|

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

79 |

|

|

|

|

|

Item 14. |

79 |

|

|

|

|

|

|

|

||

|

|

|

|

|

Item 15. |

80 |

|

|

|

|

|

|

|

83 |

|

2

PART I

|

Item 1. |

BUSINESS |

Packaging Corporation of America (“we,” “us,” “our,” “PCA,” or the “Company”) is the third largest producer of containerboard products and the third largest producer of uncoated freesheet (UFS) paper in North America. We operate six containerboard mills, two uncoated freesheet (UFS) paper mills and 95 corrugated products manufacturing plants. We are headquartered in Lake Forest, Illinois and operate primarily in the United States.

We report in three reportable segments: Packaging, Paper and Corporate and Other. For segment financial information see Note 20, Segment Information, of the Notes to Consolidated Financial Statements in “Part II, Item 8, Financial Statements and Supplementary Data” of this Form 10-K.

During the second quarter of 2018, we discontinued the production of paper grades at the Wallula, Washington mill and converted the No. 3 machine to production of virgin kraft linerboard. Before May 2018, operating results for the Wallula mill were included in the Paper segment. After May 2018, operating results for the Wallula mill are primarily included in the Packaging segment.

Production and Shipments

The following table summarizes the Packaging segment's containerboard production and corrugated products shipments and the Paper segment's UFS production.

|

|

|

|

|

|

|

First Quarter |

|

|

Second Quarter |

|

|

Third Quarter |

|

|

Fourth Quarter |

|

|

Full Year |

|

|||||

|

Containerboard Production (a) |

|

|

2019 |

|

|

|

1,037 |

|

|

|

1,063 |

|

|

|

1,070 |

|

|

|

1,079 |

|

|

|

4,249 |

|

|

(thousand tons) |

|

|

2018 |

|

|

|

953 |

|

|

|

1,020 |

|

|

|

1,087 |

|

|

|

1,021 |

|

|

|

4,081 |

|

|

|

|

|

2017 |

|

|

|

932 |

|

|

|

947 |

|

|

|

996 |

|

|

|

1,006 |

|

|

|

3,881 |

|

|

Corrugated Shipments (BSF) |

|

|

2019 |

|

|

|

14.5 |

|

|

|

14.9 |

|

|

|

15.1 |

|

|

|

14.9 |

|

|

|

59.4 |

|

|

|

|

|

2018 |

|

|

|

14.4 |

|

|

|

15.1 |

|

|

|

14.8 |

|

|

|

14.6 |

|

|

|

58.9 |

|

|

|

|

|

2017 |

|

|

|

13.6 |

|

|

|

13.9 |

|

|

|

13.7 |

|

|

|

14.5 |

|

|

|

55.7 |

|

|

UFS Production (a) |

|

|

2019 |

|

|

|

239 |

|

|

|

236 |

|

|

|

236 |

|

|

|

236 |

|

|

|

947 |

|

|

(thousand tons) |

|

|

2018 |

|

|

|

279 |

|

|

|

252 |

|

|

|

239 |

|

|

|

247 |

|

|

|

1,017 |

|

|

|

|

|

2017 |

|

|

|

273 |

|

|

|

289 |

|

|

|

278 |

|

|

|

278 |

|

|

|

1,118 |

|

|

(a) |

In May 2018, PCA ceased production of paper grades at our Wallula, Washington mill and converted the No. 3 machine to produce virgin kraft linerboard. We provide more information about the production capability of the converted machine elsewhere in this section under “– Packaging – Facilities – Wallula.” |

3

Below is a map of our locations:

Packaging

Packaging Products

Our containerboard mills produce linerboard and corrugating medium, which are primarily used in the production of corrugated products. Our corrugated products manufacturing plants produce a wide variety of corrugated packaging products, including conventional shipping containers used to protect and transport manufactured goods, multi-color boxes and displays with strong visual appeal that help to merchandise the packaged product in retail locations, and honeycomb protective packaging. In addition, we are a large producer of packaging for meat, fresh fruit and vegetables, processed food, beverages, and other industrial and consumer products.

During the year ended December 31, 2019, our Packaging segment produced 4.2 million tons of containerboard at our mills. Our corrugated products manufacturing plants sold 59.4 billion square feet (BSF) of corrugated products. Our net sales to third parties totaled $5.9 billion in 2019.

4

Facilities

We currently manufacture containerboard, which includes a variety of performance and specialty grades, at six containerboard mills. Total annual containerboard capacity was approximately 4.3 million tons as of December 31, 2019. We also produce corrugated and protective packaging products at 95 manufacturing locations. The following provides more details of our operations:

Counce. Our Counce, Tennessee mill produces kraft linerboard on two machines. The mill can produce basis weights from 26 lb. to 90 lb.

DeRidder. Our DeRidder, Louisiana mill produces kraft linerboard on its No. 1 machine and kraft linerboard and corrugating medium on its No. 2 machine. The mill can produce linerboard in basis weights of 26 lb. to 69 lb. and medium in basis weights of 23 lb. to 33 lb.

Valdosta. Our Valdosta, Georgia mill produces kraft linerboard on one machine. The mill can produce basis weights from 35 lb. to 96 lb.

Tomahawk. Our Tomahawk, Wisconsin mill produces corrugating medium on two machines. The mill can produce basis weights from 23 lb. to 47 lb.

Filer City. Our Filer City, Michigan mill produces corrugating medium on three machines. The mill can produce basis weights from 20 lb. to 47 lb.

Wallula. Our Wallula, Washington mill produces corrugating medium on its No. 2 machine and kraft linerboard on its No. 3 machine. The mill can produce medium in basis weights from 23 lb. to 33 lb. and linerboard in basis weights from 31 lb. to 52 lb.

We operate 95 corrugated manufacturing and protective packaging operations, a technical and development center, 11 regional design centers, a rotogravure printing operation, and a complement of packaging supplies and distribution centers. Of the 95 manufacturing facilities, 62 operate as combining operations, commonly called corrugated plants, which manufacture corrugated sheets and finished corrugated packaging products, 32 are sheet plants, which procure combined sheets and manufacture finished corrugated packaging products, and one is a corrugated sheet-only manufacturer.

Corrugated products plants tend to be located in close proximity to customers to minimize freight costs. Each of our plants serve a market radius of approximately 150 miles. Our sheet plants are generally located in close proximity to our larger corrugated plants, which enables us to offer additional services and converting capabilities such as small volume and quick turnaround items.

Major Raw Materials Used

Fiber supply. Fiber is the largest raw material cost to manufacture containerboard. We consume both wood fiber and recycled fiber in our containerboard mills. Our mill system has the capability to shift a portion of its fiber consumption between softwood, hardwood, and recycled sources. All of our mills can utilize virgin wood fiber and all of our mills, other than the Valdosta mill, can utilize some recycled fiber in their containerboard production. Our corrugated manufacturing operations generate recycled fiber as a by-product from the manufacturing process, which is consumed by our mills. In 2019, our usage of recycled fiber, net of internal generation, represents 17% of our containerboard production.

We procure wood fiber through leases of cutting rights, long-term supply agreements, and market purchases and believe we have adequate sources of fiber supply for the foreseeable future.

We participate in the Sustainable Forestry Initiative® (SFI®), the Programme for the Endorsement of Forest Certification (PEFC), as well as the Forest Stewardship Council® (FSC®), and we are certified under their sourcing and chain of custody standards. These standards are aimed at ensuring the long-term health and conservation of forestry resources. We are committed to sourcing wood fiber through environmentally, socially, and economically sustainable practices and promoting resource and conservation stewardship ethics.

5

Energy supply. Energy at our packaging mills is obtained through self-generated or purchased fuels and electricity. Fuel sources include by-products of the containerboard manufacturing and pulping process (including black liquor and wood waste), natural gas, purchased wood waste, and other purchased fuels. Each of our mills self-generates process steam requirements from by-products (black liquor and wood waste), as well as from the various purchased fuels. The process steam is used throughout the production process and also to generate electricity.

In 2019, our packaging mills consumed about 75 million MMBTU’s of fuel to produce both steam and electricity. Of the 75 million MMBTU’s consumed, about 62% was from mill generated by-products and 38% was from purchased fuels. Of the purchased fuels, 72% was from natural gas, 25% was from purchased wood waste and 3% was from other purchased fuels.

Chemical supply. We consume various chemicals in the production of containerboard, including caustic soda, sulfuric acid, soda ash, and lime. Most of our chemicals are purchased under contracts, which are bid or negotiated periodically.

Sales, Marketing, and Distribution

Our corrugated products are sold through our direct sales and marketing organization, independent brokers, and distribution partners. We have sales representatives and a sales manager at most of our corrugated manufacturing operations and also have corporate account managers who serve customer accounts with a national presence. Additionally, our design centers maintain an on-site dedicated graphics sales force. In addition to direct sales and marketing personnel, we utilize new product development engineers and product graphics and design specialists. These individuals are located at both the corrugated plants and the design centers. General marketing support is located at our corporate headquarters.

Our containerboard sales group is responsible for linerboard and corrugating medium order processing and sales to our corrugated plants, to outside domestic customers, and to export customers. These personnel also coordinate and execute all containerboard trade agreements with other containerboard manufacturers.

Containerboard produced in our mills is shipped by rail or truck. Our corrugated products are delivered by truck due to our large number of customers and their demand for timely service. Our corrugated manufacturing operations typically serve customers within a 150-mile radius. We sometimes use third-party warehouses for short-term storage of corrugated products.

Customers

We sell containerboard and corrugated products to approximately 17,000 customers in approximately 35,000 locations. About 70% of our corrugated products sales are to regional and local accounts, which are broadly diversified across industries and geographic locations. The remaining 30% of our customer base consists primarily of national accounts that have multiple locations and are served by a number of PCA plants. No single customer exceeds 10% of segment sales.

The primary end-use markets in the United States for corrugated products are shown below as reported in the 2018 Fibre Box Association annual report:

|

Food, beverages, and agricultural products |

|

|

44 |

% |

|

Retail and wholesale trade |

|

|

22 |

% |

|

Paper and other products |

|

|

14 |

% |

|

Chemical, plastic, and rubber products |

|

|

11 |

% |

|

Miscellaneous manufacturing |

|

|

9 |

% |

Competition

As of December 31, 2019, we were the third largest producer of containerboard products in North America, according to industry sources and our own estimates. According to industry sources, corrugated products are produced by about 460 U.S. companies operating approximately 1,200 plants. The primary basis for competition for most of our packaging products includes quality, service, price, product design, and innovation. Most corrugated products are manufactured to the customer’s specifications. Corrugated producers generally sell within a 150-mile radius of their plants and compete with other corrugated producers in their local region. Competition in our corrugated products operations tends to be regional, although we also face competition from competitors with significant national account presence.

6

On a national level, our primary competitors are International Paper Company, WestRock Company, Georgia-Pacific LLC, and Pratt Industries. However, with our strategic focus on regional and local accounts, we also compete with the smaller, independent producers.

Paper

We are the third largest manufacturer of UFS in North America, according to industry sources and our own estimates. We manufacture and sell papers, including both commodity and specialty papers, which may have custom or specialized features such as colors, coatings, high brightness, and recycled content. Our papers consist of communication papers, including cut-size office papers and printing and converting papers.

Facilities

We currently have two paper mills located in the United States. Total annual UFS capacity is 964,000 tons. Our operations include the following:

Jackson. Our Jackson, Alabama mill produces both commodity and specialty papers on two paper machines.

International Falls. Our International Falls, Minnesota mill produces both commodity and specialty papers on two paper machines.

Major Raw Materials Used

Fiber supply. Fiber is the largest raw material cost in this segment. We consume wood fiber, recycled fiber, and purchased pulp. Our Jackson mill purchases recycled fiber to produce our line of recycled office papers. We purchase wood fiber through contracts and open-market purchase, and we purchase recycled fiber and pulp from third parties pursuant to contractual agreements.

We participate in the Sustainable Forestry Initiative® (SFI®), the Programme for the Endorsement of Forest Certification (PEFC), as well as the Forest Stewardship Council® (FSC®), and we are certified under their sourcing and chain of custody standards. These standards are aimed at ensuring the long-term health and conservation of forestry resources. We are committed to sourcing wood fiber through environmentally, socially, and economically sustainable practices and promoting resource and conservation stewardship ethics.

Energy supply. We obtain energy through self-generated or purchased fuels and electricity. Fuel sources include by-products of the manufacturing and pulping process (including black liquor and wood waste), natural gas, electricity, and purchased wood waste. Each of the paper mills self-generates process steam requirements from by-products (black liquor and wood waste), as well as from the various purchased fuels. The process steam is used throughout the production process and to generate electricity.

In 2019, our paper mills consumed about 22 million MMBTU’s of fuel to produce both steam and electricity. Of the 22 million MMBTU’s consumed, about 68% was from mill generated by-products and 32% was from purchased fuels. Of the purchased fuels, 91% was from natural gas and 9% from purchased wood waste.

Chemical supply. We consume various chemicals in the production of white papers, including starch, precipitated calcium carbonate, caustic soda, and sodium chlorate. Most of our chemicals are purchased under contracts, which are bid or negotiated periodically.

Sales, Marketing, and Distribution

Our papers are sold primarily through our sales and marketing organization. We ship to customers both directly from our mills and through distribution centers and a network of outside warehouses by rail or truck. This allows us to respond quickly to customer requirements.

Customers

We have over 100 customers in approximately 400 locations. These customers include office products distributors and retailers, paper merchants, and envelope and other converters. We have established long-term relationships with many of our

7

customers. Office Depot, Inc. is our largest customer in the Paper segment. Effective January 1, 2020, we have a revised agreement with Office Depot in which we will continue to supply commodity and non-commodity office papers to Office Depot through December 31, 2022. Office Depot is not subject to a minimum volume commitment and is entitled to receive rebates for achieving certain volume thresholds. If the agreement is not renewed by the parties, Office Depot’s obligation to purchase paper would phase down over a two-year period beginning on January 1, 2023. In 2019, our sales revenue to Office Depot represented 50% of our Paper segment sales revenue and 7% of our consolidated sales revenue.

Competition

The markets in which our Paper segment competes are large and highly competitive. Commodity grades of UFS paper are globally traded, with numerous worldwide manufacturers, and as a result, these products compete primarily on the basis of price. All of our paper manufacturing facilities are located in the United States, and although we compete primarily in the domestic market, we do face competition from foreign producers. In 2016, as a result of a case brought by us and other domestic producers before United States international trade authorities, antidumping and countervailing duties at various levels were imposed on producers of uncoated freesheet papers produced in Australia, Brazil, China, Indonesia, and Portugal. These duties remain in effect. Other factors influencing competition from overseas producers include domestic and foreign demand and foreign currency exchange rates.

Our largest competitors include Domtar Corporation and International Paper Company. We also face competition from foreign producers. Although price is the primary basis for competition in most of our paper grades, quality and service are also important competitive determinants. Our papers compete with electronic data transmission, e-readers, electronic document storage alternatives, and paper grades we do not produce. Increasing shifts to these alternatives have had, and are likely to continue to have, an adverse effect on traditional print media and paper usage and lower demand for communication papers.

Corporate and Other

Our Corporate and Other segment includes corporate support staff services and related assets and liabilities. This segment also includes transportation assets, such as rail cars and trucks, which we use to transport some of our products to and from our manufacturing sites, and assets related to a 50% owned variable interest entity, Louisiana Timber Procurement Company, L.L.C. (LTP).

Employees

As of December 31, 2019, we had approximately 15,500 employees, including 4,500 salaried and 11,000 hourly employees. Approximately 63% of our hourly employees worked pursuant to collective bargaining agreements. The majority of our unionized employees are represented by the United Steel Workers (USW), the International Brotherhood of Teamsters (IBT), the International Association of Machinists (IAM), and the Association of Western Pulp and Paper Workers (AWPPW). We are currently in negotiations to renew or extend any union contracts that have recently expired or are expiring in the near future. During 2019, we experienced no work stoppages, and we believe we have satisfactory labor relations with our employees.

Environmental Matters

A discussion of the financial impact of our compliance with environmental laws is presented under the caption “Environmental Matters” in “Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations” of this Form 10-K.

Executive Officers of the Registrant

Brief statements setting forth the age at February 26, 2020, the principal occupation, employment during the past five years, the year in which such person first became an officer of PCA, and other information concerning each of our executive officers appears below.

Mark W. Kowlzan, 64, Chairman and Chief Executive Officer - Mr. Kowlzan has served as PCA's Chairman since January 2016 and as Chief Executive Officer and a director since July 2010. From 1998 through June 2010, Mr. Kowlzan led the company’s containerboard mill system, first as Vice President and General Manager and then as Senior Vice President - Containerboard. From 1996 through 1998, Mr. Kowlzan served in various senior mill-related operating positions with PCA and Tenneco Packaging, including as manager of the Counce linerboard mill. Prior to joining Tenneco Packaging, Mr. Kowlzan spent 15 years at International Paper Company, a global paper and packaging company, where he held a series of operational

8

and managerial positions within its mill organization. Mr. Kowlzan is a member of the board of American Forest and Paper Association.

Thomas A. Hassfurther, 64, Executive Vice President - Corrugated Products - Mr. Hassfurther has served as Executive Vice President - Corrugated Products of PCA since September 2009. From February 2005 to September 2009, Mr. Hassfurther served as Senior Vice President - Sales and Marketing, Corrugated Products. Prior to this he held various senior-level management and sales positions at PCA and Tenneco Packaging. Mr. Hassfurther joined the company in 1977.

Robert P. Mundy, 58, Executive Vice President and Chief Financial Officer - Mr. Mundy has served as Executive Vice President and Chief Financial Officer since May 2019. Mr. Mundy previously served as PCA’s Senior Vice President and Chief Financial Officer from 2015 to 2019. He previously served as Senior Vice President and Chief Financial Officer of Verso Corporation, a leading North American supplier of coated papers to catalog and magazine publishers, from 2006 to June 2015. Verso Corporation filed for Chapter 11 bankruptcy in January 2016. Prior to that, he worked at International Paper Company, from 1983 to 2006, where he was Director of Finance of the Coated and Supercalendered Papers division from 2002 to 2006, Director of Finance Projects from 2001 to 2002, Controller of Masonite Corporation from 1999 to 2001, and Controller of the Petroleum and Minerals business from 1996 to 1999. He served in various business positions at International Paper from 1983 to 1996.

Pamela A. Barnes, 55, Senior Vice President – Finance and Controller - Ms. Barnes has served as Senior Vice President – Finance and Controller since May 2019. Ms. Barnes previously served as a Vice President in PCA’s finance organization from 2012 to 2019. After joining the company in 1992, she has held various positions of increasing responsibility, including serving as PCA’s Treasurer since 1999. Before joining PCA, Ms. Barnes worked for Deloitte & Touche.

Charles J. Carter, 60, Senior Vice President - Containerboard Mill Operations - Mr. Carter has served as Senior Vice President - Containerboard Mill Operations since July 2013. Prior to this, he served as Vice President – Containerboard Mill Operations since January 2011. From March 2010 to January 2011, Mr. Carter served as PCA’s Director of Papermaking Technology. Prior to joining PCA in 2010, Mr. Carter spent 28 years with various pulp and paper companies in managerial and technical positions of increasing responsibility, most recently as Vice President and General Manager of the Calhoun, Tennessee mill of Abitibi Bowater from 2007 to 2010 and as manager of SP Newsprint’s Dublin, Georgia mill from 1999 to 2007.

Kent A. Pflederer, 49, Senior Vice President, General Counsel and Secretary - Mr. Pflederer has served as Senior Vice President, General Counsel and Corporate Secretary since January 2013 and has led our legal department since June 2007. Prior to joining PCA, Mr. Pflederer served as Senior Counsel, Corporate and Securities, at Hospira, Inc. from 2004 to 2007 and served in the corporate and securities practice at Mayer Brown, LLP from 1996 to 2004.

Bruce A. Ridley, 64, Senior Vice President – Environmental Health and Safety and Operational Services - Mr. Ridley has served as Senior Vice President – Environmental Health and Safety and Operational Services since May 2019. Mr. Ridley previously served as Vice President of Operations from 2012 to 2019 and at PCA’s Tomahawk, Wisconsin containerboard mill as the Operations Manager and Mill Manager from 1999 to 2011. Before joining PCA, he held several positions of increasing responsibility at multiple locations during his 19 years with International Paper Co. and two years with Champion International.

Robert A. Schneider, 54, Senior Vice President and Chief Information Officer - Mr. Schneider has served as Senior Vice President and Chief Information Officer since May 2019. He previously served as Vice President and Chief Information Officer from 2000 to 2019. Mr. Schneider joined the company in 1989 and has held various management and other positions of increasing responsibility in information systems for PCA.

D. Ray Shirley, 48, Senior Vice President – Corporate Engineering and Process Technology - Mr. Shirley has served as PCA’s Senior Vice President – Corporate Engineering and Process Technology since May 2019. Mr. Shirley previously served as PCA’s Vice President – Containerboard Mills Engineering and Process Technology from 2012 to 2019 and as Mill Manager at PCA’s Counce, Tennessee containerboard mill from 2010 to 2012. He has served in various management roles within the company, including the Operations Manager at the Filer City, Michigan containerboard mill. Before joining PCA in 1996, Mr. Shirley worked for Georgia-Pacific Corporation.

Thomas W.H. Walton, 60, Senior Vice President - Sales and Marketing, Corrugated Products - Mr. Walton has served as Senior Vice President - Sales and Marketing, Corrugated Products since October 2009. Prior to this, he served as a Vice President and Area General Manager within the Corrugated Products Group since 1998. Mr. Walton joined the company in 1981 and has also held positions in production, sales, and general management.

9

Available Information

PCA’s internet website address is www.packagingcorp.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 are available free of charge through our website as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission. In addition, our Code of Ethics may be accessed in the Investor Relations section of PCA’s website. PCA’s website and the information contained or incorporated therein are not intended to be incorporated into this report.

|

Item 1A. |

RISK FACTORS |

Some of the statements in this report and, in particular, statements found in Management’s Discussion and Analysis of Financial Condition and Results of Operations, that are not historical in nature are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements about our expectations regarding our future liquidity, earnings, expenditures, and financial condition. These statements are often identified by the words “will,” “should,” “anticipate,” “believe,” “expect,” “intend,” “estimate,” “hope,” or similar expressions. These statements reflect management’s current views with respect to future events and are subject to risks and uncertainties. There are important factors that could cause actual results to differ materially from those in forward-looking statements, many of which are beyond our control. These factors, risks and uncertainties include, but are not limited to, the factors described below.

Our actual results, performance, or achievement could differ materially from those expressed in, or implied by, these forward-looking statements, and accordingly, we can give no assurances that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what impact they will have on our results of operations or financial condition. In view of these uncertainties, investors are cautioned not to place undue reliance on these forward-looking statements. We expressly disclaim any obligation to publicly revise or otherwise update any forward-looking statements that have been made to reflect the occurrence of events after the date hereof.

In addition to the risks and uncertainties we discuss elsewhere in this Form 10-K (particularly in “Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations”) or in our other filings with the Securities and Exchange Commission (SEC), the following are important factors that could cause our actual results to differ materially from those we project in any forward-looking statement.

Industry Cyclicality - Changes in the prices of our products could materially affect our financial condition, results of operations, and liquidity. Macroeconomic conditions and fluctuations in industry capacity can create changes in prices, sales volumes, and margins for most of our products, particularly commodity grades of packaging and paper products. Prices for all of our products are driven by many factors, including demand for our products, industry capacity and decisions made by other producers with respect to capacity, and other competitive conditions in our industry. These factors are affected by general global and domestic economic conditions. We have little influence over the timing and extent of price changes of our products, which may be unpredictable and volatile. In addition, as many of our customer contracts include price adjustment provisions based upon published index prices for containerboard or certain grades of UFS papers, our selling prices are influenced by index levels published by trade publications. Changes in how these index levels are determined or maintained may affect our sales prices. If supply exceeds demand, industry operating conditions deteriorate or other factors result in lower prices for our products, our earnings and operating cash flows would be harmed.

General Economic Conditions - If business, political, and economic conditions change in an adverse manner, our business, results of operations, liquidity, and financial position may be harmed. General global and domestic economic conditions directly affect the levels of demand and production of consumer goods, levels of employment, the availability and cost of credit, and ultimately, the profitability of our business. If economic conditions deteriorate and result in higher unemployment rates, lower disposable income, unfavorable currency exchange rates, lower corporate earnings, lower business investment, and lower consumer spending, we may experience lower demand for our products, which is largely driven by demand for products of our customers which utilize our products. If economic conditions result in higher inflation, we may experience higher production and transportation costs, which we may not be able to recover through higher prices or otherwise. In addition, changes in trade policy, including renegotiating or potentially terminating existing bilateral or multilateral agreements as well as the imposition of tariffs, could impact global markets and demand for our and our customers’ products and the costs associated with certain of our capital investments. Further changes in tax laws or tax rates may have a material impact on our future cash taxes, effective tax rate or deferred tax assets and liabilities. These conditions are beyond our control and may have a material impact on our business, results of operations, liquidity, and financial position.

10

Competition - The intensity of competition in the industries in which we operate could result in downward pressure on pricing and volume, which could lower earnings and operating cash flows. Our industries are highly competitive, with no single containerboard, corrugated packaging, or UFS paper producer having a dominant position. Containerboard and commodity UFS paper products cannot generally be differentiated by producer, which tends to intensify price competition. The corrugated packaging industry is also sensitive to changes in economic conditions, as well as other factors including innovation, design, quality, and service. To the extent that one or more competitors are more successful than we are with respect to any key competitive factor, our business could be adversely affected. Our packaging products also compete, to some extent, with various other packaging materials, including products made of paper, plastics, wood, and various types of metal. If we are unable to successfully compete, we may lose market share or may be required to charge lower sales prices for our products, both of which would reduce our earnings and operating cash flows.

UFS paper products compete with electronic data transmission and document storage alternatives. Increasing shifts to electronic alternatives have had and will continue to have an adverse effect on usage of these products. As a result of such competition, the industry is experiencing decreasing demand for existing UFS paper products. As the use of these alternatives grows, demand for UFS paper products is likely to further decline. Declines in demand for our paper products may adversely affect our earnings and operating cash flows.

Some of our competitors are larger than we are and may have greater financial and other resources, greater manufacturing economies of scale, greater energy self-sufficiency, or lower operating costs, compared to our company. We may be unable to compete effectively with these companies particularly during economic downturns. Some of the factors that may adversely affect our ability to compete in the markets in which we participate include the entry of new competitors into the markets we serve, increased competition from overseas producers, our competitors' pricing strategies, changes in customer preferences, and the cost-efficiency of our facilities.

Inflation and Other General Cost Increases - We may not be able to offset higher costs. We are subject to both contractual, inflationary, and other general cost increases, including with regard to our labor costs and purchases of raw materials and transportation services. General economic conditions may result in higher inflation, which may increase our exposure to higher costs. If we are unable to offset these cost increases by price increases, growth, and/or cost reductions in our operations, these inflationary and other general cost increases could have a material adverse effect on our operating cash flows, profitability, and liquidity.

In 2019, our total company costs including cost of sales (COS) and selling, general, and administrative expenses (SG&A) was $5.9 billion, and excluding non-cash costs (depreciation, depletion and amortization, pension and postretirement expense, and share-based compensation expense) was $5.4 billion. A 1% increase in COS and SG&A costs would increase costs by $59 million and cash costs by $54 million.

Cost of Fiber - An increase in the cost of fiber could increase our manufacturing costs and lower our earnings. The market price of wood fiber varies based upon availability, source, and the costs of fuels used in the harvesting and transportation of wood fiber. The cost and availability of wood fiber can also be impacted by weather, general logging conditions, geography, and regulatory activity.

The availability and cost of recycled fiber depends heavily on recycling rates and the domestic and global demand for recycled products. We purchase recycled fiber for use at five of our six containerboard mills and both paper mills. In 2019, we purchased approximately 790,000 tons of recycled fiber, net of the recycled fiber generated by our corrugated box plants. The amount of recycled fiber purchased each year varies based upon production and the prices of both recycled fiber and wood fiber.

Periods of supply and demand imbalance have created significant price volatility. Periods of higher recycled fiber costs and unusual price volatility have occurred in the past, including during 2019 as demand for domestic recycled fiber from Chinese producers continued to remain low. Prices for recycled fiber may continue to fluctuate significantly in the future, which could result in higher costs and lower earnings. A $10 per ton price increase in recycled fiber for our containerboard mills, would result in approximately $7 million of additional expense based on 2019 consumption.

11

Cost of Purchased Fuels and Chemicals - An increase in the cost of purchased fuels and chemicals could lead to higher manufacturing costs, resulting in reduced earnings. We have the ability to use various types of purchased fuels in our manufacturing operations, including natural gas, bark, and other purchased fuels. Fuel prices, in particular prices for oil and natural gas, have fluctuated in the past. New and more stringent environmental regulations may discourage, reduce the availability of, or make more expensive, the use of certain fuels, particularly coal and fossil fuels. In addition, costs for key chemicals used in our manufacturing operations also fluctuate. These fluctuations impact our manufacturing costs and result in earnings volatility. If fuel and chemical prices rise, our production costs and transportation costs will increase and cause higher manufacturing costs and reduced earnings if we are unable to recover such increases through higher prices of our products. A $0.10 per million MMBTU increase in natural gas prices would result in approximately $3 million of additional expense, based on 2019 usage.

Transportation Costs - Reduced truck and rail availability could lead to higher costs or poorer service, resulting in lower earnings, and harm our ability to distribute our products. We ship our products primarily by truck and rail. We have experienced lower availability of third-party trucking services and service issues, interruptions, and delays in rail services. We have also experienced higher costs for transportation services in general. If these factors persist, we could experience even higher transportation costs in the future and difficulties shipping our products in a timely manner. We may not be able to recover higher transportation costs through higher prices or otherwise, which would result in lower earnings.

Material Disruption of Manufacturing - A material disruption at one of our manufacturing facilities could prevent us from meeting customer demand, reduce our sales, and/or negatively affect our results of operations and financial condition. Our business depends on continuous operation of our facilities, particularly at our mills. Any of our manufacturing facilities, or any of our machines within such facilities, could cease operations unexpectedly for a significant period of time due to a number of events, including:

|

|

• |

Unscheduled maintenance outages. |

|

|

• |

Prolonged power failures. |

|

|

• |

Equipment or information system breakdowns or failures. |

|

|

• |

Explosion of a boiler or other major facilities. |

|

|

• |

Disruption in the supply of raw materials, such as wood fiber, energy, or chemicals. |

|

|

• |

A spill or release of pollutants or hazardous substances. |

|

|

• |

Closure or curtailment related to environmental concerns. |

|

|

• |

Labor difficulties. |

|

|

• |

Disruptions in the transportation infrastructure, including roads, bridges, railroad tracks, and tunnels. |

|

|

• |

Fires, floods, earthquakes, hurricanes, or other catastrophic events. |

|

|

• |

Terrorism or threats of terrorism. |

|

|

• |

Other operational problems. |

These events could harm our ability to produce our products and serve our customers and may lead to higher costs and reduced earnings.

Environmental Matters - PCA may incur significant environmental liabilities with respect to both past and future operations. We are subject to, and must comply with, a variety of federal, state and local environmental laws, particularly those relating to air and water quality, waste disposal and the cleanup of contaminated soil and groundwater. Failure to comply with these regulations could result in fines, which may be significant, or other adverse regulatory action. Because environmental regulations are constantly evolving, we have incurred, and will continue to incur, costs to maintain compliance with those laws. See Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Environmental Matters” for estimates of expenditures we expect to make for environmental compliance in the next few years. New and more stringent environmental regulations may be adopted and may require us to incur additional operating expenses and/or significant additional capital expenditures to modify or replace certain of our boilers and other equipment. In addition, environmental regulations may increase the cost of our raw materials and purchased energy. Although we have established reserves to provide for known environmental liabilities, these reserves may change over time due to the enactment of new environmental laws or regulations or changes in existing laws or regulations, which might require additional significant environmental expenditures.

12

Mergers and Acquisitions - Our acquired businesses may underperform relative to our expectations, and we may not be able to successfully integrate these businesses into our own. We have completed several mergers and acquisitions and investments in recent years. Our success will depend in part on our ability to successfully integrate, and receive the intended benefits from, these acquisitions. There may be difficulties, costs and delays involved in the integration of these businesses into ours. Integration requires modification of operational and financial systems and may result in significant additional expenses. If the acquired businesses underperform relative to our expectations, or if we fail to successfully integrate these businesses, our business, financial condition and results of operations may be materially and adversely affected.

Customer Concentration - We rely on certain large customers. Our packaging and paper segments each have large customers, the loss of which could adversely affect the segment’s sales and profitability. In particular, because our businesses operate in highly competitive industry segments, we regularly bid for new business or for renewal of existing business. The loss of business from our larger customers, or the renewal of business on less favorable terms, may adversely impact our financial results.

Office Depot, Inc. is our largest customer in the Paper segment. Effective January 1, 2020, we have a revised agreement with Office Depot in which we will continue to supply commodity and non-commodity office papers to Office Depot through December 31, 2022. Office Depot is not subject to a minimum volume commitment and is entitled to receive rebates for achieving certain volume thresholds. If the agreement is not renewed by the parties, Office Depot’s obligation to purchase paper would phase down over a two-year period beginning on January 1, 2023.

In 2019, sales to Office Depot represented 50% of our Paper segment sales and 7% of our consolidated sales. If these sales are reduced, including if we are unable to renew the agreement at historical volume levels, we would need to find new customers. We may not be able to fully replace any lost sales, and any new sales may be at lower prices or higher costs. Any significant deterioration in the financial condition of Office Depot affecting its ability to pay or any other change that makes Office Depot less willing to purchase our products will harm our business and results of operations.

Labor Relations- If we experience strikes or other work stoppages, our business will be harmed. Our workforce is highly unionized and operates under various collective bargaining agreements. We must negotiate to renew or extend any union contracts that have recently expired or are expiring in the near future. While we believe that we have satisfactory labor relations, we may not be able to successfully negotiate new agreements without work stoppages or labor difficulties in the future or renegotiate them on favorable terms. If we are unable to successfully renegotiate the terms of any of these agreements, or if we experience any extended interruption of operations at any of our facilities as a result of strikes or other work stoppages, our business, results of operations and financial condition may be harmed.

Reliance on Personnel - We may fail to attract and retain qualified personnel, including key management personnel. Our ability to operate and grow our business depends on our ability to attract and retain employees with the skills necessary to operate and maintain our facilities, produce our products and serve our customers. The increasing demand for qualified personnel may make it more difficult for us to attract and retain qualified employees. Changing demographics and labor work force trends may make it difficult for us to replace retiring employees at our manufacturing and other facilities. If we fail to attract and retain qualified personnel, or if we experience labor shortages, we may experience higher costs and other difficulties, and our business may be adversely impacted.

In addition, we rely on key executive and management personnel to manage our business efficiently and effectively. As our business has grown in size and geographic scope, we have relied on these individuals to manage increasingly complex operations. The loss of any of our key personnel could adversely affect our business.

Cyber Security - Risks related to security breaches of company, customer, employee, and vendor information, as well as the technology that manages our operations and other business processes, could adversely affect our business. We rely on various information technology systems to capture, process, store, and report data and interact with customers, vendors, and employees. Despite careful security and controls design, implementation, updating, and internal and independent third-party assessments, our information technology systems, and those of our third party providers, could become subject to cyber-attacks or security breaches. Network, system, and data breaches could result in misappropriation of sensitive data or operational disruptions including interruption to systems availability and denial of access to and misuse of applications required by our customers to conduct business with us. Misuse of internal applications; theft of intellectual property, trade secrets, or other corporate assets; and inappropriate disclosure of confidential information could stem from such incidents. Delayed sales, slowed production, or other issues resulting from these disruptions could result in lost sales, business delays, and negative publicity and could have a material adverse effect on our operations, financial condition, or operating cash flows.

13

Debt obligations - Our debt service obligations may reduce our operating flexibility. At December 31, 2019, we had $2.5 billion of debt outstanding and a $329.2 million undrawn revolving credit facility, after deducting letters of credit. All debt is comprised of fixed-rate senior notes. We and our subsidiaries are not restricted from incurring, and may incur, additional indebtedness in the future.

Our current borrowings, plus any future borrowings, may affect our ability to operate our business, including, without limitation:

|

|

• |

Result in significant cash requirements to make interest and maturity payments on our outstanding indebtedness; |

|

|

• |

Increase our vulnerability to adverse changes in our business or industry conditions; |

|

|

• |

Increase our vulnerability to increases in interest rates; |

|

|

• |

Limit our ability to obtain additional financing for working capital, capital expenditures, general corporate, and other purposes; |

|

|

• |

Limit our flexibility in planning for, or reacting to, changes in our business and our industry; and |

|

|

• |

Limit our flexibility to make acquisitions. |

Further, if we cannot service our indebtedness, we may have to take actions to secure additional cash by selling assets, seeking additional equity or reducing investments, which may not be achievable on acceptable terms or at all.

Pension Plans – Our pension plans may require additional funding. We record a liability associated with our pensions equal to the excess of the benefit obligations over the fair value of the assets funding the plans. The actual required amounts and timing of future cash contributions will be sensitive to changes in the applicable discount rates and returns on plan assets, and could also be impacted by future changes in the laws and regulations applicable to plan funding. Fluctuations in the market performance of our plan assets will affect our pension plan costs in future periods. Changes in assumptions regarding expected long-term rate of return on plan assets, our discount rate, expected compensation levels, or mortality will also increase or decrease pension costs.

Market Price of our Common Stock - The market price of our common stock may be volatile, which could cause the value of the stock to decline. Securities markets worldwide periodically experience significant price declines and volume fluctuations due to macroeconomic factors and other factors beyond our control. This market volatility, as well as general economic, market, or political conditions, could reduce the market price of our common stock with little regard to our operating performance. In addition, our operating results could be below the expectations of public market analysts and investors, and in response, the market price of our common stock could decrease significantly.

|

Item 1B. |

UNRESOLVED STAFF COMMENTS |

None.

|

Item 2. |

PROPERTIES |

We own and lease properties in our business. Primarily all of our leases are non-cancelable and are accounted for as operating leases. These leases are not subject to early termination except for standard nonperformance clauses.

Information concerning capacity and utilization of our principal operating facilities, the segments that use those facilities, and a map of geographical locations is presented in “Part I, Item 1. Business” of this Form 10-K. We assess the condition and capacity of our manufacturing, distribution, and other facilities needed to meet our operating requirements. Our properties have been generally well maintained and are in good operating condition. In general, our facilities have sufficient capacity and are adequate for our production and distribution requirements.

We currently own buildings and land for six containerboard mills and two paper mills. Additionally, we have 95 corrugated manufacturing operations, of which the buildings and land for 53 are owned, including 45 combining operations, or corrugated plants, one corrugated sheet-only manufacturer, and seven sheet plants. We lease the buildings for 17 corrugated plants and 25 sheet plants. We own warehouses and miscellaneous other properties, including sales offices and woodlands management offices. We lease space for regional design centers and numerous other distribution centers, warehouses, and facilities. The equipment in these leased facilities is, in virtually all cases, owned by us, except for forklifts and other rolling stock, which are generally leased.

14

We lease the cutting rights to approximately 73,000 acres of timberland located near our Valdosta mill (66,000 acres) and our Counce mill (7,000 acres). On average, these cutting rights agreements have terms with approximately 18 years remaining. Additionally, we previously leased 3,000 acres of land where we operated fiber farms as a source of future fiber supply; however, we exited the leases in conjunction with the conversion of the No. 3 machine at the Wallula mill to kraft linerboard.

Our corporate headquarters is located in Lake Forest, Illinois. The headquarter facility is owned, and we lease additional neighboring office space through the next two years with provisions for two additional five year lease extensions.

|

Item 3. |

LEGAL PROCEEDINGS |

Information concerning legal proceedings can be found in Note 21, Commitments, Guarantees, Indemnifications, and Legal Proceedings, of the Notes to Consolidated Financial Statements in “Part II, Item 8. Financial Statements and Supplementary Data” of this Form 10-K.

|

Item 4. |

MINE SAFETY DISCLOSURE |

Not applicable.

15

PART II

|

Item 5. |

MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

PCA’s common stock is listed on the New York Stock Exchange (NYSE) under the symbol “PKG”.

Stockholders

On February 21, 2020, there were 96 holders of record of our common stock.

Purchases of Equity Securities

Stock Repurchase Program

On February 25, 2016, PCA announced that its Board of Directors authorized the repurchase of $200.0 million of the Company's outstanding common stock. At the time of the announcement, there was no remaining authority under previously announced programs. Repurchases may be made from time to time in open market or privately negotiated transactions in accordance with applicable securities regulations. The timing and amount of repurchases will be determined by the Company in its discretion based on factors such as PCA’s stock price and market and business conditions.

The Company did not repurchase any shares of its common stock under this authority during the years ended December 31, 2019, 2018, and 2017. As of December 31, 2019, we are authorized to repurchase $193.0 million of the Company’s common stock.

Pursuant to its equity incentive plan, the Company withholds shares from vesting employee equity awards to cover employee tax liabilities. Total shares withheld in 2019 were 87,668 to cover $8.2 million in employee tax liabilities. Total shares withheld in 2018 were 69,255 to cover $7.9 million of employee tax liabilities. Total shares withheld in 2017 were 97,946 for $10.8 million in employee tax liabilities.

The following table presents information related to our repurchases of common stock made under repurchase plans authorized by PCA's Board of Directors, and shares withheld to cover taxes on vesting of equity awards, during the three months ended December 31, 2019:

|

Issuer Purchases of Equity Securities |

|

||||||||||||||||

|

Period |

|

Total Number of Shares Purchased (a) |

|

|

|

Average Price Paid Per Share |

|

|

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

|

|

Approximate Dollar Value of Shares That May Yet Be Purchased Under the Plans or Programs (in millions) |

|

||||

|

October 1-31, 2019 |

|

|

— |

|

|

|

$ |

— |

|

|

|

— |

|

|

$ |

193.0 |

|

|

November 1-30, 2019 |

|

|

65 |

|

|

|

|

111.33 |

|

|

|

— |

|

|

|

193.0 |

|

|

December 1-31, 2019 |

|

|

698 |

|

|

|

|

111.99 |

|

|

|

— |

|

|

|

193.0 |

|

|

Total |

|

|

763 |

|

|

|

$ |

111.93 |

|

|

|

— |

|

|

$ |

193.0 |

|

|

(a) |

763 shares were withheld from employees to cover income and payroll taxes on equity awards that vested during the period. |

16

Performance Graph

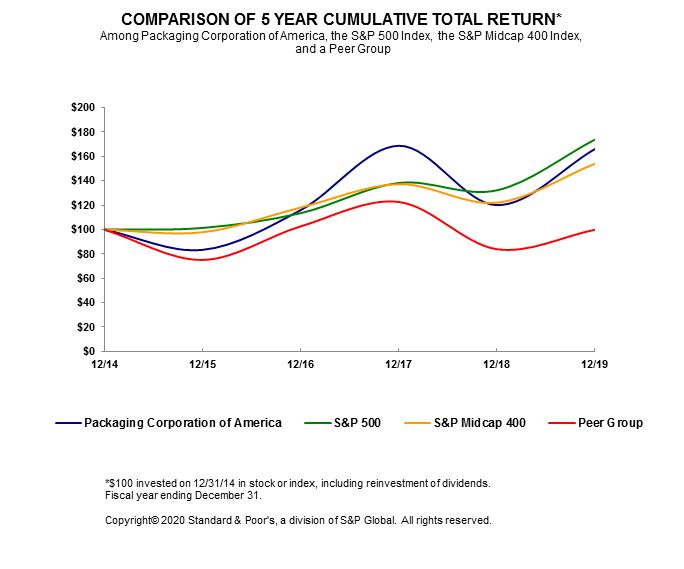

The graph below compares PCA’s cumulative 5-year total shareholder return on common stock with the cumulative total returns of the S&P 500 index; the S&P Midcap 400 index; and a customized peer group of three companies that includes: International Paper Company, WestRock Company, and Domtar Corporation. The graph tracks the performance of a $100 investment (including the reinvestment of all dividends) in our common stock, in each index, and in each peer group's common stock from December 31, 2014, through December 31, 2019. The stock price performance included in this graph is not necessarily indicative of future stock price performance.

|

|

|

Cumulative Total Return |

|

|||||||||||||||||||||

|

|

|

December 31, |

|

|||||||||||||||||||||

|

|

|

2014 |

|

|

2015 |

|

|

2016 |

|

|

2017 |

|

|

2018 |

|

|

2019 |

|

||||||

|

Packaging Corporation of America |

|

$ |

100.00 |

|

|

$ |

83.41 |

|

|

$ |

116.02 |

|

|

$ |

168.80 |

|

|

$ |

120.08 |

|

|

$ |

166.13 |

|

|

S&P 500 |

|

|

100.00 |

|

|

|

101.38 |

|

|

|

113.51 |

|

|

|

138.29 |

|

|

|

132.23 |

|

|

|

173.86 |

|

|

S&P Midcap 400 |

|

|

100.00 |

|

|

|

97.82 |

|

|

|

118.11 |

|

|

|

137.30 |

|

|

|

122.08 |

|

|

|

154.07 |

|

|

Peer Group |

|

|

100.00 |

|

|

|

75.15 |

|

|

|

102.67 |

|

|

|

122.72 |

|

|

|

83.96 |

|

|

|

99.89 |

|

The information in the graph and table above is not deemed “filed” with the Securities and Exchange Commission and is not to be incorporated by reference in any of PCA’s filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, whether made before or after the date of this Annual Report on Form 10-K, except to the extent that PCA specifically incorporates such information by reference.

17

|

Item 6. |

SELECTED FINANCIAL DATA |

The following table sets forth selected historical financial data of PCA (dollars and shares in millions, except per share data). The information contained in the table should be read in conjunction with the disclosures in “Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations” and “Part II, Item 8. Financial Statements and Supplementary Data” of this Form 10-K.

|

|

|

Year Ended December 31, |

|

|||||||||||||||||

|

|

|

2019 |

|

|

2018 |

|

|

2017 |

|

|

2016 |

|

|

2015 |

|

|||||

|

Statement of Income Data (a): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

6,964.3 |

|

|

$ |

7,014.6 |

|

|

$ |

6,444.9 |

|

|

$ |

5,779.0 |

|

|

$ |

5,741.7 |

|

|

Net income |

|

|

696.4 |

|

|

|

738.0 |

|

|

|

668.6 |

|

|

|

449.6 |

|

|

|

436.8 |

|

|

Net income per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— basic |

|

|

7.36 |

|

|

|

7.82 |

|

|

|

7.09 |

|

|

|

4.76 |

|

|

|

4.47 |

|

|

— diluted |

|

|

7.34 |

|

|

|

7.80 |

|

|

|

7.07 |

|

|

|

4.75 |

|

|

|

4.47 |

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— basic |

|

|

93.8 |

|

|

|

93.7 |

|

|

|

93.5 |

|

|

|

93.5 |

|

|

|

96.6 |

|

|

— diluted |

|

|

94.1 |

|

|

|

93.9 |

|

|

|

93.7 |

|

|

|

93.7 |

|

|

|

96.7 |

|

|

Cash dividends declared per common share |

|

|

3.16 |

|

|

|

3.00 |

|

|

|

2.52 |

|

|

|

2.36 |

|

|

|

2.20 |

|

|

Balance Sheet Data (a): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

7,235.8 |

|

|

$ |

6,569.7 |

|

|

$ |

6,197.5 |

|

|

$ |

5,777.0 |

|

|

$ |

5,272.3 |

|

|

Total long-term obligations (b) |

|

|

2,494.3 |

|

|

|

2,502.7 |

|

|

|

2,650.7 |

|

|

|

2,667.4 |

|

|

|

2,319.7 |

|

|

Stockholders' equity |

|

|

3,071.0 |

|

|

|

2,672.4 |

|

|

|

2,182.6 |

|

|

|

1,759.8 |

|

|

|

1,633.3 |

|

|

(a) |

Effective January 1, 2019, the Company adopted ASU 2016-02 (Topic 842): Leases, which requires the recognition of lease assets and lease liabilities by lessees for those leases classified as operating leases under the previous guidance. We elected to apply this guidance as of its effective date and did not restate comparative periods. See Note 2, Summary of Significant Accounting Policies, and Note 3, Leases, for more information. |

Effective January 1, 2016, the Company adopted Accounting Standards Update (ASU) 2015-03 (Topic 835): Simplifying the Presentation of Debt Issuance Costs. We applied this guidance retrospectively, as required, and reclassified the debt issuance costs from “Other long-term assets” to “Long-term debt” on our Consolidated Balance Sheet to conform with current period presentation. Total assets for all periods presented have been updated to reflect this adoption.

Net income and net income per common share are impacted by a lower U.S. corporate federal statutory income tax rate of 21% in 2019 and 2018 and 35% in all prior years presented in this table. In addition, both 2018 and 2017 include a tax benefit of $2.0 million and $122.1 million, respectively, related to the enactment in December 2017 of the Tax Cuts and Jobs Act (H.R.1). See Note 8, Income Taxes, for more information.

|

(b) |

Includes long-term debt and finance lease obligations. |

18

|

Item 7. |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion and analysis of historical results of operations and financial condition should be read in conjunction with the audited financial statements and the notes thereto which appear elsewhere in this Form 10-K. This discussion includes forward-looking statements regarding our expectations with respect to our future performance, liquidity, and capital resources. Such statements, along with any other non-historical statements in the discussion, are forward-looking. See our discussion regarding forward-looking statements included under “Part I, Item 1A. Risk Factors” of this Form 10-K. For our discussion and analysis of our results of operations, financial condition and cash flows for the year ended December 31, 2017, the earliest of the years presented in the accompanying audited financial statements included in Item 8 herein, please refer to our Annual Report on Form 10-K for the year ended December 31, 2018, filed with the Securities and Exchange Commission on February 28, 2019. Such information is presented in Item 7 of such report under the subcaptions “Results of Operations —Year Ended December 31, 2018, Compared with Year Ended December 31, 2017” and “Liquidity and Capital Resources” and is incorporated by reference herein.

Overview

PCA is the third largest producer of containerboard products and the third largest producer of uncoated freesheet paper in North America. We operate six containerboard mills, two paper mills, and 95 corrugated products manufacturing plants. Our containerboard mills produce linerboard and corrugating medium, which are papers primarily used in the production of corrugated products. Our corrugated products manufacturing plants produce a wide variety of corrugated packaging products, including conventional shipping containers used to protect and transport manufactured goods, multi-color boxes and displays with strong visual appeal that help to merchandise the packaged product in retail locations, and honeycomb protective packaging. In addition, we are a large producer of packaging for meat, fresh fruit and vegetables, processed food, beverages, and other industrial and consumer products. We also manufacture and sell UFS papers, including both commodity and specialty papers, which may have custom or specialized features such as colors, coatings, high brightness, and recycled content. We are headquartered in Lake Forest, Illinois and operate primarily in the United States.

Executive Summary

Net sales were $6.96 billion for the year ended December 31, 2019 and $7.01 billion in 2018. We reported $696 million of net income, or $7.34 per diluted share, in 2019, compared to $738 million, or $7.80 per diluted share, in 2018. Net income included $29 million of expense for special items in 2019, compared to $22 million of expense for special items in 2018. Special items in both periods are described later in this section. Excluding special items, we recorded $726 million of net income, or $7.65 per diluted share, in 2019, compared to $760 million, or $8.03 per diluted share, in 2018. The decrease was driven primarily by lower prices and mix in our Packaging segment, lower volumes in our Paper segment, and higher operating and converting costs, partially offset by higher volumes in our Packaging segment, higher prices and mix in our Paper segment, lower annual outage expense, and lower freight and logistic expenses. For additional detail on special items included in reported GAAP results, as well as segment income (loss) excluding special items, earnings before non-operating pension expense, interest, income taxes, and depreciation, amortization, and depletion (EBITDA), and EBITDA excluding special items, see “Item 7. Reconciliations of Non-GAAP Financial Measures to Reported Amounts.”

Packaging segment income from operations was $963 million in 2019, compared to $1,045 million in 2018. Packaging segment EBITDA excluding special items was $1,310 million in 2019, compared to $1,401 million in 2018. The decrease was driven primarily by lower domestic and export containerboard prices and mix and higher operating and converting costs, partially offset by higher sales and production volumes, higher corrugated products prices and mix, lower annual outage expense, and lower freight and logistic expenses.

Paper segment income from operations was $175 million in 2019, compared to $98 million in 2018. Paper segment EBITDA excluding special items was $213 million in 2019, compared to $165 million in 2018. The increase was due primarily to higher paper prices and mix, lower operating costs, and lower freight and logistic expenses, partially offset by lower sales and production volumes, and higher annual outage expense.

During the second quarter of 2018, the Company discontinued production of paper grades at its Wallula, Washington mill and converted the No. 3 paper machine to a 400,000 ton-per-year virgin kraft linerboard machine. The Company incurred charges in the Packaging and Paper segments relating to these activities during 2019 and 2018 as described below under “Special Items and Earnings per Diluted Share, Excluding Special Items.”

19

Special Items and Earnings per Diluted Share, Excluding Special Items

Earnings per diluted share, excluding special items, in 2019 and 2018 were as follows:

|

|

|

Year Ended December 31, |

|

|||||

|

|

|

2019 |

|

|

2018 |

|

||

|

Earnings per diluted share |

|

$ |

7.34 |

|

|

$ |

7.80 |

|

|

Special items: |

|

|

|

|

|

|

|

|

|

Debt refinancing (a) |

|

|

0.28 |

|

|

|

— |

|

|

DeRidder mill fixed asset disposals (b) |

|

|

0.02 |

|

|

|

— |

|

|

Wallula mill restructuring (c) |

|

|

0.01 |

|

|

|

0.24 |

|

|

Facilities closure and other costs (d) |

|

|

— |

|

|

|

0.01 |

|

|

Tax reform (e) |

|

|

— |

|

|

|

(0.02 |

) |

|

Total special items expense |

|

|

0.31 |

|

|

|

0.23 |

|

|

Earnings per diluted share, excluding special items |

|

$ |

7.65 |

|

|

$ |

8.03 |

|

|

(a) |