Exhibit 13

A Letter from the President and CEO

To the shareholders of United Bancorp, Inc….

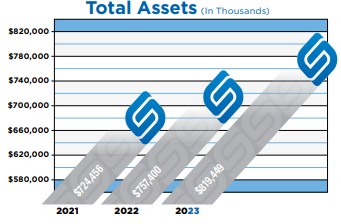

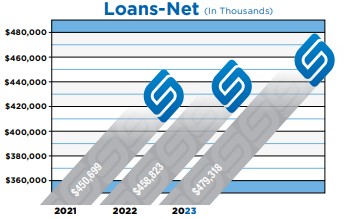

As we reflect on another year, it is with a profound sense of gratitude and optimism that I share with you the achievements and progress of United Bancorp, Inc. (UBCP) throughout 2023. Amidst a dynamic economic landscape, characterized by continued adjustments in monetary policy and evolving market conditions, our Company not only navigated these challenges with resilience; but, it also evolved and capitalized on emerging opportunities to maintain its relevance and deliver commendable financial performance and strategic growth.

As I have communicated to you in previous reports, what truly strange times these last three years have been for everyone! Beginning in 2020, we experienced a world-wide pandemic for which we had been “theoretically” preparing for many years at the guidance of our regulatory authorities. Quite frankly, many within our industry thought that doing the “table top” testing in our business continuity planning for such an event was an act of frivolity. This global pandemic, no doubt, changed the world forever and was projected to have a cataclysmic impact on the financial services industry. But, overall, our industry and Company prevailed and performed at relatively high levels throughout its duration… all things considered.

In 2021, our country started to somewhat recover from the pandemic and our economy started to slowly open, once again--- albeit, not in a linear fashion throughout the entirety of our country. During this timeframe, we started to see inflation rear its ugly head at levels we had not seen since the early 1980’s… after thinking for many years that this “inflation beast” was a thing of the past! In reality, our monetary policy was too accommodating for far too long--- being at Zero Interest Rate Policy (ZIRP) or, at least extremely relaxed relative to historic levels for the better part of the previous fourteen plus years. This relaxed and overly accommodating monetary policy started in 2008 with the general concern about our country’s low economic growth that arose out of the Great Recession (and, the real risk of deflation that prevailed at that time) and, ended in 2022 after the shutdown of our economy in response to the pandemic and the supply chain disruption resulting therefrom. During the latter part of this period… and, for the first time in almost forty years… we experienced heightening levels of inflation. But, we were told by the “experts” at The Federal Reserve and other national economists that the phenomena of heightened inflation that we had not seen for many years was simply “transitory” (or, would be short-lived) and that it would moderate as our economy recovered from the pandemic-induced slow-down and more fully normalized. How wrong they were!

As the year 2021 progressed and we entered 2022, we started to experience levels of inflation that started to create stress for everyone--- culminating in a Consumer Price Index (CPI) reaching nearly double digits. In 2022 and in response to the heightened inflation that we were experiencing, the Federal Open Market Committee of the Federal Reserve (FOMC) finally realized that inflation was more than “transitory” and started to increase the target for the Federal Funds Rate (FFR) in March of that year. Over the course of the next sixteen months, the FOMC increased the target for the FFR eleven (11) times by raising the range for the target rate from a range of zero to twenty-five basis points (0% to 0.25%) to a level of five and a quarter percent to five and a half percent (5.25% to 5.50%) by July of 2023. The rapidity of and degree to which the target for the FFR rose during this relatively short-timeframe is historically unprecedented and started to create both a drag on the earnings that our industry produced due to declining net interest incomes and compressing margins, along with putting stress on the tangible capital levels of many banks due to the unrealized losses in their securities portfolios.

As we entered the year 2023, inflation was coming down--- albeit, rather slowly--- from the higher levels that peaked in June of 2022. At the beginning of this past year, it was projected that inflation would normalize as the tightened monetary policy and elevated interest rates would finally push our economy into a recession. With an inverted yield curve for the entirety of the year (and, for the better part of the previous year for that matter), the markets certainly thought that a recession would occur and that interest rates would also decline sometime during the year. One by-product of the dramatic increase in overall interest rate levels from 2022 and continuing into 2023 was the reality that some banks were not managed prudently and had overinvested in longer-term assets over the course of 2020 and 2021 when monetary policy was Zero Interest Rate Policy (ZIRP) and overnight interest rates were at zero or close thereto. During this timeframe, the free-flow of lower-cost deposits (which were highly liquid since they were typically uninsured and not term funds) into these banks enticed them to invest longer-term to generate a profitable spread.