false2021FY0000746598July 317,3067,15751,261,48751,261,48748,528,24548,456,9542,733,2422,804,5333,538,6283,538,6283,538,6283,538,62842,71642,716700,140752,112P10YP33YP3YP10YP3YP3Y33.3333.3333.332019202100007465982020-08-012021-07-31iso4217:USD00007465982021-01-31xbrli:shares0000746598us-gaap:NonvotingCommonStockMember2021-08-310000746598us-gaap:CommonClassBMember2021-08-3100007465982021-07-3100007465982020-07-310000746598us-gaap:NonvotingCommonStockMember2021-07-310000746598us-gaap:NonvotingCommonStockMember2020-07-310000746598us-gaap:CommonClassBMember2021-07-310000746598us-gaap:CommonClassBMember2020-07-3100007465982019-08-012020-07-3100007465982018-08-012019-07-31iso4217:USDxbrli:shares0000746598us-gaap:NonvotingCommonStockMember2020-08-012021-07-310000746598us-gaap:NonvotingCommonStockMember2019-08-012020-07-310000746598us-gaap:NonvotingCommonStockMember2018-08-012019-07-310000746598us-gaap:CommonClassBMember2020-08-012021-07-310000746598us-gaap:CommonClassBMember2019-08-012020-07-310000746598us-gaap:CommonClassBMember2018-08-012019-07-310000746598us-gaap:CommonStockMember2018-07-310000746598us-gaap:AdditionalPaidInCapitalMember2018-07-310000746598us-gaap:RetainedEarningsMember2018-07-310000746598us-gaap:TreasuryStockMember2018-07-310000746598us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-07-310000746598us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-08-012019-07-310000746598us-gaap:AdditionalPaidInCapitalMember2018-08-012019-07-310000746598us-gaap:TreasuryStockMember2018-08-012019-07-310000746598srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2019-07-310000746598us-gaap:RetainedEarningsMember2018-08-012019-07-310000746598us-gaap:CommonStockMember2019-07-310000746598us-gaap:AdditionalPaidInCapitalMember2019-07-310000746598us-gaap:RetainedEarningsMember2019-07-310000746598us-gaap:TreasuryStockMember2019-07-310000746598us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-07-310000746598us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-08-012020-07-310000746598us-gaap:AdditionalPaidInCapitalMember2019-08-012020-07-310000746598us-gaap:TreasuryStockMember2019-08-012020-07-310000746598us-gaap:RetainedEarningsMember2019-08-012020-07-310000746598us-gaap:CommonStockMember2020-07-310000746598us-gaap:AdditionalPaidInCapitalMember2020-07-310000746598us-gaap:RetainedEarningsMember2020-07-310000746598us-gaap:TreasuryStockMember2020-07-310000746598us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-07-310000746598us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-08-012021-07-310000746598us-gaap:AdditionalPaidInCapitalMember2020-08-012021-07-310000746598us-gaap:TreasuryStockMember2020-08-012021-07-310000746598us-gaap:RetainedEarningsMember2020-08-012021-07-310000746598us-gaap:CommonStockMember2021-07-310000746598us-gaap:AdditionalPaidInCapitalMember2021-07-310000746598us-gaap:RetainedEarningsMember2021-07-310000746598us-gaap:TreasuryStockMember2021-07-310000746598us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-07-3100007465982018-07-3100007465982019-07-31xbrli:pure0000746598srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2020-08-012021-07-310000746598us-gaap:BuildingAndBuildingImprovementsMembersrt:MaximumMember2020-08-012021-07-310000746598srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2020-08-012021-07-310000746598us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2020-08-012021-07-310000746598brc:IdentificationSolutionsMember2019-07-310000746598brc:WorkplaceSafetyMember2019-07-310000746598brc:IdentificationSolutionsMember2019-08-012020-07-310000746598brc:WorkplaceSafetyMember2019-08-012020-07-310000746598brc:IdentificationSolutionsMember2020-07-310000746598brc:WorkplaceSafetyMember2020-07-310000746598brc:IdentificationSolutionsMember2020-08-012021-07-310000746598brc:WorkplaceSafetyMember2020-08-012021-07-310000746598brc:IdentificationSolutionsMember2021-07-310000746598brc:WorkplaceSafetyMember2021-07-310000746598brc:CodeAcquisitionMember2020-08-012021-07-310000746598brc:MagicardAcquisitionMember2020-08-012021-07-310000746598brc:NordicIDAcquisitionMember2020-08-012021-07-310000746598us-gaap:TradeNamesMember2020-08-012021-07-310000746598us-gaap:TradeNamesMember2021-07-310000746598us-gaap:TradeNamesMember2019-08-012020-07-310000746598us-gaap:TradeNamesMember2020-07-310000746598us-gaap:CustomerRelationshipsMember2020-08-012021-07-310000746598us-gaap:CustomerRelationshipsMember2021-07-310000746598us-gaap:CustomerRelationshipsMember2019-08-012020-07-310000746598us-gaap:CustomerRelationshipsMember2020-07-310000746598us-gaap:TechnologyBasedIntangibleAssetsMember2020-08-012021-07-310000746598us-gaap:TechnologyBasedIntangibleAssetsMember2021-07-310000746598us-gaap:TechnologyBasedIntangibleAssetsMember2020-07-310000746598us-gaap:CostOfSalesMember2020-08-012021-07-310000746598us-gaap:CostOfSalesMember2019-08-012020-07-310000746598us-gaap:SellingGeneralAndAdministrativeExpensesMember2020-08-012021-07-310000746598us-gaap:SellingGeneralAndAdministrativeExpensesMember2019-08-012020-07-31utr:Rate00007465982019-08-012019-08-010000746598us-gaap:NoncumulativePreferredStockMember2021-07-310000746598us-gaap:NoncumulativePreferredStockMember2020-07-310000746598brc:CumulativePreferredStock6CumulativeMemberus-gaap:CumulativePreferredStockMember2021-07-310000746598brc:CumulativePreferredStock6CumulativeMemberus-gaap:CumulativePreferredStockMember2020-07-310000746598brc:A1972SeriesMemberus-gaap:CumulativePreferredStockMember2021-07-310000746598brc:A1972SeriesMemberus-gaap:CumulativePreferredStockMember2020-07-310000746598brc:A1979SeriesMemberus-gaap:CumulativePreferredStockMember2021-07-310000746598brc:A1979SeriesMemberus-gaap:CumulativePreferredStockMember2020-07-310000746598us-gaap:CommonClassAMember2021-07-310000746598us-gaap:CommonClassAMember2020-07-310000746598brc:DeferredCompensationMember2018-07-310000746598brc:SharesHeldRabbiTrustAtCostMember2018-07-310000746598brc:DeferredCompensationMember2018-08-012019-07-310000746598brc:SharesHeldRabbiTrustAtCostMember2018-08-012019-07-310000746598brc:DeferredCompensationMember2019-07-310000746598brc:SharesHeldRabbiTrustAtCostMember2019-07-310000746598brc:DeferredCompensationMember2019-08-012020-07-310000746598brc:SharesHeldRabbiTrustAtCostMember2019-08-012020-07-310000746598brc:DeferredCompensationMember2020-07-310000746598brc:SharesHeldRabbiTrustAtCostMember2020-07-310000746598brc:DeferredCompensationMember2020-08-012021-07-310000746598brc:SharesHeldRabbiTrustAtCostMember2020-08-012021-07-310000746598brc:DeferredCompensationMember2021-07-310000746598brc:SharesHeldRabbiTrustAtCostMember2021-07-310000746598us-gaap:EmployeeStockOptionMember2020-08-012021-07-310000746598us-gaap:EmployeeStockOptionMember2019-08-012020-07-310000746598us-gaap:EmployeeStockOptionMember2018-08-012019-07-310000746598us-gaap:EmployeeStockOptionMember2021-07-310000746598us-gaap:EmployeeStockOptionMember2020-07-310000746598us-gaap:EmployeeStockOptionMember2019-07-310000746598brc:A19.9626.99Member2021-07-310000746598brc:A19.9626.99Member2020-08-012021-07-310000746598brc:A27.0032.99Member2021-07-310000746598brc:A27.0032.99Member2020-08-012021-07-310000746598brc:A33.0043.98Member2021-07-310000746598brc:A33.0043.98Member2020-08-012021-07-310000746598us-gaap:RestrictedStockUnitsRSUMember2020-08-012021-07-310000746598brc:ServiceBasedRestrictedSharesandRestrictedStockUnitsMember2020-07-310000746598brc:ServiceBasedRestrictedSharesandRestrictedStockUnitsMember2020-08-012021-07-310000746598brc:ServiceBasedRestrictedSharesandRestrictedStockUnitsMember2021-07-310000746598brc:ServiceBasedRestrictedSharesandRestrictedStockUnitsMember2019-08-012020-07-310000746598brc:PerformanceBasedRestrictedSharesandRestrictedStockUnitsMember2020-07-310000746598brc:PerformanceBasedRestrictedSharesandRestrictedStockUnitsMember2020-08-012021-07-310000746598brc:PerformanceBasedRestrictedSharesandRestrictedStockUnitsMember2021-07-310000746598brc:PerformanceBasedRestrictedSharesandRestrictedStockUnitsMember2019-08-012020-07-310000746598brc:PerformanceBasedRestrictedSharesandRestrictedStockUnitsMember2018-08-012019-07-310000746598us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-07-310000746598us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2019-07-310000746598us-gaap:AccumulatedTranslationAdjustmentMember2019-07-310000746598us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-08-012020-07-310000746598us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2019-08-012020-07-310000746598us-gaap:AccumulatedTranslationAdjustmentMember2019-08-012020-07-310000746598us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-07-310000746598us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2020-07-310000746598us-gaap:AccumulatedTranslationAdjustmentMember2020-07-310000746598us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-08-012021-07-310000746598us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2020-08-012021-07-310000746598us-gaap:AccumulatedTranslationAdjustmentMember2020-08-012021-07-310000746598us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-07-310000746598us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2021-07-310000746598us-gaap:AccumulatedTranslationAdjustmentMember2021-07-310000746598srt:ScenarioForecastMember2022-07-310000746598srt:ScenarioForecastMember2023-07-310000746598srt:AmericasMemberbrc:IdentificationSolutionsMember2020-08-012021-07-310000746598srt:AmericasMemberbrc:IdentificationSolutionsMember2019-08-012020-07-310000746598srt:AmericasMemberbrc:IdentificationSolutionsMember2018-08-012019-07-310000746598brc:IdentificationSolutionsMembersrt:EuropeMember2020-08-012021-07-310000746598brc:IdentificationSolutionsMembersrt:EuropeMember2019-08-012020-07-310000746598brc:IdentificationSolutionsMembersrt:EuropeMember2018-08-012019-07-310000746598srt:AsiaPacificMemberbrc:IdentificationSolutionsMember2020-08-012021-07-310000746598srt:AsiaPacificMemberbrc:IdentificationSolutionsMember2019-08-012020-07-310000746598srt:AsiaPacificMemberbrc:IdentificationSolutionsMember2018-08-012019-07-310000746598brc:IdentificationSolutionsMember2018-08-012019-07-310000746598srt:AmericasMemberbrc:WorkplaceSafetyMember2020-08-012021-07-310000746598srt:AmericasMemberbrc:WorkplaceSafetyMember2019-08-012020-07-310000746598srt:AmericasMemberbrc:WorkplaceSafetyMember2018-08-012019-07-310000746598brc:WorkplaceSafetyMembersrt:EuropeMember2020-08-012021-07-310000746598brc:WorkplaceSafetyMembersrt:EuropeMember2019-08-012020-07-310000746598brc:WorkplaceSafetyMembersrt:EuropeMember2018-08-012019-07-310000746598srt:AsiaPacificMemberbrc:WorkplaceSafetyMember2020-08-012021-07-310000746598srt:AsiaPacificMemberbrc:WorkplaceSafetyMember2019-08-012020-07-310000746598srt:AsiaPacificMemberbrc:WorkplaceSafetyMember2018-08-012019-07-310000746598brc:WorkplaceSafetyMember2018-08-012019-07-310000746598srt:AmericasMember2020-08-012021-07-310000746598srt:AmericasMember2019-08-012020-07-310000746598srt:AmericasMember2018-08-012019-07-310000746598srt:EuropeMember2020-08-012021-07-310000746598srt:EuropeMember2019-08-012020-07-310000746598srt:EuropeMember2018-08-012019-07-310000746598srt:AsiaPacificMember2020-08-012021-07-310000746598srt:AsiaPacificMember2019-08-012020-07-310000746598srt:AsiaPacificMember2018-08-012019-07-310000746598us-gaap:CorporateMember2021-07-310000746598us-gaap:CorporateMember2020-07-310000746598us-gaap:CorporateMember2019-07-310000746598country:US2020-08-012021-07-310000746598country:US2019-08-012020-07-310000746598country:US2018-08-012019-07-310000746598country:US2021-07-310000746598country:US2020-07-310000746598country:US2019-07-310000746598brc:OtherCountriesMember2020-08-012021-07-310000746598brc:OtherCountriesMember2019-08-012020-07-310000746598brc:OtherCountriesMember2018-08-012019-07-310000746598brc:OtherCountriesMember2021-07-310000746598brc:OtherCountriesMember2020-07-310000746598brc:OtherCountriesMember2019-07-310000746598us-gaap:IntersegmentEliminationMember2020-08-012021-07-310000746598us-gaap:IntersegmentEliminationMember2019-08-012020-07-310000746598us-gaap:IntersegmentEliminationMember2018-08-012019-07-310000746598us-gaap:IntersegmentEliminationMember2021-07-310000746598us-gaap:IntersegmentEliminationMember2020-07-310000746598us-gaap:IntersegmentEliminationMember2019-07-310000746598brc:NetofliabilitiesMember2021-07-310000746598brc:NetofassetsMember2021-07-310000746598brc:NetofliabilitiesMember2020-07-310000746598brc:NetofassetsMember2020-07-310000746598brc:NetofassetsMember2020-07-310000746598us-gaap:ForeignCountryMember2021-07-310000746598us-gaap:StateAndLocalJurisdictionMember2021-07-310000746598us-gaap:EarliestTaxYearMemberus-gaap:InternalRevenueServiceIRSMember2020-08-012021-07-310000746598us-gaap:LatestTaxYearMemberus-gaap:InternalRevenueServiceIRSMember2020-08-012021-07-310000746598brc:PreferentialDividendsOnClassNonvotingCommonStockMember2020-08-012021-07-310000746598brc:PreferentialDividendsOnClassNonvotingCommonStockMember2019-08-012020-07-310000746598brc:PreferentialDividendsOnClassNonvotingCommonStockMember2018-08-012019-07-310000746598brc:PreferentialDividendsOnDilutiveSharesMember2020-08-012021-07-310000746598brc:PreferentialDividendsOnDilutiveSharesMember2019-08-012020-07-310000746598brc:PreferentialDividendsOnDilutiveSharesMember2018-08-012019-07-310000746598us-gaap:FairValueInputsLevel1Memberus-gaap:OtherAssetsMember2021-07-310000746598us-gaap:FairValueInputsLevel1Memberus-gaap:OtherAssetsMember2020-07-310000746598us-gaap:FairValueInputsLevel2Memberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2021-07-310000746598us-gaap:FairValueInputsLevel2Memberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2020-07-310000746598us-gaap:FairValueInputsLevel2Memberus-gaap:OtherCurrentLiabilitiesMember2021-07-310000746598us-gaap:FairValueInputsLevel2Memberus-gaap:OtherCurrentLiabilitiesMember2020-07-310000746598us-gaap:DesignatedAsHedgingInstrumentMember2021-07-310000746598us-gaap:DesignatedAsHedgingInstrumentMember2020-07-310000746598us-gaap:NondesignatedMember2021-07-310000746598us-gaap:NondesignatedMember2020-07-310000746598us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-07-310000746598us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-07-310000746598us-gaap:CashFlowHedgingMember2018-08-012019-07-310000746598us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-07-310000746598us-gaap:ForeignExchangeContractMemberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-07-310000746598us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-07-310000746598us-gaap:ForeignExchangeContractMemberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-07-310000746598us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2021-07-310000746598us-gaap:ForeignExchangeContractMemberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:NondesignatedMember2021-07-310000746598us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2020-07-310000746598us-gaap:ForeignExchangeContractMemberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:NondesignatedMember2020-07-310000746598us-gaap:OtherCurrentLiabilitiesMember2021-07-310000746598us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2020-07-310000746598us-gaap:OtherCurrentLiabilitiesMember2020-07-310000746598brc:MagicardAcquisitionMemberus-gaap:CustomerRelationshipsMember2020-08-012021-07-310000746598brc:MagicardAcquisitionMemberus-gaap:TechnologyBasedIntangibleAssetsMember2020-08-012021-07-310000746598brc:MagicardAcquisitionMemberus-gaap:TradeNamesMember2020-08-012021-07-310000746598us-gaap:CustomerRelationshipsMemberbrc:NordicIDAcquisitionMember2020-08-012021-07-310000746598us-gaap:TechnologyBasedIntangibleAssetsMemberbrc:NordicIDAcquisitionMember2020-08-012021-07-310000746598brc:CodeAcquisitionMember2021-07-310000746598us-gaap:CustomerRelationshipsMemberbrc:CodeAcquisitionMember2020-08-012021-07-310000746598us-gaap:TechnologyBasedIntangibleAssetsMemberbrc:CodeAcquisitionMember2020-08-012021-07-310000746598us-gaap:TradeNamesMemberbrc:CodeAcquisitionMember2020-08-012021-07-3100007465982019-08-012019-10-3100007465982019-11-012020-01-3100007465982020-02-012020-04-3000007465982020-05-012020-07-310000746598us-gaap:NonvotingCommonStockMember2019-08-012019-10-310000746598us-gaap:NonvotingCommonStockMember2019-11-012020-01-310000746598us-gaap:NonvotingCommonStockMember2020-02-012020-04-300000746598us-gaap:NonvotingCommonStockMember2020-05-012020-07-3100007465982020-08-012020-10-3100007465982020-11-012021-01-3100007465982021-02-012021-04-3000007465982021-05-012021-07-310000746598us-gaap:NonvotingCommonStockMember2020-08-012020-10-310000746598us-gaap:NonvotingCommonStockMember2020-11-012021-01-310000746598us-gaap:NonvotingCommonStockMember2021-02-012021-04-300000746598us-gaap:NonvotingCommonStockMember2021-05-012021-07-310000746598us-gaap:SubsequentEventMember2021-08-012022-07-310000746598us-gaap:AllowanceForCreditLossMember2020-07-310000746598us-gaap:AllowanceForCreditLossMember2019-07-310000746598us-gaap:AllowanceForCreditLossMember2018-07-310000746598us-gaap:AllowanceForCreditLossMember2020-08-012021-07-310000746598us-gaap:AllowanceForCreditLossMember2019-08-012020-07-310000746598us-gaap:AllowanceForCreditLossMember2018-08-012019-07-310000746598us-gaap:AllowanceForCreditLossMember2021-07-310000746598us-gaap:InventoryValuationReserveMember2020-07-310000746598us-gaap:InventoryValuationReserveMember2019-07-310000746598us-gaap:InventoryValuationReserveMember2018-07-310000746598us-gaap:InventoryValuationReserveMember2020-08-012021-07-310000746598us-gaap:InventoryValuationReserveMember2019-08-012020-07-310000746598us-gaap:InventoryValuationReserveMember2018-08-012019-07-310000746598us-gaap:InventoryValuationReserveMember2021-07-310000746598us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-07-310000746598us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-07-310000746598us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2018-07-310000746598us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-08-012021-07-310000746598us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-08-012020-07-310000746598us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2018-08-012019-07-310000746598us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| | | | | |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended July 31, 2021

OR | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-14959

BRADY CORPORATION

(Exact name of registrant as specified in charter)

| | | | | | | | |

| Wisconsin | | 39-0178960 |

| (State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

6555 West Good Hope Road

Milwaukee, Wisconsin 53233

(Address of principal executive offices and Zip Code)

(414) 358-6600

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Class A Nonvoting Common Stock, par value $0.01 per share | BRC | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☑ | Accelerated filer | | ☐ | Emerging growth company | | ☐ |

| Non-accelerated filer | | ☐ | Smaller reporting company | | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the non-voting common stock held by non-affiliates of the registrant as of January 31, 2021, was approximately $2,104,922,847 based on the closing sale price of $45.91 per share on that date as reported for the New York Stock Exchange. As of August 31, 2021, there were 48,528,245 outstanding shares of Class A Nonvoting Common Stock (the “Class A Common Stock”), and 3,538,628 shares of Class B Common Stock. The Class B Common Stock, all of which is held by affiliates of the registrant, is the only voting stock.

INDEX

| | | | | |

| PART I | Page |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| PART II | |

| |

| |

| |

| |

| |

| |

| |

| |

| PART III | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| PART IV | |

| |

| |

| |

PART I

Forward-Looking Statements

In this Annual Report on Form 10-K for Brady Corporation ("Brady," "Company," "we," "us," "our"), statements that are not reported financial results or other historic information are “forward-looking statements.” These forward-looking statements relate to, among other things, the Company's future financial position, business strategy, targets, projected sales, costs, income, capital expenditures, debt levels and cash flows, and plans and objectives of management for future operations.

The use of words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “project” or “plan” or similar terminology are generally intended to identify forward-looking statements. These forward-looking statements by their nature address matters that are, to different degrees, uncertain and are subject to risks, assumptions, and other factors, some of which are beyond Brady's control, that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. For Brady, uncertainties arise from:

•Adverse impacts of the novel coronavirus ("COVID-19") pandemic or other pandemics

•Decreased demand for the Company's products

•Ability to compete effectively or to successfully execute its strategy

•Ability to develop technologically advanced products that meet customer demands

•Ability to identify, integrate, and grow acquired companies, and to manage contingent liabilities from divested businesses

•Raw material and other cost increases including raw material shortages

•Difficulties in protecting websites, networks, and systems against security breaches

•Risks associated with the loss of key employees

•Extensive regulations by U.S. and non-U.S. governmental and self-regulatory entities

•Litigation, including product liability claims

•Foreign currency fluctuations

•Potential write-offs of goodwill and other intangible assets

•Changes in tax legislation and tax rates

•Differing interests of voting and non-voting shareholders

•Numerous other matters of national, regional and global scale, including major public health crises and government responses thereto and those of a political, economic, business, competitive, and regulatory nature contained from time to time in Brady's U.S. Securities and Exchange Commission filings, including, but not limited to, those factors listed in the “Risk Factors” section within Item 1A of Part I of this Annual Report on Form 10-K.

These uncertainties may cause Brady's actual future results to be materially different than those expressed in its forward-looking statements. Brady does not undertake to update its forward-looking statements except as required by law.

Item 1. Business

General Development of Business

Brady was incorporated under the laws of the state of Wisconsin in 1914. The Company is a global manufacturer and supplier of identification solutions and workplace safety products that identify and protect premises, products and people. The ability to provide customers with a broad range of proprietary, customized and diverse products for use in various applications across multiple industries and geographies, along with a commitment to quality and service, have made Brady a leader in many of its markets.

The Company’s primary objective is to build upon its market position and increase shareholder value by enabling a highly competent and experienced organization to focus on the following key competencies:

•Operational excellence — Continuous productivity improvement, automation, and product customization capabilities.

•Customer service — Understanding customer needs and providing a high level of customer service.

•Innovative products — Technologically-advanced, internally-developed proprietary products that drive revenue growth and sustain gross profit margins.

•Global leadership position in niche markets.

•Digital capabilities.

•Compliance expertise.

The long-term sales growth and profitability of our segments will depend not only on improved demand in end markets and the overall economic environment, but also on our ability to continuously improve the efficiency of our global operations,

deliver a high level of customer service, develop and market innovative new products, and to advance our digital capabilities. In our Identification Solutions ("ID Solutions" or "IDS") business, our strategy for growth includes an increased focus on certain industries and products, a focus on improving the customer buying experience, and the development of technologically advanced, innovative and proprietary products. In our Workplace Safety ("WPS") business, our strategy for growth includes a focus on workplace safety critical industries, innovative new product offerings, compliance expertise, customization expertise, and improving our digital capabilities.

The following were key initiatives supporting the strategy in fiscal 2021:

•Investing in organic growth by enhancing our research and development process and utilizing customer feedback to develop innovative new products.

•Investing in acquisitions that enhance our strategic position and accelerate long-term sales growth.

•Providing our customers with the highest level of customer service.

•Expanding and enhancing our sales capabilities through an improved digital presence and the use of data-driven marketing automation tools.

•Driving operational excellence and executing sustainable efficiency gains within our selling, general and administrative structures and within our global operations including insourcing of critical products and manufacturing activities.

•Building on our culture of diversity, equity and inclusion to increase employee engagement and enhance recruitment and retention practices.

In the fourth quarter of fiscal 2021, Brady completed the acquisition of three companies: The Code Corporation ("Code"), Magicard Holdings Limited ("Magicard"), and Nordic ID Oyj ("Nordic ID"). The acquired companies allow Brady to move into faster-growing markets with the goal of accelerating long-term sales growth. The financial results of the three acquired companies were included in the IDS segment from the date of the respective acquisitions.

Narrative Description of Business

Overview

The Company is organized and managed on a global basis within two reportable segments: Identification Solutions and Workplace Safety.

The IDS segment includes high-performance and innovative safety, identification and healthcare products manufactured under multiple brands, including the Brady brand. Industrial identification products are sold through distribution to a broad range of maintenance, repair, and operations ("MRO") and original equipment manufacturing customers and through other channels, including direct sales, catalog marketing, and digital. Healthcare identification products are sold directly to customers and through distribution via group purchasing organizations.

The WPS segment includes workplace safety, identification and compliance products sold under multiple brand names primarily through catalog and digital channels to a broad range of MRO customers. Approximately 40% of the WPS business is derived from internally manufactured products and 60% is from externally sourced products.

Below is a summary of sales by reportable segment for the fiscal years ended July 31:

| | | | | | | | | | | | | | | | | | | | |

| | 2021 | | 2020 | | 2019 |

| IDS | | 73.5 | % | | 72.6 | % | | 74.4 | % |

| WPS | | 26.5 | % | | 27.4 | % | | 25.6 | % |

| Total | | 100.0 | % | | 100.0 | % | | 100.0 | % |

ID Solutions

Within the ID Solutions segment, the primary product categories include:

•Facility safety and identification and protection, which includes safety signs, floor-marking tape, pipe markers, labeling systems, spill control products, lockout/tagout devices, and software and services for safety compliance auditing, procedure writing and training.

•Product identification, which includes materials, printing systems, RFID and bar code scanners for product identification, brand protection labeling, work in process labeling, and finished product identification.

•Wire identification, which includes hand-held printers, wire markers, sleeves, and tags.

•People identification, which includes name tags, badges, lanyards, rigid-card printing systems, and access control software.

•Patient identification, which includes wristbands and labels used in hospitals for tracking and improving the safety of patients.

Approximately 69% of ID Solutions products are sold under the Brady brand, with other primary brands including identification products for the utility industry which are marketed under the Electromark brand and security and identification badges and systems which are marketed under the IDenticard, PromoVision, Brady People ID, BIG, and MAGiCARD brands. Spill control products are marketed under the SPC brand, lockout/tagout products are offered under the Scafftag brand, RFID products are marketed under the Nordic ID brand, and barcode scanners are marketed under the Code brand. Identification and patient safety products in the healthcare industry are available under the PDC Healthcare brand and custom wristbands for the leisure and entertainment industry are available under the PDC brand.

The ID Solutions segment offers high-quality products with rapid response and superior service to provide solutions to customers. IDS markets and sells products through multiple channels including distribution, direct, catalog marketing, and digital channels. The ID Solutions sales force partners with end-users and distributors by providing technical application and product expertise.

IDS manufactures differentiated, proprietary products, most of which have been internally developed. These internally developed products include materials, printing systems, and software. IDS competes for business on several factors, including customer service, product innovation, breadth of product offering, product quality, price, expertise, production capabilities, and for multinational customers, our global footprint. Competition is highly fragmented, ranging from smaller companies offering minimal product variety, to some of the world's largest adhesive and electrical product companies offering competing products as part of their overall product lines.

ID Solutions serves customers in many industries, which include industrial manufacturing, electronic manufacturing, healthcare, chemical, oil, gas, automotive, aerospace, governments, mass transit, electrical contractors, education, leisure and entertainment and telecommunications, among others.

Workplace Safety

Within the Workplace Safety segment, the primary product categories include:

•Safety and compliance signs, tags, labels, and markings.

•Informational signage and markings.

•Asset tracking labels.

•Facility safety and personal protection equipment.

•First-aid products.

•Labor law and other compliance posters.

Products within the Workplace Safety segment are sold under a variety of brands including: safety and facility identification products offered under the Seton, Emedco, Signals, Safety Signs, SafetyShop, Signs & Labels, and Pervaco brands; first aid supplies under the Accidental Health and Safety, Trafalgar, and Securimed brands; wire identification products marketed under the Carroll brand; and labor law and compliance posters under the Personnel Concepts and Clement Communications brands.

The Workplace Safety segment manufactures a broad range of stock and custom identification products, and also sells a broad range of related resale products. Historically, both the Company and many of our competitors focused their businesses on catalog marketing, often with varying product niches. Many of our competitors extensively utilize e-commerce to promote the sale of their products. A consequence of e-commerce is price transparency, as prices on non-proprietary products can be easily compared. Therefore, to compete effectively, we continue to build out our e-commerce capabilities and focus on developing unique or customized solutions, enhancing the customer experience, and providing compliance expertise as these are critical to retain existing customers and convert new customers. Workplace Safety primarily sells to businesses and serves many industries, including manufacturers, process industries, government, education, construction, and utilities.

Research and Development

The Company focuses its research and development ("R&D") efforts on pressure sensitive materials, identification and printing systems, software, industrial track and trace applications and the development of other workplace safety-related products. The Company spent $44.6 million, $40.7 million, and $45.2 million on its R&D activities during the fiscal years ended July 31, 2021, 2020, and 2019, respectively. Although there is an increasing amount of R&D that supports the WPS

segment, the majority of R&D spend supports the IDS segment. Material development involves the application of surface chemistry concepts for top coatings and adhesives applied to a variety of base materials. The design of our identification and printing systems integrates materials, embedded software, a variety of printing technologies and product scanning and identification technologies to form a complete solution for customer applications. In addition, the R&D team supports production and marketing efforts by providing application and technical expertise.

The Company owns patents and tradenames relating to certain products in the United States and internationally. Although the Company believes patents are a significant driver in maintaining its position for certain products, technology in the areas covered by many of the patents continues to evolve and may limit the value of such patents. The Company's business is not dependent on any single patent or group of patents. Patents applicable to specific products extend for up to 20 years according to the date of patent application filing or patent grant, depending upon the legal term of patents in the various countries where patent protection is obtained. The Company's tradenames are valid ten years from the date of registration, and are typically renewed on an ongoing basis.

Operations

The materials used in the products manufactured consist of a variety of plastic and synthetic films, paper, metal and metal foil, cloth, fiberglass, inks, dyes, adhesives, pigments, natural and synthetic rubber, organic chemicals, polymers, and solvents for consumable identification products in addition to molded parts, electronic components, chips, and sub-assemblies for identification and printing systems. The Company operates coating facilities that manufacture bulk rolls of label stock for internal and external customers. In addition, the Company purchases finished products for resale.

The Company purchases raw materials, components and finished products from many suppliers. Overall, we are not dependent upon any single supplier for our most critical base materials or components. However, we have chosen in certain situations to sole source, or limit the sources of materials, components, or finished items for design or cost reasons. As a result, disruptions in supply could have an impact on results for a period of time, but we believe any disruptions would simply require qualification of new suppliers and the disruption would be modest. In certain instances, the qualification process could be more costly or take a longer period of time and in certain situations, such as a global shortage of critical materials or components, the financial impact could be material.

The Company carries working capital mainly related to accounts receivable and inventory. Inventory consists of raw materials, work in process and finished goods. Generally, custom products are made to order while an on-hand quantity of stock product is maintained to provide customers with timely delivery. Average time to fulfill customer orders varies from same-day to one month, depending on the type of product, customer request, and whether the product is stock or custom-designed and manufactured. Normal and customary payment terms primarily range from net 10 to 90 days from date of invoice and vary by geography.

The Company has a broad customer base, and no individual customer represents 10% or more of total net sales.

Human Capital Management

As of July 31, 2021, the Company employed approximately 5,700 individuals worldwide, of which approximately 1,650 were employed in the United States and approximately 4,050 were employed outside the United States.

The Company’s Senior Vice President of Human Resources is responsible for developing the Company’s human capital strategy, which includes the attraction, acquisition, development, engagement and retention of talent to deliver on the Company’s strategy as well as the design of employee compensation and benefits programs. Management is responsible for executing the Company's human capital strategy. The Senior Vice President of Human Resources is also responsible for leading the Company’s diversity, equity, and inclusion initiatives. The Company’s Board of Directors and its committees receive regular updates on the operation and status of these initiatives and human capital trends and activities from the Senior Vice President of Human Resources, the CEO and others within senior management.

Key areas of focus with respect to human capital include:

Health and Safety: The Company’s health and safety programs are designed around global standards with appropriate variations addressing the multiple jurisdictions and regulations, specific hazards and unique working environments of the Company’s manufacturing, distribution and headquarter operations. The Company requires each of its locations to perform regular safety audits to ensure proper safety policies, program procedures, analyses and training are in place. The Company utilizes a mixture of leading and lagging indicators to assess the health and safety performance of its operations. Lagging indicators include the OSHA Total Recordable Incident Rate (“TRIR”) and the Lost Time Case Rate (“LTCR”) based upon the number of incidents per 100 employees. Leading indicators include reporting and closure of all near miss events and

Environmental, Health and Safety (“EHS”) coaching and engagement conversations. During the fiscal year ended July 31, 2021, the Company had a TRIR of 0.69, a LTCR of 0.32 and no work-related fatalities.

The Company provides critical products and materials to labs, hospitals and other customers who are on the front lines fighting the COVID-19 pandemic, as well as to customers who support critical infrastructure. As a result, the Company’s manufacturing facilities are generally considered essential businesses. During the COVID-19 pandemic, the Company implemented increased cleaning and sanitizing protocols, social distancing and many other actions to provide a safe environment for its employees globally. The health and safety of its employees is a top priority for the Company.

Diversity, Equity, and Inclusion: Fostering a culture of diversity, equity and inclusion in the workplace means employees feel valued and listened to, and the Company has made this a top priority. The Company believes that its culture of diversity, equity and inclusion enables it to create, develop and fully leverage the strengths of its workforce to exceed customer expectations and pursue its growth objectives. To this end, the Company engages employees through various employee resource groups staffed by employees with diverse backgrounds, experiences and characteristics who share a common interest in professional development, improving corporate culture and delivering improved business results. Each employee resource group is sponsored and supported by senior leaders throughout the organization.

The Company has implemented several measures to drive accountability for increasing diversity, equity and inclusion throughout the global organization. The CEO and other senior leaders have diversity, equity and inclusion objectives embedded in their annual performance goals. The Company also strives to have a diverse talent pipeline by partnering with its business units in their workforce planning forecasts to develop initiatives and goals to recruit diverse talent across defined organizational levels and skill areas. The Company trains its recruiting workforce in diversity sourcing strategies and partners with external organizations that develop and supply diverse talent. The Company has also expanded its university outreach program to access diverse organizations, has implemented interview guides to mitigate bias in interviewing, has implemented a Company-wide recruiting policy to drive change and ensure manager accountability, has implemented mentoring programs to increase employee engagement and retention and has implemented required training for all managers on diversity, equity and inclusion compliance and unconscious bias. As of July 31, 2021, 37.5% of the members of the Company’s Board of Directors were women and 60% of committee chairs of the Company’s Board of Directors were women.

Training and Talent Development: The Company is committed to the continued development of its people. Strategic talent reviews and succession planning occur on a planned cadence annually. The CEO and the Senior Vice President of Human Resources convene meetings with senior Company leadership and the Board of Directors to review top enterprise talent and discuss succession planning for key leadership roles.

The Company provides technical training to employees, customers and suppliers who work for or with the Company’s products. Training is provided in a number of formats to accommodate the respective learner’s style, pace, location, technical knowledge and access.

Compensation and Benefits: The Company values its people and strives to deliver compensation and benefit programs and plans that are competitive with the external market. The Company provides subsidized health and welfare benefits, as well as postretirement, incentive and equity-based compensation plans and programs, to eligible employees. Refer to the Compensation Discussion & Analysis for additional information regarding the Company’s compensation and benefits programs.

Information Available on the Internet

The Company’s Corporate Internet address is www.bradyid.com. The Company makes available, free of charge, on or through its website, copies of its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to all such reports as soon as reasonably practicable after such reports are electronically filed with or furnished to the SEC. The Company is not including the information contained on or available through its website as part of, or incorporating such information by reference into, this Annual Report on Form 10-K.

Item 1A. Risk Factors

Investors should carefully consider the risks set forth below and all other information contained in this report and other documents we file with the SEC. The risks and uncertainties described below are those that we have identified as material, but are not the only risks and uncertainties facing us. Our business is also subject to general risks and uncertainties that affect many other companies, such as market conditions, geopolitical events, changes in laws or accounting rules, fluctuations in interest rates, terrorism, wars or conflicts, major health concerns, natural disasters or other disruptions of expected economic or business conditions. Additional risks and uncertainties not currently known to us or that we currently believe are immaterial also may impair our business and financial results.

COVID-19 Risks

The COVID-19 pandemic has significantly impacted worldwide economic conditions and could have a material adverse effect on our operations and business.

The COVID-19 pandemic initially impacted our operations in the third quarter of the fiscal year ended July 31, 2020 and may continue to affect our business, particularly should government authorities impose mandatory closures, work-from-home orders or social distancing protocols, seek voluntary facility closures or impose other restrictions. Should such actions be taken, it could materially adversely affect our ability to adequately staff and maintain our operations and impact our financial results. The effects of the COVID-19 pandemic also include restrictions on our employees’ ability to visit customers as well as disruptions or temporary closures of our facilities. Some actions that we have taken in response to the COVID-19 pandemic include enabling remote working arrangements, which may create increased vulnerability to cybersecurity incidents, including breaches of information systems security, which could damage our reputation and commercial relationships, disrupt operations, increase costs or decrease revenues, and expose us to claims from customers, suppliers, financial institutions, regulators, payment card associations, employees and others. While we attempt to maintain sufficient inventory levels in order to meet rapidly shifting customer demand patterns and supplier lead time requirements, we cannot be certain we will be able to accurately predict demand or lead times, which may cause us to be unable to service customer demand or expose us to risks of product shortages, or result in excess inventory, which could lead to additional inventory carrying costs and inventory obsolescence.

The duration and ultimate impact of the COVID-19 pandemic on our business, results of operations and financial condition, including liquidity, capital and financing resources, will depend on numerous evolving factors and future developments. Such factors and developments may include the geographic spread, severity and duration of the COVID-19 pandemic, including whether there are periods of increased COVID-19 cases, disruption to our operations resulting from employee illnesses, the development, availability and administration of effective treatment or vaccines, the extent and duration of the impact on the U.S. and global economy, including the pace and extent of recovery when the pandemic subsides, and the actions that have been or may be taken by various governmental authorities in response to the outbreak, including current and future health and safety measures, such as mandatory facility closures of non-essential businesses, stay-at-home orders or similar restrictions, social distancing mandates and travel bans, and import and export restrictions, which could disrupt our relationship with customers. If we are unable to respond to and manage the impact of these events, our business and results of operations may be adversely affected.

Although our current accounting estimates contemplate current and expected future conditions, as applicable, it is reasonably possible that actual conditions could differ from our expectations, which could materially affect our results of operations and financial position. In particular, a number of estimates have been and will continue to be affected by the ongoing COVID-19 pandemic. The severity, magnitude and duration, as well as the economic consequences of the COVID-19 pandemic, are uncertain, rapidly changing and difficult to predict. As a result, our accounting estimates and assumptions may change over time in response to COVID-19. Such changes could result in future impairments of goodwill, intangible assets, long-lived assets, incremental credit losses on accounts receivable, excess and obsolete inventories, or a decrease in the carrying amount of our deferred tax assets. Any of these events could amplify the other risks and uncertainties described in this Annual Report on Form 10-K for the fiscal year ended July 31, 2021 and could have an adverse effect on our business and financial results.

Demand for our products may be adversely affected by numerous factors, some of which we cannot predict or control. This could adversely affect our business and financial results.

Numerous factors may affect the demand for our products, including:

•Deterioration of economic conditions in major markets served.

•Ongoing economic and operational impact of the COVID-19 or other pandemics.

•Consolidation in the marketplace allowing competitors to be more efficient and more price competitive.

•Competitors entering the marketplace.

•Decreasing product life cycles.

•Changes in customer preferences.

•Ability to achieve strong operational performance, including the manufacture and sale of high-quality products and the ability to meet customer delivery expectations.

If any of these factors occur, the demand for our products could suffer, and this could adversely impact our business and financial results.

Business Risks

Failure to compete effectively or to successfully execute our strategy may have a negative impact on our business and financial results.

We actively compete with companies that produce and market the same or similar products, and in some instances, with companies that sell different products that are designed for the same end user. Competition may force us to reduce prices or incur additional costs to remain competitive in an environment in which business models are changing rapidly. We compete on the basis of several factors, including customer support, product innovation, product offering, product quality, price, expertise, digital capabilities, production capabilities, and for multinational customers, our global footprint. Present or future competitors may develop and introduce new and enhanced products, offer products based on alternative technologies and processes, accept lower profit, have greater financial, technical or other resources, or have lower production costs or other pricing advantages. Any of these could put us at a disadvantage by threatening our share of sales or reducing our profit margins, which could adversely impact our business and financial results.

Additionally, throughout our global business, distributors and customers may seek lower cost sourcing opportunities, which could result in a loss of business that may adversely impact our business and financial results.

Our strategy is to expand into higher-growth adjacent product categories and markets with technologically advanced new products, as well as to grow our sales generated through the digital channel. While traditional direct marketing channels such as catalogs are an important means of selling our products, an increasing number of customers are purchasing products on the internet. Our strategy to increase sales through the digital channel is an investment in our internet sales capabilities. There is a risk that we may not continue to successfully implement this strategy, or if successfully implemented, we may not realize its expected benefits due to the continued levels of increased competition and pricing pressure brought about by the internet. Our failure to successfully implement our strategy could adversely impact our business and financial results.

Failure to develop or acquire technologically advanced products that meet customer demands, including price expectations, could adversely impact our business and financial results.

Development of technologically advanced new products is targeted as a driver of our organic growth and profitability. Technology is changing rapidly and our competitors are innovating quickly. If we do not keep pace with developing technologically advanced products, we risk product commoditization, deterioration of the value of our brand, and reduced ability to effectively compete. We must continue to develop innovative products, as well as acquire and retain the necessary intellectual property rights in these products. If we fail to innovate, or we launch products with quality problems, or if customers do not accept our products, then our business and financial results could be adversely affected.

The failure to properly identify, integrate and grow acquired companies, and to manage contingent liabilities from divested businesses could adversely affect our business and financial results.

Our historical growth has included acquisitions and our future growth strategy includes acquisitions. We completed the acquisitions of Code, Magicard and Nordic ID in fiscal 2021 for a total purchase price of $244.0 million. Acquisitions place significant demands on management, operational, and financial resources. Recent and future acquisitions will require integration of operations, sales and marketing, information technology, finance, and administrative operations, which could decrease the time available to focus on our other growth strategies. We cannot assure that we will be able to successfully integrate acquisitions, that these acquisitions will operate profitably, or that we will be able to achieve the desired sales growth or operational success. Our sales, results of operations, cash flow, and liquidity could be adversely affected if we do not successfully integrate the newly acquired businesses, including realizing synergies, or if our other businesses suffer due to the increased focus on the acquired businesses.

We continually assess the strategic fit of our existing businesses and may divest businesses that we determine do not align with our strategic plan, or that are not achieving the desired return on investment. Divestitures pose risks and challenges that

could negatively impact our business. When we decide to sell a business or specific assets, we may be unable to do so on satisfactory terms or within our anticipated timeframe, and even after reaching a definitive agreement to sell a business, the sale is typically subject to pre-closing conditions which may not be satisfied. In addition, the impact of the divestiture on our revenue and net income may be larger than projected, which could distract management, and disputes may arise with buyers. We have retained responsibility for and have agreed to indemnify buyers against certain contingent liabilities related to several businesses that we have sold. The resolution of these contingencies has not had a material adverse impact on our financial results, but we cannot be certain that this favorable pattern will continue.

Raw material and other cost increases and product shortages could adversely affect our business and financial results.

We manufacture certain parts and components of our products and therefore require raw materials from suppliers, which could be interrupted for a variety of reasons, including availability and pricing. Prices and lead times for raw materials and other components necessary for production have fluctuated in the past, including increased raw production costs, increased wage rates, and extended lead times during the year ended July 31, 2021. Significant increases could adversely affect our profit margins and results of operations. Changes in trade policies; shortages due to the COVID-19, other pandemics, or any other reason; the imposition of duties and tariffs and potential retaliatory countermeasures could adversely impact the price or availability of raw materials. In addition, labor shortages or an increase in the cost of labor could adversely affect our profit margins and results of operations. Due to competitive pressures or other factors, the Company may not be able to pass along increased raw material and component part costs to its customers in the form of price increases or its ability to do so could be delayed, which could adversely impact our business and financial results.

Global Operating Risks

Our failure or the failure of third-party service providers to protect our sites, networks and systems against security breaches, to protect our confidential information, or to facilitate our digital strategy, could adversely affect our business and financial results.

Our business systems collect, transmit and store data about our customers, vendors and others, including credit card information and personally identifiable information. We also employ third-party service providers that store, process and transmit proprietary, personal and confidential information on our behalf. We rely on encryption and authentication technology licensed from third parties in an effort to securely transmit confidential and sensitive information, including credit card numbers. Our security measures, and those of our third-party service providers, may not detect or prevent all attempts to hack our systems, denial-of-service attacks, viruses, malicious software, break-ins, phishing attacks, social engineering, security breaches or other similar disruptions that may jeopardize the security of information stored in or transmitted by our sites, networks and systems or that we or our third-party service providers otherwise maintain. We engage third-party service providers to assist with certain of our website and digital platform upgrades, which may result in a decline in sales when initially deployed, which could have an adverse effect on our business and financial results.

We and our service providers may not have the resources or technical sophistication to anticipate or prevent all types of attacks, and techniques used to obtain unauthorized access to or to sabotage systems change frequently and may not be known until launched against us or our third-party service providers. In addition, security breaches can also occur as a result of non-technical issues, including intentional or inadvertent breaches by our employees or by persons with whom we have commercial relationships. Although we maintain privacy, data breach and network security liability insurance, we cannot be certain that our coverage will be adequate or will cover liabilities actually incurred, or that insurance will continue to be available to us on economically reasonable terms, or at all. Any compromise or breach of our security measures, or those of our third-party service providers, could adversely impact our ability to conduct business, violate applicable privacy, data security and other laws, and cause significant legal and financial exposure, adverse publicity, and a loss of confidence in our security measures, which could have an adverse effect on our business and financial results.

We depend on key employees and the loss of these individuals could have an adverse effect on our business and financial results.

Our financial results could be adversely affected by increased competition for employees, difficulty in recruiting employees, higher employee turnover or increased compensation and benefit costs. Our employees are important to our success and we are dependent on our ability to retain the services of our employees in key roles. We have built our business on a set of core values, and we attempt to hire and retain employees who are committed to these values and our culture of providing exceptional service to our customers. In order to compete and to continue to grow, we must attract, retain and motivate our employees. We need qualified managers and skilled employees with technical and industry experience to operate our business successfully. If we are unable to attract and retain qualified individuals or our costs to do so increase significantly, our business and financial results could be adversely affected.

We are a global company headquartered in the United States. We are subject to extensive regulations by U.S. and non-U.S. governmental and self-regulatory entities at various levels of the governing bodies. Failure to comply with laws and regulations could adversely affect our business and financial results.

Nearly 50% of our sales are derived outside of the United States. Our operations are subject to the risks of doing business domestically and globally, including the following:

•Delays or disruptions in product deliveries and payments in connection with international manufacturing and sales.

•Regulations resulting from political and economic instability and disruptions.

•Imposition of new or changes in existing duties, tariffs and trade agreements, which could have a direct or indirect impact on our ability to manufacture products, on our customers' demand for our products, or on our suppliers' ability to deliver raw materials.

•Import, export and economic sanction laws.

•Current and changing governmental policies, regulatory, and business environments.

•Disadvantages from competing against companies from countries that are not subject to U.S. laws and regulations including the Foreign Corrupt Practices Act.

•Local labor regulations.

•Regulations relating to climate change, air emissions, wastewater discharges, handling and disposal of hazardous materials and wastes.

•Regulations relating to product content, health, safety and the protection of the environment.

•Imposition of trade or travel restrictions as a result of the COVID-19 or other pandemics.

•Specific country regulations where our products are manufactured or sold.

•Regulations relating to compliance with data protection and privacy laws throughout our global business.

•Laws and regulations that apply to companies doing business with the government, including audit requirements of government contracts related to procurement integrity, export control, employment practices, and the accuracy of records and recording of costs.

Further, these laws and regulations are constantly evolving and it is difficult to accurately predict the effect they may have upon our business and financial results.

We cannot provide assurance that our internal controls and compliance systems will always protect us from acts committed by employees, agents or business partners that would violate U.S. and/or non-U.S. laws, including the laws governing payments to government officials, bribery, fraud, anti-kickback and false claims rules, competition, export and import compliance, money laundering and data privacy. Any such improper actions could subject us to civil or criminal investigations in the U.S. and in other jurisdictions, lead to substantial civil or criminal, monetary and non-monetary penalties and related lawsuits by shareholders and others, damage our reputation, and adversely impact our business and financial results.

We are subject to litigation, including product liability claims that could adversely impact our business, financial results, and reputation.

We are a party to litigation that arises in the normal course of our business operations, including product liability and recall (strict liability and negligence) claims, patent and trademark matters, contract disputes and environmental, employment and other litigation matters. We face an inherent business risk of exposure to product liability claims in the event that the use of our products is alleged to have resulted in injury or other damage. In addition, we face an inherent risk that our competitors will allege that aspects of our products infringe their intellectual property or that our intellectual property is invalid, such that we could be prevented from manufacturing and selling our products or prevented from stopping others from manufacturing and selling competing products. To date, we have not incurred material costs related to these types of claims. However, while we currently maintain insurance coverage for certain types of claims that we believe is adequate, we cannot be certain that we will be able to maintain this insurance on acceptable terms or that this insurance will provide sufficient coverage against potential liabilities that may arise. Any claims brought against us, with or without merit, may have an adverse effect on our business, financial results and reputation as a result of potential adverse outcomes. The expenses associated with defending such claims and the diversion of our management’s resources and time may have an adverse effect on our business and financial results.

Financial and Security Ownership Risks

The global nature of our business exposes us to foreign currency fluctuations that could adversely affect our business and financial results.

Nearly 50% of our sales are derived outside the United States. Sales and purchases in currencies other than the U.S. dollar expose us to fluctuations in foreign currencies relative to the U.S. dollar, and may adversely affect our financial results. Increased strength of the U.S. dollar will increase the effective price of our products sold in currencies other than U.S. dollars into other countries. Decreased strength of the U.S. dollar could adversely affect the cost of materials, products, and services purchased overseas. Our sales and expenses are translated into U.S. dollars for reporting purposes, and the strengthening of the U.S. dollar could result in unfavorable translation effects, which occurred during fiscal years 2019 and 2020. In addition, certain of our subsidiaries may invoice customers in a currency other than its functional currency or may be invoiced by suppliers in a currency other than its functional currency, which could result in unfavorable translation effects on our business and financial results.

Failure to execute our strategies could result in impairment of goodwill or other intangible assets, which may negatively impact income and profitability.

We have goodwill of $614.1 million and other intangible assets of $92.3 million as of July 31, 2021, which represents 51.3% of our total assets, and we have recognized impairment charges in the past. We evaluate goodwill and other intangible assets for impairment on an annual basis, or more frequently if impairment indicators are present, based upon the fair value of each respective asset. The valuations prepared for the required impairment test include management's estimates of sales, profitability, cash flow generation, capital structure, cost of debt, interest rates, capital expenditures, and other assumptions. Significant negative industry or economic trends, disruptions to our business, inability to achieve sales projections or cost savings, inability to effectively integrate acquired businesses, unexpected changes in the use of the assets, and divestitures may adversely impact the assumptions used in the valuations. If the estimated fair value of our goodwill or other intangible assets change in future periods, we may be required to record an impairment charge, which would reduce net income in such period. Indicators of other-than-temporary impairment were present in our equity investment in React Mobile, Inc., an employee safety software and hardware company, and we recognized an other-than-temporary impairment charge of $5.0 million in fiscal 2021.

Changes in tax legislation or tax rates could adversely affect results of operations and financial statements. Additionally, audits by taxing authorities could result in tax payments for prior periods.

We are subject to income taxes in the U.S. and in many non-U.S. jurisdictions. As such, our income is subject to risk due to changing tax laws and tax rates around the world. Our tax filings are subject to audit by U.S. federal, state and local tax authorities and by non-U.S. tax authorities. If these audits result in payments or assessments that differ from our reserves, our future net income may be adversely impacted.

We review the probability of the realization of our deferred tax assets quarterly based on forecasts of taxable income in both the U.S. and foreign jurisdictions. As part of this review, we utilize historical results, projected future operating results, eligible carry-forward periods, tax planning opportunities, and other relevant considerations. Changes in profitability and financial outlook in both the U.S. and/or foreign jurisdictions, or changes in our geographic footprint may require modifications in the valuation allowance for deferred tax assets. At any point in time, there are a number of tax proposals at various stages of legislation throughout the globe. While it is impossible for us to predict whether some or all of these proposals will be enacted, many will likely have an impact on our business and financial results.

Substantially all of our voting stock is controlled by two shareholders, while our public investors hold non-voting stock. The interests of the voting and non-voting shareholders could differ, potentially resulting in decisions that affect the value of the non-voting shares.

Substantially all of our voting stock is controlled by Elizabeth P. Bruno, one of our Directors, and William H. Brady III, both of whom are descendants of the Company's founder. All of our publicly traded shares are non-voting. Therefore, the voting shareholders have control in most matters requiring approval or acquiescence by shareholders, including the composition of our Board of Directors and many corporate actions, and their interests may not align with those of the non-voting shareholders. Such concentration of ownership may discourage a potential acquirer from making a purchase offer that our public shareholders may find favorable and it may adversely affect the trading price for our non-voting common stock because investors may perceive disadvantages in owning stock in companies whose voting stock is controlled by a limited number of shareholders. Additionally, certain private investors, mutual funds and index sponsors have implemented rules restricting ownership, or excluding from indices, companies with non-voting publicly traded shares.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

The Company currently operates 41 manufacturing and distribution facilities across the globe and are split by reporting segment as follows:

IDS: Thirty-two manufacturing and distribution facilities are used for our IDS business. Seven facilities are located in the United States; four each in China and Belgium; three each in Mexico and the United Kingdom; two each in Brazil and India; and one each in Canada, Japan, Malaysia, Singapore, South Africa, Thailand, and Turkey.

WPS: Nine manufacturing and distribution facilities are used for our WPS business. Three facilities are located in France; two are located in Australia; and one each in Germany, Norway, the United Kingdom, and the United States.

The Company believes that its equipment and facilities are modern, well maintained, and adequate for present needs.

Item 3. Legal Proceedings

The Company is, and may in the future be, named as a defendant in various legal proceedings and claims that arise in the normal course of business in which claims are asserted against the Company. The Company records a liability for these legal actions when a loss is known or considered probable and the amount can be reasonably estimated. The Company is not currently a party to any material pending legal proceedings in which management believes the ultimate resolution would have a material effect on the Company’s consolidated financial statements.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

(a)Market Information

Brady Corporation Class A Nonvoting Common Stock trades on the New York Stock Exchange ("NYSE") under the symbol BRC. There is no trading market for the Company’s Class B Voting Common Stock.

(b)Holders

As of August 31, 2021, there were approximately 1,100 Class A Common Stock shareholders of record and approximately 10,000 beneficial shareholders. There are three Class B Common Stock shareholders.

(c)Dividends

The Company has historically paid quarterly dividends on outstanding common stock. Before any dividend may be paid on the Class B Common Stock, holders of the Class A Common Stock are entitled to receive an annual, noncumulative cash dividend of $0.01665 per share (subject to adjustment in the event of future stock splits, stock dividends or similar events involving shares of Class A Common Stock). Thereafter, any further dividend in that fiscal year must be paid on all shares of Class A Common Stock and Class B Common Stock on an equal basis. The Company believes that based on its historic dividend practice, this requirement will not impede it in following a similar dividend practice in the future.

During the two most recent fiscal years and for the first quarter of fiscal 2022, the Company declared the following dividends per share on its Class A and Class B Common Stock for the years ended July 31:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2022 | | 2021 | | 2020 |

| | | 1st Qtr | | 1st Qtr | | 2nd Qtr | | 3rd Qtr | | 4th Qtr | | 1st Qtr | | 2nd Qtr | | 3rd Qtr | | 4th Qtr |

| Class A | | $ | 0.2250 | | | $ | 0.2200 | | | $ | 0.2200 | | | $ | 0.2200 | | | $ | 0.2200 | | | $ | 0.2175 | | | $ | 0.2175 | | | $ | 0.2175 | | | $ | 0.2175 | |

| Class B | | 0.2084 | | | 0.2034 | | | 0.2200 | | | 0.2200 | | | 0.2200 | | | 0.2009 | | | 0.2175 | | | 0.2175 | | | 0.2175 | |

(d)Issuer Purchases of Equity Securities

The Company has a share repurchase program for the Company’s Class A Nonvoting Common Stock. The plan may be implemented by purchasing shares in the open market or in privately negotiated transactions, with repurchased shares available for use in connection with the Company’s stock-based plans and for other corporate purposes. As of July 31, 2021, there were 369,142 remaining shares authorized to purchase in connection with this share repurchase program. There were no repurchases of the Company's Class A Nonvoting Common Stock during the fourth quarter of fiscal 2021.

On September 1, 2021, the Company's Board of Directors authorized an increase in the Company's share repurchase program, authorizing the repurchase of up to a total of two million shares of the Company's Class A Nonvoting Common Stock, inclusive of the shares in the existing share repurchase program. The share repurchase program has no expiration date.

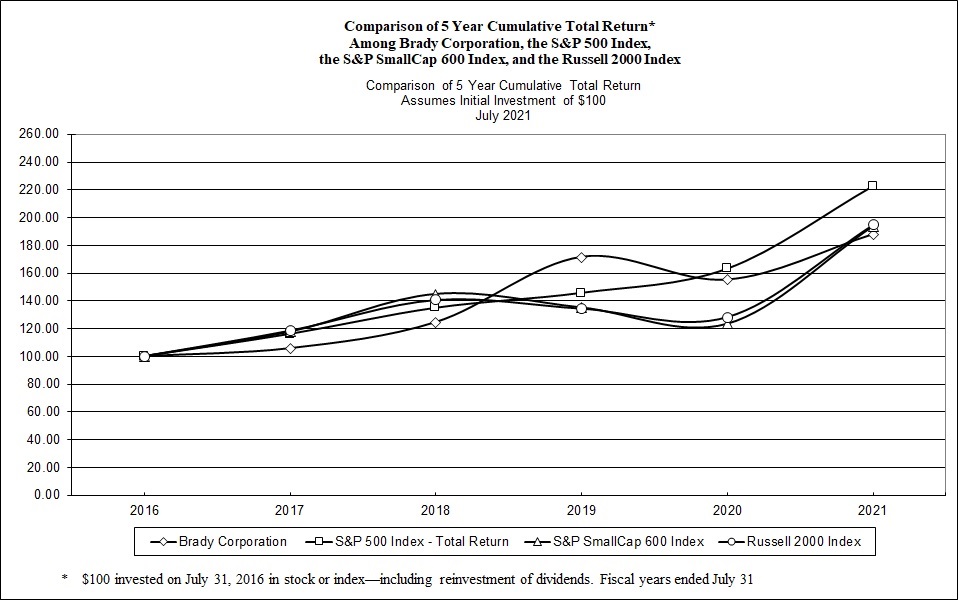

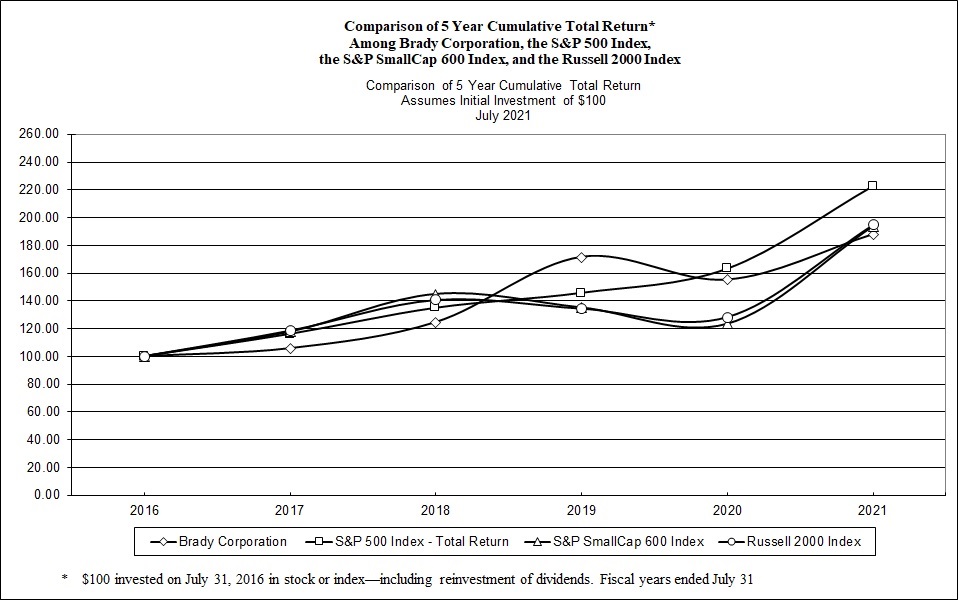

(e)Common Stock Price Performance Graph

The graph below shows a comparison of the cumulative return over the last five fiscal years had $100 been invested at the close of business on July 31, 2016, in each of Brady Corporation Class A Common Stock, the Standard & Poor’s ("S&P") 500 Index, the S&P SmallCap 600 Index, and the Russell 2000 Index.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2016 | | 2017 | | 2018 | | 2019 | | 2020 | | 2021 |

| Brady Corporation | | $ | 100.00 | | | $ | 105.77 | | | $ | 124.55 | | | $ | 171.59 | | | $ | 155.22 | | | $ | 187.87 | |

| S&P 500 Index | | 100.00 | | | 116.04 | | | 134.89 | | | 145.66 | | | 163.08 | | | 222.51 | |

| S&P SmallCap 600 Index | | 100.00 | | | 117.66 | | | 144.86 | | | 135.08 | | | 123.36 | | | 193.62 | |

| Russell 2000 Index | | 100.00 | | | 118.45 | | | 140.64 | | | 134.43 | | | 128.26 | | | 194.91 | |

Copyright (C) 2021, Standard & Poor’s, Inc. and Russell Investments. All rights reserved.

Item 6. Selected Financial Data

CONSOLIDATED STATEMENTS OF INCOME AND SELECTED FINANCIAL DATA

Years Ended July 31, 2017 through 2021

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2021 | | 2020 | | 2019 | | 2018 | | 2017 |

| | (In thousands, except per share amounts) |

| Operating data | | | | | | | | | | |