UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☑ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2019

or

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-12537

NEXTGEN HEALTHCARE, INC.

(Exact name of registrant as specified in its charter)

|

California (State or other jurisdiction of incorporation or organization) |

95-2888568 (IRS Employer Identification No.) |

|

18111 Von Karman Avenue, Suite 800, Irvine, California (Address of principal executive offices) |

92612 (Zip Code) |

(949) 255-2600

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol |

Name of each exchange on which registered |

|

Common Stock, $0.01 Par Value |

NXGN |

NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☑ |

|

Accelerated filer ☐ |

|

Non-accelerated filer ☐ |

|

Smaller reporting company ☐ |

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the voting stock held by non-affiliates of the Registrant as of September 30, 2018: $1,070,924,000 (based on the closing sales price of the Registrant’s common stock as reported on the NASDAQ Global Select Market on that date of $20.08 per share)*

The Registrant has no non-voting common equity.

The number of outstanding shares of the Registrant’s common stock as of May 23, 2019 was 64,814,090 shares.

* For purposes of this Annual Report on Form 10-K, in addition to those shareholders which fall within the definition of “affiliates” under Rule 405 of the Securities Act of 1933, as amended, holders of ten percent or more of the Registrant’s common stock are deemed to be affiliates for purposes of this Report.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive proxy statement related to the 2019 Annual Shareholders' Meeting to be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended March 31, 2019 are incorporated herein by reference in Part III of this Annual Report on Form 10-K where indicated.

2019 ANNUAL REPORT ON FORM 10-K

|

Item |

|

|

|

Page |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

Item 1. |

|

|

4 |

|

|

Item 1A. |

|

|

9 |

|

|

Item 1B. |

|

|

25 |

|

|

Item 2. |

|

|

25 |

|

|

Item 3. |

|

|

25 |

|

|

Item 4. |

|

|

25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 5. |

|

|

26 |

|

|

Item 6. |

|

|

27 |

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

28 |

|

Item 7A. |

|

|

41 |

|

|

Item 8. |

|

|

41 |

|

|

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

41 |

|

Item 9A. |

|

|

41 |

|

|

Item 9B. |

|

|

42 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 10. |

|

|

43 |

|

|

Item 11. |

|

|

43 |

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

43 |

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

43 |

|

Item 14. |

|

|

43 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 15. |

|

|

44 |

|

|

Item 16. |

|

|

44 |

|

|

|

|

|

48 |

|

This Annual Report on Form 10-K (this "Report") and certain information incorporated herein by reference contain forward-looking statements within the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. All statements included or incorporated by reference in this Report, other than statements that are purely historical, are forward-looking statements. Words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “estimate,” “will,” “should,” “would,” “could,” “may,” and similar expressions also identify forward-looking statements. These forward-looking statements include, without limitation, discussions of our product development plans, business strategies, future operations, financial condition and prospects, developments in and the impacts of government regulation and legislation and market factors influencing our results. Our expectations, beliefs, objectives, intentions and strategies regarding our future results are not guarantees of future performance and are subject to risks and uncertainties, both foreseen and unforeseen, that could cause actual results to differ materially from results contemplated in our forward-looking statements. These risks and uncertainties include, but are not limited to, our ability to continue to develop new products and increase systems sales in markets characterized by rapid technological evolution, consolidation, and competition from larger, better-capitalized competitors. Many other economic, competitive, governmental and technological factors could affect our ability to achieve our goals, and interested persons are urged to review the risks factors discussed in “Item 1A. Risk Factors” of this Report, as well as in our other public disclosures and filings with the Securities and Exchange Commission (“SEC”). Because of these risk factors, as well as other variables affecting our financial condition and results of operations, past financial performance may not be a reliable indicator of future performance and historical trends should not be used to anticipate results or trends in future periods. We assume no obligation to update any forward-looking statements. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of the filing of this Report. Each of the terms “NextGen Healthcare,” “NextGen,” “we,” “us,” “our,” or the “Company” as used throughout this Report refers collectively to NextGen Healthcare, Inc. and its wholly-owned subsidiaries, unless otherwise indicated.

3

Company Overview

NextGen Healthcare is a leading provider of ambulatory-focused healthcare software and services solutions. In pursuit of our mission to empower the transformation of ambulatory care, we provide innovative technology-based solutions that help our clients succeed while they are managing more complexity and assuming greater financial risk.

Our clients span the ambulatory care market from small single specialty practices to larger multi-specialty organizations. We have fully integrated our solutions so that our clients are able to provide their patients with comprehensive services utilizing a single platform. Our highly interoperable platform allows ambulatory practices to thrive especially in complex, heterogeneous healthcare communities where frictionless clinical data exchange is required to coordinate and optimize patient care.

NextGen Healthcare has historically enhanced our solutions through both organic and inorganic activities. In October 2015, we divested our former Hospital Solutions division to focus exclusively on the ambulatory marketplace. In January 2016, we acquired HealthFusion Holdings, Inc. and its cloud-based electronic health record and practice management solution. In April 2017, we acquired Entrada, Inc. and its cloud-based, mobile platform for clinical documentation and collaboration. In August 2017, we acquired EagleDream Health, Inc. and its cloud-based population health analytics solution. In January 2018, we acquired Inforth Technologies for its specialty-focused clinical content. The integration of these acquired technologies have made NextGen Healthcare’s solutions among the most comprehensive and powerful in the market.

The Company was incorporated in California in 1974. Previously named Quality Systems, Inc., the Company changed its corporate name to NextGen Healthcare, Inc. in September 2018. Our principal offices are located at 18111 Von Karman Ave., Suite 800, Irvine, California, 92612, and our principal website is www.nextgen.com. We operate on a fiscal year ending on March 31.

Industry Background and Market Opportunity

Over the last decade, the ambulatory healthcare market has experienced significant regulatory change, which has driven practice transformation and technology advancements. Recognizing that it was imperative to digitize the American health system to stem the escalating cost of healthcare and improve the quality of care being delivered, Congress enacted the Health Information Technology for Economic and Clinical Health Act in 2009 (“HITECH Act”). The legislation stimulated healthcare organizations to not only adopt electronic health records, but to use them to collect discrete data that could be used to drive quality care. This standardization supported early pay for reporting and pay-for-performance programs.

In 2010, the Affordable Care Act (“ACA”) established the roadmap for shifting American healthcare from volume (fee-for-service) to a value-based care (“VBC”) system that rewards improved outcomes at lower costs (fee-for-value). This was followed by the Medicare Access and CHIP Reauthorization Act of 2015 (“MACRA”), bipartisan legislation that further changed the way Medicare rewards clinicians for value vs. volume. Initially focused on government-funded care, the domain of the Centers for Medicare & Medicaid Services (“CMS”), these programs are now firmly established on the commercial insurance side of the industry as well.

VBC created the need for a new category of healthcare information technology (“HIT”) tools that could be used to identify and treat groups of patients, or cohorts, based on risk. Population Health Management (“PHM”) tools support these needs by identifying patient risk, engaging patients, coordinating care, and determining when interventions are needed to improve clinical and financial outcomes. The United States PHM market was estimated at $3.1 billion in 2018 and is expected to more than double by 2022.

Importantly, the introduction of VBC programs was only an element of the broader approach to reducing healthcare expenditure. It was also accompanied by significant reductions in Medicare spending with a projected reduction of $218 billion in payments by 2028, as reported by RevCycle Intelligence. The drive to reduce costs initially led to consolidation in the healthcare system that was followed by a significant shift of care from the inpatient to the outpatient setting as more care is being moved to this lower cost environment. Ambulatory care settings have become an essential component of comprehensive, low cost distributed care. In 2018, outpatient volumes reached over 3.5 billion encounters and are forecasted to grow 15% by 2028, as reported by Becker’s Health IT and CIO Report. The independent physicians’ practices segment is expected to generate more revenue than non-affiliated hospitals as it accepts electronic health records integrated PHM programs for better primary and follow-up care, as reported by Frost & Sullivan. The need to sustain revenue has made it extremely important for practices to secure their patient market share, elevating patient loyalty to be a significant determinant of provider success. Capturing patient market share and thriving in a market driven by VBC requires both an integrated platform and a full view of the patient population’s clinical and cost data neither of which could be accomplished without new technologies to collect and analyze multi-sourced patient data. Effectively implemented, these new technologies allow organizations to enhance financial viability while exercising the freedom to join, affiliate, integrate or interoperate in ways that maximize strategic control.

In order to maintain financial success with shifting reimbursement rules and shrinking reimbursement, we believe demand for managed services, including revenue cycle management services (“RCMS”), hosting, transcription and scribe services, aligned and integrated with clinical technology solutions, will increase in the coming years.

4

Based on these trends, successful clients must undertake the following imperatives: 1) ensure healthy predictable financial outcomes, 2) provide high quality care at a lower cost in a risk-bearing environment, 3) ensure engaged and loyal patients, and 4) optimize clinician productivity while deploying HIT solutions, 5) support frictionless interoperability.

Our Strategy

Our core strategy is to become a trusted partner to our clients as they embark on their value-based journey and begin to take on risk as part of value-based contracts. We understand that our clients are now faced with a more complex, rapidly changing practice environment and that the HIT solutions that support these endeavors must evolve to meet these challenging requirements. Providing our clients with a comprehensive multi-faceted platform and accompanying services to enable their success is the key to our strategy.

Based on current market trends, our strategic priorities are:

|

|

• |

Focus on Ambulatory Care. We create for and invest in the specific needs of ambulatory care providers, giving us a distinct competitive advantage in our target market over solution providers who focus on hospitals first. While many of our competitors spread their R&D and localization investment across global regions, NextGen Healthcare maintains an exclusive focus on U.S.-only ambulatory practices. |

|

|

• |

Provide an integrated ambulatory care platform with superb scalability, flexibility and interoperability. Many healthcare challenges are uniquely local or regional -- our platform and capabilities flex and scale to fit our clients’ practices and workflows, not the other way around. Our ability to interoperate is pervasive, allowing our clients to exchange data seamlessly. |

|

|

• |

Enable groups to successfully take on risk. We provide our clients with cloud-based population health tools that consume multi-sourced agnostic data, including adjudicated claims and risk stratification, care management tools, cost and utilization reporting, as well as quality measurement and reporting tools. Population health insights are delivered in core clinical and financial workflows enabling care givers to better engage their patients. |

5

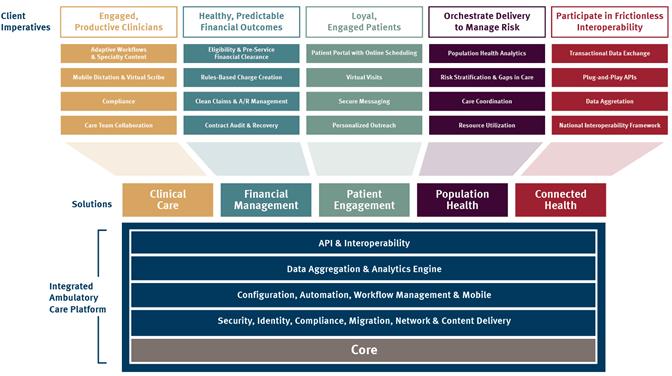

NextGen Healthcare software and services based solutions map to our clients’ strategic imperatives (refer to top row in the image below). The foundation for our integrated ambulatory care platform (blue boxes) is a core of our industry-leading electronic health records (“EHR”) and practice management (“PM”) systems that support clinical and financial activities. These can be deployed on premise or in the cloud. Our primary cloud infrastructure provider is Amazon Web Services (“AWS”). We optimize the core with an automation and workflow layer that gives our clients control over how platform capabilities are implemented to drive their desired outcomes. The workflow layer includes mobile capabilities proven to reduce physician burden. Our cloud-based population health and analytics engine allows our clients to improve results in both fee-for-service and fee-for-value environments. In support of extensibility, we surround the core with open, web-based APIs to drive the secure exchange of health and patient data with connected health solutions. Finally, our technology is augmented with services as required and is mapped to client imperatives.

Clinical Care Solutions improve the quality and efficiency of care delivery. They significantly ease the administrative burden and enable the delivery of high quality, personalized care. Providers can automate patient intake, streamline clinical workflows, and leverage vendor-agnostic interoperability to achieve quality measures and qualify for incentives.

Financial Management Solutions drive healthy, predictable financial outcomes. More than just billing and collections, financial management involves all functions that effectively capture revenue at the lowest cost. Financial management solutions help practices improve performance, correct operational inefficiencies, while enhancing the practice’s financial outcomes throughout the revenue cycle.

Patient Engagement Solutions boost loyalty and improve outcomes by engaging patients in their care. Our integrated patient engagement solutions empower patients to manage their own health through direct patient-provider messaging, online scheduling, automated reminders, easy payment options, and virtual visits. The ability of patients to handle their own scheduling and billing frees provider staff from tedious tasks, restoring valuable time.

Population Health Solutions provide a single source of truth by aggregating disparate data, including vendor-agnostic clinical data with paid claims data. Sophisticated analytics are applied to this data to generate insights that enable practices to improve the quality of care, identify high risk patients who require enriched services, and coordinate the care of patients with chronic conditions. Cost and utilization analytics allow practices to successfully participate in risk-bearing contracts by providing timely insights into areas of over-utilization, under-utilization and mis-utilization of health care resources.

Connected Health Solutions provide frictionless interoperability. Interoperability is the ability of different information technology systems to communicate and exchange usable data. In healthcare, it enables caregivers to more effectively work together within and across organizational boundaries. To provide the highest quality care at the lowest cost, organizations need to capture and share information both within and outside of their networks. Our integrated, interoperable solutions and services enable providers to leverage their current technology for better outcomes and truly connected patient care.

6

NextGen Healthcare provides real-world solutions to our clients to help them achieve their strategic objectives. Often, but not always, those solutions are comprised of both software and expert services.

Products and Services

The Core

NextGen® Enterprise EHR – Our electronic health records solution stores and maintains clinical patient information and offers a workflow module, prescription management, automatic document and letter generation, patient education, referral tracking, interfaces to billing and lab systems, physician alerts and reminders, and reporting and data analysis tools.

NextGen® Enterprise PM – Our practice management offering is a seamlessly integrated, scalable, multi-module solution that includes a master patient index, enterprise-wide appointment scheduling with referral tracking, and clinical support. Recognized as #1 Practice Management Solution (11-75 Physicians) in 2019 Best in KLAS Report.

NextGen® Office (formerly known as Meditouch®) – A cloud-based EHR and PM solution for physicians and medical billing services designed to meet the specific needs of smaller and growing practices. Received top score for Overall Satisfaction and Product Functionality in the 2019 KLAS Small Practice Ambulatory EMR/PM (10 or fewer physicians) Report.

Automation and Workflow

NextGen® Mobile (formerly known as Entrada®) – Enables physicians and other caregivers to quickly and easily create relevant documentation within the EHR without sacrificing productivity. A true EHR mobile experience, the platform provides a fast, easy way for caregivers to view and share real-time clinical content and complete key tasks directly from their mobile device.

NextGen® Electronic Healthcare Transactions – Automates the exchange of electronic data among providers, payers and patients. Included in this offering are insurance eligibility, authorizations, electronic claims, remittance, patient appointment reminders, and electronic statements.

NextGen® Pre-Service Clearance – Provides access to real-time patient data and payers’ payment systems to provide a client’s front-desk staff the ability to accurately resolve patient collections at or before the point of service.

NextGen® Patient Payment – Allows patients one integrated solution that delivers an integrated point of sale, credit card on file, automated payment collection, online and mobile compatible automated phone pay and kiosk payments

Analytics, Population Health, and Patient Engagement

NextGen® Population Health – Delivers robust capabilities for core population health insights using integrated clinical and claims data to support both broad and deep analysis for populations of interest (attribute visualization, risk stratification, gaps in care, etc.).

NextGen® Population Health Patient Care Coordination – Enables scalable management of care and payment reform initiatives driven by collaborative care and workflow automation. Stratify risk and prioritize resources. A unique feature of our offering includes analytics driven patient outreach facilitating care coordinators’ ability to automate communications with patients based on quality initiatives and value-based contract commitments.

NextGen® Population Health Performance Management – Supports proactive value-based contract management including network management (leakage/keepage), network design (geospatial view of network), clinical variation analysis, and a wide range of resource utilization metrics.

NextGen® Patient Portal – Drives patient engagement and satisfaction with easy, intuitive, 24/7 access to payments, scheduling, personal health information, and communication. It facilitates and simplifies comprehensive information exchange, offering anytime, anywhere access from PCs, tablets, and smart phones.

Interoperability

NextGen® Connect Integration Engine – Enables patient data from disparate systems to be easily and securely shared, aggregated, and put to work, regardless of EHR, PM, or other HIT platform or location.

NextGen® Share – A wide variety of plug-and-play interoperability solutions which help NextGen® Enterprise EHR users safely and securely exchange clinical content with external providers and organizations. The platform includes support for secure direct messaging with more than 1.2 million providers and organizations, care quality integration to enable automated data exchange on behalf of nearly 240 million patients, and clinical data exchange interfaces with payers.

7

NextGen® Managed Cloud Services – Our new, scalable, cloud hosting services reduce the burden of information technology expertise from our clients and speed implementations, simplify upgrades, cut technology costs significantly and provide 24/7 monitoring and support by an expanded team of technical experts.

NextGen® Financial Suite (formerly known as NextGen® RCMS) – Includes billing and collections, electronic claims submission and denials management, electronic remittance and payment posting and accounts receivable follow-up. Our dedicated account management model helps make NextGen Healthcare a top-performing provider of RCMS as reported in the KLAS Ambulatory RCM Services Report.

NextGen® Contract Audit & Recovery Service – Unlike other payment review software tools that require clients to load their own contracts and fee schedules, perform analysis reports, and appeal findings with payers themselves, we provide a turn-key service solution that frees up valuable provider and staff time while maximizing recovery opportunity through years of experience and thousands of recovery efforts.

Professional Services – Services include training, project management, functional and detailed specification preparation, configuration, testing, and installation services. Our consulting services, which include physician, professional, and technical consulting, assist clients with optimizing their staffing and software solutions, enhancing financial and clinical outcomes, achieving regulatory requirements in the drive to value-based care, and meeting the evolving requirements of healthcare reform.

Client Service and Support – Our technical services staff provides support for the dependable and timely resolution of technical inquiries from clients. Such inquiries are made via telephone, email and the internet. We offer several levels of support, with the most comprehensive service covering 24 hours a day, seven days a week.

Proprietary Rights

We rely on a combination of patents, copyrights, trademarks, service marks, trade secrets, and contractual restrictions to establish and protect proprietary rights in our products and services. To protect our proprietary rights, we enter into confidentiality agreements and invention assignment agreements with our employees with whom such controls are relevant. In addition, we include intellectual property protective provisions in our client contracts. However, because the software industry is characterized by rapid technological change, we believe such factors as the technological and creative skills of our personnel, new product developments, frequent product enhancements, name recognition, and reliable product maintenance are more important to establishing and maintaining a technology leadership position than the various legal protections of our technology.

We rely on software that we license from third parties for certain components of our products and services. These components enhance our products and services and help meet evolving client needs. The failure to license any necessary technology, or to maintain our existing licenses, could result in reduced functionality of or reduced demand for our products.

Although we believe our products and services, and other proprietary rights, do not infringe upon the proprietary rights of third parties, third parties may assert intellectual property infringement claims against us in the future. Any such claims may result in costly, time-consuming litigation and may require us to enter into royalty or cross-license arrangements.

Competition

The markets for healthcare information systems and services are intensely competitive and highly fragmented. Our traditional full-suite competitors in the healthcare information systems and services market include: Allscripts Healthcare Solutions, Inc., athenahealth, Inc., Cerner Corporation, eClinicalWorks, Epic Systems Corporation, and Greenway Health, LLC. Emerging smaller competitors also bring competition in specific sectors of the market. Additionally, we face competition from services-only competitors like business process outsourcers, hosting providers and transcription companies.

The EHR, PM, interoperability, and connectivity markets, in particular, are subject to rapid changes in technology. We expect that competition in these market segments could increase as new competitors enter the market. We believe our principal competitive advantages are our ambulatory-only focus, our comprehensive and fully-integrated solution, and our deep domain expertise, which enables our subject matter experts to serve as trusted advisors to our clients.

Research and Development

The healthcare information systems and services industry is characterized by rapid technological change, requiring us to engage in continuing investments in our research and development to update, enhance and improve our systems. This includes expansion of our software and service offerings that support pay-for-performance initiatives around accountable care organizations, bringing greater ease of use and intuitiveness to our software products, enhancing our managed cloud and hosting services to lower our clients' total cost of ownership, expanding our interoperability and enterprise analytics capabilities, and furthering development and enhancements of our portfolio of specialty-focused templates within our electronic health records software.

8

We sell and market our products primarily through a direct sales force and to a lesser extent, through a reseller channel. Software license sales to resellers represented less than 10% of total revenue for each of the years ended March 31, 2019, 2018 and 2017.

NextGen Healthcare also provides solutions to networks of practices such as managed service organizations (MSOs), independent physician associations (IPAs), accountable care organizations (ACOs), ambulatory care centers (ACCs), and community health centers (CHCs).

Our direct sales force is comprised of subject matter experts by solution, as well as engaged account managers, all of whom deliver presentations to potential clients by demonstrating our systems and capabilities on the prospective client’s premises. System demonstrations for mobile workflow and analytics solutions are more web-based as these offerings tend to be targeted to larger practices. Sales efforts aimed at smaller practices can be performed on the prospective clients’ premises, or remotely via telephone or web-based presentations. Both the direct and reseller channel salesforces concentrate on multi-product/solution sales opportunities.

Our sales and marketing employees identify prospective clients through a variety of means, including: a healthcare data and analytics platform, search engine optimization of content on nextgen.com; digital advertising; direct mail and email campaigns; referrals from existing clients and industry consultants; contacts at professional society meetings and trade shows; webinars; trade journal advertising; public relations and social media campaigns; and telemarketing. Resources have shifted more heavily to digital marketing as we meet potential clients where they are and how they shop for services. Additionally, we focus on thought leadership and content marketing to highlight our industry knowledge, expertise and the successes of our diverse client base.

Our sales cycle can vary significantly and typically ranges from six to twenty-four months from initial contact to contract execution. Software licenses are normally delivered to a client almost immediately upon receipt of an order and we normally receive up-front licensing fees. Implementation and training services are normally rendered based on a mutually agreed upon timetable. Clients have the option to purchase hosting and maintenance services which, if purchased, are invoiced on a monthly, quarterly or annual basis. Subscriptions generally involve implementation and are typically billed monthly after implementation or based on volume or throughput.

We continue to concentrate our direct sales and marketing efforts on the ambulatory market from large multi-specialty organizations to small-single specialty practices in high-opportunity specialty segments.

We have numerous clients and do not believe that the loss of any single client would adversely affect us. No client accounted for 10% or more of our net revenue during each of the years ended March 31, 2019, 2018 and 2017. Substantially all of our clients are located in the United States.

Employees

As of March 31, 2019, we had approximately 2,660 full-time employees, of which 533 were based in Bangalore, India and substantially all other employees were based in the United States. We believe that our future success depends in part upon recruiting and retaining qualified sales, marketing and technical talent as well as other employees. None of our employees are covered by a collective bargaining agreement or are represented by a labor union.

Available Information

Our principal website is www.nextgen.com. We make our periodic and current reports, together with amendments to these reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, available on our website, free of charge, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. You may access such filings through our Investor Relations website at http://investor.nextgen.com. The SEC maintains an internet site at www.sec.gov that contains the reports, proxy statements and other information that we file electronically with the SEC. Our website and the information contained therein or connected thereto is not intended to be incorporated into this Report or any other report or information we file with the SEC.

You should carefully consider the risks described below, as well as the other cautionary statements and risks described elsewhere and the other information contained in this Report and in our other filings with the SEC, including subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. We operate in a rapidly changing environment that involves a number of risks. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business operations. If any of these known or unknown risks actually occur, our business, financial condition or results of operations could be materially and adversely affected, in which case the trading price of our common stock may decline and you may lose all or part of your investment.

9

We face significant, evolving competition which, if we fail to properly address, could adversely affect our business, results of operations, financial condition and price of our stock. The markets for healthcare information systems are intensely competitive, and we face significant competition from a number of different sources. Several of our competitors have substantially greater name recognition and financial, technical, product development and marketing resources than we do. There has been significant merger and acquisition activity among a number of our competitors in recent years. Some of our larger competitors, who have greater scale than we do, have and may continue to become more active in our markets both through internal development and acquisitions. Transaction induced pressures, or other related factors may result in price erosion or other negative market dynamics that could adversely affect our business, results of operations, financial condition and price of our stock.

We compete in all of our markets with other major healthcare related companies, information management companies, systems integrators and other software developers. Competition in our markets occurs on the basis of several factors, including price, innovation, client service, product quality and reliability, scope of services, industry acceptance, and others. Competitive pressures and other factors, such as new product introductions by us or our competitors, may result in price or market share erosion that could adversely affect our business, results of operations and financial condition. Also, there can be no assurance that our applications will achieve broad market acceptance or will successfully compete with other available software products. If we fail to distinguish our offerings from other options available to healthcare providers, the demand for and market share of our offerings may decrease.

Saturation or consolidation in the healthcare industry could result in the loss of existing clients, a reduction in our potential client base and downward pressure on the prices for our products and services. As the healthcare information systems market evolves, saturation of this market with our products or our competitors' products could limit our revenues and opportunities for growth. There has also been increasing consolidation amongst healthcare industry participants in recent years, creating integrated healthcare delivery systems with greater market power. As provider networks and managed care organizations consolidate, the number of market participants decreases and competition to provide products and services like ours will become more intense. The importance of establishing relationships with key industry participants will become greater and our inability to make initial sales of our systems to, or maintain relationships with, newly formed groups and/or healthcare providers that are replacing or substantially modifying their healthcare information systems could adversely affect our business, results of operations and financial condition. These consolidated industry participants may also try to use their increased market power to negotiate price reductions for our products and services. If we were forced to reduce our prices, our business would become less profitable unless we were able to achieve corresponding reductions in our expenses.

Many of our competitors have greater resources than we do. In order to compete successfully, we must keep pace with our competitors in anticipating and responding to the rapid changes involving the industry in which we operate, or our business, results of operations and financial condition may be adversely affected. The software market generally is characterized by rapid technological change, changing client needs, frequent new product introductions and evolving industry standards. The introduction of products incorporating new technologies and the emergence of new industry standards could render our existing products obsolete and unmarketable. There can be no assurance that we will be successful in developing and marketing new products that respond to technological changes or evolving industry standards. New product development depends upon significant research and development expenditures which depend ultimately upon sales growth. Any material shortfall in revenue or research funding could impair our ability to respond to technological advances or opportunities in the marketplace and to remain competitive. If we are unable, for technological or other reasons, to develop and introduce new products in a timely manner in response to changing market conditions or client requirements, our business, results of operations and financial condition may be adversely affected.

In response to increasing market demand, we are currently developing new generations of targeted software products. There can be no assurance that we will successfully develop these new software products or that these products will operate successfully, or that any such development, even if successful, will be completed concurrently with or prior to introduction of competing products. Any such failure or delay could adversely affect our competitive position or could make our current products obsolete.

Uncertainty in global economic and political conditions may negatively impact our business, operating results or financial condition. Global economic and political uncertainty have caused in the past, and may cause in the future, unfavorable business conditions such as a general tightening in the credit markets, lower levels of liquidity, increases in the rates of default and bankruptcy and extreme volatility in credit, equity and fixed income markets. These macroeconomic conditions could negatively affect our business, operating results or financial condition in a number of ways. Instability can make it difficult for our clients, our vendors, and us to accurately forecast and plan future business activities, and could cause constrained spending on our products and services, delays and a lengthening of our sales cycles and/or difficulty in collection of our accounts receivable. Current or potential clients may be unable to fund software purchases, which could cause them to delay, decrease or cancel purchases of our products and services or to not pay us or to delay paying us for previously purchased products and services. Our clients may cease business operations or conduct business on a greatly reduced basis. Bankruptcies or similar insolvency events affecting our clients may cause us to incur bad debt expense at levels higher than historically anticipated. Further, economic instability could limit our ability to access the capital markets at a time when we would like, or need, to raise capital, which could have an impact on our ability to react to changing business conditions or new opportunities. Finally, our investment portfolio is generally subject to general credit, liquidity, counterparty, market and interest

10

rate risks that may be exacerbated by these global financial conditions. If the banking system or the fixed income, credit or equity markets deteriorate or remain volatile, our investment portfolio may be impacted and the values and liquidity of our investments could be adversely affected as well.

Our relationships with strategic partners may fail to benefit us as expected. We face risk and/or the possibility of claims from activities related to strategic partners, which could be expensive and time-consuming, divert personnel and other resources from our business and result in adverse publicity that could harm our business. We rely on third parties to provide services for our business. For example, we use national clearinghouses in the processing of some insurance claims and we outsource some of our hardware services and the printing and delivery of patient statements for our clients. These third parties could raise their prices and/or be acquired by our competitors, which could potentially create short and long-term disruptions to our business, negatively impacting our revenue, profit and/or stock price. We also have relationships with certain third parties where these third parties serve as sales channels through which we generate a portion of our revenue. Due to these third-party relationships, we could be subject to claims as a result of the activities, products, or services of these third party service providers even though we were not directly involved in the circumstances leading to those claims. Even if these claims do not result in liability to us, defending and investigating these claims could be expensive and time-consuming, divert personnel and other resources from our business and result in adverse publicity that could harm our business. In addition, our strategic partners may compete with us in some or all of the markets in which we operate.

We have acquired companies, and may engage in future acquisitions, which may be expensive, time consuming, subject to inherent risks and from which we may not realize anticipated benefits. Historically, we have acquired numerous businesses, technologies, and products. We may acquire additional businesses, technologies and products if we determine that these additional businesses, technologies and products are likely to serve our strategic goals. Acquisitions have inherent risks, which may have a material adverse effect on our business, financial condition, operating results or prospects, including, but not limited to the following:

|

|

• |

failure to achieve projected synergies and performance targets; |

|

|

• |

potentially dilutive issuances of our securities, the incurrence of debt and contingent liabilities and amortization expenses related to intangible assets with indefinite useful lives, which could adversely affect our results of operations and financial condition; |

|

|

• |

using cash as acquisition currency may adversely affect interest or investment income, which may in turn adversely affect our earnings and /or earnings per share; |

|

|

• |

unanticipated expenses or difficulty in fully or effectively integrating or retaining the acquired technologies, software products, services, business practices, management teams or personnel, which would prevent us from realizing the intended benefits of the acquisition; |

|

|

• |

failure to maintain uniform standard controls, policies and procedures across acquired businesses; |

|

|

• |

difficulty in predicting and responding to issues related to product transition such as development, distribution and client support; |

|

|

• |

the possible adverse effect of such acquisitions on existing relationships with third party partners and suppliers of technologies and services; |

|

|

• |

the possibility that staff or clients of the acquired company might not accept new ownership and may transition to different technologies or attempt to renegotiate contract terms or relationships, including maintenance or support agreements; |

|

|

• |

the assumption of known and unknown liabilities; |

|

|

• |

the possibility of disputes over post-closing purchase price adjustments such as performance-based earnouts; |

|

|

• |

the possibility that the due diligence process in any such acquisition may not completely identify material issues associated with product quality, product architecture, product development, intellectual property issues, regulatory risks, compliance risks, key personnel issues or legal and financial contingencies, including any deficiencies in internal controls and procedures and the costs associated with remedying such deficiencies; |

|

|

• |

difficulty in entering geographic and/or business markets in which we have no or limited prior experience; |

|

|

• |

difficulty in integrating acquired operations due to geographical distance and language and cultural differences; |

|

|

• |

diversion of management's attention from other business concerns; and |

|

|

• |

the possibility that acquired assets become impaired, or that acquired assets lead us to determine that existing assets become impaired, requiring us to take a charge to earnings which could be significant. |

A failure to successfully integrate acquired businesses or technology could, for any of these reasons, have an adverse effect on our financial condition and results of operations.

11

Our failure to manage growth could harm our business, results of operations and financial condition. We have in the past experienced periods of growth which have placed, and may continue to place, a significant strain on our non-cash resources. We have also expanded our overall software development, marketing, sales, client management and training capacity, and may do so in the future. In the event we are unable to identify, hire, train and retain qualified individuals in such capacities within a reasonable timeframe, such failure could have an adverse effect on the operation of our business. In addition, our ability to manage future increases, if any, in the scope of our operations or personnel will depend on significant expansion of our research and development, marketing and sales, management and administrative and financial capabilities. The failure of our management to effectively manage expansion in our business could have an adverse effect on our business, results of operations and financial condition.

We may experience reduced revenues and/or be forced to reduce our prices. We may be subject to pricing pressures with respect to our future sales arising from various sources, including amount other things, government action affecting reimbursement levels. Our clients and the other entities with which we have business relationships are affected by changes in statutes, regulations, and limitations on government spending for Medicare, Medicaid, and other programs. Recent government actions and future legislative and administrative changes could limit government spending for Medicare and Medicaid programs, limit payments to healthcare providers, increase emphasis on competition, impose price controls, initiate new and expanded value-based reimbursement programs and create other programs that potentially could have an adverse effect on our business. If we experience significant downward pricing pressure, our revenues may decline along with our ability to absorb overhead costs, which may leave our business less profitable.

Our operations are dependent upon attracting and retaining key personnel. If such personnel were to leave unexpectedly, we may not be able to execute our business plan. Our future performance depends in significant part upon the continued service of our key development and senior management personnel and successful recruitment of new talent. These personnel have specialized knowledge and skills with respect to our business and our industry. Because we have a relatively small number of employees when compared to other leading companies in our industry, our dependence on maintaining our relationships with key employees and successful recruiting is particularly significant.

The industry in which we operate is characterized by a high level of employee mobility and aggressive recruiting of skilled personnel. There can be no assurance that our current employees will continue to work for us. Loss of services of key employees could have an adverse effect on our business, results of operations and financial condition. Furthermore, we may need to grant additional equity incentives to key employees and provide other forms of incentive compensation to attract and retain such key personnel. Equity incentives may be dilutive to our per share financial performance. Failure to provide such types of incentive compensation could jeopardize our recruitment and retention capabilities.

We may be subject to harassment or discrimination claims and legal proceedings, and our inability or failure to respond to and effectively manage publicity related to such claims could adversely impact our business. Our Code of Business Conduct and Ethics and other employment policies prohibit harassment and discrimination in the workplace, in sexual or in any other form. We have ongoing programs for workplace training and compliance, and we investigate and take disciplinary action with respect to alleged violations. However, actions by our employees could violate those policies. With the increased use of social media platforms, including blogs, chat platforms, social media websites, and other forms of Internet-based communications that allow individuals access to a broad audience, there has been an increase in the speed and accessibility of information dissemination. The dissemination of information via social media, including information about alleged harassment, discrimination or other claims, could harm our business, brand, reputation, financial condition, and results of operations, regardless of the information's accuracy.

Our recent strategy shift and the resulting business reorganization plan we are implementing may be disruptive both internally and externally, and we may not fully realize the anticipated benefits. We recently embarked on a new strategic plan geared toward realigning our business structure and strategy to rapidly emerging changes in the healthcare industry. As this process continues, we anticipate that it will result in continued evaluation of our organizational structure in order to achieve greater efficiency, as well as investments in new market solutions and changes to our culture that we hope will drive revenue growth and provide increased value to stakeholders and shareholders. There can be no assurance that our current or future strategic realignment efforts will be successful. Our ability to achieve the anticipated benefits of our strategy shift is subject to estimates and assumptions, which may vary based on numerous factors and uncertainties, some of which are beyond our control. Reorganization programs entail a variety of known and unknown risks that may increase our costs or impair our ability to achieve operational efficiencies, such as distraction to management and employees, loss of workforce capabilities, loss of continuity, accounting charges for technology-related write-offs and workforce reduction costs, decreases in employee focus and morale, uncertainty and turbulence among our clients and vendors, higher than anticipated separation expenses, litigation, and the failure to meet financial and operational targets. If we are unable to effectively implement our strategic shift and realign our business to address the rapidly evolving market, we and our shareholders may not realize the anticipated financial, operational, and other benefits from these initiatives.

If we are unable to manage our growth in the new markets we may enter, our business and financial results could suffer. Our future financial results will depend in part on our ability to profitably manage our business in new markets that we may enter. We are engaging in the strategic identification of, and competition for, growth and expansion opportunities in new markets or offerings, including but not limited to the areas of interoperability, patient engagements, data analytics and population health. With several of our recent acquisitions, we have expanded into the market for cloud-based EHR products. It remains uncertain whether the market for cloud-based products will expand to the levels of demand and market acceptance

12

we anticipate, and there can be no assurance that we will be able to successfully scale the acquired companies’ products to meet our clients’ expectations. In addition, as clients move from fee-for-service to fee-for-value reimbursement strategies in conjunction with the adoption of population health business models, we may not make appropriate and timely changes to our service offerings consistent with shifts in market demands and expectations. In order to successfully execute on our growth initiatives, we will need to, among other things, manage changing business conditions, anticipate and react to changes in the regulatory environment, and develop expertise in areas outside of our business's traditional core competencies. Difficulties in managing future growth in new markets could have a significant negative impact on our business, financial condition and results of operations.

We may not be successful in developing or launching our new software products and services, which could have a negative impact on our financial condition and results of operations. We invest significant resources in the research and development of new and enhanced software products and services. Over the last few years we have incurred, and will continue to incur, significant internal research and development expenses, a portion of which have been and may continue to be recorded as capitalized software costs. We cannot provide assurances that we will be successful in our efforts to plan, develop or sell new software products that meet client expectations, which could result in an impairment of the value of the related capitalized software costs, an adverse effect on our financial condition and operating results and a negative impact the future of our business. Additionally, we cannot be assured that we will continue to capitalize software development costs to the same extent as we have done to date, as the result of changes in development methodologies and other factors. To the extent that we capitalize a lower percentage of total software development costs, our earnings could be reduced.

We have substantial development and other operations in India, and we use offshore third-party partners located in India and other countries that subject us to regulatory, economic, social and political uncertainties in India and to laws applicable to U.S. companies operating overseas. We are subject to several risks associated with having a portion of our assets and operations located in India and by using third party service providers in India and other countries. Many U.S. companies have benefited from many policies of the Government of India and the Indian state governments in the states in which we operate, which are designed to promote foreign investment generally and the business process services industry in particular, including significant tax incentives, relaxation of regulatory restrictions, liberalized import and export duties and preferential rules on foreign investment and repatriation. There is no assurance that such policies will continue. Various factors, such as changes in the current Government of India, could trigger significant changes in India’s economic liberalization and deregulation policies and disrupt business and economic conditions in India generally and our business in particular. In addition, our financial performance and the market price of our common stock may be adversely affected by general economic conditions and economic and fiscal policy in India, including changes in exchange rates and controls, interest rates and taxation policies, as well as social stability and political, economic or diplomatic developments affecting India in the future. In particular, India has experienced significant economic growth over the last several years, but faces major challenges in sustaining that growth in the years ahead. These challenges include the need for substantial infrastructure development and improving access to healthcare and education. Our ability to recruit, train and retain qualified employees, develop and operate our captive facility could be adversely affected if India does not successfully meet these challenges. In addition, U.S. governing authorities may pressure us to perform work domestically rather than using offshore resources. Furthermore, local laws and customs in India may differ from those in the U.S. For example, it may be a local custom for businesses to engage in practices that are prohibited by our internal policies and procedures or U.S. laws and regulations applicable to us, such as the Foreign Corrupt Practices Act (“FCPA”). The FCPA generally prohibits U.S. companies from giving or offering money, gifts, or anything of value to a foreign official to obtain or retain business, and requires businesses to make and keep accurate books and records and a system of internal accounting controls. We cannot guarantee that our employees, contractors, and agents will comply with all of our FCPA compliance policies and procedures. If we or our employees, contractors, or agents fail to comply with the requirements of the FCPA or similar legislation, government authorities in the U.S. and elsewhere could seek to impose civil or criminal fines and penalties which could have a material adverse effect on our business, operating results, and financial condition.

We face the risks and uncertainties that are associated with litigation and investigations, which may adversely impact our marketing, distract management and have a negative impact upon our business, results of operations and financial condition. We face the risks associated with litigation and investigations concerning the operation of our business, including claims by clients regarding product and contract disputes, by other third parties asserting infringement of intellectual property rights, by current and former employees regarding certain employment matters, by certain shareholders, and by governmental and regulatory bodies for failures to comply with applicable laws. The uncertainty associated with substantial unresolved disputes may have an adverse effect on our business. In particular, such disputes could impair our relationships with existing clients and our ability to obtain new clients. Defending litigation and investigative matters may require substantial cost and may result in a diversion of management's time and attention away from business operations, which could have an adverse effect on our business, results of operations and financial condition.

Commencing in April 2017, we have received requests for documents and information from the United States Attorney's Office for the District of Vermont and other government agencies in connection with an investigation concerning the certification we obtained for our software under the United States Department of Health and Human Services' Electronic Health Record (EHR) Incentive Program. The requests for information relate to, among other things: (a) data used to determine objectives and measures under the Meaningful Use (“MU”) and the Physician Quality Reporting System (“PQRS”) programs, (b) EHR software code used in certifying our software and information, and (c) payments provided for the referral of EHR business. We continue to cooperate in this investigation. Requests and investigations of this nature may lead to future requests for

13

information and ultimately the assertion of claims or the commencement of legal proceedings against us, as well as other material liabilities. In addition, our responses to these and any future requests require time and effort, which can result in additional cost to us. Given the highly-regulated nature of our industry, we may, from time to time, be subject to subpoenas, requests for information, or investigations from various government agencies. It is our practice to respond to such matters in a cooperative, thorough and timely manner.

There can be no assurance that such litigation and investigations will not result in liability in excess of our insurance coverage, that our insurance will cover such claims or that appropriate insurance will continue to be available to us in the future at commercially reasonable rates. In addition, any enforcement action by a government agency may result in fines, damage awards, regulatory consequences or other sanctions which could have a material adverse effect, individually or collectively, on the Company’s liquidity, financial condition or results of operations.

We may be impacted by IT system failures or other disruptions. We may be subject to IT systems failures and network disruptions. These may be caused by natural disasters, accidents, power disruptions, telecommunications failures, acts of terrorism or war, computer viruses, malware, physical or electronic break-ins, or other events or disruptions. System redundancy may be ineffective or inadequate, and our disaster recovery planning may not be sufficient for all eventualities. Such failures or disruptions could prevent access to or the delivery of certain of our products or services, compromise our data or our clients’ data, or result in delayed or cancelled orders as well as potentially expose us to third party claims. System failures and disruptions could also impede our transactions processing services and financial reporting.

Our business operations are subject to interruption by, among other, natural disasters, fire, power shortages, terrorist attacks, and other hostile acts, labor disputes, public health issues, and other issues beyond our control. Such events could decrease our demand for our products or services or make it difficult or impossible for us to develop and deliver our products or services to our clients. A significant portion of our research and development activities, our corporate headquarters, our IT systems, and certain of our other critical business operations are concentrated in a few geographic areas. In the event of a business disruption in one or more of those areas, we could incur significant losses, require substantial recovery time, and experience significant expenditures in order to resume operations, which could materially and adversely impact our business, financial condition, and operating results.

We have had to take charges due to asset impairments, and we could suffer further charges due to asset impairment that could reduce our income. We test our goodwill for impairment annually during our first fiscal quarter, and on interim dates should events or changes in circumstances indicate the carrying value of goodwill may not be recoverable in accordance with the relevant accounting guidance. In the past, we have recorded sizeable goodwill impairment charges, and we may need to do so in the future. Declines in business performance or other factors could cause the fair value of any of our operating segments to be revised downward, resulting in further impairment charges. If the financial outlook for any of our operating segments warrants additional impairments of goodwill, the resulting write-downs could materially affect our reported net earnings.

We face risks related to litigation advanced by a former director and shareholder of ours, and a shareholder derivative claim. On October 7, 2013, a complaint was filed against our Company and certain of our officers and directors in the Superior Court of the State of California for the County of Orange, captioned Ahmed D. Hussein v. Sheldon Razin, Steven Plochocki, Quality Systems, Inc. and Does 1-10, inclusive, No. 30-2013-00679600-CU-NP-CJC, by Ahmed Hussein, a former director and significant shareholder of our Company. We filed a demurrer to the complaint, which the Court granted on April 10, 2014. An amended complaint was filed on April 25, 2014. The amended complaint generally alleges fraud and deceit, constructive fraud, negligent misrepresentation and breach of fiduciary duty in connection with statements made to our shareholders regarding our financial condition and projected future performance. The amended complaint seeks actual damages, exemplary and punitive damages and costs. We filed a demurrer to the amended complaint. On July 29, 2014, the Court sustained the demurrer with respect to the breach of fiduciary duty claim, and overruled the demurrer with respect to the fraud and deceit claims. On August 28, 2014, we filed an answer and also filed a cross-complaint against Hussein, alleging that he breached fiduciary duties owed to the Company, Mr. Razin and Mr. Plochocki. Mr. Razin and Mr. Plochocki have dismissed their claims against Hussein, leaving the Company as the sole plaintiff in the cross-complaint. On June 26, 2015, we filed a motion for summary judgment with respect to Hussein’s claims, which the Court granted on September 16, 2015, dismissing all of Hussein’s claims against us. On September 23, 2015, Hussein filed an application for reconsideration of the Court's summary judgment order, which the Court denied. Hussein filed a renewed application for reconsideration of the Court’s summary judgment order on August 3, 2017. The Court again denied Hussein’s application. On October 28, 2015, May 9, 2016, and August 5, 2016, Hussein filed a motion for summary judgment, motion for summary adjudication, and motion for judgment on the pleadings, respectively, seeking to dismiss our cross-complaint. The Court denied each motion. Trial on our cross-complaint began June 12, 2017. On July 26, 2017, the Court issued a statement of decision granting Hussein’s motion for judgment on our cross-complaint. Final judgment over Hussein’s claims and our cross-claims was entered on January 9, 2018. Hussein has noticed his appeal of the order granting summary judgment over his claims, and we noticed a cross-appeal on the court’s statement of decision granting Hussein’s motion for judgment on our cross-complaint. Briefing on the cross-appeals was completed in fall 2018. A hearing on the cross-appeals has not yet been set.

On September 28, 2017, a complaint was filed against our Company and certain of our current and former officers and directors in the United States District Court for the Central District of California, captioned Kusumam Koshy, derivatively on behalf of Quality Systems Inc. vs. Craig Barbarosh, George H. Bristol, James C. Malone, Peter M. Neupert, Morris Panner, D. Russell Pflueger, Steven T. Plochocki, Sheldon Razin, Lance E. Rosenzweig, Paul A. Holt, and Quality Systems, Inc., No.

14

8:17-cv-01694, by Kusumam Koshy, a purported shareholder of ours. The complaint alleges breach of fiduciary duties and abuse of control, as well as unjust enrichment and insider selling by individual directors arising out of the allegations described above under the caption “Hussein Litigation”, and a related, now-settled, federal securities class action, as well as the Company’s adoption of revised indemnification agreements, and the resignation of certain officers of the Company. The complaint seeks restitution and disgorgement, court costs and attorneys’ fees, and enhanced corporate governance reforms and internal control procedures. On January 12, 2018, Defendants filed a motion to dismiss the derivative complaint. Defendants’ motion is scheduled to be heard on July 23, 2018. On July 25, 2018, the Court dismissed the complaint with prejudice. On August 24, 2018, the plaintiff field a notice of appeal to the United States Court of Appeals for the Ninth Circuit, and filed her opening brief on January 23, 2019. We filed our response on March 25, 2019, and the plaintiff’s reply is due this spring.

Although we believe the claims to be without merit, our operating results and share price may be negatively impacted due to the negative publicity, expenses incurred in connection with our defense, management distraction, and/or other factors related to this litigation. In addition, litigation of this nature may negatively impact our ability to attract and retain clients and strategic partners, as well as qualified board members and management personnel.

Our credit agreement contains restrictive and financial covenants that may limit our operational flexibility. If we fail to meet our obligations under the credit agreement, our operations may be interrupted and our business and financial results could be adversely affected. On March 29, 2018, we entered into a revolving credit agreement with various lenders, secured by substantially all of our and our material domestic subsidiaries’ existing and future property. The credit agreement includes certain customary covenants that impose restrictions on our business and financing activities that could limit our operations or flexibility to take certain actions. The credit agreement also contains certain customary affirmative covenants requiring us to maintain specified levels of financial performance. Our ability to comply with these covenants may be affected by events that could be beyond our control. A breach of these covenants could result in an event of default under the credit agreement which, if not cured or waived, could result in the indebtedness becoming immediately due and payable, which in turn could result in material adverse consequences that negatively impact our business, the market price for our common stock, and our ability to obtain financing in the future. In addition, our credit agreement’s covenants, consent requirements, and other provisions may limit our flexibility to pursue or fund strategic initiatives or acquisitions that might be in the long-term interests of our Company and shareholders.

We may not be successful in integrating and operating our recent acquisitions, and in implementing our post-acquisition business strategy with respect to the products acquired in these transactions. Our shift in product focus following the acquisitions may not yield the desired results. We have recently completed several acquisitions. As a result of these acquisitions, we have devoted and will continue to need to devote significant management attention and resources to integrating the acquired companies’ businesses and product platforms into our business. We may experience problems associated with the acquired companies and their personnel, processes, product, technology, liabilities, commitments, and other matters. There is no assurance that we will be able to successfully integrate the acquired businesses or realize synergies and benefits from the transactions. Furthermore, the acquisitions have substantially altered our business strategy, increasing our focus on efforts to expand our client base and cloud-based solution capabilities in the ambulatory market. If we are unable to successfully integrate acquisitions and implement post-acquisition revisions to our business strategy and product focus, our business, financial condition, and results of operations may suffer.

Risks Related to Our Products and Services

If our principal products, new product developments or implementation, training and support services fail to meet the needs of our clients due to lack of client acceptance, errors, or other problems, we may fail to realize future growth, suffer reputational harm and face the risk of losing existing clients. We currently derive substantially all of our net revenue from sales of our healthcare information systems and related services. We believe that a primary factor in the market acceptance of our systems has been our ability to meet the needs of users of healthcare information systems. Our future financial performance will depend in large part on our ability to continue to meet the increasingly sophisticated needs of our clients through the timely development and successful introduction of new and enhanced versions of our systems and other complementary products, as well as our ability to provide high quality implementation, training and support services for our products. We have historically expended a significant percentage of our net revenue on product development and believe that significant continuing product development efforts will be required to retain our existing clients and sustain our growth. Continued investment in our sales staff and our client implementation, training and support staffs will also be required to retain and grow our client base.

There can be no assurance that we will be successful in our client satisfaction or product development efforts, that the market will continue to accept our existing products and services, or that new products or product enhancements will be developed and implemented in a timely manner, meet the requirements of healthcare providers, or achieve market acceptance. Also, it is possible that our technology may contain defects or errors, some of which may remain undetected for a period of time. If we detect errors before we introduce a solution, we may have to delay deployment for an extended period of time while we address the problem. If we do not discover errors until after product deployment, we may need to provide enhancements to correct such errors. Remediating product defects and errors could consume our development and management resources. In addition, any failure or perceived failure to maintain high-quality and highly-responsive client support could harm our reputation. Quality or performance issues with our products and services may result in product-related liabilities, unexpected expenses and diversion of resources to remedy errors, harm to our reputation, lost sales, delays in commercial releases,

15

delays in or loss of market acceptance of our solutions, license termination or renegotiations, and privacy or security vulnerabilities. If new products or product enhancements are delayed or do not achieve market acceptance, or if our implementation, training and support services do not achieve a high degree of client satisfaction, our reputation, business, results of operations and financial condition could be adversely affected. At certain times in the past, we have also experienced delays in purchases of our products by clients anticipating our launch, or the launch of our competitors, of new products. There can be no assurance that material order deferrals in anticipation of new product introductions from ourselves or other entities will not occur.

If the emerging technologies and platforms of Microsoft and others upon which we build our products do not gain or continue to maintain broad market acceptance, or if we fail to develop and introduce in a timely manner new products and services compatible with such emerging technologies, we may not be able to compete effectively and our ability to generate revenue will suffer. Our software products are built and depend upon several underlying and evolving relational database management system platforms such as those developed by Microsoft. To date, the standards and technologies upon which we have chosen to develop our products have proven to have gained industry acceptance. However, the market for our software products is subject to ongoing rapid technological developments, quickly evolving industry standards and rapid changes in client requirements, and there may be existing or future technologies and platforms that achieve industry standard status, which are not compatible with our products.