EXHIBIT 13

2019 Annual Report TRANSFORMING OUR BUSINES

2019 Annual Report TRANSFORMING OUR BUSINESS first First Financial Bancorp

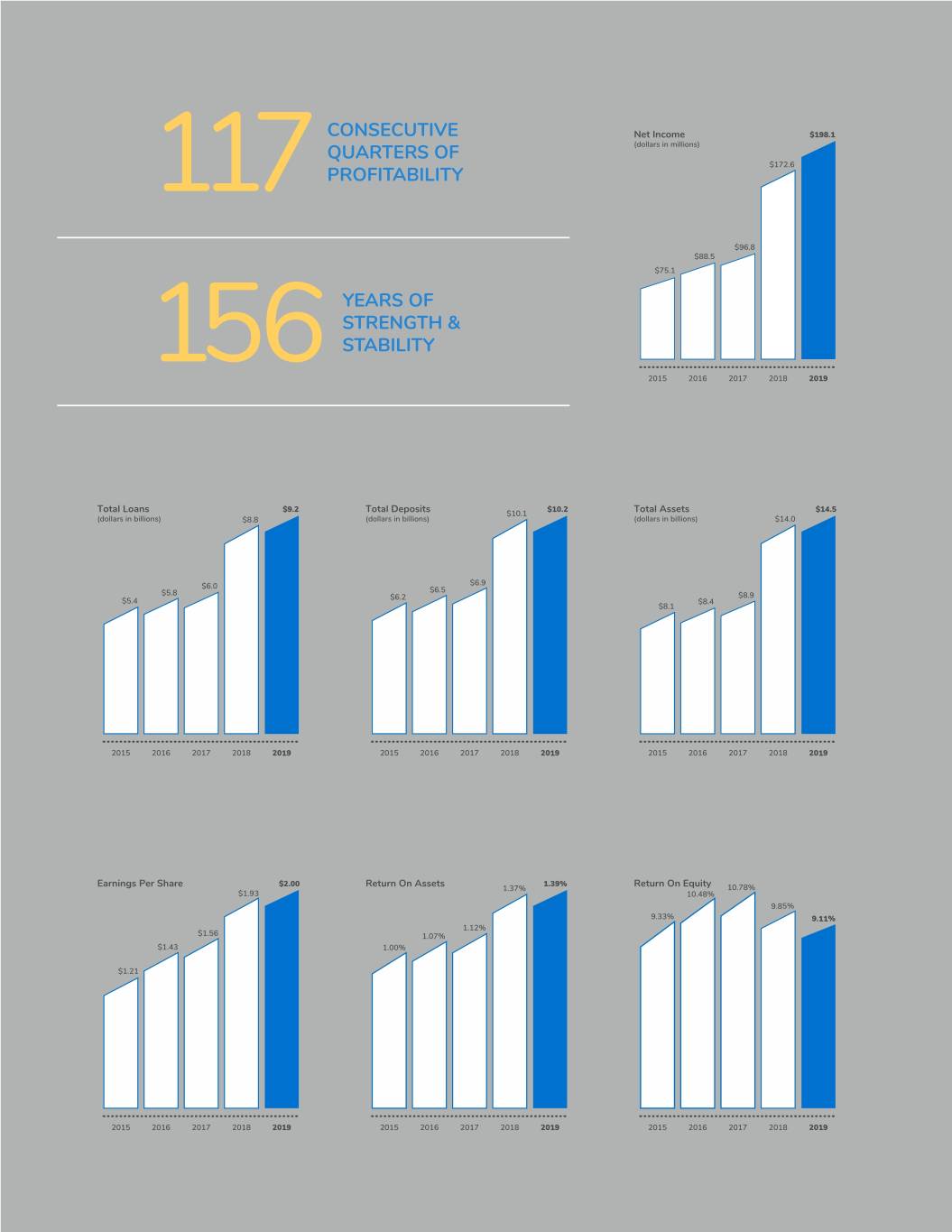

CONSECUTIVE Net Income $198.1 QUARTERS OF (dollars in millions) $172.6 117 PROFITABILITY $96.8 $88.5 $75.1 YEARS OF STRENGTH & STABILITY 156 2015 2016 2017 2018 2019 $9.2 $10.2 $14.5 Total Loans Total Deposits $10.1 Total Assets (dollars in billions) $8.8 (dollars in billions) (dollars in billions) $14.0 $6.0 $6.9 $5.8 $6.5 $6.2 $8.9 $5.4 $8.4 $8.1 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 $2.00 1.39% Earnings Per Share Return On Assets 1.37% Return On Equity 10.78% $1.93 10.48% 9.85% 9.33% 9.11% 1.12% $1.56 1.07% $1.43 1.00% $1.21 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019

Dear Fellow Shareholders, The past year was transformational for First Financial Bancorp. With the completion of the MainSource merger in 2018, First Financial emerged as a $10+ billion company, “ raising our profile within the industry and assuming new we must be in the right responsibilities to shareholders, regulators, and the clients and communities we serve. place at the right time Transformation is never simple. It presents challenges to our with the right advice people, processes, and the products and services we offer. and solutions to help I’m pleased to report that we rose to the challenge and emerged as a stronger bank, better positioned to compete, our clients innovate, and win. 2019 Highlights in technology, and in the social, economic, and political conditions that impact our key stakeholders. First Financial’s 2019 achievements are evidenced by important developments internally, in the services we offer, We must be in the right place at the right time with the and in the ways with which we engage our clients: right advice and solutions to help our clients along their financial journeys. This means understanding the needs of The roll out of our Corporate Strategic Plan, setting clear our clients on an instinctive level. We will immerse ourselves direction for our planning efforts and aligning our people into client segments, working to understand the economic, with the core tenets of our business social, and psychographic nuances of Low and Moderate Investments in key talent, adding high-quality associates in Income, Mass Affluent, and High Net Worth individuals and strategic roles to drive innovation and growth families. Similarly, we continue to develop specialized skills in understanding the specific needs of Corporate, Middle Market, The formation of our Digital Solutions Group, the creation Commercial, and Small Business clients, responding to - and of a three-year digital roadmap, and the rollout of new ultimately anticipating - needs in ways that keep businesses technologies that enable improved online business and moving forward on their journeys. We will take the concept retail mortgage lending capabilities of an advisor to an entirely new level, leveraging data to better understand needs and trends, removing friction, and The acquisition of Bannockburn Global Forex, adding making the First Financial banking experience easier and foreign currency hedging, advising, and trading capabilities more pleasing than any financial relationship our clients have to our specialty services offerings ever had. The opening of our 4th & Vine Innovation Center in Client centric. Ready to engage. Delivering expert advice and Cincinnati, providing a new distribution approach for solutions. This is where we’re going in 2020. This is the next banking services, innovation, and financial wellness stage in First Financial Bank’s transformation. The renovation of our Greensburg Operations Center and Thank you for your continued support. our commitment of $500,000 in support of the capital campaign to expand the Greensburg, IN YMCA with a Decatur County Memorial Hospital wellness facility A $1 million donation to the Cincinnati USA Regional Chamber’s Minority Business Accelerator to help continue the development of sizable minority businesses in the Greater Cincinnati area Financially, 2019 was another successful year for First Financial. The year was highlighted by record earnings, top- quartile returns, and shareholder-focused capital actions despite headwinds from Fed rate cuts, legislatively mandated reductions in interchange revenue, and increased credit costs. This success is a direct reflection of the resolve and dedication of our associates, who continue to deliver unparalleled service to our clients and return to our shareholders. What’s Ahead In 2020 With a strong foundation firmly established, we move forward in 2020 with specific execution plans that continue our transformation. We will adapt to changes in our markets, Archie M. Brown President & Chief Executive Officer

First Financial Bancorp 2019 Annual Report 1

Leadership Senior Management Archie M. Brown John M. Gavigan Amanda N. Neeley President and Chief Executive Officer Chief Operating Officer Chief Strategy Officer James M. Anderson William R. Harrod James R. Shank Chief Financial Officer Chief Credit Officer Chief Internal Auditor Scott T. Crawley Andrew K. Hauck Karen B. Woods Corporate Controller and Chief Commercial Banking Officer General Counsel and Principal Accounting Officer Chief Risk Officer Catherine M. Myers Richard S. Dennen Chief Consumer Banking Officer President, Oak Street Funding Board of Directors Claude E. Davis Erin P. Hoeflinger Board Chair, First Financial Bancorp Senior Vice President, Business Strategy and Execution Managing Director Aetna Brixey and Meyer Capital Susan L. Knust J. Wickliffe Ach Owner and President Lead Independent Director Omega Warehouse Services Board of Directors of First Financial Bancorp William J. Kramer Kathleen L. Bardwell Vice President of Operations Senior Vice President, Chief Compliance Officer Valco Companies, Inc. STERIS Corporation John T. Neighbours William G. Barron General Counsel Chairman and President AmeriQual Group Holdings William G. Barron Enterprises Thomas M. O’Brien Vincent A. Berta Senior Advisor President and Managing Director Boston Consulting Group Covington Capital, LLC Richard E. Olszewski Cynthia O. Booth Owner/Operator President and Chief Executive Officer 7 Eleven Food Stores COBCO Enterprises, LLC Maribeth S. Rahe Archie M. Brown President and Chief Executive Officer President and Chief Executive Officer Fort Washington Investment Advisors, Inc. First Financial Bancorp and First Financial Bank Corinne R. Finnerty Principal McConnell Finnerty PC

2 First Financial Bancorp 2019 Annual Report

FINANCIAL HIGHLIGHTS | |||||||||||

(Dollars in thousands, except per share data) | 2019 | 2018 | % Change | ||||||||

Earnings | |||||||||||

Net interest income | $ | 484,254 | $ | 449,235 | 7.8 | % | |||||

Net income | 198,075 | 172,595 | 14.8 | % | |||||||

Per Share | |||||||||||

Net income per common share-basic | $ | 2.01 | $ | 1.95 | 3.1 | % | |||||

Net income per common share-diluted | 2.00 | 1.93 | 3.6 | % | |||||||

Cash dividends declared per common share | 0.90 | 0.78 | 15.4 | % | |||||||

Tangible book value per common share (end of year) | 12.42 | 11.72 | 6.0 | % | |||||||

Market price (end of year) | 25.44 | 23.72 | 7.3 | % | |||||||

Balance Sheet - End of Year | |||||||||||

Total assets | $ | 14,511,625 | $ | 13,986,660 | 3.8 | % | |||||

Loans | 9,201,665 | 8,824,214 | 4.3 | % | |||||||

Investment securities | 3,119,966 | 3,324,243 | (6.1 | )% | |||||||

Deposits | 10,210,229 | 10,140,394 | 0.7 | % | |||||||

Shareholders' equity | 2,247,705 | 2,078,249 | 8.2 | % | |||||||

Ratios | |||||||||||

Return on average assets | 1.39 | % | 1.37 | % | |||||||

Return on average shareholders' equity | 9.11 | % | 9.85 | % | |||||||

Return on average tangible shareholders' equity | 16.32 | % | 17.32 | % | |||||||

Net interest margin | 3.95 | % | 4.05 | % | |||||||

Net interest margin (fully tax equivalent) | 4.00 | % | 4.10 | % | |||||||

First Financial Bancorp 2019 Annual Report 3

2019 Financial Highlights | |

4 First Financial Bancorp 2019 Annual Report

Glossary of Abbreviations and Acronyms

First Financial Bancorp has identified the following list of abbreviations and acronyms that are used in the Notes to Consolidated Financial Statements and the Management's Discussion and Analysis of Financial Condition and Results of Operations.

ABL | Asset based lending | FHLMC | Federal Home Loan Mortgage Corporation | |

ACL | Allowance for credit losses | First Financial | First Financial Bancorp. | |

the Act | Private Securities Litigation Reform Act | FNMA | Federal National Mortgage Association | |

AFS | Available-for-sale | Form 10-K | First Financial Bancorp. Annual Report on Form 10-K | |

ALLL | Allowance for loan and lease losses | FRB | Federal Reserve Bank | |

AOCI | Accumulated other comprehensive income | GAAP | U.S. Generally Accepted Accounting Principles | |

ASC | Accounting standards codification | GDP | Gross Domestic Product | |

ASU | Accounting standards update | GNMA | Government National Mortgage Association | |

ATM | Automated teller machine | HTM | Held-to-maturity | |

Bank | First Financial Bank | Insignificant | Less than $0.1 million | |

Basel III | Basel Committee regulatory capital reforms, Third Basel Accord | IRLC | Interest Rate Lock Commitment | |

BGF or Bannockburn | Bannockburn Global Forex, LLC | MBSs | Mortgage-backed securities | |

Bp/bps | Basis point(s) | MSFG | MainSource Financial Group, Inc. | |

BOLI | Bank owned life insurance | N/A | Not applicable | |

CDs | Certificates of deposit | NII | Net interest income | |

CECL | Current Expected Credit Loss | N/M | Not meaningful | |

C&I | Commercial & industrial | Oak Street | Oak Street Holdings Corporation | |

CLOs | Collateralized loan obligations | ODFI | Ohio Department of Financial Institutions | |

CMOs | Collateralized mortgage obligations | OREO | Other real estate owned | |

CRE | Commercial real estate | PCA | Prompt corrective action | |

Company | First Financial Bancorp. | ROU | Right-of-use | |

ERM | Enterprise Risk Management | SEC | United States Securities and Exchange Commission | |

EVE | Economic value of equity | Topic 842 | FASB ASC Topic 842, Leasing | |

Fair Value Topic | FASB ASC Topic 825, Financial Instruments | Special Assets | Special Assets Division | |

FASB | Financial Accounting Standards Board | TDR | Troubled debt restructuring | |

FDIC | Federal Deposit Insurance Corporation | USD | United States dollars | |

FHLB | Federal Home Loan Bank | |||

First Financial Bancorp 2019 Annual Report 5

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Table 1 • Financial Summary | ||||||||||||||||||||

December 31, | ||||||||||||||||||||

(Dollars in thousands, except per share data) | 2019 | 2018 | 2017 | 2016 | 2015 | |||||||||||||||

Summary of operations | ||||||||||||||||||||

Interest income | $ | 607,578 | $ | 540,382 | $ | 333,073 | $ | 305,950 | $ | 269,759 | ||||||||||

Tax equivalent adjustment (1) | 6,328 | 5,147 | 5,259 | 4,215 | 4,017 | |||||||||||||||

Interest income tax – equivalent (1) | 613,906 | 545,529 | 338,332 | 310,165 | 273,776 | |||||||||||||||

Interest expense | 123,324 | 91,147 | 49,528 | 33,279 | 23,257 | |||||||||||||||

Net interest income tax – equivalent (1) | $ | 490,582 | $ | 454,382 | $ | 288,804 | $ | 276,886 | $ | 250,519 | ||||||||||

Interest income | $ | 607,578 | $ | 540,382 | $ | 333,073 | $ | 305,950 | $ | 269,759 | ||||||||||

Interest expense | 123,324 | 91,147 | 49,528 | 33,279 | 23,257 | |||||||||||||||

Net interest income | 484,254 | 449,235 | 283,545 | 272,671 | 246,502 | |||||||||||||||

Provision for loan and lease losses | 30,598 | 14,586 | 3,582 | 10,140 | 9,641 | |||||||||||||||

Noninterest income | 131,373 | 103,382 | 76,142 | 69,601 | 75,202 | |||||||||||||||

Noninterest expenses | 342,167 | 323,810 | 239,942 | 201,401 | 201,130 | |||||||||||||||

Income before income taxes | 242,862 | 214,221 | 116,163 | 130,731 | 110,933 | |||||||||||||||

Income tax expense | 44,787 | 41,626 | 19,376 | 42,205 | 35,870 | |||||||||||||||

Net income | $ | 198,075 | $ | 172,595 | $ | 96,787 | $ | 88,526 | $ | 75,063 | ||||||||||

Per share data | ||||||||||||||||||||

Earnings per common share | ||||||||||||||||||||

Basic | $ | 2.01 | $ | 1.95 | $ | 1.57 | $ | 1.45 | $ | 1.23 | ||||||||||

Diluted | $ | 2.00 | $ | 1.93 | $ | 1.56 | $ | 1.43 | $ | 1.21 | ||||||||||

Cash dividends declared per common share | $ | 0.90 | $ | 0.78 | $ | 0.68 | $ | 0.64 | $ | 0.64 | ||||||||||

Average common shares outstanding–basic (in thousands) | 98,306 | 88,582 | 61,529 | 61,206 | 61,063 | |||||||||||||||

Average common shares outstanding–diluted (in thousands) | 98,851 | 89,614 | 62,172 | 61,985 | 61,848 | |||||||||||||||

Selected year-end balances | ||||||||||||||||||||

Total assets | $ | 14,511,625 | $ | 13,986,660 | $ | 8,896,923 | $ | 8,437,967 | $ | 8,147,411 | ||||||||||

Earning assets | 12,392,259 | 12,190,567 | 8,117,115 | 7,719,285 | 7,431,707 | |||||||||||||||

Investment securities | 3,119,966 | 3,324,243 | 2,056,556 | 1,854,201 | 1,970,626 | |||||||||||||||

Total loans and leases | 9,201,665 | 8,824,214 | 6,013,183 | 5,757,482 | 5,388,760 | |||||||||||||||

Interest-bearing demand deposits | 2,364,881 | 2,307,071 | 1,453,463 | 1,513,771 | 1,414,291 | |||||||||||||||

Savings deposits | 2,960,979 | 3,167,325 | 2,462,420 | 2,142,189 | 1,945,805 | |||||||||||||||

Time deposits | 2,240,441 | 2,173,564 | 1,317,105 | 1,321,843 | 1,406,124 | |||||||||||||||

Noninterest-bearing demand deposits | 2,643,928 | 2,492,434 | 1,662,058 | 1,547,985 | 1,413,404 | |||||||||||||||

Total deposits | 10,210,229 | 10,140,394 | 6,895,046 | 6,525,788 | 6,179,624 | |||||||||||||||

Short-term borrowings | 1,316,181 | 1,040,691 | 814,565 | 807,912 | 938,425 | |||||||||||||||

Long-term debt | 414,376 | 570,739 | 119,654 | 119,589 | 119,540 | |||||||||||||||

Shareholders’ equity | 2,247,705 | 2,078,249 | 930,664 | 865,224 | 809,376 | |||||||||||||||

Select Financial Ratios | ||||||||||||||||||||

Average loans to average deposits (2) | 88.59 | % | 87.49 | % | 88.12 | % | 89.33 | % | 84.00 | % | ||||||||||

Net charge-offs to average loans and leases | 0.33 | % | 0.15 | % | 0.13 | % | 0.10 | % | 0.18 | % | ||||||||||

Average shareholders’ equity to average total assets | 15.30 | % | 13.89 | % | 10.42 | % | 10.24 | % | 10.73 | % | ||||||||||

Return on average assets | 1.39 | % | 1.37 | % | 1.12 | % | 1.07 | % | 1.00 | % | ||||||||||

Return on average equity | 9.11 | % | 9.85 | % | 10.78 | % | 10.48 | % | 9.33 | % | ||||||||||

Net interest margin | 3.95 | % | 4.05 | % | 3.59 | % | 3.62 | % | 3.60 | % | ||||||||||

Net interest margin (tax equivalent basis) (1) | 4.00 | % | 4.10 | % | 3.66 | % | 3.68 | % | 3.66 | % | ||||||||||

Dividend payout | 44.78 | % | 40.00 | % | 43.31 | % | 44.14 | % | 52.03 | % | ||||||||||

(1) Tax equivalent basis was calculated using a 21.00% tax rate for 2019 and 2018 and a 35.00% tax rate for 2017, 2016 and 2015.

(2) Includes loans held for sale.

6 First Financial Bancorp 2019 Annual Report

This annual report contains forward-looking statements. See the Forward-Looking Statements section that follows for further information on the risks and uncertainties associated with forward-looking statements.

The following discussion and analysis is presented by management to facilitate the understanding of the financial position and results of operations of First Financial Bancorp. Management's discussion and analysis identifies trends and material changes that occurred during the reporting periods presented and should be read in conjunction with the Statistical Data, Consolidated Financial Statements and accompanying Notes.

Certain reclassifications of prior years' amounts have been made to conform to current year presentation. Such reclassifications had no effect on net earnings, total assets, liabilities and shareholders' equity.

EXECUTIVE SUMMARY

First Financial Bancorp. is a $14.5 billion financial holding company headquartered in Cincinnati, Ohio, which operates through its subsidiaries primarily in Ohio, Indiana, Kentucky and Illinois. These subsidiaries include First Financial Bank, an

Ohio-chartered commercial bank, which operated 145 full service banking centers as of December 31, 2019. First Financial

provides banking and financial services products to business and retail clients through its six lines of business: Commercial,

Retail Banking, Mortgage Banking, Wealth Management, Investment Commercial Real Estate and Commercial Finance.

Commercial Finance provides equipment and leasehold improvement financing for franchisees in the quick service and casual

dining restaurant sector and commission-based financing, primarily to insurance agents and brokers, throughout the United

States. Wealth Management had $2.9 billion in assets under management as of December 31, 2019 and provides the following

services: financial planning, investment management, trust administration, estate settlement, brokerage services and retirement planning.

Additional information about the Company, including its products, services and banking locations, is available at www.bankatfirst.com.

The major components of First Financial’s operating results for the previous five years are summarized in Table 1 – Financial Summary and are discussed in greater detail in the sections that follow.

MARKET STRATEGY

First Financial aims to develop a competitive advantage by utilizing a local market focus to provide superior service and build

long-term relationships with clients while helping them achieve greater financial success. First Financial serves a combination

of metropolitan and community markets in Ohio, Indiana, Kentucky and Illinois through its full-service banking centers, and

provides financing to franchise owners and clients within the financial services industry throughout the United States. First

Financial’s market selection process includes a number of factors, but markets are primarily chosen for their potential for

growth and long-term profitability. First Financial intends to concentrate plans for future growth and capital investment within

its current metropolitan markets, and will continue to evaluate additional growth opportunities in metropolitan markets located

within, or in close proximity to, the Company's current geographic footprint. Additionally, First Financial may assess strategic acquisitions that provide product line extensions or additional industry verticals that compliment its existing business and diversify its product suite and revenue streams. First Financial's investment in community markets remains an important part of the Bank's core funding base and has historically provided stable, low-cost funding sources.

BUSINESS COMBINATIONS

In August 2019, the Company acquired Bannockburn Global Forex, LLC, an industry-leading capital markets firm. The

Cincinnati-based company provides transactional currency payments, foreign exchange hedging and other advisory products to

closely held enterprises, financial sponsors and financial institutions across the United States. Bannockburn became a division of the Bank and continues to operate as Bannockburn Global Forex, taking advantage of its existing brand recognition within the foreign exchange industry. The total purchase consideration was $114.6 million, consisting of $53.7 million in cash and $60.9 million of First Financial common stock. The transaction resulted in First Financial recording $58.0 million of goodwill on the Consolidated Balance Sheet, which reflects the business’s high growth potential and the expectation that the acquisition will provide additional revenue growth and diversification. The goodwill is deductible for income tax purposes as the transaction is considered a taxable exchange.

In April 2018, First Financial completed its acquisition of MainSource Financial Group, Inc. and its banking subsidiary,

MainSource Bank. The merger positioned the combined company to better serve the complementary geographies of Ohio,

First Financial Bancorp 2019 Annual Report 7

Indiana, Kentucky and Illinois by creating a higher performing bank with greater scale and capabilities. Under the terms of the

merger agreement, shareholders of MSFG received 1.3875 common shares of First Financial common stock for each share of MSFG common stock. Including outstanding options and warrants on MSFG common stock, total purchase consideration was $1.1 billion. In the merger, First Financial acquired $4.4 billion of total assets, $2.8 billion of loans and $3.3 billion of deposits, which resulted in goodwill of $675.6 million.

The BGF and MSFG transactions were accounted for using the acquisition method of accounting. Accordingly, assets acquired, liabilities assumed and consideration exchanged were recorded at estimated fair value on the acquisition date, in accordance with FASB ASC Topic 805, Business Combinations.

See Note 23 – Business Combinations in the Notes to Consolidated Financial Statements, for further discussion of these transactions.

OVERVIEW OF OPERATIONS

Net income for the year ended December 31, 2019 was $198.1 million, resulting in earnings per diluted common share of $2.00. This compares to net income of $172.6 million and earnings per diluted common share of $1.93 in 2018. First Financial’s return on average shareholders’ equity for 2019 was 9.11%, compared to 9.85% for 2018, and First Financial’s return on average assets was 1.39% and 1.37% for 2019 and 2018, respectively.

Net interest income in 2019 increased $35.0 million, or 7.8%, from 2018, to $484.3 million, primarily driven by higher average earning asset balances subsequent to the MSFG merger as well as higher yields earned on the investment and loan portfolios. The net interest margin on a fully tax equivalent basis was 4.00% for 2019 compared to 4.10% in 2018 as rising interest costs outpaced interest income growth.

Noninterest income increased $28.0 million, or 27.1%, during 2019 to $131.4 million from $103.4 million in 2018. The increase in 2019 was driven primarily by the full year impact of the MSFG merger, an increase in client derivative fees and the BGF acquisition in August of 2019.

Noninterest expense increased $18.4 million, or 5.7%, from $323.8 million in 2018 to $342.2 million in 2019. This increase was impacted by the larger scale created by the MSFG merger as well as the BGF acquisition.

Income tax expense increased $3.2 million, or 7.6%, to $44.8 million in 2019 from $41.6 million in 2018, with the effective tax rate decreasing to 18.4% in 2019 from 19.4% in 2018. The lower effective tax rate in 2019 was primarily related to the recognition of a historic tax credit investment during the period.

Total loans increased $377.5 million, or 4.3%, to $9.2 billion at December 31, 2019 from $8.8 billion at December 31, 2018. Total deposits increased $69.8 million, or 0.7%, to $10.2 billion as of December 31, 2019 from $10.1 billion at December 31, 2018.

The ALLL was $57.7 million, or 0.63% of total loans at December 31, 2019, compared to $56.5 million, or 0.64% of total loans at December 31, 2018. Provision expense increased $16.0 million, or 109.8%, to $30.6 million in 2019 while classified assets declined $42.4 million, or 32.2%, during the year. The elevated provision expense was mainly attributed to $13.2 million of charge-offs related to a single franchise relationship.

First Financial’s operational results may be influenced by certain economic factors and conditions, such as market interest rates, industry competition, household and business spending levels, consumer confidence and the regulatory environment. For a more detailed discussion of the Company's operations, please refer to the sections that follow.

NET INCOME

2019 vs. 2018. First Financial’s net income increased $25.5 million, or 14.8%, to $198.1 million in 2019, compared to net income of $172.6 million in 2018. The increase was primarily related to a $35.0 million, or 7.8%, increase in net interest income, combined with a $28.0 million, or 27.1%, increase in noninterest income. These increases were partially offset by an $18.4 million, or 5.7%, increase in noninterest expenses and a $3.2 million, or 7.6%, increase in income tax expense during 2019.

2018 vs. 2017. First Financial’s net income increased $75.8 million, or 78.3%, to $172.6 million in 2018, compared to net

First Financial Bancorp 2019 Annual Report 8

income of $96.8 million in 2017. The increase was primarily related to a $165.7 million, or 58.4%, increase in net interest

income, combined with a $27.2 million, or 35.8%, increase in noninterest income. These increases were partially offset by an

$83.9 million, or 35.0%, increase in noninterest expenses and a $22.3 million, or 114.8%, increase in income tax expense

during 2018.

For more detail, refer to the Net interest income, Noninterest income, Noninterest expenses and Income taxes sections that follow.

NET INTEREST INCOME

First Financial’s net interest income for the years 2015 through 2019 is shown in Table 1 – Financial Summary. First Financial’s principal source of income is net interest income, which is the excess of interest received from earning assets, including loan-related fees and purchase accounting accretion, less interest paid on interest-bearing liabilities. The amount of net interest income is determined by the volume and mix of earning assets, the rates earned on such assets and the volume, mix and rates paid for the deposits and borrowed money that support the earning assets. Earning assets consist of interest-bearing loans to customers as well as marketable investment securities.

For analytical purposes, net interest income is also presented in Table 1 – Financial Summary on a tax equivalent basis assuming a 21.00% marginal tax rate for 2018 and 2019 and a 35.00% marginal tax rate for years 2015 through 2017. Net interest income is presented on a tax equivalent basis to consistently reflect income from tax-exempt assets, such as municipal loans and investments, in order to facilitate a comparison between taxable and tax-exempt amounts. Management believes it is a standard practice in the banking industry to present net interest margin and net interest income on a fully tax equivalent basis as these measures provide useful information to make peer comparisons. First Financial's tax equivalent net interest margin was 4.00%, 4.10% and 3.66% for 2019, 2018 and 2017, respectively.

Table 2 – Volume/Rate Analysis - Tax Equivalent Basis describes the extent to which changes in interest rates as well as changes in the volume of earning assets and interest-bearing liabilities have affected First Financial’s net interest income on a tax equivalent basis during the years presented. Nonaccrual loans and loans held for sale were included in the average loan balances used to determine the yields in Table 2 – Volume/Rate Analysis - Tax Equivalent Basis, which should be read in conjunction with the Statistical Information table.

Loan fees included in the interest income computation for 2019, 2018 and 2017 were $15.9 million, $16.5 million and $13.9 million, respectively. Interest income also included purchase accounting accretion of $26.8 million, $25.5 million and $0.7 million for 2019, 2018 and 2017, respectively.

2019 vs. 2018. Net interest income increased $35.0 million, or 7.8%, from $449.2 million in 2018 to $484.3 million in 2019, primarily due to an increase in average earning assets and higher yields earned during 2019. Average earning assets increased from $11.1 billion in 2018 to $12.3 billion in 2019 primarily due to the full year impact of the MSFG merger and organic loan growth, while the tax equivalent yield on earning assets increased from 4.93% in 2018 to 5.00% in 2019.

Interest income was $607.6 million in 2019, increasing $67.2 million, or 12.4%, from 2018. The increase was primarily attributable to interest income from loans, which increased $51.8 million, or 11.6%, from $447.2 million in 2018 to $499.0 million in 2019. The increase in interest income on loans resulted from a merger driven increase in average loan balances, including loans held for sale, of $797.8 million, or 9.8%, the impact from purchase accounting accretion and higher loan yields. Additionally, interest income earned on investment securities increased $15.3 million, or 16.5%, during the period. Similar to interest on loans, higher interest income on investment securities was driven by a $391.7 million, or 13.5%, merger-related increase in average investment balances as well as higher yields earned during the period.

Interest expense was $123.3 million in 2019, which was a $32.2 million, or 35.3%, increase from 2018. Interest expense increased as the average balance of interest-bearing deposits increased $478.5 million, or 6.7%, primarily due to the full year impact of the MSFG merger in 2019 in addition to increased customer demand. Additionally, higher interest rates during the twelve month period contributed to the cost of funds related to these deposits increasing to 1.04% for 2019 from 0.80% in 2018. Interest expense was also impacted in 2019 by a $199.3 million, or 21.0%, increase in average Short-term borrowings and an $83.8 million, or 19.1%, increase in average Long-term borrowings.

2018 vs. 2017. Net interest income increased $165.7 million, or 58.4%, from $283.5 million in 2017 to $449.2 million in 2018,

primarily due to an increase in average earning assets and higher yields earned during 2018. Average earning assets increased

First Financial Bancorp 2019 Annual Report 9

Management’s Discussion and Analysis of Financial Condition and Results of Operations

from $7.9 billion in 2017 to $11.1 billion in 2018, while the tax equivalent yield on earning assets increased from 4.29% in 2017 to 4.93% in 2018.

Interest income was $540.4 million in 2018, a $207.3 million, or 62.2%, increase from 2017. This increase was primarily

attributable to interest income from loans, which increased $167.1 million, or 59.6%, from $280.1 million in 2017 to $447.2

million in 2018 as well as a $36.0 million, or 63.8%, increase in interest income earned on investment securities during 2018. The increase in interest income on loans resulted from a merger driven increase in average loan balances, including loans held for sale, of $2.3 billion, or 39.4%, and the impact from purchase accounting accretion, in addition to higher loan yields resulting from rising interest rates. Similar to interest on loans, the increase in interest income on investment securities was driven by a $895.8 million, or 44.8%, merger related increase in average investment balances as well as higher yields earned during the period due to rising interest rates.

Interest expense was $91.1 million in 2018, which was a $41.6 million, or 84.0%, increase from 2017. Interest expense

increased as the average balance of interest-bearing deposits increased $2.0 billion, or 39.4%, primarily due to the MSFG merger. Additionally, rising interest rates during the twelve month period contributed to the cost of these deposits increasing to 80 bps for 2018 from 69 bps in 2017. Interest expense was also impacted in 2018 by an increase in short-term borrowing rates from 99 bps in 2017 to 1.90% in 2018 as a result of rising interest rates.

Table 2 • Volume/Rate Analysis - Tax Equivalent Basis (1) | ||||||||||||||||||||||||

2019 change from 2018 due to | 2018 change from 2017 due to | |||||||||||||||||||||||

(Dollars in thousands) | Volume | Rate | Total | Volume | Rate | Total | ||||||||||||||||||

Interest income | ||||||||||||||||||||||||

Loans (2) | $ | 44,638 | $ | 7,257 | $ | 51,895 | $ | 126,901 | $ | 39,681 | $ | 166,582 | ||||||||||||

Indemnification asset | 0 | 0 | 0 | 0 | 3,871 | 3,871 | ||||||||||||||||||

Investment securities (3) | ||||||||||||||||||||||||

Taxable | 7,846 | 3,246 | 11,092 | 21,278 | 7,230 | 28,508 | ||||||||||||||||||

Tax-exempt | 5,831 | (555 | ) | 5,276 | 9,004 | (1,112 | ) | 7,892 | ||||||||||||||||

Total investment securities interest (3) | 13,677 | 2,691 | 16,368 | 30,282 | 6,118 | 36,400 | ||||||||||||||||||

Interest-bearing deposits with other banks | 84 | 30 | 114 | 25 | 319 | 344 | ||||||||||||||||||

Total | 58,399 | 9,978 | 68,377 | 157,208 | 49,989 | 207,197 | ||||||||||||||||||

Interest expense | ||||||||||||||||||||||||

Interest-bearing demand deposits | 859 | 3,443 | 4,302 | 2,641 | 1,563 | 4,204 | ||||||||||||||||||

Savings deposits | 261 | 3,072 | 3,333 | 3,488 | (1,379 | ) | 2,109 | |||||||||||||||||

Time deposits | 5,750 | 8,685 | 14,435 | 11,766 | 3,701 | 15,467 | ||||||||||||||||||

Short-term borrowings | 4,386 | 2,816 | 7,202 | 2,228 | 7,612 | 9,840 | ||||||||||||||||||

Long-term debt | 3,056 | (151 | ) | 2,905 | 11,703 | (1,704 | ) | 9,999 | ||||||||||||||||

Total | 14,312 | 17,865 | 32,177 | 31,826 | 9,793 | 41,619 | ||||||||||||||||||

Net interest income | $ | 44,087 | $ | (7,887 | ) | $ | 36,200 | $ | 125,382 | $ | 40,196 | $ | 165,578 | |||||||||||

(1) Tax equivalent basis was calculated using a 21.00% tax rate for 2019 and 2018 and a 35.00% tax rate for 2017.

(2) Includes nonaccrual loans and loans held-for-sale.

(3) Includes HTM securities, AFS securities and other investments.

NONINTEREST INCOME AND NONINTEREST EXPENSES

Noninterest income and noninterest expenses for 2019, 2018 and 2017 are shown in Table 3 – Noninterest Income and Noninterest Expenses.

NONINTEREST INCOME

2019 vs. 2018. Noninterest income increased $28.0 million, or 27.1%, from $103.4 million in 2018 to $131.4 million in 2019. The increase was primarily related to an $8.8 million, or 144.6%, increase in Gain on sale of loans, an $8.0 million, or 103.9%,

10 First Financial Bancorp 2019 Annual Report

increase in Client derivative fees and a $7.7 million increase in Foreign exchange income. These increases were partially offset by a $1.4 million, or 7.1% decrease in bankcard income.

Higher gain on sale of loans and client derivative fees were primarily driven by the full year impact of the MSFG merger and strong loan origination activity, while foreign exchange income was directly attributable to the BGF acquisition, which closed in August of 2019. The decline in bankcard income was due to the impact of the Durbin Amendment cap on interchange fees, which became applicable to First Financial in the third quarter of 2019.

2018 vs. 2017. Noninterest income increased $27.2 million, or 35.8%, from $76.1 million in 2017 to $103.4 million in 2018.

The increase was primarily related to a $15.3 million, or 77.5%, increase in service charges on deposits, a $6.9 million, or

52.2% increase in bankcard income, a $3.6 million, or 22.8%, increase in other noninterest income, a $1.3 million, or 19.7%,

increase in client derivative fees, and a $1.0 million, or 7.2%, increase in trust and wealth management fees. These increases

were partially offset by $1.8 million, or 109.8%, decrease in gains on sale of investment securities.

The increases in service charges on deposits, bankcard income, other noninterest income, derivative fees and wealth

management fees were primarily driven by increased scale created by the MSFG merger.

Table 3 • Noninterest Income and Noninterest Expenses | |||||||||||||||||||||

2019 | 2018 | 2017 | |||||||||||||||||||

(Dollars in thousands) | Total | % Change | Total | % Change | Total | % Change | |||||||||||||||

Noninterest income | |||||||||||||||||||||

Service charges on deposit accounts | $ | 37,939 | 8.1 | % | $ | 35,108 | 77.5 | % | $ | 19,775 | 4.4 | % | |||||||||

Trust and wealth management fees | 15,644 | 3.7 | % | 15,082 | 7.2 | % | 14,073 | 6.6 | % | ||||||||||||

Bankcard income | 18,804 | (7.1 | )% | 20,245 | 52.2 | % | 13,298 | 9.6 | % | ||||||||||||

Client derivative fees | 15,662 | 103.9 | % | 7,682 | 19.7 | % | 6,418 | 40.4 | % | ||||||||||||

Foreign exchange income | 7,739 | N/M | 0 | N/M | 0 | N/M | |||||||||||||||

Net gains from sales of loans | 14,851 | 144.6 | % | 6,071 | 17.5 | % | 5,169 | (24.0 | )% | ||||||||||||

Other | 21,140 | 9.2 | % | 19,355 | 22.8 | % | 15,760 | 14.8 | % | ||||||||||||

Subtotal | 131,779 | 27.3 | % | 103,543 | 39.0 | % | 74,493 | 7.4 | % | ||||||||||||

Net gain (loss) on sales/transfers of investment securities | (406 | ) | N/M | (161 | ) | N/M | 1,649 | N/M | |||||||||||||

Total | $ | 131,373 | 27.1 | % | $ | 103,382 | 35.8 | % | $ | 76,142 | 9.4 | % | |||||||||

Noninterest expenses | |||||||||||||||||||||

Salaries and employee benefits | $ | 209,061 | 10.6 | % | $ | 188,990 | 37.7 | % | $ | 137,240 | 6.8 | % | |||||||||

Net occupancy | 24,069 | (0.6 | )% | 24,215 | 39.2 | % | 17,397 | (5.1 | )% | ||||||||||||

Furniture and equipment | 15,903 | 6.7 | % | 14,908 | 76.6 | % | 8,443 | (2.5 | )% | ||||||||||||

Data processing | 21,881 | (22.1 | )% | 28,077 | 100.2 | % | 14,022 | 22.9 | % | ||||||||||||

Marketing | 6,908 | (9.1 | )% | 7,598 | 137.4 | % | 3,201 | (19.3 | )% | ||||||||||||

Communication | 3,267 | 3.2 | % | 3,167 | 74.1 | % | 1,819 | (3.7 | )% | ||||||||||||

Professional services | 11,254 | (8.3 | )% | 12,272 | (18.3 | )% | 15,023 | 138.3 | % | ||||||||||||

State intangible tax | 5,829 | 40.4 | % | 4,152 | 56.4 | % | 2,655 | 30.5 | % | ||||||||||||

FDIC assessments | 1,973 | (50.3 | )% | 3,969 | 0.6 | % | 3,944 | (8.1 | )% | ||||||||||||

Intangible assets amortization | 9,671 | 31.4 | % | 7,359 | 466.9 | % | 1,298 | (17.6 | )% | ||||||||||||

Other | 32,351 | 11.2 | % | 29,103 | (16.6 | )% | 34,900 | 142.5 | % | ||||||||||||

Total | $ | 342,167 | 5.7 | % | $ | 323,810 | 35.0 | % | $ | 239,942 | 19.1 | % | |||||||||

NONINTEREST EXPENSES

2019 vs. 2018. Noninterest expenses increased $18.4 million, or 5.7%, in 2019 compared to 2018, primarily due to a $20.1 million, or 10.6%, increase in salaries and employee benefits, a $3.2 million, or 11.2%, increase in other noninterest expenses, and a $2.3 million, or 31.4%, increase in intangible assets amortization expense. These increases were partially offset by a $6.2 million, or 22.1%, decrease in data processing expenses and a $2.0 million, or 50.3%, decrease in FDIC assessments.

First Financial Bancorp 2019 Annual Report 11

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Higher salaries and employee benefits in 2019 were attributed to merger related increases in staffing levels, higher performance-based compensation and annual compensation adjustments. Intangible assets recorded in conjunction with the purchase accounting for the MSFG and BFG business combinations resulted in higher intangible asset amortization during 2019, while the increase in other noninterest expense included a $2.9 million historic tax credit investment write-down. Lower data processing expenses were primarily due to elevated merger-related expenses in 2018, while the reduction of FDIC assessments was attributed to the recognition of a $3.4 million FDIC small bank assessment credit in the second half of 2019.

2018 vs. 2017. Noninterest expenses increased $83.9 million, or 35.0%, in 2018 compared to 2017, primarily due to a $51.8

million, or 37.7%, increase in salaries and employee benefits, a $14.1 million, or 100.2%, increase in data processing expenses,

a $6.8 million, or 39.2%, increase in net occupancy expenses, a $6.5 million, or 76.6%, increase in furniture and equipment

expenses, a $4.4 million, or 137.4%, increase in marketing expenses, and a $0.5 million, or 1.5%, decrease in other noninterest expenses. These increases were partially offset by a $2.8 million, or 18.3%, decrease in professional services.

Higher salaries and employee benefits in 2018 were attributed to merger related increases in staffing levels, higher severance

and retention costs, higher performance-based compensation, increased health care costs and annual compensation adjustments.

The increases in data processing, net occupancy, furniture and equipment and marketing expenses were largely attributable to

merger related expenses combined with the larger scale of the Company subsequent to the MSFG merger. Lower professional services in 2018 were mainly due to elevated costs in 2017. Higher other noninterest expenses during 2017 were primarily driven by an $11.3 million historic tax credit investment write-down, a $5.1 million impairment charge resulting from the preliminary agreement to early terminate the Company's FDIC loss sharing agreements and a $3.0 million charitable contribution to the First Financial Foundation.

INCOME TAXES

2019 vs. 2018. First Financial’s income tax expense in 2019 totaled $44.8 million compared to $41.6 million in 2018, resulting in effective tax rates of 18.4% and 19.4% for 2019 and 2018, respectively. The lower effective tax rate in 2019 was related to the recognition of a historic tax credit investment, which reduced income tax expense by $3.2 million and increased 2019 net income by $0.4 million when netted against the investment write-down included in noninterest expense.

2018 vs. 2017. First Financial’s income tax expense in 2018 totaled $41.6 million compared to $19.4 million in 2017, resulting in effective tax rates of 19.4% and 16.7% in 2018 and 2017, respectively. The higher effective tax rate in 2018 was related to the recognition of a significant historic tax credit investment in 2017, which was partially offset by the impact of tax reform. The historic tax credit investment reduced income tax expense by $12.5 million in 2017, and resulted in a $1.1 million increase to net income for the year when netted against the investment write-down included in noninterest expense.

For further information on income taxes, see Note 15 – Income Taxes in the Notes to Consolidated Financial Statements.

LENDING PRACTICES

First Financial remains dedicated to meeting the financial needs of individuals and businesses through its client-focused business model. The loan portfolio is comprised of a broad range of borrowers primarily located in the Ohio, Indiana and Kentucky markets; however, the commercial finance line of business serves a national client base.

First Financial’s loan portfolio consists of commercial loan types, including C&I, lease financing (equipment leasing), construction real estate and commercial real estate, as well as consumer loan types, such as residential real estate, home equity, installment and credit card loans. First Financial's lending portfolios are managed to avoid the creation of inappropriate industry, geographic, franchise concept or borrower concentration risk.

Commercial and Industrial – C&I loans include revolving lines of credit and term loans to commercial customers for use in normal business operations to finance working capital needs, equipment purchases, leasehold improvements or other projects. C&I loans are generally underwritten individually and secured with the assets of the Company and/or the personal guarantee of the business owners. C&I loans also include ABL, equipment and leasehold improvement financing for franchisees in the quick service and casual dining restaurant sector and commission-based loans to insurance agents and brokers. ABL transactions typically involve larger commercial clients and are secured by specific assets, such as inventory, accounts receivable, machinery and equipment. In the franchise lending space, First Financial focuses on a limited number of restaurant concepts that have sound economics, low closure rates and strong brand awareness within specified local, regional or national markets. Within the insurance lending platform, First Financial serves insurance agents and brokers that are looking to maximize their book-of-business value and grow their agency business.

12 First Financial Bancorp 2019 Annual Report

First Financial maintains vigorous underwriting processes to assess prospective C&I borrowers' credit worthiness prior to origination, and actively monitors C&I relationships subsequent to funding in order to ensure adequate oversight of the portfolio.

First Financial remains optimistic that positive macroeconomic trends will result in C&I growth in future periods. While C&I growth is a strategic organizational priority, the Company will continue to monitor the size and composition of the franchise portfolio to ensure that it remains comprised of historically profitable concepts and financially responsible borrowers.

Lease Financing – Lease financing consists of lease transactions for the acquisition of both new and used business equipment for commercial clients. Lease products may include tax leases, finance leases, lease lines of credit and interim funding. The credit underwriting for lease transactions includes detailed analysis of the lessee's industry and business model, nature of the equipment, equipment resale values, historical and projected cash flow analysis, secondary sources of repayment and guarantor in addition to other considerations.

Construction Real Estate – Real estate construction loans are term loans to individuals, companies or developers used for the construction or development of a commercial or residential property for which repayment will be generated by the sale or permanent financing of the property. Generally, these loans are for construction projects that have been pre-sold, pre-leased or have secured permanent financing, as well as loans to real estate companies with significant equity invested in the project. An independent credit team underwrites construction real estate loans, which are managed by experienced lending officers and monitored through the construction phase by a centralized funding desk that manages loan disbursements.

First Financial has pursued select real estate construction lending opportunities while actively monitoring industry and portfolio-specific credit trends and sector concentrations. In general, First Financial will seek to enter into typical construction lending arrangements only when the prospect of term financing is probable upon completion of the construction period.

Commercial Real Estate – Commercial real estate loans consist of term loans secured by a mortgage lien on real estate properties such as apartment buildings, office and industrial buildings and retail shopping centers. Additionally, the Company's franchise lending activities discussed in the "Commercial and Industrial" section often include the financing of real estate in addition to equipment. The credit underwriting for both owner-occupied and investor income producing real estate loans includes detailed market analysis, historical and projected cash flow analysis, appropriate equity margins, assessment of lessees and lessors, environmental risks and the type, age, condition and location of real estate, among other factors.

Credit risk is mitigated by limiting total credit exposure to individual borrowers and by requiring borrowers to have adequate down payments or cash equity, thereby limiting the loan balance in relation to the market value of the property. First Financial also regularly reviews borrower financial performance, makes periodic site visits to financed properties and monitors rental rates, occupancy trends, capitalization rates and other factors that could potentially influence real estate collateral values in the Company's markets.

The Company believes its current underwriting criteria, coupled with active credit monitoring, provides adequate oversight of the commercial real estate loan portfolio. In addition, management continually monitors CRE balances in relation to the rest of the loan portfolio to ensure that real estate concentration risk is properly mitigated.

Residential Real Estate – Residential real estate loans represent loans to consumers for the financing of a residence.

These loans generally have a 15 to 30 year term and a fixed interest rate, but may have a shorter term to maturity with an adjustable interest rate. In most cases, these loans are extended to borrowers to finance their primary residence. First Financial sells residential real estate loan originations into the secondary market on both servicing retained and servicing released bases. Residential real estate loans are generally underwritten to secondary market lending standards, utilizing underwriting processes that rely on empirical data to assess credit risk as well as analysis of the borrower's ability to repay their obligations, credit history, the amount of any down payment and the market value or other characteristics of the property. First Financial also offers a residential mortgage product that features similar borrower credit characteristics but a more streamlined underwriting process than typically required to sell to government-sponsored enterprises and thus is retained on the Consolidated Balance Sheets.

While First Financial continues to sell the majority of residential real estate originations into the secondary market, the Company believes its current underwriting criteria coupled with the monitoring of a number of portfolio metrics, including credit scores and loan-to-value ratios, provides adequate oversight of this portfolio.

First Financial Bancorp 2019 Annual Report 13

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Home Equity – Home equity lending includes both home equity loans and revolving lines of credit secured by a first or second lien on the borrower’s residence. Home equity lending underwriting considerations include the borrower's credit history as well as to debt-to-income and loan-to-value policy limits.

First Financial believes its current underwriting criteria coupled with the monitoring of a number of portfolio metrics including credit scores, loan-to-value ratios, line size and utilization rates provide adequate oversight of the home equity portfolio.

Installment – Installment lending consists of consumer loans not secured by real estate, including loans secured by automobiles and unsecured personal loans.

Credit Card – Credit card lending consists of secured and unsecured revolving lines of credit to consumer and business customers. Credit card lines are generally available for an indefinite period of time as long as the borrower's credit characteristics do not materially or adversely change, but lines are unconditionally cancellable by the Company at any time.

Underwriting for installment and credit card lending focuses on a borrower's debt-to-income ratios and credit history among other considerations.

Credit Management. Subject to First Financial’s credit policy and guidelines, credit underwriting and approval occur within the market and/or the centralized line of business originating the loan. First Financial has delegated a lending limit sufficient to address the majority of client requests in a timely manner to each market president and line of business manager. Loan requests for amounts greater than those limits require the approval of a designated credit officer or senior credit committee and may require additional approvals from the chief credit officer, the chief executive officer and the board of directors. This allows First Financial to manage the initial credit risk exposure through a standardized, strategic and disciplined approval process, but with an increasingly higher level of authority. Plans to purchase or sell a participation in a loan, or a group of loans, requires the approval of certain senior lending and administrative officers, and in some cases could include the board of directors.

Credit management practices are dependent on the type and nature of the loan. First Financial monitors all significant

exposures on an ongoing basis. Commercial loans are assigned internal risk ratings reflecting the risk of loss inherent in the loan. These internal risk ratings are assigned upon initial approval of credit and are updated periodically thereafter. First Financial reviews and adjusts its risk ratings based on actual experience, which is the basis for determining an appropriate ALLL. First Financial's commercial risk ratings of pass, special mention, substandard and doubtful are derived from standard regulatory rating definitions and facilitate the monitoring of credit quality across the commercial loan portfolio. For further information regarding these risk ratings, see Note 5 – Loans and Leases in the Notes to the Consolidated Financial Statements.

Commercial loans rated as special mention, substandard or doubtful are considered criticized, while loans rated as substandard or doubtful are considered classified. Commercial loans may be designated as criticized/classified based on individual borrower performance or industry and environmental factors. Criticized/classified loans are subject to more frequent internal reviews to assess the borrower’s credit status and develop appropriate action plans.

Classified loans are considered to be the leading indicator of credit losses, and are typically managed by the Special Assets Department. Special Assets is a commercial credit group whose primary focus is to handle the day-to-day management of commercial workouts, recoveries and problem loan resolutions. Special Assets ensures that First Financial has appropriate oversight, improved communication and timely resolution of issues throughout the loan portfolio. Additionally, the Credit Risk Management group within First Financial's Risk Management function provides independent, objective oversight and assessment of commercial credit quality and processes.

Consumer lending credit approvals are based on, among other factors, the financial strength and payment history of the borrower, type of exposure and the transaction structure. Consumer loans are generally smaller dollar amounts than other types of lending and are made to a large number of customers, providing diversification within the portfolio. Credit risk in the consumer loan portfolio is managed by loan type, and consumer loan asset quality indicators, including delinquency, are continuously monitored. The Credit Risk Management group performs product-level performance reviews and assesses credit quality and compliance with underwriting and loan administration guidelines across the consumer loan portfolio.

LOANS AND LEASES

2019 vs. 2018. First Financial experienced steady loan growth in 2019. Loans, excluding loans held for sale, totaled $9.2 billion at December 31, 2019, increasing $377.5 million, or 4.3%, compared to December 31, 2018. Commercial real estate loans increased $440.0 million, or 11.7%, and residential real estate increased $100.3 million, or 10.5%, while construction real

14 First Financial Bancorp 2019 Annual Report

estate loans decreased $55.8 million, or 10.2%, C&I loans decreased $48.8 million, or 1.9%, home equity decreased $45.4 million, or 5.6%, and installment loans decreased $10.6 million, or 11.4%, during 2019. Average loan balances, including loans held for sale, were $8.9 billion at December 31, 2019, an increase of $797.8 million, or 9.8% compared to December 31, 2018.

Table 4 - Loan and Lease Portfolio details loan and lease balances by type as a percentage of the total portfolio as of December 31 for the last five years.

Table 4 • Loan and Lease Portfolio | |||||||||||||||||||||||||||||||||||

December 31, | |||||||||||||||||||||||||||||||||||

2019 | 2018 | 2017 | 2016 | 2015 | |||||||||||||||||||||||||||||||

(Dollars in thousands) | Loans | % of Loans to Total Loans | Loans | % of Loans to Total Loans | Loans | % of Loans to Total Loans | Loans | % of Loans to Total Loans | Loans | % of Loans to Total Loans | |||||||||||||||||||||||||

Commercial and industrial | $ | 2,465,877 | 26.8 | % | $ | 2,514,661 | 28.5 | % | $ | 1,912,743 | 31.8 | % | $ | 1,781,948 | 31.0 | % | $ | 1,663,102 | 30.8 | % | |||||||||||||||

Lease financing | 88,364 | 1.0 | % | 93,415 | 1.1 | % | 89,347 | 1.5 | % | 93,108 | 1.6 | % | 93,986 | 1.7 | % | ||||||||||||||||||||

Real estate – construction | 493,182 | 5.3 | % | 548,935 | 6.2 | % | 467,730 | 7.8 | % | 399,434 | 6.9 | % | 311,712 | 5.8 | % | ||||||||||||||||||||

Real estate – commercial | 4,194,651 | 45.6 | % | 3,754,681 | 42.5 | % | 2,490,091 | 41.4 | % | 2,427,577 | 42.2 | % | 2,258,297 | 41.9 | % | ||||||||||||||||||||

Real estate – residential | 1,055,949 | 11.5 | % | 955,646 | 10.8 | % | 471,391 | 7.8 | % | 500,980 | 8.7 | % | 512,311 | 9.5 | % | ||||||||||||||||||||

Home equity | 771,869 | 8.4 | % | 817,282 | 9.3 | % | 493,604 | 8.2 | % | 460,388 | 8.0 | % | 466,629 | 8.7 | % | ||||||||||||||||||||

Installment | 82,589 | 0.9 | % | 93,212 | 1.1 | % | 41,586 | 0.7 | % | 50,639 | 0.9 | % | 41,506 | 0.8 | % | ||||||||||||||||||||

Credit card | 49,184 | 0.5 | % | 46,382 | 0.5 | % | 46,691 | 0.8 | % | 43,408 | 0.7 | % | 41,217 | 0.8 | % | ||||||||||||||||||||

Total loans and leases | $ | 9,201,665 | 100 | % | $ | 8,824,214 | 100 | % | $ | 6,013,183 | 100 | % | $ | 5,757,482 | 100 | % | $ | 5,388,760 | 100 | % | |||||||||||||||

Table 5 – Loan Maturity/Rate Sensitivity indicates the contractual maturity of C&I loans and construction real estate loans outstanding at December 31, 2019 as well as their sensitivity to changes in interest rates.

For discussion of risks associated with the loan portfolio and First Financial's ALLL, see the Credit Risk section included in Management’s Discussion and Analysis.

Table 5 • Loan Maturity/Rate Sensitivity | ||||||||||||||||

December 31, 2019 | ||||||||||||||||

Maturity | ||||||||||||||||

After one | ||||||||||||||||

Within | but within | After | ||||||||||||||

(Dollars in thousands) | one year | five years | five years | Total | ||||||||||||

Commercial and industrial | $ | 616,407 | $ | 1,255,963 | $ | 593,507 | $ | 2,465,877 | ||||||||

Construction real estate | 198,053 | 166,755 | 128,374 | 493,182 | ||||||||||||

Total | $ | 814,460 | $ | 1,422,718 | $ | 721,881 | $ | 2,959,059 | ||||||||

After one | ||||||||||||||||

Within | but within | After | ||||||||||||||

(Dollars in thousands) | one year | five years | five years | Total | ||||||||||||

Fixed rate | $ | 131,396 | $ | 309,651 | $ | 77,716 | $ | 518,763 | ||||||||

Variable rate | 683,064 | 1,113,067 | 644,165 | 2,440,296 | ||||||||||||

Total | $ | 814,460 | $ | 1,422,718 | $ | 721,881 | $ | 2,959,059 | ||||||||

OFF-BALANCE SHEET ARRANGEMENTS

Off-balance sheet arrangements include commitments to extend credit and financial guarantees. Loan commitments are agreements to extend credit to a client absent any violation of any condition established in the commitment agreement. Commitments generally have fixed expiration dates or other termination clauses and may require payment of a fee. First Financial had commitments outstanding to extend credit, totaling $3.3 billion and $3.0 billion at December 31, 2019 and 2018, respectively. As of December 31, 2019, loan commitments with a fixed interest rate totaled $123.7 million while commitments

First Financial Bancorp 2019 Annual Report 15

with variable interest rates totaled $3.2 billion. The fixed rate loan commitments have interest rates ranging from 0.00% to 21.00% for both December 31, 2019 and 2018. The fixed rate loan commitments have maturities ranging from 1 to 31.6 years at December 31, 2019 and 1 to 30 years at December 31, 2018.

Letters of credit are conditional commitments issued by First Financial to guarantee the performance of a client to a third party. First Financial’s portfolio of letters of credit consists primarily of performance assurances made on behalf of clients who have a contractual commitment to produce or deliver goods or services. First Financial has issued letters of credit aggregating $33.4 million and $32.7 million at December 31, 2019, and 2018, respectively. Management conducts regular reviews of these instruments on an individual client basis.

ASSET QUALITY

Nonperforming assets consist of nonaccrual loans, accruing TDRs (collectively, nonperforming loans) and OREO. Loans are

classified as nonaccrual when, in the opinion of management, collection of principal or interest is doubtful or when principal or

interest payments are 90 days or more past due. Generally, loans are classified as nonaccrual due to a borrower's continued

failure to adhere to contractual payment terms, coupled with other pertinent factors. When a loan is classified as nonaccrual,

the accrual of interest income is discontinued and previously accrued but unpaid interest is reversed.

Loans are classified as TDRs when borrowers are experiencing financial difficulties and concessions are made by the Company that would not otherwise be considered for a borrower with similar credit characteristics. TDRs are generally classified as nonaccrual for a minimum period of six months and may qualify for return to accrual status once they have demonstrated performance with the restructured terms of the loan agreement.

See Table 6 – Nonperforming Assets for a summary of First Financial’s nonaccrual loans, TDRs and OREO.

2019 vs. 2018. Total nonperforming assets declined $26.6 million, or 30.1%, to $61.6 million at December 31, 2019 from $88.2 million at December 31, 2018. Nonaccrual loans declined $22.5 million and accruing TDRs declined $4.7 million, which was partially offset by a $0.6 million increase in OREO.

First Financial's nonperforming assets as a percentage of total loans plus OREO declined to 0.67% at December 31, 2019 from 1.00% at December 31, 2018 as a result of lower nonperforming loan balances during the period. Additionally, classified asset balances declined $42.4 million, or 32.2%, to $89.3 million at December 31, 2019 from $131.7 million at December 31, 2018.

The significant decreases in nonperforming and classified assets during 2019 were driven by focused resolution efforts during the period, which included significant paydowns/payoffs and a $12.2 million problem loan sale, in addition to positive risk rating migration and elevated net charge-offs during the period. Management is optimistic that the Company's credit quality trends will remain strong in future periods given the diligent underwriting and monitoring processes in place as well as the sustained improvement in employment rates, the real estate markets, and business and consumer confidence levels.

First Financial Bancorp 2019 Annual Report 16

Table 6 • Nonperforming Assets | ||||||||||||||||||||

December 31, | ||||||||||||||||||||

(Dollars in thousands) | 2019 | 2018 | 2017 | 2016 | 2015 | |||||||||||||||

Nonaccrual loans (1) | $ | 48,165 | $ | 70,700 | $ | 24,082 | $ | 17,730 | $ | 27,997 | ||||||||||

Accruing troubled debt restructurings (2) | 11,435 | 16,109 | 17,545 | 30,240 | 28,876 | |||||||||||||||

Other real estate owned (OREO) | 2,033 | 1,401 | 2,781 | 6,284 | 13,254 | |||||||||||||||

Total nonperforming assets | $ | 61,633 | $ | 88,210 | $ | 44,408 | $ | 54,254 | $ | 70,127 | ||||||||||

Nonperforming assets as a percent of total loans plus OREO | 0.67 | % | 1.00 | % | 0.74 | % | 0.94 | % | 1.30 | % | ||||||||||

Accruing loans past due 90 days or more | $ | 201 | $ | 63 | $ | 61 | $ | 142 | $ | 108 | ||||||||||

Classified assets | $ | 89,250 | $ | 131,668 | $ | 87,293 | $ | 125,155 | $ | 132,431 | ||||||||||

(1) Nonaccrual loans include nonaccrual TDRs of $18.5 million, $22.4 million, $6.4 million, $5.1 million and $9.3 million, as of December 31, 2019, 2018, 2017, 2016 and 2015, respectively.

(2) Accruing troubled debt restructurings include TDRs past due 90 days or more and still accruing of $2.7 million as of December 31, 2016. There were no TDRs 90 days past due and still accruing as of December 31, 2019, 2018, 2017, 2016 and 2015, respectively.

INVESTMENTS

First Financial utilizes its investment portfolio as a source of liquidity and interest income, as well as a tool for managing the Company's interest rate risk profile. As such, the Company's primary investment strategy is to invest in debt securities with low credit risk, such as treasury and agency-backed residential MBSs. The investment portfolio is also managed with consideration to prepayment and extension/maturity risk. First Financial invests primarily in MBSs issued by U.S. government agencies and corporations, such GNMA, FHLMC and FNMA, as these securities are considered to have a low credit risk and high liquidity profile due to government agency guarantees. Government and agency backed securities comprised 50.6% and 58.0% of First Financial's investment securities portfolio as of December 31, 2019 and 2018, respectively.

The Company also invests in certain securities that are not supported by government or agency guarantees and whose realization is dependent on future principal and interest repayments, thus carrying greater credit risk. First Financial performs a detailed collateral and structural analysis prior to any purchase of these securities and limits investments to asset classes in which the Company has expertise and experience, as well as a senior position in the capital structure. First Financial continuously monitors credit risk and geographic concentration risk in its evaluation of market opportunities that would enhance the overall performance of the portfolio. Securities not supported by government or agency guarantees represented 49.4% and 42.0% of First Financial's investment securities portfolio as of December 31, 2019 and 2018, respectively.

The other investments category in the Consolidated Balance Sheets consists primarily of First Financial’s investments in FRB and FHLB stock.

Gains and losses on debt securities are generally due to fluctuations in current market yields relative to the yields of the debt securities at their amortized cost. All securities with unrealized losses are reviewed quarterly to determine if any impairment is considered other than temporary, requiring a write-down to fair value. First Financial considers the percentage loss on a security, duration of the loss, average life or duration of the security, credit rating of the security as well as payment performance and the Company’s intent and ability to hold the security when determining whether any impairment is other than temporary. First Financial had no other than temporary impairment expense for the years ended December 31, 2019 and 2018.

2019 vs. 2018. First Financial’s investment portfolio at December 31, 2019 totaled $3.0 billion, and represented 20.6% of total assets at December 31, 2019. The $213.6 million, or 6.7%, decline in the investment portfolio during 2019 was primarily related to Company's strategic redeployment of cash flows to support loan growth and to reduce borrowings.

First Financial classified $2.9 billion, or 95.2%, and $2.8 billion, or 86.6%, of investment securities as AFS at December 31, 2019 and 2018, respectively. First Financial classified $142.9 million, or 4.8%, and $429.3 million, or 13.4%, of investment securities as HTM at December 31, 2019 and 2018, respectively. In addition, First Financial reclassified $268.7 million and

First Financial Bancorp 2019 Annual Report 17

Management’s Discussion and Analysis of Financial Condition and Results of Operations

$372.1 of HTM securities to AFS upon adoption of ASU 2017-12 and subsequent to the MSFG merger to align with post-merger investment strategies, respectively.

First Financial recorded a $41.3 million unrealized after-tax gain on the investment portfolio as a component of equity in AOCI resulting from changes in the fair value of AFS securities at December 31, 2019, which increased $52.9 million from an $11.6 million unrealized after-tax loss at December 31, 2018.

Debt securities issued by the U.S. government and U.S. government agencies and corporations, including the FHLB, FHLMC, FNMA and the U.S. Export/Import Bank represented 1.0% of the investment portfolio at December 31, 2018 but was not meaningful as a percentage of the portfolio at December 31, 2019.

Investments in MBS securities, which include CMOs, represented 61.0% and 65.2% of First Financial's portfolio at December 31, 2019 and 2018, respectively. MBSs are participations in pools of loans secured by mortgages under which payments of principal and interest are passed through to the security holders. These securities are subject to prepayment risk, particularly during periods of falling interest rates, and extension risk during periods of rising interest rates. Prepayments of the underlying residential real estate loans may shorten the lives of the securities, thereby affecting yields to maturity and market values.

Tax-exempt securities of states, municipalities and other political subdivisions totaled $687.3 million as of December 31, 2019 and $501.9 million as of December 31, 2018, comprising 22.9% and 15.6% of the investment portfolio at December 31, 2019 and 2018, respectively. The securities are diversified to include states as well as issuing authorities within states, thereby decreasing geographic portfolio risk. First Financial continuously monitors the risk associated with this investment type and reviews underlying ratings for possible downgrades. First Financial does not own any state or other political subdivision securities that are currently impaired.

Asset-backed securities were $400.4 million, or 13.4% of the investment portfolio at December 31, 2019 and $509.2 million, or 15.9% of the investment portfolio at December 31, 2018. First Financial considers these investment securities to have lower credit risk and a high liquidity profile as a result of explicit guarantees on the collateral.

Other securities, consisting primarily of taxable securities of states, municipalities and other political subdivisions and debt securities issued by corporations, were $81.6 million, or 2.7% of the investment portfolio, at December 31, 2019 and $73.2 million, or 2.3% of the investment portfolio, at December 31, 2018.

The overall duration of the investment portfolio increased to 3.4 years as of December 31, 2019 from 3.3 years as of December 31, 2018. First Financial has avoided adding to its portfolio any particular securities that would materially increase credit risk or geographic concentration risk and the Company continuously monitors and considers these risks in its evaluation of current market opportunities that would enhance the overall performance of the portfolio.

Table 7 • Investment Securities as of December 31 | ||||||||||||||

2019 | 2018 | |||||||||||||

Percent of | Percent of | |||||||||||||

(Dollars in thousands) | Amount | Portfolio | Amount | Portfolio | ||||||||||

U.S. Treasuries | $ | 100 | 0.0 | % | $ | 97 | 0.0 | % | ||||||

Securities of U.S. government agencies and corporations | 158 | 0.0 | % | 31,919 | 1.0 | % | ||||||||

Mortgage-backed securities-residential | 452,373 | 15.1 | % | 584,164 | 18.2 | % | ||||||||

Mortgage-backed securities-commercial | 577,785 | 19.3 | % | 568,815 | 17.7 | % | ||||||||

Collateralized mortgage obligations | 795,207 | 26.6 | % | 939,287 | 29.3 | % | ||||||||

Obligations of state and other political subdivisions | 687,267 | 22.9 | % | 501,868 | 15.6 | % | ||||||||

Asset-backed securities | 400,431 | 13.4 | % | 509,231 | 15.9 | % | ||||||||

Other securities | 81,625 | 2.7 | % | 73,202 | 2.3 | % | ||||||||

Total | $ | 2,994,946 | 100.0 | % | $ | 3,208,583 | 100.0 | % | ||||||

The estimated maturities and weighted-average yields of HTM and AFS investment securities as of December 31, 2019 are shown in Table 8 – Investment Securities. Tax-equivalent adjustments using a rate of 21.0% were included in calculating yields on tax-exempt obligations of state and other political subdivisions.

18 First Financial Bancorp 2019 Annual Report

First Financial held cash on deposit with the Federal Reserve of $56.9 million and $37.7 million at December 31, 2019 and 2018, respectively. First Financial continually monitors its liquidity position as part of its ERM framework, specifically through its asset/liability management process.

First Financial will continue to monitor loan and deposit demand, balance sheet composition, capital sensitivity and the interest rate environment as it manages investment strategies in future periods. See Note 4 – Investment Securities in the Notes to Consolidated Financial Statements for additional information on the Company's investment portfolio and Note 22 – Fair Value Disclosures for additional information on how First Financial determines the fair value of investment securities.

Table 8 • Investment Securities as of December 31, 2019 | ||||||||||||||||||||||||||||

Maturity (2) | ||||||||||||||||||||||||||||

Within one year | After one but within five years | After five but within ten years | After ten years | |||||||||||||||||||||||||

(Dollars in thousands) | Amount | Yield(1) | Amount | Yield(1) | Amount | Yield(1) | Amount | Yield(1) | ||||||||||||||||||||

Held-to-Maturity | ||||||||||||||||||||||||||||

Securities of other U.S. government agencies and corporations | $ | 0 | 0.00 | % | $ | 0 | 0.00 | % | $ | 0 | 0.00 | % | $ | 0 | 0.00 | % | ||||||||||||

Mortgage-backed securities-residential | 0 | 0.00 | % | 20,818 | 2.38 | % | 0 | 0.00 | % | 0 | 0.00 | % | ||||||||||||||||

Mortgage-backed securities-commercial | 0 | 0.00 | % | 83,736 | 2.36 | % | 17,531 | 2.96 | % | 0 | 0.00 | % | ||||||||||||||||

Collateralized mortgage obligations | 0 | 0.00 | % | 9,763 | 1.71 | % | 0 | 0.00 | % | 0 | 0.00 | % | ||||||||||||||||

Obligations of state and other political subdivisions | 0 | 0.00 | % | 0 | 0.00 | % | 4,756 | 3.56 | % | 6,258 | 2.39 | % | ||||||||||||||||

Total | $ | 0 | 0.00 | % | $ | 114,317 | 2.31 | % | $ | 22,287 | 3.09 | % | $ | 6,258 | 2.39 | % | ||||||||||||

Available-for-Sale | ||||||||||||||||||||||||||||

U.S. treasuries | $ | 0 | 0.00 | % | $ | 100 | 1.97 | % | $ | 0 | 0.00 | % | $ | 0 | 0.00 | % | ||||||||||||

Securities of other U.S. government agencies and corporations | 0 | 0.00 | % | 158 | 1.77 | % | 0 | 0.00 | % | 0 | 0.00 | % | ||||||||||||||||

Mortgage-backed securities-residential | 592 | 3.59 | % | 297,995 | 3.07 | % | 87,430 | 2.99 | % | 45,538 | 2.86 | % | ||||||||||||||||

Mortgage-backed securities-commercial | 85,143 | 3.78 | % | 252,558 | 3.50 | % | 98,199 | 2.95 | % | 40,618 | 2.93 | % | ||||||||||||||||

Collateralized mortgage obligations | 67,905 | 3.24 | % | 554,295 | 3.15 | % | 125,988 | 3.08 | % | 37,256 | 2.93 | % | ||||||||||||||||

Obligations of state and other political subdivisions | 34,597 | 3.12 | % | 291,443 | 2.64 | % | 278,281 | 3.19 | % | 71,932 | 3.08 | % | ||||||||||||||||

Asset-backed securities | 54,040 | 3.81 | % | 210,250 | 3.63 | % | 136,141 | 3.30 | % | 0 | 0.00 | % | ||||||||||||||||

Other securities | 2,558 | 4.09 | % | 55,029 | 5.53 | % | 24,038 | 3.47 | % | 0 | 0.00 | % | ||||||||||||||||

Total | $ | 244,835 | 3.55 | % | $ | 1,661,828 | 3.24 | % | $ | 750,077 | 3.14 | % | $ | 195,344 | 2.97 | % | ||||||||||||

(1) Tax equivalent basis was calculated using a 21.0% tax rate and yields were based on amortized cost.

(2) Maturity represents estimated life of investment securities.

DERIVATIVES

First Financial is authorized to use certain derivative instruments including interest rate caps, floors, swaps and foreign exchange contracts to meet the needs of its clients while managing interest rate risk associated with certain transactions. The Company does not use derivatives for speculative purposes.

First Financial primarily utilizes interest rate swaps as a means to offer borrowers credit-based products that meet their needs and achieve the Company's desired interest rate risk profile. These interest rate swaps generally involve the receipt by First Financial of floating rate amounts from swap counterparties in exchange for payments to these counterparties by First Financial of fixed rate amounts received from borrowers. This results in the Company's loan customers receiving fixed rate funding while providing First Financial with a floating rate asset.

First Financial Bancorp 2019 Annual Report 19

Management’s Discussion and Analysis of Financial Condition and Results of Operations

In conjunction with participating interests in commercial loans, First Financial periodically enters into risk participation agreements with counterparties whereby First Financial assumes a portion of the credit exposure associated with an interest rate swap on the participated loan in exchange for a fee. Under these agreements, First Financial will make payments to the counterparty if the loan customer defaults on its obligation to perform under the interest rate swap contract with the counterparty.

First Financial enters into IRLCs and forward commitments for the future delivery of mortgage loans to third party investors, which are considered derivatives. When borrowers secure an IRLC with First Financial and the loan is intended to be sold, First Financial will enter into forward commitments for the future delivery of the loans to third party investors in order to hedge against the effect of changes in interest rates impacting IRLCs and loans held for sale.

First Financial may enter into foreign exchange derivative contracts for the benefit of commercial customers to hedge their exposure to foreign currency fluctuations. Similar to the hedging of interest rate risk from interest rate derivative contracts, First Financial also enters into foreign exchange contracts with major financial institutions to economically hedge the exposure from client driven foreign exchange activity.