Table of Contents

Exhibit 13

18

Consolidated Highlights of Financial Condition and Results of Operations

19

Management’s Discussion and Analysis of Financial Condition and Results of Operations

64

Management’s Report on Internal Control Over Financial Reporting

65

66

Consolidated Financial Statements

70

Notes to Consolidated Financial Statements

127

Report of Independent Registered Public Accounting Firm

128

Consolidated Financial Statistics

131

132

133

Table of Contents

CONSOLIDATED HIGHLIGHTS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

SUMMARY OF SELECTED CONSOLIDATED FINANCIAL DATA

| ($ In Millions Except Per Share Information) | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

| FOR THE YEAR ENDED DECEMBER 31 |

||||||||||||||||||||

| Noninterest Income |

||||||||||||||||||||

| Trust, Investment and Other Servicing Fees |

$ | 2,169.5 | $ | 2,081.9 | $ | 2,083.8 | $ | 2,134.9 | $ | 2,077.6 | ||||||||||

| Foreign Exchange Trading Income |

324.5 | 382.2 | 445.7 | 616.2 | 351.3 | |||||||||||||||

| Treasury Management Fees |

72.1 | 78.1 | 81.8 | 72.8 | 65.3 | |||||||||||||||

| Security Commissions and Trading Income |

60.5 | 60.9 | 62.4 | 77.0 | 67.6 | |||||||||||||||

| Gain on Visa Share Redemption |

– | – | – | 167.9 | – | |||||||||||||||

| Other Operating Income |

158.1 | 146.3 | 136.8 | 186.9 | 95.3 | |||||||||||||||

| Investment Security Gains (Losses), net |

(23.9 | ) | (20.4 | ) | (23.4 | ) | (56.3 | ) | 6.5 | |||||||||||

| Total Noninterest Income |

2,760.8 | 2,729.0 | 2,787.1 | 3,199.4 | 2,663.6 | |||||||||||||||

| Net Interest Income |

1,009.1 | 918.7 | 999.8 | 1,079.1 | 845.4 | |||||||||||||||

| Provision for Credit Losses |

55.0 | 160.0 | 215.0 | 115.0 | 18.0 | |||||||||||||||

| Income before Noninterest Expense |

3,714.9 | 3,487.7 | 3,571.9 | 4,163.5 | 3,491.0 | |||||||||||||||

| Noninterest Expense |

||||||||||||||||||||

| Compensation |

1,267.2 | 1,108.0 | 1,099.7 | 1,133.1 | 1,038.2 | |||||||||||||||

| Employee Benefits |

258.2 | 237.6 | 242.1 | 223.4 | 234.9 | |||||||||||||||

| Outside Services |

552.8 | 460.4 | 424.5 | 413.8 | 386.2 | |||||||||||||||

| Equipment and Software |

328.1 | 287.1 | 261.1 | 241.2 | 219.3 | |||||||||||||||

| Occupancy |

180.9 | 167.8 | 170.8 | 166.1 | 156.5 | |||||||||||||||

| Visa Indemnification (Benefits) Charges |

(23.1 | ) | (33.0 | ) | (17.8 | ) | (76.1 | ) | 150.0 | |||||||||||

| Other Operating Expense |

267.1 | 270.0 | 136.3 | 786.3 | 245.1 | |||||||||||||||

| Total Noninterest Expense |

2,831.2 | 2,497.9 | 2,316.7 | 2,887.8 | 2,430.2 | |||||||||||||||

| Income before Income Taxes |

883.7 | 989.8 | 1,255.2 | 1,275.7 | 1,060.8 | |||||||||||||||

| Provision for Income Taxes |

280.1 | 320.3 | 391.0 | 480.9 | 333.9 | |||||||||||||||

| Net Income |

$ | 603.6 | $ | 669.5 | $ | 864.2 | $ | 794.8 | $ | 726.9 | ||||||||||

| Net Income Applicable to Common Stock |

$ | 603.6 | $ | 669.5 | $ | 753.1 | $ | 782.8 | $ | 726.9 | ||||||||||

| Average Total Assets |

$ | 91,948 | $ | 76,008 | $ | 74,314 | $ | 73,029 | $ | 60,588 | ||||||||||

| PER COMMON SHARE |

||||||||||||||||||||

| Net Income – Basic |

$ | 2.47 | $ | 2.74 | $ | 3.18 | $ | 3.51 | $ | 3.28 | ||||||||||

| – Diluted |

2.47 | 2.74 | 3.16 | 3.47 | 3.23 | |||||||||||||||

| Cash Dividends Declared |

1.12 | 1.12 | 1.12 | 1.12 | 1.03 | |||||||||||||||

| Book Value – End of Period (EOP) |

29.53 | 28.19 | 26.12 | 21.89 | 20.44 | |||||||||||||||

| Market Price – EOP |

39.66 | 55.41 | 52.40 | 52.14 | 76.58 | |||||||||||||||

| AT YEAR END |

||||||||||||||||||||

| Senior Notes |

$ | 2,127 | $ | 1,896 | $ | 1,552 | $ | 1,053 | $ | 654 | ||||||||||

| Long-Term Debt |

2,133 | 2,729 | 2,838 | 3,293 | 2,682 | |||||||||||||||

| Floating Rate Capital Debt |

277 | 277 | 277 | 277 | 277 | |||||||||||||||

| RATIOS |

||||||||||||||||||||

| Return on Average Common Equity |

8.59 | % | 10.09 | % | 12.73 | % | 15.98 | % | 17.46 | % | ||||||||||

| Return on Average Assets |

.66 | .88 | 1.16 | 1.09 | 1.20 | |||||||||||||||

| Dividend Payout Ratio |

45.4 | 40.8 | 35.2 | 32.0 | 31.4 | |||||||||||||||

| Tier 1 Capital to Risk-Weighted Assets – EOP |

12.5 | 13.6 | 13.4 | 13.1 | 9.7 | |||||||||||||||

| Total Capital to Risk-Weighted Assets – EOP |

14.2 | 15.6 | 15.8 | 15.4 | 11.9 | |||||||||||||||

| Tier 1 Leverage Ratio |

7.3 | 8.8 | 8.8 | 8.5 | 6.8 | |||||||||||||||

| Average Stockholders’ Equity to Average Assets |

7.6 | 8.7 | 8.9 | 7.0 | 6.9 | |||||||||||||||

OPERATING RESULTS – A NON-GAAP FINANCIAL MEASURE WHICH EXCLUDES VISA RELATED ADJUSTMENTS

| ($ In Millions Except Per Share Information) | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

| Operating Earnings |

$ | 589.2 | $ | 648.6 | $ | 853.0 | $ | 641.3 | $ | 821.1 | ||||||||||

| Operating Earnings per Common Share – Basic |

$ | 2.41 | $ | 2.66 | $ | 3.13 | $ | 2.82 | $ | 3.71 | ||||||||||

|

– Diluted |

2.41 | 2.65 | 3.11 | 2.79 | 3.65 | |||||||||||||||

| Operating Return on Average Common Equity |

8.50 | % | 9.89 | % | 12.68 | % | 12.89 | % | 19.72 | % | ||||||||||

Operating results for the years presented above exclude adjustments relating to Visa Inc. (Visa). Excluded for 2011, 2010, 2009 and 2008 are Visa indemnification related benefits totaling $23.1 million, $33.0 million, $17.8 million and $244.0 million, respectively. The 2008 benefits included a gain on the mandatory partial redemption of Northern Trust’s Visa shares totaling $167.9 million and a $76.1 million offset of Visa indemnification related charges recorded in 2007. Excluded for 2007 are Visa indemnification related charges totaling $150.0 million. Visa related adjustments are discussed in further detail in Note 25 to the consolidated financial statements.

| 2011 ANNUAL REPORT TO SHAREHOLDERS | 18 | NORTHERN TRUST CORPORATION | ||||||||||

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

OVERVIEW OF CORPORATION

Focused Business Strategy

Northern Trust Corporation (the Corporation) and its subsidiaries is a leading provider of asset servicing, fund administration, asset management, fiduciary and banking solutions for corporations, institutions, families, and individuals worldwide. Northern Trust focuses on servicing and managing client assets in two target market segments: individuals, families, and privately held businesses through its Personal Financial Services (PFS) business unit; and corporate and public retirement funds, foundations, endowments, fund managers, insurance companies, sovereign wealth and government funds through its Corporate & Institutional Services (C&IS) business unit. An important element of this strategy is to provide an array of asset management and related services to PFS and C&IS clients, which are provided primarily by a third business unit, Northern Trust Global Investments (NTGI). In executing this strategy, Northern Trust emphasizes quality through a high level of service complemented by the effective use of technology, delivered by a fourth business unit, Operations & Technology (O&T).

Business Structure

A financial holding company, Northern Trust conducts business through various U.S. and non-U.S. subsidiaries, including The Northern Trust Company (Bank). The Corporation has a network of offices in 18 U.S. states; Washington, D.C.; and 16 international locations in North America, Europe, the Middle East and the Asia Pacific region.

Except where the context otherwise requires, the term “Northern Trust” refers to Northern Trust Corporation and its subsidiaries on a consolidated basis.

FINANCIAL OVERVIEW

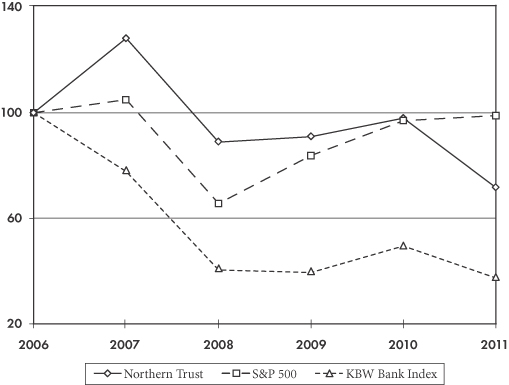

Net income in 2011 totaled $603.6 million and earnings per common share totaled $2.47. This compares with net income of $669.5 million and earnings per common share of $2.74 in 2010. 2011 results reflect restructuring, acquisition and integration related charges of $91.6 million ($59.8 million after tax, or $.25 per common share). Restructuring charges include severance expense, consulting expense, charges related to software write-offs, and reductions in office space. These charges are outlined below:

| Ÿ | Severance related charges of $54.5 million recorded in connection with acquisition related integration activities and initiatives to reduce staff levels ($50.2 million recorded within Compensation and $4.3 million within Employee Benefits); |

| Ÿ | Consulting expense and technical services of $16.8 million recorded within Outside Services; |

| Ÿ | Charges totaling $10.9 million related to software write-offs recorded within Equipment and Software; |

| Ÿ | Charges totaling $6.4 million related to reductions in office space recorded within Occupancy; and |

| Ÿ | Other miscellaneous restructuring, acquisition and integration related charges totaling $3.0 million recorded within Other Operating Expense. |

Net income in both 2011 and 2010 benefited from reductions of a liability related to potential losses from indemnified litigation involving Visa, as further described in Note 25 to the consolidated financial statements. Visa indemnification benefits totaled $23.1 million and $33.0 million in 2011 and 2010, respectively.

Revenues equaled $3.81 billion on a fully taxable equivalent (FTE) basis in 2011, an increase of 3% from 2010. Trust, investment and other servicing fees, which represents the largest component of consolidated revenues, increased by 4% to $2.17 billion, from $2.08 billion in 2010. The benefits of strong new business, higher market valuations, and acquisitions were partially offset by a decrease in securities lending revenue due to lower recoveries of previously recorded unrealized asset valuation losses in a mark-to-market investment fund, and by money market mutual fund fee waivers, which increased to $102.1 million from $62.5 million in 2010, due to the prolonged low interest rate environment. Net interest income of $1.05 billion (FTE) grew by $91.5 million, or 10%, primarily due to higher average earning assets, funded primarily by increased demand deposits and non-U.S. office interest-bearing deposits. Northern Trust’s benefit from higher deposits was limited as yields on high quality investments declined due to the persistent low interest rate environment, resulting in a decline in the net interest margin from 1.41% in 2010 to 1.27% in 2011. Foreign exchange trading income totaled $324.5 million, a decrease of $57.7 million, or 15%, from 2010 as a result of reduced volatility and client volumes.

Total noninterest expense on an operating basis, which excludes Visa indemnification benefits, equaled $2.85 billion, up 13% from 2010, primarily reflecting the $91.6 million of charges associated with the restructuring, acquisition and integration initiatives and $78.9 million of total operating costs from the 2011 acquisitions. Excluding the impact of costs attributable to the 2011 acquisitions and the restructuring,

| 2011 ANNUAL REPORT TO SHAREHOLDERS | 19 | NORTHERN TRUST CORPORATION | ||||||||||

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

acquisition and integration charges, operating noninterest expense increased 6% from 2010. A reconciliation of operating earnings, a non-GAAP financial measure which excludes Visa related adjustments, to reported earnings prepared in accordance with U.S. generally accepted accounting principles (GAAP) is provided on page 61.

Credit loss provisions of $55.0 million declined $105 million, or 66%, from $160.0 million in 2010. The decreased provision reflects improvement in the credit quality of commercial and institutional loans, while weakness persisted in residential real estate loans. Nonperforming assets decreased $63.6 million, or 17%, and net charge-offs decreased $59.8 million, or 42%, from 2010. The allowance for credit losses assigned to loans and leases at December 31, 2011 of $294.8 million was lower by $24.8 million, or 8%, than at December 31, 2010, and represented 1.01% and 1.14% of total loans and leases in 2011 and 2010, respectively. Loans and leases equaled $29.1 billion at year end, an increase of 3% from $28.1 billion at the end of 2010.

Client assets under custody and management both grew during 2011. Client assets under custody grew 4% from $4.1 trillion in 2010 to $4.3 trillion, and included $2.4 trillion of global custody assets, also up 4% from 2010. Client assets under management increased 3% to $662.9 billion from $643.6 billion in 2010. These increases reflect new business won from both existing and new clients. Increased assets under custody also reflect strategic growth through select acquisitions. In June of 2011, Northern Trust acquired the fund administration, investment operations outsourcing and custody business of the Bank of Ireland, now known as Northern Trust Securities Services (Ireland) Limited, and in July of 2011, Northern Trust acquired Omnium LLC, a leading hedge fund administrator, now known as Northern Trust Hedge Fund Services LLC. Northern Trust Securities Services (Ireland) Limited provides specialized, client-driven services to a broad range of funds, including money-market, multi-manager, exchange-traded funds, and property funds, serving both the on-shore and off-shore markets. Northern Trust Hedge Fund Services LLC provides world-class, scalable technology and dedicated expertise to serve hedge funds and large institutional investors with complex portfolios, through the provision of comprehensive administrative and middle-office services including trade processing, valuation, real-time reporting, cash management, accounting, collateral management, and investor servicing. These targeted acquisitions provide Northern Trust with new capabilities that position us to better serve our clients and enter new markets to fuel future growth.

Northern Trust continues to maintain its strong capital position, exceeding “well capitalized” levels under federal bank regulatory capital requirements, with tier 1 capital and tier 1 common ratios of 12.5% and 12.1% respectively. At year end, total stockholders’ equity equaled $7.1 billion, up 4%, from $6.8 billion a year earlier. The return on common equity achieved in 2011 was 8.59%. Northern Trust declared dividends of $273.4 million in 2011, representing a dividend payout ratio of 45%, and repurchased approximately 1.6 million shares in 2011 at a cost of $79.4 million. Dividends and share repurchases combined, Northern Trust’s total 2011 payout ratio was 58%.

CONSOLIDATED RESULTS OF OPERATIONS

REVENUE

Northern Trust generates the majority of its revenue from noninterest income that primarily consists of trust, investment and other servicing fees. Net interest income comprises the remainder of revenues and consists of interest income generated by earning assets, net of interest expense on deposits and borrowed funds.

Revenue for 2011 was $3.77 billion and included $76.6 million attributable to 2011 acquisitions. Revenue increased 3% from $3.65 billion in 2010, which was down 4% from 2009 revenue of $3.79 billion. Noninterest income represented 73% of total revenue in 2011 and totaled $2.76 billion, up 1% from $2.73 billion in 2010. Noninterest income represented 75% of total revenue in 2010 and was lower by 2% from $2.79 billion in 2009. Net interest income on an FTE basis for 2011 was $1.05 billion, up 10% from $957.8 million in 2010, which was down 8% from $1.04 billion in 2009. Net interest income stated on an FTE basis is a non-GAAP financial measure that facilitates the analysis of asset yields. When adjusted to an FTE basis, yields on taxable, nontaxable, and partially taxable assets are comparable; however, the adjustment to an FTE basis has no impact on net income. A reconciliation of net interest income on a GAAP basis to net interest income on an FTE basis is provided on page 61.

The current year increase in revenue primarily reflects increased trust, investment and other servicing fees and net interest income, partially offset by a decline in foreign exchange trading revenue. Trust, investment and other servicing fees – the largest component of noninterest income – totaled $2.17 billion in 2011 compared with $2.08 billion in 2010. Strong new business, revenue from 2011 acquisitions, and improved markets were partially offset by lower securities lending revenue and by higher waived fees in money market

| 2011 ANNUAL REPORT TO SHAREHOLDERS | 20 | NORTHERN TRUST CORPORATION | ||||||||||

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

mutual funds attributable to the prolonged low interest rate environment. Securities lending revenue in 2011 totaled $87.9 million compared with $195.2 million in 2010. The current year decrease reflects recoveries in 2010 of approximately $114 million of previously recorded unrealized asset valuation losses in a mark-to-market investment fund used in our securities lending activities. As of September 30, 2010, securities in the mark-to-market fund had been sold with the proceeds reinvested into a short duration fund, eliminating the mark-to-market impact on securities lending revenue in periods subsequent to the date of sale. Excluding the impact of the asset valuation recoveries, securities lending fees increased approximately $6.7 million, primarily reflecting widened spreads on the investment of collateral, partially offset by decreased average volumes.

The increase in net interest income is attributable to higher levels of average earning assets, partially offset by a decline in the net interest margin. Average earning assets increased $14.9 billion, or 22%, in 2011, while the net interest margin declined to 1.27% from 1.41% in 2010. During 2011, increased demand and other non-interest bearing deposits and non-U.S. office interest-bearing deposits were primarily invested in U.S. government sponsored agency securities, interest-bearing deposits with banks, U.S. government securities and other securities.

Foreign exchange trading income in 2011 totaled $324.5 million, down 15% compared with $382.2 million in 2010, reflecting reduced volatility and client volumes from 2010 levels. Additional information regarding Northern Trust’s revenue by type is provided below.

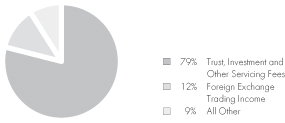

2011 TOTAL REVENUE OF $3.77 BILLION

2011 NONINTEREST INCOME

Noninterest Income

The components of noninterest income, and a discussion of significant changes during 2011 and 2010, are provided below.

| NONINTEREST INCOME | CHANGE | |||||||||||||||||||

| (In Millions) | 2011 | 2010 | 2009 | 2011 / 2010 | 2010 / 2009 | |||||||||||||||

| Trust, Investment and Other Servicing Fees |

$ | 2,169.5 | $ | 2,081.9 | $ | 2,083.8 | 4 | % | N/M | |||||||||||

| Foreign Exchange Trading Income |

324.5 | 382.2 | 445.7 | (15 | ) | (14 | )% | |||||||||||||

| Treasury Management Fees |

72.1 | 78.1 | 81.8 | (8 | ) | (5 | ) | |||||||||||||

| Security Commissions and Trading Income |

60.5 | 60.9 | 62.4 | (1 | ) | (2 | ) | |||||||||||||

| Other Operating Income |

158.1 | 146.3 | 136.8 | 8 | 7 | |||||||||||||||

| Investment Security Gains (Losses), net |

(23.9 | ) | (20.4 | ) | (23.4 | ) | 17 | (13 | ) | |||||||||||

| Total Noninterest Income |

$ | 2,760.8 | $ | 2,729.0 | $ | 2,787.1 | 1 | % | (2 | )% | ||||||||||

| 2011 ANNUAL REPORT TO SHAREHOLDERS | 21 | NORTHERN TRUST CORPORATION | ||||||||||

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Trust, Investment and Other Servicing Fees

Trust, investment and other servicing fees accounted for 58% of total revenue in 2011. These fees were $2.17 billion in 2011 compared with $2.08 billion in 2010. For a more detailed discussion of 2011 trust, investment and other servicing fees, refer to the “Business Unit Reporting” section.

Trust, investment and other servicing fees are based generally on the market value of assets held in custody, managed and serviced; the volume of transactions; securities lending volume and spreads; and fees for other services rendered. Certain market value calculations on which fees are based are performed on a monthly or quarterly basis in arrears. Certain investment management fee arrangements also may provide for performance fees, based on client portfolio returns that exceed predetermined levels. Based on an analysis of historical trends and current asset and product mix, management estimates that a 10% rise or fall in overall equity markets would cause a corresponding increase or decrease in Northern Trust’s trust, investment and other servicing fees of approximately 3% and in total revenues of approximately 2%.

The following table presents selected average month-end, average quarter-end, and year-end equity market indices and the percentage changes year over year.

| MARKET INDICES | AVERAGE OF MONTH-END | AVERAGE OF QUARTER-END | YEAR-END | |||||||||||||||||||||||||||||||||

| 2011 | 2010 | CHANGE | 2011 | 2010 | CHANGE | 2011 | 2010 | CHANGE | ||||||||||||||||||||||||||||

| S&P 500 ® |

1,281 | 1,131 | 13 | % | 1,259 | 1,150 | 9 | % | 1,258 | 1,258 | – | % | ||||||||||||||||||||||||

| MSCI EAFE ® (in U.S. dollars) |

1,609 | 1,511 | 7 | 1,549 | 1,538 | 1 | 1,413 | 1,658 | (15 | ) | ||||||||||||||||||||||||||

Custody related deposits maintained with bank subsidiaries and foreign branches are primarily interest-bearing and averaged $37.8 billion in 2011, $30.0 billion in 2010, and $30.4 billion in 2009. Assets under custody and assets under management form the primary basis of our trust, investment and other servicing fees. At December 31, 2011, assets under custody were $4.3 trillion, up 4% from $4.1 trillion a year ago. Assets under custody included $2.4 trillion of global custody assets. Managed assets totaled $662.9 billion, up 3% from $643.6 billion at the end of 2010.

| ASSETS UNDER CUSTODY | DECEMBER 31 | CHANGE | FIVE-YEAR RATE |

|||||||||||||||||||||||||||||

| ($ In Billions) | 2011 | 2010 | 2009 | 2008 | 2007 | 2011 / 2010 | 2010 / 2009 | |||||||||||||||||||||||||

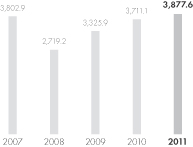

| Corporate & Institutional |

$ | 3,877.6 | $ | 3,711.1 | $ | 3,325.9 | $ | 2,719.2 | $ | 3,802.9 | 4 | % | 12 | % | 4 | % | ||||||||||||||||

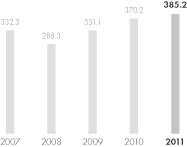

| Personal |

385.2 | 370.2 | 331.1 | 288.3 | 332.3 | 4 | 12 | 6 | ||||||||||||||||||||||||

| Total Assets Under Custody |

$ | 4,262.8 | $ | 4,081.3 | $ | 3,657.0 | $ | 3,007.5 | $ | 4,135.2 | 4 | % | 12 | % | 4 | % | ||||||||||||||||

| C&IS ASSETS UNDER CUSTODY ($ in Billions)

|

PFS ASSETS UNDER CUSTODY ($ in Billions)

| |

|

|

| 2011 ANNUAL REPORT TO SHAREHOLDERS | 22 | NORTHERN TRUST CORPORATION | ||||||||||

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

| ASSETS UNDER MANAGEMENT | DECEMBER 31 | CHANGE | FIVE-YEAR RATE |

|||||||||||||||||||||||||||||

| ($ In Billions) | 2011 | 2010 | 2009 | 2008 | 2007 | 2011 / 2010 | 2010 / 2009 | |||||||||||||||||||||||||

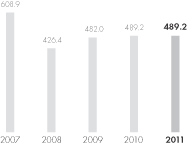

| Corporate & Institutional |

$ | 489.2 | $ | 489.2 | $ | 482.0 | $ | 426.4 | $ | 608.9 | – | % | 1 | % | (3 | )% | ||||||||||||||||

| Personal |

173.7 | 154.4 | 145.2 | 132.4 | 148.3 | 13 | 6 | 5 | ||||||||||||||||||||||||

| Total Managed Assets |

$ | 662.9 | $ | 643.6 | $ | 627.2 | $ | 558.8 | $ | 757.2 | 3 | % | 3 | % | (1 | )% | ||||||||||||||||

| C&IS ASSETS UNDER MANAGEMENT ($ in Billions)

|

PFS ASSETS UNDER MANAGEMENT ($ in Billions)

| |

|

|

Custodied and managed assets were invested as follows:

| ASSETS UNDER CUSTODY |

DECEMBER 31 | |||||||||||||||||||||||

| 2011 | 2010 | |||||||||||||||||||||||

| ($ In Billions) | C&IS | PFS | CONSOLIDATED | C&IS | PFS | CONSOLIDATED | ||||||||||||||||||

| Equities |

43 | % | 43 | % | 43 | % | 48 | % | 46 | % | 48 | % | ||||||||||||

| Fixed Income Securities |

37 | 28 | 37 | 35 | 26 | 34 | ||||||||||||||||||

| Cash and Other Assets |

20 | 29 | 20 | 17 | 28 | 18 | ||||||||||||||||||

| ASSETS UNDER MANAGEMENT |

DECEMBER 31 | |||||||||||||||||||||||

| 2011 | 2010 | |||||||||||||||||||||||

| ($ In Billions) | C&IS | PFS | CONSOLIDATED | C&IS | PFS | CONSOLIDATED | ||||||||||||||||||

| Equities |

47 | % | 34 | % | 44 | % | 48 | % | 36 | % | 45 | % | ||||||||||||

| Fixed Income Securities |

14 | 32 | 19 | 15 | 33 | 19 | ||||||||||||||||||

| Cash and Other Assets |

39 | 34 | 37 | 37 | 31 | 36 | ||||||||||||||||||

Foreign Exchange Trading Income

Northern Trust provides foreign exchange services in the normal course of business as an integral part of its global custody services. Active management of currency positions, within conservative limits, also contributes to trading income. Foreign exchange trading income decreased 15%, or $57.7 million, and totaled $324.5 million in 2011 compared with $382.2 million last year. The decrease from the prior year primarily reflects reduced volatility and client volumes.

Treasury Management Fees

The fee portion of treasury management revenues decreased to $72.1 million from $78.1 million in 2010. Treasury management revenues in 2011 were impacted by lower transaction volumes.

Security Commissions and Trading Income

Security commissions and trading income is generated primarily from securities brokerage services provided by Northern Trust Securities, Inc. The current year decline to $60.5 million from $60.9 million in 2010 principally reflects lower revenues from interest rate protection products, while core brokerage revenues remained stable.

| 2011 ANNUAL REPORT TO SHAREHOLDERS | 23 | NORTHERN TRUST CORPORATION | ||||||||||

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Other Operating Income

The components of other operating income include:

| CHANGE | ||||||||||||||||||||

| (In Millions) | 2011 | 2010 | 2009 | 2011 / 2010 | 2010 / 2009 | |||||||||||||||

| Loan Service Fees |

$ | 68.9 | $ | 60.3 | $ | 52.1 | 14 | % | 16 | % | ||||||||||

| Banking Service Fees |

54.9 | 57.3 | 53.1 | (4 | ) | 8 | ||||||||||||||

| Other Income |

34.3 | 28.7 | 31.6 | 19 | (9 | ) | ||||||||||||||

| Total Other Operating Income |

$ | 158.1 | $ | 146.3 | $ | 136.8 | 8 | % | 7 | % | ||||||||||

The increase in loan service fees is primarily attributable to growth in loan-related commitment fees. The decrease in banking service fees primarily reflects lower letter of credit revenue. The other income increase is attributable to increases in various miscellaneous income categories.

Investment Security Gains (Losses), Net

Net investment security losses were $23.9 million in 2011 compared to $20.4 million in 2010. The current and prior year included $23.3 million and $21.2 million, respectively, of pre-tax charges for the credit-related other-than-temporary impairment of residential mortgage backed securities held within Northern Trust’s balance sheet investment securities portfolio.

NONINTEREST INCOME – 2010 COMPARED WITH 2009

Trust, investment and other servicing fees for 2010 accounted for 76% of total noninterest income and 57% of total revenue. These fees were $2.08 billion in both 2010 and 2009. Higher market valuations and new business in 2010 were offset by a decrease in securities lending revenues. Foreign exchange trading income decreased 14% in 2010 to $382.2 million from $445.7 million in 2009. The decrease reflected reduced currency volatility, partially offset by increased client volumes.

Revenues from security commissions and trading income totaled $60.9 million in 2010, compared with $62.4 million in 2009. The decrease primarily reflected decreased revenue from core brokerage services.

Treasury management fees were $78.1 million in 2010, down 5% from the $81.8 million reported in 2009. The 2009 fees reflect the pass through of a higher level of Federal Deposit Insurance Corporation (FDIC) premium charges. Treasury management revenues in 2010 were impacted by lower transaction volumes.

Other operating income totaled $146.3 million in 2010, an increase of 7% from $136.8 million in 2009. The increase primarily reflected increased revenues from loan service fees and banking service fees and reduced losses from credit default swaps, partially offset by increased currency translation losses and decreases in other income.

Net investment security losses of $20.4 million in 2010 and $23.4 million in 2009 included $21.2 million and $26.7 million, respectively, of pre-tax charges for the credit-related other-than-temporary impairment of residential mortgage backed securities.

| 2011 ANNUAL REPORT TO SHAREHOLDERS | 24 | NORTHERN TRUST CORPORATION | ||||||||||

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Net Interest Income

An analysis of net interest income on an FTE basis, major balance sheet components impacting net interest income, and related ratios are provided below.

| ANALYSIS OF NET INTEREST INCOME (FTE) | CHANGE | |||||||||||||||||||

| ($ In Millions) | 2011 | 2010 | 2009 | 2011 / 2010 | 2010 / 2009 | |||||||||||||||

| Interest Income – GAAP |

$ | 1,408.6 | $ | 1,296.7 | $ | 1,406.0 | 9 | % | (8 | )% | ||||||||||

| FTE Adjustment |

40.2 | 39.1 | 40.2 | 3 | (3 | ) | ||||||||||||||

| Interest Income – FTE |

1,448.8 | 1,335.8 | 1,446.2 | 9 | (8 | ) | ||||||||||||||

| Interest Expense |

399.5 | 378.0 | 406.2 | 6 | (7 | ) | ||||||||||||||

| Net Interest Income – FTE Adjusted |

1,049.3 | 957.8 | 1,040.0 | 10 | % | (8 | )% | |||||||||||||

| Net Interest Income – GAAP |

$ | 1,009.1 | $ | 918.7 | $ | 999.8 | 10 | % | (8 | )% | ||||||||||

| AVERAGE BALANCE |

||||||||||||||||||||

| Earning Assets |

$ | 82,748.8 | $ | 67,865.4 | $ | 66,670.8 | 22 | % | 2 | % | ||||||||||

| Interest-Related Funds |

67,049.8 | 57,179.4 | 53,671.6 | 17 | 8 | |||||||||||||||

| Net Noninterest-Related Funds |

15,699.0 | 10,686.0 | 12,999.2 | 47 | (24 | ) | ||||||||||||||

| CHANGE IN PERCENTAGE | ||||||||||||||||||||

| AVERAGE RATE |

||||||||||||||||||||

| Earning Assets |

1.75 | % | 1.97 | % | 2.17 | % | (.22 | ) | (.20 | ) | ||||||||||

| Interest-Related Funds |

.60 | .66 | .76 | (.06 | ) | (.10 | ) | |||||||||||||

| Interest Rate Spread |

1.15 | 1.31 | 1.41 | (.16 | ) | (.10 | ) | |||||||||||||

| Total Source of Funds |

.48 | .56 | .61 | (.08 | ) | (.05 | ) | |||||||||||||

| Net Interest Margin |

1.27 | % | 1.41 | % | 1.56 | % | (.14 | ) | (.15 | ) | ||||||||||

Refer to pages 128 and 129 for additional analysis of net interest income.

Net interest income is defined as the total of interest income and amortized fees on earning assets, less interest expense on deposits and borrowed funds, adjusted for the impact of interest-related hedging activity. Earning assets – federal funds sold; securities purchased under agreements to resell; interest-bearing deposits with banks; Federal Reserve deposits; other interest-bearing deposits; securities; and loans and leases – are financed by a large base of interest-bearing funds that include deposits; short-term borrowings; senior notes and long-term debt. Earning assets also are funded by net noninterest-related funds, which include demand deposits; the allowance for credit losses; and stockholders’ equity, reduced by nonearning assets such as cash and due from banks; items in process of collection; and buildings and equipment. The dominant factors that affect net interest income are variations in the level and mix of earning assets; interest-bearing funds; net noninterest-related funds; and their relative sensitivity to interest rate movements. In addition, the levels of nonperforming assets and client compensating deposit balances used to pay for services impact net interest income.

Net interest income in 2011 was $1.01 billion, up 10% from $918.7 million in 2010. Net interest income on an FTE basis for 2011 was $1.05 billion, an increase of 10% from $957.8 million in 2010. The increase primarily reflects higher levels of average earning assets, partially offset by a decline in the net interest margin. Average earning assets increased $14.9 billion, or 22%, to $82.7 billion from $67.9 billion in 2010, while the net interest margin was 1.27%, down from 1.41% in 2010. Growth in earning assets primarily reflects a $6.5 billion increase in securities, a $5.0 billion increase in Federal Reserve and other interest-bearing deposits, and a $2.5 billion increase in interest-bearing deposits with banks.

Loans and leases averaged $28.3 billion, 3% higher than the $27.5 billion in 2010. The increase is primarily due to a higher average balance of short duration advances related to the processing of custodied client investments.

Securities averaged $26.4 billion, up $6.5 billion, or 33% from 2010, with the growth primarily in U.S. government sponsored agency, other securities, and U.S. government securities.

The increase in average earning assets of $14.9 billion was funded by higher levels of both non-interest and interest-related funds. The growth in interest-related funds was primarily attributable to higher average client balances in non-U.S. office interest-bearing deposits and increased savings and money market deposits, partially offset by lower average short-term borrowings. Average noninterest-related funding sources in 2011 increased $5.7 billion from 2010, primarily due to an increase in average demand and other noninterest-

| 2011 ANNUAL REPORT TO SHAREHOLDERS | 25 | NORTHERN TRUST CORPORATION | ||||||||||

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

bearing deposits. In August 2011, Northern Trust issued $500 million of 3.375% fixed-rate senior notes of the Corporation due on August 23, 2021. The senior notes are non-callable and unsecured, and were issued at a .437% discount.

Stockholders’ equity averaged $7.0 billion in 2011 compared with $6.6 billion in 2010. The increase of $389.8 million, or 6%, principally reflects the retention of earnings, partially offset by the payment of dividends and the repurchase of common stock pursuant to Northern Trust’s share buyback program. During 2011, Northern Trust repurchased 1,599,572 shares at a cost of $79.4 million ($43.63 average price per share). An additional 5.6 million shares are authorized for repurchase after December 31, 2011 under the current share buyback program.

For additional analysis of average balances and interest rate changes affecting net interest income, refer to the Average Statement of Condition with Analysis of Net Interest Income on pages 128 and 129.

NET INTEREST INCOME – 2010 COMPARED WITH 2009

Net interest income decreased in 2010 as compared to 2009 primarily as a result of a significant reduction in the net interest margin, partially offset by an increase in average earning assets. The net interest margin decreased to 1.41% from 1.56% in 2009, reflecting the prolonged low interest rate environment which resulted in reduced yields on the securities portfolio as maturing investments were replaced by lower yielding assets. In addition, due to continuing weakness in loan demand, balance sheet growth in 2010 was concentrated in lower yielding assets, while a larger percentage of funding was generated from interest-bearing sources.

Earning assets averaged $67.9 billion in 2010, up 2% from $66.7 billion in 2009. The growth reflected a $2.5 billion increase in average securities balances, partially offset by a $1.2 billion decrease in average loans and leases and a $.1 billion decrease in money market assets. The increase in average earning assets of $1.2 billion was funded primarily by higher levels of interest-related funds. The growth in interest-related funds was attributable to higher average client balances in non-U.S. office interest-bearing deposits, partially offset by lower average short-term borrowings. Average noninterest-related funding sources in 2010 declined $2.3 billion from 2009, primarily due to a decrease in average demand and other noninterest-bearing deposits. In November 2010, $500 million of 3.450% fixed-rate senior notes of the Corporation were issued that are due on November 4, 2020.

Stockholders’ equity averaged $6.6 billion in 2010 and 2009. In April 2009, 17,250,000 common shares were issued in connection with a public offering for which $834.1 million of cash proceeds were received.

Provision for Credit Losses

The provision for credit losses was $55.0 million in 2011 compared with $160.0 million in 2010 and a $215.0 million provision in 2009. The current year provision reflects improvement from the prior year in commercial and institutional and commercial real estate loans, but continued weakness in residential real estate loans. For a fuller discussion of the allowance and provision for credit losses for 2011, 2010, and 2009, refer to pages 56 and 57.

| 2011 ANNUAL REPORT TO SHAREHOLDERS | 26 | NORTHERN TRUST CORPORATION | ||||||||||

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Noninterest Expense

Noninterest expense for 2011 totaled $2.83 billion, up $333.3 million, or 13%, from $2.50 billion in 2010. Noninterest expense in 2011 reflects the $91.6 million of charges ($59.8 million after tax) associated with restructuring, acquisition and integration related activities and $78.9 million of operating costs attributable to the 2011 acquisitions. Noninterest expense also includes Visa indemnification related benefits of $23.1 million in 2011 and $33.0 million in 2010. Excluding the 2011 restructuring, acquisition and integration related charges, operating costs attributable to the 2011 acquisitions, and the 2010 and 2011 Visa indemnification benefits, noninterest expense increased $152.9 million, or 6%. The components of noninterest expense and a discussion of significant changes during 2011 and 2010 are provided below.

| NONINTEREST EXPENSE | CHANGE | |||||||||||||||||||

| (In Millions) | 2011 | 2010 | 2009 | 2011 / 2010 | 2010 / 2009 | |||||||||||||||

| Compensation |

$ | 1,267.2 | $ | 1,108.0 | $ | 1,099.7 | 14 | % | 1 | % | ||||||||||

| Employee Benefits |

258.2 | 237.6 | 242.1 | 9 | (2 | ) | ||||||||||||||

| Outside Services |

552.8 | 460.4 | 424.5 | 20 | 8 | |||||||||||||||

| Equipment and Software |

328.1 | 287.1 | 261.1 | 14 | 10 | |||||||||||||||

| Occupancy |

180.9 | 167.8 | 170.8 | 8 | (2 | ) | ||||||||||||||

| Visa Indemnification Benefits |

(23.1 | ) | (33.0 | ) | (17.8 | ) | (30 | ) | 85 | |||||||||||

| Other Operating Expense |

267.1 | 270.0 | 136.3 | (1 | ) | 98 | ||||||||||||||

| Total Noninterest Expense |

$ | 2,831.2 | $ | 2,497.9 | $ | 2,316.7 | 13 | % | 8 | % | ||||||||||

2011 RESTRUCTURING, ACQUISITION AND INTEGRATION CHARGES AND OPERATING COSTS ATTRIBUTABLE TO 2011 ACQUISITIONS

| (In Millions) | RESTRUCTURING, ACQUISITION AND INTEGRATION CHARGES |

OPERATING COSTS OF 2011 ACQUISITIONS |

||||||

| Compensation |

$ | 50.2 | $ | 27.7 | ||||

| Employee Benefits |

4.3 | 7.8 | ||||||

| Outside Services |

16.8 | 22.1 | ||||||

| Equipment and Software |

10.9 | 5.2 | ||||||

| Occupancy |

6.4 | 3.5 | ||||||

| Other Operating Expense |

3.0 | 12.6 | ||||||

| Total |

$ | 91.6 | $ | 78.9 | ||||

Compensation

Compensation costs, the largest component of noninterest expense, increased $159.2 million from 2010 and included $50.2 million of severance charges related to the planned elimination of approximately 700 positions in connection with the current year’s restructuring, acquisition and integration activities and $27.7 million of operating costs attributable to the 2011 acquisitions. Excluding these charges and operating costs, the $81.3 million, or 7%, increase from the prior year primarily reflects higher full-time equivalent staff levels and annual salary increases exclusive of the acquisitions. Staff on a full-time equivalent basis totaled approximately 14,100 at December 31, 2011 compared with approximately 12,800 at December 31, 2010, and averaged 13,500 in 2011, up 7% compared with 12,600 in 2010.

Employee Benefits

The increase in employee benefit costs for 2011 reflects $7.8 million of operating costs associated with the 2011 acquisitions and the $4.3 million of severance related accruals. The remaining increase in employee benefit costs for 2011 is primarily due to higher full-time equivalent staff levels, federal and unemployment insurance, and pension expense, partially offset by the reversal in 2011 of an employee benefit related accrual of $9.7 million for which the 2010 goal was not met.

Outside Services

Outside services expense increased $92.4 million from 2010. The increase reflects the restructuring, acquisition and integration charges of $16.8 million related to consulting and technical services expense, and $22.1 million of operating costs attributable to the 2011 acquisitions. Excluding the current year’s restructuring, acquisition and integration charges and the operating costs of the 2011 acquisitions, outside services expense increased $53.5 million, or 12%, from the prior year, primarily reflecting higher expense associated with technical services due primarily to increased market data volumes and usage, as well as higher investment manager sub-advisor fees reflecting increased market values of assets under management. Technical services includes expense for systems and application support; the provision of market and research data; and outsourced check processing and lockbox

| 2011 ANNUAL REPORT TO SHAREHOLDERS | 27 | NORTHERN TRUST CORPORATION | ||||||||||

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

services, among other services. Investment manager sub-advisor fees are those paid to external investment managers for services provided to certain funds Northern Trust manages and those relating to custom client programs.

Equipment and Software

Equipment and software expense, comprised of depreciation and amortization; rental; and maintenance costs, increased $41.0 million in 2011 compared to 2010. The increase reflects $10.9 million of restructuring charges related to software write-offs and $5.2 million of operating costs attributable to the current year acquisitions. Excluding the restructuring charges and operating costs from the current year acquisitions, equipment and software expense increased $24.9 million, or 9%, primarily reflecting higher software costs attributable to increased investment in capital assets.

Occupancy

Occupancy expense totaled $180.9 million in 2011 compared to $167.8 million in 2010, reflecting $6.4 million of restructuring charges related to reductions in office space as well as $3.5 million of operating costs attributable to the 2011 acquisitions.

Visa Indemnification Benefits

In 2011, 2010, and 2009, reductions to Northern Trust’s Visa indemnification liability and related charges totaled $23.1 million, $33.0 million, and $17.8 million, respectively. Northern Trust, in conjunction with other member banks of Visa U.S.A., Inc., is obligated to share in losses resulting from certain indemnified litigation involving Visa. The reductions reflect Northern Trust’s proportionate share of funds that Visa deposited into its litigation escrow account in those years. Visa indemnification charges are further discussed in Note 25 to the consolidated financial statements.

Other Operating Expense

Other operating expense in 2011 includes $12.6 million of operating costs associated with the 2011 acquisitions and $3.0 million of restructuring, acquisition and integration related charges. The components of other operating expense were as follows:

| CHANGE | ||||||||||||||||||||

| (In Millions) | 2011 | 2010 | 2009 | 2011 / 2010 | 2010 / 2009 | |||||||||||||||

| Business Promotion |

$ | 82.1 | $ | 81.0 | $ | 66.6 | 1 | % | 22 | % | ||||||||||

| FDIC Insurance Premiums |

29.3 | 33.9 | 54.1 | (14 | ) | (37 | ) | |||||||||||||

| Staff Related |

37.6 | 37.4 | 31.3 | 1 | 19 | |||||||||||||||

| Other Intangibles Amortization |

17.5 | 14.4 | 16.2 | 22 | (11 | ) | ||||||||||||||

| Capital Support Agreements |

– | – | (109.3 | ) | N/M | N/M | ||||||||||||||

| Other Expenses |

100.6 | 103.3 | 77.4 | (3 | ) | 33 | ||||||||||||||

| Total Other Operating Expense |

$ | 267.1 | $ | 270.0 | $ | 136.3 | (1 | )% | 98 | % | ||||||||||

The decrease in FDIC insurance premiums reflects the discontinuation in 2010 of the FDIC Transaction Account Guarantee Program. The increase in other intangibles amortization expense primarily reflects the amortization of additional intangible assets purchased in connection with the 2011 acquisitions. The other expenses component of other operating expense reflects lower charges related to account servicing activities and decreases in other miscellaneous expense categories, partially offset by miscellaneous expense attributable to the 2011 acquisitions.

NONINTEREST EXPENSE — 2010 COMPARED WITH 2009

Noninterest expense for 2010 totaled $2.50 billion, up 8% from $2.32 billion in 2009. Noninterest expense for 2009 included a net expense reduction of $109.3 million associated with the final support payments and expiration of capital support agreement (CSA) obligations.

Compensation costs increased $8.3 million, or 1%, from 2009 and reflected the reversal in 2009 of accruals totaling $22.2 million related to performance stock units granted in 2008 and 2007 which were no longer expected to vest, partially offset by a decrease in salary expense in 2010. Staff on a full-time equivalent basis averaged 12,600 in 2010, up 2% compared with 12,300 in 2009. The 2010 increase primarily reflected additional staff to support international growth.

Employee benefit costs for 2010 were $237.6 million, down $4.5 million, or 2%, from $242.1 million in 2009, reflecting lower federal and employee insurance benefits.

| 2011 ANNUAL REPORT TO SHAREHOLDERS | 28 | NORTHERN TRUST CORPORATION | ||||||||||

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Outside services expense totaled $460.4 million in 2010, up 8% from $424.5 million in 2009 due to higher expense associated with investment manager sub-advisor fees, and technical services.

Equipment and software expense increased 10% to $287.1 million in 2010 from $261.1 million in 2009. The increase reflected higher levels of computer software depreciation and amortization from additional investments in capital assets and an increase in equipment expense from higher computer maintenance and equipment rental.

Net occupancy expense for 2010 was $167.8 million, down 2% from $170.8 million in 2009 due to decreased building depreciation, rent expense, and real estate taxes, partially offset by expense associated with building operations.

Reductions to Northern Trust’s Visa indemnification liability and related charges totaled $33.0 million and $17.8 million in 2010 and 2009, respectively.

Other operating expense totaled $270.0 million in 2010, up from $136.3 million in 2009, which included a net expense reduction of $109.3 million associated with the final support payments and expiration of the CSA obligations. Other operating expense also increased in 2010 due to increases in business promotion, staff related expense, and higher charges related to account servicing activities and increases in other miscellaneous expense categories. The increases were partially offset by a decrease in FDIC insurance premiums reflecting the 2009 special assessment of $20.2 million.

Provision for Income Taxes

Provisions for income tax and effective tax rates are impacted by levels of pre-tax income, state tax rates, and the impact of certain non-U.S. subsidiaries whose earnings are indefinitely reinvested, as well as non-recurring items such as the resolution of tax matters. The 2011 income tax provision was $280.1 million, representing an effective rate of 31.7%. This compares with $320.3 million of income tax expense and an effective rate of 32.4% in 2010. The decrease in the effective rate for 2011 primarily reflects adjustments to the Corporation’s intercompany service allocation methodology and the favorable resolutions of certain leasing matters with the Internal Revenue Service and certain state tax matters.

The tax provisions for 2011 and 2010 reflect reductions totaling $21.3 million and $20.1 million, respectively, related to certain non-U.S. subsidiaries whose earnings are being indefinitely reinvested. The higher reduction in 2011 reflects the adjustments to the Corporation’s intercompany service allocation methodology.

The 2009 income tax provision of $391.0 million represented an effective rate of 31.2%. The effective tax rate in 2009 reflected income tax benefits relating to the resolution of certain state and leasing tax positions taken in prior periods and included a $20.9 million reduction in the tax provision related to non-U.S. subsidiaries whose earnings are being indefinitely reinvested.

BUSINESS UNIT REPORTING

Northern Trust, under the leadership of Chairman and Chief Executive Officer Frederick H. Waddell, is organized around its two principal client-focused business units, C&IS and PFS. Investment management services and products are provided to the clients of these business units and to other U.S. and non-U.S. clients by NTGI. Operations support is provided to each of the business units by O&T. Mr. Waddell has been identified as the chief operating decision maker, having final authority over resource allocation decisions and performance assessment.

C&IS and PFS results are presented to promote a greater understanding of their financial performance. The information, presented on an internal management-reporting basis, derives from internal accounting systems that support Northern Trust’s strategic objectives and management structure. Management has developed accounting systems to allocate revenue and expense related to each segment. They incorporate processes for allocating assets, liabilities and equity, and the applicable interest income and expense. Equity is allocated based on the proportion of economic capital associated with the business units.

Allocations of capital and certain corporate expense may not be representative of levels that would be required if the segments were independent entities. The accounting policies used for management reporting are consistent with those described in Note 1 to the consolidated financial statements. Transfers of income and expense items are recorded at cost; there is no consolidated profit or loss on sales or transfers between business units. Northern Trust’s presentations are not necessarily consistent with similar information for other financial institutions.

| 2011 ANNUAL REPORT TO SHAREHOLDERS | 29 | NORTHERN TRUST CORPORATION | ||||||||||

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

| CONSOLIDATED FINANCIAL INFORMATION | CHANGE | |||||||||||||||||||

| (In Millions) | 2011 | 2010 | 2009 | 2011 / 2010 | 2010 / 2009 | |||||||||||||||

| Noninterest Income |

||||||||||||||||||||

| Trust, Investment and Other Servicing Fees |

$ | 2,169.5 | $ | 2,081.9 | $ | 2,083.8 | 4 | % | N/M | |||||||||||

| Other |

591.3 | 647.1 | 703.3 | (9 | ) | (8 | )% | |||||||||||||

| Net Interest Income (FTE)* |

1,049.3 | 957.8 | 1,040.0 | 10 | (8 | ) | ||||||||||||||

| Revenue (FTE)* |

3,810.1 | 3,686.8 | 3,827.1 | 3 | (4 | ) | ||||||||||||||

| Provision for Credit Losses |

55.0 | 160.0 | 215.0 | (66 | ) | (26 | ) | |||||||||||||

| Visa Indemnification Benefits |

(23.1 | ) | (33.0 | ) | (17.8 | ) | (30 | ) | 85 | |||||||||||

| Noninterest Expense (Excluding Visa Indemnification Benefits) |

2,854.3 | 2,530.9 | 2,334.5 | 13 | 8 | |||||||||||||||

| Income before Income Taxes* |

923.9 | 1,028.9 | 1,295.4 | (10 | ) | (21 | ) | |||||||||||||

| Provision for Income Taxes* |

320.3 | 359.4 | 431.2 | (11 | ) | (17 | ) | |||||||||||||

| Net Income |

$ | 603.6 | $ | 669.5 | $ | 864.2 | (10 | )% | (23 | )% | ||||||||||

| Average Assets |

$ | 91,947.9 | $ | 76,008.2 | $ | 74,314.2 | 21 | % | 2 | % | ||||||||||

* Stated on an FTE basis. The consolidated figures include $40.2 million, $39.1 million, and $40.2 million of FTE adjustment for 2011, 2010, and 2009, respectively.

Corporate & Institutional Services

The C&IS business unit is a leading global provider of asset servicing, securities lending, brokerage, banking and related services to corporate and public retirement funds, foundations, endowments, fund managers, insurance companies, sovereign wealth and government funds. Asset servicing and related services encompass a full range of industry leading capabilities including but not limited to: global master trust and custody, trade settlement, and reporting; fund administration; cash management; investment risk and performance analytical services; investment operations outsourcing; and transition management and commission recapture. Client relationships are managed through the Bank and the Bank’s and the Corporation’s other subsidiaries, including support from international locations in North America, Europe, the Middle East, and the Asia Pacific region. C&IS also executes related foreign exchange transactions from offices located in the United States, United Kingdom, and Singapore.

The following table summarizes the results of operations of C&IS for the years ended December 31, 2011, 2010, and 2009 on a management-reporting basis.

| CORPORATE & INSTITUTIONAL SERVICES RESULTS OF OPERATIONS |

CHANGE | |||||||||||||||||||

| (In Millions) | 2011 | 2010 | 2009 | 2011 / 2010 | 2010 / 2009 | |||||||||||||||

| Noninterest Income |

||||||||||||||||||||

| Trust, Investment and Other Servicing Fees |

$ | 1,196.4 | $ | 1,175.1 | $ | 1,236.8 | 2 | % | (5 | )% | ||||||||||

| Other |

485.4 | 522.7 | 571.3 | (7 | ) | (9 | ) | |||||||||||||

| Net Interest Income (FTE)* |

282.5 | 271.8 | 416.0 | 4 | (35 | ) | ||||||||||||||

| Revenue (FTE)* |

1,964.3 | 1,969.6 | 2,224.1 | – | (11 | ) | ||||||||||||||

| Provision for Credit Losses |

(20.5 | ) | (16.1 | ) | 30.7 | 27 | N/M | |||||||||||||

| Noninterest Expense |

1,522.4 | 1,328.9 | 1,200.6 | 15 | 11 | |||||||||||||||

| Income before Income Taxes* |

462.4 | 656.8 | 992.8 | (30 | ) | (34 | ) | |||||||||||||

| Provision for Income Taxes* |

168.3 | 222.4 | 350.8 | (24 | ) | (37 | ) | |||||||||||||

| Net Income |

$ | 294.1 | $ | 434.4 | $ | 642.0 | (32 | )% | (32 | )% | ||||||||||

| Percentage of Consolidated Net Income |

49 | % | 65 | % | 74 | % | ||||||||||||||

| Average Assets |

$ | 47,533.7 | $ | 38,749.3 | $ | 38,117.1 | 23 | % | 2 | % | ||||||||||

* Stated on an FTE basis.

The decrease in C&IS net income in 2011 resulted from reductions in securities lending revenue, a component of trust, investment and other servicing fees; lower foreign exchange trading income; and higher noninterest expense, including operating costs from the 2011 acquisitions of $78.9 million and 2011 restructuring, acquisition and integration charges totaling $60.8 million. These impacts were partially offset by increases in custody and fund administration revenue, a component of trust, investment and other servicing fees, primarily attributable to the current year acquisitions which in total contributed $76.6 million to C&IS revenues in 2011; and an increased negative provision for credit losses. Other

| 2011 ANNUAL REPORT TO SHAREHOLDERS | 30 | NORTHERN TRUST CORPORATION | ||||||||||

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

components of C&IS trust, investment and other servicing fees increased in 2011 primarily attributable to new business. The net income decrease in 2010 as compared to 2009 primarily reflects reductions in securities lending revenue, net interest income, and foreign exchange trading income, and higher noninterest expense, partially offset by a negative provision for credit losses.

C&IS Trust, Investment and Other Servicing Fees

C&IS trust, investment and other servicing fees are attributable to four general product types: Custody and Fund Administration, Investment Management, Securities Lending, and Other Services. Custody and fund administration fees are driven primarily by asset values, transaction volumes and number of accounts. Custody fees related to asset values are often priced based on values at the beginning of each quarter; however, there are custody fees that are based on quarter-end or month-end values or average values for a month or quarter. The fund administration fees that are asset value related are generally priced using average daily balances. Investment management fees are based primarily on market values throughout a period.

Securities lending revenue is affected by market values; the demand for securities to be lent, which drives volumes; and the interest rate spread earned on the investment of cash deposited by investment firms as collateral for securities they have borrowed. Securities lending revenue prior to 2011 had also included Northern Trust’s share of unrealized gains and losses on one mark-to-market investment fund used in securities lending activities. As of September 30, 2010, securities in the mark-to-market fund had been sold with the proceeds reinvested into a short duration fund, eliminating the mark-to-market impact on securities lending revenue in periods subsequent to the date of sale. The other services fee category in C&IS includes such products as benefit payment, performance analysis, electronic delivery, and other services. Revenues from these products are based generally on the volume of services provided or a fixed fee.

Provided below are the components of C&IS trust, investment and other servicing fees and a breakdown of its assets under custody and under management.

| CORPORATE AND INSTITUTIONAL SERVICES TRUST, INVESTMENT AND OTHER SERVICING FEES |

||||||||||||

| (In Millions) | 2011 | 2010 | 2009 | |||||||||

| Custody and Fund Administration |

$ | 770.1 | $ | 646.1 | $ | 583.0 | ||||||

| Investment Management |

262.5 | 261.2 | 247.1 | |||||||||

| Securities Lending |

87.9 | 195.2 | 336.7 | |||||||||

| Other |

75.9 | 72.6 | 70.0 | |||||||||

| Total Trust, Investment and Other Servicing Fees |

$ | 1,196.4 | $ | 1,175.1 | $ | 1,236.8 | ||||||

2011 C&IS FEES

| CORPORATE AND INSTITUTIONAL SERVICES ASSETS UNDER CUSTODY |

||||||||||||

| DECEMBER 31 | ||||||||||||

| (In Billions) | 2011 | 2010 | 2009 | |||||||||

| North America |

$ | 2,112.1 | $ | 1,999.6 | $ | 1,861.9 | ||||||

| Europe, Middle East, and Africa |

1,351.4 | 1,280.7 | 1,085.9 | |||||||||

| Asia Pacific |

319.4 | 331.7 | 263.6 | |||||||||

| Securities Lending |

94.7 | 99.1 | 114.5 | |||||||||

| Total Assets Under Custody |

$ | 3,877.6 | $ | 3,711.1 | $ | 3,325.9 | ||||||

2011 C&IS ASSETS UNDER CUSTODY

| CORPORATE AND INSTITUTIONAL SERVICES ASSETS UNDER MANAGEMENT |

||||||||||||

| DECEMBER 31 | ||||||||||||

| (In Billions) | 2011 | 2010 | 2009 | |||||||||

| North America |

$ | 304.0 | $ | 284.7 | $ | 257.6 | ||||||

| Europe, Middle East, and Africa |

48.7 | 69.0 | 63.5 | |||||||||

| Asia Pacific |

41.8 | 36.4 | 46.4 | |||||||||

| Securities Lending |

94.7 | 99.1 | 114.5 | |||||||||

| Total Assets Under Management |

$ | 489.2 | $ | 489.2 | $ | 482.0 | ||||||

2011 C&IS ASSETS UNDER MANAGEMENT

| 2011 ANNUAL REPORT TO SHAREHOLDERS | 31 | NORTHERN TRUST CORPORATION | ||||||||||

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Custody and fund administration fees, the largest component of trust, investment and other servicing fees, increased $124.0 million, or 19%, primarily reflecting higher fund administration and global custody fee revenues, attributable to the 2011 acquisitions, other new business, and improved markets. Fees from investment management were relatively unchanged from the year-ago period as increases due to new business and improved markets were offset by $34.3 million of money market mutual fund fee waivers attributable to the persistent low level of short-term interest rates. Money market mutual fund fee waivers for 2010 totaled $12.9 million. Securities lending revenue decreased $107.3 million, or 55%. The prior year included the recovery of previously recorded unrealized asset valuation losses of approximately $114 million related to a mark-to-market investment fund used in our securities lending activities. There were no mark-to-market impacts in the current year as securities in the mark-to-market fund had been sold in September 2010 with the proceeds reinvested into a short duration fund. Excluding the impact of the prior year asset valuation recoveries, securities lending fees in 2011 increased by approximately $6.7 million, reflecting higher spreads on the investment of cash collateral, partially offset by lower average volumes.

C&IS assets under custody were $3.9 trillion at December 31, 2011, 4% higher than the $3.7 trillion at December 31, 2010. Managed assets totaled $489.2 billion at December 31, 2011 and 2010. Cash and other assets deposited by investment firms as collateral for securities borrowed from custody clients are managed by Northern Trust and are included in assets under custody and under management. This collateral totaled $94.7 billion and $99.1 billion at December 31, 2011 and 2010, respectively.

C&IS Other Noninterest Income

Other noninterest income for 2011 decreased $37.3 million, or 7%, to $485.4 million from $522.7 million in 2010. The decrease primarily reflects a $58.5 million, or 16%, decrease in foreign exchange trading income due to reduced volatility and client volumes in the current year, partially offset by the benefit of 2011 acquisitions and other new business. Other noninterest income for 2010 of $522.7 million decreased $48.6 million, or 9%, from $571.3 million in 2009. This decrease resulted from lower foreign exchange trading income due to reduced volatility that was partially offset by increased client volumes as compared to 2009.

C&IS Net Interest Income

Net interest income increased $10.7 million, or 4%, in 2011 to $282.5 million from $271.8 million in 2010. The increase primarily reflects higher levels of average earning assets, partially offset by a decline in the net interest margin. The C&IS net interest margin in 2011 was .70% compared to .77% in 2010 and 1.25% in 2009. The decrease in the net interest margin in 2011 is primarily attributable to a change in the application of internal funds transfer pricing used in determining net interest income. Low interest rates also impacted net interest income in 2010, which was down $144.2 million, or 35%, from $416.0 million in 2009.

C&IS Provision for Credit Losses

The provision for credit losses was negative $20.5 million for 2011 reflecting recoveries of previously charged off exposures and improvement in underlying asset quality metrics within both commercial and institutional loans and commercial real estate loans. The provision for credit losses was negative $16.1 million for 2010 compared to a $30.7 million provision in 2009, reflecting reduced loan balances and, to a lesser extent, improvement in underlying asset quality metrics within the commercial loan segment as compared to 2009.

C&IS Noninterest Expense

C&IS noninterest expense was up $193.5 million, or 15%, in 2011 and totaled $1.52 billion compared to $1.33 billion in 2010. Noninterest expense in 2011 increased primarily as a result of $78.9 million of operating expense attributable to the 2011 acquisitions and $60.8 million of current year restructuring, acquisition and integration related charges. The restructuring, acquisition and integration related charges are reflected in higher compensation and outside services expense and in higher indirect expense allocations for product and operating support. Excluding the operating expense attributable to the 2011 acquisitions and the restructuring, acquisition and integration related charges, C&IS noninterest expense increased $53.8 million, or 4%, from 2010. Noninterest expense in 2010 totaled $1.33 billion, a $128.3 million increase from 2009. 2009 included expense reductions of $100.6 million associated with the final support payments and expiration of the CSA obligations.

| 2011 ANNUAL REPORT TO SHAREHOLDERS | 32 | NORTHERN TRUST CORPORATION | ||||||||||

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Personal Financial Services

The PFS business unit provides personal trust, investment management, custody, and philanthropic services; financial consulting; guardianship and estate administration; brokerage services; and private and business banking. PFS focuses on high net worth individuals and families, business owners, executives, professionals, retirees, and established privately held businesses in its target markets. PFS also includes the Wealth Management Group, which provides customized products and services to meet the complex financial needs of individuals and family offices in the United States and throughout the world with assets typically exceeding $200 million. PFS services are delivered through a network of offices in 18 U.S. states and Washington, D.C., as well as offices in London and Guernsey.

The following table summarizes the results of operations of PFS for the years ended December 31, 2011, 2010, and 2009 on a management-reporting basis.

| PERSONAL FINANCIAL SERVICES RESULTS OF OPERATIONS |

CHANGE | |||||||||||||||||||

| (In Millions) | 2011 | 2010 | 2009 | 2011 / 2010 | 2010 / 2009 | |||||||||||||||

| Noninterest Income |

||||||||||||||||||||

| Trust, Investment and Other Servicing Fees |

$ | 973.1 | $ | 906.8 | $ | 847.0 | 7 | % | 7 | % | ||||||||||

| Other |

128.5 | 133.3 | 138.7 | (4 | ) | (4 | ) | |||||||||||||

| Net Interest Income (FTE)* |

613.7 | 591.8 | 538.1 | 4 | 10 | |||||||||||||||

| Revenue (FTE)* |

1,715.3 | 1,631.9 | 1,523.8 | 5 | 7 | |||||||||||||||

| Provision for Credit Losses |

75.5 | 176.1 | 184.3 | (57 | ) | (4 | ) | |||||||||||||

| Noninterest Expense |

1,214.9 | 1,103.0 | 1,044.6 | 10 | 6 | |||||||||||||||

| Income before Income Taxes* |

424.9 | 352.8 | 294.9 | 20 | 20 | |||||||||||||||

| Provision for Income Taxes* |

168.7 | 132.8 | 112.4 | 27 | 18 | |||||||||||||||

| Net Income |

$ | 256.2 | $ | 220.0 | $ | 182.5 | 16 | % | 21 | % | ||||||||||

| Percentage of Consolidated Net Income |

42 | % | 33 | % | 21 | % | ||||||||||||||

| Average Assets |

$ | 23,861.5 | $ | 23,564.5 | $ | 24,534.8 | 1 | % | (4 | )% | ||||||||||

* Stated on an FTE basis.

PFS net income increased from 2010 as a result of higher revenues and a lower provision for credit losses, partially offset by increases in noninterest expense, including 2011 restructuring related charges totaling $27.4 million, and in the provision for income taxes. PFS revenue totaled $1.72 billion in 2011, an increase of $83.4 million, or 5%, from $1.63 billion in 2010, primarily attributable to increased trust, investment and other servicing fees and net interest income. These increases were partially offset by higher money market mutual fund fee waivers attributable to the prolonged low interest rate environment and decreased security commission and trading income and treasury management fees. PFS net income in 2010 increased $37.5 million, or 21%, from 2009 primarily attributable to increased trust, investment and other servicing fees and net interest income, as well as a lower provision for credit losses. These were partially offset by increased money market mutual fund fee waivers, noninterest expense, and provision for income tax.

| 2011 ANNUAL REPORT TO SHAREHOLDERS | 33 | NORTHERN TRUST CORPORATION | ||||||||||

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

PFS Trust, Investment and Other Servicing Fees

Provided below is a summary of PFS trust, investment and other servicing fees and assets under custody and under management.

| PERSONAL FINANCIAL SERVICES TRUST, INVESTMENT AND OTHER SERVICING FEES |

YEAR ENDED DECEMBER 31 | |||||||||||

| (In Millions) | 2011 | 2010 | 2009 | |||||||||

| Midwest |

$ | 399.2 | $ | 373.0 | $ | 327.6 | ||||||

| Southeast |

218.1 | 200.3 | 188.6 | |||||||||

| West |

208.5 | 185.8 | 173.7 | |||||||||

| Wealth Management |

117.4 | 123.2 | 135.8 | |||||||||

| Northeast |

29.9 | 24.5 | 21.3 | |||||||||

| Total Trust, Investment and Other Servicing Fees |

$ | 973.1 | $ | 906.8 | $ | 847.0 | ||||||

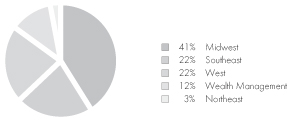

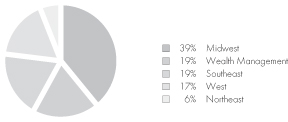

2011 PFS FEES

| PERSONAL FINANCIAL SERVICES ASSETS UNDER CUSTODY |

DECEMBER 31 | |||||||||||

| (In Billions) | 2011 | 2010 | 2009 | |||||||||

| Wealth Management |

$ | 226.5 | $ | 221.9 | $ | 196.0 | ||||||

| Midwest |

67.6 | 64.1 | 58.2 | |||||||||

| Southeast |

37.2 | 36.7 | 34.0 | |||||||||

| West |

36.5 | 34.8 | 31.1 | |||||||||

| Northeast |

17.4 | 12.7 | 11.8 | |||||||||

| Total Assets Under Custody |

$ | 385.2 | $ | 370.2 | $ | 331.1 | ||||||

2011 PFS ASSETS UNDER CUSTODY

| PERSONAL FINANCIAL SERVICES ASSETS UNDER MANAGEMENT |

DECEMBER 31 | |||||||||||

| (In Billions) | 2011 | 2010 | 2009 | |||||||||

| Midwest |

$ | 68.5 | $ | 60.4 | $ | 57.0 | ||||||

| Wealth Management |

34.0 | 31.5 | 31.4 | |||||||||

| Southeast |

32.2 | 29.1 | 27.3 | |||||||||

| West |

29.1 | 26.6 | 23.7 | |||||||||

| Northeast |

9.9 | 6.8 | 5.8 | |||||||||

| Total Assets Under Management |

$ | 173.7 | $ | 154.4 | $ | 145.2 | ||||||

2011 PFS ASSETS UNDER MANAGEMENT

The PFS regions shown above are comprised of the following: Midwest includes Illinois, Michigan, Wisconsin, Missouri, Ohio and Minnesota; Southeast includes Florida and Georgia; West includes California, Washington, Nevada, Texas, Arizona, and Colorado; Northeast includes New York, Connecticut, Massachusetts, Washington, D.C., and Delaware; Wealth Management includes the results from the focus on the family office segment, complex fiduciary assignments and ultra-wealthy individuals through the provision of specialized asset management, investment consulting, global custody, fiduciary, and private banking services for domestic and international clients.

Fees in the majority of locations in which PFS operates and all mutual fund-related revenue are calculated primarily based on market values. PFS trust, investment and other servicing fees were $973.1 million in 2011, up 7% from $906.8 million in 2010, which in turn was up 7% from $847.0 million in 2009. The current year performance benefitted from new business and higher market valuations. Impacting the results in both years were waived fees in money market funds, totaling $67.8 million and $49.6 million in 2011 and 2010, respectively, due to the low level of short-term interest rates. Trust, investment and other servicing fees for 2010 were higher compared to 2009, reflecting higher market valuations and new business.

At December 31, 2011, assets under custody in PFS were $385.2 billion compared with $370.2 billion at December 31, 2010. Managed assets were $173.7 billion at December 31, 2011 compared to $154.4 billion at the previous year end.

| 2011 ANNUAL REPORT TO SHAREHOLDERS | 34 | NORTHERN TRUST CORPORATION | ||||||||||

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

PFS Other Noninterest Income

Other noninterest income for the year totaled $128.5 million compared to $133.3 million in 2010, a decrease of 4%, primarily driven by a decrease in security commissions and trading income and in treasury management fees. The other noninterest income decrease of 4% in 2010 compared to 2009 resulted from a decrease in core brokerage fee revenue and treasury management fees.

PFS Net Interest Income

Net interest income was $613.7 million for the year, up 4% from $591.8 million in 2010, which was 10% higher than 2009. Average loans increased $248.5 million in 2011, and the net interest margin increased to 2.61% from 2.55% in 2010, which in turn was up from the 2009 margin of 2.23%. The increased net interest margin for 2011 and 2010 largely reflects lower costs of funds.

PFS Provision for Credit Losses

The provision for credit losses was $75.5 million for 2011, compared with $176.1 million in 2010, and $184.3 million in 2009. The current year provision reflects improvements in commercial and institutional and commercial real estate loans, partially offset by continued weakness in residential real estate loans. The 2010 provision reflected continued weakness in residential and commercial real estate loans in certain markets. For a fuller discussion of the allowance and provision for credit losses refer to pages 56 and 57.

PFS Noninterest Expense

Noninterest expense of PFS increased $111.9 million, or 10%, to $1.21 billion in 2011 compared to $1.10 billion in 2010, primarily due to the $27.4 million of current year restructuring related charges which are reflected in higher compensation and benefits, outside services, and occupancy expense and in higher indirect expense allocations for product and operating support. Excluding the 2011 restructuring related charges, noninterest expense of PFS increased $84.5 million, or 8%, from 2010. Noninterest expense for 2010 was 6% higher than 2009, primarily attributable to higher indirect expense allocations for product and operating support, higher compensation, and increased charges associated with account servicing activities.

Northern Trust Global Investments

NTGI, through various subsidiaries of the Corporation, provides a broad range of asset management and related services and other products to clients around the world, including clients of C&IS and PFS. Clients include institutional and individual separately managed accounts, bank common and collective funds, registered investment companies, exchange traded funds, non-U.S. collective investment funds, and unregistered private investment funds. NTGI offers both active and passive equity and fixed income portfolio management, as well as alternative asset classes (such as private equity and hedge funds of funds) and multi-manager products and advisory services. NTGI’s activities also include overlay services and other risk management services. NTGI’s business operates internationally through subsidiaries, joint ventures, alliances, and distribution arrangements and its revenue and expense are fully allocated to C&IS and PFS.

At year-end 2011, Northern Trust managed $662.9 billion in assets for personal and institutional clients compared with $643.6 billion at year-end 2010. The increase in assets reflects higher equity markets in 2011 and new business.

NORTHERN TRUST GLOBAL INVESTMENTS

2011 ASSETS UNDER MANAGEMENT OF $662.9 BILLION

ASSET CLASSES

CLIENT SEGMENTS

MANAGEMENT STYLES

| 2011 ANNUAL REPORT TO SHAREHOLDERS | 35 | NORTHERN TRUST CORPORATION | ||||||||||

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Operations and Technology

The O&T business unit supports all Northern Trust’s business activities, including the processing and product management activities of C&IS, PFS, and NTGI. These activities are conducted principally in the operations and technology centers in Chicago, London, and Bangalore.

Corporate Financial Management Group

The Corporate Financial Management Group includes the Chief Financial Officer, Controller, Treasurer, and Investor Relations functions. The Group is responsible for Northern Trust’s accounting and financial infrastructure and for managing the Corporation’s financial position.

Corporate Risk Management Group

The Corporate Risk Management Group includes the Credit Policy and other Corporate Risk Management functions. The Credit Policy function is described in the “Risk Management – Loans and Other Extensions of Credit” section. The Corporate Risk Management Group monitors, measures, and facilitates the management of risks across the businesses of the Corporation and its subsidiaries.

Treasury and Other

Treasury and Other includes income and expense associated with the wholesale funding activities and the investment portfolios of the Corporation and the Bank. Treasury and Other also includes certain corporate-based expense, executive level compensation and nonrecurring items not allocated to the business units.