UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. _____)

|

Filed by the Registrant ☒ |

|

Filed by a Party other than the Registrant |

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

|

|

|

(Name of Registrant as Specified in Its Charter) |

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Notice of Annual Meeting of Shareholders

WHEN

May 13, 2024

11:00 a.m. Eastern Time

WHERE

Interface, Inc.

1280 West Peachtree Street NW

Atlanta, Georgia 30309

ITEMS OF BUSINESS

|

1. |

To elect ten members of the Board of Directors. |

|

2. |

To approve, on an advisory basis, executive compensation, often referred to as “say on pay.” |

|

3. |

To approve the adoption of an amendment and restatement of the Interface, Inc. 2020 Omnibus Stock Incentive Plan. |

|

4. |

To ratify the appointment of BDO USA, P.C. as the Company’s Independent Registered Public Accounting Firm for 2024. |

|

5. |

Such other matters as may properly come before the meeting and at any adjournments of the meeting. |

RECORD DATE

The Board of Directors set March 15, 2024 as the record date for the meeting. This means that only shareholders of record at the close of business on March 15, 2024 will be entitled to receive notice of and to vote at the meeting or any adjournments of the meeting.

| By Order of the Board of Directors | |

| /s/ David B. Foshee | |

| David B. Foshee | |

| Secretary |

April 1, 2024

PLEASE PROMPTLY COMPLETE AND RETURN A PROXY CARD

OR USE TELEPHONE OR INTERNET VOTING PRIOR TO THE MEETING SO THAT YOUR VOTE

MAY BE RECORDED AT THE MEETING IF YOU DO NOT ATTEND PERSONALLY.

|

Page |

|

|

APPROVAL OF AMENDMENT AND RESTATEMENT OF THE 2020 OMNIBUS STOCK INCENTIVE PLAN (ITEM 3) |

|

|

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (ITEM 4) |

|

The Board of Directors ("Board") of Interface, Inc. (the "Company," "we," "us," "our" or "Interface") is furnishing this Proxy Statement and soliciting proxies in connection with the proposals to be voted on at the Interface, Inc. 2024 Annual Meeting of Shareholders ("Annual Meeting") and any postponements or adjournments thereof. This summary highlights certain information contained in this Proxy Statement, but it does not contain all of the information you should consider when voting your shares. Please read the entire Proxy Statement carefully before voting.

|

2024 Annual Meeting Information |

|

|

Date |

Monday, May 13, 2024 |

|

Time |

11:00 a.m. Eastern Time |

|

Location |

Interface, Inc. 1280 West Peachtree Street NW Atlanta, Georgia 30309 |

|

Record Date |

Friday, March 15, 2024 |

|

Stock Symbol |

TILE |

|

Stock Exchange |

NASDAQ |

|

Corporate Website |

www.interface.com |

In the event the Company changes the date, time or location of the Annual Meeting pursuant to the guidance issued by the SEC discussed above, the Company will inform shareholders in a manner as prescribed by such guidance.

Voting Items and Vote Recommendation

|

Item |

Board Recommendation |

Reasons for Recommendation |

More Information |

|

1. To elect ten members of the Board of Directors. |

FOR |

The Board and the Nominating & Governance Committee believe our nominees possess the skills, experience and qualifications to effectively monitor performance, provide oversight and support management's execution of the Company's long-term strategy. |

Page 13 |

|

2. To approve, on an advisory basis, executive compensation, often referred to as a “say on pay.” |

FOR |

Our executive compensation program incorporates many compensation governance best practices and reflects our commitment to align pay with performance. |

Page 24 |

|

3. To approve the adoption of an amendment and restatement of the Interface, Inc. 2020 Omnibus Stock Incentive Plan. |

FOR |

The Board and the Compensation Committee will use this plan to provide stock-based awards to attract, retain and incentivize key employees and directors. |

Page 52 |

|

4. To ratify the appointment of BDO USA, P.C. as the Company’s Independent Registered Public Accounting Firm for 2024. |

FOR |

Based on its assessment, the Audit Committee believes that the re-appointment of BDO USA, P.C. is in the best interests of Interface and our shareholders. |

Page 56 |

|

Vote in Advance of the Meeting |

Vote in Person |

|||

|

|

|

|

|

|

Internet |

Telephone |

|

||

|

Using the Internet and voting at the website listed on the proxy card and the Notice. |

Using the toll-free phone number listed on the proxy card and the Notice. |

Signing, dating and mailing a proxy card. |

See page 58 for details on attending the Annual Meeting in person. |

|

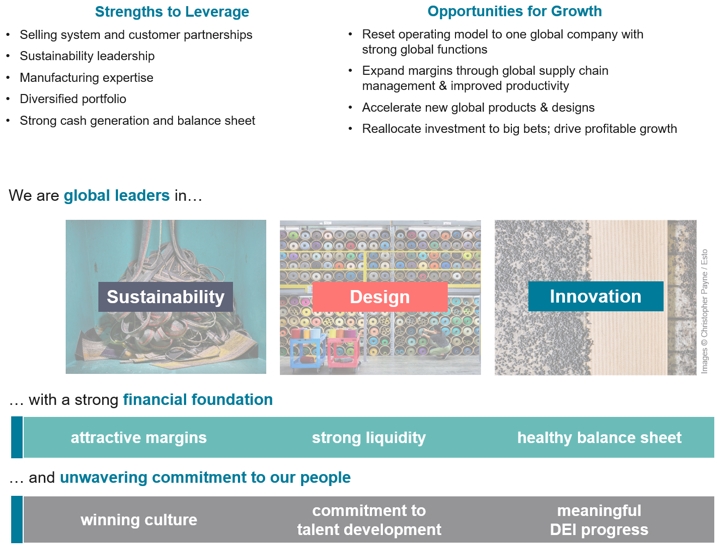

Our Company

Who We Are

We are a worldwide leader in design, production and sales of commercial flooring, such as carpet tile, luxury vinyl tile, and rubber tile and sheet products. Our flooring systems help customers create beautiful interior spaces while positively impacting those who use them and our planet. We are committed to the pursuit of sustainability and minimizing our impact on the environment while enhancing shareholder value. This commitment is exemplified by our initiative called Climate Take Back™, in which we seek to lead industry in designing and making products in ways that will maintain a climate fit for life. We believe Interface has for decades been the most environmentally conscious company in the global flooring industry, and we remain committed to leading the industry in sustainability, design and innovation.

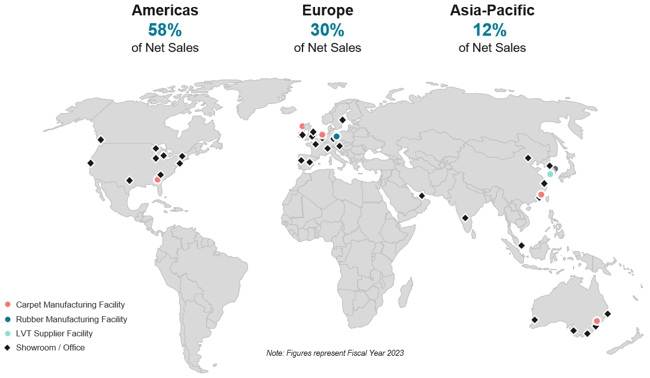

Our Global Sales and Manufacturing Platform

|

● Physical presence in 18 countries

● Six manufacturing locations on four continents

● Unique blend of efficiency and customization |

● Global account management

● Global supply chain management |

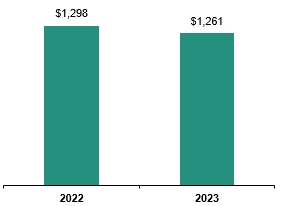

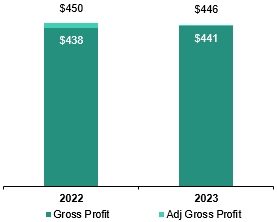

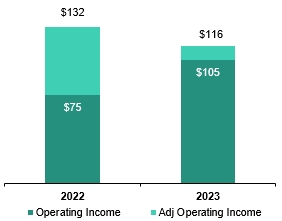

Our Performance

In addition to the financial data shown below, the Compensation Discussion and Analysis section of this Proxy Statement contains important measures of our 2023 financial performance.

|

NET SALES ($ in millions) |

GROSS PROFIT and ADJUSTED GROSS PROFIT (NON-GAAP)* ($ in millions) |

|

|

|

|

|

OPERATING INCOME and ADJUSTED OPERATING INCOME (NON-GAAP)* ($ in millions) |

DILUTED EPS and ADJUSTED DILUTED EPS (NON-GAAP)* |

|

|

|

|

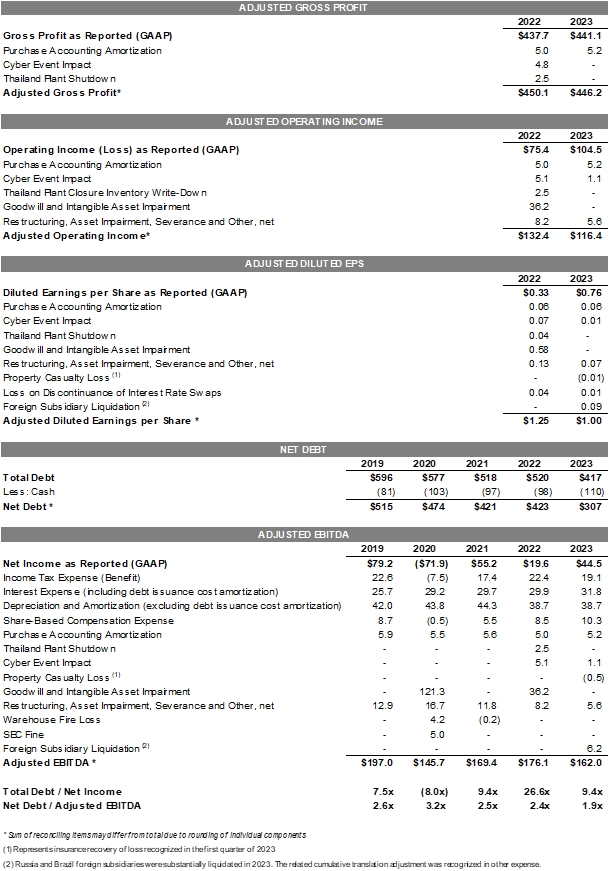

*Please see Appendix A for a reconciliation of non-GAAP measures to the most directly comparable GAAP measures and an explanation of why we believe non-GAAP measures provide useful information to shareholders and the additional purposes for which we use non-GAAP measures.

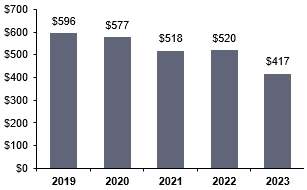

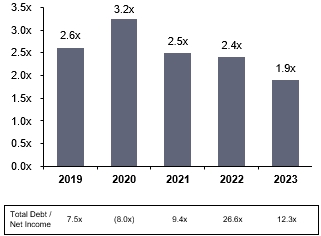

Our Capital Structure

We believe we have a strong capital structure and the financial resources to deliver on our strategic initiatives. During 2023, we generated strong cash flows and repaid $105 million of debt. We ended the year with total debt of $417 million and net debt of $307 million.

|

YEAR END TOTAL DEBT ($ in millions)

|

YEAR END NET DEBT (NON-GAAP)* ($ in millions) |

|

|

|

|

|

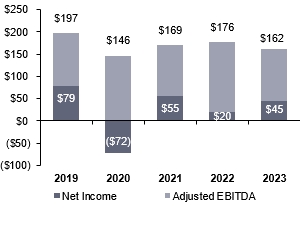

NET INCOME (LOSS) and ADJUSTED EBITDA (NON-GAAP)* ($ in millions) |

YEAR END NET DEBT / ADJUSTED EBITDA (NON-GAAP)* |

|

|

|

*See Appendix A for a reconciliation of non-GAAP measures to the most directly comparable GAAP measures.

Environmental, Social and Governance (ESG)

Interface embraces and supports core values in the areas of human rights, labor standards, environmental responsibility, and ethical practices. We have policies and actions in place that demonstrate our commitment to ESG and operating in an ethical and more sustainable manner that benefits all stakeholders – employees, customers, shareholders, and the environment. Our journey to more sustainable business practices is ongoing, guided by a purpose-driven culture and an emphasis on transparency.

Our Board of Directors oversees all areas of the overall ESG commitments at Interface. Our Nominating and Governance Committee, chaired by our Chairman, is responsible for monitoring and advising the Company’s management regarding environmental, social, and related governance matters that are significant to the Company. In addition, Interface has adopted an integrated, strategic approach to ensuring effective management of climate strategy and measurement, including oversight and monitoring by our Chairman.

Recent ESG Highlights include:

| ENVIRONMENTAL | SOCIAL | GOVERNANCE | |||||

| ● | Continued to implement our Climate Transition Plan to make progress on our verified Science-Based Targets | ● | Completed the global rollout of Workday® for improved visibility into our people demographics; expanded the platform with launch of Workday Learning and Workday Talent & Performance | ● | Adopted our Commitment to Human Rights, a global statement that outlines how we support human rights for all people | ||

| ● | Transitioned 100% of our carpet tile product manufactured in Europe to our carbon negative CQuest™ backing | ● | Continued to activate our global employee engagement strategy, introducing a mandatory Unconscious Bias Training course in the Americas and launching our first Inclusion Network, empowHER | ● | Added a new female director to the Board of Directors, increasing our female representation to 30% | ||

| ● | Expanded our carbon negative carpet tile offering to FLOR®, our specialty design brand, helping residential customers create beautiful and environmentally conscious homes | ● | Introduced expanded benefits program for U.S.-based employees that support mental and physical well-being | ● | Updated our Security Incident Response Plan and deployed new technology to support enhanced data privacy and cybersecurity | ||

| ● | Conducted our first Global Employee Commuting Survey, measuring employee commuting data with information directly from employees | ● | Launched The Home Project as part of our Reconciliation Action Plan to connect with, learn from, and collaborate with the First Nations people of Australia | ● | Updated our Code of Conduct, creating one source of guidance and policies for our employees to follow | ||

| ● | Named by the World Economic Forum as one of three “Circularity Lighthouses in the Built Environment” for our contributions to the circular economy | ● | Appointed independent Chairman of the Board |

To learn more about our progress to reduce environmental impacts, cultivate social responsibility, and operate with strong governance, please see our 2022 Impact Report. (Our ESG Report is not a part of this Proxy Statement.)

Summary of Item 1 - Election of Directors

In this proposal, shareholders are asked to vote "FOR" each of the following ten nominees.

|

Nominee Name |

Director Since |

Independent? |

Audit Committee |

Compensation Committee |

Nominating & Governance Committee |

Innovation & Sustainability Committee |

|

John P. Burke |

2013 |

Yes |

✔ |

|||

|

Dwight Gibson |

2019 |

Yes |

✔ |

|||

|

Daniel T. Hendrix |

1996 |

No |

Chair |

|||

|

Laurel M. Hurd |

2022 |

No |

||||

|

Christopher G. Kennedy |

2000 |

Yes |

Chair |

|||

|

Joseph Keough |

2019 |

Yes |

✔ |

✔ |

||

|

Catherine M. Kilbane |

2018 |

Yes |

Chair |

✔ |

||

|

K. David Kohler |

2006 |

Yes |

✔ |

✔ |

||

|

Catherine Marcus |

2023 |

Yes |

✔ |

|||

|

Robert T. O’Brien |

2022 |

Yes |

Chair |

✔ |

Summary of Item 2 - Advisory Vote to Approve Executive Compensation

We provide our shareholders with the opportunity to vote to approve, on a nonbinding, advisory basis, the compensation of our named executive officers as disclosed in this Proxy Statement in accordance with the rules of the SEC. The vote on this resolution is not intended to address any specific element of compensation; rather, the advisory vote relates to the overall compensation of our named executive officers, as well as the philosophy, policies and practices, all as described in this Proxy Statement. The vote is advisory, and therefore it is not binding on the Company, the Compensation Committee or our Board of Directors. We recommend that our shareholders vote "FOR" approval of our executive compensation as described in this Proxy Statement.

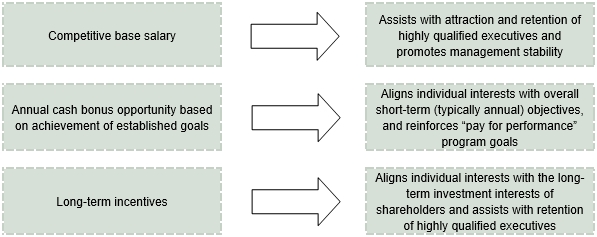

Our executive compensation program is generally designed to:

We believe that motivating and rewarding exceptional performance is the overriding principle of our executive compensation program.

|

We Do: |

We Do Not: |

||||

|

✔ |

Provide a significant portion of our named executive officers’ total compensation in the form of awards tied to our long-term strategy and our performance. |

X |

Provide supplemental retirement benefits to our executive officers (other than a legacy arrangement with Mr. Stansfield, as described below). |

||

|

✔ |

Require compliance with our Stock Ownership Guidelines, which require that our executive officers own a specified value of shares of the Company’s common stock. |

X |

Time the grants of equity awards to coordinate with the release of material non-public information, or time the release of material non-public information for the purpose of affecting the value of any named executive officer compensation. |

||

|

✔ |

Have a Compensation Committee comprised entirely of independent directors who use an independent consultant retained by the Compensation Committee. |

X |

Provide tax gross-ups for our named executives. |

||

|

✔ |

Have a clawback policy that requires the Company to recover from executives any excess incentive-based compensation resulting from an accounting restatement. |

X |

Provide excessive perquisites to executives. |

||

|

✔ |

Have ongoing consideration and oversight by the Compensation Committee with respect to any potential risks associated with our incentive compensation programs. |

X |

Have a shareholder rights plan (i.e., poison pill). |

||

|

✔ |

Prohibit our associates through our Insider Trading Policy from engaging in hedging transactions in our stock, and prohibit our officers and directors from pledging our stock as loan collateral. |

X |

Pay dividends on unvested performance-based equity awards. |

||

|

✔ |

Utilize “double trigger” change-in-control provisions in our equity award and executive severance agreements. |

||||

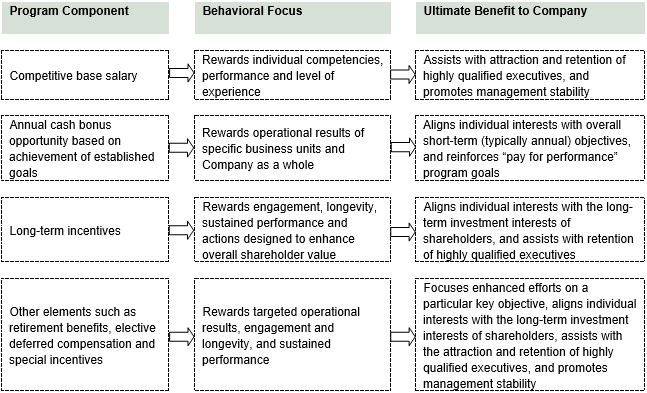

The following sets forth the primary objectives addressed by each component of our executive compensation program:

For more information regarding our compensation, please see our Compensation Discussion and Analysis beginning on page 26.

Summary of Item 3 – Approve Adoption of Amendment and Restatement of Interface, Inc. 2020 Omnibus Stock Incentive Plan

The Compensation Committee of the Board of Directors has voted to adopt an amendment and restatement of the Interface, Inc. 2020 Omnibus Stock Incentive Plan effective May 13, 2024 (the “Effective Date”), subject to shareholder approval. The primary purpose of the amendment and restatement of the 2020 Omnibus Stock Incentive Plan is to continue, by making 3,200,000 additional shares available for such use, the original purpose of the plan, which is to attract and retain key employees and directors of the Company and its subsidiaries by providing such persons with stock-based incentives and rewards for performance. The 2020 Omnibus Stock Incentive Plan is also designed to promote the loyalty and retention of senior management and strengthen the mutuality of interests between senior management and the Company’s shareholders. Thus, the Company believes that it is important to have the 2020 Omnibus Stock Incentive Plan as an element of the Company’s compensation program. The material features of the proposed amendment and restatement of the 2020 Omnibus Stock Incentive Plan are described below in Item 3.

Summary of Item 4 - Ratify Appointment of BDO USA, P.C. as the Company’s Independent Registered Public Accounting Firm

BDO USA, P.C. (“BDO USA”) served as the Company’s independent registered public accounting firm for 2023. Our Audit Committee has selected BDO USA to audit our financial statements for 2024. Although it is not required to do so, the Board is submitting the Audit Committee's selection of our independent registered public accounting firm for ratification by the shareholders at the Annual Meeting in order to ascertain the view of our shareholders regarding such selection. We recommend that our shareholders vote "FOR" the ratification of BDO USA as the Company’s Independent Registered Public Accounting Firm for 2024. Below is summary information about BDO USA’s fees for services during 2023 and 2022:

|

2023 |

2022 |

|||||||

|

Audit Fees |

$ | 2,439,012 | $ | 2,486,000 | ||||

|

Audit-Related Fees |

51,880 | 21,000 | ||||||

|

Tax Fees |

107,138 | 31,000 | ||||||

|

All Other Fees |

- | - | ||||||

|

Total |

$ | 2,598,030 | $ | 2,538,000 | ||||

See Item 4 for further information regarding these fees.

NOMINATION AND ELECTION OF DIRECTORS

(ITEM 1)

The Bylaws of the Company provide that the Board of Directors shall consist of a maximum of 15 directors, with the exact number of directors being established by action of the Board taken from time to time. The Board of Directors has set the current number of directors at ten.

In the event that any nominee for director withdraws or for any reason is not able to serve as a director, each Proxy that is properly executed and returned will be voted for such other person as may be designated as a substitute nominee by the Board of Directors. Each nominee is an incumbent director standing for re-election. Each nominee has consented to being named herein and to continue serving as a director, if re-elected. The term of office for each director continues until the next annual meeting of shareholders and until his or her successor, if there is to be one, has been elected and has qualified.

Board Skills Matrix

The matrix below summarizes certain of the key experience, skills and attributes that our director nominees bring to the Board to enable the effective oversight of our Company and execution of our business strategy. This matrix highlights the depth and breadth of the skills and experience of our director nominees. Additional details regarding each director nominee’s skills, experience and background are set forth in the individual biographies that follow.

|

Experience, skills and Attributes |

Burke |

Gibson |

Hendrix |

Hurd |

Kennedy |

Keough |

Kilbane |

Kohler |

Marcus |

O’Brien |

|

C-Suite Executive Management |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ | |

|

Industry Knowledge |

✔ |

✔ |

✔ |

|||||||

|

Accounting & Finance |

✔ |

✔ |

✔ |

✔ |

||||||

|

International Business |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

||

|

Strategy Development |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

|

Mergers & Acquisitions |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|||

|

Sales & Marketing |

✔ |

✔ |

✔ |

✔ |

✔ |

|||||

|

Environmental Sustainability |

✔ |

✔ |

✔ |

✔ |

||||||

|

Corporate Governance & Risk Management |

✔ |

✔ |

✔ |

Certain information relating to each nominee proposed by the Board is set forth below. Under our Corporate Governance Guidelines, directors are required to submit an offer of resignation upon experiencing a job change.

|

Experience: Since 1997, Mr. Burke has been Chief Executive Officer of Trek Bicycle Corporation, one of the world’s largest manufacturers of bicycles, and a company with a mission to help the world use the bicycle as a simple solution to complex problems. He served as chairman of President George W. Bush’s President’s Council on Physical Fitness & Sports and is a founding board member of the Bikes Belong Coalition. Mr. Burke also serves on the board of Trek Bicycle Corporation.

|

|

John P. Burke |

Qualifications and skills: Executive level business experience at a manufacturing company that is focused primarily on sales in the consumer channel and with an emphasis on sustainability and innovation. |

|

Age: 62 Director since 2013

Chief Executive Officer, Trek Bicycle Corporation |

|

|

Experience: Since January 2024, Mr. Gibson has been an Operating Partner with Pritzker Private Capital. From June 2021 to March 2023, he served as the Chief Executive Officer and as a director of BlueLinx Holdings, Inc. (NYSE: BXC), a leading wholesale distributor of building and industrial products in the U.S. Prior to joining BlueLinx, he was the Chief Commercial Officer for SPX FLOW, Inc., a leading global provider of process solutions and components across a variety of sanitary and industrial market applications. Previously, he served as President, Food & Beverage and Industrial Segments (May 2019 to May 2020) and President, Food & Beverage Segment (June 2016 to May 2019) for SPX FLOW. Prior to joining SPX FLOW, Mr. Gibson spent 11 years at HVAC manufacturer Ingersoll Rand. |

|

Dwight Gibson |

Qualifications and skills: Mr. Gibson brings to the Board experience in driving growth for purpose-driven global manufacturing companies, particularly in the areas of sales, operations, strategy and executive management. |

|

Age: 49 Director since 2019

Operating Partner, Pritzker Private Capital |

|

|

Experience: Mr. Hendrix joined the Company in 1983 after having worked previously for a national accounting firm. He was promoted to Treasurer of the Company in 1984, Chief Financial Officer in 1985, Vice President-Finance in 1986, Senior Vice President-Finance in 1995, Executive Vice President in 2000, and President and Chief Executive Officer in July 2001. He was elected to the Board in October 1996, and served as Chairman of the Board from October 2011 to March 2024. In March 2017, Mr. Hendrix retired from the role of Chief Executive Officer. In January 2020, Mr. Hendrix was reappointed as President and Chief Executive Officer of the Company. Mr. Hendrix again retired from the role of Chief Executive Officer in April 2022. Mr. Hendrix has served as a director of cabinet maker American Woodmark Corporation (NASDAQ: AMWD) since May 2005. |

|

Daniel T. Hendrix |

Qualifications and skills: Knowledge extending to virtually all aspects of the Company’s business, with a particular emphasis on strategic planning and financial matters, giving him a unique understanding of our strategies and operations. His tenure provides consistent leadership to the Board and facilitates the interrelationship between the Board and the Company’s executive leadership team. |

|

Age: 69 Director since 1996

Former CEO and Former Chairman of the Board, Interface, Inc. |

|

Experience: Ms. Hurd was appointed as the Company’s President and Chief Executive Officer in April 2022. From 2019 to 2022, Ms. Hurd served as Segment President, Learning and Development at global consumer goods company Newell Brands Inc., leading its Baby and Writing businesses. Previously, Ms. Hurd was the Division Chief Executive Officer for Newell Brands’ Writing division starting in February 2018. From 2016 to February 2018, she served as Chief Executive Officer of Newell Brands’ Baby division. From May 2014 until 2016, Ms. Hurd was President of the Baby and Parenting division at Newell Brands, where she oversaw the Calphalon, Goody, and Rubbermaid consumer brands. From 2012 to 2014, Ms. Hurd was Vice President, Global Development for Newell Brands, leading both Marketing and Research & Development for the Graco, Aprica, and Teutonia brands globally. Since August 2021, Ms. Hurd also has served on the board of directors of RV manufacturer Thor Industries, Inc. (NYSE: THO). |

|

Laurel M. Hurd |

Qualifications and skills: Extensive executive level experience in sales management, product development, strategy and brand stewardship in both the consumer-packaged goods and the consumer durables sectors. |

|

Age: 54 Director since 2022

President and Chief Executive Officer, Interface, Inc. |

|

|

Experience: Mr. Kennedy is the Chairman Emeritus of real estate development company Joseph P. Kennedy Enterprises, Inc., and is a Managing Member of real estate development company Wolf Point Management LLC. He has served on the board of trustees of Ariel Mutual Funds since 1994, and served on the board of directors of Knoll, Inc. (a leading designer and manufacturer of branded office furniture and textiles) from 2014 to 2021. Mr. Kennedy also serves on the boards of two non-profit organizations and one charitable foundation. Effective March 13, 2024, Mr. Kennedy was elected Chairman of the Board. |

|

Christopher G. Kennedy |

Qualifications and skills: Broad understanding of the fundamentals of our business, having managed more than 10 million square feet of commercial real estate and developed thousands of multi-family residential units, and currently oversees, on behalf of the Kennedy family, the billion-dollar Wolf Point real estate development in Chicago. Insight into our industry sector in his former role as the chief executive of one of the leading tradeshow producers in North America gave him responsibility for industry events that are critical to the go-to-market strategy for the Company. His contacts with leading architectural and design firms, as well as the commercial real estate sector, require engagement in submarkets that are important to our operations. |

|

Age: 60 Director since 2000

Chairman of the Board

Chairman Emeritus, Joseph P. Kennedy Enterprises, Inc. |

|

|

Experience: Mr. Keough serves as Chairman and Chief Executive Officer of Wood Partners. Wood Partners is one of the nation’s largest multi-family residential real estate companies. Prior to serving as Chief Executive Officer, he served as both Chief Financial Officer and President of Wood Partners. Mr. Keough began his career in consulting, and was a Principal at The Boston Consulting Group, an international strategic consulting firm, and later served as Chief Operating Officer of Fuqua Capital, the vertically integrated family office of the Fuqua family. He currently serves on the board of home builder Meritage Home Corporation (NYSE: MTH), and one private company. |

|

Joseph Keough |

Qualifications and skills: Extensive executive level experience in the multi-family residential building industry, including leadership in the areas of finance, accounting, capital markets, real estate development, strategy and operations management. |

|

Age: 54 Director since 2019

Chairman and Chief Executive Officer, Wood Partners |

|

Experience: Ms. Kilbane retired in 2017 as Senior Vice President of The Sherwin-Williams Company, a Fortune 500 global leader in paints and coatings. She joined Sherwin-Williams in 2013 as Senior Vice President, General Counsel and Secretary. Prior to that, Ms. Kilbane was Senior Vice President and General Counsel from 2003 to 2012 at American Greetings Corporation, one of the world’s largest manufacturers of social expression products. From 1987 to 2003, she was a partner in the general business group at Baker & Hostetler LLP in Cleveland, Ohio. Ms. Kilbane is a director of The Andersons, Inc. (NASDAQ: ANDE) (where she also serves as lead independent director), a Fortune 500 diversified agribusiness company in the grain, ethanol, plant nutrient, and rail sectors, and The Davey Tree Expert Company, a provider of residential and commercial tree care services. She also is a member of the board of directors of the Cleveland Clinic Foundation. |

|

Catherine M. Kilbane |

Qualifications and skills: Over thirty years of experience in corporate law, extensive experience in mergers and acquisitions, including large, multinational transactions, a solid understanding of ensuring shareholder value through her fourteen years of experience with two publicly traded companies and board member experience with for-profit and non-profit organizations. |

|

Age: 60 Director since 2018

Retired Senior Vice President and General Counsel, The Sherwin-Williams Company |

|

|

Experience: Since 2015, Mr. Kohler has served as the President and Chief Executive Officer for Kohler Co., a manufacturer of kitchen and bath products, interior furnishings, engines and power generation systems, and an owner and operator of golf and resort destinations. In 2022, he became Chair of Kohler. His previous positions at Kohler include President and Chief Operating Officer (2009-2015), Executive Vice President (2007-2009) and Group President of the Kitchen and Bath Group (1999-2007). He has served as a member of the board of Kohler Co. since 1999, and also is a director of ceramic tile and natural stone manufacturer and distributor Internacional de Cerámica, S.A.B. de C.V., a public company traded on the Mexican Stock Market. Mr. Kohler also serves as a director of the non-profit corporation Green Bay Packers, Inc. |

|

K. David Kohler |

Qualifications and skills: Extensive business experience from his service in executive positions at a manufacturing company with international operations and distribution into both commercial and consumer channels. |

|

Age: 57 Director since 2006

Chair and Chief Executive Officer, Kohler Co. |

|

Experience: Ms. Marcus serves as the Co-CEO (since October 2023) and Chief Operating Officer (since 2014) of PGIM Real Estate, one of the world’s largest global real estate investment managers and a major profit center of PGIM, the global asset management business of Prudential Financial, Inc. (NYSE: PRU). She is responsible for global strategy and oversees PGIM Real Estate’s business and investment operations globally. Prior to assuming her current roles, Ms. Marcus held several positions with PGIM Real Estate, including head of its U.S. equity business (2014-2023) and senior portfolio manager for its flagship core equity real estate fund (2011-2014). She is also a member of the board of directors for Skanska AB (Nasdaq Stockholm: SKA B), the multinational construction company. |

|

Catherine Marcus |

Qualifications and skills: Extensive experience in the commercial real estate industry and a deep understanding of the corporate office segment, which is a critical area of focus and growth for Interface. She also brings years of global operating experience, understanding how to motivate and lead local teams while also driving global efficiency and consistency. |

|

Age: 58 Director since 2023

Co-CEO and Chief Operating Officer, PGIM Real Estate |

|

|

Experience: In May 2022, Mr. O’Brien retired from the position of Deputy Managing Partner of Growth & Offerings for Deloitte’s Audit & Assurance business. In that position, which Mr. O’Brien held since August 2019, he oversaw acquisitions, business development, client pursuits, marketing and marketplace intelligence activities. From December 2009 to March 2020, Mr. O’Brien served as Deloitte’s Global and U.S. Real Estate Sector leader, developing and executing Deloitte’s real estate sector strategy and leading its activities in consulting, advisory, tax and audit services for real estate clients. Mr. O’Brien was a partner at Deloitte from 1995 until his retirement, serving in the audit and mergers and acquisitions areas. |

|

Robert T. O’Brien |

Qualifications and skills: Over 35 years of experience assisting public and privately held real estate, private equity, hospitality and technology companies execute transactions, grow their businesses, and enhance operations. Extensive experience in accounting and auditing, mergers and acquisitions, and corporate finance, as well as financial reporting, internal control, regulatory, risk, leadership succession and corporate governance best practices. Mr. O’Brien is also a certified public accountant. |

|

Age: 62 Director since 2022

Retired Deputy Managing Partner of Growth & Offerings, Deloitte & Touche LLP |

Vote Required and Recommendation of Board

Under the Company’s Bylaws, election of each of the nominees requires a plurality of the votes cast by the Company’s outstanding Common Stock entitled to vote and represented (in person or by proxy) at the meeting. As noted below, however, in an uncontested election, any nominee who does not receive a majority affirmative vote must submit a resignation (which may be conditional) to the Board or its Chair. THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE ELECTION OF EACH OF THE NOMINEES LISTED ABOVE, AND PROXIES EXECUTED AND RETURNED OR VOTED BY TELEPHONE OR INTERNET WILL BE VOTED FOR EACH OF THE NOMINEES UNLESS CONTRARY INSTRUCTIONS ARE INDICATED.

For each director, the Board makes a determination of whether the director is “independent” under the criteria established by the Nasdaq Stock Market and other governing laws and regulations. In its review of director independence, the Board considers all commercial, banking, consulting, legal, accounting, charitable or other business relationships any director may have with the Company. The current directors are John P. Burke, Dwight Gibson, Daniel T. Hendrix, Laurel M. Hurd, Christopher G. Kennedy, Joseph Keough, Catherine M. Kilbane, K. David Kohler, Catherine Marcus, and Robert T. O’Brien. As a result of its review, the Board has determined that all the current directors, with the exception of Daniel T. Hendrix (who was an employee within the last 3 years) and Laurel M. Hurd (who is an employee), are independent.

Board Leadership Structure

Effective March 13, 2024, we have an independent Chairman and separate Chief Executive Officer. Mr. Kennedy currently serves as Chairman and Ms. Hurd serves as Chief Executive Officer. Prior to March 13, 2024, and for all of 2023, we had a Lead Independent Director (Mr. Kennedy), a Chairman (Mr. Hendrix), and a separate Chief Executive Officer (Ms. Hurd). Because each of our Chairman and Chief Executive Officer were not considered “independent” under applicable standards, the Board had appointed Mr. Kennedy to serve as Lead Independent Director. The specific responsibilities of the Lead Independent Director were as follows:

|

● |

Preside at Executive Sessions. Presides at all meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors. |

|

● |

Call Meetings of Independent Directors. Has the authority to call meetings of the independent directors. |

|

● |

Function as Liaison with the Chairman. Serves as the principal liaison on Board-wide issues between the independent directors, the Chairman, and the Chief Executive Officer. |

|

● |

Participate in Flow of Information to the Board such as Board Meeting Agendas and Schedules. Provides the Chairman and the Chief Executive Officer with input as to meeting agenda items, advises the Chairman and the Chief Executive Officer as to the quality, quantity and timeliness of information sent to the Board, and approves meeting schedules to assure there is sufficient time for discussion of all agenda items. |

|

● |

Recommends Outside Advisors and Consultants. Recommends the retention of outside advisors and consultants who report directly to the Board. |

|

● |

Shareholder Communication. Ensures that he is available, if requested by shareholders and when appropriate, for consultation and direct communication. |

Because the current Chairman of the Board (Mr. Kennedy) is independent, we have not appointed a Lead Independent Director.

Meetings and Committees of the Board

The Board of Directors held six meetings during 2023. All the incumbent directors attended at least 75% of the total number of meetings of the Board and any committees of which he or she was a member.

The independent directors meet in regularly scheduled executive sessions without Mr. Hendrix or members of management present. In 2023, the independent directors met three times in executive session.

The Board of Directors currently has the following standing committees that assist the Board in carrying out its duties: the Executive Committee, the Audit Committee, the Compensation Committee, the Nominating & Governance Committee, and a new Innovation & Sustainability Committee. The following table lists the current members of each committee:

|

Executive Committee |

Audit Committee |

Compensation Committee |

Nominating & Governance Committee |

Innovation & Sustainability Committee |

|

Laurel M. Hurd (Chair) |

Robert T. O’Brien (Chair) |

Catherine M. Kilbane (Chair) |

Christopher G. Kennedy (Chair) |

Daniel T. Hendrix (Chair) |

|

Daniel T. Hendrix |

Joseph Keough |

Dwight Gibson |

John P. Burke |

Catherine M. Kilbane |

|

Christopher G. Kennedy Robert T. O’Brien |

Catherine Marcus |

Joseph Keough |

K. David Kohler |

K. David Kohler Robert T. O’Brien |

Executive Committee. The Executive Committee did not meet during 2023. Except for duties reserved to the other Board committees and for certain other exceptions, the Executive Committee may exercise all the power and authority of the Board of Directors in the management of the business and affairs of the Company.

Audit Committee. The Audit Committee met eight times during 2023. The function of the Audit Committee is to (i) serve as an independent and objective party to review the Company’s financial statements, financial reporting process and internal control system, (ii) review and evaluate the performance of the Company’s Independent Registered Public Accounting Firm, financial management, and internal auditors, and (iii) provide an open avenue of communication among the Company’s Independent Registered Public Accounting Firm, financial management, internal auditors, and the Board. The Board of Directors has determined that all three members of the Audit Committee are “independent” in accordance with applicable law, including the rules and regulations of the SEC and the rules of the Nasdaq Stock Market, and that each of Messrs. Keough and O’Brien is an “audit committee financial expert” as defined by the rules and regulations of the SEC. Ms. Marcus was appointed to the Audit Committee effective March 13, 2024 (replacing Ms. Kilbane), and therefore the Board has not yet made a determination as to whether Ms. Marcus is an “audit committee financial expert”. The Audit Committee operates pursuant to an Audit Committee Charter which was adopted by the Board of Directors and may be viewed on the Investor Relations section of our website, https://investors.interface.com/investor-relations/default.aspx.

Compensation Committee. The Compensation Committee met three times during 2023. The function of the Compensation Committee is to (i) evaluate the performance of the Company’s Chief Executive Officer and other senior executives, (ii) determine compensation arrangements for such executives, (iii) administer the Company’s stock and other incentive plans for key employees, and (iv) review the administration of the Company’s employee benefit plans. The Board of Directors has determined that each member of the Compensation Committee is “independent” in accordance with applicable law, including the rules and regulations of the SEC and the rules of the Nasdaq Stock Market. The Compensation Committee operates pursuant to a Compensation Committee Charter that was adopted by the Board of Directors and may be viewed on the Investor Relations section of our website, https://investors.interface.com/investor-relations/default.aspx. The Compensation Committee’s policies and philosophy are described in more detail below in this Proxy Statement under the heading “Compensation Discussion and Analysis.”

Nominating & Governance Committee. The Nominating & Governance Committee met four times during 2023. The Nominating & Governance Committee assists the Board in establishing qualifications for Board membership and in identifying, evaluating and selecting qualified candidates to be nominated for election to the Board, and monitoring the Company’s activities and practices regarding ESG matters that are significant to the Company. The Nominating & Governance Committee also assists the Board in reviewing and analyzing, and makes recommendations regarding, corporate governance matters, and it also recommends committee assignments for Board members. The Board of Directors has determined that each member of the Nominating & Governance Committee is “independent” in accordance with applicable law, including the rules of the Nasdaq Stock Market. The Nominating & Governance Committee operates pursuant to a Nominating & Governance Committee Charter that was adopted by the Board of Directors and may be viewed on the Investor Relations section of our website, https://investors.interface.com/investor-relations/default.aspx.

Innovation & Sustainability Committee. Effective March 13, 2024, the Board of Directors established a new Innovation & Sustainability Committee. The Company has a long history of a strong and enduring commitment to innovation and sustainability, and the Board believes these core strengths are critical to the Company’s future success and value creation. The new Innovation & Sustainability Committee will focus on accelerating the Company’s innovation and sustainability initiatives, and institutionalizing its commitments in these areas to ensure that they endure. The charter for the new committee is currently under development.

Nominations for Board Service

In the event of a vacancy on the Board, the Nominating & Governance Committee develops a pool of potential director candidates for consideration. The Nominating & Governance Committee seeks candidates for election and appointment with excellent decision-making ability, valuable and varied business experience and knowledge, and impeccable personal integrity and reputations. The Committee does not have a specific diversity policy, but considers diversity of race, ethnicity, gender, age, cultural background and professional experience in evaluating candidates for Board membership, in an effort to obtain a variety of viewpoints in the Board’s proceedings. The Nominating & Governance Committee considers whether candidates are free of constraints or conflicts which might interfere with the exercise of independent judgment regarding the types of matters likely to come before the Board, and have the time required for preparation, participation and attendance at Board and committee meetings. Other factors considered by the Nominating & Governance Committee in identifying and selecting candidates include the needs of the Company and the range of talent and experience already represented on the Board. The Nominating & Governance Committee solicits suggestions from other members of the Board, from Company management, and occasionally from outside search firms, regarding persons to be considered as possible nominees. Our newest director Ms. Marcus was recommended by a third-party search firm. Shareholders who wish the Nominating & Governance Committee to consider their recommendations for director candidates should submit their recommendations in writing to the Nominating & Governance Committee, in care of the office of the Chairman of the Board, Interface, Inc., 1280 West Peachtree Street NW, Atlanta, GA 30309. Recommendations should include the information which would be required for a “Shareholder Proposal” as set forth in Article II, Section 9 of the Company’s Bylaws. Director candidates who are recommended by shareholders in accordance with these procedures will be evaluated by the Nominating & Governance Committee in the same manner as director candidates recommended by the Company’s directors, management and outside search firms.

Majority Vote Resignation Policy for Director Elections

Pursuant to governing law and documents, including the Company’s Bylaws as noted above, in most cases the Company's directors are elected by a plurality of the votes cast. Although nominees who receive the most votes for the available positions will generally continue to be duly elected, the Board of Directors has adopted a resignation policy applicable to nominees who fail to receive the affirmative vote of a majority of the votes cast in an uncontested election for directors. This policy does not alter the applicable legal standards. The policy requires that a nominee who does not receive a majority affirmative vote in an uncontested election promptly will tender, to the Board or its Chair, their resignation from the Board and committees on which the director serves. The resignation may be conditioned upon Board acceptance. If it is not so conditioned, the resignation must specify that it is effective immediately on delivery.

A “majority affirmative vote” means that the votes cast “for” a nominee’s election exceed those voted “withhold,” with broker and other non-votes not being considered “votes cast.” You have been provided with options to vote “for” or “withhold” from each Director nominee. However, neither a “withhold” vote nor declining to vote for directors (assuming the presence of a quorum) affects whether a director nominee in an uncontested election is legally elected under the plurality vote standard (provided such nominee receives at least one “for” vote). But a “withhold” vote is considered in determining whether a director who is legally elected has received a “majority affirmative vote” for purposes of the resignation policy.

The Nominating & Governance Committee of the Board will consider any resignation conditioned upon Board acceptance, including any information provided by the Director, and, within 60 days of the shareholder meeting at which the Director failed to receive a majority affirmative vote, will recommend to the full Board what action to take on the Director’s resignation. The Nominating & Governance Committee may recommend, among other things, acceptance or rejection of the resignation, delayed acceptance pending the recruitment and election of a new director or rejection of the resignation in order to address the underlying reasons for the Director’s failure to receive the majority affirmative vote of the shareholders. The policy provides for the Board to act on the Nominating & Governance Committee’s recommendation within 90 days following the shareholder meeting.

In considering a conditional resignation, the Nominating & Governance Committee and the Board may consider those factors it deems relevant to its recommendation, including but not limited to the underlying reasons for the failure of the Director to receive a majority affirmative vote, the tenure and qualifications of the Director, the Director’s past and expected future contributions, other policies and the overall composition of the Board, including whether accepting the resignation would cause the Company to fail to meet legal or stock market requirements.

Following the Board’s decision, the Company will publicly announce the Board’s decision regarding any conditional resignation. A resigning Director cannot participate in committee or Board decisions regarding their resignation, except in certain cases where multiple directors have failed to receive majority affirmative votes, which circumstances are described in the full policy posted on the Investor Relations section of our website, https://investors.interface.com/investor-relations/default.aspx. The preceding summary of the policy is qualified in its entirety by reference to the full policy.

Shareholder Outreach Programs

In each of the past three years, we have conducted one or more shareholder outreach programs per year, with the most recent taking place in late 2023 through early 2024. In that program, we requested conference calls with each of our top 25 shareholders, representing approximately 69% of outstanding shares, and we held conference calls with each shareholder that accepted our request, representing approximately 21% of outstanding shares. During the outreach program, which was led by the Company’s Chief Executive Officer, we discussed with shareholders various proxy and Company related issues and areas of shareholder interest – such as the Company’s corporate governance practices, executive compensation philosophy and practices, and ESG initiatives.

Enterprise Risk Management

The Company maintains a formal and robust Enterprise Risk Management (“ERM”) program. The Company’s ERM program is based on the Enterprise Risk Management – Integrated Framework defined by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”), although tailored to the Company’s specific risk profile and needs. The Company’s ERM program is managed by a risk committee comprised of executive officers and other senior managers, is administered by the Company’s Director of Internal Audit, and is overseen by the Audit Committee pursuant to authority delegated by the Board of Directors in the Audit Committee Charter. The Company’s program includes a continuous process of identifying, assessing, addressing, monitoring and reporting on the risks that pose the greatest threats to the Company. As part of that process, the management risk committee conducts an annual survey of the Company’s top global leaders and its Board of Directors to assess the likelihood, potential impact and velocity of a large number of potential risks and to help identify emerging risks. The management risk committee meets quarterly to monitor the key identified risks and how they are being addressed, which may include, depending on the circumstances, mitigating, sharing, accepting or avoiding the risk. The management risk committee and Director of Internal Audit report to the Audit Committee quarterly on significant developments and key elements of the program.

In addition, the Board receives quarterly reports on other elements of risk that may potentially affect the Company, as identified and presented by management. The Board also assists in the Company’s risk oversight through its various committees described above. For example, the Audit Committee assists in overseeing the specific risks that relate to the Company’s financial statements, financial reporting process and internal control system. In that regard, the Company’s Director of Internal Audit and outside auditors report directly to the Audit Committee. The Nominating & Governance Committee assists in overseeing risk related to the Company’s corporate governance practices as well as the performance of individual Board members and committees, while the Compensation Committee assists in overseeing risk as it relates to the Company’s executive compensation program and practices.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines that provide the framework for the governance of the Company. Our Corporate Governance Guidelines are available on the Investor Relations section of our website, https://investors.interface.com/investor-relations/default.aspx and will also be made available to shareholders without charge upon request in writing to our corporate Secretary at Interface, Inc., 1280 West Peachtree Street NW, Atlanta, Georgia 30309.

Code of Conduct

The Board has adopted a Code of Conduct that applies to all of our directors, officers and employees, including our Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer. The Code is publicly available on the Investor Relations section of our website, https://investors.interface.com/investor-relations/default.aspx and will also be made available without charge to any person upon request in writing to our corporate Secretary at Interface, Inc., 1280 West Peachtree Street NW, Atlanta, Georgia 30309. We intend to disclose amendments to, or waivers from, provisions of the Code that apply to any director or principal executive, financial or accounting officers on our website at www.interface.com, in lieu of disclosing such matters in Current Reports on Form 8-K.

PRINCIPAL SHAREHOLDERS AND MANAGEMENT STOCK OWNERSHIP

The following table sets forth, as of March 15, 2024 (unless otherwise indicated), beneficial ownership of the Company’s Common Stock by: (i) each person, including any “group” as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934, known by the Company to be the beneficial owner of more than 5% of any class of the Company’s voting securities, (ii) each director and nominee for director, (iii) each person who served as the Company’s Chief Executive Officer or Chief Financial Officer, and the next three most highly compensated executive officers, during 2023 (the “Named Executive Officers”), and (iv) all executive officers and directors of the Company as a group. Due to the nature of the awards, performance shares and restricted stock units awarded to the Company’s executive officers are not included in beneficial ownership of Common Stock. Unless otherwise noted, the business address for each beneficial owner is the Company’s corporate headquarters located at 1280 West Peachtree Street NW, Atlanta, Georgia 30309.

|

Beneficial Owner (and Business Address of 5% Owners) |

Title of Class |

Amount and Nature of Beneficial Ownership |

Percent of Class(1) |

|||||||

|

BlackRock, Inc. 55 East 52nd Street New York, New York 10055 |

Common Stock |

9,736,333 | (2)(3) | 16.7 | % | |||||

|

Frontier Capital Management Co., LLC 99 Summer Street Boston, Massachusetts 02110 |

Common Stock |

3,037,957 | (2)(4) | 5.2 | % | |||||

|

The Vanguard Group, Inc. 100 Vanguard Boulevard Malvern, Pennsylvania 19355 |

Common Stock |

5,255,552 | (2)(5) | 9.0 | % | |||||

|

Pzena Investment Management, LLC 320 Park Avenue, 8th Floor New York, New York 10022 |

Common Stock |

3,490,324 | (2)(6) | 6.0 | % | |||||

|

John P. Burke |

Common Stock |

73,103 | (7) | * | ||||||

|

David B. Foshee |

Common Stock |

161,372 | (8) | * | ||||||

|

Dwight Gibson |

Common Stock |

50,070 | (9) | * | ||||||

|

Bruce A. Hausmann |

Common Stock |

181,699 | (10) | * | ||||||

|

Daniel T. Hendrix |

Common Stock |

306,219 | (11) | * | ||||||

|

Laurel M. Hurd |

Common Stock |

129,422 | (12) | * | ||||||

|

Christopher G. Kennedy |

Common Stock |

182,826 | (13) | * | ||||||

|

Joseph Keough |

Common Stock |

50,070 | (14) | * | ||||||

|

Catherine M. Kilbane |

Common Stock |

54,620 | (15) | * | ||||||

|

K. David Kohler |

Common Stock |

99,103 | (16) | * | ||||||

|

Catherine Marcus |

Common Stock |

4,799 | (17) | * | ||||||

|

Robert T. O’Brien |

Common Stock |

23,050 | (18) | * | ||||||

|

James L. Poppens |

Common Stock |

76,284 | (19) | * | ||||||

|

Nigel Stansfield |

Common Stock |

142,284 | (20) | * | ||||||

|

All executive officers and directors (14 persons) |

Common Stock |

1,534,921 | (21) | 2.6 | % | |||||

|

* |

Less than 1%. |

|

(1) |

Percent of class is based on 58,365,226 shares outstanding on March 15, 2024, and is calculated assuming that the beneficial owner or group of beneficial owners has exercised any conversion rights, options or other rights to subscribe held by such beneficial owner that are exercisable within 60 days of March 15, 2024, and that no other conversion rights, options or rights to subscribe have been exercised by anyone else. |

|

(2) |

Based upon information included in statements as of December 31, 2023, provided to the Company and filed with the SEC by such beneficial owners. |

|

(3) |

According to BlackRock, various persons have the right to receive, or the power to direct the receipt of, dividends from or the proceeds from the sale of such shares, and only one such person’s (iShares Core S&P Small-Cap ETF) interests in such shares exceeds 5% of the total outstanding shares of Common Stock. It states that it has sole voting power with respect to 9,544,204 of such shares, and sole dispositive power with respect to all such shares. |

|

(4) |

Frontier Capital Management Co., LLC is an investment advisor, and states that it has sole voting power with respect to 2,193,413 of such shares and sole dispositive power with respect to all such shares. |

|

(5) |

The Vanguard Group, Inc. is an investment advisor, and states that it has sole voting power with respect to none of the shares, shared voting power with respect to 43,763 of such shares, sole dispositive power with respect to 5,159,767 of such shares, and shared dispositive power with respect to 95,785 of such shares. It further states that its clients, including registered investment companies and other managed accounts, have the right to receive, or the power to direct the receipt of, dividends from, or the proceeds from the sale of, the reported securities, and that no one other person’s interest in the reported securities is more than five percent of the class of stock. |

|

(6) |

Pzena Investment Management, LLC is an investment advisor, and states that it has sole voting power with respect to 2,904,688 of such shares, and sole dispositive power with respect to all such shares. It further states that its clients have the right to receive and the ultimate power to direct the receipt of dividends from, or the proceeds of sale of, the reported securities, and that no interest of any one of its clients relates to more than five percent of the class of stock. |

|

(7) |

Includes 14,608 restricted shares. |

|

(8) |

Includes 45,556 restricted shares. |

|

(9) |

Includes 14,608 restricted shares. |

|

(10) |

Includes 64,787 restricted shares. |

|

(11) |

Includes 35,072 shares held indirectly by family trusts. |

|

(12) |

Includes 69,589 restricted shares. |

|

(13) |

Includes 14,608 restricted shares. Mr. Kennedy serves on the Board of Trustees of Ariel Mutual Funds, for which Ariel Investments, LLC serves as investment advisor and performs services which include buying and selling securities on behalf of the Ariel Mutual Funds. Mr. Kennedy disclaims beneficial ownership of all shares held by Ariel Investments, LLC as investment advisor for Ariel Mutual Funds. |

|

(14) |

Includes 14,608 restricted shares. |

|

(15) |

Includes 14,608 restricted shares. |

|

(16) |

Includes 14,608 restricted shares. |

|

(17) |

All of such shares are restricted shares. |

|

(18) |

Includes 14,608 restricted shares. |

|

(19) |

Includes 44,487 restricted shares. |

|

(20) |

Includes 60,612 restricted shares. |

|

(21) |

Includes 392,086 restricted shares. |

APPROVAL OF EXECUTIVE COMPENSATION

(ITEM 2)

The Company is asking its shareholders to vote, on an advisory basis, to approve the compensation of its Named Executive Officers as described in this Proxy Statement. This proposal, commonly known as a “say-on-pay” proposal, gives the Company’s shareholders the opportunity to express their views on the compensation of the Company’s Named Executive Officers.

Our executive compensation program is designed to attract, reward and retain key employees, including our Named Executive Officers, who are critical to the Company’s long-term success. Shareholders are urged to read the “Compensation Discussion and Analysis” and “Executive Compensation” sections of this Proxy Statement for greater detail about the Company’s executive compensation programs, including information about the fiscal year 2023 compensation of the Named Executive Officers.

The Company is asking the shareholders to indicate their support for the compensation of the Company’s Named Executive Officers as described in this Proxy Statement by voting in favor of the following resolution:

“RESOLVED, that the shareholders approve, on an advisory, non-binding basis, the compensation paid to the Company’s Named Executive Officers as disclosed in the “Compensation Discussion and Analysis” and “Executive Compensation” sections, including the compensation tables, notes, and narrative in those sections.”

Even though this say-on-pay vote is advisory and therefore will not be binding on the Company, the Compensation Committee and the Board value the opinions of the Company’s shareholders. Accordingly, to the extent there is a significant vote against the compensation of the Named Executive Officers, the Board will consider the shareholders’ concerns and the Compensation Committee will evaluate what actions may be necessary or appropriate to address those concerns.

You may vote “for,” “against,” or “abstain” from the proposal to approve on an advisory basis the compensation of our Named Executive Officers.

Vote Required and Recommendation of the Board

Under the Company’s Bylaws, the compensation of the Named Executive Officers is approved on an advisory basis if the affirmative votes cast by the holders of the Company’s outstanding shares of Common Stock entitled to vote and represented (in person or by proxy) at the meeting exceed the negative votes. THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE APPROVAL OF EXECUTIVE COMPENSATION, AS DISCLOSED IN THIS PROXY STATEMENT, AND THE PROXY SUBMITTED BY TELEPHONE OR INTERNET OR PROXY CARD WILL BE VOTED IN THIS MANNER UNLESS THE SHAREHOLDER SUBMITTING THE PROXY SPECIFICALLY VOTES TO THE CONTRARY (OR ABSTAINS).

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis describes the compensation program for the Company’s Named Executive Officers. For 2023, these individuals were:

|

Name |

Title |

|

Laurel M. Hurd |

President and Chief Executive Officer

|

|

David B. Foshee |

Vice President, General Counsel and Secretary

|

|

Bruce A. Hausmann |

Vice President and Chief Financial Officer

|

|

James L. Poppens |

Vice President and Chief Commercial Officer

|

|

Nigel Stansfield |

Vice President and Chief Innovation & Sustainability Officer

|

As demonstrated below, the Committee believes that the Company’s performance-based compensation is appropriately designed to pay for performance, and that the structure strikes a proper balance among motivating management and rewarding strong management performance, while also accounting for macroeconomic uncertainty, the continued impact of the COVID-19 pandemic in certain geographies, as well as the regular cyclicality of our industry that is outside of management’s control.

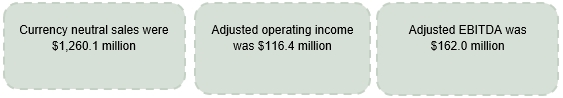

Below are the Company’s 2023 financial data that most significantly impacted our Executive Compensation Program. The non-GAAP financial measures of currency neutral sales, adjusted operating income and adjusted EBITDA were utilized as 2023 performance criteria for our annual bonus plan and long-term equity incentives as discussed further below.

(Note: Please see Appendix A for a reconciliation of non-GAAP measures to the most directly comparable GAAP measures and an explanation of why we believe non-GAAP measures provide useful information to shareholders and the additional purposes for which we use non-GAAP measures.)

Overall Philosophy and Objectives

The Company’s compensation program is designed in a manner intended to both attract and retain a highly qualified, motivated and engaged management team whose focus is on enhancing shareholder value. The Company believes a straightforward program that is readily understood and endorsed by its participants best serves these goals, and has constructed a program that contains (1) multiple financial elements, (2) clear and definitive targets, (3) challenging but attainable objectives, and (4) specified performance metrics. More specifically, the objectives of the Company’s management compensation program include:

Program Design and Administration

The Compensation Committee of the Board of Directors, which is composed entirely of independent directors, has developed and administers the Company’s executive pay program to provide compensation commensurate with the level of financial performance achieved, the responsibilities undertaken by the executives, and the compensation packages offered by comparable companies. The program currently consists of four principal components, each of which is designed to drive a specific behavioral focus, which in turn helps to provide specific benefits to the Company:

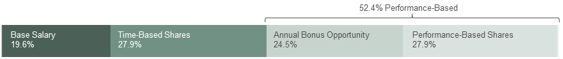

The Company strives to structure various elements of these program components so that a large portion of executive compensation is directly linked to advancing the Company’s financial performance and the interests of shareholders. For 2023, those elements were substantially performance-based, as shown below (and based on target level achievement):

Laurel Hurd, President and CEO

Bruce Hausmann, VP and CFO

James Poppens, VP

Nigel Stansfield, VP

David Foshee, VP and General Counsel

Compensation Decision-Making

The Committee establishes base salaries for the executive officers, including the Named Executive Officers listed in the “Summary Compensation Table” included in this Proxy Statement. The Committee also administers the annual bonus program, the long-term incentive program, retirement benefits, deferred compensation arrangements, and, when applicable, special incentive programs.

The Company benchmarks its compensation practices against its peer group. In selecting the peer group, the Committee directly engaged Pearl Meyer & Partners, a nationally recognized, independent compensation consultant, to provide input on compensation matters. In 2023, the Company updated the self-determined peer group to exclude Kimball International, Inc., which was acquired in 2023 and no longer trades publicly, and also to incorporate other peer group changes to align with the peer group it now uses to measure executive compensation. In determining its peer group companies, the Company considered various factors, including the potential peer’s industry, business model, size and complexity. The Company chose a peer group that is a better representation of the Company’s size and market capitalization with minimal revenue dispersion, and with companies in similar industries or lines of business or subject to similar economic and business cycles, including companies with a significant international presence that are also focused on sustainability. The updated peer group selected by the Committee is comprised of:

|

ACCO Brands Corporation |

MillerKnoll, Inc. |

|

Apogee Enterprises, Inc. |

PGT Innovations, Inc. |

|

Armstrong World Industries, Inc. |

SP Plus Corporation |

|

Enviri Corporation (formerly Harsco Corporation) |

Steelcase Inc. |

|

Glatfelter Corporation |

Unifi, Inc. |

|

HNI Corporation |

VSE Corporation |

For the past several years, including 2021-2023, Pearl Meyer assisted the Compensation Committee in benchmarking the Company's compensation practices against the peer group. Pearl Meyer performs no other work for the Company. The work of Pearl Meyer for the Compensation Committee to date has not raised any conflict of interest.

The Committee also seeks compensation input from the Company’s Chairman, Chief Executive Officer and Chief Human Resources Officer. In addition, the Committee takes into account publicly available data relating to the compensation practices and policies of other companies within and outside the Company’s industry. Furthermore, the policies and programs described below are subject to change as the Committee deems necessary from time to time to respond to economic conditions, meet competitive standards and serve the objectives of the Company and its shareholders.

Compensation Risk Assessment

The Board, in conjunction with management, has reviewed our compensation policies and practices as generally applicable to our employees and determined that they do not encourage excessive risk or unnecessary risk taking and do not otherwise create risks that are reasonably likely to have a material adverse effect on the Company.

Clawback Policy

Pursuant to Rule 5608 of the Nasdaq Stock Market, and Section 10D of the Securities Exchange Act and Rule 10D-1 thereunder, the Committee has adopted an enhanced Clawback Policy, effective October 2, 2023, which requires the Committee to take such action as it deems necessary to recover reasonably promptly from executive officers certain incentive-based compensation, including both cash and equity, following a restatement of the Company’s financial statements. Pursuant to the Clawback Policy, in the event the Company is required to prepare an accounting restatement due to the Company’s material noncompliance with any financial reporting requirement under the U.S. federal securities laws (an “Accounting Restatement”), regardless of individual fault, the Committee must require the forfeiture or reimbursement, subject to the terms of the Clawback Policy, from any current or former “Covered Executive” (meaning, any officer of the Company covered by Section 16(a) of the Securities Exchange Act) of the Company, any excess incentive-based compensation awarded during the three completed fiscal years immediately preceding the date on which the Company is required to prepare an Accounting Restatement. Excess incentive-based compensation, as defined in the Clawback Policy, essentially means the amount or value of incentive-based compensation granted, earned or vested (“Awarded”) in excess of what would have been Awarded to that Covered Executive based on the Accounting Restatement. The Committee or the Board of Directors shall recover such excess incentive-based compensation unless the Committee determines such recovery would be impracticable pursuant to the terms of the Clawback Policy.

Discussion of Principal Elements of Compensation Program

Base Salaries

The Committee generally strives to set base salaries at the market median (50th percentile) of salaries offered by other employers in our industry and other publicly traded companies with characteristics similar to the Company (size, growth rate, etc.), based, by and large, on information provided by independent third-party advisors while also considering internal equalization policies of the Company. Some of the companies considered from time to time are included in our peer group discussed above.

In addition, the Committee may consider other factors when setting individual salary levels, which may result in salaries somewhat above or below the targeted amount. These factors include the executive’s level of responsibility, achievement of goals and objectives, tenure with the Company, and specific background or experience, as well as external factors such as the availability of talent, the recruiting requirements of the particular situation, general economic conditions, and rates of inflation.

Base salary adjustments for executive officers generally are made (if at all) annually and are dependent on the factors described above. The changes in base salaries for the Named Executive Officers, and the rationale for those changes, are described below.

|

Name |

2022 Base Salary |

2023 Base Salary |

% Change |

Rationale |

|||||||||

|

Laurel Hurd |

$ | 825,000 | $ | 858,000 | 4% |

Merit |

|||||||

|

David Foshee |

$ | 405,000 | $ | 425,000 | 5% |

Merit & Benchmark Alignment |

|||||||

|

Bruce Hausmann |

$ | 500,000 | $ | 520,000 | 4% |

Merit |

|||||||

|

James Poppens |

$ | 425,000 | $ | 468,000 | 10% |

New Role & Benchmark Alignment |

|||||||

|

Nigel Stansfield |

£ | 325,552 | £ | 338,574 | 4% |

Merit |

|||||||

Please see the “Summary Compensation Table” included in this Proxy Statement for the base salaries actually paid to the Named Executive Officers in 2023.

Annual Bonus Opportunities

The Committee administers the shareholder-approved Executive Bonus Plan, which provides bonus opportunities for Company executives. The bonus opportunities provide an incentive for executives to earn cash compensation based on the achievement of important corporate or business unit (division or subsidiary) financial performance. In determining the appropriate bonus opportunities for 2023, the Committee sought to establish potential awards that, when combined with annual salary, place the total overall cash compensation opportunity for the Company’s executives between the 50th and 75th percentile for comparable companies, provided that the performance objectives are substantially achieved.

For 2023, each executive officer of the Company was assigned a bonus potential, expressed as a percentage of base salary. The 2023 bonus potential for each Named Executive Officer is described below.

|

Name |

2023 Bonus Potential (as a percentage of base salary) |

|

Laurel Hurd |

125% |

|

David Foshee |

75% |

|

Bruce Hausmann |

90% |

|

James Poppens |

90% |

|

Nigel Stansfield |

90% |

Actual payouts could range from 0% to 175% of the bonus potential (as described below), depending on the degree to which the established financial objectives were achieved, and are paid on an annual basis approximately 60 days following the end of the year.

In 2023, 100% of the bonus potential for the Chief Executive Officer, Chief Financial Officer and each of the other Named Executive Officers was based on measurable financial objectives. These objectives consisted of adjusted operating income, and currency-neutral sales, and the relative weights assigned to these financial objectives were 85% and 15%, respectively.

For each financial objective, the Committee establishes a threshold amount, a goal amount, and a maximum amount. The threshold amount must be achieved in order for any bonus amount to be earned with respect to that objective. A pro rata bonus amount is earned based upon (i) the degree to which the threshold amount (resulting in a “cut in” payout equal to 25% of the bonus potential for that criterion) is exceeded, up to the goal amount (resulting in a payout equal to 100% of the bonus potential for that criterion), or (ii) the degree to which the goal amount (resulting in a payout equal to 100% of the bonus potential for that criterion) is exceeded, up to the maximum amount (resulting in a payout equal to 175% of the bonus potential for that criterion). The approach to goal setting involves a process of reviewing, among other things, our prior year’s financial performance, our annual operating plan, and our short-term and long-term strategic objectives. We also take into account the need for setting goals that are challenging yet reasonably achievable so as to provide a competitive pay package necessary for the retention of our talent. Given this methodology, the Committee believes that the threshold level, while challenging, is reasonably likely to be achieved in normalized market conditions, the goal amount is achievable with strong management performance, and the maximum amount would encourage and reward outstanding performance.

For example, the Company’s 2023 annual thresholds, goals and maximums were as follows:

|

Criteria |

Weighting |

Threshold |

Goal |

Maximum |

||||||||||||

|

Adjusted Operating Income |

85% | $ | 78,000,000 | $ | 120,000,000 | $ | 138,000,000 | |||||||||

|

Currency-Neutral Sales |

15% | $ | 1,165,016,000 | $ | 1,273,242,000 | $ | 1,317,805,000 | |||||||||