UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

or

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from ________ to________ |

Commission file number

(Exact name of registrant as specified in its charter)

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☒ NO ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). YES ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES

The aggregate market value of the registrant’s common stock held by non-affiliates was approximately $

The number of shares of the registrant’s common stock outstanding as of February 21, 2020 was

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission in connection with the registrant’s 2020 Annual Meeting of Stockholders are incorporated by reference in Part III of this report to the extent described herein.

Nucor Corporation

Annual Report on Form 10-K

For the Fiscal Year Ended December 31, 2019

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

PART I |

|

|

|

|

|

|

||

|

|

|

|

|

|||||

|

|

|

Item 1. |

|

|

|

1 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 1A. |

|

|

|

12 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 1B. |

|

|

|

17 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 2. |

|

|

|

18 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 3. |

|

|

|

19 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 4. |

|

|

|

19 |

|

|

|

|

|

|

||||||

|

|

|

|

|

19 |

|

|||

|

|

|

|

||||||

|

PART II |

|

|

|

|

|

|

||

|

|

|

|

|

|||||

|

|

|

Item 5. |

|

|

|

21 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 6. |

|

|

|

22 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

|

24 |

|

|

|

|

|

|

|||||

|

|

|

Item 7A. |

|

|

|

40 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 8. |

|

|

|

41 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 9. |

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

|

|

79 |

|

|

|

|

|

|

|||||

|

|

|

Item 9A. |

|

|

|

79 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 9B. |

|

|

|

79 |

|

|

|

|

|

|

||||||

|

PART III |

|

|

|

` |

|

|

||

|

|

|

|

|

|||||

|

|

|

Item 10. |

|

|

|

80 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 11. |

|

|

|

80 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

|

80 |

|

|

|

|

|

|

|||||

|

|

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

|

80 |

|

|

|

|

|

|

|||||

|

|

|

Item 14. |

|

|

|

80 |

|

|

|

|

|

|

||||||

|

PART IV |

|

|

|

|

|

|

||

|

|

|

|

|

|||||

|

|

|

Item 15. |

|

|

|

81 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 16. |

|

|

|

84 |

|

|

|

|

|

|

||||||

|

|

|

|

|

85 |

|

|||

i

PART I

|

Item 1. |

Business |

Overview

Nucor Corporation, a Delaware corporation incorporated in 1958, and its affiliates (“Nucor,” the “Company,” “we,” “us” or “our”) manufacture steel and steel products. The Company also produces direct reduced iron (“DRI”) for use in its steel mills. Through The David J. Joseph Company and its affiliates (“DJJ”), the Company also processes ferrous and nonferrous metals and brokers ferrous and nonferrous metals, pig iron, hot briquetted iron (“HBI”) and DRI. Most of the Company’s operating facilities and customers are located in North America. The Company’s operations include international trading and sales companies that buy and sell steel and steel products manufactured by the Company and others.

Nucor is North America’s largest recycler, using scrap steel as the primary raw material in producing steel and steel products. In 2019, we recycled approximately 17.8 million gross tons of scrap steel.

Segments, Principle Products Produced, and Markets and Marketing

Nucor reports its results in three segments: steel mills, steel products and raw materials. The steel mills segment is Nucor’s largest segment, representing 62% of the Company’s sales to external customers in the year ended December 31, 2019.

We market products from the steel mills and steel products segments mainly through in-house sales forces. We also utilize our internal distribution and trading companies to market our products abroad. The markets for these products are largely tied to capital and durable goods spending and are affected by changes in general economic conditions.

We are a leading domestic provider for most of the products we supply, and, in many cases (e.g., structural steel, merchant bar steel, steel joist and deck, pre-engineered metal buildings, steel piling and cold finish bar steel), we are the leading supplier.

Steel mills segment

In the steel mills segment, Nucor produces sheet steel (hot-rolled, cold-rolled and galvanized), plate steel, structural steel (wide-flange beams, beam blanks, H-piling and sheet piling) and bar steel (blooms, billets, concrete reinforcing bar, merchant bar and engineered special bar quality [“SBQ”]). Nucor manufactures steel principally from scrap steel and scrap steel substitutes using electric arc furnaces (“EAFs”), continuous casting and automated rolling mills. The steel mills segment also includes Nucor’s equity method investments in Duferdofin Nucor S.r.l. (“Duferdofin Nucor”), NuMit LLC (“NuMit”) and Nucor-JFE Steel Mexico, S. de R.L. de C.V. (“Nucor-JFE”), as well as international trading and distribution companies that buy and sell steel manufactured by the Company and other steel producers.

The steel mills segment sells its products primarily to steel service centers, fabricators and manufacturers located throughout the United States, Canada and Mexico. The steel mills segment sold approximately 18,585,000 tons to outside customers in 2019.

1

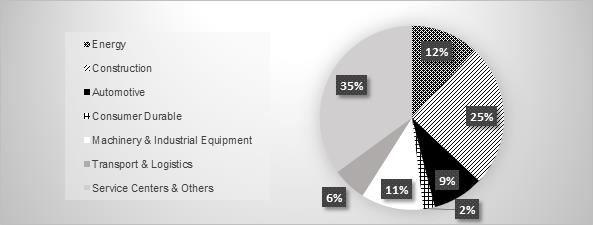

The following chart shows our outside steel shipments by end market:

In 2019, 80% of the shipments made by our steel mills segment were to external customers. The remaining 20% of the steel mills segment’s shipments went to our tubular products, piling distributor, joist, deck, rebar fabrication, fastener, metal buildings and cold finish operations.

|

|

• |

Bar mills - Nucor has 15 bar mills strategically located across the United States that manufacture a broad range of steel products, including concrete reinforcing bars, hot-rolled bars, rounds, light shapes, structural angles, channels, wire rod and highway products in carbon and alloy steels. Four of the bar mills have a significant focus on manufacturing SBQ and wire rod products. The newest mills in the group are our rebar micro mills in Sedalia, Missouri and Frostproof, Florida. The mill in Missouri will come online in early 2020, while the Florida mill is expected to come online in the fourth quarter of 2020. |

Steel produced by our bar mills has a wide usage serving end markets, including the agricultural, automotive, construction, energy, furniture, machinery, metal building, railroad, recreational equipment, shipbuilding, heavy truck and trailer market segments. Considering Nucor’s production capabilities and the mix of bar products generally produced and marketed, the capacity of the bar mills is currently estimated at approximately 8,830,000 tons per year.

Reinforcing and merchant bar steel are sold in standard sizes and grades, which allows us to maintain inventory levels of these products to meet our customers’ expected orders. Our SBQ products are hot-rolled to exacting specifications primarily servicing the automotive, energy, agricultural, heavy equipment and transportation sectors.

|

|

• |

Sheet mills - Nucor operates five strategically located sheet mills that utilize thin slab casters to produce flat-rolled steel for automotive, appliance, construction, pipe and tube and many other industrial and consumer applications. Nucor also has Castrip® sheet production facilities in Crawfordsville, Indiana and Blytheville, Arkansas. Considering Nucor’s production capabilities and the mix of flat-rolled products generally produced and marketed, the capacity of the sheet mills is estimated at approximately 12,100,000 tons per year. All of our sheet mills are equipped with galvanizing lines and four of them are equipped with cold rolling mills for the further processing of hot-rolled sheet. |

Nucor produces hot-rolled, cold-rolled and galvanized sheet steel to customers’ specifications while maintaining some inventories to fulfill anticipated orders. Contract sales within the steel mills segment are most notable in our sheet operations, as it is common for contract sales to account for the majority of sheet sales in a given year. We estimate that approximately 75% of our sheet steel sales in 2019 were to contract customers. The balance of our sheet steel sales was made in the spot market at prevailing prices at the time of sale. The proportion of tons sold to contract customers at any given time depends on a variety of factors, including our consideration of current and future market conditions, our strategy to appropriately balance spot and contract tons in a manner to meet our customers’ requirements while considering the expected profitability, our desire to sustain a diversified customer base, and our end-use

2

customers’ perceptions about future market conditions. These sheet sales contracts are generally noncancellable agreements that incorporate monthly or quarterly price adjustments reflecting changes in the current market-based indices and/or raw material cost, and typically have terms ranging from six to 12 months.

|

|

• |

Structural mills - Nucor operates two structural mills that produce wide-flange steel beams, pilings and heavy structural steel products for fabricators, construction companies, manufacturers and steel service centers. Nucor owns a 51% interest in Nucor-Yamato Steel Company (Limited Partnership) (“Nucor-Yamato”) located in Blytheville, Arkansas. Nucor-Yamato is the only North American producer of high-strength, low-alloy beams. Common applications for the high-strength, low-alloy beams include gravity columns for high-rise buildings, long span trusses for stadiums and convention centers, and for all projects where seismic design is a critical factor. Nucor also owns a steel beam mill in Berkeley County, South Carolina. Considering Nucor’s production capabilities and the mix of structural products generally produced and marketed, the capacity of the two structural mills is estimated at approximately 3,250,000 tons per year. Both mills use a special continuous casting method that produces a beam blank closer in shape to that of the finished beam than traditional methods. |

Structural steel products come in standard sizes and grades, which allows us to maintain inventory levels of these products to meet our customers’ expected orders.

|

|

• |

Plate mills - Nucor operates three plate mills that produce plate for manufacturers of barges, bridges, heavy equipment, rail cars, refinery tanks, ships, wind towers and other items. Our products are further used in the pipe and tube, pressure vessel, transportation and construction industries. Considering Nucor’s production capabilities and the mix of plate products generally produced and marketed, the capacity of the plate mills is estimated at approximately 2,925,000 tons per year. |

In January 2019, Nucor announced that it will build a state-of-the-art plate mill, to be located in Brandenburg, Kentucky. Nucor Steel Brandenburg will be located on the Ohio River and well placed to serve the U.S. midwest, which is the largest plate-consuming area in the United States. The new plate mill will enhance our ability to serve our customers and will produce cut-to-length, coiled, heat-treated and discrete plate in widths and thicknesses that are not currently offered by Nucor. With an expected investment of $1.70 billion, the mill is expected to have an annual capacity of approximately 1,200,000 tons and is expected to be completed in 2022.

Plate steel products come in standard sizes and grades, which allows us to maintain inventory levels of these products to meet our customers’ expected orders.

|

|

• |

Steel joint ventures - Nucor owns 50% interests in a North American sheet steel processing joint venture, an Italian steel mill joint venture and a galvanized sheet steel plant in Mexico. |

Nucor owns a 50% economic and voting interest in NuMit, a company that owns 100% of the equity interest in Steel Technologies LLC (“Steel Technologies”), an operator of 26 strategically located sheet processing facilities in the United States, Canada and Mexico. Steel Technologies transforms flat-rolled steel into products that meet the exact specifications for customers in a wide range of industries, including the automotive, agricultural and consumer goods markets.

Nucor owns 50% of the stock of Duferdofin Nucor, which operates a melt shop and bloom/billet caster in Brescia, Italy, with an annual capacity of approximately 1,000,000 metric tons, including the capability to produce high-quality, value-added, semi-finished SBQ products. Duferdofin Nucor announced plans to construct a new rolling mill in Brescia, Italy, which will be supplied by its existing nearby EAF. The new mill will be designed to produce beams and other rolled products. The plant will consume energy from renewable sources through a long-term Power Purchase Agreement. With the new plant, the entire Duferdofin Nucor production system will produce over 1,000,000 tons of rolled products.

Nucor owns 50% of Nucor-JFE, a joint venture with JFE Steel Corporation of Japan that operates a galvanized sheet steel plant in central Mexico that will supply the country’s automotive market with an annual capacity of approximately 400,000 tons.

3

Steel products segment

In the steel products segment, Nucor produces hollow structural section (“HSS”) steel tubing, electrical conduit, steel joists and joist girders, steel deck, fabricated concrete reinforcing steel, cold finished steel, steel fasteners, metal building systems, steel grating and expanded metal, and wire and wire mesh. The steel products segment also includes our piling distributor. These products are sold primarily for use in nonresidential construction applications.

|

|

• |

Tubular Products – The Nucor Tubular Products (“NTP”) group has eight tubular facilities that are strategically located in close proximity to Nucor’s sheet mills as they are a consumer of hot-rolled coil. The NTP group produces HSS steel tubing, mechanical steel tubing, piling, sprinkler pipe, heat-treated tubing and electrical conduit. HSS steel tubing, mechanical steel tubing and sprinkler pipe are used in structural and mechanical applications, including nonresidential construction, infrastructure, agricultural, automotive and construction equipment end-use markets. Heat-treated tubing and electrical conduit are primarily used to protect and route electrical wiring in various nonresidential structures such as hospitals, schools, office buildings, hotels, stadiums and shopping malls. Total annual NTP capacity is approximately 1,365,000 tons. |

|

|

• |

Rebar fabrication - Harris Steel (“Harris”) fabricates, installs and distributes rebar for a wide variety of construction work classified as infrastructure (e.g., highways, bridges, reservoirs, utilities and airports) and various building projects, including hospitals, schools, stadiums, commercial office building and multi-tenant residential construction. We sell and install fabricated reinforcing products primarily on a construction contract bid basis. |

Reinforcing products are essential to concrete construction. They supply tensile strength, as well as additional compressive strength, and protect the concrete from cracking. In many markets, Harris sells reinforcing products on an installed basis (i.e., Harris fabricates the reinforcing products for a specific application and performs the installation). Harris operates nearly 70 fabrication facilities across the United States and Canada, with each facility serving a local market. Total annual rebar fabrication capacity is approximately 1,650,000 tons.

|

|

• |

Vulcraft/Verco – The Vulcraft/Verco group is the nation’s largest producer and leading innovator of open-web steel joists, joist girders and steel deck, which are used primarily for nonresidential building construction. Steel joists and joist girders are produced and marketed throughout the United States by seven domestic Vulcraft facilities. The Vulcraft/Verco group’s steel decking is produced and marketed throughout the United States by nine domestic plants. Six of these plants are adjacent to Vulcraft joist facilities. The Vulcraft/Verco group also has two plants in Canada, one in Eastern Canada and one in Western Canada, that produce both joist and deck. The annual joist production capacity is approximately 745,000 tons and the annual deck production capacity is approximately 560,000 tons. |

Sales of steel joists, joist girders and steel decking are dependent on the nonresidential building construction market. The majority of steel joists, joist girders and steel decking are used extensively as part of the roof and floor structural support systems in manufacturing buildings, retail stores, shopping centers, warehouses, schools, hospitals and, to a lesser extent, in multi-story buildings and apartments. We make these products to the customers’ specifications and do not sell these finished steel products out of inventory. The majority of these contracts are firm, fixed-price contracts that are, in most cases, competitively bid against other suppliers. Longer-term supply contracts may or may not permit us to adjust our prices to reflect changes in prevailing raw material costs.

|

|

• |

Piling products - Skyline Steel LLC and its subsidiaries (“Skyline”) are primarily a steel foundation distributor serving the North American market. Skyline distributes products to service marine construction, bridge and highway construction, heavy civil construction, storm protection, underground commercial parking and environmental containment projects in the infrastructure and construction industries. Skyline also manufactures a complete line of geostructural foundation solutions, including threaded bar, micropile, strand anchors and hollow bar. It also |

4

|

|

processes and fabricates spiral weld pipe piling, rolled and welded pipe piling, cold-formed sheet piling and threaded bar. |

|

|

• |

Cold finish - Nucor Cold Finish (“NCF”) is the largest and most diversified producer of cold finished bar products for a wide range of industrial markets in North America, with assets in Canada, Mexico and throughout the United States. The total capacity of the Nucor cold finished bar and wire facilities now exceeds approximately 1,065,000 tons per year. |

Nucor’s cold finished facilities are among the most modern in the world, producing cold finished bars for the most demanding applications. NCF obtains most of its steel from the Nucor bar mills, ensuring consistent quality and supply through all market conditions. These facilities produce cold-drawn, turned, ground and polished steel bars that are used extensively for shafting and other precision machined applications. NCF produces rounds, hexagons, flats and squares in carbon, alloy and leaded steels. These bars are purchased by the appliance, automotive, construction equipment, electric motor, farm machinery and fluid power industries, as well as by service centers. NCF bars are used in tens of thousands of products. A few examples include anchor bolts, hydraulic cylinders and shafting for air conditioner compressors, ceiling fan motors, garage door openers, electric motors and lawn mowers.

In late 2018, Nucor acquired a fully integrated precision castings company, Corporacion POK, S.A. de C.V. (“POK”), with a facility in Guadalajara, Mexico. POK produces complex castings and precision machined products used by the oil and gas, mining and sugar processing industries. POK produces a wide array of precision castings using steel, bronze, iron and specialty exotic alloys. POK complements NCF’s businesses and Nucor’s cold finish facility in Monterrey.

|

|

• |

Buildings group – Nucor produces metal buildings and components throughout the United States under the following brands: Nucor Building Systems, American Buildings Company, Kirby Building Systems and CBC Steel Buildings. In total, the Nucor Buildings Group currently has nine metal buildings plants with an annual capacity of approximately 360,000 tons, as well as an insulated metal panels company in Laurens, South Carolina which are utilized in metal buildings made by the Nucor Buildings Group as well as other applications. |

The sizes of the buildings that can be produced range from less than 1,000 square feet to more than 1,000,000 square feet. Complete metal building packages can be customized and combined with other materials such as glass, wood and masonry to produce cost-effective, energy efficient, aesthetically pleasing buildings designed to the customers’ special requirements. The buildings are sold primarily through independent builder distribution networks in order to provide fast-track, customized solutions for building owners. The primary markets served are commercial, industrial and institutional buildings, including distribution centers, data centers, automobile dealerships, retail centers, schools and manufacturing facilities.

|

|

• |

Steel mesh, grating and fasteners - Nucor manufactures wire products, grating and industrial fasteners. |

Nucor produces mesh at Nucor Steel Connecticut, Inc. and Nucor Wire Products Utah. Nucor also produces mesh in Canada at the Harris operations of Laurel and Laurel-LEC. The combined annual production capacity of the steel mesh facilities is approximately 128,000 tons.

Our grating business, which operates under the brand names Nucor Grating in the United States and Fisher & Ludlow in Canada, manufactures and fabricates steel and aluminum bar grating products at facilities located in North America. Nucor Grating and Fisher & Ludlow serve the new construction and maintenance-related markets. The annual production capacity for our grating business is approximately 120,000 tons.

Nucor Fastener’s bolt-making facility in Indiana produces carbon and alloy steel hex head cap screws, hex bolts, structural bolts, nuts and washers, finished hex nuts and custom-engineered fasteners. Nucor fasteners are used in a broad range of markets, including demanding automotive, machine tool, farm implement, construction and military applications. The annual production capacity of this facility is approximately 75,000 tons.

5

Raw materials segment

In the raw materials segment, Nucor produces DRI; brokers ferrous and nonferrous metals, pig iron, HBI and DRI; supplies ferro-alloys; and processes ferrous and nonferrous scrap metal. The raw materials segment also includes our natural gas drilling operations. Nucor’s raw materials investments are focused on creating an advantage for its steelmaking operations, through a global information network and a multi-pronged and flexible approach to metallics supply.

|

|

• |

Scrap recycling and brokerage operations - DJJ operates six regional scrap recycling companies across the United States that together have shredders capable of processing approximately 5,000,000 tons of ferrous scrap annually. DJJ’s scrap recycling operations use industry-leading expertise and technology to maximize metal recovery and minimize waste. DJJ also operates 11 self-serve used auto parts stores called U Pull-&-Pay that complement its recycling operations. |

DJJ is the leading broker of ferrous scrap in North America and is a global trader of scrap metal, pig iron and other metallics. In addition to sourcing steel scrap for Nucor’s mills, DJJ is a global trader of ferro-alloys and nonferrous metals. DJJ’s logistics team owns and operates one of the largest independent fleets of railcars in the United States dedicated to the movement of scrap and steel and also offers railcar leasing and railcar fleet management services. These activities have strategic value to Nucor as the leading and most diversified North American steel producer.

Our primary external customers for ferrous scrap are EAF steel mills and foundries that use ferrous scrap as a raw material in their manufacturing process. External customers purchasing nonferrous scrap metal include aluminum can producers, secondary aluminum smelters, steel mills, and other processors and consumers of various nonferrous metals. We market scrap metal products and related services to our external customers through in-house sales forces. In 2019, approximately 10% of the ferrous and nonferrous metals and scrap substitute tons we processed were sold to external customers. We consumed the balance in our steel mills.

|

|

• |

Direct reduced iron operations - DRI is a substitute material for high-quality grades of scrap and pig iron. Nucor operates two DRI plants with a combined annual capacity of approximately 4,500,000 metric tons of material with world-class metallization rates and carbon content. Nucor’s wholly-owned subsidiary, Nu-Iron Unlimited, is in Trinidad and benefits from a low-cost supply of natural gas and favorable logistics for inbound iron ore and shipment of DRI to the United States. Nucor’s second DRI plant in Louisiana (“Nucor Steel Louisiana”) also benefits from favorable logistics and proximity to its steel mill customers. |

Nucor’s DRI production capabilities provide our steel mills flexibility to quickly adjust the metallic mix to changing market conditions and to maintain competitiveness in the sometimes-volatile scrap market. With the potential for high-quality scrap becoming scarcer, coupled with the risk of third-party supplier disruptions, Nucor’s DRI facilities provide a greater degree of certainty over its metallics supply.

In early 2018, teammates at our Nucor Steel Louisiana facility began implementation of a three-pronged strategy to increase the plant's reliability and uptime called Project 8000. The plan focuses on achieving improvements in people, process and equipment. The Louisiana DRI facility established new annual records for plant uptime, production and shipments in 2018 as improvements related to people and processes were implemented. In 2019, the critical work of replacing the convection section of our process gas heater as well as relining the reactor refractory was completed during a planned 70-day outage that began in early-September and ended in mid-November. Despite this outage, 2019 was the second-best year for uptime and output at Nucor Steel Louisiana, since its startup in 2013. We expect these projects will further improve the plant’s reliability.

|

|

• |

Natural gas drilling programs - Nucor owns leasehold interests in natural gas properties in the Piceance Basin in the Western Slope of Colorado. |

Nucor’s access to a long-term, low-cost supply of natural gas is an important component in the execution of Nucor’s raw material strategy. Natural gas produced by Nucor’s drilling operations

6

is being sold to third parties to offset our exposure to changes in the price of natural gas consumed by our DRI plant in Louisiana and our steel mills in the United States.

Customers

A significant portion of our steel mills and steel products segments’ sales are into the commercial, industrial and municipal construction markets. Our largest single customer in 2019 represented approximately 5% of sales and consistently pays within terms. Our steel mills use a significant portion of the products of the raw materials segment.

General Development of Our Business in Recent Years

Nucor has invested significant capital in recent years to expand our product portfolio to include more value-added steel mill products, improve our cost structure, enhance our operational flexibility and provide additional channels to market for our products. These investments totaled approximately $3.68 billion over the last three years, with approximately 80% going to capital expenditures and the remaining going to acquisitions. We believe that our focus on lowering costs and diversifying our operations will enable us to execute on our strategy of delivering profitable long-term growth. Further, we believe shifting our product mix to a greater proportion of value-added products and increasing end-use market diversity will make us less susceptible to imports.

New capital projects that align with our expansion of value-added product offerings and cost-reduction strategies were completed in 2019. At our sheet mill located in Ghent, Kentucky, Nucor’s approximately $200 million investment in a new hot band galvanizing and pickling line ramped up production in late 2019 and is shipping products to customers. We believe the new galvanizing line is the widest hot-rolled galvanizing line in North America with its 72-inch product, creating synergies with Nucor’s other sheet mills and allowing us to enter new automotive market segments. Our Nucor Steel Arkansas facility built an additional specialty cold mill for approximately $245 million that began start up in 2019. That cold mill facility expands our ability to produce advanced, high-strength low-alloy steel and motor lamination steel products.

We have several growth initiatives underway in our bar mill group that will enhance our position as a low-cost producer of bar. Nucor’s rebar micro mill near Kansas City in Sedalia, Missouri is capable of producing approximately 380,000 tons annually and was completed at a cost of approximately $245 million. We believe that positioning the micro mill near the Kansas City market will provide us with a freight cost advantage relative to more distant suppliers, and we will also benefit from the scrap supply in the immediate area provided by our existing DJJ operations. The new mill went into startup in early 2020. Nucor Steel Kankakee, Inc. is building a full-range merchant bar quality mill with approximately 500,000 tons of annual capacity at our existing mill in Bourbonnais, Illinois at an estimated cost of $185 million. Like the new micro mill, we believe that the Kankakee mill will also benefit from logistical advantages and low-cost scrap supply. We expect this project to begin startup in the second quarter of 2020. In March 2018, Nucor announced that it would build a second rebar micro mill capable of producing approximately 380,000 tons annually in Frostproof, Florida. Similar to the mill in Sedalia, Missouri, we believe this new micro mill will benefit from the scrap supply in the immediate area provided by our existing DJJ operations as well as strong regional demand for its products. This approximately $240 million investment is expected to be operational in the second half of 2020.

In May 2018, Nucor announced an approximately $275 million investment to construct a new 3rd generation flexible galvanizing line with an annual capacity of approximately 500,000 tons at our Nucor Steel Arkansas facility. This project complements the previously mentioned specialty cold mill recently started up at the facility and we believe it will accelerate our goal of increasing our automotive market share. The new galvanizing line is expected to be operational in mid-2021. In September 2018, Nucor announced an approximately $650 million investment to modernize and expand the production capability at its Gallatin flat-rolled sheet mill located in Ghent, Kentucky. This investment will increase the production capability from approximately 1,600,000 tons to approximately 3,000,000 tons annually and will increase the maximum coil width to approximately 73 inches. This expansion is expected to be completed in mid-2021 and complements the previously mentioned hot band galvanizing and pickling line that recently

7

started up at Gallatin. In January 2019, Nucor announced plans to build a state-of-the-art plate mill, which will be based in Brandenburg, Kentucky on the Ohio river. With an expected investment of $1.70 billion, we expect the mill to be completed in late 2022 and to be capable of producing approximately 1,200,000 tons per year of steel plate products.

Nucor’s steel products segment has also grown significantly in recent years through the acquisitions of the companies that make up our NTP group. NTP consists of the former Independence Tube Corporation (acquired in October 2016), Southland Tube, Inc. (acquired in January 2017), Republic Conduit (acquired in January 2017), and the assets of Century Tube, LLC (acquired in December 2018). The combined purchase price of these acquisitions was approximately $898 million. NTP is optimizing the teams and assets of the eight strategically located facilities to create leadership positions in the following markets: HSS steel tubing, piling, sprinkler pipe, steel electrical conduit, and mechanical tube for the automotive market. The NTP group provides Nucor with a line of value-added products to offer our customers and a significant channel to market as the businesses are consumers of Nucor’s hot-rolled and cold-rolled sheet steel.

In addition to growing through capital expansions at our existing operations and acquisitions, Nucor also uses joint ventures as a platform for growth. Nucor-JFE, our joint venture with JFE Steel Corporation of Japan, in which Nucor has 50% ownership, is expected to start up in the first quarter of 2020. Located in central Mexico, Nucor-JFE will supply galvanized sheet steel to the growing Mexican automotive market. The facility's construction has faced some unanticipated challenges, including: more difficult soil conditions requiring incremental piling and insufficient electrical system infrastructure. These events increased the total capital budget from our initial estimate of $270 million to approximately $360 million, with Nucor's share of these amounts being 50%. Nucor’s sheet mills are expected to provide approximately half of the hot-rolled steel substrate that will be consumed by the joint venture.

Capital Allocation Strategy

The significant developments in Nucor’s business in recent years have been driven by our capital allocation strategy. Our highest capital allocation priority is to invest in our business for profitable long-term growth through our multi-pronged strategy of optimizing existing operations, greenfield expansions and acquisitions.

Our second priority is to return capital to our stockholders through cash dividends and share repurchases. Nucor has paid $1.46 billion in dividends to its stockholders during the past three years. That dividend payout represents 23% of cash flows from operations during that three-year period. The Company repurchased $298.5 million of its common stock in 2019 ($854.0 million in 2018 and $90.3 million in 2017).

We intend to return at least 40% of our net income to stockholders over time via a combination of both cash dividends and share repurchases. Over the past three years we have returned approximately 55% of our net income in this manner.

Competition

We compete in a variety of steel and metal markets, including markets for finished steel products, unfinished steel products and raw materials. These markets are highly competitive with many domestic and foreign firms participating, and, as a result of this highly competitive environment, we find that we primarily compete on price and service.

In our steel mills segment, our EAF steel mills face many different forms of competition, including domestic integrated steel producers (who use iron ore converted into liquid form in a blast furnace as their basic raw material instead of scrap steel), other domestic EAF steel mills, steel imports and alternative materials. Large domestic integrated steel producers have the ability to manufacture a variety of products but face significantly higher energy costs and are often burdened with higher capital and fixed operating

8

costs. EAF based steel producers, such as Nucor, are sensitive to increases in scrap prices but tend to have lower capital and fixed operating costs compared with large integrated steel producers.

Excess global steelmaking capacity, particularly in non-market economies, continues to be a significant challenge for Nucor and the entire U.S. steel industry. Steel production in China rose from approximately 1.02 billion tons in 2018 to approximately 1.10 billion tons in 2019 – an increase of 8%. As a result, China’s share of global crude steel production rose from 51.3% in 2018 to 53.3% in 2019. The Organisation for Economic Co-operation and Development (the “OECD”) estimates that excess global steel production capacity was approximately 485 million tons through the first half of 2019, up from 455 million tons at the end of 2018. Nearly a quarter of that excess capacity is located in China, where the largest steel companies are state-owned and receive significant financial support from the Chinese government.

The Section 232 steel tariffs implemented by the current administration in 2018 are having their intended impact by preventing the dumping of steel products in the U.S. market. In addition, successful industry trade cases over the past several years have had an impact on import levels. For the full year 2019, imports of finished steel were down approximately 18% from the previous year and accounted for approximately 19% of U.S. market share. The last time steel import levels were this low was in 2010. Approximately six million fewer tons of imports entered the United States in 2019 than in 2018. The comprehensive nature of the Section 232 tariffs is also preventing the transshipment of artificially low-priced steel through third party countries.

The new United States-Mexico-Canada trade agreement was passed by the U.S. House and Senate and signed by President Trump in January 2020. The agreement has several provisions that will benefit the steel industry, including requiring that higher levels of a vehicle’s content, including steel, be produced in North America for a vehicle to qualify for zero tariffs, and that 70% of the steel used in vehicles be melted and poured in North America. There are also provisions addressing currency manipulation and state-owned enterprises.

The United States also reached a phase-one trade agreement with China in January 2020, which includes enforceable commitments from China to refrain from currency devaluation for competitive purposes. Negotiations with China continue in order to address China’s use of subsidies and state-owned enterprises which contribute to its persistent steel production overcapacity.

We also experience competition from other materials. Depending on our customers’ end use of our products, there are sometimes other materials, such as concrete, aluminum, plastics, composites and wood that compete with our steel products. When the price of steel relative to other raw materials rises, these alternatives can become more attractive to our customers.

Competition in our scrap and raw materials business is also vigorous. The scrap metals market consists of many firms and is highly fragmented. Firms typically compete on price and geographic proximity to the sources of scrap metal.

Backlog

In the steel mills segment, Nucor’s backlog of orders was approximately $1.68 billion and $2.08 billion at December 31, 2019 and 2018, respectively. Order backlog for the steel mills segment includes only orders from external customers and excludes orders from other Nucor businesses. Nucor’s backlog of orders in the steel products segment was approximately $2.24 billion and $2.26 billion at December 31, 2019 and 2018, respectively. The majority of these orders are expected to be filled within one year. Order backlog within our raw materials segment is not significant because the majority of the raw materials that segment produces are used internally.

Sources and Availability of Raw Materials

An ample supply of high-quality scrap and scrap substitutes is critical to support Nucor’s ability to produce high-quality steel. Nucor’s raw materials segment safely produces, sources, trades and

9

transports steelmaking raw materials. Nucor’s raw materials investments are focused on creating an advantage for its steelmaking operations, through a global information network and a multi-pronged and flexible approach to metallics supply.

Scrap and scrap substitutes are the most significant element in the total cost of steel production. The average cost of scrap and scrap substitutes used in our steel mills segment decreased 13% from $361 per gross ton used in 2018 to $314 per gross ton used in 2019. On average, it takes approximately 1.1 tons of scrap and scrap substitutes to produce one ton of steel. Depending on the market conditions at the time, a raw material surcharge or variable steel pricing mechanism may be implemented to assist Nucor in maintaining operating margins and in meeting our customer commitments during periods of rapidly changing scrap and scrap substitute costs.

For the past decade, Nucor has focused on securing access to low-cost raw material inputs as they are the Company’s largest expense. Nucor’s broad, balanced supply chain is an important strength which allows us to reduce the cost of our steelmaking operations, create a shorter supply chain and have greater optionality over our metallic inputs. Our investment in DRI production facilities and scrap yards, as well as our access to international raw materials markets, provides Nucor with significant flexibility in optimizing our raw material costs. Additionally, having a significant portion of our raw materials supply under our control minimizes risk associated with the global sourcing of raw materials, particularly since a good deal of scrap substitutes comes from regions of the world that have historically experienced greater political turmoil. Continued successful implementation of our raw material strategy, including key investments in DRI production, as well as in the scrap brokerage and processing services performed by our team at DJJ, gives us greater control over our metallic inputs and thus helps us mitigate the risk of significant fluctuations in the availability and costs of critical inputs.

DJJ acquires ferrous scrap from numerous sources, including manufacturers of products made from steel, industrial plants, scrap dealers, peddlers, auto wreckers and demolition firms. We purchase pig iron as needed from a variety of sources and operate DRI plants in Trinidad and Louisiana with respective annual production capacities of approximately 2,000,000 and 2,500,000 metric tons. The primary raw material for our DRI facilities is iron ore, which we purchase from various international suppliers. Another major source of raw materials used in the production of steel is pig iron. We received over 2.5 million gross tons of pig iron in 2019. As with scrap and iron ore, we source pig iron from a large number of international suppliers.

The primary raw material for our steel products segment is steel produced by Nucor’s steel mills.

Energy Consumption and Costs

Our steel mills are large consumers of electricity and natural gas, which are significant costs to Nucor. Access to long-term, low cost sources of energy in various forms is critically important to our continued success. Because of the efficiency of Nucor steel mills, we believe we are able to reduce our energy costs relative to other steel producers.

Our DRI facilities in Trinidad and Louisiana are also large consumers of natural gas. Consequently, we use a variety of strategies to manage our exposure to price risk of natural gas, including cash flow hedges, as well as our natural gas drilling operations. In addition to the currently producing wells in the Piceance Basin, Nucor owns leasehold interests in natural gas properties totaling approximately 54,000 acres in the South Piceance Basin, in the Western Slope of Colorado. To support Nucor’s operating wells and potential future well developments on these properties, Nucor has entered into long-term agreements directly with existing third-party gathering and processing service providers. Natural gas produced by Nucor’s drilling operations is being sold to third parties to offset our exposure to changes in the price of natural gas consumed by our DRI plant in Louisiana, and by our steel mills in the United States. The determination of whether or not to participate in all future drilling capital investments by one working interest owner is independent of the other working interest owner. As such, Nucor has full discretion on its participation in all future drilling capital investments.

10

Historically, manufacturers in the United States have benefited from relatively stable and competitive energy costs. The availability and prices of electricity and natural gas are influenced today by many factors, including fuel switching (coal to natural gas by public utilities), changes in supply and demand, and pipeline and export infrastructure expansion. Because energy is such a significant cost for Nucor, we strive to make our operations in all three of our business segments more energy efficient. We also closely monitor developments in public policy relating to energy production and consumption. When appropriate, we work to shape those developments in ways that we believe will allow us to continue to be a competitive producer of steel and steel products in an increasingly competitive global marketplace.

Environmental Laws and Regulations

Nucor operates an aggressive and sustainable environmental program that incorporates the concept of individual employee, as well as management, responsibility for environmental performance. All of Nucor’s steelmaking operations are ISO 14001 certified. Achieving ISO 14001 certification means that each of Nucor’s steel mills has put an environmental management system in place with measurable targets and objectives, such as reducing the use of oil and grease and minimizing electricity use and has implemented site-wide recycling programs. Many of our facilities have incorporated energy efficiency targets to reduce both cost and environmental impacts into their environmental management systems. These environmental management systems help facilitate compliance with our environmental commitment, which is every Nucor teammate’s responsibility. Nucor’s environmental program maintains a high level of ongoing training, commitment, outreach and visibility.

Our business operations are subject to numerous federal, state and local laws and regulations intended to protect the environment. The principal federal environmental laws include the Clean Air Act that regulates air emissions; the Clean Water Act (the “CWA”) that regulates water discharges and withdrawals; the Resource Conservation and Recovery Act (the “RCRA”) that addresses solid and hazardous waste treatment, storage and disposal; and the Comprehensive Environmental Response, Compensation and Liability Act (the “CERCLA”) that governs releases of hazardous substances, and remediation of sites contaminated thereby. Our operations are also subject to state laws and regulations that are patterned on these and other federal laws.

As the leading recycler in North America and often one of the largest employers in the communities where we operate, we take considerable interest and pride in our environmental track record. We believe that we are in substantial compliance with the provisions of all federal and state environmental laws and regulations applicable to our business operations.

The CWA regulates water discharges and withdrawals. Nucor maintains discharge and withdrawal permits as appropriate at its facilities under the national pollutant discharge elimination system program of the CWA and conducts its operations in compliance with those permits. Nucor also maintains permits from local governments for the discharge of water into publicly owned treatment works where available.

The RCRA establishes standards for the management of solid and hazardous wastes. The RCRA also addresses the environmental impact of contamination from waste disposal activities and from recycling and storage of most wastes. While Nucor believes it is in substantial compliance with these regulations, past waste disposal activities that were legal when conducted but now may pose a contamination threat are periodically discovered. These activities and off-site properties that the U.S. Environmental Protection Agency (the “EPA”) has determined are contaminated, for which Nucor may be potentially responsible at some level, are quickly evaluated and corrected. While Nucor has conducted and is in the final stages of completing some cleanups under the RCRA, we believe these liabilities either are identified already and being resolved or have been fully resolved.

Because Nucor long ago implemented environmental practices that have resulted in the responsible disposal of waste materials, Nucor is also not presently considered a major contributor to any major cleanups under the CERCLA for which Nucor has been named a potentially responsible party. Nucor regularly evaluates these types of potential liabilities and, if appropriate, maintains reserves sufficient to remediate the identified liabilities. Under the RCRA, private citizens may also bring an action against the

11

operator of a regulated facility for potential damages and payment of cleanup costs. Nucor believes that its system of internal evaluation and due diligence has sufficiently identified these types of potential liabilities so that compliance with these regulations will not have a material adverse effect on our results of operations, cash flows or financial condition beyond that already reflected in the reserves established for them.

The primary raw material of Nucor’s steelmaking operations is scrap metal. The process of recycling scrap metal brings with it many contaminants such as paint, zinc, chrome and other metals that produce air emissions which are captured in specialized emission control equipment. This filtrant (“EAF dust”) is classified as a listed hazardous waste under the RCRA. Because these contaminants contain valuable metals, this filtrant is recycled to recover those metals. Nucor sends all but a small fraction of the EAF dust it produces to recycling facilities that recover the zinc, lead, chrome and other valuable metals from this dust. By recycling this material, Nucor is not only acting in a sustainable, responsible manner but is also substantially limiting its potential for future liability under both the CERCLA and the RCRA.

Capital expenditures at our facilities that are associated with environmental regulation compliance for 2020 and 2021 are estimated to be less than $100 million per year.

Employees

Nucor has a simple, streamlined organizational structure to allow our employees to make quick decisions and to innovate. Our organization is highly decentralized, with most day-to-day operating decisions made by our division general managers and their staff. We have slightly more than 100 employees in our principal executive offices. The vast majority of Nucor’s approximately 26,800 employees as of December 31, 2019 are not represented by labor unions.

Nucor places the highest value on our teammates’ well-being and safety. Our foremost responsibility is to work safely, which requires our teammates to identify unsafe conditions and activities and mitigate these hazards. In 2019, we achieved our best safety performance in the key metrics we measure, including Injury/Illness Rate and Days Away, Restricted and Transfer (DART) Case Rate. We will continue to eliminate exposures that can lead to injury and encourage our teammates to share their ideas for safety improvement.

The operations in our mills are highly automated, resulting in lower employment costs. Employee turnover in Nucor mills is extremely low. Nucor employees have a significant part of their compensation based on their productivity. Production employees work under group incentives that provide increased earnings for increased production. This additional incentive compensation is paid weekly. Additionally, because we use EAFs to produce our steel, we can easily vary our production levels to match short-term changes in demand, unlike our integrated competitors. Taking advantage of this highly variable, low-cost structure has enabled Nucor to better control our costs during weaker market conditions.

Available Information

Nucor’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to these reports, as well as proxy statements and other information, are available on our website at www.nucor.com, as soon as reasonably practicable after Nucor files these documents electronically with, or furnishes them to, the U.S. Securities and Exchange Commission (the “SEC”). Except as otherwise expressly stated in these documents, the information contained on our website or available by hyperlink from our website is not incorporated into this report or any other documents we file with, or furnish to, the SEC.

|

Item 1A. |

Risk Factors |

Many of the factors that affect our business and operations involve risk and uncertainty. The factors described below are some of the risks that could materially negatively affect our business, financial condition, results of operations and cash flows.

12

Overcapacity in the global steel industry could increase the level of steel imports, which may negatively affect our business, results of operations, financial condition and cash flows.

The current global steelmaking capacity significantly exceeds the current global consumption of steel. According to the OECD, global steel production overcapacity was approximately 485 million tons at the halfway point of 2019, with a quarter of that amount located in China. Overcapacity is down from its peak in 2015 and 2016. Efforts by China to close inefficient steel production and improve air quality, steel mill closures in Europe and stronger global economic growth all contributed to reduce excess capacity.

During periods of global economic weakness, this overcapacity is amplified because of weaker global demand. This excess capacity often results in manufacturers in certain countries exporting significant amounts of steel and steel products at prices that are at or below their costs of production. In some countries the steel industry is subsidized or owned in whole or in part by the government, giving imported steel from those countries certain cost advantages. These imports, which are also affected by demand in the domestic market, international currency conversion rates, and domestic and international government actions, can result in downward pressure on steel prices, which could materially adversely affect our business, results of operations, financial condition and cash flows.

Section 232 steel tariffs are keeping dumped steel products out of the U.S. market. The U.S. government is also negotiating new or renegotiating existing trade agreements with many countries, including China, which provide another opportunity to address excess steelmaking capacity. Should these efforts fail to reduce excess capacity and the Section 232 tariffs be lifted, U.S. steelmakers would be at risk of having to compete again against steel products dumped in the U.S. market.

Our industry is cyclical and both recessions and prolonged periods of slow economic growth could have an adverse effect on our business.

Demand for most of our products is cyclical in nature and sensitive to general economic conditions. Our business supports cyclical industries such as the commercial construction, energy, metals service centers, appliance and automotive industries. As a result, downturns in the U.S. economy or any of these industries could materially adversely affect our results of operations, financial condition and cash flows. General economic conditions in the United States and steel demand in this country are currently stronger than in many parts of the world, but challenges from global overcapacity in the steel industry and ongoing uncertainties, both in the United States and in other regions of the world, remain.

While we believe that the long-term prospects for the steel industry remain bright, we are unable to predict the duration of current economic conditions. Future economic downturns or prolonged slow-growth or a stagnant economy could materially adversely affect our business, results of operations, financial condition and cash flows.

Competition from other steel producers, imports or alternative materials may adversely affect our business.

We face strong competition from other steel producers and imports that compete with our products on price, quality and service. The steel markets are highly competitive and a number of firms, domestic and foreign, participate in the steel, steel products and raw materials markets. Depending on a variety of factors, including the cost and availability of raw materials, energy, technology, labor and capital costs, currency exchange rates and government subsidies of foreign steel producers, our business may be materially adversely affected by competitive forces.

In many applications, steel competes with other materials, such as concrete, aluminum, plastics, composites and wood. Increased use of these materials in substitution for steel products could have a material adverse effect on prices and demand for our steel products.

Since 2011, automobile producers have begun taking steps towards complying with new Corporate Average Fuel Economy (“CAFE”) mileage requirements for new cars and light trucks that they produce.

13

As automobile producers work to produce vehicles in compliance with these new standards, they may seek to reduce the amount of steel they incorporate in their vehicles or begin utilizing alternative materials in cars and light trucks to improve fuel economy, thereby reducing their demand for steel. Certain automakers have begun to use greater amounts of aluminum and smaller proportions of steel in some models since 2015.

The results of our operations are sensitive to volatility in steel prices and the cost of raw materials, particularly scrap steel.

We rely to an extent on outside vendors to supply us with key consumables such as graphite electrodes and raw materials, including both scrap and scrap substitutes that are critical to the manufacture of our steel products. The raw material required to produce DRI is pelletized iron ore. Although we have vertically integrated our business by constructing our DRI facilities in Trinidad and Louisiana and also acquiring DJJ in 2008, we still must purchase most of our primary raw material, steel scrap, from numerous other sources located throughout the United States. Although we believe that the supply of scrap and scrap substitutes is adequate to operate our facilities, prices of these critical raw materials are volatile and are influenced by changes in scrap exports in response to changes in the scrap, scrap substitutes and iron ore demands of our global competitors, as well as currency fluctuations. At any given time, we may be unable to obtain an adequate supply of these critical raw materials with price and other terms acceptable to us. The availability and prices of raw materials may also be negatively affected by new laws and regulations, allocation by suppliers, interruptions in production, accidents or natural disasters, changes in exchange rates, worldwide price fluctuations, and the availability and cost of transportation. Many countries that export steel into our markets restrict the export of scrap, protecting the supply chain of some foreign competitors. This trade practice creates an artificial competitive advantage for foreign producers that could limit our ability to compete in the U.S. market.

If our suppliers increase the prices of our critical raw materials, we may not have alternative sources of supply. In addition, to the extent that we have quoted prices to our customers and accepted customer orders for our products prior to purchasing necessary raw materials, we may be unable to raise the price of our products to cover all or part of the increased cost of the raw materials. Also, if we are unable to obtain adequate and timely deliveries of our required raw materials, we may be unable to timely manufacture sufficient quantities of our products. This could cause us to lose sales, incur additional costs and suffer harm to our reputation.

Changes in the availability and cost of electricity and natural gas are subject to volatile market conditions that could adversely affect our business.

Our steel mills are large consumers of electricity and natural gas. In addition, our DRI facilities are also large consumers of natural gas. We rely upon third parties for our supply of energy resources consumed in the manufacture of our products. The prices for and availability of electricity and natural gas are subject to volatile market conditions. These market conditions often are affected by weather, political, regulatory and economic factors beyond our control, and we may be unable to raise the price of our products to cover increased energy costs. Disruptions, including physical or information systems related issues that impact the supply of our energy resources could temporarily impair our ability to manufacture our products for our customers. Increases in our energy costs resulting from regulations that are not equally applicable across the entire global steel market could materially adversely affect our business, results of operations, financial condition and cash flows.

Our steelmaking processes, our DRI processes, and the manufacturing processes of many of our suppliers, customers and competitors are energy intensive and generate carbon dioxide and other greenhouse gases (“GHGs”). The regulation of these GHGs through significant new rulemaking or legislation could have a material adverse impact on our results of operations, financial condition and cash flows.

Carbon is an essential raw material in Nucor’s production processes. As a carbon steel producer, Nucor could be increasingly affected both directly and indirectly if more stringent domestic GHG

14

regulations are further implemented. Because our operations are subject to most of these new GHG regulations, we are already impacted in the permit modification and reporting processes. Both GHG regulations and National Air Ambient Quality Standards, which are more restrictive than previous standards, can make it significantly more difficult to obtain new permits and to modify existing permits.

These same regulations have indirectly increased the costs to manufacture our products as they have increased and continue to increase the cost of energy, primarily electricity, which we use extensively in the steelmaking process. The discovery of new natural gas reserves utilizing the practice of horizontal drilling and hydraulic fracturing is mitigating some of this indirect impact, as some utilities switch fuels to natural gas from coal thereby reducing their emissions significantly. However, because some generating facilities when faced with new regulations are idling facilities instead of converting to natural gas, the resulting reduction in capacity can lead to increased electrical energy prices.

In 2019, the EPA issued its Affordable Clean Energy (ACE) rule to replace the promulgated Clean Power Plan that was driving many utilities to shutter coal fired power plants. While this is expected to result in lower electric power costs in the United States, another change in regulatory approach due to political or other considerations could cause, either directly or indirectly an increase in the cost of energy, adversely impacting Nucor’s competitive position.

While the federal government has moved in recent years to relax some regulations that can impact domestic energy costs, some states are moving to enact their own regulations to curtail carbon and other GHG emissions. If such regulations are enacted in states in which Nucor does business, it could increase our costs there. Numerous states, including California, Washington, Oregon and New York, are considering or have passed laws using Environmental Product Declarations (“EPDs”) to evaluate environmental impacts of products. California has implemented the “Buy Clean California Act” and California is currently requesting EPDs from manufacturers to be used in State of California funded projects. EPDs are now required for certain materials including some steel products. Global Warming Potentials (“GWP”) will be established by January 1, 2021 for applicable product categories and EPDs will be used to determine product compliance to the GWP limits. The impacts identified by EPDs could impact future state/consumer purchasing decisions. In addition to increased costs of production, we could also incur costs to defend and resolve legal claims and other litigation related to these regulations and the alleged impact of our operations on the environment.

We are subject to information technology and cyber security threats which could have an adverse effect on our business and results of operations.

We utilize various information technology systems to efficiently address business functions ranging from the operation of our production equipment to administrative computation to the storage of data such as intellectual property and proprietary business information. Despite efforts to assure secure and uninterrupted operations, threats from increasingly sophisticated cyber-attacks or system failures could result in materially adverse operational disruptions or security breaches of our systems or those of our third-party service providers. These risks could result in disclosure or destruction of key proprietary information, personal data, reputational damage or could adversely affect our ability to physically produce steel, resulting in lost revenues, as well as delays in reporting our financial results. We also could be required to spend significant financial and other resources to remedy the damage caused by a security breach, including to repair or replace networks and information technology systems. We may also contend with potential liability for stolen information, increased cybersecurity protection costs, litigation expense and increased insurance premiums.

Our operations are subject to business interruptions and casualty losses.

The steelmaking business is subject to numerous inherent risks, particularly unplanned events such as explosions, fires, other accidents, natural disasters such as floods or earthquakes, critical equipment failures, acts of terrorism, inclement weather and transportation interruptions. While our insurance coverage could offset a portion of the losses relating to some of those types of events, our results of operations and cash flows could be adversely impacted to the extent that any such losses are not covered by our insurance, or that there are significant delays in resolving our claims with our insurance providers.

15

Environmental compliance and remediation could result in substantially increased costs and materially adversely impact our competitive position.

Our operations are subject to numerous federal, state and local laws and regulations relating to protection of the environment, and accordingly, we make provision in our financial statements for the estimated costs of compliance. There are inherent uncertainties in these estimates.

Nucor has implemented revised EPA rules and definitions around recycling and solid wastes. The new rules require states to create new programs and certification processes for the companies that wish to continue recycling materials. We have incurred increased administrative and operational costs to handle steel mill recycled materials such as slag, mill scale, iron dusts, lime and air filtration control dusts. To the extent that competitors, particularly foreign steel producers and manufacturers of competitive products, are not subject to similar regulation and required to incur equivalent costs, our competitive position could be materially adversely impacted.

If one of our permits is revoked or if we were to experience significant delays in obtaining a permit modification or a new permit, this could result in operational delays at one or more of our facilities, causing a negative impact on our results of operations and cash flows.

We acquire businesses from time to time and we may encounter difficulties in integrating businesses we acquire.

We plan to continue to seek attractive opportunities to acquire businesses, enter into joint ventures and make other investments that strengthen Nucor. Realizing the anticipated benefits of acquisitions or other transactions will depend on our ability to operate these businesses and integrate them with our operations and to cooperate with our strategic partners. Our business, results of operations, financial condition and cash flows could be materially adversely affected if we are unable to successfully integrate these businesses.

Our business requires substantial capital investment and maintenance expenditures, and our capital resources may not be adequate to provide for all of our cash requirements.

Our operations are capital intensive. For the five-year period ended December 31, 2019, our total capital expenditures, excluding acquisitions, were approximately $4.0 billion. Our business also requires substantial expenditures for routine maintenance. Although we expect requirements for our business needs, including the funding of capital expenditures, debt service for financings and any contingencies, will be financed by internally generated funds, short-term commercial paper issuance or from borrowings under our $1.5 billion unsecured revolving credit facility, we cannot guarantee that this will be the case. Additional acquisitions or unforeseen events could require financing from additional sources.

Risks associated with operating in international markets could adversely affect our business, financial position and results of operations.

Certain of our businesses and investments are located outside of the United States, in Europe, Mexico and in emerging markets. There are a number of risks inherent in doing business in such markets. These risks include but are not limited to: unfavorable political or economic factors; local labor and social issues; changes in regulatory requirements; fluctuations in foreign currency exchange rates; and complex foreign laws, treaties including tax laws, and the United States Foreign Corrupt Practices Act of 1977 (FCPA). These risks could restrict our ability to operate our international businesses profitably and therefore have a negative impact on our financial position and results of operations. In addition, our reported results of operations and financial position could also be negatively affected by exchange rates when the activities and balances of our foreign operations are translated into U.S. dollars for financial reporting purposes.

16

The accounting treatment of equity method investments, goodwill and other long-lived assets could result in future asset impairments, which would reduce our earnings.

We periodically test our equity method investments, goodwill and other long-lived assets to determine whether their estimated fair value is less than their value recorded on our balance sheet. The results of this testing for potential impairment may be adversely affected by uncertain market conditions for the global steel industry, as well as changes in interest rates, commodity prices and general economic conditions. If we determine that the fair value of any of these assets is less than the value recorded on our balance sheet, and, in the case of equity method investments the decline is other than temporary, we would likely incur a non-cash impairment loss that would negatively impact our results of operations.

Tax increases and changes in tax laws and regulations could adversely affect our financial results.

The steel industry and our business are sensitive to changes in taxes. As a company based in the United States, Nucor is more exposed to the effects of changes in U.S. tax laws than some of our major competitors. Our provision for income taxes and cash tax liability in the future could be adversely affected by changes in U.S. tax laws.

We are subject to legal proceedings and legal compliance risks.