UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

September 27, 2023

Dear Lam Research Stockholders,

We cordially invite you to attend the Lam Research Corporation 2023 Annual Meeting of Stockholders. The annual meeting will be held on Tuesday, November 7, 2023, at 9:30 a.m. Pacific Standard Time. This year’s annual meeting will be a virtual meeting. You may attend the annual meeting, vote, and submit your questions during the live webcast of the annual meeting by visiting virtualshareholdermeeting.com/LRCX2023 and entering the 16-digit control number included in our Notice of Internet Availability or on your proxy card.

At this year’s annual meeting, stockholders will be asked to elect the eleven nominees named in the attached proxy statement as directors to serve until the next annual meeting of stockholders, and until their respective successors are elected and qualified; to cast an advisory vote to approve our named executive officer compensation; to cast an advisory vote to approve the frequency of holding future stockholder advisory votes on our named executive officer compensation; and to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2024. The Board of Directors recommends that you vote in favor of each director nominee; for future stockholder advisory votes on our named executive officer compensation at a frequency of every one year; and for each of these other proposals. Management will not provide a business update during this meeting; please refer to our latest quarterly earnings report for our most recently-provided outlook.

Please refer to the proxy statement for detailed information about the annual meeting, each director nominee, and each of the proposals, as well as voting instructions. Your vote is important, and we strongly urge you to cast your vote as soon as possible by the internet, telephone, or mail, even if you plan to attend the meeting.

Sincerely yours,

Abhijit Y. Talwalkar

Chairman of the Board

| Notice of 2023 Annual Meeting of Stockholders |

4650 Cushing Parkway

Fremont, California 94538

Telephone: 510-572-0200

Meeting Information

| Category | Details |

||

| Date and Time | Tuesday, November 7, 2023 9:30 a.m. Pacific Standard Time |

||

| Place | Via

the Internet at virtualshareholdermeeting.com/ LRCX2023 |

||

| Record Date | Only stockholders of record at the close of business on September 8, 2023, the “Record Date,” are entitled to notice of, and to vote at, the annual meeting. |

Proxy and Annual Report Materials

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2023 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD NOVEMBER 7, 2023

Our notice of 2023 Annual Meeting of Stockholders, proxy statement, and annual report to stockholders are available on the Lam Research website at investor.lamresearch.com.

|

Elect Electronic Delivery Save Time, Money & Trees As part of our efforts to be an environmentally responsible corporate citizen, we encourage Lam stockholders to voluntarily elect to receive future proxy and annual report materials electronically. |

|

| • | If you are a registered stockholder, please visit enroll.icsdelivery.com/lrcx for simple instructions. |

| • | If you are a stockholder who owns stock through a broker or brokerage account, please opt for e-delivery at enroll.icsdelivery.com/lrcx or by contacting your nominee. |

Date of Distribution

This notice, proxy statement and proxy card are first being made available and/or mailed to our stockholders on or about September 27, 2023.

Items of Business

| # | Proposal | Our Board’s Recommendation |

|||

| 1. | Election of eleven directors to serve until the next annual meeting of stockholders, and until their respective successors are elected and qualified | þ |

FOR each |

||

| 2. | Advisory vote to approve our named executive officer (“NEO”) compensation | þ |

FOR |

||

| 3. | Advisory vote to approve the frequency of holding future advisory votes on NEO compensation | þ |

ONE YEAR |

||

| 4. | Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2024 | þ | FOR | ||

| Transaction of such other business as may properly come before the annual meeting (including any adjournment or postponement thereof) | |||||

Voting

Please vote as soon as possible, even if you plan to attend the annual meeting, on all of the voting matters. You have three options for submitting your vote before the annual meeting:

|

|

|

| By internet | By phone | By mail |

The proxy statement and the accompanying proxy card

provide detailed voting instructions.

IT IS IMPORTANT THAT YOU VOTE to play a part in the future of the Company. Please carefully review the proxy materials for the 2023 Annual Meeting of Stockholders.

By Order of the Board of Directors,

Ava M. Hahn

Secretary

Lam Research Corporation

Proxy Statement for 2023 Annual Meeting of Stockholders

TABLE OF CONTENTS

| Proxy Statement Summary |

To assist you in reviewing the proposals to be acted upon at the annual meeting, we call your attention to the following summarized information about the Company, the proposals and voting recommendations, the Company’s director nominees, highlights of the directors’ key qualifications, skills and experiences, board composition, corporate governance, executive compensation, and environmental, social and governance (“ESG”) matters. For more complete information about these topics, please review the complete proxy statement before voting. We also encourage you to read our latest annual report on Form 10-K, which is available at investor.lamresearch.com, and our latest ESG report, which is available at lamresearch.com/company/environmental-social-governance/. The content of any website or report referred to in this proxy statement is not a part of nor incorporated by reference in this proxy statement unless expressly noted.

We use the terms “Lam Research,” “Lam,” the “Company,” “we,” “our,” and “us” in this proxy statement to refer to Lam Research Corporation, a Delaware corporation. We also use the term “Board” to refer to the Company’s Board of Directors.

This proxy statement contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include any statements that are not statements of historical fact, including statements regarding our ESG plans and goals. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from the expectations expressed, including the risks and uncertainties described in our filings with the U.S. Securities and Exchange Commission (“SEC”), including specifically the Risk Factors described in our annual report on Form 10-K and our quarterly reports on Form 10-Q. You should not place undue reliance on forward-looking statements. We undertake no obligation to update any forward-looking statements.

About Lam Research Corporation

Lam Research is a global supplier of innovative wafer fabrication equipment and services to the semiconductor industry. We have built a strong global presence with core competencies in areas such as nanoscale applications enablement, chemistry, plasma and fluidics, advanced systems engineering, and a broad range of operational disciplines. Our products and services are designed to help our customers build smaller and better performing devices that are used in a variety of electronic products, including mobile phones, personal computers, servers, wearables, automotive vehicles, and data storage devices.

Our customer base includes leading semiconductor memory, foundry, and integrated device manufacturers that make products such as non-volatile memory, dynamic random-access memory (DRAM), and logic devices. Their continued success is part of our commitment to driving semiconductor breakthroughs that define the next generation. Our core technical competency is integrating hardware, process, materials, software, and process control enabling results on the wafer.

Semiconductor manufacturing, our customers’ business, involves the complete fabrication of multiple dies or integrated circuits on a wafer. This involves the repetition of a set of core processes and can require hundreds of individual steps. Fabricating these devices requires highly sophisticated process technologies to integrate an increasing array of new materials with precise control at the atomic scale. Along with meeting technical requirements, wafer processing equipment must deliver high productivity and be cost-effective.

Demand from cloud computing, the Internet of Things, or “IoT,” and other markets is driving the need for increasingly powerful and cost-efficient semiconductors. At the same time, there are growing technical challenges with traditional two-dimensional scaling. These trends are driving significant inflections in semiconductor manufacturing, such as the increasing importance of vertical scaling strategies like three-dimensional architectures as well as multiple patterning to enable shrinks.

We believe we are in a strong position with our leadership and expertise in deposition, etch, and clean to facilitate some of the most significant innovations in semiconductor device manufacturing. Several factors create opportunity for sustainable differentiation for us: (i) our focus on research and development, with several on-going programs relating to sustaining engineering, product and process development, and concept and feasibility; (ii) our ability to effectively leverage cycles of learning from our broad installed base; (iii) our collaborative focus with semi-ecosystem partners; (iv) our ability to identify and invest in the breadth of our product portfolio to meet technology inflections; and (v) our focus on delivering our multi-product solutions with a goal to enhance the value of Lam’s solutions to our customers.

Lam Research Corporation 2023 Proxy Statement 1

Figure 1. Fiscal Year 2023 Financial Highlights

| (1) | Figures for capital returned to stockholders and amounts repurchased include brokerage fees and commissions and excise taxes. |

Figure 2. Proposals and Voting Recommendations

| Voting Matters | Board Vote Recommendation |

|||

| Proposal No. 1: Election of Directors | FOR each nominee | |||

| Proposal No. 2: Advisory Vote to Approve Our Named Executive Officer Compensation | FOR | |||

| Proposal No. 3: Advisory Vote to Approve the Frequency of Holding Future Stockholder Advisory Votes on Our Named Executive Officer Compensation | ONE YEAR | |||

| Proposal No. 4: Ratification of the Appointment of Ernst & Young LLP as our Independent Registered Public Accounting Firm for Fiscal Year 2024 | FOR | |||

| Transaction of such other business as may properly come before the annual meeting (including any adjournment or postponement thereof) |

Figure 3. Summary Information Regarding Director Nominees

You are being asked to vote on the election of these eleven directors. The following table provides summary information about each director nominee as of September 8, 2023. Information about nominee diversity is shown in Figure 4 on the following page, information about their key qualifications, skills and experiences is shown in Figure 5, and their biographical information is contained in the “Voting Proposals – Proposal No. 1: Election of Directors – 2023 Nominees for Director” section beginning on page 65 below.

| Name | Director | Committee Membership(2) |

Other Current Public Boards | ||||||||||||||

| Age | Since | Independent(1) | AC | CHC | NGC | ||||||||||||

| Sohail U. Ahmed | 65 | 2019 | Yes | M | |||||||||||||

| Timothy M. Archer | 56 | 2018 | No | * | |||||||||||||

| Eric K. Brandt | 61 | 2010 | Yes | * | C | M | Dentsply Sirona, Gen Digiital, Macerich |

||||||||||

| Michael R. Cannon | 70 | 2011 | Yes | M/FE | C | Seagate Technology | |||||||||||

| John M. Dineen | 60 | 2023 | Yes | Cognizant Technology Solutions, Syneos Health |

|||||||||||||

| Ho Kyu Kang | 61 | 2023 | Yes | ||||||||||||||

| Bethany J. Mayer | 61 | 2019 | Yes | M/FE | M | Box, Hewlett Packard Enterprise, Sempra Energy |

|||||||||||

| Jyoti K. Mehra | 47 | 2021 | Yes | M | |||||||||||||

| Abhijit Y. Talwalkar | 59 | 2011 | Yes (Chairman) |

M | M | Advanced Micro Devices, iRhythm Technologies, TE Connectivity |

|||||||||||

| Lih Shyng (Rick L.) Tsai | 72 | 2016 | Yes | M | MediaTek | ||||||||||||

| Leslie F. Varon | 66 | 2019 | Yes | C/FE | Dentsply Sirona, Hamilton Lane |

||||||||||||

| (1) | Independence determined in accordance with Nasdaq rules. |

| (2) | Memberships shown will continue through November 7, 2023, on which date Mr. Dineen will join the audit committee. |

| AC – Audit committee | C – Chair | |||

| CHC – Compensation and human resources committee | M – Member | |||

| NGC – Nominating and governance committee | FE – Audit committee financial expert (as determined based on SEC rules) * – Qualifies as an audit committee financial expert (as determined based on SEC rules) |

|||

2

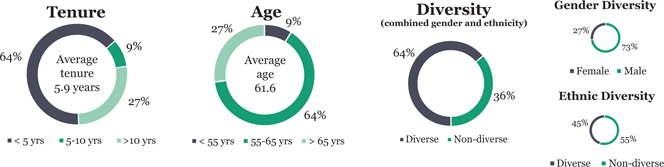

Figure 4. Director Nominee Composition Highlights

The Board is committed to diversity and the pursuit of board refreshment and balanced tenure. The following charts show the tenure, age, and diversity of the director nominees. For more information about our Board’s approach to refreshment and diversity, including our board diversity matrix, please refer to the section “Governance Matters - Corporate Governance - Our Approach to Ensuring Board Effectiveness” beginning on page 11 below.

Figure 5. Director Nominee Key Qualifications, Skills, and Experiences

The table below summarizes the key qualifications, skills, and experiences of our nominees. Not having a mark does not mean the director nominee does not possess that qualification, skill, or experience. The director biographies contained in the “Voting Proposals – Proposal No. 1: Election of Directors – 2023 Nominees for Director” section below describe each director nominee’s background and relevant experience in more detail, and identify those qualifications, skills, and experiences considered most relevant to the decision to nominate candidates to serve on our Board.

| Key Qualifications, Skills & Experiences of Director Nominees |

Sohail U. Ahmed |

Timothy M. Archer |

Eric K. Brandt |

Michael R. Cannon |

John M. Dineen |

Ho Kyu Kang |

Bethany J. Mayer |

Jyoti K. Mehra |

Abhijit Y. Talwalkar |

Lih Shyng (Rick L.) Tsai |

Leslie F. Varon |

| Industry Knowledge – Knowledge of and experience with our semiconductor and broader technology industries and markets provides our Board members with a deeper understanding of our products and services, the market sectors in which we and our customers compete, and the broader technology end markets that drive demand in our industry. | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Customer/Deep Technology Knowledge – Directors who possess deep knowledge and understanding of semiconductor processing equipment technologies, assist our Board in overseeing our business and strategies and enhance the Board’s understanding of our customers’ markets and needs. | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||

| Marketing, Disruptive Technology, and Strategy Experience – Directors with extensive knowledge and experience in business-to-business marketing and sales, and services and/or business development, or experience identifying and developing disruptive technologies and leading corporate strategy, provide value to the Board by offering critical insights and expertise on identifying and understanding new markets, expanding market share, and communicating with customers, particularly where such experience is in a capital equipment industry, and also provide the Board with critical guidance needed to progress in our innovation goals and drive semiconductor breakthroughs. | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Leadership Experience – Current or former experience in an executive-level leadership position at a significant business allows our directors to provide the Board with important perspectives and knowledge regarding business strategy, operations, corporate culture, succession planning, and management and leadership best practices. | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

Lam Research Corporation 2023 Proxy Statement 3

| Key Qualifications, Skills & Experiences of Director Nominees |

Sohail U. Ahmed |

Timothy M. Archer |

Eric K. Brandt |

Michael R. Cannon |

John M. Dineen |

Ho Kyu Kang |

Bethany J. Mayer |

Jyoti K. Mehra |

Abhijit Y. Talwalkar |

Lih Shyng (Rick L.) Tsai |

Leslie F. Varon |

| Finance Experience – Directors with profit and loss (“P&L”) and financing experience as an executive responsible for financial results of a breadth and level of complexity comparable to the Company help our Board oversee the Company’s financial planning, operations, investment strategies, capital allocation, and financial reporting. | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||

| Global Business Experience – Experience as a current or former business executive of a business with substantial global operations provides our Board with unique insights on managing an international business, global scale expansion, and understanding cultural norms. | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Mergers and Acquisitions (“M&A”) Experience – Directors with M&A and integration experience (including buy- and sell-side and hostile M&A experience) as a public company director or officer provide our Board with key background and insights in assisting management with reviewing strategic alternatives, analyzing potential targets, post-deal integration, and oversight of transactions. | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Comparative Board/Governance Experience – Recent or current experience as a director of another public company or significant involvement with the corporate governance requirements and practices of a public company board while serving in a senior leadership position at another public company, provides our Board with an understanding of the board’s role in essential matters, including oversight of strategy, operations, risk, compliance and succession planning, effective interactions with significant stockholders, and the proper dynamics between the board and senior management. | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||

| Cybersecurity Experience – An understanding of and/or experience overseeing corporate cybersecurity or information security programs and a history of participation in relevant cyber education, is an increasingly important background for our directors to possess and provides our Board with valuable knowledge in overseeing and navigating cybersecurity threats. | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||

| Human Capital Management Experience – Experience serving as a member of the compensation committee of a public company, head of human resources, or as direct manager of the head of human resources, or other experience in setting talent management policies in large organizations, aids our Board in overseeing the management of human capital, including culture, engagement, recruiting, retention, compensation, and succession planning. | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Risk Management Experience – Directors with experience serving as a member of the audit committee of a public company, or directly overseeing enterprise risk management or business continuity planning in a large organization, or other experience in managing risk at the enterprise level or in a senior compliance or regulatory role assist our Board in understanding how to effectively evaluate and oversee the management and reporting of enterprise risks. | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||

| Manufacturing/Operations Experience – Directors with relevant experience in manufacturing and operations processes or management experience in operations at a company comparable to Lam serve as a valuable asset to our Board and have deeper knowledge of our business, products, services, and customers. | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

4

Figure 6. Corporate Governance Highlights

| Board and Other Governance Information | As of September 2023 | |||

| Size of Board as Nominated | 11 | |||

| Number of Independent Nominated Directors | 10 | |||

| Number of Nominated Directors Who Attended ≥75% of Meetings | 10 | (1) | ||

| Number of Nominated Directors on More Than Four Public Company Boards | 0 | |||

| Number of Nominated Non-Employee Executive Officer Directors Who Are on More Than Two Public Company Boards | 0 | |||

| Limitations on Director Commitments, Including Other Board and Committee Memberships and Leadership, With Commitments Evaluated Annually (Page 15) | Yes | |||

| Directors Subject to Stock Ownership Guidelines (Page 16) | Yes | |||

| Hedging and Pledging Prohibited (Page 11) | Yes | |||

| Annual Election of Directors (Page 65) | Yes | |||

| Voting Standard (Page 65) | Majority | |||

| Plurality Voting Carveout for Contested Elections | Yes | |||

| Separate Chair and CEO | Yes | |||

| Independent Board Chair (Page 15) | Yes | |||

| Independent Directors Meet Without Management Present (Page 15) | Yes | |||

| Annual Board (Including Individual Director) and Committee Self-Evaluations (Page 12) | Yes | |||

| Annual Independent Director Evaluation of CEO (Page 18) | Yes | |||

| Risk Oversight by Full Board and Committees (Page 18) | Yes | |||

| Commitment to Board Refreshment and Diversity (Page 12) | Yes | |||

| Robust Director Nomination Process (Page 14) | Yes | |||

| Significant Board Engagement (Page 18) | Yes | |||

| Board Orientation/Education Program (Page 13) | Yes | |||

| Code of Ethics Applicable to Directors (Page 11) | Yes | |||

| Stockholder Proxy Access (Pages 14, 82) | Yes | |||

| Stockholder Ability to Act by Written Consent | Yes | |||

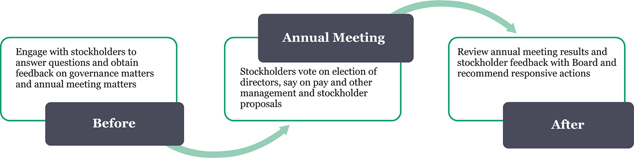

| Stockholder Engagement Program (Page 20) | Yes | |||

| Poison Pill | No | |||

| Board Oversight of ESG (including Climate), Human Capital, Information Security & Political Activities (Page 18) | Yes | |||

| Publication of Annual ESG Report aligned with SASB and TCFD (Pages 7, 22) | Yes |

| (1) | Mr. Dineen was appointed to the Board effective August 24, 2023 and, therefore, did not attend any meetings during the fiscal year ended June 25, 2023. |

Lam Research Corporation 2023 Proxy Statement 5

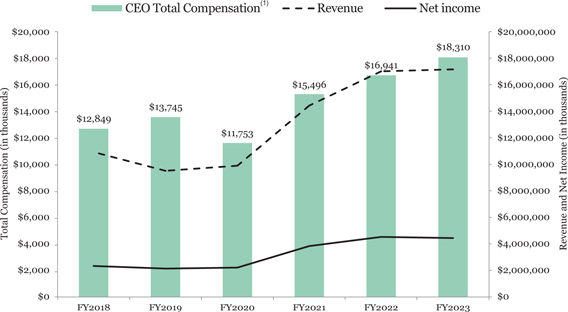

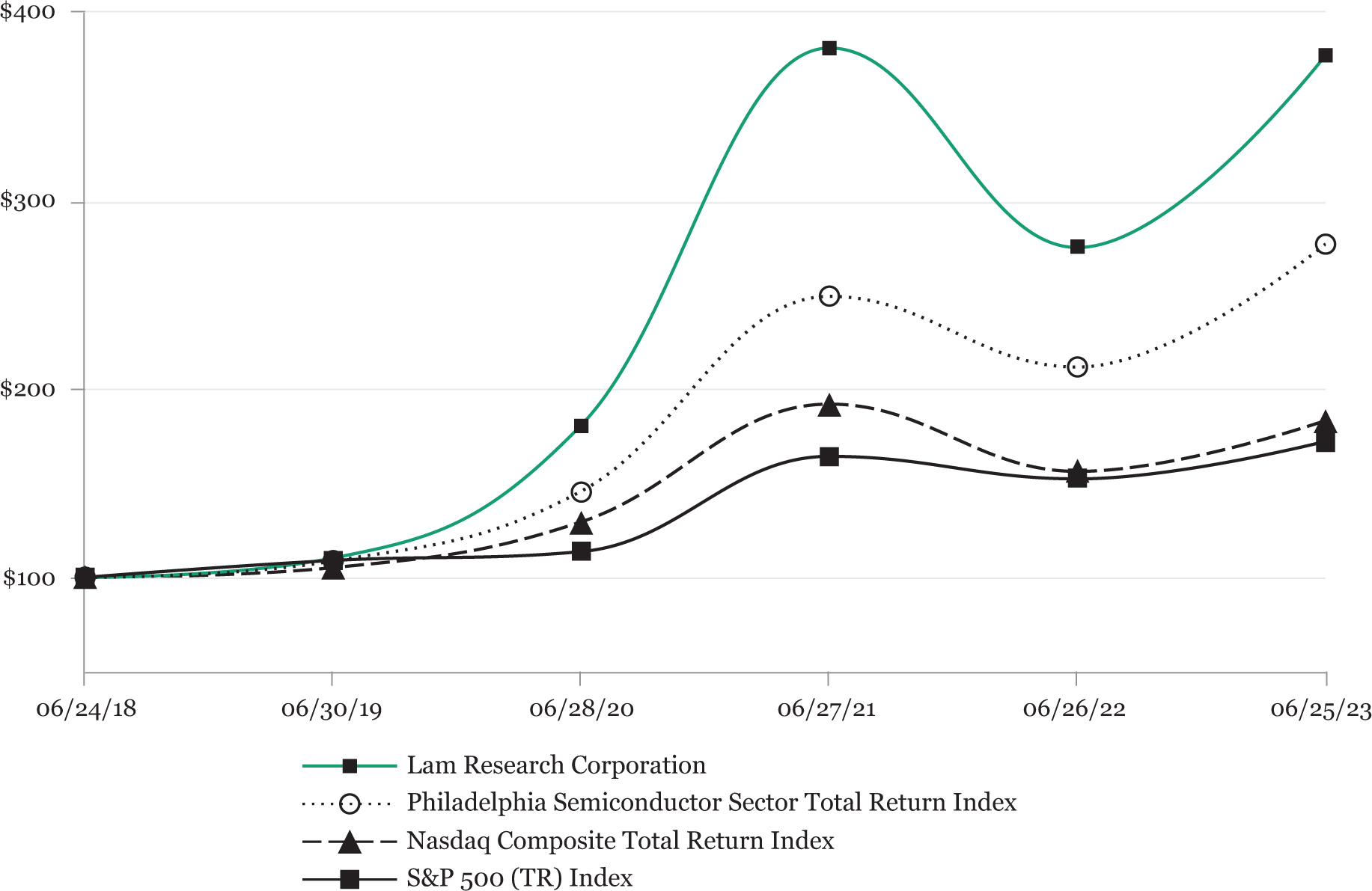

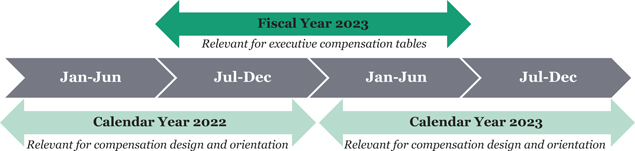

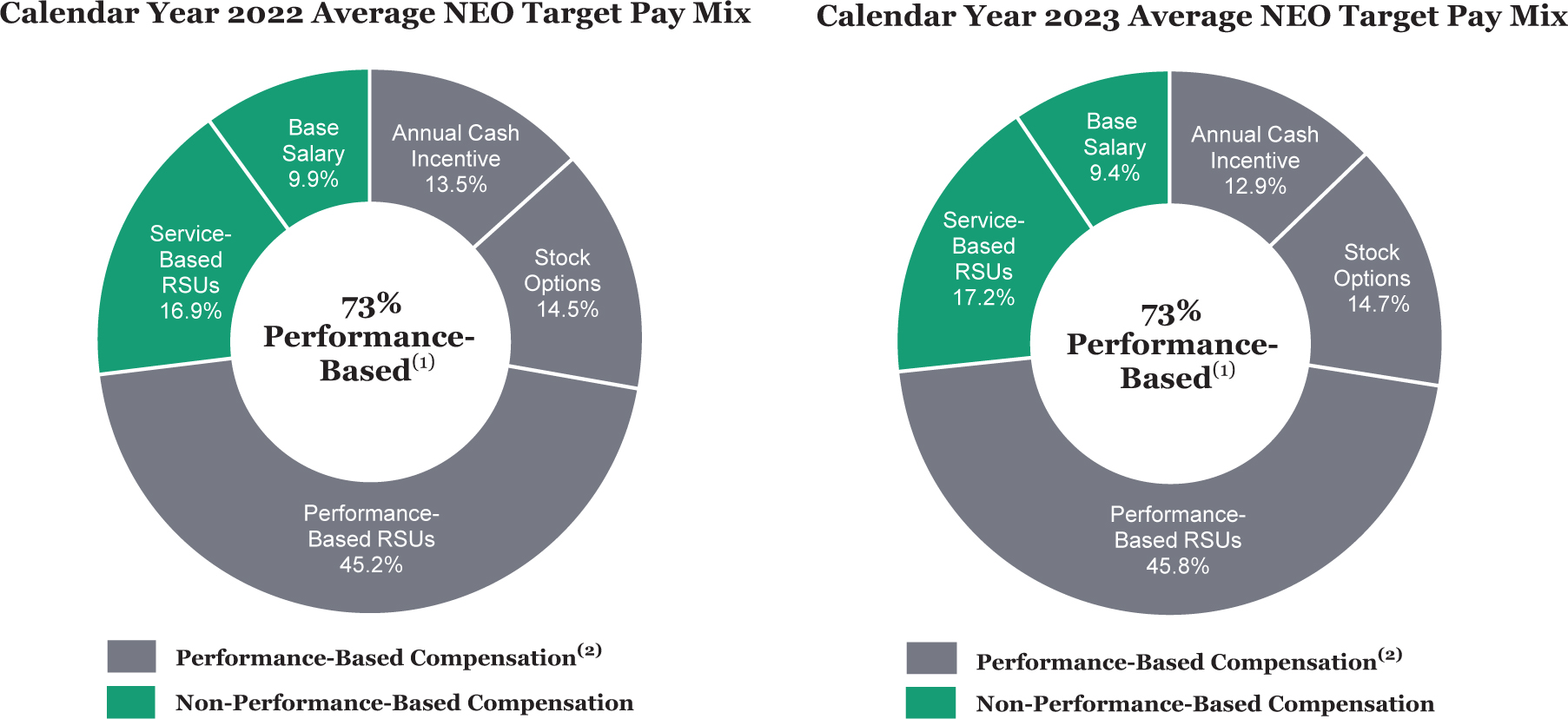

Figure 7. Executive Compensation Highlights

| What We Do |

| Pay for Performance (Pages 29-32, 58) – Our executive compensation program is designed to pay for performance; 100% of the annual incentive program is tied to company financial, strategic, and operational performance metrics; the long-term incentive program uses a combination of market-based performance restricted stock units ("Market-based PRSUs") with performance based on relative total shareholder return (“TSR”), stock options, and service-based restricted stock units (“RSUs"). |

| Three-Year Performance Period for Our Long-Term Incentive Program (Page 43) – Our current long-term incentive program is designed to pay for performance over a period of three years. |

| Absolute and Relative Performance Metrics (Pages 32, 37, 43) – Our annual and long-term incentive programs for executive officers include the use of absolute and relative performance factors. |

| Balance of Annual and Long-Term Incentives – Our incentive programs provide a balance of annual and long-term incentives. |

| Different Performance Metrics for Annual and Long-Term Incentive Programs (Pages 32, 37, 43) – Our annual and long-term incentive programs use different performance metrics. |

| Capped Amounts (Pages 37, 43) – Amounts that can be earned under the annual and long-term incentive programs are capped. |

| Compensation Recovery/Clawback Policy (Page 46) – We have a policy pursuant to which we can recover the excess amount of cash incentive-based compensation granted and paid to our officers who are covered by section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our Board intends to adopt a new or revised clawback policy that complies with the new SEC and Nasdaq requirements under the Dodd-Frank Wall Street Reform and Consumer Protection Act prior to the December 1, 2023 compliance deadline under Nasdaq's final listing standards. |

| Prohibit Option Repricing – Our stock incentive plans prohibit option repricing without stockholder approval. |

| Stock Ownership Guidelines (Page 46) – We have stock ownership guidelines for each of our executive officers and certain other senior executives; each of our named executive officers as set forth in Figure 21 has met their individual ownership level under the current program or has a period of time remaining under the guidelines to do so. |

| Independent Compensation Advisor (Page 34) – The compensation and human resources committee benefits from its utilization of an independent compensation advisor retained directly by the committee that provides no other services to the Company. |

| Stockholder Engagement (Page 33) – We engage with stockholders on an annual basis and stockholder advisory firms on an as needed basis to obtain feedback concerning our executive compensation program. |

| What We Don’t Do |

| Tax “Gross-Ups” for Perquisites, for Other Benefits or upon a Change in Control (Pages 46, 49, 52) – Our executive officers do not receive tax “gross-ups” for perquisites, for other benefits, or upon a change in control.(1) |

| Single-Trigger Change in Control Provisions (Pages 46, 52) – Our executive change in control policy does not have single-trigger provisions. |

| (1) | Our executive officers may receive tax gross-ups in connection with relocation benefits and anniversary milestone awards, which are widely available to all of our employees. |

6

Figure 8. ESG Highlights

Our ESG strategy supports the success of our business. It provides a framework for meaningful investments, proactive risk management, and globally focused action. Our approach emphasizes engagement, goal setting, and accountability. Our ESG strategy is composed of six key pillars, which are described in greater detail beginning on page 22 and in our annual ESG report, available at lamresearch.com/company/environmental-social-governance/. We have set goals aligned with our strategy; these goals are highlighted below, together with some of our recent progress. In 2022, we made important strides forward, including surpassing our 2025 water and volunteer hour goals years ahead of schedule. We also received approval from the Science Based Targets initiative (“SBTi”) for our near-term emissions reduction goals.1 We aim to achieve each of the following goals by calendar year 2025, unless otherwise stated. In the table below, references to specific years are to calendar, not fiscal, years.

| Goals | 2022 Progress | |||

| Governance | ||||

| • Continue to expand our disclosure and alignment with industry-recognized frameworks and standards | • Our efforts to increase disclosure raised our ratings and rankings with third parties | |||

| Product Innovation | ||||

| • 83% of customers measured by emissions set science-based targets (“SBTs”) | • 16.9% of customers measured by emissions have set SBTs | |||

| Sustainable Operations(1) | ||||

|

• Achieve net zero greenhouse gas (GHG) emissions by 2050 by meeting the following targets: – Achieve 100% renewable electricity(2) by 2030 – Reduce absolute Scope 1 and 2 (market-based) GHG emissions 25% by 2025 and 60.6% by 2030 from a 2019 baseline; by 2040, achieve net zero operations(3) – Achieve 12 million kilowatt-hours (kWh) in total energy savings from a 2019 baseline • Achieve zero waste to landfill for hazardous waste • Achieve 17 million gallons of water savings (15%) in water-stressed regions from a 2019 baseline |

• Sourced 44% renewable electricity globally in 2022 • 207% increase in Scope 1 and 2 (market-based) GHG emissions • Achieved 6.9 million kWh in energy savings • Diverted 99.99% of hazardous waste from landfills in 2022 • Achieved 46.9 million gallons of water savings in water-stressed regions, surpassing our 2025 goal by more than 175%; our updated goal will be to achieve 80 million gallons of water savings from a 2019 baseline |

|||

| Our Workplace | ||||

|

• Build on our high-performance culture with global employee engagement at the global benchmark, as measured by our annual employee surveys • Maintain an Occupational Safety and Health Administration recordable injury rate at or below 0.4 annually • Increase the proportion of women (globally) and underrepresented employees (U.S.) across the Company |

• Ended the year with an engagement score of 78, one point below the global top tier benchmark of 79 • Realized recordable injury rate of 0.35 in 2022 • Increased the proportion of women in our global workforce by 3.0% and underrepresented employees in the U.S. by 5.0% over 2021 |

(table continues on next page)

| (1) | Renewable electricity, energy savings, waste and water savings data exclude Lam’s subsidiaries Avonisys, Coventor, Metryx, SemSysco, Solmates, and Talus. Scope 1 and 2 (market-based) GHG emissions data exclude Lam’s subsidiaries Avonisys, Solmates and SemSysco. |

| (2) | Previously, this goal targeted 100% renewable energy by 2030. Lam updated this goal in 2022 per the SBTi verification and approval process. |

| (3) | Previously, the 2030 goal targeted a 46% reduction in Scope 1 and 2 (market-based) GHG emissions. Due to a previously unidentified source of Scope 1 emissions, Lam worked with SBTi to update our 2019 emissions inventory and restate our 2030 goal. |

| 1 | The 2030 GHG emissions goal was validated in 2022 and was subsequently restated in 2023 in alignment with SBTi. |

Lam Research Corporation 2023 Proxy Statement 7

| Goals | 2022 Progress | |||

| Responsible Supply Chain | ||||

|

• Achieve more than 90% compliance rate with our social and environmental expectations across our top-tier suppliers • Engage with at least 50% of our top-tier suppliers on environmental sustainability opportunities • Increase engagement with all suppliers on social and environmental topics through assessment, training, and capacity building • 46.5% of suppliers measured by emissions will set SBTs |

• Exceeded our goal with 94% of suppliers responding to our conflict minerals survey in 2022 • Exceeded our goal by engaging with 100% of top-tier suppliers in 2022 • Deepened supplier engagement through our inaugural ESG Supplier Forum, new supplier engagement platform, new monthly webinar series and newsletter, and additional trainings via the Responsible Business Alliance (RBA) • 14.5% of suppliers as measured by emissions have set SBTs |

|||

| Our Communities | ||||

|

• Determine key targets for larger-scale impact aligned to a new strategic focus • Implement measurement of outcomes for key program and large-scale grants • Increase annual unique participation rate in all employee giving programs from 10% to 30% • Increase employee volunteer hours by 33% from a 2019 baseline |

• Achieved goal by launching new social impact framework with three strategic focus areas to guide our giving and signature program initiatives • Began developing a reporting process and measurement outcomes • Increased annual unique employee participation rate from 10% in 2021 to 18% in 2022 • Achieved and surpassed our goal with employees completing 21,133 volunteer hours in 2022 for a total increase of 58% from a 2019 baseline and set a new goal to achieve 40,000 by end of 2025 |

8

| Stock Ownership |

Security Ownership of Certain Beneficial Owners and Management

The table below sets forth the beneficial ownership of shares of Lam common stock by: (1) each person or entity who we believe, based on our review of filings made with the SEC, beneficially owned more than 5% of Lam’s common stock on the date set forth below; (2) each current director of the Company; (3) each NEO identified below in the “Compensation Matters – Executive Compensation and Other Information – Compensation Discussion and Analysis” section; and (4) all current directors and current executive officers as a group. With the exception of 5% owners, and unless otherwise noted, the information below reflects holdings as of September 8, 2023, which is the Record Date for the 2023 Annual Meeting of Stockholders and the most recent practicable date for determining ownership. For 5% owners, holdings are as of the dates of their most recent ownership reports filed with the SEC, which are the most practicable dates for determining their holdings. The percentage of the class owned is calculated using 132,222,362 as the number of shares of Lam common stock outstanding on September 8, 2023.

Figure 9. Beneficial Ownership Table

| Name of Person or Identity of Group | Shares Beneficially Owned (#)(1) |

Percentage of Class |

||

| 5% Stockholders | ||||

| The Vanguard Group 100 Vanguard Boulevard Malvern, PA 19355 |

11,788,267 | (2) | 8.92% | |

| BlackRock, Inc. 55 East 52nd Street New York, NY 10055 |

11,026,970 | (3) | 8.34% | |

| Directors | ||||

| Sohail U. Ahmed | 2,694 | * | ||

| Timothy M. Archer (also a Named Executive Officer) | 150,646 | * | ||

| Eric K. Brandt | 28,115 | * | ||

| Michael R. Cannon | 18,310 | * | ||

| John M. Dineen | — | — | ||

| Ho Kyu Kang | 452 | * | ||

| Bethany J. Mayer | 2,690 | * | ||

| Jyoti K. Mehra | 1,020 | * | ||

| Abhijit Y. Talwalkar | 12,999 | * | ||

| Lih Shyng (Rick L.) Tsai | 7,090 | * | ||

| Leslie F. Varon | 2,465 | * | ||

| Named Executive Officers (“NEOs”) | ||||

| Douglas R. Bettinger | 96,966 | * | ||

| Patrick J. Lord | 17,774 | * | ||

| Vahid Vahedi | 24,712 | * | ||

| Seshasayee (Sesha) Varadarajan | 37,560 | * | ||

| All current directors and executive officers as a group (17 people) | 418,330 | * |

| * | Less than 1% |

Lam Research Corporation 2023 Proxy Statement 9

| (1) | Includes shares subject to outstanding stock options that are now exercisable or will become exercisable within 60 days after September 8, 2023, as well as RSUs, that will vest within that time period, as follows: |

| Shares | |||

| Sohail U. Ahmed | 563 | ||

| Timothy M. Archer | 62,405 | ||

| Eric K. Brandt | 563 | ||

| Michael R. Cannon | 563 | ||

| John M. Dineen | — | ||

| Ho Kyu Kang | 452 | ||

| Bethany J. Mayer | 563 | ||

| Jyoti K. Mehra | 563 | ||

| Abhijit Y. Talwalkar | 563 | ||

| Lih Shyng (Rick L.) Tsai | 563 | ||

| Leslie F. Varon | 563 | ||

| Douglas R. Bettinger | 3,545 | ||

| Patrick J. Lord | 6,881 | ||

| Vahid Vahedi | 1,514 | ||

| Seshasayee (Sesha) Varadarajan | 15,270 | ||

| All current directors and executive officers as a group (17 people) | 98,027 |

The terms of any outstanding stock options that are now exercisable or will become exercisable within 60 days after September 8, 2023, and RSUs that will vest within that time period, are reflected in “Figure 55. Outstanding Equity Awards at Fiscal Year 2023 Year-End,” except as described in the following sentences. Ava M. Hahn has options covering 3,456 shares, which are unexercised and exercisable within 60 days of September 8, 2023. The grants for Ms. Hahn have terms consistent with the terms reflected in “Figure 55. Outstanding Equity Awards at Fiscal Year 2023 Year-End.”

As discussed in “Governance Matters – Director Compensation” below, the non-employee directors receive an annual equity award as part of their compensation. These awards generally vest on October 31, 2023, subject to continued service on the board as of that date, with immediate delivery of the shares upon vesting. For 2023, Messrs. Ahmed, Brandt, Cannon, and Talwalkar; Mses. Mayer, Mehra and Varon; and Dr. Tsai each received awards of 563 RSUs. Dr. Kang, who was appointed as a director following the annual equity grant, received a pro-rated grant for 2023 of 452 RSUs, which is included in the tables above.

| (2) | All information regarding The Vanguard Group (“Vanguard”) is based solely on information disclosed in amendment number 11 to Schedule 13G filed by Vanguard with the SEC on February 9, 2023. According to the Schedule 13G filing, of the 11,788,267 shares of Lam common stock reported as beneficially owned by Vanguard as of December 30, 2022, Vanguard did not have sole voting power with respect to any shares, had shared voting power with respect to 203,167 shares, had sole dispositive power with respect to 11,215,795 shares, and had shared dispositive power with respect to 572,472 shares of Lam common stock. |

| (3) | All information regarding BlackRock Inc. (“BlackRock”) is based solely on information disclosed in amendment number 15 to Schedule 13G filed by BlackRock with the SEC on February 3, 2023 on behalf of BlackRock and certain subsidiaries. According to the Schedule 13G filing, of the 11,026,970 shares of Lam common stock reported as beneficially owned by BlackRock as of December 31, 2022, BlackRock had sole voting power with respect to 9,922,105 shares, did not have shared voting power with respect to any shares, had sole dispositive power with respect to 11,026,970 shares, and did not have shared dispositive power with respect to any shares of Lam common stock. |

10

| Governance Matters |

Corporate Governance

Our Board and members of management are committed to responsible corporate governance to manage the Company for the long-term benefit of its stockholders. To that end, the Board and management periodically review and update, as appropriate, the Company’s corporate governance policies and practices. As part of that process, the Board and management consider the requirements of federal and state law, including rules and regulations of the SEC; the listing standards for the Nasdaq Global Select Market (“Nasdaq”); published guidelines and recommendations of proxy advisory firms; published guidelines of some of our top stockholders; published guidelines of other selected public companies; and any feedback we receive from our stockholders. A list of key corporate governance practices is provided in the “Proxy Statement Summary” above.

Corporate Governance Policies

We have instituted a variety of policies and procedures to foster and maintain responsible corporate governance, including the following:

Figure 10. Policies and Procedures Summary

| Policy or Procedure |

Summary | ||

| Board committee charters* |

Each of the Board’s audit, compensation and human resources, and nominating and governance committees has a written charter adopted by the Board that delegates authority and responsibilities to the committee. Each committee reviews its charter, and the nominating and governance committee reviews the charters of all of the committees, annually and recommends changes to the Board, as appropriate. See “Board Committees” below for additional information regarding these committees. |

||

| Corporate governance guidelines* |

We adhere to written corporate governance guidelines, adopted by the Board and reviewed annually by the nominating and governance committee and the Board. Selected provisions of the guidelines are discussed below, including in the “Board Nomination Policies and Procedures,” “Director Independence Policies,” and “Other Governance Practices” sections below. |

||

| Corporate Code of Ethics* |

We maintain a code of ethics that applies to all employees, officers, and members of the Board. The code of ethics establishes standards reasonably necessary to promote honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships, and full, fair, accurate, timely, and understandable disclosure in the periodic reports we file with the SEC and in other public communications. We will promptly disclose to the public any amendments to, or waivers from, any provision of the code of ethics to the extent required by applicable laws. We intend to make this public disclosure by posting the relevant material on our website, to the extent permitted by applicable laws. |

||

| Global Standards of Business Conduct* | We maintain written standards of business conduct to address a variety of situations that apply to our worldwide workforce. Among other things, these global standards of business conduct address relationships and/or conduct with one another, with Lam (including conflicts of interest, safeguarding of Company assets, and protection of confidential information), and with other companies and stakeholders (including anti-corruption). | ||

| Insider Trading Policy |

Our insider trading policy restricts the trading of Company stock by our directors, officers, and employees, and includes provisions addressing insider blackout periods and prohibiting pledges of Company stock, and prohibiting such persons from engaging in hedging transactions, such as “cashless” collars, forward sales, equity swaps and other similar arrangements. Investments in exchange funds are permitted if the fund is broadly diversified and comprises less than 2% of Company stock; exceptions to the 2% threshold may be permitted on a case-by-case basis. |

| * | A copy is available on the Investors section of our website at investor.lamresearch.com/corporate-governance. |

Our Approach To Ensuring Board Effectiveness

As part of the Board’s commitment to responsible corporate governance, we have developed a number of practices that together serve to ensure that, over time, the Board continues to function in an effective manner that serves the long-term interests of the Company and its stockholders. Several of the practices that we consider to be most important are summarized in Figure 11 below, and the practices themselves are described in greater detail below.

Lam Research Corporation 2023 Proxy Statement 11

Figure 11. Board Effectiveness Practices

Board and committee evaluations. Every year, the Board conducts a self-evaluation of the Board, its committees, and the individual directors, overseen by the nominating and governance committee. From time to time, the evaluation is facilitated by an independent third-party consultant. The evaluation solicits the opinions of the directors regarding the effectiveness of the Board, Board committees, and individual directors in fulfilling their obligations. Feedback on Board effectiveness is provided to the full Board for discussion, feedback on each committee’s effectiveness is provided to the committee for discussion, and feedback regarding individual director performance is provided to each individual director. The Board and committees identify and hold themselves accountable for action items stemming from the evaluation. The results of the evaluations are also considered by the nominating and governance committee and the Board as part of the director nomination process.

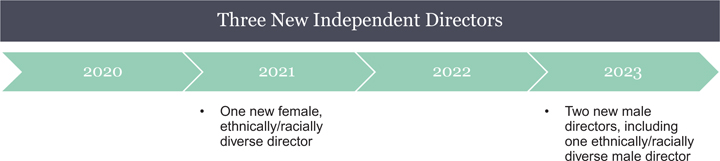

Board composition, diversity and refreshment. The Board and the nominating and governance committee regard board refreshment as important, and strive to maintain an appropriate balance of tenure, turnover, diversity, and skills to meet the needs of the Company and the Board. In consideration of the Company’s evolving strategic priorities and as part of its refreshment planning, the nominating and governance committee regularly evaluates the Board’s composition, skills and experiences and diversity, and directors’ time commitments and committee assignments, to ensure that the Board functions effectively. See “Proxy Statement Summary - Figure 5. Director Nominee Key Qualifications, Skills, and Experiences” and “Proxy Statement Summary - Figure 4. Director Nominee Composition Highlights” for additional information regarding the key qualifications, skills and experiences considered by the Board and the nominating and governance committee in nominating our nominees. Since 2020, the Board has gained three new independent directors, two of whom are diverse in terms of gender identity, ethnicity or race, as shown in Figure 12.

Figure 12. Refreshment of Independent Directors Since 2020

The Board is committed to diversity, and for many years, the composition of the Board has reflected that commitment. The Board believes that board diversity is important to serving the long-term interests of the Company’s stockholders. In identifying potential director candidates outside the Company, the nominating and governance committee is committed to actively seeking out qualified candidates who reflect diverse backgrounds, skills and experiences, including diversity of geography, gender identity, LGBTQ+

12

identity, age, race and ethnicity, and classification as a member of an underrepresented minority, to include in the pool from which Board nominees are chosen, and any third-party search firms retained for a related search will be instructed to include such candidates in initial lists of candidates they prepare. Every year since 2006, the Board has had at least two female directors, and since 2019 we have had either three or four female directors. We began asking directors to self-identify their ethnicity/race beginning in 2020 and their gender identity and LGBTQ+ identity beginning in 2022, and have reported those metrics for the current and prior years in Figure 13 below. As illustrated in “Proxy Statement Summary - Figure 4. Director Nominee Composition Highlights”, 64% of our nominees are diverse overall, with 27% of our nominees being diverse on the basis of gender identity and 45% on the basis of ethnicity/race. In addition, over a number of years, the Board has appointed directors who have expanded the experiences, areas of substantive expertise, and geographic and industry diversity of the Board, as illustrated by the information provided in their biographies under “Voting Proposals - Proposal No. 1: Election of Directors - 2023 Nominees for Director” below.

Figure 13. Board Diversity Matrix(1)

| As of September 8, 2023 | As of September 9, 2022 | ||||||||||

| Total number of directors | 11 | 10 | |||||||||

| Part I: Gender Identity | Female | Male | Non-Binary | Did Not Disclose Gender |

Female | Male | Non-Binary | Did Not Disclose Gender |

|||

| Directors | 3 | 8 | – | – | 4 | 6 | – | – | |||

| Part II: Demographic Background | |||||||||||

| African American or Black | – | – | – | – | – | – | – | – | |||

| Alaskan Native or Native American | – | – | – | – | – | – | – | – | |||

| Asian | 1 | 4 | – | – | 1 | 3 | – | – | |||

| Hispanic or Latinx | – | – | – | – | – | – | – | – | |||

| Native Hawaiian or Pacific Islander | – | – | – | – | – | – | – | – | |||

| White (not of Hispanic or Latinx origin) | 2 | 4 | – | – | 3 | 3 | – | – | |||

| Two or More Races or Ethnicities | – | – | – | – | – | – | – | – | |||

| LGBTQ+ | – | – | – | – | – | – | – | – | |||

| Did Not Disclose Demographic Background | – | – | – | – | – | – | – | – | |||

| (1) | Diversity is presented according to the categories and definitions specified in Nasdaq Rule 5605(f). |

The Board is also committed to the pursuit of Board refreshment and balanced tenure. The Board believes that new perspectives and ideas are important to a forward-looking and strategic board, as is the ability to benefit from the valuable experience and familiarity of longer-serving directors who can leverage their experience with the Company and with the industry and business environment in which the Company operates. Our corporate governance guidelines do not impose a term limit on Board service; however, the Board regularly assesses the directors’ tenure mix and strives to maintain a balance that will ensure both fresh perspectives and experience on the Board. In addition, our corporate governance guidelines impose an age limitation for directors to be nominated to the Board, as described under “Board Nomination Policies and Procedures - Board Membership Criteria” below.

The Board also considers refreshment and tenure with respect to the leadership and membership of its standing committees, and the nominating and governance committee evaluates short-term and long-term roadmaps for committee membership and leadership on a regular basis. When reviewing committee assignments, the nominating and governance committee considers the rotation of chairs and members with a view toward balancing the benefits derived from the diversity of experience and viewpoints of the various directors. The nominating and governance committee also considers individual directors’ skills, experiences and qualifications, prior committee experience, and other positions and commitments.

Director onboarding and education. To ensure that new directors are able to effectively participate in and contribute to the Board as quickly as possible, we provide a comprehensive orientation and onboarding program for our new directors. Upon joining the Board, new directors participate in an orientation program which includes introductions to other Board members and our senior management team, and in depth learning about our industry, business, technology, operations, culture, people, performance, strategic plans, risk management and corporate governance practices, among other topics. The onboarding process also includes tours of one or more of our manufacturing or lab facilities. These in-person tours were paused during the COVID-19 pandemic but have recently resumed. First time directors (i.e. those without prior public company board experience) are encouraged to attend an outside course shortly after joining the Board.

Our Board is also committed to ongoing education. Our corporate governance guidelines provide that directors are expected to participate in educational events sufficient to maintain their understanding of their duties as directors and to enhance their ability to fulfill their responsibilities. In addition to any external educational opportunities that the directors find useful, the Company and the board leadership are expected to facilitate such participation by arranging for appropriate educational presentations from time to time. In 2022, our Board heard from external advisors on multiple subjects, including cybersecurity, employee engagement and retention, and the economic and political climate in China.

Lam Research Corporation 2023 Proxy Statement 13

Board Nomination Policies and Procedures

Board membership criteria. Under our corporate governance guidelines, the nominating and governance committee is responsible for recommending nominees to the independent directors, and the independent directors nominate the slate of directors for approval by our stockholders. In making its recommendations, whether for new or incumbent directors, the nominating and governance committee assesses the appropriate balance of experience, skills, and characteristics required for the Board at the time.

Our corporate governance guidelines set out a non-exclusive list of factors to be considered by the nominating and governance committee in recommending nominees, which were selected by the Board to ensure proper board composition and effectiveness. These factors are reviewed and updated by the Board on a regular basis. In May 2023, the factors were updated to include additional diversity attributes. The factors include, but are not limited to:

| • | experience; |

| • | business acumen; |

| • | wisdom; |

| • | integrity; |

| • | judgment; |

| • | the ability to make independent analytical inquiries; |

| • | the ability to understand the Company’s business environment; |

| • | the candidate’s willingness and ability to devote adequate time to board duties; |

| • | diversity with respect to any attribute(s) the Board considers appropriate, including geography, gender identity, LGBTQ+ identity, age, ethnicity or race, and classification as a member of an underrepresented minority; |

| • | specific skills, background, or experience considered necessary or desirable for board or committee service; |

| • | specific experiences with other businesses or organizations that may be relevant to the Company or its industry; and |

| • | the interplay of a candidate’s experiences and skills with those of other Board members. |

In addition, our corporate governance guidelines provide that a director may not be nominated for re-election or reappointment to the Board after having attained the age of 75 years. To be nominated, a new or incumbent candidate must provide an irrevocable conditional resignation that will be effective upon (1) the director’s failure to receive the required majority vote at an annual meeting at which the nominee faces re-election and (2) the Board’s acceptance of such resignation.

Upon the recommendations of the nominating and governance committee, the independent members of the Board have nominated all of our current directors for re-election to serve on the Board. Each nominee’s key qualifications, skills, and attributes considered most relevant to the nomination of the candidate to serve on the Board are reflected in their biography under “Voting Proposals-Proposal No. 1: Election of Directors - 2023 Nominees for Director” below. For a summary of the key qualifications, skills, and attributes of the nominees to the Board, see “Proxy Statement Summary - Figure 5. Director Nominee Key Qualifications, Skills, and Experiences.”

Nomination procedure. The nominating and governance committee sets specific qualifications for new directors, and identifies, screens, evaluates, and recommends qualified candidates for appointment or election to the Board. The committee considers recommendations from a variety of sources, including search firms, Board members, executive officers, and stockholders. Nominations for election by the stockholders are made by the independent members of the Board. New candidates to join the Board typically meet with our chair, our lead independent director (if applicable), members of the nominating and governance committee, additional board members, and our president and CEO, as well as representatives of the Company’s executive team, prior to being considered for recommendation by the nominating and governance committee for appointment to the Board. See “Voting Proposals - Proposal No. 1: Election of Directors - 2023 Nominees for Director” below for additional information regarding the 2023 candidates for election to the Board.

The nominating and governance committee will consider for nomination persons properly nominated by stockholders in accordance with the Company’s bylaws and nomination procedures. Our bylaws provide that under certain circumstances, a stockholder, or group of up to 20 stockholders, who have maintained continuous ownership of at least three percent (3%) of our common stock for at least three years may nominate and include a specified number of director nominees in our annual meeting proxy statement that cannot exceed the greater of two or 20% of the aggregate number of directors then serving on the Board (rounded down). Information regarding the nomination procedures is provided in the “Voting and Meeting Information - Other Meeting Information - Stockholder - Initiated Proposals and Nominations for 2024 Annual Meeting” section below. Subject to then-applicable law, stockholder nominations for director will be evaluated by the Company’s nominating and governance committee in accordance with the same criteria as are applied to candidates identified by the committee or other sources.

Director Independence Policies

Board independence requirements. Our corporate governance guidelines require that a majority of the Board members be independent. The nominating and governance committee annually reviews the independence of each director, including with respect to the Board and each individual committee, and recommends to the Board director independence determinations made with

14

respect to continuing and prospective directors. No director will qualify as “independent” unless the Board affirmatively determines that the director qualifies as independent under the Nasdaq rules and has no relationship that would interfere with the exercise of independent judgment as a director. In addition, no non-employee director may serve as a consultant or service provider to the Company without the approval of a majority of the independent directors (and any such director’s independence must be reassessed by the full Board following such approval).

Board member independence. The Board has determined that all current directors and persons who served as directors during any part of fiscal year 2023, other than Mr. Archer, are independent in accordance with Nasdaq criteria for director independence. In making the determination, the Board considered prior employment with the Company, disclosed related party transactions, known familial relationships of directors with employees (not involving immediate family members) and commercial transactions involving other parties with common directorships, none of which qualified as related party transactions or were considered by the Board to interfere with the exercise of independent judgment as a director.

Board committee independence. All members of the Board’s audit, compensation and human resources, and nominating and governance committees must be non-employee or outside directors and independent in accordance with applicable Nasdaq criteria as well as Rule 16b-3 under the Exchange Act. See “Board Committees” below for additional information regarding these committees.

Lead independent director. Our corporate governance guidelines authorize the Board to designate a lead independent director from among the independent members. As described below under “Leadership Structure of the Board,” an independent director, Mr. Talwalkar, currently serves as chairman of the Board, and as a result, the Board has not designated a lead independent director.

Executive sessions of independent directors. The Board and its audit, compensation and human resources, and nominating and governance committees hold meetings of the independent directors and committee members, without management present, as part of each regularly scheduled meeting and at any other time at the discretion of the Board or committee, as applicable.

Board access to independent advisors. The Board as a whole, and each standing Board committee separately, has the complete authority to retain, at the Company’s expense, and terminate, in their discretion, any independent consultants, counselors, or advisors as they deem necessary or appropriate to fulfill their responsibilities.

Leadership Structure of the Board

The Company’s governance framework provides the Board with the authority and flexibility necessary to select the appropriate leadership structure for the Board. In making determinations about the leadership structure, the Board considers many factors, including the specific needs of the business and what is in the best interests of the Company’s stockholders.

Under our corporate governance guidelines, the Board’s leadership structure includes a chair and may also include a separate lead independent director. Currently, Mr. Talwalkar, an independent director, serves as chairman of the Board, and as a result, the Board has not designated a lead independent director.

The chair’s duties include (1) preparing the agenda for the Board meetings with input from the CEO, the Board, and the committee chairs; (2) upon invitation, attending meetings of any of the Board committees of which they are not a member; (3) conveying to the CEO, together with the chair of the compensation and human resources committee, the results of the CEO’s performance evaluation; (4) reviewing proposals submitted by stockholders for action at meetings of stockholders and, depending on the subject matter, determining the appropriate body, among the Board or any of the Board committees, to evaluate each proposal, and making recommendations to the Board regarding action to be taken in response to such proposal; (5) as requested by the Board, providing reports to the Board on the chair’s activities; (6) coordinating and developing the agenda for, and moderating executive sessions of the Board’s independent directors; (7) conveying to the CEO, as appropriate, discussions from executive sessions of the Board’s independent directors; and (8) performing such other duties as the Board may reasonably request from time to time.

Other Governance Practices

In addition to the principal policies and procedures described above, we have established a variety of other practices to enhance our corporate governance, including the following:

Director resignation or notification of change in executive officer status. Under our corporate governance guidelines, any director who is also an executive officer of the Company must offer to submit their resignation as a director to the Board if the director ceases to be an executive officer of the Company. The Board may accept or decline the offer, in its discretion. The corporate governance guidelines also require a non-employee director to notify the nominating and governance committee if the director changes or retires from their executive position at another public company. The nominating and governance committee reviews the appropriateness of the director’s continuing Board membership under the circumstances, and the director is expected to act in accordance with the nominating and governance committee’s recommendations.

Limitations on director commitments, including other board and committee memberships and leadership. The Board believes that it is critical that directors dedicate sufficient time to their service on the Board. Under our corporate governance guidelines, the nominating and governance committee considers a director’s other board and committee leadership positions and

Lam Research Corporation 2023 Proxy Statement 15

memberships that may affect a director’s ability to contribute effectively to the Board, and evaluates director commitments at least annually. In particular, our corporate governance guidelines provide that Board members may not serve on more than four public company boards (including service on the Company’s Board). Non-employee directors who are executive officers at other public companies may not serve on more than two public company boards (including the Company’s Board). In addition, non-employee directors may not serve on more than three audit committees of public company boards (including the Company’s audit committee), unless approved by the nominating and governance committee. Finally, the Company’s CEO may not serve on more than one other public company board without obtaining prior approval of such directorship by the nominating and governance committee. All of our directors are currently in compliance with the limitations on director commitments in our corporate governance guidelines.

Director and executive stock ownership. Under the corporate governance guidelines, each non-employee director is expected to own at least the lesser of five times the value of the annual cash retainer (not including any committee chair or other supplemental retainers for directors) or 5,000 shares of Lam common stock, by the fifth anniversary of their initial election to the Board. The requirements are specified in the alternative of shares or dollars to allow for stock price volatility. The dollar alternative is translated into a number of shares by dividing the applicable multiple of the annual cash retainer by the average closing price of our common stock for the 30 trading days through June 30 of the most recently-completed fiscal year as of the measurement date. Guidelines for stock ownership by designated members of the executive management team are described below under “Compensation Matters - Executive Compensation and Other Information - Compensation Discussion and Analysis.” All of our directors and designated members of our executive management team were in compliance with the Company’s applicable stock ownership guidelines at the end of fiscal year 2023 or have a period of time remaining under the guidelines to meet the requirements.

Communications with board members. Any stockholder who wishes to communicate directly with the Board, with any Board committee, or with any individual director regarding the Company may write to the Board, the committee, or the director c/o Secretary, Lam Research Corporation, 4650 Cushing Parkway, Fremont, California 94538. Subject to certain exceptions specified in our corporate governance guidelines, the Secretary will forward communications to the appropriate director(s).

Any stockholder, employee, or other person may communicate any complaint regarding any accounting, internal accounting control, or audit matter to the attention of the Board’s audit committee by sending written correspondence by mail (to Lam Research Corporation, Attention: Board Audit Committee, P.O. Box 5010, Fremont, California 94537-5010) or by telephone (855-208-8578) or internet (through the Company’s third-party provider website at www.lamhelpline.ethicspoint.com). The audit committee has established procedures to ensure that employee complaints or concerns regarding audit or accounting matters will be received and treated anonymously (if the complaint or concern is submitted anonymously and if permitted under applicable law).

Meeting Attendance

Our Board held a total of five meetings during fiscal year 2023. The number of committee meetings held is shown below under “Board Committees”. All of the directors attended at least 75% of the aggregate number of Board meetings and meetings of Board committees on which they served during their tenure in fiscal year 2023.

We expect our directors to attend the annual meeting of stockholders each year unless unusual circumstances make attendance impractical. All of the individuals who were directors as of the 2022 annual meeting of stockholders attended that meeting.

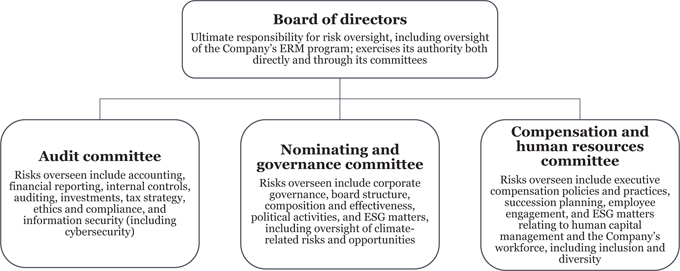

Board Committees

The Board has three standing committees: an audit committee, a compensation and human resources committee, and a nominating and governance committee. The functions, membership, and charter of each are described below. Copies of each committee’s charter are available on the Investors section of our website at investor.lamresearch.com/corporate-governance.

Audit Committee

Membership as of September 8, 2023:2 Sohail U. Ahmed, Michael R. Cannon, Bethany J. Mayer, and Leslie F. Varon (Chair) Meetings held in fiscal year 2023: Ten

Key responsibilities:

| • | oversee the Company’s accounting and financial reporting processes, internal audit program, and the audits of its financial statements, including the system of internal controls; |

| • | oversee the Company’s investment policies and performance, |

| • | review the Company’s hedging strategy and tax strategies; |

| • | oversee the Company’s ethics and compliance program; |

| • | oversee the Company’s cybersecurity and information security policies and internal controls; |

| • | review and oversee potential related party and conflict of interest situations, transactions required to be disclosed pursuant to Item 404 of Regulation S-K of the SEC, and any other transaction involving an executive or Board member, and |

| 2 | Mr. Ahmed joined the committee on November 7, 2022. |

16

| • | oversee (i) the determination of whether an accounting restatement is required due to the material noncompliance of the Company with any financial reporting requirement under the securities laws and (ii) the preparation of the Company’s accounting restatements to correct such noncompliance. |

The Board concluded that all members of the audit committee, and persons who served as members of the audit committee during any part of fiscal year 2023, are non-employee directors who are independent in accordance with the Nasdaq listing standards and SEC rules for audit committee member independence. Furthermore, each member is able to read and understand fundamental financial statements as required by the Nasdaq listing standards, and the Board has determined that Mr. Cannon and Mss. Mayer and Varon are each an “audit committee financial expert” as defined in the SEC rules.

Effective November 7, 2023, John M. Dineen will become a member of the audit committee.

Compensation and Human Resources Committee

Membership as of September 8, 2023:3 Eric K. Brandt (Chair), Jyoti K. Mehra, Abhijit Y. Talwalkar, and Lih Shyng (Rick L.) Tsai Meetings held in fiscal year 2023: Five

Key responsibilities:

| • | review and approve the Company’s executive officer compensation philosophy, objectives and strategies; |

| • | recommend to the independent members of the Board corporate goals and objectives under our compensation plans; |

| • | recommend to the independent members of the Board compensation packages and compensation payouts for the CEO, and approve the compensation packages and compensation payouts for our other executive officers; |

| • | oversee incentive, equity-based plans, and other compensatory plans in which our executive officers and/or directors participate; |

| • | produce an annual report on executive compensation for inclusion, as required, in our annual proxy statement; |

| • | oversee management’s determination as to whether our compensation policies and practices, including those related to pay equity laws, create risks that are reasonably likely to have a material adverse effect on the Company; and |

| • | discharge certain responsibilities of the Board with respect to organization and people matters, including executive succession planning, employee engagement programs, and assisting the Board in overseeing ESG matters relating to our workforce, including inclusion and diversity. |

The Board concluded that all members of the compensation and human resources committee, and persons who served as members of the committee during any part of fiscal year 2023, are non-employee directors who are independent in accordance with Rule 16b-3 under the Exchange Act and the Nasdaq criteria for director and compensation committee member independence.

Nominating and Governance Committee

Membership as of September 8, 2023:4 Eric K. Brandt, Michael R. Cannon (Chair), Bethany J. Mayer, and Abhijit Y. Talwalkar Meetings held in fiscal year 2023: Four

Key responsibilities:

| • | identify individuals qualified to serve as members of the Board and recommend nominees for election as directors; |

| • | recommend committee membership and leadership assignments; |

| • | review our corporate governance guidelines and other governing documents and recommend amendments to the Board; |

| • | oversee self-evaluations of the Board and individual directors; |

| • | assist the Board in overseeing ESG matters not assigned to other committees, including our overall ESG strategy and goals, ESG report, sustainability initiatives, and oversight of climate-related goals; |

| • | oversee the Company’s political activities and review our policy regarding political contributions and spending; and |

| • | review the independence of the Board and its committees and recommend director independence determinations to the Board; |

| • | monitor and evaluate the educational needs of directors and make recommendations to the Board where appropriate; and |

| • | administer the process for director candidates nominated by stockholders. |

The Board concluded that all members of the nominating and governance committee, and persons who served as members of the nominating and governance committee during any part of fiscal year 2023, are non-employee directors who are independent in accordance with the Nasdaq criteria for director independence.

| 3 | Ms. Mehra joined the committee on November 7, 2022. |

| 4 | Ms. Mayer joined the committee on November 7, 2022. |

Lam Research Corporation 2023 Proxy Statement 17

Board’s Role and Engagement

General. The Board oversees the management of the business and affairs of the Company. In this oversight role, the Board serves as the ultimate decision-making body of the Company, except for those matters reserved for the stockholders. Board agendas facilitate dialogue between the Board and management regarding drivers of long-term stockholder value and key strategic and operational risks. The Board’s and its committees’ agendas include both regular, recurring topics as well as time for special agenda topics that are scheduled on an as-needed basis by the Board or committee chairs, as applicable.

The Board and its committees have the primary responsibilities for:

| • | overseeing the Company’s business strategies, and approving the Company’s capital allocation plans and priorities, annual operating plan, and major corporate actions as set forth in the below sub-bullets; |

| ◦ | a strategic plan is presented to the Board for discussion on an annual basis; |

| ◦ | an operating plan is presented to the Board for discussion on an annual basis, and updates are presented at each quarterly Board meeting; and |

| ◦ | capital allocation plans and priorities and other major corporate actions are presented and discussed as part of regular management updates and as special agenda topics, as appropriate. |

| • | appointing, annually evaluating the performance of, and approving the compensation of, our CEO; |

| • | reviewing with our CEO the performance of the Company’s other executive officers and approving their compensation; |

| • | reviewing and approving CEO and top leadership succession planning; |

| • | advising and mentoring the Company’s senior management; |

| • | overseeing the Company’s internal controls over financial reporting and disclosure controls and procedures; |

| • | overseeing the Company’s material risks and enterprise risk management processes and programs; |

| • | overseeing the Company’s ethics and compliance programs, including the Company’s code of ethics, with updates presented to the audit committee quarterly and to the full Board annually; |

| • | overseeing the Company’s information security programs (including cybersecurity), with updates presented to the audit committee quarterly and to the full Board annually; |

| • | overseeing the Company’s human capital management, with updates presented to the compensation and human resources committee quarterly and to the full Board annually; |

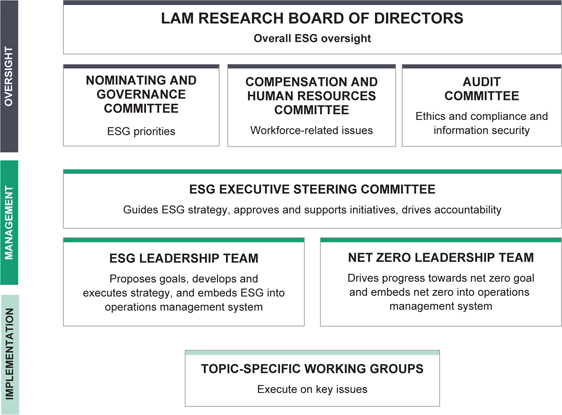

| • | overseeing ESG matters, with quarterly updates on our ESG program and performance provided to the nominating and governance committee, and the Company’s ESG strategy, goals and performance presented to, and ESG reporting reviewed by, the full Board annually; and |

| • | overseeing the Company’s political activities, with updates presented quarterly to the nominating and governance committee. |

Risk Oversight. Effective and comprehensive risk management is critical to our Company’s success, given the dynamic economic, geopolitical, and social landscape in which we operate. Our Board is actively engaged in risk oversight both directly and through its committees. As a general matter, the Board exercises its oversight responsibility directly, including overseeing management’s implementation of the Company’s Enterprise Risk Management (“ERM”) program. In addition, the Board delegates oversight of certain risks to its various committees as further detailed below. The Board, and as applicable, each of its committees, oversees the Company’s risk profile by regularly reviewing management’s assessment of the Company’s material risks and evaluating management’s risk mitigation strategies.

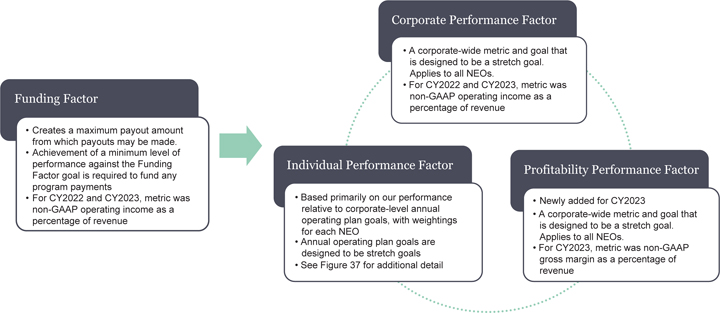

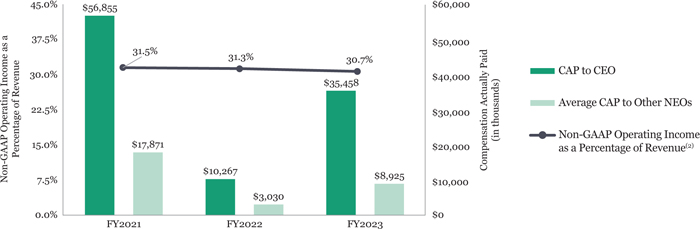

The Company’s ERM program is a enterprise-wide program designed to leverage existing management processes to enable effective identification of critical enterprise risks, design and implementation of appropriate risk mitigation strategies, and regular assessment of the status of risks and mitigation plans. The ERM program (i) establishes a comprehensive, enterprise-wide system to identify, evaluate, manage, and report risks, (ii) clearly defines management’s roles and responsibilities by allocating responsibility for specific risks to specific members of our senior management team, and (iii) facilitates dialogue between senior management and the Board regarding the Company’s top risks.