000075000412/312023Q3FALSE00007500042023-01-012023-09-3000007500042023-11-03xbrli:shares0000750004us-gaap:ServiceMember2023-07-012023-09-30iso4217:USD0000750004us-gaap:ServiceMember2022-07-012022-09-300000750004us-gaap:ServiceMember2023-01-012023-09-300000750004us-gaap:ServiceMember2022-01-012022-09-300000750004us-gaap:ProductMember2023-07-012023-09-300000750004us-gaap:ProductMember2022-07-012022-09-300000750004us-gaap:ProductMember2023-01-012023-09-300000750004us-gaap:ProductMember2022-01-012022-09-3000007500042023-07-012023-09-3000007500042022-07-012022-09-3000007500042022-01-012022-09-30iso4217:USDxbrli:shares0000750004us-gaap:SegmentDiscontinuedOperationsMember2022-07-012022-09-300000750004us-gaap:SegmentDiscontinuedOperationsMember2022-01-012022-09-3000007500042023-09-3000007500042022-12-3100007500042021-12-3100007500042022-09-30lnw:Segment0000750004lnw:SciPlayMemberus-gaap:SubsequentEventMember2023-10-23xbrli:pure0000750004lnw:SciPlayAcquisitionMemberus-gaap:SubsequentEventMember2023-10-232023-10-230000750004us-gaap:EmployeeStockMember2022-01-012022-09-300000750004us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-09-300000750004us-gaap:SegmentDiscontinuedOperationsMemberlnw:LotteryBusinessSegmentMember2022-04-012022-06-300000750004us-gaap:SegmentDiscontinuedOperationsMemberlnw:SportsBettingBusinessSegmentMember2022-07-012022-09-300000750004lnw:GamingOperationsMemberus-gaap:OperatingSegmentsMemberlnw:GamingGroupMember2023-07-012023-09-300000750004lnw:GamingOperationsMemberus-gaap:OperatingSegmentsMemberlnw:GamingGroupMember2022-07-012022-09-300000750004lnw:GamingOperationsMemberus-gaap:OperatingSegmentsMemberlnw:GamingGroupMember2023-01-012023-09-300000750004lnw:GamingOperationsMemberus-gaap:OperatingSegmentsMemberlnw:GamingGroupMember2022-01-012022-09-300000750004us-gaap:OperatingSegmentsMemberlnw:GamingGroupMemberlnw:GamingMachineSalesMember2023-07-012023-09-300000750004us-gaap:OperatingSegmentsMemberlnw:GamingGroupMemberlnw:GamingMachineSalesMember2022-07-012022-09-300000750004us-gaap:OperatingSegmentsMemberlnw:GamingGroupMemberlnw:GamingMachineSalesMember2023-01-012023-09-300000750004us-gaap:OperatingSegmentsMemberlnw:GamingGroupMemberlnw:GamingMachineSalesMember2022-01-012022-09-300000750004us-gaap:OperatingSegmentsMemberlnw:GamingSystemsMemberlnw:GamingGroupMember2023-07-012023-09-300000750004us-gaap:OperatingSegmentsMemberlnw:GamingSystemsMemberlnw:GamingGroupMember2022-07-012022-09-300000750004us-gaap:OperatingSegmentsMemberlnw:GamingSystemsMemberlnw:GamingGroupMember2023-01-012023-09-300000750004us-gaap:OperatingSegmentsMemberlnw:GamingSystemsMemberlnw:GamingGroupMember2022-01-012022-09-300000750004lnw:TableProductsMemberus-gaap:OperatingSegmentsMemberlnw:GamingGroupMember2023-07-012023-09-300000750004lnw:TableProductsMemberus-gaap:OperatingSegmentsMemberlnw:GamingGroupMember2022-07-012022-09-300000750004lnw:TableProductsMemberus-gaap:OperatingSegmentsMemberlnw:GamingGroupMember2023-01-012023-09-300000750004lnw:TableProductsMemberus-gaap:OperatingSegmentsMemberlnw:GamingGroupMember2022-01-012022-09-300000750004us-gaap:OperatingSegmentsMemberlnw:GamingGroupMember2023-07-012023-09-300000750004us-gaap:OperatingSegmentsMemberlnw:GamingGroupMember2022-07-012022-09-300000750004us-gaap:OperatingSegmentsMemberlnw:GamingGroupMember2023-01-012023-09-300000750004us-gaap:OperatingSegmentsMemberlnw:GamingGroupMember2022-01-012022-09-300000750004lnw:MobileMemberus-gaap:OperatingSegmentsMemberlnw:SciPlayMember2023-07-012023-09-300000750004lnw:MobileMemberus-gaap:OperatingSegmentsMemberlnw:SciPlayMember2022-07-012022-09-300000750004lnw:MobileMemberus-gaap:OperatingSegmentsMemberlnw:SciPlayMember2023-01-012023-09-300000750004lnw:MobileMemberus-gaap:OperatingSegmentsMemberlnw:SciPlayMember2022-01-012022-09-300000750004lnw:WebAndOtherMemberus-gaap:OperatingSegmentsMemberlnw:SciPlayMember2023-07-012023-09-300000750004lnw:WebAndOtherMemberus-gaap:OperatingSegmentsMemberlnw:SciPlayMember2022-07-012022-09-300000750004lnw:WebAndOtherMemberus-gaap:OperatingSegmentsMemberlnw:SciPlayMember2023-01-012023-09-300000750004lnw:WebAndOtherMemberus-gaap:OperatingSegmentsMemberlnw:SciPlayMember2022-01-012022-09-300000750004us-gaap:OperatingSegmentsMemberlnw:SciPlayMember2023-07-012023-09-300000750004us-gaap:OperatingSegmentsMemberlnw:SciPlayMember2022-07-012022-09-300000750004us-gaap:OperatingSegmentsMemberlnw:SciPlayMember2023-01-012023-09-300000750004us-gaap:OperatingSegmentsMemberlnw:SciPlayMember2022-01-012022-09-300000750004lnw:IGamingGroupMemberus-gaap:OperatingSegmentsMember2023-07-012023-09-300000750004lnw:IGamingGroupMemberus-gaap:OperatingSegmentsMember2022-07-012022-09-300000750004lnw:IGamingGroupMemberus-gaap:OperatingSegmentsMember2023-01-012023-09-300000750004lnw:IGamingGroupMemberus-gaap:OperatingSegmentsMember2022-01-012022-09-300000750004lnw:CorporateAndReconcilingItemsMember2023-07-012023-09-300000750004lnw:CorporateAndReconcilingItemsMember2022-07-012022-09-300000750004lnw:CorporateAndReconcilingItemsMember2023-01-012023-09-300000750004lnw:CorporateAndReconcilingItemsMember2022-01-012022-09-300000750004us-gaap:EmployeeSeveranceMember2023-07-012023-09-300000750004us-gaap:EmployeeSeveranceMember2022-07-012022-09-300000750004us-gaap:EmployeeSeveranceMember2023-01-012023-09-300000750004us-gaap:EmployeeSeveranceMember2022-01-012022-09-300000750004lnw:StrategicReviewAndRelatedMember2023-07-012023-09-300000750004lnw:StrategicReviewAndRelatedMember2022-07-012022-09-300000750004lnw:StrategicReviewAndRelatedMember2023-01-012023-09-300000750004lnw:StrategicReviewAndRelatedMember2022-01-012022-09-300000750004lnw:ContingentAcquisitionConsiderationMember2023-07-012023-09-300000750004lnw:ContingentAcquisitionConsiderationMember2022-07-012022-09-300000750004lnw:ContingentAcquisitionConsiderationMember2023-01-012023-09-300000750004lnw:ContingentAcquisitionConsiderationMember2022-01-012022-09-300000750004lnw:RestructuringIntegrationAndOtherMember2023-07-012023-09-300000750004lnw:RestructuringIntegrationAndOtherMember2022-07-012022-09-300000750004lnw:RestructuringIntegrationAndOtherMember2023-01-012023-09-300000750004lnw:RestructuringIntegrationAndOtherMember2022-01-012022-09-300000750004us-gaap:GeographicDistributionDomesticMember2023-09-300000750004us-gaap:GeographicDistributionDomesticMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2023-09-300000750004us-gaap:GeographicDistributionDomesticMember2022-12-310000750004us-gaap:GeographicDistributionDomesticMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2022-12-310000750004us-gaap:GeographicDistributionForeignMember2023-09-300000750004us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMemberus-gaap:GeographicDistributionForeignMember2023-09-300000750004us-gaap:GeographicDistributionForeignMember2022-12-310000750004us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMemberus-gaap:GeographicDistributionForeignMember2022-12-310000750004us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2023-09-300000750004us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2022-12-3100007500042023-01-012023-03-310000750004us-gaap:GeographicDistributionDomesticMember2023-01-012023-03-310000750004us-gaap:GeographicDistributionForeignMember2023-01-012023-03-3100007500042022-01-012022-03-3100007500042023-03-310000750004us-gaap:GeographicDistributionDomesticMember2023-03-310000750004us-gaap:GeographicDistributionForeignMember2023-03-3100007500042022-03-3100007500042023-04-012023-06-300000750004us-gaap:GeographicDistributionDomesticMember2023-04-012023-06-300000750004us-gaap:GeographicDistributionForeignMember2023-04-012023-06-3000007500042022-04-012022-06-3000007500042023-06-300000750004us-gaap:GeographicDistributionDomesticMember2023-06-300000750004us-gaap:GeographicDistributionForeignMember2023-06-3000007500042022-06-300000750004us-gaap:GeographicDistributionDomesticMember2023-07-012023-09-300000750004us-gaap:GeographicDistributionForeignMember2023-07-012023-09-300000750004srt:LatinAmericaMember2023-09-300000750004srt:LatinAmericaMemberus-gaap:FinancialAssetNotPastDueMember2023-09-300000750004srt:LatinAmericaMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2023-09-300000750004us-gaap:LandMember2023-09-300000750004us-gaap:LandMember2022-12-310000750004lnw:BuildingsandLeaseholdImprovementsMember2023-09-300000750004lnw:BuildingsandLeaseholdImprovementsMember2022-12-310000750004us-gaap:MachineryAndEquipmentMember2023-09-300000750004us-gaap:MachineryAndEquipmentMember2022-12-310000750004us-gaap:FurnitureAndFixturesMember2023-09-300000750004us-gaap:FurnitureAndFixturesMember2022-12-310000750004us-gaap:ConstructionInProgressMember2023-09-300000750004us-gaap:ConstructionInProgressMember2022-12-310000750004us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2023-09-300000750004us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2022-12-310000750004us-gaap:CustomerRelationshipsMember2023-09-300000750004us-gaap:CustomerRelationshipsMember2022-12-310000750004us-gaap:IntellectualPropertyMember2023-09-300000750004us-gaap:IntellectualPropertyMember2022-12-310000750004us-gaap:LicensingAgreementsMember2023-09-300000750004us-gaap:LicensingAgreementsMember2022-12-310000750004lnw:BrandNameMember2023-09-300000750004lnw:BrandNameMember2022-12-310000750004us-gaap:TradeNamesMember2023-09-300000750004us-gaap:TradeNamesMember2022-12-310000750004us-gaap:PatentsMember2023-09-300000750004us-gaap:PatentsMember2022-12-310000750004lnw:GamingBusinessSegmentMember2022-12-310000750004lnw:SocialBusinessSegmentMember2022-12-310000750004lnw:IGamingGroupMember2022-12-310000750004lnw:GamingBusinessSegmentMember2023-01-012023-09-300000750004lnw:SocialBusinessSegmentMember2023-01-012023-09-300000750004lnw:IGamingGroupMember2023-01-012023-09-300000750004lnw:GamingBusinessSegmentMember2023-09-300000750004lnw:SocialBusinessSegmentMember2023-09-300000750004lnw:IGamingGroupMember2023-09-300000750004lnw:SciPlayRevolverMaturing2024Memberus-gaap:SecuredDebtMemberus-gaap:RevolvingCreditFacilityMember2023-09-300000750004lnw:SciPlayRevolverMaturing2024Memberus-gaap:SecuredDebtMemberus-gaap:RevolvingCreditFacilityMember2022-12-310000750004us-gaap:SecuredDebtMemberus-gaap:RevolvingCreditFacilityMemberlnw:SeniorSecuredRevolverMaturing2027Member2023-09-300000750004us-gaap:SecuredDebtMemberus-gaap:RevolvingCreditFacilityMemberlnw:SeniorSecuredRevolverMaturing2027Member2022-12-310000750004lnw:SeniorSecuredCreditFacilityTermLoanBMaturingIn2029Memberus-gaap:SecuredDebtMemberus-gaap:RevolvingCreditFacilityMember2023-09-300000750004lnw:SeniorSecuredCreditFacilityTermLoanBMaturingIn2029Memberus-gaap:SecuredDebtMemberus-gaap:RevolvingCreditFacilityMember2022-12-310000750004us-gaap:SeniorNotesMemberlnw:SeniorUnsecuredNotesMaturing2025Member2023-09-300000750004us-gaap:SeniorNotesMemberlnw:SeniorUnsecuredNotesMaturing2025Member2022-12-310000750004lnw:SeniorUnsecuredNotesMaturing2028Memberus-gaap:SeniorNotesMember2023-09-300000750004lnw:SeniorUnsecuredNotesMaturing2028Memberus-gaap:SeniorNotesMember2022-12-310000750004lnw:SeniorUnsecuredNotesMaturing2029Memberus-gaap:SeniorNotesMember2023-09-300000750004lnw:SeniorUnsecuredNotesMaturing2029Memberus-gaap:SeniorNotesMember2022-12-310000750004us-gaap:SeniorNotesMemberlnw:SeniorSubordinatedNotesMaturing2031Member2023-09-300000750004us-gaap:SeniorNotesMemberlnw:SeniorSubordinatedNotesMaturing2031Member2022-12-310000750004lnw:CapitalLeaseObligationsPayableMonthlyMemberus-gaap:CapitalLeaseObligationsMember2023-09-300000750004lnw:CapitalLeaseObligationsPayableMonthlyMemberus-gaap:CapitalLeaseObligationsMember2022-12-310000750004us-gaap:SeniorNotesMemberlnw:SeniorSubordinatedNotesMaturing2031Member2023-08-230000750004us-gaap:SeniorNotesMemberlnw:SeniorSubordinatedNotesMaturing2031Member2023-08-232023-08-230000750004us-gaap:SeniorNotesMemberlnw:SeniorUnsecuredNotesMaturing2025Member2023-08-230000750004us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-09-300000750004us-gaap:InterestRateSwapMember2023-07-012023-09-300000750004us-gaap:InterestRateSwapMember2022-07-012022-09-300000750004us-gaap:InterestRateSwapMember2023-01-012023-09-300000750004us-gaap:InterestRateSwapMember2022-01-012022-09-300000750004us-gaap:InterestRateSwapMemberus-gaap:OtherAssetsMember2023-09-300000750004us-gaap:InterestRateSwapMemberus-gaap:OtherAssetsMember2022-12-310000750004us-gaap:AccruedLiabilitiesMember2022-12-310000750004us-gaap:OtherNoncurrentLiabilitiesMember2022-12-310000750004us-gaap:AccruedLiabilitiesMember2023-09-300000750004us-gaap:OtherNoncurrentLiabilitiesMember2023-09-300000750004us-gaap:CommonStockMember2022-12-310000750004us-gaap:AdditionalPaidInCapitalMember2022-12-310000750004us-gaap:RetainedEarningsMember2022-12-310000750004us-gaap:TreasuryStockCommonMember2022-12-310000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000750004us-gaap:NoncontrollingInterestMember2022-12-310000750004us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310000750004us-gaap:TreasuryStockCommonMember2023-01-012023-03-310000750004us-gaap:RetainedEarningsMember2023-01-012023-03-310000750004us-gaap:NoncontrollingInterestMember2023-01-012023-03-310000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310000750004us-gaap:CommonStockMember2023-03-310000750004us-gaap:AdditionalPaidInCapitalMember2023-03-310000750004us-gaap:RetainedEarningsMember2023-03-310000750004us-gaap:TreasuryStockCommonMember2023-03-310000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310000750004us-gaap:NoncontrollingInterestMember2023-03-310000750004us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300000750004us-gaap:TreasuryStockCommonMember2023-04-012023-06-300000750004us-gaap:NoncontrollingInterestMember2023-04-012023-06-300000750004us-gaap:RetainedEarningsMember2023-04-012023-06-300000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300000750004us-gaap:CommonStockMember2023-06-300000750004us-gaap:AdditionalPaidInCapitalMember2023-06-300000750004us-gaap:RetainedEarningsMember2023-06-300000750004us-gaap:TreasuryStockCommonMember2023-06-300000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300000750004us-gaap:NoncontrollingInterestMember2023-06-300000750004us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300000750004us-gaap:TreasuryStockCommonMember2023-07-012023-09-300000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300000750004us-gaap:CommonStockMember2023-09-300000750004us-gaap:AdditionalPaidInCapitalMember2023-09-300000750004us-gaap:RetainedEarningsMember2023-09-300000750004us-gaap:TreasuryStockCommonMember2023-09-300000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300000750004us-gaap:NoncontrollingInterestMember2023-09-300000750004us-gaap:CommonStockMember2021-12-310000750004us-gaap:AdditionalPaidInCapitalMember2021-12-310000750004us-gaap:RetainedEarningsMember2021-12-310000750004us-gaap:TreasuryStockCommonMember2021-12-310000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000750004us-gaap:NoncontrollingInterestMember2021-12-310000750004us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310000750004us-gaap:TreasuryStockCommonMember2022-01-012022-03-310000750004us-gaap:RetainedEarningsMember2022-01-012022-03-310000750004us-gaap:NoncontrollingInterestMember2022-01-012022-03-310000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310000750004us-gaap:CommonStockMember2022-03-310000750004us-gaap:AdditionalPaidInCapitalMember2022-03-310000750004us-gaap:RetainedEarningsMember2022-03-310000750004us-gaap:TreasuryStockCommonMember2022-03-310000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310000750004us-gaap:NoncontrollingInterestMember2022-03-310000750004us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300000750004us-gaap:NoncontrollingInterestMember2022-04-012022-06-300000750004us-gaap:RetainedEarningsMember2022-04-012022-06-300000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300000750004us-gaap:CommonStockMember2022-06-300000750004us-gaap:AdditionalPaidInCapitalMember2022-06-300000750004us-gaap:RetainedEarningsMember2022-06-300000750004us-gaap:TreasuryStockCommonMember2022-06-300000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300000750004us-gaap:NoncontrollingInterestMember2022-06-300000750004us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300000750004us-gaap:NoncontrollingInterestMember2022-07-012022-09-300000750004us-gaap:RetainedEarningsMember2022-07-012022-09-300000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-300000750004us-gaap:CommonStockMember2022-09-300000750004us-gaap:AdditionalPaidInCapitalMember2022-09-300000750004us-gaap:RetainedEarningsMember2022-09-300000750004us-gaap:TreasuryStockCommonMember2022-09-300000750004us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300000750004us-gaap:NoncontrollingInterestMember2022-09-300000750004us-gaap:SegmentDiscontinuedOperationsMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-300000750004us-gaap:SegmentDiscontinuedOperationsMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-09-300000750004us-gaap:EmployeeStockOptionMember2023-07-012023-09-300000750004us-gaap:EmployeeStockOptionMember2022-07-012022-09-300000750004us-gaap:EmployeeStockOptionMember2023-01-012023-09-300000750004us-gaap:EmployeeStockOptionMember2022-01-012022-09-300000750004us-gaap:RestrictedStockUnitsRSUMember2023-07-012023-09-300000750004us-gaap:RestrictedStockUnitsRSUMember2022-07-012022-09-300000750004us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-09-300000750004us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-09-300000750004us-gaap:RestrictedStockUnitsRSUMemberlnw:SciPlayMember2023-07-012023-09-300000750004us-gaap:RestrictedStockUnitsRSUMemberlnw:SciPlayMember2022-07-012022-09-300000750004us-gaap:RestrictedStockUnitsRSUMemberlnw:SciPlayMember2023-01-012023-09-300000750004us-gaap:RestrictedStockUnitsRSUMemberlnw:SciPlayMember2022-01-012022-09-300000750004lnw:LiabilityAwardsMember2023-07-012023-09-300000750004lnw:LiabilityAwardsMember2023-01-012023-09-300000750004lnw:LiabilityAwardsMember2022-07-012022-09-300000750004lnw:LiabilityAwardsMember2022-01-012022-09-300000750004us-gaap:RestrictedStockUnitsRSUMember2022-12-310000750004us-gaap:RestrictedStockUnitsRSUMember2023-09-300000750004lnw:AmendedAndRestatedRightsAgreementMemberus-gaap:SeriesAPreferredStockMember2023-06-190000750004lnw:AmendedAndRestatedRightsAgreementMemberlnw:PreferredStockPurchaseRightsMemberus-gaap:SeriesAPreferredStockMember2023-06-190000750004lnw:ShareRepurchaseProgramMarch2022Member2023-09-300000750004lnw:ShareRepurchaseProgramMarch2022Member2023-01-012023-09-300000750004lnw:ShareRepurchaseProgramMay2022Member2023-09-300000750004lnw:ShareRepurchaseProgramMay2023Member2023-09-300000750004lnw:ShareRepurchaseProgramMay2022Member2023-01-012023-09-300000750004us-gaap:GuaranteeOfBusinessRevenueMember1993-06-300000750004lnw:EcosaludMember1999-06-011999-06-30iso4217:COP

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-11693

LIGHT & WONDER, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Nevada | | 81-0422894 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

6601 Bermuda Road, Las Vegas, Nevada | | 89119 |

| (Address of principal executive offices) | | (Zip Code) |

(702) 897-7150

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $.001 par value | LNW | The Nasdaq Stock Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ý

Common stock outstanding as of November 3, 2023 was 90,047,398.

LIGHT & WONDER, INC. AND SUBSIDIARIES

INDEX TO FINANCIAL AND OTHER INFORMATION

THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2023

| | | | | | | | |

| | Page |

| | |

| | |

Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Item 2. | | |

| | |

Item 3. | | |

| | |

Item 4. | | |

| | |

| | |

| | |

Item 1. | | |

| | |

Item 1A. | | |

| | |

Item 2. | | |

| | |

Item 3. | | |

| | |

Item 4. | | |

| | |

Item 5. | | |

| | |

Item 6. | | |

| | | | | | | | |

| Glossary of Terms | | |

| The following terms or acronyms used in this Quarterly Report on Form 10-Q are defined below: |

| Term or Acronym | | Definition |

| 2022 10-K | | 2022 Annual Report on Form 10-K filed with the SEC on March 1, 2023 |

| | |

| | |

| | |

| 2025 Unsecured Notes | | 8.625% senior unsecured notes due 2025 issued by LNWI |

| | |

| 2028 Unsecured Notes | | 7.000% senior unsecured notes due 2028 issued by LNWI |

| 2029 Unsecured Notes | | 7.250% senior unsecured notes due 2029 issued by LNWI |

| 2031 Unsecured Notes | | 7.500% senior unsecured notes due 2031 issued by LNWI |

| AEBITDA | | Adjusted EBITDA, our performance measure of profit or loss for our business segments |

| | |

| ASC | | Accounting Standards Codification |

| ASU | | Accounting Standards Update |

| ASX | | Australian Securities Exchange |

| CDIs | | CHESS Depositary Interests, instruments traded on the ASX |

| CMS | | casino-management system |

| COVID-19 | | Coronavirus disease first identified in 2019 (declared a pandemic by the World Health Organization on March 11, 2020), the resulting pandemic and the associated impacts on the macroeconomic environment in general and our business environment specifically |

| D&A | | depreciation, amortization and impairments (excluding goodwill) |

Divested Businesses or Divestitures | | The Lottery Business and Sports Betting Business combined or the sales of these, as appropriate within the context |

| | |

| Exchange Act | | Securities Exchange Act of 1934, as amended |

| | |

| | |

| KPIs | | Key Performance Indicators |

| L&W | | Light & Wonder, Inc. |

| | |

| LBO | | licensed betting office |

| | |

| LNWI | | Light and Wonder International, Inc., a wholly-owned subsidiary of L&W and successor to Scientific Games International, Inc. |

| LNWI Credit Agreement | | That certain credit agreement, dated as of April 14, 2022, among LNWI, as the borrower, L&W, as a guarantor, the lenders from time to time party thereto, JPMorgan Chase Bank, N.A., as Administrative Agent, Collateral Agent and Swingline Lender, BofA Securities, Inc., BNP Paribas Securities Corp., Deutsche Bank Securities Inc., Fifth Third Bank, National Association, Barclays Bank PLC, Citizens Bank, N.A., Goldman Sachs Bank USA, Morgan Stanley Senior Funding, Inc., Royal Bank of Canada, Truist Securities, Inc., Credit Suisse Loan Funding LLC and Macquarie Capital (USA) Inc. as Lead Arrangers and Joint Bookrunners, as amended, restated, amended and restated, supplemented or otherwise modified from time to time |

| LNWI Revolver | | Revolving credit facility with aggregate commitments of $750 million extended pursuant to the LNWI Credit Agreement |

| LNWI Term Loan B | | Term loan facility, issued pursuant to the LNWI Credit Agreement |

| | |

| Lottery Business | | Our prior operating business segment that provided instant and draw‑based lottery products, lottery systems and lottery content and services to lottery operators wagering solutions to various gaming entities. This business segment was divested during the second quarter of 2022 and is included in discontinued operations in our financial statements |

| | |

| Note | | a note in the Notes to Condensed Consolidated Financial Statements in this Quarterly Report on Form 10-Q, unless otherwise indicated |

| | |

| Participation | | refers to gaming machines provided to customers through service or leasing arrangements in which we earn revenues and are paid based on: (1) a percentage of the amount wagered less payouts; (2) fixed daily-fees; (3) a percentage of the amount wagered; or (4) a combination of (2) and (3) |

| | |

| R&D | | research and development |

| | |

| RSU | | restricted stock unit |

| SciPlay | | SciPlay Corporation |

| SciPlay Revolver | | $150 million revolving credit facility agreement entered into by SciPlay Holding Company, LLC, a subsidiary of SciPlay Corporation, that matures in May 2024 |

| SEC | | Securities and Exchange Commission |

| | |

| Securities Act | | Securities Act of 1933, as amended |

| | | | | | | | |

| Senior Notes or Unsecured Notes | | refers to the 2028 Unsecured Notes, 2029 Unsecured Notes and 2031 Unsecured Notes, collectively |

| SG&A | | selling, general and administrative |

| | |

| Shufflers | | various models of automatic card shufflers, deck checkers and roulette chip sorters |

| SOFR | | Secured Overnight Financing Rate |

| Sports Betting Business | | Our prior line of business that provided sports betting services which enable customers to operate sports books, including betting markets across both fixed-odds and pari-mutual betting styles, a distribution platform, full gaming process support services and brand and player management. This business was divested during the third quarter of 2022 and is included in discontinued operations in our financial statements |

| | |

| U.S. GAAP | | accounting principles generally accepted in the U.S. |

| U.S. jurisdictions | | the 50 states in the U.S. plus the District of Columbia, U.S. Virgin Islands and Puerto Rico |

| | |

| VGT | | video gaming terminal |

| VLT | | video lottery terminal |

| | |

Intellectual Property Rights

All ® notices signify marks registered in the United States. © 2023 Light & Wonder, Inc. and/or their respective affiliates. All Rights Reserved.

The MONOPOLY name and logo, the distinctive design of the game board, the four corner squares, the MR. MONOPOLY name and character, as well as each of the distinctive elements of the board, cards, and the playing pieces are trademarks of Hasbro for its property trading game and game equipment and are used with permission. © 1935, 2023 Hasbro. All Rights Reserved. Licensed by Hasbro.

and James Bond indicia © 1962-2023 Danjaq, LLC and MGM.

and James Bond indicia © 1962-2023 Danjaq, LLC and MGM.  and all other James Bond related trademarks are trademarks of Danjaq, LLC. All Rights Reserved.

and all other James Bond related trademarks are trademarks of Danjaq, LLC. All Rights Reserved.

FORWARD-LOOKING STATEMENTS

Throughout this Quarterly Report on Form 10-Q, we make “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements describe future expectations, plans, results or strategies and can often be identified by the use of terminology such as “may,” “will,” “estimate,” “intend,” “plan,” “continue,” “believe,” “expect,” “anticipate,” “target,” “should,” “could,” “potential,” “opportunity,” “goal,” or similar terminology. The forward-looking statements contained in this Quarterly Report on Form 10-Q are generally located in the material set forth under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” but may be found in other locations as well. These statements are based upon management’s current expectations, assumptions and estimates and are not guarantees of timing, future results or performance. Therefore, you should not rely on any of these forward-looking statements as predictions of future events. Actual results may differ materially from those contemplated in these statements due to a variety of risks and uncertainties and other factors, including, among other things:

•our inability to successfully execute our strategy and rebranding initiative;

•slow growth of new gaming jurisdictions, slow addition of casinos in existing jurisdictions and declines in the replacement cycle of gaming machines;

•risks relating to foreign operations, including anti-corruption laws, fluctuations in currency rates, restrictions on the payment of dividends from earnings, restrictions on the import of products and financial instability;

•difficulty predicting what impact, if any, new tariffs imposed by and other trade actions taken by the U.S. and foreign jurisdictions could have on our business;

•U.S. and international economic and industry conditions, including increases in benchmark interest rates and the effects of inflation;

•public perception of our response to environmental, social and governance issues;

•changes in, or the elimination of, our share repurchase program;

•resulting pricing variations and other impacts of our common stock being listed to trade on more than one stock exchange;

•level of our indebtedness, higher interest rates, availability or adequacy of cash flows and liquidity to satisfy indebtedness, other obligations or future cash needs;

•inability to further reduce or refinance our indebtedness;

•restrictions and covenants in debt agreements, including those that could result in acceleration of the maturity of our indebtedness;

•competition;

•inability to win, retain or renew, or unfavorable revisions of, existing contracts, and the inability to enter into new contracts;

•risks and uncertainties of potential changes in U.K. gaming legislation, including any new or revised licensing and taxation regimes, responsible gambling requirements and/or sanctions on unlicensed providers;

•inability to adapt to, and offer products that keep pace with, evolving technology, including any failure of our investment of significant resources in our R&D efforts;

•the possibility that we may be unable to achieve expected operational, strategic and financial benefits of the SciPlay Merger (as defined below);

•the outcome of any legal proceedings that may be instituted following completion of the SciPlay Merger;

•failure to retain key management and employees of SciPlay;

•unpredictability and severity of catastrophic events, including but not limited to acts of terrorism, war, armed conflicts or hostilities or the COVID-19 pandemic, the impact such events may have on our customers, suppliers, employees, consultants, business partners or operations, as well as management’s response to any of the aforementioned factors;

•changes in demand for our products and services;

•dependence on suppliers and manufacturers;

•SciPlay’s dependence on certain key providers;

•ownership changes and consolidation in the gaming industry;

•fluctuations in our results due to seasonality and other factors;

•security and integrity of our products and systems, including the impact of any security breaches or cyber-attacks;

•protection of our intellectual property, inability to license third-party intellectual property and the intellectual property rights of others;

•reliance on or failures in information technology and other systems;

•litigation and other liabilities relating to our business, including litigation and liabilities relating to our contracts and licenses, our products and systems, our employees (including labor disputes), intellectual property, environmental laws and our strategic relationships;

•reliance on technological blocking systems;

•challenges or disruptions relating to the completion of the domestic migration to our enterprise resource planning system;

•laws and government regulations, both foreign and domestic, including those relating to gaming, data privacy and security, including with respect to the collection, storage, use, transmission and protection of personal information and other consumer data, and environmental laws, and those laws and regulations that affect companies conducting business on the internet, including online gambling;

•legislative interpretation and enforcement, regulatory perception and regulatory risks with respect to gaming, especially internet wagering, social gaming and sports wagering;

•changes in tax laws or tax rulings, or the examination of our tax positions;

•opposition to legalized gaming or the expansion thereof and potential restrictions on internet wagering;

•significant opposition in some jurisdictions to interactive social gaming, including social casino gaming and how such opposition could lead these jurisdictions to adopt legislation or impose a regulatory framework to govern interactive social gaming or social casino gaming specifically, and how this could result in a prohibition on interactive social gaming or social casino gaming altogether, restrict our ability to advertise our games, or substantially increase our costs to comply with these regulations;

•expectations of shift to regulated digital gaming or sports wagering;

•inability to develop successful products and services and capitalize on trends and changes in our industries, including the expansion of internet and other forms of digital gaming;

•the continuing evolution of the scope of data privacy and security regulations, and our belief that the adoption of increasingly restrictive regulations in this area is likely within the U.S. and other jurisdictions;

•incurrence of restructuring costs;

•goodwill impairment charges including changes in estimates or judgments related to our impairment analysis of goodwill or other intangible assets;

•stock price volatility;

•failure to maintain adequate internal control over financial reporting;

•dependence on key executives;

•natural events that disrupt our operations, or those of our customers, suppliers or regulators; and

•expectations of growth in total consumer spending on social casino gaming.

Additional information regarding risks and uncertainties and other factors that could cause actual results to differ materially from those contemplated in forward-looking statements is included from time to time in our filings with the SEC, including under “Risk Factors” in Part II, Item 1A of this Quarterly Report on Form 10-Q and Part I, Item 1A in our 2022 10-K. Forward-looking statements speak only as of the date they are made and, except for our ongoing obligations under the U.S. federal securities laws, we undertake no and expressly disclaim any obligation to publicly update any forward-looking statements whether as a result of new information, future events or otherwise.

You should also note that this Quarterly Report on Form 10-Q may contain references to industry market data and certain industry forecasts. Industry market data and industry forecasts are obtained from publicly available information and industry publications. Industry publications generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of that information is not guaranteed. Although we believe industry information to be accurate, it is not independently verified by us and we do not make any representation as to the accuracy of that information. In general, we believe there is less publicly available information concerning the international gaming, social and digital gaming industries than the same industries in the U.S.

Due to rounding, certain numbers presented herein may not precisely recalculate.

PART I. FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements

LIGHT & WONDER, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue: | | | | | | | |

| Services | $ | 503 | | | $ | 453 | | | $ | 1,476 | | | $ | 1,329 | |

| Products | 228 | | | 195 | | | 655 | | | 501 | |

| | | | | | | |

| Total revenue | 731 | | | 648 | | | 2,131 | | | 1,830 | |

| Operating expenses: | | | | | | | |

Cost of services(1) | 113 | | | 101 | | | 331 | | | 283 | |

Cost of products(1) | 105 | | | 92 | | | 307 | | | 251 | |

| | | | | | | |

| Selling, general and administrative | 204 | | | 181 | | | 599 | | | 535 | |

| Research and development | 55 | | | 56 | | | 168 | | | 163 | |

| Depreciation, amortization and impairments | 90 | | | 102 | | | 298 | | | 317 | |

| | | | | | | |

| Restructuring and other | 17 | | | 27 | | | 66 | | | 106 | |

| Operating income | 147 | | | 89 | | | 362 | | | 175 | |

| Other (expense) income: | | | | | | | |

| Interest expense | (78) | | | (68) | | | (231) | | | (254) | |

| | | | | | | |

| Loss on debt financing transactions | (15) | | | — | | | (15) | | | (147) | |

| Gain on remeasurement of debt and other | — | | | — | | | — | | | 27 | |

| Other income, net | 40 | | | 3 | | | 23 | | | 10 | |

| Total other expense, net | (53) | | | (65) | | | (223) | | | (364) | |

Net income (loss) from continuing operations before income taxes | 94 | | | 24 | | | 139 | | | (189) | |

| Income tax expense | (14) | | | (4) | | | (27) | | | (8) | |

Net income (loss) from continuing operations | 80 | | | 20 | | | 112 | | | (197) | |

Net income from discontinued operations, net of tax(2) | — | | | 315 | | | — | | | 3,855 | |

| Net income | 80 | | | 335 | | | 112 | | | 3,658 | |

| Less: Net income attributable to noncontrolling interest | 5 | | | 7 | | | 16 | | | 13 | |

| Net income attributable to L&W | $ | 75 | | | $ | 328 | | | $ | 96 | | | $ | 3,645 | |

| Per Share - Basic: | | | | | | | |

Net income (loss) from continuing operations | $ | 0.83 | | | $ | 0.14 | | | $ | 1.05 | | | $ | (2.20) | |

| Net income from discontinued operations | — | | | 3.33 | | | — | | | 40.43 | |

| Net income attributable to L&W | $ | 0.83 | | | $ | 3.47 | | | $ | 1.05 | | | $ | 38.23 | |

| Per Share - Diluted: | | | | | | | |

Net income (loss) from continuing operations | $ | 0.81 | | | $ | 0.14 | | | $ | 1.03 | | | $ | (2.20) | |

| Net income from discontinued operations | — | | | 3.28 | | | — | | | 40.43 | |

| Net income attributable to L&W | $ | 0.81 | | | $ | 3.42 | | | $ | 1.03 | | | $ | 38.23 | |

| Weighted average number of shares used in per share calculations: | | | | | | | |

| Basic shares | 91 | | | 94 | | | 91 | | | 95 | |

| Diluted shares | 92 | | | 96 | | | 93 | | | 95 | |

| | | | | | | |

| (1) Excludes depreciation, amortization, and impairments. |

(2) The three and nine months ended September 30, 2022 include a pre-tax gain of $362 million and $4,930 million, respectively, on the sale of discontinued operations (see Note 2). |

|

| | | | | | | |

See accompanying notes to condensed consolidated financial statements. |

LIGHT & WONDER, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited, in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income | $ | 80 | | | $ | 335 | | | $ | 112 | | | $ | 3,658 | |

| Other comprehensive loss: | | | | | | | |

| Foreign currency translation loss, net of tax | (71) | | | (105) | | | (21) | | | (183) | |

| | | | | | | |

| Derivative financial instruments unrealized gain, net of tax | 5 | | | 24 | | | 8 | | | 29 | |

| Other comprehensive loss from continuing operations | (66) | | | (81) | | | (13) | | | (154) | |

| Other comprehensive income from discontinued operations | — | | | 12 | | | — | | | — | |

| Total comprehensive income | 14 | | | 266 | | | 99 | | | 3,504 | |

| Less: comprehensive income attributable to noncontrolling interest | 5 | | | 7 | | | 16 | | | 13 | |

| Comprehensive income attributable to L&W | $ | 9 | | | $ | 259 | | | $ | 83 | | | $ | 3,491 | |

| | | | | | | |

|

| | | | | | | |

| See accompanying notes to condensed consolidated financial statements. |

LIGHT & WONDER, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Unaudited, in millions, except par value)

| | | | | | | | | | | |

| As of |

| September 30, 2023 | | December 31, 2022 |

ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 891 | | | $ | 914 | |

| Restricted cash | 50 | | | 47 | |

Receivables, net of allowance for credit losses of $40 and $38, respectively | 477 | | | 455 | |

| Inventories | 183 | | | 161 | |

| Prepaid expenses, deposits and other current assets | 119 | | | 117 | |

| | | |

| Total current assets | 1,720 | | | 1,694 | |

| Non-current assets: | | | |

| Restricted cash | 6 | | | 6 | |

Receivables, net of allowance for credit losses of $1 and $2, respectively | 11 | | | 14 | |

| Property and equipment, net | 229 | | | 204 | |

| Operating lease right-of-use assets | 43 | | | 49 | |

| Goodwill | 2,903 | | | 2,919 | |

| Intangible assets, net | 638 | | | 797 | |

| Software, net | 151 | | | 145 | |

| Deferred income taxes | 112 | | | 114 | |

| Other assets | 74 | | | 67 | |

| | | |

| Total assets | $ | 5,887 | | | $ | 6,009 | |

| | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

Current liabilities: | | | |

Current portion of long-term debt | $ | 22 | | | $ | 24 | |

Accounts payable | 162 | | | 154 | |

Accrued liabilities | 403 | | | 380 | |

| Income taxes payable | 32 | | | 64 | |

| | | |

Total current liabilities | 619 | | | 622 | |

Deferred income taxes | 43 | | | 87 | |

Operating lease liabilities | 30 | | | 37 | |

Other long-term liabilities | 194 | | | 232 | |

Long-term debt, excluding current portion | 3,855 | | | 3,870 | |

| | | |

Total liabilities | 4,741 | | | 4,848 | |

Commitments and contingencies (Note 16) |

| |

|

Stockholders’ equity: | | | |

Common stock, par value $0.001 per share, 199 shares authorized; 116 and 115 shares issued, respectively, and 90 and 91 shares outstanding, respectively | 1 | | | 1 | |

Additional paid-in capital | 1,402 | | | 1,370 | |

Retained earnings | 613 | | | 517 | |

Treasury stock, at cost, 26 and 24 shares, respectively | (726) | | | (580) | |

Accumulated other comprehensive loss | (331) | | | (318) | |

Total L&W stockholders’ equity | 959 | | | 990 | |

Noncontrolling interest | 187 | | | 171 | |

Total stockholders’ equity | 1,146 | | | 1,161 | |

Total liabilities and stockholders’ equity | $ | 5,887 | | | $ | 6,009 | |

|

| See accompanying notes to condensed consolidated financial statements. |

LIGHT & WONDER, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, in millions)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2023 | | 2022 |

Cash flows from operating activities: | | | |

Net income | $ | 112 | | | $ | 3,658 | |

| Less: Income from discontinued operations, net of tax | — | | | (3,855) | |

| | | |

Adjustments to reconcile net income (loss) from continuing operations to net cash provided by (used in) operating activities from continuing operations | 436 | | | 488 | |

Changes in working capital accounts, excluding the effects of acquisitions | (81) | | | (641) | |

Changes in deferred income taxes and other | (44) | | | 4 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Net cash provided by (used in) operating activities from continuing operations | 423 | | | (346) | |

| | | |

Net cash provided by operating activities from discontinued operations | — | | | 52 | |

| Net cash provided by (used in) operating activities | 423 | | | (294) | |

Cash flows from investing activities: | | | |

| Capital expenditures | (182) | | | (158) | |

| Acquisitions of businesses, net of cash acquired | (4) | | | (118) | |

| | | |

| | | |

| Proceeds from settlement of cross-currency interest rate swaps and other | (1) | | | 52 | |

| | | |

Net cash used in investing activities from continuing operations | (187) | | | (224) | |

| | | |

Net cash (used in) provided by investing activities from discontinued operations(1) | (3) | | | 6,368 | |

| Net cash (used in) provided by investing activities | (190) | | | 6,144 | |

Cash flows from financing activities: | | | |

| | | |

Borrowings under revolving credit facilities | — | | | 280 | |

Repayments under revolving credit facilities | — | | | (280) | |

Proceeds from issuance of senior notes and term loans | 550 | | | 2,200 | |

| Repayment of notes and term loans (including redemption premium) | (562) | | | (6,984) | |

| Payments on long-term debt | (17) | | | (103) | |

Payments of debt issuance and deferred financing costs | (8) | | | (37) | |

Payments on license obligations | (26) | | | (30) | |

| Purchase of L&W common stock | (145) | | | (203) | |

| Purchase of SciPlay’s Class A common stock | (23) | | | (18) | |

| Net redemptions of common stock under stock-based compensation plans and other | (20) | | | (35) | |

| | | |

| | | |

| | | |

Net cash used in financing activities from continuing operations | (251) | | | (5,210) | |

| Net cash used in financing activities from discontinued operations | — | | | (3) | |

| Net cash used in financing activities | (251) | | | (5,213) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (2) | | | (12) | |

(Decrease) increase in cash, cash equivalents and restricted cash | (20) | | | 625 | |

| Cash, cash equivalents and restricted cash, beginning of period | 967 | | | 701 | |

Cash, cash equivalents and restricted cash, end of period | 947 | | | 1,326 | |

| Less: Cash, cash equivalents and restricted cash of discontinued operations | — | | | — | |

| Cash, cash equivalents and restricted cash of continuing operations, end of period | $ | 947 | | | $ | 1,326 | |

| | | |

Supplemental cash flow information: | | | |

| Cash paid for interest | $ | 221 | | | $ | 271 | |

Income taxes paid | 119 | | | 497 | |

| Distributed earnings from equity investments | 2 | | | 4 | |

| Cash paid for contingent consideration included in operating activities | 9 | | | — | |

Supplemental non-cash transactions: | | | |

| | | |

| | | |

| | | |

Non-cash interest expense | $ | 8 | | | $ | 12 | |

| Fair value of securities received in sale of discontinued operations | — | | | 46 | |

| | | |

(1) The nine months ended September 30, 2022 include $6,409 million in gross cash proceeds from the sale of discontinued operations, net of cash, cash equivalents and restricted cash transferred. |

| | | |

| See accompanying notes to condensed consolidated financial statements. |

LIGHT & WONDER, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited, amounts in USD, table amounts in millions, except per share amounts)

(1) Description of the Business and Summary of Significant Accounting Policies

Description of the Business

We are a leading cross-platform global games company with a focus on content and digital markets. Our portfolio of revenue-generating activities primarily includes supplying game content and gaming machines, CMSs and table game products and services to licensed gaming entities; providing social casino and other mobile games, including casual gaming, to retail customers; and providing a comprehensive suite of digital gaming content, distribution platforms, player account management systems, as well as various other iGaming content and services. We report our results of operations in three business segments—Gaming, SciPlay and iGaming—representing our different products and services.

Our common stock is listed on The Nasdaq Stock Market under the ticker symbol “LNW.” Our common stock is also listed as CDIs on the ASX and commenced active trading on May 22, 2023 (AEST) under the ticker symbol “LNW.”

On October 23, 2023, we acquired the remaining approximately 17% equity interest in SciPlay not already owned by us pursuant to a merger (the “SciPlay Merger”) in an all-cash transaction of $496 million, excluding transaction fees and expenses. As a result of the SciPlay Merger, SciPlay ceased to be publicly traded and became a wholly owned subsidiary of L&W. Upon completion of the SciPlay Merger, the SciPlay Revolver was terminated. There were no borrowings outstanding under the SciPlay Revolver at the time of termination.

We completed the sales of our former Lottery Business and Sports Betting Business during the second and third quarters of 2022, respectively. We have reflected the prior period financial results of these Divested Businesses as discontinued operations in our consolidated statements of operations. Refer to Note 2 for further information. Unless otherwise noted, amounts and disclosures included herein relate to our continuing operations.

Basis of Presentation and Principles of Consolidation

The accompanying condensed consolidated financial statements have been prepared in accordance with U.S. GAAP and include the accounts of L&W, its wholly owned subsidiaries, and those subsidiaries in which we have a controlling financial interest. All intercompany balances and transactions have been eliminated in consolidation.

In the opinion of L&W and its management, we have made all adjustments necessary to present fairly our consolidated financial position, results of operations, comprehensive income and cash flows for the periods presented. Such adjustments are of a normal, recurring nature. These unaudited condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and related notes included in our 2022 10-K. Interim results of operations are not necessarily indicative of results of operations to be expected for a full year.

Significant Accounting Policies

There have been no changes to our significant accounting policies described within the Notes of our 2022 10-K.

Other Income, net

Other income, net includes gains and losses from foreign currency transactions, interest income, earnings (losses) from equity investments and other items. Other income, net for the three and nine months ended September 30, 2023 primarily consisted of a gain of $30 million and a loss of $9 million, respectively, related to foreign currency transactions as well as $10 million and $28 million, respectively, in interest income. Foreign currency transaction gains and losses as well as interest income were not material for the three and nine months ended September 30, 2022.

Computation of Basic and Diluted Net Income Attributable to L&W Per Share

Basic and diluted net income attributable to L&W per share are based upon net income attributable to L&W divided by the weighted average number of common shares outstanding during the period. Diluted net income attributable to L&W per share reflects the effect of the assumed exercise of stock options and RSUs only in the periods in which such effect would have been dilutive to net income from continuing operations.

For the three and nine months ended September 30, 2023, we included 1 million and 2 million, respectively, of common stock equivalents in the calculation of diluted net income attributable to L&W per share, and for the three months ended September 30, 2022, we included 2 million of common stock equivalents in the calculation of diluted net income

attributable to L&W per share. Basic and diluted net income attributable to L&W per share were the same for the nine months ended September 30, 2022, as all common stock equivalents would have been anti-dilutive for that period. We excluded 2 million of stock options and 2 million of RSUs outstanding from the calculation of diluted weighted-average common shares outstanding for the nine months ended September 30, 2022.

New Accounting Guidance

There have been no recent accounting pronouncements or changes in accounting pronouncements since those described within the Notes of our 2022 10-K that are expected to have a material impact on our consolidated financial statements.

(2) Discontinued Operations

We completed the Divestitures in 2022 and reflected the prior period financial results of the Divested Businesses as discontinued operations in our consolidated statements of operations. For the sale of our former Lottery Business completed during the second quarter of 2022, we received $5.7 billion in gross cash proceeds and recorded a pre-tax gain of $4.6 billion. For the sale of our former Sports Betting Business completed during the third quarter of 2022, we received $796 million in gross proceeds and recorded a pre-tax gain of $362 million. The summarized results of our discontinued operations were as follows:

| | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, 2022 | | | | Nine Months Ended

September 30, 2022 |

| Total revenue | | | $ | 32 | | | | | $ | 371 | |

| Total cost of revenue | | | 9 | | | | | 177 | |

Other operating expenses(1) | | | 31 | | | | | 180 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating (loss) income | | | (8) | | | | | 14 | |

| Total other income, net | | | 2 | | | | | 10 | |

Net (loss) income from discontinued operations before income taxes | | | (6) | | | | | 24 | |

| Gain on sale of discontinued operations before income taxes | | | 362 | | | | | 4,930 | |

| Total net income from discontinued operations before income taxes | | | 356 | | | | | 4,954 | |

| Income tax expense | | | (41) | | | | | (1,099) | |

| Net income from discontinued operations, net of tax included in the consolidated statement of operations | | | $ | 315 | | | | | $ | 3,855 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

(1) The three and nine months ended September 30, 2022 include stock-based compensation of $7 million and $18 million, respectively, and $7 million and $85 million, respectively, related to direct transaction closing fees. |

(3) Revenue Recognition

The following table disaggregates revenues by type within each of our business segments:

| | | | | | | | | | | | | | | | | | | | | | | |

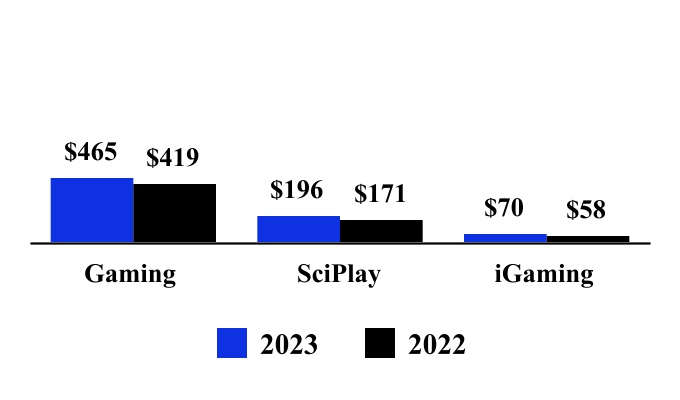

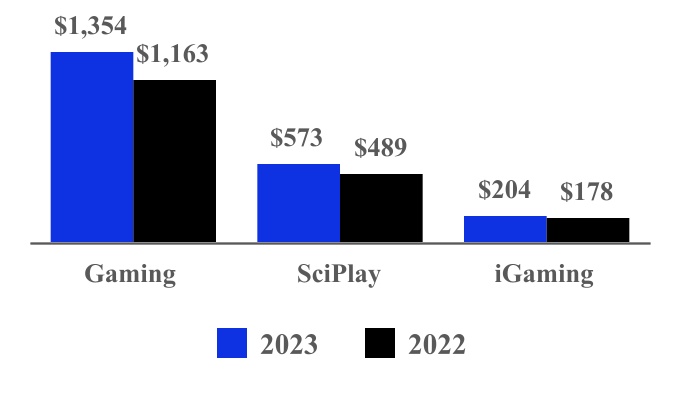

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

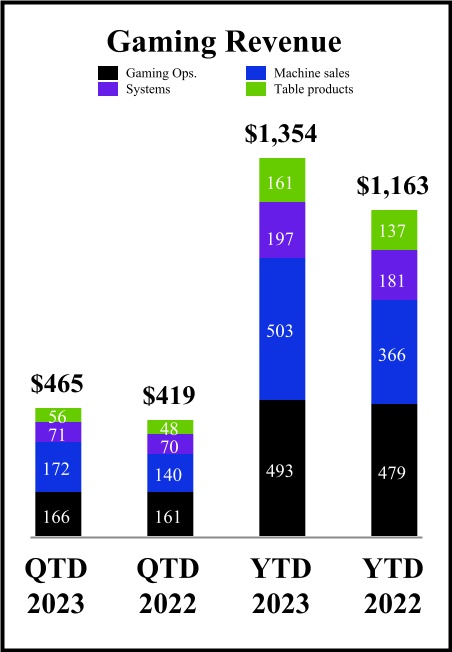

| Gaming | | | | | | | |

| Gaming operations | $ | 166 | | | $ | 161 | | | $ | 493 | | | $ | 479 | |

| Gaming machine sales | 172 | | | 140 | | | 503 | | | 366 | |

| Gaming systems | 71 | | | 70 | | | 197 | | | 181 | |

| Table products | 56 | | | 48 | | | 161 | | | 137 | |

| Total | $ | 465 | | | $ | 419 | | | $ | 1,354 | | | $ | 1,163 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

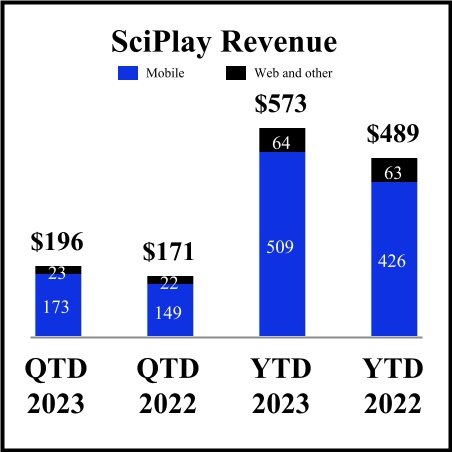

| SciPlay | | | | | | | |

| Mobile in-app purchases | $ | 173 | | | $ | 149 | | | $ | 509 | | | $ | 426 | |

Web in-app purchases and other(1) | 23 | | | 22 | | | 64 | | | 63 | |

| | | | | | | |

| Total | $ | 196 | | | $ | 171 | | | $ | 573 | | | $ | 489 | |

| | | | | | | |

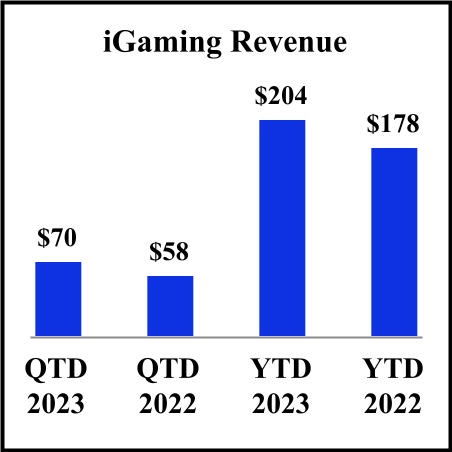

| iGaming | $ | 70 | | | $ | 58 | | | $ | 204 | | | $ | 178 | |

| | | | | | | |

| | | | | | | |

(1) Other primarily represents advertising revenue, which was not material in the periods presented. |

The amount of rental income revenue that is outside the scope of ASC 606 was $127 million and $367 million for the three and nine months ended September 30, 2023, respectively, and $116 million and $347 million for the three and nine months ended September 30, 2022, respectively.

Contract Liabilities and Other Disclosures

The following table summarizes the activity in our contract liabilities for the reporting period:

| | | | | | | | |

| | | | Nine Months Ended September 30, 2023 |

| | | | |

| | | | |

Contract liability balance, beginning of period(1) | | | | $ | 36 | |

| Liabilities recognized during the period | | | | 15 | |

| Amounts recognized in revenue from beginning balance | | | | (20) | |

Contract liability balance, end of period(1) | | | | $ | 31 | |

| | | | |

| (1) Contract liabilities are included within Accrued liabilities and Other long-term liabilities in our consolidated balance sheets. |

The timing of revenue recognition, billings and cash collections results in billed receivables, unbilled receivables (contract assets), and customer advances and deposits (contract liabilities) on our consolidated balance sheets. Other than contracts with customers with financing arrangements exceeding 12 months, revenue recognition is generally proximal to conversion to cash. The following table summarizes our balances in these accounts for the periods indicated (other than contract liabilities disclosed above):

| | | | | | | | | | | |

| Receivables | | Contract Assets(1) |

| Beginning of period balance | $ | 469 | | | $ | 24 | |

End of period balance, September 30, 2023 | 488 | | | 20 | |

| | | |

| | | |

|

(1) Contract assets are included primarily within Prepaid expenses, deposits and other current assets in our consolidated balance sheets. |

As of September 30, 2023, we did not have material unsatisfied performance obligations for contracts expected to be long-term or contracts for which we recognize revenue at an amount other than for which we have the right to invoice for goods or services delivered or performed.

(4) Business Segments

We report our operations in three business segments—Gaming, SciPlay and iGaming—representing our different products and services. A detailed discussion regarding the products and services from which each reportable business segment derives its revenue is included in Notes 3 and 4 in our 2022 10-K.

In evaluating financial performance, our Chief Operating Decision Maker focuses on AEBITDA as management’s primary segment measure of profit or loss, which is described in footnote (2) to the below table. The accounting policies of our

business segments are the same as those described within the Notes in our 2022 10-K. The following tables present our segment information:

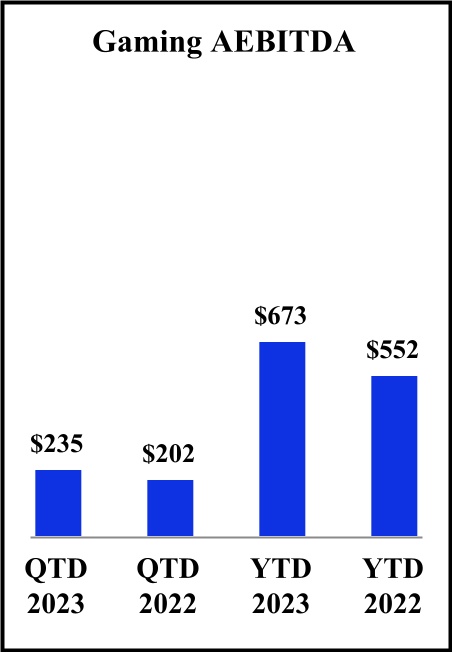

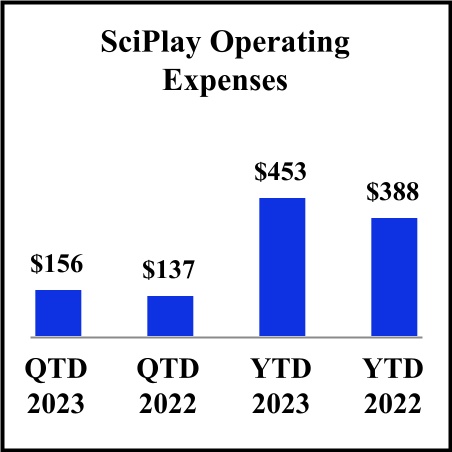

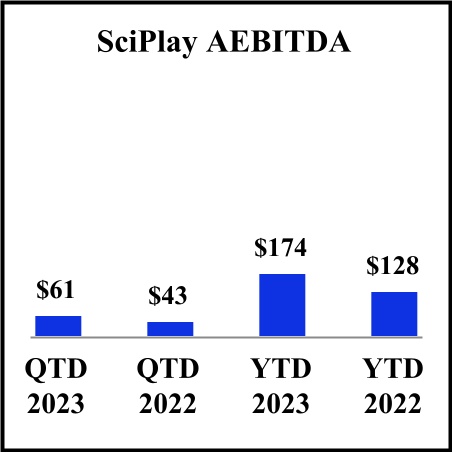

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 |

| Gaming | | SciPlay | | iGaming | | Unallocated and Reconciling Items(1) | | Total |

Total revenue | $ | 465 | | | $ | 196 | | | $ | 70 | | | $ | — | | | $ | 731 | |

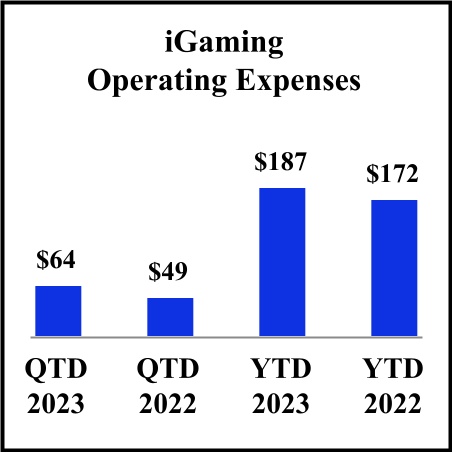

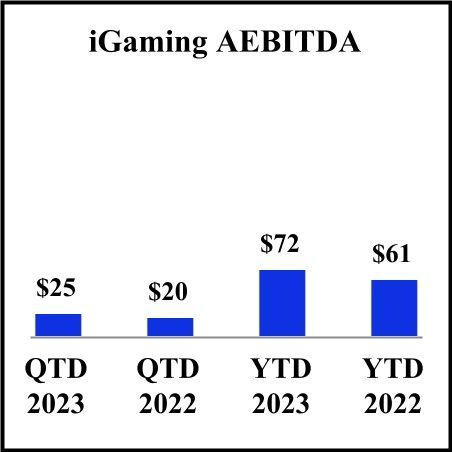

AEBITDA(2) | 235 | | | 61 | | | 25 | | | (35) | | | $ | 286 | |

Reconciling items to net income from continuing operations before income taxes: |

D&A | (64) | | | (6) | | | (12) | | | (8) | | | (90) | |

| | | | | | | | | |

Restructuring and other | (1) | | | (2) | | | (4) | | | (10) | | | (17) | |

| | | | | | | | | |

| | | | | | | | | |

Interest expense | | | | | | | (78) | | | (78) | |

| Loss on debt financing transactions | | | | | | | (15) | | | (15) | |

| | | | | | | | | |

Other income, net | | | | | | | 39 | | | 39 | |

Stock-based compensation | | | | | | | (31) | | | (31) | |

Net income from continuing operations before income taxes | | | | | | | | | $ | 94 | |

| | | | | | | | | |

| | | | | | | | | |

|

| (1) Includes amounts not allocated to the business segments (including corporate costs) and items to reconcile the total business segments AEBITDA to our consolidated net income from continuing operations before income taxes. |

| (2) AEBITDA is reconciled to net income (loss) from continuing operations before income taxes with the following adjustments: (1) depreciation and amortization expense and impairment charges (including goodwill impairments); (2) restructuring and other, which includes charges or expenses attributable to: (i) employee severance; (ii) management restructuring and related costs; (iii) restructuring and integration; (iv) cost savings initiatives; (v) major litigation; and (vi) acquisition- and disposition-related costs and other unusual items; (3) interest expense; (4) loss on debt financing transactions; (5) change in fair value of investments and remeasurement of debt and other; (6) other (expense) income, net, including foreign currency gains or losses and earnings from equity investments; and (7) stock-based compensation. AEBITDA is presented as our primary segment measure of profit or loss. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2022 |

| Gaming | | | | SciPlay | | iGaming | | Unallocated and Reconciling Items(1) | | Total |

Total revenue | $ | 419 | | | | | $ | 171 | | | $ | 58 | | | $ | — | | | $ | 648 | |

AEBITDA(2) | 202 | | | | | 43 | | | 20 | | | (30) | | | $ | 235 | |

Reconciling items to net income from continuing operations before income taxes: |

D&A | (81) | | | | | (6) | | | (10) | | | (5) | | | (102) | |

| | | | | | | | | | | |

Restructuring and other | (1) | | | | | (1) | | | — | | | (25) | | | (27) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Interest expense | | | | | | | | | (68) | | | (68) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Other income, net | | | | | | | | | 1 | | | 1 | |

| Stock-based compensation | | | | | | | | | (15) | | | (15) | |

Net income from continuing operations before income taxes | | | | | | | | | | | $ | 24 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| (1) Includes amounts not allocated to the business segments (including corporate costs) and items to reconcile the total business segments AEBITDA to our consolidated net income from continuing operations before income taxes. |

(2) AEBITDA is described in footnote (2) to the first table in this Note 4. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2023 |

| Gaming | | | | SciPlay | | iGaming | | Unallocated and Reconciling Items(1) | | Total |

Total revenue | $ | 1,354 | | | | | $ | 573 | | | $ | 204 | | | $ | — | | | $ | 2,131 | |

AEBITDA(2) | 673 | | | | | 174 | | | 72 | | | (104) | | | $ | 815 | |

Reconciling items to net income from continuing operations before income taxes: |

D&A | (221) | | | | | (23) | | | (36) | | | (18) | | | (298) | |

| | | | | | | | | | | |

Restructuring and other | (10) | | | | | (5) | | | (14) | | | (37) | | | (66) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Interest expense | | | | | | | | | (231) | | | (231) | |

| Loss on debt financing transactions | | | | | | | | | (15) | | | (15) | |

| | | | | | | | | | | |

Other income, net | | | | | | | | | 19 | | | 19 | |

Stock-based compensation | | | | | | | | | (85) | | | (85) | |

Net income from continuing operations before income taxes | | | | | | | | | | | $ | 139 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| (1) Includes amounts not allocated to the business segments (including corporate costs) and items to reconcile the total business segments AEBITDA to our consolidated net income from continuing operations before income taxes. |

| (2) AEBITDA is described in footnote (2) to the first table in this Note 4. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Nine Months Ended September 30, 2022 |

| Gaming | | | | SciPlay | | iGaming | | Unallocated and Reconciling Items(1) | | Total |

Total revenue | $ | 1,163 | | | | | $ | 489 | | | $ | 178 | | | $ | — | | | $ | 1,830 | |

AEBITDA(2) | 552 | | | | | 128 | | | 61 | | | (93) | | | $ | 648 | |

Reconciling items to net loss from continuing operations before income taxes: |

D&A | (246) | | | | | (16) | | | (37) | | | (18) | | | (317) | |

| | | | | | | | | | | |

Restructuring and other | (5) | | | | | (4) | | | (15) | | | (82) | | | (106) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Interest expense | | | | | | | | | (254) | | | (254) | |

Loss on debt financing transactions | | | | | | | | | (147) | | | (147) | |

| Gain on remeasurement of debt and other | | | | | | | | | 27 | | | 27 | |

Other income, net | | | | | | | | | 7 | | | 7 | |

| Stock-based compensation | | | | | | | | | (47) | | | (47) | |

Net loss from continuing operations before income taxes | | | | | | | | | | | $ | (189) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

|

| (1) Includes amounts not allocated to the business segments (including corporate costs) and items to reconcile the total business segments AEBITDA to our consolidated net loss from continuing operations before income taxes. |

| (2) AEBITDA is described in footnote (2) to the first table in this Note 4. |

(5) Restructuring and Other

Restructuring and other includes charges or expenses attributable to: (i) employee severance; (ii) management restructuring and related costs; (iii) restructuring and integration; (iv) cost savings initiatives; (v) major litigation; and (vi)

acquisition- and disposition-related costs and other unusual items. The following table summarizes pre-tax restructuring and other costs for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Employee severance and related | $ | 2 | | | $ | 5 | | | $ | 15 | | | $ | 7 | |

| | | | | | | |

Strategic review and related(1) | 9 | | | 14 | | | 27 | | | 68 | |

Contingent acquisition consideration(2) | 1 | | | — | | | 10 | | | 12 | |

| Restructuring, integration and other | 5 | | | 8 | | | 14 | | | 19 | |

| Total | $ | 17 | | | $ | 27 | | | $ | 66 | | | $ | 106 | |

|

|

|

| (1) Includes costs associated with the SciPlay Merger, ASX listing, Divestitures (including ongoing separation activities), rebranding and related activities. |

| (2) Represents contingent consideration fair value adjustment (see Note 12). |

|

|

(6) Receivables, Allowance for Credit Losses and Credit Quality of Receivables

Receivables

The following table summarizes the components of current and long-term receivables, net:

| | | | | | | | | | | |

| As of |

| September 30, 2023 | | December 31, 2022 |

| Current: | | | |

Receivables | $ | 517 | | | $ | 493 | |

Allowance for credit losses | (40) | | | (38) | |

Current receivables, net | 477 | | | 455 | |

| Long-term: | | | |

Receivables | 12 | | | 16 | |

Allowance for credit losses | (1) | | | (2) | |

| Long-term receivables, net | 11 | | | 14 | |

Total receivables, net | $ | 488 | | | $ | 469 | |

| | | |

| | | |

| | | |

Allowance for Credit Losses

We manage our receivable portfolios using both geography and delinquency as key credit quality indicators. The following summarizes geographical delinquencies of total receivables, net:

| | | | | | | | | | | | | | | | | | | | | | | |

| As of |

| September 30, 2023 | | Balances over 90 days past due | | December 31, 2022 | | Balances over 90 days past due |

| Receivables: | | | | | | | |

| U.S. and Canada | $ | 331 | | | $ | 3 | | | $ | 297 | | | $ | 5 | |

| International | 198 | | | 41 | | | 212 | | | 34 | |

| Total receivables | 529 | | | 44 | | | 509 | | | 39 | |

| Receivables allowance: | | | | | | | |

| U.S. and Canada | (18) | | | (5) | | | (18) | | | (5) | |

| International | (23) | | | (13) | | | (22) | | | (22) | |

| Total receivables allowance | (41) | | | (18) | | | (40) | | | (27) | |

| Receivables, net | $ | 488 | | | $ | 26 | | | $ | 469 | | | $ | 12 | |

| | | | | | | |

| | | | | | | |

Account balances are charged against the allowances after all internal and external collection efforts have been exhausted and the potential for recovery is considered remote.

The activity in our allowance for receivable credit losses for each of the three and nine months ended September 30, 2023 and 2022 is as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| 2023 | | 2022 |

| Total | | U.S. and Canada | | International | | Total |

Beginning allowance for credit losses | $ | (40) | | | $ | (18) | | | $ | (22) | | | $ | (54) | |

Provision | (1) | | | (1) | | | — | | | (3) | |

Charge-offs and recoveries | 1 | | | — | | | 1 | | | 7 | |

| Allowance for credit losses as of March 31 | $ | (40) | | | $ | (19) | | | $ | (21) | | | $ | (50) | |

Provision | (4) | | | — | | | (4) | | | (1) | |

Charge-offs and recoveries | 2 | | | 1 | | | 1 | | | 3 | |

| Allowance for credit losses as of June 30 | $ | (42) | | | $ | (18) | | | $ | (24) | | | $ | (48) | |

| Provision | — | | | — | | | — | | | 4 | |

| Charge-offs and recoveries | 1 | | | — | | | 1 | | | 1 | |

| Allowance for credit losses as of September 30 | $ | (41) | | | $ | (18) | | | $ | (23) | | | $ | (43) | |

| | | | | | | |

|

As of September 30, 2023 and December 31, 2022, 5% and 3%, respectively, of our total receivables, net, were past due by over 90 days.

Credit Quality of Receivables

We have certain concentrations of outstanding receivables in international locations that impact our assessment of the credit quality of our receivables. We monitor the macroeconomic and political environment in each of these locations in our assessment of the credit quality of our receivables. The international customers with significant concentrations (generally deemed to be exceeding 10%) of our receivables with terms longer than one year are primarily in the Latin America region (“LATAM”) and are primarily comprised of Mexico, Peru and Argentina. The following table summarizes our LATAM receivables: | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of September 30, 2023 | | |

| Total | | | | Current | | Balances over 90 days past due | | | | | | |

| Receivables | $ | 56 | | | | | $ | 38 | | | $ | 18 | | | | | | | |

| Allowance for credit losses | (17) | | | | | (9) | | | (8) | | | | | | | |

| Receivables, net | $ | 39 | | | | | $ | 29 | | | $ | 10 | | | | | | | |

We continuously review receivables and, as information concerning credit quality arises, reassess our expectations of future losses and record an incremental reserve if warranted at that time. Our current allowance for credit losses represents our current expectation of credit losses; however, future expectations could change as international unrest or other macro-economic factors impact the financial stability of our customers.

The fair value of receivables is estimated by discounting expected future cash flows using current interest rates at which similar loans would be made to borrowers with similar credit ratings and remaining maturities. As of September 30, 2023 and December 31, 2022, the fair value of receivables, net, approximated the carrying value due to contractual terms of receivables generally being less than 24 months.

(7) Inventories

Inventories consisted of the following:

| | | | | | | | | | | |

| As of |

| September 30, 2023 | | December 31, 2022 |

Parts and work-in-process | $ | 120 | | | $ | 124 | |

Finished goods | 63 | | | 37 | |

Total inventories | $ | 183 | | | $ | 161 | |

| | | |

| | | |

Parts and work-in-process include parts for gaming machines and our finished goods inventory primarily consists of gaming machines for sale.

(8) Property and Equipment, net

Property and equipment, net consisted of the following:

| | | | | | | | | | | |

| As of |

| September 30, 2023 | | December 31, 2022 |

| Land | $ | 6 | | | $ | 6 | |

| Buildings and leasehold improvements | 59 | | | 56 | |

| Gaming machinery and equipment | 725 | | | 685 | |

| Furniture and fixtures | 25 | | | 25 | |

| Construction in progress | 10 | | | 9 | |

| Other property and equipment | 99 | | | 88 | |

| Less: accumulated depreciation | (695) | | | (665) | |

| Total property and equipment, net | $ | 229 | | | $ | 204 | |

|

| | | |

| | | |

Depreciation expense is excluded from cost of services, cost of products and other operating expenses and is separately presented within Depreciation, amortization and impairments.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Depreciation expense | $ | 30 | | | $ | 27 | | | $ | 87 | | | $ | 82 | |

|

(9) Intangible Assets, net and Goodwill

Intangible Assets, net

The following tables present certain information regarding our intangible assets as of September 30, 2023 and December 31, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of |

| September 30, 2023 | | December 31, 2022 |

| Gross Carrying Value | | Accumulated Amortization | | | | Net Balance | | Gross Carrying Value | | Accumulated Amortization | | Net Balance |

Amortizable intangible assets: | | | | | | | | | | | | | |

| Customer relationships | $ | 899 | | | $ | (549) | | | | | $ | 350 | | | $ | 902 | | | $ | (503) | | | $ | 399 | |

| Intellectual property | 934 | | | (747) | | | | | 187 | | | 948 | | | (714) | | | 234 | |

| Licenses | 374 | | | (295) | | | | | 79 | | | 371 | | | (273) | | | 98 | |

| Brand names | 127 | | | (116) | | | | | 11 | | | 129 | | | (108) | | | 21 | |

| Trade names | 162 | | | (155) | | | | | 7 | | | 162 | | | (122) | | | 40 | |

| Patents and other | 11 | | | (7) | | | | | 4 | | | 12 | | | (7) | | | 5 | |

| Total intangible assets | $ | 2,507 | | | $ | (1,869) | | | | | $ | 638 | | | $ | 2,524 | | | $ | (1,727) | | | $ | 797 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

The following reflects intangible amortization expense included within Depreciation, amortization and impairments.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

Amortization expense(1) | $ | 41 | | | $ | 60 | | | $ | 160 | | | $ | 180 | |

| | | | | | | |

(1) The nine months ended September 30, 2023 include an intangible assets non-cash impairment charge of $4 million related to SciPlay restructuring of a certain foreign studio. |

Goodwill

The table below reconciles the change in the carrying value of goodwill by business segment for the period from December 31, 2022 to September 30, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Gaming(1) | | | | SciPlay | | iGaming | | | | Totals |

Balance as of December 31, 2022 | | $ | 2,373 | | | | | $ | 213 | | | $ | 333 | | | | | $ | 2,919 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Foreign currency adjustments | | (3) | | | | | (5) | | | (8) | | | | | (16) | |

Balance as of September 30, 2023 | | $ | 2,370 | | | | | $ | 208 | | | $ | 325 | | | | | $ | 2,903 | |

| | | | | | | | | | | | |

(1) Accumulated goodwill impairment charges for the Gaming segment as of September 30, 2023 were $989 million. |

|

(10) Software, net

Software, net consisted of the following:

| | | | | | | | | | | |

| As of |